Part III

Research for Drug Policy

The final part of this report examines the research now available to inform drug control policy, identifies important gaps in knowledge, and makes commensurate recommendations. Current policy instruments include an array of activities related to enforcement—domestic enforcement, interdiction, crop eradication, and administrative and informal sanctions—and a wide range of prevention and treatment programs being implemented throughout the country.

It is inevitably difficult to assess the effects of the diverse activities that, taken together, comprise the nation’s effort to diminish illegal drug trafficking and use. The present state of knowledge varies considerably across the different policy instruments, with a considerable amount known about some instruments and little at all about others. In part, the state of knowledge reflects the differential investments that the nation has made in research and data collection. Research on enforcement has received very little support; as a consequence, we know very little about the effectiveness of the many dimensions of enforcement policy. Drug treatment research has been supported in a sustained, serious manner; as a consequence, a significant body of work exists. Prevention research has focused almost entirely on school-based programs, virtually ignoring the many other community-based efforts under way. The specificity of the committee’s recommendations varies across areas, reflecting variation in the state of knowledge.

We begin our review in Chapter 5 with supply-reduction policy. This chapter and Chapter 6 contain the recommendations regarding the agenda

of principal concern to this committee: strengthening research and data on enforcement strategies. The discussion in Chapter 5 stresses the need for research on how drug suppliers respond to enforcement policy and, more broadly, the need for research on the operation of drug markets. The discussion in Chapter 6 pays particular attention to both tine declarative and deterrent effects of sanctions against use of illegal drugs. Given the high rate of incarceration under current drug sentencing and its financial and human costs, such research is imperative.

In Chapter 7 the discussion turns to research on programs aimed at preventing or delaying drug use among children and youth. The widespread adoption of many prevention programs whose effects—beneficial or harmful—are unknown requires urgent research attention. Chapter 8 examines the use of randomized clinical trials to test the effectiveness of new treatment protocols in different settings, with diverse clients and for different types of drugs. Special attention is paid to the potential benefits and ethical problems of including no-treatment control groups in clinical trials.

Choosing the right mix of instruments to control the sale of illegal drugs and reduce their use presents complex policy problems: there are many different lines of attack. The committee believes that sustained and systematic research efforts such as those recommended here are essential if the nation is to have any hope of improving the quality of its decision making.

5

Supply-Reduction Policy

To many, it seems obvious that reducing the supply of drugs offers an important way to control the drug problem. If there were no drugs to use, there would be no problem. If lesser quantities of drugs reached consumers in the United States, the problem would be diminished. If drugs were harder to find, or riskier to obtain, or simply more expensive, some potential users might be discouraged from starting, and some current users might seek treatment or abandon their use.

In this chapter, we concentrate on enforcement and other policy instruments that aim to reduce drug supply. We discuss the problems of measuring or otherwise estimating the effectiveness of supply-reduction efforts, assess current knowledge of retail drug markets, explain why an understanding of these markets is important for supply-reduction policy, and assess knowledge of the extent to which arrested drug dealers may be replaced by others. Enforcement efforts directed at drug users are examined in Chapter 6.

DIMENSIONS OF SUPPLY-REDUCTION POLICY

Efficacy and Justice as Evaluative Criteria

The belief that reducing the supply of drugs can help to control the drug problem is but one concern that drives the public commitment to enforcing the drug laws. In addition, the public enthusiasm for enforcement, including imprisonment of offenders, is supported by the view that

it is morally wrong to produce and sell drugs, and that those who do so despite laws prohibiting this activity ought to be punished. In short, many people believe not only that enforcement of drug laws helps to solve the problem of drug use, but also that enforcement advances the cause of justice. Of course, a countervailing libertarian view argues that government enforcement of drug laws intrudes on individual freedoms and hence should be minimized to the extent possible.

For a committee of the National Research Council, the fact that some of the enthusiasm for enforcement derives from a moral view of what is right and wrong, as well as from a practical, empirical claim that such policies will succeed in controlling the drug problem creates a difficulty. Scientists know how to measure things and how to reach conclusions about whether a particular intervention works to solve a particular problem or achieve a specified goal. With respect to the question of what sorts of acts are good or bad, and what constitutes a good versus a bad effect, scientists have no special expertise to offer. In a democratic society, that is a job for all citizens, and their representatives, not for scientists alone. What scientists can do is to help citizens judge whether the practical reasoning that links drug enforcement and supply-reduction efforts to the severity of the drug problem is sound, and what the available empirical evidence seems to say about the efficacy of these efforts. That is what we aim to do in this chapter and the next.

We note, however, that findings of either efficacy or inefficacy cannot determine whether the nation should enhance, reduce, or abandon efforts to reduce drug supply and to enforce drug laws. Such efforts could be supported even if ineffective if they were considered a just response to people who produce or sell drugs. And they could be abandoned even if considered effective if they came to be regarded as sufficiently unjust. The worst of all worlds would be one in which the nation supported drug enforcement efforts that were both ineffective and unjust. The best of all worlds would be one in which the policies used were both just and effective. The point is that supply-reduction and drug law enforcement efforts have to be evaluated in terms of their justice as well as their practical effect. It is important to think about whether it is bad to produce and sell prohibited drugs as well as whether it is effective in discouraging people from doing so by threatening to punish them. It is important to think about whether the laws that are enforced are fair, and whether they can be enforced fairly as well as whether the laws can help protect children from having early experiences with drug use that bode poorly for their future. In this discussion, we on occasion note issues of justice as well as efficacy, but it is important to emphasize that the committee’s expertise

lies in judgments about impact and efficacy against agreed-on objectives, not in our views of justice or social value.

Supply-Reduction Policy and Drug Law Enforcement

Supply-reduction policy is often treated as identical with drug law enforcement. While there is a substantial overlap among the interventions that belong in each category, there is an important conceptual difference between these ideas, and there are some policy interventions that belong in one category but not the other. Supply-reduction efforts include all those interventions that are made to reduce the availability of drugs to unauthorized users. This category includes many things that are not ordinarily thought of as drug law enforcement. For example, it includes efforts to persuade farmers in foreign countries to substitute legitimate crops for illegal drugs. It also includes efforts to police the regulatory boundary between drugs prescribed for legitimate users and those who would like to abuse them. Some activities, such as crop replacement, are supply-reduction efforts but are not law enforcement efforts.

By the same token, drug law enforcement includes many interventions that do not aim to reduce the supply of drugs. For example, it is a crime in all states to possess and use certain drugs as well as to sell them. Nearly 1 million people a year are arrested for personal possession or use of small amounts of drugs (Office of National Drug Control Policy, 1999a).1 Enforcement of laws prohibiting personal possession or use is properly seen as operating on the demand side rather than the supply side of the drug problem. Such enforcement adds the threat of arrest to all the other reasons that already exist to avoid using illegal drugs and brings current drug users into the criminal justice system, where they can be sent to jail or sent to drug treatment alternatives to jail.

Plausible Efficacy: Reasoning About Supply-Reduction Efforts

To begin our analysis of supply-reduction instruments, it is useful to lay out the logic that links supply-reduction policy to drug use. Many common errors of reasoning show up in policy debates about supply-reduction policy.

Some drug policy analysts appear to believe that supply-reduction efforts fail to deter drug use because most drug users are addicted and

compulsive in their use; they will “do anything” and “pay anything” to consume drugs.2 If this is true, then supply-reduction efforts can have very little effect on the quantity of drugs consumed. Rather, such efforts simply act to increase the profits of illegal dealers by enabling them to raise the prices of drugs. This argument ignores the possibility that users and potential users who are not yet addicted to drugs could be dissuaded from experimenting with them by high prices or by the inconvenience and danger of buying drugs. It also ignores the possibility that increases in the price and inconvenience of buying drugs may cause older users who are tired of “the life” to make serious efforts to quit their use. Effects such as these appear to occur with changes in price for legal addictive commodities, such as alcohol, tobacco, and caffeine. Why shouldn’t they occur for heroin, cocaine, marijuana, and amphetamines? Indeed, the best current estimates of the elasticity of cocaine consumption with respect to price is that it lies between –0.59 and –2.5: if accurate, this means that a 10 percent increase in the price of the illegal drugs will lead to at least a 5.9 percent reduction in overall levels of use. Apparently it is not true that all drug users will do anything or pay any price (although some of them will do a lot and pay a lot) for drugs. If drug users can be discouraged from using drugs by high prices, unavailability, or risks associated with buying and using drugs, and if enforcement and supply-reduction efforts can raise the price and risks, then these efforts may succeed in dissuading new users from starting, experimental users from advancing to higher levels of use, and advanced users from continuing to use drugs even when treatment is available to them.

Other researchers suggest that drug enforcement and supply-reduction efforts will fail because they cannot succeed in meaningfully raising the price or reducing the availability of drugs. In this view, there is a plentiful supply of people willing to run the moral, economic, and physical risks of dealing drugs for the profit that can be earned. One can agree that there are many people in sufficiently desperate circumstances that dealing in drugs represents a relatively attractive income earning opportunity. But there are many things about dealing in drugs that are unattractive and are made unattractive by its illegal status. In thinking about how drug enforcement affects opportunities for drug dealing, one begins with the idea that each dealer is threatened with the prospect of arrest and

imprisonment. But the greater risk may come not from the police, but from other dealers and criminals. Indeed, from the point of view of a drug dealer, one of the worst consequences of the illegality of drugs is that the police and courts do not assist in enforcing contracts and providing security. A drug dealer must absorb all the costs of contract enforcement and security, possibly to the point of being willing to use violence.

Dealing drugs is an economically and physically risky business. That fact dissuades some people from entering the business. It also motivates those people who enter to demand compensation for their risks by increasing the price. In addition, dealers must manage their inventories and transactions so as to minimize the risks of theft and arrest. This means that drugs flow through the supply system less openly and more expensively than would be true if drugs were legal. Indeed, current estimates indicate that the price of illegal drugs is much above the price that would obtain if they were sold in legitimate markets (discussed below). This is a combined effect of both the illegal status of the drugs (which expose drug dealers to attacks from other criminals even if the police do nothing) and of enforcement efforts (which expose drug dealers to the specific threat of arrest by government agents). It is difficult to know what portion of that price increase should be attributed to what effect, but it does suggest that making drugs illegal does increase their price.

Economic theory is unequivocal about the direction of the effect of drug law enforcement on total supply. Enforcement tends to reduce the supply of drugs because it makes drug dealing more risky, demanding, and unpleasant than it would be if drugs were legal. Therefore, at any given price, smaller quantities of drugs come into the market than would be the case in the absence of antidrug laws and law enforcement. How big this effect is and how much it matters in reducing drug use and the adverse consequences of drug use are empirical questions. As we discuss in the remainder of this chapter, the answers to these questions are unknown at present.

A main concern of this chapter is the quality of available empirical evidence on the effectiveness of supply-reduction efforts. Economic or other theory does not provide a basis for making confident or quantitative judgments about the effectiveness of these efforts. Empirical evidence of efficacy is needed to evaluate the benefits and costs of the substantial investments that the nation has made in supply reduction. The required evidence is largely nonexistent. The problem is not just that the relevant studies have not been done. Systems for acquiring the needed data are inadequate or nonexistent. Moreover, the analytic problems of inferring efficacy would be highly complex even if good data were available. The committee makes several recommendations about what can be done to improve evidence on the effectiveness (or lack thereof) of supply-reduc-

tion efforts. Developing this evidence is an urgent matter, for the nation’s investment in supply reduction, in terms of both money and the exercise of state authority, is very large.

The next two sections introduce the two main modes of research that have been used to evaluate supply-reduction policy. Impulse-response analysis seeks to draw causal inferences directly from temporal sequences of events without specifying the mechanism leading from the hypothesized cause (the impulse) to the suspected effect (the response).3 Systems research refers to the development of formal models of the behavior of agents who interact in a social system and the use of such models to predict system outcomes as policy varies.

IMPULSE-RESPONSE ANALYSIS

The principle of impulse response analysis is remarkably simple: interventions take place and one observes the consequences. Impulse-response analysis has much appeal when an intervention of interest is the only notable event occurring in a time period under study. Laboratory experiments conducted in tightly controlled environments aim to achieve this ideal. When it is not possible to ensure that the intervention of interest is the only notable event, researchers often recommend performance of multiple independent experiments with randomized assignment of interventions. Randomized assignment enables a probabilistic form of impulse-response analysis from which one may learn the distribution of responses following an intervention of interest. On occasion, natural experiments in uncontrolled environments may approximate the conditions of laboratory or randomized experiments.

Supply-reduction interventions are neither performed in the controlled environments of laboratories nor randomized in the field. Measurements of the response variable of most direct interest, namely the supply of drugs, are not readily available. For these reasons, impulse-response analysis of supply-reduction policy poses a formidable challenge.

In the absence of data on drug supply, impulse-response analysis of supply-reduction policy has mainly sought to connect policy to domestic drug prices. Standard economic analysis predicts that if interdiction and domestic enforcement succeed in reducing the supply of drugs, then the price of drugs will rise, and consumption of drugs will fall, everything

else being equal. This motivates analysis that attempts to relate enforcement activities to domestic drug prices.4

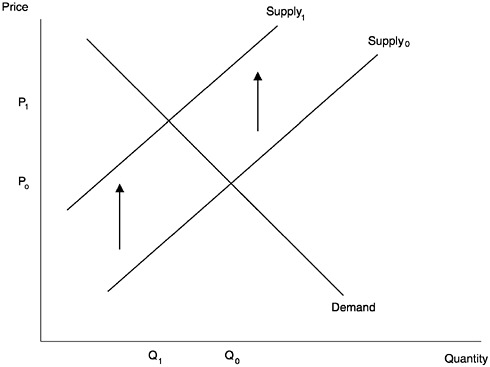

Figure 5.1 portrays the standard economic reasoning. The curve labeled “Demand” shows the quantity of a drug that consumers wish to purchase at any given price, and the curve labeled “Supply0” shows the quantity that producers are willing to sell at any given price. The intersection of the supply and demand curves is the market equilibrium: the price P0 at which the quantities demanded and supply are equal, so that the market is in balance. If the government were to intensify interdiction, domestic enforcement, and other supply-reduction activities, the cost of production would rise and thus shift the supply curve up. The result, everything else being equal, would be a new equilibrium with a higher price (P1) and lower consumption (Q1). This is the classic view of the effect of supply-reduction policy on the market.

A formal impulse-response analysis of supply reduction policy was performed in the Institute for Defense Analyses (IDA) study (Crane et al., 1997) assessed by the committee in its Phase I report. This research sought to connect specific interdiction activities (what we refer to as the impulse) to particular subsequent domestic drug price fluctuations (what we refer to as the response). It also sought to connect aggregate spending on interdiction (the impulse) to long-term trends in domestic drug prices (the response). Informal use of impulse-response analysis is common in public discussions of supply-reduction policy. Time-series data describing spending on enforcement are often juxtaposed with data on drug prices, the idea being that the effects of enforcement should be seen in the price data.

We first examine issues that arise in impulse-response analysis relating specific enforcement activities to particular fluctuations in domestic drug prices. We then consider in some depth the use of long-term trends in domestic drug prices to assess the effectiveness of supply-reduction policy writ large.

FIGURE 5.1 Supply and demand for illicit drugs

As noted earlier, measurement of the time-series variation in drug prices is problematic at present. There are also difficulties in characterizing the timing and character of enforcement activities. The discussion below focuses on issues that would arise even if satisfactory data were available.

Enforcement Activities and Domestic Drug Price Fluctuations

Efforts to connect specific enforcement activities to particular price fluctuations must inevitably confront the basic fact that enforcement activities are not the only notable events that may affect drug prices. It is unreasonable to suppose that, except for enforcement activities, the supply and demand forces that determine drug prices are stable over time. One obvious source of price fluctuations is time-series variation in drug demand. For example, the demand for cocaine may fluctuate as a result of changing attitudes toward cocaine consumption, a changing mix of light and heavy users, and changing patterns of enforcement and penalties for cocaine possession. Another source of price fluctuations may be variation

in the supply of drugs due to changing source country conditions, from weather to political stability.

Even if all determinants of drug prices except enforcement were time-invariant, the dynamics that connect enforcement to domestic drug prices would be complex. An enforcement activity undertaken in a specific place and time presumably does not generate an instant response in drug prices. Does the response in drug prices begin to appear a week, month, or year following the enforcement activity? Does the response persist for a week, month, year, or longer before dissipating? The time path of the response in drug prices presumably depends on the nature of the enforcement activity, on the inventories of drugs held by traffickers in domestic and foreign locations, on the speed with which new drug production can replace seizures, and on the deterrent effect of the enforcement activity on trafficking. Moreover, the time path of the response may vary geographically, depending on the nature of the drug distribution networks and enforcement activities in different locales.

If a single enforcement activity could be undertaken in isolation, as in a laboratory experiment, it would be relatively straightforward to track the time path of the response in drug prices. However, what we actually observe results from the conjunction of numerous enforcement activities undertaken in different times and places, as well as of the many other forces operating on the demand and supply of drugs. This considerably complicates analysis.

The difficulty of carrying out impulse-response analysis is well illustrated by the large upward fluctuation in cocaine prices that the STRIDE data (described in Chapter 3) show to have occurred in 1990. Accepting the STRIDE data as valid, for purposes of the present discussion, the price of domestic cocaine increased sharply between mid-1989 and mid-1990. It returned to its early 1989 level between mid-1990 and late 1991. The price increase occurred shortly after the Bush administration’s war on drugs began, suggesting that the war may have contributed to the increase. The war on drugs included a variety of enforcement activities. It is not possible to determine through impulse-response analysis the separate effects of these actions. Moreover, the war on drugs and the 1990 price increase also roughly coincided with the dismantling of the Medellin cartel in Colombia, which may have caused a temporary increase in the price of cocaine by temporarily disrupting production and distribution operations. If one had independent evidence on the magnitude of the response to the collapse of the Medellin cartel, then it might be possible to infer the combined effects of the various actions undertaken during the war on drugs, but no such evidence is available. Thus, considerable uncertainty exists as to the cause of the largest upward fluctuation in domestic cocaine prices in the past 15 to 20 years.

Despite the difficulties, there may be situations in which impulse-response analysis of domestic price fluctuations can yield useful findings. Consider, for example, the effect of an unusually large interdiction action on cocaine prices in a single city. Suppose that, for relatively long periods before and after the interdiction event, records were available of all interdiction activities, domestic enforcement actions, gang wars, and other events that might affect price. Suppose further that the interdiction action of interest did not occur contemporaneously with other unusually large interdiction or enforcement actions. Then it might be possible to use the records of normal enforcement activities together with data on prices to infer the price response to normal events. If so, then any abnormal price response following the interdiction event of interest might reasonably be interpreted as a consequence of this event. This interpretation would not be unambiguous, because one can never be sure that one has taken into account all possible confounding events. However, such analysis might at least be suggestive.

The committee is not aware of impulse-response analyses of supply-reduction policy performed in the manner just described. Indeed, as discussed in Chapter 3, the existing price data are unlikely to be accurate enough to support such an analysis. This form of impulse-response analysis would require not only improved price data but also extensive data on interdiction, domestic enforcement, and other factors that may affect prices. Although such data are currently unavailable, it is conceivable that they might be assembled over time. This warrants further investigation.

In addition to impulse-response studies of price movements, it may be possible to evaluate experiments in police departments. For the last 30 years or so, several departments have conducted experiments in which a particular law enforcement strategy has been tried in certain police districts or precincts, but not in others. The districts are sometimes selected randomly or after an effort to match experimental and control units. Such work has been done, for example, to evaluate the effect of foot patrol officers and intensified patrol in unmarked patrol cars. Although all such experiments must deal with the likelihood that some criminal activities will be displaced to neighboring areas, this problem can be partially addressed by gathering crime data and interviewing citizens in these adjoining locations as well as in the experimental and control areas.

Enforcement and Long-Term Price Trends

Impulse-response thinking has often been used to infer the broad effectiveness of interdiction and domestic enforcement policy from long-term trends in drug prices. The Institute for Defense Analyses (IDA) study

contained an analysis in which aggregate spending on interdiction was taken to be the impulse and the long-term trend in the domestic price of cocaine was taken to be the response. To infer the effect of interdiction spending on the price trend, the IDA report put forward two assumptions about what the time-series path of cocaine prices would have been in the absence of interdiction activities. One is that, in the absence of interdiction in the source zone, price would have remained constant over time. The other is that, in the absence of both source and transit zone interdiction, price would have decreased on an exponential curve over time. These counterfactual price paths both lay below the observed time series of domestic cocaine price. The IDA report concluded that the positive differences between observed cocaine prices and the counterfactual price paths measure the effect of source and transit zone interdiction on price.

Whereas the IDA report used particular counterfactual assumptions, informal impulse-response arguments not invoking explicit counterfactuals have been common in public discussions of enforcement policy. Notwithstanding the measurement problems discussed in Chapter 3, there is widespread agreement about two basic features of drug prices during the past 20 years:

-

Price Decline in the 1980s: During the 1980s, domestic prices of illegal cocaine and heroin fell very substantially. Since then, prices may have fluctuated over short periods of time but have been relatively stable over the longer term.

-

Prices Remain High: Throughout the 1980s and 1990s, the prices of illegal cocaine and heroin remained much higher than prices in the small legal markets for pharmaceutical drug use and also much higher than the prices of broadly comparable licit agricultural commodities.

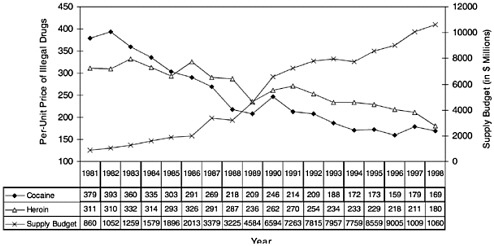

The question is: What should be made of these features of drug prices? It has been particularly common to observe that in the 1980s, sharp increases in spending on domestic enforcement and interdiction coincided with sharp decreases in the domestic prices of cocaine and heroin. Juxtaposition of these two trends, shown in Figure 5.2, has led many to conclude that supply-reduction policy has been ineffective.

For example, a recent essay in the New Yorker states (Hertzberg, February 7, 2000:31–32):

At the level of national government, discussion of drug policy has been dormant since the nineteen-eighties ushered in the crack epidemic, just say no, three strikes and you’re out, and the prison boom….Yet the failure of the twenty-year “drug war” has never been more apparent. The most damning evidence can be found in the most recent “Fact Sheet” handed out by the White House Office of National Drug Control Policy.

FIGURE 5.2 Enforcement spending and drug prices over time.

Sources: The cocaine and heroin prices are based on the STRIDE data, as reported in Office of National Drug Control Policy (2000, Table 42). These prices reflect retail purchases of less than 1 gram for cocaine, and of less than 0.1 gram for heroin. The cocaine estimates are for the price of a pure gram. The heroin estimates are the price per pure 0.1 gram. The supply budget is from Office of National Drug Control Policy (1997, 1998). The budget figures include domestic law enforcement, international enforcement, and interdiction.

…The surest measure of the success of drug interdiction and enforcement is price: if drugs are made harder to come by, the price must increase. According to the “Fact Sheet,” however, the average price of a gram of pure cocaine dropped from around $300 in 1981 to around $100 in 1997; for heroin the price fell from $3,500 to $1,100.

Much the same reasoning appears in recent testimony of Eric Sterling (2000) to the House Committee on Appropriations:

In the streets, our policy is a failure. As best we can reckon, the street prices of heroin and cocaine are near historic lows. A pure gram of cocaine was $44 in 1998, down from $191 in 1981. Heroin prices have fallen from $1200 per gram to $318 per gram over the same period. This means traffickers are discounting the risks they face. This means the traffickers are finding it easier to get drugs to our streets, not harder.

Analysts cognizant of the many forces acting on the drug market are aware that juxtaposition of spending and price trends does not suffice to evaluate supply-reduction policy. Clearly interdiction and domestic enforcement have not made cocaine and heroin prohibitively expensive. At the same time, the fact that the prices of illegal drugs have remained well above the prices of similar legal commodities suggests that policies seeking to reduce drug supply have had some effect on prices. It is difficult to go beyond these broad statements in the absence of a deeper understanding of the manner in which drug markets have operated in the past 20 years.

Moreover, it is essential to keep in mind that the only meaningful conclusions about the effectiveness of past drug policy are ones that compare this policy with some well-defined alternative. When considering the effect of supply-reduction policy on drug prices, one needs to specify an alternative policy and predict the counterfactual path that prices would have taken under this alternative. Any conclusion about the effectiveness of recent policy necessarily depends on what alternative policies one entertains and what one predicts the counterfactual price paths would have been.

Suppose, for example, that spending on domestic enforcement and interdiction had been much below its 1980s level. Would the 1998 price of a pure gram of cocaine have remained at its 1981 level of nearly $400, would the price have fallen to its observed level of around $200, or would it have fallen further? Research to date on supply-reduction policy does not provide a basis for answering this basic counterfactual question.

What Explains the 1980s Price Drop?

The sharp fall in illegal drug prices during the 1980s has long perplexed analysts of drug policy, and this committee as well. It is easy to cite

multiple factors that may have contributed to the phenomenon, but it is very difficult to determine their respective roles. Caulkins and Reuter (1998:602–603) offer these possible explanations for the price drop:

[I]t is possible for overall price to decline even as enforcement stringency increases if the declines in the other cost-components more than off-set the increase in enforcement’s component. For example, import costs might decline as smugglers acquire experience (Cave and Reuter, 1988). Labor costs might decline if the industry shifted to less skilled labor (e.g. from pilots to small boat crew members) or if there was a decline in the prevailing wage for the current dealer (e.g. aging dealer/users whose legitimate labor force opportunities weaken as their drug-using careers lengthen). Risk compensation for the physical risks of selling drugs could decline if the markets stabilized and the risk of being killed declined. Stares (1996) argues that the trend toward globalization, improved communication and transportation networks, and the persistence of poverty in source countries are enhancing the ability to bring drugs to market cheaply.

As Caulkins and Reuter suggest, there are many ways in which the costs of drug production and distribution may have fallen during the 1980s, shifting the supply curve downward and thus implying lower equilibrium prices, everything else being equal. Production efficiencies may have stemmed from new higher-yielding crops or from economies of scale as the industry adjusted to the heightened demand associated with the emergence of crack. The drug industry may have experienced the learning-curve effect often associated with new industries as they find ways to be more efficient in their operations.5 The cost of marketing drugs may have fallen as retail selling was taken over by juveniles willing to work for low wages. High profits may have attracted new producers and dealers into the market and may have led existing dealers to expand their transaction volumes (Kleiman, 1992).

At the same time, the demand for drugs may have changed during the 1980s. The usual presumption has been that demand for cocaine increased until the mid-1980s as the crack epidemic took hold. However, at least two countervailing forces were at work as well. First, the federal government substantially increased spending on prevention and treatment programs. The Office of National Drug Control Policy estimates that from fiscal year 1981 to 1989, federal spending on treatment doubled and spending on prevention increased by a factor of 8 (Office of National Drug Control Policy, 1999b). An increase in spending on mass media prevention campaigns should, if effective, unambiguously shift the de-

mand function for drugs downward. An increase in spending on treatment is more difficult to assess. To the extent that treatment is effective and the increased spending makes treatment more available, the demand for drugs should shift downward. However, it may be that the spending increase reflects increases in the cost of treatment or increases in the number of persons requiring treatment as drug consumption rose.

Second, the intensity of domestic enforcement increased substantially during the 1980s. Whereas enforcement directed at dealers aims to reduce the supply of drugs, enforcement directed at users aims to reduce the demand for drugs. To the extent that increased enforcement directed at users deterred drug purchases or incapacitated users, the demand for drugs should have shifted downward during the 1980s. See Chapter 6 for further discussion.

It is unclear how much of the 1980s price fall was due to production and distribution innovations, how much to changes in demand-side forces, how much to changes in enforcement that may have affected both the supply and demand for drugs, and how much to the insensitivity of supply or demand to the increased enforcement that occurred during that time. Sorting out this matter is of more than historical interest. Understanding what happened in the 1980s would help in the design of drug policy today.

Prices of Illegal Drugs and Comparable Legal Commodities

There appears to be nearly unanimous support for the idea that the current policy enforcing prohibition of drug use substantially raises the prices of illegal drugs relative to what they would be otherwise.6 The basic economic argument underlying the near consensus is that enforcement of prohibition raises the costs of drug production and distribution. The basic empirical finding is that prices of illegal drugs as measured by STRIDE are substantially higher than the retail prices of comparable legal commodities.7

|

6 |

See, for example, Caulkins and Reuter (1998), Koper and Reuter (1996), Moore (1990), Morgan, (1991), Nadelmann (1991), Reuter and Kleiman (1986). Miron (1999) draws a somewhat more ambivalent conclusion. Contrasting the price effects of enforcement against the tax and regulatory costs imposed on legal markets, Miron (1999) argues that the illegal price of cocaine may not be inflated at all and is at most two to three times higher than the legal price. |

|

7 |

This empirical finding should be tempered by two caveats. First, as we discussed in Chapter 3, the STRIDE data do not constitute a representative sample of retail prices. Second, even if the price data were valid, price measures only the pecuniary cost of buying illegal drugs. Enforcement of prohibition presumably raises the nonpecuniary costs of buying drugs as well—time costs, threat of robbery and physical harm, and the threat of arrest. These costs may be substantial. |

Comparison of the illegal price of cocaine to the legal pharmaceutical price reveals that the illegal price substantially exceeds the legal price. In 1981 the illegal price exceeded the legal price by a multiplicative factor of almost 50, in 1998 by a factor of nearly 2.5. Pharmaceutical prices are not likely to be valid as measures of the prices of recreational drugs in a hypothetical regime of regulated use, but the large pre-1990 markups are nonetheless suggestive. Moore (1990), citing similar figures, concludes “these data make it clear that prohibition and supply-reduction efforts can increase the price of psychoactive drugs well above levels that would obtain in a legal market.”8 Nadelmann (1991), Morgan (1991), and Kleiman (1992) draw similar conclusions. Miron (1999), focusing on data from the late 1990s, finds the evidence less persuasive.9

Price markups along the production and distribution process have also been used as suggestive evidence of the effects of enforcement. Reuter and Kleiman (1986: Table 1) displays interval price estimates at various stages of the process for a pure kilogram of heroin, cocaine, and marijuana. Many of the intervals are wide, reflecting the limitations of existing data. Nevertheless, two general conclusions may be drawn. First, the markups from the farm to retail distribution are substantial. The retail price may be 100 times the farmgate price for cocaine and marijuana and perhaps 1,000 times for heroin. Second, a substantial portion of the final price is added in the final stages of distribution. For heroin and cocaine, prices increase between 7 and 13 times in the transition from import to retail; for marijuana, prices increase 2 to 6 times.10

These data have been used to evaluate the price effects of the current prohibition environment. Only part of the price markup from farmgate to retail can be attributed to enforcement of prohibition; after all, bringing drugs to market incurs real resource costs. The question is: How much?

Several researchers have used aggregate data on seizures (both drugs and other assets), incarceration rates, and estimated wage rates to make educated guesses on the part of the markup that is due to enforcement of prohibition. Caulkins and Reuter (1998) argue that risk compensation accounts for over half of the total cost of production, while seizures and money laundering fees account for another 10–15 percent of production costs. Thus, they estimate that enforcement accounts for about 60–70 percent of the retail price of cocaine. Miron (1999) finds that arrests and seizures account for as much as half the illegal price, but that these costs are nearly offset by tax and regulatory costs incurred in legal markets. Any markup, Miron argues, must be due to “secrecy cost” (i.e., nontrivial actions taken to avoid detection) that he does not evaluate.

Other analyses compare the price markups in the production process for cocaine with markups for agricultural commodities that may be comparable to cocaine. Caulkins and Reuter (1998) suggest substantial price markups similar to those observed for cocaine are consistent with some goods (e.g., the farmgate value of wheat in a box of shredded wheat is about 2.5 percent of the retail price) but not others (e.g., the border value of a pound of sugar is about 50 percent of the retail value). Miron (1999) claims that all kinds of common agricultural products (e.g., cocoa, coffee, tea, beer) have farmgate-to-retail markups comparable to that of cocaine. For example, the price of raw coffee beans in Colombia is $0.75 per pound, while the per-pound price of espresso at Espresso Royale in Boston is $111.30.

Of course, Miron’s conclusion rests on his assumption that the Espresso Royale retail price is the relevant measure. The per-pound price of a cup of coffee at Dunkin Donuts is $25.43, and the retail price of Roaster Whole supermarket beans is $6.36 per pound. Whether one should measure the retail price at Espresso Royale, Dunkin Donuts, or the supermarket is an open question. If restricted to supermarket prices, beer is the only good for which Miron finds markups similar to cocaine, and for it taxes are usually a big component of the markup.

In any case, the relevance of these comparisons between cocaine and legal agricultural commodities is not clear. The reasons for the coffee markup and the cocaine markup are likely to be very different. For illegal drugs, a relatively substantial fraction of the costs may be due to risk and asset seizures. For legal agricultural commodities, a relatively large fraction of costs are associated with marketing (e.g., packaging and advertising), taxes, and regulations.

To summarize, basic economic thinking combined with comparisons of the prices of illegal drugs to pharmaceutical drug prices and to prices of legal agricultural commodities have led to the consensus view that illegal drug prices are raised by the existing prohibition policy. Thus, enforcement of prohibition through interdiction and domestic enforcement do appear to affect the market. However, the marginal effect of enforcement spending remains uncertain. As Caulkins and Reuter (1998:603) state, “it is not clear how much enforcement is ‘enough’ to keep prices high.” Nor is it known which specific enforcement measures contribute to price increases, which do not, and by how much specific effective measures increase prices.

SYSTEMS RESEARCH

Economists have long developed highly sophisticated systems models to explain markets for goods and services. Systems research, which consists of formal efforts to model behavior of actors or agents in a social system, was used to evaluate supply-reduction policy in the RAND study (Rydell and Everingham, 1994) assessed in the committee’s Phase I report, as well as in several other recent analyses. A Simulation of Adaptive Response (SOAR) model was developed by Caulkins et al. (1993) to simulate the effects of enforcement activities on the route and mode choices of smugglers. Economic models of the cocaine trade have been developed by Kennedy et al. (1993) and Riley (1993) and used to simulate the impacts of voluntary crop substitution programs and forced crop eradication, among other enforcement activities.

Even in the absence of empirical analysis, systems research can play a useful role in evaluating supply-reduction policy. Thoughtful development of formal behavioral models encourages coherent thinking about the technology of drug production, transport, and distribution. It forces one to make explicit judgments about the manner in which enforcement activities may affect the behavior of producers and traffickers. Simulation exercises can show how assumptions translate into predictions of policy impacts. The performance of sensitivity analyses can clarify the critical empirical questions that must be answered to credibly predict the consequences of enforcement policy.

Systems research can do much more to inform supply-reduction policy if a model’s assumptions and parameter values have firm foundations. The central requirement is empirical research illuminating how drug production, transport, and distribution respond to interdiction and domestic enforcement activities. In the absence of empirical research, analysts can argue endlessly about the realism of any systems model that

may be proposed. With it, analysts may be able to develop models whose predictions of policy impacts are widely accepted.

To date, systems research on supply-reduction policy has had to rest on weak empirical foundations. In part because the data available to support empirical study of interdiction and domestic enforcement are so limited, analysts have not been able to provide strong grounding for the assumptions about the behavior of drug producers and traffickers that are embedded in systems models. There is uncertainty about how consumers respond to variation in prices (see Chapter 2). Current knowledge about the structure of retail drug markets is largely based on qualitative ethnographic and journalistic research, as this chapter notes. Current knowledge about how the production process responds to supply-reduction policies is very limited.

Substitution, Deterrence, and Adaptation

In the committee’s view, systems research has much potential to inform supply-reduction policy and drug control policy more generally. However, this potential cannot be realized quickly or easily. The committee recommends that the Office of National Drug Control Policy and other agencies support a sustained program of data collection and empirical research aiming to discover how drug production, transport, and distribution respond to interdiction and domestic enforcement activities. The committee strongly recommends that empirical research address three critical issues: geographic substitution, deterrence, and adaptation:

-

Geographic substitution: interdiction and domestic enforcement activities commonly target drug production, transport, and distribution in specific geographic areas. To what extent can producers and traffickers thwart geographically delimited operations by shifting their activities elsewhere?

-

Deterrence: interdiction and domestic enforcement activities may reduce existing drug supply through seizures and eradication, and they may reduce future supply through deterrence of new drug production and trafficking. Seizures and eradication are directly observable in principle, but deterrence is not. How can the deterrent effects of supply-reduction activities be measured? How large are they?

-

Adaptation: drug production and trafficking may respond to supply-reduction activities by drawing on inventories, by increasing production, by initiating cultivation in new territories, or by altering geographic routes of distribution. How quickly can such adaptation occur, and what happens to supply and price during the period of adaptation? To the

-

extent that supply-reduction operations deter new drug supply, how long do the deterrent effects last before new supply sources emerge?

With such a program in place, we envision a gradual process of model improvement as new findings on the nature of production, transport, and distribution accumulate.

Assessing Crop-Reduction Policy

Assessment of crop-reduction policy provides a ready illustration of the importance of substitution, deterrence, and adaptation. As this report was being written, an ongoing debate about the effectiveness of crop-reduction policy continued to evolve. The immediate issue was the wisdom of the Clinton administration’s request to Congress in spring 2000 for emergency funding to support Colombia in its efforts to suppress production of cocaine and heroin in southern Colombia. This emergency funding request followed the large increase in coca and poppy cultivation that appears to have occurred in Colombia in the latter 1990s.

Geographic substitution of cultivation looms large as an issue in assessing crop-reduction policy. The recent dramatic rise in coca cultivation in Colombia has coincided with equally dramatic falls in coca cultivation in Peru and Bolivia. These events have become inextricably linked in public discussions of crop-reduction policy as the “balloon effect,” described in a recent New York Times special report on “Cocaine War” (Larry Rohter, April 21, 2000):11

The rapid expansion of coca production in Colombia is in large part a consequence of two developments. One is what is known as the “balloon effect” —the reappearance of a problem in a new place after it has been squeezed in another—which followed successful American-led campaigns against coca growers in Peru and Bolivia.

The geographic substitution suggested by the balloon effect has potentially strong implications for the effectiveness of crop-reduction policy. The New York Times article contains this passage: “One additional concern, both in Andean capitals and in Washington, is that any success against coca cultivation in Colombia will inevitably lead to a resurgence of coca growing in Peru or Bolivia.” The article does not offer an explicit argument for this prediction, but the basis appears to be static competitive economic theory. This theory predicts that, in the absence of resource

constraints, an exogenous event removing one farm from production should generate an increase in product price that induces another farm to enter, restoring the original status quo. If cocaine production fits this simple competitive story, then geographic substitution of cultivation may even be one-for-one, entirely negating the effectiveness of crop-reduction efforts in Colombia.

Committee discussions with government analysts of drug production suggest that cocaine production may fit the simple competitive story in some important respects. First, resource constraints do not prevent substitution from occurring. A variety of current and potential source countries appear to have plentiful land suitable for growing coca, as well as the requisite labor supply. Second, there are no obvious barriers to the entry of new farms to replace those in which production ceases.

However, open empirical questions regarding deterrence and adaptation suggest that cocaine production may not fit the story in other important respects. Deterrence occurs if potential growers in country A, observing the success of U.S.-led crop-reduction efforts in country B, decide not to initiate production because they anticipate that the U.S. government will lead successful crop-reduction efforts against them as well.12 In the context of the current policy debate, deterrence can counter the prediction of the New York Times article that success against coca cultivation in Colombia will inevitably lead to a resurgence of coca growing in Peru or Bolivia.

Static competitive theory abstracts from the adaptation by growers and governments, which may be an important consideration in evaluation of crop-reduction policy. Static theory contemplates a single enforcement action by government followed by an immediate response by growers. The reality, however, is a dynamic of action and reaction as envisioned in the theory of sequential games. In the absence of deterrent effects, the effectiveness of crop-reduction policy depends on (1) how quickly potential growers commence new planting following the disruption of production elsewhere and (2) how quickly governments become aware of new planting and act to suppress it. In the presence of deterrent effects, adaptation issues become more subtle as responses (1) and (2) become linked together.

In summary, land on which cocaine can be grown is plentiful. There is evidence that past campaigns against coca growers have caused produc-

tion to shift to other geographical areas. Such shifting significantly decreases and may entirely vitiate the effect of crop suppression on the supply of cocaine. It is unknown whether deterrence measures can be developed that would diminish or prevent geographical shifting of production in response to suppression of coca cultivation in limited areas.

Issues of substitution, deterrence, and adaptation have arisen repeatedly in the committee’s deliberations on supply-reduction policy as well as in presentations made to the committee in public workshops. These issues arise as much in discussion of domestic law enforcement as in discussion of interdiction policy. The remainder of this chapter examines questions related to domestic enforcement, beginning with the structure of retail drug markets.

RETAIL DRUG MARKETS

A retail drug market is the set of people, facilities, and procedures through which a drug such as cocaine is transferred from suppliers to users. Users and suppliers interact through retail markets. Much law enforcement activity is aimed at disrupting this interaction by increasing the price that users must pay, decreasing the quality (purity) of the drugs that are sold, making it more difficult for users and sellers to find each other, or increasing the risks of buying and selling drugs. Other actions to reduce drug use also operate, at least in part, through their effects on retail markets. For example, a successful treatment or prevention program is likely to reduce the demand for drugs and therefore the earnings of individuals who sell them. This in turn may reduce the number of drug sellers. A program that improves legitimate employment for youths may also reduce the number of individuals who sell drugs, thereby increasing the difficulty that users encounter in finding drugs for sale and perhaps increasing the price that users must pay.

There are many questions about retail drug markets whose answers, were they available, would be useful to policy makers. For example:

-

What is the price elasticity of the demand for powder cocaine? For cocaine base (crack)? Other drugs? That is, by how much does the quantity consumed decrease (increase) in when the retail price increases (decreases)? If the price increases, to what extent is the reduction in consumption caused by cessation of use by casual users? By heavy users? To what extent is the reduction in consumption caused by decreased use but not cessation by casual users? By heavy users? To what extent does a price increase limit initiation of new users? To what extent does the demand for one drug depend on the price of other drugs? What are the dynamics of the response of demand to price changes?

-

How do changes in the costs of production or in wholesale prices affect retail prices? For example, suppose that the wholesale price of cocaine in Colombia increases from $1.00 to $1.50 per pure gram (an increase of 50 percent) at a time when the retail price in the United States is $100. Does the price change in Colombia cause the U.S. retail price to increase by $0.50? By $50? By an amount between these extremes? What are the dynamics of the response? The answers are unknown but have obvious implications for the effectiveness of actions that increase the price of cocaine in Colombia.13

-

Analyses of the STRIDE price data have shown that there is little relation between the retail price of cocaine and its purity. The same is true for heroin. Why is there no relation between price and purity? For example, why don’t sellers of higher-quality cocaine either charge higher prices or cut their product so that they are able to make more sales at the existing price?14 More generally, how do market conditions and other variables influence the purity of drugs that are sold at retail? Kleiman (1992) wrote that “no student of the drug markets has ever produced anything like a convincing theory to explain how changes in market conditions cause changes in average purities over time or from market to market.” Kleiman’s statement remains true today.

-

By how much (if at all) do policy interventions that increase the risks of selling cocaine or other illegal drugs (for example, an aggressive program of seeking out and arresting drug dealers) deter persons from dealing illegal drugs? Increase the price of cocaine? Increase the difficulty that consumers experience in finding sellers?

-

To what extent is employment in the retail drug trade affected by

|

13 |

Several investigators (Caulkins, 1994; Crane et al., 1997; Abt Associates, 1999) have attempted to use STRIDE price data to analyze the relation between retail prices and prices at higher levels of the production and distribution chain. As discussed in Chapter 3, the committee concludes that STRIDE data do not provide reliable indicators of retail price movements in actual drug markets. Moreover, for the reasons that are explained earlier in this chapter, existing data do not permit firm conclusions to be reached about the causes of price changes. |

|

14 |

Some observers have suggested that the answer to this question is that buyers and sellers of cocaine do not have information about purity. Although it is true they do not have the quantitatively precise information that a laboratory analysis would provide, there are many ways for them to obtain approximate information. For example, dealers often distribute free samples to enable consumers to assess purity (Simon and Burns, 1997). Indeed, STRIDE contains over 4,000 records of cocaine acquisitions through free samples. In addition, impure crack cocaine can have a distinctive texture and leave a residue when smoked. Powder cocaine is soluble in alcoholic beverages such as vodka, but many of its impurities are not. |

-

the availability of legitimate employment opportunities? For example, to what extent do increases in legitimate employment opportunities or wages for unskilled labor draw individuals away from drug dealing?

Interest in such questions is not restricted to markets for illegal drugs. Similar questions are routinely asked and answered in economic analyses of markets for legitimate products and labor markets. Indeed, economists have developed theoretical models and statistical methods for studying retail markets and labor markets. There is little doubt that these models and methods can be adapted for application to markets for illegal drugs. The main obstacle to doing so is lack of the required data. The economic analysis of legal markets uses data on prices, purchase frequencies, quantities bought and sold, employment levels, and wages, among other variables. Reliable data of these kinds on markets for illegal drugs do not exist.

And because they do not exist, current knowledge of these markets is based largely on investigations by ethnographers and journalists. Ethnographic and journalistic research has provided invaluable information about the organization of drug markets, their effects on neighborhoods, and the behavior of market participants. The results of this research provide essential inputs to any economic analyses that may be undertaken in the future, but ethnographic and journalistic research is largely descriptive and case-specific. As a result, it has only a limited ability to provide quantitative answers to questions such as the ones listed above. It is the committee’s view that until data required for economic analyses of retail drug markets become available, policy interventions aimed at influencing these markets will be largely shots in the dark, and estimates of the effectiveness of these interventions will be largely speculative.

We summarize below current knowledge and significant outstanding questions about aspects of retail drug markets that are especially important for policy analysis. The topics discussed are the social organization of retail drug markets, price determination in retail markets, issues of labor supply, and the problem of estimating demand functions and price elasticities of demand for illegal drugs.

Social Organization of Retail Markets

The social organization of retail drug markets has been investigated in ethnographic studies. Curtis and Wendel (1999, 2000) have identified three forms of retail organizations in the New York City area: freelance dealers, corporate-style organizations, and socially bonded organizations. The National Development and Research Institutes (1998) have also docu-

merited the existence of such organizations in the crack cocaine trade in New York.

Freelancing tends to be the most visible, disruptive, and violent form of market organization. Socially bonded organizations are based on social ties, such as kinship, ethnicity, and neighborhood. They are held together by personal relationships, are often discreet about their sales practices (for example, they tend not to advertise drugs openly in the street), and are often less violent and disruptive to their communities than are other types of drug-dealing organizations. Some socially bonded organizations provide substantial financial support to the neighborhoods in which they operate. Thus, these organizations are more likely to be tolerated or even supported by neighborhood residents (Curtis and Wendel, 1999). According to Curtis and Wendel (1999, 2000), corporate-style businesses tend to be more visible, violent, and disruptive than are socially bonded ones. Corporate-style organizations are large and hierarchical, often with few opportunities for advancement for street-level employees. The separation of ownership and labor in corporate-style organizations can create serious tensions among employees (Curtis and Wendel, 1999). In discussing implications of different forms of social organization for the effectiveness of efforts by local police to disrupt retail markets and arrest their participants, Curtis and Wendel (2000) conclude that police operations against corporate-style businesses are most likely to succeed. Operations against socially bonded businesses are least likely to succeed.

The implications of different forms of social organization for economic analysis have not been investigated and are uncertain. It is possible though unverified that members of socially bonded organizations are less likely than are freelancers or lower-level corporate employees to respond to legitimate employment opportunities. It is also possible that differently organized businesses have different policies on drug prices and purity. For example, a socially bonded business that sells mainly to residents of the neighborhood in which its members live may charge less or provide higher-quality drugs than does a corporate-style business that is selling to strangers and feels no special ties to the communities in which it operates. However, the committee is unaware of the existence of any research on the relations, if any, among social organization, prices, and purity.

Two studies describe ways that drug markets have changed in response to increased police pressure (National Development and Research Institutes, 1998; Curtis and Wendel, 1999). In New York, there appears to be evidence of geographic substitution. For example, some drug sellers now operate delivery services that take orders by telephone and deliver drugs to customers’ homes or offices. Other businesses allow customers to contact sellers by beeper and then arrange discreet meetings over the telephone. Delivery and beeper services operate out of sight and reduce

the risks of detection by police relative to sales in streets or known drug-dealing locations.

Curtis and Wendel (1999) describe considerable fragmentation of the retail market for drugs in New York City. They report that even within a relatively small geographical area, there are many different markets rather than a single one. For example, some markets exist in bars and sell a highly adulterated form of cocaine to occasional sniffers. Cocaine injectors and freebasers do not purchase such material. Moreover, sellers of highly adulterated powder cocaine in bars do not want to service injectors and freebasers, because doing so would attract unwanted attention.

In an interview with two committee members, Richard Curtis of the John Jay College of Criminal Justice described a situation in which a classical musician in New York sold cocaine to midtown clients, many of whom were in the fashion industry. This seller knew the purity level desired by each client and prepared cocaine accordingly. He sold purer cocaine to freebasing customers than to sniffers. He also charged different customers different prices for the same material, possibly depending on his familiarity with the customer or the customer’s familiarity with market prices.

Curtis also described geographical fragmentation of the market. Customers in midtown or lower Manhattan tend not to travel to Harlem or Washington Heights to buy drugs, although doing so would save them money.

In addition, the risk of detection by undercover police has increased the difficulty that a new customer has in finding a dealer. Curtis reported that it is easy to find low-purity powder cocaine in a bar, but a first-time buyer of purer powder cocaine or of cocaine base is likely to have to operate through a broker. The broker may buy the drug and deliver it to the customer, or he may introduce the customer to the seller. Either way, selling through a broker reduces the risks to the seller and increases the customer’s monetary and search costs. National Development and Research Institutes (1998) has also reported increased use of brokers and middlemen in the retail crack trade in New York.

It is unknown whether market fragmentation like that in New York exists in other cities. If so, then fragmentation undoubtedly explains part of the considerable dispersion of prices that is present in the STRIDE data. (For example, Appendix Figure A.6 shows that agents of the Drug Enforcement Administration pay considerably more for cocaine base in Washington, D.C., than do agents of the Metropolitan Police of the District of Columbia.) Regardless of its geographical extent, the causes of market fragmentation are poorly understood. Moreover, different customer needs, price discrimination by sellers, and geographical separation do not explain all of the variation in cocaine prices. In the interview with

committee members, Curtis reported that cocaine prices in New York can vary greatly over distances of a few blocks. The cause of such variation is not known but seems not to be sellers’ ignorance of the prices that their competitors charge. Sellers, according to Curtis, are well informed about the prices that other sellers charge. Similarly, buyers apparently know many dealers. For example, Riley (1997) reports the results of a survey of drug-using arrestees in six cities. He found that cocaine-using arrestees knew on average between 7 and 26 dealers, depending on the city and the form of cocaine. He does not report whether buyers know the prices that various dealers charge.

Price Determination

The forces that determine the retail prices of illegal drugs are not well understood. It is clear that prices are highly dispersed. That is, there is not a single price of, say, cocaine base in a given market but, rather, a distribution of prices that may be very wide. In Washington, D.C., for example, the retail price of cocaine base can vary among purchase occasions by a factor of two or more (see Appendix Figure A.6). The relation between retail prices and prices at wholesale and other levels is also not well understood. As mentioned earlier, analysts have proposed a variety of models of the relation between retail prices of cocaine in the United States and prices in, say, Colombia, but data that would support a persuasive analysis are not available.

There is some evidence that drug dealers charge different prices to different customers and that prices can be substantially above marginal costs. In a competitive market with fully informed consumers, the price of a good equals the marginal cost of supplying it. No seller can charge more than the market price, and a seller who charges less than the market price will lose money. Price discrimination among buyers is impossible in such a competitive market. However, as noted earlier, drug markets are highly fragmented (at least in New York), and prices vary widely among dealers and among the customers of a given dealer.

Levitt and Venkatesh (1998) provide further evidence on these matters. They analyzed the financial records of a drug-dealing street gang in a large American city.15 They report that gang members attempted to charge buyers whom they thought were naïve higher prices. If price differences among customers do not reflect different costs of serving them,

including costs such as the risk of being arrested or robbed, then price discrimination is being practiced. Although there are many dealers in a large city, the fragmentation of the market may enable them to have local market power (for example, if it is costly for customers to search for another dealer). Levitt and Venkatesh also report that during the 4-year period they studied, the retail price of crack sold by the gang exceeded marginal costs by 25 to 150 percent.16 Their measure of marginal cost captures financial costs but not nonfinancial ones such as the risk of arrest and imprisonment. Nonetheless, the presence of large markups and the existence of price discrimination are consistent with local market power and noncompetitiveness in the market studied by Levitt and Venkatesh (1998).

The causes of market fragmentation and noncompetitiveness are not clear. For example, if dealers know the prices that are charged by their competitors, why is it that low-price dealers do not raise their prices to levels comparable to those of high-price dealers? If buyers know many sellers, why do they not seek a seller with a low price? Do prices vary systematically according to the social organization of the seller’s operation (e.g., corporate style, socially bonded, etc.)? How important are search costs and nonprice factors to buyers? Does the extent of market fragmentation vary with the level and type of law enforcement? The answers to these questions are unknown.

The committee recommends research on how illegal drug prices are determined. Much law enforcement activity is aimed, at least in part, at increasing the price of drugs. Without reliable knowledge of how retail prices are determined, one can only speculate about the effectiveness of such programs.

Ethnographers who study drug dealers and consumers can carry out some of the needed research. For example, an ethnographer could ask sellers for information about their prices and could ask consumers about their knowledge of prices charged by different sellers. An ethnographer might also be able to monitor price levels in a neighborhood and ask dealers about the causes of any large price changes that occur. The resulting information would not necessarily have the theoretical and statistical validity of the results that economists obtain with formal models and large survey datasets, but it has the potential to provide increased understanding of important but poorly understood aspects of retail drug mar-

kets. Other research issues are more difficult to address. For example, persuasive research on the relation between retail and wholesale prices will not be possible unless and until improved price data become available.

Labor Supply Issues

It is likely that the prices of illegal drugs and the difficulty of obtaining them would increase if substantial numbers of retail dealers could be induced to accept legitimate employment in place of drug dealing. Higher prices and search costs, in turn, would tend to decrease drug consumption. Thus, it is useful to investigate the extent to which drug dealers respond to changes in legitimate employment opportunities. The central issue is the extent to which drug dealers move between illegal and legal employment in response to changes in employment opportunities, relative wages, and relative risks.

Labor economists have developed sophisticated models and statistical techniques for investigating individuals’ decisions to participate in the labor force or not, the process of searching for employment, and the means by which employees are matched to employers. However, empirical investigations of these topics rely on large cross-sectional and longitudinal datasets that provide detailed information about the employment status and history, earnings, education, and personal characteristics of probability samples of individuals. Similar data pertaining to actual and potential drug dealers do not exist. Therefore, it has not been possible to use the methods of labor economics to study labor supply in markets for illegal drugs.

There have, however, been several ethnographic and other less formal studies of labor supply in retail drug markets. These have taken place in several different cities, have gathered information from nonrandom and arguably nonrepresentative samples of individuals, and have reached conflicting conclusions.17 Simon and Burns (1997) studied a drug-dealing neighborhood in Baltimore, MD. They report that many of the drug dealers they encountered lacked the skills, self-confidence, and motivation needed to obtain and hold legitimate jobs. Richard Curtis (in an interview with committee members) reported that most of the dealers he knows in New York hold legitimate jobs and sell drugs on the side. He said that he had not seen dealers move in and out of the legitimate labor market.

MacCoun and Reuter (1992:477) studied arrested drug dealers in Washington, D.C., during the mid 1980s. They report that most members of their sample had legitimate employment in addition to drug selling, concluding that “drug selling seemed to be a complement to, rather than a substitute for, legitimate employment.”

Fagan (1992), who studied labor force participation by drug dealers in the Washington Heights and Central Harlem sections of New York during the mid-1980s, reached a different conclusion. Fagan estimated an econometric model of the relation between participation in the legitimate labor force, drug-dealing activities, and indicators of skills, such as education levels. He found that increased drug market participation was associated with decreased participation in the legitimate labor force. Thus, drug selling and legitimate employment were substitutes. Fagan also found that increased education was associated with increased participation in legitimate labor. Fagan does not report how relative opportunities for legitimate and illegitimate employment may have changed over time or how individuals’ employment arrangements (legal versus illegal) may have changed. Fagan’s findings are suggestive but do not necessarily imply that increased opportunities or wages in the legitimate labor force attract drug dealers away from dealing. It is possible, for example, that, as in the Baltimore neighborhood studied by Simon and Burns (1997), the skills and motivation of those who sell drugs are so poorly matched to the needs of legitimate employers that no realistic change in relative employment opportunities would move them from drug dealing to legitimate jobs. Indeed, Fagan (1992:129) concluded that “in Central Harlem drug sellers are recruited largely from a universe of nonworkers who otherwise might not be in the labor force at all or would be engaged in other types of crime.” Similarly, he concluded that drug selling in Washington Heights “apparently attracts workers with less human capital, people who might not otherwise fare particularly well in the formal economy.”

Levitt and Venkatesh (1998) provide limited evidence for movement of drug dealers between legitimate and illicit employment. They quote one member of the gang they studied as saying that he quit his job at a fast food restaurant when he started earning a relatively high income by selling drugs but returned to the restaurant job when his drug-related earnings decreased. Levitt and Venkatesh also report that in the last year of their study, gang members’ wages from selling drugs increased substantially and their participation in the legitimate labor market decreased.

In summary, the available evidence is incomplete and conflicting on the extent to which drug dealing is a substitute for legitimate employment. A much better understanding of labor force participation and supply by drug dealers and potential drug dealers could be obtained if the

data needed to apply the methods of labor economics were available. The committee recommends survey research on the labor supply of illegal drug dealers. The Current Population Survey and the National Longitudinal Surveys, among others, routinely gather data on the supply of legitimate labor. Surveys using questions similar to those in the Current Population Survey and National Longitudinal Surveys could be carried out in drug-dealing neighborhoods of a few large cities. The surveys could be carried out over a period of years, and it is likely that many of the same individuals could be reinterviewed periodically, thereby providing longitudinal data. Methods such as those developed by the National Household Survey of Drug Abuse could be used to maintain confidentiality of responses and to ensure that respondents are not put in legal jeopardy by their answers to questions.

Estimating Demand Models and Price Elasticities