Page 66

3

Work, Retirement, and Pensions

Labor market participation and patterns of work among older men and women have changed dramatically over the past 20 years, as have pension systems and sources of retirement income. There are many key economic, health, and social factors behind these changes. Yet, as emphasized in Chapter 1, not all countries or all individuals within a country have experienced the same trends, and understanding these differences is central for identifying the key determinants of the changes that have occurred. Achieving such understanding, in turn, requires the collection of detailed scientific data for comparative study. The objective of this chapter is to set forth some basic facts about these changes, drawn from a wide range of experience across countries, and to suggest minimal data requirements for the successful understanding of these phenomena. A central theme is that much can be learned from careful comparative analyses of policy reforms and changes in work and retirement behavior across countries.

With regard to work patterns, there is evidence that retirement increasingly occurs in different forms (Lazear, 1986; Organization for Economic Co-operation and Development, 1995a; National Research Council, 1996). In fact, many countries that have experienced a decrease in labor market attachment among older workers have done so without any change in the normal retirement age. Although social norms and the demand for the labor supplied by older workers play a role, changes in retirement patterns also depend heavily on the precise form of early retirement provisions in pension and social security plans, as well as on the structure of income support and welfare programs for older individuals

Page 67

(Burtless and Moffitt, 1984; Börsch-Supan and Schnabel, 1998, 1999). As a result, data with which to study retirement will need to include a wide range of information on potential income sources and earning opportunities (National Research Council, 1997; Hurd, 1998). Moreover, the collection of these data must begin much earlier than at normal retirement age, possibly as early as age 45. Health status also plays a role in retirement decisions (Bound et al., 1999), and it will therefore be necessary as well to stress the importance of accurate health and disability information. It may well be that changes in workplace environment or even the act of retirement itself may affect health and disability outcomes. Longitudinal data that record the timing of these work, retirement, and health events are therefore essential.

A further complication arises from the need to compute accurate summary measures of retirement incentives. As discussed below, different countries and different individuals within a country vary considerably with regard to the mix of private and public pension entitlements. Moreover, contribution periods and contribution rules can pose significant challenges for lifetime data collection. However, relatively simple summary measures can be collected through a sensible mix of longitudinal survey data and access to administrative sources. Indeed, the need to supplement standard sample survey data with administrative data is a major requirement for accurate analysis and inference, a theme to which we return in Chapter 8.

Measuring the work opportunities for older individuals requires careful consideration of the changing demand for older workers (Straka, 1992; Organization for Economic Cooperation and Development, 1995b). For example, the earnings profiles of those who remain in work may provide a misleading guide to the earnings opportunities of those who leave the labor force early. This will be especially true if those who withdraw early are predominantly from a single skill group or industry. For measuring changes in work opportunities there is no real alternative to having accurate earnings histories with skill and occupational information.

Comparative analysis is particularly effective in enhancing understanding of the issues surrounding work and retirement, and there already exist many successful comparative studies in this area (see, e.g., Quinn and Burkhauser, 1994; Gruber and Wise, 1998, 1999; Johnson, 1999; Hermalin and Chan, 2000; Borsch-Supan, 2000b; Disney and Johnson, in press). These studies have documented the differing experiences of various countries and have significantly enhanced understanding of the retirement process. Comparisons are particularly instructive among countries that have experienced differing trends in retirement but, on the basis of standard economic and demographic statistics, might otherwise appear rather similar.

Page 68

A sophisticated comparative analysis can exploit changes in policy rules across countries to isolate the impact of policy from that of other macroeconomic and social changes. Gruber and Wise (1999) managed to uncover three important features in their analysis of 11 developed countries that could not easily be discerned from single-country studies. First was a strong correspondence between early and normal retirement ages and departure from the labor force. Second, public pension provisions in most countries were found to place a heavy tax burden on work past the age of early retirement eligibility and thus to provide a strong incentive to withdraw early from the labor force. Third, the implicit tax—and thus the incentive to leave the labor force was found to vary substantially among countries, as did retirement behavior. Through such cross-national comparisons, then, some general conclusions about the relationship between retirement incentives and retirement behavior can begin to be drawn.

The remainder of this chapter provides more detail on these issues. First, we consider the evidence on patterns of work and retirement across countries and highlight common trends, as well as note interesting differences in behavior. The following section addresses the measurement of retirement incentives and how they differ across countries. It also considers important policy reforms from around the world and their likely impact on retirement behavior. Finally, we take stock of the implications of these changes for data collection that is adequate to enable the accurate description of work patterns and retirement incentives at the approach of retirement age and thereafter. We realize that there are other, related issues that are not emphasized here. Some, such as the importance of health status and wealth, are discussed more thoroughly elsewhere in this volume; others are mentioned briefly at the end of this chapter.

PATTERNS OF WORK AND RETIREMENT AROUND THE WORLD

This section reviews labor force participation rates for men and women across a wide array of countries. These contrasts are of interest in themselves, but they take on special relevance in any examination of the determinants of retirement behavior. They highlight the importance of comparative analysis by showing that countries that for most part are rather similar economically and demographically can display considerable variation in retirement pattern. Along with more detailed individual-level data, such comparisons offer some hope for teasing out the main explanations for the observed variations in retirement behavior.

While assessing the evidence on labor force participation, it is important to anticipate the discussion in the next section of the incentives to retire faced by individuals at older ages and consequently the mecha-

Page 69

nisms by which people support themselves when out of the labor market. This often means examining the role of early retirement. For example, Table 3-1 reveals that male labor force participation rates fall well before normal ages of retirement, indeed often well before eligibility for public pensions.

To study these aspects of retirement and retirement income requires an understanding of the full range of potential sources of income for older individuals, including disability schemes and private pensions in addition to public pension or social security arrangements. Recent reforms in pension systems and the growth of private schemes in many countries increase the range of data needed to adequately describe retirement incentives, a point to which we return in detail in the concluding section of the chapter.

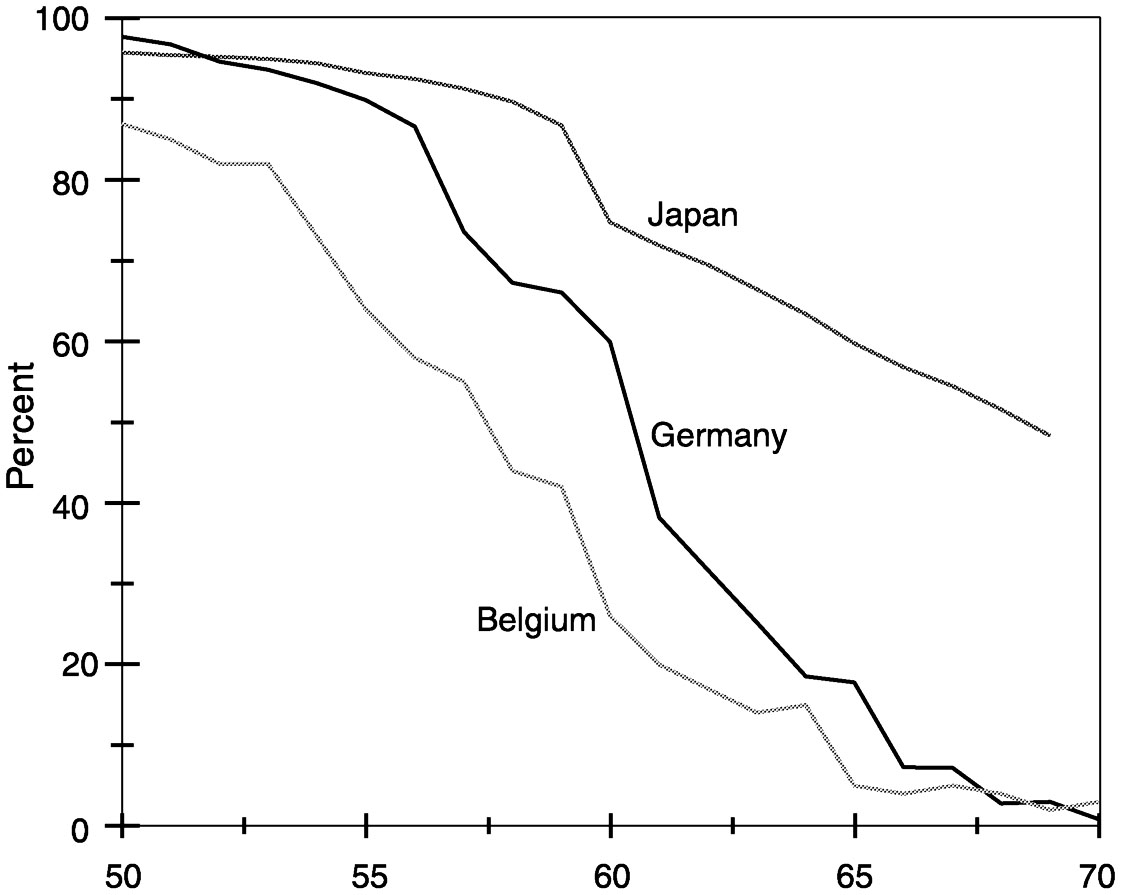

The declining labor force participation of older persons and the general increase in female participation are the most significant feature of labor force change in the developed world over the past several decades. However, these changes have not been experienced in many developing countries, and there are vastly different trends even among developed countries in this regard. Japan and Belgium provide two of the most dramatic extremes. Figure 3-1 presents this contrast, with Germany included for comparison. The figure shows a surprisingly large decline in male participation with age in Belgium. By age 69, virtually no men in

|

Pension Age |

Employment Rates (%) |

|||

|

Country |

Normal |

Early |

At Age 59 |

At Ages 60-64 |

|

Sweden |

65 |

60 |

74 |

49 |

|

United Kingdom |

65 |

60 |

62 |

50 |

|

United States |

65 |

62 |

74 |

53 |

|

Germany |

65 |

60 |

81 a |

35 |

|

Italy |

60 |

55 |

47 |

30 |

|

Netherlands |

65 |

60 |

57 a |

19 |

|

Australia |

65 |

60 |

73 |

47 |

|

Japan |

65 |

60 |

87 |

76 |

|

New Zealand b |

65 |

63 |

80 a |

50 |

aRefers to ages 55-59.

bPension age in New Zealand is currently being raised from 60 to 65; see

Table 3-2.

SOURCES: Gruber and Wise (1999); Johnson (1999).

Page 70

FIGURE 3-1 Labor force participation rates for men aged 50-70 in three countries: Early-to-mid 1990s. SOURCE: Gruber and Wise (1999). Reprinted with permission.

~ enlarge ~

Belgium are working, whereas in Japan, almost half are still in the labor force. Indeed, most men in Belgium are no longer in the labor force at age 65, and only about a quarter are working at age 60. In Japan, on the other hand, nearly two-thirds are working at age 65 and three-quarters at age 60.

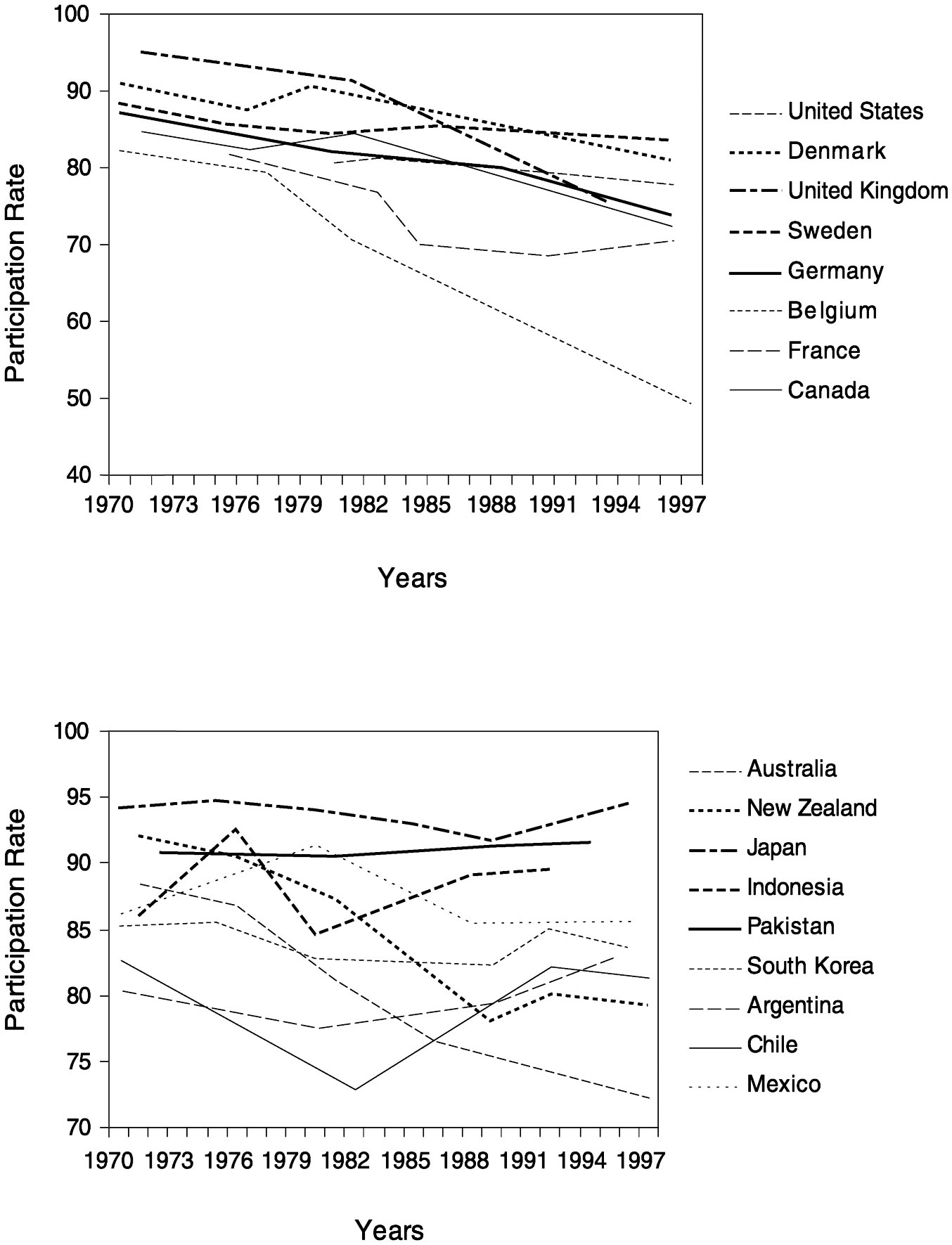

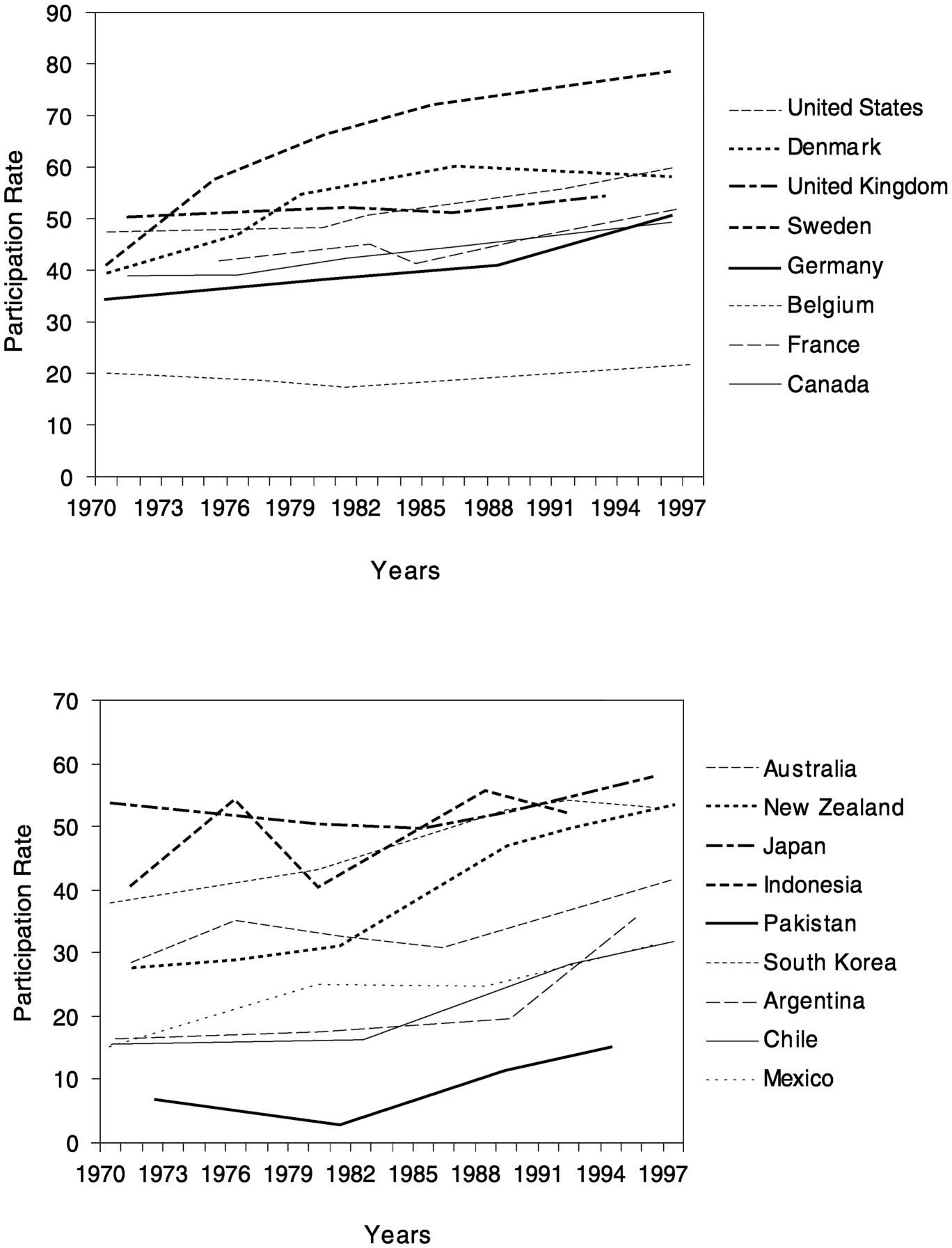

Figure 3-2, for Europe and North America and for Australasia and Latin America, respectively, shows the labor force participation rates of men aged 55 to 59 since 1970. Even at these early ages, before early retirement ages in most public pension systems, wide differences in participation are apparent. As we have seen, Belgium has extremely low levels of participation; the situation there contrasts with that in Sweden, Denmark, and the United States, where participation rates have remained at about 80 percent. Figure 3-2 shows the strong decline in Australia, which contrasts with the relatively stable rates in Japan.

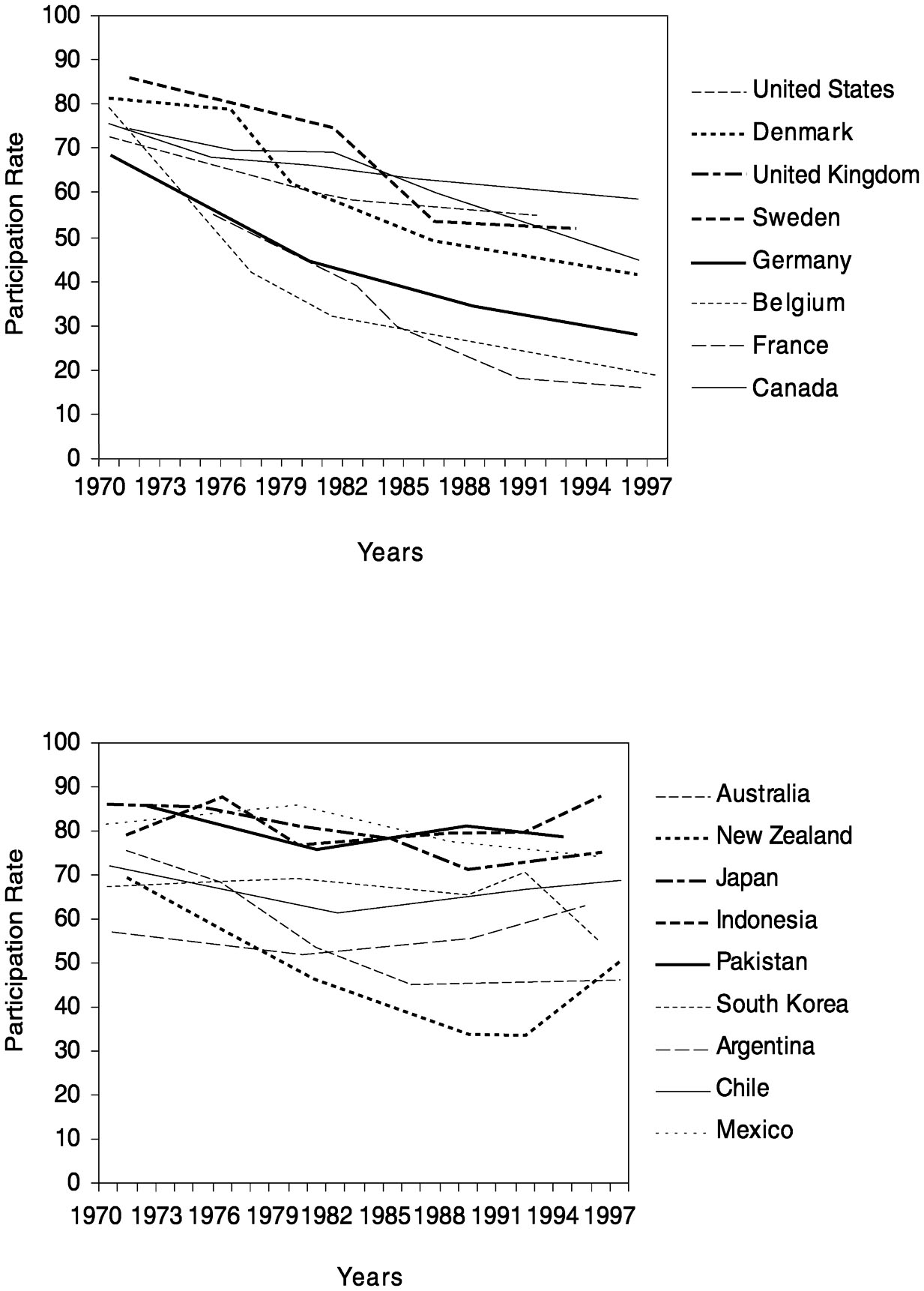

It is above age 60 that differences across countries are most apparent (see Figure 3-3 and Figure 3-4). Figure 3-3 shows the sharp declines in France, Belgium, and Germany, which contrast with the much higher participation rates in the United States and Sweden. Among Australasian and Latin American countries, there are equally sharp declines in Australia

Page 71

FIGURE 3-2 Labor force participation rates for men aged 55-59 in two regions: Circa 1970 to circa 1998. NOTE: Top panel—Europe and North America, bottom panel—Australasia and Latin America. SOURCE: International Labour Office, various years.

~ enlarge ~

Page 72

FIGURE 3-3 Labor force participation rates for men aged 60-64 in two regions: Circa 1970 to circa 1998. NOTE: Top panel—Europe and North America, bottom panel—Australasia and Latin America. SOURCE: International Labour Office, various years.

~ enlarge ~

Page 73

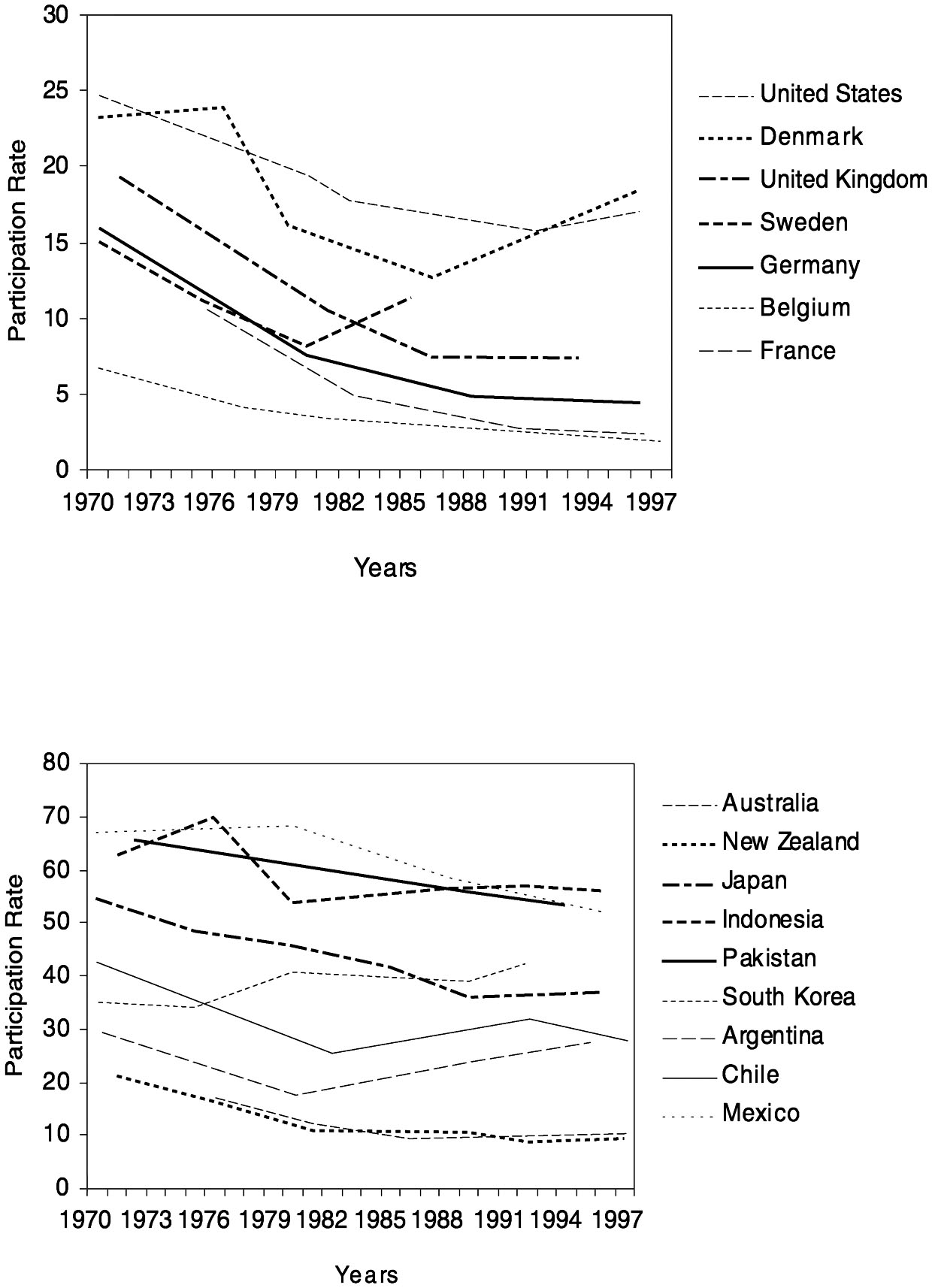

FIGURE 3-4 Labor force participation rates for men aged 65 and over in two regions: Circa 1970 to circa 1998. NOTE: Top panel—Europe and North America, bottom panel—Australasia and Latin America. SOURCE: International Labour Office, various years.

~ enlarge ~

Page 74

and New Zealand, whereas participation rates remain high in Indonesia and Japan.

An intriguing feature of Figure 3-3 is the rise in participation rates experienced by New Zealand in the mid- to late 1990s. This increase closely follows the raising of the retirement age to 65 and the change in indexation of retirement benefits, which is discussed further in the next section. Note from Figure 3-4 that there is little impact on those men aged 65-plus. Indeed, the retirement behavior of men of this age in New Zealand and Australia looks quite similar. The contrast for women is even more illuminating, as discussed below.

In general, the participation rates among men over age 65 show the most interesting variation in the Australasian and Latin American countries. Outside of New Zealand and Australia, men in this age group in these countries have relatively high participation rates. Men in Indonesia, Mexico, and Pakistan, for example, maintain rates above 50 percent into their late 60s. Of course, this high level of participation reflects in part less wealth than that of comparable men represented in the top panel of Figure 3-4. Similar experience has been documented in other developing countries. For example, Hermalin and Chan (2000) show high rates of male participation in Thailand and the Philippines. However, as that study also points out, such high rates are not common to all developing countries and depend on pension rules and coverage (the latter often being limited and highly selective), health factors, and family arrangements (see also Raymo and Cornman, 1999; Yashiro, 1997).

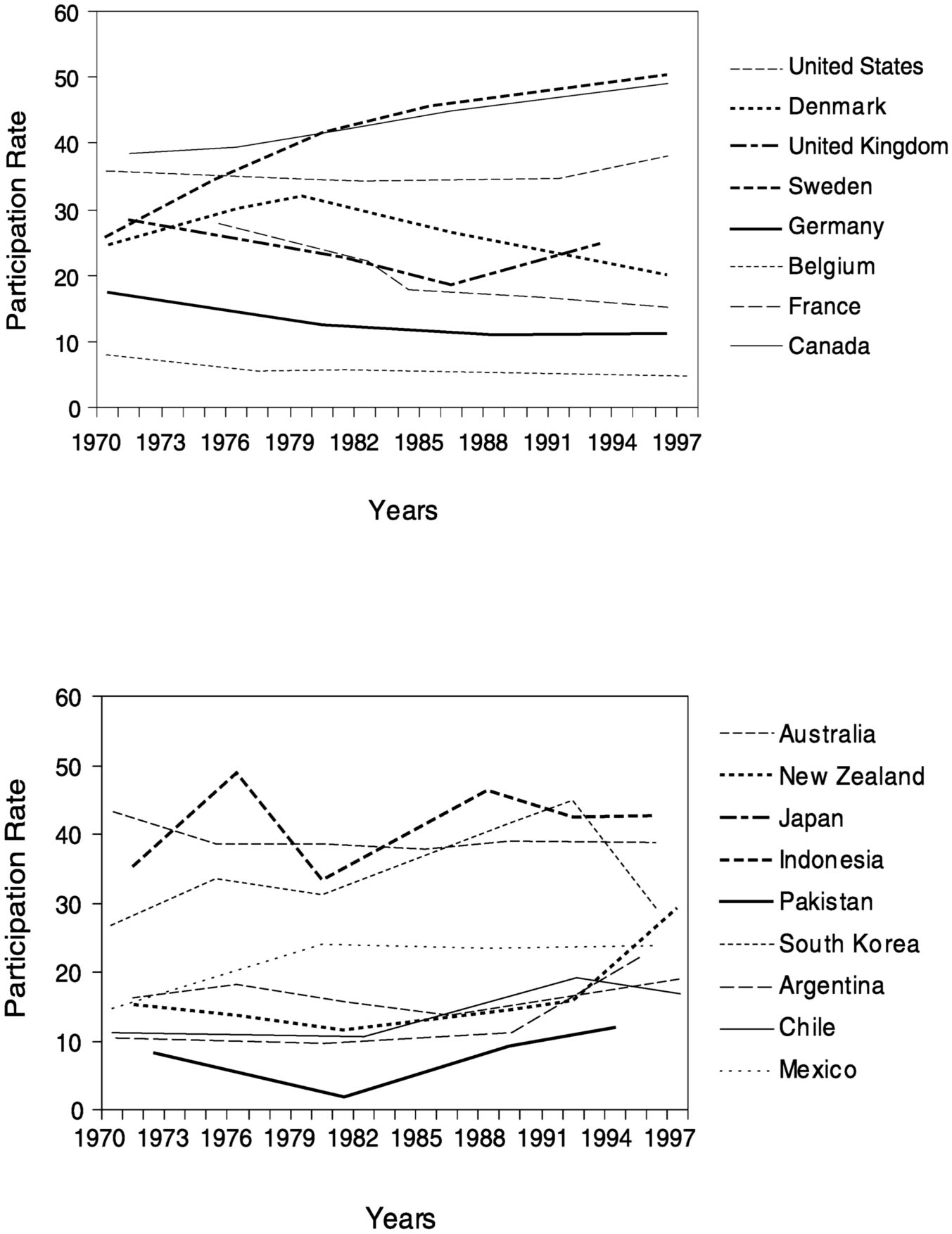

Underlying these changes in participation rates over time are secular changes experienced by all age cohorts, as well as aging effects experienced by each cohort through its lifetime. This is particularly the case for women. Figure 3-5, for example, shows the participation rates of Swedish women aged 55-59 increasing year by year. However, if we look at the behavior of the 1976 cohort in 1981, when they are in the 60-64 age group presented in Figure 3-6, we see the participation rate has fallen from around 58 percent to about 42 percent. Younger cohorts of women in many countries are exhibiting a high rate of labor market participation at all stages in their life cycle. But it is still true that their participation rate declines, often quite dramatically, with age. Thus for each cohort group, patterns of retirement for women can match quite closely the declines experienced by their male counterparts, even though their overall participation rates at older ages are often observed to rise steadily.

One useful contrast for older women is displayed in Figure 3-6, which shows falling rates of participation in France and extremely low rates in Belgium, mirroring the low attachment at older ages for men in both of these countries. These figures can be compared with the rising rates for older women in Sweden and the United States.

Page 75

FIGURE 3-5 Labor force participation rates for women aged 55-59 in two regions: Circa 1970 to circa 1998. NOTE: Top panel—Europe and North America, bottom panel—Australasia and Latin America. SOURCE: International Labour Office, various years.

~ enlarge ~

Page 76

FIGURE 3-6 Labor force participation rates for women aged 60-64 in two regions: Circa 1970 to circa 1998. NOTE: Top panel—Europe and North America, bottom panel—Australasia and Latin America. SOURCE: International Labour Office, various years.

~ enlarge ~

Page 77

Low rates of female participation among women over age 60 have been a common feature in New Zealand and Australia. This situation reflects in part the state pension system and the retirement age for women, which, as in the United Kingdom, was set historically at 60. The impact of a rise in this age in New Zealand is again clearly displayed in the increasing participation rate for that country in Figure 3-6. This increase is much more dramatic than that in neighboring Australia, where a similar reform to the normal retirement age is being introduced at a much slower rate (see the discussion of Table 3-2 below).

In summary, not only do participation rates vary widely across countries, but they also show dramatic changes across time within countries. It is this difference in the participation rates across and within countries that presents an opportunity to use comparative analysis to identify the factors underlying such changes. Moreover, the size and systematic nature of these variations offer some hope that the major determinants of the differences can be revealed through careful statistical analysis.

RETIREMENT INCENTIVES AND PENSION ARRANGEMENTS

Researchers have long been interested in the dynamics of work and retirement (see, e.g., Sheshinski, 1978; Rust, 1989; Lumsdaine et al., 1992; Blau, 1994; Johnson et al., 1998; Tanner, 1998). Perhaps the most important argument in favor of more systematic collection of data on work and retirement is the opportunity to understand how features of retirement and other programs affect these decisions. To achieve such understanding requires evaluating the incentive effects of the provisions of retirement programs, which in turn depend both on the provisions and on individual work histories, marital status, and other individual and family circumstances. Thus it is important to be able to match detailed plan provisions with individual data.

Individual employment and earnings histories differ widely, as do individual retirement plans. For some countries, self-employment and part-time work among older workers are a growing feature of staged early retirement. In many nations worldwide, the growth of dual-career families almost certainly will have an influence on retirement patterns. Also in some countries, private retirement plans are becoming increasingly important and can involve difficult data requirements concerning the history of employer and employee contributions. Disability benefits and other welfare programs are also likely to be important in understanding patterns of retirement (see, e.g., Piachaud, 1986; Disney and Webb, 1991; Manton et al., 1997). Alongside the obvious need for detailed health and asset information, these considerations shape the data demands we consider briefly below.

Page 78

Public Pension Reforms and Features

Table 3-2 illustrates the general types of reform that have occurred across a selection of Organization for Economic Cooperation and Development (OECD) countries. Shown are changes in normal retirement ages, in indexation procedures, and in pension calculations that have been introduced in recent years in each country. A majority of countries have seen some planned increase in retirement age or in the minimum years of contribution required to earn a full pension, at least for women. Recall the discussion in the last section of participation rates for women and men in New Zealand.

In many countries, benefits are indexed to some measure of inflation. As of the end of the 1990s, few countries indexed their pensions to gross wages (Australia being an important exception), although a majority had employed gross wage indexation in the previous two decades. A wage index is generally thought to reflect price increases plus growth in worker productivity, and thus leads to larger increases than indexation to a price index. Indexing benefits to a consumer price index is now common. The changes reduce the level of benefits or, equivalently, delay the age at which benefits can be received. Most countries employing an earnings-related scheme have made adjustments that will have the effect of reducing the eventual replacement rate; popular changes include expanding the earnings base on which the eventual pension is calculated.

For purposes of summarizing public pension reforms, Disney and Johnson (in press), from which much of this discussion is drawn, group OECD countries into a small number of broad categories. For example, France, Germany, and Italy have generous earnings-related public systems that provide high levels of benefits to most pensioners on the basis of a comprehensive system of social insurance. The United States, the United Kingdom, Japan, and Canada also employ earnings-related schemes. In the case of the two North American countries, however, these schemes are explicitly redistributive 1 and provide much lower replacement rates to high than to low earners. In the United Kingdom, there is an earnings-related pension, but it was introduced recently and is relatively small by comparison with the main flat-rate basic pension. Japan also has a mixed system, combining a flat and an earnings-related pension. New Zealand and the Netherlands both have flat-rate public pension schemes, and in both cases the pension is paid purely on the basis of past residence in the country, not a contributory record. Finally, Aus-

1Although the redistributive impact of Social Security in the United States all but disappears when a life-time view of incomes and differential mortality is accounted for (see Coronado et al., 2000).

Page 79

|

Country |

Changes to Pension Age |

Changes to Indexation |

Changes to Benefit Calculation |

|

Australia |

Phased rise in pension age for women from 60 to 65 by 2013. |

Indexation to wages formalized in 1997. |

Ongoing tinkering with details of means test. |

|

New Zealand |

Rising from 60 to 65 in 2001. |

Indexation to prices since 1993 but not to fall below 65% of average earnings. |

Surcharge introduced but now being withdrawn, |

|

Canada |

None planned. |

Already price indexed. |

Introduction of a clawback on basic pension; series of minor changes to financing and benefits of second tier. |

|

France |

Minimum contribution duration rising from 37.5 to 40 years, reducing chance of retiring at 60. |

Price indexation since 1987. |

Wage base for pension calculation rising from best 10 years to best 25 years; earnings revalued to retirement by prices. |

|

Germany |

Women's pension age rising from 60 to 65 by 2004. Actuarial reductions being introduced for retirement before 65. |

Indexation to net wages rather than gross wages from 1992. |

1999 reform to cut replacement rate after 40-year earnings history from 72 to 64 percent; to be phased in through link to life expectancy. |

|

Italy |

Complex reforms raising pension ages and minimum years of contribution. |

Move from wage to price indexation in 1992. |

Move from traditional defined-benefit public scheme to “virtual” defined contribution, effectively based on each year's salary. |

|

Japan |

Age for receipt of basic pension rising from 60 to 65 between 2001 and 2013. |

Move from gross wage to net wage indexation. |

1985 act put a ceiling on pensions of 68 percent of average lifetime earnings. |

|

United Kingdom |

Women's pension age to rise from 60 to 65 between 2010 and 2020. |

Basic pension indexed only to prices since 1980, greater of prices and earnings before that. |

State earnings-related pensions based on average earnings, not best 20 years, to replace 20 percent of earnings, not 25 percent. Generosity to widows cut. |

|

United States |

Rising from 65 to 66 in 2009 and to 67 by 2027. |

Price indexation. |

No information. |

Page 80

tralia is the only major country in which the public pension system consists entirely of a means-tested benefit for pensioners.

Table 3-3 and Table 3-4, drawn from Disney and Johnson (in press) illustrate for a set of OECD countries the pension a single person would re-

|

Country |

Net Replacement (%) |

Gross Replacement (%) |

Net over National Average (%) |

Gross over National Average (%) |

|

Canada |

||||

|

Half |

76 |

59 |

50 |

35 |

|

Average |

44 |

31 |

51 |

37 |

|

Twice |

25 |

15 |

51 |

37 |

|

France |

||||

|

Half |

84 |

68 |

48 |

39 |

|

Average |

84 |

70 |

95 |

79 |

|

Twice |

73 |

56 |

165 |

136 |

|

Germany a |

||||

|

Half |

67 (79) |

48 |

34 (40) |

24 |

|

Average |

72 |

45 |

72 |

45 |

|

Twice |

75 |

40 |

150 |

80 |

|

Italy |

||||

|

Quarter |

103 |

103 |

32 |

24 |

|

Average |

90 |

78 |

82 |

72 |

|

Three times |

85 |

70 |

192 |

193 |

|

Netherlands |

||||

|

Half |

73 |

63 |

41 |

32 |

|

Average |

43 |

32 |

41 |

32 |

|

Twice |

25 |

16 |

41 |

32 |

|

United Kingdom |

||||

|

Half |

72 |

63 |

25 |

19 |

|

Average |

50 |

44 |

34 |

26 |

|

Twice |

35 |

33 |

48 |

39 |

|

United States a |

||||

|

Half |

65 |

47 |

32 |

23 |

|

Average |

55 |

38 |

55 |

38 |

|

Twice |

32 |

21 |

64 |

42 |

Page 81

|

Country |

Net Replacement (%) |

Gross Replacement (%) |

Net over National Average (%) |

Gross over National Average (%) |

|

Australia a |

||||

|

Half |

N/A |

N/A |

33 |

25 |

|

Average |

N/A |

N/A |

33 |

25 |

|

Twice |

N/A |

N/A |

33 |

25 |

|

New Zealand |

||||

|

Half |

75 |

66 |

38 |

33 |

|

Average |

38 |

33 |

38 |

33 |

|

Twice |

19 |

15 |

38 |

33 |

|

Japan |

||||

|

Half |

77 |

68 |

N/A |

36 |

|

Average |

56 |

49 |

N/A |

49 |

|

Twice |

43 |

36 |

N/A |

72 |

aThe figures for Australia are for the maximum benefit. Replacement rates are not really relevant in this means-tested system.

NOTES: The replacement rate is calculated on the basis of the earnings distribution among workers approaching retirement age. N/A = not available.

ceive. This is expressed as four different proportions: (1) net pension as a proportion of previous net earnings, (2) gross pension relative to previous gross earnings, (3) net pension as a proportion of national average net earnings, and (4) gross pension as a proportion of national average gross earnings. These figures are calculated on three bases: (1) for someone with half average earnings during his/her life, (2) for someone with average earnings, and (3) for someone with twice average earnings. Naturally this is a great simplification in that there is a broad range (the bases for Italy are different, as shown in Table 3-3) of possible earnings histories that can result in a large variety of eventual pension payments, but the figures provide a good illustration of the nature and generosity of the various systems.

The results are as expected. Italy, France, and Germany all have very high replacement rates at all levels of income considered. Note also that in these countries, pensioners with histories of high earnings receive pensions from the state that provide them with an income that is higher than the average earnings of current workers.

Despite having important earnings-related elements, the systems of

Page 82

the United Kingdom, the United States, and Canada provide lower replacement rates for higher than for lower earners. This is also true for Japan (see Table 3-4). Indeed, Canada has almost a flat-rate system. Naturally the flat-rate Dutch and Australian systems offer the same cash level of benefits whatever the previous earnings history and thus, relative to earnings, provide higher retirement incomes to low than to high earners. Two further issues are worthy of special attention in examining work incentives in public pension schemes: the treatment of spouses and indexation.

Treatment of Spouses

There are two notable features of the treatment of spouses. The first is that in fully earnings-related social insurance systems, only those who have been in the labor market earn pensions in their own right, and married couples may receive no additional benefits at all. Married women pensioners in such countries are likely to enjoy less financial independence than those in countries such as New Zealand and the Netherlands where the benefit system is not work related. In a sense, the state systems in Germany, France, and Italy almost mimic private provision in a number of other countries. They involve neither redistribution from rich to poor nor, to a major extent, redistribution from men to women. Second, in those countries that do provide extra pensions for couples, the relative size of the pensions of single persons and married couples is quite similar across countries, with the former tending to be in the range of 60-70 percent of the latter.

Indexation

One of the most important features of any pension system is the way in which benefits are indexed. On the whole, the changes that have occurred have been toward less generous indexation procedures. Indexation of benefits in accordance with some form of earnings index ensures that the incomes of pensioners will keep pace with the general living standards of the rest of the population. Indexation of benefits in line with prices will maintain the same real standard of living for the pensioner, but a declining standard relative to other groups in the population. Indexation at a lower rate than this results in declining living standards.

In countries with an earnings-related system of benefits, there is another important aspect of indexation, which concerns how earnings are revalued to retirement to calculate the initial pension level. Most OECD countries effectively revalue in line with a measure of earnings growth. But this does not mean that once in payment, pensions must rise in line

Page 83

with earnings growth. State earnings-related pensions in the United Kingdom are a good example (see, e.g., Creedy et al., 1993; Dilnot et al., 1993). The initial payment is calculated by reference to previous earnings uprated to the year of retirement using an earnings index. But once in payment, the pension is raised each year only in line with prices. One interesting development has been that in recent years, both the Germans and Japanese have moved toward indexing their earnings-related pensions to a measure of after-tax earnings growth rather than of gross wages.

Retirement Incentives and Public Pensions

Two central features of public pension plans have an important effect on labor force participation incentives. The first is the age at which benefits are first available, called the early retirement age (see Table 3-1). The “normal” retirement age is also important, but typically much less so than the early retirement age. The extent to which people continue to work after the early retirement age is closely related to the second important feature of plan provisions, the pattern of benefit accrual. Suppose that at a given age a person has acquired entitlement to future benefits upon retirement. The present discounted value of these benefits is the person's public pension wealth (PPW) at that age (PPWa). The key consideration for retirement decisions is how this wealth will evolve with continued work. If a man is aged 59, for example, what is the change in PPW if he retires at age 60 instead of age 59? The difference between PPW if retirement is at age a and PPW if retirement is at age a + 1, PPWa+1 − PPWa, is called PPW accrual.

PPW accrual can be compared with net wage earnings over the year. If the accrual is positive, it adds to total compensation from working the additional year; if the accrual is negative, it reduces total compensation. The ratio of the accrual to net wage earnings is an implicit tax on earnings if the accrual is negative and an implicit subsidy to earnings if the accrual is positive. Thus a negative accrual discourages continuation in the labor force, and a positive accrual encourages continued participation. This accrual rate, along with the associated tax rate, is a key calculation in explaining individual retirement decisions. Table 3-5 presents accrual rate computations for public pensions across a number of countries. The pension accrual is negative at older ages in many countries. Consequently, continuation in the labor force means a loss of pension benefits, which imposes an implicit tax on work and provides an incentive to leave the labor force.

The magnitude of PPW accrual is determined by several provisions. The most important of these is the adjustment to benefits if a person

Page 84

works for another year. An additional year of work means a delay in receiving benefits, which will be received for one fewer year. In some countries, an “actuarial” adjustment is made such that benefits are increased to offset the fact that they are received for fewer years. In other countries, however, there is no such adjustment. The greater the adjustment, the greater is the inducement to continue working. If the adjustment is not large enough to offset the fewer years of benefit receipt, however, there is an incentive to leave the labor force. Second, a person who continues to work generally must pay taxes on earnings, lowering net public pension accrual. These tax payments make retirement more attractive. Third, the additional year of earnings is often used in the recomputation of public pension benefits, which are typically based on some measure of lifetime average earnings. Since earnings are often higher later in life than earlier, net accrual may rise, making retirement less attractive. This effect may be especially important for the younger old who are not fully vested in their public pension systems until they have paid in for some minimal number of years. Finally, a delay in receiving benefits raises the odds that the worker might die without being able to collect any benefits. This may be an important consideration for the oldest workers.

There is no completely satisfactory way to summarize the country-specific incentives for early retirement. 2 One crude measure is based on continued labor earnings once a person is eligible for public pension benefits. Gruber and Wise (1999) sum the implied tax rates on continued work beginning with the early retirement age—when a person is first eligible for public pension benefits—and continuing through age 69. They call this the “tax force” to retire (see the second-to-last column of Table 3-5).

Table 3-5 indicates a strong relationship between unused labor capacity and the tax rate on continued work. To understand the relationship more clearly, it is useful to divide the countries into three groups: (1) those with high unused capacity (Belgium, France, Italy, the Netherlands, and the United Kingdom); (2) a group with medium unused capacity (Germany, Spain, and Canada); and (3) a group with low unused capacity (the United States, Sweden, and, in particular, Japan). The average replacement rate at early retirement in the first group is 76.6 percent of median earnings, and the average tax on continued labor earnings in that year is 91.8 percent. In the third group, with the least unused labor capacity, the average replacement rate at the early retirement age is 50 percent, and the tax rate on continued earnings is 24.7 percent. These com-

2For a look at incentive effects in different nations and various problems related to their measurement, see Disney et al., 1994; Baker and Benjamin, 1996; Meghir and Whitehouse, 1997; Disney and Whitehouse, 1999; Peracchi and Viviano, 1999; and Börsch-Supan, 2000a.

Page 85

|

Country |

Unused Labor Capacity, Age 55 to 65 (%) a |

Replacement Rate at ER Age (%) b |

Accrual in Next Year (%) |

Implicit Tax on Earnings in Next Year (%) |

Tax Force, ER Age to 69 c |

Hazard Rate at Early Retirement Age (%) d |

|

Belgium |

67 |

77 |

−5.6 |

82 |

8.87 |

33 |

|

France |

60 |

91 |

−7.0 |

80 |

7.25 |

65 |

|

Italy |

59 |

75 |

−5.8 |

81 |

9.20 |

10 |

|

Netherlands |

58 |

91 |

−12.8 |

141 |

8.32 |

70 |

|

United Kingdom |

55 |

48 |

−10.0 |

75 |

3.77 |

22 |

|

Germany |

48 |

62 |

−4.1 |

35 |

3.45 |

55 |

|

Spain |

47 |

63 |

4.2 |

−23 |

2.49 |

20 |

|

Canada |

45 |

20 |

−1.0 |

8 |

2.37 |

32 |

|

United States |

37 |

41 |

0.2 |

−1 |

1.57 |

25 |

|

Sweden |

35 |

54 |

−4.1 |

28 |

2.18 |

5 |

|

Japan |

22 |

54 |

−3.9 |

47 |

1.65 |

12 |

a

Unused labor capacity is defined as the proportion of persons aged 55 to 65 not in the labor force.

b

ER = early retirement.

c

Tax force is the summation of the implied tax rates on continued work beginning with the early retirement age—when a person is first eligible for public pension benefits—and running through age 69.

d

Hazard rate at early retirement measures the percentage of working individuals who leave the labor market at the early retirement age.

Belgium: The public pension early retirement age is 60, but employees who are laid off are eligible for large benefits at younger ages. Thus the accrual, implicit tax, and tax force measures treat unemployment benefits as early retirement benefits available at age 55.

France: Counting public pension benefits, available at age 60, but not accounting for guaranteed income benefits for those losing their jobs at age 57 or older.

Italy: Public pension benefits for private-sector employees, not counting disability availability.

Netherlands: In addition to public pension benefits, the calculations account for virtually universal employer private pension benefits. The employer plan is assumed to provide for early retirement at age 60. There is no public pension early retirement in the Netherlands, but employer early retirement benefits are commonly available at age 60.

United Kingdom: Based on public pension benefits only, but counting “incapacity” benefits at 60 as early retirement benefits.

Germany: Counting public pension benefits and assuming a person is eligible for “early” disability benefits.

Spain: Based on RGSS (the main public pension program).

Canada: Counting public pension benefits only.

United States: Counting public pension benefits only.

Sweden: Counting public pension benefits only. The hazard rate at the early retirement age is the average of the rates between ages 59 and 61.

Japan: Assuming a “diminishing earnings” profile. The employment option is to work in the primary firm until age 60 and then in a secondary firm, where the worker would be eligible for the 25% wage subsidy if his/her earnings were low enough.

Page 86

parisons point to a rather strong correlation between public pension incentives and unused capacity.

Impact of Disability and Welfare Programs

Other government-provided programs may have an important effect on retirement. In many European countries, unemployment insurance and disability benefit programs essentially provide early retirement benefits before the official public pension early retirement age. In the mid-1990s in Belgium, for example, 22 percent of men were receiving unemployment or disability benefits at age 59. In France, 21 percent were receiving these benefits at that age, in the Netherlands 27 percent, in the United Kingdom 33 percent, and in Germany 37 percent. Even in Sweden, where departure rates are relatively low before age 60, 24 percent were receiving unemployment or disability benefits at age 59.

In the United States and Japan, on the other hand, only about 12 percent were receiving unemployment or disability benefits at age 59. In France, almost all those who are unemployed at age 60 begin to receive public pension benefits at that age and thereafter are officially classified as retired. In the Netherlands, the United Kingdom, Germany, and Sweden, the majority of persons receiving disability benefits before age 65 start to receive public pension benefits at that age and are classified as retired. Thus in many countries, one must be able to calculate accrual under various programs, in addition to accrual under the public pension program.

Employer-Provided Pensions

In addition to public pension plans, other pension programs may affect observed retirement patterns. One such program is employer-provided pension plans. For example, half of employees in the United States are covered by employer-provided plans, and about half of these are defined-benefit plans that have substantial retirement incentive effects. Employer-provided plans are also common in Canada, Japan, the United Kingdom, and the Netherlands, for example. In other countries, such as France, Germany, and Italy, employer plans are of negligible significance. Where such plans are salient, it is important to try to obtain the information that would allow calculation of accrual as is done for public pension plans. This task is often complicated because there is typically great variation in the provisions of employer plans. The Health and Retirement Survey in the United States (Juster and Suzman, 1995) has attempted to collect information on the provisions of respondent plans, with difficulty but with some success.

Page 87

In a number of Latin American countries, most notably Chile, as well as in Switzerland, Singapore, and Australia, private pension savings have been made compulsory. In the United Kingdom and the United States, a series of legislative changes since the early 1980s has extended the range of options for tax-privileged pension saving to individual pension savings accounts. Even in countries such as Italy, new legislative frameworks have been set in place to facilitate the growth of private provision, though to little effect as yet.

Table 3-6 provides some idea of the extent of occupational pension coverage for a number of OECD countries studied by Disney and Johnson (in press). The first column shows the proportion of pensioners in receipt of private pension income, while the second displays the proportion of workers covered. The table confirms the obvious patterns. Coverage among workers ranges from around 90 percent in Japan and the Netherlands; almost 90 percent in Australia; about half in the United Kingdom, the United States, and Canada; around 40 percent in Germany; to under 20 percent in New Zealand, and less than 10 percent elsewhere. In general, occupational pensions are less prevalent among pensioners than among active workers. In part this is because not all pensioners are exworkers. In addition, in some countries occupational pension schemes are not mature, so that more members of later generations participate. In Australia, the vast difference reflects two factors. First is the relatively recent introduction of compulsory membership for all employees. Sec-

|

Country |

% of Pensioners Receiving |

% of Working Population Covered |

|

Australia |

c. 20% men, 7% women a |

87% |

|

Canada |

54% men, 31% women |

45% |

|

France |

Negligible |

Negligible |

|

Germany |

21% men, 9% women |

42% |

|

Italy |

Negligible |

Negligible |

|

Japan b |

10% a |

c. 90% |

|

Netherlands |

76% men, 23% women |

c. 90% |

|

New Zealand |

21% men, 10% women |

17% |

|

United Kingdom |

66% men, 32% women |

48% |

|

United States |

48% men, 26% women |

44% |

aFigures on recipients for Japan and Australia are difficult to interpret since most occupational plans in these countries provide lump-sum benefits. Takayama (1996) estimates that 55% of retirees in Japan receive some lump-sum benefit.

bJapanese figures are for 1991.

SOURCES: Davis (1995); Takayama (1996); Bateman and Piggott (1997); Disney and Johnson (in press).

Page 88

ond is the fact that most people take their accrued pension rights as a lump sum rather than as a pension, so that while they may have benefited from a private pension, they are not recorded as receiving any pension income. The same is true in Japan, where a large proportion of occupational schemes provide lump-sum benefits. To a large extent these features reflect the history and development of occupational schemes, which tended to emerge first in the public sector, especially among civil servants and the armed forces, and then to be negotiated between unions and larger companies, often taking the civil service scheme as a benchmark.

Table 3-7 compares the probability of receipt of occupational pensions among the recently retired according to sex and marital status. In all cases, married women are much less likely to receive such pensions than any other group. Interestingly, however, single never-married women are more likely to receive such pensions than are single men. Married men have the highest likelihood of receipt. The commonality of these patterns is striking and is of course a reflection of the work-related basis for receipt and lower levels of labor market attachment among women. On the other hand, it is among women that coverage continues to grow as work patterns change.

|

Marital Status |

Male |

Female |

Total |

|

Canada |

|||

|

Single (never married) |

34.2 |

48.9 |

42.1 |

|

Single (other) |

54.1 |

34.8 |

38.1 |

|

Married/cohabiting |

56.3 |

25.3 |

42.1 |

|

All |

54.1 |

30.8 |

40.8 |

|

Netherlands |

|||

|

Single (never married) |

61.7 |

67.7 |

63.6 |

|

Single (other) |

83.8 |

60.6 |

66.8 |

|

Married/cohabiting |

75.5 |

12.6 |

46.7 |

|

All |

76.4 |

23.0 |

50.2 |

|

United Kingdom |

|||

|

Single (never married) |

54.6 |

56.2 |

55.2 |

|

Single (other) |

56.4 |

44.8 |

49.1 |

|

Married/cohabiting |

69.5 |

25.8 |

48.0 |

|

All |

66.3 |

32.0 |

48.7 |

|

United States |

|||

|

Single (never married) |

33.5 |

39.7 |

36.9 |

|

Single (other) |

41.9 |

31.0 |

34.0 |

|

Married/cohabiting |

49.5 |

20.4 |

36.2 |

|

All |

47.5 |

25.5 |

35.5 |

Page 89

It is interesting to examine how common receipt of private pensions is among the retired. Performing such an assessment in the same way as was done for public systems, by reference to what example people would receive, is difficult because the occupational systems are diverse and depend critically on work histories. Table 3-8 presents figures for four countries showing the proportions of pensioners' incomes that derive from private pensions. What is perhaps most striking is that in none of these countries do occupational pensions provide half of total income for pensioners. Indeed, only in the Netherlands does the proportion reach a third. In all four countries, the share of total income from private pensions is largest for couples and smallest for single (including never-married, divorced, and widowed) women. On the whole, receipt of private pensions is more important for younger than for older pensioners.

There are three important types of private pensions. In the United States, employer-provided pensions are of two types. The most common type used to be termed a defined-benefit plan, with benefits based on earnings, often those just before retirement. Such plans typically have provisions similar to those discussed above for public pension systems and generally provide large early retirement incentives, much like the public pension incentives in many countries. A second type of employer-provided pension is the defined-contribution plan. Under such a plan, contributions—typically a percentage of earnings—are made to an employee's account. The account grows according to the investment allocation of the account funds. At retirement, benefits depend on the accumulated assets in the employee's account. This type of plan has none of the incentive effects associated with defined-benefit plans. In the United States, a third form of private pension, the personal retirement plan, is the most rapidly growing form of retirement saving. Individual retirement accounts (IRAs) and 401(k) plans are the most common of these. IRAs are not provided through employers, whereas 401(k) plans are. Both have

|

Country |

Couples |

Single Men |

Single Women |

|

Canada a |

26.9 |

23.7 |

20.4 |

|

Netherlands |

37.3 |

35.7 |

22.9 |

|

United Kingdom |

26.5 |

20.1 |

14.1 |

|

United States |

21.4 |

21.9 |

16.7 |

Page 90

key features of conventional employer-provided defined-contribution plans, but it is useful to distinguish them from the latter plans. Contributions to 401(k) plans have grown rapidly since their introduction in 1982, and contributions to these plans are now much larger than contributions to all other plans combined. The decline in defined-benefit plans in the United States has been particularly dramatic. Between 1980 and 1995, the proportion of full-time employees in medium and large private companies participating in a such a plan dropped from 84 to 52 percent. Again, IRAs and 401(k) plans have virtually none of the incentive effects of defined-benefit plans, and their rapid rise is therefore likely to change the incentive for early retirement faced by the typical worker. 3

The use of public-sector disability benefit schemes to finance early retirement has already been mentioned. Occupational pensions can also be used as a vehicle for early retirement. In the Netherlands, such schemes often pay for early retirement, guaranteeing employees a benefit of 70-80 percent of previous earnings up to age 65. In the past, the costs of early retirement were often covered on a pay-as-you-go rather than a funded basis. Firms are now dealing with the extra costs imposed by the funding approach by reducing benefits or increasing minimum eligibility ages.

The role that privately provided pensions can play in promoting early retirement is often neglected, and this can make it difficult to understand retirement behavior in countries with a large private sector. It is often unclear how one should regard this type of early retirement. To the extent that individuals have accumulated adequate funds to retire at 55 rather than 65, they are simply enjoying the fruits of their own labor and savings, and such early retirement can be seen as an indicator of the success of the system. Pensions, however, are rarely that simple. In final occupational salary schemes, the costs of early retirement are often borne by scheme participants other than those who benefit. In addition, the structure of such schemes, which tend to be most generous to long-staying and older individuals, can make companies less willing than they might otherwise be to take on older workers; some have even argued that the structure encourages the sacking of incumbents. On the other hand, the fact that such schemes can be used effectively to ease the pain of workforce redundancies indicates that they may perform a more important role in the welfare state than simply the provision of retirement pen-

3An important point with regard to private pension provisions is the ability of people to allocate their resources across time in a sensible manner. The desirability of privatizing some or all of public pension programs depends in large part on this ability, and the monitoring/measurement of its impact will become increasingly important to the extent that countries reformulate their pension schemes to incorporate greater emphasis on a private pillar.

Page 91

sions. Finally, where occupational pensions are unfunded, as in much of the public sector in the United Kingdom, early retirement can be used as in state pay-as-you-go systems to relieve current pressures, but in a way that leads to growing cost pressures for the future.

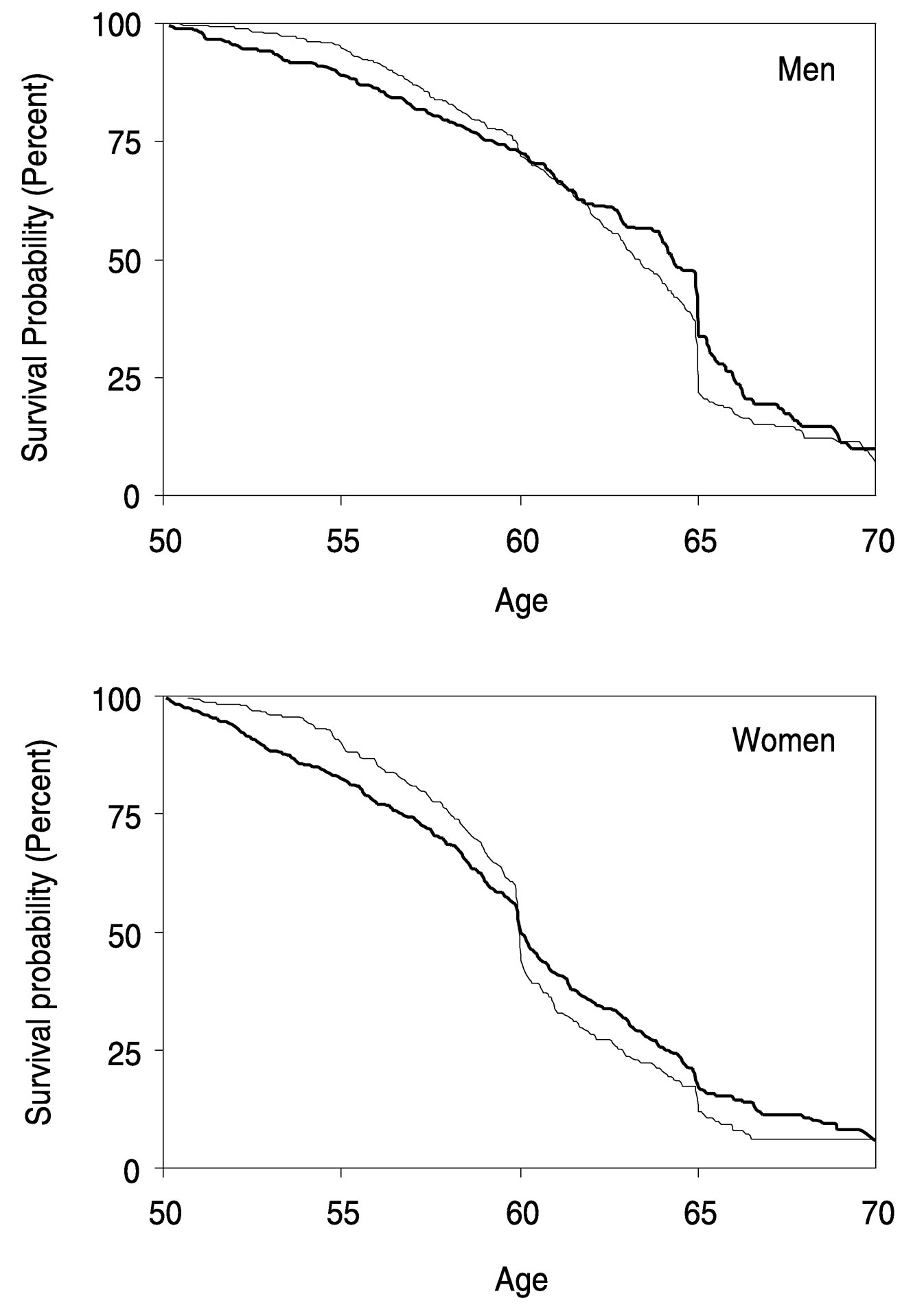

The important role of occupational pensions in the tendency to early retirement in the United Kingdom is illustrated in the top panel of Figure 3-7, which shows employment survival curves for men with and without an occupational pension (Blundell and Johnson, 1998; Blundell and Tanner, 1999). Those without an occupational pension, who tend to be much lower paid and less skilled, leave the labor force more rapidly in their 40s and early 50s. But the interesting point is that after about age 55, those with an occupational pension start leaving employment very rapidly indeed. The bottom panel of Figure 3-7 shows the same survival probabilities for women, and the retirement age of 60 is clearly visible.

More detailed analysis of the effects on retirement behavior of incentives built into occupational schemes has been carried out in the United States by Lumsdaine et al. (1990, 1994) and Stock and Wise (1990a, 1990b). These studies have revealed very substantial effects of the specific incentives for workers to retire at particular ages that are offered by many U.S. occupational pension plans. Thus people react to the design of private pension plans in much the same way as they make use of generous government-sponsored early retirement programs.

KEY DATA REQUIREMENTS

To understand trends in work and retirement and to assess the impact of ongoing pension reforms and changes in retirement incentives, one must gather information on work histories and longitudinal data on earnings, marital status, health status, and disability. While long earnings histories are not typically needed under defined-benefit regimes (which are often based on the last few years of wages), such data are required to measure opportunities in work, as argued above. Moreover, many of the more recent pension reforms move in the direction of defining pension amounts on the basis of an individual's working history or payroll tax payments over the life cycle. Private pension funds are also shifting from final-salary benefits to average-salary benefits or even to defined-contribution schemes (see, e.g., Disney and Whitehouse, 1992, 1999). In addition, reforms tend to allow for more freedom in choice of retirement age. Such reforms thus provide interesting evidence about the influence of scheme-specific details on retirement behavior.

This is not to diminish the importance of social factors (changes in marital status, partner's employment status, social participation, social networks) and health issues (functional ability and cognitive function) in

Page 92

FIGURE 3-7 Employment survival probability for men and women aged 50-70 in the United Kingdom: Circa 1989. NOTE: Bold—Occupational pensions, Light—State Social Security pensions. SOURCE: Blundell and Tanner (1999).

~ enlarge ~

Page 93

the decision to retire. Retirement changes roles within a household, and a related issue is synchronization in the retirement decisions of couples. Changing roles related to retirement are also likely to affect social participation. But the form these changes take and the resulting impact on social participation depend on economic resources, preexisting social networks, and functional ability and cognitive functioning. It is also possible that individuals' perceptions and expectations regarding retirement and aging may influence changes in their social participation. In particular, expectations regarding future dependency and illness may become self-fulfilling, but such expectations may themselves be dependent on social position prior to retirement and local context (such as access to public transport).

Public Pension Plan Provisions and Personal Attributes

Understanding individual retirement decisions and how they relate to retirement programs requires evaluating the incentive effects of the programs' various provisions. Those effects in turn depend both on the plan provisions and on individual work histories, marital status, and other individual and family circumstances. As noted earlier, continuation in the labor force can mean a loss in public pension benefits. In many countries, this loss of benefits can offset a large fraction of the wage earnings a person would receive from continued work. Thus there is an implicit tax on work, and total compensation can be much less than net wage earnings.

Given the variation in the magnitude of the public pension tax on work from country to country, the details of plan provisions must be known precisely. In addition, to conduct microanalysis of the effect of those provisions on individual retirement decisions, employment histories, family status, and other circumstances that determine individual accrual rates must also be known. Thus it is important to be able to match detailed plan provisions with individual survey data.

Plan provisions are typically recorded in administrative documents and can usually be obtained rather easily. Data on individual attributes can be gathered from many different sources. For instance, in many countries administrative data collected as part of public pension programs include the individual data used to determine benefits, and in this sense are ideal. These data files are also typically very large and may allow analysis by birth cohort, for example. Administrative data, however, do not typically include information on other individual attributes, such as health status, that may have an important effect on retirement decisions. Surveys such as the Health and Retirement Survey in the United States include such data. They may also include administrative

Page 94

data that can be used in conjunction with the survey data (for example, the Health and Retirement Survey obtains Social Security earnings histories). Thus one must take a flexible approach to data collection.

Disability, Unemployment, and Private Pension Plan Provisions

In many countries, disability and unemployment insurance programs effectively provide for early retirement before the explicit public pension early retirement age. In Germany, for example, the path to retirement for most employees is not the public pension system narrowly defined, but rather unemployment and disability insurance programs. Such programs are also important in France, Belgium, the Netherlands, and other countries. Thus in addressing public pension reform, these programs must be considered as well. Ideally, one should also know which paths to retirement are available to each person. One who is eligible for disability benefits, for example, typically faces much greater early retirement incentives than one not eligible for these benefits. Eligibility usually depends on program provisions and individual circumstances that are often difficult to determine from administrative or survey data. For this reason, a new way to obtain these data may be desirable. Perhaps surveys could collect the necessary individual information, which, together with plan provisions, would allow determination of eligibility.

The public pension system is the principal source of retirement benefits in many countries, whereas in others it is only one of multiple sources of retirement support. In the United States, the United Kingdom, the Netherlands, Canada, and Japan, for example, employer-provided pension plans are a key source of benefits. Indeed in some countries, such as the United States, employer-provided benefits are often integrated with public pension benefits. The incentive effects of these private defined-benefit plans are quite similar to those of public pension programs. Thus in some countries it may be necessary to consider public and private plans jointly. Where the latter plans are prevalent, it is important to try to obtain the information needed to calculate accrual for these plans, just as for public plans. This task is often complicated by great variation in the provisions of employer plans.

As noted above, the most dramatic change in retirement saving in the United States is the growth in individual retirement saving plans. Individuals must decide how much to contribute to these accounts, how to invest their contributions, and how to withdraw funds after retirement. In 1980, almost 92 percent of pension plan contributions were to traditional employer-provided plans, and about 64 percent of these contributions were to conventional defined-benefit plans. Today, almost 60 percent of contributions are to personal retirement accounts, including 401(k),

Page 95

IRA, and other plans. Including employer-provided (non-401[k]) defined-contribution plans, more than 76 percent of contributions are to plans controlled in large measure by individuals. For persons retiring three decades from now, personal assets in 401(k) plans alone are likely to be substantially greater than public pension wealth (see Poterba and Samwick, 1999; Poterba and Wise, 1999; Poterba et al., 1999). As noted earlier, a critical feature of these plans is that they have none of the retirement incentive effects of public pension and other defined-benefit programs. Thus they must be considered by those attempting to understand future retirement incentives.

Other Related Data

In addition to financial incentives to retire, a comprehensive analysis of retirement should account for individual attributes, in particular health status, but also job attributes that may affect the benefit gained from working. Such effects could be additional costs of early retirement beyond the implicit financial tax on work discussed earlier. This observation also raises the question of “productive activity” and how it might be measured; it would surely include more than paid employment.

The goals of data collection should also be conditioned by looking forward. What issues are likely to arise? Gradual withdrawal from the labor force, which is uncommon now but may become more prevalent in the future, is one such issue. The increased entry of women into the labor force has promoted more flexible work arrangements, and computers have facilitated work at home. What would facilitate gradual rather than precipitous departure from the labor force? How would firm institutional arrangements have to be changed? What information would help answer these questions?

There are also close connections between retirement and the domains discussed in other chapters of this report. Saving for retirement and health status are obviously related to retirement. Perhaps less obvious is the relationship between demographic projections and retirement incentives. For example, projected dependency ratios may depend importantly on pension plan provisions and their effect on the proportion of older persons out of the labor force.

Because the provisions of public pension plans often constitute strong incentives for early retirement, it may be valuable to understand the reasons for such provisions. There are two distinct issues here. First, while it appears clear that public pension provisions affect labor force participation, it is also apparent that in at least some instances the provisions were adopted to encourage older workers to leave the labor force. For example, anecdotal evidence suggests that in some countries, it was thought

Page 96

that the withdrawal of older employees from the workforce would provide more job opportunities for young workers. This possibility does not call into question a causal interpretation of the relationship between plan provisions and retirement. To the extent that it is true, it simply means that in some instances the provisions were adopted for a particular reason—and the data show that they worked.

The second issue, however, does complicate data analysis. It can be argued that to some extent at least, public pension provisions were adopted to accommodate existing labor force participation patterns, rather than the patterns being determined by the provisions. For example, early retirement benefits could be provided to support persons who are unable to find work and thus already out of the labor force. Early retirement programs related to disability and unemployment could also have been adopted to accommodate preexisting labor force departure rates, and this possibility must temper a causal interpretation of the relationship between program provisions and retirement.

To address either or both of these issues requires historical data on unemployment rates, which are typically available from existing country data sources. But complete analysis may also require study of legislative records and other less quantitative data sources. If a goal is to understand how a given system might be improved, it is often useful to understand as well how it came about in the first place.

Throughout this chapter, we have focused on individual attributes and the incentives faced by individuals, and on corresponding data collection. We have given little attention to macro labor market analysis (e.g., labor demand for older workers) and macro determinants of retirement (e.g., the role of pensions in the labor market; see Gustman et al., 1994), age-related changes in productivity, or the potential importance of firm goals and changing firm characteristics. In many respects, this latter arena is almost a separate direction of study requiring a separate data collection effort, and we have not explicitly addressed what is likely to become an important area of inquiry (see, e.g., National Research Council, 1997; Haltiwanger et al., 1999a; 2000). Some countries have administrative data that link individual attributes to the firms in which people work and thus to characteristics of the firms (Lane et al., 1998; Abowd and Karmarz, 1999; Haltiwanger et al., 1999b). In principle, this sort of connection could be drawn as an add-on to individual-based data collection efforts. It might also be important to study firm internal labor markets and institutional arrangements that might, for example, affect the possibility for older workers to withdraw gradually from the labor force. In some countries, such as the United States, age discrimination laws may have an important effect on these arrangements. In many instances, it would be difficult for an older worker to obtain a lower wage while

Page 97

assuming less responsibility in order to stay in the labor force longer. These issues have not been forgotten, but merely are not emphasized in this chapter.

Finally, it is surely the case that cultural values and social preferences affect the generosity of retirement plans, and changing preferences may have affected recent changes in retirement plans. We have chosen in this chapter to avoid focusing on social preferences and cultural values, instead emphasizing systematic quantitative data collection, consistent with the focus of the volume as a whole. Indeed the key illustrative analysis presented in the chapter shows that the incentive effects of plan provisions appear to be highly comparable over countries with widely varying social histories.

RECOMMENDATIONS

3-1. National and cross-national studies should focus on the retirement incentive effects of the provisions of public pension plans. The magnitude of social security taxes on work differs greatly from country to country, and must be understood through careful monitoring of the details of plan provisions and conversion of those provisions into economically meaningful measures—such as benefit accrual rates—that can be related to individual retirement decisions. These measures can then be compared across nations to examine differential policy effects.

3-2. The nature and effects of disability and unemployment insurance programs should be considered when analyzing retirement schemes and individual retirement choices. Disability and unemployment insurance programs in many countries effectively provide for early retirement before the explicit early retirement age and must be considered in conjunction with the public pension program itself. One must be able to calculate accrual under both types of programs. Data also are needed on the paths to retirement that are available to individuals, in particular on the interaction between eligibility criteria and individual circumstances.

3-3. Research into patterns of work and retirement should include consideration of the interaction of private retirement plans and public programs. A growing number of countries, including many in the developing world, now have compulsory private pension schemes. Such schemes are likely to proliferate as nations attempt to reform and/or extend pension coverage. A critical feature of these plans is that they have none of the retirement incentive effects of public and other defined-benefit programs. Where these plans are prevalent, it is necessary to collect information that will allow calculation of accrual as a means of understanding likely associated retirement incentives.

Page 98

3-4. To understand individual retirement choices, information on individual work histories, earnings histories, health status, saving, and other individual attributes should be collected in addition to data on public and private plan provisions. The most effective way to collect the broad array of individual data on the determinants of retirement choices is through longitudinal surveys that address a range of behavioral domains. Data from such surveys can often be supplemented with administrative data files that provide earnings histories, and are in fact used currently to analyze retirement behavior in many countries.

REFERENCES

, and 1999 Econometric analysis of linked employer-employee data. Labour Economics 6: 53-74 .

, and 1996 Early Retirement Provisions and the Labour Force Behavior of Older Men: Evidence from Canada. Unpublished paper. University of Toronto .

, and 1997 Private Pensions in OECD Countries – Australia . Labour Market and Social Policy Occasional Papers 23. Paris : Organization for Economic Co-operation and Development .

1994 Labour force dynamics of older men. Econometrica 62: 117-156 .

, and 1998 Pensions and labor force participation in the UK. American Economic Review 88(2): 173-178 .

, and 1999 Labour Force Participation and Retirement in the UK. Paper prepared for the Panel on a Research Agenda and New Data for an Aging World, Committee on Population, National Research Council .

2000a Data and Research on Retirement in Germany. Paper prepared for the Panel on a Research Agenda and New Data for an Aging World, Committee on Population, National Research Council.

2000b Incentive effects of social security on labour force participation: Evidence in Germany and across Europe. Journal of Public Economics 78(1-2): 25-49 .

, and 1998 Social security and declining labour force participation in Germany. American Economic Review 88(2): 173-178 .

1999 Social security and retirement in Germany. In International Comparison of Social Security Systems , J. Gruber and D. Wise, eds. Chicago : The University of Chicago Press .

, , , and 1999 The dynamic effect of health on the labor force transitions of older workers. Labour Economics 6(2): 179-202 .

Page 99

, and 1984 The effect of Social Security benefits on the labor supply of the aged. In Retirement and Economic Behavior , H. Aaron and G. Burtless, eds., pp. 135-175 . Washington, DC : Brookings Institution .

, , and 2000 The Progressivity of Social Security . NBER Working Paper 7520. Cambridge, MA : National Bureau of Economic Research .

, , and 1993 The earnings-related state pension, indexation and lifetime redistribution in the UK. Review of Income and Wealth 39(3): 257-278 .

1995 Pension Funds . Oxford : Clarendon Press .

, , , and 1993 Pension Policy in the UK: An Economic Analysis . London : Institute for Fiscal Studies .

, and in Pension Systems and Retirement Incomes Across OECD Countries . Cheltenham, UK : press Edward Elgar .

, and 1991 Why are there so many long-term sick in Britain. Economic Journal 1011: 252-262 .

, , , and 1994 Retirement behaviour in Britain. Fiscal Studies 15(1): 24-43 .

, and 1992 The Personal Pension Stampede . London : Institute for Fiscal Studies .

1999 Pension Plans and Retirement Incentives . Working Paper, May. Washington, DC : World Bank .

, and 1998 Social Security and retirement: An international comparison. American Economic Review Papers and Proceedings 88(2): 158-163 .

Gruber, J., and D.A. Wise, eds. 1999 Social Security and Retirement Around the World . Chicago : University of Chicago Press .

, , and 1994 The role of pensions in the labor market: A survey of the literature. Industrial and Labor Relations Review 47(3): 417-438 .

, , and 1999a Productivity differences across employers: The role of employer size, age, and human capital. American Economic Review 89(2): 94-98 .

2000 Wages, Productivity, and the Dynamic Interaction of Businesses and Workers. Unpublished paper. University of Maryland .

, , , , and 1999b The Creation and Analysis of Employer and Employee Matched Data . Amsterdam: North-Holland .

, and 2000 Work and Retirement Among the Older Population in Four Asian Countries: A Comparative Analysis . CAS Research Paper Series No. 22. Singapore : Centre for Advanced Studies, National University of Singapore .

1998 Symposium on assets, incomes and retirement. Fiscal Studies 19(2): 141-151 .

var. Year Book of Labour Statistics. Geneva : International Labour Office . years

Page 100

1999 Pension Provision and Pensioners' Incomes in Ten OECD Countries . Monograph. London : Institute for Fiscal Studies .

, , and 1998 The dynamics of incomes and occupational pensions after retirement. Fiscal Studies 19(2): 197-215

, and 1995 An overview of the health and retirement study. Journal of Human Resources 30(Supplement): S7-S56 .

, , and 1998 The uses of longitudinal matched employer/employee data in labor market analysis. Proceedings of the American Statistical Association .

1986 Retirement from the labour force. In Handbook of Labour Economics , O. Ashenfelter and R. Layard, eds. Amsterdam: North-Holland .

, , and 1990 Efficient windows and labor force reduction. Journal of Public Economics 43: 131-159 .

Three models of retirement: Computational complexity versus predictive validity. In Topics in the Economics of Aging , D. Wise, ed., pp. 21-57 . Chicago : University of Chicago Press .

1994 Pension plan provisions and retirement: Men and women, Medicare, and models. In Studies in the Economics of Aging , D. Wise, ed. Chicago : University of Chicago Press .

, , and 1997 Chronic disability trends in elderly United States populations: 1982-1994. Proceedings of the National Academy of Sciences, Medical Sciences 94: 2593-2598 .

, and 1997 Labour market transitions and retirement of men in the UK. Journal of Econometrics 79: 327-354 .

1996 Assessing Knowledge of Retirement Behavior . Panel on Retirement Income Modeling. E.A. Hanushek and N.L. Maritato, eds. Commission on Behavioral and Social Sciences and Education. Washington, DC : National Academy Press .

1997 Assessing Policies for Retirement Income: Needs for Data, Research and Models . Panel on Retirement Income Modeling. C.F. Citro and E.A. Hanushek, eds. Commission on Behavioral and Social Sciences and Education. Washington, DC : National Academy Press .

1995a The Transition from Work to Retirement . Social Policy Studies Series #16. Paris : Organization for Economic Co-Operation and Development .

1995b The Labor Market and Older Workers . Social Policy Studies Series #17. Paris : Organization for Economic Co-Operation and Development .

, and 1999 Italian Micro-Data on Work and Retirement . Paper prepared for the Panel on a Research Agenda and New Data for an Aging World, Committee on Population, National Research Council .

1986 Disability, retirement and unemployment of older men. Journal of Social Policy 15: 145-162 .

Page 101

, and 1999 Taxation and Household Portfolio Composition: U.S. Evidence from the 1980s and 1990s . NBER Working Paper W7392, October. Cambridge, MA : National Bureau of Economic Research.

, , and 1999 Implications of Rising Personal Retirement Saving . NBER Working Paper W6295, March. Cambridge, MA : National Bureau of Economic Research .

, and 1999 Individual Financial Decisions in Retirement Saving Plans and the Provision of Resources for Retirement . NBER Working Paper W5762, March. Cambridge, MA : National Bureau of Economic Research .

, and 1994 Retirement and labor force behavior of the elderly. In Demography of Aging . Committee on Population. L.G. Martin and S.H. Preston, eds., pp. 50-101 . Commission on Behavioral and Social Sciences and Education. Washington, DC : National Academy Press .

, and 1999 Labor force status transitions at older ages in the Philippines, Singapore, Taiwan, and Thailand, 1970-1990. Journal of Cross-Cultural Gerontology 14: 221-244 .

1989 A dynamic programming model of retirement behaviour. In The Economics of Aging , D. Wise, ed. Chicago : Chicago University Press for the National Bureau of Economic Research .