5

Economic and Ecological Impacts of Abrupt Climate Change

Most studies of the potential ecological and economic impacts of climate change and greenhouse warming have focused on scenarios that involve gradual climate change. Accumulating evidence from the paleosciences, however, shows that the patterns of change suggested by projections of future climate change are not representative of past climatic changes or of the transitions between different climatic regimes. In particular, many recent paleostudies indicate that current climate is much more stable than were climates in earlier periods.

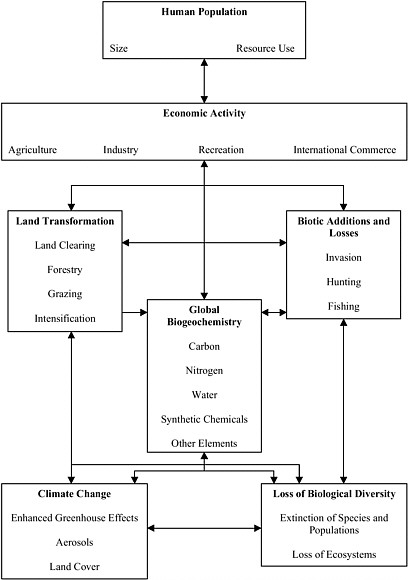

One notable aspect of large, abrupt global and regional climatic changes is precipitation, which is inherently more variable than temperature. Paleoclimatic records show that extreme and persistent droughts have occurred throughout the last few thousand years in widespread regions, as summarized in Chapter 2. These types of droughts have greatly affected societies. For example, abrupt but persistent droughts have been suggested as the cause of societal disruptions of the Maya (Hodell et al., 1995; Gill, 2000; Figure 5.1). Analogous results have been found for the Tiwanaku cultures (Binford et al., 1997), and Brenner et al. (2001) pointed out that droughts in the Yucatan in the ninth century may be linked across the equator to warming in Peru. Weiss et al. (1993) pointed to the role of abrupt climate shifts in the collapse of third-millennium north Mesopotamian civilization. De Vries (1976) examined the impact of the Little Ice Age in Northern Europe, and there is growing evidence of the impact of droughts and other

FIGURE 5.1 Core stratigraphy from Lake Chichancanab showing measurements of calcium carbonate, sulphur, and δ18O of ostracods and the gastropod P. coronatus. General lithology is shown at the right of the diagram. Two periods of particularly dry climate (high evaporation/precipitation) are marked by coincident peaks of sulphur content and δ18O of both ostracods and gastropods. The first occurs between 8,000 and 7,200 years ago, and the second is centered at 1200 during the late Holocene. The latter is linked to the Mayan collapse (from Hodell et al. 1995).

features associated with the El Niño-Southern Oscillation (ENSO) in modern times (e.g., Kitzberger et al., 2001). While the discussion of future climate changes has been dominated by the paradigm of gradual climate warming, we highlight the paleoclimate evidence of Holocene drought because such abrupt changes are likely to be more disruptive of human societies, especially in those parts of the globe that currently have water shortages and marginal rain-fed agriculture.

The recognition of abrupt changes in past climates reinforces concerns about the potential for significant impacts of anthropogenic climate change. Current trends along with forecasts for the next century indicate that the

climate averages and variabilities likely will reach levels not seen in instrumental records or in recent geological history. These trends have the potential to push the climate system through a threshold to a new climatic state. What are the likely impacts of anthropogenic changes in climate on human and ecological systems? What kinds of tools do we have to foresee potential impacts? What steps can societies take to reduce and increase adaptiveness?

To gather information and facilitate discussions on these questions, the committee hosted a workshop on the societal and economic impacts of abrupt climate change. The workshop included scientists grouped roughly into the areas of economics and ecology, although this grouping does not adequately capture the broad range of interests and disciplines of the participants. Initially, it may appear that ecology and economics are disparate and unrelated disciplines—seemingly working more at odds than together—with one apparently concerned only with maximizing short-term profits while the other is apparently concerned with maximizing long-term ecosystem preservation. Yet the workshop revealed similarities in methodologies and interests. Both areas are concerned with highly complex, nonlinear, dynamic systems, in which individual firms, industries, plants, or animals interact to produce strange and surprising outcomes. Both disciplines are concerned with empirical understanding of systems and with preserving valuable entities or systems from ill-designed and often inadvertent human interventions. The committee believes that the interaction between workshop participants from these two disciplines was a valuable contribution to the understanding of how abrupt climate change can affect the natural and human-influenced systems. The workshop highlighted a considerable body of work directly relevant to understanding impacts of abrupt climate change exists in disciplines such as archaeology, sociology, and geography, and identified opportunities for the concept of abrupt climate change to motivate better connections between these diverse fields of study.

RECENT SCIENTIFIC STUDIES IN THE ECOLOGICAL AND SOCIAL SCIENCES

Given the focus of this chapter, it is important to understand the term “abrupt climate change” in the context of ecological and economic systems. As defined in Chapter 1, an abrupt climate change occurs when the climate system is forced to cross some threshold, triggering a transition to a new state at a rate determined by the climate system itself and faster than the

cause. Chaotic processes in the climate system may allow the cause of such an abrupt climate change to be undetectably small.

Abrupt climate change generally refers to large-scale events (such as for an entire country or continent), of significant duration (for at least a few years), whose rate of change or variability is significantly greater than the recent variability of climate. From the point of view of societal and ecological impacts and adaptations, abrupt climate change can be viewed as a significant change in climate relative to the accustomed or background climate experienced by the economic or ecological system being subject to the change, having sufficient impacts to make adaptation difficult.

Another important consideration is that there is virtually no research on the economic or ecological impacts of abrupt climate change (Street and Glantz, 2000). Geoscientists are just beginning to accept and adapt to the new paradigm of highly variable climate systems, but this new paradigm has not yet penetrated the impacts community, particularly in economics and the other social sciences. The committee hopes that the diffusion of ideas among the different disciplines investigating climate change happens rapidly, so that research on the impacts of abrupt climate change can move ahead in a timely fashion.

Abrupt Climate Change and Abrupt Impacts

When investigating the impacts of climate change, it is natural to look first for the impacts of abrupt climate changes. An abrupt climate change—whether warming or cooling, wetting or drying—could have lasting and profound impacts on human societies and natural ecosystems. But it must be remembered that profound impacts are not limited to cases of abrupt climate change. Modest changes or increased variability of climate may be sufficient to produce severe impacts, giving the false appearance that these impacts were caused by an abrupt external forcing.

Abrupt impacts result from the fact that economic and ecological processes have adapted to specific climatic patterns and are therefore typically bounded by experience (in the case of society) or history (in the case of ecosystems). Abrupt impacts therefore have the potential to occur when gradual climatic changes push societies or ecosystems across thresholds and lead to profound and potentially irreversible impacts, just as slow geophysical forcing can cross a threshold and trigger an abrupt climate change. Consider that since the nineteenth century, Grand Forks, North Dakota, had successfully fought frequent floods up to a river stage of 49 feet. Then,

in 1997, a flood crested at 54 feet and caused catastrophic damages despite the fact that the flood crests were only 10 percent higher than the previous high. This modest difference from typical experience was sufficient to cross an impact threshold (Pielke, 1999).

Research by Pearce (2000) explored impact thresholds for migrating species, describing problems encountered by caribou on their 1,500-km-long trek from winter grounds in the mountains to the Arctic coastal plain in spring. Increased winter snowfall has led to delayed migration and increased river volume. In 1999, snowfall was 50 percent above average, snow melted a month later than usual, and none of the females in the herd made it to the coast before calving. A record low number of calves eventually reached the coast, and some were forced to swim the Porcupine River when only a few days old. These events were observed by the native people in the area, who were moved to reduce their traditional harvest of caribou. The size of the herd dropped from 178,000 in 1989 to 129,000 in 1999. Impacts on the migration of many other species are similarly dependent on boundaries linked to climate.

The Grand Forks floods also help demonstrate the interaction between societal decisions, perceptions of what constitutes “typical climate,” and impact thresholds. Following the 1997 Grand Forks floods, the community decided to relocate some properties and build additional levees to raise its threshold to catastrophic impacts. Depending on the assessment of the probabilities and consequences of future flood levels as well as the cost and benefit of flood protection, the community could have chosen 55, 60, or 65 feet as the elevation for the levees. Often, such decisions are made based on assumptions of past weather patterns and runoff. However, if climate is changing, or if the underlying climate system is itself variable, decisions based on past precipitation, runoff, and flood patterns are likely to build in thresholds that incorrectly estimate potential threats compared to decisions based on expectations that allow for changes in climatic means or climate variability. (For more information on the flooding and response in Grand Forks and along the Red River, see International Red River Basin Task Force, 2000.)

Trends in Abrupt Impacts

In the long march of human history, technology has increasingly insulated humans and economic activity from the vagaries of weather. In the preindustrial age, work and recreation were dictated by the cycles of day

light, the seasons, and the agricultural growing season. This was summarized by the economic historian Fernand Braudel, who wrote, “The world (before the nineteenth century) consisted of one vast peasantry where between 80 and 95 percent of people lived from the land and nothing else. The rhythm, quality, and deficiency of harvests ordered all material life” (Braudel, 1973). Gradually, with growing linkages through national and international trade, and as agriculture’s share of economic activity has decreased, the role of local weather on harvests (and of climate on the economy) has declined in significance. Many people are surprised to learn that in 1999, farming contributed only $74 billion of the $9.3 trillion (about 0.8 percent) of US gross domestic product. Furthermore, in 1999 agriculture’s share of total hours worked also totaled 0.8 percent (Bureau of Economic Analysis, 2001).

Today, modern technology enables humans to live in large numbers in virtually every climate on earth. For the bulk of economic activity, variables such as wages, unionization, labor-force skills, and political factors overwhelm climatic considerations. For example, when a manufacturing firm decides between investing in Hong Kong and Moscow, climate will probably not be on the list of factors considered. Moreover, the processes of economic development and technological change tend progressively to reduce sensitivity to climate as the share of agriculture in output and employment declines and as capital-intensive space heating and cooling, enclosed shopping malls, artificial snow, and accurate weather or hurricane forecasting reduce the vulnerability of economic activity to weather. This trend is seen even in developing countries; countries classified as “low income” by the World Bank (including China and India) had 31 percent of their output coming from agriculture in 1980, while by 1998 that share had declined to 23 percent (World Bank, 2001).

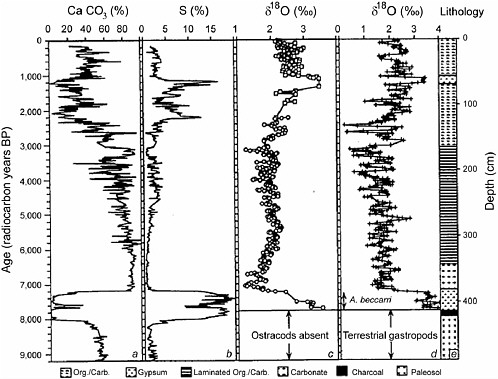

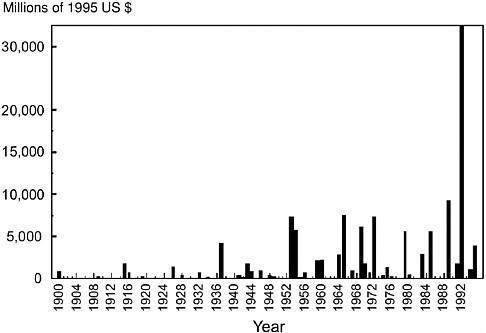

Changes in the historical vulnerability of the US economy to weather can be seen by looking at variability of output in agriculture, which is the most weather-sensitive sector of the economy. The variability is measured as the deviations from trend of real gross output originating in agriculture in 1996 prices over the 1929-2000 period (Figure 5.2)1 and is caused by a wide variety of factors including weather, floods, exchange-rate changes, demand volatility, as well as bad harvests abroad. The year-to-year variability of agricultural output has risen over time along with the growth in

FIGURE 5.2 Variability of total US farm output, 1929-2000. Variability is measured as the deviation of real farm output from its quadratic trend, where output is measured in billions of dollars in 1996 prices. These data include all farm output including cereals, fruits and vegetables, and livestock. (Data from Bureau of Economic Analysis.)

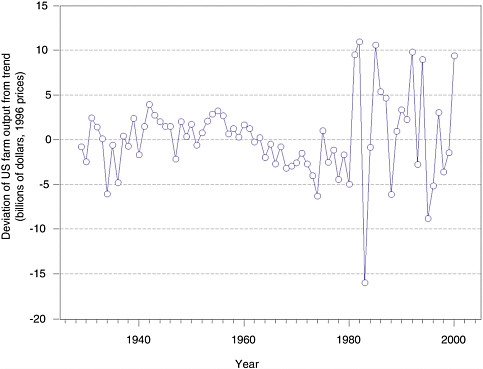

the output of that sector. Surprisingly, however, the vulnerability of the overall economy to agricultural shocks has declined over the last seven decades. The overall vulnerability is here measured as the ratio of the deviation from trend of real gross output shown in Figure 5.2 divided by trend real gross domestic product (Figure 5.3). The maximum deviation due to agriculture over the entire period was –0.75 percent of total output in 1934, while the maximum deviation in the last decade was only 0.14 percent in 1992. The declining sensitivity of overall output to agricultural shocks lies primarily in the declining share of output originating in agriculture. Agricultural output was 5 percent of total gross domestic product in the early 1930s but averaged 1.2 percent of total output in the late 1990s, so weather shocks to farming have a relatively smaller overall impact today than in earlier years.

FIGURE 5.3 Relative variability of US farm output as share of total gross domestic product, 1929-2000. Relative variability is the dollar variability shown in Figure 5.2 as a percent of trend real gross domestic product. Even though the variability in Figure 5.2 has increased over the last seven decades, its size relative to the overall economy has declined because of the declining share of agriculture in total output. (Data from Bureau of Economic Analysis.)

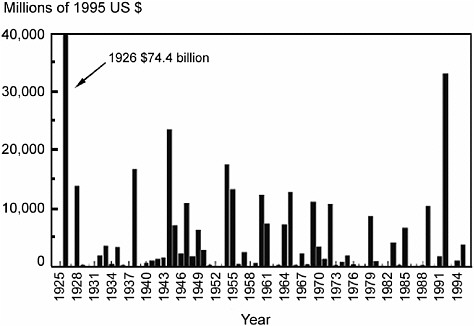

Another human vulnerability to climate change is impacts from severe storms. Total economic losses from hurricanes in the United States over the 1900-1995 period have increased sharply (Figure 5.4). In contrast to agriculture, when these data are normalized to account for inflation, wealth, and population (Figure 5.5), they exhibit an extremely skewed distribution but show no clear trend.2 Furthermore, data on floods show no decline in flood damage per unit wealth in the United States (Pielke and Downton, 2000) over an equivalent period.

The relationship between climate and human civilizations has long been a subject of research and speculation among historians and economists.

FIGURE 5.4 Annual hurricane damages from 1900-1995. Total economic losses from hurricanes in the United States have increased sharply during this period; however, after accounting for inflation, wealth, and population, no clear trend emerges, as shown in Figure 5.5. (SOURCE: Pielke and Landsea, 1998.)

Much historical work has focused on periods of abrupt climatic changes or politico-economic convulsions. But questions have been raised whether traditional approaches are based on a sufficiently rigorous methodology (de Vries, 1981). Often, studies select extraordinary events (such as revolutions or depopulations) or marginal regions and then look for explanatory events such as climate changes. Unless these crises can be shown to be typical responses to similar changes in climate, the estimated impacts are biased upwards because of statistical selection bias. Such an approach applied to banking would convince people that banking history was essentially the study of bank robberies (de Vries, 1981). To remedy this situation, statistical time-series approaches based on continuous meteorological, economic, and other social data should be used to provide more accurate information regarding the systematic relationship between weather/climate and economic activity (de Vries, 1981).

FIGURE 5.5 Normalized hurricane damages from 1925-1995 (adjusting for inflation, coastal county population changes, and changes in wealth). (SOURCE: Pielke and Landsea, 1998.)

Impact of Abrupt Climate Change on Economic and Ecological Stocks

One way of understanding the impact of abrupt climate change is through its impact on economic and ecological stocks or “capital stocks.” This approach rests on the idea that most useful economic and ecological activity depends on stocks of capital, where that phrase is defined in the most general sense as accumulations of valuable and durable, tangible and intangible goods and services.3 In the economy, capital stocks include tangible goods such as factories, equipment, and roads as well as intangible items such as patents, intellectual property, and institutions. Similarly, ecosystems depend on stocks of species, forests, water, and carbon as well as complex “webs” of interacting systems. Viewed along with other inputs,

such as labor and water flows, capital stocks produce most of the world’s valuable market and non-market services such as food, recreation, water, erosion control, and many other environmentally related goods and services (sometimes termed “ecosystem services”).

Serious impacts to ecological or economic capital stocks can occur when they are disrupted in a manner preventing their timely replacement, repair, or adaptation. It is generally believed that gradual climate change would allow much of the economic capital stocks to roll over without major disruption. By contrast, a significant fraction of these stocks probably would be rendered obsolete if there were abrupt and unanticipated climate change. For example, a rapid sea-level rise could inundate or threaten coastal build-ings; abrupt changes in climate, particularly droughts or frosts, could destroy many perennial crops, such as forests, vineyards, or fruit trees; changes in river runoff patterns could reduce the value of river facilities and flood-plain properties; warming could make ski resorts less valuable and change the value of recreational capital; and rapid changes in climate could reduce the value of improperly insulated, heated, and cooled houses. There may also be an impact on more intangible investments such as health, technological, and “taste” capital, although these are more speculative.

Similarly, ecological systems are vulnerable to abrupt climate change because they have long-lived natural capital stocks, they are often relatively immobile and migrate slowly, and they do not have the capacity of humans to adapt to or reduce vulnerability to major environmental changes. Ecological systems are also vulnerable because of anthropogenic influences on the environment, which repeatedly alter ecosystems and limit species abundance and composition as a result of habitat disturbance, fragmentation, and loss. Past examples of ecosystem vulnerability to rapid climate change, such as the Younger Dryas cooling, illustrate the fragility of species diversity at one location as forests experienced rapid change. In southern New England, trees such as spruce, fir, and paper birch experienced local extinctions within a period of 50 years at the close of the Younger Dryas (Peteet et al., 1993). North American extinctions of horses, mastodons, mammoths, saber-toothed tigers, and many other animals were greater at this time than at any other extinction event over millions of years (Meltzer and Mead, 1983). The reasons for this extinction have been linked to both climate and early human impacts (Martin, 1984).

The vulnerability of ecological and economic capital stocks to abrupt climate change arises because these stocks are often specific to particular locations and are adapted to particular climates. Demographic rates of mi-

gratory songbirds, such as black-throated blue warblers, in both north temperate breeding grounds and tropical winter quarters are shown to vary with fluctuations in ENSO (Sillett et al., 2000). In 1999, warmer waters resulting from El Niño were more deadly to coral reefs (showing a 16 percent loss) than for losses in previous years due to pollution (estimated as a 11 percent loss) (Brown et al., 2000).

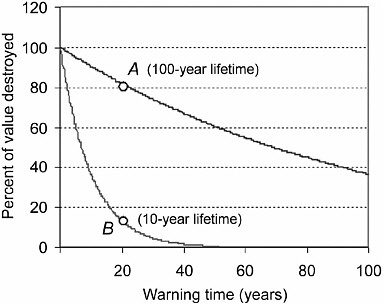

The loss in capital value therefore depends on factors such as the lifetime of the capital stocks, the mobility of the capital, the abruptness and predictability of the climate change, as well as the extent to which the capital is managed or unmanaged. For very short-lived produced capital, such as computers or health-care facilities, climate change occurring over two or three decades would have little impact. On the other hand, for dwellings and infrastructure, which have lifetimes of 50 to 100 years, or for slowly adapting and unmanaged ecological systems, such as mature forests, migratory birds, and coral reefs, abrupt climate change could reduce the capital value significantly. The most vulnerable stocks are probably unmanaged ecosystems with long lifetimes (“natural capital”). These capital stocks include forests and similar ecosystems whose lifetimes are on geological time scales, species, and interacting biological systems whose lifetimes are on the biological scale of evolutionary time.

The vulnerability of capital stocks to climate change (measured as the percent of the value destroyed by an abrupt event) is a function of the warning time and the lifetime of the capital stock (Figure 5.6).4 Suppose, for example, that the owner of capital stock has warning that an abrupt event will occur and it will render the capital completely obsolete. For example, there might be a 20-year warning about shoreline erosion. Under the extreme assumption that the owner can take no remedying measures (such as cost to move the house or abandon the farm), 82 percent of the initial value will be lost for the relatively long-lived capital of 100 years. For capital with relatively short lifetime of 10 years, only 14 percent of the value remains at the end of 20 years, so the vulnerability is relatively low (Figure 5.6).

A detailed simulation of the market value of land and structures of developed coastal properties in the United States on 500 meter by 500-meter samples has been developed to show the dynamics of capital-stock depreciation under different climate-change scenarios (Yohe and

FIGURE 5.6 Vulnerability of capital stocks is higher with reduced warning times and longer lifetimes. The fraction of the value of capital stock that is destroyed or becomes obsolete is a function of the lifetime of the capital stock and the warning time. For an abrupt change that makes the capital completely obsolete, 82 percent of the value is lost for capital with 100-year lifetime and 20 year warning time (A) (top line). For shorter lifetime of 20 years at point B, only 14 percent of the value is lost (bottom line). Note that for a gradual climate change with warning times of at least 100 years, relatively little value is lost even for long-lived capital.

Schlesinger, 1998). This study compared the economic losses from perfectly anticipated and completely unanticipated sea-level rise scenarios ranging from 10 to 90 centimeters over the next 100 years. This example is particularly interesting because the capital stocks involved are long-lived compared to the average reproducible capital stock and coastal structures are among the most vulnerable and immobile capital stocks in our economy.

As would be expected, the results show that the high sea-level-rise scenarios show much higher damages (Table 5.1). Under perfect foresight, the property owner is assumed to optimize the depreciation schedule in light of the need for abandonment when sea-level-rise makes the structure uninhabitable (Table 5.1). Under the myopic case, the owner continues to operate and maintain the dwelling assuming no sea-level-rise until forced to abandon. The ratio of the myopic to the perfect-foresight case ranges from 1.02 for 2050 with slow sea-level-rise to 1.49 for 2100 and the rapid sea-level-rise case (Table 5.1). The interpretation is that, without adaptation, a sea-

TABLE 5.1 Scenarios Comparing the Costs of Sea Level Rise for Different Expectations

level-rise of about 1 meter could add about 50 percent to the cost of coastal structures damaged by sea-level-rise (Yohe and Schlesinger, 1998); adaptive capacity is diminished by myopia. This analysis also suggests why ecosystems are particularly vulnerable to abrupt climate change: they tend to be long-lived systems, they are generally unmanaged (e.g., coral reefs) and thus lack the ability to anticipate future events, and their ability to migrate or adapt is slow.

It would be useful to extend an analysis such as that above to the entire economy. This task can be readily undertaken for tangible capital, for which comprehensive valuation and lifetime data exist. But undertaking such an analysis for ecological capital presents a greater challenge because no comprehensive inventory and valuation system exists.

Is Abrupt Climate Change Likely to Exacerbate the Effects of Gradual Climate Change?

Until recently, most research on the impacts of climate change has focused on gradual climate change primarily because the early scenarios developed by climate scientists asked questions such as “what would happen if CO2 doubled?” and then simulated a situation in which climate moved

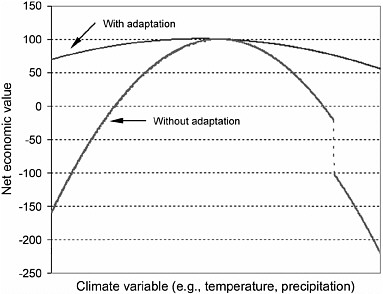

FIGURE 5.7 Illustration of difference between impacts with and without adaptation. The upper line shows the impact of climate change with full adaptation where farmers can change crops and irrigate, where leisure facilities can be replaced, and where forests regenerate. The lower line shows the impacts without adaptation, as is likely to occur with abrupt climate change. Note that for managed systems without externalities, the line without adaptation will lie everywhere below the adaptation line, indicating the costs are likely to be lower with adaptation. We have also shown a break in the no-adaptation line to reflect the potential for sharp threshold effects, such as those due to floods or fire.

smoothly from an initial state to a warmer one. In reality, it is likely that the impacts of abrupt climate change will be both larger and more acute than those under gradual climate change. The major reason for this difference, as discussed previously, is that economies and ecological systems usually will have an easier time adapting to more gradual and better anticipated changes. The net effect of small gradual climatic changes on the economy, as is indicated by most current economic studies for developed countries, is likely to be small relative to the overall economy (Figure 5.7). On the other hand, where economies cannot adapt, impacts resulting from abrupt climate change are likely to be larger and there may be threshold effects if the abrupt climate change triggers fires, water shortages, or exceeds the normal safety margins built into structures or policies.

There is now a substantial literature on the potential impacts of gradual climate change. This was recently reviewed by interdisciplinary teams for the Intergovernmental Panel on Climate Change in its Third Assessment Report (Intergovernmental Panel on Climate Change, 2001a; Ch. 18 is especially relevant). There are also numerous studies of the impacts of climate variability on environment and society at the regional scale, such as caused by El Niño, and some of the more extreme variability considered in these studies may be analogous to abrupt change. There have, however, been few studies that directly analyze the impact of global abrupt climate change. Therefore, the question arises as to whether studies of gradual climate change are useful to assess the impacts of abrupt climate change. In certain areas, existing studies are likely to be instructive. For example, it is likely that those sectors of economies and ecosystems most vulnerable to gradual change are also likely to be vulnerable to abrupt change and, to some extent, the converse should also be true. Agriculture and forests have been identified as systems that are vulnerable to gradual changes, and they are likely to be even more vulnerable to abrupt changes. On the other hand, many manufacturing processes are thought to be relatively robust to climate change at any temporal scale.

For natural systems, it is well documented that gradual climate change can affect species distribution, population abundance, morphology, and behavior, ultimately affecting community structure (Easterling et al., 2000). Although less is known about the links between small- and large-scale climate processes and ecosystems during extremes in climate variability, it is clear that ecosystem structure and function are both affected by disturbances associated with weather extremes such as floods, tornadoes, and tropical storms (Pickett and White, 1985; Walker and Willig, 1999). For example, in the 1950s, widespread drought in New Mexico was responsible for a significant shift of the boundary between ponderosa pine forest and pinyon-juniper woodland (Allen and Breshears, 1998).

In some economic and ecologic sectors, where climatic impacts are of a smooth and linear nature, it is likely that the influence of abrupt climate change will be to accelerate the effects of climate change rather than to qualitatively change the impact. The case of slow sea-level rise discussed earlier provides an example where rapid and unanticipated changes appear to cause only a modest increase in damages. However, under some circumstances, abrupt climate change may not only exacerbate the impacts of gradual climate change but may lead to qualitatively different and more severe impacts.

Abrupt Climate Change Impacts are Likely When Systems Cross Thresholds

The major impacts of abrupt climate change are most likely to occur when economic or ecological systems cross important thresholds. For example, high water in a river will pose few problems until the water runs over the bank, after which levees can be breached and massive flooding can occur. Many biological processes undergo shifts at particular thresholds of temperature and precipitation (Precht et al., 1973; Easterling et al., 2000). For example, many plants are adapted to a specific climate and limited by parameters such as frost and drought tolerance (Woodward, 1987; Andrewartha and Birch, 1954). Phenology, the progression of biological events throughout the year, is linked to climate. Several studies have demonstrated this link for climatic warmings over the last half century, For example, in southern Wisconsin a phenological study of over 61 years of springtime events showed that several of these events were occurring earlier in the year. The events that did not are probably linked to photoperiod or regulated by a physiological signal other than temperature (Bradley, 1999; Leopold, 2001). Data spanning 60 years in Britain show that breeding patterns of birds are linked to the North Atlantic Oscillation (NAO), with 53 percent of birds showing long-term, significant trends toward earlier breeding since 1939 (Crick et al., 1997; Crick and Sparks, 1999). The trends toward earlier nesting in birds are paralleled in studies of bird migration (Sparks et al., 1999), butterfly emergence (Roy and Sparks, 2000), and flowering (Schwartz and Reiter, 2000). In North America, similar studies have noted earlier egg laying in tree swallows (Dunn and Winkler, 1999), earlier robin migration, and earlier exit from hibernation by marmots (Inouye et al., 2000). Although these studies indicate a change in organism behavior relating to a steady shift in climate over time, abrupt shifts may exceed the limits of organisms’ ability to adapt.

Many important threshold effects occur at the boundaries of systems. Ecotones, the narrow zones where ecological communities overlap, are particularly susceptible to abrupt climate change, primarily because the species diversity is great and the vegetation is often limited by a sharp climatic gradient. Paleorecords of the decadal response of forest dieback (Peteet, 2000) demonstrate how rapidly boreal forest can be replaced by mixed hardwoods, as was observed in eastern United States ecotonal forests at the close of the Younger Dryas. European pollen records from the cold event about 8,200 years ago indicate significant species changes in fewer than 20 years (Tinner and Lotter, 2001). Furthermore, modern studies also point to

climatic stress as a probable cause of many historical forest declines (Hepting, 1963; Manion, 1991). For example, a few unusually warm summers were associated with past declines of red spruce (Picea rubens) in eastern North America (Cook and Johnson, 1989).

Extremes of environment are most damaging to the reproductive stages of plants. For example, changes in mast fruiting,5 which are often synchronous over large regions, have strong effects that cascade through all levels of an ecosystem (Koenig and Knops, 2000). One example is the influence that large acorn crops have on increasing the populations of deer, mice, and ultimately ticks (Jones et al., 1998). Thus, climatically induced changes in masting that lead to increased acorn production can result in an enhanced risk of Lyme disease, which then impacts human health. It is likely that the effects of abrupt climate change on mast fruiting will be nonlinear and thus the impacts of these changes will be difficult to predict (Koenig and Knops, 2000).

Drought is also of primary importance to forests. In contrast to earlier predictions that global warming would increase radial growth of trees in boreal forests, white spruce (Picea glauca) tree ring records show recent decreases in radial growth. These decreases are presumed to be due to temperature-induced drought stress, which has implications for forest carbon storage at high latitudes. In the Southern Hemisphere (Patagonia), recent pulses of mortality in Austrocedrus chilensis trees were associated with only 2 to 3 years of drought (Villalba and Veblen, 1998). Not only is the lack of water directly damaging in a drought, but there is increased susceptibility to fire as a forest dries out. Further, there is evidence that drought triggered an ecotonal shift in New Mexico (Allen and Breshears, 1998) where ponderosa pine experienced high mortality rates in less than 5years and the ecotone migrated over 2 km. Woody mortality loss occurs much faster than tree growth gain, which has pervasive and persistent ecological effects on associated plant and animal communities.

Ice-core records from Greenland record changes in the frequency of layers enriched in fallout from forest fires (Taylor et al., 1996). The frequency of occurrence of layers was anomolously high during the abrupt cold event about 8,200 years ago, which in turn is associated with drought in regions upwind of Greenland, likely including the United States mid-continent (Alley et al., 1997). In the southwestern US, synchrony of fire-free and severe-fire years across diverse forests implies that climate forces

fire regimes on a subcontinental scale (Swetnam and Betancourt, 1990; Plate 9).

Droughts and floods are also responsible for changes in erosion patterns, as reduced vegetation due to fires results in greater soil loss (Allen, 2001). For example, in the Indonesian tropics, drought years have led to a greater frequency and magnitude of fires resulting in a loss of peatlands, increased erosion, and increased global air pollution. Globally, rates of soil erosion are 10 to 40 times greater than rates of soil formation (i.e., over 75 billion tons from terrestrial systems annually; Pimentel and Kounang, 1998).

Droughts have also been implicated in insect outbreaks and pulses (births and deaths), with impacts on tree demography (Swetnam and Betancourt, 1998). Episodic outbreaks of pandora moth (Coloradia pandora), a forest insect that defoliates ponderosa pine (Pinus ponderosa) and other western US pine species, have been linked to climatic oscillations (Speer et al., 2001). Drought years have been linked to insect crashes as well as booms (Hawkins and Holyoak, 1998).

Tundra systems are highly susceptible to the effects of climate change because of their sensitivity to water table fluctuations, snow-albedo feedbacks, fire frequency, and permafrost melting (Gorham, 1991). Tundra areas are significant in the terrestrial/atmospheric carbon balance because tundra peat is a large source and sink of greenhouse gases, most notably carbon dioxide and methane (Billings, 1987). Furthermore, 15 to 33 percent of the global soil carbon is contained in the northern wetlands (Gorham, 1991; Schlesinger, 1991). The sensitivity of tundra ecosystems to abrupt climate change, and the widespread influence these areas have on feedbacks in the climate system, make these key areas for climate change monitoring. For example, field measurements and modeling have shown that even vegetation changes induced by summer warming could result in climatic feedbacks (Chapin et al., 2000).

Paleoclimatic investigations have shown that changes in biodiversity are correlated to climate variations. Abrupt climate shifts have been linked to increases in biodiversity as well as to species extinction, although extinctions can occur much more rapidly than can origin of diversity by evolution. The evolution of large beaks among Darwin’s finches (Geospiza fortis) is thought to be the result of ecological stress from El Niño drought years, while extremely wet years favored evolution of small beaks (Boag and Grant, 1984). But recent research suggests that the rate of species extinctions is on the order of 100 to 1,000 times higher than before humans were dominant (Lawton and May, 1995; Vitousek et al., 1997). For example,

over the last two millennia, one-fourth of all bird species are believed to have gone extinct as a result of human activities (Olsen, 1989). This increase in species extinctions is in part because extinctions are occurring on the time scale of human economies, but evolution typically occurs more slowly (except for microorganisms, including those that cause disease).

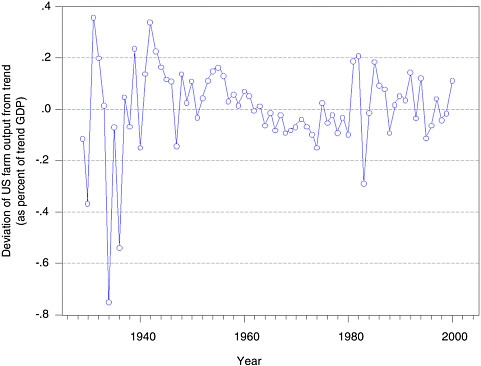

Despite convincing scientific evidence, there seems to be a general lack of public awareness concerning the global decline in biodiversity, related ecological and societal impacts, and the fact that biodiversity changes are not amenable to mitigation after they occur (Chapin et al., 2000) (Figure 5.8 ). Overall, land transformation is identified as the primary driving force in the loss of biodiversity worldwide (Vitousek et al., 1997). It is estimated that 39 to 50 percent of available land has been degraded by human activity (Vitousek et al., 1986; Kates et al., 1990). Human influences include loss of permeable surfaces to pavement and increases in greenhouse gases, aerosols, and pollutants. Humans use over half the world’s accessible surface fresh water, and more nitrogen is fixed by humans than by all natural sources combined (Vitousek et al., 1997). After land transformation, the next most important cause of extinctions is invasion of nonnative species. Many biological invasions are irreversible, degrade human health, and cause large economic losses. The impact of the zebra mussel on the US Great Lakes states is one such example.

Montane ecosystems are valued highly even though they are small in area compared to other major biomes. Recognized by scientists for their importance to hydrological, biochemical, and atmospheric processes, they are particularly sensitive to climate change because of their many ecotones (Spear et al., 1994) and limited spatial area. Montane areas are scenic, relatively pristine, and often provide water for many urban and agricultural areas (Walker et al., 1993).

Changes in snowfall and snowpack in montane regions have a large impact on treeline and plant communities (Patten and Knight, 1994). The timing of snowmelt affects plants in many ways, including the alteration of leaf traits, the changing of leaf production, shoot growth (Kudo et al., 1999), and flowering (Inouye and McGuire, 1991). In addition, changes to the timing of snowmelt will alter the exposure to late spring frosts (Inouye, 2000). A decrease in synchrony associated with phenological events at high and low altitudes may pose problems for animal species that migrate between altitudinal zones (Inouye et al., 2000). For example, marmots are presently emerging from hibernation 38 days earlier than they did 23 years ago in the Rocky Mountains (Inouye et al., 2000). As this example relates

to gradual climate change, the impacts of abrupt climate change are expected to be greater.

Wetlands are among the most important ecosystems on earth, due to their many “ecosystem services.” They serve as “kidneys of the landscape” by cleansing polluted waters, recharging aquifers, and protecting shorelines (Mitsch and Gosselink, 2000). Wetlands, including estuaries, provide protection for organisms and serve as nurseries for the young of many oceanic food chain species. Furthermore, wetlands can be important carbon sinks. Only recently valued for stabilization of water supplies, wetlands have been filled, drained, or ditched throughout history. In the United States, over half of wetland areas have been drained (Mitch and Gosselink, 2000).

Wetlands are particularly vulnerable to abrupt climate change, especially droughts. Along with lakes and rivers, wetlands are dependent on precipitation for the health of their associated ecosystems. The paleorecord of droughts recorded by wetlands provides an indication of the sensitivity of these areas to climate change. These records are useful for predicting the frequency of abrupt climate change and the sensitivity of water bodies to future climate change. The impacts of abrupt climate changes will be exacerbated because of alteration to the natural environment from the impoundment of rivers, depletion of fossil groundwater, and draining of wetlands.

Montane glaciers are among the most responsive indicators of climate change. Past records of glacial advance and retreat are important for understanding relative magnitudes of abrupt climate change. These records show that the global altitude drop of the equilibrium snow line during abrupt climate changes was of similar magnitude at widely scattered locations, implying that an overall cooling of the atmosphere took place, not a redistribution of the heat balance (Broecker and Denton, 1989; Lowell, 2000; Broecker, 2001). Loss of montane glacier volume has been more or less continuous since the nineteenth century, but loss in the last decade has accelerated (Dyurgerov and Meier, 2000). The loss of montane glaciers in the tropics is dramatic, and in a warmer world this loss may extend to many temperate locations used for recreation.

Ice sheets are linked to abrupt climate change because melting of Greenland or the West Antarctic ice sheet would add directly to global sea level rise and to possible changes in the thermohaline circulation (Manabe and Stouffer, 1997). Much attention has been focused on the possibility of a rapid collapse of the West Antarctic ice sheet. Recent geological and glaciological evidence points to a stable but net decay since the last ice age (Conway et al., 1999), but with considerable uncertainty about future trends

and the possibility of rapid dynamic response to future warming. The Greenland ice sheet has the potential for rapid surface melting and perhaps enhanced ice flow with continued greenhouse warming. Laser-altimeter surveys in the 1990s indicated an overall negative mass balance for Greenland ice that results in a 0.13 mm per year sea level rise (Krabill et al., 2000). Since the late 1800s the margin of the Greenland ice sheet has retreated 2 km in some places (Funder and Weidick, 1991) indicating that Greenland ice is responding to twentieth century warming. The influence of the Greenland ice sheet system on potential abrupt climate change appears to be linear except for the possibility of threshold changes in ocean circulation, but the existence of dynamically controlled ice streaming at least suggests the possibility of dynamical changes (Fahnestock et al., 1993).

Much attention has focused on observations that indicate a reduction in the extent and thickness of Arctic sea ice (Cavalieri et al., 2000; Rothrock et al., 1999; Wadhams and Davis, 2000; Parkinson, 2000). Sea ice trends are less clear in the Antarctic. Published estimates from satellite measurements include no significant trend in sea ice from 1973-1996 (Jacka and Budd, 1998), and over a slightly different interval, an increase of 1.3 ± 0.2 percent per decade in mean-annual sea-ice area from 1978-1996 (Cavalieri et al., 2000). However, an interpretation of whaling records indicates a large and rapid decrease in Antarctic summertime sea ice extent between the mid 1950s and early 1970s (de la Mare, 1997). This variability, whether natural or human-induced, is important because it is large and may contribute to “surprises” that may accompany future climate change (Broecker, 1987).

Similar concerns regarding the impacts of abrupt climate change on thresholds apply to social systems. Over human history, one of the major ways humans have adapted to changing economic fortunes has been to migrate from unproductive or impacted regions to more productive and hospitable regions. Until the twentieth century, national boundaries were often open, allowing people to migrate freely in response to economic conditions. For example, as a result of the potato blight (Phytophthora infestans) in Ireland, there was a disastrous famine between 1845 and 1847 and almost one million people emigrated, mainly to America. Because national borders may be less open today, it may be difficult for people to migrate to other countries when famines or civil wars occur. These “boundary effects” could be particularly severe for small and poor countries, whose populations are often unwelcome in richer countries. To the extent that abrupt climate change may cause rapid and extensive changes of fortune for

those who live off the land, the inability to migrate may remove one of the major safety nets for distressed people.

SECTORAL APPROACHES

One promising approach to investigating the economic impacts of abrupt climate change would be to focus on individual sectors. Economic studies often have relied on the organizing framework of the national income and product accounts, in which the economy is divided into major sectors and for which both income and output data are available for most countries and numerous years (see Toth, 2000). For example, for the United States, detailed income and output data are available for 83 different sectoral breakdowns during the period 1948-1999. There is no similar accounting framework for nonmarket sectors or for ecological studies.

Agriculture

Under the sectoral approach, there are a few obvious sectors to examine. Perhaps the most important is agriculture, which is the sector most heavily affected by weather and climate. Current studies indicate that the impact of gradual climate change on agriculture over the next few decades is likely to be relatively modest for the United States. For example, a recent survey found that the impact of a 2.5°C gradual warming is likely to reduce agricultural value between 0.1-0.2 percent of global income (Nordhaus and Boyer, 2000).

Agriculture is likely to be the most accessible sector for studies on the impact of abrupt climate change because of the extensive information available and the well-developed research infrastructure in this field (Reilly, submitted). It is important to emphasize that it will be necessary to view different abrupt climate impact scenarios from a probabilistic rather than a mechanistic point of view. This applies not only to agriculture but also to other areas such as species extinction, floods, wildfires, hurricanes, human and wildlife diseases, and droughts. It is unlikely that an abrupt climate change will occur as a single abrupt event; rather, it will occur as a distribution of potential events, with increasing severity at lower probabilities. This probabilistic nature of abrupt climate change adds another layer of complexity to impact analyses and to communicating the risks and opportunities to the public.

Because of a methodological coincidence, certain approaches used to

analyze the effects of gradual climate change on agriculture can be applied for abrupt climate change. Many early studies of the impact of gradual climate change on agriculture used what came to be referred to as the “dumb-farmer” scenario. Under this approach, farmers were assumed to take only the most limited steps to adapt to climate change. For the “dumbest” of scenarios, even with a 3-6°C warming over a century, farmers would plant the same crops in the same place with the same fertilizers and the same planting and harvesting dates. These assumptions were criticized by those advocating a “smart-farmer” world. Increasingly, studies now allow for extensive adaptation, including the “Ricardian approach” (relying on cross-sectional data on land prices; Mendelsohn et al., 1994), which assumes virtually complete adaptation to climate change.

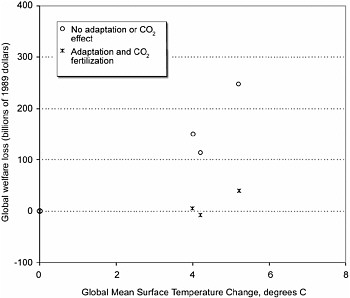

Ironically, studies that were undertaken using a non-adaptation approach are ideal to investigate the impacts of abrupt climate change. This is particularly true if the abrupt climate change is unforeseen, widespread, and sudden, for in such a case farmers could only undertake very limited adaptation. With full adaptation, linked economic-climate models project essentially no impact on the economic value of global agriculture even for globally averaged temperature changes of as much as 4°C (Figure 5.9).6 With very limited adaptation, as is likely to occur with abrupt climate change, the costs are substantial, ranging from $100 billion to $250 billion depending on the climate scenario (Figure 5.9). Moreover, these scenarios are likely to underestimate the damages from abrupt climate change because they predict relatively smooth regional changes, whereas evidence suggests that abrupt climate change will produce abrupt, magnified changes at local scales. Note that this figure shows exactly the kind of pattern of impact that was illustrated hypothetically in Figure 5.9.

Forests

A second priority sector for research is forests. This sector may be affected more than agriculture by abrupt climate change because forests are highly climate-sensitive, with long-lived ecological and economic capital stocks. Most ecological studies of the impact of climate change on forests have been limited to describing long-term equilibrium effects (Mendelsohn, 2001). The models predict ecological changes that will occur in two or

FIGURE 5.9 Illustration of the impacts of gradual climate change with adaptation and abrupt climate change without adaptation (Reilly, submitted). Global welfare losses from agricultural impacts for different climate and CO2 fertilization scenarios. Upper plots (o) represent global welfare loss associated with abrupt climate change as modeled by an assumption of no adaptation and no CO2 fertilization. The lower plots (x) allow for full adaptation and include CO2 fertilization. The three different results are three alternative global yield scenarios from Rosenzweig and Parry (1994) as simulated by Reilly, Hohmann, and Kane (1993) or briefly reported in Reilly and Hohmann (1993). Note that all scenarios go through the origin as a normalization of no welfare loss with no climate change.

more centuries after climate settles down to a new level. Ecologists disagree on how quickly ecological systems will adjust and what they will look like in the process of adjustment. Some ecologists predict vast and rapid losses of forests and grasslands to fires and insects. Others predict slow and gradual change as reproductive competition dominates the dynamics. Both may be correct in different locations, but it seems safe to conclude that there is little secure knowledge about how these new ecosystems will react to climate change.

Abrupt climate change would increase the required adjustment and the uncertainty for forests. Ecosystems may collapse more rapidly, with forests disappearing in vast fires and grasslands dying and turning lands into dust bowls. Such events have occurred in historical times, earlier during the

Holocene, and probably occurred during the glacial periods when dust levels were significantly higher around the world (Overpeck et al., 1996). Ecosystems may be dominated by early successional species. Given that the economy depends on many late-successional species, losses of existing trees would dig into inventories of standing timber and raise timber prices, perhaps for long periods of time. Wildlife dependent on mature systems may be especially stressed; landscape appearances may dramatically change; and runoff may change completely from historic ranges. These changes suggest the potential for large damages.

The impact of climate change on forest systems is currently an area of intensive research (e.g., Hansen et al., 2001a; Shafer et al., 2001), although the focus is on gradual climate change. These studies suggest that there may be some immediate damages associated with dieback in forests and that long-term productivity may increase in some species if CO2 fertilization occurs, but not in others. Some paradoxes lurk here, however. In a study of how forests in the United States might adjust to future climate change, Sohngen and Mendelsohn (1998) were surprised to find that a scenario with significant dieback of existing stands did almost as well as a scenario where natural change occurred more slowly (Sohngen and Mendelsohn, 1998). Their study illustrates the important point that adaptation (or well-designed management) can help ecosystems to adjust more rapidly and with lower overall economic costs.

Little is known about how climate-change impacts on forests would affect nonmarket services. Little is known about what would happen to wildlife because of complex interactions, and how much people would value the changes. Forest products such as fruits, nuts, medicine, and mushrooms are highly valued, but it is not clear how the flow or value of these products might change with abrupt climate change. Although ecologists predict that biomes will shift with warming, there has been little accompanying social science research to evaluate such shifts. There has been scant research on how forests might change in appearance or how much people would care about the changes. Thus, many of the quality-of-life effects on forests have not been evaluated.

Water Resources

There is a growing awareness of the scarcity of freshwater at the earth’s surface compared with the total amount of water on the planet, and concern about how climate change might affect water resources (Gleick, 2000;

Postel, 2000; Sampat, 2000). According to these authors, only 3 percent of the earth’s water is fresh, and most of this water is tied up in glaciers and ice sheets. Only about 0.01 percent of the total water is available in lakes, the atmosphere, and soil moisture. Water that is “clean” in terms of its suitability for human use is estimated today to be unavailable for 20 percent of the world’s population. Humans have a long history of arguments and conflict over water rights. Water from rivers is impounded for energy generation, agriculture, dilution of wastes, and transport. The construction of dams affects biotic habitats both directly and indirectly; for example, damming of the Danube River has altered the silica chemistry of the entire Black Sea (Vitousek et al., 1997). In the United States only 2 percent of rivers flow unimpeded, and the flow is regulated in over two-thirds of all rivers (Abramowitz, 1996).

The water cycle has important nonlinearities that are relevant to the impacts of abrupt climate change (Kling, 2001). First, the water balance of lakes is extremely sensitive to climate change, and small shifts in the ratio of precipitation to evaporation can result in large changes in lake levels. Extremely large shifts in paleolake levels have been tied to abrupt climate change that is global in extent (Broecker et al., 1998). Lake levels in Lake Victoria and throughout Africa rose suddenly at the beginning of the Bolling warming about 14,700 years ago, a warming that is evident in Greenland, Europe, and North and South America. During the Holocene, rapid lake level shifts are found in western North America (Laird et al., 1996; Stine, 1994) as well as southern South America and Africa. Changes in the Great Lakes water levels have also been linked to climate change, most recently in the last few decades (Sellinger and Quinn, 1999). The declining extent of the Aral Sea and Lake Chad involve both human impact and climate change (Kling, 2001).

Second, the depletion of groundwater is highly nonlinear in its impact on water use when the aquifers dry up (i.e., going from a situation of plentiful water to one of no water or very salty water over a period of a few months). Groundwater deficits, which represent the amount of water withdrawn compared to the amount of recharge water put back into the aquifer, are now equal to at least 163 cubic kilometers per year throughout the world, which is equivalent to about 10 percent of the world’s grain production (Brown et al., 2000). In many cases groundwater is nonrenewable, or fossil water, that took extremely long periods to accumulate and is now being used more rapidly than it is replenished. For example, three-quarters of the water supply of Saudi Arabia currently comes from fossil water-

(Gornitz et al., 1997). Finally, pollution of existing groundwater supplies is a persistent problem in many regions. Understanding the causes and consequences of these deficits and problems is critical for managing the future of water resources on earth (Kling, 2001).

Third, a nonlinear response exists between soil moisture and the production of greenhouse gases. As soil dries, microbes limited by water respire less soil organic matter, which produces less carbon dioxide and methane. As soil moisture increases, respiration increases and more greenhouse gases are produced. But if the soils are waterlogged, they become anoxic and overall microbial activity is again reduced (leading to increased net carbon storage). Thus knowing where any system lies on this nonlinear response curve is necessary to predict how greenhouse gas production will change as water availability changes (Kling, 2001).

Fourth, many biological systems are nonlinear in their response to water. Outbreaks of vector-borne diseases, such as cholera outbreaks linked to El Nino and water-temperature changes (Colwell, 1996; Pascual et al., 2000) and other unpleasant events are often linked to deviations in precipitation patterns (Balbus and Wilson, 2000). Both extremes in precipitation can be harmful, because some outbreaks are linked to precipitation increases and flooding, while others are associated with droughts. Both extremes lead to stresses on organisms and ecosystems, and as such the biological nonlinear and complicated response may have undesirable effects for humans.

There is virtually no direct research on the economics of water systems and abrupt climate change at this time (exceptions are Glantz, 1999; Arnell, 2000). Given the importance of water for many aspects of society, from agriculture to electricity production, as well as the documented record of periodic droughts, this should be one of the priority areas for research.

Human and Animal Health

Yet another area of potential concern is health—both of humans, of domesticated plants and animals, and of wildlife (National Research Council, 1999a). There is widespread appreciation of the potential for unwelcome invasions of new or exotic diseases in the human population, particularly of vector-borne diseases such as malaria. Similar concerns may arise for pests and diseases that attack livestock or agriculture. Another concern is diseases of wildlife.

Scenarios based on climate models for greenhouse warming indicate that changes will occur in the geographic distribution of a number of water-

borne diseases (e.g., cholera, schistosomiasis) and vector-borne diseases (e.g., malaria, yellow fever, dengue, leishmaniasis) if not countered by changes in adaptation, public health, or treatment availability. These changes will be driven largely by increases in precipitation leading to favorable habitat availability for vectors, intermediate and reservoir hosts, and/ or warming that leads to expansion of ranges in low latitudes, oceans, or montane regions. The host-parasite dynamics for abrupt climate change have not been targeted specifically as yet, but Daszak et al. (2001) suggested three phenomena that indicate abrupt climate change may have had heightened impacts on key human diseases:

-

There appears to be a strong link between El Niño-Southern Oscillation (ENSO) and outbreaks of Rift Valley fever, cholera, hantavirus, and a range of emergent diseases (Colwell, 1996; Bouma and Dye, 1997; Linthicum et al., 1999), and if ENSO cycles become more intense, these events may become more extensive and have greater impact;

-

Malaria has reemerged in a number of upland tropical regions (Epstein, 1998) (although this is debated by Reiter, 1998); and

-

Recent extreme weather events have precipitated a number of disease outbreaks (Epstein, 1998).

Criteria that define emerging infectious diseases of humans were recently used to also identify a range of emerging infectious diseases that affect wildlife (Daszak et al., 2000). They include a fungal disease that is responsible for mass mortality of amphibians on a global scale and linked to species extinctions (Berger et al., 1998), canine distemper virus in African wild dogs, American ferrets and a series of marine mammals, and brucellosis in bison as well as others. An ongoing reduction in biodiversity and increased threats of disease emergence in humans and livestock make the impacts of these changes potentially very large.

Emerging diseases are affected by anthropogenic environmental changes that increase transmission rates to certain populations and select for pathogens adapted to these new conditions. Daszak (2001) points to abrupt climate change as pushing environmental conditions past thresholds that allow diseases to become established following their introduction. For example, African horse sickness (a vector-borne disease of horses, dogs, and zebras) is endemic in sub-Saharan Africa. Although it usually dies out within 2 to 3 years of introduction to Europe, the latest event involving imported zebras to Spain resulted in a 5-year persistence, probably because

recent climate changes have allowed the biting midge vector to persist in the region (Mellor and Boorman, 1995).

Introduced diseases are costly—a single case of domestic rabies in New Hampshire led to treatment of over 150 people at a cost of $1.1 million. The cost of introduced diseases to humans, livestock, and crop plant health is estimated today at over $41 billion per year (Daszak et al., 2000). Abrupt climate change-driven disease emergence will significantly increase this burden. Furthermore, the economic implications of biodiversity loss due to abrupt climate change-related disease events may be severe, as wildlife supports many areas (fisheries, recreation, wild crops) very significant to our well-being.

Other Sectors and Technological Responses

Work in other sectors is still in its infancy. The results for sea-level rise (without storms) were reviewed earlier in the chapter, and the preliminary results reported there indicate that the cost of unforeseen climate change was only modestly more expensive than anticipated climate change. These estimates would change if storms were also included (West et al., 2001), emphasizing that work will need to consider variability and extremes as well as trends.

In addition, little attention has been given to the impact of abrupt climate change on leisure and recreational activities such as tourism. Such attention may seem frivolous, but in fact a substantial part of human time and of economic output is devoted to outdoor recreation—fishing, hunting, bird-watching, golfing, skiing, swimming, walking, and so forth. Efforts to understand the impact of climate change on leisure and recreation are hampered by lack of systematic data on time use of the population.

It is useful to remind ourselves that over the longer term, technological changes can modify the impact of climate and of abrupt climate change on human activities, on ecosystems, and on economic welfare. Irrigation and fertilization change the impact of climate on agriculture; plant and animal breeding have produced drought- and pest-resistant varieties; forest management practices have changed the pattern of tree growth and timber harvesting; land fills, dikes, and sea walls have kept the sea at bay in low-lying regions; dams and drip irrigation have spread out available water supplies; heat pumps and white roofs can change local energy balances; social and private insurance have reduced individual vulnerability to extreme weather events; vaccines and medications have reduced the impact of many diseases

that earlier rendered the tropics uninhabitable; snow-making equipment has turned marginal mountains into thriving ski areas. While few of these are unalloyed improvements, and many have unwelcome impacts on ecosystems, they have reduced human vulnerabilities markedly. Moreover, it is unlikely that these trends will suddenly stop tomorrow. Thus, one of our societal challenges is to harness technology to improve monitoring and prediction and enhance adaptation in the face of potential abrupt climate change. A second challenge is to better understand the interactions and feedbacks between the natural and human-dominated systems, and the limitations of technology when dealing with ecosystem vulnerabilities.

MODELING THE IMPACTS OF CLIMATE CHANGE

Economic and ecological systems are extremely complex nonlinear systems. Both involve individual components (whether firms or organisms) which interact in ways where “everything depends on everything else.” Because of this complexity, economists and ecologists increasingly have turned to computerized numerical models to help understand the functioning of these large systems and to help predict the impacts of shocks or disturbances.

Over the last decade, these models have been deployed to help understand the potential impacts of climate change on economic and ecological systems. As a result, substantial advances have been made in understanding the way that economic and ecological systems may be affected by gradual climate change. One of the important developments in economics over the last decade has been the development of integrated-assessment economic models, which analyze the problem of global warming from an economic point of view. Integrated-assessment economic models are empirical computerized models that incorporate the major linkages between climate change and the economy. Dozens of modeling groups around the world have brought to bear the tools of economics, mathematical modeling, optimization, decision theory, and related disciplines to investigate the effects of accumulations of greenhouse gases as well as the costs and benefits of potential policy interventions such as emissions limitations or carbon taxes.7

As with economic impact studies, virtually all the studies undertaken by the integrated-assessment economic models community of scholars have

addressed the questions of gradual climate change. Recently, a few researchers have investigated the impact of threshold events, such as a weakening and eventual shutdown of the North Atlantic thermohaline circulation (for shorthand, such events are called thermohaline circulation collapse or THCC). One set of studies has examined “inverse” analyses in which emissions trajectories were constructed that would keep greenhouse gas accumulations away from the threshold at which a THCC would occur (Toth, 2000). A further set of studies examined policies that would keep climate short of a “catastrophic” threshold (Nordhaus, 1994; Nordhaus and Boyer, 2000).

One recent set of studies (Keller, 2000; Keller et al., 2001) is particularly relevant because it shows that threshold effects can have surprising impacts on efficient economic policies. These studies begin with the dynamic integrated model of climate and the economy model of climate change (Nordhaus, 1994; Nordhaus and Boyer, 2000) and introduce an ocean-circulation model that allows for a THCC. They assume that the THCC was essentially irreversible and would impose a large economic penalty (either in the sense of actual economic losses or in the sense of a large willingness to pay to prevent the THCC). They then couple the dynamic integrated model of climate and the economy model of climate change with their ocean circulation model to investigate the efficient economic policy. An “efficient” policy is one that minimizes the net economic impact or maximizes net incomes when taking into account both the damages from climate change as well as the costs of slowing climate change.

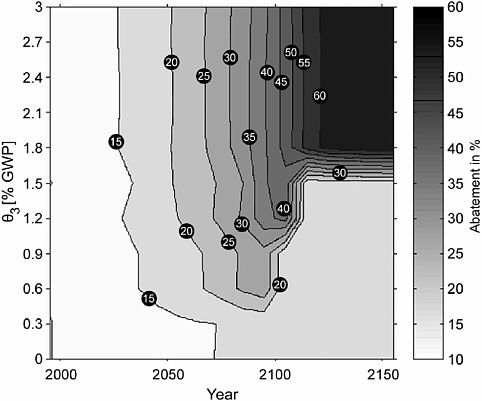

Figure 5.10 shows the result of the Keller et al. (2001) calculations. This shows the abatement rate (measured as a percent of baseline emissions reduced) as a function of time on the horizontal axis and the damage on the vertical axis. Low abatement rates occur early and for low THCC costs, while high abatement rates occur in later periods and for high THCC costs. Two features of the result are worth noting. First, the abatement rate or carbon tax is relatively insensitive to the cost of the THCC for the first half of the twenty-first century. The reason is that it is economically advantageous to postpone costly abatement because of such factors as discounting due to the productivity of investments or because society might discover an economical low-carbon fuel. A second and surprising result occurs for damage cost in the range of 0.5 to 1.5 percent of gross world product. For this region, abatement rises rapidly until around 2100 and then actually declines. The reason is that the early high abatement delays the THCC for a few years and thereby postpones the costs; however, once reversal has oc-

FIGURE 5.10 Efficient abatement policies as a function of threshold specific damages (Keller, 2000). The efficient carbon abatement policies are derived in an “optimal economic growth model.” The figure shows abatement rate contours (reduction rate as a percent of baseline) as a function of time on the horizontal axis and damages from a shutdown of the thermohaline circulation as a percent of world output on the vertical axis. The economic model is based on Nordhaus (1994), modified to allow for an ocean thermohaline circulation collapse. Ocean modeling studies suggest that the thermohaline circulation may shut down when the equivalent CO2 concentration rises above a critical value (Stocker and Schmittner, 1997). The model assumes a CO2-temperature sensitivity of 3.6°C for CO2 doubling and neglects parameter uncertainty. (See Keller, 2000 and Keller et al., 2001 for details.)

curred, then abatement only occurs from the non-THCC part of climate damages.

These first efforts to apply integrated-assessment economic models to abrupt climate change are useful in suggesting how abrupt climate change might influence our thinking about the nature of policies to slow climate change. At the same time, attention needs to be paid to other shocks. In one sense, the THCC is an extremely nasty climatic outcome but, as modeled to

date, not really abrupt. It would be useful to pay more explicit attention in integrated-assessment economic models to other kinds of potential shocks, perhaps focusing on major changes in water and agriculture systems for the United States as well as to shifts in monsoonal patterns or droughts in other regions. This effort is hampered to date, however, because there are few scenarios for abrupt climate change that have been handed off by geoscientists to the economic modelers.

Attention to climate extremes in the wake of anthropogenic-induced gradual warming has been reported by Easterling et al. (2000). This study examined outputs of general circulation models that show changes in extreme events for future climates under greenhouse warming scenarios, such as increases in high temperatures, decreases in extreme low temperatures, and increases in precipitation events. These authors suggested a range of impacts due to these extremes, including the impacts to natural ecosystems and society.

In summary, climate change inevitably has impacts. Abruptness increases those impacts, especially on unmanaged and long-lived systems. To date, however, relatively little research has addressed the possible costs of abrupt climate change or ways to reduce these costs, both because climatologists have not produced appropriate scenarios and because ecological and economic scientists have not concentrated on abruptness. Ways to address this shortcoming are discussed in the next chapter.