income level. It is not clear how the commercial markets will offer or restrict access. The Internet system inherited from the academic environment presumed a lack of gateways and a transparent system without excludability. The ideal entrepreneurial system, however, must be able to exclude people so that it can charge fees for entry and earn a profit.29

The Issue of Internet Gateways

Indeed, Dr. Greenstein said, the next generation of communications networks has many gateways. Some are necessary security firewalls, some virtual private network tunnels. Nevertheless, their effect is to exclude people from the network. For uses like point-to-point communications people are uncomfortable when somebody has the financial right to exclude somebody else. The debate over instant messaging at AOL suggests a larger debate to come. He returned to the example of Napster as a possible example of a profitable business model: a company that uses centralized directory services to facilitate point-to-point communication. As such, a larger company would probably buy Napster immediately. What should the regulatory and standard-making bodies do about all this? What will be the difference between a public and a private infrastructure?

Dr. Greenstein summarized his talk with three points:

-

There are alternative modes for developing new infrastructure and they are presently treated asymmetrically.

-

We are seeing the restructuring of information-intensive activities and we have little understanding of where they are going.

-

Some core principles behind the regulation of communication activities are being upended and these will be debated over the next decade.

ECONOMIC ISSUES OF E-BUSINESS

Erik Brynjolfsson

MIT/Sloan School of Management

Dr. Brynjolfsson began by noting previous comments about the risk of making predictions and suggested that e-business is not exempt from this risk. He

said that if economists have a modestly good record in predicting technological changes, this is not the case for predictions about organizational and business model impacts.

There are parts of the economy we can measure fairly well but there are also dark areas that we do not understand. He admitted that some of the keys to the New Economy lie hidden in those dark areas, including ways to evaluate new business models and organizational structures. He talked about two parts of that dark area: how technology and the Internet are changing markets and how they are changing firms and organizations. All of these entities—markets, firms, networks, and network organizations—can be thought of as information processors. Researchers including Hayek, Roy Radner, and others30 have modeled them as such and suggested that they will be significantly affected by the dramatic changes in information processing described earlier in the symposium.

An Investigation of Internet Buying Behavior

Dr. Brynjolfsson started with a discussion of predictions about e-business, including the prediction that the Internet, by lowering search costs and facilitating comparisons among products, would lead to fierce price competition, dwindling product differentiation, and vanishing brand loyalty.31 He cited the rise of price search engines and comparison intermediaries. He demonstrated one of them that can check several dozen Internet bookstores and seek out the best price for a given book and rank them by price in just a few seconds. He found a typical spread among these search engines of about $10 for a given book, which is fairly significant. There is also information about shipping time, shipping charges, and other criteria, but they largely de-emphasize the company itself so that the main feature the shopper sees is the price.

Dr. Brynjolfsson and his colleagues decided to take advantage of the data gathered by these search companies to try to understand how consumers were actually using the Internet to shop. They knew that every book is the same— down to the last comma—no matter who is selling it, so they hoped to detect the motivations for purchasing from a particular seller. They were able quickly to gather over a million price offers from company logs for a period of 69 days. They wanted to see whether a consumer would simply buy from the cheapest source or whether other factors would matter.32

Price Is Not the Most Important Factor

They were surprised to find that there were four important variables, not just one. Total price was quite significant, as was shipping time and advertising. However, the most important factor was whether the person had previously visited that site before. This can be tracked on the Internet by “cookies,” which are signals left on the hard drive to speed the downloading of a site already visited. The site owners can also tell when you have returned to their site—by far the most important factor in making a purchase. This reveals that even though a book is as close to a commodity as one might expect to get on the Internet, price was not everything. In fact, fewer than half the buyers chose the lowest-priced entries on the tables. Moreover, this is among the set of consumers who chose to go to a price intermediary in the first place, so one would assume they are more price sensitive than the average consumer. Instead, service, branding, customer loyalty, and the quality of the experience all made a big difference.

In a second exercise, Dr. Brynjolfsson conjectured that these results would be more likely to hold as they start testing more heterogeneous products and products with more levels of unobserved service quality. For instance, they looked at the subset of consumers who wanted their screen sorted on the basis of delivery times instead of price. Indeed, delivery time was more important and price was less important, but other features were also more important, such as various measures of branding and other ways of guessing at the unobserved quality of the vendor, such as shipping time, which is harder to guarantee than price.

Third, they were able to begin to quantify the value of customer loyalty. They could see that a customer who has shopped there is more likely to come back again, even when they have access to shopping intermediaries. As a result, this market has been altered substantially by access to shopping intermediaries and over the next year or less many more sophisticated intermediaries will populate not just business-to-consumer markets but even more of the business-to-business markets.

The Internet Is Not the Great Equalizer

In this case the expected “law of one price” did not hold. There is much more to a product than its price, even for a commodity item. Researchers have to be careful when making measurements, because they might not capture everything, whether for purchase of a personal computer or service. In fact, consumers apparently perceive much more differentiation between products than economists might impute to them, such as customer service, product selection, convenience, and timeliness. These considerations should be acknowledged even if they cannot always be measured.

Dr. Brynjolfsson said that managers say they are putting a lot of their information technology effort into addressing things that economists and statisticians

|

Box C: Beyond the Law of One Price “The expected law of one price did not hold. There is much more to a product than its price, even for a commodity item. Researchers have to be careful when making measurements, because they might not capture everything, whether for purchase of a personal computer or service. In fact, consumers apparently perceive much more differentiation between products than economists might impute to them, such as customer service, product selection, convenience and timeliness. These considerations should be acknowledged even if they cannot always be measured.” Erik Brynjolfsson |

do not yet measure, such as quality, customer service, flexibility, and speed. For example, Amazon got six times as many click-throughs as one would predict if one took only price into account.

The good news is that clickstream data brings a tremendous amount of new information that can be analyzed to predict consumer behavior. He compared this technique with experimental methodology of 5 to 10 years ago. He imagined that he had found 50 undergraduates, paid them a dollar, asked them that if they had $10 to spend, would they buy the book from the red store or the blue store. This would not only be very difficult to do, but it would not be nearly as accurate as real consumers looking at a million and a half real price offers.

E-Business Is Not Just About Technology

Dr. Brynjolfsson turned to the topics of production and organization, stressing the point that e-business is not just about technology. He described a joint project with Merrill-Lynch, a sponsor of the Center for E-Business at MIT, to study online versus traditional brokerages. A traditional brokerage has a physical retail front office where customers interact directly with brokers. An Internet brokerage has a Web site where customers interact with Web servers and e-mailbased communication. To gain some indication of how that technology affects the brokerage, an online broker might buy the technology using traditional assumptions about its cost and what the hedonic price improvement is. This would be missing the forest for the trees, said Dr. Brynjolfsson, to limit oneself to such assumptions. In fact, the differences between a traditional and online brokerage are both more complex and more significant.

The Importance of Co-invention

E-business, he said, includes a tremendous amount of what Dr. Bresnahan referred to earlier as co-invention,33 the process by which technology brings opportunities to invent new business models and new organizational structures.34 Internet entrepreneurs and managers spend a great deal of time calculating what the compensation structure should be, who should be the target for the market, and what the revenue streams are going to be. That is why the entrepreneurs earn so much money: Those with successful Internet business models have learned that the technology is important only as a catalyst in this e-business revolution. This conclusion, said Dr. Brynjolfsson, is seen time and time again in every industry. The success of Amazon.com provides a good example. Simply adding e-mail services to a traditional bookstore would not bring even a small fraction of the personalization, customization, book recommendation, and the other parts of the business model that Amazon invented.

Measurement of Intangible Assets Is Difficult

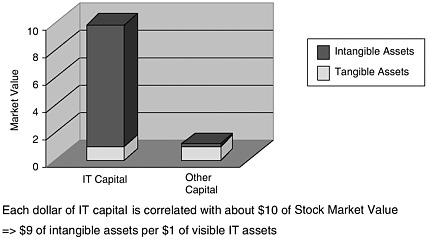

He said that he does not yet have good data on how to measure the value of such e-business context, but his group has studied traditional information technology and has found a striking difference between the intangible investments associated with information technology versus traditional capital investments (Figure 13). Investors value $1 of information technology capital at about $10 of traditional capital but not because information technology is that much more valuable. The reason for the difference is that whenever somebody spends $1 in information technology they have to spend another $9 or $10 on implementation, organization, and other co-invention costs.35

Investors apparently understand that additional costs are really investments, even though accountants write the costs off in the current year as an expense. In reality this investment creates assets—some new business process or customer base—and these assets bring new abilities. This is one reason for the success of Wal-Mart, he said; its managers have developed a well-understood and valuable set of business processes that are difficult to copy. Such knowledge is somewhat “sticky” and particular to the organization that develops it. Its value is also diffi-

FIGURE 13 Tangible and Intangible Assets.

SOURCE: Brynjohlsson and Yang, “Intangible Costs and Benefits of Computer Investments: Evidence from the Financial Markets.”

cult to measure, even though enormously important to the success of modern businesses.

The Value of Organizational Capital

He showed a final chart summarizing an attempt to measure the computer capital of a series of firms and come up with an organizational capital metric. Dr. Brynjolfsson’s group sent a survey to about 500 human resource managers and asked them how they organized production. They distilled the results into a single dimension of organizational capital. They found that organizational capital and computer capital were correlated with each other, but most strikingly, investors rewarded firms that ranked high in both computer capital and organizational capital. Dr. Brynjolfsson judged that it must be fairly difficult to bring these two into high equilibrium, or else the returns would be beaten down.

He summarized by saying that the Internet is transforming the way markets function and that the successful Web businesses of today are just the first wave of this transformation. Secondly, the Internet is transforming firms themselves. He repeated the finding that technology is just the tip of the iceberg in that transformation. It is a very important tip—arguably the catalyst that enables it all—but it is not where most of the time, effort, and investment go. Most of the investment goes into the intangible costs that change the way firms organize themselves.