TABLE 7.1 Annual Requirements for Principal Primary Materials Used in the United States (Pounds per capita, 1972)

|

A. Nonmetallic Inorganic Materials: |

|

|

|

Sand and gravel |

9000 |

|

|

Stone |

8500 |

|

|

Cement |

800 |

|

|

Clays |

600 |

|

|

Salt |

450 |

|

|

Other |

1200 |

20550 |

|

B. Metals: |

|

|

|

Iron and steel |

1200 |

|

|

Aluminum |

50 |

|

|

Copper |

25 |

|

|

Lead |

15 |

|

|

Zinc |

15 |

|

|

Other |

35 |

1340 |

|

C. Natural Organic Materials: |

|

|

|

Forest products |

2750 |

|

|

Natural fibers and oils |

50 |

|

|

Natural rubber |

10 |

2810 |

|

D. Synthetic Organic Materials: |

|

|

|

Synthetic polymers |

116 |

|

|

(including rubber) |

|

116 |

|

|

TOTAL |

24816 |

|

(Equivalent total for entire U.S. population = 2.57 billion short tons.) |

||

technology that may make it feasible to mine down to 4 pounds per ton.

While advances in extraction technology are capable of easing our dependence on foreign sources of raw materials, improved technology in other stages of the materials cycle could enhance the effectiveness of materials utilization and hence relieve pressure on new supply. Figure 2.4 of Chapter 2*illustrates some of the social and technical pressures that operate at various stages of the economic utilization of materials. A strong materials technology is a key element in permitting industry to be responsive to these pressures and yet still produce goods at reasonable cost.

MATERIALS IN INDUSTRY

Consideration was directed in Chapter 2 to the changing world conditions in which the institutions of the materials field—in industry, government, and universities—must function. Attention is now given to illustrating in more detail the principal features of industrial areas which operate to meet man’s present and future needs for materials to perform desired functions in goods and services. The features are highlighted by examining three key materials-producing industries (metals, inorganic nonmetals, and plastics), and five industries that are major users of materials (electronics, lighting, containers, automobile, and building). Finally, in the closing part of this section, the important role of materials standards and specifications is reviewed.

Before discussing the individual industries, it is useful to view their relative efforts devoted to process and product improvement and innovation through their R&D activities. Although accurate information for these industries is unavailable, some comparison with the full range of U.S. manufacturing industry is given by data in Tables 2.19, 2.20, and 2.21 of Chapter 2. The industries listed in these tables are the Standard Industry Classification (SIC) sectors often used in national statistics. While these sectors do not always exactly match the industries to be discussed here, they are close enough to indicate two important points. The first is that the metals and inorganic-nonmetals producing industries—like most primary product industries—show R&D expenditures that are considerably smaller in absolute terms than the four industry sectors leading the list, and they also stand lower as a proportion of the industry sales revenue. The second point is that, unlike the leading industries (except for chemicals, in which the plastics industry would be included), these materials-producing industries essentially fund their own R&D and receive little federal R&D support. While presently available national statistics do not permit a more detailed analysis of industrial materials R&D, Table 2.21 indicates that total R&D in the materials-producing industries is somewhat more than one billion dollars, almost all of which is supported by industrial funds. In addition, a substantial amount of R&D is carried out in the materials-using industries, although the actual dollar value has not been ascertained.

Principal Materials-Producing Industries

Metals Industry

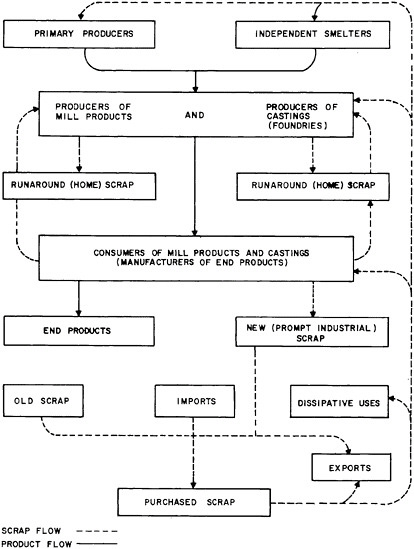

Table 7.2 shows the expected demand for metals over the next 15 years. Iron and steel continue to be the leading metals industry in scale and value and a significant indicator of the nation’s economic wellbeing. In terms of both quantity and value, aluminum and copper are the principal metals in the nonferrous group. They are followed by 44 other elements, ranging from the precious metals, gold, silver, and platinum, with very high unit values but relatively small volume usage, through the industrial metals such as lead, zinc, mercury, and the light metals such as magnesium and titanium.

Major applications and future growth areas are strongly oriented toward consumer goods, transportation and construction industries, and the generation and use of electrical energy. Continuing increases in the real costs of production and an anticipated growth in utilization are the principal factors contributing to an increase in domestic demand for the nonferrous commodities (from about 15% of the 1970 value for all mineral commodities up to about 18% of the total in 1985).

Industry Structure: A large part of the metals industry is concentrated, i.e. is characterized by large vertically integrated companies which are able to optimize both their raw materials sources and their markets. Major factors leading to this structure are the worldwide occurrences of ores and raw materials and the complex coproduct-byproduct relationships. Thus, dispersion of raw material sources encourages formation of multinational companies, and broad-based markets results from the production of the many metals of interrelated occurrence. The latter is especially true in the base metals. The significance of imports and import sources to the U.S. is illustrated in Table 7.3. Similarly, Table 7.4 shows the metal byproducts recovered in the processing of ores for the major metal content.

A tendency toward horizontal integration along functional lines has developed during the last two decades. For example, major copper-producing companies have expanded their operations to include production of primary aluminum. Primary aluminum producers are likely to become involved in primary copper production within the next decade. Because of the many common markets shared by the light metals, aluminum, magnesium, and titanium, the production and processing of two or more of these elements by single firms will tend to expand during the remainder of this century. The similarities in uses and properties of titanium and alloys of iron have already led steel companies to invest in primary production facilities for both of these elements. The following paragraphs illustrate these various structural features for specific metals industries.

In iron and steel, an estimated 60% of domestic iron ore production was accounted for by nine steel companies; these same organizations produced about 75% of the nation’s crude steel in 1970. The two largest U.S. companies produced 34% of the domestic iron ore, 40% of the crude steel, and also accounted for the bulk of U.S. imports of iron ore from mines in Canada, Venezuela, Liberia, and Chile.

TABLE 7.2 U.S. Demand for Selected Primary Metals, 1970 and 1985*

|

|

|

Demand |

Growth, percent |

||

|

Metal |

Units |

1970 |

1985 |

Annual Compound |

Total 1970–1985 |

|

Ferrous: |

|

||||

|

Iron |

Million S.T. |

84 |

113 |

2.0 |

135 |

|

Manganese |

Thousand S.T. |

1,327 |

1,770 |

1.9 |

135 |

|

Chromium |

Thousand S.T. |

462 |

700 |

2.8 |

150 |

|

Vanadium |

S.T. |

7,066 |

14,700 |

5.0 |

210 |

|

Nickel |

Thousand lb. |

311,400 |

492,200 |

3.1 |

160 |

|

Molybdenum |

Thousand lb. |

49,104 |

96,500 |

4.6 |

195 |

|

Tungsten |

Thousand lb. |

16,200 |

34,200 |

5.1 |

210 |

|

Nonferrous: |

|

||||

|

Aluminum |

Thousand S.T. |

3,951 |

11,500 |

7.4 |

290 |

|

Copper |

Thousand S.T. |

1,572 |

2,900 |

4.2 |

185 |

|

Zinc |

Thousand S.T. |

1,302 |

1,820 |

2.3 |

140 |

|

Lead |

Thousand S.T. |

829 |

1,100 |

1.8 |

130 |

|

Magnesium** |

Thousand S.T. |

96 |

235 |

6.1 |

245 |

|

Tin |

Thousand L.T. |

53 |

70 |

1.9 |

130 |

|

Titanium** |

Thousand S.T. |

24 |

65 |

6.9 |

270 |

|

Mercury |

Thousand fl. (flasks) |

54 |

66 |

1.3 |

120 |

|

Silver |

Thousand Troy oz. |

73,100 |

124,000 |

3.6 |

170 |

|

Gold |

Thousand Troy oz. |

6,147 |

9,200 |

2.7 |

150 |

|

Platinum |

Thousand Troy oz. |

407 |

634 |

3.0 |

155 |

|

* From First Annual Report of Secretary of the U.S. Department of Interior, March 1972. ** Metal only, all others include both metallic and nonmetallic applications. |

|||||

TABLE 7.3 U.S. Imports by Source and as Percent of Apparent Consumption, 1970

|

Metal |

Imports /Consumption, percent |

Major Import Source |

|

Ferrous: |

||

|

Iron |

33 |

Canada, Venezuela |

|

Manganese |

82 |

Brazil, Gabon, Rep. South Africa, India |

|

Chromium |

84 |

U.S.S.R., Rep. South Africa, Turkey, Philippines |

|

Vanadium |

29 |

Rep. South Africa, U.S.S.R., Chile |

|

Nickel |

75 |

Canada, Norway |

|

Molybdenum |

Nil |

|

|

Tungsten |

8 |

Canada, Peru, Mexico |

|

Nonferrous: |

||

|

Aluminum |

118 |

Jamaica, Surinam, Canada, Australia |

|

Copper |

19 |

Chile, Peru, Canada |

|

Zinc |

51 |

Canada, Mexico, Peru |

|

Lead |

27 |

Canada, Australia, Peru, Mexico |

|

Magnesium* |

3 |

Canada |

|

Tin |

76 |

Malaysia, Thailand |

|

Titanium* |

40 |

Japan, U.S.S.R. |

|

Mercury |

35 |

Canada, Spain |

|

Silver |

48 |

Canada, Peru, Mexico, Honduras |

|

Gold |

47 |

Canada, Switzerland, United Kingdom, Nicaragua |

|

Platinum |

139 |

United Kingdom, Rep. South Africa, Japan, U.S.S.R. |

|

* Metal only, all others include both metallic and nonmetallic applications. |

||

TABLE 7.4 Byproduct Relationships for Selected Metals, 1970

|

Ore |

100 Percent of Total Output |

Less Than 100 Percent of Total Output |

||

|

Iron |

Cobalt |

|

Manganese Copper |

Gold Silver |

|

Aluminum |

|

Gallium |

|

|

|

Copper |

Arsenic Rhenium |

Selenium |

Palladium Tellurium Gold Silver Molybdenum |

Platinum Nickel Zinc Iron Lead |

|

Lead |

Bismuth |

|

Antimony Zinc Silver Tellurium |

Gold Copper Manganese |

|

Zinc |

Cadmium Germanium |

Indium Thallium |

Lead Silver Manganese Gallium |

Gold Mercury Copper |

In aluminum, four of the 12 domestic firms producing primary aluminum and representing about 72% of total productive capacity in 1970 were vertically integrated from mining through production of semifabricated shapes. Two of the remaining firms were owned or associated with foreign integrated firms. Others produced aluminum from purchased bauxite or alumina, and all had facilities for producing semifabricated shapes. Worldwide, the aluminum industry is vertically integrated with very few exceptions. Six companies control or influence (by majority or minority interests) over 75% of the world productive capacity for primary aluminum.

In copper, 25 mines accounted for 93% of the U.S. copper output in 1970. The five largest produced 42%, and three companies accounted for a little more than half of the domestic mine production. Virtually all copper ore continued to be treated at concentrators near the mines. Concentrates were processed at 17 smelters—eight in Arizona and one each in Utah, Michigan, Montana, Nevada, New Mexico, Tennessee, Texas, New Jersey, and Washington. Copper smelting capacity in the U.S. in 1970 totaled 9.2 million tons of charge, equivalent to about 1.9 million tons of smelter product; four companies constituted nearly 80% of the capacity. Refinery capacity totaled 2.7 million tons of which 89% was electrolytic refining capacity and 11% was fire-refining (including Lake copper) capacity.

Many large domestic copper producers, through subsidiaries or stock holdings, operate or control foreign copper-producing properties in Canada, Mexico, Peru, the Republic of South Africa, and Zambia. In addition to copper and the usual byproducts, some of these companies are also major producers of aluminum, cadmium, chromium, germanium, lead, titanium, uranium, vanadium, zinc, asbestos, fluorspar, precious metals, and liquid and solid fuels.

In lead, domestic companies accounted for 61% of the lead mined and practically all of the primary smelter production in 1970. These large companies are vertically integrated (from mine to refined lead) and are also horizontally integrated with other base-metal production. Other companies in the industry are essentially mine operators utilizing, to a varying degree, custom plants for concentration, smelting, and refining. The leading 25 mines accounted for over 95%, and the leading 5 mines for 64% of the total domestic primary production in 1970. Four states produced 97% of the total domestic production; Missouri contributed 74%; Idaho, 11%; Utah, 8%; and Colorado, 4%.

In zinc, companies prominent in the U.S. zinc mining or smelting industry likewise have substantial interests in important mines and related operations in foreign countries. Conversely, certain foreign firms have significant interests in segments of the U.S. zinc industry. In 1970, the primary zinc producing industry in the U.S. was dominated by six large vertically integrated firms that controlled mines, smelters, and/or refineries. These six, along with one company having only an electrolytic refiner, accounted for 90% of the slab zinc produced domestically. Nine prominent U.S. companies have substantial interests in foreign zinc activities. Holdings are in properties located in Canada, Mexico, Argentina, Peru, Australia, and southwestern Africa.

Recycling of Metals: Published statistics on the reuse of metal wastes through recycling are frequently confusing in that they often fail to distinguish between scrap recovered from the materials-producing or using

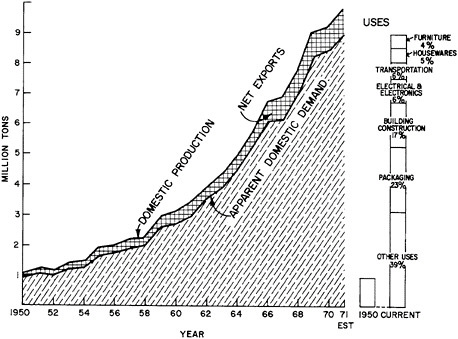

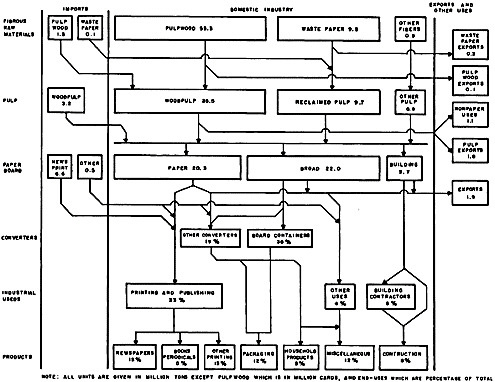

industry (home or prompt industrial scrap) and that derived from post-consumer wastes (old scrap) or imports. Figure 7.2, which is based on the aluminum industry, illustrates the origins of these types of scrap at the different stages of metal flow through the materials system. Clear delineation of these separate scrap sources is especially important in the light of current material concerns about the management of waste or residual flows for purposes of environmental protection and materials conservation.

Table 7.5 shows the current levels of total scrap recovered in the U.S. for the major metals. These data indicate the modest recovery of secondary aluminum and zinc (17% of consumption) compared with that for secondary copper (i.e. copper recovered from scrap as metal, as alloys without separation of the copper, or as compounds). Both the intrinsic value and long-established recovery technologies contribute to the higher rate for copper. The largest amount recovered as metal is reclaimed by the primary copper producers as electrolytic copper. However, alloyed copper, principally brass and bronze, comprises more than 50% of the total recovery and is prepared by secondary smelting and casting processes.

Lead, like copper, has a high annual rate of recovery—amounting to 44% of consumption. Half of the lead consumed each year is added to the lead-in-use resource, i.e. becomes available for recycling. In contrast to copper and lead, only 17% of zinc supply comes from scrap. Most of the zinc from old scrap (such as manufactured items discarded because of wear, damage, or obsolescence) is recovered in the form of die-castings, engravers’ plates, brass, and bronze, but this represents less than 5% of the total supply. New scrap, principally zinc-base and copper-base alloys from manufacturers, and drosses, from molten galvanizing and die-casting pots, contribute 10–15%. The large usage of zinc in galvanizing and in compounds (such as paints) where the zinc is lost is a major obstacle to improved recycling of zinc.

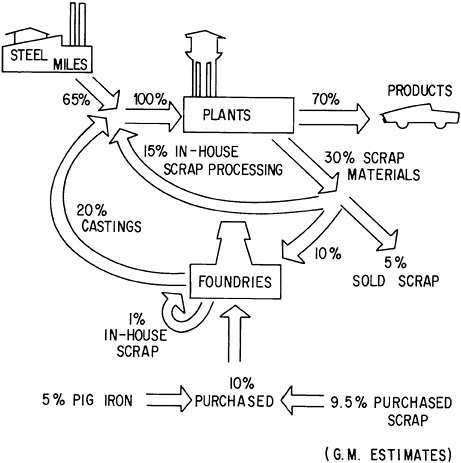

Over the last 30 years, total annual consumption of ferrous scrap by the iron and steel industry has been close to a 1:1 ratio with virgin pig iron. Home scrap accounts for well over 60% of the scrap used in the steelmaking furnaces; less than 15% is prompt scrap, and the balance is obsolete material.

Currently, the development of sophisticated processing and materials-handling equipment is revolutionizing major areas of the purchased-scrap industry. For example, giant shredders, or fragmentizers, with magnetic separators and pneumatic cleaning devices can convert up to 1,000 automobile bodies per day into scrap (i.e. at a rate of less than 30 seconds each). The combined national capacity of about 70 super-shredders and small-to-medium sized shredders in operation in 1968 was described as over 6 million tons, about equalling the tonnage of cars junked that year. Advances in balers, automatic shears, and conveyors contributed to the mechanization trend. Improved quality-control equipment permits the processor to deliver scrap material to more exacting specifications. In contrast with such changes, economically viable technologies for metals recovery from another major source—urban wastes—remain to be developed.

Environmental Considerations: Environmental-quality requirements introduced over the past decade have significant impacts on the mineral industry. For instance, fumes from zinc smelters may contain cadmium, those from copper smelters may contain arsenic, and both operations generate sulfur dioxide.

To control such pollutants within acceptance limits requires add-on equipment to remove them or even changes in the technology of the extraction processes themselves. Thus, in order to assist in minimizing the release of such pollutants, there is a need to improve the methods of recovery of “associated” metals (e.g. bismuth antimony, rhenium, cadmium, indium, and others) that occur with copper, lead, and zinc ores. Ordinarily, these associated metals are present in such small amounts that they are disregarded in commercial smelting operations.

In addition to problems in processing, the actual utilization of some metals is being reduced because of environmental concern. Examples are the curtailed demand for mercury and the decrease in the demand for lead as automobile fuel is switched away from leaded gasoline. Conversely, demand for other metals is likely to increase due to construction requirements for pollution-control equipment. One specific example is the expected increase in demand for platinum in automobile catalytic mufflers to meet the requirements of the Clean Air Act of 1970. Correspondingly, petroleum refineries may need more platinum for catalysts as demand for lead-free gasoline is increased.

The following summarizes the capital expenditures expected in the various metal industries to comply with environmental regulations over the next several years. To control air and water pollution associated with the smelting and refining of aluminum, an investment of $935 million will be required for the period 1972 through 1976. Annual costs are estimated to range from $22 million in 1972 to approximately $290 million in 1976. Cost increases per pound of aluminum in 1976 may average $0.020 to $0.032.2 For copper, control of smelter stack-gas emissions is the most pressing problem facing the U.S. industry. Estimated capital investment for air- and water-pollution controls required of the copper industry between 1972 and 1976 is expected to total $300 million to $690 million, with a most likely estimate of $340 million. Annual costs are estimated to increase from $6 million in 1972 to $95 million in 1976. Per pound of refined copper, these costs would average $0.001 in 1972 and $0.025 in 1976, with a possible high estimate of $0.05 in 1976.2

For lead, the total capital expenditure required to control the pollution associated with smelting and refining, might be about $70 million for the 1972 to 1976 period, with annual costs increasing from $1.1 million in 1972 to $20 million in 1976. Costs per pound of lead in 1976 have been estimated at $0.012 to $0.017.2 However, these studies did not consider the substantial changes in the lead markets that might be caused by other pollution abatement regulations such as those to reduce the lead content of gasoline. For zinc smelting and refining, $62 million of capital expenditures are estimated for the period 1972 to 1976. Annual pollution-control costs may increase from $1.5 million in 1972 to $27 million in 1976, averaging $0.0123 to $0.0267 per pound of zinc, with an expected cost of $0.0135 per pound.2

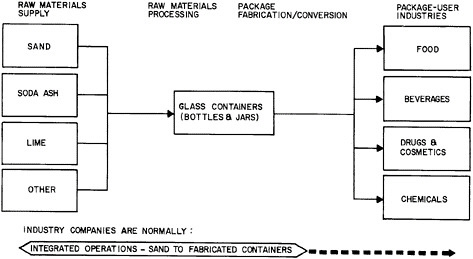

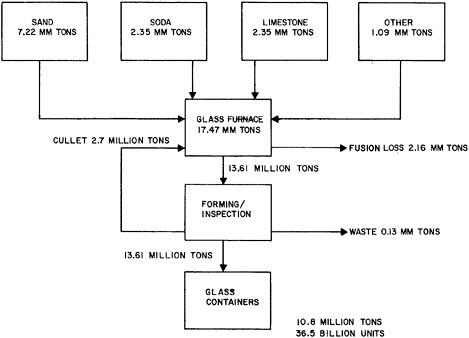

Inorganic Nonmetals Industry

Demand for inorganic nonmetallic materials accounted for 8% of total mineral tonnage in 1950, an estimated 8% in 1971, and is projected to be 11% in 2000. These materials include a wide range of substances, from large-bulk items such as sand, gravel, stone, and clay, through intermediate processed materials such as ceramics, electronic crystals, and synthetic high-hardness abrasives. In general, they are produced in response to near-term demand, and domestic reserves for most major nometallics are large. Domestic mineral production of nonmetallics in 1971 was valued at $5.9 billion. The corresponding variety of materials is shown in Table 7.6. Many are large tonnage items, of initial low value in the unprocessed stage, but acquiring substantial added value in the form of glass, ceramics, chemicals, etc.

Nonmetal mining or industrial-minerals operations tend to be diverse in size and degree of integration. In general, the abundance of these items is such that there is no reclaimed material production. For the most part, the secondary or reclamation segment of the nonmetallic minerals industry is limited to some reclaimed fluorine, diamonds, and abrasives. Pollution-control regulations may force an increase in recycling but high transportation costs are likely to limit the size and market for such operations.

In the following, attention is given to some of the major categories of materials involved in order to illustrate the principal features of the industry. The categories are ceramics, construction materials, fertilizer minerals, and a selection of the other major nonmetallic materials.

Ceramic Materials: The technology of ceramic materials may be divided into two major categories. One branch produces large quantities of relatively simple products which in total play a significant role in the U.S. economy: cement, brick, tile, glass, whiteware, refractories, clay products, etc. The technology of these materials has, in general, kept pace with needs. In recent years, however, the float process for flat glass came from abroad, and glass imports have been sufficiently large to cause some problems for the domestic industry. Another branch of ceramics is more closely allied to the frontiers of materials science, solid-state physics, and solid-state chemistry. This branch has developed the transistor, synthetic diamonds, luminescent phosphors, and high-temperature oxides, carbides, nitrides, borides, etc. Nuclear fuels are an important development of this activity. These specialized materials require the application of scientific thinking and practices, and have resulted in the establishment of whole new industries. However, continued progress in the science of such materials is dependent upon further extensive research of the most fundamental nature and the interchange of information among widely differing scientific disciplines.

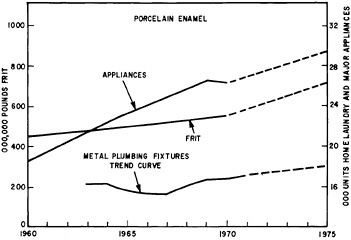

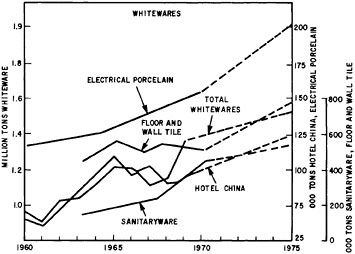

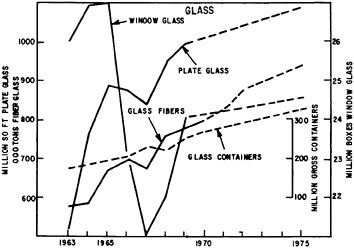

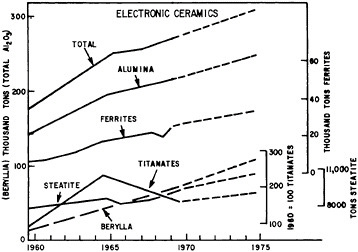

Shipments of products from the ceramic industry which totalled some $15 million in 1972 are important inputs into the construction, container, auto, lamp, and electronics industries discussed in other sections of this chapter. In addition, nuclear fuels, refractories, carbon, and graphite are important components of energy supplies, containment, and use. Materials listed in Table 7.7 illustrate the wide variety of essential ceramic products and the industries to which they contribute. Figures 7.3 through 7.6 show the different growth characteristics of some of the principal ceramic materials and products since the early 1960’s.

TABLE 7.6 Nonmetallic Minerals, 1971 (Preliminary Data)* Short Tons

TABLE 7.7 Ceramic Industry—Total Value of Shipments* (in billions of dollars)

|

|

1972** |

1967 |

1963 |

1958 |

1954 |

1947 |

|

Construction Ceramics |

||||||

|

Flat Glass |

.732 |

.611 |

.549 |

.385 |

.371 |

.224 |

|

Cement Hydraulic |

1.370 |

1.247 |

1.177 |

1.074 |

.811 |

.409 |

|

Brick & Structural Clay Tile |

.445 |

.362 |

.366 |

.287 |

.250 |

.145 |

|

Wall & Floor Tile |

.198 |

.161 |

.165 |

.136 |

.097 |

.041 |

|

Structural Clay Products NEC |

.196 |

.153 |

.160 |

.135 |

.111 |

.076 |

|

Vitreous Plumbing Fixtures |

.260 |

.170 |

.156 |

.143 |

.116 |

.068 |

|

Mineral Wool |

.504 |

.454 |

.392 |

.241 |

.157 |

.073 |

|

TOTAL CONSTRUCTION |

3.705 |

3.158 |

2.965 |

2.401 |

1.913 |

1.036 |

|

Consumer Ceramics |

||||||

|

Glass Containers |

1.988 |

1.352 |

1.004 |

.862 |

.635 |

.422 |

|

Pressed & Blown Glass NEC |

1.205 |

.886 |

.631 |

.445 |

.411 |

.235 |

|

Vitreous China Food Utensils |

.092 |

.067 |

.051 |

.048 |

.044 |

.043 |

|

Fine Earthenware Food Utensils |

.064 |

.047 |

.059 |

.050 |

.066 |

.072 |

|

Pottery Products NEC |

.107 |

.096 |

.096 |

.079 |

.055 |

.039 |

|

** Metal Stamped Enameled Products |

.183 |

.126 |

.090 |

.080 |

.066 |

.050 |

|

** Porcelain Enameled Stove Equipment |

.137 |

.095 |

.079 |

.067 |

.056 |

.036 |

|

** Porcelain Enameled Refrigeration Equipment |

.212 |

.147 |

.122 |

.066 |

.048 |

.028 |

|

** Porcelain Enameled Domestic Laundry Parts |

.134 |

.094 |

.076 |

.062 |

.045 |

.027 |

|

** Porcelain Enameled Electrical Appliance Parts |

.103 |

.053 |

.047 |

.045 |

.037 |

.028 |

|

Porcelain Teeth |

.014 |

.013 |

.012 |

.014 |

.013 |

.011 |

|

TOTAL CONSUMER |

4.239 |

2.976 |

2.267 |

1.818 |

1.476 |

.996 |

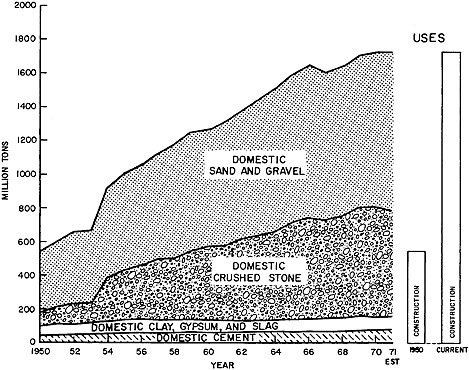

Construction Materials: Figure 7.7 shows that the use of nonmetallics in construction has more than tripled over the past two decades. These materials are produced almost wholly within the U.S. and imports are negligible. Further, except for the reuse of some old brick, and of building rubble as construction fill, recycling is not a factor. It is apparent that there have been steady and roughly proportionate increases in the use of cement, stone, and sand and gravel; these substances are commonly mixed together in specific proportions to make the heavy construction material for foundations, bridges, buildings, airports, roads, dams, etc. The consumption of clay and gypsum has increased slightly in recent years; clay is used to make a variety of products such as tile, pipe, and ceramics for construction, and gypsum is used to make plaster board which is in wide demand for its insulating and fire-retardant properties.

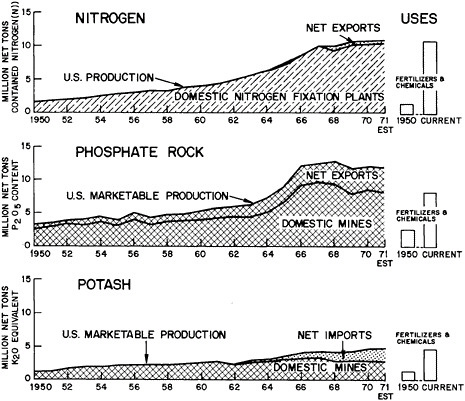

Fertilizer Materials: Figure 7.8 shows the rise in the U.S. use of the three major fertilizer ingredients—nitrogen, phosphorus, and potassium (N-P-K). The major increase in domestic agricultural productivity since World War II has resulted, in significant degree, from the intensive application of N-P-K, and other trace elements. Figure 7.8 also shows that exports of phosphate rock have provided a substantial market for the domestic phosphate mines, and indicates the increasing role of potash imports in the past several years.

Other Nonmetallic Minerals: Other nonmetallic minerals of importance to the U.S. economy include asbestos, barium, boron, bromine, calcium, corundum, diamonds, diatomite, emery, feldspar, fluorine, garnet, graphite, gypsum, kyanite, lithium, mica, perlite, pumice, quartz, sodium, strontium, sulfur, talc, soapstone, pyrophyllite, and vermiculite.

Asbestos demand is expected to increase domestically at an annual rate of 2.7 to 3.5% over the next few years. The worldwide shortage once predicted for the mid-70’s may be alleviated by the regulation of its use because of toxicity. Substitutes for asbestos are being sought for many applications. Currently, about 70% of asbestos consumption is in the cement products and construction field where the fibers are reinforcing agents. Other uses are: floor tile (10%), paper products (7%), transportation products (3%), textiles (2%), paints and caulking (2%), and plastics industries (1%). Nine companies produced all of the asbestos in the U.S. in 1970. Fully integrated companies, which are producer, consumer and end-product retailer, are common in this industry.

Barite demand is forecast to increase domestically at an annual rate of 1%. The U.S. is the world’s largest consumer, and while it produces about 20% of the world output, it is still a large importer. The major use for barite is as a weighting agent in oil- and gas-well drilling muds; this accounted for 79% of the 1970 consumption. The manufacture of barium chemicals takes up 10% of barite consumption. Most of the remaining 11% is used as a flux, oxidizer, and decolorizer in producing glass, and as a filler in paint and rubber. Four companies accounted for 69%, and 10 companies for 93% of the 1970 mine output, which was valued at $854,000.

Boron demand is expected to increase at an annual rate of 3 to 4%. For the next twenty years or more, these increased needs are expected to be met

largely by expanded domestic production. Important uses of boron compounds are in the manufacture of starch adhesives, ceramics, paints, soaps and detergents, fiberglass, flameproofing, gasoline additives, electrolytic condensers, glass, leather tanning, nonferrous-metal refining, nuclear-reactor control rods, photographic chemicals, and porcelain enamels. Boron compounds are also used in fungus control, herbicides, and agriculture. Glass and glassware accounted for about 42% of total U.S. consumption of boron; vitreous enamel and paints, 10%; soaps, cleansers, and detergents, 16%; fertilizers, 5%; and other uses, 27%.

Clay demand is forecast to increase at an annual rate of 3.5% and will be met by expanded domestic production. Reserves are plentiful and few problems of supply are expected. Imports declined nearly 25% to an all-time low of 64,000 short tons in recent years. Clay uses are many and varied, and sources are widely distributed throughout the country. Principal applications in 1970 were: structural clay products, 40%; hydraulic cement, 21%; and expanded clay, 18%. Other important markets were iron-ore processing, paper mills, and nonferrous metals.

Clay was produced at 1,457 mines in 1970, in all States except Alaska and Rhode Island. Brick plants and cement mills are scattered all over the country. Specialty clays such as ball clay, bentonite, fuller’s earth, and kaolin, are produced in localized areas and are shipped throughout the country.

Corundum demand is forecast to decrease domestically at an annual rate of 2%. U.S. requirements, which were met by imports from Southern Rhodesia until trade was stopped because of U.N. sanctions, have been supplied since 1969 from industry and government inventories. A single U.S. company acquired the entire surplus of corundum after the stockpile objective was reduced to zero and this supply was authorized for disposal.

Emery demand is forecast to increase domestically at an annual rate of 3%. However, the number of producers in New York, where the only commercial deposits of emery are found, has decreased to one; and zoning restrictions may close the remaining one. Corundum in its grain or powder form is used as an abrasive for lens grinding, (45%); pressure blasting of fabricated metals (40%); and other uses (15%). Emery is used primarily in the U.S. for nonskid concrete floors (45%), on highways (30%), and other miscellaneous abrasive applications (25%) which include coated abrasives, bonded products, polishing grain, and pressure blasting. One company in Massachusetts is the sole importer, processor, and distributor of corundum abrasives in the U.S. A New York company is the sole emery producer in the U.S.

Industrial diamond demand is forecast to increase domestically at an annual rate of 4 to 5.5%. Much of the increased need can be met by domestic manufactured synthetic diamond (25 mesh or finer). The U.S. has no domestic resources of natural diamond. The principal uses are in dies, grinding wheels, bits, tools, and in lapping and polishing compounds. The principal markets are in the manufacture of transportation equipment, 21%; electrical, 16%; concrete construction, 11%; exploration, 9%; dimension stone, 7%; stone, clay and glass, 4%; and all other uses, 15%.

Diatomite demand is expected to increase domestically at an annual growth rate of about 5%, and can be met by increasing production from existing open-pit operations in the Western States. In 1970, industrial and

and municipal water, food, beverage, and pharmaceutical processing required 58% of the diatomite production; industrial chemicals, 19%; thermal insulation, 4%; and other, 19%. During 1970, nine companies operating 11 plants principally produced and prepared all the domestic diatomite valued at $32.6 million.

Feldspar demand is forecast to increase domestically at an annual rate of 3.4 to 5.8%. These needs can be met by increasing production capacity through more than adequate reserves. (Note: Since a high percentage of feldspar supply is consumed in the manufacture of disposable bottles, legislation regulating their use may significantly alter the market for feldspar.) Feldspar is used in glassmaking to increase workability and chemical stability. Applications are for container glass, 44%; flat glass, 11%; ceramics (principally as a flux), and pottery making, 36%; enameling, 2%; and other uses such as abrasives, scouring soap, fillers, welding-rod coatings, 7%. Three firms accounted for 62%, and 7 firms accounted for 90% of 1970 mine production of the domestic feldspar (650,000 tons total).

Fluorspar demand is forecast to increase domestically at an annual rate of 3.6 to 4.6%, a rate which is faster than the probable domestic supply. In the near future, the importation of fluorspar is expected to continue at current or increasing rates. About 36% of the fluorspar consumed in the U.S. is used in the fluorocarbon industry; 40% in the steel industry; 21% in the aluminum industry; and the remaining 3% in miscellaneous electrometallurgical, chemical, ceramic, and other industries. In 1971, 2 large companies and 13 small companies operated 27 mines in 9 states. Fluorspar ores are concentrated in heavy-media and/or flotation plants. In 1971, U.S. companies produced finished fluorspar having a total value of $17 million.

Garnet demand is forecast to increase domestically at an annual rate of 2.1% for abrasive quality and 4.7% for sandblast quality. The increased needs are expected to be met by expanded domestic production. Uses for garnet are: grinding and polishing flat glass and optical glass, 32%; aircraft, 28%; other transportation, 10%; wood furniture, 10%; plastic products, 6%; semiconductors, 6%; fabricated leather products, 5%; and miscellaneous, 3%. In these applications, garnet competes with other natural and artificial abrasives. One company produces all the abrasive-quality garnet in the U.S. and accounts for all U.S. exports. Three other companies produce sandblast quality.

Graphite demand is forecast to increase domestically at an annual rate of 1 to 2% based on 1969 consumption of 61,000 tons. The increased needs are expected to be largely met, for the short term, by expanded imports. Nationalization of the Ceylonese mines has created uncertainty about future U.S. supplies from there. In 1970, natural graphite was used for foundry facing, 33%; crucibles, 9%; other refractories, 15%; a carbon raiser in steelmaking, 10%; dry lubricants, 10%; pencil leads, 4%; batteries, 3%; truck and bus brake linings, 3%; and other uses, 13%. Two hundred and thirty-five manufacturing plants account for an estimated 65% of graphite. Many small firms consume the rest. Primary metals use 43%; stone, clay, and glass products, 26%; nonpetroleum lubricants, 10%; pencils, 4%; and other uses, 17%.

Kyanite demand is predicted to increase domestically at an average rate of 3.8 to 6.7% annually. This rate could decline substantially if the direct

reduction process for steel production becomes commercially feasible. More complete recovery and use of byproducts such as pyrite, silica, and flake mica should be feasible with future advances in technology. The U.S., already the world’s largest producer of kyanite and synthetic mullite, could become the largest exporter of these commodities. Nearly 90% of the 1970 consumption of kyanite and mullite was for refractories employed in the production of iron, steel, glass, ceramics, and nonferrous metals. Three firms, each with combined mining and processing facilities, supplied 100% of marketable production in 1971. Synthetic mullite was produced in 1970 by 7 firms.

Mica scrap and flake demand is forecast to increase domestically at an annual rate of about 4.5%. Increasing demand can be met from several domestic resources which are amenable to economic benefication techniques. Although foreign producers will endeavor to increase their future scrap exports to the U.S., domestic production should remain competitive. Good quality scrap mica is delaminated and fabricated into mica paper for the electronic and electrical industries. The remaining scrap and flake is processed into ground mica for various industrial end uses, with a significant quantity of good quality scrap being delaminated for fabrication into reconstituted mica products. In 1970, scrap and flake mica were processed by 20 companies operating 22 grinding plants in 14 states. End uses for ground mica were: mica paper, 4%; gypsum plasterboard cement, 30%; roofing, 25%; paint pigment extender, 22%; molded rubber products, 6%; and other miscellaneous items, 13%. There are approximately 20 flake mica producers in the U.S. The 1970 flake mica production was valued at $2.5 million.

Mica sheet, consisting of block, film, and splittings is expected to decline in demand domestically at an average rate of 8% annually, because of the substitution impact of solid-state electronics and the availability of suitable alternate materials, both mica and nonmica based. Sheet mica is used in the manufacture of vacuum tubes, capacitors, and other electrical and nonelectrical items. Muscovite block and film was consumed by 17 companies in 8 states during 1970. Splittings were fabricated into built-up mica products by 13 companies in 9 states. Six companies accounted for almost four-fifths of total consumption.

Perlite demand is forecast to increase domestically at an annual rate of 3 to 4%. No immediate raw-material source problem is seen. Further growth in consumption is likely to be proportional to the rate of building construction. Expanded perlite is consumed as follows: aggregates (plaster, concrete, and insulating board), 59%; industrial water, food, beverage, and pharmaceutical processing, 23%; thermal insulation, 3%; agriculture, 4%; and other uses, 11%. Crude perlite was produced by 12 companies at 14 mines in 7 states. The value of crude perlite sold and used to make expanded material in 1970 was $4.9 million; the value of expanded perlite sold and used by 89 plants in 33 states was nearly $25 million.

Natural quartz crystal demand is predicted to increase domestically at a maximum annual growth rate of 0.25%. Substitution of synthetic manufactured quartz for natural quartz has lowered U.S. dependence on Brazilian imports. Practically all electronic-grade natural quartz is processed into finished crystals for electronic frequency-control or selection equipment. A very small quantity is used for prisms, wedges, lenses, and other optical

purposes. Raw quartz crystal in 1970 was consumed by 26 cutters in 12 states. Quartz crystal is used in the manufacture of oscillator plates, 73%; filter plates, 18%; telephone resonator plates, 8%; and other miscellaneous items, 1%.

Sodium carbonate or soda ash demand is expected to grow at an annual rate of about 4%. In the past, most soda ash has been produced from salt by the solvay process, but an increasing quantity (41% in 1971) is being produced from natural sources of sodium carbonate. New soda ash production facilities are dependent entirely on natural sodium carbonate minerals rather than salt. Some solvay plants have been ordered to close because their effluent could not meet new standards set by environmental protection authorities. Of the total sodium carbonate produced in the U.S., about 50% was consumed in the manufacture of glass, and 40% in the production of other chemicals. The processing of wood pulp into paper required 8%, and the remainder was consumed in soap, detergents, and other uses. Sodium carbonate is derived from natural sources by four companies. Five companies produce sodium carbonate from salt.

Sodium sulfate demand is expected to increase at an annual rate of 4%. In 1971, 46% of domestic output came from natural sources and the remainder was produced by byproducts from salt and sulfur compounds in manufacturing rayon, cellophane, and other commodities. Sodium sulfate is used in the production of kraft paper (74%) and in other miscellaneous products such as glass, ceramic glazes, detergents, stock feeds, dyes, textiles, medicines, and other chemicals. In 1971 natural sodium sulfate was produced by six companies, valued at $12.6 million.

Talc-group minerals demand is forecast to grow at between 2.5 and 4.6% annually. Domestic resources will be more than adequate to meet domestic needs. Talc and soapstone uses in 1970, in order of importance, were: ceramics, 27%; paint, 18%; paper, 6%; roofing, 5%; insecticides, 4%; rubber, 3%; toilet preparations, 2%; textiles, 1%, and other products, 34%. Talc, soapstone, and pyrophyllite are consumed by many firms in all parts of the country. Uses by industry in 1970 were: stone, clay and glass products, 34%; chemicals, 29%; paper, 6%; asphalt, 4%; rubber, 3%; and other uses, 24%. Mine output came from 40 operations and was valued at $7.8 million in 1970. Crude output was processed by about 40 grinders, mostly in the same locations.

Vermiculite demand is predicted to increase domestically at an annual rate of 3.5%. In an expanded form, vermiculite is important commercially as a concrete aggregate and as a thermal insulating material, but faces competition from other low-cost products with similar properties such as perlite and pumice. Improvements to minimize the treatment losses in fine fractions or to provide a market for fine-size vermiculite could enhance the competitive position of vermiculite. Uses for vermiculite are many; it is a loose-fill insulating medium with or without the addition of a binder. Mixed with gypsum plaster, vermiculite forms an acoustical medium for sound absorption; with portland cement, a lightweight concrete results. Gypsum, clay, asbestos, and suitable cements are added to vermiculite to produce a fireproofing medium that can be applied to building structures. Agricultural uses are as soil conditioner, a plant growing medium, and a packing material for nursery stock. Construction utilizes 80% of production; agriculture, 14%; and other uses, 6%. One company accounted for nearly all of 1970 mine output, valued at $6.5 million, from three mining operations. One company predominates in exfoliating

and operates 23 large plants in 20 states. In all, 25 companies operate 52 exfoliating plants in 33 states.

Plastics Industry

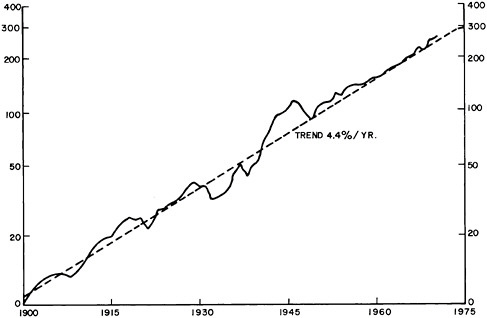

For the past twenty years, plastics production has been growing at an annual rate of between 10% and 15%. The 1969 production total was about 10 million tons, which is comparable with the nonferrous metals. Moreover, as first pointed out by Houwink3, the volume of plastics being produced is rapidly approaching that of all metals. Table 7.8 shows cubic feet of plastics, elastomers (rubbers), and fibers for 1968 and 1973 compared with ferrous and nonferrous metals4.

The production of key plastics by type, based on data by Jenest5 is shown in Table 7.9 for 1969 and estimated 1974. The “big three” (known commonly as the polyethylene-polystyrene family and PVC) draw heavily on petroleum as a raw material, as shown in Table 7.10. Many additives are employed to modify plastic materials; the scale of their use is shown by the fact that such additives had a 1969 value of $0.8 billion compared to $3.8 billion for the plastic materials themselves6.

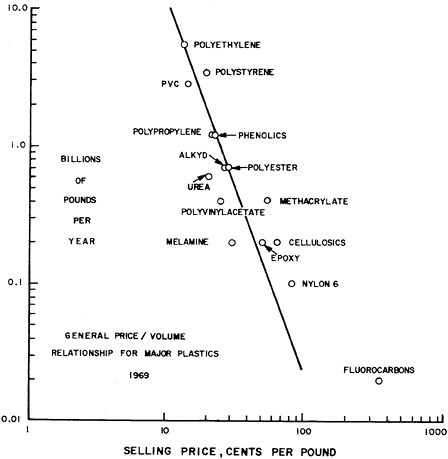

The financial characteristics of the plastics industry have been well summarized by Jenest5. Two aspects having a materials orientation are worth noting here. The first is the price-volume relationship. Figure 7.9 is a double logarithmic plot of pounds of different plastic materials sold in 1969 as a function of selling price. The line, as drawn, has a slope of -3, indicating the extreme sensitivity of sales volume to selling price. Certain plastics, notably Nylon 6 and fluorocarbons are sold in greater quantities than would be indicated by their price alone. Secondly, in comparing cost of plastics with metals, the large difference in density often requires that costs be expressed in price per unit volume. For example, a polycarbonate resin selling at about 75c/lb. costs 3.3c/cu. in. Zinc selling for about 18c/lb. costs 4.5c/cu. in. Thus, the polycarbonate is more than competitive with zinc in applications where its properties are adequate, particularly since the polycarbonate is easier to fabricate.

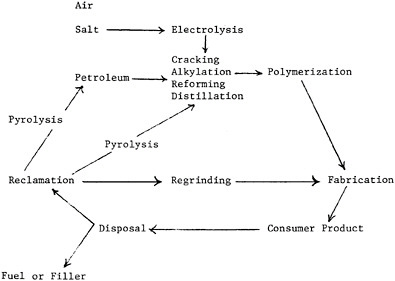

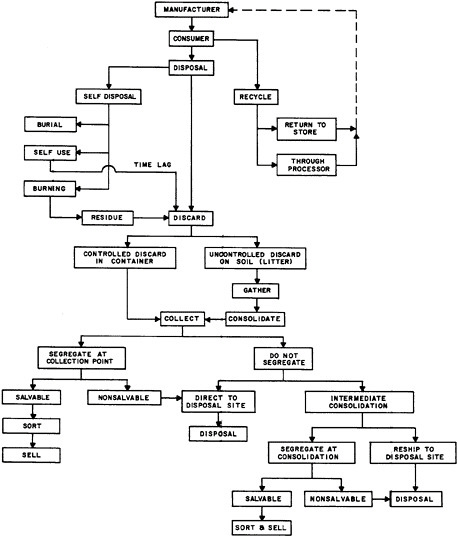

The major types of plastics-fabrication processes in use today5 are shown in Table 7.11. One significant recent trend in plastics fabrication is that major end-users of plastics parts, such as the appliance and automotive industries, are undertaking the fabrication themselves with large and sophisticated facilities. Another trend is the increasing attention being given to the disposal of post-consumer plastic wastes. Reuse and recycling possibilities are currently receiving greater attention, as well as disposal via energy generation as fuel. Table 7.12 diagrams schematically the waste and recycle aspects of plastics.

TABLE 7.8 Production of Principal Polymers and Metals in the U.S.

|

|

1968 (Cu. Ft. 107 |

1973 (Cu. Ft. 107, Estimate) |

|

Synthetic Polymers |

400 |

710 |

|

Plastics |

260 |

500 |

|

Elastomers |

80 |

110 |

|

Fibers |

60 |

100 |

|

Steel and Nonferrous Metals |

424 |

574 |

|

Steel |

370 |

500 |

|

Aluminum |

40 |

50 |

|

Zinc |

6 |

7 |

|

Copper |

4.5 |

4.7 |

|

Magnesium |

2 |

3 |

|

Lead |

1.5 |

1.6 |

TABLE 7.9 Production of Plastic Materials by Type, 1969–1974

|

|

1969 Production |

|

||||||||

|

Type |

Value $ Millions |

% of Total Value |

Average Price (c/lb., dlvd.) |

Billion Lb. |

1974 Production Billion Lb. |

|||||

|

Polyethylene |

|

725 |

|

19 |

|

13 |

|

5.5 |

|

10.7 |

|

Low density |

470 |

|

12 |

|

12 |

|

3.9 |

|

7.2 |

|

|

High density |

225 |

|

7 |

|

16 |

|

1.6 |

|

3.5 |

|

|

Styrenes |

|

645 |

|

17 |

|

19 |

|

3.4 |

|

6.0 |

|

Polystyrenea |

475 |

13 |

17 |

2.8 |

4.8 |

|

||||

|

ABS |

170 |

4 |

28 |

0.6 |

1.2 |

|

||||

|

Polyvinyl Chloride |

405 |

11 |

14 |

2.9 |

4.9 |

|||||

|

Phenolic |

265 |

7 |

22 |

1.2 |

1.7 |

|||||

|

Polypropylene |

250 |

7 |

21 |

1.2 |

3.0 |

|||||

|

Methacrylate |

200 |

6 |

55 |

0.4 |

0.7 |

|||||

|

Polyester |

195 |

5 |

28 |

0.7 |

1.4 |

|||||

|

Alkyd |

180 |

5 |

26 |

0.7 |

0.8 |

|||||

|

Cellulosic |

130 |

3 |

65 |

0.20 |

0.24 |

|||||

|

Urea |

120 |

3 |

20 |

0.6 |

0.9 |

|||||

|

Polyvinyl Acetate |

100 |

3 |

25 |

0.4 |

0.6 |

|||||

|

Epoxy |

90 |

2 |

50 |

0.2 |

0.4 |

|||||

|

Polyamide (nylon) |

80 |

2 |

82 |

0.1 |

0.2 |

|||||

|

Fluorocarbon |

75 |

2 |

350 |

0.02 |

0.03 |

|||||

|

Melamine |

60 |

2 |

30 |

0.2 |

0.3 |

|||||

|

All Otherb |

280 |

7 |

22 |

1.3 |

2.2 |

|||||

|

Total |

3820 |

100c |

20 |

19.0 |

34.0 |

|||||

|

a Includes impact grades. b Includes other vinyls (e.g. saran, polyvinyl butyral, polyvinyl alcohol), acrylates , urethane resins, polycarbonate, silicones, acetal, coumarone-indene, and others; values calculated by subtraction. c Does not add because of rounding. Sources: U.S. Tariff Commission; Modern Plastics, January and June, 1970; and Arthur D.Little, Inc., estimates. |

||||||||||

TABLE 7.10 Percentage Raw Material Make-up of Key Plastics

|

|

Ethylene |

Propylene |

Benzene |

Chlorine |

Cellulose |

Other |

|

Polyethylene |

100 |

— |

— |

— |

— |

— |

|

Polypropylene |

— |

100 |

— |

— |

— |

— |

|

Polystyrene |

27 |

— |

73 |

— |

— |

— |

|

Phenolic |

— |

— |

70 |

— |

— |

30b |

|

Epoxy |

— |

37 |

44 |

— |

— |

19c |

|

PVC |

43 |

— |

— |

57 |

— |

— |

|

Cellulosea |

12 |

— |

— |

— |

75 |

— |

|

a Cellulose triacetate assumed for calculations. The figure would be 100% for cellophane. b Carbon, oxygen, and hydrogen. c Oxygen. |

||||||

TABLE 7.11 Common Fabrication Methods for Plastics

|

Casting (curing of liquid components in a mold) Compression molding Transfer molding Injection molding of thermoplastics Extrusion Calendering Blow molding (for hollow shapes such as bottles) Thermoforming of plastic sheet with vacuum with pressure Rotational molding (for hollow shapes such as gasoline tanks) Slush molding (with chopped glass fiber—polyester resins) Injection molding of thermostats Matched die molding of glass reinforced plastics Hand lay-up of glass-reinforced plastics followed by heat curing |

Plastics as used for engineering purposes are usefully considered in terms of two major classes—engineering plastics and composition. Engineering plastic materials are specific polymers that have a combination of properties—strength, temperature resistance, solvent resistance, creep resistance, etc. —which permits them to be employed for structural purposes in engineered end-applications. Such materials are nylon, polyacetals, teflon, polycarbonates, polyphenylene oxide, etc. Composites—as the name implies—are mixtures of polymers or of polymers and inorganic materials in physical forms and ratios designed to develop specific properties:

-

Fiber-reinforced thermoplastics and thermosets: Glass fibers in the form of chopped fiber, continuous roving, and cloth are used to reinforce plastics of both thermoset types: polyester and epoxy, as well as in thermoplastics such as polyethylene, polypropylene, polystyrene, nylon, etc.

-

Rubber-reinforced (high impact) polymers: The toughness of brittle plastics such as polystyrene, polymethyl-methacrylates, and PVC can be enhanced by blending the plastic with an unvulcanized rubber (elastomer).

-

Polymer/polymer blends: Polymer/polymer blends are used to improve one or more of such factors as cost, melt processing or physical properties. Since any two polymers are typically incompatible, a rather complex two-phase morphology results. The MSE aspects are similar to those for rubber/plastic blends.

-

Metal/plastic laminates: A laminate of aluminum sheet and an ethylene-acrylic acid copolymer (for good adhesion) is used as cable sheathing for power and communication cables. Ease of fabrication plus enhanced properties are achieved. A sandwich made of two sheets of metal with an inner core of a plastic having high internal friction is an efficient sound deadener. As with a metal skin on a foamed plastic core, sandwich panels provide a high section modulus, thermal insulation, gas barrier, and light weight.

-

Plastics in concrete: The brittleness of concrete can be overcome to some extent by incorporating fibers such as nylon and glass, polyethylene particles, or latex.

In its utilization of technical manpower, the plastics industry has traditionally employed the following professionals in the role of materials scientists and engineers:

|

Organic Chemists |

Mechanical Engineers |

|

Analytical Chemists |

Microscopists |

|

Physical Chemists |

Plastics Engineers |

|

Physicists Polymer |

Chemists and Physicists |

Sixteen plastic producers list the following distribution of personnel in their R&D operations:

|

1% |

Biochemists |

|

26% |

Chemists |

|

7% |

Chemical Engineers |

|

1% |

Mathematicians |

|

1% |

Physicists |

|

22% |

Other Professionals |

|

27% |

Technicians |

|

15% |

Other Support |

Finally, in considering long-term ecological aspects of the plastics industry, it is important to recall that the major raw material in plastics has shifted from cellulose to natural gas and petroleum. The trend away from cellulose as a base has been largely an economic one arising from the cost of raw materials and the high capital investment involved in converting natural cellulose to moldable plastics. The average selling price of cellulose plastics (excluding cellophane) is about 65c/lb. compared with an average of 20c/lb. for all plastics and 13c/lb. for polyethylene. It appears unlikely at the present time that, in the absence of legislation based on ecological considerations or a dramatic change in price or availability of petroleum, the plastics industry will expand the use of cellulose derivatives, cellophane film, and chemically-treated wood. Nevertheless, it is worth noting that the greater use of cellulose could have the following effects on ecology in addition to conserving petroleum:

-

Newsprint and waste cotton fabric might be recycled to become a raw-material base for plastics.

-

Cellulose-rich plastics might be more biodegradable than hydrocarbon or chlorohydrocarbon polymers.

-

At the same time, other ecological aspects might be worsened such as greater use of insecticides and fertilizer in the growing of cotton or wood as a raw material for plastics.

Examples of Major Materials-Using Industries

In a very real sense, no industry is independent of materials to construct or produce its products—whether goods or services. Thus, the limited number of industries described in this section have been selected for attention because they illustrate the different ways in which materials enter into the manufacturing process and they also represent key sectors of

U.S. industry. The order in which they are discussed—electronics, electric lamps, containers, automobiles, and construction—corresponds both to an increasing scale of the product involved, and to a shift of emphasis from electrical to mechanical properties in designing materials for the product.

Electronics Industry

Illustration of the Role of Materials Science and Engineering: Even before the invention of the transistor in July 1948, electronics was a substantial industry with an emerging area of manufacture and application of several semiconductors. In fact, a large effort had been exerted on silicon and germanium during the late 1930’s and during World War II, principally in support of detector and mixer technology at radar frequencies. Thus, knowledge of the science and technology of both silicon and germanium had become rather advanced both in this country and abroad. However, the 1948 announcement of the first transistor by Bardeen and Brattain at Bell Telephone Laboratories initiated a new era unique in the interplay it engendered between science and technology and between materials and device concepts, a phenomenon that has characterized the industry now for a quarter of a century. This interplay has been complex because of the great number of device requirements and the variations of materials, designs, and processes to be controlled to widely different parameters and to close tolerances. What has resulted is a variety of new electronic materials, new devices, and a wide variety of applications that have had major impact on man’s situation in the world and his perception of it.

The current period has been variously called “the computer age,” “the space age,” and “the age of communications.” All of these now-familiar features of the present world have depended crucially on the transistor, and have greatly influenced the character of warfare, international politics, and advances in the automation and control of production processes. The understanding of the solid state that has come as a byproduct of these developments in the electronics industry may turn out to be an even greater contribution. Because of this general importance, it is useful to examine some of the technical developments that have led to this understanding.

In the same year that the invention of the transistor was announced, and in the same Laboratories, Teal and Little began experiments to grow large single crystals of high structural perfection in germanium by a pulling technique to test their idea that grain boundaries and other defects normally present masked the desirable electronic properties. Buehler and Teal also improved the purity by repeated recrystallization methods. These single crystals had, as well as improved uniformity, such strikingly new and different properties in contrast to polycrystalline germanium as lifetimes of minority carriers 20–300 times greater and mobilities 3–4 times greater. Analogous success was attained in early 1951 with preparing single crystals of silicon.

With the development of useful devices, the demands for these high-purity materials increased sharply. Satisfaction of these demands was greatly simplified, in 1951, when Pfann developed a method particularly appropriate for production—the process of zone refining—in which a

molten zone is repeatedly passed through an ingot by relative motion between the heat source and the crystal. By the middle 1950’s, this identification of the importance of purity was requiring measurement techniques never before considered feasible for routine materials scrutiny, namely, a sensitivity of one part per billion (equivalent to detecting three people in the earth’s population).

The first transistor was an experimental triumph in that it was not really clear what processes were actually taking place at the all-important conductor point brought into contact with the semiconductor material. However, during the next year (1949), Shockley analyzed the rectification in p-n junctions and showed the possibility of obtaining transistor action using p-n junctions in bulk material. In response to this development, Sparks devised a unique method for preparing p-n junctions by modifying the Teal-Little crystal-pulling apparatus to allow controlled addition of impurities during crystal growth; the resulting new kind of transistor was first prepared in 1950. These single crystal materials not only provided a revolutionary electronic device, but also gave media sufficiently perfect to test the validity of solid-state theories, and so further their development. The same basic techniques of making multiple junction structures was applied later to silicon, then a more difficult material to work with than germanium, and was the exclusive method for making commercial silicon transistors, beginning in 1954, for several years.

In 1950, an alloying technique was used successfully to prepare single p-n junctions in germanium by Hall and Dunlap of General Electric, and Saby prepared p-n-p transistors in the same manner. Application of the alloying technique to silicon was delayed until an improved silicon purification technique, floating-zone refining, was developed by Theuerer (and independently by Emeis and Keck). Pfann’s initial zone-refining method could not be used on silicon because of interaction between the molten silicon and its containing boat. However, other experimenters conceived the idea of setting up a stable molten zone in a vertical rod of material by virtue of surface tension, which meant that zone purification could then be extended to silicon. (Diffusion processes rapidly displaced alloying techniques and alloyed silicon transistors never became as significant as in the earlier application to germanium.)

Engineering demands to make semiconductor devices operate at higher and higher frequencies stimulated work on materials processes that would provide the smaller and smaller geometries that were required. Following original work of Fuller at the Bell Telephone Laboratories and Dunlap at General Electric, the Bell Telephone Laboratories published in early 1956 descriptions of both germanium and silicon transistors made by diffusion techniques. The combination of diffusion technology with the earlier processes, and the device designs made possible by the new approach, produced a wide variety of innovative devices of increasing performance.

During the next year or so, two particular milestones in materials technology were passed which were of special importance in the light of later events: (a) the observation by Frosch that a thermally-grown oxide on silicon impeded the diffusion of certain impurities, coupled with photographic masking against etching, provided a powerful tool for silicon processing; and (b) the studies by Dash of dislocations in silicon resulted in developing methods for growing silicon single crystals with essentially no

dislocations.

In June 1960, the Bell Laboratories announced a new method of fabricating transistors using epitaxial single crystals grown from the gas phase with controlled impurity levels. The advantages of this method broke the 12-year-old requirement of having to start with a high-purity crystal and then add impurities in a controlled manner to obtain the characteristics required in the device.

In 1958, Kilby (Texas Instruments) fabricated the first integrated circuit. This concept made possible the implementation of many functions on a single chip of silicon, viz., the elements of a complete circuit, such as resistors, capacitors, transistors, and diodes. Key modifications to the technology already developed for discrete devices included diffusion through the epitaxial layer of an integrated circuit to provide the high resistance of a reversed-bias p-n junction as isolation for adjacent devices and the MOS concept. The field-effect device proposed originally by Shockley, and now called the MOS transistor—for metal-oxide-semiconductor transistor— became possible because of advances in materials surface-treatment techniques; for some applications, the MOS technology, because of its low-power requirements, high-packing densities, fewer processing operations, and other characteristics, turns out to be markedly superior to the conventional bipolar technology. Now, after little more than a decade, the integrated circuit has evolved from Kilby’s primitive phaseshift oscillator to the high-production manufacturing of circuits with over 10,000 components apiece.

The preceding discussion provides an illustrative example of some of the significant advances made in electronic materials. It is confined to semiconductor work with the two significant elemental materials, germanium and silicon; and dwells principally on the beginnings through the 1960’s with only sketchy reference to the recent years. Nevertheless, the outline does demonstrate the tremendous degree to which the materials technologist has achieved control of electronic materials: for example, the extremes of purity; the control over doping at very low levels; the variety of techniques for creating junction structures by introducing impurities at exactly the right positions in the lattice and with very close tolerances on their positions and concentration profiles; the intricate combinations of single-crystal regions in device structures; crystals of high structural perfection; crystal-growth techniques.

An additional, but especially important, point is the cross-fertilization effect for research on other classes of materials. For instance, the extended study of semiconductor crystals has increased understanding of the mechanical behavior of structural materials; dislocations were first seen in semiconductor materials, and much of our direct knowledge of defects in solids was obtained initially from studying these materials. The creation of dislocation-free crystals was of great significance for the scientist and engineer working with nonelectronic materials.

At the time of the invention of the transistor, solid-state physics was a minor part of physics, but now it is the largest single subfield of physics. The present sophisticated understanding of the electronic structure of solids grew from the semiconductor work, first on carrier behavior and then followed by the study of band structure.

An unique aspect of the advances in electronics materials described

above is the pace. As indicated by the sequence of dates, achievement after achievement crowded one upon the other, somewhat reminiscent of the urgency of wartime development of technology. During the decade when the principal production consisted of discrete devices, process gave way to process in such quick succession that manufacturers hesitated to invest in technically possible mass-production equipment because it might become obsolete in literally a few months. Although the normal research communication media of journal publications and seminars continued to be used, the visit and the telephone seemed to have become the mode of exchange among scientists, metallurgists, engineers, and the many varieties of production people. In this mode, it is often difficult to determine in which of the conventional disciplines a given individual is acting. An additional feature was that the sequence of invention often was reversed from the older concept of first conceiving the device and then developing the material which makes it possible; in many instances, it was research on semiconductor materials that laid the basis for a new device design.

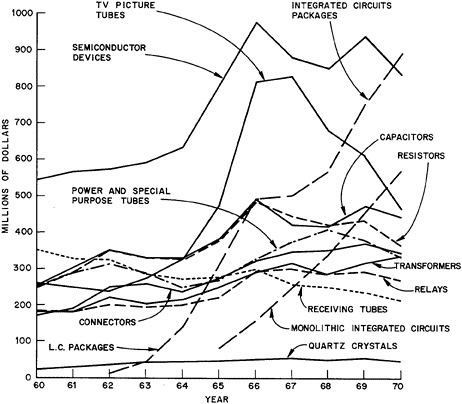

Some Characteristics of the Electronics Industry: Figure 7.10 shows the values of shipments of electronic components by U.S. manufacturers for the years 1960–1970. These particular components can be regarded as the major ones in the industry. The various curves are mutually exclusive except that the “monolithic integrated circuits” are also included in the data for the more general “integrated circuit packages.” The most important components on the basis of 1970 values are seen to be the “integrated circuit packages” and “semiconductor devices;” each being close to $900 million. Next, fairly tightly grouped, are: TV picture tubes, $464 million; capacitors, $440 million; resistors, $365 million; connectors, $346 million; power and special purpose tubes, $337 million; transformers (and reactors), $335 million; relays (for electronic applications), $271 million; and receiving tubes, $212 million. Finally, having declined in relative importance over the 1960’s, are quartz crystals at $45 million.

The shapes of the curves shown in Figure 7.10 are especially significant as indicators of the stage of maturity of a given device. Thus, the topmost curve for most of the decade, semiconductor devices, displays the characteristics of a “mature” industry—the leveling-off being associated with its partial replacement by integrated-circuit packages. Its principal predecessor, receiving tubes, is past maturity and is now steadily declining. It is interesting to note that the power and special purpose tubes, which are not as easily replaced by semiconductor devices or integrated circuits, still maintain an upward trend. For the TV picture-tube curve, the unusual shape arises largely from the superposition of two curves—black and white TV picture tubes and color TV picture tubes. In 1970, total shipments were about 9 million tubes (3 million black and white and 7 million color), and the ratio in per-tube value had declined to about 4.5.

Six classes of components appear to be holding essentially steady growth. These are capacitors, resistors, power and special purpose tubes, connectors, transformers (and reactors), and relays. All had comfortable growth experience with no prominent peaks, starting the decade in the range from $169

million to $255 million and ending in the range from $271 million to $440 million.

The most spectacular curve in Figure 7.10 is that for integrated circuit packages, which is roughly paralleled by its subclass, monolithic integrated circuits. Starting at $14 million in 1962, integrated circuit packages achieved a rapid climb to $888 million in 1970, an average increase per year of almost 68 percent for eight years. Monolithic integrated circuits started at $85 million in 1965 (the first year for which statistics are available) and reached $576 million in 1970, an average increase per year of almost 47 percent in five years. Over this same period of five years, the whole integrated circuit class averaged 23 percent growth per year.

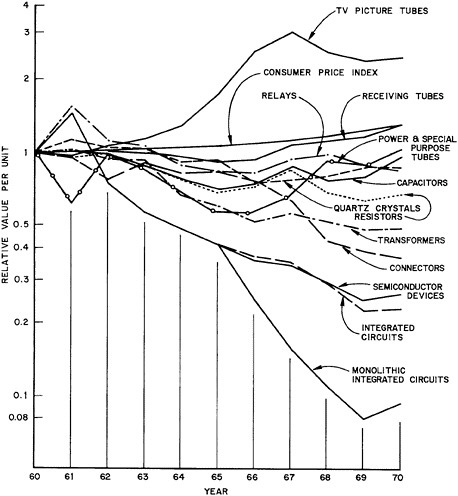

Whereas value of shipments is a useful industry measure of a components sector performance, from the users’ point-of-view the better measure is price for comparable quality and quantity. Such a measure is indicated in Figure 7.11, where all unit values for the components are normalized to unity in 1960. For reference, the analogous consumer prize index is also plotted to provide a measure of inflation over the period. A significant general characteristic is the stiffening of per-unit values from 1969 to 1970, when curves tend to change slope toward a positive direction. As in the previous figure, the most distinctive behavior is exhibited by integrated circuits; assuming that this sector branches off from the parent semiconductor devices in 1965, the equivalent per-unit value declined by 1970 to less than one-tenth that of 1960. Even the semiconductor devices, which have a history of continuous decline in unit-value over the whole decade, still have a per-unit value in 1970 of 26% compared with the value in 1960.

Processing of Semiconductor Materials: The most commonly used semiconductor material in the electronics industry is silicon. Next to oxygen as the most abundant element, silicon makes up about one-fourth of the crust of the earth. Not found in elemental form, it occurs chiefly as the oxide, silica (SiO2), and as various silicates in such familiar forms as sand, quartz, rock crystal, amethyst, agate, flint, jasper, opal, etc. Almost without exception, the type required by the electronics industry is monocrystalline, high-purity silicon; this is prepared by reducing silica with carbon to produce metallurgical grade silicon (98–99% purity), as the usual “raw material” for the electronics industry.

The characteristics of semiconductor materials that make them useful in electronic devices are profoundly influenced by impurities. Controlled addition of desired impurities (dopants) in the range from 0.001 to 100 parts per million (in silicon) to the high-purity host material causes it to become either a p-type (positive holes being the majority carrier) or n-type (negative electrons being the majority carrier) conductor. In “bipolar” transistors, certain sensors, and diodes, the electrical behavior of the junction between p-type and n-type materials accounts for the basic function of the particular device. Accordingly, semiconductor-device technology is focused principally on the controlled doping of materials and the formation of junctions between materials of different impurity concentrations while maintaining a continuous single-crystal structure, without appreciable defects, from one side to the other of each junction.

For the preparation of multiple junctions, successive dopants are added

by diffusion; the silicon slice is held at a temperature in the range from 900 to 1300° C (depending on the dopant and the desired results), and a carrier-gas bearing the impurity is passed over the slice. Diffusion depth and concentration are controlled by the time and temperature of exposure as well as by the chemistry of the dopant gas.

To provide insulation between layers or to install a mask against a succeeding diffusion, silicon dioxide is grown on the silicon surface by heating the silicon and exposing it to oxygen or steam. Selective diffusion or placement of a contact is done by cutting a window through the silicon dioxide layer to get at the semiconductor surface. (A similar process is used to etch selectively the metallized layers into the desired configurations of electrical conductors.) To make ohmic (nonrectifying) electrical contacts on the semiconductor material or electrical conductors, aluminum or gold is vacuum-evaporated onto all exposed surfaces.

By a succession of steps like those described above, hundreds of microscopic, intricate circuits made up of transistors, diodes, resistors, and capacitors are created on a single 2-inch slice of single-crystal silicon. The representative processes discussed show how the steps of material processing, device design, circuit design, and system design have been telescoped and blended so that one activity often cannot be distinguished from another.

In contrast to these developments in integrated circuitry, which are focused on the task of packing more and more components (of the order of 10,000) into tiny chips of silicon, progress in another branch of silicon technology has led to large discrete devices capable of controlling power in the 10 to 100Kw range. The basic element used to perform this function is the thyristor, the semiconductor analog of the gas-discharge thyratron. Thyristors range in size from those used in light dimmers and speed controls for home appliances up to large industrial devices capable of controlling load currents of hundreds of amperes at a thousand volts or more. They are now being used to rectify and invert power for DC transmission lines at the 100Mw level.

The applications for individual semiconductor devices and integrated circuits are increasingly requiring improvement in the economics of materials usage as well as in performance and reliability. To reduce overall process costs in integrated circuits, the trend is toward 3-inch or larger diameter starting crystals. Such large diameters are generally achieved by pulling the crystals from quartz crucibles—a technique that serves the larger part of the semiconductor market. For the thyristor, in order to avoid the traces of oxygen found in crystals pulled from quartz, long-lifetime float-zone material is used almost exclusively. Since the working current that can be controlled by a single thyristor is limited by the diameter of the starting crystals presently available, there is strong incentive for obtaining material of the highest quality in purity and homogeneity together with still larger diameters. Such enhancement in quality may also lead to improved electrical performance in terms of higher voltage ratings.