|

BOX 2.1 The Rodriguez family of four in Oakland, California, fell through the cracks.1 Both Mr. and Mrs. Rodriguez work at low-paying jobs without health insurance coverage; they make ends meet only by picking up as much overtime as possible. Because of their extra efforts, the family’s income is too high for them to be eligible for Medicaid but too low to cover the cost of independently purchased health coverage. When they checked, they found that reasonable coverage in a health maintenance organization (HMO) could cost more than $4,000 just for the annual premium for Mr. Rodriguez, and he is basically a healthy 50-year-old.2 Mrs. Rodriguez had developed lupus a couple of years ago, which is currently under control. She requires periodic medical attention and drugs, however, and cannot get affordable independent insurance to help cover the costs. They have never thought of themselves as needing or wanting charity. Mrs. Rodriguez had been covered by a state program Access for Infants and Mothers (AIM) when her last child was born five years ago, but the coverage only lasted for two months after delivery. Maria, the baby, is covered by the state Medicaid program, called Medi-Cal, and she belongs to an HMO not far from their home. The older daughter, Joanna, is now 10 and is covered by Healthy Families, the State Children’s Health Insurance Program (SCHIP). She had to register in a different HMO from her sister. Now Mrs. Rodriguez goes to a county health department clinic when she has to, but has difficulty getting referred to the specialty care she needs, particularly when the disease flares up. Fortunately, the Rodriguez family’s problem will soon be addressed by a public–private partnership created by the Alameda Alliance, the Family Care program, which provides seamless family coverage, including comprehensive health and dental coverage for those family members not eligible for Medi-Cal and Healthy Families. The Alliance Family Care Program includes all families in Alameda County with incomes up to 300 percent of the federal poverty level (FPL).

|

2

Insurance Coverage of Families

The health and economic stability of families may be affected by the variety of health insurance arrangements within families. There is much variation in uninsured rates and in patterns of insurance coverage among different types of families. Sometimes not all members of a family are covered, or if they are, each may have coverage from different sponsors and different terms of insurance. This variation is influenced by the rules, policies, and requirements of public coverage programs as well as those of employment-based insurance plans. In addition, the socioeconomic and demographic characteristics of families influence these patterns of coverage. In Coverage Matters the Committee described the characteristics of uninsured individuals. This chapter aggregates the data on individuals into family groups and describes various family configurations as a unit.

This chapter describes coverage variations, the reasons for them, and some of the implications for families. The first section gives an overview of the sources of health insurance coverage, including employment-based, individually purchased, and public coverage. Because each source or type of insurance has distinctive rules for eligibility and they do not necessarily match a family’s perception of its members, many families have some members who are uninsured. The second section examines the resulting coverage patterns of various types of families in the United States and describes how coverage varies within different families and for different family members. It also takes a closer look at specific characteristics, such as income level, racial and ethnic identity, and immigrant status of families with children that may affect a family’s likelihood of having one or more uninsured members. Many of the social and economic characteristics associated with individual uninsurance are, not surprisingly, also related to family uninsurance. There is a summary section at the end of the chapter.

OVERVIEW OF SOURCES OF COVERAGE

There are differing eligibility rules and benefit packages for each source of health insurance that result in some family members having coverage and others not. Insurance plans operate in the context of state and local economies and politics as well as local health services markets, leading to geographic variation in family insurance patterns as well as different patterns within families. The size and other characteristics of a state’s employers and the types of industries making up a state’s economy all influence the level of employment-based coverage, the proportion of the population who may need other sources of coverage, and family coverage patterns. These economic factors, and the nature of a state’s fiscal and political circumstances, can affect the proportion of its population covered by employment-based or public insurance and the proportion that remains uninsured.

Employment-Based Insurance

Most of America’s families and their members obtain health insurance through their job or that of a family member. Provision of health benefits is routine for many jobs, particularly those at relatively high wages. Nonetheless, more than 80 percent of uninsured adults and children live in working families, but insurance either is not offered with the job or is not affordable for them (IOM, 2001).

For those with employment-based coverage, the employer typically pays some portion of the cost and the employee is responsible for the remainder. Employment-based plans generally are more expensive when they include coverage for dependents in addition to the employee. Children are less likely than working parents to be covered by this type of insurance. The total premium cost of employment-based plans for family coverage is on average two and a half times greater than that for employee-only coverage, $588 compared to $221 per month. Employers tend to pay a smaller portion of the insurance cost for coverage for the entire family (73 percent) than for the employee only (85 percent) (Kaiser-HRET, 2001). Employees cite the cost of coverage as the most common reason for not taking an employer’s offer and for not covering their family members (Cooper and Schone, 1997). Most workers, even those from lower-income families, take this workplace coverage when it is offered (IOM, 2001).

Individually Purchased Insurance

When family members are not offered or do not take health benefits on the job, they can sometimes, if they are healthy, purchase health insurance in the individual, nongroup market. Such insurance, however, would likely cost the purchaser considerably more than employment-based insurance for comparable coverage, both because there is no employer contribution to premiums and because premiums are higher than those employers obtain. (If the person is not completely healthy, private insurers may refuse to offer a policy or may increase the premium, limit the benefits, or exclude coverage of the particular condition.) The lower

premiums for employment-based coverage mainly reflect lower underwriting costs because the risks are pooled and administrative and marketing costs are lower. As a result, individually purchased insurance is relatively rare. According to the most recent Current Population Survey (CPS), only 7 percent of the population under age 65 had individually purchased coverage (Fronstin, 2001).1 A national telephone survey of adults from ages 19 to 64 finds, however, that 27 percent of working-age adults had considered the purchase or had bought it in the previous three years (Duchon and Schoen, 2001). The financial aspects of a family’s decision to purchase health insurance independently are discussed further in Chapter 4.

Public Programs

Individual family members who are not covered through employment-based plans may qualify for Medicaid, the State Children’s Health Insurance Program (SCHIP), Medicare, or state-regulated high-risk pools if they meet certain eligibility criteria. In general, different eligibility requirements in Medicaid and SCHIP make it more likely for children to be covered than their parents; see Appendix B. Medicaid and SCHIP cover more than 40 million poor and disabled Americans, half of whom are children. They include over half of the children living in families with incomes below the federal poverty level (FPL) (8.5 million) and 30 percent of children living between 100 and 199 percent FPL (4.5 million) (Hoffman and Pohl, 2002).2

Income eligibility thresholds for public programs differ by state. Within each state, these income thresholds vary by age group, family type, and health status and include different limits on family income, assets, and methods for deducting and disregarding certain costs and income (see Appendix B and Appendix D, Table D.2). Although Medicaid has the advantage of limited or no cost sharing for participants and may have more generous benefits than either employment-based or individually purchased coverage, small increases in family income can disqualify the family, or particular family members such as older children or adults, from the program. Discontinuities in coverage also may result from the administrative requirements for periodic recertification of eligibility.

INSURANCE PATTERNS BY FAMILY CHARACTERISTICS

This section details the different types of families in the United States and their social and economic characteristics that can affect their insurance coverage. It looks particularly at distinctive coverage patterns for families with children.

|

1 |

See Committee’s report Coverage Matters, Appendix B, (IOM, 2001) for a discussion of the main national population surveys on insurance. |

|

2 |

The federal poverty guideline in 2000 was $13,738 for a family of three, and 200 percent FPL is $27,476. (See Appendix D, Table D.1, for the federal poverty guidelines.) |

Demographic Overview

Because in this report the Committee is concerned mainly with the consequences of uninsurance on families and particularly on dependent children, it examines patterns of health insurance coverage within families and across families with different social and economic characteristics. This is a challenge because much of the readily available data are based on the individual rather than the family unit. Another challenge in drawing parameters around the family unit stems from definitional inconsistencies among various surveys and program statistics. The Committee’s analyses in the following chapters demonstrate that the presence of an uninsured family member has the potential to affect the health and well-being of all the members of that family. For this reason, it is important to consider not only the number of families but also the total number of people living within the families with uninsured members.

In addition to the more than 38 million uninsured individuals, almost 20 million insured family members live with them. Thus, a total of approximately 58 million, or one-in-five, people in the United States potentially may be affected by the lack of insurance within their family.3 Most of the Committee’s population analyses in this report are based on data collected in the March 2001 CPS and reflect insurance coverage during calendar year 2000. These data are available in public use files of the Census Bureau and the tables presented in Appendix D. Box 2.2 explains how the CPS elicits information on familial relationships and Box 2.3 provides a demographic overview.

The experiences that families with children have in gaining, maintaining, and losing coverage are distinctive because of the role that parents play in obtaining coverage, as well as care, for their dependent children and because of the broad public policy commitment to insuring all of the nation’s children. The Committee focuses on a subset of families and excludes people living alone and families with all members over age 65.

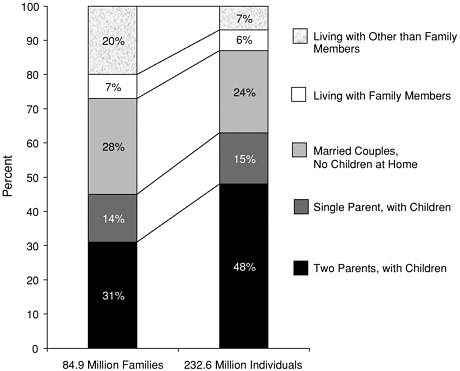

Almost 85 million families comprised of 232.6 million individuals are the main focus of this report. Families with minor children account for more than 38 million of these families and include roughly 146 million individuals; see Figure 2.1 and Appendix D. Within these families with children, 26.3 million individuals either are uninsured or live with someone who is uninsured. Table 2.1 shows these families with children, along with married couples with no children at home, at the top of the table because they are the family types most likely to be eligible for coverage as dependents of a working family member.

|

BOX 2.2 Who Counts as “Family”? Each person has his or her own sense of who counts as family. Surveys that ask about health insurance use a uniform definition of who counts as family to facilitate the survey process. Likewise, private insurance plans and policies use certain conventional definitions of who is eligible for coverage within a family unit. Public programs also use family relationships as a criterion for determining individual eligibility for coverage. This report relies largely on data from the Current Population Survey carried out by the Bureau of the Census to describe the nature of families and the extent of health insurance coverage. The CPS is a household survey. The sampling process selects dwelling places, not people. A household consists of all the persons who occupy a housing unit (most often a house or apartment). CPS interviews begin by establishing a list of all persons who live in the unit. The list, called a household roster, includes individuals who are temporarily absent and who have no other usual address. College students account for most absent household members; those in institutions such as nursing homes or the military are not included. The interviewer asks the respondent to start with the name of a person who owns or rents the housing unit. This person is termed the reference person. The interviewer presents a card to the household respondent that lists relationship categories (e.g., spouse, child, grandchild, parent, brother or sister, unmarried partner, non-relative). The interviewer asks the respondent to report each household member’s relationship to the reference person. The responses about relationships are used to group families. A family is defined as a group of two or more individuals residing together who are married or related by birth or adoption. A housing unit might contain subfamilies, defined as families that live in housing units where either none of the members of the family are related to the reference person or the related person has his or her own spouse or child living with them. In this report, subfamilies are considered separate family units in the data analysis. For example, an apartment with a man and a woman, their grown daughter, and her infant would appear in the tabulations in this report as two families. The grandparents would be a “married couple no children at home” and the daughter and her baby would be a single-parent family. Family income is calculated separately for each subfamily unit, including income from all the members of the subfamily. Note: In this report the Committee recognizes that self-defined families may include members unrelated by birth, marriage, or adoption. By including households with persons other than legal family members in some of the data analyses, the Committee recognizes that it likely also includes some individuals who do not consider themselves family and are not closely related financially or emotionally. (See Table D.4 for a list of the various population groupings.) SOURCE: Census Bureau. 2000a. |

|

BOX 2.3 Demographic Overview The Committee has chosen to focus on families and how they experience being uninsured. However, few of the data related to health insurance coverage are available based on family units so special tabulations of the March 2001 Current Population Survey public use tapes were prepared for Committee analyses.1 To put these data in context, consider the following:

The Committee has also excluded from consideration in this report the following:

The remaining families total 84.9 million and include 232.6 million individuals. |

The other family configurations, listed in the bottom half of Table 2.1, are less likely to have the opportunity for dependent coverage, although they may function much like the families listed in the top half of the table. This remaining one-quarter of American families include people living with relatives other than their own children under age 18 and those living with people other than legally recognized kin. While members of these families are not generally able to obtain coverage as dependents on another member’s employment-based insurance policy, they may nonetheless bear financial responsibility for the health care needs of others in their unit. Examples of these types of families include adult siblings living together, grandparents caring for grandchildren, and unmarried mixed-sex or same-sex couples.4

FIGURE 2.1 Percent of families and individuals in various types of families. NOTES: Percentages are subject to rounding error. Includes all two-or-more person households with at least one person under age 65. Excludes single adults under 65 living alone, 17.9 million adults.

SOURCE: See Appendix D.

Families of Married Adults with No Children at Home

One-quarter of people included in this analysis of families are married and have no children under age 18 at home: 85 percent of these 23.7 million couples are fully insured, 9 percent have only one member covered, and 6 percent have neither member insured (see Figure 2.1 and Table 2.1). The proportion of those insured increases as family income increases. Many married couples in late middle age fit this family category and are of particular interest because their health status tends to worsen as they age and the need for health care and insurance is greater. In the next chapter, “Insurance Transitions over the Family Life Cycle,” the insurance status of pre-retirement families is examined.

TABLE 2.1 Extent of Insurance Coverage By Family Type And Income Group, 2000

|

|

|||||

|

|

|||||

|

Living Arrangement or Family Type |

Number (in thousands) |

Percentage of overall total |

Within family configuration |

||

|

Family Configurations Where Dependent Coverage Is Likely |

|||||

|

Two-parent family |

26,442 |

|

31.2 |

|

|

|

All insured |

|

22,427 |

|

84.8 |

|

|

Some insured |

|

2,393 |

|

9.0 |

|

|

None insured |

|

1,622 |

|

6.1 |

|

|

Married, no children at home |

23,681 |

|

27.9 |

|

|

|

All insured |

|

20,010 |

|

84.5 |

|

|

Some insured |

2,196 |

9.3 |

|||

|

None insured |

1,475 |

6.2 |

|||

|

Single-parent family |

12,118 |

|

14.3 |

|

|

|

All insured |

|

8,637 |

|

71.3 |

|

|

Some insured |

1,929 |

15.9 |

|||

|

None insured |

1,552 |

12.8 |

|||

|

Configurations Where Dependent Coverage Is Less Likely |

|||||

|

Living with others than family members |

16,798 |

|

19.8 |

|

|

|

All insured |

|

11,963 |

|

71.2 |

|

|

Some insured |

— |

— |

|||

|

None insured |

4,835 |

28.8 |

|||

|

Living with family members |

5,837 |

|

6.9 |

|

|

|

All insured |

|

4,647 |

|

79.6 |

|

|

Some insured |

— |

— |

|||

|

None insured |

1,191 |

20.4 |

|||

|

Total |

|

|

84,876 |

|

|

|

Families of this income class as percentage of all families |

|

||||

|

NOTE: Among families whose head is age 65. Not included in this table are persons living alone and families with children as householder/reference person. SOURCE: March supplement to the 2001 Current Population Survey; see Appendix D. |

|||||

|

By Income Group |

||||||||

|

Under 100% FPL |

100–200% FPL |

>200% FPL |

||||||

|

Number |

Percentage (share of row) |

Number |

Percentage (share of row) |

Number |

Percentage (share of row) |

|||

|

1,679 |

|

4,006 |

|

20,757 |

|

|||

|

|

812 |

3.6 |

|

2,669 |

11.9 |

|

18,946 |

84.5 |

|

475 |

19.8 |

831 |

34.7 |

1,087 |

45.4 |

|||

|

392 |

24.2 |

506 |

31.2 |

724 |

44.6 |

|||

|

902 |

|

1,856 |

|

20,923 |

|

|||

|

|

491 |

2.5 |

|

1,211 |

6.1 |

|

18,308 |

91.5 |

|

168 |

7.7 |

319 |

14.5 |

1,709 |

77.8 |

|||

|

243 |

16.5 |

326 |

22.1 |

906 |

61.4 |

|||

|

4,252 |

|

3,468 |

|

4,398 |

|

|||

|

|

2,650 |

30.7 |

|

2,335 |

27.0 |

|

3,652 |

42.3 |

|

865 |

44.8 |

661 |

34.3 |

403 |

20.9 |

|||

|

737 |

47.5 |

472 |

30.4 |

343 |

22.1 |

|||

|

3,531 |

|

3,343 |

|

9,924 |

|

|||

|

|

1,761 |

14.7 |

|

2,024 |

16.9 |

|

8,178 |

68.4 |

|

— |

— |

— |

— |

— |

— |

|||

|

1,770 |

36.6 |

1,319 |

27.3 |

1,746 |

36.1 |

|||

|

506 |

|

1,127 |

|

4,204 |

|

|||

|

|

309 |

7.6 |

|

815 |

17.4 |

|

3,522 |

75.0 |

|

— |

— |

— |

— |

— |

— |

|||

|

197 |

16.5 |

312 |

26.2 |

682 |

57.3 |

|||

|

10,870 |

|

13,800 |

|

60,206 |

|

|||

|

|

12.8 |

|

16.3 |

|

70.9 |

|||

Families with Children

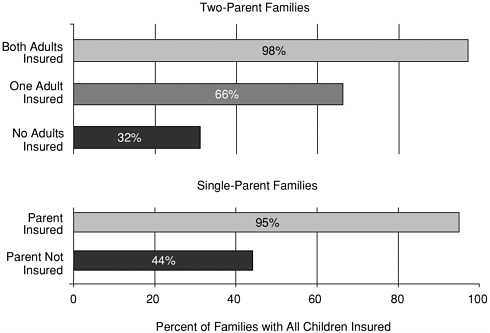

Finding: If parents have health insurance, children are likely to be covered as well.

Almost 12 percent of children nationally are uninsured (Fronstin, 2001). Figure 2.2 illustrates that in almost all families, if the parents are covered, the children are too. In two-parent families, if both adults are covered, virtually all the children are as well, but if neither of the parents is covered, children are covered in only a third of the families. The patterns are similar for single-parent families; children are more than twice as likely to be covered if the custodial parent is covered than if he or she is not.

Finding: In one-fifth of the more than 38 million families that include children, there are one or more family members uninsured.

There are 7.5 million families (19 percent) with at least one family member lacking insurance and 31.1 million families (81 percent) with all members insured. More than 6 million children live in families where everyone is uninsured. An

FIGURE 2.2 Percent of families with children, where all children are insured, by parental coverage.

NOTE: Percentages are subject to rounding error.

SOURCE: See Appendix D.

additional 9.4 million children live in families where at least one member is lacking insurance. Chapters 4 and 5 discuss related financial, economic, and psychosocial consequences of uninsurance that can affect the whole family.

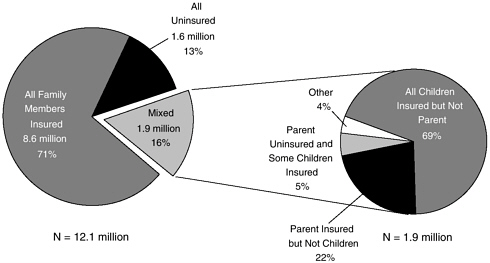

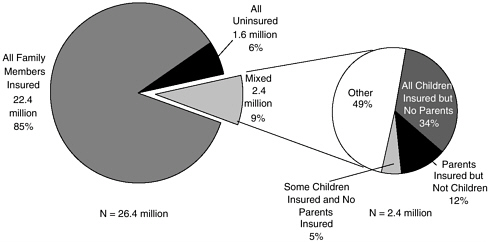

Finding: Single-parent families with children are less likely to have all members covered than are two-parent families. Single-parent families are twice as likely as two-parent families to have no insured members.

Family composition influences insurance status directly and indirectly as well, through income. Patterns of coverage differ for single-parent and two-parent families, in part because having two parents may increase the family’s income and improve its chances of being offered affordable employment-based coverage that includes dependents (see Figures 2.3 and 2.4). Of all two-parent families with children, 85 percent have all members insured, compared with 71 percent of single-parent families. In addition, single-parent families are more than twice as likely to have no members insured than are two-parent families, and a greater proportion of single-parent families have at least one uninsured member, compared with two-parent families.

Single-parent families with at least one uninsured member are more likely than two-parent families with at least one uninsured member to have coverage either for the children but not the parent(s) or for only the parent(s). This distinctive pattern reflects the availability of public coverage (Medicaid, SCHIP) for lower-income children, who are disproportionately in single-parent families. It also reflects the relative difficulty of securing affordable employment-based dependent coverage for single mothers, who are likely to be lower-income workers. Families in which some but not all children have coverage often include an ill or disabled child who may qualify for federal or state programs designed to insure disabled persons.

There are 9.1 million uninsured parents in the United States, representing about one-third of all uninsured adults (Lambrew, 2001b). Parents are more likely to be uninsured than their children and have less access to public programs because of more restrictive income eligibility requirements (see Appendix D). Half of the uninsured parents with incomes below 200 percent FPL had all their children insured. That is a better record than might be expected from Figure 2.2, which shows that only 32–44 percent of families at all income levels with both or one parents uninsured had all their children covered. In part, the better coverage of children in lower-income families compared with wealthier families reflects the eligibility limits of public coverage for children. In 1997, more than two out of five low-income uninsured parents—1.5 million people—had at least one child covered by Medicaid (Dubay et al., 2000). Since then, states have implemented SCHIP programs and have launched major education and outreach efforts aimed at uninsured children who may be eligible for Medicaid as well as SCHIP. States also have taken steps to make the enrollment process easier for both programs (Edmunds et al., 2000).

FIGURE 2.3 Patterns of insurance coverage in single-parent families with children. NOTES: Other: parent covered, some but not all children covered. Percentages are subject to rounding error.

SOURCE: See Appendix D.

FIGURE 2.4 Patterns of insurance coverage in two-parent families with children. NOTES: Other: one parent covered; all, some, or no children covered. Percentages are subject to rounding error.

SOURCE: See Appendix D.

Finding: Many children who are eligible for publicly sponsored coverage do not participate and remain uninsured.

A long-standing policy concern is that many children who are eligible for publicly sponsored coverage are not enrolled and remain uninsured. Nearly 5 million uninsured children, more than half of all uninsured children, are eligible for Medicaid and SCHIP but not enrolled, according to an eligibility simulation model designed by the Urban Institute (Urban Institute, 2002a).5 The uninsured rate for the under-age-18 population overall is almost 12 percent (Mills, 2001). Some of this gap between eligibility and enrollment has been attributed to sharp declines in Medicaid enrollment following federal welfare reform in 1996 (Kronebusch, 2001). Other contributing factors include the administrative complexities of signing up for and maintaining public coverage and limited general knowledge about the programs.

Many more children on Medicaid and SCHIP have uninsured parents rather than parents covered privately. Only about 2 percent of these children have a different type of insurance from that of their primary parent (e.g., the parent with employment-based coverage and the child with Medicaid or SCHIP) (Davidoff et al., 2001b).6

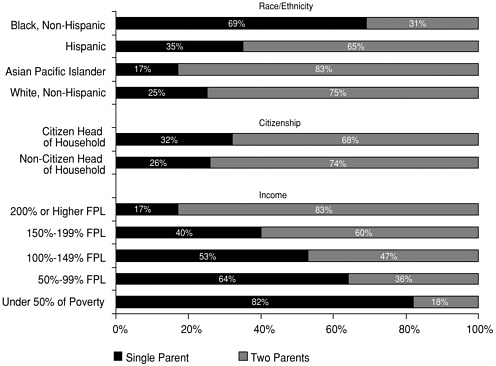

Children in lower-income households (less than 200 percent FPL), minorities, immigrants, and those with parents who work in less than full-time, full-year positions are more likely than average to be uninsured (Ku and Blaney, 2000; IOM 2001; Hoffman and Pohl, 2002). In Coverage Matters the Committee examined the effects of many of these characteristics on the individual’s likelihood of being uninsured; here the perspective of the family is examined. Social, economic, and demographic characteristics are strongly related to a family’s chances to gain and keep health insurance coverage. These characteristics may be influenced by coverage as well as influencing whether the family is covered. The existence and strength of causal relationships among family characteristics may thus be hard to distinguish. The discussion that follows addresses the characteristics of income level, residence with one or two parents, racial and ethnic identity, and immigrant and citizenship status (see Figure 2.5). From a policy perspective, the key characteristic for families is income, since it determines both the eligibility of individual family members for public insurance and the ability to purchase health insurance independently or health care out of pocket, without insurance. Chapter 4 examines these financial concerns.

FIGURE 2.5 Structure of families with children by race/ethnicity and citizenship, and income.

NOTE: Percentages are subject to rounding error.

SOURCE: See Appendix D.

Income Levels

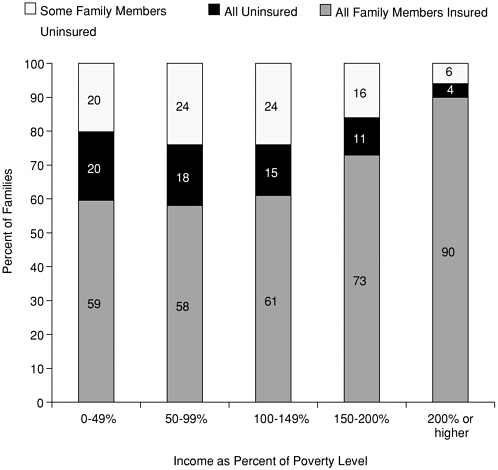

Finding: Family insurance coverage is strongly and positively related to income. Just 59 percent of families with children and with income less than 50 percent of FPL have all members covered, compared with 90 percent of families whose income is above 200 percent of FPL.

Higher-income families are more likely to have employment-based coverage (because it is more likely to be offered in businesses with higher-wage employees) and lower-income families are more likely to have public insurance.7 Of the 38.6 million American families that include children, two-thirds (25.1 million families)

earn more than 200 percent FPL, about 19 percent (7.5 million families) earn between 100 and 200 percent FPL, and the remaining 16 percent (5.9 million families) live below the official poverty line (100 percent FPL) (Table 2.1).

As family income increases, the likelihood that all members will be uninsured decreases (see Figure 2.6). For families with children and with incomes less than 50 percent of FPL, 59 percent have all members covered (1.5 million families), 20 percent (0.5 million families) have some insured members, and another 20 percent have no insurance at all. Families with children and with earnings above 100 percent FPL fare better, with the proportion of insured members increasing as family income increases. Not until families’ incomes rise above the poverty level are parents likely to gain access to employment-based insurance, counteracting a slight decline in coverage as they lose their income-linked eligibility, while children may

FIGURE 2.6 Insurance status of members of families with children, by income.

NOTE: Percentages are subject to rounding error.

SOURCE: See Appendix D.

still maintain their eligibility for public coverage. This can be seen in the increase in the proportion of families with some members uninsured in the 50-149 percent FPL level.

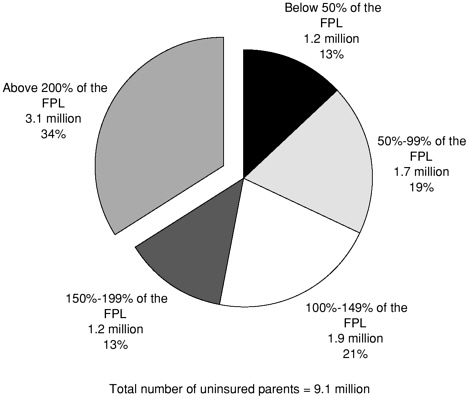

Approximately one-third of uninsured parents have incomes below 100 percent FPL. Another third of uninsured parents have incomes between 100 and 199 percent FPL (see Figure 2.7). Of all lower-income parents (<200 percent FPL), about one-third are uninsured and another 16 percent are covered by public programs (Lambrew, 2001b). Lower-income parents are more likely to be uninsured than are their children, and the parents’ uninsured rate is growing. In 33 states, adults lose their eligibility for public insurance when they earn more than 50 percent FPL. Nevertheless, having family income below half the poverty level does not ensure public coverage; 40 percent of families below that income level have uninsured parents and/or uninsured children (Lambrew, 2001b; Appendix D). There is a gap between eligibility and enrollment for lower-income parents as well as their children.

FIGURE 2.7 Income distribution of uninsured parents in families with children.

NOTE: Percentages are subject to rounding error.

SOURCE: See Appendix D.

Race or Ethnicity

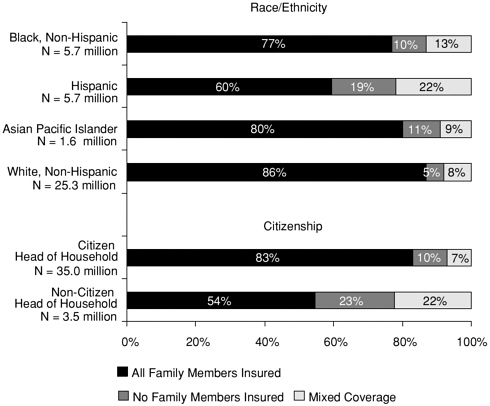

Finding: Among families with children, Hispanic families are most likely to have at least one uninsured member (41 percent), followed by non-Hispanic African-American families (23 percent), and non-Hispanic white families (13 percent).

Ethnic and racial minority group members are more likely than non-Hispanic whites to be uninsured and to be members of families with at least one uninsured member (see Figure 2.8). For all adults, with and without children, uninsurance rates are higher for minority populations, with Hispanics having the highest uninsurance rate of all (Holahan and Brennan, 2000; IOM, 2001). All members are insured in only 60 percent of Hispanic families (3.4 million families), compared with 77 percent (4.4 million) of African-American, non-Hispanic families and 80 percent (1.3 million) of Asian or Pacific Islander families. In contrast, all members

FIGURE 2.8 Insurance coverage within families with children, by race or ethnicity and citizenship.

NOTE: Percentages are subject to rounding error.

SOURCE: See Appendix D.

are insured in 86 percent (21.8 million) of white, non-Hispanic families. The coverage pattern for families generally follows that among all adults.

The greater likelihood that minority families have at least one uninsured member may contribute to the decreased access to care and lower quality of care that minority group members experience, relative to non-Hispanic whites. However, the relative importance of insurance coverage, compared with such factors as income, health status, and the cultural competency of health service institutions and practitioners, has yet to be fully explained. Even after taking health insurance status into account, racial and ethnic minorities tend to receive lower-quality and less health care than do non-minorities (IOM, 2002b). Health insurance coverage, however, plays a part in reducing disparities. Population groups that most often lack stable health insurance coverage and have relatively worse health status, including racial and ethnic minorities and lower-income adults, would stand to benefit most from increased levels of health insurance coverage (IOM, 2002a). The Committee concluded in its previous report Care Without Coverage that increased coverage would likely reduce some of the racial and ethnic disparities in the utilization of appropriate health care services and may also reduce disparities in morbidity and mortality among racial and ethnic groups. (See chapters 5 and 6 of this report for further discussion.)

Citizenship and Immigrant Status

Finding: Families whose head is a non-citizen are more likely to have some or all members uninsured than are families headed by citizens, 45 percent and 17 percent, respectively. However, most families with children that have at least one uninsured member are headed by U.S. citizens. Families headed by a non-citizen comprise only one-tenth the total number of families in the United States.

The length of time of residence in the United States, together with income level, public insurance eligibility criteria, and race and ethnicity, influences the likelihood that one or more members of immigrant families are uninsured. The uninsured rate for individuals who are immigrants, including naturalized citizens, is significantly higher than it is for U.S.-born citizens, with the uninsured rate for immigrants declining with increasing length of residency in the United States (IOM, 2001).8 Proportionally fewer families headed by non-citizens have all members insured, compared with families headed by U.S. citizens. All members are covered in 54 percent of immigrant families (1.9 million families) compared with 83 percent of families headed by citizens (29.1 million families) (see Figure 2.8).

Higher uninsured rates among immigrant families reflect lower rates of

employment-based coverage, the impact of legislative changes in 1996, and more restricted access to public insurance, compared to families headed by a U.S. citizen (Rosenbaum, 2000; Ku and Freilach, 2001; Ku and Matani, 2001). First- and second-generation immigrant children are at significantly higher risk of being uninsured than are third- and later-generation children. This pattern holds true for all ethnic groups, although the uninsured rate varies substantially by country of origin (Brown et al., 1999). The cost of health insurance is given by immigrant parents as the main reason for lack of coverage of their children (Brown et al., 1999).

SUMMARY

One-fifth of the total U.S. population, 58 million people, may be directly affected by being uninsured or indirectly affected by living with an uninsured family member. Nearly one in five families with children has at least one member uninsured. For these families, public programs are more likely to provide coverage for the children than for their parents, and employment-based insurance is more likely to cover the parents than the children. Most uninsured children are SCHIP-and Medicaid-eligible but not enrolled. Among the families with some lack of coverage, there are more families with some members covered than there are families with no one covered (see Box 2.4).

Insurance coverage of families follows patterns similar to those of coverage for individuals. Families with at least one uninsured member tend to have low incomes, have a single parent, and/or be of a racial or ethnic minority. The risk is relatively high that Hispanic families and those headed by an immigrant lack coverage for all their members compared with non-Hispanic whites and citizen-headed families. Also, children are at greater risk of being uninsured if their parents do not have coverage.

The financial risks to families of having an uninsured member are studied in Chapter 4. The risks to family well-being and access to care for children, particularly if a parent is uninsured, are explored in Chapter 5.

Often the gain or loss of coverage is linked to common family transitions related to aging, employment, or marital status. These issues are considered in Chapter 3 which contains an analysis of key transition points in the family life cycle that have a particular impact on whether the family maintains insurance coverage or not. The focus is on understanding the gaps in coverage just discussed. These gaps are endemic to the current system of health insurance in the United States. The next chapter examines how and why so many people slip through them.

|

BOX 2.4 Summary of Findings

|