3

Data on System Performance: Trends and Case Studies

As explained in Chapter 1, the committee relied on four kinds of information to support its conclusions: aggregate trends and projections regarding traffic volumes, infrastructure development, and system performance; case studies of freight projects and planning efforts; interviews with participants in the freight transportation industries; and a review of the conclusions of past studies of related transportation policy questions. Findings from the first three of these sources are summarized in this chapter; conclusions from the review of past studies were presented in Chapter 2.

TRENDS IN TRAFFIC, INFRASTRUCTURE, AND PERFORMANCE

Historical data on freight traffic, infrastructure development, and freight transportation system performance are summarized in the sections below. The presentation is organized in seven topical areas: highway trends; railroad industry trends; problems related to congestion at freight terminals and border crossings; the long lead times and rising costs of infrastructure projects; trends in congestion in urban areas, especially on facilities shared by passengers and freight; trends in other freight modes; and underlying trends in productivity, finance, and technology. The first five of these topics parallel the perceived developments identified in Chapter 1 as having been instrumental in shaping industry and public views on freight capacity problems. The degree of consistency of the aggre-

gate trend data with these perceptions and the extent to which the data support judgments about the nature and severity of freight capacity problems are examined in this section.

The public policy questions regarding freight capacity are whether public investment in additional capacity is justified, public infrastructure is efficiently managed, and government policies are hindering private-sector investment and management. The answers to these questions depend on whether total costs would be lower at a different scale of the physical plant or with different management practices. Therefore, performance measures are required that indicate the costs of capacity constraints and hence the benefits of expansion (which may include reduced congestion, lower freight rates, or lower accident or environmental costs). Performance measures that could be useful for this purpose include carrier costs and prices and shipper delays. Some performance data are presented below, but readily available information is limited.

Trend data on traffic and investment are, by themselves, insufficient as guides to policy. For example, a declining ratio of capital stock in an industry to the output of the industry does not necessarily indicate that the rate of investment is too low, but may rather reflect productivity growth.

A further inadequacy of the aggregate data is that capacity constraints in transportation systems typically are local. The average link at an average time period may be operating well below capacity even if the performance of the system as a whole is hampered by problems at local bottlenecks during peak periods. Local problems can have a severe impact on a network transportation system such as an airline or a railroad. Problems at a hub airport or rail center can quickly spread hundreds or thousands of miles from the source. (Trucking is less vulnerable to such cascading impacts.) Another consequence of the local character of capacity problems is that severe congestion in a few of the culturally and politically most important urban areas (New York, Los Angeles, and Washington, D.C.) may bias the views of opinion makers and the public regarding the scope of problems. The case studies presented later in this chapter illustrate some of these local circumstances.

Highway Spending and Traffic Growth

Perhaps more than any other development, the perception that highway traffic growth has outstripped the ability to provide roads has given rise to concern among transportation professionals and the public that current trends in transportation capacity are unsustainable. Roads are shared by trucks and cars, so it is impossible to separate highway freight capacity from the question of overall system capacity for serving all vehicles.

Trucking is the major freight mode in terms of expenditures in the United States. According to estimates by the Eno Foundation, 81 percent of domestic intercity freight transportation expenditures in 1999

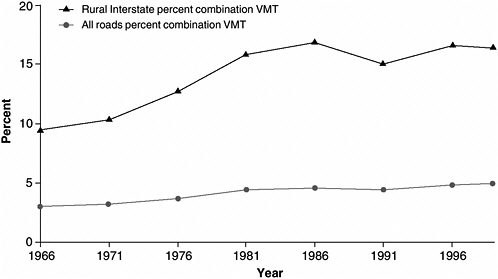

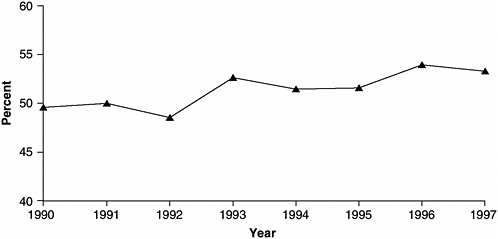

were for trucking, and trucks carried 27 percent of intercity ton-miles (Wilson 2001, 7, 12). In 1999, combination trucks accounted for 5 percent of vehicle-miles traveled (VMT) on all roads and 17 percent on rural Interstates (Figure 3-1) (FHWA 2000a, Table VM1). Highway engineers estimate that a large truck has approximately the same effect on traffic operations as two cars, so large trucks account for about 30 percent of all passenger-car equivalents on rural Interstates.

Capital Expenditures, Capital Stock, and Traffic

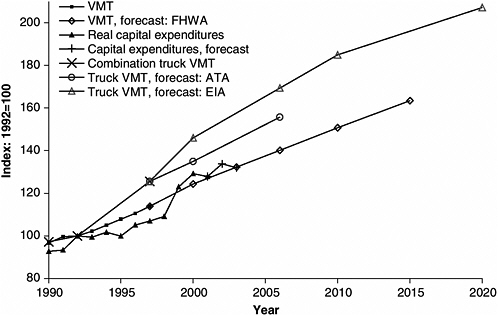

From the late 1940s to the 1960s, real capital expenditures for highways grew at least as fast as did highway travel; but since that time, while VMT has steadily grown, the long-run trend in real capital expenditures appears nearly flat (Figure 3-2). Capital expenditures on public roads in 1999 were $59.5 billion, VMT was 2.7 trillion, and VMT for combination trucks was 132 billion (FHWA 2000a).

A more relevant question for performance is whether the stock of highways, rather than the rate of capital expenditures, is expanding in pace with traffic. A constant rate of capital expenditures can yield growth in capacity if assets are long-lived. Data on road-miles or lane-miles can serve as approximate physical measures of the capital stock of highways (although roads vary greatly in their traffic-bearing capabilities). These physical measures of highway capacity appear to be flattening in the past

FIGURE 3-1 Combination truck share of traffic. (SOURCE: FHWA various years.)

FIGURE 3-2 Highway capital expenditures and vehicle-miles traveled. (SOURCES: FHWA 1987–2000; BEA 1998, 159; BEA 2000, 132.)

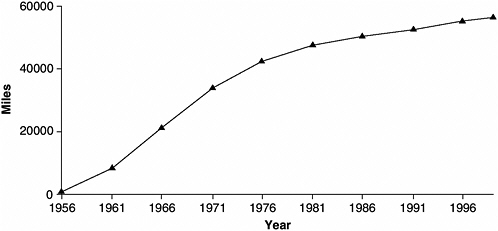

decade, after nearly three decades of rapid postwar expansion. For example, mileage of limited-access divided highways grew rapidly during the peak years of Interstate highway system construction; mileage is still growing but much more slowly compared with the 1960s and 1970s (Figure 3-3).

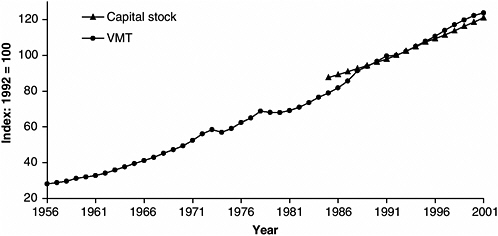

An economic measure of the capital stock of highways is estimated by the Commerce Department’s Bureau of Economic Analysis (BEA). It is defined as the replacement cost of all past capital expenditures less depreciation, in constant dollars. The BEA measure of capital stock, published only since 1985, exhibits more rapid growth than do the data for road miles. BEA estimates that capital expenditures have been considerably exceeding depreciation (Figure 3-4). Much highway capital expenditure today—for example, projects to widen roads, improve roadway geometry, or improve traffic control—increases capacity but is not reflected in gross indicators of physical capacity like road-miles. Between 1985 and 2001, average annual growth rates were 2.8 percent for VMT on all roads, 2.0 percent for BEA capital stock, and 0.7 percent for miles of limited-access highways.

Another estimate of highway capital stock, produced by the Federal Highway Administration (FHWA) using a definition somewhat different from that of the BEA estimates, indicates that productive capital stock grew at an annual rate of 1.7 percent from 1985 to 1995, 1.3 percent from 1975 to 1985, and 5.1 percent from 1955 to 1975 (Fraumeni 1999).

FIGURE 3-3 Miles of limited-access divided highway. (SOURCE: FHWA 1987–2000.)

Performance

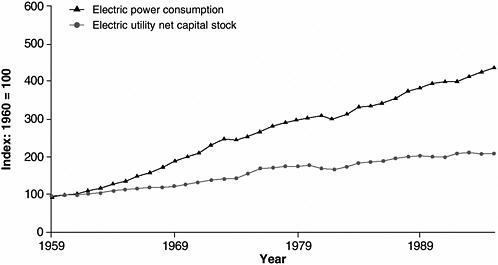

As noted above, a declining ratio of roadway stock to travel does not in itself demonstrate that more rapid expansion of the system is called for. The system may have been larger than necessary in earlier decades, or the declining ratio may represent productivity growth rather than a decline in the level of service. The overall pattern of a declining ratio of capital to output does not seem to be rare in U.S. industry; the trend in the rail industry has been parallel, as shown in the next section, and another

FIGURE 3-4 Net capital stock of highways and streets; annual vehicle-miles. (SOURCES: FHWA various years; Katz and Herman 1997, Table 12; Lally 2002, Table 12.)

network industry, electric utilities, shows a similar trend (Figure 3-5). The electric utility industry, like the railroads, has recently experienced a severe temporary regional supply disruption, which has stimulated debate about the adequacy of capacity and the need for government intervention. In both industries, more productive use of capacity in recent decades has benefited the public, but it may have increased vulnerability to disruptions caused by extraordinary external circumstances.

There is evidence that highways are becoming more productive, in part because of changes in users’ behavior. Traffic engineers have discovered that roads today maintain free-flowing traffic conditions while carrying traffic volumes that would have resulted in slow-speed or stop-and-go traffic conditions according to traffic models calibrated in earlier decades. The data suggest that a freeway can today carry perhaps 15 percent greater peak traffic volume before speed slows to 80 percent of free-flow speed, compared with the 1960s (TRB 1996, 64, 142). Apparently drivers, as they become more accustomed to high-speed, high-traffic-density driving, are learning to make more efficient use of the available road space. Changes in the dimensions and performance of vehicles may also be affecting the relationship of speed to traffic density. Improved traffic management has the potential to significantly increase the effective capacity of existing roads, but the most powerful techniques have as yet seen little application.

Data on time trends in performance of the entire highway system are sparse, and forecasting future performance has proven to be difficult. A 1987 study of urban freeway congestion estimated an annual cost of 1.2

FIGURE 3-5 Electric power consumption and utility capital stock. (SOURCES: Katz and Herman 1997, Table 4; EIA 2002, Table 8.5.)

billion vehicle-hours of delay, and projected a 5.6 percent annual rate of growth of vehicle-miles of congested travel on urban freeways through 2005, compared with a projected 1.9 percent rate for all vehicle-miles (Lindley 1987). However, a 1997 FHWA analysis found that the fraction of daily peak-hour vehicle-miles of travel on urban Interstates that takes place in congested conditions was fairly constant between 1990 and 1995 (Figure 3-6), while total urban Interstate travel grew at 4.1 percent annually during the period.

Projections

Projections of total and combination truck VMT typically predict lower rates of growth in the next decades than occurred during the 1990s. On the supply side, highway capital expenditures for the next few years may be projected on the basis of the size of the federal-aid program enacted periodically by Congress, if it is assumed that the ratio of state to federal expenditures remains constant (Figure 3-7). The 1998 program provided for moderate spending growth through 2003, and preliminary proposals for the successor legislation also call for increases.

FHWA produces a biennial projection of national highway capital spending requirements based on a benefit–cost analysis, using its HERS (Highway Economic Requirements System) model. The model employs a sample of road segments, reported to FHWA by the states, with information on traffic, geometry, and state of repair of each sample segment; and a set of cost factors to allow projections of infrastructure and user costs for

FIGURE 3-6 Percent of peak-hour travel that occurs under congested conditions, urban Interstates. (SOURCES: FHWA 1997a; FHWA 2000d, Exhibit 4-5.)

FIGURE 3-7 Forecasts: VMT, combination VMT, capital expenditures. (SOURCES: VMT: FHWA various years, Table VM-1; real capital expenditures: FHWA various years, Table HF10 and BEA 2001, 133; combination truckVMT: FHWA various years, Table VM-1; truck VMT, forecast: EIA: EIA 1999, Table 55, heavy trucks; truck VMT, forecast: ATA: ATA 2000.)

each segment for specified assumptions about future road improvements and traffic growth. Given a forecast of traffic and a budget, the model computes the most cost-effective highway improvements. The DOT model has two major shortcomings. First, it does not support comparisons of highway expansions with congestion pricing or other demand management alternatives. Therefore, the model overlooks attractive policy alternatives in many instances. Second, it does not incorporate a network model. Consequently, the estimate of benefits from expansion of a highway link does not change if a decision is made to simultaneously expand a substitute or complementary link. Necessary revisions to DOT models to make them more useful for planning are identified in Chapter 4.

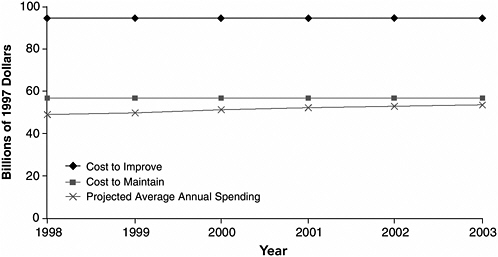

The most recent projections using this model (Figure 3-8) assume VMT growth of about 2.2 percent annually, depending on the level of investment. FHWA estimates that a highway capital spending program in which projects were carried out in order of cost-effectiveness and the level of spending was just sufficient to maintain present physical conditions of pavements and bridges would require annual capital expenditures averaging $57 billion (in 1997 dollars) over the period 1998–2017, a rate

FIGURE 3-8 Projected annual highway capital spending versus cost to maintain physical conditions and cost of all cost-effective improvements. (SOURCE: FHWA 2000d, ES-13.)

of spending 16 percent above the actual 1997 level. In this scenario, the average benefit–cost ratio of all projects carried out (other than bridge projects) is 6.1. If all projects with a benefit–cost ratio greater than 1 were carried out, FHWA estimates that annual spending would be $94 billion, 93 percent greater than the 1997 level, and the average benefit–cost ratio of all projects would be 3.7 (FHWA 2000d, ES.13–ES.15, 7.15–7.18, 9.5).

Summary

Although the picture that can be formed from aggregate trends is necessarily incomplete, as emphasized earlier, the data suggest a more complicated situation than the simple conclusion that the nation is near to running out of highway capacity. Real highway capital spending slumped severely in the 1970s but recovered afterwards, spurred by larger federal-aid programs. The stock of highway capital is growing, although not as fast as VMT. Although the available data on highway performance are inadequate, they do not demonstrate widespread deterioration. Nonetheless, DOT economic analysis indicates that at current funding levels many opportunities for high-payoff, mobility-improving projects are being missed.

Railroad Infrastructure Downsizing and Service Disruptions

Capital Expenditures and Traffic

In 1999, railroads carried 37 percent of intercity freight ton-miles in the United States and rail revenues accounted for 10 percent of expenditures

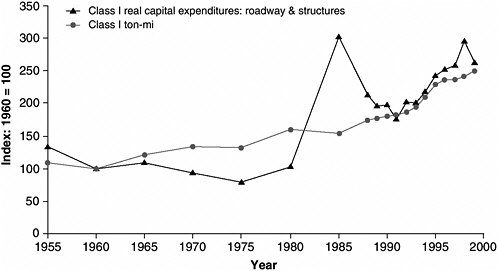

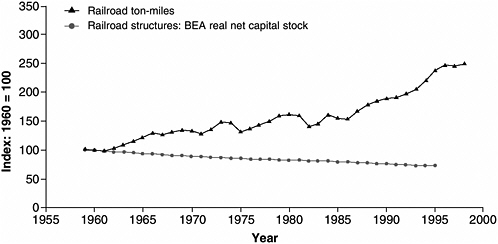

for domestic intercity freight services (Wilson 2001, 7, 12). The recent history of the development of the railroads differs markedly from that of highways and trucking. Rail freight traffic grew slowly, and the rate of real capital expenditures declined in the post–World War II period through the 1970s. Since the end of most economic regulation of the industry in 1980, traffic growth has accelerated, and spending for roadway and structures has grown more rapidly than traffic (Figure 3-9). In 1999, capital expenditures for roadway and structures by Class I railroads (the largest U.S. railroads, accounting for 91 percent of rail freight revenues) were $4.4 billion, and the number of ton-miles was 1.4 trillion (AAR 2000).

The mileage of track owned by Class I railroads has contracted throughout this period (Figure 3-10). Some of the decline shown in the figure reflects divestitures of track to small regional and shortline railroads, which operated 29 percent of road-miles in use in 1999. Rail roadway operated by all U.S. railroads declined from 181,000 miles in 1987 to 171,000 miles in 1999 (AAR 2000, 3; AAR 1988, 2). Much of the reduction in mileage since World War II was the result of the decline in passenger service. Technology also has played a role; for example, computerized traffic management has increased effective capacity. Patterns differ by region: in the East and Midwest after World War II, multiple independent railroads operated redundant mainlines and branchlines. The South had fewer carriers and less duplication, and far fewer multiple-track lines, and the West was largely single-tracked. From the 1960s, the

FIGURE 3-9 Class I railroad roadway and structures capital expenditures and ton-miles. (SOURCES: AAR 1999; AAR 2000; BEA 2000, 132.)

FIGURE 3-10 Track-miles owned, Class I railroads. (SOURCES: AAR 1999; AAR 2000.)

South and West were growing and rail traffic was generally on the rise. Growth on a large single-tracked system led to congestion problems in the West in the 1980s at the same time that track was being removed from the East and Midwest. Thus, it would be an oversimplification to ascribe any present capacity problems to rail infrastructure downsizing. Most of the downsizing occurred in the Northeast, where traffic growth has been relatively modest.

According to BEA estimates, the strong rate of capital spending for new roadway and structures has not kept pace with depreciation and retirements, so the real net capital stock of all U.S. railroads has declined (Figure 3-11). Trends in rail roadway and structures spending and net

FIGURE 3-11 Railroad structures net capital stock and ton-miles (all railroads). (SOURCES: Katz and Herman 1997, Table 4; Wilson 2001.)

stock are presented here as measures more directly related to long-term capacity than are equipment spending and stocks, and for comparability with the highway capital trends presented above. Short-term capacity problems often are related to equipment availability.

The capital stock and investment trends are consistent with the view that the railroad industry had substantial excess capacity in 1980 and has since been shedding uneconomic capacity while maintaining and upgrading the best-performing components of the network. By some accounts, the period of systemwide downsizing came to an end within the past few years, and the railroads now face the need for expansion if they are to serve expected demand growth (Machalaba 1998).

Like highways, railroads carry both passengers and freight. Traffic is overwhelmingly freight: annual Amtrak car-miles are 1 percent of freight car-miles (AAR 2000, 34, 77). Nonetheless, requirements for freight traffic to share track with intercity and commuter passenger trains are a significant capacity constraint in some locations.

Performance

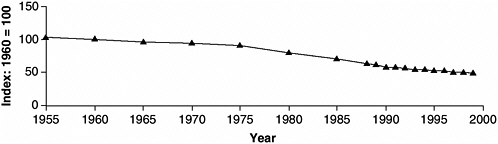

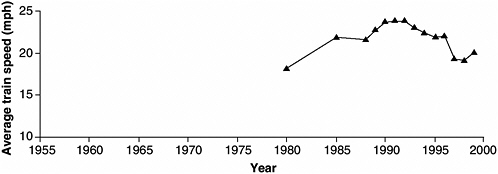

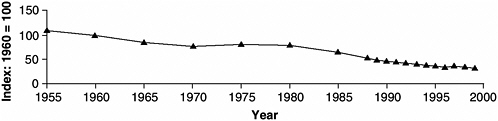

Available measures of railroad performance also are consistent with this view. A physical measure of performance, average train speed, showed improvement from 1980 to 1992 and then declined (Figure 3-12). This is suggestive of a capacity problem, although many other factors can influence the performance of this measure. Railroads report that speeds have largely recovered since the postmerger problems of the 1990s were resolved. Average revenue per ton-mile in constant dollars (i.e., average price) has been declining for many decades (Figure 3-13). This price trend presumably reflects the combined effects of productivity growth, excess capacity, and deregulation. Recently the rate of decline may have slowed compared with that in the preceding decade, although a pronounced price

FIGURE 3-12 Average train speed, Class I railroads. (SOURCES: AAR 1999, 37, 38; AAR 2000, 37, 38.)

FIGURE 3-13 Average revenue per ton-mile, Class I railroads (constant dollars). (SOURCE: AAR 2000.)

rise, such as might be expected to accompany a capacity crunch, does not appear in the aggregate data.

The railroads’ operating income grew throughout the 1990s, a trend not inconsistent with tightening capacity (Figure 3-14). However, according to some analysts, the rate of return is insufficient to attract the capital that would be needed to develop new lines of business to the railroads and serve expected growth of established lines (Machalaba 1998; Ellis 2000). A low rate of return would presage further contraction, rather than capacity expansion.

The trends in railroad output, capital stock, and average revenue suggest strong productivity growth; that is, the railroads are getting more and more service out of existing facilities. Caution is required in interpreting trends in ratios of outputs to inputs for railroads, as for any transportation sector, because ton-miles is a very approximate measure of physical output. Rail costs depend on the mix of traffic among bulk commodities, general merchandise, and intermodal containers, since these lines of business demand different services. One careful estimate of rail industry productivity indicates that multifactor productivity grew by

FIGURE 3-14 Net railway operating income, Class I railroads. (SOURCE: AAR 2000.)

4.5 percent annually in the decade after deregulation, twice as fast as during the preceding decade and faster than in other freight sectors or in the economy as a whole during the 1980s (Gordon 1992). However, apparently no available rail productivity measure does a thorough job of taking into account changes in output and input quality (Oum et al. 1999).

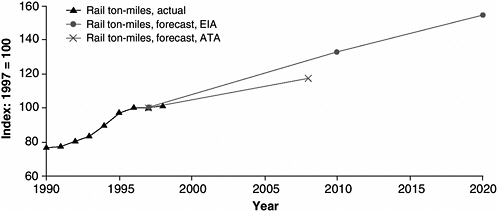

Projections

Two recent forecasts predict strong growth in rail traffic in the coming decades, although neither appears to explicitly take into account any capacity constraint (Figure 3-15). A forecast of freight traffic for all modes for the American Trucking Associations, with gross domestic product (GDP) growth of 3.3 percent annually for 2000–2008, predicts rail tonnage will grow at 1.3 percent annually from 1998 through 2008, compared with 1.7 percent for total freight tonnage (ATA 2000); this implies a rail ton-mile growth rate of 1.5 percent annually. A forecast of the Department of Energy’s Energy Information Administration, on the basis of assumed GDP growth averaging 3.0 percent annually from 1999 through 2020, predicts rail ton-mile growth of 1.9 percent annually over the period (EIA 2000, 138).

Service Disruptions

No recent event has brought greater public scrutiny of the national freight transportation system than the service disruptions that occurred following the 1996 merger of the Union Pacific (UP) and Southern Pacific (SP) Railroads. For the purposes of this study, these events as well as the service disturbances following the 1999 Conrail breakup are

FIGURE 3-15 Railroad ton-mile forecasts. (SOURCES: ATA 2000, 19; EIA 2000, 138; Wilson 2001.)

relevant only insofar as they may indicate underlying long-run capacity problems. A General Accounting Office (GAO) report described the Union Pacific episode as follows:

In the summer of 1997, during implementation of the Union Pacific/Southern Pacific merger, rail lines in the Houston/Gulf Coast area became severely congested, and freight shipments in some areas came to a complete halt. As the problem spread, many grain shippers experienced delays in railcar deliveries of 30 days or more, while some grain shippers in Texas did not receive railcars for up to 3 months. Transit times for movements of wheat from Kansas to the Gulf of Mexico in some cases exceeded 30 days—four to five times longer than normal. In late 1997, the [Surface Transportation] Board determined that the service breakdown, which had a broad impact throughout the western United States, constituted an emergency and among other things, ordered Union Pacific to temporarily release its Houston area shippers from their service contracts so that they could use other railroads serving Houston, and to cooperate with other carriers in the region that could accept Union Pacific traffic for movement, to help ease the gridlock. (GAO 1999, 67)

By December 1998, UP announced that its operations had returned to normal (GAO 1999, 84). The Surface Transportation Board and industry officials reported to GAO that they regarded the service breakdown as an aberration, related more to prior deficiencies at SP, including substantial deferred maintenance, than to the merger itself (GAO 1999, 67, 72). Nonetheless, when Conrail was split up between the CSX and Norfolk Southern (NS) railroads in 1999, disruptions again occurred, although not on the scale of events following the UP/SP merger. Shippers reported delays of shipments and unavailability of service (Larson and Spraggins 2000). Major intermodal customers, including United Parcel Service, suspended some use of the railroads (Lang 2000). The service failures were attributed mainly to problems of integrating separate operations, and especially to information system failures.

Most observers concluded that the postmerger rail service disruptions were exceptional events rather than indicators of long-run capacity problems, and the railroads report that they have largely put merger-related service problems behind them. However, it is plausible that availability of capacity will reduce risks of disruptions and that tight capacity may aggravate disruptions once they occur. Rail mainlines today typically operate at high utilization levels compared with past practices. The eastern railroads reportedly relied on the region’s older facilities, now in the hands of shortline railroads, to alleviate operating problems after the

Conrail breakup, and had made important capacity enhancements leading up to the breakup that probably averted more severe difficulties (Phillips 1999).

Summary

Do the data support the view that traffic on the nation’s mainline railroads is nearing maximum capacity? As noted previously, capacity constraints are localized in time and space, so aggregate trends cannot be definitive tests. However, most trends are consistent with a condition of tightening capacity: long-run contraction of the extent of the network, the declining net capital stock measure in spite of historically high rates of industry capital expenditures, rising profits, slowing train speed, and sporadic service failures. In spite of these trends, freight rates, driven mainly by productivity gains, continue to fall, and rates of return remain modest. These last two trends suggest the possibility that the industry may contract further before it reaches a sustainable scale.

Growing Congestion at Terminals and Border Crossings

The scope of terminal capacity issues is broad: it can be defined to encompass the internal adequacy of the terminal facilities themselves (e.g., the capacity of ports to load and unload ships and of rail terminals to handle rail cars) as well as the capacity of intermodal connections to the terminals (e.g., access by rail and truck to ports, and truck access to rail yards). Data indicating the performance of all these components are fragmentary. The issue of terminal capacity received attention in the 1990s because of the growth of international trade and intermodal freight traffic, and because of intent to facilitate development of intermodal transportation that Congress expressed in the 1991 surface transportation act (ISTEA).

The professed federal commitment to an intermodal approach to freight transportation policy has been put into practice largely through a focus on congestion at terminals and other local bottlenecks, such as border crossings. When in 1995 DOT undertook to develop ties to the private sector to jointly address freight problems through its National Freight Partnership, the group’s initial priorities were two terminal areas (the Southern California ports and Alameda Corridor project, and rail interchange in Chicago) and two border crossings (El Paso and Laredo, Texas) (FHWA 1997b). The most recent federal surface transportation act (TEA-21 of 1998) created two aid programs aimed at these bottlenecks: the Corridors and Borders program and Transportation Infrastructure Finance and Innovation Act (FHWA 1998). Following congressional directives in ISTEA and subsequent legislation, DOT and the states have

been engaged in an effort to identify important road connections between terminals and major through highways, to make them eligible for federalaid funding, and to assess their condition and investment needs. A Federal Highway Administrator explained the philosophy behind this program emphasis as follows: “Freight flows rapidly across our system but then comes to a virtual stop as vehicles come off exit ramps out to congested, narrow streets with multiple stoplights leading to our seaports, airports, rail terminals and stations, and major manufacturing facilities. If we focus on less than 2 percent of the system, we can significantly increase productivity” (Smallen 1998).

As part of its intermodal connectors program, in 2000 DOT completed an inventory of roads serving as intermodal freight connectors. These were defined as the most important secondary roads carrying truck traffic between freight terminals and major highways. By DOT’s definitions, 1,200 miles of such connectors were identified, connecting 250 ports, 200 rail terminals, 100 airports, and 60 pipeline heads to the National Highway System. DOT found that $1.5 billion of improvements were carried out or planned for 1996–2000 on these roads, $250,000 per mile per year, although much of the spending was concentrated on a few projects (DOT 2000; FHWA 2000b).

The DOT study acknowledged that data are insufficient to judge the adequacy of these roads or the funding levels devoted to their improvement (DOT 2000, 4). This finding is significant, since it means that the case for devoting more funding to the connectors has not yet been made. At issue is whether earmarking a portion of transportation funds, at the federal or state level, for improvements to the connectors would yield greater public benefits than allowing the states to choose transportation uses for the funds.

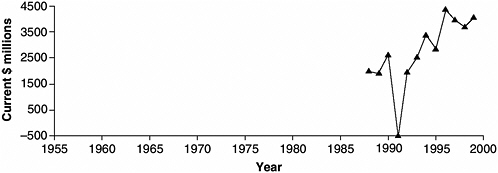

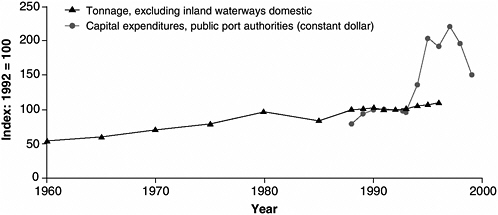

To illustrate the demands on port waterside facilities, Figure 3-16 shows the trends in tonnage of U.S. waterborne commerce (excluding inland waterway traffic but including domestic Great Lakes and coastwise tonnage), as well as historical and projected capital expenditures by public port authorities. The aggregate data are not very illuminating because tonnage is dominated by a few bulk commodities, especially petroleum. Port authority capital spending has been accelerating, although to gain a complete picture, the capital expenditures of private-sector terminal operators, shipping companies, railroads, state governments, and others would have to be included.

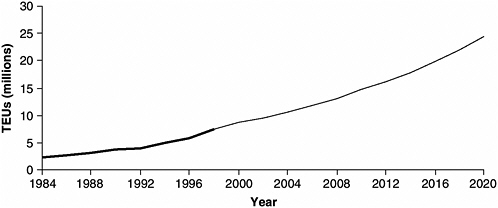

Examination of trends by port or by region, or, to the extent that expenditures can be allocated, by type of commodity (e.g., bulk versus container), would be necessary to give a clear indication of the relationship between capital expenditures and traffic. Figure 3-17 shows historical and projected volumes for one category of cargo in one region: loaded containers in international trade handled in the Ports of Los Angeles and Long

FIGURE 3-16 U.S. port authority capital expenditures and waterborne commerce tonnage. (SOURCES: MARAD 1990–1997; MARAD 2000b; BEA 2000, 132.)

Beach. Growth in this traffic at these ports was nearly 10 percent annually in the 1990s and is expected to continue at a more moderate rate, providing port and landside facilities continue to expand (SCAG 2000, 78). These ports handle 30 percent of U.S. ocean container traffic.

While growth of some categories of freight at certain ports has been remarkable, there is some evidence that the waterside facilities of the U.S. port system as a whole are at present not capacity-constrained. Ocean cargo has a choice of ports on all U.S. coasts, and cargoes can bypass landside congestion out of busy west coast ports by sailing directly to the east

FIGURE 3-17 Container volume, Ports of Los Angeles and Long Beach (1984–1998 historical; 1999–2020 projected). (SOURCE: SCAG 2000.)

coast (Phillips 2000; Gillis and Damas 1998). One indication of capacity conditions is port pricing practices. Competition among ports and the leverage that ocean carriers can exert in negotiating port leases and service fees have depressed the rates charged at many U.S. ports to a level below costs (MARAD 1998, 47–48). Although port operating revenues have increased in the past decade and more ports are becoming self-sufficient, many ports still rely on various forms of public aid to break even. The depressed pricing and reliance on subsidies both are suggestive of over-capacity. Some apparent port waterside excess capacity probably reflects landside capacity constraints. Poor landside access may be discouraging use of some ports that have low utilization of waterside capacity.

Border crossings, although they are not terminals, are analogous physical choke points in the freight system. Growth in international trade has put strains on border crossing facilities. As one illustration, truck border crossings between Mexico and Texas increased 220 percent from 1990 to 2000 (Texas Center for Border Economic and Enterprise Development 2001). Congestion and delays for truck and rail traffic at U.S. land border crossings have been frequent. Delays are the consequence of physical infrastructure limitations as well as of the complexities of customs and immigration proceedings at borders.

Long Lead Times and Rising Costs of Infrastructure Projects

Public-sector construction projects for highways or other transportation infrastructure typically require 5 to 15 years to plan and complete. In U.S. urban areas, examples of billion-dollar infrastructure projects with 20-year delivery times can be cited, and projects costing in the hundreds of millions of dollars are no longer rare (GAO 1997; GAO 1998). Among the factors that have added to the uncertainties and costs of infrastructure development are the following:

-

Increasing population density and urbanization. The population of U.S. urban areas has grown by 75 million since 1960, when Interstate highway construction was first reaching full speed. Urban land is valuable, and the spillover effects of infrastructure are more objectionable in cities.

-

Stronger environmental regulations, which primarily reflect greater value placed on environmental quality by the public.

-

Greater emphasis on safety, which has necessitated upgrading of design standards.

-

More intensive use. Traffic volumes and truck loads on a typical road are much greater today than in earlier decades.

Systematic data on trends in project delivery times and costs are not available. Construction cost indexes reflect unit costs but not the

effects of changes in preconstruction project development costs or design standards. The following anecdotal data indicate the nature of the problem:

-

In a recent survey, state transportation officials reported that projects in which delays caused by federally required environmental reviews retard completion by 1 to 2 years occur with regularity [TransTech Management (forthcoming)].

-

DOT data reported to Congress on the environmental review process for highway and transit projects show that the average time required to process environmental documents for major federal-aid highway projects was 2 years in the 1970s, 4 years in the 1980s, and peaked at 5 years 10 months in 1999. DOT reported that its efforts to streamline reviews according to legislative directives had reduced the average to 5 years 2 months by 2001 (DOT 2002).

-

A review of large transportation infrastructure projects worldwide found that among 41 U.S. and European projects with costs mostly in the range of $100 million to several billion dollars, the median cost overrun of completed projects was 50 percent compared with preconstruction estimates, in constant prices (Skamris and Flyvbjerg 1996).

-

A GAO review of eight U.S. public-sector transportation projects, costing from $300 million to $11 billion each and including highway, freight rail, and transit projects, found that most, but not all, were experiencing significant cost or schedule overruns (GAO 1998).

-

Another GAO study, of environmental reviews of airport expansion projects, found that most major U.S. airports are operating at or near capacity and that balancing airport operation with environmental protection has become much more difficult in the past decade, which increases the time and cost of airport development. GAO concluded that poor coordination and communication among federal agencies and between the federal government and airports make compliance with requirements for environmental review of expansion projects more difficult. According to an operator survey, environmental issues were the most common cause of project delays in the preceding 5 years. One-fourth of major airports reported canceling or indefinitely postponing expansion projects in the past 10 years because of environmental issues (GAO 2000).

-

A comparison of the development of two toll roads in California, SR-91 in Orange County and SR-125 in San Diego County, concluded that environmental reviews added 6 years to the schedule for SR-125 compared with SR-91, which did not require an environmental impact statement because the new lanes were being added to the median of an existing freeway. Project development and engineering for the 12-mile SR-125 toll road required 9 years (Lockwood et al. 2000).

Of course, processing delays may be the price of achieving desired environmental outcomes. Still, state officials see curtailing the growth of project delivery times as essential to their ability to control the costs of future infrastructure expansion. The attention of the states and the federal government has recently been focused on the issue of environmental streamlining, that is, efforts to reduce the time and cost of environmental regulatory reviews of transportation projects (DOT 2002).

The consequences of lengthening project delivery times and rising costs are that the adjustment of infrastructure to changing markets will be slow, development decisions must be based on highly uncertain long-term forecasts, and investments become more risky. Changes in practices and policies that reduced delivery time, cost, and risk would greatly reduce the difficulty of efficiently matching capacity to traffic demand. The Interstate 81 and Upper Mississippi navigation case studies in this chapter illustrate these issues.

Urban Congestion and Passenger–Freight Conflicts

Most major freight nodes (ports, airports, and railheads) and the origins and destinations of most shipments are in cities. Freight must compete with passenger traffic for use of transport facilities and with all other land uses for space for expansion. Once again, data that isolate trends in the freight impacts of urban congestion are not available, so the problem must be demonstrated anecdotally.

The Freight Action Strategy (FAST) Corridor project in Seattle, described in one of the case studies below, is representative of urban competition between freight traffic and other activities. Conflicts between freight traffic at the Seattle region’s ports and other road traffic, as well as other community impacts of port traffic in a major city, impose strong constraints on port development. The Alameda Corridor port access project in Los Angeles has its origins, in part, in the same set of issues; that is, the new rail link to the ports was considered necessary not only to increase physical capacity but also to reduce the impacts of port traffic on residents, automobile travelers, and other businesses (Shaw 1992, 26–54; GAO 1998, 33–34).

The GAO survey of airport operators described in the preceding section shows that airports face an analogous challenge: operators reported that noise pollution is the most important environmental problem they face and constitutes one of the principle constraints on expansion. The growing importance of environmental constraints is driven by growing populations near airports.

The Alameda Corridor project, which involves eliminating some surface rail lines, illustrates how pressure grows to displace freight traffic when urban freight–passenger conflicts worsen. Other examples of

this process are proposals for various forms of urban truck bans or restrictions (Shaw 1992, 49–50). In aviation, an official of the authority operating Boston’s Logan Airport proposed in 2001 that consideration be given to adopting a Northeast airports regional plan that would allocate traffic among the airports, reserving Logan for long-distance passenger traffic and moving short-range and cargo operations to other regional airports (Krause 2001). Similarly, freight railroads often have been obliged to cede access to local commuter trains. The American Public Transportation Association in 2001 supported a legislative proposal that would allow local governments to petition the federal Surface Transportation Board to gain access to track when they failed to reach agreement with the railroad (AASHTO 2001).

Chicago is the setting for some of the most challenging problems involving urban freight–passenger conflicts. All the major North American railroads interchange traffic in the urban area. As a component of these interline exchanges, 1.2 million containers annually are hauled by trucks over city streets and expressways (Prince 2001). These highway interchanges are significant for the performance of the nationwide intermodal container transportation system and the costs of intermodal to shippers and the community.

The growth of intermodal will aggravate the problem concentration of truck traffic near terminals. The most important constraint on intermodal growth in the future may be the difficulty of expanding terminal capacity in urban areas (Prince 2001, 68). As one additional illustration of this problem, NS reportedly required 10 years to negotiate arrangements with local government to construct an intermodal terminal at Austell, Georgia, to serve as its Atlanta hub. The main point of contention was local residents’ concern about truck traffic (Gallagher 2001).

Trends in Other Modes

The trends described above have been emphasized because of their visibility and because they affect the largest freight modes. However, two other infrastructure systems utilized for freight, inland waterways and aviation facilities, have experienced performance problems related to tight capacity.

Inland Waterways and Ports

Inland waterways (rivers, canals, and the Intracoastal Waterway, but excluding the Great Lakes and oceangoing coastwise shipping) carry 11 percent of domestic intercity ton-miles but account for only 1 percent of freight expenditures (Wilson 2001, 7, 12), making the system the cheapest freight mode in terms of average transportation cost per ton-mile.

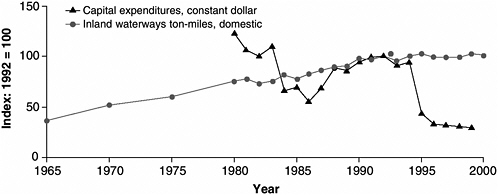

Farm products, coal, and petroleum products make up two-thirds of ton-miles. Traffic (in ton-miles) has grown steadily at close to 3 percent annually in recent decades (Figure 3-18), while tons have grown at about 1 percent annually. Annual federal capital expenditures have been variable, as Congress has enacted authorizations at irregular intervals (Figure 3-18). The U.S. Army Corps of Engineers (USACE) estimates that federal expenditures account for at most half of all capital expenditures related to the waterways, since terminals and equipment are privately owned (USACE 1997, ES-4). USACE periodically produces forecasts of expected traffic growth by commodity and by segment of the waterways, which depend on assumed growth rates of the economy as a whole and individual sectors as well as export forecasts. The projections call for overall growth of 0.8 to 1.6 percent annually to 2010 (USACE 1997, ES-13).

Potential capacity-related problems on the inland waterways include the aging of facilities and peak-period congestion at certain locks. The median age of all lock chambers is 35 years (USACE 1997, 2-4). USACE maintains detailed data on lock performance. Average delays have been rising slightly in spite of recent elimination of some bottlenecks. Average delay is 6 hours at the most congested locks and much longer during peaks (USACE 1997, 2-18). The case study on Upper Mississippi planning below illustrates waterway capacity issues.

Air Freight

The U.S. aviation system experiences recurring congestion in airport flight operations, airport landside connections, and the air traffic con-

FIGURE 3-18 Inland waterways: federal government capital expenditures and ton-miles. (SOURCES: USACE 1997, Table 4-1; USACE 2001, Table 1-9; USACE 2002, 12; BEA 2001, 121; Wilson 2001, 12.)

trol system. All three kinds of congestion represent constraints on the development of air freight. Freight and passenger air traffic grew much faster than overall economic activity throughout most of the 1990s. Annual growth rates from 1993 to 2000 were 4.3 percent for revenue passenger-miles on U.S. carriers, 5.1 percent for U.S. air carrier domestic freight revenue ton-miles, and 10.1 percent for U.S. air carrier international freight revenue ton-miles (FAA 2001a, I-2). As a consequence, by the end of the decade delays had worsened at most major airports (FAA 2001a, I-4). The Federal Aviation Administration (FAA) monitors the frequency of flight operation delays that are caused by air traffic control congestion. In 2000, at the 31 busiest U.S. airports, the median fraction of flight operations (takeoffs and landings) delayed more than 15 minutes by air traffic control was under 2 percent. The most frequent delays were at La Guardia (16 percent of operations) and Newark (8 percent) (FAA 2001b). These delays may not directly affect air freight flight operations, which can be scheduled in off-peak periods; however, as the section above on urban freight-passenger conflicts describes, a consequence of growing congestion at shared facilities tends to be the crowding out of freight.

U.S. carriers in 1999 produced 14 billion revenue ton-miles of domestic air freight services. International traffic of U.S. carriers was also 14 billion ton-miles (FAA 2001a, Table I-2R). Air freight is less than 0.5 percent of all U.S. domestic freight ton-miles and accounts for 5 percent of expenditures for domestic intercity freight (Wilson 2001, 7, 12). FAA forecasts that freight ton-miles on U.S. carriers will double between 2000 and 2012, an average annual growth rate of 5.8 percent. The forecast shows U.S. carrier passenger-miles growing at 4.7 percent annually over the period (FAA 2001a, Table I-2R). The challenges that airport authorities face in expanding runway capacity to respond to traffic growth are described in the sections above on lead times for infrastructure projects and urban conflicts. Proposals that have been made for reform of FAA’s air traffic control function to allow more efficient traffic management are described in Chapter 2.

Trends in Underlying Forces

The prominent trends that were described above represent the most visible concerns of the past decade. To put them in context, the committee examined certain more fundamental developments. These include freight transportation industry productivity and output, which are measures of overall industry performance; public infrastructure finance, which is one of the key determinants of the performance of public-sector transportation activities; and technological and social developments, which are the drivers of long-run change.

Productivity and Output

In recent decades, freight outperformed the economy as a whole. Output per hour, adjusted for quality change, grew by 4.3 percent/year between 1980 and 1995 in railroads and by 1.9 percent/year in trucking, compared with 0.7 percent/year in all of business. But by the mid-1990s, productivity growth was slowing in freight transportation and accelerating in the economy as a whole: growth between 1995 and 1998 was 3.6 percent/year in rail, 1.3 percent/year in trucking, and 2.2 percent/ year in all business (BLS 2002). Freight productivity growth in the 1980s may be attributed primarily to deregulation and new infrastructure; the slowing in the 1990s may reflect the impact of the five trends identified above.

It would be a misconception to view freight as an “old economy” industry of diminishing importance. Rail and truck ton-miles per real dollar of gross domestic product, after declining by nearly half from 1950 to 1987, rose 12 percent by 1998. One possible interpretation of this trend is that the decline in the postwar years reflected the decline in relative importance of the extractive industries and heavy manufacturing, while the growth since the 1980s may reflect, at least in part, the growing importance of trade in the economy.

Finance

In spite of endorsements of the principle of user fee finance by successive administrations and congresses and by state transportation agencies, there has been no pronounced trend in favor of user fees to finance public-sector construction and operation or in favor of reliance on the market mechanism for managing public-sector transportation facilities. A modest fuel tax on inland waterway users was introduced in 1986, but harbor maintenance lost user fee finance in 1997. Federal rules have blocked airport efforts to rationalize pricing. By FHWA definitions, the ratio of highway user fee collections to spending declined from 78 percent in 1970 to 68 percent in 1998. When decisions are not market driven and subsidies are available, expansion of public infrastructure capacity beyond the economically justified level is a threat to efficiency. As one example, U.S. port authorities’ current and projected capital spending is at the rate of $1.6 billion/year, twice the rate of the 1990– 1995 period. Excluding the Southern California ports, most of the planned spending is to be financed from sources other than port revenues; yet most ports would have difficulty increasing revenues because of intense competition, a circumstance indicating overcapacity. Conversely, on some heavily used components of public-sector infrastructure, imposition or increase of user fees could readily finance high-return capacity investments.

Technological and Social Developments

Improvements in equipment and infrastructure design and successful applications of information technology to operations and management have been continuous processes throughout recent decades. Advances in the management of transportation and logistics are a form of technological progress. Economic deregulation after 1980 was a stimulus to these innovations. Better logistics management lowers costs by reducing inventory and allowing suppliers to respond quickly and precisely to changes in the market.

One prominent aspect of these organizational developments has been the growth of rail intermodal, the carriage of road trailers and containers on railcars. The new service options and competition created by intermodal service stimulate efficiency and reduce costs. The railroads carried more than 9 million containers and trailers in 1999, and rail intermodal loadings grew 4.4 percent annually during the 1990s. Rail intermodal is seen as an opportunity to relieve pressure on overburdened highways and reduce external costs of freight transportation. However, growth will be inhibited in the future by capacity constraints on the rail system, and the potential to displace trucking is limited: rail intermodal traffic is today roughly equivalent to 8 percent of the volume of combination truck traffic; if it doubles in the next decade (nearly twice its growth rate in the 1990s), it will still amount to only about 10 percent of combination truck traffic.

Freight transportation companies are not responsible for certain costs of their activities and therefore do not have incentive to control them. These include costs of congestion on public rights-of-way, air and noise pollution, accident losses for which carriers are not liable, and environmental costs of infrastructure construction. Recent decades have seen substantial reductions in pollutant emission rates and accident rates per unit of freight services, but freight traffic volume and the population exposed to pollution have increased, so total costs probably are increasing. Also, possibly as the result of increased wealth and urbanization, the public may value environmental quality more highly today than at earlier times.

Interpreting the Trends

Historical trends are interesting only if they provide some insight into the future. For now, insights must rely more on judgment than on quantitative forecasts. Structural models with the network detail and reliability that would be required to reduce the risks of long-run public-sector investment decisions are not available, and their development would require substantial effort. For example, congestion is probably an important determinant of regional or metropolitan population dispersion, but existing forecasts will not reflect this feedback. The state of the art of forecasting suggests

that public policy should seek to increase the flexibility of the transportation system to respond to developments that cannot be reliably foreseen.

Nonetheless, the trends described above support some conclusions about the likely future evolution of the freight system. An assessment and qualitative predictions about developments over the next few decades are presented in Chapter 4 in the section Prospects for Freight Capacity.

CASE STUDIES

Because aggregate trend data are insufficient as indicators of the adequacy of capacity, the committee also examined individual system components as case studies to provide a more concrete understanding of freight supply problems and insight into the institutional setting of project-level decision making. The cases were Virginia’s 20-year plan for expanding capacity on I-81, a major truck corridor; plans of USACE to expand lock capacity on the Upper Mississippi River; the FAST Corridor port access project in Washington State; the Florida Freight Stakeholders Task Force, a body charged with advising the Florida Department of Transportation on freight issues, including capital expenditure decisions; and PrePass, a public– private system to automate certain trucking regulatory enforcement functions. The Virginia and Upper Mississippi River cases each involve efforts of a government agency to expand capacity on a mainline route that it owns and operates. The Florida and Washington cases are efforts to foster public–private cooperation in identifying and resolving terminal access problems in local areas. PrePass illustrates the potential of information technology to increase the effective capacity of transportation systems.

The case studies alone are too few in number to support definite conclusions about the sources of obstacles to efficient provision of freight capacity. However, they point to hypotheses about this question deserving closer examination.

Virginia Interstate 81 Widening Project

I-81, an Interstate highway running from southwest to northeast through Virginia, is a major truck route. The state has a plan for several billion dollars in improvements to the highway in the next 20 years to accommodate expected traffic growth. The state studied construction of exclusive truck lanes as part of the project, but rejected that option. The NS has a parallel route on which it believes there is potential for growth of container and general merchandise traffic. During the Conrail breakup proceedings, the railroad stated that it could divert some I-81 traffic from truck to rail. There may be a connection between the level of state investment in upgrading I-81 and the railroad’s willingness to invest in building up rail service. The railroad has proposed to the state that it consider

providing public funding for improvements on the rail route as a lower-cost alternative to accommodating more freight traffic on the highway.

This case illustrates several of the public policy issues related to freight capacity that were identified in Chapter 2. I-81 is a major intercity highway freight artery facing capacity constraints in the future if no action is taken. At issue is whether resources will be available for increasing capacity on such routes, how environmental impacts or local community objections may affect the feasibility of expansion, and what alternatives have been recognized for responding to traffic growth. The case constitutes a test of the prospects for multimodal corridor planning because of the consideration given to the possibility of publicly financed expansion of rail capacity as a supplement or alternative to highway capacity expansion.

Highway Facility

I-81 extends 325 miles in Virginia, running northeast to southwest along the Appalachians. The route continues to Harrisburg and Syracuse to the north and terminates at its junction with I-40 near Knoxville, with direct Interstate connections throughout the Southeast. The Virginia portion, completed in 1969, is four lanes except for one short six-lane section. The route in Virginia is not heavily urban; the largest city traversed is Roanoke (population 120,000).

Annual average daily travel (AADT) over most sections of I-81 in Virginia in 1997 ranged from 30,000 to 60,000 vehicles per day (counting both directions), with an average over all sections of about 40,000. Tractor-semitrailers accounted for 25 percent of vehicles on average (VDOT 1999a), or more than 10,000 vehicles per day. Traffic studies show that, in estimating the capacity of a highway, a tractor-semitrailer is equivalent to approximately two passenger cars; therefore tractor-semitrailers are consuming about 40 percent of the utilized capacity. For comparison, AADT averaged over all Interstates in the United States in 1997 was 20,000 vehicles per day and average volume of combination vehicles (predominantly tractor-semitrailers) was 3,500 vehicles per day, 17 percent of the total.

The greatest one-way peak-hour volume among 18 locations for which the state provided traffic data is 2,720 vehicles per hour (1,360 per lane); typical peak-hour volume on the route is 1,600 vehicles per hour in each direction, or 800 vehicles per hour per lane. Traffic slows appreciably at about 1,800 vehicles per hour per lane on Interstates. With these peak volumes, and in the absence of large cities, serious recurrent congestion on the route should be uncommon.

The state conducted a survey of truck drivers at I-81 truck stops in 1997 (VDOT 1997). It found that tractor-semitrailer traffic is predomi-

nantly Interstate: half of all trips have an origin or destination within Virginia, Tennessee, North Carolina, or Pennsylvania, and half have an origin or destination outside these four states. (The survey might have undercounted intrastate trucks if local operators make less use of truck stops on the Interstate.) Commodities are diverse: according to the drivers’ responses, general freight and household goods are 34 percent of loads, food and agricultural commodities 18 percent, and construction materials 13 percent.

In 1971, 2 years after the route was fully open in Virginia, AADT (averaging three sites for which data are available) was 11,300 and tractor-semitrailer volume was 1,700 vehicles per day (15 percent of the total). From 1971 to 1997, AADT grew at an average annual rate of 4.8 percent and tractor-semitrailer volume at 6.4 percent.

Traffic Forecasts

The Virginia Department of Transportation (VDOT) traffic forecast used in its study of highway expansion requirements predicted that AADT would increase by 100 percent from 1997 to 2020, equivalent to a 3 percent annual growth rate. The tractor-semitrailer share of total traffic is forecast to remain constant. Peak-hour volume on the busiest segment in the forecast is 5,150 vehicles per hour in one direction, exceeding the capacity of the present highway. Tractor-semitrailer volume would exceed 1,000 vehicles per hour in one direction during the peak hour on the busiest section.

One of the important considerations for the purposes of this case study is the degree to which the state’s highway expansion plans are driven by the growth of truck traffic. As noted above, tractor-semitrailers account for 40 percent of the utilized capacity on the route, today and in the forecast for 2020. If there were no growth in tractor-semitrailer traffic between 1997 and 2020 and automobile traffic grew according to the state’s forecast, peak-hour passenger-car-equivalent volume in 2020 would be about 85 percent of the volume in the state’s present forecast and projected peak traffic on the most heavily traveled segments would exceed capacity. (Trucks constitute a smaller fraction of traffic at peak hours than throughout the day.) Therefore, eliminating growth in truck traffic might not greatly change the state’s assessment of the need for highway expansion.

While some aspects of the state’s forecast might be debatable, it is noteworthy that the forecast does not play as critical a role in decision making in this case as in the Upper Mississippi case. Construction of highway improvements will be staged over many relatively small projects over a period of years. For example, the $2.6 billion FY 2000 Virginia state highway program budget included $28 million of engineering studies for improvements on four short sections and two interchanges on the highway (VDOT 1999b), and two construction projects are under way.

The State’s Plan

In 1997 VDOT was directed by the Commonwealth Transportation Board to develop a plan for improvements on I-81 in the state to accommodate expected traffic growth. VDOT reported its recommendation in December 1998, which called for widening the route to at least six lanes, with eight lanes near four cities, and interchange improvements. It concluded that the widening would be essential to accommodate forecast traffic in 2020. The estimated cost for all recommended improvements was $3.4 billion (VDOT 1999c). VDOT also recommended construction priorities. The project would be staged over 20 years. As noted, the Board has approved the next stage of engineering studies for several segments and the start of construction.

At the direction of the state legislature, VDOT also studied the option of constructing a separate exclusive truck facility along the I-81 right-of-way. The analysis questioned whether a separate facility would be justifiable. The design considered was two truck-only lanes in each direction (because provision for passing would be essential) plus separate truck lanes on some interchanges. The estimated cost of the separate truck facility was $2.5 billion. The facility would require substantial right-of-way acquisition (apparently more than the recommended widening, which involves adding only one lane in each direction), increasing the potential for environmental damage and local community disruption. Most important, if a separate truck facility were constructed and automobiles were left with four lanes, automobile travelers would still experience significantly degraded levels of service by 2020. That is, the truck-only lanes would not solve the underlying problem. Finally, the study concluded that the recommended design would be safer than the separate truck facility option. The analysis apparently did not estimate cost savings from not having to accommodate large trucks in the automobile-only lanes or any perceived service improvements to motorists from the absence of trucks (other than reduced congestion delay).

In early 2002, a consortium of construction companies made a proposal to the state, following procedures in Virginia’s 1995 Public–Private Transportation Act, to widen the highway and add dedicated truck lanes to be financed by truck tolls. The proposal was taken under consideration by the state (Truckinginfo.com 2002; Laurio 2002).

NS’s Shenandoah Corridor Route

A secondary mainline route of the NS lies parallel to I-81 and its connecting Interstates, from Harrisburg through Roanoke and Knoxville to Birmingham and New Orleans. It carries virtually no intermodal traffic and only a very limited volume of merchandise traffic.

Historically, the route was little used for through rail traffic. Ownership was divided between three companies: the Pennsylvania Railroad operated between the Northeast and Hagerstown, Maryland; the Norfolk and Western between Hagerstown and Bristol, Virginia/Tennessee; and the Southern between Bristol and points in the Southeast and gateways to the Southwest. While these railroads did cooperate on some passenger and bulk commodity services, both the Pennsylvania and the Southern preferred to route most of the merchandise traffic on alternate routes that provided longer hauls and more revenue for them. The 1982 merger of Norfolk and Western and the Southern and the 1999 purchase of Conrail lines by NS finally created a route under single control between the Northeast and the Southeast.

Largely on account of this historic balkanization, there has been only limited investment in the route. Reflecting the difficult terrain involved and the poverty of the South when the railroad was built, the line has many curves and gradients. Always a minor rail route, it did receive minor improvements over the decades, mainly in the form of signaling and a track structure capable of carrying heavy loads. (It is important as a coal route.)

With the Conrail acquisition complete, NS has increased traffic over the route. Both coal and carload merchandise traffic have increased. NS operates a Memphis–Harrisburg service on this line. However, the running times are slow, and the railroad reports that it will utilize alternate, faster north–south routes for the majority of its intermodal volume. Substantial infrastructure improvements would be required to provide the trip times needed to divert traffic from the highway. Curve straightening and other changes are very costly in the region’s mountainous terrain. NS also reports that such investments are unlikely to occur just to support the diversion of additional traffic from the highway. The margins on such traffic make it attractive only if the lengths of haul are long (more than 1,000 miles) or where surplus capacity exists. Neither of these conditions holds for this market.

During the proceedings leading to the Conrail breakup, NS designated this new single-line route the Shenandoah Route and cited it as one of the routes that would spur improved rail service between the Northeast and Southeast. NS stated that it expected to draw significant general merchandise and intermodal freight from trucks to rail service on the route and that it planned $33 million in investment for sidings and for doublestack clearances between Front Royal, Virginia, and Roanoke (Norfolk Southern n.d.).

The Railroad’s Proposal to the State

In August 2000, NS proposed to the state of Virginia that it consider public investment in improvements to the Shenandoah line as an alternative

solution to I-81 congestion problems. State officials from Maryland, North Carolina, Pennsylvania, Tennessee, and West Virginia also participated in discussions with the railroad. As a consequence, the Virginia legislature instructed VDOT to conduct a study, to be completed in 2001, of the feasibility of shifting traffic in the I-81 corridor from highway to rail.

The NS proposal included double-tracking much of the line, upgrading signals, reengineering curves, improving existing yard facilities, and developing intermodal terminals. The improvements would increase capacity and allow higher train speeds, which are requirements for attracting intermodal traffic to the line. The railroad estimated that at least 1,000 heavy trucks per day, and possibly as many as 3,000 per day, could be removed from the Interstate between Harrisburg and Chattanooga, that is, 10 to 30 percent of present heavy truck traffic. The railroad argued that it would be much cheaper to add needed capacity on the rail line than to the highway, especially considering benefits from improved safety and reduced environmental impact (Norfolk Southern 2000a; Norfolk Southern 2000b).

It may be something of an oversimplification of the functioning of the freight system to relate traffic growth on a specific highway to improvements on a specific rail line. A more realistic approach from the state’s point of view might be to consider whether improvements on rail lines throughout a corridor or region could reduce truck traffic on the main roads throughout the region. If rail improvements were successful in developing intermodal freight, then such traffic reductions would be achieved, although the effect of the rail line improvements might be to increase truck traffic in certain locations on roads leading to intermodal terminals.

Policy Issues

FEASIBILITY OF INTERCITY HIGHWAY CAPACITY EXPANSION

The VDOT plan for improvements to I-81 gives some grounds for optimism about the capability of the states to continue to expand highway capacity in response to traffic growth on major intercity truck routes. Although the highway is an older Interstate connecting some of the most densely populated parts of the nation, the state’s initial study indicates that right-of-way for widening will be available and does not identify any insurmountable environmental obstacles. The cost seems not unreasonable: it amounts to about $0.02 per vehicle-mile of travel that will occur on the road during the project’s 20-year schedule, according to the VDOT projections, and the improvements will have a lifetime beyond that 20-year period. The project has low risk in the sense that it can be done in stages, widening those segments earliest on which the immediate benefits would be greatest, and the schedule can be accelerated or retarded in accordance with the growth of traffic.

On the other hand, limitations on the state’s planning approach might raise concern over whether all potentially attractive options have been fully explored. VDOT’s recommendations to the Transportation Board seem to have been based primarily on projections of the date at which congestion on the route will start to become severe. They do not include quantitative estimates of benefits of the proposed improvements or analysis of sensitivity of benefits to uncertainties in traffic projections. The state agency did not explore the possible benefits of coordinated planning with adjoining states along the route of I-81. It was prompted to consider the alternatives of exclusive truck facilities and state-funded rail developments, but did not publish the results of its exclusive truck lanes analysis and did not consider any options involving alternative management and funding approaches to developing the highway. Planning for developing the route is still in preliminary stages, so there will be opportunity for VDOT to conduct more detailed analyses in the future.

Although the state apparently did not consider such alternatives relevant in this project, in some states facility management alternatives to highway expansion are regularly evaluated during project planning. An example is Minnesota, where ramp metering on urban freeways was installed after evaluation indicated that this technique would be preferable to physical expansion.

PUBLIC FUNDING OF RAIL CAPACITY AS AN ALTERNATIVE TO HIGHWAY EXPANSION

As described in Chapter 2, government grants to private freight railroads have occurred, usually on a small scale, for many years in the United States. They have included state rail assistance programs with and without federal support and ad hoc arrangements for single projects. TEA-21 contained a new program for federal rail assistance, the Railroad Rehabilitation and Improvement Financing program, which is to provide loans and loan guarantees to public or private sponsors for development or improvement of rail or intermodal facilities or equipment. The total amount of loans provided or guaranteed is $3.5 billion. This program would institutionalize the kind of federal credit assistance given to the Alameda Corridor port access project in Los Angeles.

Several arguments have been made in support of proposals for rail freight grants. First, it might be cheaper in some circumstances from the standpoint of the government to aid the railroad than to provide the same freight capacity by expanding highways. Such cost savings might be most significant in a densely developed location where right-of-way was more readily available for rail upgrading than for highway expansion.

Second, rail aid might be justified as a means to improve freight mar-

ket efficiency by offsetting subsidies truck operators receive because they do not pay the full cost of the highway service provided to them. As also described in Chapter 2 in the section on the future of user fee finance in state highway programs, the most recent DOT highway cost allocation study estimates that fuel taxes, registration fees, and other user fees paid by truck operators amount to 80 percent of the highway expenditures of all levels of government attributable to trucks, the same as the ratio of fees to costs for all vehicles. The DOT study does not compare fee revenues to costs by class of road. However, one analysis made plausible allocations of fees and costs between urban and rural roads and concluded that in 1975, payments by urban highway users exceeded urban highway expenditures by 13 percent, while on rural roads payments were 30 percent below costs (Meyer and Gómez-Ibáñez 1981, 198–203). Thus, according to these estimates, urban road users subsidize rural users.

Intercity roads include the truck routes that directly compete with railroads. Therefore, a subsidy to rural truck traffic paid by urban highway users would distort modal competition and degrade freight transportation efficiency. The significance of any urban/rural cross subsidy in highway user fees today is unknown. The study cited above is old and compared payments with costs for all vehicles, rather than for trucks alone. The study Paying Our Way (TRB 1996) estimated external costs and subsidies for case studies of individual truck trips. It found that the difference between estimated costs and fees paid varies widely and depends on the characteristics of the truck trip, but no consistent urban/rural bias is apparent in the small number of cases considered.

Because a railroad builds and owns its own track, it bears all the financial risk of misjudging the appropriate scale of infrastructure. Because highways are publicly owned and operated, a trucking company bears relatively little of the analogous risk of over- or under-building of highway infrastructure, even if the highway taxes it pays match the average highway agency costs attributable to it. The railroads argue that the public assumption of this risk also biases freight markets in favor of trucking.

Third, it is argued that rail freight transportation generates lower external costs per ton-mile (air pollution, highway congestion, and external accident costs) than truck and that favoring rail over truck would tend to promote more environmentally benign high-density urban development rather than low-density development. Fourth, the purpose of some large state aid projects has been to improve rail access to seaports, which the states regard as critical drivers of economic development. Finally, state programs to aid shortline railroads are often a means to indirectly aid farmers who use the lines.

Objections to rail aid programs have to do in part with administrative practicality. Would the government be able to discriminate between rail aid proposals that actually had a high chance of producing net benefits and

required government support and proposals that were without merit or that should be left in the private sector? Evidently, the states would have to use sophisticated analysis methods that they do not now possess in order to make such distinctions. Without tight management controls, the risk would be that application for government aid whenever a railroad wished to undertake a capital improvement would become routine, regardless of the merits of each case, and that states would feel obliged to provide aid, as governments do now for sports stadiums, for fear of losing development to rival states. Finally, subsidies limited to capital expenditures would bias railroads toward favoring capital solutions to capacity constraints instead of operating improvements to better utilize existing capacity that might be more cost-effective. Financial discipline would be easier to maintain if the aid program offered only partial grants and required a high level of private contributions.

In cases where the main argument for rail subsidy is the existence of subsidies or high external costs in trucking, an alternative would be for the state to adjust truck taxes to ensure that trucks covered their costs. Shippers would then select the best transportation options on the basis of true costs. The bias of shippers’ decisions would be further reduced if truck taxes were adjusted so that truck operators paid the costs of their use of roads not only on the average but for classes of operations, or, ideally, for individual movements. For example, as noted above, some evidence indicates that urban highway users subsidize rural users. Any subsidy to rural truck travel being paid by urban road users could be eliminated by imposing route-specific fees. If this method was judged to be impractical, the market distortion could be reduced by adjusting registration fees on various classes of trucks and fuel tax rates so that fees generated by rural truck travel in the aggregate more nearly matched the costs of that travel.

Arguments can be put forth that having urban road users subsidize rural travel is a beneficial arrangement, either on economic grounds (i.e., that because of scale economies, efficient charges imposed on rural road users could never finance the level of investment in rural roads that is economically justified) or as a way to make congestion pricing on urban roads more attractive (e.g., Small et al. 1989, 122). However, neither argument is generally accepted or well supported empirically. The growth of traffic and congestion on several important intercity truck routes today suggests that self-financing through marginal cost-based user fees on these routes might be as feasible as on congested urban roads. In any case, it would be possible to maintain a user fee scheme that featured an urban-to-rural subsidy in the aggregate but did not subsidize intercity truck travel.