8

International Perspective

Looking at some experiences with formula allocation programs outside the United States, the panel examined two such programs in detail: the United Nations’ (UN) assessment scale methodology for allocating the expenses of the organization among member states (Suzara, 2002), and Canada’s Equalization Program (Taylor et al., 2002). We also comment on experiences in Australia and some European countries.

In general, the panel found that the statistical issues and problems arising in these programs were similar to those in U.S. programs. The choice of how to measure the fiscal capacity, or capacity to pay, of jurisdictions arises in every program. Many programs put caps or ceilings on the amounts (or the changes in amounts) that can be allocated to jurisdictions, in order to constrain expenditure for the financing jurisdiction and to preserve stability for the recipient jurisdiction. The issue of whether and how to account for differential costs of providing services across jurisdictions arises in most programs. Some of the ways in which these statistical issues have been addressed by other countries and international organizations may provide guidance to U.S. programs.

However, the different political and administrative contexts that operate in other jurisdictions make these aspects of foreign programs less applicable to U.S. programs. The ways in which programs are developed, approved, and administered depend to such a large extent on the political and cultural environment in which they operate that some practices may not be easily adapted to the situation in this country. Nevertheless, we

point out some practices that are likely to be beneficial if they could be adapted.

UNITED NATIONS

Unlike the other formula allocation programs the panel studied, the UN’s system for determining member states’ contributions involves a formula that allocates a tax rather than a benefit. Nevertheless, it has many of the characteristics of conventional formula allocation programs that transfer funds in the opposite direction. When the United Nations came into existence it instituted a mechanism that would systematically allocate the contributions to be secured from member states to finance its operations. Thus a scale of assessments was formulated and since then has been the basis on which the expenses are distributed among the membership. It was recognized that no perfect formulation existed or could exist. Instead it was understood that the best formula was one for which a consensus existed. The underlying principle of this scale of assessment was that expenses should be apportioned according to capacity to pay. At that time it was recognized that it would be difficult to measure such capacity merely by statistical means and that it would be impossible to arrive at any definitive formula. In order to avoid anomalous assessments resulting from the use of comparative estimates of national income, other factors were also to be considered. Taken together, all of these have led to the basic elements of the current assessments methodology.

-

Income as measure of capacity to pay. The economic basis for assessment is the concept of “capacity to pay.” Comparative estimates of income (gross national product or GNP) are determined to be the fairest guide in measuring this capacity. Other measures, such as wealth, socioeconomic indicators, dependence on one or a few primary products, and deteriorating terms of trade, had also been considered, but problems arising with the availability, reliability, and comparability of existing data for all member states precluded their use.

-

Low per capita income allowance. In order to prevent anomalous assessments resulting from the use of comparative levels of income, comparative income per head of population is factored into the formula through the application of the low per capita income allowance formula (LPAF). LPAF embodies the principle that citizens of a rich country contribute a larger share of their taxes toward the United Nations than those of a poor

-

country who need to allocate a larger part of their income to basic necessities. The LPAF derives a common yardstick called “assessable income” that reduces the assessable income of members with large populations by the percentage difference between per capita income and a per capita income threshold corresponding to the average per capita income of all UN members. Countries having per capita income equal to or greater than the income threshold absorb the relief obtained from this application.

-

Maximum and minimum rates of assessment. These rates are considered to be constraints in the scale that have been accepted as inherently political decisions and not in strict conformity with the principle of capacity to pay. At the same time, it is recognized to be an essential mechanism in an organization in which there is a wide divergence in the range of income levels of members. The maximum or ceiling rate was instituted as a means of reducing the financial dependence of the organization on a single member without seriously obscuring the relation between a member’s contribution and its capacity to pay. The minimum or floor rate is based on the premise that the collective financial responsibility of an organization is borne by the entire membership and that each member pays at least a minimum fee in order to belong.

-

A per capita ceiling principle specifies that the per capita contribution of any member state not exceed that of the highest paying contributor.

-

An allowance to ease the burden of heavily indebted member states who devote a large portion of foreign earnings toward the servicing of external debt.

-

A cap of 0.01 percent of total expenditures on the assessment rates of the least developed countries.

-

A scheme of limits designed to mitigate extreme variations in assessments between two successive scales.

-

A mitigation process whereby the resulting scale derived from the step-by-step application of the methodology is adjusted in order to take account of relevant factors, such as natural disasters and civil strife, that could have possible impact on capacity to pay.

The first three elements have always been part of the scale of assessments while the other elements have been included as part of the methodology at one time or another.

CANADIAN EQUALIZATION PROGRAM

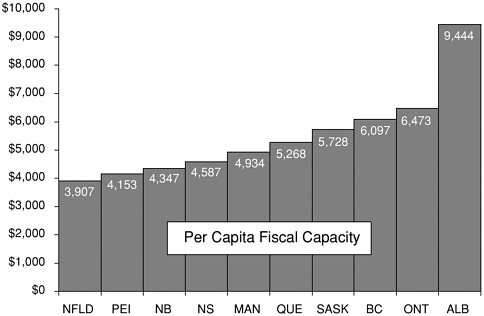

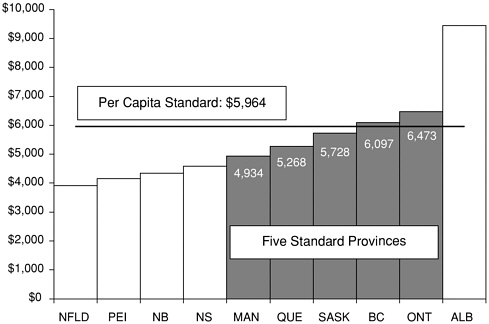

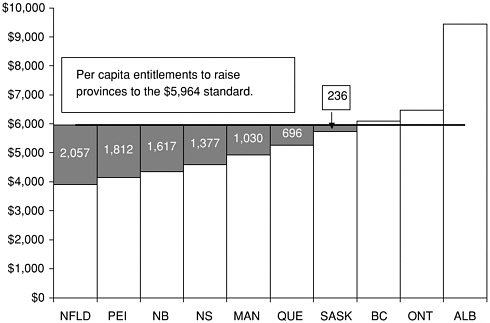

In Canada, the concept of equalization dates back to the country’s foundation in 1867 and was incorporated into the Constitution Act of 1982. The Canadian Equalization Program aims to ensure that “provincial governments have sufficient revenues to provide reasonably comparable levels of public service at reasonably comparable levels of taxation” (Taylor et al., 2002). It is part of a broad system of federal-provincial fiscal arrangements, which includes many other provincial and territorial transfers. The program uses the concept of per capita fiscal capacity as the basis for payments. Each province’s ability to generate revenues, measured by applying national average tax rates to commonly defined provincial tax bases, is compared on a per capita basis with a common standard. Provinces below the standard receive their shortfall in per capita fiscal capacity multiplied by their population; provinces above the standard receive nothing (and contribute nothing). The common standard is currently defined as the average per capita fiscal capacity for five “middling” provinces (the four Atlantic provinces, which are relatively poor, and Alberta, which is relatively rich, are excluded). Figures 8-1, 8-2, and 8-3 show the results of this calculation for 2001-2002 and illustrate how poorer provinces are brought up to the standard, leaving richer provinces above the standard.

In some senses, the program is not unlike the general revenue sharing program that operated in the United States in the 1970s and 1980s. The equalization payments are not tied to any particular expenditures; the provinces are free to use them as they see fit. So, while the program ensures that funding is available to provide comparable levels of service, it does not guarantee that any particular service is provided.

Some features of the Canadian system may represent practice that could be emulated in some U.S. programs:

-

An overall budgetary cap on total equalization payments, if it kicks in, causes the same per capita reduction in payments in each recipient province (equivalent to lowering the per capita standard), rather than a proportionate reduction of the entitlement of each province. This favors the poorest provinces.

-

Almost all statistical estimates that go into the formulas, many of them coming from provincial governments, are assembled and checked by Statistics Canada (Canada’s central statistical agency), which certifies them and passes them to the Department of Finance.

FIGURE 8-1 Per capita fiscal capacity 2001-2002 (Canadian dollars).

Note: The abbreviations on the horizontal line of the figure represent the 10 Canadian provinces. They are: NFLD = Newfoundland, PEI = Prince Edward Island, NB = New Brunswick, NS = Nova Scotia, MAN = Manitoba, QUE = Quebec, SASK = Saskatchewan, BC = British Columbia, ONT = Ontario, and ALB = Alberta (Taylor et al., 2002).

-

Special measures have been put in place to counter distorting impacts of sudden price shifts in some commodities and dominance of a particular source of revenue by one province.

-

Initial payments are made on the basis of estimated figures and adjusted as final data become available. This helps to provide early warnings of changes in equalization payments and provide time to soften their impact. In addition, a hold-harmless provision limits year-to-year decline in the per capita entitlement of any province to 1.6 percent of the standard.

AUSTRALIA, THE UNITED KINGDOM, AND THE EUROPEAN UNION

Australia also has a long history of federal assistance to its poorer states. It has operated an equalization program for its states since the 1970s. The

FIGURE 8-2 The per capita standard 2001-2002 (Canadian dollars).

Note: The abbreviations on the horizontal line of the figure represent the 10 Canadian provinces. They are: NFLD = Newfoundland, PEI = Prince Edward Island, NB = New Brunswick, NS = Nova Scotia, MAN = Manitoba, QUE = Quebec, SASK = Saskatchewan, BC = British Columbia, ONT = Ontario, and ALB = Alberta (Taylor et al., 2002).

Commonwealth Grants Commission, established by an Act of Parliament in 1933, provides independent advice to the Australian Parliament on inter-governmental financial relations, particularly grants of financial assistance by the commonwealth (i.e., federal) government to the states.

In the United Kingdom, also, large sums of money are distributed as a result of formula allocations. A recent study by Smith et al. (2001) noted that “the favored approach to distributing large amounts of public funds is increasingly to place weight on more ‘objective’ means of allocation which entails the use of mathematical formulae to model expenditure needs” (p. 218). They also noted a tendency for these formulas to become increasingly intricate. They noted that attempts to simplify formulas often fail, as the distributor of funds comes under increasing pressure to make the system more sensitive to local concerns. They report that this issue has also been examined by a House of Commons committee, which concluded that “fairness and equity are more important than simplicity, and that the drive

FIGURE 8-3 Per capita equalization entitlements 2000-2001 (Canadian dollars).

Note: The abbreviations on the horizontal line of the figure represent the 10 Canadian provinces. They are: NFLD = Newfoundland, PEI = Prince Edward Island, NB = New Brunswick, NS = Nova Scotia, MAN = Manitoba, QUE = Quebec, SASK = Saskatchewan, BC = British Columbia, ONT = Ontario, and ALB = Alberta (Taylor et al., 2002).

to improve transparency should be a secondary concern” (Smith et al., 2001:218).

The formulas used in the financing of the European Union’s budget are also complicated, as might be expected for a supranational organization.1 Beginning in 1970, a system of national contributions was replaced by a system more like tax revenues comprising three sources:

-

Agricultural levies.

-

Customs duties, derived from the application of the common customs tariff to the customs value of goods imported from nonmember countries.

|

1 |

Additional detail is available from the web site of the European Union: http://www.europa.eu. |

-

Income from the value added tax (VAT), derived from the application of a uniform rate to the VAT assessment base of each member state, harmonized in accordance with agreed-upon rules.

By 1984 these resources had become insufficient and in 1988 the European Community created an additional category of revenue, based on the gross domestic product of each member state. At that time a revenue ceiling of 1.2 percent of total European Community GNP was set. This was subsequently raised to 1.21 percent in 1995 and ultimately to 1.27 percent in 1999. At the same time, the VAT rate was gradually reduced from 1.4 percent to 1 percent in 1999, and the VAT base was also cut.

In addition to following a principle of capacity to pay, the European Community has also shown concerns with equity and attempts to rationalize anomalous situations. The former is illustrated by the fact that the budget of the European Union has a cohesion fund to reinforce equity and that those eligible for assistance under the cohesion fund had their VAT base capped at 50 percent of GNP in 1995. As noted earlier, the UN assessment scale provides for relief to nations affected by anomalous situations, such as a sudden and temporary severe distortion of the foreign exchange values of their currencies. Such situations have also arisen in the European Community. In one instance, it was agreed by the member states of the European Union that the financing of one of the members needed a specific correction. In 2000 this decision was confirmed and, moreover, new rules were established with respect to the correction, with the share of the financing of the correction of some of the counties going down and a ceiling on the amount of the correction.