|

BOX 4.1 Organization of Chapter The Value Lost in Healthy Life Years

Quality of Life and Security for Families

Developmental Outcomes for Children Uninsurance and Public Programs

Workforce Participation, Productivity, and Employers

Health Systems Impacts

Summary |

4

Other Costs Associated with Uninsurance

In this chapter the Committee considers costs other than the direct costs of health care—opportunity losses—that uninsured individuals, their families, local communities, and the nation bear due to the lack of continuous and permanent health insurance coverage for the entire population. In contrast with the estimates of the costs of medical care provided to those without insurance, the costs considered in this chapter have not, in most cases, been studied systematically. The Committee has developed quantified estimates only for two kinds of internal or private opportunity losses: the worse health attributable to lacking coverage and the financial “exposure” faced by uninsured individuals that would be eliminated by health insurance.

The Committee reserves one important, noneconomic opportunity loss for consideration in Chapter 6. In its conclusion to the report, the Committee examines the implications of extensive uninsurance nationally for American social and political values and ideals, including those of mutual caring and concern, equality of respect among members of a democracy, and equality of opportunity. This normative discussion is cast in terms of the benefits that could be expected if everyone had comparable financial access to care and the security afforded by health insurance.

Box 4.1 provides a roadmap to the organization of the chapter.

Following the schema of consequences of uninsurance that are presented in Figures 2.1 and 2.2, here the Committee relates its findings from previous reports and considers additional information from cost-of-illness and productivity studies to draw qualitative conclusions about certain economic impacts of lacking coverage and of relatively high rates of uninsurance within communities. The first two sections present quantified findings and the last four sections qualitative findings.

The first section focuses on the findings from Care Without Coverage and Health Insurance Is a Family Matter concerning health and health care deficits among uninsured adults and children and excess morbidity among uninsured adults resulting from a lack of health insurance. The Committee estimates the value of the increased lifespan and better health that uninsured persons could be expected to experience if they had continuous health insurance coverage over the course of their lives. This estimate is based on a commissioned analysis that is included as Appendix B of the report (Vigdor, 2003). The presentation of the qualitative findings notes when this quantified estimate of the probable value of healthier years of life forgone encompasses and subsumes the costs described qualitatively later in the chapter and when it does not.

The second section considers the quality of family life and financial security, building on the Committee’s investigation of these issues in Health Insurance Is a Family Matter. Here the Committee presents its estimate of the monetary value of the financial risk protection that health insurance would provide to those now without coverage, both per capita and in the aggregate.

The third section reviews findings from Health Insurance Is a Family Matter on children’s health and developmental outcomes as they depend on receipt of adequate services facilitated by insurance coverage. The fourth section looks at the implications of uninsurance for public program spending, including those that represent economic transfers as well as those that entail real resource costs. The fifth section considers productivity and workforce participation as related to health insurance status, primarily from the perspectives of the employer and the employee. Last, the sixth section summarizes findings from the Committee’s fourth report, A Shared Destiny, about health system and population health impacts of uninsurance at the community level.

THE VALUE LOST IN HEALTHY LIFE YEARS

Finding: The Committee’s best estimate of the aggregate, annualized economic cost of the diminished health and shorter life spans of Americans who lack health insurance is between $65 and $130 billion for each year of health insurance forgone. These are the benefits that could be realized if extension of coverage reduced the morbidity and mortality of uninsured Americans to the levels for individuals who are comparable on measured characteristics and who have private health insurance. These estimated benefits could be either greater or smaller if unmeasured personal characteristics were responsible for part of the measured difference in morbidity and mortality between those with and those without coverage. This estimate does not include spillover losses to society as a whole of the poorer health of the uninsured population. It accounts for the value only to those experiencing poorer health and subsumes the losses to productivity that accrue to uninsured individuals themselves.

The Committee approached placing a value on the difference in health outcomes that health insurance would make for those who lack it using the concept of health capital. As described in Chapter 2, health capital is the value to the individual of the “stock” of health that he or she can expect to have over the remaining course of life. Health capital encompasses and subsumes the market-based valuation of an individual’s productive capacity over the years of labor force participation that is represented by the notion of human capital. The capacity to be economically productive and to earn income is some, but not all, of the reason that we value good health. In order to account more fully for the value of better health, the Committee chose to base its estimates on the broader metric of health capital.

The value ascribed to health capital, the present value of the stock of health that one will experience over the remainder of one’s lifetime, is the value the individual herself places on life in particular states of health. Most of the benefits that can be expected to accrue to uninsured individuals themselves if they were to gain health insurance, including increased productivity and labor force participation, and improved developmental outcomes among children (with whom the formation of human capital begins), are represented in the single estimate of gains in health capital. It does include, but goes beyond, the value we attach to being alive rather than being dead. It does not, however, include the value that others may ascribe to an individual’s particular state of health. The benefits realized by families, such as greater financial security and less stress and worry about health care and coverage, may well be additional to those that are accounted for in the aggregate estimate of gains in healthy life years because these benefits are interpersonal, not individual.

The Committee commissioned an analysis by economist Elizabeth Richardson Vigdor to estimate the value of diminished health and longevity among the 40- some million persons who lack health insurance.1 Vigdor measures health capital empirically by combining data on length of life, the prevalence of adverse conditions among those alive, and the health-related quality of life conditional on having these conditions for insured and uninsured populations. She used the Current Population Survey (CPS) for determining the size and demographic composition of the uninsured population and the National Health Interview Survey (NHIS) for morbidity information.

Relative mortality rates for insured and uninsured populations were taken from the Committee’s systematic literature review of health outcomes as a function of health insurance status presented in Care Without Coverage and Health Insurance Is a Family Matter (IOM, 2002a, 2002b). Based on its earlier work, the Committee chose to use a point estimate of a 25 percent greater mortality risk for

uninsured individuals between ages 1 year and 65 years compared with those insured. This value reflects the results of two observational longitudinal studies (Franks et al., 1993; Sorlie et al., 1994) that adjusted for demographic and socioeconomic characteristics (and in the former for multiple health status and health behaviors as well). The confidence intervals around the mortality differentials found in these two studies are large; hence the point estimate of 25 percent is uncertain. However, these two studies’ results are reinforced by multiple crosssectional studies of disease and condition-specific mortality rates as a function of health status that are also part of the literature review, and the Committee believes this assumption is reasonable.

Estimating Health Capital

In her analysis, Vigdor uses alternative assumptions that bound the range of likely values of health capital. In the first set of estimates, the years of life (YOL) approach, everyone who is alive is assumed to be in perfect health. Thus the difference in health capital for the insured and the uninsured is due exclusively to the differences between their adjusted mortality rates, as reported previously by the Committee in Care Without Coverage (IOM, 2002a).

The second approach incorporates morbidity information to determine quality-adjusted life years (QALYs), but assumes that the insured and uninsured populations have the same disease prevalence and health-related quality of life (HRQL). This approach provides a lower bound of the loss in morbidity-adjusted health capital because, in fact, the uninsured are likely to have additional morbidity as a result of lacking coverage. Vigdor derived HRQL weights empirically from population-wide prevalence estimates for 15 conditions (from the NHIS and the Surveillance, Epidemiology and End Results databases).

The third approach took into account variations in disease prevalence and HRQL by insurance status. Because the uninsured differ from the insured across several characteristics, however, the observed difference in morbidity is unlikely to be entirely caused by lack of health insurance. Even after controlling for differences between the two populations in terms of age, gender, race and ethnicity, and educational attainment, unobserved differences that are correlated with higher morbidity among the uninsured likely remain. Therefore this estimate serves as an upper bound to the possible health gains from insurance. In this upper-bound approach, age and sex-specific prevalence estimates were obtained from the NHIS, controlling for insured status, race, ethnicity, income, urbanicity, and region of the country. In age-sex groups where the insurance status coefficient was not statistically significant at p = 0.10, no difference in prevalence by insurance status was assumed for that condition. The HRQL weights were also allowed to vary by insurance status, although most of these interactions were not significant. Notably, being uninsured had a significant negative effect on HRQL even after controlling for other factors. This result is reflected in the health capital estimates as well.

After calculating health capital as a function of insurance status under each set

of assumptions, Vigdor determined how much health would be gained if the current population of uninsured individuals had coverage. The analysis assumes that those without coverage acquire the same mix of insurance policies as those currently insured and that the previously uninsured maintain coverage until turning 65 and becoming eligible for Medicare. The coverage scenario presented in this chapter assumes that each individual faces the average probability of being insured each year until reaching age 65. This results in a conservative estimate because it assumes (1) that there is no correlation between current insurance status and insurance status next year, and (2) that the overall rate of uninsurance does not increase in the future. If being uninsured currently increases the probability of being uninsured in the future, and if length of uninsured spell has an adverse impact on health outcomes, this scenario underestimates the potential gains from health insurance.

The actual mortality differential between insured and uninsured individuals could be either less than or greater than the estimated 25 percent, and the economic value estimated for health insurance is approximately proportional to this estimate. If unmeasured personal characteristics account for some of the mortality differential, this would lower the estimate of health capital attributable to health insurance. On the other hand, several disease- and condition-specific outcomes studies, including studies of breast and prostate cancer and HIV infection report higher mortality differentials (Ayanian et al., 1993; Lee-Feldstein et al., 2000; Roetzheim et al., 2000a,b; Goldman et al., 2001).

Imputing a Value for a Year of Life

Each of the benchmark estimates of health capital assumes a value of $160,000 per year of life in perfect health. As noted in Chapter 2, the value of a life year is taken from a survey of the literature by Hirth and colleagues (2000) and is the mean value of the estimates they obtained from a number of contingent valuation studies. Contingent valuation is a survey-based methodology that captures the value of intangible benefits (such as the intrinsic value of having good health) and benefits that are not traded in a competitive market. The results from contingent valuation studies are not driven solely by the respondent’s ability to pay. Vigdor notes that ascribing a value of $160,000 to a year of life in perfect health corresponds to an average value of $4.8 million for a statistical life, assuming a 3 percent discount rate and a life expectancy at birth of 76 years. This places the $160,000 value in the mid-range of values ($3 to $7 million for a statistical life) used by federal regulatory agencies to evaluate the economic costs and benefits of risk reduction and life-saving interventions (Vigdor, 2003).

In this analysis, contingent valuation measures the entire health benefit to an individual (and thus incorporates gains in productivity or productive capacity that accrue to the individual), but does not capture any external effects that an individual’s improved health might have for society. The analysis gives equal value to every life year across people, ages, and time. Thus, by assuming that a year of

each person’s life is equally valuable, this approach builds in a substantial element of equity.

Following the recommendations of the Panel on Cost-Effectiveness in Health and Medicine (Gold et al., 1996b), the analysis uses a 3 percent annual discount rate for costs and benefits occurring in future years. Tables in Appendix B also present results using 0 and 6 percent annual discount rates, producing a wider range of estimated values.

Results

Table 4.1 presents the summary results of the commissioned analysis. Using the benchmark assumptions just described, the approximate present value of future forgone health to an uninsured 45-year-old male is $10,300 using the YOL approach, and between $8,300 and $12,600 when morbidity is incorporated (QALY approach, upper and lower bounds). For a male newborn, the figures are $7,700 under the years of life method, and $6,600 to $15,600 using the QALY approach. The value of future forgone health to an uninsured 45-year-old female is $7,800 for the YOL method, and between $6,200 and $10,500 once morbidity is incorporated. An uninsured baby girl forgoes health worth $4,600 under the YOL method and $3,900 to $11,600 under the QALY method. The differences in estimates by sex reflect differences in life expectancy and morbidity, not differences in earnings. These numbers add up to a very large aggregate cost across the currently uninsured population of approximately 40 million, with estimates of the total discounted present value of this cohort’s forgone health ranging from $250 billion to $500 billion. (See Table B.11 in Appendix B.)

These estimates range over a wide interval and depend critically on the assumptions used in the analysis. It is not possible to select a single set of assumptions to represent the adverse health consequences of uninsurance. The lower-bound number likely underestimates the size of the effect that health insurance status has on health outcomes and the higher-bound number likely overstates this effect.

These estimates can also be construed in terms of the expected gain in value of statistical healthy years per year of additional insurance provided. Because health insurance is an investment in future health, and most adverse health outcomes occur at older ages, the benefit per year of insurance provided rises quite sharply with age. In this exercise, the value of future health gains is discounted to the present annual value. The benefit per year of insurance for a 45-year-old male ranges from approximately $3,100 to $4,800 under the different scenarios, while for a 45-year-old woman it ranges from $2,100 to $3,600. In contrast, the health capital gain per year of additional insurance for a newborn boy (discounted to present value at 3 percent per year) ranges from $1,200 to $2,800, and for a newborn girl the gain is between approximately $750 and $2,300.2 It is important

|

2 |

These values are presented in Tables B.9 and B.10 in Appendix B. |

to remember that these annualized values are predicated on continuous health insurance coverage. Based on its previous review of studies, the Committee found that health measures and outcomes for those with intermittent coverage are more similar to those for uninsured than to insured counterparts (Schoen and DesRoches, 2000; Baker et al., 2001; IOM, 2002a).

Using the actual age distribution of those who reported being uninsured in 2000, the average value of health capital (i.e., quality-adjusted years of life) that could be gained with a year of insurance for a member of this population ranges from $1,645 to $3,280. (See the next-to-last row in Table 4.1.) Aggregating over the population of uninsured individuals (40 million individuals × $1,645 or $3,280), the annualized value of health capital lost through uninsurance is in the range of $65–$130 billion. (See the last row in Table 4.1.)

QUALITY OF LIFE AND SECURITY FOR FAMILIES

Finding: Uninsured individuals and families bear the burden of increased financial risk and uncertainty as a consequence of being uninsured. Although the estimated monetary value of the potential financial losses that those without coverage bear is relatively small (compared to the full cost of their services) because of uncompensated care, the psychological and behavioral implications of living with financial and health risks and uncertainty may be significant.

Health insurance confers health and financial benefits on families. It also improves their well-being in ways that extend beyond their individual health status and family finances. Having family members insured reduces the extent of tradeoffs that families must make between health care and other uses of their money. Even if all members are healthy today, health insurance reduces the stress and uncertainty about future medical care needs and financial demands that can accompany the lack of coverage. Families in which all members have health insurance do not experience the worries, demands, and indignities that accompany illness without coverage (Kaiser, 2000; Andrulis et al., 2003).

The lower incomes of families who are uninsured further constrain their financial choices. As incomes rise, families have more to spend both on necessities and on discretionary purchases. The lower income among families with uninsured members means the payment for a doctor visit represents a larger share of income than it does for the typical family where all members have health insurance. Gaining health insurance would relieve some of the impact of health expenses on family budgets.

The Value of Avoiding Risk and Uncertainty

Health insurance reduces families’ risks and uncertainty regarding future health care costs. People with health insurance benefit from less unpredictability and

TABLE 4.1 Increases in Health Capital with Health Insurance for Those Currently Uninsured, by Sex and Agea

|

|

Change in Health Capital |

|

Benefit per Year of Insurance |

||||

|

Average pr (ins) Until 65b |

|

Average pr (ins) Until 65b |

|||||

|

YOL Approach |

Lower-Bound QALY Approach |

Upper-Bound QALY Approach |

|

YOL Approach |

Lower-Bound QALY Approach |

Upper-Bound QALY Approach |

|

|

|

(dollars) |

|

|||||

|

Men |

|

||||||

|

0 |

7,716 |

6,567 |

15,572 |

|

1,408 |

1,198 |

2,842 |

|

18 |

10,715 |

8,942 |

19,136 |

1,841 |

1,536 |

3,288 |

|

|

25 |

10,652 |

8,789 |

17,680 |

2,197 |

1,812 |

3,646 |

|

|

35 |

10,581 |

8,612 |

15,362 |

2,952 |

2,403 |

4,286 |

|

|

45 |

10,268 |

8,271 |

12,638 |

3,872 |

3,119 |

4,766 |

|

|

55 |

8,433 |

6,732 |

9,075 |

4,466 |

3,565 |

4,806 |

|

|

Women |

||||||

|

0 |

4,577 |

3,864 |

11,646 |

893 |

754 |

2,273 |

|

18 |

5,874 |

4,826 |

13,018 |

1,120 |

920 |

2,482 |

|

25 |

6,427 |

5,241 |

12,180 |

1,427 |

1,164 |

2,705 |

|

35 |

7,258 |

5,864 |

11,528 |

2,009 |

1,624 |

3,191 |

|

45 |

7,772 |

6,225 |

10,544 |

2,661 |

2,131 |

3,610 |

|

55 |

7,076 |

5,618 |

8,186 |

3,267 |

2,594 |

3,780 |

|

Overall average per uninsured personc |

2,014 |

1,645 |

3,280 |

|||

|

|

(dollars in millions) |

|

||||

|

Total for 40 million uninsured |

80,560 |

65,800 |

131,200 |

|||

|

aCalculations assume a value of a life year of $160,000 and a real discount rate of 3 percent. bAssumes that uninsured individuals face the average probability of being uninsured until reaching age 65. cCalculated by summing the average difference in health capital by age and sex over all uninsured people under age 65 in the Uni ted States in 2000. SOURCE: Vigdor, 2003. |

||||||

variability in their out-of-pocket spending for health care. Lower variability itself is a benefit to people who do not like to face financial risks. Those who are “risk averse” care both about the expected cost of a risky event as well as about how variable those expected costs are. The value of the reduction in the risk of financial loss that health insurance provides is calculable empirically (Buchanan et al., 1991). The Subcommittee on the Societal Costs of Uninsured Populations followed the methodology of Buchanan and colleagues to construct an estimate of the value of the risk borne by the uninsured.3 The insurance value of coverage was estimated by applying a constant relative risk aversion parameter (0.00024) to the reduction in the variance of out-of-pocket spending obtained through insurance coverage.4 While risk reduction is one consideration in valuing health benefits, it turns out to have a small value for those without health insurance because of the kinds of out-of-pocket costs the uninsured actually pay. (See the discussion in Chapter 3 and Figure 3.1 on out-of-pocket costs among uninsured individuals.)

There is much more variance in the total expenses incurred by persons without health insurance than there is in their out-of-pocket payments. In the sample of respondents to the Medical Expenditure Panel Survey (MEPS), the highest total annual health expense observed for an uninsured individual was nearly $500,000. The highest amount reported paid out of pocket by an uninsured individual, however, was $26,000 (although less than 1 percent of those without insurance spent $5,000 or more).5 If buffering mechanisms such as charity care, bad-debt writeoffs, and bankruptcy did not exist, and each uninsured person was compelled to pay for the health care he or she used (through loans, for example), the per capita value of the risk reduction from having health insurance would be more than $2,100. Because out-of-pocket expenses for the uninsured show less variation than their total expenses, the value of the reduction in variance is proportionately lower. The predominant source of variation, inpatient costs, is not being paid out of pocket by uninsured individuals. They tend, instead, to pay out of pocket for the smaller elements, and inpatient costs are borne by a combination of public and charitable support and absorbed as hospital bad debt. In effect, a large share of the overall “financial exposure” has been shifted to those who ultimately pay for uncompensated care. For this reason, the estimated value of the risk that uninsured individuals bear (and that they would not have if insured) is between $40 and $80. This modest amount represents an annual aggregate cost borne by families with uninsured members of $1.6 to $3.2 billion.

This finding of the relatively small value of the reduction in financial risk that health insurance would bring to those who lack it helps to explain why some individuals who could afford insurance or who are eligible for public coverage but not enrolled forgo it. The “cost” of the extra financial risk that such individuals bear may be outweighed by the value of personal resources (money, time and effort, personal dignity) that is conserved by not purchasing health insurance or applying for public program benefits.

Peace of Mind

Even for families that have health insurance now, the prospect of not having health insurance in the future can be a source of anxiety and uncertainty. While the annual estimate of the number of uninsured Americans is more than 41 million, a study of insurance status over a longer time (from the 1996 to 1997 MEPS panel) found that 80.2 million people experienced some period of time without health insurance over that 2-year period (Short, 2001.) For many persons who currently have health insurance, the prospect of losing it is a very real fear (Ehrenreich, 1989; Rubin, 1994; Sullivan et al., 2000; Kaiser Family Foundation, 2003). Box 4.2 describes federal legislation over the past 15 years that has attempted to address the problem of loss of coverage. Some have referred to such provisions as “uninsurance insurance.”

If health insurance were universal and effectively permanent, as Medicare now is for those over age 65, not only would those who now live without it have the added security of knowing that, at the point of needing it, health care is both accessible and not ruinous financially, but those with health insurance today would not have to worry about losing it tomorrow. The impermanence of health insurance coverage not only exacts costs in terms of disruptions in care and exposure to financial risks, it distorts personal choices about employment (including those about retirement and changing jobs), affects whether children participate in school sports (both schools and parents may prohibit uninsured children from playing), and amplifies the distress of unemployment and impoverishment. It is difficult for Americans to imagine how major life choices might be affected if maintaining coverage or anticipating its loss were not something to be considered in weighing important personal and family decisions.

DEVELOPMENTAL OUTCOMES FOR CHILDREN

Finding: Uninsured children are at greater risk than are children with health insurance of suffering delays in development that may affect their achievements and opportunities in later life.

Development in infancy and childhood shapes individuals’ opportunities and prospects in later life. The health and health care of infants and children are investments that affect their future life chances, just as education does. The dimin-

|

BOX 4.2 Federal Initiatives to Prevent the Loss of Coverage Congress responded to the demands for more certainty of future coverage for those currently insured with several pieces of legislation, as follows:

Although each of these programs is limited in scope or impact, they represent policy initiatives to increase the continuity and security of health insurance coverage among workers and their families. |

ished developmental outcomes of uninsured children are captured by the estimates of health capital forgone presented later in this chapter. The following discussion illustrates the mechanisms by which this loss of value occurs.

The Committee concluded in Health Insurance Is a Family Matter that children who do not have health insurance have less access to health care and use appropriate, recommended medical and dental care less than do children who have coverage. As a result, uninsured children often receive care late in the development of a health problem or do not receive any attention for problems that could be resolved or ameliorated with prompt attention (IOM, 2002b).

In 2000, about 7.6 percent of all newborns had low birthweight (Martin et al., 2002). Uninsured newborns are more likely than insured newborns to have low birthweight. Health insurance expansions accompanied by enhanced prenatal services have shown some efficacy in reducing low birthweight, although expanded coverage alone may not be effective (IOM, 2002b).

One study of 8,000 children ages 6 to 15 participating in the Child Health Supplement of the NHIS that adjusted for sex, race, education of the head of household, poverty status, and geographic region found that children that were low weights (< 2,500 grams) at birth were 50 percent more likely to be enrolled in special education classes than were children with higher birthweights (Chaikind

and Corman, 1991). The authors of this study estimated that the incremental effect of low birthweight on special education costs amounted to $370 million in 1990.

Less access to care and use of fewer services could follow many paths in reducing children’s future chances. In the most severe cases, health insurance provides access to care that prevents premature death. Coarctation of the aorta, a relatively common congenital cardiovascular malformation that can be treated with surgery or medical management, is one condition for which outcomes have been found to differ starkly for insured and uninsured infants. One study reported that infants with this condition who did not have health insurance coverage were more likely to die, in part but not solely due to a failure to identify the condition timely (33 percent compared with 3.8 percent of children with any kind of health insurance) (Kuehl et al., 2000).

For many more children, the connections between health insurance and life chances relate to their ability to achieve normal developmental milestones and to benefit from schooling. A path can be traced from lack of health insurance to a child not fulfilling his or her academic potential. Some pieces of the chain of evidence have been established. There is a body of evidence that show a relationship among illness, school absence, and learning (Wolfe, 1985). Extensive research literatures have developed around a number of common and treatable childhood conditions, including iron deficiency anemia, dental disease, otitis media (ear infection), asthma, and attention deficit hyperactivity disorder (IOM, 2002b). The Committee concluded, based on research that relates improved health outcomes to receipt of treatment and on studies demonstrating that private or public health insurance increase the likelihood of receipt of care for children, that providing health insurance to children would improve health outcomes for conditions critical to their normal development and opportunities for success in school (IOM, 2002b).

Asthma is the most common chronic illness among U.S. children, affecting roughly 5 million under the age of 18 nationally (CDC, 1996). It accounts for between 3.6 and 11.8 million lost school days every year (Smith et al., 1997; Weiss et al., 2000). For children with poorly controlled asthma, absences may lead to poor performance in school. In time, the child could be reading below grade level and beginning to experience frustration that culminates in a decision to drop out of high school or a decision not to pursue higher education. In an evaluation of a health insurance expansion in New York State prior to the establishment of the State Children’s Health Insurance Program (SCHIP), parents of children with asthma reported that their child’s severity level and quality of care for the condition had improved following enrollment in the program, and about half of the surveyed parents reported that their child’s overall health had improved (Szilagyi et al., 2000).

Although the discrete contribution of uninsurance to poorer health among children and their diminished academic achievement as a result cannot be measured, these costs should not be ignored. These worse outcomes have long-term

implications for the productive capacity of the American workforce, which is discussed later in this chapter.

UNINSURANCE AND PUBLIC PROGRAMS

Finding: Public programs, including Medicare, Social Security Disability Insurance, and the criminal justice system almost certainly have higher budgetary (transfer and economic) costs than they would if the U.S. population in its entirety had health insurance up to age 65. It is not possible, however, to estimate the extent to which such program costs are increased as a result of worse health due to lack of health insurance.

This section explores the potential for savings due to improved health outcomes to accrue to public programs such as Medicare, disability income support programs, and the criminal justice system, if those who now lack health insurance were to gain continuous coverage. We assume spending implications for the Medicare program of the increases in longevity beyond age 65 that would result from health gains among the currently uninsured population are negligible. Recent studies of the impact of improved health on Medicare expenditures have found that healthier people have similar discounted costs over their remaining lifetime to sicker people because the savings from reduced expenditures with good health in the years before death and from postponing the high costs associated with death are large enough to pay for medical care in the additional years (Singer and Manton, 1998). Likewise, the Committee has not included in its estimates of increased health capital changes beyond age 65.

Some of the potential budgetary savings, such as reduced income support payments resulting from lower rates of disability, represent changes in the transfer of resources (i.e., from taxpayers, to the Social Security Disability Insurance [SSDI] program, to disabled beneficiaries) rather than the conservation of economic resources. Other potential savings, however, such as a reduction in crimes, prosecution, and incarceration of uninsured people with severe mental illnesses whose symptoms might be better controlled if they had coverage and appropriate care, represent resources conserved (i.e., costs avoided), and thus reduced societal economic costs.

Savings to Medicare

The projections presented at the beginning of this chapter of improved longevity and health status among the uninsured do not take into account any benefits of insuring the uninsured that might extend past age 65 and the acquisition of Medicare coverage (Vigdor, 2003). This is a conservative assumption, one that most likely underestimates both the health benefits enjoyed by the individuals who gain additional years and health-related quality of life after age 65 and the

potential savings to the Medicare program of uninsured individuals entering the program in poorer health and with health care deficits that demand costly “catch up” services. The question of whether uninsured adults incur such “catch up” costs upon gaining Medicare at age 65 is one that researchers and health policy analysts have speculated about, but one that has not yet been subjected to systematic analysis. The Committee hypothesizes that, based on the evidence that it has considered of

-

health and functional status declines in late middle age among those who are uninsured or who lose coverage (Baker et al., 2001), and of

-

the greater disease severity found among uninsured persons with end-stage renal disease (ESRD) who enter the Medicare program (Obrador et al., 1999; Kausz et al., 2000),

uninsured persons gaining Medicare coverage at age 65 use health care services more intensively and incur program costs higher than they would have had they been continuously insured prior to age 65. This question is one that merits further investigation. One obstacle to such research that has stymied researchers so far is the absence of any information about prior health insurance status in Medicare beneficiary records and data files. While it is relatively straightforward to analyze utilization of and expenditures for services by Medicare beneficiaries with the Medicare Current Beneficiary Survey, a cohort analysis comparing beneficiaries aging into Medicare who did and did not have health insurance prior to age 65 requires a reliable source of information about previous insurance status.

The Committee suggests that the Department of Health and Human Services undertake such research into the excess program costs that uninsurance imposes on the Medicare program. Such an analysis could possibly be conducted by matching existing data sets such as the National Health Interview Survey and the Current Beneficiary Survey.

Disability Income Support

In 2001, the SSDI Program paid benefits to 6.2 million people. Disability insurance payments to disabled workers and their dependents amounted to $60 billion (SSA, 2002). Disabled workers account for approximately 85 percent of disability insurance beneficiaries (others are widow[er]s and adult children). The average age of a disabled worker receiving SSDI payments is 51. About one out of seven low-income SSDI beneficiaries also receive Supplemental Security Income (SSI), which is primarily federally funded.6 Unlike SSDI, SSI does not require that its beneficiaries previously participated in the labor force.

|

6 |

See Box 4.3 for the Social Security Act definition of disability, which applies to both SSDI and SSI. |

Although the rate of disability among those over age 65 has declined over the past several decades (Manton et al., 1997; Freedman and Martin, 1998), the rate among the working-age population has increased. Lakdawalla and colleagues constructed a model using National Health Interview Survey (NHIS) data from 1970, 1978, 1984, 1990, and 1996 that produced age-specific estimates of disability prevalence with a smoothing technique that allowed them to avoid the problem of small sample sizes within each age band. Between 1984 and 1996, the rate of disability reported in the NHIS, defined in terms of needing help with personal care or other routine needs, has increased nearly 40 percent among those in their 40s, from 2 percent of the population to nearly 3 percent (Lakdawalla et al., 2001).7 This increase has coincided with the increasing prevalence of asthma and diabetes among younger Americans. The researchers found that the increase in asthma prevalence alone was enough to account for the change in reported disability. Between 1990 and 1996, the proportion of people in the NHIS who report that their health status was good, fair or poor (in contrast to very good or excellent) grew significantly for people under age 50, remained constant for those between 50 and 60, and decreased for those older than 60. The authors also present an alternative but compatible hypothesis to explain increasing rates of reported disability: changing incentives for disability insurance claims.

The Committee has not attempted to calculate what proportion of disability income support payments might be avoided with universal health insurance coverage of the population under age 65. Based both on the evidence of worse health outcomes among uninsured adults presented in Care Without Coverage and on the divergent trends in disability rates among younger (under age 65) as compared with older Americans within the past few decades, the Committee concludes that some portion of the disability insurance claims would be eliminated if the nearly one out of every five working age adults without health insurance had continuous coverage.

Reductions in Justice System Costs for Uninsured Persons with Severe Mental Illness

About 1 percent or 2 million adults in the United States have schizophrenia, a serious and chronic mental illness whose symptoms may include psychosis, and another 0.7 percent or 1.4 million adults have bipolar disorder (also referred to as manic-depressive disease), also a chronic mental illness that may involve psychotic symptoms (Narrow et al., 2002). Fully 20 percent of noninstitutionalized adults with these severe illnesses lack health insurance (McAlpine and Mechanic, 2000). Although having health insurance does not guarantee that mental health services are covered, persons with either public or private insurance are more likely to receive some kind of care for their condition than are those without coverage

(Rabinowitz et al., 1998, 2001; Cooper-Patrick et al., 1999; McAlpine and Mechanic, 2000; Wang et al., 2000). People with severe mental illnesses are particularly vulnerable to losing coverage, either when they can no longer work or because maintaining enrollment in Medicaid presents major challenges, given their reduced capacity to navigate complex administrative procedures (Sturm and Wells, 2000; IOM, 2002a).

One of the consequences of the inadequate treatment of persons with severe mental illness is their disproportionate and potentially avoidable involvement with the criminal justice system (Arons, 2000; President’s New Freedom Commission on Mental Health, 2002). In mid-1998, according to surveys conducted by the Department of Justice, more than 280,000 mentally ill persons were incarcerated in U.S. prisons and jails, 16 percent of state prison and local jail inmates, and 7 percent of federal prison inmates (Ditton, 1999). More than half a million probationers (16 percent) also reported a mental condition or an overnight stay in a mental hospital. Altogether, between 600,000 and 700,000 persons with severe mental illnesses are jailed each year, primarily for nonviolent offenses (Bazelon Center for Mental Health Law, 2003). An evaluation of the societal costs of schizophrenia based on 1991 data and dollars calculated that approximately $2 billion was spent on jailing, prosecuting, and imprisoning schizophrenic offenders in that year, about 10 percent of the estimated cost of treatment-related services provided to persons with schizophrenia in that year (Wyatt et al., 1995). Ironically, contact with the criminal justice system increases the chances that someone with a severe mental illness will receive specialty mental health care services (McAlpine and Mechanic, 2000).

A position statement of the Bazelon Center for Mental Health Law on criminalization of people with mental illnesses argues as follows:

Perversely, the drift of people with mental illnesses into criminal justice has benefited public mental health systems by shifting their financial burden for “hard to serve” groups to the budgets of state corrections departments. As a result, taxpayers’ resources are wasted on expensive and counterproductive incarceration instead of financing more appropriate and effective community mental health and supportive services (2003, p. 2).

Although health insurance coverage alone will not remedy the inadequacies of treatment of those who have severe mental illness, continuous and permanent health insurance coverage would improve the chances that persons with severe mental illness receive appropriate treatment that maintains their ability to function and reduces symptoms that lead to arrest.

WORKFORCE PARTICIPATION, PRODUCTIVITY,AND EMPLOYERS

Finding: Individual employers who do not currently provide healthinsurance benefits to their employees are unlikely to be economi-

cally worse off—taking the cost of providing insurance into account—as a result. Any systemic, regional, or national losses of productivity or productive capacity as a result of uninsurance among almost one-fifth of the working-age population cannot be measured with the data now available.

This section considers one aspect of the value of health to individuals: its impact on work and productivity. Although the information necessary to measure the impact of uninsurance on these indicators is not available, the Committee presents analyses that have evaluated discrete aspects of the multiple connections among the workplace, health insurance, health, and productivity to illuminate the decisions made about health insurance and the workplace by both employers and employees. Almost two-thirds (65.6 percent in 2001) of Americans under age 65 have health insurance through their own or a family member’s job (Fronstin 2002). Although the Committee has for the most part adopted the societal perspective in this report, the motivations of and incentives facing employers and employees are important for understanding labor market outcomes involving health insurance and for evaluating alternative policy reforms for the financing and organization of health insurance coverage.

The first section considers workforce participation and the productive capacity of the workforce overall as it is related to health and functional status. The second section considers evidence relating to incentives for employers to offer health insurance to their workforce.

Workforce Participation

Illness and functional limitations impair people’s abilities to work and consequently impose the costs of forgone income and productive effort on those who are sick or disabled, their families, and potentially on their employers as well.8 In 1994, among the 159 million adults aged 18–64, 78.6 percent were in the labor force. That is, they were employed, just laid off, or actively looking for work. Among those without any activity limitation, 83 percent were in the labor force. Of those with any activity limitation, however, only 52 percent were in the labor force (1994 NHIS, reported in Kraus et al., 1996). Box 4.3 presents estimates of the population affected by functional limitations and work disabilities.

The lack of health insurance among 18.5 percent of U.S. residents aged 18– 64, almost one out of every five, is one factor contributing to the burden of disease, functional limitations, and reduced health status of those without coverage. The extent to which the lack of coverage contributes to workforce participa-

|

BOX 4.3 Estimates of Functional Limitations and Work Disability The size of the U.S. working-age population that is disabled or has health problems that limit their performance of work can be estimated only over a fairly wide range of values because of the various definitions of disability and health and functional limitations that are used in different national surveys and analyses of program and economic data. The most restrictive definition of the disabled, working-age population is people who receive benefits from either Social Security Disability Insurance or Supplemental Security Income.1 In 2001, 8.8 million persons between the ages of 18 and 65, 5 percent of the working-age population, received benefits from one or both of these programs (SSA, 2002). An alternative source of national data is the Current Population Survey (CPS), which estimates, from self-reports of work limitations, the proportion of working-age people who are unable to work or who work restricted hours or for limited periods within the year for reasons of health at 7.6 percent of the working-age population in 1988, or 11.1 million people (Haveman et al., 1995). A broader measure of the economic impact of functional limitations and disabilities is that of lost earnings capability, which reflects losses in the productive capability of the workforce. Haveman and colleagues (1995) define this as the difference between the actual earnings capability of the working-age population and what the earnings capability of the population would be in the absence of health and disability limitations. This broader measure, unlike the calculation of lost earnings in most cost-of-illness studies, is not influenced by individual preferences to work and also accounts for the impact of functional limitations on wage rates (in addition to changes in the amount of time at work). The authors used alternative sources of information to identify those working-age adults who could be characterized as having potential earnings losses for health-related reasons (those reporting through the CPS that they had work limitations due to health problems or that they received disability payments from a public program and, separately, responses to the Survey of Income and Program Participation [SIPP] on labor force participation and health status and functional limitations). Depending on how health problems and disabilities were defined (e.g., whether fair or poor health, or number of limitations in activities of daily living are used), the SIPP yielded estimates of the population with health limitations that range from 8.5 million (7 percent of the working-age population) to 24 million people (nearly 20 percent of the same population.) |

tion, however, has not been studied directly. Conversely, although better health status is associated with higher incomes and longer working lives, the contribution that health insurance coverage makes to workplace productivity has not been well documented.

Although estimates of the prevalence of work disability vary widely depending on both its definition and measurement, the overall economic losses to the U.S. economy are substantial across the entire range of estimates. For a period in the mid-1980s, Haveman and colleagues estimated that the economic loss in earnings capability and productivity for the U.S. working-age population fell within a range of from $131 billion annually for a narrowly defined health-limited and disabled population (7 percent of the working-age population) to $285 billion annually for a more broadly defined population with health limitations (including up to 20 percent of the working-age population). These amounts represent a loss of about 5 to 10 percent of the potential earnings capacity of the entire U.S. working-age population (Haveman et al., 1995).

Whether and how employers or the economy at large captures any of the benefits of increased worker productivity due to improved health (in addition to the benefits reaped by individual workers) is another question that cannot be resolved with research to date. In international comparisons of economic productivity, Bloom and colleagues (2001) conducted a cross-sectional study of national economic performance as a function of population health. They hypothesized that the positive individual productivity impacts of education and good health could have positive spillover effects on the productivity of coworkers. The econometric model estimated the presence and size of any externalities. Comparing life expectancies (a proxy for health status in this study) among countries, the authors concluded that relative longevity has a positive and substantial effect on aggregate output and economic growth, with a one-year improvement in life expectancy contributing to a 4-percent increase in aggregate national output. Although this study tells us nothing about impacts of health insurance coverage per se, it suggests that not only direct but also spillover productivity effects can be investigated.

Employment-based Health Insurance

This section explores the economic implications for employers of the decision to offer employees health insurance as a benefit of employment. As discussed in Box 4.4, most economists conclude that employees as a group ultimately bear the cost of employer contributions to health insurance premiums through reduced cash wages. Federal and state tax subsidies, however, make it relatively more attractive for employees to receive compensation as health benefits than as wages and thus serve to encourage employers to include health insurance as a benefit of employment.

Employer offers of health insurance benefits to employees need not be all or nothing; employers may legally limit the offer of benefits to employees who work a minimum number of hours per week and to those who have been employed for

|

BOX 4.4 The Incidence of the Employer Premium Contribution Standard economic theory posits that employers do not, in most instances, bear the costs of premiums paid for their employees’ health insurance, but rather that employers reduce cash wages dollar-for-dollar (adjusted for tax treatment) for any premium payments made on behalf of their employees (Pauly, 1997; Currie and Madrian, 1999). Employees often benefit from having their pretax earnings decreased because they get health insurance at an advantageous group rate and because their wages after taxes fall by only a fraction of the pretax reduction. On average, the marginal federal tax rate on wage income is about 26 percent and the Social Security tax is 15.3 percent up to $87,000 annual earned income in 2003 (or 7.65 percent if the employee share is excluded).1,2 State income tax for all but the 9 states without one adds another 3 to 10 percent.2 For each $100 decrease in pretax wages associated with health insurance, then, the average employee only sees a decline in after-tax earnings of between $50 and $60. For workers with lower incomes and thus lower marginal tax rates, this decline in after-tax income is smaller and the subsidy is smaller. For workers with higher wages and higher marginal rates, the decline is larger and the subsidy is larger. Because many of the taxes are flat, have caps, or are regressive, the overall progressivity is less than indicated here. The distribution of benefits across workers within a firm depends on how the costs of health insurance are allocated among the workers, as well as on the workers’ marginal tax rates.

|

a minimum length of time such as 6 months or a year. They may not, however, discriminate among classes of workers with respect to offering health insurance benefits by characteristics such as level of compensation (Farber and Levy, 2000; Christensen et al., 2002).

Could employers who do not offer health insurance benefits to any of their employees improve their profitability if they did so? (The same question could be asked of employers that exclude certain groups of employees, such as part-time workers or recent hires, but the calculus of the employer’s advantage would have different parameters in the marginal case.) Are there benefits that accrue to the particular employers who do offer health insurance that make the costs of doing so worthwhile? More narrowly, is there empirical evidence of such benefits? Would these benefits accrue to other employers that currently do not offer health insurance if they were to provide health benefits? Box 4.5 describes recent trends in employment-sponsored health insurance.

|

BOX 4.5 Recent Trends in Employer Health Insurance Coverage Even though the number of firms offering health insurance to at least some of their workers has increased in recent years, the proportion of workers with an offer of coverage has decreased. Between 1979 and 1998, the proportion of workers with insurance provided by their own employer fell from 66 percent to 54 percent (Medoff et al., 2001). This decline accompanied a shift in that 20-year period from manufacturing jobs to service jobs and from large employers to small employers, who in either case are less likely to offer insurance to their employees. Shifts in industry and occupation accounted for about 30 percent of the decline in employment-based coverage. The rest was the result of a widespread drop in coverage in nearly all industries. See Figure 4.1 for changes in employment-based coverage over time. The decline in coverage among wage earners is not distributed uniformly across the labor force, however. Over the period 1979–1998, the percentage of private-sector workers aged 21–64 with insurance from their own employer fell from 72 to 60 percent.1 The percentage of workers with such insurance in the highest income quintile fell from 90 to 80 percent. The percentage of workers with such insurance in the lowest 20 percent of the wage distribution fell from 42 to 26 percent. As posited by economic theory, the decline in the insurance status among workers is larger for the low-wage workers whose productivity increases are likely to be smaller than the increase in premiums. Several studies have confirmed that declining take-up rates of employment-based coverage are a major component of overall declines in coverage (Cooper and Schone, 1997; Farber and Levy, 2000; Cutler, 2002). Examining the change in employment-based coverage over the past decade, David Cutler (2002) found that the proportion of the U.S. population under age 65 with such coverage fell from 71 percent in 1987 to 68 percent in 2000, while the proportion of the same population that was uninsured increased by 3 percentage points or 7.2 million persons. While the share of workers in firms offering insurance to at least some of its workers remained roughly constant between 1988 and 2001 at about 80 percent, and the eligibility for coverage in firms offering benefits declined only slightly from 93 to 91 percent over the same period, the take-up rate among eligible workers declined from 88 to 85 percent. Among full-time, full-year male workers, for whom offers of and eligibility for coverage are higher than for other workers, the take-up rate among those eligible declined even more over this period, from 94 to 90 percent. Cutler’s analysis attributes 61 percent of decline in workers’ coverage from their own employer to changes in take-up and the remainder to changes in eligibility. Among full-time male workers, changes in take-up accounted for 80 percent of the decline in own-employer coverage. Using data from employer surveys over this period to model the change in take-up rates as a function of the health insurance premium price faced by the employee, Cutler concluded that nearly all of the decrease in the take-up of insurance coverage between 1988 and 2001 could be attributed to increases in employee share of premiums over this same period. |

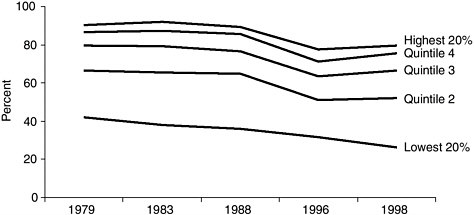

FIGURE 4.1 Percent of private-sector employees with insurance from own employer, by hourly wage quintile, 1979–1998.

NOTE: In 1998, the lowest 20 percent earned less than $7 per hour and the highest 20 percent earned more than $21 per hour.

SOURCE: Medoff et al., 2001. Data from the Current Population Surveys: May 1979, 1983, 1988; March 1996, 1999.

In their review of the history of health insurance in the United States, Currie and Madrian (1999) observe the following:

. . . the genesis of employer-provided health insurance is rooted in employment-based programs implemented precisely because health impacts labor market activity and labor market activity impacts health (p. 3365).

Although employees have reasons to want health insurance as part of their compensation package and employers also have reasons to provide this workplace benefit, the extent to which employers realize tangible financial benefit from having an insured workforce is not well documented. Two recent surveys of health services and economics research identify the possible reasons that employers might be willing to accept higher production costs in order to provide health insurance to their employees and review the evidence for this proposition (Buchmueller, 2000; O’Brien, 2003). These review articles encompass and expand on much of the discussion that follows.

Having health insurance as part of the offered wage may help employers to attract employees more easily. However, employment situations that provide health insurance benefits may attract workers in relatively worse health or those with sick dependents, which can increase an employer’s group premium rate. Still, even healthy employees may value health insurance at more than the forgone wages. Second, health insurance may also help employers to retain workers once they are recruited, although insurance may not be more effective in retaining employees than the equivalent wage (Gruber and Madrian, 2001). Because chang-

ing jobs often entails an interruption in or loss of coverage during which the employee or his family may be financially exposed to uninsured health expenses, an aversion to this risk may help keep workers in a firm. This phenomenon, called job lock, may or may not benefit the employer. If it increases retention of valued workers, it is positive for the employer. On the other hand, if an employer is unable to attract a desired worker from another firm because of the preferred set of health insurance benefits offered by the current employer, the recruiting employer may feel disadvantaged, and offering benefits can be viewed as providing an advantage to the current employer.

Health insurance may enhance worker effort and productivity because workers may feel that insurance is part of the package that makes a job a desirable one. Employees may work harder if they believe it would be difficult to find an equivalent or better paying job that included health insurance. Health insurance, then, may be considered an employer investment in employees along with education and training, services offered to employees, and general workplace environment for the purpose of maintaining morale and retaining workers. As Buchmueller notes, however, a particular employer will not necessarily reap the benefits of her investment in the better health consequent to offering health insurance to employees; to the extent the worker has the ability to move between employers, another employer may benefit from the worker’s enhanced productivity. If long-term health gains can be realized from having health insurance, the benefits would only accrue to the employer if employees were retained for a number of years. Employers that experience relatively high turnover in their workforce would likely continue to do so even if they offered health insurance coverage (Buchmueller, 2000).

Employer Surveys

Employer surveys and business management literature reveal that employers believe that health insurance contributes positively to firm performance. Three-quarters of small employers that offer health benefits reported in one national survey that these benefits had a positive effect on recruitment, on employee retention, or on employee attitudes and performance. About two-thirds believed that health benefits contributed to better employee health, and more than half reported that the benefits helped reduce absenteeism (Fronstin and Helman, 2000).

The Employee Benefit Research Institute and the Consumer Health Education Council recently conducted a Web-based, nonrepresentative survey of 800 firms of all sizes (representing 3 million full- and part-time workers) to determine employer attitudes and policies regarding workplace health benefits (Christensen et al., 2002). Virtually all respondents (97 percent) represented firms that offered health insurance to full-time employees and a third of them to part-time employees. Eighty percent of the respondents identified health benefits as “extremely” or “very important” in recruiting and retaining workers. Forty percent thought that

such benefits were extremely or very important for improving worker productivity.

Health Benefits and Workplace Productivity Studies

Although employers who offer health benefits view them positively, the evidence for improved employee health and productivity as a result of health insurance is limited and mixed. Studies of absenteeism rarely include health insurance as an explanatory variable and provide little support for the notion that absenteeism is decreased by health insurance. One simulation study indicates that physician visits and work absences substitute for each other. That is, ill workers have fewer days absent if they receive medical attention, which requires taking time off from work, and they are more likely to receive medical attention if they have health insurance. Health insurance coverage and sick leave benefits together, however, increase both the number of workers taking sick days and the number of sick days taken (Gilleskie, 1998). Thus, having health insurance cannot be shown to reduce absenteeism.

Studies have demonstrated that impaired health is related to absenteeism and reduced productivity (Chirikos and Nestel, 1985; Greenberg et al., 1995; Berndt et al., 1997; Bound et al., 1999; Druss et al., 2001; Fronstin and Holtmann, 2000; Blau and Gilleskie, 2001; Kessler et al., 2001a,b; Ramsey et al., 2002). Particular health care interventions have been demonstrated to make a difference for individual labor market outcomes, including labor force participation, hours worked, and earnings. Studies have shown that people in poor health or with specific illnesses (e.g., arthritis, depression or other psychological disorders, asthma, or chronic backache) work less and earn less than people in good health (Bartel and Taubman, 1986; Mitchell and Butler, 1986; Mitchell and Burkhauser, 1990; Berndt et al., 1997; Ettner et al., 1997; Greenberg et al., 1999; Kessler et al., 1999; Berndt et al., 2000; Birnbaum et al., 2002). Other studies have found that workers in poor health are more likely to quit work or retire early than are workers in better health (Diamond and Hausman, 1984; NAAS, 2000). Still, the measurement of workplace productivity in relation to health and as a function of particular health interventions is a relatively young field.

Greenberg and colleagues (1995) suggest that employers can take either a narrow view of illness-related costs in the workplace or a much broader view. In the former case, employers focus only on their out-of-pocket costs related to illness and health care, including employer health insurance premium contributions, employer contributions to the Medicare trust fund, workers’ compensation and temporary disability insurance, and in-house health services. In the latter case, adopting a broader view, employers take into account indirect costs related to their decisions about health care. These indirect costs include productivity effects, in terms of both performance on the job and health-related absences. These authors propose a model to estimate the value of employee productivity lost to illness rates, based on both the prevalence of the illness in the workforce (the

impairment rate) and the annual percentage of work time affected by the illness. Obviously, both of these factors vary by the illness in question. Particular employers also must consider the wage profiles of the employees affected in order to calculate their specific costs.

A number of management tools for the measurement of workplace productivity are currently under development (Lynch and Riedel, 2001). Experts in the field of health and productivity management stress the importance of focusing analyses relatively narrowly on particular health conditions and job performance requirements and criteria if these tools are to be useful to managers. Although this field of inquiry is promising, it has little to contribute at this time to informing an employer’s decision to offer workers health insurance benefits.

The benefits of having healthier workers may include reductions in other labor costs, especially long-term and short-term disability insurance rates and workers compensation costs. Studies of workers compensation and health insurance fail to show significant reductions in these related costs, however (Card and McCall, 1996; Buchmueller, 2000). Experience rating of workers compensation premiums for large firms might show small reductions, but virtually all those firms offer health insurance to at least some of their employees anyway. Small firms that do not offer health insurance are also not paying workers compensation premiums that vary with their own employees’ claims experience.

The Small Group Market

The practices and policies of insurers that sell in the small group market also figure in the decisions of some firms to offer health insurance. These insurers require firms perceived as having higher than average medical risk to pay higher premiums, relative to the value of the coverage purchased. Nearly every state has enacted legislation to curb the more extreme of these practices. These reforms have neither resulted in the increase in coverage of workers hoped for by the reformers, nor in the decrease feared by the critics of those reforms. Overall, the impacts of reform legislation have not been large. One reason for this may be that small employers are not aware of the reforms and may continue to have a distorted impression of the barriers to their offering insurance (Fronstin and Helman, 2000; Mulkey and Yegian, 2001). Education of small employers might help to expand coverage, although its potential impact is limited.

Many small employers are also employers of relatively low-waged workers. The cost of health insurance benefits represents a proportionately larger share of low-waged workers’ total compensation package than it does for higher-waged workers. Both the employers of low-waged workers and low-waged workers themselves may be reluctant to trade off take-home pay for health benefits (Hadley and Reschovsky, 2002).

Summary

Evidence shows that, other things being equal, having health insurance im-proves the health of working-age Americans (Hadley, 2002; IOM, 2002a). Nonetheless, the information available does not lead to the conclusion that any productivity benefits accruing to individual employers of insured workers are sufficient to induce them to offer health insurance when offering it increases their payroll costs. Worker demand for health insurance is the primary determinant of whether or not a firm offers it (Buchmueller, 2000; Christensen et al., 2002). Those employers that provide this workplace benefit have demonstrated the value that they ascribe to it through their action. The “business case” probably cannot be made, however, for the group of employers that now do not offer it to any workers, predominantly smaller and lower-wage firms. It is unlikely that additional small employers can be induced to offer health insurance to their workers without additional public subsidies.

HEALTH SYSTEMS IMPACTS

Finding: Not only those who lack coverage but others in theircommunities may experience reduced access to and availability of primary care and hospital services resulting from relatively high rates of uninsurance that imperil the financial viability of health care providers and institutions. In addition, population health resources and programs, including disease surveillance, communicable disease control, emergency preparedness, and community immunization levels, have been undermined by the competing demands for public dollars for personal health care services for those without coverage.

Uninsurance throughout the United States at its present level (16.5 percent of the population below the age of 65) has deleterious effects on the financial stability of health care providers and institutions and may affect the availability and quality of health care services not only to those who lack coverage but also to others who share common health care facilities and community resources (IOM, 2003a). Although extensive insurance coverage has led to excess capacity in the health care system over the past three decades, this trend has recently been countered by its converse. In this section, the Committee summarizes its findings, presented in A Shared Destiny: Community Effects of Uninsurance, regarding two aspects of health care services that are adversely affected by uninsurance: the availability and quality of personal health care services within communities and the ability of public health agencies to perform their core mission of protecting population health.

Access to and Quality of Health Care

As discussed in Chapter 3, health care practitioners and institutions provide substantial amounts of uncompensated care to uninsured patients. The cost of this

care is ultimately borne by providers themselves as bad debt and donated services, local, state, and federal taxpayers; and, to a much lesser extent, organized philanthropy. Where support and subsidies for care provided to uninsured patients is not adequate, physicians, clinics and hospitals may cut back or withdraw services from areas with large uninsured populations, affecting access to and quality of care to local residents more broadly. A Shared Destiny assesses available evidence about what happens, and lays out the Committee’s hypotheses about what reasonably can be expected to happen within communities when one factor, the local rate of uninsurance, is relatively high or rising. This section reviews the findings from that report and suggests how health insurance coverage for the whole population could improve the availability and quality of health care within communities.

The effects of uninsurance at the community level are components for assembling the national picture of spillover costs. These effects are often easier to detect locally than nationally, where the aggregation of information averages out marked local variation in the organization, financing, and delivery of health care. One key causal pathway by which uninsurance affects communities is lower provider revenues resulting from the combination of less use of services by the uninsured compared with that of insured persons and the costs of uncompensated care that providers incur when uninsured patients receive services for which they cannot pay.

Uninsurance may affect the availability of health services within communities. In an effort to avoid the burden of uncompensated care or to minimize its impact on the financial bottom line, health care providers may cut back on services, reduce staffing, relocate, or close. Already overcrowded hospital emergency departments may be further strained as they increasingly serve as the provider of first and last resort for uninsured patients. Physicians’ offices or even hospitals may relocate away from areas of towns or entire communities that have concentrations of uninsured persons. Especially for institutions that serve a high proportion of uninsured patients such as center-city community hospitals or academic medical centers, a large or growing number of uninsured persons seeking health care may “tip” a hospital’s or clinic’s financial margin from positive to negative.

The quality of care for both uninsured and insured persons may be adversely affected by uninsurance within the community. The IOM Committee on the Quality of Health Care in America describes the goals for health care in the United States as a systematic approach to care that is safe, effective, patient centered, timely, efficient, and equitable for all Americans, irrespective of insurance status (IOM, 2001b). While the Committee’s second and third reports, Care Without Coverage and Health Insurance Is a Family Matter, have documented the lesser effectiveness of health care received by the uninsured, its fourth report considers how high uninsured rates undermine the capacity of health care institutions to provide high-quality care more generally. A Shared Destiny documents reduced availability within the community to clinic-based primary care, specialty services, and hospital-based care, particularly emergency medical services and

trauma care, in areas with relatively large uninsured populations (Gaskin and Needleman, 2003; Needleman and Gaskin, 2003).

Reduced access to primary care increases the demand for services by both insured and uninsured persons in already overcrowded hospital emergency departments (EDs) (Derlet, 1992; Grumbach et al., 1993; Baker et al., 1994; Billings et al., 2000). In 1986, the Emergency Medical Treatment and Labor Act (EMTALA), which was conceived to counter the practice of hospitals turning away or inappropriately transferring patients who did not have the means to pay for their care, established a right to medical screening and stabilization and hospitalization, if necessary, for all patients presenting to EDs for treatment regardless of ability to pay (Bitterman, 2002). Thus hospital EDs may be one of the few health care providers to whom uninsured patients can turn when they seek routine or urgent, as well as emergency care.

Large metropolitan areas and multicounty rural areas depend on highly specialized and resource-intensive care provided by trauma centers affiliated with EDs. The lack of adequate financing for the emergent care of uninsured ED and trauma patients risks diminished access for all residents of a region. In many urban and rural areas, hospital emergency departments are often filled beyond capacity, affecting all who rely on them (Richards et al., 2000; Derlet et al., 2001; Lewin Group, 2002).

Relatively high uninsured rates are associated with the lessened availability of on-call specialty services to hospital emergency departments and the decreased ability of primary care providers to obtain specialty referrals for patients who are members of medically underserved groups (Asplin and Knopp, 2001; Bitterman, 2002). One strategic response of some hospitals to such cost pressures has been to eliminate specialty services with relatively high levels of uncompensated care, such as burn units, trauma care, pediatric and neonatal intensive care, emergency psychiatric inpatient services, and HIV/AIDS care (Gaskin, 1999; Commonwealth Fund Task Force on Academic Health Centers, 2001). In rural areas, all residents may experience lessened access to specialty care (as with primary care) if providers leave the community because of financially unviable practice conditions (Ormond et al., 2000).