12

Federal and State Governments

The federal and state governments have several roles to play in implementing the proposed strategy. However, as emphasized throughout this report, responsibility for preventing and reducing underage drinking lies with everyone, as a national community. For example, although minimum drinking age laws enacted and enforced by government underpin society’s efforts, their effectiveness depends on the active support of parents and other adults, businesses, and many other organizations in every community. In addition to their roles in enacting and enforcing pertinent laws, federal and state governments have many other important opportunities to stimulate and solidify the strategy. They can fund statewide or national media campaigns, provide financial support and other assistance to communities to help them mobilize to reduce underage drinking, set up the necessary apparatus to monitor trends in underage drinking and the effectiveness of efforts to reduce it, and support necessary research. In this chapter we lay out the roles for the federal and state governments in the overall strategy. Two of these roles are to coordinate and monitor the various components, including providing the data and research needed to assess and improve the strategy. The third role is to increase alcohol excise taxes to both reduce consumption and provide funds to support the strategy. There is strong and well-documented evidence of the effects of raising taxes on consumption, particularly among youth.

FEDERAL AND STATE ACTIVITIES

Federal Programs

Multiple federal agencies play a role in preventing underage drinking. According to a recent report by the U.S. General Accounting Office (GAO) (2001) that reviewed federal funding targeted at preventing underage drinking, the U.S. Departments of Justice, Health and Human Services, Transportation, Labor, Defense, Treasury, Agriculture, and Interior, as well as the Executive Office of the White House and the Corporation for National Service funded efforts that include underage alcohol use within broader mandates that target alcohol and other drug use. Of the total amount reported ($1.09 billion), almost all ($1.01 billion) included alcohol as part of a larger undifferentiated category relating to alcohol and other drug use; thus, it was not possible to determine what portion of the funds were targeted specifically to alcohol prevention activities. A relatively small proportion—less than 7 percent of the total amount–in three federal departments both had a specific focus on alcohol and identified youth or youth and the broader community as the specific target population.

Specifically, the Departments of Justice, Health and Human Services (HHS), and Transportation reported a combined $71.1 million focusing on alcohol and youth or alcohol and youth and the broader community. According to the GAO report, within HHS, resources are split between the National Institute on Alcohol Abuse and Alcoholism (NIAAA), the Substance Abuse and Mental Health Services Administration (SAMHSA), and the Centers for Disease Control and Prevention (CDC). The majority of HHS resources that specifically target underage drinking are in NIAAA, (part of the National Institutes of Health) that “conducts and supports biomedical and behavioral research in order to provide science-based approaches to the prevention and treatment of alcohol abuse and alcoholism (General Accounting Office, 2001, p. 11).” The GAO report provides no specific information about how these funds are used to prevent underage drinking; NIAAA staff report that the preponderance of their resources are used for research. Research is primarily investigator-initiated and includes such topics as the effectiveness of various media campaigns; education interventions, and environmental strategies, as well as research on the epidemiology and causes of underage drinking.

NIAAA also has supported two notable efforts to influence local action. The first is a comprehensive effort to review approaches to drinking on college campuses, which resulted in the publication of A Call to Action: Changing the Culture of Drinking at U.S. Colleges (NIAAA, 2002) which outlines strategies for addressing drinking on college campuses. NIAAA is currently in the process of conducting regional meetings to disseminate the

report’s findings nationwide. NIAAA also is one of the leading funders, with SAMHSA and the Robert Wood Johnson Foundation, of Leadership to Keep Children Alcohol Free, a major national effort involving governors’ spouses to reduce alcohol use among children aged 9 to 15. SAMHSA staff reported funding a wide variety of interventions including initiatives aimed at education and awareness, supporting community-based initiatives, developing guides and toolkits, and furthering research objectives. Several of these initiatives involve collaboration with other HHS agencies (e.g., NIAAA, CDC).

The largest single targeted program included in the GAO report is in the Department of Justice’s Office of Juvenile Justice and Delinquency Prevention (OJJDP). According to the report (U.S. GAO, 2001, p. 12), OJJDP funds “retail compliance initiatives, prevention programs, and fostering a juvenile justice system that, among other things, provides appropriate sanctions, treatment and rehabilitative services based on the needs of the individual juvenile.” OJJDP’s Enforcing the Underage Drinking Laws Program is “designed to reduce the availability of alcoholic beverages to minors and prevent the consumption of alcoholic beverage by minors.” The funds are distributed through block and discretionary grants. A national training and technical assistance center, the Center for Enforcing the Underage Drinking Laws Program is funded through this program.

A relatively small program at the National Highway Traffic Safety Administration (NHTSA) funds interventions that “address the problems of drunk and drugged driving and prevention programs targeting zero tolerance for alcohol and drug use among youth. They administer a formula and incentive grant program, award discretionary grants and contracts and enter into cooperative agreements with other entities (U.S. GAO, 2001, p. 14).” Formula grants to states fund highway safety programs, which may include underage drinking programs.

Several agencies also provide resources to advance efforts to prevent underage drinking. Both NIAAA and SAMHSA have published several technical assistance documents highlighting various aspects of underage drinking and approaches to reducing underage drinking and have multiple mechanisms in place to disseminate this information. OJJDP provides both training and technical assistance through its Center for the Enforcement of Underage Drinking Laws. NHTSA has published several documents aimed at reducing drinking and driving. In addition, the Department of Education, through its Higher Education Center for Alcohol and Other Drug Prevention, provides training and technical assistance related to reducing drinking on college campuses. However, there is no coordinated, central mechanism for disseminating research findings or providing technical assistance to grantees or others interested in developing strategies that target underage drinking.

In sum, numerous federal agencies fund multiple research, intervention, and technical assistance efforts to reduce underage drinking. Although coordination mechanisms are in place for specific initiations, and agency staff report regular staff-level communication, the committee is not aware of any ongoing effort to coordinate all of the various federal efforts either within or across departments. The multitude of agencies and initiatives involved suggests the need for an interagency body to provide national leadership and provide a single federal voice on the issue of underage drinking.

Recommendation 12-1: A federal interagency coordinating committee on prevention of underage drinking should be established, chaired by the secretary of the U.S. Department of Health and Human Services.

Membership on the coordinating committee should include senior officials from each of the agencies included in the GAO report. The coordinating committee also should periodically consult with the range of national nongovernmental organizations—including National Alcohol Beverage Control Association, Mothers Against Drunk Driving, Students Against Destructive Decisions, Distilled Spirits Council of the United States, Century Council, National Beer Wholesalers Association—who sponsor initiatives aimed at preventing underage drinking to facilitate a coordinated, research-based approach by all key players. Once the recommended nonprofit foundation is established, the foundation should also be regularly consulted.

The committee recommends that the secretary of HHS chair the coordinating committee for several reasons. First, HHS plays the federal government’s lead role in the prevention of substance abuse. Although other agencies have programs that target underage drinking, their primary missions are not related to substance abuse. The initiatives funded by and evaluated by HHS have the widest scope. HHS also administers the major national surveys that are likely to be used to monitor changes in the prevalence or intensity of youth drinking and has the greatest resources available to fund the research necessary for continued improvement of the strategy. Which HHS agency should have operational responsibility for the coordinating committee should be determined by the secretary.

Recommendation 12-2: A National Training and Research Center on Underage Drinking should be established in the U.S. Department of Health and Human Services. This body would provide technical assistance, training, and evaluation support and would monitor progress in implementing national goals.

To the greatest possible extent, interventions aiming to prevent or reduce underage drinking should be science based. In addition, as discussed in Chapter 11, community efforts are most likely to succeed if they have

strong and informed leadership. For this reason, resources are needed for training and leadership development for coalition and task force members as well as key decision makers. The recommended center would complement HHS’s existing activities on underage drinking.

This report sets forth a comprehensive set of recommendations for the reduction of underage drinking, and community mobilization will provide the context for many of these interventions. Thus the mission of the new center would include the provision of technical assistance and training in community assessment, leadership development, policy development, community organizing, strategic use of the news media, and community-based evaluation to support the program of action laid out in this committee’s recommendations.

Currently the federal government does not report regularly on activities across the various agencies that fund targeted underage drinking activities, and evaluating the effect of those activities, as it does for illegal drugs through an annual report issued by the Office of National Drug Control Policy.

Recommendation 12-3: The secretary of the U.S. Department of Health and Human Services should issue an annual report on underage drinking to Congress summarizing all federal agency activities, progress in reducing underage drinking, and key surveillance data.

At a minimum, this report should include

-

amount and sources of funds targeted at underage drinking;

-

activities funded;

-

results of activities funded;

-

data on key indicators of underage drinking to monitor progress in reaching stated objectives (discussed below);

-

data on brand preferences and source of alcohol (discussed below);

-

data on the extent to which alcohol advertising or entertainment with alcohol content reaches underage populations (discussed below); and

-

future planned activities and modifications in strategy.

State Programs

Numerous state-level agencies are also involved in administering programs to reduce underage drinking. The precise role of various agencies and their relative contributions vary from state to state. However, in most states, the health or human service, transportation, and criminal justice departments play some role. Those roles include administration of a variety of federal block grants that target underage drinking. In addition, in states

that control the sale and distribution of alcohol, the state alcohol beverage control (ABC) body likely plays an important role.

Currently, each state and Washington, D.C., receives a block grant under OJJDP’s Enforcing the Underage Drinking Laws Program for activities related to preventing underage drinking. According to OJJDP staff, these funds are administered by a variety of agencies, including those for health and human services, traffic safety, criminal justice, and law enforcement, ABC agencies and other agencies. Each state also receives block grants that include underage drinking from HHS (substance abuse prevention and treatment) and from the Department of Transportation (highway safety and drunk driving). The diversity of agencies involved in administering the OJJDP block grant illustrates the fact that there is no clear lead agency across the states. In the committee’s view, the identity of the lead agency is unimportant as long as there is one within each state.

Recommendation 12-4: Each state should designate a lead agency to coordinate and spearhead its activities and programs to reduce and prevent underage drinking.

Coordinating the efforts of all the participating state agencies is particularly important to local communities that are trying to create strong coalitions. The committee also suggests that states be encouraged to produce annual reports on their activities and progress based on those activities.

SURVEILLANCE AND MONITORING

In order to assess the overall public health effects of the strategy proposed by the committee—to reduce underage drinking and the harms it causes—the strategy must include an adequate surveillance and monitoring system. Such a system can provide a significant portion of the information necessary to make informed policy decisions. In the context of this report, a surveillance system should include information on:

-

the onset and prevalence of underage drinking;

-

the patterns and consequences of underage drinking;

-

the amounts and types of alcohol products consumed by underage populations; and

-

the availability of alcohol to underage populations and the exposure of this population to messages regarding alcohol in alcohol advertising and in the entertainment media.

National Indicators

There are three national surveys commonly used to report on the prevalence of underage drinking: the National Survey on Drug Use and Health (NSDUH, formerly the National Household Survey on Drug Abuse, NHSDA), the Youth Risk Behavior Survey (YRBS), and Monitoring the Future (MTF). The NHSDA was an annual household-based survey of individuals 12 and older funded by SAMHSA. YRBS and MTF are school-based surveys. YRBS, conducted in conjunction with the states on a voluntary basis, and funded by CDC, surveys high school students (grades 9-12) on a biannual basis. MTF, a survey of eighth, tenth, and twelfth-graders, has been conducted annually since 1975 by the University of Michigan, funded by the National Institute on Drug Abuse.

Differences in the estimates produced by these various surveys have been publicly acknowledged and widely debated. There has been no consensus, however, on the preferable survey to use or the best set of questions to include. In fact, a recent series of articles (Harrison, 2001; Fendrich and Johnson, 2001; Fowler and Stringfellow, 2001; Cowan, 2001) analyzing differences in the surveys generally concluded that each has merit in its own right and did not recommend one over the other. The articles did report, however, that while the overall trends are generally consistent across the three surveys, the NHSDA tended to provide the lowest estimates and may underestimate youth consumption. One unique aspect of the NHSDA was the inclusion of adults in the sample, which allows comparison of adult and youth consumption patterns. The NSDUH is continuing the format.

Recommendation 12-5: The annual report of the secretary of the U.S. Department of Health and Human Services on underage drinking should include key indicators of underage drinking.

The key indicators should include:

-

(average) age of first use;

-

prevalence of (current) use among pertinent age groups;

-

intensity (frequency and quantity) of drinking among pertinent age groups; and

-

harmful consequences of alcohol use among pertinent age groups.

The committee does not believe it matters which data source is used for these indicators, provided it is used consistently over time.

Quantity Consumed and Brand Preferences

As discussed in Chapter 3, none of the major surveys currently include adequate items on the amount (number of drinks) and type of alcohol (beer,

wine, liquor) consumed on specific occasions or during specific time periods to allow direct estimates of quantity of underage consumption. Moreover, there are currently no national data on the brands of alcohol consumed by youth. MTF data provides general evidence that youth tend to consume beer more often than other types of alcohol, but the data do not allow more in-depth analysis. For alcohol, MTF does not collect information on the preferred brand. In contrast, MTF asks respondents the brand of cigarette usually smoked which revealed that three cigarette brands account for nearly all teen smoking and that one of those brands alone accounts for the majority of the underage tobacco market (Johnston et al., 1999). While a logical hypothesis is that a small number of brands also account for the underage drinking market, available monitoring systems do not provide the data necessary to make this conclusion.

Recommendation 12-6: The Monitoring the Future (MTF) Survey and the National Household Survey on Drug Use and Health (NSDUH) should be revised to elicit more precise information on the quantity of alcohol consumed and to ascertain brand preferences of underage drinkers.

Although questions could be added to any of the three relevant national surveys, the committee recommends that parallel questions be added to the MTF survey and the NSDUH. The MTF survey already includes a question on type of beverage, and the administrators of the survey have experience developing a similar question related to preferred tobacco brands, so the MTF should be able to serve as a model in developing a consistent approach across the two surveys. Questions should be added to the NSDUH as well as MTF to include underage drinkers not in school and allow comparisons to adults.

Groups that represent alcohol producers consistently emphasize their commitment to reducing underage drinking. This new data would help target industry efforts toward specific producers. The monitoring of specific brands, coupled with information on advertising and marketing by specific producers, would also provide the public and policy makers with information necessary to hold alcohol producers accountable for profits made from persons who are illegally using their product.

Monitoring of Advertising and Entertainment Media

As discussed in Chapter 7, abundant evidence shows that alcohol advertising and other promotional activities now reach large underage audiences, and it is reasonable to expect more aggressive self-regulatory efforts by the alcohol industry to restrain marketing practices that tend to encourage underage drinking, even in the absence of clear evidence that such

exposures cause underage drinking. Similarly, Chapter 8 shows that movies, television, video, and musical recordings are awash with images appealing to youth. Although research does not indicate that these media have a causal impact on underage drinking, the entertainment industries also share a social responsibility to refrain from glamorizing alcohol use. The committee believes that standards to minimize underage exposure should be implemented on a voluntary basis, similar to the alcohol industry. However, some independent oversight of these standards is warranted. In both contexts, the committee believes that the most promising strategy is to promote industry accountability by facilitating public awareness of industry practices. Accordingly, the committee recommends that DHHS be authorized and funded to monitor these media practices and report to Congress and the public.

EXCISE TAXES

As discussed in Chapter 1, one approach to reducing underage consumption is to reduce the overall level of alcohol consumption in the society. Although such an approach has its advocates, the committee decided that primary reliance on such a strategy would not be compatible with the congressional mandate to which this report responds. Instead, we took the view that broad interventions (those that would tend to affect overall consumption rather than underage consumption alone) should be included in the strategy only if they could be expected to have a particularly strong effect on the harms associated with underage consumption.

We have concluded that there is one such intervention—increasing alcohol excise taxes. There are three arguments for higher taxes to combat underage drinking. First, underage drinking imposes particularly high average social costs, as discussed below. Second, raising excise tax rates, and hence prices, is a strategy that has strong and well-documented prevention effects on underage drinking. Third, a designated portion of the funds generated by the taxes can be earmarked for preventing and reducing underage drinking.

Around the world, historically and currently, alcoholic beverages have been singled out for special taxes. Indeed, the first inland-revenue measure enacted by the first U.S. Congress was a tax on whiskey. Currently, special excise taxes are imposed on alcoholic beverages by the federal and all state governments. The federal tax rates are at $2.14 per 750 milliliter bottle of 80 proof spirits, $0.33 per six-pack of beer, and $0.21 per bottle of table wine.

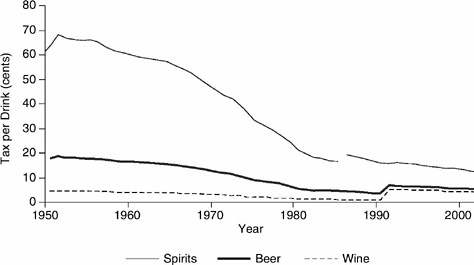

By the standards of recent history, current tax rates are low; see Figure 12-1. Congress has not legislated increases in these taxes, so their real costs have been eroded by inflation. Restoring the federal excise tax on beer to its

FIGURE 12-1 Historical trends, federal taxes on beer, wine, and spirits 1950-2002, with tax per drink in 2002 dollars.

SOURCE: Adapted from the Bureau of Alcohol, Tobacco, and Firearms web site (2003) and the Bureau of Labor Statistics web site (2003).

value in, say, 1960, would require that it be increased by a factor of three. The same lack of adjustment to inflation has occurred at the state level. One result was a long steep slide in the prices of distilled spirits relative to the price of other goods. Beer prices also declined in inflation-adjusted terms until the early 1980s. Alcohol prices have kept roughly even with overall inflation since then. Overall, alcoholic beverages are far cheaper today than they were in the 1960s and 1970s.

Current excise taxes and prices are low not only by historical standards, but also and more importantly by the standard that prices (inclusive of tax) should reflect the full social cost of production and consumption: if an item is underpriced, then too much will be purchased and consumed. A much-cited study of the costs of heavy drinking by Willard Manning and his associates documented this gap between social cost and price (Manning et al., 1989). They used the economists’ normative framework, distinguishing between internal costs (those that are borne by the drinker and therefore presumably taken into account in the drinking decision) and external costs (inflicted by drinkers on bystanders and not therefore taken fully into account in the drinking decision). If the principle of consumer sovereignty is accepted, they argue, then it is only the external costs that are relevant for tax-policy purposes. On the basis of data from the mid-1980s, they found that the external cost per ounce of ethanol consumed was about 48 cents,

double the average combined state and federal tax per ounce that was then in place. Much of the external costs of alcohol consumption are borne by victims of intoxicated drivers. A subsequent study amplified this conclusion by noting that Manning and colleagues had failed to account for nonfatal highway injuries (Miller and Blincoe, 1994); including injuries increased the estimate of external costs to 63 cents per ounce.

Such cost-per-drink numbers are averages over all consumption. The social costs for drinks consumed by teenagers are higher than for older drinkers. While there are no estimates for teen drinking that are directly comparable to those cited above, there is a more recent and comprehensive estimate (Pacific Institute for Research and Evaluation, 1999), discussed in Chapter 3. According to that estimate, the total social costs of underage drinking are $53 billion. Given that underage youths account for at least 10.8 percent of total consumption, that works out to $0.91 per ounce of ethanol.1 One explanation for the high social costs per drink is the abusive style of teen drinking. By one estimate, based on the National Household Survey on Drug Abuse, 91 percent of all drinks consumed by teenagers are consumed by those who drink heavily (Biglan et al., 2003). Furthermore, alcohol abuse amplifies what tend to be high baseline (that is, when sober) rates of risky and harmful activity, including reckless driving, violent crime, and unsafe sex. Of course, as discussed in Chapter 1, these are precisely the arguments that support minimum drinking age laws and accompanying restrictions on youthful access to alcohol: the social costs of drinking by youths are unacceptably high.

Higher taxes would bring alcohol prices closer to the average social costs of consumption by youths (and others) and create an incentive for youths to consume less alcohol. Despite various arguments that alcohol is somehow the exception to the economists’ principle of downward-sloping of demand (that is, that for any commodity, the quantity consumed is inversely related to price) the empirical evidence demonstrates that alcoholic beverages are not exceptional in this respect (Chaloupka, 2004; Cook and Moore, 2002). The overall quantities of beer, wine, and distilled spirits that are sold respond to changes in price in the expected way. The extensive published research on youthful drinking is quite consistent in reporting that the prevalence of drinking by underage youths, and the prevalence of heavy

drinking, are responsive to even small changes in tax rates (Chaloupka, 2004; Cook and Moore, 2002). The evidence also supports a conclusion that an increase in alcohol excise taxes leads to a reduction in alcohol-related harms (Coate and Grossman, 1988; Kenkel, 1998; Saffer and Grossman, 1987; Chesson et al., 1997).

One interesting question is whether youthful drinking is more or less responsive to changes in price than adult drinking. Responsiveness is usually measured by the price elasticity of demand, defined as the percentage reduction in alcohol consumed in response to a 1 percent increase in price. A typical estimate of the overall price elasticity of demand for beer, for example, is −0.3, which is to say that beer purchases decline by about 0.3 percent in response to a 1 percent increase in price. Estimated elasticities for wine and spirits are higher than for beer (Cook and Moore, 2000). In a state in which excise taxes (federal and state combined) constitute 10 percent of the average price of a six-pack, doubling the tax would increase the average price by about 10 percent, which would result in a 3 percent reduction in sales.

There are reasons to believe that underage drinking is more responsive to price changes than adult drinking: youths tend to have less discretionary income, and they are more likely to buy their drinks from package stores rather than at bars and restaurants (where the large mark-up makes the excise tax proportionately less important). Although there are a range of estimates for the price elasticity for youths and adults, there are no studies that provide evidence on the relative elasticities using comparable data and methods. However, on the basis of evidence available for other goods, including tobacco (Chaloupka and Warner, 2001), it seems highly likely that youthful drinking is more responsive to price changes, in a proportional sense, than adult drinking.

There is stronger evidence on the effects of excise taxes (reflecting presumed differences in price) on the harms associated with youthful alcohol abuse. An analysis of state-level highway fatality rates during the 1980s (Chaloupka et al., 1993, pp. 161-162) concluded that “significant increases in alcoholic beverage excise taxes are among the most effective policies for reducing drinking and driving in all segments of the population, with the largest reductions occurring among teens and young adults.” This result was confirmed by Ruhm (1996)2 and is in accord with studies of survey

data on self-reported drinking and driving (Kenkel, 1993; Chaloupka and Laixuthai, 1997). Other studies have documented the influence of alcohol excise taxes on such predominantly youthful activities as robbery, rape, and the transmission of gonorrhea through unprotected sex (Chaloupka, 2004).

A focus on the beer excise tax is warranted by the fact that beer is the most popular form of alcoholic beverage with underage drinkers by a wide margin. The fact that the federal excise tax on beer is less than half that on distilled spirits (per ounce of ethanol) reflects a traditional belief that more dilute beverages (beer) are less harmful than “hard” liquor. But, the predominant beverage of use and abuse by youths is beer.

Of course the conventional reason to raise tax rates is to increase tax revenues. Alcohol excise taxes contribute $12 billion to the federal and state treasuries, and raising the rates would lead to a near-proportional increase in that revenue, despite the fact that higher tax rates will reduce consumption. The arithmetic here is simple. If, as in the example presented earlier, the combined state and federal beer excise rate is doubled, beer sales would decrease by about 3 percent, and tax revenue would almost double. These calculations depend to some extent on the mark-up applied to tax increases by beer sellers—a large mark-up would result in a somewhat larger reduction in sales and a correspondingly smaller increase in revenue. Under commonsense assumptions about the mark-up (i.e. that the mark-up is about 20 percent), it remains true that a doubling of the tax will result in a near-doubling of revenue.

The committee concludes that state and federal excise taxes are potentially important instruments for preventing underage drinking and its harmful consequences and for generating revenue to fund a broad prevention strategy. We believe the long downward slide in the actual cost of these taxes to consumers has considerably exacerbated the underage drinking problem. Raising these tax rates at both the federal and state level is justified by established principles of public finance, by public health considerations, and by the specific goals of Congress in creating this committee. Of course, the amount of any increase is not a scientific question; rather it is a policy question.

Recommendation 12-7: Congress and state legislatures should raise excise taxes to reduce underage consumption and to raise additional revenues for this purpose. Top priority should be given to raising beer taxes, and excise tax rates for all alcoholic beverages should be indexed to the consumer price index so that they keep pace with inflation without the necessity of further legislative action.

RESEARCH AND EVALUATION

The committee believes that rigorous research and evaluation is necessary to ensure that any national strategy is based on the most effective approaches.

Recommendation 12-8: All interventions, including media messages and education programs, whether funded by public or private sources, should be rigorously evaluated, and a portion of all federal grant funds for alcohol-related programs should be designated for evaluation.

To ensure that activities are adequately evaluated and that interventions are research based, the committee recommends that a specific standard portion, perhaps 15 percent, of grant funds be set aside for independent evaluations. Currently, the proportion set aside for evaluation varies from program to program. There is an obvious tension between the need for resources to fund services and the need for evaluation. Both SAMHSA and the Department of Education have demonstrated a commitment to funding research-based interventions. The committee believes that this interest, and the effectiveness of funded programs, would be enhanced by a standard evaluation expectation across all funded programs. Programs also need to be provided with tools for conducting research and evaluation.

Chapter 6 outlines the need for prototype development for the proposed adult media campaign. This research activity is a core component of the strategy outlined in this report. There are several other approaches discussed throughout this report that may have promise, but where the evidence is insufficient to make definitive recommendations. We therefore recommend several areas for continued research.

Youth Media Messages

As discussed in Chapter 10, careful research should be conducted to identify specific messages to use in a youth-oriented media campaign that would demonstrate the risks of alcohol use, especially of heavy drinking. In the short-term, this should include testing a serious prototype for a youth-focused campaign. For example, the research design might include funding one or more 2- to 4-year campaigns in geographically focused areas, with substantial resources both in message development and transmission and in careful evaluation. The appropriate message focus for such prototype campaigns would need to be researched, developed, and tested before launching the campaigns.

Access

Numerous interventions have been designed to reduce underage access to alcohol. Some have not yet been extensively evaluated and could be further improved by continued research. States and the federal government should study the effect of a range of access-oriented interventions on underage drinking and drinking problems:

-

dram shop liability laws;

-

shoulder tap and similar programs;

-

keg registration laws;

-

social host liability laws;

-

conditional use permits; and

-

sobriety checkpoints.

Youth-Oriented Interventions

Further research and evaluation is necessary to identify successful approaches for reaching populations generally not included in school-based education approaches and refine assessments of interventions on college campuses.

Recommendation 12-9: States and the federal government—particularly the U.S. Department of Health and Human Services and the U.S. Department of Education—should fund the development and evaluation of programs to cover all underage populations.

Such programs should consider a wide range of issues:

-

preschool, early elementary, and high school strategies for preventing alcohol use, and, for high school, additional emphasis on programs targeted at individuals with apparent drinking problems;

-

characteristics of colleges and universities that may be associated with intervention effectiveness, including the size of student enrollment, type of institution (e.g., 2- or 4-year college, residential or commuter campus, single gender), and urban versus rural setting;

-

effectiveness of social norms approaches, parental notification, and other college-based interventions;

-

continuing care approaches for treatment;

-

interventions implemented within healthcare settings (including campus-based health care) and whether and how training for health professionals can enhance effectiveness of screening and referral for underage populations;

-

faith-based approaches to prevention and treatment;

-

workplace-based and military-based interventions that target underage populations;

-

interventions with youth who are currently drinking; and

-

research to further refine understanding of the multiple interrelated factors that affect underage drinking and long-term outcomes.

COSTS AND COST-EFFECTIVENESS OF THE STRATEGY

Some of the committee’s recommendations, especially those in Chapters 7 and 8, are addressed to the private sector; they do not entail any public expenditure and, for the most part, require little more than commercial self-restraint. Similarly, some of the recommendations directed to the government in this chapter do not involve significant new expenditures. The data collection and monitoring needed to implement the overall strategy are unlikely to entail substantial new costs, although the proposed data collection efforts may require consideration of the value and opportunity costs of the data proposed in comparison with the data that are currently collected. Similarly, the committee’s recommendation (in Chapter 10) that resources for school-based programs be explicitly targeted at programs with elements of proven effectiveness will entail a shift of funding rather than significant new expense. And the committee’s recommendations for research are an effort to identify policy-relevant priorities for research funding agencies, both private and public, and do not necessarily involve new funding.

Several components of the proposed strategy will require new investment, at the federal, state, or community levels: the adult-centered media campaign (Chapter 6); improved enforcement of existing laws at the state and local levels (Chapter 9); community mobilization grants (Chapter 11); funding for prevention and treatment of adolescent alcohol use and abuse (above); and resources for HHS to monitor adolescent exposure to alcohol messages in advertising and entertainment media (above). Responsibility for funding the strategy could be shared by the federal and state governments and the industry-funded nonprofit foundation envisioned by the committee (Chapter 7). The necessary government contribution could be offset by revenue generated by increased federal and state alcohol excise taxes (above).

Available data do not allow the committee to make specific estimates of the costs of developing and implementing individual components of the strategy or the strategy as a whole. However, the actual costs of similar programs provide a starting point for gauging the likely cost of some components. For example, the Office of National Drug Control Policy’s antidrug campaign and the American Legacy Foundation’s anti-tobacco campaign each cost approximately $100 million per year for production and

advertising for a single audience3 during full implementation. The campaign proposed in this report is likely to be larger and to entail more outreach work than either of these campaigns, but the 3-year developmental phase is likely to be less costly since it will not require national media time.

A possible model for new community mobilization grants that are specific to underage drinking is the Drug-Free Communities Support Program, which provides grants to community coalitions of up to $100,000 per year with a dollar-for-dollar match from nonfederal sources. The number of such grants would depend, of course, on the strength of the proposals as well as the availability of funds. The committee is not aware of a model on which to base an estimate of the cost for HHS to monitor alcohol advertising messages and entertainment media. The Center on Alcohol Marketing and Youth, a private organization, receives foundation funding to conduct similar activities, but its mandate is broader than what the committee has proposed. We do not anticipate that the monitoring will be necessary on an annual basis, however, or that it will continue to be necessary over the long term.

The level of new expenditure required for state and local enforcement activities (e.g., compliance checks) and substance abuse prevention and treatment will vary, depending on how much is currently spent on those activities and how those resources are used. States currently receive block grant funds and some states receive discretionary funds targeted at enforcing the underage drinking laws through the Department of Justice, but there is wide variability in how those funds are used. States also receive block grant funds for substance abuse prevention and treatment through the Department of Health and Human Services, but there is no information on how much of this is spent on youth-specific activities. These block grant funds are often supplemented with other state, local, or private resources. For example, state alcohol beverage control agencies often dedicate resources to such activities as compliance checks to enforce underage drinking laws. It is worth emphasizing, however, that the committee anticipates that much of the effort to promote compliance will be undertaken though education and communication approaches rather than direct enforcement activities.

The lack of precise data with which to determine program costs, to predict the level of effects, or to quantify likely outcomes also preclude a prospective determination of the cost-effectiveness of the proposed strat-

egy. Nonetheless, the committee believes that the proposed strategy, if adequately implemented, could reasonably be expected to achieve a significant reduction in underage drinking and the associated social costs. The exact decrease that could be expected is speculative. Available information on the social costs of underage drinking is a starting point for gauging the potential cost-effectiveness of the recommended strategy. If annual social costs attributable to underage drinking (conservatively estimated to be $53 billion per year in 1996; most likely higher now due to inflation) were reduced by only 2 percent after 10 years, or if a 1 percent reduction were sustained for 2 years, an expenditure of approximately $1 billion over that period would be economically justified. If social costs were reduced by 5 or 10 percent after 10 years, the economically justifiable cost would be significantly higher. While the committee believes that the enormous social costs of underage drinking warrant an investment in the proposed strategy, specific efforts to collect cost data and to quantify the proposed outcome measures should be built into strategy implementation in order to obtain more precise measures of cost-effectiveness.