3

A Conceptual Framework

It is the view of the panel that, as a general matter, the conceptual framework to be applied in accounting for nonmarket activity ideally should parallel that used in the existing national accounts. Using the national accounts as the starting point offers two basic advantages: national accounts have been scrutinized, reflecting extensive research and policy use for many decades; and the underlying principles are well tested, and practice shows they can be implemented. Additionally, many of the methodological questions about the augmented accounts have analogues and therefore answers in the national accounts (Nordhaus, 2002, p. 3).

The national accounts have proven extraordinarily useful as a vehicle for monitoring and studying the evolution of the economy. They have the intentional restriction, of course, that they do not systematically incorporate nonmarket activity.1 It is this restriction that this panel is charged with addressing. But given the heavy reliance of policymakers and others on the existing accounts, we believe that any supplemental accounts that are developed will be most useful if the information they contain is as consistent as possible with the information in the core accounts.

What specifically does this imply? In endorsing the framework used in the existing national accounts, the panel is arguing for an approach that uses dollar values as a metric; seeks to value outputs at their marginal rather than their total value; and derives these marginal values wherever possible from observable market transactions. Each of

these points is discussed below. Moreover, insofar as is feasible, the panel advocates adaptation of the double-entry structure of the core accounts for use in any supplemental accounts that may be developed. One implication of this last position is that every effort should be made to value outputs independently of inputs. The panel recognizes, however, that implementing such a structure for measuring nonmarket outputs will pose significant challenges, and that methodological compromises may be required during intermediate steps of the accounts’ development.

INTEGRATING CORE AND SATELLITE ACCOUNTS—OR NOT

Ideally, an experimental set of expanded accounts would integrate market and nonmarket components. From this perspective, the System of National Accounts (SNA) may offer some lessons.2 Though it does not endorse nonmarket accounts, a major feature of SNA is that it is a multi-element set of accounts linking production income, consumption, accumulation, and wealth.3 Both the SNA and the National Income and Product Accounts (NIPA) allow for the possibility of satellite accounts; for example, in the early 1990s, BEA developed the Integrated Environmental and Economic Satellite Accounts which could be integrated with the NIPA accounts.4 This integrated feature has become a stated goal of the U.S. accounts and would, if feasible, also be a desirable element in augmented nonmarket accounts (Nordhaus, 2002, p. 4).

A less ambitious, simpler alternative—and perhaps necessary first step—might be to construct free-standing accounts for individual nonmarket components. Under this alternative, the core accounts would remain much as they are, and the satellite accounts would provide alternative perspectives on selected areas of activity—such as household production, human capital, and health. The shortcomings of this “interim solution” are obvious: Given the overlap of nonmarket areas, with each other and with market areas already captured in the national accounts, a system that fails to integrate core plus satellite accounts would produce numbers that do not add up to a meaningful total and would be inconsistent with current practices at BEA—the virtues of which have already been enumerated.

One advantage of the nonintegrated approach, relative to a fully integrated one, is that it might allow experimental accounts to be produced much more quickly. However, for various nonmarket areas, experimental work might follow heterogeneous approaches—particularly with regard to valuation methods. The nonintegrated approach would also allow work in each area to proceed at its own pace as data and concepts evolve, without seriously disturbing the existing accounts. This seems to be the thinking behind the new satellite household production account in the United Kingdom, for instance.5

|

2 |

SNA guidelines were prepared by the Inter-Secretariat Working Group on National Accounts, a joint effort by the International Monetary Fund, the European Union, the Organization for Economic Co-operation and Development, the United Nations, and the World Bank. The effort was mandated by the Statistical Commission of the United Nations to oversee international coordination in the development of national accounts |

|

3 |

Another research project under way at BEA would create wealth accounts by integrating the Flow of Fund Accounts with the National Income and Product Accounts. |

|

4 |

Congress directed BEA to suspend this work in 1994. |

|

5 |

For a description of this account, see http://www.statistics.gov.uk/statbase/Product.asp?vlnk=9338 [4 April 2002]. |

The more general question that the panel must consider is whether nonmarket accounts should be allowed to expand only in terms of the boundary of economic activity covered or also in terms of methodology. One attractive feature of working under an “experimental” umbrella is the flexibility that it can give to explore different layers of accounting approaches, which may not all be consistent with those underlying NIPA, but may yield interesting results. It might be possible, also, to tailor nonintegrated satellite accounts more specifically for the uses to which they are most often put. For example, environmental accountants might choose to include consumer surplus values for some purposes, while researchers working on household production accounts might prefer valuations at the margin. We address this consumer surplus question below.

An interim approach could produce very useful data for research and policy purposes, while avoiding several difficult design and data issues. Perhaps the most obvious obstacle to producing a fully integrated account is the nonparallel level of maturity of underlying data and concepts currently available for accounting in various nonmarket areas. Because of dissimilar conventions in valuation methods and accounting objectives, it is currently impossible to construct an integrated set of nonmarket accounts. The literature on household production emphasizes imputations of values for productive inputs. For many areas of household production, little has been done to define, much less measure, output, though work (e.g., Ironmonger) is proceeding on this front. In health and environmental areas, good data on expenditures exist for many inputs, and researchers are attempting to quantify outcomes and output (and, sometimes, consumer surplus values are included).

Integrating nonmarket and core accounts would also require revision to the current framework (though nothing precludes concurrent calculation of the standard accounts in the traditional way). For example, shifting selected capital and consumption goods currently included in the "market" sector into the household sector might make sense conceptually. However, creating an alternative national account that includes a broadly inclusive household satellite would require some shifting of the way goods and services are categorized. Satellite accounts do allow for flexibility: one can add to and rearrange the structure of the existing accounts to show what an expanded, redesigned, and integrated account would look like (see, for example, Landefeld and McCulla, 2000).

Economic logic—and specifically the idea that there is a household production function—suggests that household capital and raw materials should be treated as intermediate rather than final consumption. Money spent on food, cleaning supplies, and household appliances all are counted as part of personal (final) consumption but are also inputs to household production. Similar examples arise in the health, education, and environmental cases. But, in most cases the panel is exploring, the accounts do not reflect the full range of inputs used in the production of the output of interest. And in no case is the value of the resulting output, whether goods and services produced for current consumption or the creation of a productive asset, measured fully and independently of the value of the inputs used in its production.

THE INPUTS/OUTPUTS PUZZLE

Virtues of the Double-Entry Bookkeeping Approach

One of the strengths of the core accounts is the double-entry bookkeeping used in their construction. Independent estimates of total (marketed) output are developed on the

basis of the dollar value of output sales, on one hand, and the dollar value of payments to factors of production, on the other. At least in principle, these two sums should be equal. If the output estimated using product-side data differs significantly from the output estimated using income-side data, it is a signal that something has gone awry.

Things are more complicated in the nonmarket context. Absent market transactions, one cannot simply add up money spent on goods and services and money flowing to factors of production to yield product-side and income-side estimates of the value of output. And in contrast to the market environment, there is no strong reason to believe that inputs will be allocated to equate value marginal products across different uses. An estimate of the output from a nonmarket activity based on the value of the inputs employed in that activity may either overstate or understate the output’s true value. In a competitive market, one can expect that an inefficient firm—a firm at which the value of the resources employed exceeds the value of the output produced—eventually will be driven out of business. An inefficient household, however, may continue to exist so long as its members remain alive. Valuing such a household’s output using information on input quantities and prices thus could overstate the value of its output. On the other hand, capital market constraints, such as might arise from lenders’ reluctance to finance the production of assets that cannot be marketed and therefore cannot readily serve as loan collateral, may lead to underinvestment in certain nonmarket activities. Capital market constraints may, for example, lead to underinvestment in education which, in turn, would imply that the marginal value of time devoted to education may exceed the marginal value of comparable time devoted to other uses. Valuing educational output based on the costs of the inputs employed thus could lead to a figure far below the true value of the asset produced.

Though the sum of the values of the inputs used to produce a nonmarket output may provide a poor estimate of the value of that output, this has commonly been the practice for measuring some areas of nonmarket production. It is, for example, by far the most common approach in the literature on the value of government services or of home production (see National Research Council, 1998, on the former, and Holloway et al., 2002, on the latter). If they can be accurately measured as they relate to production, input-based output valuations are a clear improvement over ignoring nonmarket activity altogether. Only with an independent measure of the value of nonmarket output, however, can one hope to address many of the questions for which nonmarket accounts could be most valuable.

Additionally, for some accounts, it may be reasonable to lift the requirement that input and output sides must balance—it is certainly possible to envision certain nonmarket activities leading to a “social profit.”6 In contrast to the core market accounts, double-entry bookkeeping in the sense of trying to reconcile sums of output-based values and input-based values for the nonmarket accounts may be a fruitless exercise.7 The

panel nonetheless believes it to be worthwhile to preserve, at least as a goal, a double-entry structure for these accounts. Having independent estimates of the value of the output produced and the value (at market or quasimarket prices) of the inputs used in production allows one to identify shortfalls or surpluses in the returns to those inputs in different nonmarket activities. Independent measurement of the value of the output produced, as distinct from the inputs employed in production, is also essential to analyses of productivity and economic efficiency.

Ideally, then, both inputs and outputs to nonmarket production would be tracked. It is clear, though, that for some areas (e.g., household production), input and output measurement will not develop in tandem. Advances in the collection of time-use data will move work forward in terms of identifying and measuring productive inputs, and it might even provide information about outputs.

In sum, the panel believes there to be a strong argument for adapting the double-entry bookkeeping that characterizes the existing national accounts for use in any supplemental accounts relating to nonmarket activity, even though such double-entry bookkeeping generally will not serve the exactly same role in the supplemental accounts as it does in the core accounts.

Monetary versus Nonmonetary Units of Measurement

One question that has been debated in the nonmarket accounting literature, particularly abroad, is whether the development of supplemental accounts should be structured around the reporting of physical measurements (or other quantity indicators) or whether the goal should be to report input and output values denominated in monetary units. This question has obvious links to the question of whether supplemental accounts should be designed as a system of multiple indicators for the areas they cover or whether they should be designed to include a summary measure of output for each area.

In the market sector, monetary aggregates generally are the most accessible measures of the level of activity—dollar values of sales, dollars paid as wages and salaries, and so on—and measuring quantities often is more difficult. By definition, however, nonmarket activity does not involve monetary transactions. This means that data on monetary aggregates that form the building blocks for traditional national income accounting are simply not available. Instead, available data may consist of physical or other quantity indicators of the level of activity, such as hours of time devoted to home production, student-years of education provided, or ambient concentrations of various air pollutants.

On one side are those who argue strongly that no nonarbitrary way exists for assigning monetary values to a heterogeneous set of nonmarket inputs or outputs, and that any such assignment unavoidably will reflect value judgments that are inappropriate for a statistical agency (see, e.g., van de Ven et al., 1999, p. 8). The counterposition holds that, without an attempt to assign monetary values to the quantity indicators that are the basic unit of measurement for nonmarket outputs, it will be difficult for policymakers to digest and use the information. Policymakers will want to assign monetary values: rather than pretending this will not happen, it is incumbent on specialists to provide the best possible methods for the inevitable calculations. Another argument for attempting to assign monetary values to quantity indicators is that the effort filters out indicators that may be of minor economic importance. One problem with purely physical accounting systems is

that, useful as they may be for some research topics, they tend to be encyclopedic and difficult to comprehend.

It is the panel’s view that, to the maximum extent possible, nonmarket inputs and outputs should be valued in dollar terms. The usefulness of this conclusion depends on the extent and accuracy with which monetary values can ultimately be assigned to the inputs and outputs in question. In order that such assignments be as objective as possible, the panel favors basing these valuations wherever possible on information derived from the terms of observable market transactions or their analogues. And, even when it is difficult to base valuations on market transactions, it is important that valuation methods be, in principle, reproducible by independent observers. This judgment notwithstanding, the panel recognizes the difficulty of finding clear market substitutes for certain goods and services and of estimating the ways in which market values may deviate from social welfare because of externalities and other market imperfections. The panel will likely place higher priority on areas of nonmarket accounting for which valuation can draw from market comparisons.

Classifying Goods and Services

As noted above, a key feature of the underlying framework of the national accounts is that the aggregated cost of inputs can be checked against the aggregated price of outputs. In some cases this classification is relatively clear-cut (steel input into an automobile output); in other cases (textbooks), it is not. Several efforts to modify or otherwise expand the national accounts have originated from the belief that supposed misclassifications in the present accounts give a false impression of economic activity. For example, several commentators have argued that at least some portion of governmental activity should be properly treated as an input to business (e.g., protection and inspection services) rather than an output of the economy, as is current practice.8 Similarly, commuting costs and other work-related consumer expenditures could be viewed as purchasing inputs to productive activity rather than as purchsing output. Even if there is agreement that a particular entry does contribute to the economy’s final output, ample room exists for debate about whether the output is more properly classified as investment than as consumption. Researchers at BEA have recognized this issue and changed the way they classify some things: for instance, BEA (and the SNAs) now recognize computer software as investment rather than as an intermediate expense.

As with market accounts, goods and services must be systematically classified in order for a double-entry approach to work and to make the accounts useful for certain types of analyses (e.g., productivity and efficiency). Classification is not always easy in market-oriented activities (consider banking, for example), much less nonmarket ones. Defining and measuring output is perhaps the central issue in economic measurement, not just nonmarket accounting and, as such, represents the most important research area in the field.

A related question is how to count public goods and externalities in nonmarket accountts.9 Some externalities are captured, often indirectly, in the core accounts—as in the example of pollution generated by an industrial firm leading to a reduction in agricultural production. Conceptually, externalities should also be included in nonmarket accounts, as such factors affect that which we are trying to measure, whether it is described as output or welfare. Externalities often flow across the market-nonmarket border, however, creating difficult measurement and data issues. It may be necessary for appropriate accounting of environmental externalities to remove from consumption certain purchases of goods whose only purpose is to defend against such externalities. As desirable as this may appear (after all, why should such defensive outlays be added to the body of more desired goods and services?), to do so raises troublesome problems regarding the classification of “final” as opposed to intermediate input goods.10 The problem is that nearly all “final” expenditures can be interpreted as “defending” against something and thus be reclassified as inputs. As Jaszi wrote, “…food expenditures defend against cold and rain,…medical expenditures defend against sickness, and religious outlays against the fires of hell.” (Jaszi, 1973, p. ). Indeed, one could imagine a simple economy without investment or governmental activity in which labor is viewed as the “output” of the household sector and consumption the “input.” Under such a view, there would be no final expenditures, no consolidated account, and none of the usual, well-known account aggregates such as gross domestic product (GDP). Similarly, in a more complex economy if all “final” expenditures were interpreted as “defending” against something, there would be no GDP.

Jaszi’s observation serves to highlight the extent of the problem—that there is no clear conceptual distinction between intermediate and final consumption from the standpoint of all potential uses—but it does not provide a clear solution.11 In view of the above arguments, it clearly is not useful to declare all consumption as “intermediate.” But simply following tradition and its often arbitrary distinctions (e.g., a refrigerator installed in a home is a consumption good; installed in a supermarket, it is an investment good) is particularly unsatisfactory in the effort to expand the accounts to include coverage of nonmarket externalities.

One possible approach, for the environment example, might be to exclude from consumption totals those outlays whose purpose is to defend against environmental damage. In practice, however, it may not be possible to make this adjustment since it is

often difficult to determine the ultimate purpose of any particular consumption item. A crucial problem is jointness of purpose: an air conditioner may defend against air pollution, but it also cools the home.

Measuring Quantities

Dollar values are relatively easy to obtain for the market inputs to nonmarket production. If one wants quantity indexes for these market inputs, they can be constructed by using appropriate price indexes as deflators for the nominal expenditure data. In contrast, for both nonmarket inputs and nonmarket outputs, quantity measurement will often be a necessary first step in the development of monetary valuations.

Even in the case of market inputs, complications arise. Purchases of capital equipment by households, for example, are treated in the core accounts as purchases for final consumption. But measuring the inputs to household production requires a measure of the stock of consumer durables. To create such a stock estimate, one must combine information on spending for such items over time with information on the useful life of dishwashers, refrigerators, vacuum cleaners, washing machines, and other capital equipment used in home production. Although there are practical difficulties that complicate estimation of the stock of capital equipment used in home production, the basic approach is well developed.12

An especially important nonmarket input on which, until very recently, quantity data have been lacking is the time devoted to nonmarket production. Fortunately, the American Time Use Survey (ATUS), launched at the start of 2003 by the Bureau of Labor Statistics, should go a long way towards filling this gap.13

The ease with which the quantity of nonmarket outputs can be measured varies widely. Relatively good data are available, for example, on the educational attainment of the working-age population, which provide a starting point for quantifying the output of the educational sector. Changes in mortality rates are similarly well documented and may provide a basis for quantifying changes in the health status of the population. In other cases, considerable creativity may be required to measure the quantities of nonmarket outputs, and doing an adequate job ultimately may require the collection of new data. Tracking air quality would require better measures of the pollutants to which the public is exposed and of the costs they impose. To track the output (narrowly defined) of the household sector, for example, one would need data on such things as meals prepared or loads of laundry washed and dried.14 But at least in principle, it is possible to see how this task might be approached.

For much nonmarket activity, measuring the output side accurately is a bit more speculative. Data and methodological advances will continue to improve measurement of

|

12 |

This is a case for which the BEA already maintains the desired data series, albeit not as a part of the core accounts. |

|

13 |

The ATUS is described in some detail on the BLS website: http://www.bls.gov/tus/home.htm [7 April 2003]. |

|

14 |

More thought needs to be given to what productivity measures mean when they are based on market substitute valuations. In the absence of direct measures of the output of nonmarket activities, one might impute them from observed market activities; but in such cases, productivity measures for nonmarket activities may simply recover the imputation scheme. |

nonmarket outputs. For household production, one approach might be to state assumptions for the underlying production functions that allow the value of this output to be assigned to capital, raw materials, and labor.15 Assuming any linear homogenous production function with constant returns to scale—a Cobb-Douglas production function would be an example—the cost of household capital and raw materials used up can be subtracted from the value of output, and the remainder of the value assigned to labor. Taking the example of laundry, a labor input-based method tallies the number of hours devoted to laundry and multiplies these by a market-determined wage, either the cost of hiring a domestic servant to do laundry or the opportunity cost or predicted market wage of the person doing the laundry (these methods are discussed in the next section). An output-based method calculates the total amount of laundry done, estimates what it would cost to have it done commercially, and assigns that value to the household. This value is assumed to be the product of household capital (a washing machine and dryer), raw materials (electricity, soap) and labor hours.

The output-based component of the accounts recognizes the importance of technology, which the input-based approach does not. A simple example illustrates the problem: household 1 has a washing machine and dryer and spends 1 hour doing laundry; household 2 does not have a washer and dryer and requires 2 hours. A time input-based calculation would conclude that, in comparison with household 1, household 2 produces twice as much output in the form of laundry services, which is incorrect. The output-based calculation recognizes that the nonmarket work time is more productive when combined with greater household capital, which is more consistent with the assumptions typically made regarding valuation of market output.

Marginal Versus Total Valuations

Attaching dollar values to nonmarket inputs and outputs, as the panel favors, leads to additional questions. Key among them is the issue of whether output valuation should always reflect marginal valuations or whether total valuations might sometimes be defensible.

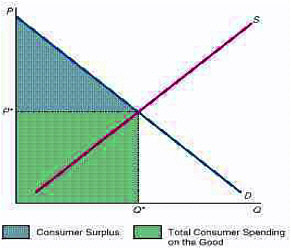

In the case of a product or service sold in a competitive market, the price is set at a value that equates the cost of producing and the value of consuming the marginal unit of output. In a standard supply-and-demand diagram, shown in Figure 3-1, a value of p* is assigned to each of the Q* units of output, for a total market valuation represented by the dark-shaded rectangle. The total value to the consuming public of these Q* units of output, however, is the larger, total shaded, area. The difference between these two areas, the blue triangle, is the consumer surplus associated with the consumption of Q* units of the product or service in question at a price p*.

FIGURE 3-1

The panel proposes that, insofar as possible, output should be valued on the basis of the value of the last (marginal) unit of output produced. In other words, valuing nonmarket output should be based on the market price at which it could be sold, were it possible to develop a market for the output in question. This preference particularly applies to any accounts that are ultimately intended to be a component of a new version of GDP that more broadly captures nonmarket activity. This proposal is tentative: the panel may reconsider if it finds areas in which pushing too hard in this direction creates unacceptable measurement errors or has little policy value. As noted above, the panel may be willing to sacrifice some consistency and the ability to integrate some sectors, especially in the early stage of developing nonmarket accounts, if so doing produces useful results for policy.

One reason for preferring a marginal valuation approach—which means excluding the consumer surplus associated with output—is that it would make the resulting satellite accounts more comparable with the core national accounts, and more amenable to a double-entry accounting framework, the advantages of which have been noted. Additionally, allowing for inclusion of consumer surplus also raises what Nordhaus (2002, p.15) calls the “zero problem,” illustrated by the following example:

…if we introduce the consumer surplus of water consumption, then we need to integrate the marginal surpluses between some “zero” level and current output… . Is it literally zero water (in which case consumer surplus is essentially infinite)? Or is the level in pre-industrial times? If the latter, should pre-industrial times relate to the 1700s, when water in the U.S. was plentiful? Or to the time when humans first crossed the Siberian peninsula, when ice cubes were plentiful but water was scarce? Moreover, if we pursue consumer surplus in too many areas with relatively low “zeroes,” we will undoubtedly find ourselves with multiple infinities of output and income.

The case for marginal valuation is not open and shut, however, and the panel acknowledges the tradeoffs inherent in this choice. While total value estimates would

introduce a harsh inconsistency to the accounting framework, they can be extremely useful for policy analysis. For many applications, such as assessing the economic efficiency of potential policies, it may be the total value—or the change in the total value—of a nonmarket output that one would like to know. Cost-benefit analyses of increased subsidies to higher education or increased pollution control expenditure, for example, rest on an estimate of the total return the increased spending would produce. For these purposes, one does not want estimates devoid of consumer (or producer) surplus.16 Similarly, one can envision a version of the health accounts designed to capture consumer surplus. In other sectors, such as national defense, which is now valued at cost, it may not even be possible to calculate a meaningful marginal value.

This line of reasoning does not mean that the national accounts (even an experimental version) is the appropriate place for developing “total value” data; and this has implications for discussion of the policy uses of satellite accounts. If one accepts that, at least as a long run goal, it is undesirable to introduce inframarginal valuations into the accounts, it becomes clear that nonmarket accounts are not a substitute for the data required in benefit-cost analyses. In initiating development of nonmarket accounts, however, there is a practical motive for flexible thinking. An emphasis on the “management” role of accounting data, at least in areas for which it is difficult to estimate marginal valuation, may allow for higher degrees of “impurity” in the accounting effort.17 Given the cost of data development and the scarcity of resources for such purposes, any practical nonmarketing accounting effort will have to face compromises. For example, it may be almost impossible to generate marginal valuation estimates of pollution and environmental services. Virtually all the valuation techniques in the literature generate estimates that include consumer surplus. Acknowledging the management role implicitly demonstrates that the panel places value on the nonmarket accounting effort, as well as on the accounts themselves. Nonmarket accounting deserves support even if the likelihood of quickly generating a complete and consistent set of accounts appears slim.

Valuation in the Absence of Markets

In many cases (though not all) pricing the inputs to nonmarket production is an easier task than pricing the resulting output. Some inputs are marketed inputs; as already noted, it should be relatively straightforward to assign these a dollar value.

Valuing nonmarket inputs raises different issues. Consider, for example, the valuation of unpaid time devoted to nonmarket production. One possible approach is to value nonmarket time at the opportunity cost of the person performing the nonmarket activity. Alternatively, this time might be valued at market substitute prices—the wage that would be paid to a person hired to perform the task in question.

Appropriate choices may vary with circumstance. For some types of household activities, researchers have favored valuing the time devoted to production at the market wage that would be paid to someone hired to perform the work in question. In contrast, time devoted to investment in education generally has been valued at the opportunity cost of the person in whom the investment is being made. But there are many (thoughtfully rationalized) inconsistencies in the literature. For example, one might assume that the time of a college-educated person who chooses to prepare a meal rather than hiring the job out is no more valuable than the time spent by a high school drop for the same task; in this case, the market replacement valuation may be appropriate. In contrast, a parent with a college education may very likely do a better job of developing a child's verbal skills or helping with algebra homework; in this case, the opportunity cost approach could be justified. In either case, however, there is a market wage—whether the (actual or imputed) wage that could be earned by the person performing a nonmarket task or the wage paid to workers who perform similar tasks—to which one can appeal in valuing the time input.

Valuing nonmarket outputs often will be more difficult. A guiding principle might be to treat nonmarket goods and services as if they were produced and consumed in markets. Under this convention, the prices of nonmarket goods and services would be imputed; thus, the easiest cases would be those in which a nonmarket output has a clear market counterpart. Many youth sports organizations, for example, are operated largely by volunteers. Although a fee may be charged for participation in the activity, that fee cannot be viewed as a market price. But there are also private firms that offer opportunities for children to participate in similar recreational activities that do charge a market-determined price. Given information on the relevant output quantities—for example, numbers of children participating in a nonprofit youth sports organization’s various recreational programs—the price charged for participating in similar activities offered by private firms could be used in valuing the nonprofit organization’s output.

The problem, then, may be less acute for near-market goods, such as owner-occupied housing, home-grown produce, and house cleaning, that follow the “third party rule”—that someone else could produce the good or service just as well as the consuming unit (Nordhaus, 2002, p. 7). “Leisure” is an example of a good that does not follow the third party rule: no one can produce leisure for the person who consumes it. For such personal goods, estimating a value is extremely difficult and would be very controversial.

Even for the near-market cases, many goods exist for which the degree of replacement comparability—and, hence, substitutability—is not at all clear. More difficult yet are the cases for which a nonmarket good is an asset that has no direct market counterpart and is never sold. A possible approach in these cases may be to use market prices to value the stream of output produced by the asset over time and then to treat the present value of the returns as a measure of the asset’s value. This approach has a clear grounding in the standard theory that underlies the valuation of marketable capital assets and is the approach taken, for example, by Fraumeni and Jorgenson (1989, 1992) in their work on the valuation of investments in human capital. They begin by calculating the increments to earnings associated with successive increments to education. The present value of the earnings increments, cumulated over a person’s productive lifetime (and assuming that education enhances the value of market and nonmarket time equally), then is used as a measure of the value of the incremental investment in human capital.

An additional layer of complexity is introduced in the case of nonmarketed assets that yield a flow of nonmarketed services over time. Investments in health fall into this category, in that improved health increases not only expected years of labor market activity, and thus labor market earnings, but also the expected number of years available in which to enjoy all that makes life rewarding. Developing a market-based measure of the value of additional years of life that may flow from health care investments is more difficult than, for example, developing a market-based measure of the value of the earnings increment attributable to additional education. Labor market data have proven useful for this purpose. Specifically, the fact that different occupations are associated both with different risks of fatal injury and different relative wage rates has been exploited to derive estimates of the value of an additional year of life. Such measures are controversial. But, in comparison with conceivable alternatives, they have the advantage of being based on real-world decisions that yield observable market outcomes, and for that reason they have appeal.

Different approaches may be necessary for the case of nonmarket outputs that are public in nature, such as crime rates and air quality. Again, however, it may be possible to develop measures of the value of these outputs on the basis of market transactions. The levels of many, if not all, of these nonmarket outputs are likely to differ across localities. People presumably will be willing to pay more to live in communities with low crime rates and good air quality than in communities that lack these attributes. The value of such positive attributes are expected to be reflected in house prices. At least in principle, one could derive an estimate of the value of lower crime rates, better schools, or higher air quality from a hedonic model that relates house prices to these (and other) community characteristics.18

There are a number of areas for which market valuation, or even imputations based on nonmarket analogues, are simply unavailable and impossible to obtain. Examples of these might include some aspects of social capital, such as family stability; the affect of terrorism on the population’s sense of well-being; or the “existence” and “legacy” values of national monuments, such as the Grand Canyon. In these cases, valuation must rely on weaker arguments. The panel urges that attention be directed first to those areas where the most defensible, market-based approaches to valuation are possible.