Benefits and Costs of an Opposition Process1

Jonathan Levin

Stanford University

Richard Levin

Yale University

ABSTRACT

In recent years, patent protection has extended into new areas, giving rise to serious concern about the lack of clear guidelines for patentability. We analyze the effect of introducing a patent opposition process that would allow patent validity to be challenged directly after a patent is granted. In many cases, such a system would avoid costly litigation at a later date. In other cases, the opposition process would increase the cost of conflict resolution but would also reward holders of valid patents and limit the rewards for invalid patents. Our analysis suggests significant positive welfare gains from the introduction of a patent opposition process.

INTRODUCTION

In just over two decades, a succession of legislative and executive actions has served to substantially strengthen the rights of patentholders.2 At the same

time, the number of patents issued in the United States has nearly tripled from 66,290 in 1980 to 184,172 in 2001. Although the surge in patenting has been widely distributed across technologies and industries, decisions by the U.S. Patent and Trademark Office and the courts have expanded patent rights into three important areas of technology in which previously the patentability of innovations was presumed dubious: genetics, software, and business methods.3 As in other areas of innovation, patents in these fields must meet standards of usefulness, novelty, and nonobviousness. A serious concern, however, in newly emerging areas of technology is that patent examiners may lack the expertise to assess the novelty or nonobviousness of inventions, leading to a large number of patents likely to be invalidated on closer scrutiny by the courts.

Although similar examples could be drawn from the early years of biotechnology and software patenting, economists in particular will appreciate that many recently granted patents on business methods fail to meet a commonsense test for novelty and nonobviousness. Presumably, this occurs because the relevant prior art is unfamiliar to patent examiners trained in science and engineering. Consider U.S. Patent No. 5,822,736, which claims as an invention the act of classifying products in terms of their price sensitivities and charging higher markups for products with low price sensitivity rather than a constant markup for all products. The prior art most relevant to judging the novelty of this application is neither documented in earlier patents nor found in the scientific and technical literature normally consulted by patent examiners. Instead, it is found in textbooks on imperfect competition, public utility pricing, or optimal taxation.

The almost certain unenforceability of this particular business method patent may render it of limited economic value, but other debatable patents have already been employed to exclude potential entrants or extract royalties. A much publicized example is Jay Walker’s patent (U.S. Patent No. 5,794,207) covering the price-matching system used by Priceline.com. After several years of legal wrangling, Microsoft Expedia agreed to pay royalties for allegedly infringing on this patent. Many economists, however, would object that Walker’s patent covers only a slight variation on procurement mechanisms that have been used for hundreds if not thousands of years. Interestingly, in terms of prior art, Walker’s patent application cites several previous patents but not a single book or academic article on auctions, procurement, or market exchange mechanisms.

If challenged in court, a patent on the “inverse elasticity rule” would likely be invalidated for failing to meet the test of novelty or nonobviousness. The Walker patent, a closer call, also might not survive such scrutiny. Current U.S. law, however, permits third-party challenges only under very limited circum

stances. An administrative procedure, re-examination, is available to third parties who seek to invalidate a patentee’s claim by identifying prior art, in the form of an earlier patent or publication, that discloses the precise subject matter of the claimed invention.4 In practice, however, re-examination is used primarily by patentees to amend their claims after becoming aware of uncited prior art.

Broader objections to a patent’s validity can be adjudicated only in response to a patentholder’s attempts to enforce rights against an alleged infringer. In response to an infringement suit, the alleged infringer may file a counterclaim of invalidity. In response to a “desist or pay” letter, the alleged infringer may seek a declaratory judgment to invalidate the patent. Generally speaking, such proceedings are very expensive and time consuming. A recent survey estimated the median cost of a litigated patent infringement suit at $1.5 million in cases involving stakes of $1 million to $25 million; when the stakes exceed $25 million, the median cost of a suit was estimated to be $3 million (American Intellectual Property Law Association, 2001). A typical infringement suit might take 2 to 5 years from initial filing to final resolution.

What are the costs of uncertainty surrounding patent validity in areas of emerging technology? First, uncertainty may induce a considerable volume of costly litigation. Second, in the absence of litigation, the holders of dubious patents may be unjustly enriched and the entry of competitive products and services that would enhance consumer welfare may be deterred. Third, uncertainty about what is patentable in an emerging technology may discourage investment in innovation and product development until the courts clarify the law, or, in the alternative, inventors may choose to incur the cost of product development only to abandon the market years later when their technology is deemed to infringe. In sum, one suspects a timelier and more efficient method of establishing ground rules for patent validity could benefit innovators, followers, and consumers alike.

One recently suggested remedy is to expand the rights of third parties to challenge the validity of a patent in a low-cost administrative procedure before sinking costly investments in the development of a potentially infringing product, process, or service (see Merges, 1999 and Levin, 2002). Instead of the current re-examination procedure, which allows post-grant challenges only on very narrow grounds, the United States might adopt an opposition procedure more akin to that practiced in Europe, where patents may be challenged on grounds of failing to meet any of the relevant standards: novelty, nonobviousness, utility, written description, or enablement. The European system requires only minimal expenditure by the parties. When interviewed, senior representatives of the European Patent Office estimated expenditures by each party at less than $100,000. The

time required for adjudication, however, is extremely long, nearly 3 years, owing to very generous deadlines for filing of claims, counterclaims, and rebuttals.5

The idea of a streamlined, efficient U.S. administrative procedure for challenges to patent validity is clearly gaining momentum in the response to mounting concern about the quality of patents in new technology areas. In its recently released 21st Century Strategic Plan, the U.S. Patent and Trademark Office stated as one of its intended actions: “Make patents more reliable by proposing amendments to patent laws to improve a [sic] post-grant review of patents” (U.S. Patent and Trademark Office, 2002).6

This chapter makes a modest attempt to evaluate the potential costs and benefits of introducing such a post-grant opposition process. In the next two sections, we develop a simple model of patent enforcement and patent oppositions. We model patent oppositions as essentially a cheaper and earlier way to obtain a ruling on patent validity. The one further difference between patent opposition and litigation captured by the model is that patent oppositions can be generated by potential infringers, whereas litigation must be initiated or triggered by the patentholder. The analysis divides naturally into two cases: one case in which the potentially infringing use of the patent is rivalrous (i.e., it competes directly with the patentee’s product) and one case in which the uses are nonrivalrous (i.e., independent or complementary). The key difference between these cases is that in the former the patentholder wants to deter entry whereas in the latter the patentholder simply wants to negotiate for a large licensing fee.

We identify several effects of introducing an opposition process. First, if the parties foresee costly litigation in the absence of an opposition, they have a clear incentive to use the cheaper opposition process to resolve their dispute. This lowers legal costs and potentially prevents wasteful expenditure on product development. At the same time, giving the parties a lower-cost method of resolving disputes can lead to oppositions in cases when the entering firm might either have refrained from development or been able to negotiate a license without litigation. These new oppositions have a welfare cost in that the firms incur deadweight costs from preparing their opposition suits. Nevertheless, these oppositions generate potential benefits. They can prevent unwarranted patents from resulting in monopoly profits, and, more broadly, if decisions under the opposition process are more informed than those made directly by the patent examiners, the rewards to patentholders end up more closely aligned with the true novelty and non-

obviousness of their invention. From a dynamic welfare standpoint, this has the favorable effect of providing more accurate rewards for innovation.

The model suggests that in some cases, introducing an opposition process will have an unambiguous welfare benefit, whereas in other cases there will be a trade-off between static welfare costs and static and dynamic welfare benefits. In the fourth section of this chapter, we use available information on the cost of litigation and plausible parameters for market size and the cost of development to provide a rough quantitative sense of the welfare effects. Our general conclusion is that the costs of introducing an opposition system are likely to be small in relation to the potential benefits.

The fifth section concludes with a discussion of some aspects of the opposition process not captured in our simple modeling approach. The model provides a reasonable assessment of how an opposition system affects the gains and losses realized by a single inventor, a single potential infringer, and their respective customers. It ignores, however, substantial positive externalities from greater certainty and more timely information about the likely validity of patents that would flow to other parties contemplating innovation and entry in a new technology area. In this respect, our analytic and quantitative findings probably understate the full social benefit of introducing a low-cost, timely system for challenging patent validity.

A MODEL OF PATENT ENFORCEMENT

We start by developing a simple benchmark model from which we can investigate the effect of an opposition process. There are two firms. Firm A has a newly patented innovation, and Firm B would like to develop a product that appears to infringe on A’s patent. The dilemma is that the legitimacy of A’s patent is uncertain. In the event of litigation, B may be able to argue convincingly that part or all of the patent should be voided.

The interaction between the firms unfolds as follows. Initially, Firm B must decide whether to develop its technology into a viable product. Let k denote the costs of development. If B does not develop, A will be the monopoly user of its technology. If B does develop, it can enter negotiations to license A’s technology. If negotiations are successful, B pays a licensing fee (the precise amount will be determined by bargaining) and both parties use the technology. If B does not obtain a license, it may still introduce its product. In this event, A can either allow B to market its product unhindered or file suit to enforce its intellectual property rights. If A files suit, the parties enter litigation.

We adopt a simple formulation for thinking about litigation. In litigation, each party incurs a cost L to prepare its case. At trial, the court assesses the validity of A’s patent and whether B’s patent infringes upon it. We focus on the determination of validity, because this is the aspect of patent disputes for which an opposition process has relevance. Let pA and pB denote the subjective prob

abilities that Firms A and B assign to the court upholding the patent and let p denote the true objective probability of validity. We assume that the firms’ subjective probabilities (but not the true objective probability) are commonly known, although not necessarily equal.7

If the court invalidates the relevant parts of Firm A’s patent, B is free to market its product. In contrast, if the patent is upheld, A has the option of excluding B from the market. Firm B may try again to negotiate a license, but if it fails A proceeds to market alone.

The firms’ profits depend on whether B’s product reaches the market and whether they incur litigation costs. Let πA|B and πA denote the gross profits that A will realize if B’s product does or does not reach the market, respectively. Let πB denote the gross profits that B’s product will generate. In making decisions, the firms must factor in these eventual profits as well as development costs, litigation costs, and licensing fees in the event of a licensing agreement.

We model licensing negotiations, both before and after litigation, by using the Nash bargaining solution. This means that if there are perceived gains to licensing, each party captures its perceived payoff in the absence of a license and the additional surplus generated by the agreement is divided equally.

The timing of the benchmark model is displayed in Figure 1. After development, the firms can negotiate a license. If this fails, B must make a decision about whether to enter and A can respond by litigating. If there is litigation, the court rules on the patent’s validity, at which point the parties have another opportunity to negotiate a license.

In thinking about this benchmark situation and the effects of an opposition process, we have found it useful to distinguish two prototypical situations. In the first, which we refer to as the case of nonrivalrous innovation, the firms have a joint interest in bringing Firm B’s product to market. This is the situation, for instance, when Firm A’s patent covers a research tool or perhaps a component of a product that B can produce at lower cost than A. In the second case, rivalrous innovation, Firm B’s product will compete directly with A’s product and the introduction of B’s product will decrease joint profits through intensified competition. Think, for instance, of A as a drug company and B as a rival with a closely related therapeutic.

We analyze these situations separately for a simple reason. When innovations are nonrivalrous, litigation and opposition hearings will not bar entry. They

serve only to affect the terms of licensing agreements. In contrast, with rivalrous innovation, litigation is an instrument for Firm A to defend its monopoly status. In this regard, we assume that antitrust law precludes A from paying B not to enter or from designing a licensing agreement that manipulates future competition.8 Thus if A’s patent rights are upheld, it denies its rival access to the market. Changing the method for resolving disputes from litigation to an opposition may substantively affect what products eventually reach market.

Nonrivalrous Innovation

We start by considering nonrivalrous innovation. To focus attention on this case, we make the following parametric assumption, which is sufficient to ensure that introducing Firm B’s product generates a joint gain for the two firms.

Assumption NR πA|B + πB − 2k ≥ πA.

In fact, this assumption is slightly stronger than is needed to ensure non-rivalry. A weaker condition would be that πA|B + πB − k ≥ πA. The stronger condition has the benefit of guaranteeing that Firm B will have a sufficient incentive to develop its product before negotiating a license, rather than needing to seek a license before development. Because the effect of an opposition proceeding turns out to be essentially the same in this latter case, we omit it for the sake of clarity.9

To analyze the model, we work backward. First, we describe what happens if the parties wind up in litigation. We then consider whether litigation will occur or whether B will negotiate a license or simply enter with impunity. Finally, we consider B’s incentives to develop its product.

Outcomes of Litigation

Suppose that Firm B introduces its product without a license and Firm A pursues litigation. Two outcomes can result. If the court voids the relevant sections of A’s patent, B can enter without paying for a license. If the court upholds A’s patent, B must seek a license. Because the products are nonrivalrous, there is a gain πA|B + πB − πA > 0 to be realized from an agreement. Development costs do not appear in the calculation of the gain from introducing B’s product because

they have already been sunk. Nash bargaining means that this gain is split equally through a licensing fee FV:

Here we use the subscript V to refer to bargaining under the presumption that A’s patent is valid.

Factoring in these two possible outcomes of litigation, we can calculate the (subjective) expected payoffs to the two firms upon entering litigation. These are πA|B − L + pAFV for Firm A and πB − k − L − pBFV for Firm B.

Determinants of Litigation

We now back up and ask what will happen if Firm B develops its technology.

The first question is whether A has a credible threat to litigate if B attempts to market its product without a license. Because A’s subjective gains from litigation are pAFV − L, it will want to pursue litigation only if

pAFV − L ≥ 0. (A)

If this inequality fails, Firm A has a weak patent—the benefit of enforcing it is smaller than the litigation costs. If A’s patent is weak, Firm B can simply ignore it and enter without fear of reprisal. Indeed, even if an opposition system is in place, B would never want to use it because A’s patent is already of no meaningful consequence. This makes the weak patent case relatively uninteresting from our perspective. For this reason, we assume from here on that A’s patent is not weak.

Given that Firm A has a credible threat to litigate, we now ask whether litigation will actually occur. The parties will end up in court if and only if the following two conditions are met:

πB − pBFV − L ≥ 0 (B)

and

(pA − pB)FV − 2L ≥ 0. (L)

The first condition says that Firm B would prefer to endure litigation than to withdraw its product. The second condition says that the two firms have a joint incentive to resolve the patent’s validity in court rather than reaching a licensing

agreement with validity unresolved. Note that this can only occur if the parties disagree about the probable outcome in court (i.e., if pA > pB). Moreover, it is more likely to occur if litigation costs are small relative to the value generated by B’s product.

If either condition (B) or condition (L) fails, litigation will not occur. Rather, the parties will negotiate a license without resolving the patent’s validity. The specific license fee is determined by Nash bargaining with the parties splitting the surplus above their threat points should negotiations fail. If (B) fails, Firm B does not have a credible threat to litigate so Nash bargaining results in a licensing fee FV—in essence, the parties treat the patent as if it were valid. In contrast, if Firm B has a credible threat to litigate but there is no joint gain to licensing after litigating (i.e., (L) fails), the alternative to licensing is litigation. In this case, B will pay a somewhat lower fee, FU:

Here, the subscript U refers to bargaining under uncertainty about the validity of the patent. Intuitively, the licensing fee is lower when there is uncertainty about the patent’s validity.

Development

The last piece of the model is to show that Firm B has an incentive to develop its product regardless of whether it anticipates licensing or litigation. The worst outcome for B is that (B) fails and it is forced to pay a licensing cost FV. Even in this case, however,

So B still has an incentive to develop its product, a conclusion that follows directly from Assumption NR.

We can now summarize the benchmark outcomes when innovation is non-rivalrous.

Proposition 1 Suppose the innovation is nonrivalrous and that Firm A ’s patent is not weak. The possible outcomes are:

-

(Litigation) If both (B) and (L) hold, Firm B develops its product and there is litigation to determine patent validity. If the patent is upheld, Firm B pays FV for a license.

-

(Licensing without Litigation) If either (B) or (L) fails, Firm B develops and negotiates a license. The fee is either FU if (B) holds or FV if not.

The table below summarizes the (objective) payoffs to the two firms in each scenario.

|

|

A’s profit |

B’s profit |

|

Litigation |

πA|B + pFV − L |

πB − k − pFV − L |

|

Licensing |

πA|B + {FU, FV} |

πB − k − {FU, FV} |

Rivalrous Innovation

Next we consider the case of rivalrous innovation. To do this, we assume that introducing Firm B’s product reduces joint profits. The following assumption is sufficient to imply this.

Assumption R πA|B + πB/pA + 2L/pA < πA.

As in the previous section, this is slightly stronger than is needed. A weaker condition that would guarantee rivalry is that πA|B + πB − k < πA. The stronger condition implies that if Firm B chooses to enter, then not only will Firm A have an incentive to litigate (ruling out the weak patent case), it will not want to license just to avoid costly litigation. We rule out this latter situation in an effort to keep the model as simple as possible. Nevertheless, it can be worked out, and in such a circumstance the effect of an opposition process corresponds closely to the nonrivalrous environment described above.10

To analyze the possible outcomes, we again work backward. We first consider what would happen in the event of litigation, then ask whether litigation will occur if B develops, and finally consider the incentive to develop.

Outcomes of Litigation

If Firm B introduces its product and there is litigation, there are two possible outcomes. If the court voids the patent, B can market its product without paying any licensing fee. If the court upholds A’s patent, the rivalry of the products means that A will deny B a license. Thus the firms’ (subjective) profit expectations entering litigation are pAπA +(1 − pA) πA|B − L for Firm A and (1 − pB) πB − k − L for Firm B.

Determinants of Litigation

Now consider what would happen should B develop its product. If B attempts to introduce its product, Assumption R implies that A will certainly want to initiate litigation because:

pA(πA − πA|B) − L > 0. (A)

That is, Assumption R rules out the weak patent case where Firm A is not willing to defend its intellectual property rights.

At the same time, Firm B is willing to introduce its product and face litigation if and only if

(1 − pB)πB − L ≥ 0. (B)

If this inequality fails, the litigation cost outweighs B’s expected benefit from a product introduction. If it holds, B will introduce its product and the parties will end up in court. To see this, we note that under Assumption R, the sum of the perceived gains from litigation necessarily outweigh the litigation costs so long as (B) is satisfied. In particular, combining (B) and Assumption R shows that

pA(πA − πA|B) − pBπB − 2L ≥ 0, (L)

so there is a joint gain to litigation versus a licensing agreement.

Development

Finally, we consider Firm B’s incentive to develop. If B would not introduce a product it developed, it should certainly not develop the product. On the other hand, B’s subjective expected profits from litigation are greater than zero if

(1 − pB)πB − L − k ≥ 0. (E)

Importantly, whenever (E) holds, so will (B). That is, if B is willing to develop in expectation of litigation, it certainly wants to litigate having sunk the development costs. Intuitively, B is more likely to develop and endure litigation if litigation costs are relatively low, if A’s patent does not seem certain to be upheld, or if the potential profits from entry are large.

It is now easy to summarize the equilibrium outcomes.

Proposition 2 Suppose that B’s product is rivalrous. The possible outcomes are:

-

(Litigation) If (E) holds, Firm B will develop its product and there will be litigation. Firm B will enter if and only if Firm A’s patent is voided.

-

(Deterrence) If (E) fails, Firm B is deterred from developing by the threat of litigation.

The following table summarizes the firm’s expected payoffs in the two cases.

|

|

A’s profit |

B’s profit |

|

Litigation |

pπA + (1 − p) πA|B − L |

(1 − p)πB − k − L |

|

No Entry |

πA |

0 |

AN OPPOSITION PROCESS

In this section, we introduce an opposition process that allows for the validity of Firm A’s patent to be assessed immediately after the granting of the patent. Then, starting with the benchmark outcomes derived in the previous section, we examine the effect of allowing for opposition hearings.

With an opposition process, the timing proceeds as follows. After the grant of the patent, Firm B is given the opportunity to challenge Firm A’s patent. Before initiating a challenge, B can approach A and attempt to license its technology. If B does not obtain a license, it must decide whether to challenge. If B declines to challenge, everything unfolds exactly as in the earlier case—that is, B retains the option of developing and either licensing or facing litigation. On the other hand, if B initiates a challenge, the parties enter a formal opposition hearing.

We model the opposition proceeding essentially as a less expensive way of verifying patent validity than litigation. In an opposition proceeding, each firm incurs a cost C ≤ L to prepare its case. There are several reasons to believe that the costs of an opposition would be lower than litigation should the United States adopt an opposition process. First, an opposition hearing would be a relatively streamlined administrative procedure rather than a judicial process with all the associated costs of extensive discovery. Second, as noted above, the cost of an opposition in Europe is estimated by European Patent Office officials to be less than 10% of the cost of litigation. Although the crossover to the United States is imperfect, it suggests that an opposition procedure could be made relatively inexpensive if that were a desired goal.

Once the parties present their cases in an opposition hearing, an administrator rules on the patent’s validity. We assume that the firms assign the same subjective probabilities (pA and pB) to A’s patent being upheld in the opposition process as in litigation and also that the objective probability p is the same. Similarly, if A’s patent is upheld in the opposition, Firm B must obtain a license to market its product. (In particular, Firm A need not endure another round of costly litigation

to enforce its property rights against B.) Conversely, if the relevant parts of A’s patent are voided, B can develop and market its product without fear of reprisal.

Nonrivalrous Innovation

We now derive the equilibrium outcomes with an opposition process and contrast these to the benchmark outcomes without an opposition.

The first question is whether Firm B has any incentive to use the opposition process. If not, the change will have no effect. Assume as before that Firm A’s patent is not weak (in which case the patent could simply be ignored). Then Firm B has an incentive to use the opposition process if and only if

πB − k − pBFV − C ≥ ΠB. (BC)

Here ΠB denotes Firm B’s subjective expected payoff should it decline to challenge. That is, ΠB is the payoff derived for B in the previous section.

If Firm B has a credible threat to use the opposition process, an opposition proceeding will still only occur if the parties do not have a joint gain from negotiating a settlement. The sum of their subjective expected payoffs from an opposition hearing exceeds their joint payoff from licensing if and only if:

(pA − pB)FV − 2C ≥ 0. (C)

Note that this condition is precisely the same as that which characterizes whether there is a joint gain from litigation, except that the litigation cost L is replaced by the opposition cost C.

If both (BC) and (C) hold, the result is an opposition proceeding. If the patent is upheld, B will be forced to pay a fee FV for a license. On the other hand if (BC) holds but (C) does not, there will be licensing under uncertainty at a fee FU.

From here, it is easy to see that the effect of introducing the opposition process depends on the relevant no-opposition benchmark. If the result without an opposition process was litigation, then because the incentives to enter an opposition process are at least as strong as the incentives to enter litigation (because C ≤ L), the new outcome will be an opposition hearing. Importantly, because an opposition is less expensive than litigation, both firms benefit from the introduction of the opposition process.

In contrast, suppose that the result without an opposition process would be licensing at a fee of either FV or FU. In this case, simple calculations show that both (BC) and (C) may or may not hold. The new outcome depends on the exact parameters. One possibility with the opposition system in place is that there is no change. Another possibility is that Firm B goes from not having a credible threat to fight the patent’s validity in litigation to having a credible threat to launch an

opposition. In this event, the licensing fee drops from FV to FU. The last possibility is that an opposition proceeding occurs.

What is certain in all these cases is that Firm B’s expected payoff with the opposition proceeding is at least as high as without it. This should be intuitive. Introducing the opposition process gives Firm B an option—it can always decline to challenge and still get its old payoff. On the other hand, A’s expected payoff may increase or decrease. The case in which litigation costs decrease benefits A; the case in which licensing fees decrease hurts A. The case in which an opposition proceeding replaces licensing certainly hurts A if the earlier licensing fee would have been FV but could potentially benefit A if the licensing fee would have been FU.

In the simple static model we are looking at, the direct welfare effects are limited to the cost of conflict resolution and the change in licensing fees. An important point, however, is that the impact on A depends on whether its patent is valid. In particular, the opposition process tends to help A if its patent is valid and hurt it if its patent is invalid. Because the opposition process tends to more closely align the rewards to innovation with truly novel inventions, it seems clear that in a richer dynamic model in which A was to make decisions about R&D expenditures and patent filing, the opposition process would have an additional positive incentive effect. We argue in the next section that this effect might be fairly large in practice relative to the costs of oppositions.

The next result summarizes oppositions in the nonrivalrous case.

Proposition 3 Suppose that the products are nonrivalrous and that A’s patent is not weak. The introduction of a opposition process will have the following effects depending on the outcome in the benchmark case of no oppositions:

-

(Litigation) If the benchmark outcome was litigation, the outcome with an opposition process will be an opposition. Legal costs are reduced, and both firms benefit.

-

(Licensing) If the benchmark outcome was licensing, the outcome with an opposition process may be the same, licensing before development, or an opposition. Legal costs may be higher, but license fees will tend to go down for invalid patents and up for valid patents. The social welfare effects are ambiguous, because the deadweight loss from the opposition process is offset by the increased incentive to file valid patents.

Rivalrous Innovation

We now turn to the case of rivalrous innovation and again consider the effects of introducing the opposition process.

The first question again is whether Firm B has an incentive to make use of the opposition procedure. Firm B is willing to initiate an opposition if and only if:

(1 − pB)(πB − k) − C ≥ ΠB. (BC)

Again ΠB denotes Firm B’s subjective expected payoff in the absence of oppositions.

Unlike in the nonrivalrous case, (BC) is not just a necessary condition for an opposition proceeding to occur but also a sufficient condition. If (BC) holds, then Assumption R implies that the joint benefit from the opposition proceeding exceeds the costs. In particular, combining (BC) and Assumption R shows that:

pA(πB − πA|B) − pB(πB − k) − 2C ≥ 0,

so there is no gain from licensing rather than facing the opposition process. Thus if (BC) holds the new outcome is an opposition, whereas if it fails the outcome is unchanged from the no-opposition benchmark.

To see how the opposition process affects previous outcomes, imagine that the result without an opposition process was litigation. In this case, B was willing to face litigation for an opportunity to market its product so it will certainly be willing to ante up the opposition costs. By taking the opposition route rather than the litigation route, B can also avoid sinking the development cost k in the event that A’s patent is upheld rather than voided. It follows that the previous litigation over the validity of A’s patent will be replaced by opposition hearings.

In contrast, suppose the result without an opposition process was that Firm B chose not to enter. Now the introduction of oppositions may encourage B to initiate a challenge. B can enter if the challenge succeeds. From a welfare standpoint, this potential change has a cost, which is that both firms will have to spend opposition cost C on the challenge. It also has the benefit of increased competition. Although B’s entry will decrease industry profits, the increase in consumer surplus typically will exceed this loss. Thus the net welfare gain depends on whether the potential increase in market surplus is greater than 2C.

As in the nonrivalrous case, Firm B always gains from the introduction of the opposition process. Because it need not use the opposition option, it can certainly do no worse. Firm A’s situation is more complex. If it previously would have had to litigate, it benefits from the cheaper opposition process. If it previously would have been able to deter entry without litigation, it loses from having to pay the opposition costs and loses substantially if its patent, which would not have been litigated, is held invalid and its monopoly profits disappear.

Proposition 4 Suppose the products are rivalrous. Depending on the benchmark outcome, an opposition system has the following effects:

-

(Litigation) If the outcome without oppositions was litigation, the new outcome is an opposition hearing. This reduces dispute costs and saves on wasted development costs in the event of a valid patent.

-

(Deterrence) If the outcome without oppositions was deterred entry, the new outcome may be an opposition. If it is, dispute costs increase but Firm B is able to enter if the patent is invalid.

As in the nonrivalrous case, there is a potential dynamic welfare effect in addition to the static effects. The static welfare effects are limited to the cost of conflict resolution, the possible reduction in monopoly power, and the potential savings on wasted development. Dynamically, the opposition process also serves to reward valid patents and punish invalid patents. So, again, the better alignment of rewards with true innovation should tend to provide better incentives for R&D and patent filing decisions.

WELFARE EFFECTS OF AN OPPOSITION PROCESS

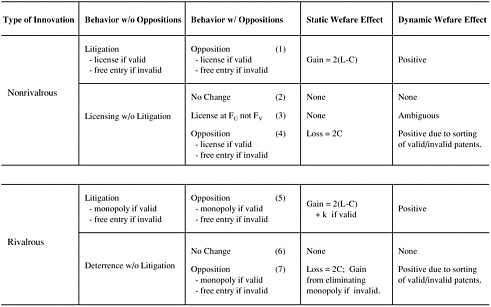

Figure 2 summarizes the welfare effects of introducing an opposition system. The first column distinguishes cases in which Firms A and B are nonrivalrous and rivalrous. The second column classifies the possible behaviors under a regime comparable to the current status quo. As the figure illustrates, there are four pos-

FIGURE 2 Welfare economics of patent oppositions.

sible outcomes: litigation and licensing without litigation in the nonrivalrous case and litigation and deterrence without litigation in the rivalrous case.

The third column of the figure indicates how behavior changes when Firm A’s patent is subject to challenge in an opposition proceeding. There are now seven possible outcomes, as described in the third section of this chapter, and columns four and five indicate the static welfare and dynamic incentive effects of each outcome.

One striking implication of our model, which is apparent from inspection of Figure 2, is that once a challenge procedure is available, full-scale litigation never occurs. This conclusion depends on several of the model’s assumptions concerning full information that are unlikely to represent every empirical situation with accuracy. For example, some patents are (allegedly) infringed and thus may become the subject of lawsuits, without the knowledge of the (alleged) infringer, who may be ignorant that his product, process, or service is potentially covered by the patent. Or suppose that both Firms A and B initially agree that the probability of a patent’s validity is very low. This is the weak patent case that we noted but did not analyze, in which B’s entry is accommodated by A. In such a circumstance B would not file a challenge, but if, subsequent to B’s entry, A revised its estimate of validity significantly upward, it might sue for infringement. Finally, an opposition system would rule only on the validity of A’s patent or specific claims within the patent. It would not pass judgment on whether a particular aspect of B’s product infringed on A’s patent. For all these reasons, we clearly would not expect an opposition system to supplant litigation entirely.

To get a sense of the likely magnitude of the welfare effects displayed in Figure 2, we constructed a simple simulation model, which we calibrated with empirically plausible parameter estimates. The theoretical model contains nine parameters (πA, πA|B, πB, pA, pB, p, L, C, and k). We add three more in order to make welfare calculations. The first of these additional parameters is the consumer surplus generated by the entry of Firm B. The other two parameters represent an attempt to capture the dynamic incentive effects implicit in an otherwise static model. Thus we assume not only that Firm A’s profits enter directly into a social welfare function that sums consumer and producer surpluses but that extra weight is given to A’s profits when it has a valid patent and some weight is subtracted when it licenses or exclusively exploits an invalid patent.

With so many parameters to vary, a comprehensive presentation of simulation results would be tedious. Therefore, we limit ourselves to describing just two plausible cases, one nonrivalrous and the other rivalrous. In both cases we assume that the present value of Firm A’s monopoly profit from its patent is $100 million and that Firm B must spend $20 million to develop its innovation. We also assume that patent litigation costs each party $2.5 million, which, given the size of the market, is consistent with the estimates reported by the American Intellectual Property Law Association. We assume, given the U.S. propensity to spend on lawyers, that the cost of an opposition proceeding would be 20 percent

of the cost of litigation, or $500,000 for each party. This is a conservative assumption in light of the report of the European Patent Office that oppositions cost less than $100,000. Finally, in both nonrivalrous and rivalrous examples, we assume that the objective probability of the validity of Firm A’s patent is 0.55, corresponding to the empirical frequency of validity calculated by Allison and Lemley (1998) on all litigated patent cases from 1989 through 1996.

In the nonrivalrous case we assume that Firm B’s entry would yield it a gross profit of $60 million and generate an equivalent amount of consumer surplus. We also assume no decline in Firm A’s gross profit given B’s entry. This leaves us free to examine what happens as we vary first the subjective probabilities of validity and then the dynamic welfare parameters. For simplicity, we assume that the subjective probabilities of A and B are symmetric around the objective probability of 0.55.

Under these circumstances, if the firms have very similar expectations about the validity of the patent, there will be no litigation before the introduction of a challenge system and no use of the opposition procedure thereafter. This situation is represented as Case (2) in Figure 2. The introduction of an opposition system has no effect on either static or dynamic welfare.

If the expectations of the firms diverge by more than 0.032 but less than 0.166 (i.e., as Firm A’s subjective probability of validity increases from 0.566 to 0.633), there would be no litigation before the introduction of a challenge system but Firm B would initiate an opposition proceeding. This situation is represented as Case (4) in Figure 2. There is a net static welfare loss equal to the total cost of an opposition proceeding, or $1 million. Still, the opposition process has advantages because it sorts out valid from invalid patents. If, when the patent is valid, we give an additional positive weight of only 14 percent to Firm A’s profit as a proxy for the incentive effect, then the welfare benefits of an opposition system outweigh the cost of a proceeding. If we subtract an equal percentage from A’s profit when its patent is ruled invalid, we need subtract only an 8 percent weight to offset the cost of the opposition proceeding. If we give substantial weight to these incentive effects, such as counting as a component of social welfare 150 percent of A’s profit in the case of a valid patent and only 50 percent if the patent is invalid, then introducing an opposition system increases social welfare by $6.4 million.

The final possibility arises when the divergence in subjective probabilities exceeds 0.166 (i.e., Firm A’s subjective probability exceeds 0.633). In this instance, there is an unambiguous social benefit of the difference between the total cost of litigation and the total cost of opposition, as represented in Case (1) in Figure 2. Given our assumptions, this produces a gain of $4 million. Because our model implies that half the gain is realized by Firm A, there is a small (favorable) dynamic incentive effect. In this case, however, the gain comes not from sorting valid from invalid patents but from Firm A’s capture of a portion of the social saving.

To explore the rivalrous case, we vary only two parameters and assume that the present value of post-entry gross profits of Firms A and B are now $45 million. Again, if the subjective probabilities of validity are close together, litigation will not occur, because Firm B’s entry can be deterred without it. In this instance, if the difference in subjective probabilities does not exceed 0.1 (i.e., Firm A’s subjective probability does not exceed 0.6), there will be no litigation but B will challenge A if oppositions are permitted. As shown in Case (7) in Figure 2, there is a static welfare loss equal to the total cost of the challenge ($1 million) if the patent is valid. If the patent is not valid, there is a substantial net gain of $29 million, representing the incremental producer plus consumer surplus ($50 million) created by B’s entry minus the development cost ($20 million) minus the cost of the challenge ($1 million).

Finally, if Firms A and B have subjective probabilities that differ by more than 0.1, litigation will occur when oppositions are not permitted. If oppositions are allowed, a challenge will be lodged and, as in Case (5) in Figure 2, there will be an unambiguous gain in static welfare, amounting to $4 million if the patent is invalid and $24 million if the patent is valid, because B will not sink the cost of development if it loses a challenge.

In all, it would appear that the cost of introducing an opposition procedure is quite small relative to the potential static welfare gains and dynamic incentive effects. A static welfare loss arises only when a challenge is lodged under circumstances that would not have given rise to litigation, such as when the parties do not differ greatly in their subjective expectations of the patent’s validity. In such instances the loss is never greater than the cost of both parties participating in the administrative proceeding, which, if European experience is any guide, is likely to be modest. By contrast, both the potential static and dynamic welfare gains that arise under other circumstances will be considerably larger. The low-cost opposition procedure will often supplant higher-cost litigation; larger profits to the innovator will provide a favorable dynamic incentive; and wasteful development expenses may sometimes be avoided. All of these effects are likely to be larger in magnitude than the cost of an opposition proceeding.

DISCUSSION

The analysis of our two-firm model of a patentee and a potential entrant makes clear that in this simple framework an opportunity to contest the validity of an issued patent is likely to yield net social benefits. In the model, however, benefits and costs are evaluated strictly by the standard welfare metrics in the product markets occupied by Firms A and B, assuming that there are no additional firms that might potentially infringe on A’s patent. As a result, the model fails to capture several additional effects and likely benefits of introducing an opposition system.

First, opposition proceedings should speed the education of patent examiners in emerging technologies. Third parties will tend to have far greater knowledge of the prior art in fields that are new to the U.S. Patent and Trademark Office. Allowing the testimony of outside experts to inform the opposition proceedings should have substantial spillovers in pointing patent examiners to relevant bodies of prior art, thus making them more likely to recognize non-novel or obvious inventions when they first encounter them.

Second, in an emerging area of technology, a speedy clarification of what is patentable and what is not confers substantial external benefit on those who wish to employ the new technologies. Because precedent matters in litigation and would presumably matter in opposition proceedings, a decision in one case, to the extent that it articulates principles and gives reasons, has implications for many others. Clarifying the standard of patentability in an area could have significant effects on firms developing related technologies, even if these technologies are unlikely to infringe on the patent being examined. Early decisions making clear the standard of patentability would encourage prospective inventors to invest in technology that is appropriable and to shun costly investments in technology that might later prove to be unprotected.

More narrowly, clarifying the validity of a patent has an obvious effect on future users of the technology.11 In fact, it is not difficult to broaden our two-firm model to allow for future infringers on A’s patent. One important change then is that A’s future profits are likely to depend on whether or not a definitive decision is handed down concerning the validity of its patent. In principle, this future patent value effect might make A either more or less inclined to grant an early infringer a license. To the extent that A becomes more inclined to grant a license, this can lead to one new outcome not captured in the model—the firms may negotiate a license even if B’s product is rivalrous. In this case, the introduction of oppositions can result in a hearing when without the opposition process the result would have been licensing, with consequent positive and negative welfare effects.

In closing, we note that we have offered little guidance about the specific design of a system permitting post-grant review of patent validity. To be effective, such a system should have a broader mandate than the current re-examination process, which is not an adversary proceeding and which allows third-party

intervention on only very limited grounds. Presumably, a more thoroughgoing U.S. system would allow challenges to validity on any of the familiar grounds now available to litigants in a court proceeding. The testimony of experts and the opportunity for cross-examination would seem desirable as means of probing questions of novelty and nonobviousness. Still, it would be important to avoid extensive prehearing discovery, unlimited prehearing motions, and protracted hearings. The costs of using a challenge system should be kept substantially below those of full-scale infringement litigation or its benefits will be negligible. In designing an opposition system, we would do well to examine the diverse experience with administrative proceedings in various federal agencies and imitate the best practices.

REFERENCES

Allison, J., and M. Lemley. (1998). “Empirical Evidence on the Validity of Litigated Patents.” American Intellectual Property Law Association Quarterly Journal 26: 185-277.

American Intellectual Property Law Association. (2001). Report of the Economic Survey. Arlington, VA: American Intellectual Property Law Association.

Choi, J. P. (1998). “Patent Litigation as an Information Transmission Mechanism.” American Economic Review 88(December): 1249-1263.

Graham, S., B. Hall, D. Harhoff, and D. Mowery. (2003). “Patent Quality Control: A Comparison of U.S. Patent Re-examinations and European Patent Oppositions.” In W. Cohen and S. Merrill, eds., Patents in the Knowledge-Based Economy. Washington, D.C.: The National Academies Press.

Lemley, M. (2001). “Rational Ignorance at the Patent Office.” Northwestern University Law Review 26: 1495-1532.

Levin, R. (2002). Testimony before the FTC-DOJ Joint Hearings on Competition and Intellectual Property Law, Washington, D.C., February 6.

Merges, R. (1999). “As Many as Six Impossible Patents before Breakfast: Property Rights for Business Methods and Patent System Reform.” Berkeley Technology Law Journal, 14(Spring): 577-616.

Meurer, M. (1989). “The Settlement of Patent Litigation.” Rand Journal of Economics 20(Spring): 77-91.

U.S. Patent and Trademark Office. (2002). The 21st Century Strategic Plan, June 3. http://www.uspto.gov/web/offices/com/strat21/index.htm