Patent Litigation in the U.S. Semiconductor Industry1

Rosemarie Ham Ziedonis

University of Michigan Business School

INTRODUCTION

Firms in many industries utilize and build on the innovations of others, often in the face of short product life cycles. Recognizing this, scholars and industry representatives alike have started to question whether changes in the U.S. patent system over the past two decades are, in effect, hindering rather than promoting this cumulative process of innovation. Record numbers of patents are issuing from the U.S. Patent and Trademark Office (USPTO) in areas ranging from semiconductors and computer software to business methods and human gene sequences, raising concerns about the costs and feasibility of navigating through mazes of overlapping patent rights in these areas (Shapiro, 2001; Heller and Eisenberg, 1998). At the same time, the past two decades have witnessed a noticeable rise in patent litigation in the United States (Merz and Pace, 1994; Moore, 2000) as well as an escalation in the costs associated with enforcing patent rights in court (Ellis, 1999; AIPLA, 1999). Calling for reform, some have started to question whether the direct and indirect costs associated with obtaining and enforcing U.S. patent rights have started to outweigh the benefits provided by this system (Barton, 2000; Pooley, 2000; Mazzoleni and Nelson, 1998).

This chapter aims to shed additional light on the operation of the U.S. patent system by tracing the incidence and nature of patent-related legal disputes over the past three decades in one important cumulative technological setting—semiconductors. Much like software or computer firms, semiconductor firms typically require access to a “thicket” of external intellectual property to advance technol-

ogy or to legally manufacture and sell their products. In contrast to software, business methods, or biomedical inventions, however, innovation in semiconductors was already highly cumulative and subject to patent protection prior to the 1980s “pro-patent” shift in the United States.2 For example, over 20,000 U.S. patents had been issued on inventions pertaining to semiconductor devices and manufacturing processes by 1981 (USPTO, 1995). In contrast, few software or biotechnology-related patents had been awarded before 1980 in part because of the legal uncertainty over patentable subject matter in these emerging areas (see Graham and Mowery, 2003 on software; Merges, 1997 on biotechnology-related inventions). The extent to which changes in the U.S. patent landscape during the 1980s have altered patterns of cooperation and conflict over patented technologies in semiconductors remains unclear.

The semiconductor industry is also an important empirical context within which to examine the broader incentives generated by the patent system in cumulative technological settings. In surveys on appropriability conducted in 1983 and 1994, (the “Yale” and “Carnegie Mellon” surveys, respectively), R&D managers in semiconductors consistently report that patents are among the least effective mechanisms for appropriating returns to R&D investments (Levin et al., 1987; Cohen et al., 2000).3 Driven by a rapid pace of technological change and short product life cycles, semiconductor manufacturers tend to rely more heavily on lead time, secrecy, and manufacturing or design capabilities than patents to recoup investments in R&D.

However, in a recent study on patenting in semiconductors, Hall and Ziedonis (2001) find that the strengthening of patent protection in the United States in the 1980s had two divergent effects on dedicated U.S. semiconductor firms. On the

one hand, the “pro-patent” shift induced capital-intensive firms to “ramp up” their portfolios of patents more aggressively—largely to deter threats of litigation and to improve their bargaining positions in negotiations with external patent owners.4 On the other hand, the strengthening of U.S. patent rights also appeared to facilitate entry into the industry by firms specializing in chip design. Interviews with representatives from design firms suggest that these firms (often relatively small in size) enforce their patent rights quite aggressively in court vis-à-vis direct rivals, primarily to establish proprietary rights in niche product markets.5 If this is true, any apparent increase in patent litigation within this sector may simply reflect the emergence of these specialized firms and their reliance on U.S. courts to bar use of their intellectual assets. Combined, these findings underscore the importance of considering the multifaceted effects of the U.S. patent system even among firms within an industry.

With this in mind, this study seeks to address several basic empirical questions. How do the characteristics of semiconductor firms involved in legal patent disputes over the past three decades compare with those of nonlitigating semiconductor firms? To what extent have firms in this sector been involved in more legal disputes over intellectual property during the so-called “pro-patent” era? Is patent litigation in this industry still fairly “uncommon” as sometimes claimed? Finally, do semiconductor design firms and manufacturers differ in their propensity to enforce patents or in the characteristics of their patent-related legal disputes?

To address these questions, the study examines the characteristics of patent cases filed in U.S. District Courts and the U.S. International Trade Commission (USITC) from January 1, 1973, through June 30, 2001, that involve 136 dedicated U.S. semiconductor firms as plaintiff, defendant, or owner of a litigated patent. Firms in the sample include the universe of publicly traded U.S. firms during 1973-2000 that either (a) list semiconductors and related devices (SIC3674) as their primary line of business or (b) were identified by industry sources as dedicated U.S. semiconductor firms. In 2000, sample firms collectively generated over $88 billion in revenues, spent $12 billion in R&D, and had been awarded roughly 31,000 U.S. patents. An unfortunate weakness of this approach is the exclusion from the sample of large U.S. “systems” manufacturers (e.g., IBM,

AT&T, or Motorola) and non-U.S. firms (e.g., Mitsubishi, Samsung, or Siemens). Although these firms are important patent owners and users of semiconductor technologies, it is not possible to isolate the share of R&D expenditures directed toward semiconductor technologies for these diversified firms.

This approach offers several methodological advantages. First, it enables the identification of a fairly large sample of firms whose R&D expenditures are primarily directed toward semiconductor-related innovation, regardless of whether the firms are involved in legal disputes over patents. By focusing on the patent acquisition and enforcement histories at the level of individual firms, it is possible to examine changes in the propensity of firms to enforce their own patents while also observing changes in the propensity of firms of different sizes and types to encounter patent lawsuits initiated by others. The sample also includes a mix of U.S. semiconductor manufacturers and design firms, including 81 “manufacturers” (i.e., firms like Intel, Texas Instruments, and Micron Technologies, which design and manufacture the majority of their products in-house) and 55 “design” firms (i.e., firms like Altera, Xilinx, and SonicBlue, which specialize in chip design but contract out the manufacture of products to third parties).6 Even though most of the design firms in the sample commercialize and sell products of their own, they are typically much smaller in size (in terms of number of employees or sales revenues) than semiconductor manufacturers in the sample and they invest more heavily in R&D. The results of this study may therefore help inform the underlying factors driving patterns of litigation involving small firms—at least in this sector.

Finally, comparing patent litigation and patent issuance trends yields “litigation rates” that are somewhat difficult to interpret in the context of the semiconductor industry. Typically, patent litigation rates are calculated by denominating the number of filed patent cases with the number of patents “at risk” for litigation (Lerner, 1995; Lanjouw and Schankerman, 2001, 2003; Somaya, 2003). Yet, as mentioned above, the decision to patent for many semiconductor firms is, in fact, driven by a desire to deter litigation (Hall and Ziedonis, 2001; Cohen et al., 2000). This methodology enables me to offer a different perspective by calculating liti-

gation rates in the industry (overall, and for manufacturers and design firms separately) using (a) firm-level patenting activity and (b) firm-level R&D expenditures.

Detailed information about all reported patent cases involving one or more of the 136 semiconductor firms in the sample is merged with information about the patents and other parties involved in the disputes. Several empirical patterns emerge, which are summarized as follows:

-

Of the 136 U.S. semiconductor firms in the sample, roughly 56 percent were involved in at least one reported patent case filed in U.S. District Courts and the USITC between January 1, 1973, and June 30, 2001. On average, sample firms involved in patent lawsuits spent more on R&D (in absolute terms and per employee), were larger (in terms of sales or number of employees), and owned more patents than “peer” semiconductor firms not involved in patent litigation during this period.

-

The number of annual cases filed that involve these firms (as a group) increased sharply around the mid-1980s and continued at a higher level throughout the 1990s. This trend is not remarkable when compared to the overall growth in U.S. patent litigation during this period documented elsewhere (Merz and Pace, 1994; Moore, 2000). It is consistent, however, with popular reports that legal disputes over intellectual property have become more common in semiconductors—despite the widespread use of cross-licenses in this industry.

-

Relative to annual R&D spending by these firms, the patent litigation rate in semiconductors rose considerably during 1986-2000 from that in the preceding decade (by as much as 93 percent). In contrast, the number of cases filed per 1,000 patents awarded to these firms (a more common metric used to estimate litigation rates) exhibited a slight decline between the two periods. The apparent decline in litigated patents per patents awarded during the latter period is driven, however, by the dramatic rise in patenting by semiconductor firms since the mid-1980s (as reported in Hall and Ziedonis, 2001). Indeed, updating the trends reported in Hall and Ziedonis (2001) reveals that the “patent portfolio races” of U.S. semiconductor manufacturers continued to accelerate through the end of the 1990s both in absolute terms and relative to firm-level R&D spending.

-

Regardless of how it is measured, the average litigation rate of specialized design firms in the sample is high and is more than twice that of manufacturers in the sample. Manufacturers, on average, are involved in disputes with a more disparate set of parties and tend to enforce patents that are almost 4 years older than the average patent in their portfolios. In contrast, design firms typically enforce their patents against other design firms and litigate over patents that are roughly the same age as the average patent in their portfolios.

In addition to these general trends, it was also interesting to observe what appears to be an active “market” for intellectual property that predates the filing

of a patent lawsuit. In at least 30 percent of identified cases, legal title to a litigated patent had been reassigned from the original inventor (or assignee) to one of the litigating parties—typically, to the plaintiff in an infringement suit. Some of these disputes involved plaintiffs that had acquired the intellectual property as part of a broader acquisition of a firm or its physical assets (e.g., SGS Thomson successfully enforced Mostek’s memory chip patents after acquiring the company in the mid-1980s; similarly, Atmel enforced patents awarded to Seeq Technologies after acquiring Seeq’s intellectual and physical assets pertaining to non-volatile memory). In other cases, the plaintiff appeared to be using externally generated patents in reciprocal suits. For example, after failing to reach agreement on the terms of a renewed cross-license agreement, Hyundai sued Texas Instruments in 1991 for infringing five patents—four of which Hyundai had purchased from outside inventors. There also was an apparent rise in infringement suits brought by specialized “patent licensing” companies.7 On one hand, the emergence of specialized patent management and enforcement companies may help “tilt the table” more in favor of independent inventors or patentees from small businesses (see Lerner, 1995; Lanjouw and Lerner, 2001) or may represent the continued development of markets for technology (Arora et al., 2001). On the other hand, others raise concerns that an increased trade in and enforcement of so-called “paper patents” (i.e., “blocking” patents owned by inventors or companies that do not compete in the related product markets) is imposing an implicit tax on innovation (Pooley, 2000). These are interesting issues that warrant future investigation.

Before turning to the rest of the chapter, it is important to acknowledge two inherent limitations of this research. First, like any study of litigation events, this study is inherently limited by its examination of the proverbial “iceberg’s tip.”8

As discussed above, semiconductor firms have long licensed and cross-licensed their intellectual property and private settlement over intellectual property rights is still the rule rather than the exception (Grindley and Teece, 1997). Although future versions of this research will attempt to control more explicitly for this selection bias, this study simply summarizes the characteristics of observable case filings. A second limitation of this study is its primary reliance on data that may underestimate the number of patent cases filed in U.S. District Courts, particularly during the early period of the study (i.e., before 1984). As discussed in the third section of this chapter, several attempts were made to address this shortcoming in the data. Nonetheless, underreporting in the early period may still exist, and the results should be interpreted with this in mind.

The remainder of this chapter is organized as follows. The second section summarizes what is often referred to as the “pro-patent” shift in the U.S. legal environment during the 1980s and discusses its effects on the use of patents in the semiconductor industry. The third section presents the data and methodology used to trace patent litigation involving U.S. semiconductor firms during 1973-2001. The descriptive findings are summarized in the fourth section, and concluding remarks follow.

THE CHANGING PATENT LANDSCAPE

The patent system has long been recognized as an important policy instrument used to promote innovation and technological progress. Two fundamental mechanisms underpin the patent system. First, an inventor discloses to the public a “novel,” “useful,” and “nonobvious” invention. In return, the inventor receives the right to exclude others from using that patented invention for a fixed period of time (now 20 years from the date of patent application in the United States). The rules of the patent game may differ from country to country (e.g., whether rights are assigned to the first inventor or the first to file the patent application), but the underlying principle remains the same. By providing exclusionary rights for some period of time and a more conducive environment in which to recoup R&D investments, the patent system aims to encourage inventors to direct more of their resources toward R&D than would otherwise be the case. At the same time, detailed information about the invention is disclosed to the public when the patent application is published.

The So-Called Pro-Patent Shift in the United States

The creation of the Court of Appeals for the Federal Circuit (CAFC) in 1982 is often credited with ushering in an era that reversed the judicial treatment of patent rights in the United States from the preceding decades in ways that favored patent owners.9 From the trust-busting era of the 1930s through much of the 1970s, patents were largely viewed as anticompetitive weapons used to stifle competition.10 For example, in 1959, Scherer and his co-authors report:

During the past two decades a pronounced change has taken place in the policies of governmental bodies towards patents owned by corporations…. The courts have become increasingly critical of patent validity, and cases in which the exercise of patent rights conflicted with antitrust statutes have been prosecuted by denying the exclusiveness of the patent grant. Since 1941, more than 100 judgments have been entered which required corporations to license their patents to all applicants at reasonable royalties or no royalties at all. This trend was brought sharply to the public’s attention in January of 1956 when two of the nation’s foremost leaders in industrial technology, the American Telephone and Telegraph Co. and International Business Machines, Inc., entered into decrees requiring them to license all of their more than 9,000 patents, in most cases without receiving royalties in return.” (Scherer et al., 1959, p. 2-3)

Antipatent sentiment continued through much of the 1970s. As Merges (1997) states: “It was difficult to get a patent upheld in many federal circuit courts, and the circuits diverged widely both as to the doctrine and basic attitudes toward patents. As a consequence, industry downplayed the significance of patents” (p. 12).

By the early 1980s, the pendulum started to swing away from a restrictive treatment of patents toward a view that patent rights should be construed liberally to stimulate innovation. Driven by general concerns about increased international competition in several key industries—including semiconductors—and a growing belief that stronger intellectual property rights were needed to stimulate innovation, Congress passed a series of laws in the early 1980s aimed at improving the function of the U.S. patent system and at relaxing antitrust constraints on the

collaborative R&D activities of firms.11 Unique to semiconductors, the 1984 Semiconductor Chip Protection Act (SCPA) also conferred protection against theft of the “mask works,” the overall layout of the chip designs (see Samuelson and Schotchmer, 2001 for a recent review of this form of protection).

No other event signaled the shift toward stronger legal protection for patents in the United States than the 1982 creation of the CAFC, a centralized appellate court with jurisdiction over all patent infringement appeals (Jaffe, 2000).12 Although the driving force behind the legal reform was a need to unify U.S. patent doctrine, the Federal Circuit put in place a number of procedural and substantive rules that collectively favored patent owners. For example, the new court endorsed the broad, exclusionary rights of patent owners through its interpretation of patent scope, increased evidentiary standards to make it more difficult to invalidate the rights of patent owners, was more willing to halt allegedly infringing actions early in the dispute process by granting preliminary injunctions, and was more willing to sustain large damage awards and thereby penalize infringing parties more severely.13 The plaintiff success rates in patent infringement suits also increased substantially during this period (Lerner, 1995).

Although the CAFC was created in 1982 and issued a flurry of written opinions during 1983 (Adelman 1987; Nies 1993), the impact of the CAFC on the favorable legal treatment of patent rights in U.S. courts was not widely publicized until the mid-1980s.14 The “surprising new power of patents” was perhaps most clearly revealed by Polaroid’s success in a longstanding lawsuit against Kodak for infringing certain instant photography patents awarded to Polaroid. In a 1985

ruling, Kodak was required to pay Polaroid almost $1 billion in damages and interest, was barred from manufacturing and selling instant cameras, and was forced to close its instant camera production line (Warshofsky, 1994). As reported by Hall and Ziedonis (2001), representatives from the semiconductor industry emphasized the importance of this case, along with Texas Instruments’ successful patent infringement cases against Japanese and Korean firms during 1985-1986, in demonstrating the “new power of patents.” Not only did TI and other large patent owners such as IBM and Motorola increase the price (i.e., royalty rates) charged for “rights to use” their patents, but the increased value associated with patents may have induced entry into the patent licensing business as the licensure of patents became more profitable under the new regime (as discussed below).

The Evolving Role of Patents in Semiconductors

Not surprisingly, the use and importance of U.S. patents in semiconductors was affected by this changing patent landscape, albeit in some unanticipated ways. By the early 1980s, a broad range of semiconductor technologies, including methods for manufacturing semiconductors and integrated circuit design, had diffused widely across the industry (Levin, 1982). The “technological giants” in semiconductors, including AT&T and IBM, were effectively curtailed from aggressively enforcing their patent rights against rival firms (either merchant manufacturers or other users of semiconductor technologies) from the 1950s to the late 1970s by the antitrust constraints discussed above. As a result of its 1956 consent decree with U.S. antitrust authorities, for example, AT&T had licensed its semiconductor inventions widely to other firms in return for access to subsequent inventions by licensees. AT&T’s active role in licensing and disseminating semiconductor technologies is credited with stimulating the early growth of the U.S. merchant semiconductor industry (Tilton, 1971; Grindley and Teece, 1997; Mowery and Rosenberg, 1998). Nonetheless, Tilton (1971, p. 76) concludes:

Certainly the great probability that other firms were going to use the new technology with or without licenses is another reason for the liberal licensing policy. Secrecy is difficult to maintain in the semiconductor field because of the great mobility of scientists and engineers and their desire to publish. Moreover, semiconductor firms, particularly the new, small ones, have demonstrated over and over again their disposition to infringe on patents. The prospect of lengthy and costly litigation in which its patents might be overturned could not have been very attractive to AT&T.

Similarly, Von Hippel (1988) emphasizes that the semiconductor field was a very fast-moving one that, even by the early 1980s, contained many unexpired patents with closely related subject matter and claims. He writes:

Since patents challenged in court are unlikely to be held valid, the result of high likelihood of infringement accompanying use of one’s own patented—or unpat-

ented—technology is not paralysis of the field. Rather, firms in most instances simply ignore the possibility that their activities might be infringing the patents of others. The result is what Taylor and Silberston’s interviewees in the electronics components field termed ‘a jungle’ and what one of my interviewees termed a ‘Mexican standoff’…. The usual result is cross-licensing, with a modest fee possibly being paid by one side or the other. (p. 52-53)15

Two other factors contributed to the infrequent patent litigation and widespread cross-licensing that have historically characterized the semiconductor industry. First, as reported in the introduction to this chapter, semiconductor firms tend to rely on mechanisms other than patents to recoup their R&D investments, including being first to market and safeguarding the “know-how” (often through secrecy) required to manufacture commercially viable chips (Levin et al., 1987; Cohen et al., 2000). Indeed, there is little evidence that the strengthening of U.S. patent rights boosted aggregate R&D spending by firms in this sector (Hall and Ziedonis, 2001; Bessen and Maskin, 2000). Second, to reduce the risk of disruptions in supply, large customers of chips (e.g., IBM and the U.S. government) typically required dedicated manufacturers to transfer to a competing supplier the know-how and patent rights required to manufacture a compatible product (Shepard, 1987). These second source agreements further promoted cross-licensing in the industry but declined in use over the decade of the 1980s as the industry matured and built up capacity (Grindley and Teece, 1997).

Although cross-licensing continues to be an important mechanism by which firms trade access to one another’s patents, the terms of these agreements appear to have changed (not surprisingly) as the rights of patent owners have grown stronger. Firms with large patent portfolios, such as Texas Instruments, IBM, AT&T, and Motorola, adopted a more aggressive licensing and litigation strategy to profit directly from their patent portfolios—both by seeking licenses from a larger number of firms and by increasing royalty rates on use of their inventions. For example, in the early 1980s, Texas Instruments launched a more aggressive patent licensing program—initially against Japanese and Korean competitors in the market for memory chips. During 1986-1993, TI earned almost $2 billion from licensing rights to its semiconductor patents (Grindley and Teece, 1997). Similarly, IBM increased its royalty rates around 1987-1988 from 1 percent of sales revenues for products using IBM patents up to a range of 1 to 5 percent (Shinal, 1988). By 2000, IBM earned over $1.5 billion in income from licensing its intellectual property portfolio, up from $646 million in 1995.16 According to industry representatives as well as accounts in the general business press (e.g., Warshofsky, 1994; Rivette and Kline, 2000), the increased value associated with

|

15 |

Similarly, writing in 1987, Levin et al. report: “In the semiconductor industry … the cumulative nature of technology makes it difficult to participate legally without access to the patents of numerous firms. In consequence, there is widespread cross-licensing” (p. 798, fn 29). |

|

16 |

As reported in IBM annual reports, available at www.ibm.com. |

patents also induced entry into the more lucrative patent licensing business by firms and individuals that had not found it worth their while to assert legal rights under the previous patent regime. As one industry representative put it, around the mid-1980s “we started receiving more knocks on the door and letters threatening infringement suits [from patent owners seeking royalty payments].”

As the effective price of purchasing legal “rights to use” patented semiconductor technologies rose during the 1980s, so too did the capital investments required to build and operate state-of-the-art manufacturing facilities. In the early 1980s, a wafer fabrication facility (fab) cost about $100 million and had an expected life span of 10 years. By the mid-1990s, however, the cost of a new fab had risen to over $1 billion, while the useful life of these capital investments had been reduced to little more than 5 years (ICE, 1995). As a result, the costs associated with halting production or altering production processes used in high-volume facilities had risen significantly, exacerbating concerns among capital-intensive firms of being “held up” by owners of patented technologies used in the design or manufacture of their products. Indeed, Hall and Ziedonis (2001) find a sharp increase in patenting rates by capital-intensive semiconductor firms around the mid-1980s. Instead of being driven by a desire to win strong legal rights to a stand-alone technological prize, these firms appear to be engaged in “patent portfolio races” aimed at reducing concerns about being held up by external patent owners and at negotiating access to external technologies on more favorable terms. In principle, such racing behavior is not an inevitable outcome of strengthening patent rights in cumulative technological areas; if patents were strictly awarded to inventors of “nonobvious,” “useful,” and “novel” inventions, it should become increasingly difficult to obtain a patent when a thicket of prior art exists. In line with the more general findings of Quillen and Webster (2001), however, it does not appear that the USPTO is successfully “weeding out” marginal patent applications in this sector.

Although the “pro-patent” shift induced capital-intensive semiconductor firms to amass larger portfolios of patents for trading purposes, Hall and Ziedonis (2001) also find that the strengthening of U.S. patent rights may have facilitated entry by firms specializing in chip design. In the early 1980s, the U.S. semiconductor industry comprised two main types of firms: (1) vertically integrated “systems” manufacturers (e.g., AT&T, Motorola, or IBM) that manufactured semiconductors primarily for in-house use, and (2) less diversified “merchant” manufacturers (e.g., Analog Devices, Intel, or National Semiconductor) that specialized in designing, making, and selling semiconductor products. Since the mid-1980s, however, there has been a considerable increase in entry by specialized design firms (ICE, 1995; Macher et al., 1998).17 As discussed above, these so-

called fabless firms design semiconductor components (e.g., graphics, communications, or networking chips) but rely on third parties, or “foundries,” to manufacture their designs. Competing primarily on the basis of innovative products or functional designs, these firms appear to rely more heavily on patents to profit from innovation than appears to be true of the semiconductor manufacturing firms represented in the Yale and Carnegie Mellon surveys mentioned above. Consistent with this view, Hall and Ziedonis (2001) find that the “bargaining chip” role of patents was less apparent in interviews with representatives from design firms. Interviewees typically emphasized the importance to their firms of securing strong, “bulletproof” patents in areas surrounding their core product lines and of signaling to potential rivals the firm’s commitment to protecting its intellectual property in court. Although some design firms register mask works with the U.S. Copyright Office (under the SCPA discussed above), interviews with industry representatives suggest that the lion’s share of their intellectual property-related financial and managerial attention is devoted toward protecting inventions with patents (Ziedonis, 2000).

DATA

To examine changes, if any, in the incidence and nature of legal disputes over patents in the semiconductor industry during the “pro-patent” era, one first must establish an appropriate sample of firms and compile information about their patent-related disputes. Ideally, one would use information about threats of litigation and the terms of intellectual property-related settlements over time, but such data are not publicly available. This chapter therefore relies on information contained in patent cases filed in U.S. courts, which (as the title of Lanjouw and Schankerman’s 2001 paper suggests) provide a useful window through which to view competition and conflict over intellectual property. After describing the sample of semiconductor firms selected for study, this section identifies the main sources used to compile information about (1) sample firms, (2) their involvement in patent disputes filed in U.S. courts since 1973, and (3) the characteristics of the parties and technologies involved in those disputes.

Sample Selection

The sample of semiconductor firms is drawn from two main sources. A universe of 108 publicly traded U.S-owned firms identified their principal line of business as semiconductors and related devices (SIC3674) and reported financial data in Compustat in at least one year during 1973 and 2000. Of these, nine firms were dropped from the sample because they were partially owned subsidiaries of more diversified firms. An additional set of 37 dedicated U.S. semiconductor firms was identified with annual reports from Integrated Circuit Engineering, Inc. (ICE)—a market research firm that tracks the commercial activities of semiconductor firms (ICE, 1976-1998). Most firms added to the sample from the ICE reports were specialized design firms assigned to nearby four-digit SIC classes (e.g., pertaining to storage, telecommunications, and other electronics).

The final sample includes 136 dedicated U.S. semiconductor firms that were publicly traded in the United States for one or more years during 1973-2000. Using sources discussed in Hall and Ziedonis (2001), I updated and assembled financial information and patenting data for the 96 firms in the original Hall-Ziedonis sample and assembled corresponding data for the 41 newer firms for which sufficient data were now available.18 The resulting database contains, for all 136 firms, the following information:

-

the number of U.S. patents awarded to each firm and its subsidiaries from 1965 to 2000;19

-

detailed characteristics of those patents (e.g., the patent number and class);

-

annual balance sheet and income statement data for each firm through 2000 (e.g., sales, R&D spending, number of employees);

-

the founding year of the firm; and

-

annual information about whether the firm owned and operated its own manufacturing facilities (manufacturer) or whether it specialized in product design alone (design firms).20

Summary statistics for these variables are shown in Table 1. The median firm in the sample is 17 years old (in 2000), has 420 employees, spends $7.6 million (in constant 1996 dollars) on R&D, and receives one U.S. patent a year. The distribu-

|

18 |

Sources include Micropatent and the NBER/Case Western databases (for patent data); Compustat (for financial information); ICE industry reports (for manufacturing information and founding years); and annual 10-K filings and LEXIS/NEXIS business directories (to confirm manufacturing status, founding years, and ownership structures). Detailed information about these sources is provided in the on-line version of Hall and Ziedonis (2001), available at: http://jonescenter.wharton.upenn.edu/papers/2000/wp00-16.pdf. |

|

19 |

Patent portfolios were constructed based on each firm’s 1996 ownership structure. |

|

20 |

Following ICE industry status reports, a firm was designated as “design” if more than 50 percent of its products sold in a given year were manufactured by third parties. |

TABLE 1 Sample Statistics U.S. Semiconductor Firms, 1973-2000

|

|

All Firms (1725 Observations; 136 Firms) |

||||

|

Variable |

Mean |

Std. Dev. |

Median |

Min |

Max |

|

Age (2000-founding year) |

22.08 |

12.20 |

17.00 |

6 |

64 |

|

D(Founded before 1982=1) |

0.49 |

0.50 |

0.00 |

0 |

1 |

|

D(Manu=1) |

0.59 |

0.49 |

1.00 |

0 |

1 |

|

Sales (Constant 1996 $M) |

368.31 |

1,844.78 |

45.30 |

0.00 |

36,056.47 |

|

Employees (1,000s) |

3.10 |

10.46 |

0.42 |

0.01 |

89.88 |

|

Prop, Plant & Equip (Constant 1996 $) |

271.11 |

1,440.95 |

19.45 |

0.00 |

30,205.28 |

|

R&D (Constant 1996 $M) |

51.46 |

201.11 |

7.60 |

0.00 |

3,747.09 |

|

R&D Intensity (R&D/Employee) |

26.81 |

31.26 |

15.88 |

0.00 |

295.29 |

|

R&D Intensity (R&D/Total Assets) |

0.15 |

0.19 |

0.11 |

0.00 |

2.95 |

|

# Annual US Patents Received |

14.95 |

79.16 |

1 |

0 |

1,463 |

tion of these variables is, however, highly skewed. One firm was awarded 1,463 U.S. patents in a single year (Texas Instruments in 1998), whereas another spent over $3.7 billion in R&D in one year (Intel in 2000; again, based in 1996 dollars).

Many firms enter and exit the sample over the 29-year period.21 As seen in Figure 1, the annual number of firms in the sample grew from 18 to 119 between 1973 and 1994, primarily because of two waves of entry by design firms in the

FIGURE 1 Number of sample firms by year (U.S. semiconductor manufacturers and design firms.

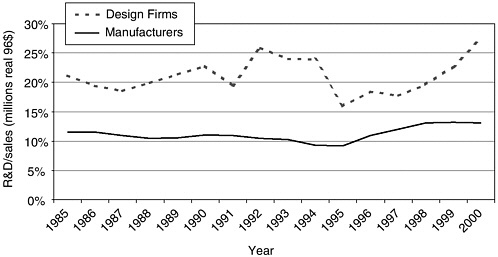

mid-1980s and early 1990s. The number of sample firms fell to 91 by 2000, however, as an economic downturn forced consolidation in the industry. As discussed above, design firms in the sample are more R&D intensive than sample manufacturers. More specifically, design firms spent on average 19-20 percent of their revenues on R&D during 1985-2000, whereas the R&D intensity of manufacturers hovered around 12 percent during the same period (see Figure 2). Deflating R&D spending by number of employees (instead of revenues) reveals similar trends.

Linking Firms to U.S. Patent Cases

As mentioned in the introduction to this chapter, the sample includes a large number of firms whose R&D investments are primarily directed toward semiconductor-related innovation. In the next phase of this research, I hope to investigate the economic effects, if any, of patent-related litigation on the R&D and patenting activities of firms in the industry. With this longer-term objective in mind, it is important to identify all reported patent disputes that involve each firm in the sample—regardless of whether the patents involved pertained to semiconductors or to broader classes of inventions.22 I therefore relied on sources that identify the

FIGURE 2 Average annual R&D intensity of sample firms: design firms v. manufacturers, 1985-2000.

names of all litigating parties involved in patent cases filed with either the USITC or U.S. District Courts. For cases filed with the USITC, I reviewed the universe of 464 investigations filed under Section 337 between January 1973 and June 2001, as reported on the USITC website (http://info.usitc/gov/337).23 From this search, I identified 28 cases that involved semiconductor firms as either plaintiffs or defendants. Most of these cases also identified (by U.S. patent number) the inventions involved in the dispute.

For patent cases filed in U.S. District Courts, I retrieved information about the litigating parties and patents from the LitAlert database produced by Derwent.24 This private database, which is available on Westlaw, reports information about U.S. patent and trademark suits filed in U.S. District Courts that are reported to the USPTO Commissioner. The database includes cases filed (and reported to the USPTO) from January 1973 to date and is updated weekly (see http://www.derwent.com/data/specs/lita.pdf). To identify patent lawsuits that involved firms in my sample, I searched the LitAlert database using the following search terms for each firm: (1) its name; (2) common misspellings of that name; (3) former names attributed to the firm (e.g., as cross-listed in Hoover’s Business Directory or reported in industry reports); and (4) names of major subsidiaries, if any. A list of 318 patent cases were identified that involved one or more of the semiconductor firms in my sample as plaintiff, defendant, or patent assignee and that had been filed in U.S. District Courts between January 1973 and June 30, 2001. Two duplicative records (where identical information was filed under different LitAlert case identification numbers) and 57 sequential cases (where a change in venue or an outcome of a previously filed case was announced but the

patents and litigated parties involved in the lawsuit were the same) were omitted from the sample.

In total, I identified 287 unique patent cases filed from January 1973 through June 2001 that involved at least one sample firm. Of these, 259 cases were filed in U.S. District Courts and 28 were filed with the USITC. For each case, I recorded or assembled information about:

-

the parties named in the dispute (all plaintiffs, defendants, and patent assignees)

-

type of entity (firm, independent inventor, university/government agency)

-

nationality (by headquarters of firms or address listed on disputed patents for independent inventors)

-

primary and secondary SICs for all firms and the parent company, if any, of the named litigants in the year of the dispute

-

-

when and where the case was filed (filing date; name of U.S. District Court)

-

the litigated patents (by U.S. patent number)

-

“front page” information from the published patent document [e.g., year applied for and issued, name of inventors and original assignee (if any), patent classes, etc.]

-

whether the invention pertained primarily to semiconductor-related products or manufacturing processes (Appendix A describes how I defined these categories and coded the inventions)

-

To determine the type of dispute involving the patent, I followed the convention of Lanjouw and Schankerman (2001) and classified cases as (1) an infringement suit if the plaintiff was the original assignee of one or more of the patents or (2) a suit for declaratory judgment if the defendant was the original assignee of one or more of the disputed patents.25 Using this approach, I identified 146 infringement suits and 23 declaratory judgment suits. However, I was unable to classify a large number of cases (118 cases, or 41 percent of the total) using this information alone.26 On closer examination, it was clear that the plaintiffs in some

of the “unclassified” cases had acquired the patent rights of other companies (e.g., the well-known enforcement by Harris Corporation of patents acquired from RCA). By searching the patent “reassignment” data (at the U.S. Patent Depository of the Free Library of Philadelphia) I discovered—somewhat to my surprise—that 82 of the 118 unclassified cases (70 percent) involved situations in which the original assignee had transferred, or “reassigned,” legal title to one or more of the litigated patents and registered the transaction with the USPTO. In almost all of these cases, title to the disputed patents was reassigned to the plaintiff in an infringement suit. In the end, the additional information about patent reassignments enabled me to classify 221 cases (77 percent of the total) as infringement suits and 32 cases (11 percent) as declaratory judgment suits; 34 cases (12 percent) remained unclassified. As discussed in Appendix A, roughly 75 percent of the patents involved in these disputes pertained to product-related inventions either for semiconductor devices or downstream products; approximately 23 percent of the litigated patents pertained solely to production processes.

Finally, recognizing the potential downward bias in the number of cases reported in Derwent during the early period of my study (discussed in the introduction),27 I searched the trade press and “litigation” sections of 10-K reports filed during 1973-1985 for the 38 sample firms that were publicly traded in those years. Using these sources, I identified only four patent lawsuits filed in U.S. District Courts during this period that were not also reported in Derwent.28 On one hand, the lack of reported legal disputes over patents before the mid-1980s is consistent with historical accounts of the industry discussed in the second section of this chapter.29 On the other hand, it is possible that the numbers I report below still suffer from an underreporting bias in the early period despite my attempts to

mitigate the problem. In future versions of this research, I plan on investigating this issue further by examining archival records in selected U.S. District Courts.30

MAIN FINDINGS

How do the characteristics of semiconductor firms involved in legal patent disputes over the past three decades compare with those of nonlitigating firms in the industry? To what extent have semiconductor firms been involved in more patent lawsuits during the “pro-patent” era? Is patent litigation in this industry still fairly “uncommon,” as sometimes claimed? Finally, do semiconductor design firms and manufacturers differ in their propensity to enforce patents or in the characteristics of their patent-related legal disputes? This section presents the descriptive findings that pertain to these main questions.

TABLE 2A Mean Values of Firm Characteristics: Litigating Versus Nonlitigating Sample Firms, 1725 Observations (136 Firms), 1973-2001a

|

|

All Firms (mean values) |

|||

|

Variable |

Litigating Firms |

Nonlitigating Firms |

p-Value, Test of Equalityb |

|

|

Age (2000-founding year) |

20.45 |

24.15 |

0.093 |

|

|

D(Founded before 1982=1) |

0.47 |

0.52 |

0.622 |

|

|

D(Manu=1) |

0.53 |

0.68 |

0.074 |

|

|

Sales (M Constant 1996$) |

619.72 |

34.46 |

0.000 |

|

|

Employees (1,000s) |

5.11 |

0.40 |

0.000 |

|

|

Prop, Plant & Equip (Constant 1996 $) |

463.22 |

57.13 |

0.000 |

|

|

R&D (M Constant 1996 $) |

82.45 |

4.59 |

0.000 |

|

|

R&D Intensity (R&D/Employee) |

32.70 |

17.75 |

0.000 |

|

|

R&D Intensity (R&D/Total Assets) |

0.16 |

0.14 |

0.077 |

|

|

# Issued US Patents |

25.35 |

0.84 |

0.000 |

|

|

n |

76 |

60 |

|

|

|

aBased on annual financial information and patent counts, 1973-2000, and litigation events, 1973-June 2001. bP-values based on a two-tailed test of equality are presented. |

||||

Characteristics of Litigating vs. Nonlitigating Firms

Roughly 56 percent of the semiconductor firms in the sample are involved in one or more U.S. patent lawsuits filed during 1973-2001. Table 2A compares the mean characteristics of the sample firms involved in litigation (“litigating firms”) with those of sample firms that were not listed in patent lawsuits (“nonlitigating firms”) during the sample period. On average, litigating firms spend more on R&D (in absolute terms and per employee), are much larger (as measured by sales, number of employees, or capital expenditures), and have larger patent portfolios than “peer” semiconductor firms not involved in legal patent disputes during this period. In a study of intellectual property-related case filings before the USITC during 1976-1990, Mutti and Yeung (1996) report similar findings.

To see whether these results differ between design firms and manufacturers, Table 2B divides the sample into these two main types of firms. Again, a similar pattern emerges. For both subsets of firms, those involved in patent litigation (on average) tend to be larger, invest more heavily in R&D, and own more patents compared to nonlitigating firms. It should also be noted from Table 2B that a higher share of design firms in the sample are involved in patent litigation over the sample period than is true for manufacturers: Whereas 65 percent of the design firms (36 of 55 firms) appear in at least one reported legal dispute over patents between 1973 and June 2001, less than half of the manufacturers in the sample (40 of 81 firms) are involved in reported patent cases during the same period. Whether these disputes represent design firms enforcing their own patent rights or defending against lawsuits initiated by others is an issue that I return to below.

Overall Litigation Trends and “Rates”

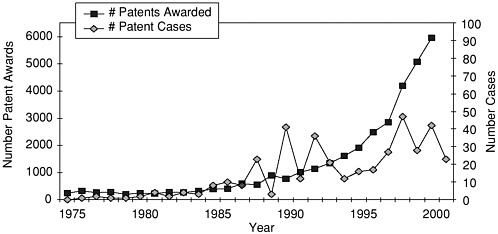

Figure 3 plots the annual number of reported cases that list at least one sample firm as plaintiff, defendant, or patent assignee from 1973 through June 2001. For perspective, the annual number of patents issued to sample firms (collectively) is also reported for 1973-2000.

Two prominent trends emerge. First, in general, the number of cases involving these firms has increased over time, with relatively infrequent litigation activity until the mid- to late 1980s. As acknowledged above, the lack of reported cases in the early period could reflect an underreporting bias in the data (Lanjouw and Schankerman, 2001, 2003). Even so, the upward trend in litigation for firms in this sample is unremarkable when compared with trends reported by other studies using the more comprehensive (but less detailed) data from the Federal Judicial Center. For example, Merz and Pace (1994) report that annual patent case filings neither increased nor decreased between 1971 and 1982 but rose steadily by an average rate of 25 percent per year from around 1983 through 1991.

TABLE 2B Mean Values of Manufacturing and Design Firms Characteristics: Litigating Versus Nonlitigating Firms, 1725 Observations (136 Firms), 1973-2001a

|

Manufacturers (n=81) |

|||

|

Variable |

Litigating Firms |

Nonlitigating Firms |

p-Value, Test of Equalityb |

|

Age (2000-founding year) |

25.33 |

29.23 |

0.000 |

|

D(Entered before 1982=1) |

0.68 |

0.68 |

1.000 |

|

Sales (Constant 1996 $M) |

872.85 |

34.05 |

0.000 |

|

Employees (1,000s) |

7.41 |

0.45 |

0.000 |

|

Prop, Plant & Equip (Constant 1996 $) |

683.76 |

16.62 |

0.000 |

|

R&D (Constant 1996 $M) |

113.35 |

4.07 |

0.000 |

|

R&D Intensity (R&D/Employee) |

19.26 |

9.66 |

0.000 |

|

R&D Intensity (R&D/Total Assets) |

0.13 |

0.09 |

0.000 |

|

# Issued US Patents |

32.70 |

0.64 |

0.000 |

|

n |

40 |

41 |

|

|

Design Firms (n=55) |

|||

|

Variable |

Litigating Firms |

Nonlitigating Firms |

p-Value, Test of Equalityb |

|

Age (2000-founding year) |

15 |

14 |

0.120 |

|

D(Entered before 1982=1) |

0.25 |

0.21 |

0.746 |

|

Sales (Constant 1996 $M) |

138.09 |

36.98 |

0.000 |

|

Employees (1,000s) |

0.46 |

0.15 |

0.000 |

|

Prop, Plant & Equip (Constant 1996 $) |

44.25 |

15.10 |

0.000 |

|

R&D (Constant 1996 $M) |

24.04 |

6.56 |

0.000 |

|

R&D Intensity (R&D/Employee) |

59.65 |

50.44 |

0.009 |

|

R&D Intensity (R&D/Total Assets) |

0.21 |

0.33 |

0.000 |

|

# Issued US Patents |

4.89 |

1.21 |

0.000 |

|

n |

36 |

19 |

|

|

aBased on annual financial information and patent counts, 1973-2000, and litigation events, 1973-June 2001. bP-values based on a two-tailed test of equality are presented. |

|||

Even more striking in Figure 3 is the growth in patenting by semiconductor firms, which continued to accelerate through the last half of the 1990s.31 As reported by Hall and Ziedonis (2001), the propensity of semiconductor firms to patent (relative to their R&D spending) more than doubled between 1982 and

FIGURE 3 Number of annual patent awards v. patent case filings (U.S. semiconductor firms, 1973-2001).

1992, from about 0.3 to 0.6.32 Similar calculations for the expanded sample suggest that the upward trend reported in Hall and Ziedonis did not level off during the decade of the 1990s: Between 1992 and 1997, patenting per million real R&D dollars in semiconductors continued to climb from 0.6 to almost 0.8.

Has the litigation rate in semiconductors increased? Because I have information about R&D spending and patenting trends related to these firms, I approach this question from several angles. In brief, the answer depends on how you measure “litigation rate.” The answer ranges from “no” to “slightly” (when case filings are deflated by patent counts) to “yes” (when compared with firm-level R&D spending).

The most common way to estimate patent litigation rates is to deflate the number of annual patent cases filed (or number of patents involved in disputes) with a measure of relevant patents “at risk” of litigation that year. Using a similar approach, I find that the average litigation rate for semiconductor manufacturers fell slightly (by 5 percent) between 1973-1985 and 1986-2000, from 9.5 to 9.0 cases filed per thousand patents—as reported in Table 3, column 3.33 Given the dramatic growth rates in patenting by firms in this industry since the mid-1980s (discussed in the second section of this chapter and revealed clearly in Figure 3), these results are not particularly surprising. On the one hand, they may echo the econometric findings of Lanjouw and Schankerman (2003) that firms with large

|

32 |

During the same period, the patent yield for manufacturing as a whole was fairly stagnant and that for pharmaceuticals actually declined (see Figure 1 in Hall and Ziedonis, 2001). |

|

33 |

The sample was divided into periods that predate and follow 1985, in line with the discussion in the second section of this chapter about key “demonstration events” around 1985-1986 that signaled the importance of the new patent regime to firms in this industry. |

TABLE 3 Patent Litigation “Rates,” Before and After 1986, U.S. Semiconductor Manufacturers Versus Design Firms

|

Variablesa |

Column 1b 1973-1985 |

Column 2 1986-2000 |

Column 3c (% change, 2 vs. 1) |

|

Manufacturers |

|||

|

Number of cases/1,000 patents awarded |

9.477 |

9.020 |

–5% |

|

Number of litigated patents/1,000 patents awarded |

7.190 |

9.262 |

29% |

|

Number of cases/million real R&D dollars |

0.0028 |

0.0040 |

43% |

|

Number of litigated patents/million real R&D dollars |

0.0021 |

0.0041 |

94% |

|

Design Firms |

|||

|

Number of cases/1,000 patents awarded |

na |

40.75 |

na |

|

Number of litigated patents/1,000 patents awarded |

na |

39.98 |

na |

|

Number of cases/million real R&D dollars |

na |

0.012 |

na |

|

Number of litigated patents/million real R&D dollars |

na |

0.012 |

na |

|

Magnitude of Difference (Design v. Manufacturing, second period only) |

|||

|

Number of cases/1,000 patents awarded |

|

4.52 X |

|

|

Number of litigated patents/1,000 patents awarded |

|

4.32 X |

|

|

Number cases/million real R&D dollars |

|

2.93 X |

|

|

Number litigated patents/million real R&D dollars |

|

2.80 X |

|

|

aVariables in the left-hand column were calculated as follows: •“number of cases” = the number of unique U.S. patent cases filed that involved one or more sample firms in that category (averaged across firms and within period) •“1,000 patents owned” = based on the cumulative stock of patents awarded to sample firms in that category (averaged across firms and within period, with deletion of expired patents) •“litigated patents” = the number of patents assigned to firms in that category that were involved in patent cases during each period •“million real R&D dollars” = average R&D spending by sample firms in that category during each period (based in 1996 dollars using NSF R&D Deflators). bThe average litigation rate for 1973-1985 was calculated with the subset of manufacturing firms that existed throughout both periods; few design firms were involved in patent cases filed before 1986. cAdjusting the two periods by 1-2 years did not substantively alter the results. |

|||

portfolios more successfully avoid litigation; semiconductor manufacturers may have deterred litigation events more effectively or reached agreement more easily in licensing negotiations as their patent portfolios grew larger. Although this is perhaps true, the disproportionate growth in patenting by these firms (the denominator) could mask important underlying trends or variation within the sample.

If we compare case filings with an “input” measure of innovation (R&D spending), a different pattern emerges. Here, the average rate of litigation for manufacturers rises noticeably between the two periods—with a 45 percent in-

crease in the number of patent cases filed and almost twice as many patents being litigated per R&D dollar in the post-1985 period (see again Table 3, column 3). Numerous studies report that the direct and indirect costs associated with preparing, negotiating, filing, and (for the subset of cases that proceed to trial) litigating patent cases have risen over time (e.g., see Ellis, 1999; AIPLA, 1999). If true, this suggests that—relative to their investments in R&D—semiconductor manufacturers on average have been devoting far more financial resources toward enforcing, defending, and challenging patents in court since 1985 than was true in the preceding period.

A Closer Look at Litigation Patterns for Design Firms vs. Manufacturers

Regardless of how it is measured, the average litigation rate for design firms is consistently higher—by an order of magnitude—than that for manufacturers. This is particularly interesting because the design firms in this sample are (as a group) relatively small in size. During the sample period, the median design firm had less than 250 employees; in 1990, roughly 80 percent of the design firms in this sample had less than 500 employees.

Table 3 (column 2) reveals that during 1986-2000, design firms were involved (as either plaintiff or defendant) in approximately 4 patent cases for every 100 patents in their portfolios—a “litigation rate” that is more than 4.5 times that of manufacturers based on similar calculations. Restricting the sample to cases in which the firms enforce their own patents suggests that (on average) design firms in the sample enforce approximately 4 of every 100 patents they own. Although litigation rates of similar magnitude have been reported for new biotechnology firms during 1990-1994 (Lerner, 1995), they are unusual across technological sectors; for example, they are roughly three times the litigation rates reported by Lanjouw and Schankerman (2001) in electronics classes more generally and more than twice those reported in computers by Somaya (2003).34 The high propensity of design firms to enforce their patents is similarly revealed in the R&D-based measures reported in Table 3 (column 2). Relative to manufacturers, design firms were involved (on average) in almost 3 times as many cases and enforced over 2.5 times as many patents per R&D dollar during the 1986-2000 period.

To illuminate factors that might underpin these divergent litigation propensities of manufacturers and design firms, Tables 4A and 4B compare the characteristics of cases that involve these two types of firms. For clarity, the tables distinguish among cases in which firms are enforcing their own patent rights against others (plaintiffs in infringement suits), are defending themselves against claims

TABLE 4A Profile of Cases Involving Sample Manufacturing Firms, by Type of Case

|

|

|

Infringement Suits |

Declaratory Judgment Suits |

||

|

Panel A. Cases Involving Manufacturers |

Total (includes 3rd party) |

As Plaintiff |

As Defendant |

As Plaintiff |

As Defendant |

|

Overview |

|||||

|

Number of casesa |

209 |

101 |

91 |

13 |

14 |

|

Number, excluding Texas Instruments |

170 |

83 |

81 |

12 |

9 |

|

Number of unique parties involved |

173 |

97 |

82 |

28 |

22 |

|

Average number of parties/case (median) |

2.61 (2) |

2.47 (2) |

2.78 (2) |

2.61 (2) |

2.21 (2) |

|

Number of patents involved |

372 |

182 |

156 |

51 |

62 |

|

Average number of patents/case (median) |

2.48 (1) |

2.46 (1) |

2.09 (1) |

3.92 (1) |

4.43 (1.5) |

|

By characteristics of opposing party:b percent cases “within sample” |

|||||

|

percent with other US semiconductor manufacturers |

16.75% |

28.71% |

31.87% |

38.46% |

35.71% |

|

percent with US Design firms |

11.96% |

18.81% |

4.40% |

0.00% |

7.14% |

|

percent cases with foreign firms |

24.40% |

27.72% |

14.29% |

7.69% |

14.29% |

|

percent cases with non-semiconductor firmsc |

49.28% |

32.67% |

45.05% |

53.85% |

28.57% |

|

percent cases with independent inventors |

8.61% |

2.97% |

6.59% |

23.08% |

0.00% |

|

percent cases with univs or govt labs |

0.96% |

0.99% |

0.00% |

0.00% |

0.00% |

|

By characteristics of litigated patents: |

|||||

|

percent in electronics-related classes (G01-G21; H- ) |

90.59% |

91.21% |

90.38% |

88.24% |

98.39% |

|

percent that pertain to new or improved semiconductor devices (Invention Type=1)d |

53.23% |

65.93% |

55.77% |

45.10% |

48.39% |

|

percent that pertain to new or improved manufacturing processes (Invention Type=3)d |

23.66% |

21.98% |

21.15% |

41.18% |

17.74% |

|

aOverall, manufacturers were involved in 209 cases and design firms were involved in 90 cases during the sample period. This exceeds the number of cases in the sample (287) because of 12 cases that involve both manufacturers and design firms in the sample. bPercentages exceed 100% since multiple parties (of different types) can be involved in a case. cDefined as firms for which SIC3674 is not listed as a primary or secondary class among its lines of business. dSee Appendix A for information about invention types and how they were coded. |

|||||

TABLE 4B Profile of Cases Involving Sample Design Firms, by Type of Case

|

|

|

Infringement Suits |

Declaratory Judgment Suits |

||

|

Panel B. Cases Involving Design Firms |

Total (Includes 3rd party) |

As Plaintiff |

As Defendant |

As Plaintiff |

As Defendant |

|

Overview |

|||||

|

Number of casesa |

90 |

43 |

48 |

5 |

4 |

|

Number of unique parties involved |

92 |

57 |

47 |

10 |

4 |

|

Average number of parties/case (median) |

2.41 (2) |

2.30 (2) |

2.27 (2) |

3 (2) |

2.75 (3) |

|

Number of patents involved |

134 |

60 |

80 |

19 |

6 |

|

Average number of patents/case (median) |

2.19 (1) |

1.91 (1) |

2.12 (1) |

4.8 (4) |

3.25 (3.5) |

|

By characteristics of opposing party:b |

|||||

|

Percent cases “within sample” |

|||||

|

Percent with other US semiconductor manufacturers |

27.78% |

9.30% |

39.58% |

20.00% |

0.00% |

|

Percent with US Design firms |

18.89% |

37.21% |

33.33% |

0.00% |

0.00% |

|

Percent cases with foreign firms |

11.1% |

13.95% |

6.25% |

0.00% |

0.00% |

|

Percent cases with non-semiconductor firmsc |

43.3% |

34.88% |

25.00% |

60.00% |

100.00% |

|

Percent cases with independent inventors |

2.2% |

0.00% |

0.00% |

20.00% |

0.00% |

|

Percent cases with univs or govt labs |

0.0% |

0.00% |

0.00% |

0.00% |

0.00% |

|

By characteristics of litigated patents: |

|||||

|

Percent in electronics-related classes (G01-G21; H- ) |

98.51% |

100.00% |

98.75% |

100.00% |

100.00% |

|

Percent that pertain to new or improved semiconductor devices (Invention Type=1)d |

79.9% |

93.33% |

82.50% |

57.89% |

100.00% |

|

Percent that pertain to new or improved manufacturing processes (Invention Type=3)d |

6.77% |

0.00% |

8.75% |

5.26% |

0.00% |

|

aOverall, manufacturers were involved in 209 cases and design firms were involved in 90 cases during the sample period. This exceeds the number of cases in the sample (287) because of 12 cases that involve both manufacturers and design firms in the sample. bPercentages exceed 100% since multiple parties (of different types) can be involved in a case. cDefined as firms for which SIC3674 is not listed as a primary or secondary class among its lines of business. dSee Appendix A for information about invention types and how they were coded. |

|||||

of infringement (defendants in infringement suits), or are engaged in declaratory judgment suits. Because of the limited number of declaratory judgment suits in the sample, the discussion below focuses on the trends reported in the overall and patent infringement columns.

In general, we see from Tables 4A and 4B that cases involving manufacturers tend to include a more disparate set of parties and inventions than is true of disputes involving design firms. Almost 25 percent of cases involving manufacturers are against foreign firms, and almost 10 percent of the cases include an independent inventor as an opposing party. In contrast, less than 12 percent of cases involving design firms are against non-U.S. firms, and only 2 percent are in opposition with an independent inventor. Similarly, opposing parties in disputes involving design firms are more heavily concentrated among other design firms or U.S. semiconductor manufacturers. Design firm disputes also involve a more focused set of technologies more targeted toward product-related inventions (as revealed in the lower rows of Tables 4A and 4B). Many of these trends are, of course, not surprising given the broader range of technological and commercial activities in which manufacturers are involved. Table 4B also reveals, however, that design firms (on average) tend to enforce their patent rights most frequently against other design firm rivals. Interestingly, they most commonly defend themselves in litigation initiated by domestic semiconductor manufacturers, followed by disputes initiated by other design firms.

To the extent that design firms are using the courts to protect market share (as suggested in interviews discussed in the second section of this chapter), we should expect them to enforce their patents relatively early in the patent’s lifetime to block competition in related markets. Consistent with this view, I find that design firms enforce patents that are roughly the same age as the average patent in their portfolios. In contrast, manufacturers in the sample enforce patents that are, on average, almost 4 years older than the average patent in their portfolios.35 Somaya (2003) argues that the “strategic stakes” are higher for patents enforced early in their lifetimes. In a study comparing case filings and settlements in computers and research medicines, Somaya finds that the patentee’s strategic stakes renders settlement less likely in both sectors. My descriptive results are consistent with this finding, albeit in a different setting.

CONCLUDING REMARKS

This chapter examines the enforcement of U.S. patents in semiconductors— an industry characterized by a rapid, cumulative process of innovation. Starting with a sample of 136 dedicated U.S. semiconductor firms, the study compares the

characteristics of litigating and nonlitigating firms and explores the incidence and nature of litigation events involving these firms from 1973 through June 30, 2001. Despite active cross-licensing in this industry, the results suggest that litigation events over patented technologies have become more frequent during the period associated with stronger U.S. patent rights. Previous research suggests that the aggressive patenting by manufacturing firms in this sector is driven by a desire to deter such litigation and to negotiate more favorable access to external technologies (Hall and Ziedonis, 2001; Cohen et al., 2000). Indeed, this study finds that the “patent portfolio races” of U.S. semiconductor manufacturers identified by Hall and Ziedonis continued apace throughout the decade of the 1990s, dwarfing overall patent litigation trends in this sector. Although the number of patent cases involving these firms has declined slightly relative to their patenting activity since the mid-1980s, I nonetheless find that it has increased relative to the R&D investments of these firms during the same period. Assuming that the direct and indirect costs associated with litigation have also increased over time (Barton, 2000; AIPLA, 1999), these trends suggest that semiconductor firms have been directing a larger share of their innovation-related resources toward defending, enforcing, and challenging patents in court since the mid-1980s than was true in the preceding period.

The descriptive findings yield somewhat mixed results regarding the litigation behavior of small firms—a matter explored in detail in recent studies by Lanjouw and Lerner (2001) and Lanjouw and Schankerman (2003). On one hand, I find that semiconductor firms involved in litigation over the sample period are larger, invest more in R&D, and own more patents than nonlitigating firms in the industry. This result holds both across the sample and within each group of design and manufacturing firms. Yet the high average litigation propensity of design firms in the sample is quite striking. These firms, which typically employ less than 500 employees, enforce an average of 4 out of every 100 patents they own—a litigation rate that is not only high relative to semiconductor manufacturers but closely resembles that of dedicated biotechnology firms in the early 1990s (as reported by Lerner, 1995). As “technology specialists” lacking complementary manufacturing assets of their own, semiconductor design firms appear to rely quite heavily on U.S. courts to protect their intellectual assets—primarily against other design firm rivals. At least within this sector, these results call into question whether the propensity of small firms to enforce patents stems from a desire to aggressively defend technological niches (“high stakes”) or from a lack of large portfolios with which to trade (as Lanjouw and Schankerman’s 2003 study suggests). The next step in this research is to test between these competing explanations econometrically, which will also enable us to investigate a broader range of factors shaping cooperation and conflict over intellectual property rights in this sector.

Although suggestive, these results highlight several important (but unresolved) questions about the role of patents, and patent portfolios, in the complex

process of innovation. What is the effect of litigation—and threats of litigation— on the R&D and patenting behavior of firms? Do firms in cumulative technological settings “avoid the shadows” of better-capitalized rivals (or those with larger patent portfolios), as Lerner (1995) finds in the biotechnology sector? Alternatively, if “mutual blocking” conveys value to these firms in terms of more favorable cross-licensing deals or implicit design freedom, firms may seek to “race into” the patent thickets by amassing larger portfolios of their own with which to trade. Addressing these questions would enrich our understanding of the underlying incentives generated by the patent system.

Finally, to what extent is the emergence of patent thickets deterring entry or “tilting the tables” more in favor of large firms (or, somewhat separately, firms with large patent portfolios)? This question extends well beyond the scope of this study but is important from a policy perspective and interesting to consider within the context of semiconductors.36 As mentioned in the second section of this chapter, the early success of the U.S. semiconductor industry is often attributed to the liberal licensing terms offered by firms such as AT&T and IBM for rights to use their portfolios of patents in the 1950s through 1970s—in part because of constraints imposed by antitrust authorities (Tilton, 1971; Levin, 1982; Grindley and Teece, 1997). Yet, as demonstrated by the emergence of design firms within this sample, widespread entry continued to characterize this industry during the period associated with stronger U.S. patent rights and a less restrictive antitrust regime. Several recent studies provide partial insights into this apparent paradox. For example, by modeling the decision of patent owners to invest in monitoring potential infringers, Crampes and Langinier (2002) show that strengthening the rights of patent owners may deter entry if an incumbent already had incentives to negotiate licenses with the entrant (to settle rather than sue) but now imposed a higher license fee. Alongside this conventional finding, however, they also find that strengthening the rights of patent owners may (1) expand the “settlement area” under which it is becomes profitable for the patent owner to license rather than sue (and thereby induce entry) and (2) induce entry by firms with highly differentiated products (where the bargaining surplus is greatest). Recent empirical findings by Gans et al. (2002) similarly suggest that, in the shadows of stronger patent protection, the relationships between incumbents and start-up firms may become more cooperative than competitive in nature, whereas others emphasize the importance of patent rights in sustaining entry by specialized firms (e.g., Arora et al., 2001). In summary, these studies highlight the importance of

understanding the economic incentives generated by the patent system but also underscore the multifaceted effects that may arise even within one technological sector.

REFERENCES

Adelman, M. J. (1987). “The New World of Patents Created by the Court of Appeals for the Federal Circuit.” Journal of Law Reform 20(4): 979-1007.

American Intellectual Property Law Association (AIPLA). (1999). Report of Economic Survey 1999. Arlington, VA: AIPLA.

Arora, A., A. Fosfuri, and A. Gambardella. (2001). Markets for Technology: The Economics of Innovation and Corporate Strategy. Cambridge, MA: MIT Press.

Barton, J. H. (2000). “Reforming the Patent System.” Science 287: 1933-1934.

Bessen, J., and E. Maskin. (2000). “Sequential Innovation, Patents, and Imitation,” Working Paper No. 00-01, Department of Economics, Massachusetts Institute of Technology.

Cohen, W. M. (1995). “Empirical Studies of Innovative Activity,” in P. Stoneman, ed., Handbook of Economics of Innovation and Technological Change. Oxford, UK: Blackwell Publishers Inc.

Cohen, W. M., R. R. Nelson, and J. Walsh. (2000). “Protecting Their Intellectual Assets: Appropriability Conditions and Why U.S. Manufacturing Firms Patent (or Not),” NBER Working Paper 7552.

Crampes, C., and C. Langinier. (2002). “Litigation and Settlement in Patent Infringement Cases.” RAND Journal of Economics 33(2): 258-274.

Ellis, Judge T. S., III. (1999). “Distortion of Patent Economics by Litigation Costs.” In K.M. Hill, T. Takenaka, and K. Takeuchi, eds., Streamlining International Intellectual Property: Enforcement and Prosecution, University Technology Transfer, and Incentives for Inventors. Seattle, Washington: University of Washington School of Law Center for Advanced Study and Research on Intellectual Property, publication series No. 5.

Farn, M. (1996). “A Quasi-Statistical Analysis of the Acquisition and Enforcement of Patent Rights in the Computer and Semiconductor Industries for the Period 1986-1995,” Stanford Law School directed research, Fall 1996.

Gans, J. S., D. H. Hsu, and S. Stern. (2002). “When Does Start-Up Innovation Spur the Gale of Creative Destruction?” RAND Journal of Economics 33(4): 571-586.

Graham, S., and D. C. Mowery. (2003). “Intellectual Property Protection in the U.S. Software Industry.” In W. Cohen and S. Merrill, eds., Patents in the Knowledge-Based Economy.Washington, D.C.: The National Academies Press.

Grindley, P. C., and D. J. Teece. (1997). “Managing Intellectual Capital: Licensing and Cross-Licensing in Semiconductors and Electronics.” California Management Review 39(2): 1-34.

Hall, B. H., and R. H. Ziedonis. (2001). “The Patent Paradox Revisited: An Empirical Study of Patenting in the US Semiconductor Industry, 1979-95.” RAND Journal of Economics 32(1): 101-128.

Heller, M. A., and R. S. Eisenberg. (1998). “Can Patents Deter Innovation? The Anticommons in Biomedical Research.” Science 280: 698-701.

Hunt, R. M. (1999). “Nonobviousness and the Incentive to Innovate: An Economic Analysis of Intellectual Property Reform,” working paper no. 99-3, Economic Research Division, Federal Reserve Bank of Philadelphia.

Integrated Capital Monitor. (1999). “Company Analysis: Rambus, Inc.” 1(1): 6-7.

Integrated Circuit Engineering Corporation (ICE). (1995). Cost Effective IC Manufacturing, 1995. Scottsdale, AZ: Integrated Circuit Engineering Corporation.

Integrated Circuit Engineering Corporation (ICE). (1976-1998). Status: A Report on the Integrated Circuit Industry. Scottsdale, AZ: Integrated Circuit Engineering Corporation.

Jaffe, A. (2000). “The U.S. Patent System in Transition: Policy Innovation and the Innovation Process.” Research Policy 29: 531-557.

Kortum, S., and J. Lerner. (1998). “Stronger Protection or Technological Revolution: What Is Behind the Recent Surge in Patenting?” Carnegie-Rochester Conference Series on Public Policy 48: 247-304.

Lanjouw, J. O., and M. Schankerman. (2001). “Characteristics of Patent Litigation: A Window on Competition.” RAND Journal of Economics 32(1): 129-151.

Lanjouw, J. O., and M. Schankerman. (2003). “Enforcement of Patent Rights in the United States.” In W. Cohen and S. Merrill, eds., Patents in the Knowledge-Based Economy. Washington, D.C.: National Academies Press.