1

Background

INTRODUCTION

The Tax Systems Modernization (TSM) effort of the Internal Revenue Service (IRS) represents a huge undertaking—given the size of the system being modernized and the number of processes that will be affected. In effect, TSM represents a complete business re-engineering of the IRS over a decade, estimated to cost in excess of $8 billion to develop and implement. This committee and its predecessor1 have spent 5 years reviewing the directions and accomplishments of the IRS’s TSM effort and have provided periodic recommendations through a series of committee reports. Other organizations, such as the General Accounting Office (GAO), have also monitored and commented on TSM. Needless to say, an expansive list of information has been accumulated about the TSM program (see Appendix A), and the committee refers the reader to that information for a complete background on and introduction to the IRS’s modernization effort. This chapter provides a brief summary of the goals of TSM and a high-level view of its essential components.

GOALS OF TAX SYSTEMS MODERNIZATION

Not only is the effective and fair collection of taxes an essential government function, but it also forms one of the primary points of interaction between most citizens and the federal government. Consequently, any improvement in this process not only will increase the effectiveness of the government but also will reduce the frustrations of taxpayers. Since the tax system is an information-intensive activity, it can, in principle, benefit from modern information technology to improve quality of service and efficiency simultaneously. The IRS has come to understand these goals, and the committee has seen, over the last 5 years, examples of its determination to achieve them.

TSM has existed for almost a decade, with about another 7 years of activity scheduled.2 During that time, the following specific goals have emerged for TSM:

-

Decrease the risk of catastrophic failure;

-

Increase the efficiency of tax return processing;

-

Provide better services; and

-

Increase enforcement capabilities.

When the committee first met with the IRS, most of the discussions centered on the possibility that the current system would collapse. The IRS was using systems and techniques that were antiquated, and although it was completing its core tasks every year, the IRS was unable to make any advances in keeping with the general advance of information technology. The desire to avoid a catastrophe was clearly the primary objective of TSM initially, and this committee wholeheartedly agreed with that goal.

Naturally, an inherent goal of any modernization program is to improve the efficiency of the system and the organization that uses that system. With regard to the IRS, however, this goal is not important in its own right: the goal of increasing efficiency is important only because it is needed to support the other goals.

During the committee’s tenure, the IRS shifted its perspective on TSM from “modernizing a technical system” to that of “modernizing the IRS.” This shift was an absolute necessity and showed the committee that the IRS was prepared to alter its way of doing business in order to gain full benefit from the technical changes. To this end, the IRS embraced a goal of providing a better quality of service. That is, the IRS was prepared to alter its fundamental handling of taxpayer issues to reduce the amount of erroneous information given out by the IRS and to make it easier for the average taxpayer to conduct business with the IRS. Technical capabilities, such as modern telephone call processing and on-line case processing, are being built specifically to support this goal.

Finally, it must be noted that one of the goals of TSM is to improve the IRS’s ability to collect taxes, including its ability to enforce the tax laws so that every taxpayer pays his or her legal share. This ability has always been controversial, with almost everyone taking both sides of the discussion at some point in his or her life. Taxpayers generally agree that the IRS should be empowered to collect taxes from tax evaders, but the same taxpayers are frustrated when they have to participate in an IRS audit, regardless of its outcome. Consequently, the goal of improving the IRS’s enforcement capabilities is not discussed often, but it is an important part of the overall modernization effort.

It is difficult to say which of these various goals is more important, primarily because they are intertwined. For example, it is difficult to provide better service if the system is not efficient enough to issue refund checks in a timely manner. When addressing any aspect of TSM it is important to consider all of these goals. The IRS along with all of its oversight organizations must remember this point in order to properly guide itself through the modernization effort.

HIGH-LEVEL VIEW OF TAX SYSTEMS MODERNIZATION

TSM is essentially a collection of applications and systems that will incrementally replace or add to the existing capabilities of the IRS. However, over the last 5 years, the definition and description of TSM have changed as various issues and concerns were discussed. Such an evolution is to be expected, given the size and complexity of the modernization effort. Nonetheless, in order to understand the key issues associated with TSM, it is important to define the major components. Although the IRS has been asked repeatedly by this committee to describe TSM in such terms, only recently has it characterized the program as a collection of projects grouped as follows:3

-

Computing/Infrastructure

-

Service Center Support System

-

Corporate Systems Modernization/Mirror Image Acquisition

-

Corporate Accounts Processing System

-

Work Load Management System

-

Electronic Management System

-

Cash Management System

-

Electronic Fraud Detection System

-

Management Systems Program

-

Security and Communications Systems

-

Communications Modernization

-

Service-Wide Technical Infrastructure and Desk/Laptop Acquisition

-

Program Management

-

Contractor Support

-

Universal Workstation Deployment

-

Software Development Environment

-

Wage Reporting Simplification

-

-

Submission Processing

-

Document Processing System

-

Telephone Filing

-

Service Center Recognition Image Processing System

-

-

Customer Service

-

Integrated Case Processing

-

Telephone Routing Interactive System

-

Case Processing System

-

-

District Office

-

Integrated Collection System

-

Compliance Research Information System

-

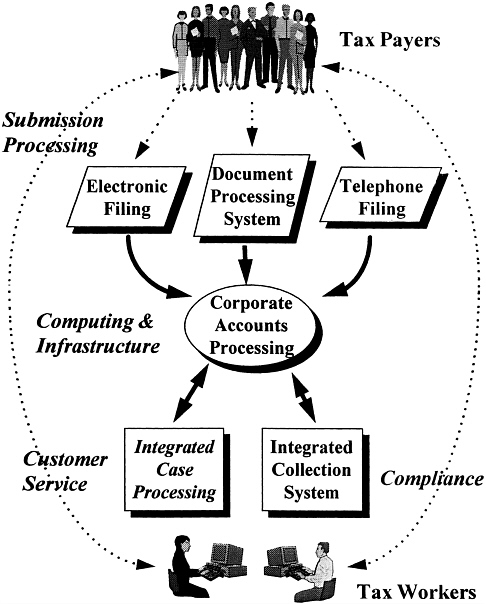

Although this representation has been useful for understanding how various projects are managed, it does not provide a view of how TSM will eventually work. Based on the committee’s interactions with the IRS, the picture of TSM illustrated in Figure 1 has emerged.

The Integrated Case Processing (ICP) and the Integrated Collection System (ICS) projects are the principal drivers for TSM. ICP is being implemented as a set of workstation applications, supported eventually by a set of database servers at each customer service site. ICP will eventually support 56,000 customer service representatives, who will have modern telephone call distribution and on-line access to taxpayer records. In principle, this will allow the IRS to perform “one-stop” processing of taxpayer requests and to reduce inaccuracies in the system. ICS will allow IRS auditors to conduct more efficient audits and to determine areas of noncompliance that should receive more focus.

ICP and ICS will require access to a modern, nationwide database of taxpayer records, which is the principal responsibility of the Corporate Accounts Processing System (CAPS).4 CAPS is being developed on a suite of new mainframes, housed in the three corporate computing centers. These centers will share the transaction work load coming from all other IRS sites and will serve as mutual backup sites in case of failure.

In order to service the information requirements of the ICP and ICS applications, a greater amount of tax return data will be needed in the tax return databases. Current, manual-intensive data entry operations conducted at the submission processing centers record about 40 percent of the numeric data contained on tax returns. The primary objectives of the submission processing projects (Document Processing System, DPS; Electronic Filing, ELF; Telephone Filing, TeleFile; Service Center Recognition Image Processing System, SCRIPS) are to increase in a cost-efficient manner the ability of the IRS to record 100 percent of the numeric data found on tax returns. Another objective of these projects is to decrease the number of tax returns that are stored and processed in paper form.

CURRENT STATUS

As of the writing of this report, TSM is roughly half way through the design and implementation cycle. With varying degrees of success, TSM goals have been specified, architectural guidelines have been written, detailed designs have been generated, and the development of initial versions of the major applications and systems has begun. The IRS has not yet demonstrated an integrated capability resulting from TSM projects, nor has it fully deployed any significant TSM component.

Chapters 2 and 3 comment on the “success” of each step in the development cycle and provide recommendations on how to best improve known deficiencies and increase the likelihood of future success.