4

The Challenges of Integration

Hispanics’ social, economic, and political well-being depends crucially on opportunities to earn a living, to contribute to and share in national prosperity, and to become empowered socially and politically. In short, the integration pathways of newcomers, the economic prospects of the emerging second generation, and the social mobility of established residents together will shape the future of Hispanics in the United States. While in some respects the Hispanic experience mirrors that of other immigrant groups, there are important differences between the economic and demographic profile of the United States now and a century ago, when previous immigration flows reached their historical peak. In particular, three significant conditions existing today in the United States will color the Hispanic experience in the decades to come: the changing social contract, evolving economic trends, and the aging of the white majority. In addition, the historical tendency for Hispanic immigrants to cluster regionally and in urban ethnic neighborhoods has changed; Hispanics today are transforming the face of American cities and towns as they disperse to new destinations across the nation. Accompanying these new trends is the evolution of Hispanic voices in the nation’s political arenas.

THE CHANGING SOCIAL CONTRACT

America’s social contract has become more conservative over the last 25 years. As a result, safety nets that protect children and families have

become less dependable, and social policies have sharpened distinctions between immigrants and citizens and between the young and the old. The Personal Responsibility and Work Opportunity Reconciliation Act, a sweeping welfare reform bill signed into law by President Clinton in 1996, signaled a dramatic shift in U.S. income security policy for immigrants and the poor. Replacing the long-standing Aid to Families with Dependent Children program with Temporary Assistance to Needy Families, the new legislation imposed time limits on cash assistance benefits and required adults to work or participate in education or training programs in exchange for benefits.

Policy changes in the education and health domains also have far-reaching implications for the future welfare of Hispanics of all ages. Skyrocketing health insurance premiums have forced many two-parent working families to drop their health care coverage and also have taken a significant toll on small businesses, which have had to scale back benefits, increase copayments and employee contributions, or cease offering insurance plans altogether. In the last 3 years alone, businesses with fewer than 99 employees have witnessed a decline in health care coverage from 57 to 50 percent.1 This trend is particularly detrimental to Hispanics, who are more highly concentrated in small firms than are non-Hispanics. In 1997, for example, nearly half of Hispanic nonagricultural workers were employed in firms with 99 or fewer employees, compared with 43 percent of non-Hispanics.2

In the realm of higher education, waning federal support for low-income students to attend college has coincided with above-average tuition hikes designed to offset shortfalls in state and local budgets—just when growing numbers of students, an increasing number of them Hispanic, have been requesting financial aid. When the Pell program was created, for example, the maximum grant covered 84 percent of college expenses for the neediest students; today it covers just one-third of those expenses. (The subject of education is discussed in detail in Chapter 5.)

ECONOMIC TRENDS

The United States features the most inequitable distribution of wealth and income among industrialized nations. Not since the Jazz Age of the 1920s has the imbalance in income and wealth been greater. Currently, the top 1 percent of all households enjoy more pretax income than the bottom 40 percent.3 Wealth inequalities are even more pronounced. The rise in

wage inequality has been traced to technological change, which requires higher labor market skills and gives more-educated workers wage premiums. It has also been linked to a decline in unionization and to a minimum wage infrequently adjusted for inflation.4 There is some evidence that immigration may have contributed to the increase in economic inequality in the United States by depressing the earnings of the lowest skilled workers.5

Inequality in U.S. wages began to climb about three decades ago, coinciding with the surge in Hispanic immigration. The steady rise in inflation-adjusted wages that began after World War II ended during the early 1970s, when a decade of high inflation was followed by a decade of high unemployment. Both periods were accompanied by the decline of durable manufacturing industries and the expansion of service industries. Although real wages grew a brisk 8.3 percent between 1995 and 2001 after a prolonged stagnation, earnings inequality rose yet again.6 The top 20 percent of male workers earned about 6 times as much as the bottom 20 percent in 1973, as compared with 10 times as much in 2001.7

Young workers with only a high school education or less—precisely the demographic profile characterizing recent Hispanic immigrants (see Chapter 5)—were hardest hit by the wage erosion that began in the early 1970s.8 Compared with the postwar period through 1973, workers lacking a college education today have a more difficult time making ends meet. Between 1973 and 1996, the average real wage of male high school graduates fell almost $3.00 per hour—$4.00 for those without a diploma. Despite the robust economy of the late 1990s, which allowed low-skill groups to recoup some of these wage declines, their 2001 hourly wages remained below those earned by their low-skilled counterparts in 1973. By contrast, real wages of male college graduates were unchanged between 1973 and 1996, but rose during the late 1990s.9

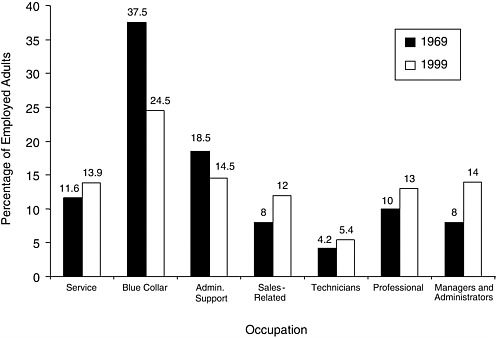

As a result of these trends job growth is now greatest for higher-skilled occupations, with more moderate expansion in low-end, low-wage service sector jobs. Meanwhile, midlevel occupations have declined; specifically, between 1969 and 1999 there was growth at both ends of the occupational spectrum, while the middle slumped.10 Service, sales, technical, professional, and managerial occupations each grew between 2 and 4 percentage points, while blue collar and support occupations declined precipitously—from 56 to 39 percent of all adult workers (see Figure 4-1).

The reduction in demand for less skilled workers and precarious economic prospects in today’s economy have set the stage for both the risks and opportunities confronting the rapidly growing Hispanic population,

FIGURE 4-1 Adult occupational distribution: 1969 and 1999.

SOURCE: Figure 3-2 in Levy and Murnane (2004).

with its youthful age structure and low skill levels.11 Young, unskilled workers are especially vulnerable to business cycle fluctuations and future changes in labor market demand. Better education is the single resource that in the long run will improve the economic prospects and social integration of the burgeoning Hispanic population. Despite significant improvements in high school and college graduation rates among young Hispanics since 1980, large education gaps remain in comparison with other groups, especially for Hispanic immigrants, but the prospects of the second generation are worrisome as well (see Chapter 5).

COMING OF AGE IN AN AGING SOCIETY

Not only are Hispanics forging their national presence in an age of rising inequality, but they are also coming of age in an aging society. Although the Hispanic population will continue to grow through immigration, it is primarily the U.S.-born children and grandchildren of immigrants—the rising second generation and their offspring—who will define its economic and social contours (see Chapter 2).12 In 2000, children of Hispanic immigrants had a median age of just over 12 years. Thus, the

impact of the youthful age structure and above-average birthrates of Hispanics is already being felt in schools today; it will be felt tomorrow in higher education and in labor markets.

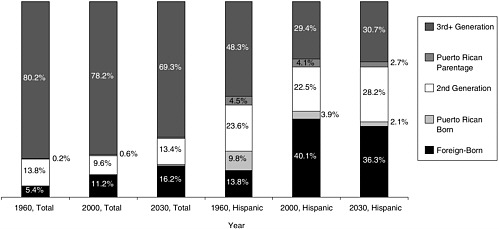

With the exception of Mexicans and Puerto Ricans, most Hispanics are first-generation immigrants, but even 42 percent of Mexicans are foreign born. In 1960, a mere 5 percent of the U.S. population was foreign born, and only about 25 percent of Hispanics were born abroad or in Puerto Rico.13 At the time, almost half of all Hispanics—primarily Mexicans—were U.S. born to U.S.-born parents. Just over one in four Hispanics (28 percent) were second generation. After four decades of immigration, the foreign-born share of the total U.S. population doubled to 11 percent, but the foreign-born share of Hispanics (exclusive of island-born Puerto Ricans) nearly tripled—from 14 to 40 percent. By 2030, the second generation is projected to represent 30 percent of the entire Hispanic population, and a third generation will be well on its way, thus sustaining the youthful composition of the Hispanic population (see Figure 4-2).

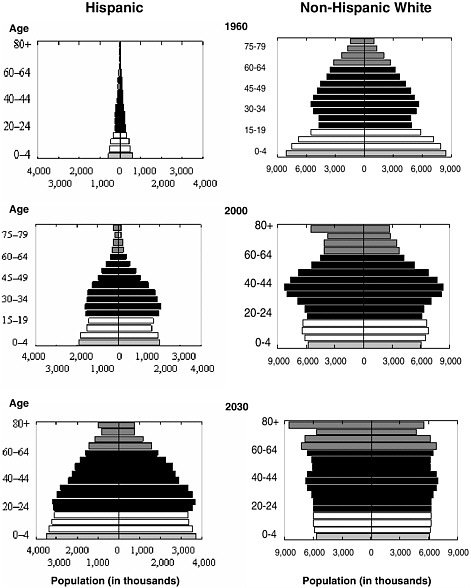

This infusion of young people into the United States is a potentially positive development, slowing the nation’s overall population aging while partially offsetting the rising burden of dependency of an aging majority—what might be viewed as a demographic dividend. In 1960, less than 10 percent of the total U.S. population was of retirement age or older, compared with less than 3 percent of the Hispanic population. Four decades later, these proportions were more than 12 percent and less than 5 percent, respectively. This relative age difference is echoed in median ages of 39 and 27 years, respectively. A generation from now—by 2030—about 25 percent of white Americans will have reached retirement age or beyond, compared with only 10 percent of Hispanics, just when the burgeoning Hispanic second generation, with a median age of 21, will have reached its prime working years. But labor market impacts will occur well before this time as a result of Hispanics’ younger average age at first employment and growing share of the working-age population (see Figure 4-3).

An aging industrialized society can balance its rising old-age dependency ratio by importing workers and raising women’s labor force participation rates. In the absence of substantial productivity increases, however, such demographic solutions will be insufficient.14 In particular, funding the pensions of a swelling elderly population requires a productive workforce capable of paying taxes, saving, and investing. Hispanic workers—immigrant and natives alike—already contribute to the social security system. In fact, illegal workers, the majority of whom are Hispanic,

FIGURE 4-3 Age pyramids for Hispanic and non-Hispanic white populations: 1960, 2000, and projected 2030.

SOURCE: Passel (2004).

are estimated to contribute as much as $7 billion a year to social security without being entitled to any of the benefits.15 Thus, immigrant labor can help to support the costs of an aging population, but their potential contributions depend on earnings capacity, which in turn depends on educational investments.

The potential dividend offered by working-age Hispanic immigrants

and their future offspring is tempered by their relatively low average earning capacity on arrival. Given the very substantial differences in earnings, education, English fluency, attitudes, and median age between foreign-born and native-born Hispanics, the economic and social repercussions of the generational transformation now under way will depend largely on social investments in U.S.-born Hispanics—the second and later generations—with the proviso that this upward mobility might increase competition with currently more educated segments of the labor force. Hence the amount of Hispanic upward mobility that can be expected from future educational investments may be uncertain, but a sustained presence in low-wage jobs in the absence of significant educational improvement is a virtual certainty.

HISPANIC DISPERSAL

Until recently, the U.S. Hispanic population was concentrated regionally in the southwest, primarily near the southern border with Mexico; in the northeast, most notably in the greater New York and Boston metropolitan areas; and after 1960, in southern Florida. California and Texas have served as both ports of entry and final destinations for Mexican immigrants, and since 1980, for El Salvadorians and Guatemalans. Central and South American immigrants have settled largely in Florida—where they have diluted the Cuban ethnic hegemony—and in New York and New Jersey. In 2000, 7 of every 10 Hispanics resided in these five states. Other important immigrant-receiving states include Arizona, New Mexico, and Illinois—where Mexican neighborhoods emerged in the 1920s, and Puerto Rican communities flourished after World War II.

While these states continue to attract and retain the bulk of new arrivals, many Hispanic immigrants are now choosing to settle in nontraditional destinations such as the cities of the deep south. Significant Hispanic settlement is also occurring in rural areas of the south and midwest.16 In fact, the state with the fastest-growing Hispanic population in the country is not California, nor is it Texas, Florida, Illinois, or New York; it is North Carolina. According to the Census Bureau, the Hispanic population in North Carolina grew five-fold during the 1990s—from 77,000 to 379,000, while that in Georgia quadrupled, and that in Nevada tripled.

In addition, areas once considered “capital cities” for immigrants from just one or two countries are witnessing ethnic diversification as various Hispanic subgroups vie for economic and social space. New York City, long

the “home away from home” for Puerto Ricans, is now the principal destination for Dominicans, Ecuadorians, Panamanians, and Paraguayans. Mexicans are New York’s fourth-largest Latin American group, while in Florida, Central Americans, Colombians, and Puerto Ricans collectively now outnumber Cubans, who remain politically dominant nonetheless.

Another distinctive feature of the Hispanic dispersal is that, in many cases, entire families are relocating rather than sending male workers on seasonal labor sojourns. Given the number of people and places involved, the geographic dispersal of Hispanics not only is redrawing spatial contours, but also may be reshaping the social and economic experiences of the Hispanics who settle in the new destinations.

Paradoxes of Place

The spatial dispersal of Hispanics presents an interesting paradox. Even as Hispanics are experiencing less regional segregation, they are finding themselves resegregated in both traditional settlement cities and their new destinations. By one account, between 1990 and 2000 Hispanic segregation from whites rose in 124 of 210 metropolitan areas, while it fell in 86—a net increase of 38 areas in which segregation increased. During this same period, black–white segregation declined in 240 of 265 metropolitan areas and remained stable in the remainder.17 Whether and to what extent Hispanic geographic dispersal may have contributed to the decline in black–white segregation is unclear, but some experts claim that Hispanics are softening color lines because they are more likely than whites to share social space with blacks and Asians.18

Hispanics are generally less segregated in neighborhoods outside their traditional settlement areas, although levels of segregation vary greatly in the new destinations. Immigrants are typically more segregated residentially than their native-born counterparts, but this trend is highly variable and depends to some extent on the state of the economy.19 In fact, the great diversity in levels of Hispanic residential segregation across metropolitan areas defies generalization. Multiethnic metropolitan areas with large and well-established Hispanic barrios, such as Los Angeles, Chicago, and San Francisco, are characterized by moderate overall segregation levels, relatively low exposure of Hispanics to blacks and Asians, and only moderate exposure to whites. Compared with the native born, Hispanics born abroad experience higher levels of social isolation, particularly in metropolitan areas such as Austin, Dallas, and Houston in Texas or Sacramento and San Diego

in California, where immigration has fueled unusually rapid population growth.

The tendency for foreign-born Hispanics to cluster in high-density immigrant neighborhoods while they familiarize themselves with U.S. institutions and acquire proficiency in English largely explains their higher levels of social isolation. In 2000, Hispanic immigrants typically resided in neighborhoods where more than one-third of their neighbors were also foreign born and where fewer than half of their neighbors spoke English at home.20 Although the residential concentration of newcomers with limited English proficiency may retard their cultural assimilation, their economic integration is not necessarily hampered because many new arrivals use their social ties with established Hispanic residents to find housing and work. To what extent preexisting social ties promote the integration of Hispanic immigrants in new destinations is not yet known, but the pace at which Hispanic communities are expanding in some of the new locations suggests that social networks both reinforce growth and facilitate settlement.

Engines of Growth

One factor driving the geographic dispersal of Hispanics is the lure of employment opportunities in rapidly growing, labor-intensive industries. Having gained a reputation as hard workers in southwestern and mid-western agricultural labor markets, Mexican immigrants have made their way to the agricultural belt between Florida and New Jersey, moving from south to north and back again in response to harvest seasons and putting down roots in areas that offer more-permanent work. The relocation of meat and poultry processing plants from cities to nonmetropolitan areas to reduce labor costs has opened up many opportunities for unskilled workers, often leaving thousands of unionized workers jobless as a result. The poultry and meat processing industries in Iowa, Minnesota, and Nebraska and the seafood industry along the East Coast have attracted numerous immigrants seeking stable employment, including many undocumented workers.21

In the new Hispanic destinations—primarily urban and suburban communities—there is expanding labor demand in construction, dwelling maintenance and repair services, private household services, and nondurable manufacturing. These industries are readily absorbing immigrant laborers searching for stable jobs in smaller, more affordable communities. In Nevada, for example, the Hispanic population swelled in response to a new phase of hotel and casino development that revived the construction

industry. Now, Mexican immigrants dominate Nevada’s hotel, casino, and restaurant service industries—jobs once held by blacks and poor white workers.22 Nevada offered other advantages to migrants, such as affordable housing and lower living costs, permitting entire families to move and making Las Vegas and Reno more appealing than expensive gateway cities such as New York and Los Angeles, where the limited options of the barrios and long commutes to suburban jobs undermine family life.

Of the largest 100 U.S. metropolitan areas, 50 have been designated as “new Hispanic destinations.” In those areas, Hispanics made up less than 2 percent of both the population and the workforce in 1980; by 2000, they represented 7 percent of the population in these areas and 7 percent of the labor force.23 Hispanic job market niches in the new destinations mirror those in the more established Hispanic metropolitan destinations. Nonetheless, a noteworthy labor market transformation is occurring. The growing demand in these industries is being met by foreign-born rather than U.S.-born Hispanics (who presumably would have a stronger command of English). Some striking examples dramatize this point. While the occupational share of native-born Hispanics working as dwelling maintenance workers in the new destination areas inched up from 2 to 3 percent between 1980 and 2000, the share of foreign-born Hispanics in the same industry skyrocketed from less than 1 percent to 18 percent. The construction and private household industries in the new destination areas witnessed a similar evolution in the composition of their workforce after 1980.24 From 1980 to 2000, the proportion of native-born Hispanics among all construction workers in the new destination labor markets rose from 1 to 2 percent, while that of foreign-born Hispanics rose from under 1 percent to over 10 percent. In the traditional metro areas, where immigration played a major role in population growth during the 1990s, similar trends are evident in the dwelling maintenance, construction, and domestic household work industries.

Uncertain Promises

The significance of rising Hispanic residential segregation in both traditional and new destinations is unclear. If the phenomenon is transitory and related to the tendency of immigrants to huddle in ethnic neighborhoods until they become familiar with U.S. institutions, spatial divisions should diminish over time as successive generations come of age. On the other hand, because spatial assimilation unfolds very gradually and is often

accompanied by class and racial divisions, persistent spatial segregation could undermine Hispanics’ long-term social integration. Much will depend on how well newcomers are received in the nontraditional locales; while immigrants are welcomed as hard workers in some communities, in others they increasingly experience a backlash of discrimination.25

Given that Hispanic geographic dispersal is a relatively recent occurrence, it is difficult to say which circumstances will promote integration and what divisions—ethnic, class, or language—will persist over the long run. The pace of assimilation for Hispanics arriving in the newer destinations will depend on, among other factors, the relative and absolute size of the black and Asian populations in the same communities, the proportion of recent immigrants in the overall population mix, and the size of the receiving community.

Two factors related to Hispanics’ geographic dispersal have particularly important implications for their long-term prosperity—educational outcomes and home ownership rates. Hispanic dropout rates are disturbingly high in some of the new settlement areas.26 In new destinations such as the south where Hispanic workers are typically illegal, have little education, and speak limited English, the educational challenges for their children are profound but not unsurmountable.27

To the extent that dispersal shifts Hispanics from high- to low-cost areas, home ownership rates should increase; however, the change will be gradual because lower-income immigrants, who are driving the geographic dispersal, are less likely than natives to own their homes.28 Nevertheless, Hispanic home ownership rates have risen appreciably since 1980—from about 33 percent in 1983 to 44 percent in 2001—even as the share of immigrant Hispanic households has risen appreciably.29 By one estimate, the home ownership rates of Hispanic immigrants approach those of native-born Hispanics after 20 years of U.S. residence.30 This, too, may change, however, depending on whether and how integration unfolds in the new destinations. If limited access to affordable housing relegates Hispanic youths—the second generation in particular—to segregated, resource-poor schools, the benefits of home ownership among the current generation may well be offset by the diminished life options of future generations.

POLITICAL VOICE

Increased mass migration from Latin America and the Caribbean has generated a growing need to incorporate Hispanic voices into community

and national politics. In addressing this need, it is important to recognize that popular but oversimplified references to “the” Hispanic political community or “the” Hispanic vote ignore the population’s enormous diversity and ambivalence about panethnic identity (see Chapter 3). Over the last 20 years, Hispanic elites, particularly those of non-Cuban origin, have organized primarily under a panethnic umbrella rather than according to national-origin identities. The agendas of national organizations such as the Mexican American Legal Defense and Education Fund, the National Council of La Raza, and the Congressional Hispanic Caucus, while reflecting the considerable diversity of the Hispanic population, cross-cut nationalities and party affiliations. These national organizations have their local and regional Hispanic counterparts in areas of Latino concentration throughout the nation.

Despite their substantial class and status differences, Hispanic ethnic groups share a surprising number of social priorities. As a group Hispanics tend to support political positions associated with both conservative and liberal agendas—a characteristic that distinguishes them from typical political constituencies. Although seemingly contradictory, Hispanics’ opposition to such practices as same-sex unions and abortion and their support for civil rights, higher taxation, and government-provided social benefits are both consistent with views that value collective over individual goals.31 Yet Hispanics’ weak political infrastructure at the national level undermines their opportunities for political cohesion even when such a disposition exists.32

Driving Hispanics’ social policy agenda are the growing numbers—U.S.- and foreign-born alike—who recognize that their own and their children’s socioeconomic progress depends on both civil rights protections and publicly funded social services, particularly education. Virtually all public opinion polls reveal that Hispanics consider education the single most important issue facing the nation, and themselves in particular. (As the subgroup with the oldest age structure, Cubans are somewhat more likely than other Hispanic subgroups to identify elderly assistance as a priority issue.)

The political agenda of Hispanics has a distinct social focus that distinguishes it from that of non-Hispanics, which is more likely to emphasize economic issues. Even on shared priorities such as education, Hispanics and non-Hispanics often have different objectives. In the 2000 presidential race, for example, the educational concerns of whites focused on measures of teacher and student assessment, while Hispanics stressed the process of

education, including school overcrowding and the need for culturally sensitive curricula. Local races in which funding for or access to education is central to the debate witness disproportionate increases in Hispanic turnout.

Compared with whites, Hispanics also express greater trust in government, which partly explains their support for higher taxes to expand government programs. Cubans report the highest levels of trust in the U.S. government, probably because of the special concessions they have enjoyed as political refugees, but differences in trust among other Hispanic subgroups are relatively small. Equally noteworthy is the low priority accorded to ethnic-specific issues, such as bilingual education or U.S. relations with Latin America. Although Hispanics share with other racial and ethnic groups concerns about the volume of contemporary migration, their focus is not on stemming those flows but on fair treatment regardless of legal status. Finally, the major issues defining the conservative moral agenda—abortion, family values, and the death penalty—are rarely mentioned as important issues among Hispanics.33 Nonetheless, preliminary evidence from the 2004 election shows that such issues can be framed to mobilize Hispanics selectively and further divide them along partisan lines.34

While Hispanics hold strong views on many social issues, their levels of participation in electoral, civic, and organizational activities fall well below those of whites or blacks (with the notable exception of self-reported parental involvement in school-based activities). Hispanics are less likely than whites to be members of community-based organizations and to donate time or money to civic activities in their communities. And fewer Hispanics assume leadership roles in civic organizations than do whites or blacks.35

Some preliminary evidence suggests that Hispanics’ involvement in the politics of their home countries or communities serves as a precursor to their civic involvement in the United States. Hispanic immigrants are increasingly participating in transnational civic activities; the best estimate suggests that approximately 20 percent of Hispanic immigrants engage in such activities. However, this participation declines with longer periods of residence and once a migrant’s immediate family has fully migrated to the United States.

The gap between the growth of the Hispanic population and its voting numbers has been developing for some time, but has widened considerably in recent years.36 Surveys of voter registration and turnout consistently show lower rates for Hispanics—approximately 10 percentage points below those for blacks and 15 points below those for whites—over the last 25 years. For

the 2004 election, approximately 58 percent of Hispanic citizens were registered to vote, and 47 percent voted; the comparable figures for whites were 75 and 67 percent. Voting among Hispanics has increased only marginally over the last 20 years despite considerable growth in outreach to potential Hispanic voters.

The voting gap between registered Hispanic and non-Hispanic citizens largely parallels group differences in characteristics that are correlated with electoral participation. Simply put, poor, young citizens with low educational levels, even if registered to vote, are significantly less likely to cast ballots than well-educated, affluent seniors. Additional factors responsible for low Hispanic voter turnout include institutional arrangements and past exclusion, but their impact cannot be assessed accurately with available data.37

Foreign-born Hispanics, even naturalized citizens, are less likely to become involved in civic and nonelectoral political activities than Hispanics who are U.S. citizens by birth. More generally, cultural assimilation appears to foster political engagement: civic involvement increases with longer periods of U.S. residence, with third-generation Hispanics voting at higher rates than their second-generation counterparts.38 Still, low rates of naturalization among the foreign-born dampen Hispanics’ electoral participation relative to whites. Over the last three decades, as immigration has fueled Hispanic population growth, each new Hispanic voter has essentially been matched by one nonvoter and nearly two adult noncitizens. For political activities that require citizenship for participation, therefore, the immigrant-heavy population composition of Hispanics not only tempers their political influence at the ballot box, but also renders predictions about their future political behavior highly uncertain.

Moreover, political office holding by Hispanics has barely kept pace with demographic growth. Despite some high-profile Hispanic victories—such as Antonio Villaraigosa’s defeat of incumbent James Hahn in the 2005 Los Angeles mayoral race—Hispanics’ representation in elected offices relative to their population size has not increased since the 1970s. With a significantly larger and increasingly more geographically dispersed population, Hispanics’ low levels of voter turnout and political office holding have more profound implications for representation and governance now than in the past.

If Hispanics are to use politics effectively in advancing their social and economic interests, two conditions must be met: their rates of civic engagement, particularly at the ballot box and in elected positions, must increase,

and democratic institutions must be more responsive to their demands. Because large numbers of Hispanics are not citizens and hence cannot vote, their success in expressing political views requires mobilization beyond the ballot box, such as coalition politics, representation through community-based organizations, and alignment with interest groups supporting the politics of inclusion. Districting strategies that maximize the likelihood of electing Hispanics to influential positions can help by strengthening Hispanics’ political influence.

Los Angeles offers a clear example of these conditions. Over the past 20 years, the Hispanic share of the city electorate has more than doubled, in part because of a surge in naturalization during the late 1990s and early 2000s. Yet the large numbers of youth and noncitizens among the voting-age population means that the Hispanic share of the city’s electorate is less than half their share of the city’s population. Mayor Villaraigosa’s victory required a coalition of Hispanics, blacks, and whites.

Given the many uncertainties faced by Hispanics in the demographic, economic, and social realms (see Chapter 6), their political future is highly uncertain. It is possible that some catalyst—such as the anti-immigrant provisions of the 1996 welfare reform law—will cause large numbers of Hispanic adults who now either do not vote, or as noncitizens are ineligible to vote, to become citizens and participate in the political process. Alternatively, Hispanics’ current passive attitude toward politics may persist, resulting in limited success in recruiting new voters—particularly the young, second generation. Should this scenario play out, parties and candidates would likely lose interest in Hispanics’ political mobilization.

The most plausible scenario, however, is that the Hispanic electorate will continue to grow incrementally over successive election cycles and will maintain some distinctive features relative to the non-Hispanic electorate. Even slow incremental growth in the Hispanic electorate raises the possibility that Hispanics will become a critical swing constituency that decides future electoral outcomes, as was the case in Los Angeles in 2005. The 2004 election clearly demonstrated that Republicans can make inroads into Hispanic electorates; so, too, can Democrats, as they did among traditionally Republican Florida Hispanics. Yet neither population size nor electorate strength can guarantee influence or political voice. To be influential as a bloc, Hispanics will have to build and maintain political cohesiveness.

CONCLUSION

For Hispanics, as with other immigrant groups, the challenges of integration include social and economic mobility and the development of an effective political voice. Contemporary conditions, such as the changing social contract, economic trends, and the aging of the white majority—along with the geographic dispersal of Hispanic communities—both define these challenges and present both risks and opportunities for successful integration of native- and foreign-born Hispanics.

Economic trends that reduce the demand for less-skilled workers pose formidable risks, especially for prospective workers. The Hispanic age boomlet poses a potential demographic dividend that can partially offset the rising burden of dependency of the aging white majority. In the political arena, Hispanics are potentially influential because of their growing numbers and residential dispersion, but low rates of civil engagement continue to limit their collective voice.

How these aspects of Hispanic integration into U.S. society will play out into the foreseeable future remains highly uncertain. The next chapter examines key dimensions of the Hispanic experience that will play a major role in how these uncertainties are resolved.