2

Indicators for Trends in Globalization

IS MSE R&D BECOMING A GLOBAL ACTIVITY?

Chapter 1 considered globalization and its impact on R&D as well as discussing the scope and definition of MSE. Researchers, engineers, and scientists active in MSE R&D believe that their field is becoming increasingly globalized. But what data are available to back up this common wisdom? Trends in global R&D activity can be difficult to demonstrate with clarity. Typically, when analysts try to identify and assess the internationalization or globalization of R&D, they turn to patent data, trends in the national origins of literature in major scientific journals, education trends, the activities of professional societies, and trends in the activities of international corporations. For this report the committee uses the same methodologies. First, however, it defines the globalization of MSE R&D as the worldwide expansion of MSE knowledge-creation centers as a result of U.S. and non-U.S. industry and government investments along with the worldwide increase in collaboration facilitated by information technology.

The Use of Patent Indicators

As a policy instrument, patents are intended to encourage innovation by providing a framework for protecting intellectual property. Patent data can be mined for indicators that measure the output of R&D in particular sectors. Patent data have advantages and disadvantages. Among the advantages are the wealth of infor-

mation contained in patent records—on the applicant, the inventor, locations, and so on. However, the interpretation of patent data has many caveats associated with it. For instance, the value distribution of patents is skewed because many patents awarded have little or no industrial application.1 In addition, many inventions are never patented—corporate inventors, for instance, might choose to keep them as trade secrets for competitive advantage. Also, differences in national intellectual property (IP) regimes can hinder the accurate disaggregation and interpretation of data. Changes in patent law and in patenting patterns make analysis over time difficult. The time lag between an invention and the award of a patent for that invention also causes patent data analysis to be insensitive to very recent trends in invention. Nevertheless this tracking of international activity in a particular field is a good complement to other methodologies and can identify trends.

Because the focus of this report is to look at the globalization of MSE R&D, information on the inventor’s country of residence at the time of the invention is of paramount interest and can indicate shifts in the international location of inventive activity. Although patents with inventors from more than one country are likely to have been counted more than once, the trends displayed are unlikely to change if fractions of those patents are allocated across the countries.

Before looking at the indicators for some key MSE subfields, it is worth asking if there are overall trends in patenting that can help identify baseline trends for patenting in general and from which we can discern MSE-specific trends. These overall trends in all patents are reported in more detail in Appendix C and can be summarized as follows. Fifty-three percent of the inventors associated with U.S. patents reside in the United States, more than in any other country and a larger share than that of the European Union and Japan combined. However, caution is warranted and advisable when drawing any conclusions about the U.S. share of R&D activity based on patent share because of what is called the “home advantage,” whereby proportionate to their inventive activity, patent applicants are more likely to file for a patent in their home country than to file with a foreign patent office. The Organisation for Economic Co-operation and Development (OECD) has worked hard to understand the home advantage, and the data it has amassed point to an increase in transnational activity—that is, a growing share of patents in any given country is owned by individuals, companies, or organizations residing in other countries, indicating an increase in global and transnational ownership and collaboration.

Global Trends in MSE Patent Data

While the OECD has analyzed data on patents to identify trends for aggregate R&D, no similar analysis has been carried out for patents relating to MSE. The committee therefore carried out a limited and focused analysis of the location (by country) of inventors associated with U.S. patents awarded over the last 25 years in certain key and well-defined MSE subfields. Notwithstanding the weaknesses associated with single-patent-office (USPTO) methodology, such an analysis can be useful in understanding the extent to which U.S. dominance has changed over time, a key question for this study. The data were gathered from the online USPTO database.2

Patents of interest were identified by their associated World Intellectual Property Organization (WIPO) category or by searching for a keyword in the patent title. The number of inventors from countries with well-established and emerging levels of activity in MSE were recorded. The key subfields chosen for this analysis were alloys, catalysts, ceramics, magnetic materials, and composites.

It is worth noting that since the issue at hand is the level of global activity in MSE R&D, the information tracked by the committee was the location of the inventors recorded on the patent approval. The following analysis does not record whether the work that led to the invention was part of an international collaboration or partnership or some other form of transnational arrangement. In addition, because the main purpose in carrying out these analyses is to understand the evolution of U.S. and non-U.S. R&D activity over the period, the data were normalized to the numbers for the United States. The following summarizes the results in each of the subfields. A fuller presentation of the results can be found in Appendix C.

Alloys

Patent applications in the alloys subfield are dominated by inventors in the United States, Japan, and Western Europe. U.S. activity remained fairly steady from 1979 to 2004, at around 550 patents a year. Japan significantly increased its absolute number of patents (from 251 to 653 in the period reported), and its share (relative to that of the United States) surged, surpassing the U.S. share in the mid-1990s. Western Europe has had a steady increase in activity, with its share relative to the U.S. share increasing by 50 percent over the last 25 years. While the number of patents awarded with inventors in China and Korea—the two strongest nontraditional performers—has increased, the absolute numbers remain an order of

magnitude behind Europe, Japan, and the United States. Activity rose sharply, however, and may reflect early and emerging stages of globalization of this type of R&D in Asia.

Catalysts

Patents for catalysts exhibit some different trends. The dominance of the United States is persistent, with over twice as much patent activity for inventors in the United States as for inventors in Europe and Asia. However, the numbers for inventors in Germany and Italy have surged, and France remains a strong participant. Among the emerging centers of R&D, China, India, Korea, and Taiwan all show substantial increases over 25 years ago. As is the case with the alloy data, the increase in these countries is strong, but the number of patents remains an order of magnitude less than in Japan and Western Europe and two orders of magnitude less than in the United States.

Ceramics

Patents in ceramics are dominated by the United States and Japan. The number of patents with inventors in Japan jumped significantly at the beginning of the 1980s, and activity there recently appeared to be on a par with the United States. Given the home advantage for the United States, Japan may have equaled or even surpassed the United States in the last decade. Germany dominates European activity, but its share remained fairly steady over the last 25 years. Taiwan and Korea show the strongest increases in performance, but the absolute numbers remain very low.

Magnetic Materials

In magnetic materials, patent output from the United States and Japan has grown along with economic activity and outperformed the combined activity of the five European countries by a factor of 4. Europe’s share decreased over the past 20 years, primarily because its output stagnated when that of Japan and the United States was growing. The data also show significant increases in output from Taiwan and Korea—although as with the other subfields, the absolute numbers of patents with inventors in those countries remains low.

Composite Materials

In the field of composite materials there has been a noticeable increase in global research, with patent output from the United States, Asia, and Europe

about equal. Activity in Europe is dominated by Germany and France. Patent output by inventors in Italy shows a significant upward trend, while activity in the United Kingdom and Switzerland remains static. The United States appears to have lagged behind Japan in the mid-1980s but has caught up since. Taiwan and Korea have been active, but overall numbers remain low; China and India have displayed no significant activity.

Summary of Patent Data

Although there are significant differences in the indicators for the five subfields measured and although there are limitations to this type of analysis, some general trends emerge:

-

In each subfield the United States is the world leader or among the world leaders.3

-

Japan and Western Europe are the closest rivals for leadership. Japan appears to have surpassed the United States in alloys and seems set to surpass it in ceramics.

-

Global activity in all the subfields examined is diversifying, with significant increases in activity in Asian countries that were not previously very active in these fields. How this trend may evolve is unclear.

-

Notwithstanding the global diversification of research activity, the number of patents with inventors in the emerging centers remains low relative to patents by U.S. inventors.

Global Trends in MSE Literature Data

While trends in patenting help to elucidate global innovation, their ability to track basic research might be called into question. Trends in the authorship of journal articles around the world should be expected to reflect broader R&D activity in science and engineering in a manner complementary to trends in patenting. Accordingly, the location of authors has been searched for five key subfields of materials research. As research grows around the world, the numbers of authors from countries with an emerging presence in materials should grow. Details of this information can be found in Appendix D. However, it is important to point out that this kind of analysis does not measure the quality of the research or its impact on the relevant field.

Alloys

In the alloys subfield, the global output of scientific papers grew considerably in the past 20 years. The number of papers from the United States increased steadily, but its share of the global output has decreased. The same is true for Japan, whereas Europe and Asia steadily increased their share of the global output. In particular, the number of papers by authors from China and Korea shows exceptional growth, with the number from China approaching the numbers from the United States and Japan and outstripping traditional R&D leaders such as Germany, France, and Britain.4

Catalysts

In catalysis there was an increase in the number of papers over the past 20 years. Notwithstanding the strong increase in papers authored in the United States, the U.S. share of the global total declined somewhat after 1990. The United States does not enjoy any definitive lead but remains among the leaders. Japan’s share has remained steady, and the numbers from the Euro5 show a small but discernible increase in the 1990s but some stagnation more recently. The Asian share of the literature output showed a steady and strong increase over the last 20 years, outstripping U.S. activity over the last 5 years. China shows a particularly strong increase, surpassing the individual European countries and approaching the output of Japan. Korea and, to a lesser extent, Taiwan show significant increases in share.

Composite Materials

In composite materials there has been a surge in global output over the last 15 years, with the United States remaining in the lead. However, the data also show this leadership being challenged recently by the European and Asian regions. In Europe, Britain enjoys the lead, with Germany close behind. China’s share is approaching Japan’s, and significant increases can be seen in the share of output for Taiwan and Korea, although the numbers are small.

Optical-Photonic Materials

In optical-photonic materials, the United States maintained its lead, but over the last 15 years the European and Asian regions have been challenging the United States. Italy shows the strongest surge in Europe. Japan’s share remained steady over the 20 years, although the increases seen in China, Taiwan, and Korea were not as strong as in the other subfields.

Summary of Literature Data

Although there are differences from one subfield to another, some trends emerge:

-

The United States is among the world leaders in all four subfields, but it does not clearly dominate in any of them.

-

Western Europe and Japan are also among the leaders in these subfields, showing clear surges in activity over the last 15 years, overcoming previous U.S. dominance.

-

In all four subfields there have been significant increases in the literature presence of the Asian countries included in these searches; most notably, the number of papers from China increased substantially over the last 5 to 10 years, at times approaching the number from Japan and several West European countries.

-

Authorship in the world’s journals appears to be globalizing rapidly, with clear gains for authors from countries that had no traditional background in these fields.

GLOBALIZATION OF THE U.S. MATERIALS COMMUNITY

To understand better the globalization experienced by the materials community, a Web-based poll was conducted over a 2-week period. An e-mail announced the poll to members of the materials professional societies. The responses to questions in the poll are summarized in Appendix E. It is important to bear in mind that the exercise was based on a self-selected response group. In addition, while a broad range of societies (see Appendix E) assisted in this exercise, reflecting the broad nature of MSE, it cannot be assumed that the self-selected group fully represents the increasingly interdisciplinary MSE community. (See Box 2.1, “Recent Experience of MSE Professional Societies.”) The poll should therefore be considered as providing qualitative information on the global nature of MSE activity. A more reliable poll would require applying the usual criteria in choosing a statistically relevant sampling.

|

BOX 2.1 Recent Experience of MSE Professional Societies The general health of the field may be gauged by the number of professionals staying active in MSE. Table 2.1.1 shows membership trends for the professional societies that most materials scientists and engineers identify with.a The trend shows clearly a loss of about 25 percent in membership between 1996 and 2003, but there are details that are of more concern. For example, while the American Ceramic Society (ACerS)—the home of the National Institute of Ceramic Engineers (NICE)—has about 8,000 members, fewer than 1,000 are members of NICE, and many ACS members are ceramic artists. Also, while ASM International (the former American Society for Metals) has about 34,000 members, only about 27,000 are active professionals and around 7,000 are retired senior members. The average age of members of ASMI is 48. The median age of the 6,500 members of The Minerals, Metals and Materials Society (TMS) is 53, and 1,200 are senior members over 65. There are about 1,000 student members jointly in these two societies. When joint memberships of both societies are taken into account, the total active is only about 29,000. The shares of foreign members in ASMI and TMS are 18 and 33 percent, respectively. The membership of the Society of Manufacturing Engineers, which obviously represents a much broader set of interests, also fell 30 percent over the 1996–2003 period. TABLE 2.1.1 Materials-Related Professional Engineering Society Memberships

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notwithstanding this caveat, the makeup of the response group was varied. A total of 719 respondents completed the questionnaire between November 8 and 13, 2004, with 144 identifying themselves as being based outside the United States. The respondents were drawn from a wide variety of organizations—U.S. universities, 32.9 percent; U.S.-headquartered corporations, 27.7 percent; U.S. national laboratories, 14.6 percent; non-U.S. universities, 9.7 percent; overseas-

TABLE 2.1 Nature of International Collaboration

headquartered corporations, 6.7 percent; non-U.S. national laboratories, 2.1 percent; and other, 6.3 percent. Thirty-five percent of the respondents reported that they carried out their research exclusively in the United States, 54.8 percent carried out their research mostly in the United States, and 10.3 percent reported carrying out their research in an international partnership.

Respondents who reported some international element to their research activities were asked to clarify the international nature of their work (Table 2.1).

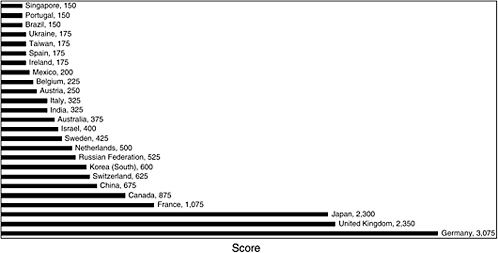

FIGURE 2.1 Respondents to a poll of the MSE community in this country were asked to list their top three international partners. The committee weighted the first choice by an arbitrary score factor of 100, the second choice by 50, and the third choice by 25. The rankings above are based on the total weighted scores. International partnerships were dominated by activity with Germany, Japan, and the United Kingdom. The rankings are indicative only and not based on a statistically relevant sampling.

Germany was identified as the most important partner by a majority of the respondents in each ranking. Japan and the United Kingdom also remain important partners according these data, and China, Korea, and Russia are just as important or perhaps more important partners than more-traditional European partners (see Figure 2.1).

It is important to recall the potential bias of the self-selected response group. Nevertheless the responses indicate that about one-third of U.S. MSE research appears to be carried out exclusively in the United States, and the international activity reported is dominated by research carried out mostly in the United States. The majority of international activity reported is between researchers at academic institutions. Twenty-four percent of U.S. research reported is carried out between U.S. corporations and foreign affiliates of U.S. corporations or in joint arrangements with foreign corporations.

In summary, MSE R&D in the United States is an internationalized activity with a diversified set of international partners.

INFORMATION TECHNOLOGY AS AN ENABLER OF GLOBALIZATION

Technology available in the marketplace today has enabled the globalization of all R&D areas, including MSE R&D. Advances in information technology and communications technology have made current research information accessible to even the most remote parts of the world. Cell phones are inexpensive, and cell phone service is available in most populated areas. Communication via satellites is more costly yet not prohibitively so and offers broadband service. Communication, whether wireless or land based, is an essential component of getting connected to the World Wide Web. According to the A.T. Kearney/Foreign Policy Globalization Index, more than 130 million new Internet users came online in 2002, bringing the total to more than 620 million. Arguably, the Internet has had the greatest impact on the globalization of research.

The Web has affected what research people perform and how and where they perform it. Internet search engines can supply researchers at their desks with information on active research areas, research needs, published information, how the research is performed, and potential places for collaboration. Of course the expansion of the Internet has coincided with the proliferation of inexpensive, high-performance computers. Computer processors continue to increase in power yet decrease in price. The Internet is the vehicle for e-mail, teleconferencing, videoconferencing, and telephony. E-mail is a powerful communication method and can support attachments such as documents, photos, and audio/video clips. People around the globe have come to accept the underlying technologies that allow Internet connectivity—communication protocols, digital formats, intercon-

nects, viewers, and common application software. The Web and e-mail offer a faster, cheaper, and better method of obtaining and transferring information.

The Internet and e-commerce have facilitated the global availability of research tools—for example, instrumentation, laboratory equipment, computational computers, and modeling software—allowing research methods to be mimicked anywhere in the world. The current generation of computer-controlled laboratory testing equipment greatly enables the diffusion of materials R&D to developing countries. Today’s scanning electron microscopes, gas-chromatography-coupled mass spectrometers, Fourier transform infrared microscopes, and ion chromatographs use Windows-based computer control and can be networked to the Internet. Not only do you not need a Ph.D. to operate these instruments, but one trained technologist can operate many different machines and share the results globally over the Internet for evaluation and discussion. The availability of these machines encourages locating advanced materials labs at major manufacturing sites around the world to provide rapid onsite evaluation and development.

In summary, information technology and global communications are affecting the execution of R&D in innumerable ways and enabling R&D to evolve new and global modalities.

GLOBALIZATION OF CORPORATE MSE R&D

Offshoring is part of the global trade system, and the decision to offshore corporate activity is a strategic business decision. Offshoring no longer involves just manufacturing but also extends to other functions, including services, from human resources and information technology management to R&D. Over time, shifts in manufacturing capabilities can result in the migration of research, design, and development activities—see Box 2.2, “Globalization and an American Company: The Timken Company.” Technology transfer is also becoming a global phenomenon—see Box 2.3, “An Evolving Model of Technology Transfer: The Transfer of Nanotechnology from New Zealand to an American Firm for Introduction to the Global Market.” Recent actions announced by a number of corporations reaffirm the globalized marketplace and continuing offshoring trends—see Box 2.4, “Recent Corporate Global Announcements.”

What are the drivers of decisions to globalize corporate MSE R&D portfolios? While it appears that no data specific to MSE are available, it is reasonable to assume that the trends in transnational corporate MSE R&D are not significantly different from trends for all R&D, recognizing that specific materials subfields may exhibit more intense trends or trends that are different from those of the field as a whole. It is also reasonable, therefore, to assume that the major concerns of corporations involved in MSE R&D are similar to those of corporations involved in

R&D in other sectors: that is, the continuing globalization of the knowledge economy, including competition from other countries to attract innovation activities; the importance of being close to customers, be they end users or manufacturers; global trends in education, manufacturing, and the workforce; increasing global competitiveness; attractiveness of alternative regulatory and tax environments; and the need to access and tailor products to local markets. One of the most recent surveys in this regard was carried out by the Economist Intelligence Unit (EIU).5

In the EIU survey of 104 corporate leaders from a broad range of leading global companies, 71 percent of executives cited the ability to exploit pools of skilled labor as a key benefit of globalizing R&D. Other important benefits identified in the surveys included the ability to tailor goods and services to particular markets, reduced R&D costs, and reduced time to market. When asked to rate which aspects of the business environment are most important in deciding where to locate R&D, 65 percent of executives in the survey said the quality of the local education system is very or critically important. Related to this, proximity to major universities and research labs remains an important advantage for many types of R&D activity. When asked in which country the company was intending to spend the most R&D in the next 3 years, China was the most cited, the United States was number 2, and India number 3. The top 10 countries6 show a mix of traditional and emerging centers of R&D.

R&D costs are escalating in high-tech industries, so it was not surprising that more than half the companies surveyed said R&D costs are an important benefit of a global R&D strategy and an important factor in determining a destination for R&D investments. According to the survey, companies weigh cost benefits in a range of areas—including lower-cost labor, cheaper land and office rental costs, and favorable tax regimes. However, it is noteworthy that cost is still less important than skills and expanding markets when it comes to determining a destination. The EIU survey also reports that companies consider the availability of local R&D expertise, among scientists and managers, as one of the most important factors. The EIU report suggests that one reason for this is that savings from cheaper labor are partially offset by the costs of coordinating R&D across multiple countries. How companies respond to these pressures often depends on size: Big companies are generally able to globalize R&D internally by opening their own

|

5 |

EIU, Scattering the Seeds of Invention: The Globalization of Research and Development (2004), available at http://www.eiu.com/GlobalisationOfRandD. It is important to note that findings from such surveys are not scientific and may contain biases. |

|

6 |

The top 10 were China, United States, India, United Kingdom, Germany, Brazil, Japan, France, Italy, and Czech Republic. |

|

BOX 2.2 Globalization and an American Company: The Timken Company The Timken Company is a 105-year-old firm that has become a global company.a In 2003, it had more than $4 billion in sales spread over three primary businesses: metals (alloys and specialty steels), bearings for automotive applications (from engine to wheels), and bearings for industrial applications (from agriculture to aerospace). In recent years, Timken’s primary application focus for its products has come to be power transmission and friction management. When the company could not source steel of the purity needed for the bearings its customers wanted, it decided to develop its own steel. Timken’s R&D has ever since mostly focused on the development aspect—that is, on developing solutions for very demanding applications like alloy tubing, gears, shafts, bearings, and so on. Timken’s R&D program also searches for new alloys, new thermal treatments, and new anticorrosion paths. Currently, the overwhelming majority of its R&D is carried out within the United States, including the R&D carried out under federal government contracts. However, occasionally some of the collaborations Timken engages in involve universities outside the United States. Nevertheless, essentially all the intellectual property has been and continues to be generated in the United States, although this may not continue indefinitely. Timken is aware that investment in the more traditional subfields of materials research is decreasing in the United States and increasing in other parts of the world, like China. If this trend continues, Timken may need to consider doing R&D outside the United States in order to generate intellectual property for future products. |

overseas laboratories, whereas medium-sized firms, constrained by cost considerations, may be more likely to globalize through outsourcing or alliances. Alternatives include the acquisition or licensing of existing technology in other countries (many companies do this by buying R&D expertise in other countries). Another increasingly important strategy in cost-sensitive industries is joint R&D ventures that enable companies to reduce substantially the time, cost, and risk involved in establishing overseas R&D operations.

Respondents to the EIU survey were also asked to name the biggest challenges of globalized R&D. Thirty-eight percent of the respondents said that robust pro-

|

Currently, most of the non-U.S.-based R&D sponsored by Timken is done to tailor products to local market needs. These limited excursions have demonstrated that there is a huge talent pool in places such as India and China. Accessing an equivalent talent pool in the United States is hindered by deterrents such as unfavorable education trends, as well as stricter immigration controls and increasing security concerns, which make it more difficult to employ noncitizens and recruit from abroad. On the educational side, the pool of universities Timken hires from has shrunk to only a handful. Although advances in the kinds of research of interest to Timken (for example, alloy research) can be very challenging to achieve and therefore slow to emerge, they remain necessary for the health of the company. While corporations such as Timken contemplate investments outside the United States, it appears that opening technical and R&D centers abroad is only a matter of time. China’s infrastructure is growing, and incentives are being put in place to attract investment there. In addition, and perhaps most importantly, the market for products is burgeoning, and U.S. corporations such as Timken need to be close to their customers. The kinds of operations corporations contemplate vary from opening foreign subsidiaries to collaborating with local suppliers and manufacturers. But all these options only deepen the internationalization of corporate R&D and increase globalization. There are, however, disincentives corporations consider when making decisions about international R&D investments. Maintaining the ownership of IP is a major concern, as are the economic and, at times, the human rights and political systems in the potential receiver countries. Indeed, protecting IP can trump economic concerns in such decisions. U.S. companies can be expected to consider ethics to be very important for corporate policy and to not do business where they cannot follow ethical practices. Furthermore, it should not be expected that corporations like Timken will create IP in a country where the IP regime could compromise the company’s global control of its IP. However, being close to customers remains the number one reason for deciding where to locate R&D. The availability of talent is another important reason. |

tection for IP was critical and entered into their decision on where to base R&D more than any other business factor. Another 46 percent of respondents ranked it number 3 or 4 on the 5-point scale of importance used in the survey. Although China was ranked as the number 1 planned destination for new R&D, respondents to the survey expressed concern about the level of IP protection there. Along with IP concerns, 51 percent of the respondents said attracting top R&D talent was very important or critical, ranking it number 4 or 5. Other important challenges were identified: effective collaboration between international teams and compressing the time to commercialization.

|

BOX 2.3 An Evolving Model of Technology Transfer: The Transfer of Nanotechnology from New Zealand to an American Firm for Introduction to the Global Market The globalization of the electronics industry, combined with the innovative and disruptive introduction of nanostructures in materials, is leading to new business models and flows of technology from research to the marketplace. The following shows how a start-up American firm with nanoprocessing technology and strong marketing links to major firms making electronics materials and their customers created a joint venture with a New Zealand firm to complement the U.S. firm’s technology base and to help the New Zealand firm to transition technology from research into the marketplace. NanoDynamics, a U.S. nanotechnology firm and manufacturer of nanomaterials, signed a joint venture agreement with a New Zealand-based technology company, Nano Cluster Devices Ltd. (NCD). NanoDynamics will be working to commercialize NCD’s technology for the self-assembly of nanowires in the production of semiconductors and electronic components. Under the agreement, NanoDynamics will be responsible for sales and applications development, targeting semiconductor companies, consumer applications, and aerospace, biotech, and industrial manufacturers. NCD will be responsible for advancing the technology platform. NanoDynamics is building an IP portfolio to provide significant product and technology value to a wide range of customers and partners. It is doing this through its own invention process, along with technology acquisitions and partnerships, extending its technology and product offerings to the markets it understands: the electronics, semiconductor, and energy markets. Its management team has launched commercial products from new technologies,a particularly in the area of advanced materials. NCD, in conjunction with the University of Canterbury, developed a novel technology platform to produce electrically conducting nanowires by the deposition of atomic clusters onto lithographically prepared templates. The NCD technology produces small, well-controlled linear structures with different functionalities on a range of substrates. The key feature of its technology is that it is essentially a self-assembly process, which means that the slow manipulation of nanosized building blocks, which is often unavoidable in many other nanotechnologies, is completely avoided. The nanowires produced are smaller and more economical to apply due to their controlled placement and use of existing semiconductor processes. From NCD’s perspective the partnership with NanoDynamics is an important step in transferring its enabling technology to global industrial partners, to which NanoDynamics already offers advanced nanomaterial solutions.

|

|

BOX 2.4 Recent Corporate Global Announcements To reinforce its position as the leading coatings supplier in the growing Chinese automotive industry and accelerate the upgrading and expansion of production, DuPont has boosted its ownership stakes in a joint venture in automotive coatings businesses in China (March 2004). Agilent Technologies announced that it would increase its R&D workforce in India from 900 in 2004 to more than 2,500 by 2006, focusing on wireless solutions, billing software for telecom service providers, and device drivers for electronic products (July 2004). Cisco is set to build an R&D facility with 100 new hires over 18 months in China (September 2004). The company is joining top U.S. and European technology companies such as Motorola, Microsoft, IBM, SAP, and Oracle that have set up sales and manufacturing centers and R&D facilities in China. Cisco’s CEO said that over the next decade, half of Cisco’s top 12 business partners and half of its main competitors would come from China. Nokia announced (July 2004) several R&D activity expansions in China, concentrating on Asian user interfaces; 3G and other radio technology; Internet Protocol; and Chinese mobile applications. Under this reorganization, 40 percent of Nokia’s handsets will be designed and developed in Beijing. Motorola announced (July 2004) that it plans to merge its 19 R&D centers in China into one R&D firm. The company is expected to invest about $500 million over the next 4 years to strengthen Chinese R&D capabilities. Dell opened a center in China (September 2004) for multinational customers that need faster response times for IT services. Timken, a global leader in bearings and steel, has inaugurated an R&D center that will house 250 employees in Bangalore, India. It is Timken’s largest R&D center outside the United States and the first in Asia. The center in Bangalore will support applications staff all over the world, design tools, do process engineering, and develop IT applications for the rest of the company. GE has reorganized its R&D activities into GE Global Research, which is made up of 12 global laboratories organized by scientific discipline, all focused on leveraging technology breakthroughs across multiple GE businesses. GE Global Research consists of 2,500 employees working in four facilities: Niskayuna, New York; Bangalore, India (opened in September 2000); Shanghai, China (opened in October 2003); and Munich, Germany (opened in June 2004). |

In addition to economic and market drivers for locating R&D in a particular foreign or domestic location, politics, both domestic and international, can be a driver. A study of political impacts and drivers is beyond the scope of this report, however.

One area of corporate MSE R&D that has undergone major changes in recent years is superalloy research. Its evolution is presented in Box 2.5, “Superalloy Case Study.” A more detailed version of this case study can be found in Appendix F.

|

BOX 2.5 Superalloy Case Study Superalloys are alloys based primarily on nickel and cobalt that have tremendously useful properties at elevated temperatures and/or in corrosive environments. The superalloy industry serves a limited market, albeit with critically important products. Superalloys find application in the aerospace industry as the enabling and primary material used in the hot end of jet engines—both rotating and static components—in the auxiliary power units used in aircraft, and in land-based industrial gas turbines. They are also used in petrochemical refining facilities where elevated temperatures are involved, in chemical plants where corrosive conditions can exist for which normal stainless steels are not useful, and in sour oil and gas wells. Maintaining a competitive position relies on managing operating costs and maintaining a competitive lead in state-of-the-art technology, which in turn requires continuing R&D on constantly evolving compositions and processing technology. The number of U.S. superalloy R&D personnel decreased significantly in the past decade—by more than 50 percent in most companies and up to 100 percent in some. For example, Special Metals reduced R&D spending and personnel, from 50 or 60 engineers in the mid-1990s to about 5 at present. Allvac decreased R&D staffing to 14 from a peak of 30. Cartech has also cut back on R&D staff, from about 40 people in the 1990s to 20 today. From 1980 to 2004, the R&D effort at Haynes International decreased from 125 persons to 32 persons, and R&D spending was cut from $3.7 million in 2002 to an annualized rate of $2.4 million in 2004. International Nickel Co. (INCO) has gone from being the primary developer of nickel-base superalloy compositions to doing no R&D. The number of researchers at Howmet Research Center (Howmet is a wholly-owned subsidiary of Alcoa) has gone from 240 at the time of Alcoa’s acquisition to 117 today. GE Engines has supplanted the R&D that was once done at the GE Corporate Research Lab and now works with partner Snecma (France) and suppliers of materials such as Cannon-Muskegon. It is also engaged in moving more investment overseas, particularly to China. Pratt & Whitney has cut back drastically on the number of researchers involved with superalloy R&D, concentrating on commercial engines and on solving supplier quality problems. Honeywell has cut back drastically on research and is essentially doing none. Solar Turbines has reduced alloy-development activities dramatically and relies almost exclusively on suppliers for new alloys and parts. International activity is also evolving. Virtually all of the research to develop new superalloys in the United Kingdom is being carried out by primary producers and funded by Rolls-Royce. Germany’s Krupp-VDM no longer has an R&D operation, and Asea Brown Boveri has cut back R&D in recent years. Superalloy research continues at government-supported laboratories such as the Max-Planck Institute, the Fraunhofer Laboratory, and so on. Italy’s Acceria Foroni, regarded as a tough competitor in the marketplace, is investing in large-diameter (33-in) VAR technology with a view to producing 718 alloy ingots for rotating parts. Japan’s Mitsubishi Materials and Daido Steel continue to be very active. Hitachi Heavy Industries has eliminated R&D at its laboratory but continues R&D in its plant. The main |

|

research institutes in China are the Central Iron and Steel Research Institute, the Beijing Institute of Aeronautic Materials, and the Institute of Metals Research. The Shanghai No. 5 steel plant is a large superalloy production facility with a large amount of the latest and best equipment in the world and a research group said to have 2,000 professionals. The Special Metals Processing Consortium (SMPC), a U.S. consortium of production companies, has helped solve some difficult problems common to all which one company would have found difficult to solve alone. Originally there were 13 companies, but over the past 5 years the number of companies supporting SMPC has dwindled to six or seven, because several went into bankruptcy, suffered financial losses, or were merged out of existence. Government support has been obtained from Sandia National Laboratories (SNL) and the Federal Aviation Administration (FAA). However, SNL has indicated that the relevant laboratory there would be closed in 2005, and the amount (in real terms) of FAA research support has been cut by more than one-half over the last 15 years. Universities that have conducted research on some aspect of physical metallurgy or processing of superalloys in recent times include the University of Michigan, Lehigh University, Purdue University, the University of Arizona, the University of Texas, Ohio State University, Penn State University, the University of Tennessee, Michigan Tech, the University of Pittsburgh, the University of Florida, and Northwestern University. NASA and the Air Force Research Laboratory are also active in superalloys research. The superalloy industry has evolved to the point that production facilities are now divisions or subsidiaries of larger companies. Those that are still independent are widely thought to be facing difficult markets, with their customer base moving increasingly offshore. The main challenge for superalloy R&D is that it takes a long time to develop a new alloy, on the order of years, and to get customer acceptance and large orders takes even longer. Furthermore, new alloys often replace existing products, resulting in very low returns on R&D investments and little incentive to support the development of new alloys or processes. The lack of new products on the market is both a result of and a cause of the continued financial weakness of the industry over the past two decades. Much alloy development is now being done in government-supported laboratories overseas. Process improvement continues to be done on a limited basis in the United States and is the key to commercial U.S. success for the time being. However, as new alloys are developed elsewhere and U.S. process know-how diffuses offshore, that competitive edge will disappear. It is possible that as the manufacturing end of the industry moves overseas, the ideas for research, which in the past came largely from working with customers, will move with it, because most alloy development is for the purpose of solving a customer problem or providing a new product idea. The result might be a drying up of research ideas in American companies. |

|

In conclusion, it is clear that U.S. superalloy R&D has declined significantly over the past decade. This is at least in part because U.S. firms that develop and manufacture superalloys face slower demand growth and higher costs, and many are in financial difficulties. Attracted by lower production costs and stronger growth in demand, superalloy manufacturers are increasingly looking to locate manufacturing overseas. U.S. companies that do so will probably stay competitive and survive, but only to the extent that they are privy to future developments in non-U.S. laboratories and plants. |

SOME TRENDS IN MSE EDUCATION

An examination of globalization and MSE R&D would not be complete without some consideration of MSE education, even though a thorough review would be beyond the scope of this study, especially because MSE practitioners come from very diverse backgrounds, from engineering to natural sciences, making a comprehensive review very broad. Nevertheless, examining some of the issues related to education and globalization—for instance, trends in student enrollment and the supply of U.S.-trained practitioners and the role of non-U.S.-born researchers—provides an interesting perspective on the broader topics in this report.

Materials Education Today

If MSE professional and research positions are being lost in the United States in MSE subfields like superalloy research, then clearly there is a concomitant loss of skills, experience, and accumulated and tacit knowledge. This situation, in turn, can translate into lost R&D capacity and a loss in the ability to apply new ideas, products, and processes to national security and other national needs. How well is the country’s MSE education system going to be able to react to and address this potential loss in capacity?

One immediately obvious challenge for MSE education, and indeed the education system in general, is the poor standing of U.S. high-school graduates in mathematics and science. According to the latest OECD triennial Program for International Student Assessment (PISA),7 the United States ranks 20th in the

TABLE 2.2 PISA (Program for International Student Assessment) Mean Scores in Science, 2003

|

Country |

Mean Score |

Country |

Mean Score |

|

Finland |

548 |

Poland |

498 |

|

Japan |

548 |

Slovak Republic |

495 |

|

Hong Kong (China) |

539 |

Iceland |

495 |

|

Korea |

538 |

United States |

491 |

|

Liechtenstein |

525 |

Austria |

491 |

|

Australia |

525 |

Russian Federation |

489 |

|

Macao (China) |

525 |

Latvia |

489 |

|

Netherlands |

524 |

Spain |

487 |

|

Czech Republic |

523 |

Italy |

486 |

|

New Zealand |

521 |

Norway |

484 |

|

Canada |

519 |

Luxembourg |

483 |

|

Switzerland |

513 |

Greece |

481 |

|

France |

511 |

Denmark |

475 |

|

Belgium |

509 |

Portugal |

468 |

|

Sweden |

506 |

Turkey |

434 |

|

Ireland |

505 |

Mexico |

405 |

|

Hungary |

503 |

Brazil |

390 |

|

Germany |

502 |

|

|

|

SOURCE: OECD, available at www.pisa.oecd.org. |

|||

world in the science literacy of its high school students (Table 2.2). Science literacy among freshman college students in MSE and other science and engineering fields is a challenge to universities in that they are faced with bringing the knowledge and skills of these students up to international standards. B.S. curricula, therefore, have to start with some course work in basic mathematics, chemistry, and physics.

Not only are students lacking in some basic skills in comparison with their international peers, but MSE education is also faced with low and—worse—declining enrollments of undergraduate students in materials courses. There are also interesting trends when enrollment in science and engineering (S&E) programs in the United States is compared with that in competitor countries.

Looking at data gathered by the OECD on global education trends,8 in 2000 about 2.8 million degrees were in awarded around the globe in S&E fields9—more than 1 million in engineering, almost 850,000 in social and behavioral sciences, and almost 1 million in mathematics and natural, agricultural, and computer

|

8 |

OECD, Education Statistics and Indicators: Education at a Glance (2002). Available at http://www.oecd.org/education. |

|

9 |

These worldwide totals include only countries for which data are readily available (primarily the Asian, European, and American regions) and are therefore an underestimation. |

sciences combined. Asian universities accounted for almost 1.2 million of the world’s S&E degrees in 2000, with almost 480,000 degrees in engineering. Students across Europe (including eastern Europe and Russia) earned more than 830,000 S&E degrees, and students in North America earned more than 500,000. The OECD reports that in 2000 the proportion of the college-age population who earned degrees in natural science and engineering was substantially larger in more than 16 countries in Asia and Europe than in the United States. The United States achieved a ratio of 5.7 per 100 after several decades of hovering between 4 and 5. Other countries and economies recorded bigger increases over similar time periods: South Korea and Taiwan increased their ratios from just over 2 per 100 in 1975 to 11 per 100 in 2000–2001. At the same time, several European countries doubled and tripled their ratios, reaching between 8 and 11 per 100.

In several emerging Asian countries and economies, the proportion of first university degrees earned in S&E was higher than in the United States. In 2001, 38.6 percent of degrees awarded in China were in engineering and 11.2 percent in the natural sciences. In South Korea in 2000 the numbers were 26.9 percent and 6.4 percent, respectively. In the European Union the numbers averaged 13.5 percent and 8.5 percent, respectively. In contrast, students in the United States in 2000 earned about 4.8 percent of their bachelor’s degrees in engineering fields and about 6.6 percent in the natural sciences.

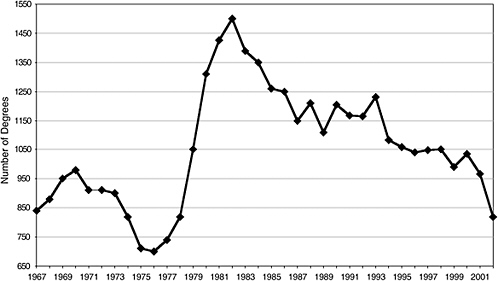

Figure 2.2 shows the number of degrees awarded in the United States in metallurgy and materials over the last few decades. It is noteworthy that almost the same number of B.S. degrees is granted today as in 1967, while over that time the U.S. population has doubled and college participation has increased significantly.10 One consequence of the small total enrollment in MSE and a proliferation of programs—see Box 2.6, “Evolution of Materials Departments”—is low enrollment per program. For example, 18 MSE programs have fewer than 10 graduates per year and 25 have between 10 and 25 per year. Over 50 percent of the graduates each year come from just 15 programs.

With few students per class, MSE departments can find it extremely difficult to justify the cost and number of faculty having the expertise to cover MSE—performance, properties, synthesis and processing, and composition and microstructure—in any one program. The National Academy of Sciences report Materials and Man’s Needs (1974) noted that there was a need for all engineers to receive more in the way of materials education. Arguably this statement is truer now than

|

10 |

The National Center for Education Statistics reports that between 1967 and 2001 the percentage of all 18- to 24-year-old high school completers enrolling in degree-granting institutions increased from 33.7 percent to 44.2 percent. See Digest of Educational Statistics (2003), available at http://nces.ed.gov/programs/digest/d03/tables/dt188.asp. |

FIGURE 2.2 Number of B.S. degrees in metallurgy and materials science since 1967. The curve shows a steady decline since the early 1980s, a period during which the number of college-going students increased significantly. SOURCE: Digest of Education Statistics, 2003, available at http://nces.ed.gov/programs/digest/d03/tables/dt188.asp.

it was then, but there is no evidence that engineers other than materials engineers are receiving significantly more materials education today than in 1974. In fact, many of the other engineering fields have cut course work in materials from the curriculum or made it an elective. Rarely does a mechanical, civil, chemical, or electrical engineering graduate have more than a single survey course in materials. As an example, the number of manufacturing engineering programs grew from 2 in 1978 to 23 in 2003, but while some materials processing is taught in these programs, only a few have more than one survey course devoted to materials per se or more than two courses in materials processing.

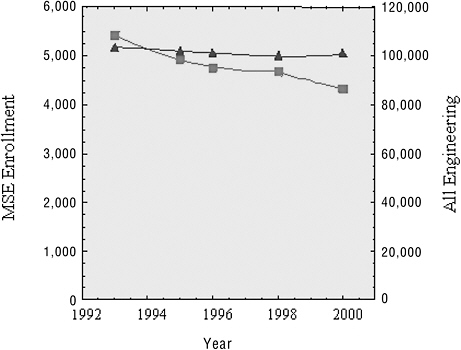

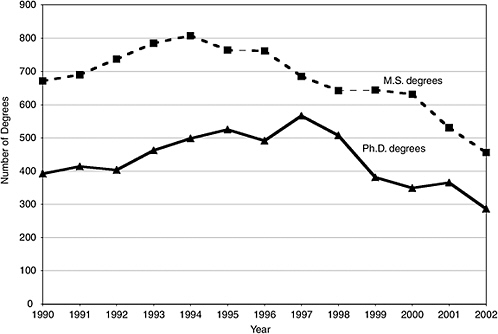

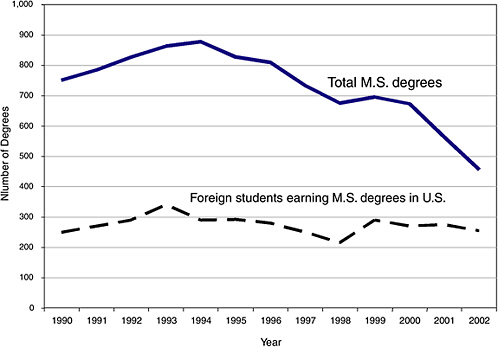

The situation with graduate education is also challenging. Figure 2.3 indicates the steadily declining enrollment in MSE programs relative to enrollment in all engineering over the same period. Figure 2.4 indicates the number of graduate degrees in materials each year since 1990, with a decline over the most recent years. Some MSE practitioners say that many MSE graduate students come from a diverse S&E undergraduate background; sometimes this background includes MSE but sometimes it does not. So, they say, being in a graduate MSE program does not necessarily mean having a broad background in materials, and since graduate students are not often required to make up the MSE coursework they missed, the

|

BOX 2.6 Evolution of Materials Departments In 1955 there were about 45 programs in the United States where metallurgy and metallurgical engineering were taught. The curricula, averaging 142 semester hours, covered not only metallic materials but also, by extension, semiconductors and other solid inorganic materials with interesting properties, including oxides. There were also 12 undergraduate programs in ceramic engineering but no undergraduate degree programs in polymer science or plastics. In 1959, DOD established three materials science centers at major universities. More were added in the next years, and some were then cut, with eight being transferred from DOD to NSF in the 1970s. This development caused former departments of metallurgy to morph into materials science departments in order to qualify for funding from DOD and the Advanced Research Projects Agency. By 1974, more materials programs had emerged and 60 were ABET-accredited,a most offering at least 134 semester hours for the B.S. degree. The course work in these programs required engineering mechanics, physical chemistry, and electrical engineering. At that time, there were 12 ceramic engineering programs, and course work relating to polymeric materials and technology was largely taught in chemical engineering departments. The watershed 1974 report Materials and Man’s Needs: Materials Science and Engineeringb sped up the transformation of materials programs, and the trend toward materials science took place despite the report’s recognition of the need for what it termed curricular balance. The report recommended that, depending on local circumstances, materials-related degree programs should provide more emphasis on materials preparation and pro

|

depth of materials knowledge of some of those graduating with advanced MSE degrees comes into question.

Figure 2.5 shows that while the number of students graduating with a master’s degree in materials is in decline, the number of foreign-born students graduating with that degree has held steady. This confirms the widespread belief that MSE has increasingly become dependent on attracting non-U.S. students. In many respects this is an early impact of the globalization of MSE R&D. In 2002, of the 286 doctorates granted in MSE in the United States, 151 were granted to foreign students—with Indian, Korean, and Chinese students being the most numerous. However, as these countries establish their own institutions of graduate education, prospective students will probably be less inclined to come to the United States.

|

cessing; polymer technology; design and systems analysis; computer modeling; and relations among the properties, function, and performance of materials. As programs continued to evolve, small-enrollment ceramic engineering departments merged with small-enrollment metallurgical engineering departments and became “materials” programs. This trend resulted in the disappearance of ceramic engineering departments. In 1977, the first undergraduate program in polymer science was accredited, and in 1978 the first program in plastics engineering was recognized. A common response from many materials programs was to include polymeric materials in their new curricula, so faculty were added and course work dealing with polymeric materials was developed. The greater emphasis on polymers resulted in a concomitant decrease in the time devoted to metals and ceramics. Coincidentally, many universities reduced the number semester hours required to obtain a B.S. degree to as few as 128. Today there are 63 undergraduate materials/metallurgical programs, only 4 undergraduate degree programs in polymer science and engineering, and 6 undergraduate degree programs in ceramic engineering. Over the years, many MSE departments have broadened the scope of their curricula to cover all material classes. A criticism of this trend is that such a broad approach can risk cutting several corners of the field (such as processing or performance) and not covering some areas at all or in sufficient depth. For instance in a survey of materials curricula,c 50 percent neither required nor taught engineering mechanics and many required no course work in materials processing. Meanwhile, as discussed in this report elsewhere, undergraduate and graduate enrollment in MSE departments and schools is in decline. |

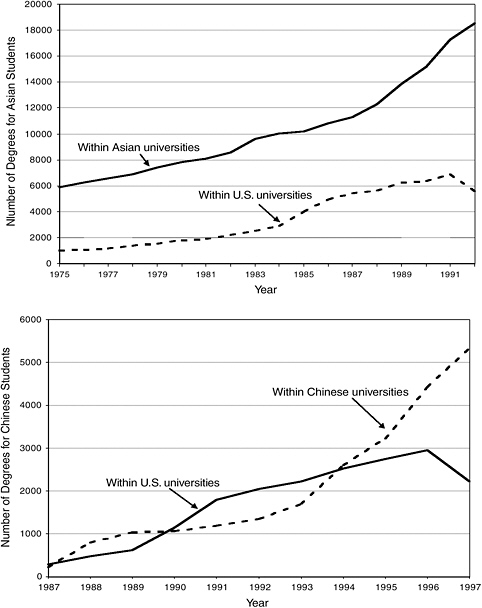

Figure 2.6 shows the number of S&E Ph.D. degrees earned by Asian students within Asian and U.S. universities and compares it with the number awarded to Chinese students within Chinese and U.S. universities. There is no reason to expect that the trend in numbers shown in Figure 2.6 for S&E in general will be much different from the trend for MSE-degreed graduates in Asia, China, and the United States. A further problem for the field is that relatively few U.S.-produced MSE graduates enroll in graduate studies.

Given the dependence of MSE R&D in the United States on foreign talent, the data gathered by the NSF on graduated students who return to their home countries is also of interest. Historically, approximately 50 percent of foreign students who earned S&E degrees at universities in the United States planned to stay in the

FIGURE 2.3 Enrollment in graduate MSE programs lags behind enrollment in engineering graduate programs in general. Graduate enrollment in engineering shows an 11 percent drop and in MSE a 21 percent drop for the period 1993–2000. Data from NSF, taken from presentation of Julia Weertman at the National Materials Advisory Board workshop Workforce and Education in Materials Science and Engineering: Is Action Needed? October 21, 2002, Irvine, California.

United States, and a smaller proportion said they had firm offers that would allow them to do so. These percentages increased significantly in the 1990s. From 1985 to 2000, most U.S. S&E doctoral degree recipients from China and India planned to remain in the United States for further study and employment. In 2001, 70 and 77 percent, respectively, reported accepting firm offers for employment or post-doctoral research in the United States. Recipients from South Korea and Taiwan are less likely to stay in the United States. Over the 1985–2000 period, only 26 percent of South Koreans and 31 percent of Taiwanese reported accepting firm offers to remain in the United States. Both the number of S&E students from these Asian economies and the number who intended to stay in the United States after receipt of their doctoral degree fell in the 1990s. This decline could be due to the efforts by Taiwan and South Korea to expand and improve their advanced S&E programs and create R&D institutions that offer more attractive careers for their

FIGURE 2.4 Graduate degrees awarded in metallurgy and materials engineering since 1990. The number of such degrees declined in recent years.

expatriate scientists and engineers. Notwithstanding these trends, by 2001 about 50 percent of their new U.S. doctorate holders reported accepting U.S. appointments.

Conclusion on Education

With the downturn in industrial activity in the MSE sector in the United States, the case can be made that the country does not need as many professionals in the materials field. However, the case can also be made that with improved productivity, manufacturing can be stabilized and, since materials are the enabling technology for most products, knowledge of materials is still very important to the future of the country. MSE professionals who can be productive on the domestic scene and competitive on the international scene must be well educated in all

FIGURE 2.5 Master’s degrees in materials: total and foreign students The number of foreign students graduating with a master’s in materials has remained steady, while overall graduation numbers have declined. MSE graduate programs appear to be becoming more reliant on foreign students. SOURCE: American Society for Engineering Education.

aspects—performance, properties, synthesis and processing, and composition and microstructure—of a specific material, be it metallic, ceramic, electronic, or polymeric.

In summary, a number of challenges exist for the MSE educational system: the increasingly broad curricula in materials departments, the decreasing attraction of MSE as a career choice for high school and university graduates, and the continuing dependence of graduate programs on attracting foreign students in an increasingly competitive global market for the best students. It is not clear that the current MSE education system, including research at universities, can meet the nation’s needs by producing graduates with the required depth of knowledge.

FIGURE 2.6 Comparison of S&E doctoral degrees earned by Asian students at Asian and U.S. universities (upper) and by Chinese students at Chinese and U.S. universities (lower). Data in the upper figure include degrees earned at universities in selected Asian countries: China, India, Japan, South Korea, and Taiwan. Asian students at U.S. universities include students on either temporary or permanent visas from China, Hong Kong, India, Japan, South Korea, Taiwan, and Thailand. In both cases the number of students completing their doctoral science and engineering degrees in Asian/ Chinese universities is increasing rapidly while fewer Asians are attending U.S. universities following continuing growth in earlier years. SOURCE: NSF, Science and Engineering Indicators (2000).

Conclusion. The MSE education system, including K–12 mathematics and science education, will have to evolve and adapt so as to ensure a supply of MSE professionals educated to meet U.S. national needs for MSE expertise and to compete on the global MSE R&D stage. The evolution of the U.S. education system will have to take into account the materials needs identified by the federal agencies that support MSE R&D as well the needs of the materials industry.

SUMMARY REMARKS

In summary, the evidence presented in this chapter and its associated appendixes—patent data, literature data, trends in corporate research—indicates increasing activity in MSE R&D around the world, with concomitant increases in global and transnational ownership and collaboration. In the subfields of MSE, the United States is the leader or among the leaders, and Japan and Western Europe are the closest rivals for leadership. Global activity in all the subfields examined is diversifying, with significant increases in activity in Asian countries that have not heretofore had substantive activity in these fields. On the home front, MSE R&D in the United States appears to be a highly internationalized activity with a highly diversified set of international partners. Advances in IT and communications technology have been drivers for the globalization of R&D. The case study in superalloys (Appendix D) shows that the environment for R&D in this field is evolving in the face of globalization. A deeper analysis of the current state of R&D in 10 MSE subfields is presented in Chapter 3.