Principles for Government Involvement in Freight Infrastructure

Randall W. Eberts, W. E. Upjohn Institute for Employment Research

The Committee for a Study of Policy Options To Address Intermodal Freight Transportation of the Transportation Research Board has been charged with providing guidelines for determining government’s role in freight-related activities. The committee has been asked to consider several questions:

-

What circumstances (e.g., market inefficiencies, equity concerns, or historical institutional patterns) justify or necessitate government involvement?

-

Will optimizing the freight system require centralized decision making (e.g., arbitration of interstate rivalries), or conversely, will existing, decentralized decision making suffice?

-

How can federal responsibilities be distinguished from those of state and local government?

-

What practical analysis tools do governments need to evaluate individual proposals for government involvement in projects for developing freight facilities?

A conceptual framework to aid the committee in addressing these questions is provided in this paper. Intermodal freight operations are defined and illustrations of existing facilities are offered. Potential benefits of intermodal freight facilities are set forth. Barriers to the effective implementation and operation of intermodal freight facilities are discussed. Reasons for government involvement, including market failures and externalities, are introduced. The relationship between regional economic development, intermodal freight activity, and government involvement is described. Finally, the appropriate roles of the various levels of government are examined.

INTERMODAL FREIGHT ACTIVITY

Intermodal freight activity is any shipment of goods that involves two or more modes of transportation during a single journey. Various combinations of modes are used to ship goods: trucks, railroads, ships and barges, and aircraft. Consequently, intermodal freight activity requires terminals for intermodal transfers and appropriate highway, rail, waterway, and runway access to link these facilities to the national transportation network.

The most common intermodal activity, with respect to tons shipped, is the combination of rail and water transport. According to the 1993 Commodity Flow Survey, 42 percent of all U. S. domestic tonnage shipped intermodally was shipped by a combination of rail and water, whereas 36 percent was shipped by truck and water. When measured in ton miles, the ranking stays the same but the percentage increases for the rail-water combination from 42 to 46 and decreases for the truck-water combination from 36 to 27. The truck-rail combination stands at 21 percent for tons and 25 percent for ton miles. Intermodal freight shipments are used predominantly for long-distance hauls. Intermodal shipments are at least twice as long as single-mode shipments. Multimodal shipments involving trucks averaged 2250 km (1,400 mi) in 1993; single-mode shipments by for-hire truck averaged 760 km (470 mi) and by rail averaged 1230 km (770 mi) (Bureau of Transportation Statistics and Bureau of the Census 1996, Table 1).

Intermodal freight activity is still a small portion of total freight activity, according to statistics from the Commodity Flow Survey. In

1993, 2 percent of the 8.7 billion t (9.6 billion tons) transported that year was shipped intermodally. When measured in ton miles, the percentage is higher (6 percent). Nonetheless, intermodal freight shipments are considered beneficial to the national economy, and increased attention has been focused on how to expand the nation’s intermodal capacity.

To illustrate the steps involved in intermodal shipments, consider the movement of a container from a domestic producer to a foreign destination. In this case, the shipment involves trucks, railroad flatcars, and containerized ships. A typical intermodal arrangement begins with the assembly of products to be loaded into the container. The products may come from a single location or may be collected from several locations by small trucks or vans and taken to a trucking terminal, where they are loaded into a container. The container is hoisted onto chassis and transported by truck to a truck-rail intermodal terminal, where it is transferred to either a double-stack or single-stack train, depending on the distance shipped and the terminal facilities. Once assembled, the train, which will probably include other types of cars, embarks for the port. At the port facilities, the shipload is assembled from this and other trains and trucks while awaiting the arrival of the containership. En route, information concerning the containers and their contents is sent to the shipping company’s agents at the arrival port, and steps are initiated for customs clearance. Carriers are notified of the number and type of railroad cars needed to ship the incoming containers and the expected arrival time of the containership. Receivers are also notified. On the ship’s arrival, containers are off-loaded directly onto an awaiting train or onto chassis and trucked to their destinations (DOT 1995).

The example highlights several facts about intermodal freight activity that are important in understanding the appropriate roles of government and the private sector. First, intermodal freight activity improves the efficiency of shipments by combining existing modes of transportation. The efficiency occurs through the optimal use of existing modal capacity. Second, because intermodal freight activity connects publicly provided transportation systems, such as highways and water navigation improvements, with privately provided systems such as rail, it involves from the start a public-private partnership. Third, the construction of intermodal facilities, such as seaport facilities, entails large fixed costs, which may give the facility the status of a natural monopoly and thus has

implications for the pricing of services.1 Fourth, the efficient operation of intermodal freight facilities requires a high degree of coordination among modes and the efficient flow of information across modes.2

Two intermodal facilities illustrate these characteristics and provide a basis for motivating the discussion on government involvement. The Alliance International Tradeport, located in the Dallas–Fort Worth area, is a hub for rail, truck, and air freight transport. Although it is a successful enterprise, local governments have provided substantial financial support. To attract a maintenance facility of a large airline to the tradeport, the Alliance Airport Authority, a government entity, issued up to $800 million in tax-exempt special facility revenue bonds. The city of Fort Worth financed $10.7 million in street, utility, and runway improvements, and the state approved a 15-year abatement of personal and real property taxes. Jet fuel charges were waived, and airline inventories were exempted from taxation (W. E. Upjohn Institute for Employment Research 1995).

Another example is Rickenbacker International Airport in Columbus, Ohio. The tradeport is considered one of the most successful truck–air cargo facilities in the nation. Nine air cargo carriers average at least 65 arrivals per week. In 1994, the airport handled more than 215 million kg (475 million lb) of air cargo, employing nearly 5,000 individuals. Even with this success, the airport has not broken even, nor is it expected to do so in the near term. The county currently subsidizes airport operations by $3.5 million to $4.0 million per year (W. E. Upjohn Institute for Employment Research 1995).

These two examples illustrate the current role of government in intermodal activities and the private-public partnerships that have been established. In both cases, government has provided infrastructure improvements, directly financed construction costs, and subsidized operating expenses. The purpose of this paper is to arrive at a set of principles and guidelines to assess the role of government in intermodal activities.

BENEFITS OF INTERMODAL FREIGHT ACTIVITY

Understanding the type and magnitude of benefits generated from intermodal freight activity is critical for determining whether intermodal freight facilities and activities should be the responsibility of the private sector or government. The National Commission on Intermodal Transportation, in its final report to Congress, listed several types of benefits that may accrue from an efficient national intermodal transportation system (National Commission on Intermodal Transportation 1994, 3). The commission considered all intermodal transportation, including passenger, but the list presented here includes only the benefits that are most likely to result from intermodal freight activity:

-

Lowering overall transportation costs by allowing each mode to be used for the portion of the trip to which it is best suited;

-

Increasing economic productivity and efficiency, thereby enhancing the nation’s global competitiveness;

-

Reducing congestion and the burden on overstressed infrastructure components;

-

Generating higher returns from public and private infrastructure investments; and

-

Reducing energy consumption and contributing to improved air quality and environmental conditions.

The commission’s list combines direct benefits, such as the reduction in transportation costs, congestion, and pollution, with secondary or resulting benefits, such as enhanced competition and higher returns, which may be confusing when considering the distinct consequences of intermodalism. Nonetheless, the list is helpful in thinking about the

benefits accruing from intermodalism. The importance of freight transportation to national defense should also be mentioned, since an efficient transportation system is necessary for troop and ordnance deployment and the efficient production of materials used for national defense. This list, with the addition of national defense, will be used in this paper to establish principles for determining the extent of government involvement in intermodal freight activity.

BARRIERS TO DEVELOPMENT OF AN INTERMODAL FREIGHT SYSTEM

Whereas intermodal freight activities account for only 2 percent of the volume of shipments, intermodal activity is predicted to grow substantially in the next few years if barriers to the development of intermodal facilities are overcome. Many intermodal facilities report increased congestion not only within their facilities but also on access routes to the facility. A study contracted by the Federal Highway Administration (DOT 1995, 1–12) cited the following impediments to the expansion of intermodal facilities:

-

Lack of adequate infrastructure,

-

Congestion,

-

Operational inefficiencies,

-

Financial limitations, and

-

Institutional relationships.

Behind these impediments are complex issues of planning, coordination of the various modes, financing, and environmental and land use regulations, to name a few. It is not simply the issue of whether the private sector or the government should take sole responsibility for intermodal freight activity. The private sector has taken the lead in intermodal development, and partnerships between the two sectors have already been formed. Rather, the question is whether the government needs to modify its established transportation programs to further accommodate and enhance the private sector’s move toward intermodalism as the demand for less costly, more efficient freight shipments increases.

PRINCIPLES OF GOVERNMENT INVOLVEMENT IN ECONOMIC ACTIVITY

The principles and suggested guidelines posited in this paper are based on the concept of market failure. This principle assumes that markets are the most efficient means of allocating resources to economic activities. Consequently, economic transactions, including investment in capital projects, are best performed by individuals acting in their own self-interest within a market that is unconstrained by government regulation or other impediments that may distort prices or otherwise alter behavior. Therefore, market failure is the failure of private markets to achieve an efficient allocation of resources. One well-accepted role of government is to correct market failures. However, in establishing this framework for considering the role of government in intermodal freight facilities, it must be recognized that what we will propose is only a second-best solution. Given the deeply rooted institutional arrangements for the public provision of highways, ports, and air facilities, it is impossible to start from scratch and redo the entire system to comply with market principles. Nonetheless, market failure provides guidelines with which to gauge the appropriateness of future transportation infrastructure investment decisions.

At least three types of market failure can be associated with intermodal freight activity. The first type relates to market failures associated with the large fixed cost incurred in constructing the facility and to the inability of marginal cost pricing to cover the costs of building and operating the facility. The second type has to do with externalities directly generated by the facility, such as the likelihood that intermodalism will reduce traffic congestion and air pollution and create network externalities. In addition, the contribution of intermodal freight activity to national defense is considered an external benefit. The third type calls for government intervention, in the form of an infrastructure project, to correct perceived market failures of high unemployment and low economic activity within specific regional economies. This type is similar to the second in that it generates externalities, but the two types of externalities are differentiated, because the third type frames intermodal freight activity as a means to an end that is not directly related to transportation, that is, to boost the overall local economy. Other

government-sponsored projects could achieve the same purpose and may be more effective in doing so.

Therefore, the appropriate role of government depends not only on the characteristics of the intermodal transportation facilities themselves, but also on freight-related activities as a potential tool for local economic development. That is, guidelines should include ways to counter factors that impede the private sector from investing efficiently in intermodal facilities (if indeed market failures do exist) as well as reasons why government subsidies to private partners in intermodal activities or government management of intermodal transportation systems may be an effective tool for pursuing economic development strategies. The extent of government involvement in freight-related activities is determined by a host of factors, including the nature of the activities, the type and magnitude of market and nonmarket benefits resulting from intermodal freight activities, cost characteristics, and the economic condition of the local economy in which the activity is located.

INTERMODAL FREIGHT ACTIVITY AS PRIVATELY PROVIDED

Intermodal freight activity combines existing modes of freight transportation to use these modes efficiently. The ability to cross between modes allows shippers to utilize the comparative advantages of the different modes. For example, trucks are generally less expensive than rail for shorter distances, typically those less than 1600 km (1,000 mi). Over longer distances, rail service, especially double-stack container flatcars, is less expensive than trucking. Trucking also offers special services for some types of shipments, such as more flexible departure and arrival times, better reliability, and better tracking, which may render trucking more cost-effective for some type of commodities regardless of the distance (DOT 1995, 1–18). Morlok et al. (1996) provide several examples of intermodal freight shipments being less costly than single modes.

Because intermodal freight activities enhance modal efficiency, they lower transportation costs for all users of the transportation net-

work.3 These direct benefits are reflected in the prices paid for transportation services, and when businesses operate in a competitive market these lower costs are passed along to customers as lower prices. Shippers have incentives to use the freight facility and thus pay for the services offered, because they can cut costs and, in the case of some commodities, can offer special services because they can combine modes with different attributes, such as more frequent deliveries, on-time departures, and greater reliability. Consequently, intermodal terminal owners can reap the benefits of their investment through the market system. Indeed, most rail and truck intermodal terminals and facilities are privately owned and operated, so the private sector has taken primary responsibility for the terminal component of the intermodal freight system (DOT 1995).

FAILURE OF MARKETS TO INVEST OPTIMALLY IN INTERMODAL FACILITIES

A private entity decides to invest in a facility if the internal rate of return on the project is greater than the market rate of interest. Why should government intervene in facility investment when private businesses provide it more efficiently? First, consider private market impediments to building and operating an intermodal freight facility. Government intervention may be justified because of the nature of the facility, particularly its large size, and in the case of intermodal systems because of the need to coordinate various activities and parties and to obtain strategic rights-of-way.

Thus, governments, at various levels, become involved in the construction and operation of intermodal facilities

-

Through direct financing of all or part of the intermodal project or providing the transportation system to the facility,

-

As a fiscal agent that can use its creditworthiness and tax-exempt status to secure loans for the facility,

-

As a taxing agent to collect revenues that otherwise would not be available to the facility through the pricing of services,

-

As an agent that coordinates the activities of various parties to bring the project to fruition, and

-

As an entity that can exercise eminent domain to obtain strategic properties necessary for the efficient operation of the facility.

Natural Monopoly

Some intermodal facilities tend to be natural monopolies because of their locational advantage or because of the large fixed costs of constructing the facilities. Examples include the nation’s half-dozen or so major seaports. A natural monopoly may also occur where major modal systems intersect, such as the facilities recently constructed at the Alliance International Tradeport outside Fort Worth, Texas. In addition to the air freight operations, a large truck-rail intermodal facility has been completed there. In these and other cases, the size of the facility more than likely causes the average cost of building and operating the facility to decline over the entire feasible range of operation. When this occurs, the marginal cost is below the average cost, and setting price equal to marginal cost will not cover the total cost of the facility. Railroading is a classic example of a natural monopoly. The indivisibility of the right-of-way and the coordination problems of having more than one carrier use a given set of tracks lead to efficiencies if only one carrier provides the services (Scherer 1970, 520). Similarly, it is more efficient to build and operate one large terminal than to construct several smaller ones near each other.

One difficulty with a large facility is the pricing of services. Unless price equals average cost, the facility will not collect sufficient revenues to cover the cost of construction and operation and to enjoy a normal rate of return. No investor would find this type of project attractive. One option is for government to regulate the facility. Most natural monopolies, such as electric utilities, are regulated in one form or another by the government and must gain approval by regulatory bodies for rate changes.

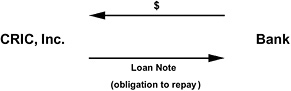

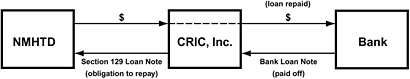

Another option is for natural monopolies to follow the marginal cost pricing rule but to allow the government to subsidize the monopolies’ chronic deficit out of tax revenues. Consider the following hypo-

thetical example in which the taxing authority of a city helps a private entity collect revenue to finance the construction and operation of an intermodal freight facility. A railroad seeks to construct an intermodal facility next to an industrial park for exclusive use by industrial park businesses. The industrial park is owned and operated by the government of a midsize city. The facility consists of a rail siding, a large loading dock, warehouses, and an access road to the nearby Interstate highway. The cost of constructing the facility is sizable. The railroad plans to finance the facility by charging users a fee. Since it is easy to control access and use of the facility, the railroad does not foresee any problem in collecting a fee that covers the marginal cost of providing shipping services.

However, because the initial construction cost of the facility is so large, the railroad cannot charge users their marginal cost of using the facility and break even. (The marginal cost is below the average cost at the optimal level of use of the facility.) To cover costs, the railroad proposes a two-tier pricing system in which a fixed charge and a variable price (equal to the marginal cost) are imposed. Since most users are willing to pay more than the marginal price because of the cost advantage they gain from using the facility, the fixed component of the twotier price can be charged (up to the value of their consumer surplus). Since only businesses within the industrial park will use the facility and the industrial park is owned by the city, the city agrees to collect the fixed component of the two-part price. In this case, a private entity seeks a government subsidy to build an intermodal freight facility to cover the cost of the facility and extract part of the customer’s consumer surplus.

An approach that does not necessarily involve government directly is for the facility to practice price discrimination among its customers. Electric utilities engage in price discrimination among different types of users, such as residential and commercial customers. Industrial buyers, who typically purchase large quantities of electricity, often receive more favorable rates than residential customers. Electric utilities even discriminate among users from the same sector, charging higher rates for those who use electricity during peak-demand times. Rail companies and motor carriers may charge rates according to what the traffic will bear. Shippers of high-value commodities have historically paid higher rates, relative to marginal transportation costs, than those shipping lower-value commodities (Scherer 1970, 522–523).

Inefficiencies of Government Funding

It has long been recognized that raising funds through government taxation exacts a cost on society by distorting business and household behavior. For example, income taxes discourage income-producing activities, sales taxes reduce consumer spending, and capital gains taxation may discourage investment. Government revenue bonds also distort economic behavior. By offering lower interest rates, they may crowd out privately financed projects. When local governments raise revenue through these and other taxes by imposing higher rates than found in neighboring jurisdictions, there is an additional incentive for businesses and households to move from the high- to the low-tax areas, further distorting economic behavior. Research has produced many estimates of the excess burden of taxation. Most estimates of the marginal excess burden of raising a dollar of public funds through taxation fall between $1 (no excess burden) and $1.50 (50 percent more than the revenue raised). However, there are instances in which the marginal excess burden may be less than $1. These circumstances involve assumptions about the labor supply curve and are beyond the scope of this discussion. However, one should simply be aware that the cost of raising revenue through taxation distorts economic behavior and that the net burden may exceed the actual amount raised through taxation (Ballard and Fullerton 1992, 117–131).

Whereas there is no consensus about the magnitude of the excess burden, the possibility that government financing of intermodal freight activities may entail costs beyond the amount raised should be taken into consideration. For instance, in the extreme case in which the excess burden is $0.50, one must weigh the likelihood that externalities will exceed 150 percent of the contribution of the public sector in financing the intermodal facility. If the value of the externalities is below this amount, the cost of government financing will exceed any benefits being taken into account. Suppose that the annual operating budget of an intermodal facility is $100 million and the government contributes $10 million each year from general revenue funds. If in the extreme case this costs society an additional $5 million each year, the annual value of the external benefits of the facility should exceed $15 million. External benefits would then need to amount to more than 15 percent of the annual operating budget of the intermodal facility. If the

government contributes more than 10 percent of the annual operating budget, the externalities would need to be a larger percentage of the total operating budget to justify its involvement.

Coordination of Modal Operations

Intermodal freight facilities also require the coordination and integration of rail, truck, and water transport modes. Private information may not be sufficient to bring private agents together to make the transaction. Imperfect information can cause market failure by preventing awareness of market transactions that have net benefits (Bartik 1990, 362). The long-standing practice among freight carriers of operating within their respective modes of transport has impeded the formation within the transportation industry, broadly defined, of mechanisms to coordinate access to intermodal freight facilities and the flow of communication between modes during operation. The government has exacerbated the problem by structuring regulations and guidelines to perpetuate the separation of modes. A minimal involvement of government would be to eliminate the regulations that impede communication between modes. Another level of involvement would be to facilitate the establishment of standards necessary to ensure proper communication and coordination.

EXTERNALITIES AS JUSTIFICATION FOR GOVERNMENT INTERVENTION

From the perspective of the broader community, such as a regional economy, the commercial profitability decision criterion may not reflect the extent of the benefits or costs associated with the intermodal freight facility. Thus, the investment decision may not be optimal. By ignoring external benefits, the private sector would invest in fewer intermodal freight facilities than would be socially optimal. Conversely, by neglecting the negative externalities, the private sector would overinvest in intermodal facilities.

Externalities, or external benefits and costs, occur when the actions of one economic agent affect the environment of another agent other than through prices (Varian 1984, 259). Markets typically ignore exter-

nalities, so market-determined prices (and thus costs) do not incorporate these effects. One reason why markets do not internalize externalities is the lack of a market for a commodity. For instance, there is no market for pollution, and thus there is no market-determined price (or cost) for polluting. The same is true of highway congestion. Vehicles that add to congestion and contribute to a highway environment that impedes traffic flow are not charged for use of the highway in accordance with their effect on other drivers. It may also be that there is no market mechanism for parties who directly benefit from their proximity to a transportation facility to compensate the owner of that facility. Businesses benefit from their proximity to Interstate interchanges, but they do not directly pay the government units that financed and constructed the Interstate. Therefore, one appropriate role for government is to establish mechanisms for businesses to take externalities into account, such as through taxes or subsidies.

In considering the benefits or costs of intermodal facilities, it is important to determine which effects are already reflected in prices and thus internalized in the markets and which are not reflected in prices. To make this distinction, the former are referred to as internal benefits (costs) and the latter as external benefits (costs).

Consider the hypothetical example of the same intermodal facility as introduced earlier, but this time consider the fact that the intermodal freight facility generates externalities. The railroad plans to build an intermodal freight facility next to an industrial park and recognizes that the benefits of the intermodal facility extend beyond the customers who directly use it. The facility makes the industrial park more attractive to businesses who use rail and trucks to ship their commodities. The added attractiveness of the area raises property values, and the railroad would like to extract some of these rents to help finance the construction and operation of the facility. It indicates to the city that it will not be able to go ahead with the project unless it receives a subsidy. The city agrees to the subsidy and increases the property taxes of businesses in the industrial park on the basis of higher land values. In this case, the intermodal facility is constructed by a private party aided by a subsidy from the city that equals the benefits to the businesses in the industrial park.

Most of the benefits listed by the National Commission on Intermodal Transportation (1994, 3) involve externalities, although there is no way to determine the relative size of the externalities. Empirical

research on the benefits of freight transportation does not offer estimates of the benefits and costs with sufficient precision to be of much help in making these decisions. Yet it is useful to go through the list of benefits offered by the National Commission on Intermodal Transportation to determine which are direct or internal benefits and which are indirect or external benefits.

It should be noted that benefits do not always fall neatly into these two distinct categories. In Table 1, benefits are classified as internal or external depending on their predominant effects. Of course, an economic activity initiated in the private sector prima facie generates internal benefits, otherwise the action would not be undertaken. Some actions generate additional benefits to other parties. When private activities clearly yield external benefits of significant magnitude, both categories are checked in the table. However, external benefits generated from one item may be listed under another item. The first two benefits given in the table illustrate this possibility.

The first benefit in the table, lowering transportation costs, generates both internal and external benefits. With respect to internal bene-

TABLE 1 Classification of Internal and External Benefits from Intermodal Freight Activities

|

BENEFITS |

INTERNAL |

EXTERNAL |

|

Lowering overall transportation costs |

|

|

|

Increasing national and regional economic productivity and efficiency |

|

|

|

Multiplier effects from building and operating freight facilities |

|

|

|

Reducing congestion and the burden on overstressed infrastructure |

|

|

|

Generating higher returns |

|

|

|

Reducing energy consumption and contributing to improved air quality and environmental conditions |

|

|

|

National defense |

|

|

fits, lower overall transportation costs are reflected directly in lower freight costs, which reduce business costs. These cost savings could be substantial for some firms, since logistics costs can account for as much as 25 to 35 percent of the sales dollar for some companies (DOT 1995, 1–8). In turn, the cost savings will be passed on to customers in the form of lower consumer prices, as long as competitive market conditions exist. When the benefits are directly embodied in the market prices, they are considered to be internalized by the consumers, and there is no reason for government involvement to account for externalities.

The externalities associated with lower transportation costs are related to the second benefit, increasing economic productivity and efficiency. Consequently, external benefits from the first item are indicated under the second item. These benefits have important implications at the national and local levels. Increased productivity allows companies to expand production, raise wages, and create more jobs. These effects may be concentrated more in regions of the country that are home to intermodal facilities. Whereas benefits accrue to anyone with access to the intermodal freight system, proximity to these facilities may give some businesses an advantage over others, thus creating more jobs causing higher wages to be paid in that region than would be the case if the facility were located elsewhere.

Moreover, the operation of the facility itself creates jobs for those living within the labor market serving that facility. One cannot consider benefits to the national economy without considering the importance of access to the transportation system to specific regional economies. The national economy comprises regional economies that have different growth processes and characteristics. Therefore, the effects of intermodal freight activity and facilities on these regions will vary accordingly.

The ability of intermodal activities to generate higher returns is another example of an internal benefit that may be confused with an external benefit. Higher returns are incorporated in the price of the assets through the net discounted value of the physical facility. Therefore, market-oriented activities take these benefits into account through the setting of prices and the response to prices in economic transactions that involve these assets. However, the presence of an intermodal facility may benefit those who do not directly or even indirectly compensate the facility owners for providing this advantage. Even if land prices reflect the advantage of an intermodal facility, the facility owner is not compensated

for this external benefit unless the facility owner owns the land or has a way of collecting taxes from the use of the land.

Intermodal activities can reduce congestion and decrease the burden on overstressed infrastructure by spreading freight shipments across several modes. As documented by Morlok et al. (1996), intermodal rail-truck transport may reduce the air and noise pollution caused by trucks and bring about more efficient energy use (p. 9). The first two externalities are nonmarket benefits, since they are not captured in the price of the transportation service. Intermodal systems may also benefit users of other transportation modes. For instance, by moving cargo from trucks to rail, congestion on highways is reduced, which increases the value highway users place on highway transportation services and reduces the cost to taxpayers and others by reducing the need to build additional highway capacity.

Government could go a long way in reducing pollution and congestion caused by highway use by pricing highways properly. For instance, trucks do not pay the full cost of using highways. Because roads are underpriced, truck shipments are also underpriced, and there is an incentive to ship by truck rather than alternatives, such as rail. Furthermore, neither passenger vehicles nor trucks pay congestion costs. The price of using a highway system is the same regardless of the marginal effect of adding another vehicle to the highway system. If congestion pricing were pursued, the need to build additional highways would be reduced. Nonetheless, use of the most efficient combination of transportation modes is expected to reduce energy consumption and pollution (Morlok et al. 1996).

Other Externalities and Market Failures

Another possible market failure is the existence of imperfect capital markets that distort the market rate of return. Regulated capital markets may limit the risk that lending agencies can make. This restriction may limit the payoff period in which returns exceed costs and thus causes underestimation of the profitability of the project. The absence of complete insurance markets may also inefficiently restrict the amount of risk that financial markets may take. Market interest rates may be above optimal social discount rates, particularly for long-term loans.

Second, market profitability takes into account only the net benefits of the marginal consumer. However, consumers (except for the marginal one) who actually consume the product are willing to pay more for the product than the market price. Consequently, the value they place on their consumption is higher than the market price. The difference between their willingness to pay and the market price is called consumer surplus. Governments, through their taxing authority, can extract part of this surplus to help finance the construction of the facility.

Third, the project may result in income redistribution, which increases the social welfare of the community. Whereas some argue that income distribution can be changed more directly through the tax/transfer structure, political, economic, and social constraints on this more direct method may make it easier to pursue redistribution objectives through project selection. For example, it is simple to bring about income redistribution by locating a project in a poor or high-unemployment region instead of a wealthy, low-unemployment area, so long as local residents are employed by the project.

Government Subsidies and Taxes

For all these reasons, government intervention may be warranted, depending on the relative magnitude of these characteristics. Government would intervene in basically two ways: subsidize the facilities according to the level of positive externalities it generates, or tax the facility to recover the costs of the facility on the surrounding economy. In theory, it is conceivable that the levels of subsidies and taxes could be determined so that the facility is fully compensated for the value placed on its positive externalities and that taxes or penalties totally offset the costs of emitting pollution or other negative externalities, or the fact that the prices are not true market prices. However, in practice, this would be very difficult, since the calculation of externalities and of the tax and subsidy instruments to offset them is imprecise. The more these subsidies and taxes are out of line, the more inefficient the allocation of resources.

Disentangling Externalities

When considering externalities, it is important to separate the externalities accruing from existing transportation modes from those attribut-

able directly to intermodal freight activities. For instance, highways support transportation services apart from intermodal possibilities. Some estimates suggest that highways have externalities that result in higher rates of return than are generated by private capital (Nadiri and Mamuneas 1996). Yet, when considering the external benefits of intermodal freight facilities, the benefits generated by the existing highway system should not be considered. Only the benefits resulting from additional highway use (or less highway use) as a direct result of intermodal freight activities can be considered.

FREIGHT FACILITIES AS AN ECONOMIC DEVELOPMENT TOOL

The material in this section is borrowed heavily from Bartik (1990).

Economic development efforts, either through subsidizing private businesses or investing in public services such as infrastructure projects, can be justified on the grounds of market failure of the regional economy. For instance, regional economic development policies will encourage the expansion of benefits that private markets fail to recognize adequately. What differentiates these externalities from the ones in the previous section is that intermodal freight facilities are not the only project that could address these regional market failures. Many other projects, including improvements in education and training as well as simply subsidization of private business investments, may produce similar results. These policies are efficient if the value of these nonmarket benefits exceeds program costs. However, the justification of government intervention for this reason hinges on the magnitude of these benefits. Unfortunately, the level of sophistication in data collection and in evaluation of the costs and benefits of projects, particularly with respect to externalities, is not sufficient to obtain precise answers. The first step, then, is to understand the forms that nonmarket benefits may take.

To continue the hypothetical cases used to illustrate the three types of market failure, consider the proposal by a consortium of governments within a metropolitan area to build an intermodal facility integrating air, rail, and truck shipments. The facility is located next to an industrial park. The governments argue that the intermodal facility would be a catalyst for a sluggish local economy and position the area for an

expected increase in air freight. They expect that businesses who use or expect to use air freight will locate in the area, particularly in the industrial park, providing jobs for the local unemployed and increasing the critical mass of businesses, which will benefit all businesses in the area. To finance this facility, they provide a tax abatement, which is financed out of the general fund. In this case, the local government proposes to build an intermodal facility as an economic development initiative to address the market failure problems of unemployment and enhance the region’s agglomeration economies, which in turn reduces the cost of doing business for many businesses in the area.

This case has to do with government intervention, in the form of an infrastructure project, to correct perceived market failures of high unemployment and economic activity below a critical mass. The facility generates benefits beyond the customers who directly use the facility, but the benefits are not necessarily related to transportation services. Rather, the facility is used as one of many possible government interventions to spur local economic development.

Why should government intervene, particularly in the form of subsidies to attract businesses, when businesses are apt to locate and expand anyway? There are several types of broad market failures that could be addressed by government intervention.

First, unemployment may result from market failure if individuals without jobs are willing to work at prevailing wages for jobs they are qualified to fill. Government intervention is justified if the investment or subsidies cost less than the value of the employment benefits. Similar arguments can be made for underemployment of local workers, in which workers in some industries seek jobs in other industries that pay more and for which they are qualified. Shifting a regional economy toward high-wage industries provides nonmarket benefits that are a possible goal of regional economic development.

Second, publicly provided services, such as a government-sponsored intermodal freight facility, benefit businesses and residents. A perfectly efficient state and local tax system would set the taxes paid by a business or household equal to the marginal cost of providing that public service. In this form, the tax would be equivalent to a user charge. The distinction between a government-sponsored investment and a government-subsidized investment, as discussed in the preceding section, is somewhat vague. The first starts as a government project with specific external ben-

efits to the community that justify its investment. The public-good nature of the project leads to questions concerning the efficient financing of the project, with perhaps some combination of user charges and a general tax instrument. The possibility of user charges brings up the notion of marginal cost pricing, which will be touched on in a later section. The second is a private venture; the issue is whether externalities are sufficient to justify government intervention. The project may be viewed first as generating private benefits sufficiently internalized by private agents that market prices can be used to finance the venture, along with whatever subsidies are offered.

The net fiscal benefit of infrastructure investments depends on the particular circumstances of the regional economy. For instance, if a region is growing quickly and bottlenecks occur in the current transportation system, additional investment designed to alleviate the bottlenecks would benefit the region. On the other hand, if a regional economy is declining because of a loss in comparative advantage, intermodal freight facilities with innovative systems may benefit the region by offering lower-cost transportation, which in turn may lower costs of doing business in that region and attract businesses. However, if transportation systems are underused because of the lack of economic activity in the area, subsidies to businesses or other economic development efforts may be more effective.

Third, cost savings can accrue to businesses when economic activity in a region reaches a critical level. Economists refer to this benefit as agglomeration economies. By creating or enhancing a transportation node, intermodal freight operations may attract businesses within similar industries, using similar suppliers, drawing from common labor pools, and so forth. If these benefits are realized, the justification for government intervention is that a business’s location decision fails to recognize that its agglomeration economies benefit other businesses. Empirical research indicates that only cities just below the critical mass of economic activity may benefit from a program that encourages economic expansion [a literature review is given by Eberts and McMillen (forthcoming)].

Other market failures addressed by economic development initiatives include the underinvestment in education and training and the underdevelopment of research and innovations. They will not be elaborated on here, since it is not likely that intermodal freight investment

will have much of an effect on these areas. However, whether they have an effect that warrants government intervention, as in the previous cases, is an empirical matter.

As in the first case, it is conceivable that government subsidies and taxes can be levied such that all the external benefits and costs are fully compensated. If this were to happen, the freight facility would be analogous to a private entity with no externalities. Consequently, the facility would have no external effect on the rest of the local economy, because all of the benefits and costs have been extracted through the tax and subsidy system.

DETERMINING GOVERNMENT INVOLVEMENT

The possibility that an intermodal facility could yield external benefits and costs is a convenient justification for government intervention. However, in many cases it is not defensible from a benefit-cost perspective because of the lack of reliable information about whether the facility actually generates externalities and the magnitudes of these effects, particularly the type of information that would be useful in comparing the various benefits. The lack of precise estimates of the magnitudes of internal versus external effects makes it difficult to determine whether intermodal freight activity should be left exclusively to the private sector or government should become involved. Simply because intermodal freight activities generate externalities that appear to be reasonable does not warrant government involvement. A determination should be based on the magnitude of the externalities relative to internal benefits and to public goals with regard to the reduction of pollution and congestion or economic development.

The inability to measure externalities has been and continues to be a major problem in using benefit-cost analysis for public investment decisions. A United Nations’ handbook on the methodology and practice of national benefit-cost analysis for industrial project preparation and evaluation plainly states that “it appears to be practically impossible to quantify many externalities.” The authors conclude, “At our present state of knowledge it appears to be impossible to prove decisively that one project is inferior to another in terms of its contribution to indirect benefits.” In the context of determining the appropriate involvement of government in intermodal freight projects, this conclu-

sion would be paraphrased to state that it is impossible to determine decisively the appropriate involvement of government on the basis of the extent of externalities. Nevertheless, the United Nations guidelines do not advocate ignoring what cannot be precisely measured: “We cannot emphasize too strongly that this is not a good reason for ignoring externality” (United Nations 1972, 66–67).

In the absence of precise estimates of externalities, rules of thumb have been adopted. For instance, the federal grants for Interstate highways have matching ratios of 90 percent federal and 10 percent state. If this ratio reflected external benefits accruing to highway users who live outside the state, we would expect 90 percent of the benefits to flow outside the state. Readily available statistics show that this ratio may overstate the extent of benefits from highways flowing outside the state. The U.S. Department of Transportation estimates that only 30 percent of a state’s Interstate highway traffic is out of state. On the other hand, freight-related shipments within state, based on vehicle registrations, are somewhat closer to the state-federal funding ratios but still fall short. For instance, the average percentage of vehicle miles of for-hire trucks traveled outside the state of registration averages around 50 percent. The range varies depending on the size of the state: 17 percent for California and 77 percent for Rhode Island. However, the ratio based on the weight of shipments is further from the funding ratio. For example, 25 percent of the goods (by weight) originating in Michigan are shipped to destinations outside of Michigan (Bureau of Transportation Statistics and Bureau of the Census 1996). Yet when value of shipments is used, the percentage of goods originating in Michigan shipped out of the state is closer to 50.

If we assume that states are responsible for road construction, as they traditionally have been, an efficient funding formula for federal assistance would be based on the percentage of highway use by those outside the state. As illustrated by these four measures, it is difficult to decide on the appropriate measure, even when we have reasonable estimates from which to choose.

How should one proceed when such information is not available?4 The first step would be to list the range of benefits that are likely to flow

from intermodal freight facilities. This would be tantamount to checking the various boxes in Table 1 and adding up the number of checks. It is reasonable to assume that the wider the range of benefits, the greater the overall magnitude of externalities.

Another step in this process would be to consider components of the intermodal freight facility that traditionally are built and operated by the private and government sectors. In this regard, it is convenient to think of intermodal freight systems as comprising three components: the terminal, terminal access, and communication among modes. The terminal typically includes the warehousing and loading facilities. The warehouse could be a covered area or simply an open yard for storage of goods awaiting shipment. The loading facilities include the mechanical devices for transferring cargo as well as the road and rail lines within the terminal compound. Terminal access includes the roads, highways, and tracks linking the terminal facility to the national highway and rail systems. Information concerning destinations, departure and arrival times, liability, customs, and billings must also move efficiently between terminals and shippers to ensure a seamless movement of goods.

As indicated in Table 2, these three components can be easily classified as performed by either the private or the public sector. The terminal facility proper is typically a private venture, particularly for truck-rail facilities (DOT 1995, 1–19). Therefore, there may be little justification for government to become heavily involved in this aspect of the activity. On the other hand, terminal access may be considered an area where government has been traditionally involved, particularly with respect to highway and water access. With highways, for example, state and local governments have primary responsibility for highway construction in financial partnership with the federal government. Furthermore, as mentioned previously, if the federal-state funding ratio is

TABLE 2 Typical Public-Private Responsibility for Intermodal Freight Activities

|

|

PRIVATE |

PUBLIC |

|

Terminal |

|

|

|

Terminal Access |

|

|

|

Communication Across Modes |

|

|

any guide, highways are perceived to have extensive externalities, although research cannot justify the existing funding ratio as based solely on the level of externalities. Thus, access to existing transportation modes, as a component of the intermodal activity, could be assigned to government entities. Finally, communication and coordination may be considered within the realm of both private and public entities, and the choice may depend on each entity’s relative capacities to contribute to this component of the activity. Additional criteria with regard to which level of government should become involved, if government involvement is indeed justified, are included in the next section.

COMPETITION AMONG GOVERNMENTS

We have made the argument that government has a role in intermodal freight systems if nonmarket benefits or other market failures are large enough that the benefits to society are greater than the cost of the government intervention. The next question is whether the pursuit of investment in intermodal transportation by individual state and local governments acting independently to foster economic development in their regions is efficient. It has been argued that competition among local governments leads to an overinvestment in various infrastructure facilities and excessive and needless subsidies to business, which in turn takes resources away from important public services and increases tax rates.5

One concern with regional competition for intermodal freight facilities is inefficiencies associated with building too many large facilities, such as seaports, which have extensive economies of scale. If two cities along the same seacoast decided that each needed a port with intermodal facilities to enhance local economic development, problems may arise from a less-than-optimal volume of activities for both ports. As mentioned earlier, some intermodal freight facilities may be char-

acterized as natural monopolies, in which average costs decline throughout the range of operations. However, if two facilities within close proximity share the volume, the average cost will increase for both facilities, and the efficiency of the entire freight system that is linked to these ports will be reduced. Moreover, if these ports find themselves running a deficit, government may be called on to subsidize the facility to a much larger extent than would be necessary if only one port were in operation. On the other hand, if substantial bottlenecks exist because the existing port is operating far beyond capacity, a second port may be necessary. Yet the question remains as to whether the existing port should expand and capitalize on additional economies of scale or another port should be established.

Proponents of development incentives argue that they “create a business-friendly, entrepreneurial climate; promote local job opportunities and worker training; enhance private sector productivity and competitiveness. Opponents charge that these giveaways divert government money from supporting traditional public goods like education, frequently cost far more than any realized benefits, misallocate resources and make everyone worse off” (Farrell 1996). Proponents also argue that states, by pursuing their own self-interest, are laboratories for innovative programs; opponents counter that states are impediments to economic union.

CRITERIA FOR EFFICIENT LOCAL ECONOMIC DEVELOPMENT INITIATIVES

There are several criteria to determine whether such incentives are detrimental to national efficiency and thus national growth. The criteria are adapted from Bartik (1994). The first is that as long as the benefits exceed the costs of government intervention, local competition may not produce undesirable effects and will enhance national efficiency.

Second, economic development incentives that enhance business productivity will enhance the national economy. Reallocating resources to their most productive use is the hallmark of freely functioning private markets. The same can be said of government intervention, under special circumstances. If government intervention reallocates resources toward more productive uses, national economic efficiency is improved.

The benefits are particularly promising when government intervention takes place in poor areas with high unemployment.

Third, subsidies would be considered unproductive if discretionary subsidies provided to selected firms would not have any permanent effect on the local economy if they leave the area. It is clear under this definition that subsidizing the building of an intermodal freight system would be productive, since benefits of infrastructure improvements and more efficient transport systems would remain even if the firm that initiated the project left the area. A problem would arise only if the facility was abandoned before generating benefits sufficient to justify its subsidy.

Arguing that investment in freight systems by state and local governments raises national efficiency is easy in theory, but it is not easy to meet the conditions necessary for this to happen. For instance, we have assumed that state and local governments provide subsidies that do not exceed the net external benefits of the project. However, if the subsidies are greater, competition could be detrimental to the national economy. Furthermore, if state and local governments are inclined to offer subsidies that exceed the net external benefits, there would be a tendency to overinvest in these facilities.

Two aspects of state and local government financial decision making may lead to the provision of subsidies that are too generous. First, the political horizon of elected officials is short relative to the life of an intermodal freight terminal and its ancillary infrastructure. Governors and local officials are apt to negotiate subsidies that provide a large share of the subsidies after the current term of office is over. Second, there are typically few fiscal constraints on the amount of subsidies that may be offered. Tax abatement, in particular, is not included on the expenditure side of the government’s budget, and consequently there is little fiscal constraint on these decisions.

Several proposals have been offered to address the issue of competition among state and local governments (Farrell 1996):

-

Disclose incentive offers made during the bidding process, including disclosure by company.

-

Initiate a multistate compact that would share information, create an analysis model, identify “best” and “worst” practices, and note legal risks and costs.

-

Encourage legislators to adopt uniform standards and accountability measures.

-

Develop standards for awarding incentives that derive from best practices. State and local governments should include in these standards an assessment of the quality of jobs and their availability to local populations. These standards would include performance and enforcement mechanisms.

-

Establish a multiorganization task force to promulgate uniform reporting standards that would measure and evaluate the costs and benefits of incentives.

The network nature of transportation facilities raises another issue related to government involvement. The value of transportation facilities is related to their ability to link locations. For networks to work efficiently, access standards (e.g., lane widths, bridge widths and clearances, tunnel heights, load capacities, etc.) must be maintained. Because transportation systems are costly and consume valuable land rights-of-way, they should be built with minimal redundancy except for what is needed to ensure that access is maintained when branches of the network are closed down or traffic flow is slowed. If governments are involved in building and maintaining freight transport facilities, the question arises as to whether centralized decision making is necessary to ensure efficient networks or decentralized decision making by state and local governments will suffice.

There are two ways to view the network dimension to the question of government intervention in freight transportation systems. The first view is that accessing transportation networks is an economic benefit to local areas. Therefore, economic development initiatives that provide new access or improve access to a transportation network are likely to offer benefits to a local economy (with the usual conditions mentioned earlier). In addition, increased traffic flow may create the demand for more direct routes to destinations. If these routes are constructed, the system is enhanced. Vickrey (1972) suggests that there are significant economies of scale when traffic demand creates more direct routes within the network. This benefit is akin to the expansion of networks within the Internet system. However, unlike the Internet, surface transportation imposes significant costs when additional links are constructed within the network. Therefore, the second view is that access to net-

works imposes costs. Additional access and additional traffic may introduce costs in the form of congestion, impeding the flow of all participants in the system (until perhaps additional links are established), which may not be accounted for in the usual benefit-cost calculations. Of course, building capacity to transportation systems in the form of additional routes and additional lanes on existing corridors results in land right-of-way costs and construction costs, which must be balanced against the benefits mentioned earlier.

ROLE OF VARIOUS LEVELS OF GOVERNMENT

If the criteria given in the preceding section are followed, the choice of the appropriate level of government would not be affected by the concern that investment by local governments in intermodal freight activities is necessarily inefficient. A basic tenet in economics is that the government jurisdiction should encompass the region on which the benefits or costs of a particular activity fall. Examples are water districts, air quality districts, and port authorities. Traditional government jurisdictions such as cities, counties, or states rarely match the extent to which externalities are contained within their jurisdictions. Therefore, various responsibilities are more appropriately assumed by different levels of government according to the extent of the externalities.6 For example, federal involvement in financing the Interstate highway system is justified on the grounds that the benefits of the system extend beyond local and state boundaries. Port authorities, transcending city and county boundaries, include areas that are perceived to receive benefits from the operations and that contain the various components of the transportation system under the responsibility of the port authority. Federal involvement is also justified on the grounds that the construction and operation of an efficient highway network requires coordination throughout the system.

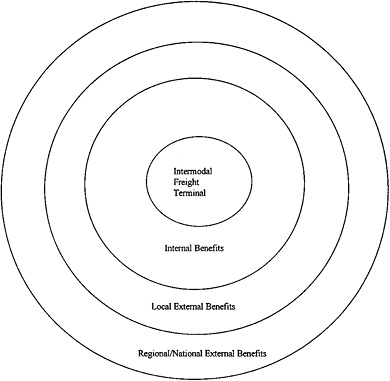

Therefore, the level of government that should intervene depends on the characteristics of the intermodal freight facility. If the facility generates externalities that extend beyond its direct customers, there is reason for government intervention. If the externalities extend beyond the boundaries of the local jurisdictions, there is reason for higher levels of government (e.g., special districts, counties, states, or the federal government) to take responsibility. As shown in Figure 1, the intermodal freight terminal can be considered as the core of several concentric circles. The innermost circle represents the benefits that are internal to the operation of the facility and that will be reflected in market prices. Included in this circle are the characteristics of the terminal, such as economies of scale and access to transportation systems. The next outer circle encompasses benefits that accrue to the local economy that are not reflected in market prices. The outermost circle captures the external

FIGURE 1 External benefits from intermodal freight activities.

benefits that go beyond the local area. If an attempt were made to draw these circles to scale to reflect the relative amount of benefits, the incremental radius of each circle could be drawn accordingly. The role of government then depends on the relative distances between the first and second circle (local government involvement) and the second and third circles (state and federal involvement).

FINANCING ARRANGEMENTS

Once the combination of private-public involvement in intermodal freight activity is determined by the criteria given in the paper, financing instruments and arrangements can be determined. Whereas it is not the purpose of this paper to offer suggestions for specific types of financing, the options that appeared in the final report of the National Commission on Public Works Improvement (Revis and Tarnoff 1987, 113) are set forth:

-

Leasing facilities,

-

Franchises,

-

Contracting for services,

-

Direct public and private bargaining over infrastructure finance (particularly where developmental projects are involved),

-

Transfer of development rights,

-

Assessment districts,

-

Local growth-management programs (as in California),

-

100 percent vendor ownership,

-

Limited partnerships,

-

Leveraged leases for privatizing financing,

-

Tax breaks, and

-

Low risks (with guaranteed cash flows through service contracts).

Whereas the list appears extensive, obviously not all options can be pursued. One of the problems that prompted the formation of this commission is the increased competition for public funds to finance transportation infrastructure. State governments provide slightly more than 50 percent of total highway funds, with about 22 percent coming

from the federal government and the remainder from local government. All levels of government are pressed for funds to maintain and upgrade the highway system, not to mention the current issues with rail and water ports. By making freight transportation more efficient through more efficient use of existing facilities and more efficient pricing, intermodal freight activities could reduce the funding burden.

Recognizing that the current state of knowledge about the costs and benefits of transportation infrastructure and the effects of economic development incentives in general is insufficient to yield an optimal solution through such methodologies as benefit-cost analysis, it follows that the financing question should be approached from a pragmatic perspective. Financial ventures, such as intermodal freight facilities with their ancillary components, are from the beginning a partnership between the private and public sectors. This partnership would exist even if the private sector funded the entire project, simply because of all the regulations at all levels of government that must be addressed. Also, extensive coordination is required for the intermodal facility to access the highway, rail, and water systems, and this entails working with many different government agencies. Conversely, the partnership would involve the private sector even if a government entity decided to fund the entire project, since private transportation carriers will ultimately use the facility.

The pragmatic view, then, is to consider the available resources of all parties and the extent to which the stakes of the various partners in the venture can be justified. The financial commitments of the stakeholders rest in part on asking the appropriate questions about the distribution of benefits across all parties and assembling reliable and convincing evidence of this distribution.

PROCEDURAL STEPS

Given the multitude of factors that should be considered in determining government involvement in intermodal freight activity, several steps to follow in organizing and assessing the relevant information are given. The first two steps assess the economics of the terminal facility and the conditions of the linkages to the transportation networks and determine what, if any, government subsidy may be required to support operations.

Step 1: Ask questions about the intermodal freight terminal.

-

What are the internal benefits of expanding the facility?

-

Is the facility operating beyond capacity and creating bottlenecks?

-

Would expansion of the existing terminal alleviate bottlenecks?

-

Would expansion reduce the average cost of operations and thus provide transportation services at a lower price?

-

Would construction of a new terminal alleviate bottlenecks and enhance intermodal freight activities?

If the answer to one or more of these questions is yes, calculate the expected revenue and costs of the operation and the projected deficit (if any) in terms of net present value.

Step 2: Ask questions about access to the intermodal freight facility.

-

Do bottlenecks that impede efficient access from the transportation systems (e.g., highways, rail, waterborne shipments) to the intermodal facility exist?

-

Could additional modes be connected to the intermodal facility so that it would further enhance the transportation network?

If the answer to one or both of these questions is yes, calculate the cost of making these improvements. The next step is to sum the costs in Steps 1 and 2 and compare them with the revenues generated by the intermodal freight facility. If the ratio of costs to revenues is greater than 1, the facility within its present volume and pricing scheme cannot cover costs. For instance, if the ratio is 1.2, then 20 percent of the costs are not covered by revenue from the private sector.

Justification for government subsidies to help finance the deficit depends on sufficient levels of external benefits. Since precise estimates of externalities are very difficult if not impossible to obtain, Step 3 provides a method of calculating a rough estimate of external benefits. It should be kept in mind that tax financing may entail an additional cost, as described in the section on inefficient government financing.

Step 3: Determine the existence of external benefits generated by the intermodal freight facility.

-

Use the checklist provided in Table 1 to determine what external benefits may be generated by the facility.

-

With respect to economic development goals, determine the number of additional jobs and the amount of income that might be generated by the expanded facility, or the number of jobs that would be lost if the facility closed.

We can begin to add up the value of the externalities by estimating some of the more readily quantifiable items. For example, it is fairly straightforward to estimate the value to the local community of the additional jobs created by expanding the facility or building a new one. It is important to ensure that these are additional jobs, however. Once these items are estimated, how close does the result come to meeting the projected deficit? If more externalities whose values can be easily estimated are needed to match the deficit, they can be considered, and estimates of these externalities can be added to the list. The list of acceptable estimates may fall short of the value needed to match the projected deficit. In this case, which is highly likely, other rules of thumb may be needed, including prioritizing through the political process what is important to the community.

Step 4: Determine which level of government is most appropriate for considering the subsidy.

-

For each externality listed in Step 3, ask which level of government most encompasses the benefits. Use the concentric circle diagram in Figure 1 to give a rough approximation of the spatial boundaries of these benefits.

-

Assign priorities to these externalities on the basis of traditional roles of government, such as national defense to the federal government and job creation to the local government.

For the involvement of local governments to be efficient, the criteria for efficient government provision addressed in a previous section should be considered.

CONCLUSION

The U.S. freight transportation system has had a long history of single-mode use. Intermodal freight activity provides an opportunity to use the single modes more efficiently, reducing transportation costs,

increasing productivity, and generating external nonmarket benefits. The purpose of this paper is to lay out principles that could guide the committee in providing recommendations for government involvement in the construction and operation of intermodal freight facilities. The conceptual framework is based on the principle that freight activities are best performed by the private sector. However, it is recognized that the private sector may not provide freight transportation services efficiently because of market failures. Furthermore, it is acknowledged that the government has taken a major role in the construction of the transportation system, particularly highways, rail, and navigable waters. Therefore, the partnership between the private and public sectors in providing freight service has been long established.

Whereas the principles of government involvement are simple and clear in theory, they are difficult to implement because of the inability to generate precise estimates of the value of many external benefits. Moreover, it is difficult to determine the spatial boundaries of these externalities and thus assign responsibility to various levels of government. There is insufficient knowledge of the cost structure of intermodal freight facilities to determine whether their marginal cost curves are below their average cost curves over the feasible range of operations characteristic of natural monopolies. The difficulties are exacerbated by inefficiencies inherent in the local government sponsorship of some projects that may lead to an inefficient allocation of resources at the broader regional or national levels.

Using a simple cost-benefit methodology and rules of thumb for determining externalities, a framework is presented in this paper on how to account for these factors. These principles should be helpful in organizing important factors into cost and benefit categories to aid in the decision process. They can be of further use when the various stakeholders from the private and public sectors come together to collaborate to various degrees on expanding and improving the nation’s intermodal freight facilities.

REFERENCES

Abbreviation

DOT U.S. Department of Transportation

Ballard, C. L., and D. Fullerton. 1992. Distortionary Taxes and the Provision of Public Goods. Journal of Economic Perspectives, Vol. 6, No. 3 (Summer).

Bartik, T. J. 1990. The Market Failure Approach to Regional Economic Development Policy. Economic Development Quarterly, Vol. 4, No. 4, Nov.

Bartik, T. 1994. Jobs, Productivity, and Local Economic Development: What Implications Does Economic Research Have for the Role of Government? National Tax Journal, Vol. 47, No. 4, Dec., pp. 847–861.

Bureau of Transportation Statistics and Bureau of the Census. 1996. 1993 Commodity Flow Survey. U.S. Department of Transportation and U.S. Department of Commerce.

DOT. 1995. Intermodal Freight Transportation: Volume 1. Final report. Dec.

Eberts, R. W., and D. P. McMillen. Forthcoming. Agglomeration Economies and Urban Public Infrastructure. In Handbook of Regional and Urban Economics, Vol. 3, North-Holland Press.

Farrell, C. 1996. The Economic War Among the States: An Overview. The Region, Federal Reserve Bank of Minneapolis, Minneapolis, Minn., June.

Morlok, E. K., L. N. Spasovic, and J. G. Cunningham. 1996. Regional Options and Policies for Enhancing Intermodal Freight Transport. Presented at INFORMS International Meeting, Washington, D.C. May.

Nadiri, M. I., and T. P. Mamuneas. 1996. Contribution of Highway Capital Industry and National Productivity Growth. Draft. New York University, National Bureau of Economic Research, and University of Cyprus. March.

National Commission on Intermodal Transportation. 1994. Toward a National Intermodal Transportation System. Final report. Washington, D.C., Sept.

Revis, J. S., and C. Tarnoff. 1987. The Nation’s Public Works: Report on Intermodal Transportation. National Council on Public Works Improvement, Washington, D.C., May.

Scherer, F. M. 1970. Industrial Market Structure and Economic Performance. Rand McNally, New York.

United Nations. 1972. Guidelines for Project Evaluation. New York.

Varian, H. 1984. Microeconomic Analysis (2nd edition). W. W. Norton & Co., New York.

Vickrey, W. S. Economic Efficiency and Pricing. In Public Prices for Public Products (S. Mushkin, ed.), The Urban Institute, Washington, D.C.