Ensuring That the United States Has the Best Environment for Innovation

SUMMARY

A number of recent reports have raised concerns about the United States’ long-term ability to sustain its global science and engineering (S&E) leadership.1 They argue that erosion of this leadership threatens our ability to reap the rewards of innovation in the form of higher incomes and living standards, better health, a cleaner environment, and other societal benefits.

Certainly, the leadership position the United States has maintained in research and the creation of new knowledge since World War II has been an important contributor to economic growth and other societal rewards. However, a look at US history and some contemporary international examples shows that leadership in research is not a sufficient condition for gaining the lion’s share of benefits from innovation. A favorable environment for innovation is also necessary. The environment for innovation includes such elements

as the market and regulatory environment, trade policy, intellectual-property policies, policies that affect the accumulation of human capital, and policies affecting innovation environments in specific regions. In addition, grand challenges issued by the president (such as the reaction to Sputnik and the call for the Apollo project) can mobilize resources and the national imagination in pursuit of important innovation-related goals.

How can the United States sustain and improve the environment for innovation even in a future where its relative share of global S&E inputs to the innovation process (such as R&D spending, S&E personnel, and the quantity and quality of scientific literature) declines?

Many approaches to improving the innovation environment have been suggested. On some issues, including the offshoring of service-industry jobs, contradictory diagnoses and prescriptions have emerged on the basis of interests and political outlook of the analysis. On other issues, such as patent-system reform, similar suggestions have emerged from several different reports. The approaches suggested include the following:

Market, Regulatory, and Legal Environment

-

Establish a public-private body to assess the impact of new regulations on innovation.

-

Reduce the costs of tort litigation for the economy.

-

Reform Section 404 of the Sarbanes–Oxley Act.

-

Drop current efforts to expense stock options.

-

Create best practices for collaborative standard-setting.

-

Undertake market and regulatory reforms in the telecommunications industry with the goal of accelerating the speed and accessibility of networks.

Trade

-

Increase focus on enforcement of the prevailing global rules for intellectual-property protection, particularly in China and in other countries where significant problems remain.

-

Make completion of the Doha Round of world-trade talks a priority.

Intellectual Property

-

Harmonize the US, European, and Japanese patent systems.

-

Institute a postgrant open-review procedure for US patents.

-

Stop diverting patent application fees to general revenue to provide the US Patent and Trademark Office (USPTO) with sufficient resources to modernize and improve performance.

-

Shield some research uses of patented inventions from liability for infringement.

-

Leverage the patent database as an innovation tool.

Tax Policy

-

Make the R&D tax credit permanent, and extend coverage to research conducted in university–industry consortia.

-

Provide new tax incentives for early-stage investments in innovative startups.

-

Provide more favorable tax treatment (expensing and accelerated depreciation) for the purchase of high-technology manufacturing equipment to encourage industry to keep manufacturing in the United States.

Human Capital

-

Create incentives for investments by employers and employees in lifelong learning, including the creation of tax-protected accounts.

-

Restructure and expand worker-assistance programs like the Trade Adjustment Assistance program so that they are more flexible and cover workers displaced by reasons other than trade.

-

Expedite the immigration process, including issuance of permanent residence status (green cards) to all master’s and doctoral graduates of US institutions in science and engineering.

-

Make H1-B visas “portable” to reduce the possibility of visa holder’s being exploited and to reduce the negative impacts on US workers in those fields.

-

Fund new programs that promote entrepreneurship at all levels of education.

-

Reform policies toward health and pension benefits.

-

Require companies operating in the United States to be transparent in reporting offshoring decisions.

-

Use procurement policies to discourage government contractors from offshoring by requiring that certain tasks be performed by US workers.

New “Apollo”

-

Gain presidential-level commitment to the proposition that sustaining and enhancing US ability to innovate is a key national priority.

-

Have the President issue a major challenge encompassing federal research and all aspects of the innovation process to mobilize resources in pursuit of a critical national goal. The candidate fields for such a challenge include energy, space, and healthcare.

Support for Regional Innovation

-

Establish a program of national innovation centers, or “hot spots,” with matching funds from states and educational institutions.

-

Designate a lead agency to coordinate regional economic-development programs to ensure that there is a common focus on innovation-based growth.

INNOVATION AND THE ECONOMY

Wm. A. Wulf points out that “there is no simple formula for innovation. There is, instead, a multi-component ‘environment’ that collectively encourages, or discourages, innovation.”2 This environment includes research funding, an educated workforce, a culture that encourages risk-taking, a financial system that provides patient capital for entrepreneurial activity, intellectual-property protection, and other elements.

The significance of this innovation environment has long been a subject of study. As far back as Adam Smith, economists have been interested in technologic innovation and its impact on economic growth.3 Early in the 20th century, Joseph Schumpeter argued that innovation was the most important feature of the capitalist economy. Starting in the 1950s, Robert Solow and others developed methods of accounting for the sources of growth, leading to the observation that technologic change is responsible for over half the observed growth in labor productivity and national income. These methods are subject to continued debate and refinement. For example, over long periods the contributions of technologic change and other causes of growth—such as worker skills, capital deepening, and institutional change—are highly interactive and difficult to separate.

Other economists have focused on a more qualitative study of the institutions and practices underlying innovation in individual industries and entire economies. The effort to understand “national innovations systems” has been one focus of recent studies.4 Others have examined the performance of particular industries.5 The Sloan Foundation has given understanding innovation a high priority in its funding.6

|

2 |

Wm. A. Wulf. 2005. “Review and Renewal of the Environment for Innovation.” Unpublished Paper. |

|

3 |

J. Mokyr. Innovation in an Historical Perspective: Tales of Technology and Evolution. In B. Steil, D. G. Victor, and R. R. Nelson, eds. Technological Innovation and Economic Performance. Princeton, NJ: Princeton University Press, 2002. |

|

4 |

R. R. Nelson, ed. National Innovation Systems: A Comparative Analysis. New York: Oxford University Press, 1993. |

|

5 |

National Research Council. US Industry in 2000: Studies in Competitive Performance. Washington, DC: National Academy Press, 1999. |

|

6 |

See the Alfred P. Sloan Foundation Web site. Available at: http://www.sloan.org. |

This literature underscores the importance of the environment for innovation and points to several lessons from recent history. Japan’s growth trajectory in various S&E inputs and outputs (such as R&D investments, S&E personnel, and patents) since the early 1990s has been similar to what it was before.7 Yet the Japanese economy’s ability to reap the rewards of innovation in the form of higher productivity and incomes was much higher in the earlier period. This can be explained partly by the dual nature of the Japanese economy, where world-class manufacturing industries serving a global market exist side by side with inefficient industries, such as construction.8 Economic mismanagement and a lack of flexibility in factor markets (labor and capital) also have played an important role.

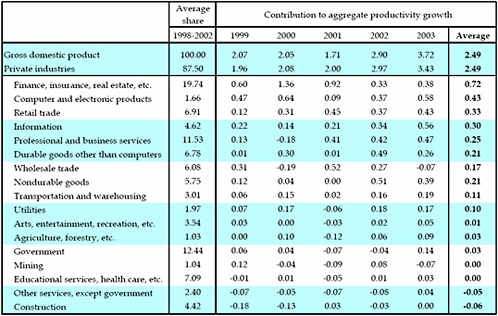

In contrast, in the mid-1990s the United States saw a jump in productivity growth from the levels that had prevailed since the first oil shock of the early 1970s.9 In addition to gains in information technology (IT) manufacturing productivity, productivity gains from IT use and the creation of new business methods that take advantage of IT were widespread throughout the economy (see Figure EI-1).

It is important to note that science and technology and the innovation process are not zero-sum games in the international context.10 The United States has proved adept in the past at taking advantage of breakthroughs and inventions from abroad, such as the jet engine and monoclonal antibodies.11

Groups and individuals have made numerous recommendations for change in the US environment for innovation.

MARKET, REGULATORY, AND LEGAL ENVIRONMENT

Many analyses of innovation focus on the supply side of the equation, such as the size and composition of R&D spending, the number of S&E graduates, and so forth. The importance of the demand side is sometimes

FIGURE EI-1 Contribution of different industries to the productivity rebound, by broad industry group, 1998-2003.

SOURCE: W. Nordhaus. The Source of the Productivity Rebound and the Manufacturing Employment Puzzle. NBER Working Paper 11354. Cambridge, MA: National Bureau of Economic Research, 2005. Table 4, p. 24. Available at: http://www.nber.org/papers/w11354.

neglected. The imperative of meeting the needs of demanding buyers and consumers plays a key role in driving the creation and diffusion of innovations. An open dynamic market is the source of US competitive strength in a range of industries. Even under the “Dell model”—in which development, manufacturing, and other functions are sourced and performed around the globe—contact with customers and knowledge of their needs is a critical capability that Dell keeps inhouse.12

In contrast, industries and economies where markets are closed, competition is limited, or consumer rights are not protected tend to act as a drag on innovation and growth. McKinsey and Company’s international studies on sector productivity during the 1990s showed that competitive markets were the key factor separating successes and failures.13

A wide variety of policies and practices influence the market, regulatory, and legal environment for innovation. These include financial regulations,

where the Sarbanes–Oxley Act has produced a number of changes in recent years. In addition, the costs of US approaches to litigation affecting product liability and securities fraud are a perennial target of industry groups.

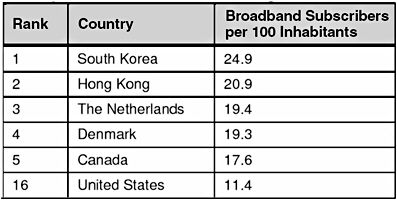

Given the fact that the United States has lagged behind a number of other countries in broadband access (see Figure EI-2) and the potential positive impact of better and cheaper network access for the economy and the research enterprise in particular, the complex regulations governing telecommunications, the broadcast spectrum, and related areas would seem a promising target of reform.

Possible federal actions include the following:

-

“The impact of new regulations on market investments in innovation should be more carefully and collaboratively assessed by a public-private Financial Markets Intermediary Committee, where periodic meetings can score existing and proposed legislation. This committee would follow the model of the Foreign Exchange Committee and Treasury Borrowing Committee.”14

-

“The country should set a goal to reduce the costs of tort litigation from the current level of two percent of GDP [gross domestic product]—some$200 billion—down to one percent.”15

-

Reform Section 404 of the Sarbanes–Oxley Act, which requires an internal control report in the company’s annual report. “Many small and medium-sized companies have serious concern with Section 404 and the expense of the internal control reporting requirements. Small and medium-sized companies are disproportionately burdened by Section 404, and these provisions need to be examined to ensure a proper balance between accountability and bureaucracy.”

-

Drop efforts to expense stock options. “No industry has benefited more than the high-tech industry from the use of stock options. Stock options provide employees with a direct link to the growth and profitability of companies. They also are an essential tool for attracting and retaining the best workforce, especially for small businesses and start-ups who do not always have the capital to compete on salary alone. Already China and India have learned from the successful use of stock options in Silicon Valley and are using it to attract and retain businesses and employees.”

-

“The Federal government, through the Internal Revenue Service or Treasury Department, should establish clear guidelines in the Internal Revenue Code on the acceptability of investment of foundation assets in start-up ventures.”16

FIGURE EI-2 Ranking of select countries by broadband subscribers per capita.

SOURCE: M. Calabrese, Vice President and Director, Wireless Future Program, New America Foundation. “Broadcast to Broadband: Completing the Digital Television Transition Can Jumpstart Affordable Wireless Broadband.” US Senate Testimony, July 12, 2005.

-

“The Federal government should encourage best practices and processes for standards bodies to align incentives for collaborative standard setting, and to encourage broad participation.”17

-

Congress should “use the DTV transition to encourage both licensed and unlicensed wireless broadband networks as competitive alternatives to wireline cable and DSL offerings.”18

-

“Provide industry the incentives to promote broadband and cellular penetration. Countries like South Korea and Italy have realized enormous competitive advantages by investing heavily in broadband and cellular deployment. Just as the interstate highway system dramatically increased the efficiency and productivity of the US economy half a century ago, so too can efficient communications networks have the same positive effect today. Broadband and cellular diffusion also foster competitive advantages by creating demand for cutting edge products and services.”19

TRADE

Multilateral trade liberalization has been a goal of US policy-makers of both political parties since the end of World War II. The renewal of large US trade deficits in recent years has spurred debate over how to correct it and other global imbalances. The very large US deficit with China has pro-

duced calls for exchange-rate adjustment and other measures. In many important respects, China’s industrial-development strategy has followed the export-led “playbook” developed by Japan, Korea, and other high-growth Asian economies during the 1960s, 1970s, and 1980s.20

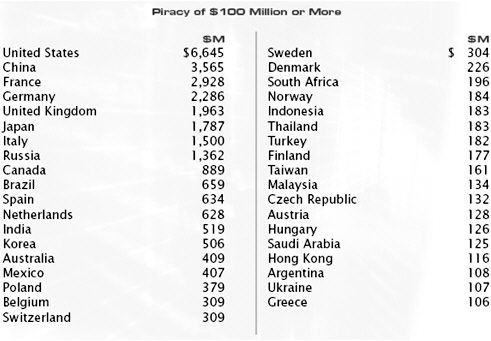

Improving the protection of intellectual property worldwide, and especially in such large countries as China where piracy rates are high, has been a policy focus of industry groups (see Figure EI-3). It is important to note that China’s laws and policies have come into line with international standards as a result of its accession to the World Trade Organization, so the main issue is enforcement.

Possible federal actions include the following:

-

“Promote stronger enforcement of intellectual property protection worldwide. Intellectual property is typically the core asset of any high-tech company. From patents and copyrights to software and trade secrets, intellectual property forms the basis of the knowledge economy. Far too often, foreign legal systems do not adequately protect the owner of these valuable creations, resulting in the loss of literally billions of dollars. The Business Software Alliance estimated that 36 percent of software worldwide was illegally pirated in 2003. This translates to a $29 billion loss in revenue. In China, this figure is 92 percent and the revenue loss is estimated at $3.8 billion. Digital technology has made intellectual property theft that much easier on a wide scale. When foreign companies and consumers can steal this hard-earned property, the profitability and, ultimately, the competitiveness of US companies suffer.”

-

Make conclusions of the Doha Round a top priority. “The United States economy has gained greatly from liberalization of trade worldwide and from the rules-based system facilitated by the World Trade Organization (WTO). The Doha round of trade talks broke down in the summer of 2003 as negotiations on agriculture and certain service sectors reached an impasse. As a result, the United States risks losing momentum in further opening global markets to US products and services.”21

INTELLECTUAL PROPERTY

With the rise of knowledge-based industries and a number of legislative, judicial, and administrative actions, intellectual-property protection in the United States has been significantly strengthened over the last 25 years.22

FIGURE EI-3 Ranking of 2004 piracy loses.

SOURCE: Business Software Alliance and IDC. Second Annual BSA and IDC Global Software Piracy Study. Washington, DC: Business Software Alliance. Available at: http://www.bsa.org/globalstudy/upload/2005-Global-Study-English.pdf.

With the increase in the value of a US patent have come an increase in patenting and greater focus by companies and other inventors on the management of intellectual property as an asset. In this environment, debate continues on how to tweak US intellectual-property policies so that they maximize incentives for the generation and broad diffusion of innovations.

Possible federal actions include the following:

-

“Reduce redundancies and inconsistencies among national patent systems. The United States, Europe, and Japan should further harmonize patent examination procedures and standards to reduce redundancy in search and examination and eventually achieve mutual recognition of results. Differences that need reconciling include application priority (first-to-invent versus first-inventor-to-file), the grace period for filing an application after publication, the best mode requirement of US law, and the US exception to the rule of publication of patent applications after 18 months. This objective should continue to be pursued on a trilateral or even bilateral basis if multilateral negotiations are not progressing.”23

-

“Strengthen USPTO capabilities. To improve its performance the USPTO needs additional resources to hire and train additional examiners and fully implement a robust electronic processing capability. Further, the USPTO should create a strong multidisciplinary analytical capability to assess management practices and proposed changes, provide an early warning of new technologies being proposed for patenting, and conduct reliable, consistent, reputable quality reviews that address office-wide and individual examiner performance. The current USPTO budget is not adequate to accomplish these objectives.”24

-

“Institute an Open Review procedure. Congress should seriously consider legislation creating a procedure for third parties to challenge patents after their issuance in a proceeding before administrative patent judges of the USPTO. The grounds for a challenge could be any of the statutory standards—novelty, utility, non-obviousness, disclosure, or enablement—or even the case law proscription in patenting abstract ideas and natural phenomena. The time, cost, and other characteristics of this proceeding should make it an attractive alternative to litigation to resolve patent validity questions both for private disputants and for federal district courts. The courts could more productively focus their attention on patent infringement issues if they were able to refer validity questions to an Open Review proceeding.”25

-

“Leverage the patent database as an innovation tool. Develop pilot projects (jointly funded by industry, universities and government) to highlight techniques for leveraging patent data for discovery.”26

TAX POLICY

Tax policy is another element of the environment for innovation. The research and experimentation tax credit (popularly known as the R&D tax credit) is a longstanding feature of the tax code, although it is generally renewed year to year. The tax treatment of investments in startup companies and purchases of high-technology manufacturing equipment have also been the focus of recent recommendations.

Possible federal actions include the following:

-

“The federal government should provide a 25 percent tax credit for early stage investments when made through qualified angel funds. The indi-

-

viduals participating in these funds would need to make a minimum investment of $50,000 each year in order to receive the tax credit. Acceptable investments would be restricted to those that meet requirements for revenue size and age of firm.”27

-

“Enact a permanent, restructured R&E tax credit and extend the credit to research conducted in university-industry consortia.”28

-

Allow more favorable tax treatment of purchases of high-technology manufacturing equipment. “Accelerated depreciation or expensing of high technology equipment would have a particularly positive investment impact. Many of our economic competitors—who actively seek to lure investment in semiconductor manufacturing overseas—offer far more favorable tax treatment than that offered in the United States. As part of the discussion of fundamental reforms of the tax code to promote investment and manufacturing in the US, the Congress should consider allowing companies to expense high technology equipment.”29

-

“Use the required repeal of the Foreign Sales Corporation exemption to fund a revenue-neutral tax credit for investment in information-processing equipment, software, and industrial equipment. In response to WTO rulings, Congress passed a reduction of the corporate tax rate, which really does little to encourage companies to be more competitive and innovative. An investment tax credit would help companies increase investment which would in turn boost productivity. Moreover, it would make US companies more likely to invest in equipment in the United States and not overseas.”30

HUMAN CAPITAL

A highly skilled, flexible labor force is an essential component of this nation’s ability to reap the benefits of innovation. Recent debates over workforce issues have revolved around several issues.

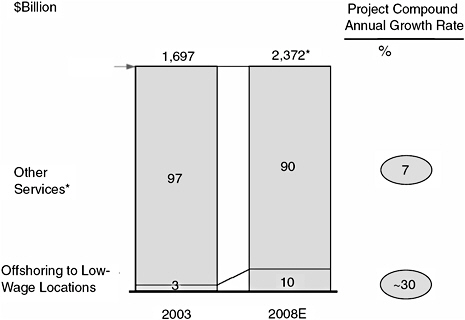

The first trend is that growing numbers of service industries and their labor forces are becoming subject to global competition, a condition with which manufacturing industries have long familiarity. Offshore outsourcing of business process and IT jobs, or “offshoring,” is growing rapidly (see

|

27 |

Ibid., p. 62. |

|

28 |

Ibid., p. 59. There are similar recommendations in numerous other reports, including National Academy of Engineering. Mastering a New Role: Prospering in a Global Economy. Washington, DC: National Academy Press, 1993; and American Electronics Association, 2005. |

|

29 |

Semiconductor Industry Association Web site. Available at: http://www.sia-online.org/backgrounders_ tax.cfm. |

|

30 |

R. Atkinson. Meeting the Offshoring Challenge. Washington, DC: Progressive Policy Institute, 2004. |

Figure EI-4). Aspects of research and education are included. There are strong disagreements about what outsourcing means, the ultimate impacts, and policy prescriptions.31 In any case, the trend reinforces the imperative for the promotion of lifelong learning in the United States. As illustrated by Figure EI-5, working adults and other nontraditional students are of growing importance in fields like computer science. Calls to rethink approaches to incentives for continuing education and trade-displacement assistance programs have come from several quarters.

A second element focuses on the immigration of scientists, engineers, and other skilled professionals who contribute to the innovation process. Several recent reports have suggested ways to encourage skilled foreigners to continue immigrating. US openness to people and ideas from around the world is a longstanding strength of the American environment for innovation.32 In particular, immigrant scientist-engineer-entrepreneurs from Alexander Graham Bell and Andrew Carnegie to Andrew Grove have played key roles in the creation of leading US companies and entire industries.

A third human-capital issue is the reform of health insurance, pensions, and other public and private benefits infrastructures. The goals here are to make these systems sustainable from a long-term cost perspective and to help them support a workforce that is increasingly mobile and less likely to be employed by large organizations for extended periods.

A fourth issue is the promotion of education about entrepreneurship at various educational levels, including S&E education. Among the recommendations that have been suggested are these:

-

“Create the human capital investment tax credit to promote continuous education. Companies often lack incentives to invest in educating and retraining workers as they risk losing that return on investment if the worker subsequently leaves the firm. By providing human-capital investment tax credits, the US government can encourage companies to retrain workers by reducing or eliminating out-of-pocket costs. At the forefront of technology innovation, companies are often the best predictor of what skills will be most valuable in the future. Continuous retraining, education, and skills acquisition ensure that fewer technology workers will find themselves suddenly displaced with no skills to participate in the constantly shifting

FIGURE EI-4 Business Process Outsourcing/IT offshore to low-wage locations as a percentage of total global services exports, 2003 and 2008.

NOTE: *Estimated at 6 percent annual growth from 2002 figure.

SOURCE: McKinsey and Company. “The Emerging Global Labor Market.” June 2005. Executive Summary, p. 19.

-

high-tech industry. Furthermore, society would benefit from the continuous education of workers, which also increases productivity and decreases downtime between jobs.”33

-

Create lifelong learning accounts for employees that allow tax-exempt contributions by workers and tax credits for employer contributions.34

-

“Reform and rename the Trade Adjustment Assistance Program to cover workers displaced for reasons other than trade, including service sector workers.”35

-

“Offer more flexibility and focus under federal-state employment and training programs. States and the federal government should have more discretion to devote employment and training resources toward high-performance programs, high-growth skills and skills in demand by local firms.”36

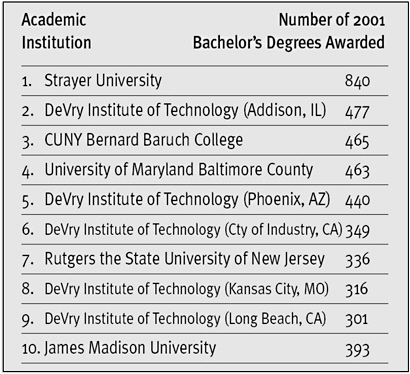

FIGURE EI-5 Top producers of computer science bachelor’s degree, 2001.

SOURCE: American Association for the Advancement of Science. Preparing Women and Minorities for the IT Workforce: The Role of Nontraditional Educational Pathways. Washington, DC: American Association for the Advancement of Science, 2005. Available at: http://www.aaas.org/publications/books_reports/ITW/PDFs/Complete_book.pdf.

-

“Expand temporary wage supplements that help move workers more quickly off unemployment insurance and into new jobs and on-the-job training. The Alternative Trade Adjustment for Older Workers Program should be expanded to include younger workers and should not be linked exclusively to trade dislocation.”37

-

“Re-institute H1-B training grants to ensure that Americans are trained in the skills and fields for which companies now bring in foreign nationals.”38

-

“Establish an expedited immigration process, including automatic work permits and residency status for foreign students who: a) hold graduate degrees in S&E from American universities, b) have been offered jobs by US-based employers and who have passed security screening tests.”39

-

“Give green cards to all US trained master and doctoral students. Accredited US colleges and universities award 8,000 doctoral and 56,000 master’s degrees in S&E to foreign nationals per year. Instead of sending these people back to their countries, they should be given a Green Card to stay in the United States. These people will make significant contributions to the economy and workforce. The United States benefits by keeping them here.”40

-

“H1-B visas should be made ‘portable’ so that a foreign temporary nonimmigrant worker can more easily change jobs in the United States.”41

-

The National Science Foundation should take a significant role in funding pilot efforts to create innovation-oriented learning environments in K–12 and higher education. It also should sponsor research into the processes involved in teaching creativity, inventiveness, and commercialization in technical environments.42

-

The federal government should create legal certainty for cash-balance pension plans to ensure that employers can continue to offer them. These plans are popular with many employees and have significant advantages over many defined-contribution plans.43

-

Have the states and the federal government encourage the widespread availability of Health Savings Accounts, including affordable options for low-income workers, as a health-insurance option that provides portability for employees.44

-

“States and the federal government should define a role for government re-insurance of higher-cost healthcare expenses, so as to reduce the cost of employer-provided coverage and reduce the cost of healthcare to employees.”45

-

“Government procurement rules should favor work done in the United States and should restrict the offshoring of work in any instance where there is not a clear long-term economic benefit to the nation or where the work supports technologies that are critical to our national economic or military security.”46

|

40 |

American Electronics Association, 2005, p. 25. A similar recommendation appears in Council on Competitiveness, 2004. |

|

41 |

National Research Council. Building a Workforce for the Information Economy. Washington, DC: National Academy Press, 2001. |

|

42 |

Council on Competitiveness, 2004, p. 53. |

|

43 |

Council on Competitiveness, 2004, p. 55. |

|

44 |

Ibid. |

|

45 |

Ibid. |

|

46 |

Institute of Electrical and Electronics Engineers. Position Statement on Offshore Outsourcing. Washington, DC: Institute of Electrical and Electronics Engineers, 2004. Available at: www.ieeeusa.org/policy/positions/offshoring.asp. A similar recommendation appears on the Economic Policy Institute Web site. |

-

Require transparent disclosure of offshoring. “The publicly owned firms that engage in offshoring ought to at least be transparent in their business dealings, offering layoff notices and providing clear accounting of the employment in their various units, both domestic and abroad.”47

SUPPORTING CLUSTERS AND REGIONS

The tendency of innovative capabilities (such as research, manufacturing, educational institutions, and the workforce) to conglomerate in specific regions has been a subject of economic inquiry for some time.48 The Council on Competitiveness sponsored a multiyear initiative to study the phenomenon in the US context.49 One recent analysis postulates that regions need to draw a “creative class” human-resource base to compete effectively in knowledge-intensive industries.50 Although many of the policy levers to promote regional innovation are in the hands of state and local governments, the federal government could play a larger role through such actions as the following:

-

“The federal government should create at least ten Innovation Hot Spots over the next five years. State and local economic development entities and educational institutions should raise matching funds and develop proposals to operate these pilot national innovation centers.”51

-

“Innovation Partnerships need to be created to bridge the traditional gap that has existed between the long-term discovery process and commercialization. These new partnerships would involve academia, business and government, and they would be tailored to capture regional interests and economic clusters.”52

-

“The federal government should establish a lead agency for economic development programs to coordinate regional efforts and ensure that a common focus on innovation-based growth is being implemented.”53

NEW “APOLLO,” “SPUTNIK,” OR “MANHATTAN PROJECT”

As part of the 2004-2005 debate over the sustainability of US S&E leadership, some individuals and groups have called for a presidential-level challenge to mobilize resources and national imagination in an effort that also would grow the S&E enterprise. Somewhat related is the call for the President to identify innovation as having a major national priority. Specific recommendations include the following:

-

Launch an explicit national innovation strategy and agenda led by the President. “Innovation is the critical pathway to building prosperity and competitive advantage for advanced economies. Yet no single institution in government or the private sector has the horizontal responsibility for strengthening the innovation ecosystem at the national level—it is and always will be a shared responsibility. The United States should establish an explicit national innovation strategy and agenda, including an aggressive public policy strategy that energizes the environment for national innovation.”54

-

“Establish a focal point within the Executive Office of the President to frame, assess and coordinate strategically the future direction of the nation’s innovation policies. This could be either a Cabinet-level interagency group, or a new, distinct mission assigned to the National Economic Council.”55

-

“Establish an explicit innovation agenda. Direct the President’s economic advisors to analyze the impact of current economic policies on US innovation capabilities and identify opportunities for immediate improvement.”56

-

“Direct the Cabinet officers to undertake a policy, program and budget review and propose initiatives designed to foster innovation within and across departments. This is an opportunity to break down ‘stovepipes’ and foster closer collaboration among the agencies to meet clear national needs.”57

-

“The United States should build an integrated healthcare capability by the end of the decade.”58

-

Apply information technology, research, and systems-engineering tools to US healthcare delivery.59

-

Launch a US-China crash program to develop alternative energies.60