5

Finance Reform Proposals

Toll Road Expansion and Road Use Metering

This chapter and Chapter 6 review proposals for changes in revenue sources and other financing arrangements for highways and transit in the United States. The proposals are diverse and from a variety of sources, and they have been useful resources to the committee in forming its conclusions. The proposals are also valuable because they shed light on the nature of the finance problems confronting transportation agencies that have motivated calls for reform.

The diversity of reform proposals reflects different points of view on how the underlying problems of transportation finance should be defined. The proposals all recognize, to some extent, dual goals of finance policy: to assemble a collection of revenue flows adequate to support a desired level of spending and to establish practices that promote investment in high-return projects and efficient operation of existing facilities. The starting point of proposals from government sources and transportation interest groups tends to be spending needs (generally seen as greater than present revenues can support). Proposals from academia and other independent sources tend to emphasize the importance of finance practices that provide incentives for better spending and operating decisions and usually avoid judgments on the proper levels of revenue and taxes.

Each of the proposals described in the two chapters concentrates on particular aspects of the finance structure—for example, user fee collection techniques or the definition of federal and state responsibilities—rather than on comprehensive reform. However, decisions about changing any of these elements of the finance scheme in the future will be unavoidably linked, and proposals sometimes overlook these essential connections. Therefore, in comparing proposals, it will be

helpful to keep in mind a definition of a generic, comprehensive reform package. Such a package would have five components:

-

Defined goals: The proposal should define what the finance scheme is intended to accomplish, with reference to overall transportation policy goals. Finance system goals should not only refer to revenue adequacy but also acknowledge that finance provisions influence transportation program outcomes, including operating efficiency and the quality of investment decision making.

-

Assignment of responsibilities among the federal, state, and local government and the private sector: The appropriate assignment of responsibility will depend in large part on revenue sources, so if new revenue sources are contemplated, it will be necessary to think through the implications for spheres of responsibility. For example, to the extent that local and state governments have mechanisms to charge all users of roads within their jurisdictions rather than just residents, the need for involvement of higher levels of government is lessened. Changes in the control of revenue will translate into changes in control of spending and operating decisions.

-

User fee and pricing rules: The proposal should identify sources of funds and, assuming user fees are employed, should specify how rates would be set. Today, federal and state elected officials directly decide the distribution of the burden of taxes and fees supporting transportation among categories of users (e.g., between light vehicles and large trucks) and the public. These decisions are influenced to an extent by transportation agencies’ needs studies and cost allocation studies. In a finance scheme that relied heavily on revenue from tolls or mileage fees, success or failure would depend on the rules determining the levels of tolls and fees and the fee differentials corresponding to characteristics of users, traffic, and the facility. Revenue and demand management are not necessarily incompatible pricing objectives; however, both consequences of pricing decisions would have to be taken into account.

-

Rules on disposition of revenues and on budget and project selection decision making:Today, as a consequence of the mechanisms of dedicated taxes and trust funds in federal and state transportation programs, transportation program spending is constrained by revenues during the intervals between legislative rate adjustments. Individual project selection is also influenced through the details of federal-aid program rules, such as matching share and project design requirements. A new finance scheme could involve different forms of connections between revenue and spending, or it could suppress any direct linkage. For example, if tolls or mileage charges become important sources of revenue, the revenue-raising potential of new road projects is likely to become a factor in project selection decisions, and components

-

of the transportation system that raise surplus revenue (e.g., the roads under control of a toll authority) may be able to claim priority in new spending plans. Also, new finance arrangements might alter the rationale or need for modal cross-subsidies.

-

A transition strategy: Fundamental changes—for example, development of a new base revenue source or a substantial scaling back of the present federal role in finance—would have to be preceded by a coordinated program of research, planning, and communication among government officials and the public. The transition might involve large-scale trials and progress through a series of interim stages. A road map and schedule for the transition would be an essential part of a complete reform proposal (although the road map would be subject to revision throughout the process).

Given the complexity of the problem, it is not surprising that past proposals have not attempted to specify all these aspects of a finance scheme comprehensively. Nonetheless, as reforms are implemented over time, the inherent connections among the aspects will become evident. Therefore, it would be an error to plan at the outset to alter one aspect, for example, to replace the fuel tax with another form of user fee, while disregarding how the change might affect the other aspects of the finance system.

The review in this chapter covers two categories of proposals: first, substantial expansion of toll roads of the existing design; that is, limited-access roads whose users pay a fee, commonly upon exit and depending on the distance traveled and possibly on time of day; and second, direct metering of use of all roads within a geographic area [for example, by using Global Positioning System (GPS) technology], with charging based on distance traveled and possibly varying with the road, traffic conditions, or time of day. These proposals focus on developing new basic revenue sources and would require a period of years to implement (although toll road development is taking place today and may be stimulated by provisions of the 2005 legislation reauthorizing federal surface transportation aid programs). Chapter 6 describes proposed reforms that retain the basics of present arrangements, in particular, reliance on dedicated revenue from fuel taxes and other existing user fees. These concentrate on more effective use of existing instruments and could be implemented more quickly.

In its ultimate form, the road use metering concept would be a comprehensive approach to road pricing and finance reform. After a certain date, all vehicles would be required to have metering equipment, travel on all roads within the jurisdiction would be subject to charges, and the revenues would constitute the basic funding source for the transportation program. In contrast, toll road expansion proposals embody a more gradualist vision. The mileage of toll roads and tolled lanes would grow over time, both supplanting and supplementing traditional forms of funding and management. Eventually all the roads most suitable for

tolling with today’s conventional technology (mainly urban arterial limited-access routes and major intercity expressways) would be tolled.

These three categories of reforms certainly are not mutually exclusive; rather, they could be complementary: reforms within the present system could be part of a phased transition strategy to a system that relied on tolls or mileage fees. (As an example, the Oregon road user fee proposal described below contains elements of all three categories.) General road use metering might emerge as a natural consequence of a program of expansion of conventional toll roads. The goal of examining the proposals is to assess the contribution that each of them might make to a finance scheme that promoted efficient operation and development of the transportation system.

TOLL ROADS AND TOLL LANES

It was noted in Chapter 2 that highway and bridge tolls account for 8 percent of U.S. highway user revenues (Table 2-2). This share has been nearly constant since the 1950s. Tolling of public roads has long faced opposition; the original federal-aid program for highways in 1916 banned tolling of roads receiving aid (P.L. 64-155, Section 1). Consideration was given to toll financing in the earliest stages of planning for the Interstate highway program, but a 1939 congressionally commissioned study concluded that most highways on a nationwide network would not generate sufficient revenue to be self-supporting, and later finance proposals all focused on the suite of fees and taxes in place today (Weingroff 1996). Except in some special cases, the federal-aid highway program does not allow states to collect tolls on Interstates or other roads built with federal assistance, although some preexisting toll roads were incorporated in the Interstate system and continue to collect tolls. In contrast with the United States, several countries, including Italy, Spain, Portugal, and France, have relied heavily on toll finance to develop their national expressway networks (Table 2-7).

Several recent developments have increased interest in (if not application of) toll finance. Information technology has greatly reduced the cost and inconvenience of toll collection. Today nearly every major toll facility provides for electronic toll collection. Communications devices in vehicles and at tollway entrances record the passage of a vehicle and charge the owner (for example, the E-ZPass system in place on most toll facilities in the northeastern United States). In addition, the search for additional revenue sources for transportation, especially in the states experiencing the highest rates of traffic growth, and hopes of attracting private investment in highways have stimulated attention.

The first subsection below surveys examples of proposals for expansion of the scope of tolling in the United States. In the second, the relation of tolling to private-sector participation in provision of roads is examined. The third describes

proposals and recent actions to change federal highway aid program rules to promote toll road development. The final subsection is a summary.

Proposals for Expanding Toll Roads

The four proposals described here are representative of efforts to work out a practical basis for increasing reliance on tolls in transportation finance on the basis of present tolling technology. The first, HOT (high-occupancy/toll) networks, is a conceptual proposal for a scheme that might allow relatively rapid development of a rational system of urban tolled lanes by starting with conversion of existing high-occupancy vehicle (HOV) lanes. The second, FAST (fast and sensible toll, or freeing alternatives for speedy transportation) lanes, is the original version of a proposal that was enacted in modified form on a trial basis in the 2005 federal surface transportation program reauthorization legislation. The underlying concept is similar to HOT networks, but the proposal is concerned with changes in federal law to give impetus to toll lane development rather than with laying out how the toll system should develop. Both proposals call for toll lanes rather than toll roads because offering motorists a choice between tolled and free lanes is viewed as a way to mitigate public objections to placing a toll on previously free facilities. The third proposal described is for development of toll lanes restricted to use by large trucks. The final proposal (a measure adopted by the state of Texas) is a plan to restructure state transportation programs to allow tolls to take on a greater role in funding.

HOT Networks

The HOT networks concept, proposed in a 2003 study of the Reason Public Policy Institute, is an example of an incremental approach to expanded use of tolls for finance and facilities management (Poole and Orski 2003). The authors call for development of networks of HOT lanes on limited-access expressways in congested urban areas. The lanes would be open toll-free to multioccupant vehicles (as are today’s HOV lanes) and to single-occupant vehicles paying a toll. Toll collection would be electronic, and the fare would be varied according to actual traffic conditions to maintain freely flowing traffic at all times. The lanes also would be open to express buses to provide low-cost, high-speed public transit. Development of the system would start with existing infrastructure by converting existing HOV lanes to HOT lanes, and additional mileage of lanes and interchanges would be added to create a rational network in each metropolitan area.

The proposal incorporates features aimed at broadening public acceptance. HOT lanes would be marketed as a premium, congestion-free service option, with drivers offered the choice of congestion-free toll lanes alongside more crowded free lanes, and the system would improve transit as well as private auto mobility.

To illustrate the proposal, the authors present maps, cost estimates, and revenue estimates for HOT networks in eight highly congested U.S. metropolitan areas. The networks range from 240 to 1,000 lane miles each and total 4,400 miles in the eight cities (Washington, D.C.; Miami; Atlanta; Dallas; Houston; Seattle; San Francisco; and Los Angeles). The estimated construction cost is $44 billion (not including the cost of constructing the HOV lanes already in place). Toll revenues are estimated to be $2.9 billion per year and to be sufficient to cover two-thirds of the debt service on the construction cost, with average peak-period tolls around $0.26 per mile. The authors propose that the federal government take the lead in implementing the plan by offering aid within the structures of the existing federal highway and transit programs.

FAST Lanes

FAST lanes was a legislative proposal, originally put forth in 2003, to lift the prohibition in federal law on collection of tolls on federal-aid highways for new lanes, lanes on new highways, or existing HOV lanes that are converted to toll lanes, provided that the highway has a free lane parallel to the toll lane. A version of the proposal, entitled the Express Lanes Demonstration Program, was enacted as a trial in the 2005 federal surface transportation program reauthorization legislation [Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU), Section 1604]. The secretary of transportation is authorized to permit 15 projects with the following features:

-

A state or a state-authorized public or private entity may impose tolls on an existing HOV lane or a newly constructed lane on any road, including Interstate highways. Capital expenditures for the project will be eligible federal-aid expenditures.

-

The purpose of the tolls must be to manage congestion, reduce emissions, or finance the lane addition. The state must set performance goals for the project and monitor and report performance.

-

Revenues are to be used first to pay for debt service (presumably on debt incurred to construct the facility), for a “reasonable return on investment of any private financing,” and for operation and maintenance of the facility. Any surplus is to be used for any federal-aid highway or transit project.

-

Former HOV lanes converted to toll lanes must have variable pricing by time of day or by level of congestion. Newly added lanes may use variable pricing but are not required do so.

-

Toll collection must be automated, and the U.S. Department of Transportation is to set standards to ensure interoperability of tolling equipment.

Another section of the same legislation (SAFETEA-LU, Section 1121) authorizes conversion of HOV lanes on federal-aid roads to HOT lanes. Design and operating requirements are similar to those of the Express Lanes Demonstration Program listed above, but there is no restriction on the number of projects. How the two provisions of the act will work together has not yet been established.

An analysis of the potential extent and feasibility of FAST lanes projects (Poole 2003) considered a scenario in which states decided to add two FAST lanes to all Interstate highway segments classified as severely congested by the Federal Highway Administration (with volume–capacity ratio over 0.95 in the peak direction during the peak hour). There are 3,600 miles of such routes, nearly all in urban areas. Estimated construction costs were $57 billion to $84 billion, and toll revenues were estimated to be sufficient to cover between 33 and 57 percent of these costs. It was noted that FAST lanes on high-volume expressways in smaller urban and rural areas might be better able to pay for themselves because construction costs would be much lower than in the largest urban areas, although such projects would yield lower travel benefits.

The inability of HOT network or FAST lane projects in major urban areas to pay for themselves would not be surprising and would not necessarily imply that such projects were economically unjustified. The lanes would all be competing with untolled and hence underpriced capacity, including the adjacent free lanes that are part of the design of these projects as well as alternate routes over the urban network. Also, it is likely that highway agencies would choose not to build some of the capacity expansions that are included in the estimates of cost and revenue described above because their construction and operating costs would be too high in comparison with toll revenue and benefits. Eliminating the least attractive projects would boost the ratio of revenue to costs.

Features of the FAST and HOT lane concepts that are aimed at increasing public acceptance—the adjacent free lanes and the guarantee of free-flowing traffic at all times in the premium lanes—compromise their effectiveness and financial viability. One study illustrating this difficulty used a travel demand model to compare the performance of a hypothetical expressway with congestion tolls on both lanes in one direction with performance with only one lane tolled (Parry 2002). The study estimated that the economic benefit from providing both a tolled and a free lane would be no more than a third of the benefit of tolling both lanes. (The benefit is the value of travel time savings and of new trips resulting from the increase in speed in the tolled lane, net of the loss to travelers who are displaced by imposition of the toll.) The optimum toll on a single tolled lane would be only a fraction of the optimum toll if both lanes paid. If the single-lane toll were increased above its optimum level, the cost of added congestion caused by diverted traffic in the free lane would exceed the added benefit of reduced congestion in the tolled lane. Also, providing separate tolled and free lanes may add to the construction

cost of the facility by complicating interchange design. Similarly, guaranteeing free flow in the tolled lane can reduce the public benefit compared with allowing some degree of congestion there, if diverted traffic increases delay in the free lanes enough to offset the benefits to users of the tolled lane. In one simulation study (Small and Yan 2001, 321), guaranteeing free traffic flow in the tolled lane harms overall public welfare under nearly all assumptions.

Imposing a toll on a single lane will not necessarily harm users of the free lanes. If the tolled lane had been congested to the point of stop-and-go traffic flow conditions before tolling, then imposing a toll will increase throughput on the tolled lane and may decrease congestion in the free lane. Also, if the tolled lane was previously an HOV lane, it may have been so lightly utilized that opening it to toll-paying vehicles will decrease congestion in the free lanes. Regardless of prior conditions, however, the optimum toll generally will still be lower than if all lanes were tolled.

Truck-Only Toll Lanes

Another possible near-term application of specialized toll lanes is new lanes for trucks only on Interstate routes with heavy truck traffic. A 2002 analysis of such facilities estimated the potential productivity gains of truck-only toll lanes on long-distance Interstate routes and concluded that in many cases truckers would willingly pay tolls in the range of 40 to 80 cents per mile to obtain the increased payload benefits (Samuel et al. 2002). That study proposed that longer combination vehicles (for example, a tractor pulling two full-sized semitrailers) be required to use the truckways but that conventional heavy trucks, which are legal on all Interstates, have the option of using either the truckway or the regular lanes.

The rationale for such facilities is partly fiscal and partly operational. On the fiscal side, states see toll financing as a means to finance widening of heavily traveled Interstate highways over the next 20 years. The operational rationale is a combination of safety and productivity. Separation of cars from heavy trucks is expected to produce significant safety gains. Also, if heavy trucks operate in barrier-separated lanes, there should be fewer safety objections to longer and heavier combination vehicles, which can significantly increase the productivity of trucking by permitting a single rig and driver to haul more payload. In urban areas, relief from freeway congestion should further enhance productivity gains to truckers. The voluntary approach, with free lanes and toll lanes accessible to conventional trucks, might have more success in gaining trucking industry support than mandatory tolls, which the industry has opposed (McNally 2005).

Truck-only toll lanes feature in the plans of several public agencies. In 2005 the Virginia Department of Transportation was considering proposals of a private-sector bidder for an $11 billion project to add two truck-only toll lanes in each direction to all 325 miles of I-81 in Virginia. The possible tolling of all lanes on

I-81 is under consideration as part of this project (Bowman 2004; VDOT 2005). In Texas, the first of a number of long-distance trans-Texas corridors has entered the negotiation stage with the Texas Department of Transportation’s selection of a winning bidder for the first major segment of the corridor that will parallel I-35. This $6 billion project will initially build a four-lane divided toll highway open to all traffic. When it is subsequently expanded to as many as 10 lanes, the original four lanes will become truck-only lanes (Powers 2004). In California, the 2030 long-range transportation plan adopted in 2004 by the Southern California Association of Governments includes a $16.5 billion system of toll truckways, in part to serve the ports of Los Angeles and Long Beach (Southern California Association of Governments 2004).

Texas Toll Road Authorizing Legislation

Programs created by a referendum passed in 2001 and subsequent legislation seek to integrate use of toll roads and debt finance as components of the Texas state transportation program. This ambitious reform package is too new to allow an assessment of its impact, but it is being cited as a model for other states. The new law authorized creation of county-level or multicounty toll road authorities, called regional mobility authorities (RMAs). RMAs must work with the existing metropolitan planning organizations, which retain authority over planning transportation development in their local areas. The goal of the RMAs is to give metropolitan areas greater control over development of their highway systems and to accelerate projects that would not receive high priority in the statewide program (TxDOT 2004; Orski 2004; Urban Transportation Monitor 2004).

RMAs can issue bonds backed by toll revenues, develop projects, operate toll roads, and contract with private-sector firms to build and operate toll roads. They also have access to regular state highway funds and federal aid to the extent allowed under federal program rules.

The law provides for payments of per-vehicle fees, called shadow tolls or pass-through tolls, to RMAs by the state to compensate the RMAs for the costs of roads they provide to the state as part of the state highway system. The provision’s purpose apparently is to allow the state to subsidize low-revenue toll projects with general state highway user fee revenue or to associate a revenue stream with untolled RMA projects for financing purposes.

At the state level, the new laws created the Texas Mobility Fund and authorized the state to sell bonds to finance new road construction. The commission has required the state department of transportation to evaluate all new state construction for feasibility of tolling.

Three RMAs have been formed, and two more are being organized. RMA projects involving more than 100 miles of road construction costing several billion dollars are in early stages of development. The Texas program is noteworthy as an

effort to mainstream tolls as an element of state transportation finance. It focuses on metropolitan areas and gives metropolitan areas lead responsibilities since these areas are where most of the promising toll projects will be located.

Programs similar to the Texas RMAs exist in other states. In Colorado, the 1987 Public Highway Authority Law allows cities and counties to create special authorities with the necessary powers to construct and operate toll roads. Two authorities operate toll roads in the Denver area under the law’s provisions, one funded entirely by toll revenue and the other by a combination of toll revenue and a special local vehicle registration fee (E-470 Public Highway Authority 2005; Northwest Parkway Public Highway Authority 2004). The state also has created the Colorado Tolling Enterprise, which is authorized by the legislature to issue bonds and construct and operate toll roads at any location in the state, consistent with the state and regional transportation plans (Colorado Tolling Enterprise Board 2005). In Florida, independent regional expressway authorities in Miami, Orlando, Kissimmee, and Tampa operate networks of toll roads.

Private-Sector Participation and Toll Finance

The possibility of increasing the resources available for expanding capacity by eliciting private-sector participation has begun to receive serious attention. Most such projects and proposals have been for toll roads constructed entirely or partially with private-sector capital and operated by a private entity.1 Nearly all U.S. toll roads today are operated by publicly controlled special-purpose authorities. Tolls are the obvious choice for funding privately operated roads because an identifiable revenue stream is necessary for attracting private capital and because one of the hoped-for benefits of such projects is an improvement in efficiency through operating the road on business principles, including charging for use. Thus measures to promote toll finance of U.S. roads may also increase the opportunity for private-sector participation.

The number of such projects carried out in modern times in the United States is small thus far; a 2004 General Accounting Office (GAO) report identified five private toll roads (GAO 2004). Two of the most prominent projects are located in Southern California. The State Route (SR) 91 Express Lanes project, 10 miles of tolled express lanes with variable time-of-day pricing, constructed in the median of an existing freeway, opened in 1995 as a privately operated road. The facility was later purchased by a public authority because the government wished to construct parallel capacity in violation of its noncompete clause with the franchisee.

|

1 |

The most common form of public–private partnership, as the term is used conventionally in U.S. transportation, is a contract in which a private firm takes responsibility for design, construction, and often operation and maintenance of a road and bears part of the risk of cost or schedule overruns or performance failures (USDOT 2004). These arrangements and other management controls to make available resources go further are described in Chapter 6. |

The second California project is a new 10-mile expressway, a section of SR 125, scheduled to open as a privately operated toll road in 2006. In 2005, in the first privatization of a public toll road in the United States, the city of Chicago turned over operation of the Chicago Skyway, an 8-mile expressway constructed in 1958, to a private firm under a 99-year lease. The operator will receive all toll revenue (which amounted to $43 million in 2002) in return for a $1.8 billion payment to the city. The operator has instituted time-of-day pricing for trucks.

The California private toll road projects were developed through the program created by Assembly Bill 680, 1989 California legislation that authorized the state transportation department to enter into agreements with private entities for construction and operation of four toll road projects, as demonstrations, to be carried out without state funds. The statement of findings introducing the law indicates that the program is to develop alternative funding sources “to augment or supplement available public sources of revenue,” to “take advantage of private-sector efficiencies in designing and building transportation projects,” and to “allow for the rapid formation of capital necessary for funding transportation projects” (Caltrans n.d.).

In a presentation to the committee, a California official emphasized that the state saw the AB 680 projects primarily as a way of supplementing funding. The law was enacted at a time of exceptional constraint in the state transportation budget. During the 1990s, growth in state revenues and federal grants diminished interest in recruiting private capital for road development. However, interest has been renewed now that transportation budgets are tightening again. Similarly, the SR 125 franchisee described the project’s funding arrangement to the committee as a means of allowing construction of a road for which funding would otherwise not have been available.

Enabling Legislation

Provisions in state law that set ground rules for participation in road development are seen as critical to the prospects for these kinds of projects. For example, AB 680, the legislation governing the California projects, authorized up to four projects subject to the following provisions:

-

Projects are to be constructed entirely at private-sector expense.

-

Roads are to be leased by the state to the private operator for 35 years and then revert to state operation.

-

The state transportation department “may exercise any power possessed by it” (presumably a reference to eminent domain) to facilitate projects.

-

The state can provide planning and environmental certification services, with costs to be reimbursed by the operator.

-

The state will provide maintenance and traffic law enforcement, with reimbursement.

-

All design and environmental standards applicable to conventional state projects apply.

-

The private party’s return is capped at “a reasonable return on investment.”

As the owner of the roads, the state retains liability for their operation. The state also provides access to certain financing sources, for example, federal credit assistance. In the SR 91 project arrangement, the state agreed not to construct competing facilities.

The GAO assessment of private-sector participation in road and transit projects found that legal authority exists in 20 states for private-sector participation in highway projects (GAO 2004, 5). The Texas toll road legislation described in the preceding section is an example of a recent legislative charter.

Prospects for Private Participation

GAO’s assessment concluded: “While legislative proposals [during the congressional debate over reauthorization of the federal surface transportation program] could encourage greater private participation, private sponsorship seem[s] best able to advance a small number of projects—but seems unlikely to stimulate significant increases in funding for highways and transit” (GAO 2004). GAO cites as obstacles the absence of authorizing legislation in most states, as well as “significant political and cultural resistance to toll roads—the most common way that the private sector generates revenues” (GAO 2004, 5). However, it emphasizes the impact on toll revenue from competition between free roads and toll roads as the primary obstacle and observes that “absent fundamental changes to current federal transportation programs, states are likely to continue to devote significant funding including federal funds to building untolled roads.”

The perspective of GAO’s assessment, that private participation should be judged in terms of its ability to increase total funding for transportation, seems to parallel the perspective of the states (for example, in California’s AB 680 program described above). However, it is not evident that the choice between private and public ownership and operation of toll roads should be viewed primarily as a funding issue. Increasing private-sector participation will not necessarily increase the total funds available for roads or allow accelerated road investment if the toll revenues that would attract private-sector partners and backers are available to the government acting alone. Instead, the choice to involve the private sector should be viewed as similar to other privatization decisions that governments have faced in regard to a variety of services and administrative functions with similar potential benefits and drawbacks. For example, the private sector may have costs differ-

ent from those of the government, and political pressures and public expectations may affect the relative flexibility of public and private toll road operators to set prices for road use.2

Pricing policy is key to gaining the potential efficiency benefits of toll roads. It has even been argued that privatization will be essential for effective application of pricing and effective use of the information that pricing would provide to guide highway management (Winston 1999). The record on the ability of public and private operators to price flexibly is mixed. Traditional public toll road authorities have hesitated to introduce variable pricing, but some are now doing so. One important highway congestion pricing experiment in the United States, the California SR 91 Express Lanes, is now operated by a public authority but was originally developed and operated by a private-sector firm. A local government operating toll roads might be tempted to use its power over tolls to “export” traffic to neighboring communities (De Borger et al. 2005) or, alternatively, might feel obliged to compete with its neighbors for commercial activity by reducing tolls below costs.

As the cost estimates described above for the HOT network and FAST lane proposals suggest, it will not be possible to have extensive self-supporting toll roads and optimal traffic patterns if travelers are always offered untolled or subsidized alternatives. One response to the problem of competition from untolled roads would be to subsidize toll roads (as the Texas toll road legislation described above apparently would allow). If tolling parallel routes is not practical, a toll road’s failure to generate revenue sufficient to cover its cost is not proof that the benefits of the road are less than its costs. In this case, a subsidy to the toll road, to reduce the distortion of travelers’ route decisions, might be economically justified. Such subsidies, paid from traditional road user fee revenues, could serve as a transitional step toward more widespread dependence on toll revenue.

The California SR 91 and SR 125 toll projects were developed under highly favorable circumstances for a private road: high congestion and rapid growth ensured high demand and revenue potential; the state had already completed environmental reviews on SR 91, which greatly reduced the risk that the project would be stopped; and right-of-way already existed for the SR 91 Express Lanes. There may be few projects with similar circumstances in the future, in California or elsewhere. In general, where demand and revenue potential are high, environmental and right-of-way obstacles will also be high (Boarnet et al. 2002). Expanding the pool of attractive potential private road projects may therefore require granting more concessions to the franchisee than California’s AB 680 allowed. More recent laws in other states (for example, the Texas legislation described above) may prove

more conducive to tolling and public–private partnerships than the California AB 680 pilot program.

Federal Policy Changes Favorable to Toll Road Development

In general, toll advocates have sought changes in law to remove restrictions on institution of tolls on federal-aid highways, to give toll roads and roads developed with private participation the same access to federal aid and tax-favored financing as conventionally developed roads, and to have government retain some of the risk of project delays related to regulatory requirements. The 2005 federal surface transportation aid reauthorization legislation (SAFETEA-LU) contained provisions to

-

Classify federal-aid highway projects as eligible for tax-exempt private-activity bond finance, with a $15 billion nationwide cap on such bonds over the life of the bill (Section 1143). (This provision appears to apply mainly to financing projects with mixed public–private funding. Government-owned airports, docks, and wharves were already eligible for tax-exempt financing, but highways had been excluded.)

-

Allow tolls on newly constructed express lanes or former HOV lanes on federal-aid highways through the Express Lanes Demonstration Program and HOT lanes provisions described above (Sections 1604 and 1121).

-

Authorize an Interstate System Construction Toll Pilot Program (Section 1604) limited to three projects nationwide. The program would allow tolls on Interstate highways, bridges, or tunnels for the purpose of financing construction of the facility. This provision apparently is in addition to a previously authorized pilot program that allows up to three projects in which a state collects tolls on an Interstate to finance reconstruction of the highway.

-

Expand the Transportation Infrastructure Finance and Innovation Act credit assistance program that was the source of part of the funding for the California SR 125 private toll road.

The restriction of tolling to limited numbers of projects in pilot programs is a compromise. The states had advocated elimination of federal restrictions on tolls, while the trucking industry had led opposition to lifting restrictions (Fischer 2004, 31–33; McNally 2005; AASHTO Journal 2004). The states have made little use of previous federal tolling pilot programs.

A private-sector view on policy changes needed to promote toll finance is indicated in a proposal from a firm active in toll road projects internationally (and the parent of the SR 125 franchisee). The proposal (James 2003) calls for the following changes in federal law:

-

Make development phase activities (planning, environmental review, permitting, and preliminary design) for privately owned or operated projects

-

eligible for federal funding. The object apparently is to impose on the state a major share of the risk that projects will fail to pass environmental and other permitting reviews.

-

Expand federal highway and transit grant programs to allow federal funding of projects that are privately constructed, owned, and operated, with grant funds passing through the states. Presumably the concept is that if the state were planning to construct a facility that was not expected to be self-supporting through user fees, it could solicit proposals for private participation and select the proposal that produced the project at lowest cost to the state.

-

Mandate consideration of private financing for highway and transit projects. Such a mandate is seen as necessary to change conventional attitudes of government planners toward private participation. This requirement exists in the United Kingdom.

-

Allow tolling on Interstates.

-

Facilitate private-investor access to tax-exempt financing, in part by expanding the definition of “exempt facilities” eligible for funding with tax-exempt private activity bonds to include highways.

-

Facilitate state sale or lease of facilities to private investors by clarifying that such transactions involving facilities built with federal aid are permissible.

As described, the 2005 surface transportation legislation contained measures in the direction of some of these proposals.

Summary

With the toll collection technology in use now in the United States, the two main technical limits on the potential of tolls in highway finance are that tolls can be applied on only a fraction of the road system and that toll roads always directly compete with untolled roads.

State and local governments spend roughly $22 billion annually, about one-sixth of all highway spending, on construction, reconstruction, maintenance, and operation of urban and rural limited-access freeways (that is, the roads whose design is suitable for tolling with conventional technology and that are not now tolled). Revenue from existing toll roads and bridges was $7.7 billion in 2003 (FHWA 2004, Table SDF; FHWA 2005, Table LDF). The estimates summarized above indicate that tolls imposed on urban HOT network or FAST lanes might typically be expected to generate revenue sufficient to cover half the capital cost of the lanes. On this basis, an ambitious program of toll conversion and new toll road development in the United States today, following the HOT network or FAST lanes models, might at most double annual highway toll

revenue. Although electronic toll collection has greatly reduced the physical infrastructure required for tolling, retrofitting some existing urban expressways for tolls might prove impractical because of physical constraints or high initial costs. Imposing tolls on all lanes of selected heavily traveled intercity routes, on the model of the existing turnpikes, might generate substantial additional revenue, but this measure has received consideration only in a few locations. The added revenue from tolls probably would reduce legislatures’ willingness to raise fuel tax and registration fee rates, so the net increase in highway budgets would be less than the added toll revenues.

A toll program on this scale could have significant benefits even though toll revenues would remain a small fraction of total highway spending. It would improve traffic flow on the tolled facilities (provided congestion pricing was employed) and speed construction of needed projects. If states evaluated all proposed major capacity expansions for their potential for toll finance (a practice now in force in Texas and recommended for Oregon in that state’s Road User Fee Task Force proposal), project selection would be improved because projects with the least direct benefit and therefore the least potential for toll revenue would tend to be deferred. Perhaps most important, an expanded toll program would allow officials and the public to gain experience with road pricing and consider whether more extensive application would be desirable.

As the GAO review of U.S. private road projects (GAO 2004) observed, competition with untolled roads will restrict the revenue toll roads can generate. Except in some settings where before tolling the road regularly experienced stop-and-go traffic conditions, imposing tolls will divert traffic to parallel lanes and roads and increase delay and accident costs on these roads. The responsible government authority must take care that tolls are not set so high that the net effect for all travelers is negative.

The following measures probably are prerequisites for substantial expansion of tolling and recruitment of private-sector participation in toll road development: access to federal aid for toll roads and to tax-favored financing for privately developed roads, mechanisms for funding toll facilities that are not expected to have toll revenue sufficient to break even (e.g., the pass-through toll mechanism in the Texas toll road program), and continued advances in improving the convenience and reducing the cost of electronic toll collection devices. Also, governments will need to give consideration to the appropriate public and private shares of risk from regulatory delays in projects.

The unpopularity of toll roads and public skepticism toward the concept of road pricing are recognized as fundamental obstacles (Stough et al. 2004, 17–19; McNally 2005). The following are among the objections commonly expressed: paying tolls is inconvenient and slows travel; when a toll is placed on an existing road the users are being forced to pay for the road twice; congestion tolling rewards highway agency inefficiency, since the worse the congestion the greater the rev-

enues; tolls inequitably burden the poor; congestion pricing in effect reserves road use for the wealthy; road use metering technology constitutes an invasion of privacy. However, the evidence on public acceptance is mixed. For example, a recent metropolitan Washington, D.C., opinion survey found a marked public preference for tolls over tax increases for funding new roads (Ginsberg 2005), and some new toll projects have gained public acceptance (FHWA 2003, 30).

The proposals described above contain features intended to help gain public acceptance—in particular, offering users a choice of toll lanes, free lanes, and transit, rather than forcing all travel onto the toll facility. However, these provisions reduce the public economic benefits that can be gained through pricing. The opportunity to accustom a larger share of the public to the idea of road pricing gradually sometimes is cited as one important benefit of incremental expansions of tolling and demonstrations of new kinds of toll roads (Parker 2004). The problem of public acceptance is examined further in the next section.

ROAD USE METERING AND MILEAGE CHARGING

This section describes proposals and projects involving direct metering of use of an extensive network of roads for the purpose of imposing charges on each road user that depend on miles traveled. Charges also could vary with other factors related to the cost of the user’s trip, such as the specific road used, traffic conditions, and time of day.

This method of charging for road use would have several advantages. If mileage fees largely replaced fuel taxes, user fee payments would no longer depend arbitrarily on vehicle fuel efficiency or the type of fuel consumed, and revenues would not be vulnerable to shifts in vehicle technology. In addition, if all use of all roads were monitored and charged for, local governments could readily fund their streets and roads with revenue from user fees, as the states do now, rather than relying on general or general sales taxes. Most important, the benefits of the transportation system to travelers and the public could be substantially increased, because travelers would have incentives to use roads efficiently and road authorities would have better information to guide investment decisions.

Trucks have paid mileage fees in several U.S. states for many years. The weight–distance tax in Oregon produces the most revenue, $178 million in 2003 (FHWA 2004, Table MV-2). Oregon rates are from $0.04 to $0.185 per mile depending on the truck’s registered weight and number of axles (ODOT 2004). Fuel consumed by trucks paying the weight–distance tax is exempt from the state fuel tax. Truck operators must periodically report their trucks’ in-state and out-of-state mileage and submit payments (Rufolo et al. 2000).

Applying a fee-charging system similar to the Oregon truck weight–distance tax to cars and small trucks would impose impractical requirements on all vehicle

operators to record and report their mileage. Mileage charging even for large trucks has not gained wide acceptance, in part because of the burden of manual recording and reporting. Therefore, all recent proposals for charging mileage-based fees have involved automated data collection. Technology is available that could accurately and reliably measure each vehicle’s travel and assess charges at reasonable overhead cost and without great inconvenience for vehicle owners.

Proposals for road use metering and mileage-charging systems must address not only technical plans but also administrative and political problems more challenging than the engineering aspects. Among these problems are the following:

-

Gaining public acceptance of a system that may force some road users to pay more or travel less and that employs technology sometimes regarded as a privacy threat,

-

Managing the transition from the present transportation funding scheme to a new one, and

-

Learning how to set fees properly so that the potential economic benefits of the new charging scheme are realized.

The first subsection below is a summary of proposals and projects for mileage charging and other forms of road pricing. The next two subsections present examples of proposals for road use metering and charging systems in the United States and experience with such systems applied to trucks in Europe. The final subsection discusses implementation issues.

Survey of Proposals and Projects

The committee commissioned a review of projects and planning studies involving road use metering and mileage charging and related road pricing schemes in the United States and other countries (Sorensen and Taylor 2005). The review covered proposals for measuring or observing road use within a geographic area or on an extensive network of roads and for imposing charges that depend directly on miles driven, the specific roads used, time of day, or traffic conditions. Cordon tolls (i.e., schemes in which vehicles are charged for entering or traveling within an area) and toll roads with variable rates were included, but traditional turnpikes charging flat rates were not covered in the survey. Projects were included that have purposes other than assessing road use fees but that demonstrate techniques that could be applied for that purpose, for example, systems to monitor commercial vehicles for regulatory enforcement. For each project or proposal, the review examined

-

The objectives and history of the system,

-

Techniques of metering road use and collecting fees,

-

Pricing policy,

-

Governance (that is, control of policies and revenue),

-

Experience with public acceptance, and

-

Uses of revenues and sources of funds for constructing and operating the system.

The review disclosed a high level of interest in road pricing and road use metering among road authorities worldwide, although implementation is in only the earliest stages. Eighty-eight relevant projects were identified. Most are still in the proposal stage, and the systems in operation are nearly all cordon tolls or variable tolls on expressway segments. Table 5-1 shows the kinds of projects reviewed. Appendix C is a summary of the review.

A recent proposal in the United Kingdom, which was not covered in the commissioned review, is worth mentioning because of its breadth. The government has committed itself to a policy of developing a nationwide road pricing scheme within the next 10 to 15 years that would impose charges on all road travel according to distance traveled and congestion conditions. A conceptual plan has been developed for a system using satellite positioning technology and metering devices in vehicles. The concept is thus similar to the U.S. proposals and the existing German truck tolling system described below. Regional or local pilot implementations are envisioned as a stage in development of the system. In the government’s policy, revenue from mileage charges would be offset by reductions in the motor vehicle fuel tax (European Commission 2005; Darling 2005; Department for Transport 2004, Chapter 3).

The remainder of this section concentrates on proposals for road use metering and mileage charging. These schemes appear to be the most promising alternatives to the gasoline tax as a primary revenue source and as a means of assessing user fees applicable to all vehicles and roads. In contrast, cordon tolling usually is seen primarily as a traffic management measure applicable in a restricted area. The review found no proposals for application of a zone charging scheme over an extensive area.

U.S. Proposals for Road Use Metering and Mileage Charging

The Oregon Road User Fee Task Force proposal and the New Approach to RoadUser Charges study, which were cited in Chapter 1, are the most prominent U.S. proposals for road use metering and charging schemes intended to replace or substantially supplement fuel taxes as a basic revenue source for transportation programs. The two proposals are similar in conception but differ in some significant design details. Together they suggest the range of design issues that will require evaluation.

TABLE 5-1 Road Pricing, Road Use Metering, and Mileage-Charging Projects and Proposals

In addition to these two proposals, a plan for a test of a road use metering and mileage-charging system involving 500 vehicles in Seattle, Washington, was announced in 2005 by the Puget Sound Regional Council. The test is receiving funding from the federal Value Pricing Pilot Program. The technology is related to that of the German Toll Collect truck-charging system (described below) and is supplied by the firm that developed the German application (Inside ITS 2005).

Oregon Road User Fee Task Force Proposal

The Oregon Road User Fee Task Force was charged by the legislature with designing a method of charging users of the state’s roads to replace the current system. The task force’s proposal has three main provisions (Road User Fee Task Force 2003):

-

Eventual imposition of new charges in place of existing ones:

-

A mileage fee, that is, charging a fee per mile driven on the state’s roads.

-

Congestion pricing, that is, charging a fee for use of certain roadways during periods of congestion.

-

New facility tolling: collecting tolls on all newly constructed roads, bridges, or lanes, to the extent practicable, to cover the costs of construction, maintenance, and operation.

The report explains that “the only broad revenue source that the task force believes could ultimately replace the fuel tax is a mileage fee. The other … revenue sources would address specific problems related to road revenue and are designed for certain geographical areas, certain road projects, or certain road users” (p. 2).

-

-

A 20-year phase-in period during which the state would operate both the mileage fee and the fuel tax. All new vehicles would be equipped with the meters necessary to collect the mileage fee, and their owners would receive credits or refunds of their fuel tax payments.

-

Pilot testing of alternative hardware and administrative arrangements for the mileage fee as the first step toward implementation.

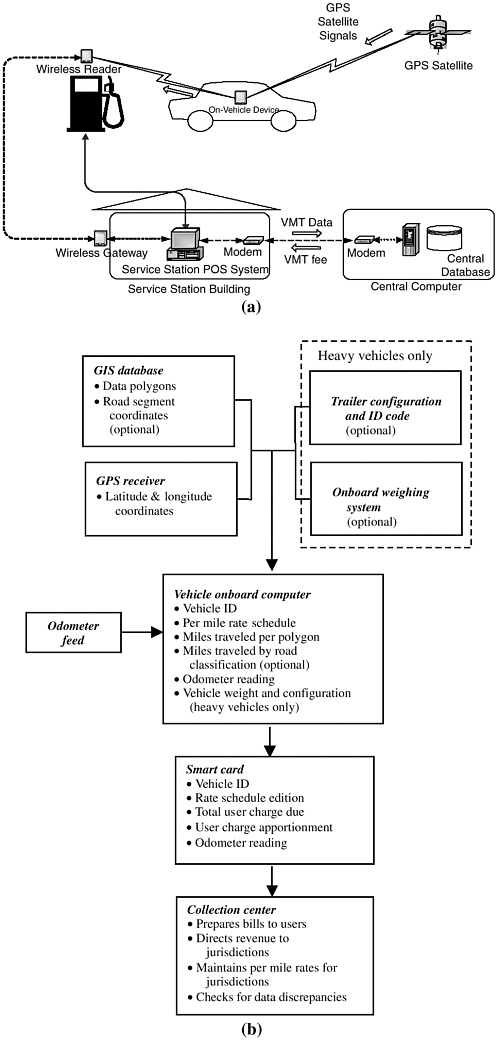

The task force recommended pilot testing of metering and charging technology with the following features (Figure 5-1):

-

Mileage would be recorded on board the vehicle either with a system using a GPS receiver to determine distance and location of travel or with a device for recording miles driven from the vehicle’s odometer. Both options would be evaluated in the pilot test. The GPS option would allow imposition of congestion charging or charges that depended on the physical characteristics or ownership of the road.

-

Only the minimum summary data required to compute the charge would be transmitted outside the vehicle; this information would be insufficient to allow reconstruction of the routes and times of travel of the vehicle.

-

Fees would be collected by one of two alternative methods. In the first, at each refueling a device on the fuel pump would receive a transmission from the vehicle’s mileage recorder, add the mileage charges accumulated since the

-

previous refueling to the price of the fuel purchase, and subtract the state’s fuel excise tax from the purchase price. In the second option, the vehicle’s mileage meter would be read at service stations or other data collection centers, and the state would periodically send the vehicle owner a bill for mileage charges less fuel excise tax paid.

The task force estimated that the largest capital cost associated with road use metering would be the cost of in-vehicle equipment, on the order of $250 per vehicle for prototypes. However, it noted that the main component, the GPS navigation system, probably will become standard equipment on automobiles soon, so much of this cost will not be attributable to the charging scheme. Total initial capital expenses for setting up central facilities and installing devices at gas stations are estimated at $33 million (Whitty and Imholt 2005, 41–42). Estimated annual operating costs for a central data collection and billing center are $50 million, but state administrative costs for the decentralized fee-collection option (with the entire mileage fee transaction handled at the gas pump and no central data collection) were estimated to be much less (Road User Fee Task Force 2003, 31). For comparison, Oregon had 3.1 million registered vehicles and collected $640 million in state highway user fees in 2003 (FHWA 2004, Tables MV-1, SF-1). For the United States as a whole, collection expenses for present state highway user fees are 5 percent of revenue collected (FHWA 2004, Table HF-10). The state planned to conduct a 1-year pilot test of the technology involving several hundred vehicles in Portland, Oregon, beginning in 2006. The operators will pay mileage charges and have fuel taxes deducted at the gas pump (Whitty and Imholt 2005).

New Approach to Road User Charges Proposal

A proposal developed with the support of 15 state departments of transportation calls for a road use metering system that could be implemented nationwide but that would provide flexibility so that each state or substate jurisdiction could decide independently whether to charge mileage fees and establish its own rate structure (Forkenbrock and Kuhl 2002; Forkenbrock 2004). The 2005 federal surface transportation aid reauthorization legislation (SAFETEA-LU, Sections 1919 and 1934) authorized a 3-year, large-scale field test of the technical approach of the NewApproach to Road User Charges proposal funded at $16.5 million. The main elements are as follows (Figure 5-1):

-

Each vehicle would be equipped with an onboard computer. The computer would receive inputs from a GPS receiver and the vehicle odometer and would contain a data file defining the boundaries of taxing jurisdictions and tax rates.

-

In the simplest implementation, the fee schedule would be a flat rate for each mile traveled within a jurisdiction. The onboard computer would calculate the fee and accumulate the total amount owed. The computer would read mileage from the odometer; the GPS input would be used to determine the jurisdiction in which the travel occurred so that the appropriate fee per mile could be applied.

-

Periodically, the vehicle operator would communicate with a fee collection center to report the amount owed. The communication would be by a wireless connection or a smart card. Smart card readers would be attached to motorists’ home computers or located at service stations or in other convenient places. In the same communication, the onboard computer’s data file of rate information would be updated. The collection center would bill the operator and distribute the receipts among the participating jurisdictions.

The system would be capable of supporting more complex fee schedules, including charges that depended on the specific road and time of day. Such applications would be at the discretion of each jurisdiction and are seen in the proposal as a later development, after experience was gained with the flat rate mileage charge. Trucks equipped with onboard weighing devices (which are in commercial use today) could be charged fees that depended on road characteristics and weight. Identifying the road on which travel occurred would allow the state to set rates on state-owned roads and local governments to set rates on roads that they owned.

If the system incorporated a means of keeping track of the revenues generated by each road segment, this information would be likely to exert a strong influence on road capacity expansion decisions. However, applications that required uploading data from each vehicle on travel or fees owed by road segment might be seen as compromising privacy.

The proposal envisions a transition period of several years during which mileage fees and fuel taxes would be collected simultaneously. After a certain date, all new vehicles would be required to be equipped with the computer and GPS device; however, the authors judge that retrofitting the fleet of existing vehicles with the required equipment would not be feasible. Two technological options for avoiding double-charging of road user fees during the transition are suggested: devices on fuel pumps that would recognize when a vehicle being refueled was equipped for mileage charging and cause the fuel to be sold tax free, and an input to the onboard computer from a sensor measuring fuel added to the gas tank so that the computer could deduct fuel taxes paid in computing the mileage charge owed. The transition might proceed in three stages. In the first, all new vehicles sold would be equipped with the metering devices but only freight-carrying trucks and vehicles not paying traditional fuel taxes (i.e., hydrogen-fueled and electric

vehicles) would be charged mileage fees. In the second, all meter-equipped vehicles would be charged by the mile but collection of fuel taxes would be continued. In the final stage, all vehicles would be required to have meters and pay mileage fees (Forkenbrock and Kuhl 2002, 93, 100–102).

Toll Collect and Other Truck Mileage-Charging Systems

Aside from conventional toll roads, the only mileage-charging systems in effect today apply to large trucks. The truck weight–distance taxes in effect for a number of years in Oregon and other U.S. states, which rely on manual reporting of mileage, were mentioned above. Automated truck-charging systems are in operation in Europe. Trucks have been subject to mileage charges in advance of other vehicles for several reasons. As a commercial activity, trucking has always been regulated and monitored. For example, U.S. trucks are stopped routinely for checking of weight and registration and insurance documentation. Also, infrastructure costs directly attributable to truck traffic have long been recognized and quantified and, in the United States, reflected in user fees. These costs arise from pavement wear and bridge impacts, are proportional to mileage, and vary with vehicle and axle weights.

Some design features of the European truck systems may be applicable to general road use monitoring and charging schemes for all vehicles. The most significant implementation is the German Toll Collect system. (Toll Collect is the name of the private consortium of companies operating the system under contract to the German government.) Simpler systems are in operation in Austria and Switzerland.

Toll Collect measures distance traveled and collects mileage fees from trucks of over 12 tons loaded weight using the German Autobahn motorway system, a 7,500-mile network of roads with 2,500 interchanges that is managed by the national government. The Autobahns were conceived as a toll-free system, and the large number of interchanges renders traditional toll collection methods impractical. Annual travel of large trucks is 15 billion vehicle miles, of which 35 percent is by trucks operated by carriers outside Germany. Before 1995, foreign truck operators usually paid no German taxes, since they could purchase fuel in neighboring countries with lower fuel taxes and no other fees were imposed. In 1995, Germany began to collect permit fees from German and foreign truck operators as a member of the six-nation cooperative Eurovignette program (Kossak 2004). Toll Collect replaces the permit fees.

The operators of a truck using the Autobahn can equip it with an onboard computer with input from a GPS receiver. The computer uses the GPS position information to determine the vehicle’s route and mileage on the Autobahn network and computes charges owed. The computer transmits data to a processing center via digital cellular telephone, and vehicle operators are billed periodically.

Eventually, 800,000 vehicles are expected to have the onboard equipment for automatic payment installed. Truck operators have the option of manually booking and paying the fee for an Autobahn trip.

Gantries spanning the motorway at various points record license plates and communicate with the trucks’ onboard computers and the processing center to ensure that trucks are not using the motorway without paying. Vehicles with equipment to verify compliance are also employed for enforcement.

A consideration in selecting the toll collection technology was that it should be extendable to roads other than the Autobahns and to vehicles other than trucks (Kossak 2004). The system was constructed and is operated by a private firm under contract to the government. After overcoming some technical and administrative difficulties and delays, Toll Collect went into operation in January 2005.

The average toll is €0.124 per kilometer ($0.26 per mile) and varies with the number of axles on the vehicle and a pollution rating assigned to each vehicle. Revenue of €3 billion per year is expected (Kossak 2004). Rates varying with traffic volume are planned for later (CNT 2005, 2). Rates are to be set so that the total annual revenue equals the total cost to the road authority of serving truck traffic, as determined in a cost allocation study. Limiting revenues to road authority costs is in compliance with a 1999 European Union directive establishing a common policy on road use charges for goods-carrying vehicles (Sorensen and Taylor 2005, 99).

Revenue is dedicated to transport infrastructure: 51 percent for roads and 49 percent for railroads and inland waterways. A commission on infrastructure funding advising the German Ministry of Transport concluded in its 2000 report that “user charges can only be legitimized by the direct relationship between infrastructure use and the application of funds. Revenue from user charges should therefore normally be used in those infrastructure spheres for whose use the charges are levied…. The calculation of the level of user charges should be based exclusively on infrastructure costs” (Commission on Transport Infrastructure Funding 2000). The user charges recommended were mileage charges for trucks and, initially, periodic permit fees by operators of other vehicles. Although the commission was generally influential in setting government policy, the allocation of road user fees to waterways and railroads appears inconsistent with this recommendation as long as users of these facilities do not pay fees equal to costs. The effect of the revenue allocation also is questionable, since if the truck fee revenues actually approximate costs, then ultimately the road authority will need to replace the funds used for nonroad purposes (Kossak 2004).

Austria has operated a simpler system for collecting mileage fees since 2004. An overhead gantry has been installed on each of the 420 road segments between pairs of interchanges on the nation’s 1,200-mile motorway system. Trucks and buses over 12 tons are subject to the toll and carry devices that communicate with devices on the overhead gantries. They employ a communication technique

known as DSRC (dedicated short-range communication). Vehicles passing under the gantries at normal motorway speeds are identified and their operators assessed charges corresponding to the road link and vehicle type. Charges are €0.13 to €0.273 per kilometer ($0.28 to $0.58 per mile), depending on vehicle type, and all revenues are dedicated to expenditures on the motorways (ASFiNAG n.d. a; ASFiNAG n.d. b). The Austrian system is essentially a large installation of an advanced version of the automated toll collection technology that has become standard on most toll roads. The design would allow toll collection to be extended to all vehicles on the expressways but generally is regarded as impractical as a means of assessing mileage fees on all roads because of the great number of stationary sensors that would be required.

Finally, the Swiss system, in operation since 2001, employs both DSRC (that is, short-range communications with roadside sensors) and GPS. Vehicles over 3.5 tons are assessed mileage charges for travel on all classes of roads in Switzerland. An onboard computer records the vehicle’s mileage from the odometer. The computer determines mileage within Switzerland by sensing border crossings. It uses either DSRC with overhead gantries at major border crossings or position information from GPS to detect border crossings on minor roads. Operators must periodically forward the data recorded in the onboard computer to the road authority. Foreign operators who do not choose to install the onboard equipment must record and report mileage manually. Rates are higher than in Austria and Germany and are calculated to include a charge for environmental externalities as well as road authority costs (Sorensen and Taylor 2005, Appendix J).

Implementation Issues

Serious and credible technical proposals have been made for road use metering and mileage charging in the United States, and the essential components of such a system have been demonstrated in the truck mileage-charging schemes in operation in Europe. The U.S. proposals have been motivated by concern for the future viability of present funding sources as well as recognition of the benefits of pricing: more efficient operation of roads, better investment decisions, economies in the provision of capacity improvements, and avoidance of arbitrary or unfair distribution of the cost burden of road transportation. However, challenging problems remain to be solved before mileage charging could become the basis of U.S. highway funding. Among them are the following:

-

Gaining public acceptance: It can be anticipated that the public and elected officials will be skeptical of a road use metering system that could be used by the government to track individuals’ movements and activities. Road users who expect to pay more than they do under present charges or to be compelled to curtail their travel will also object, and the public and interest

-

groups will object if the new charging scheme is perceived as unfairly favoring some categories of road users over others or as increasing the disadvantages of the poor.

-

Making the transition from present to new revenue sources: If mileage fee revenue is to wholly or partially replace revenue from present highway user fees, highway agencies will need to establish procedures for fitting vehicles and infrastructure with the necessary equipment, discontinuing collection of the old fees, and commencing collection of the new fees, with minimum disruption to revenues or inconvenience to travelers, over a transition period that may last a decade or more.

-

Setting appropriate prices: Because of inexperience, highway agencies do not now have the competence to set mileage fees that maximize the benefits of the transportation system or to use the information provided by fee revenues to improve the payoffs from capacity expansions. Improper pricing practices could degrade system performance and harm the public welfare.

Appropriate technical design of metering and charging systems will be part of the solution to problems in each of these areas. For example, technical design features can help ensure privacy, the transition will be eased if systems allow users to choose to pay through either the old or the new charging scheme, and a system that is flexible enough to allow individual jurisdictions to set their own pricing policies and observe the results will speed the process of learning to set mileage fees. These three categories of problems and the problem of choosing a technical design are examined in the following subsections.

Gaining Public Acceptance

The likely objections to metering among the public and politicians are the same as those listed above with regard to toll roads: the scheme would be expensive and a nuisance, it would create perverse incentives influencing government transportation policy (e.g., increasing congestion could increase revenue), the fees would be unfair because they would be regressive and would reserve the best transportation service for the rich, and giving the government the capability to track the daily movements of all highway travelers is unacceptable.

Several analyses of the possible distributional consequences of road congestion pricing have indicated that the effects would be complex and would vary greatly depending on the nature of the pricing and road finance scheme, travel patterns and transit alternatives in the urban area, and travelers’ occupations and household characteristics, and that a prediction that the wealthy would gain and the poor would lose would be an oversimplification (Santos and Rojey 2004; Safirova et al. 2004; Nash 2003; Sorensen and Taylor 2005, 58–60; Appendix C of this report). Nonetheless, there could be substantial numbers of people who found themselves

paying more and traveling less, at least in the early period of implementation of a congestion pricing program. Objections from this group could lead to failure of the program (Giuliano 1994, 273–276).

Road congestion pricing, especially pricing applied to nonfreeway arterial roads (as, for example, the Oregon road use metering proposal would allow), holds promise as a means to greatly improve the speed, reliability, and ridership of bus transit; reduce average costs; and generate sufficient new fare box revenue to pay for expanding transit service to meet increased demand. Transit gains would result from reduced road congestion and higher out-of-pocket costs for peak-period automobile travel, regardless of whether any road toll revenue was dedicated to transit (Small 2004). In addition, carpooling would become a more attractive travel alternative. These improvements would benefit lower-income households, and in some cities the benefits to this income group could be comparable in magnitude to losses suffered from being priced off roads or required to pay tolls (Kain 1994, 508–510).

Congestion pricing in urban areas would be a likely, but not essential, application of any future general road use metering and mileage-charging installation. Estimates have not been carried out of the distributional impacts of replacing or supplementing existing highway user fees with a mileage charge that could vary by jurisdiction but did not feature congestion pricing. Regardless of the exact character of impacts, planning for mileage charging should include identification of techniques to offset undesirable distributional effects without seriously eroding the potential benefits of the new form of charging (Nash 2003, 346). One possible solution would be direct compensation to low-income or other disfavored households. For example, transport vouchers that could be used to pay road tolls or transit fares could be distributed.

In defense of tolls and congestion pricing, it may be noted that present highway user fees may be regressive, if low-income drivers are likely to pay a larger share of their income for fuel tax and registration fees than high-income drivers [although the difference in shares among income groups may be small (Parry 2002, 31)]. If pricing is in effect, the motorist who chooses to pay the fee and use the road always gains in the transaction, since the use of the road is worth at least as much to him or her as the fee. Pricing can be regarded as fair in this sense.

The response to privacy concerns most commonly proposed is to construct the metering system so that the central facility is incapable of tracking individuals’ travel. The Oregon and New Approach proposals both include such a design as an option: the onboard unit in each vehicle collects all information necessary to calculate the toll owed, and only this total amount need be transmitted outside the vehicle. This approach may be acceptable but has at least two drawbacks: enforcement and settlement of billing disputes might be more difficult than if detailed central records were kept, and information on the toll revenue generated by each segment of the road network would not be directly available.

Jurisdictions owning roads are likely to demand that mileage fee revenue be distributed accurately according to travel on each jurisdiction’s roads. (Jurisdictional boundaries do not correspond to road ownership.) In addition, if jurisdictions had detailed information on the revenue generated by each road segment in their networks, they would be able to predict and observe the revenue effects of individual road improvements on their own or their neighbors’ roads. Revenue impacts would influence investment choices and the evolution of the transportation system. This connection between demand and investment might be one of the most significant consequences of the metering and charging system.