2

Present Finance Arrangements

The first two sections of this chapter describe features of the finance system for highways and transit in the United States today, including the fees and use-related taxes that users of the facilities pay; levels of spending; sources of funds; responsibilities of federal, state, and local governments; and decision making on budgets, project selection, and operations. As explained in Chapter 1, the concern that adherence to the original principles of the finance system has eroded over time has been one of the motivations to seek finance reforms. Therefore, the final section of the chapter examines developments that may affect the viability of the finance system. These include trends in the share of highway user fee revenues applied to purposes other than highways, adjustments of user tax rates to allow for inflation and changes in costs, devolution of transportation responsibilities to local governments, reliance on revenues other than user fees, and revenue adequacy and stability.

Examination of the workings of the present finance system is a necessary first step toward designing improvements. If the present system is producing unsatisfactory results, the structural sources of problems should be identified, and if the system is performing well, it may be possible to build on its strengths. Chapter 3 will consider the problem of evaluating the performance of the finance system.

HIGHWAY FINANCE

This section presents aggregate nationwide data on spending for highways, fuel taxes and other taxes and fees paid by highway users, and other sources of funds for highway programs. The data and definitions are mainly from the Federal Highway Administration’s (FHWA’s) annual compilation in the Highway Statistics publication series. The final two subsections briefly outline administration and

decision making in the federal-aid program and state highway programs and the historical origins of the present system.

Spending

Governments spent $136.4 billion to construct and operate highways in the United States in 2004 (FHWA 2005a, Table HF-10). Highways are predominantly an activity of state governments: 60 percent of all spending and 72 percent of all capital spending are by the states (Table 2-1). Highways accounted for 9 percent of state and 4 percent of local general government direct expenditures in 2003 (U.S. Census Bureau 2005a).

The capital spending share of total expenditures has declined since the 1960s and 1970s. Since at least the 1980s (earlier data are not available), the fraction of construction expenditures that is classified by the states as new construction (that is, substantially new roads rather than reconstruction or upgrades of existing roads) has declined. For capital expenditures by state governments on roads other than local roads, 39 percent was new construction in 1981, 33 percent in 1991, and 19 percent in 2004 (FHWA 1997, Table SF-212A; FHWA 2005a, Table SF-12A).

Funding Sources

State and local governments dedicate, by law, certain revenues from highway user fees and other taxes to pay for highways. They also receive federal grants designated for highways and issue bonds with the proceeds dedicated to highways. These sources of funds are described below. If they fall short of highway spending, the difference is charged to general funds.

Identifying the sources of funds for specific government expenditures is inherently ambiguous because revenues are fungible. To say that highway expenditures come from a particular revenue source may be taken to mean that

TABLE 2-1 Highway Spending by Level of Government and Function, 2004 (Percent Distribution) (FHWA 2005a, Table HF-10)

when revenue from the source increases, spending increases, and that spending falls when revenue falls, in like amounts (possibly with a time lag when there is a trust fund, but eventually keeping spending and revenue in balance). The connection between legally dedicated revenues and spending usually is imperfect in the highway program and in similarly funded government activities. For example, it will be seen below that when highway user fee revenues fell sharply in the 1970s, highway spending slowed, but governments made up part of the shortfall from other sources. The structure of transportation finance is best understood as the result of two independent policy decisions: first, how users of transportation facilities should be charged; and second, what connections should be established between the revenue raised from users and the level of spending on facilities and services.

User Fees

Total receipts of highway user revenues as defined by FHWA were $106.8 billion in 2004. FHWA defines this quantity to include revenue from any tax or fee paid by owners or operators of vehicles that use public roads, as a consequence of their use of the roads, and that is not paid by others. For example, FHWA classifies revenue from motor fuel taxes that apply only to fuel consumed on public roads as a user revenue, but not sales tax collected on gasoline if the state collects the tax at the same rate on all gasoline sales regardless of use. The definition does not consider whether the revenues are dedicated to road expenditures (FHWA 2004, IV-4–IV-5). In this chapter the FHWA definition is used. Box 2-1 explains how the term “highway user fee” is used in this report.

Fuel taxes are the major user fee and account for nearly two-thirds of the total (Table 2-2). The share of user fee revenue derived from fuel taxes has been stable over the past 40 years except for a dip in the late 1970s to early 1980s. Most revenues in the “other user taxes and fees” category in Table 2-2 are from vehicle registration and operator license fees. The majority of state and local user fee revenues are from fuel taxes. However, 13 states, including California, Illinois, Michigan, New Jersey, and Texas, collected more in registration and license fees than in fuel taxes in 2004 (FHWA 2005a, Tables MV-2, MF-1). Tolls are collected on roads, tunnels, or bridges in 33 states, although 38 percent of all tolls paid in 2003 were collected in two states, New York and New Jersey. Nearly all toll facilities in the United states are operated by publicly controlled special authorities.

The large discrepancies between the share of user fees collected by level of government and spending shares by level of government (shown in Table 2-1) reflect intergovernmental transfers and application of funds other than user fee revenues to highway purposes. The federal government distributes nearly all its revenues to the states and local governments through the federal-aid highway program and federal mass transit assistance, and states distribute a portion of their user fee revenues to local governments.

|

BOX 2-1 Highway User Fees FHWA defines the term “highway user revenues,” in part, as follows (FHWA 2004, IV-4–IV-5): [Revenues generated by] taxes and fees imposed on the owners and operators of motor vehicles for their use of public highways are … highway-user revenues…. The clearest example of a highway-user tax or fee is a toll…. Most motor fuel taxes are classified as highway-user taxes…. For motor fuel revenues to qualify as a highway-user revenue …, a motor-fuel tax must be levied per unit of volume…. It must also apply only to motor fuel [as] opposed to all petroleum products, … or provide a separate rate for motor fuel…. Motor-vehicle registration fees, certificate-of-title fees, driver-license fees, and other miscellaneous vehicle fees are all highway user taxes…. Weight–distance taxes, oversize–overweight permits and trip permits are even more directly related to highway use…. Those taxes and fees that target a broader base than highway users are considered to be a part of the general tax structure of the State, and are not considered to be highway user taxes…. State sales taxes imposed on motor vehicle sales typically are not highway user revenues…. When motor vehicle sales are charged a separate tax rate from that imposed on general sales transactions, the motor vehicle sales tax is considered highway user revenue. Definition of highway user revenues or of highway user fees (as the payments are sometimes called) is complicated by the great diversity of federal, state, and local tax provisions that must be taken into account. The correct definition depends on the reason that importance is placed on motorists paying directly for their use of highways. If user fees are seen as a means of promoting economic efficiency, the definition should be that user fees are payments that function to some degree like market prices (i.e., payments that reflect the cost of providing service and thus provide an incentive to avoid wasteful use of highways). Historically, the user fee–based highway finance system was not created with this efficiency consideration in mind, but rather because it was seen as a stable and equitable mechanism for raising a desired level of revenues. Payments are related to use of roads and to costs occasioned, but the correspondence is very imperfect. |

|

Most kinds of payments listed in the FHWA definition of highway user revenues (exceptions include tolls and trip permit fees) are taxes. It may be objected that the term “user fee” (which is employed in this report) is a mischaracterization of the special taxes charged to road users because it implies a greater government obligation to road users than actually exists. A fee is a payment in return for receipt of a service, while a tax can be defined as a mandatory payment to government for public purposes, in return for which the government does not commit itself to provide any specific service to the payer. By these definitions, postage stamps and tolls on government-operated roads are fees rather than taxes. In the case of motor fuel excise taxes, the government has no contractual obligation to provide road services in return for tax payments, although it is commonly argued that a commitment in the form of a political understanding at the time of enactment does exist (Patashnik 2000, 2). Federal and state budgeting rules that tie highway spending to user fee revenues reinforce this supposed commitment. This report accepts the FHWA classification of payments qualifying as highway user revenues and refers to these payments as highway user fees. By this classification, highway user fees include all excise taxes paid on highway fuels, vehicles, and parts that are not paid on similar purchases for nonhighway use; highway vehicle registration and permit fees; driver’s license fees; and tolls. For some state taxes, the FHWA classification may be questionable; however, the amounts involved in such cases do not appear to be important. The classification does not depend on whether the revenue from the tax is dedicated to any particular use. |

TABLE 2-2 Highway User Revenues by Level of Government and Source, 2004 (Percent Distribution) (FHWA 2005a, Tables HF-10, SDF, LDF, FE-10)

|

|

Federal |

State |

Local |

Total |

|

Fuel taxes |

31 |

32 |

1 |

64 |

|

Tolls |

– |

6 |

2 |

8 |

|

Other user taxes and fees |

3 |

24 |

1 |

28 |

|

Total |

34 |

63 |

4 |

100 |

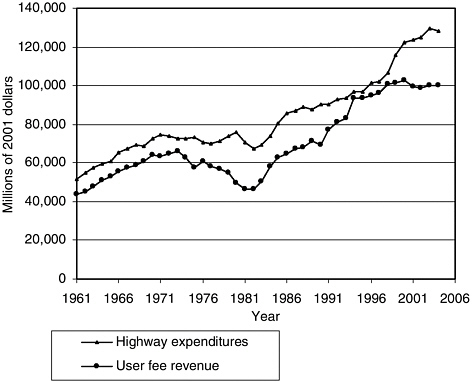

In the past 40 years (a period nearly matching the history of the federal-aid highway program in its present form), some marked swings have occurred in finance patterns, particularly in the late 1970s and early 1980s (Table 2-3). In those years, constant-dollar user fee collections fell precipitously as a result of high inflation, slow growth in highway travel caused by high fuel prices and recession, and improvements in fuel economy caused by regulation and high fuel prices. Spending fell in the same period, especially state government capital spending, at least partially as a result of reduced revenues, although the capital spending decline may also reflect the completion of major components of the Interstate system in the period. Congress increased federal excise tax rates in the 1982 highway act, and many states increased rates in the same period, so by 1991 the ratio of revenues to expenditures had returned to its level of the 1960s. Since the late 1990s the ratio has been declining.

The predominant role of state governments in highway finance and the ratio of federal aid to total spending have not changed greatly over the period shown in Table 2-3. The ratio of federal highway aid received by state and local governments to total highway expenditures has been 20 to 25 percent for most of the period. The ratio of federal aid to highway expenditures (22 percent in 2004; see Table 2-3) is smaller than the ratio of federal highway user fee revenue to total user fee revenue (34 percent in 2004; see Table 2-2) because the federal government devotes a larger share of its user fee revenue to transit than do state and local governments.

Federal excise tax rates are 18.4 cents per gallon for gasoline and 24.4 cents per gallon for diesel fuel (FHWA 2005a, Table FE-21B). Until 2005, gasohol (a blend of gasoline and ethanol) was taxed at a rate of 13.2 to 15.4 cents per

TABLE 2-3 Historical Trends in National Highway Spending, User Fee Revenue, and Highway Travel (FHWA 2002; FHWA 2005a; FHWA 1997)

gallon, depending on ethanol content. The gasohol excise is now collected at the same rate as the gasoline tax, and gasohol producers are paid a rebate from the general fund. In addition, federal excise taxes are collected on tires, large trucks, and trailers, and trucks pay the annual federal heavy vehicle use tax. Sales-weighted average state fuel tax rates in 2004 were 19.2 cents per gallon for gasoline and 20.0 cents per gallon for diesel fuel (FHWA 2005a, Table MF-121T). Most states tax gasohol at the same rate as gasoline. Registration fees and miscellaneous other federal, state, and local taxes and fees (that is, all user fees except fuel taxes and tolls) averaged $125 per registered vehicle in 2004 (FHWA 2005a, Tables SDF, LDF, FE-210, VM-1).

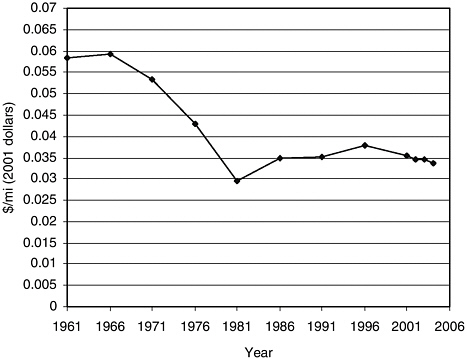

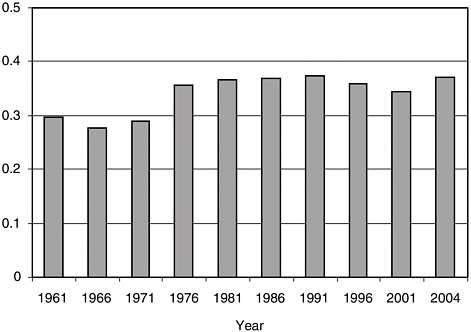

The average of all user fees paid per vehicle mile of highway travel declined (in 2001 dollars) from $0.06 per mile in the 1960s to $0.03 per mile by 1980 (Figure 2-1). The average fee has recovered somewhat, to $0.034 per mile today, but remains well below the peak of the 1960s. Trends in tax rates are examined in the final section of this chapter.

State and federal tax and fee schedules discriminate between light and heavy vehicles in an effort to collect revenues from different kinds of vehicles proportionate to relative responsibilities for highway costs. At the federal level, a 12 percent

FIGURE 2-1 Average user fee, 1961–2004. (Sources: FHWA various years, Table HF-10; FHWA 1997, Table HF-210.) Price index is gross domestic product implicit price deflator (BEA 2002, 135; BEA 2005, 188–189).

excise tax on trucks over 33,000 pounds gross weight and on trailers and a per pound excise on tires are credited to the Highway Trust Fund, and trucks over 55,000 pounds gross weight pay an annual federal fee of from $100 to $550 depending on weight (FHWA 2005a, Table FE-21B). States also impose higher fees on trucks, and a few states charge trucks a tax based on mileage. Large trucks pay higher average fuel tax per mile than light vehicles because they have lower fuel efficiency. According to the 1997 U.S. Department of Transportation (USDOT) highway cost allocation study, the average total user fee per mile paid to all levels of government is six times higher for a combination truck than for an automobile. Combination vehicles, which account for 5 percent of all vehicle miles, pay 19 percent of all user fees in the USDOT estimates. The cost allocation study estimates did not count federal motor fuel tax revenues not credited to the Federal Highway Trust Fund as user fees and so understate user fees according to the definition used elsewhere in this chapter (USDOT 1997, Tables II-6, IV-8, IV-11). Proposals for better aligning average fees with costs for automobiles and trucks are described in Chapter 6.

Other Revenue Sources

State and local governments legally dedicate the revenues from particular taxes in addition to highway user fees to pay for transportation programs. Such taxes are most commonly local property taxes and state and local sales taxes (Goldman and Wachs 2003). Revenue from taxes dedicated by law to highway use, other than highway user fees, was $15.4 billion in 2004, 11 percent of all highway spending (FHWA 2005a, Table HF-10). This ratio has been nearly constant over the past 40 years, although the portion derived from taxes other than property taxes, including dedicated state sales taxes, has been growing.

In addition to the revenue of legally dedicated taxes, state and local governments appropriate funds from general revenues each year for spending on roads. Comparing these general fund appropriations with total spending is difficult, because many jurisdictions deposit some part of their highway user revenue into their general funds and then make appropriations for highways out of general funds. Also, the federal government distributes about $1 billion per year from general fund appropriations to state and local governments for highway purposes through grant programs of various agencies (FHWA 2005a, Table FA-5). Highway user fee revenue (whether dedicated to highways or not) equaled 78 percent of highway spending in 2004, and revenue from dedicated taxes other than user fees equaled 11 percent, so the net contribution from general revenue may be defined as the remaining 11 percent.

Debt Finance

Highway finance in the United States is commonly described as a pay-as-you-go system, which is to say that debt finance is little used (except for toll roads)

and spending tends to track revenues. The revenue figures in Tables 2-2 and 2-3 exclude bond issue proceeds, and the spending figures exclude interest payments and debt retirement. State and local government bond issue proceeds for highway uses in 2004 (excluding notes with maturities of 2 years or less) were $15.8 billion, equal to 12 percent of spending. The volume of bonds issued for highways has fluctuated over the past 40 years, but this is a typical ratio for the period. Interest payments and bond retirements in 2004 were $13.8 billion (FHWA 2005a, Table HF-10). Toll facilities are major issuers of bonds.

Federal and State Highway Program Structure

The federal-aid highway program distributed $28.3 billion to the states in 2004 for spending on highway construction, equal to 21 percent of all highway spending that year (FHWA 2005a, Table HF-10). The rules of the program affect thetotal of highway spending, the projects selected, and the performance of the highway system. The main features of the federal-aid program are as follows (FHWA 1999):

-

Periodic federal surface transportation acts provide multiyear funding authorizations for federal highway and mass transportation capital grant programs and set program rules and highway user taxes. Federal rules include standards with regard to design, maintenance, and safety for projects making use of federal aid.

-

The amounts authorized for each year in the surface transportation act are distributed annually to the states. Most funds are apportioned according to formulas specified in the act, within categorical programs. [The 2005 reauthorization legislation—Safe, Accountable, Flexible, Efficient Transportation Equity Act: A Legacy for Users (SAFETEA-LU)—funds six program categories receiving $1 billion per year or more each and several smaller ones.] Apportionment formulas include such factors as each state’s shares of highway lane miles, vehicle miles of travel, and Highway Trust Fund revenue collections. The surface transportation acts provide contract authority, that is, state spending that incurs a federal obligation may take place as soon as funds are apportioned each year. This is in contrast to most federal programs, in which amounts authorized may not be used until Congress enacts a second law appropriating funds to pay for authorized spending.

-

Federal-aid funds are available to the states for 4 years after they are distributed, but Congress regularly enacts annual limitations on thetotal amount of federal-aid funds that may be obligated in the year, so states may not be able to use the entire amounts authorized. The provision of contract authority in multiyear surface transportation acts, together with the annual obligation limitations, is regarded as granting the states greater certainty and flexibility than would reliance on annual appropriations.

-

Funds are appropriated annually to reimburse the states for the federal share of expenditures (80 or 90 percent for most kinds of projects, specified in the law) that the states have made on eligible projects.

-

The highway user taxes collected by the federal government are deposited in the Federal Highway Trust Fund (divided between a highway account and a mass transit account), and payments to states are withdrawn from the fund. The Highway Trust Fund is a bookkeeping device to make apparent the relation of user fee collections to spending. Authorizations in the surface transportation acts are limited by the balance in the fund and the projected deposits from user tax revenues. The balance in the highway account of the fund stood at $14.6 billion in 2004, the equivalent of about 6 months of disbursements (FHWA 2005a, Tables HF-10, FE-210).

Because the states are directly responsible for most highway spending, state procedures with regard to programming and budgeting have great importance for the performance of the transportation system. Most states have finance arrangements analogous to those at the federal level, including trust funds and dedication of user tax revenue to highway uses. Only Alaska, Georgia, New Jersey, and the District of Columbia credit most highway user revenues to general funds rather than earmarking them for highways, transit, or other special purposes (FHWA 2005a, Table DF).

Federal-aid highway program capital grants plus required matching funds equal approximately 52 percent of all state and local government highway capital spending. Federal-aid rules do not dictate state project selection (with the exception of certain projects specifically identified by Congress, as described below), but they do influence the process. The mechanisms of influence include the following:

-

As a practical first priority in budgeting, states must provide sufficient matching funds, by program category, to ensure that all available federal aid is obtained.

-

The federal government imposes design standards on federal-aid projects and oversees design and construction.

-

Each federal-aid project must be listed in the State Transportation Improvement Program (STIP) for the state. Federal regulations define the content of the STIP, a multiyear capital program that lists all federal-aid highway and transit projects by year and in priority ranking, with costs and funding sources identified. The STIP must show that the spending program for federal-aid projects is consistent with expected sources of funds. Federal-aid projects in metropolitan areas must be from improvement programs approved by the local metropolitan planning organizations. Projects must be shown to be in conformity with the State Implementation Plan for attaining federal air quality standards, and the STIP must list non-federal-aid proj-

-

ects that could affect air quality (USDOT 2003; Wisconsin Department of Transportation 2004).

-

Although only construction, reconstruction, and certain major maintenance activities are eligible for federal aid, federal law requires states to maintain roads constructed with federal aid to specified standards. States also are required to have management systems for pavements, bridges, congestion, and safety (23 USC 303). These involve systematic collection of data on physical condition and performance and formal procedures for planning and evaluating maintenance and construction schedules.

Despite federal requirements, a state with funds for capital spending in excess of federal-aid matching requirements has a degree of flexibility to minimize the impact of the rules on its ability to carry out projects according to its own priorities (TRB 1987, 49–64). Projects that have no federal-aid funding do not have to comply with many federal requirements (for example, design requirements), and the smaller the federal-aid share of total state spending is, the less importance the division of federal aid into the various program categories has for actual state spending priorities. The effects of the federal-aid program rules on state spending and project selection have never been comprehensively studied. Some possible impacts are discussed in Chapter 3.

TRANSIT FINANCE

Most transit services in the United States are operated by special-purpose authorities controlled by local and state governments. Transit was primarily a private-sector industry until the 1960s, but publicly owned systems carried 50 percent of all passengers by 1967 and 94 percent by 1980 (APTA 1981, 27). The industry’s major sources of funds are passenger fares; other revenue related to transportation operations (e.g., from advertising and chartered buses); revenue from special taxes dedicated to transit; and other federal, state, and local government aid (Table 2-4).

Federal grants are about one-sixth of all funds expended; the federal share has declined from a high of nearly one-third in the early 1980s (Table 2-5). Most federal funding depends on revenue from the federal highway motor fuel tax, including the $0.0286 per gallon share dedicated by Congress to the Mass Transit Account of the Highway Trust Fund as well as funds in certain categories of the federal-aid highway program that states and localities can transfer to transit. Federal assistance includes formula grants for capital and operating expenditures apportioned among urbanized areas according to population and transit service characteristics and discretionary capital grants (in the New Starts and Bus Capital programs) distributed to specific projects selected by Congress or the Federal

TABLE 2-4 Public Transit Sources of Funds, 2000 (Percent of Total Funds)

|

Item |

Percentage |

|

Fares |

25 |

|

Other revenue from transport services |

3 |

|

Federal grants |

|

|

From dedicated federal fuel tax revenue |

14 |

|

From general fund |

3 |

|

State government sources |

|

|

From general revenue |

7 |

|

From dedicated sales tax revenue |

2 |

|

From other sources |

9 |

|

Local sources |

|

|

From general revenue |

8 |

|

From dedicated sales tax revenue |

14 |

|

From other sources |

16 |

|

Total |

100 |

|

SOURCES: USDOT n.d., p. 6-22; FTA n.d. a, Table 1. [The original source is the National Transit Database (NTD), compiled by USDOT from transit agency reports. The NTD shows that dedicated state and local fuel taxes were the source of $500 million of transit funding in 2000. In contrast, reports of state and local governments to USDOT tabulated in Highway Statistics (Tables SDF, LDF, HDF) show $1.3 billion in state fuel tax revenue and $3.2 billion in total state and local highway user fee revenue distributed to transit in 2000 (in addition to $5.1 billion in federal highway user revenue to transit). Highway user fee revenue devoted to transit at local officials’ option, rather than as a matter of law, may account for some of the discrepancy.] |

|

Transit Administration. The required state and local matching share for federal grants is 20 percent (that is, at least 1 state or local dollar for every 4 federal dollars) for capital projects and 50 percent for operating assistance (APTA 2005, 1–4; USDOT n.d., 6-23–6-33). Eighty percent of federal assistance received in 2001–2003 was for capital expenditures (APTA 2005, Tables 55, 66).

State and local funding derives from dedicated taxes and general revenue. Sales taxes are the most important form of state and local dedicated tax and accounted for 16 percent of transit funding in 2000 (Table 2-4). State and local highway user fee revenue devoted to transit was $3.2 billion in 2000, equal to 9 percent of all transit expenditures, and $4.4 billion, 11 percent of expenditures, in 2003. The total of federal, state, and local highway user fee revenue devoted to

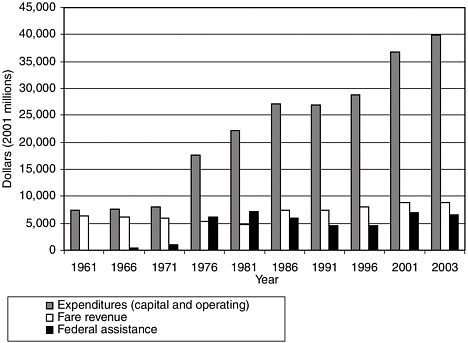

TABLE 2-5 Trends in Transit Expenditures, Sources of Funds, and Transit Use

transit equaled 24 percent of transit expenditures in 2000 and 25 percent in 2003 (FHWA 2001; FHWA 2005a, Table HF-10; APTA 2005, Tables 55, 66). The section below on nonhighway uses of highway user fee revenue further describes transit applications of these revenues.

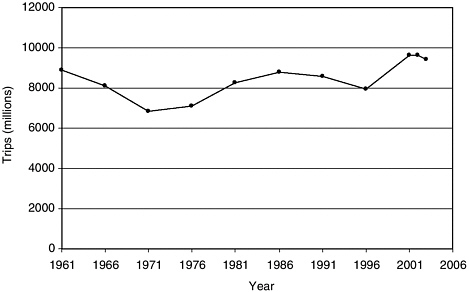

Passenger fare revenues have equaled about one-fourth of annual expenditures since the 1980s. Transit ridership and constant-dollar fares have been more or less constant over the past 40 years, while total and capital expenditures per passenger have risen (Table 2-5). These trends are in contrast to the experience of the highway sector: average highway user fees (per vehicle mile) have fallen over this period, but highway use has increased substantially and average public (Table 2-3) and private (Wilson 2002, 40) highway expenditures per vehicle mile have fallen.

The growth in transit spending without corresponding growth in fare revenue or federal assistance has stressed state and local government transportation budgets. Until the mid-1980s, revenue sources other than state and local government covered the majority of transit expenditure. (As Table 2-5 shows, fare revenue was sufficient to cover most operating and capital expenditures until the early 1970s; by 1981 fares had declined to 21 percent of expenditures but federal aid covered 32 percent.) However, by 2003 the share of spending covered by these sources had declined to less than 40 percent. (Fares remained at 22 percent but the federal-aid share had declined to 17 percent.) State and local subsidies to transit

reached $25 billion in 2003, an increase of 135 percent in constant dollars since 1981 (Figure 2-2). Ridership grew 14 percent in the same period (Figure 2-3).

Transit use and spending are highly concentrated in a small number of metropolitan areas. New York City Transit, the largest system, accounted for 30 percent of all U.S. transit passenger trips and 18 percent of transit spending in 2002 and received 10 percent of all federal transit assistance. The five largest systems in terms of ridership (the central systems in New York City, Chicago, Los Angeles, Washington, D.C., and Boston) had 49 percent of passengers and 33 percent of expenditures and received 27 percent of federal assistance. If independent suburban and commuter services are counted, these five metropolitan areas’ combined share of nationwide ridership is well over half (FTA n.d. b).

COMPARISONS WITH OTHER INFRASTRUCTURE AND INTERNATIONAL PRACTICES

The preceding two sections described arrangements for financing highways and transit in the United States. In assessing alternatives to these arrangements, a broader perspective derived from comparisons with finance arrangements for

FIGURE 2-2 Constant-dollar annual transit expenditures, fare revenue, and federal assistance, 1961–2003. (Sources: APTA 2005; APTA 1992; APTA 1978.) Price index is gross domestic product implicit price deflator (BEA 2002, 135; BEA 2005, 188–189).

FIGURE 2-3 Annual unlinked transit passenger trips, 1961–2003. (Sources: APTA 2005; APTA 1992; APTA 1978.)

other U.S. public utilities and transportation systems in other countries may be helpful. The characteristic features of these arrangements include the degree of reliance on revenue from users and other sources, the structure of user fees, and the spheres of involvement of the national, regional, and local governments and of the private sector. Such comparisons can suggest options for alternative finance arrangements. They may reveal how alternative finance arrangements have influenced the performance of the various public utility sectors—the quality of services and the public return on investments. Comparisons also may provide some insight into why U.S. highways and transit are financed as they are—whether finance arrangements arise from intrinsic characteristics of these industries related to the costs of producing the services they provide or the nature or social significance of these services, or, alternatively, whether the arrangements are more the result of the historical development of the industries or of external factors.

The comparisons summarized in Tables 2-6 and 2-7—among highways, transit, and other government-provided infrastructure services in the United States and among highway systems in Europe and the United States—show that diverse financial arrangements exist. They suggest that differences in finance practices may arise more often from historical accident than from inherent differences among the industries. In the United States in 2002, governments spent $39 billion to construct and operate public transit, $133 billion for highways, $22 billion for airports and air traffic control, $1 billion for inland waterways navigation facilities, and $65 billion for local water and sewerage systems (Table 2-6). Local

TABLE 2-6 Sources of Funds and Expenditures for Public Water and Sewer (2001), Transit (2002), Highway (2002), Airport and Aviation (1999), and Inland Waterways Navigation (2002) Facilities

|

|

Water and Sewer |

Transit |

Highway |

Airport and Aviation |

Inland Waterways |

|

User fee revenue ($ billions) |

56.6 |

8.6 |

100.5 |

21.1 |

0.1 |

|

Total expenditures ($ billions) |

64.8 |

39.3 |

132.6 |

21.8 |

0.8 |

|

Capital |

|

12.8 |

68.2 |

|

0.3 |

|

Operating |

|

24.8 |

59.0 |

|

0.5 |

|

User fee revenue/expenditures |

0.87 |

0.22 |

0.75 |

0.97 |

0.12 |

|

Federal grants and direct spending ($ billions) |

3.2 |

6.6 |

32.9 |

10.7 |

0.8 |

|

(Federal grants and direct spending)/expenditures |

0.05 |

0.14 |

0.25 |

0.49 |

1.0 |

|

NOTE: Water and sewer excludes federal water projects. Total expenditure amounts include interest on debt. Airport and aviation includes the federal air traffic control system. SOURCES: FHWA 2003, Table HF-10; U.S. Census Bureau various years, Table 1; BTS n.d., Tables 2-A, 3-A, 13-A, 14-A; CBO 2002, 7; IWR 2004; CBO 2005, 94; APTA 2004. |

|||||

governments are the direct providers of most transit, water and sewer, and public airport services; states provide the majority of highway services; the federal government operates air traffic control and the inland waterways. Infrastructure provided by the private sector accounts for no more than a small fraction of expenditures in all these industries. Federal grants and direct federal spending (in the years shown in Table 2-6) equal 25 percent of spending for highways, 17 percent for transit, 49 percent for airports and air traffic control, and 5 percent for water and sewer.

No rule that determines the extent of federal involvement or the extent to which public expenditures are covered by user fees in these industries is evident. Substantial federal involvement in highways and in airports and air traffic control and low involvement in water and sewer may be roughly consistent with the mix of national and local services that these systems provide. Federal grants to water and sewer were much higher in the 1970s and 1980s than today. The purpose of the grants was to reduce water pollution; the grants may have reflected the regional nature of pollution impacts (EPA 2003, 3). Federal involvement in transit is high compared with water and sewer, another mainly local service, but is declining over time.

Highways, local water and sewer, and airports and air traffic control are largely paid for by fees and taxes collected from users. (Airport revenues include

TABLE 2-7 Road User Revenues and Highway Expenditures in Europe

|

|

France |

Germany |

United Kingdom |

Western Europe |

|

Sources of road user revenues (percent of total) |

||||

|

Taxes related to vehicle ownershipa |

27 |

22 |

47 |

33b |

|

Fuel tax |

57 |

78 |

53 |

55 |

|

Tolls and permits |

8 |

– |

– |

4 |

|

Other |

8 |

– |

– |

8 |

|

Road user revenuesc (ECU billions) |

|

38.4d |

23.3d |

119.7d |

|

Expenditures (ECU billions) |

|

15.0 |

8.3 |

60.0 |

|

Revenue/expenditures |

|

2.6 |

2.8 |

2.0 |

|

Distribution of expenditures by level of government (percent, 1990) |

||||

|

Central |

23 |

39 |

60 |

48e |

|

Regional |

12 |

15 |

– |

12 |

|

Local |

65 |

46 |

40 |

40 |

|

NOTE: ECU =European currency units; equal to about $1 in the period. Dash indicates negligible. aIncludes vehicle purchase taxes, import duties, and registration and license fees. bFourteen countries, about 1993. cIncludes fuel taxes, annual vehicle registration fees, tolls, and permit fees. dFor Germany and the United Kingdom, 1994; for Western Europe, 11 countries, various years. eSeventeen countries. SOURCE: Farrell 1999, 44–62. |

||||

fees paid by airlines and rents paid by concessions, which are indirectly derived from air travelers.) In contrast, in the years shown in Table 2-6, transit fare revenues covered 22 percent of expenditures of government-provided transit services, and waterway user fees (a tax on commercial towboat fuel) covered 12 percentof inland waterways navigation expenditures. Some of this variation reflects the relative ease of measuring and charging for individual uses. For example, the gap between highway user fee revenue and expenditures is in part the consequence of local governments’ lack of practical methods of charging for use of local streets.

Road user fees and highway finance in Europe show some marked contrasts to U.S. practices. Most notably, revenues derived from road users greatly exceed highway spending, by 2:1 on average in western Europe and by up to 3:1 in some countries (for example, €38 billion in revenue versus€15 billion in expenditures in Germany and €23 billion revenue versus €8 billion expenditure in the United Kingdom in 1994) (Table 2-7). The relative importance of various kinds of fees

is roughly similar to that in the United States: fuel taxes generate over half of revenues; tolls on average generate 4 percent but up to one-eighth of the total in some countries. The national government is directly involved in road construction and operation throughout Europe.

Most European governments credit fuel tax and vehicle fee revenues to general funds, but Germany, Switzerland, the Netherlands, Belgium, and Greece dedicate specific shares of these revenues to roads; and the Netherlands, Belgium and Greece have set up infrastructure funds with dedicated revenues and with disbursements limited to certain types of projects (Farrell 1999, 59–61). A high percentage of expressway mileage in several European countries is tolled (88 percent in Italy and 82 percent in France in 1995), but because the expressway network is not extensive, tolls do not account for a large share of total highway program revenues (Farrell 1999, 62–66).

Until the past decade, with few exceptions, toll roads were operated by public or quasi-public entities. However, Italy and Portugal privatized their major toll road providers through public stock offerings in 1999, and Spain sold some of its state toll road operators in 2003. France has begun to privatize its toll roads (TollRoads News 2005).

TRENDS IN THE EVOLUTION OF THE FINANCE SYSTEM

Chapter 1 identified three arguments that have been used to motivate transportation finance reform. The first is that future oil price increases, advances in automotive technology, and new pollution and energy regulations will substantially reduce fuel tax revenues and thereby threaten the viability of the present finance system. The second is that the viability of the present system is threatened by an accumulation of structural changes that have caused it to diverge from the original concept of the user fee–trust fund system. The third is that, regardless of the stability of existing arrangements, reform presents opportunities for increasing the public benefits of transportation spending by improving operations of facilities and by directing funds to the best projects.

These lines of argument obviously are not mutually exclusive, and all three might be reasonable grounds for reform. This section examines the evidence supporting the second argument, which concerns the erosion of support for the user fee finance principle and the consequent decline in effectiveness of the present finance system. A premise of this argument is that the historical system, which reached its full development with the federal-aid highway act of 1956 and in the state programs with features parallel to the federal, served the public interest well. (Chapter 3 examines the evidence for this claim.) The basic features were that revenues derived from highway users were fully dedicated to paying for highway construction and operation and that these revenues covered all such costs other than

those for local streets. Trust funds were established to enforce the connection between user fee revenue and spending. The arrangement was perceived as fair by the taxpayers, generated revenues for a substantial highway program, and served efficiency to some extent since users recognized that any upgrading of highways required increases in fees.

However, according to this argument, in the evolution of transportation finance arrangements over the past 30 years, this original conception has been compromised:1

-

Adherence to the user-pays finance principle has weakened as a result of devolution of responsibilities to local governments (which are less capable of collecting user fees and historically rely mainly on other revenue sources); diversion of highway user revenue to nonhighway purposes; resort to expedient sources of revenue in the face of pressing needs; and growing demands for transit improvements, which are unable to cover a major portion of their costs with fees.

-

In part as a result of these changes in the structure of the program (which have tended to undermine the basis of its political support) but also on account of broader trends (the “taxpayer revolt” opposing growth in state and local government spending), the public and legislators no longer support fuel tax rates and fees necessary to sustain the programs, and the merit of the user-pays principle is no longer recognized.

-

To the extent that the user fee finance system historically has had a positive effect on program performance, divergence from the principle has been harmful.

The subsections below describe developments in five areas of finance practices:

-

Application of highway user fee revenue to nonhighway purposes and earmarking of federal aid,

-

Legislative action to adjust user fees to keep up with inflation and cost changes,

-

Devolution of responsibilities to local governments and related trends in reliance on user fee revenue,

-

Revenue adequacy, and

-

Revenue stability.

Changes in these five areas of practice are indicators of the extent to which the finance system has departed from its original conception and its effectiveness as a funding mechanism has been altered.

Application of User Fee Revenue to Nonhighway Purposes and Earmarking of Federal Aid

As Chapter 1 noted, the practice of dedicating highway user revenues to purposes other than highways has been controversial. Highway program supporters sometimes have claimed that the accretion of diversions is a threat to the viability of the present finance system. Transit advocates and others argue that transit and the other uses to which highway-derived revenues have been dedicated are as reasonable applications of the revenue as is highway construction, and they object to the term “diversion” as implying that highway programs have a proprietary claim to the revenue.

Chapter 3 will present evidence that providing subsidies to transit and raising revenues from highway users that exceed the highway agency’s cost of providing roads both can be justifiable practices, and that highway travelers benefit from transit’s impact on highway congestion. However, regardless of the merit of arguments in favor of dedicating highway user revenues to transit or other nonhighway purposes, it is reasonable to suppose that the growth of such uses could affect the viability of the highway finance system by weakening its political support among highway users. Constituencies that might be expected to oppose nonhighway uses of revenues (or to cease to support maintaining highway user fees once such uses become large) include trucking companies and motorists who reside in nonmetropolitan areas.

Of $106.8 billion in highway user revenues collected in 2004 by the federal, state, and local governments, $10.7 billion was devoted to mass transit (either dedicated by law to transit, as the federal fuel tax revenues credited to the Mass Transit Account of the Highway Trust Fund, or allocated to transit at the discretion of local officials, for example, through the flexible fund provisions of the federal-aid highway program). In addition, $10.2 billion was credited to general funds or dedicated to purposes other than highways and transit. The share of state and locally collected highway user revenues that is devoted to purposes other than highways and transit grew from 10 percent in 1991 to 13 percent in 2004 (FHWA 1997, Table HF-210; FHWA 2005a, Table HF-10). As described above, the total spent on highways exceeds highway user fee revenue, primarily because local governments fund most of their street and road expenditures from general or non–user fee revenue sources. States also devote funds from nonhighway sources to highways. In national totals, states’ revenues from highway users nearly equal their highway spending: the sum of all state-imposed highway user fee revenues and Federal Highway Trust Fund aid received by states was $94.7 billion in 2004

and current spending by states for highways plus state grants for highways to local governments was $95.3 billion (FHWA 2005a, Table HF-10). However, the balance between revenue and spending varies from state to state (FHWA 2005a, Tables DF, SF-1, SF-2).

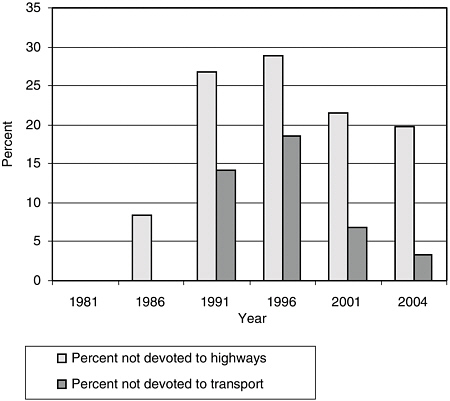

The Federal-Aid Highway Act of 1956 created the Highway Trust Fund and dedicated to the fund all revenues from a set of excise taxes on highway fuels, vehicles, and parts, as well as an annual fee paid by operators of large trucks. Since 1983, a portion of the fuel tax (presently 2.86 cents per gallon) has been dedicated to mass transit. Since 1987, a small portion of the fuel tax (0.1 cents per gallon) has been devoted to the Leaking Underground Storage Tank Trust Fund. From 1990 until 2005, a portion of fuel taxes (2.5 cents per gallon from 1990 to 1993, 6.8 cents per gallon from 1993 to 1995, and 4.3 cents per gallon from 1995 to 1997 on all fuels, and 3.15 or 2.5 cents per gallon on gasohol only from 1997 to 2003) was credited to the general fund. The fraction of federal highway user revenues dedicated by federal law to nonhighway uses peaked at about 30 percent in the mid-1990s and has declined since (Figure 2-4).

FIGURE 2-4 Percentage of federal highway user revenues not devoted to highways or transport, 1981–2004. (Sources: FHWA various years, Table HF-10.)

The preamble of the 1991 act reauthorizing the federal surface transportation aid program (ISTEA, the Intermodal Surface Transportation Efficiency Act) declared a new emphasis on intermodalism for the program: “It is the policy of the United States to develop a National Intermodal TransportationSystem [which shall consist of all forms of transportation in a unified, interconnected manner …]” (P.L. 102-240). ISTEA granted limited flexibility to state and local governments to use federal aid drawn from the Highway Trust Fund for transit and for nonhighway freight projects, and it increased the influence of local governments in project selection. Under the terms of two grant categories introduced in the 1991 act (the Surface Transportation Program and the Congestion Mitigation and Air Quality Program), states may choose to use grants for highway or nonhighway transportation purposes. These two categories constituted 24 percentof federal highway authorizations from 1998 through 2003. In 2004, states transferred $1.1 billion of federal-aid funds from highway programs to transit (FHWA 2005a, Table HF-10).

Out of $104.8 billion in spending at the state level for highways and transit in 2004 (including grants to local governments and to transit operators but excluding direct spending of independent transit operators owned by states), $9.5 billion,or 9 percent, was for transit. Highway user revenues dedicated to state transit programs or transit grants equaled less than half of this amount (FHWA 2005a, Tables MT-1A, MT-1B, HF-10, DF). Distribution of state highway user fee revenue for transit purposes is concentrated in a few states. In 2004, three states—New York, Pennsylvania, and Maryland—accounted for 58 percent of such distributions; 23 percent of highway user fee revenues collected by these three state governments was devoted to transit. In the remaining states, 3 percent of state highway user fee revenue was devoted to transit (FHWA 2005a, Table SDF). Although these shares of spending are disproportionate to relative use [1.8 percent of vehicular trips are by transit (Hu 2004, Table 7)], it is not evident that state transit spending is large enough nationwide to have a major impact on state highway programs.

The federal excise tax rate on gasohol (a blend of gasohol and ethanol) used as a highway fuel was lower than the rate on gasoline from 1979 through 2004. The data in Figure 2-4 reflect the crediting of part of gasohol tax revenue to the general fund, but not the lower tax rate. Taxing gasohol at the same rate as gasoline and depositing all revenues in the Highway Trust Fund would have increased trust fund deposits by about $1.6 billion (5 percent) in 2002. The General Accounting Office projected in 2002 that this forgone revenue would grow to $2.2 billion per year by 2012 if the present tax treatment of gasohol continued (Hecker 2002, 25). Legislation enacted in 2004 (the American Jobs Creation Act of 2004, P.L. 108-357) contained a provision setting the gasohol rate equal to the rate on gasoline and crediting all revenue from the tax to the Highway Trust Fund as of January 1, 2005. The gasohol subsidy via the

Highway Trust Fund was replaced with a subsidy representing a loss to the revenues of the general fund in the form of tax credits that gasohol producers earn for payment of the excise tax.

Congressional earmarking is a second practice affecting the use of federal-aid funds that has been the subject of controversy. A small but growing proportion of federal funding for highways is devoted to highway projects identified by Congress rather than to the normal grant programs. The latter provide funds, apportioned among the states according to formulas (taking into account population, traffic, and other state characteristics), that states and local governments can apply to projects that they select. If earmarking curtailed funding of the highest-value highway projects, then its financial impact on the highway program would be analogous to the impact of applying funds to nonhighway uses. Authorizations for projects specifically designated by Congress jumped from about 1 percent of the highway program in the 1982 and 1987 federal-aid highway acts to 5 to 6 percent in the 1991 and 1998 acts and to over 10 percent in the 2005 surface transportation aid program reauthorization legislation (SAFETEA-LU) (Table 2-8).

The impact of this practice depends on whether the projects Congress chooses have greater benefits than the projects that the states would choose if they received the funds through normal grants. To the extent that state and local governments have well-developed sources of information on project benefits and formal and open processes for setting priorities, there are grounds for concern that federal earmarking may divert some funds from higher-payoff to lower-payoff projects. State officials report that members of Congress sometimes solicit their state departments of transportation for nominations for projects for earmarking from among projects that are already in state capital plans and at

TABLE 2-8 Earmarked Projects in Federal-Aid Highway Acts

advanced stages of preparation. These interactions may reduce the distorting effect of earmarking on project selection.

In contrast with some other federal infrastructure grant programs (in particular,the water resources development program) in which authorized projects frequently fail to receive appropriations of funds, in the federal-aid highway program all earmarked projects authorized to be funded from the Highway Trust Fund have federal funds available. Under the terms of the highway program, authorized amounts become available for obligation without further action by Congress. Apparently the majority of earmarked highway projects eventually are carried out, but many are not, in part because earmarked amounts often fall well short of project costs and projects do not correspond to states’ priorities (GAO 1995, 25–26).

Although the fraction of federal funding that is earmarked for specific projects is growing, it remains small in the highway program compared with some other federal transportation programs. In the 5-year federal transit assistance program authorized in 2005 (SAFETEA-LU Title III), about three-quarters of grants to state and local governments are apportioned by formula and one-quarter are earmarked or discretionary (FTA 2005). Substantial amounts of discretionary funds are earmarked. Most inland waterways and ports authorizations are for specifically identified projects.

Legislative Adjustments of User Fee Rates

Because fuel tax rates are defined in cents per gallon, state and federal legislative action is required to adjust for the effects of inflation on revenues. In contrast, sales taxes or income taxes automatically generate higher revenues in nominal dollars as prices and wages rise. This dependence on regular legislative action, coupled with allegedly increasing political resistance over time to tax rate increases in general, is commonly cited as a principal disadvantage of reliance on the fuel tax as the main revenue source for transportation programs. For example, a background paper for the Transportation Research Board’s 2000 National Finance Conference cited “political barriers to raising user taxes” as one of the “fundamental structural problems” of the current highway finance system and observed:

Fuel taxes are regarded as just another tax, and politicians risk losing their jobs if they raise fuel taxes to meet the full costs of the highway system…. [I]ncreases in user fees have been few and far between. During the 1980s, states raised their own fees to match inflation on a regular basis…. By the 1990s, the number of states increasing their gas tax had dropped…. Federal taxes dedicated to transportation had not been raised since the famous nickel increase in 1982 until the enactment of TEA-21. (Giglio and Williams 2001, 199–200)

Similarly, the California and Oregon transportation finance studies summarized in Chapter 1 both assume that future substantial increases in fuel tax rates will not be a feasible solution to funding problems.

It has been argued that legislatures’ failure to adjust fuel tax rates arises not simply from inattention, unpopularity of taxes in general, or competitionfrom other programs for resources, but from an inherent structural flaw of the fuel tax. The Federal Highway Administrator expressed this view as follows (Peters 2004):

In the 1950s and ’60s, when the interstate system was built, a gas tax made sense because virtually every driver benefited from a new, nationwide highway system. But today, capacity and maintenance are largely urban and suburban problems unique to the short lengths of highway used by commuters. Raising gas taxes does little or nothing to improve commuter congestion and punishes the millions of drivers and businesses that don’t use busy urban highways.

In other words, according to this argument, needs are concentrated (on urban roads and transit, and primarily in a small number of highly congested urban areas) but the revenue source is broadly based, so many voters oppose tax increases because they see the benefits going elsewhere. This argument finds support in reports of recent state transportation finance debates indicating that rural and small-town legislators perceive that their constituents tend to drive a lot and hence pay high taxes, while pressures to increase spending are strongest in urban areas (Montgomery 2004; Barnes 2005).

As the first section of this chapter described, in spite of these potential obstacles to maintaining highway user fee revenue, the average constant-dollar user fee paid per vehicle mile of highway travel has been fairly constant since the late 1970s. The average state gasoline tax rate also shows no consistent trend over this period (Figure 2-5). The rate is higher today than during the 1980s, although it has declined in the past decade. The frequency of revisions of state gasoline tax rates has slowed. About four states per year changed the rate in the past decade compared with eight per year in the 1980s (Figure 2-6), but the decline may be attributable, at least in part, to the slowing of inflation during the period. At the end of 2004, gasoline excise tax rates in 23 states were the same as or lower than the rates in 1994, although the rates in 11 of the 23 states remained above the national average of $0.191 per gallon. Only five states had rates below $0.15 per gallon (FHWA 2005a, Table MF-205).

Not all states depend on legislative action to change rates. At least nine states (Florida, Iowa, Kentucky, Maine, Nebraska, New York, North Carolina, West Virginia, and Wisconsin) have variable rate cents-per-gallon gasoline taxes. In five of these states (Florida, Nebraska, New York, North Carolina, and Wisconsin), the tax rate was adjusted nearly every year from 1998 to 2004 without legislative action (FHWA 2003, Table MF-121T; ARTBA 2004; AASHTO Journal 2005). Methods of indexation vary, and the effects on revenue have sometimes not been

FIGURE 2-5 Sales-weighted constant-dollar average state gasoline tax rate, 1981–2004. (Sources: FHWA 1987; FHWA 1997; FHWA 2005a, Table MF-205.) Price index is gross domestic product implicit price deflator (BEA 2002, 135; BEA 2005, 188–189).

those intended (Ang-Olson et al. 2000). (See Chapter 6.) Wisconsin has repealed its automatic adjustment after 2006. Several states collect sales taxes on highway motor fuels, although revenues from these taxes are generally not dedicated to highway use.

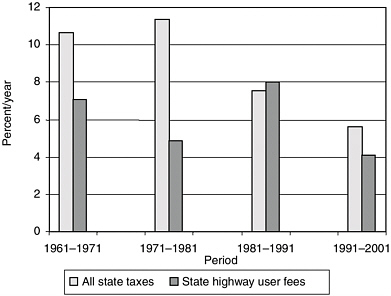

In assessing the willingness of state legislatures to adjust highway user taxes, it is instructive to compare overall state government tax effort with highway user fee revenues. In the 1960s and 1970s, revenue from all state taxes grew much faster than state highway user fee revenue (Figure 2-7). In the 1980s and 1990s the difference lessened, although in recent years total state tax revenues have continued to grow faster than highway-related revenues. In the period shown in Figure 2-7, the sphere of state government responsibilities was expanding. Consequently, highways’ share of state government total expenditures (including transfers to local governments) fell from 23 percent in 1960 to 15 percent in 1970 and 7 percent in 2002 (U.S. Census Bureau 2005b, Table 438; U.S. Census Bureau 1976, Table 439).

The history of changes in the rate of the federal excise tax on gasoline since the 1956 federal-aid highway act is as follows:

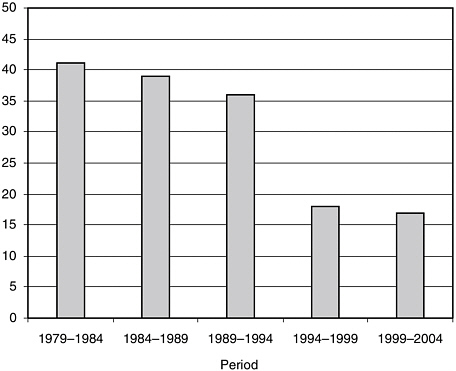

FIGURE 2-6 Number of states raising cents per gallon gasoline tax rates, 5-year intervals, 1979–2004. Note: Eleven states lowered rates during some interval in the period 1979–2004. (Sources: FHWA 1987; FHWA 1997; FHWA 2005a, Table MF-205.)

|

Year |

Rate ($/gallon) |

|

1956 |

0.03 |

|

1959 |

0.04 |

|

1983 |

0.09 |

|

1987 |

0.091 |

|

1993 |

0.184 |

|

1996 |

0.183 |

|

1997 |

0.184 |

In constant dollars, the rate today is about 7 percent higher than in 1956. The diesel fuel rate increased from $0.03 per gallon in 1956 to $0.244 per gallon since 1997. The rates for the excise tax on sales of new large trucks and trailers and the heavy vehicle use tax (an annual federal fee for all large trucks in use) were last increased in 1984 (FHWA 1997, Tables FE-101a, FE-101b; FHWA 2003, Table FE-21B). Changes in law in 1997 (when $0.043 per gallon that had been credited to the general fund began to be credited to the trust fund) and in

FIGURE 2-7 Average annual percentage growth rates, all state tax receipts and state highway user fee receipts, 10-year periods, 1961–2001. (Sources: FHWA various years, Table MF-121T; Baker 2003.)

2004 (when the revenue impact of the federal gasohol subsidy was transferred from the trust fund to the general fund) increased contributions to the Federal Highway Trust Fund without increasing the fuel tax rate paid by motorists.

Devolution and Reliance on User Fees

As Chapter 1 described, parallel trends in at least some jurisdictions toward devolution of responsibilities for transportation programs from state to local government (that is, municipalities, counties, and special authorities districts within a state) and decreasing reliance on user fees have been cited as threats to the continuation of historical highway finance arrangements. Whereas state government highway programs are predominantly funded by state-imposed user fees (fuel taxes and registration and licensing fees) and federal aid derived from federal user fees, local governments historically have relied mainly on property and sales taxes to pay for transportation programs. Therefore, devolution of transportation program responsibility to local government would be likely to entail decreased reliance on revenues from fuel taxes, registration fees, and tolls.

Devolution of responsibilities to local governments would in many circumstances be in the public interest, if it were accompanied by adequate finance arrangements. When local governments provide facilities and services whose primary users are local residents, taxpayers are most likely to receive the kinds of

services they want and are willing to pay for. However, devolution of transportation programs may lead to finance and governance problems if revenue sources remain oriented toward state-level programs.

One popular way to fund expanded local transportation responsibilities has been adoption of new special taxes, with revenues dedicated for a specified term to a specified set of projects. Such taxes often require approval in statewide or local referenda. A study by the Surface Transportation Policy Project identified 41 such referenda on ballots in 2002: nine at the state level that would have authorized $77 billion of spending and 32 local referenda for $40 billion. (Not all were approved.) Most revenues were to be derived from dedicated taxes other than user fees. Such special taxes typically fund both transit and road projects. The growth in local dedicated taxes has been driven in part by growing local expenditures on transit and the absence of secure funding sources for transit analogous to the state and federal highway user fees dedicated to highways (Ernst et al. 2002, Goldman and Wachs 2003, McMillan 2004).

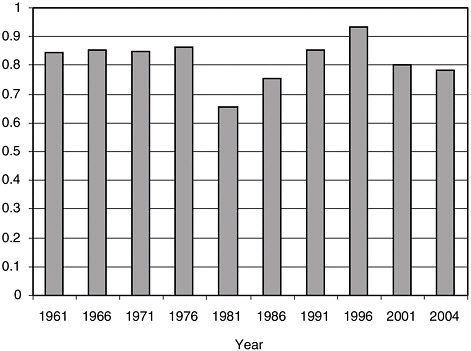

Nationwide, for highways only, the local government share of spending has averaged around 35 percent since the 1960s and shows no consistent trend (Figure 2-8). The ratio of highway user fee revenues to highway expenditures over the same period also shows no trend (Figures 2-9 and 2-10). Local governments

FIGURE 2-8 Ratio of local government highway, road, and street expenditures to total U.S. highway, road, and street expenditures, 1961–2004. (Sources: FHWA various years, Table HF-10.)

FIGURE 2-9 Ratio of highway user fee revenues to highway expenditures, 1961–2004. (Sources: FHWA various years, Table HF-10; FHWA 1997, Table HF-210.)

account for most spending not supported by user fee revenues. In 2004, local user fee revenue plus local highway grant receipts that derived from state and federal highway user fees equaled 32 percent of local highway spending (FHWA 2005a, Table HF-10). As a percentage of local spending, local user fee revenue plus grants from states has been declining slowly since the 1970s.

Local governments’ lack of reliance on user fees is the result of historical and practical circumstances. Local jurisdictions may lack legal authority to impose fuel taxes or vehicle fees, and motorists can easily avoid a local fuel tax if neighboring jurisdictions have lower rates. In general, fiscal competition among local governments makes them more susceptible than state governments to loss of a tax base when they try to increase revenue by increasing tax rates independently. In some instances, a local property tax assessment dedicated to streets or infrastructure may function essentially as a user fee—for example, in a suburban residential community where the streets to be maintained are primarily for local access, there is little through traffic, and household characteristics are somewhat uniform. Such taxes may be an entirely satisfactory means of paying for local streets, since replacing them with a fuel tax or a mileage fee might have negligible effects on street use or expenditures.

FIGURE 2-10 Highway user fee revenue and highway expenditures, 1961–2004. (Sources: FHWA various years, Tables HF-10, FE-10a.) Price index is gross domestic product implicit price deflator (BEA 2002, 135; BEA 2005, 188–189).

National totals obscure substantial state-to-state variation in relative local government shares and in the trend in state and local shares. Comparison of local government shares of transit plus highway spending in 1991 and 2002 in the United States and in the six states with the most spending illustrate the variation (Table 2-9).

As the two lines labeled “United States” in the table indicate, in 2002 state governments nationwide retained responsibility for 62 percent of highway spending (100 percent minus the 38 percent local share) and 51 percent of total highway and transit spending. In the United States as a whole and in five of the six states shown (all except Illinois), the local share of highway spending fell over the decade. For the total of highway and transit spending, the local share rose slightly nationwide (from 47 to 49 percent) and in three of the six states (California, Illinois, and Texas).

The magnitude of local government transportation responsibilities has led to calls for greater direct local control of revenue. For example, a 2004 paper published by the Brookings Institution (Puentes 2004), arguing for increased direct

TABLE 2-9 Total Spending and Local Shares for Highways and All Transportation, United States and Selected States, 1991 and 2002

local government control of federal grants, observes: “Metropolitan areas make decisions that dispose of only about 10 cents of every transportation dollar they generate even though local governments within metropolitan areas own and maintain the vast majority of the transportation infrastructure.” However, considering only highways, state governments in 2003 owned and operated roads that carried 64 percent of all vehicle miles of travel, and state government direct spending on highways was 64 percent of all highway spending (FHWA 2004, Tables HM-81, VM-1, HF-10). Thus by this measure at least, state and local resources may appear, on average, to be in line with state and local infrastructure responsibilities. As Table 2-2 shows, state governments collect nearly all nonfederal highway user revenues, but a third of these revenues are devoted by the states to local government grants or other local purposes (FHWA 2005a, Table DF). It is only when the state and local shares of transportation-generated revenue

(mainly derived from highways) are compared with their shares of total highway and transit spending that an apparent imbalance emerges.

In summary, when nationwide aggregates of highway spending and highway user-derived revenues are examined, neither devolution of responsibility to local governments nor decline in the ratio of user revenue to expenditures is evident. However, there may be a trend toward devolution of responsibility for the total of transit and highway spending in some states.

Revenue Adequacy

To many critics of the present finance system, the culmination of its structural flaws has been failure to generate sufficient revenues to keep up with growth in traffic and to replace aging facilities. Illustrating this view are two comments, the first by a Senate Environment and Public Works Committee staff member and the second by the president of the Motor Freight Carriers Association: “There’s a growing recognition that we need to begin to move to new approaches for financing…. The pay-as-you-go user fee that we’ve had in place since 1956 is not really up to the task” (McNally 2004) and “The inability of Congress to tax or not to tax, to toll or not to toll, makes it impossible to pay for a core program” (Wlazlowski 2004). The AASHTO Journal (2004) reports the conclusion of the Federal Highway Administrator in an address that the current fuel-tax-based system of financing highways is likely to fall short of covering identified needs, and a Brookings Institution study of fuel tax revenues concludes that because of stagnant revenues, “states do not have the financial wherewithal to address a wide variety of transportation concerns” (Puentes and Prince 2003). To clarify the basis for these concerns, this section describes aggregate trends in highway spending and highway system expansion compared with highway use, and contrasts these trends with experience in other industries.

As Chapter 1 explained, the committee did not interpret its task as finding revenue mechanisms that will support an increased level of spending for transportation. However, if the present funding arrangement has structural features that are causing its effectiveness as a means of raising revenue to decline, its viability would be questionable.

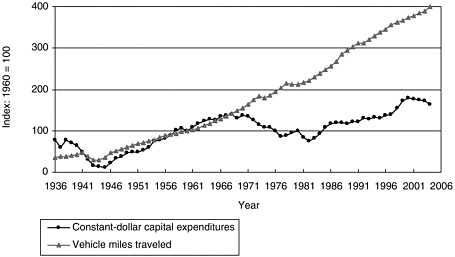

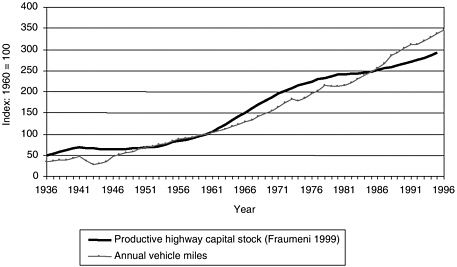

From the late 1940s to the 1960s, constant-dollar capital expenditures for highways grew at least as fast as did highway travel; since that time, while annual vehicle miles have steadily grown, the long-run trend in real capital expenditures appears nearly flat (Figure 2-11). This trend has been interpreted as evidence of chronic revenue inadequacy (e.g., CTI 1996, 16–17; Consdorf 2003). However, a constant rate of capital expenditures can yield growth in capacity if assets are long-lived. Economic measures of the capital stock of highways have been developed by the Bureau of Economic Analysis (BEA) (Katz and Herman 1997) and FHWA (Fraumeni 1999). The measures are derived from data on all past capital

FIGURE 2-11 Highway capital expenditures and vehicle miles traveled, 1936–2004. (Sources: FHWA various years, Tables HF-10, VM-1.) Price index is private nonresidential structures (BEA 2005, 188–189).

expenditures on streets and highways by all levels of government (expressed in constant dollars) and estimates of rates of depreciation (or of decline in productive capacity). The measures are intended as indices of capacity, in which different kinds of facilities are aggregated by weighting them according to the relative costs of providing them.

The measures from both these sources indicate that the stock of highways is growing. The BEA measure shows an average annual growth rate of 2.1 percent for capital stock between 1985 and 1995. The average annual growth rate for vehicle miles in the same period was 3.2 percent. The FHWA measure, which uses a definition somewhat different from BEA’s, indicates that net capital stock (defined as the sum of all past investment, less retirements, adjusted for efficiency decline of the stock as it ages) grew at an annual rate of 1.7 percent from 1985 to 1995, 1.3 percent from 1975 to 1985, and 5.1 percent from 1955 to1975 (Figure 2-12). Much highway capital expenditure today—for example, projects to widen lanes, improve roadway geometry, or improve traffic control—increases capacity but is not reflected in gross indicators of physical capacity like road miles.

A Transportation Research Board study of freight transportation capacity (TRB 2003, 54–55) pointed out that the pattern of an increasing ratio of output to infrastructure capital is not unusual in U.S. industry. The ratio of output to net capital stock of structures has been rising in the railroad industry, and another network industry, electric utilities, shows a similar trend. In the rail and electric utility industries, these trends are interpreted as productivity growth. Changes in ratios of output to infrastructure capital in the three industries from 1959 to 1995

FIGURE 2-12 Net capital stock of highways and streets; annual vehicle miles, 1936–1996. (Sources: FHWA various years; Fraumeni 1999.)

were as follows (Fraumeni 1999; Katz and Herman 1997; EIA 2002, Table 8.5; Wilson 2001):

|

Industry and Ratio |

Change (%) |

|

Highways [annual VMT/(productive capital stock)] |

+16 |

|

Railroads [annual ton-miles/(structures net capital stock)] |

+360 |

|

Electric utilities [annual electric energy consumption/(utility net capital stock)] |

+200 |

This comparison suggests that relatively lackluster productivity growth in the highway industry may merit concern. Highway productivity could be increased by concentrating investment in the most valuable projects; improving traffic management through better engineering or through pricing; and adopting more cost-effective design, construction, and maintenance practices.

Trends in spending, investment, and capital stock relative to traffic volume are useful as indicators of changes in underlying economic and political factors that drive transportation system development but cannot by themselves provide guidance on appropriate levels of spending. An investment rule that called for increasing capital spending, capital stock, or lane miles of roads at the rate of increase of traffic would yield poor results, since such a rule would fail to take intoaccount the circumstances that determine the return on highway investment. These circumstances include the capacity and condition of the highway system at the outset of the period under consideration (e.g., whether it was over- or underbuilt), the possibility of economies of scale as the system expands,technological progress and

improvements in operating practices that allow growth in the productivity of infrastructure, and rising costs of providing infrastructure. As the cost of incremental expansion of capacity increases, providing levels of service that were considered normal in the past may lose economic justification. Chapter 3 will examinethe available evidence on whether highway investments that would yield worthwhile benefits are not being made for lack of funds.

Revenue Stability

The transportation finance system has also been charged with failure to provide stable funding, because revenues depend on unpredictable external events like petroleum market developments and automotive fuel economy trends (Giglio and Williams 2001, 200). A more common view may be that stability and predictability are among the strengths of the user fee–trust fund mechanism compared with funding dependent on annual legislative appropriations, even though lags between changes in the external factors affecting fuel tax revenue and legislative adjustments of rates have at times disrupted funding. Constant-dollar highway capital spending declined severely from the mid-1970s through the early 1980s but recovered later (Figure 2-11). The same trough is evident in trends in the rate of growth of capital stock (Figure 2-12), in constant-dollar highway user revenues and the ratio of revenues to spending (Table 2-3), and in the average highway user fee per mile (Figure 2-1). These disturbances resulted from the impact of high inflation on constant-dollar fuel tax revenue, rising motor vehicle fuel efficiency driven by fuel economy regulations and fuel prices, and slower growth in driving as a result of higher costs and economic recession. State legislatures and Congress eventually responded with increases in nominal tax rates (Figure 2-6). Reducing the risk of unintended funding disruptions in the future might be a worthwhile goal of reforms to the transportation finance system.

REFERENCES

Abbreviations

AASHTO American Association of State Highway and Transportation Officials

APTA American Public Transit Association and American Public Transportation Association

ARTBA American Road and Transportation Builders Association

BEA Bureau of Economic Analysis

BTS Bureau of Transportation Statistics

CBO Congressional Budget Office

CTI Commission on Transportation Investment (California)

EIA Energy Information Administration

EPA Environmental Protection Agency

FHWA Federal Highway Administration

FTA Federal Transit Administration

GAO General Accounting Office

HUF Highway Users Federation

IWR Institute for Water Resources

TRB Transportation Research Board

USDOT U.S. Department of Transportation