4

Institutional Considerations and Changing Impacts

The previous two chapters identified the demand- and supply-side options for replacing the generating capacity of the Indian Point Energy Center’s two operating nuclear re-actors. Putting these options into action in planning and administering the New York Control Area (NYCA) electrical system must be done in the context of economic, social, and institutional impacts as well as with regard to the technological opportunities and constraints. This chapter reviews the most significant general, statewide considerations:1

-

Financial underpinnings of the electrical supply system (that is, how the various organizations that generate, transmit, and distribute power underwrite the necessary investments to ensure reliable service) and how that relates to the evolving institutional structure in New York State; and

-

Environmental and other impacts that affect society.

REGULATION, FINANCE, AND RELIABILITY

Financial and economic considerations will have a profound effect on the choice of options to replace Indian Point, the reliability of the system, and the costs of substituting generation or transmission options for the Indian Point units. Procedures for maintaining the reliability of the New York State system are discussed mainly in Chapter 5.

The New York State Electricity Market

The impact of the replaced costs of the Indian Point units if they are shut down is dictated by the evolving New York State competitive market and by the socioeconomic background in the state. Indian Point’s replacement costs to the customer are virtually impossible to project at present, given the electricity market operation and its evolving status. The reasons are summarized in Boxes 4-1 and 4-2, on the cost of replacing Indian Point: “In Theory” and “In Practice.”

This section provides background information on the regulatory and financial environment in New York State and on how this environment shapes the incentives for investing in generation and transmission facilities. It also explains why there are growing concerns about the continued reliability of electricity supply, particularly in New York City. Appendix E, “Paying for Reliability in Deregulated Markets,” gives a fuller account of how the regulation of the electric utility industry in New York State has changed and the implications of these changes for reliability.

In response to a number of financial problems, such as the cost of building excess generating capacity in the 1980s, the Federal Energy Regulatory Commission (FERC) supported new legislation in the 1990s to facilitate increased competition in the electric power industry. Competition was introduced initially in the northeastern states and in California, regions that had relatively high prices for electricity under traditional regulation. In 1999, regulators in New York State took the first major step by introducing new markets for electricity (real energy) and ancillary services, such as reserve generating capacity. At the same time, the New York Independent System Operator (NYISO) was established to run these new markets and to control the operation of all power plants in the New York Control Area. Unlike the generation components of the industry, the transmission and distribution components continued to be regulated by the New York Public Service Commission (NYPSC).

Appendix E explains that the current patterns of spot prices in the NYCA have changed and are now much less volatile, with fewer price spikes than when the market was first introduced in 1999. This change in price behavior has made prices more predictable, but at the same time it has reduced the financial earnings of peaking capacity (generating units that are used only to meet relatively short periods of peak demand and therefore have low capacity factors) relative to those of baseload capacity. The consequences of

|

BOX 4-1 The Cost of Replacing Indian Point: In Theory The cost of replacing Indian Point is substantial because its two operating nuclear reactors, Units 2 and 3, represent 2,000 megawatts (MW) of baseload capacity with relatively low operating costs. In addition, a large capital investment of these units has already been made. To the extent that a replacement strategy includes conventional generating capacity (e.g., using natural gas as a fuel), the incremental cost of building this new capacity will include the capital costs, and in addition, the operating costs will be higher. Under traditional regulation, all of these incremental costs would be passed on directly to customers in New York State. Although someone has to pay for these higher costs, customers may not see major increases in their monthly bills in the new deregulated market in the state. How is this possible? An explanation follows using a simple example of the magnitudes of the costs involved. Let us assume that the full operating costs of Indian Point are $20 per megawatt-hour (MWh) and that the units operate for a total of 8,000 hours per year. These operating costs would include the nuclear fuel, labor, and capital costs for operations and maintenance (which might require adding a cooling tower in the future), and payments into a sinking fund to cover decommissioning as well as a charge paid to the federal government to cover the cost of disposing of nuclear waste. Since Indian Point has a capacity of 2,000 MW, the total annual cost of operations is $320 million per year (20 x 2,000 x 8,000). The average wholesale price of electricity in New York Control Area Zone H was $80 per MWh in 2005 (when the price of natural gas was substantially higher than historical levels). Consequently, the annual revenue, if all power had been sold in the wholesale market, would be $1,280 million per year (80 x 2,000 x 8,000) and the annual earnings for Entergy Corporation (the plant’s owner) would be $960 million per year (1,280 – 320). The situation is more complicated in reality, because Entergy may have long-term contracts to sell some of the power at prices below the current high level in the wholesale market. Nevertheless, these contracts will have to be renewed periodically, and with high prices for natural gas, Indian Point represents a very valuable source of income for Entergy. To keep the example simple, let us assume that Indian Point is replaced completely by 2,000 MW of combined-cycle capacity using natural gas as a fuel. The operating cost of these units is $60 per MWh, and the annualized capital cost is $120 per kilowatt per year (kW/year). These units will also operate for 8,000 hours per year, and as a result, the capital cost prorated to the annual amount generated corresponds to $15/MWh (120,000/8,000). The total annual cost of generation is $1,200 million per year ([60 + 15] 2,000 x 8,000), and the incremental cost of replacing Indian Point is $880 million per year (1,200 – 320). That is a very large amount of money, but it could be much lower for a number of valid reasons. For example, reducing load by improving the efficiency of appliances is shown in Chapter 2 of this report to be much more cost-effective than building new generating capacity, and the transmission upgrades discussed in Chapter 3 may allow existing units in other locations to generate more power. Under traditional regulation, all prudent operating costs and capital costs for generation, transmission, and distribution are aggregated to determine the size of the revenue requirement and the corresponding retail rates charged to customers.1 In a competitive market for generation, the most expensive unit needed to meet the load sets the wholesale price paid to all units that are generating in the market (prices actually vary from location to location owing to congestion on the transmission lines, but this is not an important issue for this example). When an expensive peaking unit sets the price on a hot summer day, the wholesale price paid to generators is much higher than the operating costs of most units. This “extra” income can be used to cover the capital cost of generation. In theory, the wholesale price in a competitive market should cover all of the operating and capital costs of generation, but, as explained in this chapter and in Appendix E, “Paying for Reliability in Deregulated Markets,” a truly competitive market will not cover the capital cost of a peaking unit unless high prices (scarcity prices) are allowed. However, the total cost of the combined-cycle unit in this example ($75/MWh) is covered by the wholesale price ($80/MWh). Although these results are clearly sensitive to the assumptions made, this specific example shows that it is quite possible in a competitive market to add new generating capacity without increasing the wholesale price. In fact, the simulated market prices in some of the scenarios presented in Chapter 5 are lower when new generating capacity is added. The reason is that the new efficient units displace some generation from existing units that are more expensive to operate, and the more efficient units set the market price more frequently. Who does pay for the incremental cost of replacing Indian Point in this example, if customers still pay the same wholesale price as before? The main loser in this example is Entergy, because the substantial annual earnings from Indian Point have now been eliminated. Given the many complexities of determining costs, such as the effect of increases in the use of natural gas on the future price of natural gas, it is extremely difficult to measure the true cost to customers of replacing Indian Point. The most important complications about determining this cost are discussed in Box 4-2. The main point of the present example is to show that the current wholesale price of electricity in the New York market may cover a large part of the incremental costs of replacing Indian Point. In a competitive market, the financial consequences for customers are likely to be smaller than the consequences would have been under traditional regulation. There is, however, an important qualification that should be made. The example here and the scenarios presented in Chapter 5 assume that new generating capacity will be built in a timely way before Indian Point is retired. If Indian Point experienced an unscheduled failure and had to be taken off-line in an emergency, the wholesale price would increase substantially. Without Indian Point and without new capacity, more-inefficient units with higher costs would have to be used to meet load. These expensive units would set higher wholesale prices. |

|

BOX 4-2 The Cost of Replacing Indian Point: In Practice Although the cost of building and operating new electric generating capacity to replace some or all of the 2,000 MW at the Indian Point Energy Center would be substantial, it is very difficult to determine what the overall effect would be on the bills paid by customers. The committee’s scenarios, presented in Chapter 5, project the basis for the wholesale market prices in different zones. Generally, these prices are higher than the prices in the base case with Indian Point operating, but in some situations they are lower. The explanation for getting lower wholesale prices is that new efficient capacity displaces some of the old inefficient capacity and sets the market price more often. The pricing mechanism used in all of the scenarios is based on a uniform-price auction assuming that the market is competitive (i.e., that the offers submitted into the auction by generators are equal to the true production costs, and under this specification, it would be extremely unlikely for the market price ever to be set by the low production cost of Indian Point). Assuming that the market is competitive is a reasonably close representation of how the market is actually performing at this time. Hence, the predicted prices in the scenarios provide a consistent way to determine how wholesale prices would be affected in different situations. Higher wholesale prices would result in higher rates charged to customers unless there was an offsetting reduction in the other costs of generation. The main complication for determining the total cost of generation in the current market structure is that the wholesale price of electricity is only one of the components of the total cost. It would be necessary to determine how the costs of the other components would change to get a complete accounting of the effects of replacing Indian Point. Some of these costs are set by regulators and are subject to change. Consequently, unlike modeling wholesale prices, there is no consistent structure for modeling the other costs, and it is virtually impossible to predict how they would change in different scenarios. The best examples of the other costs of generation are (1) payments for availability in the installed capacity (ICAP) market, and (2) payments for reserve capacity. In addition, the discussion of reliability in this chapter explains why the current structure of markets is still not providing sufficient incentives for new merchant projects. The implication is that investors will have to be paid some form of additional premium above the revenue received from the existing markets if new capacity is going to be built. In the long run, customers will have to pay for all of the additional costs of generation as well as for purchases in the wholesale market. Information on the performance of the wholesale market is readily available, but information about the other costs of generation is much more limited. Patton (2005, pp. 22-25) provides a valuable discussion of the performance of the ICAP and reserve markets; in that report, Section F, and Figure 16 in particular, shows a “net revenue analysis” of the annual net revenue (revenue minus production costs) in 2002-2004 for a combined-cycle turbine and a combustion turbine in different locations. For generators in New York City, the ICAP market is the primary source of net revenue for combustion turbines (roughly $140,000 per year per MW out of a total net revenue of $160,000 per year per MW in 2004) and a major source for com-bined-cycle turbines (roughly $140,000 per year per MW out of a total net revenue of $260,000 per year per MW in 2004). The net revenue from the ancillary service markets (e.g., reserve capacity) is small for both types of turbine (roughly $10,000 per year per MW). The net revenues for generators on Long Island are similar to the levels in New York City, but for upstate generators, the net revenue from the ICAP and reserve markets is very small (roughly $25,000 per year per MW). The discussion above is relevant for assessing the cost to customers of replacing Indian Point because it shows the importance of the location of capacity on the magnitudes of the “other” costs of generation. In New York City and Long Island, customers will eventually have to pay the relatively high wholesale prices for all of their purchases (the annual average prices in 2005 were $83 per megawatt-hour (MWh) and $98/MWh, respectively, compared to prices ranging from $65/MWh to $72/MWh in Zones A through F upstate) and the high other costs of generation for all generating capacity in New York City and Long Island (Zones J and K). New capacity that is built in zones other than J and K will incur relatively low costs in the ICAP and reserve markets but may require a higher premium to make them financially attractive (i.e., because the net revenue from the existing markets will be low). It is beyond the scope of this study to try to determine the net effect of these offsetting factors. The current regulatory strategy in the ICAP market is to make all generating capacity in a region eligible for capacity payments. Hence, the relatively high prices for capacity in Zones J and K are paid to all installed capacity that have offers accepted in the ICAP auctions for those zones. Nevertheless, it is probable that additional premiums will have to be paid to get new merchant capacity built. An alternative regulatory strategy is to direct capacity payments to cover the premium for new capacity, and possibly for existing capacity that operates most of the time at a minimum level but is still essential for reliability. This alternative strategy may be a less expensive way to maintain reliability in the long run, because making capacity payments to all installed capacity in the current ICAP market places no obligation on existing generators to build new capacity. Once again, there is a lot of uncertainty about how regulators will decide to deal with current concerns about reliability and what the additional costs will be above the price in the wholesale market. |

this type of change in price behavior have been discussed extensively in the regulatory literature. Competitive spot prices will provide enough income to cover the operating cost of peaking capacity but not the capital cost, and as a result, the owners of peaking capacity do not earn enough in the spot market to be financially viable.

There are various ways to provide additional income to generators, but the current projections of installed generating capacity made by NYISO suggest that the market procedures adopted in the NYCA have not been entirely effective. In particular, installed capacity in the New York City metropolitan area could fall below the level needed to meet industry standards for reliability by 2008 (NYISO, 2005). Regulators had not anticipated this situation only a year ago. The outlook in 2004 indicated that sufficient new generating units had been approved and were expected to be completed in the near future so that standards for reliability in the NYCA would be exceeded for another 10 years. Subsequently, many of the proposed new generating units were delayed indefinitely, owing to the unfavorable market conditions faced by investors.

Given the size and importance of the financial, commercial, and residential sectors in the New York City region, the very high cost of blackouts makes it essential to maintain a reliable supply of electricity to customers in the region. Evidence from other published studies demonstrates that the value of avoiding a blackout is likely to be many times the typical wholesale price of electricity (Hamachi LaCommare and Eto, 2004). In other words, customers are willing to pay a substantial amount to ensure that the supply of electricity is reliable, and the current industry standard of limiting out-ages to less than 1 day in 10 years, established by the North American Electric Reliability Council (NERC), is consistent with this high value of reliability (NERC, 2004). The possibility that reliability in the New York City region will fall below the industry standard by 2008 presents a challenge that regulators will have to address in the near future (NYISO, 2005).

Before new ways are considered to supplement the earnings of generators in the spot market, it is important to identify three assumptions that have been adopted by regulators in the NYCA, which have limited the effectiveness of market forces in maintaining reliability, as explained in Appendix E. These assumptions, which are consistent with the NYISO planning strategy,2 are

-

That setting minimum levels of installed generating capacity is an acceptable proxy for meeting the NERC standards for reliability in the NYCA,

-

That setting locational requirements for generating capacity in New York City and Long Island is an acceptable way to offset the limitations of the legacy transmission system into the New York City region,3 and

-

That the political realities in the NYCA make it infeasible to allow high price spikes in the spot market above short-run competitive levels as a way to supplement the earnings of generators.

By accepting the first two assumptions, regulators have reduced the problem of determining how to maintain the reliability of supply to one of simply ensuring that requirements for installed generating capacity in New York City and Long Island, and the reserve margin requirement for NYCA, are met. Clearly, this transformation of concerns about the reliability of supply to concerns about minimum levels of generating capacity (generation adequacy) is more likely to be economically efficient when the transmission system is relatively robust and the availability of generating capacity is the main limiting factor. This is no longer the case in the NYCA, given the structure of the legacy transmission system and the size and location of New York City. Nevertheless, regulators have accepted the assumption that meeting locational requirements for generating capacity is an effective strategy for meeting the NERC reliability standards. By focusing on generation adequacy, however, the current regulatory practices followed in the NYCA, using the NYISO planning models adopted in Chapter 5, estimate the required levels of generating capacity. This modeling framework tends to discount the potential value of upgrades to the transmission system as a way to improve the reliability of supply. However, alternative planning models could be adopted that, in principle, would treat generation and transmission in a more integrated way. The development of such models was beyond the scope of this analysis.

By adopting the third assumption—that it is desirable to maintain short-run competitive spot prices—regulators have ensured that earnings for some peaking units that are needed for operating reliability will be insufficient to make them financially viable.

Two distinct ways to address the economic problem of funding sufficient capacity are under discussion. The first is to supplement the profits earned in the spot market for all generating units by providing enough additional income from another source to cover the “missing” capital costs. The second is to use targeted contracts, such as Power Purchase Agreements (PPAs), with sufficient generating units to meet reliability standards.

Regulators in the NYCA have chosen the first approach, because they apparently consider that it is economically fair for both the owners of installed generating capacity and po-

tential investors in new capacity. In contrast, contracts with some but not all generators are inherently discriminatory and may distort market behavior. Although the basic rationale for these arguments is consistent with regulatory theory, there is still no guarantee that the approach chosen by regulators for maintaining reliability in the NYCA will be either effective or economically efficient.

In other electricity markets (e.g., Australia), short-term price spikes in the spot market are acceptable to regulators so long as the average spot prices are competitive. Discussions are under way in Texas on adopting a similar approach. The regulatory focus in this type of market is on maintaining long-run competitive prices, rather than short-run competitive prices, and the effect is to make the earnings of generators correspond more closely to the true costs of production, including the capital costs. In the NYCA, however, regulators appear to try to avoid high price spikes in the spot market. Given this restriction, one possible way to recover the missing capital costs for peaking units is through a separate market for generating capacity.

The approach just described has been proposed by regulators in the three northeastern power pools. At this time, NYISO is the only one of the three to fully implement such a capacity market. There is still a considerable amount of political opposition to the proposal in New England, and there is an ongoing debate about it among stakeholders in the “Pennsylvania Jersey Maryland” (PJM) power pool. To provide a perspective on current conditions in the NYCA, it is important to understand why there is so much controversy about the effectiveness of capacity markets as a way to provide the incentives needed to initiate merchant investments in new generating capacity.

Initially, the installed capacity (ICAP) market run by NYISO was simply an auction for availability, designed to ensure that enough installed generating capacity would be available to meet the projected loads in New York City, Long Island, and the NYCA for a few months ahead. In general, this type of ICAP market does provide additional earnings for generators; these earnings may be significant for the continued financial viability of some peaking units. On the one hand, for example, the existence of the ICAP market may result in some units being available instead of unavailable, and it may also delay the retirement of some units. On the other hand, the extra earnings from the ICAP market are really a bonus for other generating units, such as nuclear and hydro units, because these units would be available anyway without the ICAP market. Nevertheless, regulatory theory implies that all generators should be eligible for participation in the ICAP market, and this issue is not the major source of controversy among regulators.

The main controversy about the ICAP market arises when the objectives of this market are extended to deal with the construction of new generating capacity. The following three limitations of an ICAP market in providing incentives for potential investors are explained more fully in Appendix E:

-

The time horizon in an ICAP market does not extend far enough into the future to meet the needs of investors.

-

It is unrealistic to place the primary responsibility for maintaining generation adequacy (and by assumption, system reliability) on load serving entities (LSEs).

-

There is no legal requirement that any of the additional earnings from an ICAP market be used to build new generating capacity when and where it is needed.

The basic structure of the ICAP market in the NYCA is that regulators have placed a legal obligation on buyers (LSEs) to purchase enough generating capacity to meet their projected load plus a reserve margin before the spot market for electricity clears. (LSEs can also meet some of their own capacity requirements if these sources are certified by NYISO.) The final monthly auction in the ICAP market clears a few days before the month begins. It represents the last chance for LSEs to meet their capacity obligations without paying a substantial penalty.

The final monthly ICAP auction includes a specified “de-mand curve” that is designed to ensure that the market price of capacity is equivalent to the capital cost of a peaking unit if the total supply of capacity in the ICAP auction falls to the minimum amount needed to meet the regulated standards of generation adequacy. The market price will be higher (lower) if the total capacity offered is lower (higher) than the required amount. The basic objective of the current ICAP market is to make the market price of capacity cover the missing capital cost of a peaking unit when the market is economically efficient (i.e., when the total supply of capacity is equal to the amount needed for adequacy).

The financing of new generation and transmission facilities in the NYCA, whether it is needed to accommodate the retirement of existing facilities, the projected growth of load, or the intentional shutdown of Indian Point Units 2 and 3, must be understood in the context of the current hybrid mix of competitive markets and regulatory interventions that has resulted from the restructuring of the electric sector. Proposals to build new generation and transmission facilities are no longer preapproved by the New York Public Service Commission with the implicit guarantee to investors that all prudent production costs and capital costs will be recovered from customers. Investors face “regulatory risk” due to concerns that current market rules may be changed in the future, as they were after the energy crisis of 2000 and 2001 in California, as well as competitive risk. Risk increases the financial risk of an investment in new generating capacity, implying that the cost of borrowing capital for investors will be substantially higher than it would be under regulation.

Market forces have been able to maintain adequate levels of generation with relatively little regulatory intervention in Australia, for example, but not in the NYCA. Appendix E explains why the successful efforts of regulators to maintain short-run standards of economic efficiency in the spot market have undermined the financial viability of generating

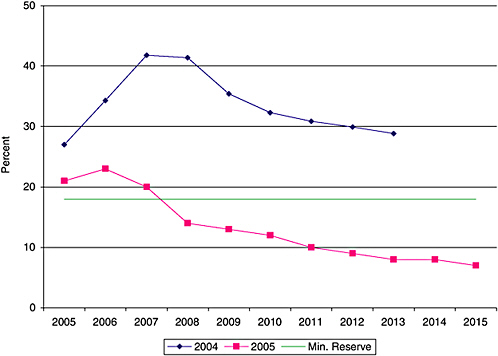

FIGURE 4-1 Projections made by NYISO in 2004 and 2005: summer reserve margin for generating capacity in the New York Control Area.

SOURCES: Projections made in 2004 from NYISO (2004), Table V-2; those made in 2005 from NYISO (2005), Table 7.2.1.

units that are needed for reliability (i.e., units with low capacity factors). This change in the pattern of spot prices has reduced the earnings of peaking units relative to baseload units and, coupled with the current uncertainty about the future prices of fossil fuels such as natural gas, has led to delays in the construction of new facilities already licensed in the NYCA.

The deteriorating outlook for reliability in the NYCA is best summarized by the drop in projected reserve margins for generating capacity from the forecast made in 2004 to that in 2005. A year ago as of this writing, in 2004, the reserve margin in 2008 was expected to be over 40 percent; however, the 2005 projection for 2008 was less than the 18 percent needed to meet the NERC reliability standards.

Figure 4-1 shows the two projections of reserve margins for the summer peak load in the NYCA that were published by NYISO in 2004 and 2005. The drop in the projected reserve margins shown in the figure was caused by delays in the construction of new generating units that had already received construction licenses. The lists of potential new generating units underlying the two projections of reserve margins in 2004 and 2005 are essentially the same, but the “Proposed In-Service” dates are quite different. In 2004, 2,038 MW were under construction (four units); 3,120 MW were approved (seven units); and 1,605 MW had applications pending (two units), for a total of 6,763 MW. Five of the nine projects (2,430 MW) with applications approved or pending had proposed in-service dates no later than 2007. However, although the amount of capacity under construction was still 2,038 MW in 2005, none of the other nine projects had proposed in-service dates, and under current market conditions, there is no guarantee that any of these generating units will actually be built.4

The current concern about meeting the levels of generation adequacy needed to maintain reliability in the NYCA coincides with two important changes in regulatory procedures and responsibilities. First, a new Comprehensive Reliability Planning Process (CRPP) was implemented by NYISO in 2005; the new forecasted reserve margins for 2005

|

4 |

The time frame for deciding on alternatives is not known. However, NYISO is sufficiently concerned about the delays or cancellation of new generation capacity to have requested proposals for alternative solutions for addressing electricity supply, especially for the New York City area as discussed in Chapter 5. |

shown in Figure 4-1 were produced for the CRPP. The second regulatory change is that the Energy Policy Act of 2005 has given FERC stronger oversight responsibilities for maintaining reliability standards for all users of the bulk power system in the United States. Under this legislation, FERC is permitted to pass these responsibilities to a single Electric Reliability Organization (ERO) that will determine explicit reliability standards and also have the authority to enforce them.

When uncertainty about the retirement dates of existing generating units in the NYCA is combined with uncertainty about whether new generating units will be built, the task of ensuring that there will be enough installed generating capacity to meet reliability standards is very challenging. Nevertheless, reliability standards must be met because the cost of blackouts in a dense urban area like New York City is so high. Although the importance of maintaining reliability has been recognized in the implementation of the CRPP and the Energy Policy Act of 2005, it is still too early to know exactly how regulators will meet their new responsibilities and use their new authority. Nevertheless, it is clear that the objective of meeting reliability standards is a high priority at both the state and federal levels, as it should be.

The current pessimistic outlook for maintaining reliability standards in the NYCA also poses a challenge for this committee. Although the committee is convinced that regulators should place the highest priority on maintaining reliability, the committee’s responsibilities do not include making specific recommendations about how this should be done. Since the current projections of installed generating capacity fall short of the minimum levels needed for generation adequacy, the first step in evaluating alternatives to Indian Point is to specify a new scenario that does meet reliability standards with Indian Point operating. The assumptions used to specify this scenario are discussed in detail in Chapter 5 of this report.

The Permitting Process with Article X

The committee is aware that New York State will face a formidable task in constructing sufficient power plants to satisfy the continued load growth being experienced in the state and to replace old power plants that are to be retired for various reasons. Early retirement of Indian Point would add to those problems, whichever options are selected. A business-as-usual approach is unlikely to achieve the additional capacity that would be required. The siting of new major electric generating facilities would be facilitated if the State of New York reauthorized Public Service Law Article X, which expired on January 1, 2003.5

Article X had centralized the process of environmental permitting for electric power plants and provided for a firm, finite schedule for the approval or denial of environmental permits, limiting the risks of delay. This approach grew in importance with the restructuring of the electric power sector. Before restructuring, the monopoly franchise utility would propose a project based on the need to meet local loads, and the appropriate regulatory body (e.g., the NYPSC) approved or denied the proposal. In this approach, additional costs imposed on the utility company by environmental regulatory requirements or delays could be (and usually were) passed on to ratepayers. Now, the costs and risks of power plant development fall to private developers, who seek to be compensated in the marketplace—which may be intolerant of any additional expenses due to delays or other contingencies.

While it was in force, Article X set forth a review process for consideration of applications to construct and operate electric generating facilities of 80 MW or more. An approval would result in the applicant being granted a Certificate of Environmental Compatibility and Public Need, which is required before the construction of such a facility.

Most of the review under Article X is conducted by two examiners, one from the New York Department of Public Service and one from the New York Department of Environmental Conservation (NYDEC). Numerous opportunities for public involvement in hearings and other proceedings existed, and the applicants were required to pay fees that inter-veners could use, with permission of the examiners. Municipalities and individuals within a 5-mile radius of the proposed facilities were granted routine intervener status.

Within a year of receipt of the application, the Board on Electric Generating Siting and the Environment was required to make a decision. This board consisted of the chair of the New York Public Service Commission, the chair of the New York State Energy Research and Development Authority (NYSERDA), the commissioners of NYDEC, the New York Department of Health, and the New York Department of Economic Development, plus two public members who reside near the proposed facility and are appointed by the governor.

For example, in 2000 the board granted the Athens Generating Station a certificate (Board on Electric Generating Siting and the Environment, 2000). Topics that the board considered included the legality of the application and review process, regional and local aquatic impacts (including erosion control and deposition of pollutants), the visibility of the plant and stacks to the public (especially from historic sites), the visibility of the proposed cooling-tower plume, air quality, terrestrial biology, chemical storage and waste management, impacts on agricultural lands, noise, traffic, land use (including wetlands mitigation), public interest concerns (including the enhancement of competition, alternative sites, electrical interconnection, and local taxes), and the status of

|

5 |

For additional information, see http://www.dps.state.ny.us/articlex_ process.html. Accessed January 2006. |

required permits. During the process, many interveners participated; they and the applicant agreed to many changes in plant design, some of which were fairly expensive. Important changes included shorter stacks, the use of dry cooling, the use of state-of-the-art emissions controls, and payments to mitigate various impacts. The board also imposed several conditions on the applicant in its approval.

Since the expiration of Article X, electric generating project developers must obtain all of the appropriate local and state permits and approvals and must undergo environmental review subject to the State Environmental Quality Review Act (Article 8 of the Environmental Conservation Law). Project developers may also obtain a Certificate of Public Convenience and Necessity, based on the traditional approach to adding electric generating capacity. New York’s Governor George Pataki and several state legislators have proposed new laws to replace Article X, but there is none currently in place.

Industry groups (e.g., the Business Council of New York State) have promoted a new siting law, while some advocacy groups (e.g., the New York Public Interest Research Group) have expressed concerns. One specific concern is about whether or not the local community must give its permission for a new plant. Under Article X, municipalities could participate in the process, but the final decision was made by the board.

If action is taken to reauthorize Article X, the following issues, among others, could be considered:

-

The addition of modifications and measures to Article X’s procedural requirements that would enable the siting board to streamline its review when interested parties, including affected communities groups, had reached a consensus as to the specific issues presented by an Article X application.

-

The appropriateness of developing specific procedures with respect to the expansion, modification, or repowering of existing major generating facilities.

In addition, the committee suggests consideration of the reauthorization of Article 6 of New York’s energy law, for statewide energy planning, that expired on January 1, 2003.6 In addition to statutory modifications, the following administrative steps might be taken:

-

The Energy Planning Board could meet annually to coordinate the development and implementation of energy-re-lated strategies and policies, receive reports from the agen-cies’ staffs on the compliance of major energy suppliers with its information-filing requirements, and receive summary reports on the information filed.

-

The information-filing regulations of the Energy Planning Board could be modified to recognize new entrants into the energy marketplace and the need for pertinent energy-related information and data.

SOCIAL CONCERNS

The social concerns considered here are environmental impacts, energy security, and indirect socioeconomic factors, including impacts on the affected communities. The concerns can have a significant effect on what sort of facilities can replace Indian Point and where they can be built.

Environmental Regulation

All energy technologies have environmental impacts. Replacement technologies discussed in Chapters 2 and 3 include efficiency and distributed generation,7 natural-gas-fired turbines, and, potentially, coal-fired generation (any new coal plants are likely to be upstate or out of state, with long-distance transmission). Replacing the Indian Point nuclear power generators with a different type of electricity supply may reduce some environmental effects but may increase others. In contrast, energy-efficient technologies reduce the need for both capacity (megawatts) and energy (megawatt-hours) and thus tend to reduce environmental impacts (unless their manufacture, recycling, or disposal is problematic).

In New York as elsewhere in the United States, a complex set of regulations and permit requirements are in place to manage these effects and to ensure that they impose a minimal burden on the public and the environment. Environmental effects of nuclear power plants associated with plant construction, fuel production, and disposal of radioactive waste have been evaluated extensively elsewhere (e.g., McFarlane, 2001; NRC, 2001, on spent fuel disposal) and are outside the scope of this study. In normal operation, nuclear power plants such as those at Indian Point emit very little air pollution. Large releases of radionuclides might occur as the result of an accident or attack (Farrell, 2004b), but that potential has a relatively low probability. Indian Point does have a significant impact on the Hudson River, as discussed in the subsection below, on “Water Use.”

The most significant pollutants from natural-gas com-bined-cycle plants, the most likely fossil-fueled generation replacement for Indian Point, are nitrogen oxides, NO and NO2 (designated as NOx), and, to a much lesser extent, car

bon monoxide (CO), volatile organic compounds (VOCs), and particulate matter (PM) (e.g., Barboza et al., 2000). However, emissions of all of these pollutants are sufficiently low from gas turbines or can be controlled sufficiently well so that it is quite feasible to obtain air quality permits which guarantee plant operation that protects human health and the environment (U.S. EPA, 1997). Carbon dioxide emissions, currently not regulated, are discussed below.

The effect of possible replacements for the Indian Point reactors on a broader size range of particulate matter (PM10) emissions is likely to be small because of (1) permitting requirements that will require low emission rates and a tall stack to control local effects, and (2) emission-reduction offset requirements that will yield a net decrease in regional emissions of PM10. For the more important emissions of the smaller particulate matter (called PM2.5), the effect on mass emissions is largely determined by SO2 and NOx emissions, which, on a regional basis, will be unaffected owing to the emissions caps imposed on the electric power sector for these pollutants.

Three important pollutants from power plants, including coal-fired units, are or will be controlled by cap-and-trade programs: NOx, sulfur dioxide (SO2), and mercury (Hg) (U.S. Congress, 1990; Farrell, 2004a).

Both NOx and SO2 can have direct negative effects on human health, and so are “criteria pollutants,” with their own standards under the federal Clean Air Act. Southeastern New York (and, in fact, the entire country) has attained healthful air quality for NOx and SO2 and is classified as “in attainment” of the National Ambient Air Quality Standards (NAAQS) for these pollutants. Nitrogen oxides and SO2 contribute indirectly to two other criteria pollutants, ozone (O3) and particulate matter. The former is produced in the atmosphere through photochemical reactions of NOx and VOCs. The latter involves nitrate and sulfate formation from oxidation of the two gases in the air forming condensable material as PM. Measured O3 and PM2.5 concentrations in various cities have resulted in local nonattainment of the NAAQS for these pollutants, including cities in some parts of southeastern New York. The nonattainment designation requires the state to provide plans for achieving attainment, which in turn requires reductions in NOx and SO2 concentrations well below levels otherwise required. These requirements affect choices of power plant technology using fossil fuels.

The attainment of the NAAQS for NOx (as NO2) and SO2 has been achieved locally through the use of cleaner fuels, improved combustion technologies, and combustion by-products emitted well above ground level, to disperse and dilute remaining emissions. As with PM and CO, the regulatory process to approve new power plants involves atmospheric modeling to set emissions limitations and stack heights in order to help ensure that there are no local health impacts from the expected NOx and SO2 emissions. A new power plant would also be required to offset its emissions and retire emission “credits” equal to 30 percent of those emissions, creating a net reduction in regional NOx and SO2 emissions.

Nitrogen oxides and SO2 contribute not only to local issues, but also to larger-scale (regional) environmental problems of tropospheric ozone, fine particulate matter (PM2.5), acidification of sensitive ecosystems, and (in the case of NOx) eutrophication (Regens, 1993; Chameides et al., 1994; Jaworski et al., 1997; Tucker, 1998; Solomon et al., 1999; U.S. EPA, 2000; Mauzerall and Wang, 2001; Streets et al., 2001; Farrell and Keating, 2002; Creilson et al., 2003). In order to manage these regional problems, additional controls for NOx and SO2 are superimposed on controls designed to ensure local air quality. These regional air-quality-related problems result from aerometric phenomena that occur over several hundred kilometers and can take several days to complete. Therefore, projecting the impact of potential fossil-fueled replacements for Indian Point requires placing them into a context of regional changes in emissions, not simply the localized changes near new power plants or urban settings.

In the United States, SO2 and NOx emissions from large electric generators are regulated by a “cap-and-trade” system; this type of regulation has been proposed for Hg as well (Farrell, 2004a). Current regulations for SO2 and NOx are contained in the Clean Air Interstate Rule (CAIR), which was published in its final form in March 2005 and will be implemented fully by 2020 (U.S. EPA, 2005).8

The CAIR will lower SO2 emissions from the electric power sector across a 28-state region (including New York) by about 65 percent and NOx emissions by about 50 percent. However, the CAIR imposes an annual cap on NOx emissions, while the key problem in the northeastern states is summertime ozone and fine particulate formation. Some analyses suggest that the annual cap in the CAIR may not be sufficient to maintain current summer air quality in the New York area, and that an additional, seasonal NOx control program may be required (Palmer et al., 2005).

The Clean Air Mercury Rule (CAMR) is still under review. Even without it, Hg emissions are expected to decline as a co-benefit of the more stringent controls on SO2 and NOx emissions.

In considering a potential replacement of the Indian Point reactors with fossil-fuel generation, the key feature of cap-and-trade systems is that emissions are limited in absolute magnitude and do not respond to changes in the amount of electricity generated or in the technologies used. While increased generation at an existing power plant may lead to additional emissions at that facility, such increased generation would not be allowed if new emission controls are added to the plant, as is happening (and has been happening for over a decade) across the nation. Even if no new control technologies are added, under a cap-and-trade system addi

|

8 |

See www.epa.gov/interstateairquality. Accessed November 2005. |

tional emissions at one plant (including a new one) must be compensated for by reduced emissions from another plant. This trade-off would result in no net change in regional emission. The SO2 and NOx cap-and-trade programs are designed to solve such regional (not local) problems. These requirements are added to protect local air quality. Under the federal Clean Air Act amendments of 1990, the air quality standards that these policies are designed to achieve must protect human health with an adequate margin of safety.

Thus, if the Indian Point plants are replaced by gas- or coal-fired generators, total emissions of SO2, NOx, and Hg will not change (assuming that the CAMR or a more restrictive cap is put in place) and should not significantly affect human health. Instead, the spatial patterns of emissions may change slightly, and the cost of controlling emissions will increase slightly.

Local air quality in the immediate vicinity of power plants is controlled separately by environmental regulations (as discussed above). These regulations set limits on rates of emissions and require the use of tall exhaust stacks to ensure that pollutants are diluted sufficiently to avoid negative health impacts in the communities immediately surrounding the facilities under expected meteorological conditions (Davis et al., 2000; Goodfellow, 2000).

Most cap-and-trade systems, such as the one that controls SO2 emissions, include “antibacksliding” provisions that prevent facilities from violating local air quality regulations through the use of emissions trading. Nonetheless, because the emissions of specific sources are not directly controlled by cap-and-trade programs, concerns have been raised about the possibility of “hotspots,” areas of greater air pollution (or air pollution that is not lowered sufficiently) in the vicinity of some sources (Nash and Revesz, 2001). However, there is little evidence of hotspots having occurred in SO2 and NOx cap-and-trade programs (Farrell, 2004a; U.S. EPA, 2004). Nevertheless, local effects of emissions of toxics under a cap-and-trade program have been found to be a cause for concern (Chinn, 1999). Thus, it is reasonable to be concerned about the possibility of negative effects of Hg emissions if a coal-fired power plant replaces the Indian Point plants. However, the difficulty of finding an adequate site and of delivering coal in sufficient quantities to a location near New York City makes such an outcome unlikely in the short term (to 2015) examined in this study.

There is scientific consensus (with few dissenting opinions) that rising concentrations of greenhouse gases (GHGs) in the atmosphere have already caused perceptible changes in climate and will lead to further climate change in the future (Intergovernmental Panel on Climate Change, 2001). The impact of climate change may be significant for water resources, agriculture, ecosystems, and the incidence of cata-strophic weather systems (Malmqvist and Rundle, 2002; Hayhoe et al., 2004). The most important anthropogenic GHG is carbon dioxide (CO2), and the most important source of CO2 is the combustion of fossil fuel.

Avoiding serious climate change impacts will require deep cuts in global CO2 emissions. Deep cuts in return will require significant changes from current practices in energy supply and demand, because fossil fuels dominate global energy use (Hoffert et al., 1998). As a non-fossil-fuel source of energy, nuclear power may grow in importance in the future. Replacement of the Indian Point Energy Center with fossil-fueled generation could increase CO2 emissions, the opposite of the direction necessary to avoid climate change.

There is currently no regulatory framework in the United States for controlling GHG emissions, but on December 20, 2005, Governor Pataki signed the Regional Greenhouse Gas Initiative (RGGI) Memorandum of Understanding, which committed New York State to proposing a cap-and-trade program to limit GHG emissions from the electric power sector starting in 2009. Six other states were part of this agreement: Connecticut, Delaware, Maine, New Hampshire, New Jersey, and Vermont. Fossil-fueled replacements for the Indian Point plant would emit CO2 and would be subject to this regulation.

Costs of Emissions from New Fossil Power Plants

An upper-bound estimate of the cost of obtaining pollut-ant-emission allowances to cover annual emissions is calculated assuming two technologies that could be adopted as replacements for the Indian Point units up to 2018 and perhaps beyond. These are the natural gas combined cycle (NGCC) and coal-based integrated gasification combined cycle (IGCC), with the latter serving as a proxy for advanced pulverized coal with state-of-the-art emission-control technologies. The amount of energy required is assumed to be the amount produced by the two Indian Point units operating at 90 percent capacity factor for 1 year, which is about 17 million MWh. Assuming 80 percent capacity factors for the fossil-fueled plants, a total capacity of about 2,430 MW would be required.

For purposes of evaluation, nominally representative emission rate data are taken from the observed performance of Sithe Independence and Polk Stations, as given in the U.S. Environmental Protection Agency’s (EPA’s) database, e-grid. Two scenarios are considered: in one, CAIR and CAMR are implemented but there is no GHG emission control; the other is identical except that the RGGI baseline policy package is also implemented. Emission allowance prices for these two scenarios are taken from the September 2005 RGGI analysis (Table 4-1). The price of CO2 allowances in the latter scenario is $1 per ton. While this is lower than the amount estimated in other policies, including that of the European Union, it nevertheless is consistent with current projections for the Northeast. Below are considered the consequences of a range of CO2 charges, ranging from $1 per ton of CO2 removed to $25 per ton of CO2 removed.

The results are shown in Tables 4-2 and 4-3. The projected upper bound for the policy with GHG controls is only

TABLE 4-1 Estimated Future Emission Allowance Prices

|

Study |

Description |

NOx ($/ton) |

SO2 ($/ton) |

Hg ($/lb) |

CO2 ($/ton) |

|

Energy Information Administration (2001, Table 4) |

50%-75% reductions in SO2, NOx, and Hg |

1,108-2,825 |

719-1,737 |

21,119-85,225 |

N.A. |

|

Palmer et al. (2005, Table 14) |

CAIR, CAMR, and seasonal NOx cap |

1,042 |

0-1,347 |

35,760 |

N.A. |

|

Regional Greenhouse Gas Initiative (RGGI)a |

Baseline: CAIR and CAMR |

1,710 |

1,268 |

21,730 |

N.A. |

|

Regional Greenhouse Gas Initiative |

Reference: CAIR, CAMR, constant CO2 emissions, 2009-2014 |

1,713 |

1,267 |

21,670 |

1 |

|

NOTE: N.A., not available. Abbreviations are defined in Appendix C. aRGGI prices are based on the September 2005 analysis. See http://www.rggi.org/documents.htm. Accessed November 2005. |

|||||

about $60 million per year, using the RGGI baseline price for CO2 allowances. However, many other studies have suggested that higher prices for CO2 allowances are likely. Hold-ing the other allowance prices constant, adjusting CO2 allowance prices to $10 per ton yields total annual allowance costs for NGCC of about $72 million and for IGCC of about $210 million. At $25 per ton of CO2, these costs become about $175 million for NGCC and $450 million for IGCC.

Given the uncertainties in fuel prices, policies, and technologies, it is reasonable to expect that the cost of air emission allowances for fossil-fueled replacements for the Indian Point units would vary from a few million to ten million dollars per year if there is no GHG policy, and from ten million to possibly several hundred million dollars per year if a GHG policy is imposed.9

Water Use

The Indian Point Energy Center is located on the eastern shore of the Hudson River and uses three intake structures to withdraw approximately 2.5 billion gallons of water per day for cooling the reactor units in once-through heat exchang-ers; the water is returned to the river somewhat warmer (NYDEC, 2003, p. 8). Under the federal Clean Water Act, discharges of heat to water bodies are considered pollution and are regulated by NYDEC. In addition, the cooling-water intake systems at Indian Point contribute to significant mortality of aquatic organisms in the Hudson River estuary. For this reason the cooling-water intake system is also subject to regulation under the Clean Water Act and state regulations. These regulations require that the location, design, construction, and capacity of the cooling-water intake system must reflect the best technology available for minimizing adverse environmental impacts.

In 2003, NYDEC issued a draft State Pollutant Discharge Elimination System (SPDES) permit for Indian Point that required immediate and long-term steps to reduce the adverse impacts on the Hudson River estuary.10 The short-term steps include mandatory outage periods, reduced intake during certain periods, continued operation of fish-impingement mitigation measures, the payment of $25 million to a Hudson River Estuary Restoration Fund, and the conduct of various studies. In the long term, NYDEC staff has determined that closed-cycle cooling is the best technology available to minimize environmental impacts of the Indian Point facility. However, the implementation of the very large, expensive modification is contingent on approval of the U.S. Nuclear Regulatory Commission (U.S. NRC) and extension of the U.S. NRC operating license for Indian Point and so is not yet certain.

Alternatives to Indian Point would likely also be required to use closed-cycle or “dry cooling” technologies that use little water. This type of cooling technology was required of the new Athens Generating Station up the Hudson River (Board on Electric Generating Siting and Environment, 2000). Small-scale generators (used for distributed generation and combined heat and power) use air cooling and thus have no significant water use.

Overall, potential replacements for Indian Point would have less impact on the Hudson River than Indian Point currently does. However, if Indian Point adds closed-cycle cooling, its impact would be reduced also.

Environmental Justice

Equity and aesthetic concerns about the impacts of electric power plants (and all energy infrastructure) are often called matters of environmental justice, which is typically

|

9 |

Higher levels of costs would encourage energy-efficiency investments or replacements that emit less carbon, thus reducing the total cost. |

|

10 |

Available at http://www.dec.state.ny.us/website/dcs/eisanddp/Indian PointSPDES.pdf. Accessed November 2005. |

TABLE 4-2 Annual Costs for Allowances to Replace Indian Point Generation, Without CO2 Control (Regional Greenhouse Gas Initiative Baseline Scenario, No CO2 Control)

|

|

Nuclear Plant |

Natural Gas Combined-Cycle Plant |

Coal Integrated Gasification Combined-Cycle Plant |

|

Capacity (MW) |

2,158 |

2,428 |

2,428 |

|

Capacity factor |

0.9 |

0.8 |

0.8 |

|

Generation (MWh) |

17,013,672 |

17,013,672 |

17,013,672 |

|

NOx rate (lb/MWh) |

0 |

0.134 |

0.719 |

|

NOx emissions (tons) |

0 |

1,140 |

6,116 |

|

NOx allowance cost (cost per ton: $1,710) |

$0 |

$1,949,256 |

$10,459,070 |

|

SO2 rate (lb/MWh) |

0 |

0.025 |

1.55 |

|

SO2 emissions (tons) |

0 |

213 |

13,186 |

|

SO2 allowance cost (cost per ton: $1,268) |

$0 |

$269,667 |

$16,719,335 |

|

Hg rate (lb/GWh) |

0 |

0 |

0.0397 |

|

Hg emissions (lb) |

0 |

0 |

675 |

|

Hg allowance cost (cost per lb: $21,730) |

$0 |

$0 |

$14,667,493 |

|

Total emission allowance cost |

$0 |

$2,218,923 |

$41,845,898 |

|

NOTE: Allowance prices are based on September 2005 analysis of the Regional Greenhouse Gas Initiative. See http:// www.rggi.org/documents.htm. Accessed November 2005. Abbreviations are defined in Appendix C. |

|||

defined as the fair treatment of all people, regardless of race or income, with respect to environmental issues. Ensuring environmental justice has been a matter of policy for the federal government for more than a decade, and in 2004 the U.S. Nuclear Regulatory Commission reaffirmed its commitment to this goal. In practice this means that “while the NRC [Nuclear Regulatory Commission] is committed to the general goals of E.O. 12898, it will strive to meet those goals through its normal and traditional NEPA [National Environ mental Policy Act of 1969] review process” (President of the United States, 1994; U.S. NRC, 2004).

As a concept rooted in ideas of rights and fairness, not science and technology, environmental justice concerns are very different from the other types of issues discussed in this section. In addition, environmental justice concerns associated with energy can include a wide array of issues, because many people find electric power plants and transmission towers ugly and undesirable to live or work near. For this

TABLE 4-3 Annual Costs for Allowances to Replace Indian Point Generation with CO2 Control (Regional Greenhouse Gas Initiative Reference Scenario)

|

|

Nuclear Plant |

Natural Gas Combined-Cycle Plant |

Coal Integrated Gasification Combined-Cycle Plant |

|

Capacity (MW) |

2,158 |

2,428 |

2,428 |

|

Capacity factor |

0.9 |

0.8 |

0.8 |

|

Generation (MWh) |

17,013,672 |

17,013,672 |

17,013,672 |

|

NOx rate (lb/MWh) |

0 |

0.134 |

0.719 |

|

NOx emissions (tons) |

0 |

1,140 |

6,116 |

|

NOx allowance cost (cost per ton: $1,713) |

$0 |

$1,952,676 |

$10,477,419 |

|

SO2 rate (lb/MWh) |

0 |

0.025 |

1.55 |

|

SO2 emissions (tons) |

0 |

213 |

13,186 |

|

SO2 allowance cost (cost per ton: $1,267) |

$0 |

$269,454 |

$16,706,150 |

|

Hg rate (lb/GWh) |

0 |

0 |

0.0397 |

|

Hg emissions (lb) |

0 |

0 |

675 |

|

Hg allowance cost (cost per lb: $21,670) |

$0 |

$0 |

$14,626,993 |

|

CO2 rate (lb/MWh) |

0 |

828 |

1,959 |

|

CO2 emissions (tons) |

0 |

7,043,660 |

16,664,892 |

|

CO2 allowance cost (cost per ton: $1) |

$0 |

$7,043,660 |

$16,664,892 |

|

Total emission allowance cost |

$0 |

$9,265,790 |

$58,475,454 |

|

NOTE: Allowance prices are based on September 2005 analysis of the Regional Greenhouse Gas Initiative. See http:// www.rggi.org/documents.htm. Accessed November 2005. Abbreviations are defined in Appendix C. |

|||

reason, there are often concerns that new power plants or power lines will lower property values. By contrast, some communities might welcome a new power plant because of the jobs and tax revenues it would bring.

Everyone uses electricity, and it must be generated somewhere and delivered in some way. Why should one community accept a power plant or transmission line when that facility will serve another community? This problem can create tensions among communities or between residents of different states. Indian Point serves Westchester County and New York City. Once the power goes onto the grid, it is indistinguishable from all other power sources, but Indian Point is basically a local plant for Westchester County and New York City. In fact, it is essentially the only generating plant in Westchester County. New York City is required to generate 80 percent of its power, but Westchester County currently has no local generation requirement. As noted elsewhere in this report, if Indian Point is closed, it will have to be replaced at least in part with new generating capacity. If these are not local plants, then all of Westchester County’s power would have to be imported, impacting other communities that might object to new facilities being imposed on them.

This problem has been exacerbated by the transition from the traditional model of a regulated monopoly franchise in the electric power sector toward a model of a competitive generation market with monopoly franchise distribution utilities and a transmission system owned by various firms, but coordinated by an independent system operator. In this new framework, the traditional concepts applied to proposed power plants—including estimating the public interest in granting construction permits against the need for new generation to meet local loads—no longer fits. Instead, plants are built to be competitive in the marketplace, as embodied in the New York State Energy Plan, which describes competition as being in the public interest, as discussed earlier in this chapter.11

As discussed in Chapter 1, safety is a primary concern for many people living near Indian Point. They feel threatened by the plant and want it closed. This committee has not assessed the vulnerability of Indian Point. It defers to other experts to analyze whether those risks are real or negligible. What this committee can say is that the socioeconomic, environmental, and environmental justice impacts of replacing Indian Point are significant, although not universally negative. The committee also notes that safety risks of the plant would not be eliminated until the spent fuel pool is emptied, which may be many years after the plant is closed. Storage of the spent nuclear fuel, presumably onsite, may involve costs that will be borne by the current owner, or by negotiated settlement with the state or federal authorities. Policy makers must balance the risks of continued operation against the impacts inherent in closing the plant.

Energy Security

Historically, access, availability, and affordability have dominated public policy and the design of energy systems. The costs of existing security measures have been implicitly divided between energy users, suppliers, and the government. Today, the security of energy infrastructures against deliberate attack has become a growing concern. Therefore, the context within which energy is supplied and used has evolved well past the paradigm that has led to the current physical energy infrastructure and associated institutional arrangements.

Concerns about deliberate attacks on the energy infrastructure have highlighted many critical questions to which no ready answers exist. For example: How much and what kind of security for energy infrastructure do we want and who will pay for it? Current government efforts directed at critical infrastructure protection tend to ignore this issue entirely, focusing on preventing attacks and protecting whatever energy infrastructure the private sector creates. These decisions are being made implicitly for decades, favoring certain risk-creating technologies over others (Farrell, 2004b).

Many different approaches are likely to be necessary to achieve desired levels of energy-infrastructure security. Routine security and emergency planning have obvious roles, and some features seem to inherently enhance system security, including decentralization, diversity, and redundancy. Other features, such as the utilization of specific energy sources and energy-efficiency measures, seem to have mixed effects. In particular, some renewable energy technologies can be deployed more securely than can fossil-fuel and nuclear technologies; others cannot.

Socioeconomic Factors Including Indirect Costs to the Public

The direct-cost projections, as exemplified in the scenarios discussed in Chapter 5, depend on the generation choices to replace the 2,000 MW baseload of Indian Point, the location of the generation, modifications in transmission and distribution, the timing of any projected changes, and the load growth in the New York area. Each of the options considered has certain costs associated with it in addition to the direct costs of replacement capacity and environmental protection. These likely will be borne by the public, either through arrangements with the state or through changes in the electricity rates in southern New York, although the indirect costs do not appear directly on the customer’s electricity bill. At least three kinds of potential indirect, or hidden, costs are associated with replacing the power from Indian Point:

-

The economic value of the plant and its associated property. Entergy Corporation might have to be reimbursed if the Indian Point reactors are shut down prior to their end

|

11 |

See http://www.nyserda.org/Energy_Information/energy_state_ plan.asp. Accessed January 2006. |

-

of licenses (including the period of extended operation if they are relicensed).

-

Higher natural gas costs to all users because of increased demand from the electric power sector. Natural gas is likely to be the main fuel for replacement generating capacity, and unless new supplies are created, constraints are likely to be experienced.

-

Changes in employment opportunities and the tax base and the loss of local services associated with the Indian Point plant. These costs (or potential benefits, e.g., if the Indian Point plant site is converted to other economic uses) would be borne mainly by Westchester County.

The committee was unable to assess these costs, but they could be significant relative to the direct replacement costs, depending on the arrangements for the possible closure of Indian Point.

Additional sociopolitical issues to be faced by the New York communities are less tangible than are projected costs or regulation. However, there are factors that may constrain or severely limit the options for replacing Indian Point and may affect the communities in the next 20 to 30 years. These factors include the following:

-

Public attitudes toward siting power plants and transmission lines (aesthetics and the not-in-my-backyard, or NIMBY, phenomenon);

-

The willingness of the public to invest in energy-efficiency measures;

-

Attitudes toward advanced nuclear power plants as an option that would help maintain electric energy fuel-source diversity and minimize CO2 emissions;

-

Growth and development in southern New York, requiring major decisions on resource management and infrastructure, including energy, social services, primary and secondary education, and so on; and

-

Attitudes of the state government regarding the regulation of the energy sector and its approach to permitting new facilities in the state.

Accounting for these factors will influence the choices of technological options discussed or summarized in Chapters 2 and 3 in ways that are beyond the scope of this study. However, implicitly these factors, along with others discussed in this chapter, tend to reinforce the focus on the short-term options of natural-gas-supplied generation and added transmission in southern New York State as key to a replacement strategy for Indian Point.

REFERENCES

Barboza, M.J., M.J. Cannon, N.J. Charno, and P.S. Oliver. 2000. “Stationary Gas Turbines.” Pp. 242-248 in Air Pollution Engineering Manual. W.T. Davis, ed. New York: Wiley.

Board on Electric Generating Siting and Environment. 2000. “Opinion and Order Granting Certificate of Environmental Compatibility and Public Need: Application by Athens Generating Company.” Albany, N.Y., p. 127.

Chameides, W.L., P.S. Kasibhalta, J. Yienger, and H. Levy. 1994. “Growth of Continental-Scale Meso-Agro-Plexes, Regional Ozone Pollution, and World Food Production.” Science 264(5155): 74-77.

Chinn, L.N. 1999. “Can the Market Be Fair and Efficient? An Environmental Justice Critique of Emissions Trading.” Ecology Law Quarterly 26(1): 80-125.

Creilson, J.K., J. Fishman, and A.E. Wozniak. 2003. “Intercontinental Transport of Tropospheric Ozone: A Study of Its Seasonal Variability Across the North Atlantic Utilizing Tropospheric Ozone Residuals and Its Relationship to the North Atlantic Oscillation.” Atmospheric Chemistry and Physics 3: 2053-2066.

Davis, W.T., A.J. Buonicore, L. Theodore, and L.H. Stander. 2000. “Introduction: Air Pollution Control Engineering and Regulatory Aspects.” Pp. 1-21 in Air Pollution Engineering Manual. W.T. Davis, ed. New York: Wiley.

Energy Information Administration. 2001. Analysis of Strategies for Reducing Multiple Emissions from Electric Power Plants with Advanced Technology Scenarios. Washington, D.C.: U.S. Department of Energy.

Farrell, A.E. 2004a. “Clean Air Markets.” Encyclopedia of Energy, Vol.1. C.J. Cleveland, ed. San Diego: Academic Press, pp. 331-342.

—. 2004b. “Environmental Impacts of Electricity.” Encyclopedia of Energy, Vol. 2. C.J. Cleveland, ed. San Diego: Academic Press, pp.165-175.

— and T.J. Keating. 2002. “Transboundary Environmental Assessments: Lessons From OTAG.” Environmental Science and Technology 36: 2537-2544.

Goodfellow, H.D. 2000. “Ancillary Equipment for Local Exhaust Ventilation Systems.” Pp. 143-190 in Air Pollution Engineering Manual. W.T. Davis, ed. New York: Wiley.

Hamachi LaCommare, Kristina, and Joseph H. Eto. 2004. “Understanding the Cost of Power Interruptions to U.S. Electricity Customers.” Berkeley, Calif: Lawrence Berkeley National Laboratory. September.

Hayhoe, K., D. Cayan, C.B. Field, P.C. Frumhoff, E.P. Maurer, N.L. Miller, S.C. Moser, S.H. Schneider, K.N. Cahill, E.E. Cleland, L. Dale, R. Drapek, R.M. Hanemann, L.S. Kalkstein, J. Lenihan, C.K. Lunch, R.P. Neilson, S.C. Sheridan, and J.H. Verville. 2004. “Emissions Pathways, Climate Change, and Impacts on California.” Proceedings of the National Academy of Sciences of the United States of America 101: 12422-12427.

Hoffert, M., K. Caldeira, A.K. Jain, E.F. Haites, L.D.D. Harvey, S.D. Potter, M.E. Schlesinger, S.H. Schneider, R.G. Watts, T.L. Wigley, and D.J. Wuebbles. 1998. “Energy Implications of Future Stabilization of Atmospheric CO2 Content.” Nature 395: 881-884.

Intergovernmental Panel on Climate Change. 2001. Third Assessment Report: The Scientific Basis. New York: Cambridge University Press.

Jaworski, N.A., R.W. Howarth, and L.J. Hetling. 1997. “Atmospheric Deposition of Nitrogen Oxides onto the Landscape Contributes to Coastal Eutrophication in the Northeast United States.” Environmental Science and Technology 31: 1995-2004.

Malmqvist, B., and S. Rundle. 2002. “Threats to the Running Water Ecosystems of the World.” Environmental Conservation 29: 134-153.

Mauzerall, D.L. and X.P. Wang. 2001. “Protecting Agricultural Crops from the Effects of Tropospheric Ozone Exposure: Reconciling Science and Standard Setting in the United States, Europe, and Asia.” Annual Review of Energy and the Environment 26: 237-268.

McFarlane, A. 2001. “Interim Storage of Spent Fuel in the United States.” Annual Review of Energy and the Environment 26: 201-235.

Nash, J.R. and R.L. Revesz. 2001. “Markets and Geography: Designing Marketable Permit Schemes to Control Local and Regional Pollutants.” Ecology Law Quarterly 28: 569-661.

NERC (National Electrical Reliability Council). 2004. “Princeton, N.J.: Long-Term Reliability Assessment.” North American Electrical Reliability Council. September.

NRC (National Research Council). 2001. Disposition of High-Level Waste and Spent Nuclear Fuel: The Continuing Societal and Technical Challenges. Washington, D.C.: National Academy Press.

NYDEC (New York Department of Environmental Conservation). 2003. “State Pollutant Discharge Elimination System (SPDES) Draft Permit Renewal with Modification, Indian Point Electric Generating Station Fact Sheet.” Albany.

NYISO (New York Independent System Operator). 2004. “2004 Load and Capacity Data.”

—. 2005. Comprehensive Reliability Planning Process Supporting Document and Appendices for the Draft Reliability Needs Assessment. NYISO, Albany, N.Y., December 21.

Palmer, K., D. Burtraw, and J.-S. Shih. 2005. Reducing Emissions from the Electricity Sector: The Costs and Benefits Nationwide and in the Empire State. Albany, N.Y.: New York State Energy Research and Development Authority.

Patton, David. 2005. “2004 State of the Market Report, New York ISO.” Prepared by the Independent Market Advisor to the New York ISO. Unpublished report. Potomac Economics, Ltd. July.

President of the United States. 1994. “Executive Order 12898: Federal Actions to Address Environmental Justice in Minority and Low-Income Populations.” Federal Register 59: 7629-7633.

Regens, J.L. 1993. “Acid Deposition.” Pp. 165-188 in Keeping Pace with Science and Engineering, M. Uman, ed. Washington, D.C.: National Academy Press.

Solomon, P.A., E.B. Cowling, G.M. Hidy, and C.S. Furiness. 1999. “Comparison of Scientific Findings from Major Ozone Field Studies in North America and Europe.” Atmospheric Environment 34: 1885-1920.

Streets, D.G., Y.S. Chang, M. Tompkins, Y.S. Ghim, and L.D. Carter. 2001. “Efficient Regional Ozone Control Strategies for the Eastern United States.” Journal of Environmental Management 61: 345-365.

Tucker, W.G. 1998. “Particulate Matter Sources, Emissions, and Control Options—USA.” Pp. 149-164 in Air Pollution in the 21st Century: Priority Issues and Policy. T. Schneider, ed. New York: Elsevier.

U.S. Congress. 1990. Clean Air Act Amendments. Title 42, Chapter 85.

U.S. EPA (U.S. Environmental Protection Agency). 1997. AP-42: Compilation of Air Pollutant Emission Factors. Research Triangle Park, N.C.

—. 2000. Findings of Significant Contribution and Rulemaking on Section 126 Petitions for Purposes of Reducing Interstate Ozone Transport. Washington, D.C.

—. 2004. The OTC NOxBudget Program (1999-2002): Emission Trading and Impacts on Local Emission Patterns. Office of Air and Radiation. Washington, D.C.: U.S. Environmental Protection Agency.

—. 2005. Rule to Reduce Interstate Transport of Fine Particulate Matter and Ozone (Clean Air Interstate Rule); Revisions to Acid Rain Program; Revisions to the NOx SIP Call; Final Rule. Federal Register 70: 25162-25405.

U.S. NRC (U.S. Nuclear Regulatory Commission). 2004. “Policy Statement on the Treatment of Environmental Justice Matters in NRC Regulatory and Licensing Actions.” Federal Register 69: 52040-52048.