D

Supply Technologies

This appendix provides additional details and background information related to the 18 potential alternative supply technologies, examined in Chapter 3, “Generation and Transmission Options.” Appendix D contains the following:

-

Appendix D-1, “Cost Estimates for Electric Generation Technologies”—Table D-1-1 summarizes estimated total costs and the later tables detail the key cost elements for each of the technologies examined by the committee.

-

Appendix D-2, “Zonal Energy and Seasonal Capacity in New York State, 2004 and 2005”—Table D-2-1 provides a summary, and the remaining tables present data for summer and winter capacity (MW) and energy production (GWh) by fuel and provide other data on the New York Control Area (NYCA).

-

Appendix D-3, “Energy Generated in 2003 from Natural Gas Units in Zones H Through K”—This appendix contains tabular data on power generation from natural gas in the New York City area in 2003 and 2004, indicating the oil products used in the overall production of electricity from gas turbines in the New York City area.

-

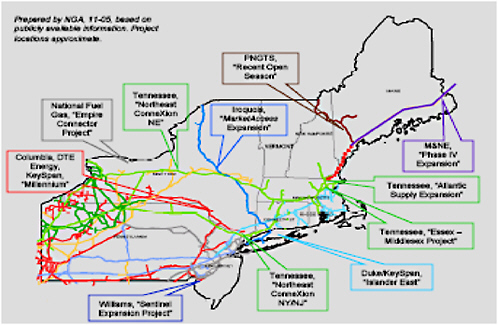

Appendix D-4, “Proposed Pipeline Projects in the Northeast of the United States”—A map of the northeastern states shows proposed natural gas pipelines.

-

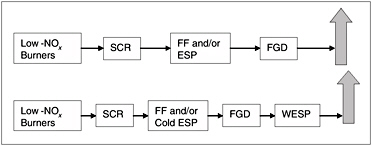

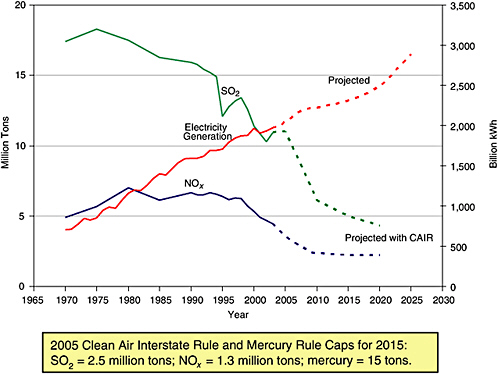

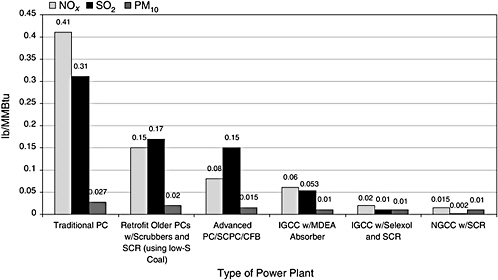

Appendix D-5, “Coal Technologies”—Committee member James R. Katzer presents a discussion of the coal-based technologies that the committee considered and evaluated with respect to operating costs, including the technology (integrated gasification, combined cycle [IGCC]) that will be most appropriate for the capture of carbon dioxide. The appendix explores the issue of emissions control for coal plants.

-

Appendix D-6, “Generation Technologies—Wind and Biomass”—Dan Arvizu of the Department of Energy’s National Renewable Energy Laboratory (NREL) summarizes an analysis performed by NREL to evaluate the potential of wind energy and biomass resources as sources of electricity for the New York City region. Issues associated with the expanding use of wind in New York State are discussed.

-

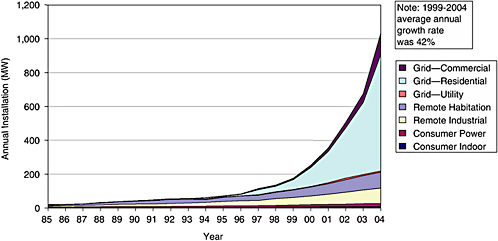

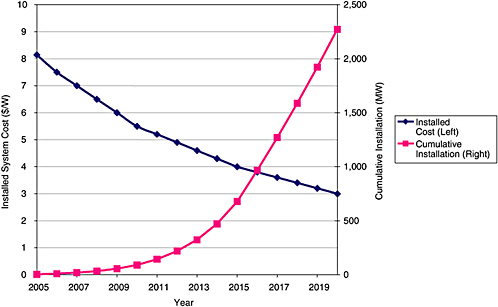

Appendix D-7, “Distributed Photovoltaics to Offset Demand for Electricity”—Dan Arvizu summarizes an NREL analysis that evaluated the potential of distributed photovol-taics (PV) for the New York City region. Also included are a summary of New York State’s current policies related to PV technology and an accelerated PV-deployment scenario for New York State through 2020.

-

References

APPENDIX D-1

COST ESTIMATES FOR ELECTRIC GENERATION TECHNOLOGIES

Parker Mathusa and Erin Hogan1

TABLE D-1-1 Summary Cost Estimates: Total Cost of Electricity (in 2003 U.S. dollars per kilowatt-hour) for Generating Technologies Examined by the Committee

|

|

Costs Estimated by: |

||

|

Technology |

EIAa |

University of Chicagob |

MITc |

|

Municipal solid waste landfill gas |

0.0352 |

|

|

|

Scrubbed coal, new (pulverized) |

0.0382 |

0.0357 |

0.0447 |

|

Fluidized-bed coal |

|

0.0358 |

|

|

Pulverized coal, supercritical |

|

0.0376 |

|

|

Integrated coal gasification combined cycle (IGCC) |

0.0400 |

0.0346 |

|

|

Advanced nuclear |

0.0422 |

0.0433 |

0.0711 |

|

Advanced gas combined cycle |

0.0412 |

0.0354 |

0.0416 |

|

Conventional gas combined cycle |

0.0435 |

|

|

|

Wind 100 MW |

0.0566 |

|

|

|

Advanced combustion turbine |

0.0532 |

|

|

|

IGCC with carbon sequestration |

0.0595 |

|

|

|

Wind 50 MW |

0.0598 |

|

|

|

Conventional combustion turbine |

0.0582 |

|

|

|

Advanced combined cycle with carbon sequestration |

0.0641 |

|

|

|

Biomass |

0.0721 |

|

|

|

Distributed generation, base |

0.0501 |

|

|

|

Distributed generation, peak |

0.0452 |

|

|

|

Wind 10 MW |

0.0991 |

|

|

|

Photovoltaic |

0.2545 |

|

|

|

Solar thermal |

0.3028 |

|

|

|

NOTE: EIA: Energy Information Administration; MIT: Massachusetts Institute of Technology. Data exclude regional multipliers for capital, variable operation and maintenance (O&M), and fixed O&M. New York costs would be higher. Data exclude delivery costs. Data reflect fuel prices that are New York State-specific; see Table D-1-7. Costs reflect units of different sizes; while some technologies have lower costs than others, the total capacity of the lower-cost generation technology may be limited—for example, a 500-MW municipal solid waste landfill gas project is unlikely. MIT calculations assumed a 10-year term; consequently, estimated costs are higher. aFor EIA data, see Table D-1-3 in this appendix, column “Total Cost of Energy ($/kWh).” Annual Energy Outlook 2005, Basis of Assumptions, Table 38. The 0.6 rule was applied to the wind 10 MW and 100 MW units using 50 MW as the base reference. Solar thermal costs exclude the 10 percent investment tax credit. bFor University of Chicago data, see Tables D-1-5 and D-1-6 in this appendix. cFor MIT data, see Table D-1-2 in this appendix. |

|||

TABLE D-1-2 Cost Components for Electricity Generation Technologies

|

Source |

Capital Costs ($/kWh) |

O&M Costs ($/kWh) |

Fuel Costs ($/kWh) |

Cost of Electricity Without Regional Multipliers ($/kWh) |

|

Natural Gas Combined Cycle |

|

|

|

|

|

Chicago Report |

$0.0088 |

$0.0030 |

$0.0236 |

$0.0354 |

|

MIT (moderate gas $) |

NR |

NR |

NR |

$0.0416 |

|

EIA (Advance CC) |

$0.0083 |

$0.0031 |

$0.0298 |

$0.0412 |

|

Natural Gas Aeroderivative Turbine |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA (Advanced CT) |

$0.0056 |

$0.0040 |

$0.0406 |

$0.0501 |

|

Pulverized Coal Steam |

|

|

|

|

|

Chicago Report |

$0.0167 |

$0.0077 |

$0.0113 |

$0.0357 |

|

MIT |

NR |

NR |

NR |

$0.0447 |

|

EIA (scrubbed coal new) |

$0.0209 |

$0.0069 |

$0.0122 |

$0.0382 |

|

Pulverized Coal Supercritical |

|

|

|

|

|

Chicago Report |

$0.0179 |

$0.0085 |

$0.0113 |

$0.0376 |

|

MIT/EIA |

NR |

NR |

NR |

NR |

|

Fluidized-Bed Coal |

|

|

|

|

|

Chicago Report |

$0.0179 |

$0.0059 |

$0.0120 |

$0.0358 |

|

MIT |

NR |

NR |

NR |

NR |

|

EIA (scrubbed coal new) |

$0.0181 |

$0.0071 |

$0.0130 |

$0.0382 |

|

Integrated Coal Gasification Combined Cycle |

|

|

|

|

|

Chicago Report |

$0.0199 |

$0.0052 |

$0.0094 |

$0.0346 |

|

MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0209 |

$0.0069 |

$0.0122 |

$0.0400 |

|

Biomass |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0284 |

$0.0094 |

$0.0219 |

$0.0598 |

|

Municipal Solid Waste |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0223 |

$0.0128 |

$0.0000 |

$0.0352 |

|

Wind 10 MW |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0896 |

$0.0095 |

$0.0000 |

$0.0991 |

|

Wind 50 MW |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0471 |

$0.0095 |

$0.0000 |

$0.0566 |

|

Wind 100 MW |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.0357 |

$0.0095 |

$0.0000 |

$0.0452 |

|

NREL w/o Tax Credit |

$0.037 to $0.057 |

$0.003 to 0.009 |

$0.0000 |

$0.04 to $0.06 |

|

NREL w Tax Credit |

$0.022 to $0.047 |

$0.003 to 0.009 |

$0.0000 |

$0.025 to $0.05 |

|

Offshore Wind 500 MW |

|

|

|

|

|

NREL |

$0.045 or more |

$0.0150 |

$0.0000 |

$0.06 or more |

|

Solar |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.2646 |

$0.0382 |

$0.0000 |

$0.3028 |

|

Photovoltaic |

|

|

|

|

|

Chicago Report/MIT |

NR |

NR |

NR |

NR |

|

EIA |

$0.2496 |

$0.0049 |

$0.0000 |

$0.2545 |

|

NREL-Current (2004) Low |

$0.20 |

$0.03 |

$0.00 |

$0.23 |

|

NREL-Current (2004) High |

$0.32 |

$0.06 |

$0.00 |

$0.38 |

|

NREL-Projected (2015) Low |

$0.11 |

$0.01 |

$0.00 |

$0.12 |

|

NREL-Projected (2015) High |

$0.18 |

$0.02 |

$0.00 |

$0.20 |

|

New Next-Generation Nuclear |

|

|

|

|

|

Chicago Report |

$0.0238 |

$0.0152 |

$0.0042 |

$0.0433 |

|

MIT |

NR |

NR |

NR |

$0.0711 |

|

EIA |

$0.0292 |

$0.0081 |

$0.0050 |

$0.0422 |

|

NOTE: Abbreviations are defined in Appendix C. EIA and Chicago report capital costs are overnight costs only. Delivery costs are not included. Capital costs assumed 100 percent debt with a 20-year term at 10 percent. MIT report assumed a 10-year term; consequently costs are higher. All costs are in 2003 U.S. dollars. Adjustment to fuel costs may change relative cost of electricity. NREL wind costs noted that Canadian wind/hydro would add $0.002/kWh to $0.006/ kWh to the cost of pure wind alone. SOURCES: Energy Information Administration, 2005, Assumptions to the Annual Energy Outlook 2005; MIT study on the future of nuclear power, An Interdisciplinary MIT Study, 2003; University of Chicago study, The Economic Future of Nuclear Power, August 2004. |

||||

TABLE D-1-3a Energy Information Administration National Average Cost Estimates (2003 dollars)

|

|

Total Costa |

Capacity |

Financing (20 year term at 10%/year) |

||||||||||

|

Plant Typeb |

Annual Cost (million $) |

Capital Cost ($/kWh) |

Operating Costs ($/kWh) |

Fuel Costs ($/kWh) |

Total Cost of Electricity ($/kWh) |

Delivery Cost ($/kWh)c |

Assumed Capacity (MW) |

Capacity Factor |

Hours Operated per Year |

Capital Cost (million $) |

Annual Payment (million $) |

Payment ($/kWh) |

|

|

MSW Landfill Gas |

8.3 |

0.0223 |

0.0128 |

0.0000 |

0.0352 |

0.0852 |

30 |

0.90 |

7884 |

1,500 |

45.0 |

5.3 |

0.0223 |

|

Scrubbed Coal New |

180.8 |

0.0181 |

0.0071 |

0.0130 |

0.0382 |

0.0882 |

600 |

0.90 |

7884 |

1,213 |

727.8 |

85.5 |

0.0181 |

|

Integrated Coal Gasification Combined Cycle (IGCC) |

173.5 |

0.0209 |

0.0069 |

0.0122 |

0.0400 |

0.0900 |

550 |

0.90 |

7884 |

1,402 |

771.1 |

90.6 |

0.0209 |

|

Advanced Nuclear |

332.8 |

0.0292 |

0.0081 |

0.0050 |

0.0422 |

0.0922 |

1,000 |

0.90 |

7884 |

1,957 |

1,957.0 |

229.9 |

0.0292 |

|

Advanced Gas Combined Cycle |

130.1 |

0.0083 |

0.0031 |

0.0298 |

0.0412 |

0.0912 |

400 |

0.90 |

7884 |

558 |

223.2 |

26.2 |

0.0083 |

|

Combined Cycle Conventional Gas |

85.7 |

0.0084 |

0.0032 |

0.0318 |

0.0435 |

0.0935 |

250 |

0.90 |

7884 |

567 |

141.8 |

16.7 |

0.0084 |

|

Wind 100 MWd |

12.8 |

0.0357 |

0.0095 |

0.0000 |

0.0452 |

0.0952 |

100 |

0.32 |

2829 |

859 |

85.9 |

10.1 |

0.0357 |

|

Advanced Combustion Turbine |

90.9 |

0.0056 |

0.0040 |

0.0406 |

0.0501 |

0.1001 |

230 |

0.90 |

7884 |

374 |

86.0 |

10.1 |

0.0056 |

|

IGCC with Carbon Sequestration |

159.4 |

0.0299 |

0.0090 |

0.0143 |

0.0532 |

0.1032 |

380 |

0.90 |

7884 |

2,006 |

762.3 |

89.5 |

0.0299 |

|

Wind 50 MW |

8.0 |

0.0471 |

0.0095 |

0.0000 |

0.0566 |

0.1066 |

50 |

0.32 |

2829 |

1,134 |

56.7 |

6.7 |

0.0471 |

|

Conventional Combustion Turbine |

73.4 |

0.0059 |

0.0045 |

0.0478 |

0.0582 |

0.1082 |

160 |

0.90 |

7884 |

395 |

63.2 |

7.4 |

0.0059 |

|

Advanced CC with Carbon Sequestration |

187.6 |

0.0166 |

0.0048 |

0.0381 |

0.0595 |

0.1095 |

400 |

0.90 |

7884 |

1,114 |

445.6 |

52.3 |

0.0166 |

|

Biomass |

34.8 |

0.0284 |

0.0094 |

0.0219 |

0.0598 |

0.1098 |

80 |

0.83 |

7271 |

1,757 |

140.6 |

16.5 |

0.0284 |

|

Distributed Generation Base |

1.0 |

0.0120 |

0.0081 |

0.0440 |

0.0641 |

0.1141 |

2 |

0.90 |

7884 |

807 |

1.6 |

0.2 |

0.0120 |

|

Distributed Generation Peak |

0.6 |

0.0145 |

0.0081 |

0.0495 |

0.0721 |

0.1221 |

1 |

0.90 |

7884 |

970 |

1.0 |

0.1 |

0.0145 |

|

Wind 10 MWd |

2.8 |

0.0896 |

0.0095 |

0.0000 |

0.0991 |

0.1491 |

10 |

0.32 |

2829 |

2,159 |

21.6 |

2.5 |

0.0896 |

|

Photovoltaic |

2.7 |

0.2496 |

0.0049 |

0.0000 |

0.2545 |

0.3045 |

5 |

0.24 |

2102 |

4,467 |

22.3 |

2.6 |

0.2496 |

|

Solar Thermale |

39.8 |

0.2646 |

0.0382 |

0.0000 |

0.3028 |

0.3528 |

100 |

0.15 |

1314 |

2,960 |

296.0 |

34.8 |

0.2646 |

|

aExcludes regional multipliers. bAnnual Energy Outlook 2005, Basis of Assumptions Table 38, DOE (2005). cAssumed $0.05/kWh delivery cost excluding line losses. dApplied the 0.6 rule using 50 MW as the base reference. eCapital costs are without the 10 percent investment tax credit. |

|||||||||||||

TABLE D-1-3b Energy Information Administration National Average Cost Estimates (2003 dollars)

|

|

Variable O&M |

Fixed O&M |

Fuel Cost |

||||||

|

Plant Typea |

($/kWh)a |

Annual (million $) |

($/kW)a |

($/kWh) |

Annual O&M (million $) |

Fuel Cost ($/mmBtu)b |

Heat Rate (Btu/kWh)a |

Fuel Cost ($/kWh) |

Fuel Cost (million $/yr) |

|

MSW Landfill Gas |

0.0000 |

2.4 |

101.07 |

0.0128 |

3.0 |

0.00 |

13,648 |

0.0000 |

0 |

|

Scrubbed Coal New |

0.0041 |

19.2 |

24.36 |

0.0031 |

14.6 |

1.47 |

8,844 |

0.0130 |

61.5 |

|

Integrated Coal Gasification Combined Cycle (IGCC) |

0.0026 |

11.2 |

34.21 |

0.0043 |

18.8 |

1.47 |

8,309 |

0.0122 |

53.0 |

|

Advanced Nuclear |

0.0004 |

3.5 |

60.06 |

0.0076 |

60.1 |

|

10,400 |

0.0050 |

39.4 |

|

Advanced Gas Combined Cycle |

0.0018 |

5.6 |

10.35 |

0.0013 |

4.1 |

4.42 |

6,752 |

0.0298 |

94.1 |

|

Conventional Gas Combined Cycle |

0.0018 |

3.6 |

11.04 |

0.0014 |

2.8 |

4.42 |

7,196 |

0.0318 |

62.7 |

|

Wind 100 MWc |

0.0000 |

0 |

26.81 |

0.0095 |

2.7 |

0.00 |

10,280 |

0.0000 |

0 |

|

Advanced Combustion Turbine |

0.0028 |

5.1 |

9.31 |

0.0012 |

2.1 |

4.42 |

9,183 |

0.0406 |

73.6 |

|

IGCC with Carbon Sequestration |

0.0039 |

11.8 |

40.26 |

0.0051 |

15.3 |

1.47 |

9,713 |

0.0143 |

42.8 |

|

Wind 50 MW |

0.0000 |

0 |

26.81 |

0.0095 |

1.3 |

0.00 |

10,280 |

0.0000 |

0 |

|

Conventional Combustion Turbine |

0.0032 |

4.0 |

10.72 |

0.0014 |

1.7 |

4.42 |

10,817 |

0.0478 |

60.3 |

|

Advanced CC with Carbon Sequestration |

0.0026 |

8.2 |

17.60 |

0.0022 |

7.0 |

4.42 |

8,613 |

0.0381 |

120.1 |

|

Biomass |

0.0030 |

1.7 |

47.18 |

0.0065 |

3.8 |

2.46 |

8,911 |

0.0219 |

12.8 |

|

Distributed Generation Base |

0.0063 |

0.1 |

14.18 |

0.0018 |

0.03 |

4.42 |

9,950 |

0.0440 |

0.7 |

|

Distributed Generation Peak |

0.0063 |

0 |

14.18 |

0.0018 |

0.01 |

4.42 |

11,200 |

0.0495 |

0.4 |

|

Wind 10 MWc |

0.0000 |

0 |

26.81 |

0.0095 |

0.3 |

0.00 |

10,280 |

0.0000 |

0 |

|

Photovoltaic |

0.0000 |

0 |

10.34 |

0.0049 |

0.05 |

0.00 |

10,280 |

0.0000 |

0 |

|

Solar Thermald |

0.0000 |

0 |

50.23 |

0.0382 |

5.0 |

0.00 |

10,280 |

0.0000 |

0 |

|

aAnnual Energy Outlook 2005, Basis of Assumptions Table 38, DOE (2005). bFuel prices are New York-specific. cApplied the 0.6 rule using 50 MW as the base reference. dCapital costs are without the 10 percent investment tax credit. |

|||||||||

TABLE D-1-4a Energy Information Administration Regional Cost Estimates (2003 dollars)

|

|

Total Costa |

Capacity |

Financing (20-year term at 10%/year) |

||||||||||

|

Plant Typeb |

Annual Cost ($ million) |

Capital Cost ($/kWh) |

Operating Costs ($/kWh) |

Fuel Costs ($/kWh) |

Total Cost of Electricity ($/kWh) |

Delivery Cost ($/kWh)c |

Capacity (MW) |

Capacity Factor |

Hours Operated per Year |

Capital Cost ($ million) |

Annual Payment ($ million) |

Payment ($/kWh) |

|

|

MSW Landfill Gas |

11.1 |

0.0340 |

0.0128 |

0.0000 |

0.0468 |

0.0968 |

30 |

0.90 |

7884 |

2,280 |

68.4 |

8.0 |

0.0340 |

|

Scrubbed Coal New |

225.3 |

0.0275 |

0.0071 |

0.0130 |

0.0476 |

0.0976 |

600 |

0.90 |

7884 |

1,844 |

1,106.2 |

129.0 |

0.0275 |

|

Integrated Coal Gasification Combined Cycle (IGCC) |

220.6 |

0.0317 |

0.0069 |

0.0122 |

0.0509 |

0.1009 |

550 |

0.90 |

7884 |

2,131 |

1,172.1 |

137.7 |

0.0317 |

|

Distributed Generation Base |

0.5 |

0.0257 |

0.0034 |

0.0000 |

0.0291 |

0.0791 |

2 |

0.90 |

7884 |

1,724 |

3.5 |

0.4 |

0.0257 |

|

Distributed Generation Peak |

0.3 |

0.0339 |

0.0034 |

0.0000 |

0.0373 |

0.0873 |

1 |

0.90 |

7884 |

2,274 |

2.3 |

0.3 |

0.0339 |

|

Advanced Gas Combined Cycle |

143.7 |

0.0126 |

0.0031 |

0.0298 |

0.0456 |

0.0956 |

400 |

0.90 |

7884 |

848 |

339.3 |

39.8 |

0.0126 |

|

Wind 10 MWd |

1.3 |

0.0376 |

0.0095 |

0.0000 |

0.0471 |

0.0971 |

10 |

0.32 |

2829 |

905 |

9.1 |

1.1 |

0.0376 |

|

Conventional Gas Combined Cycle |

94.4 |

0.0128 |

0.0032 |

0.0318 |

0.0479 |

0.0979 |

250 |

0.90 |

7884 |

862 |

215.5 |

25.3 |

0.0128 |

|

Advanced Nuclear |

452.3 |

0.0443 |

0.0081 |

0.0050 |

0.0574 |

0.1074 |

1,000 |

0.90 |

7884 |

2,975 |

2,974.6 |

349.4 |

0.0443 |

|

Advanced Combustion Turbine |

111.1 |

0.0089 |

0.0045 |

0.0478 |

0.0613 |

0.1113 |

230 |

0.90 |

7884 |

600 |

138.1 |

16.2 |

0.0089 |

|

IGCC with Carbon Sequestration |

205.9 |

0.0454 |

0.0090 |

0.0143 |

0.0687 |

0.1187 |

380 |

0.90 |

7884 |

3,049 |

1,158.7 |

136.1 |

0.0454 |

|

Wind 100 MWd |

19.9 |

0.0236 |

0.0061 |

0.0406 |

0.0703 |

0.1203 |

100 |

0.32 |

2829 |

568 |

56.8 |

6.7 |

0.0236 |

|

Advanced CC with Carbon Sequestration |

221.9 |

0.0183 |

0.0081 |

0.0440 |

0.0704 |

0.1204 |

400 |

0.90 |

7884 |

1,227 |

490.7 |

57.6 |

0.0183 |

|

Conventional Combustion Turbine |

89.1 |

0.0398 |

0.0089 |

0.0219 |

0.0707 |

0.1207 |

160 |

0.90 |

7884 |

2,671 |

427.3 |

50.2 |

0.0398 |

|

Biomass |

47.4 |

0.0238 |

0.0083 |

0.0495 |

0.0816 |

0.1316 |

80 |

0.83 |

7271 |

1,474 |

118.0 |

13.9 |

0.0238 |

|

Wind 50 MW |

16.6 |

0.0703 |

0.0088 |

0.0381 |

0.1172 |

0.1672 |

50 |

0.32 |

2829 |

1,693 |

84.7 |

9.9 |

0.0703 |

|

Photovoltaic |

4.0 |

0.3793 |

0.0049 |

0.0000 |

0.3843 |

0.4343 |

5 |

0.24 |

2102 |

6,790 |

33.9 |

4.0 |

0.3793 |

|

Solar Thermale |

57.9 |

0.4022 |

0.0382 |

0.0000 |

0.4404 |

0.4904 |

100 |

0.15 |

1314 |

4,499 |

449.9 |

52.8 |

0.4022 |

|

aIncludes a regional multiplier for capital costs only to account for higher construction costs in New York. The regional multiplier of 1.52 based on Regional Greenhouse Gas Initiative modeling assumptions. An additional regional multiplier for the variable and fixed O&M would be needed to reflect the higher costs in New York. bAnnual Energy Outlook 2005, Basis of Assumptions Table 38, DOE (2005). cAssumed $0.05/kWh delivery cost excluding line losses. dApplied the 0.6 rule using 50 MW as the base reference. eCapital costs shown are before the 10 percent investment tax credit is applied. |

|||||||||||||

TABLE D-1-4b Energy Information Administration Regional Cost Estimates (2003 dollars)

|

|

Variable O&M |

Fixed O&M |

Fuel Cost |

||||||

|

Plant Typea |

($/kWh)a |

Annual (million $) |

($/kW)a |

($/kWh) |

Annual O&M (million $) |

Fuel Cost ($/mmBtu)b |

Heat Rate (Btu/kWh)a |

Fuel Cost ($/kWh) |

Fuel Cost (million $/yr) |

|

MSW Landfill Gas |

0.0000 |

2.4 |

101.07 |

0.0128 |

3,032,100 |

0.00 |

13,648 |

0.0000 |

0 |

|

Scrubbed Coal New |

0.0041 |

19.2 |

24.36 |

0.0031 |

14,616,000 |

1.47 |

8,844 |

0.0130 |

61.6 |

|

Integrated Coal Gasification Combined Cycle (IGCC) |

0.0026 |

11.2 |

34.21 |

0.0043 |

18,815,500 |

1.47 |

8,309 |

0.0122 |

53.0 |

|

Distributed Generation Base |

0.0000 |

0 |

26.81 |

0.0034 |

53,620 |

0.00 |

10,280 |

0.0000 |

0 |

|

Distributed Generation Peak |

0.0000 |

0 |

26.81 |

0.0034 |

26,810 |

0.00 |

10,280 |

0.0000 |

0 |

|

Advanced Gas Combined Cycle |

0.0018 |

5.6 |

10.35 |

0.0013 |

4,140,000 |

4.42 |

6,752 |

0.0298 |

94.1 |

|

Wind 10 MWc |

0.0000 |

0 |

26.81 |

0.0095 |

268,100 |

0.00 |

10,280 |

0.0000 |

0 |

|

Conventional Gas Combined Cycle |

0.0018 |

3.6 |

11.04 |

0.0014 |

2,760,000 |

4.42 |

7,196 |

0.0318 |

62.7 |

|

Advanced Nuclear |

0.0004 |

3.5 |

60.06 |

0.0076 |

60,060,000 |

0.00 |

10,400 |

0.0050 |

39.4 |

|

Advanced Combustion Turbine |

0.0032 |

5.7 |

10.72 |

0.0014 |

2,465,600 |

4.42 |

10,817 |

0.0478 |

86.7 |

|

IGCC with Carbon Sequestration |

0.0039 |

11.8 |

40.26 |

0.0051 |

15,298,800 |

1.47 |

9,713 |

0.0143 |

42.8 |

|

Wind 100 MWc |

0.0028 |

0.8 |

9.31 |

0.0033 |

931,000 |

4.42 |

9,183 |

0.0406 |

11.5 |

|

Advanced CC with Carbon Sequestration |

0.0063 |

19.9 |

14.18 |

0.0018 |

5,672,000 |

4.42 |

9,950 |

0.0440 |

138.7 |

|

Conventional Combustion Turbine |

0.0030 |

3.7 |

47.18 |

0.0060 |

7,548,800 |

2.46 |

8,911 |

0.0219 |

27.7 |

|

Biomass |

0.0063 |

3.7 |

14.18 |

0.0020 |

1,134,400 |

4.42 |

11,200 |

0.0495 |

28.8 |

|

Wind 50 MW |

0.0026 |

0.4 |

17.60 |

0.0062 |

880,000 |

4.42 |

8,613 |

0.0381 |

5.4 |

|

Photovoltaic |

0.0000 |

0 |

10.34 |

0.0049 |

51,700 |

0.00 |

10,280 |

0.00 |

0 |

|

Solar Thermald |

0.0000 |

0 |

50.23 |

0.0382 |

5,023,000 |

0.00 |

10,280 |

0.00 |

0 |

|

aAnnual Energy Outlook 2005, Basis of Assumptions Table 38, DOE (2005). bFuel prices are New York-specific. cApplied the 0.6 rule using 50 MW as the base reference. dCapital costs shown are before the 10 percent investment tax credit is applied. |

|||||||||

TABLE D-1-5 University of Chicago National Average Cost Estimates (2003 dollars)

|

|

Total Costa |

Capacity |

||||||||

|

Plant Type |

Annual Cost ($/yr) |

Capital Cost ($/kWh) |

Operating Costs ($/kWh) |

Fuel Costs ($/kWh) |

Total Cost of Electricity ($/kWh) |

Delivery Cost ($/kWh)b |

Assumed Capacity (MW) |

Assumed Capacity (kW) |

Capacity Factor |

Hours Operated per Year |

|

Integrated Coal Gasification Combined Cycle |

136,251,949 |

0.0199 |

0.0052 |

0.0094 |

0.0346 |

0.0846 |

500 |

500,000 |

0.90 |

7,884 |

|

Natural Gas Combined Cycle |

139,350,109 |

0.0088 |

0.0030 |

0.0236 |

0.0354 |

0.0854 |

500 |

500,000 |

0.90 |

7,884 |

|

Pulverized Coal Steam |

140,577,240 |

0.0167 |

0.0077 |

0.0113 |

0.0357 |

0.0857 |

500 |

500,000 |

0.90 |

7,884 |

|

Fluid Bed Coal |

141,076,995 |

0.0179 |

0.0059 |

0.0120 |

0.0358 |

0.0858 |

500 |

500,000 |

0.90 |

7,884 |

|

Pulverized Coal Supercritical |

148,369,695 |

0.0179 |

0.0085 |

0.0113 |

0.0376 |

0.0876 |

500 |

500,000 |

0.90 |

7,884 |

|

Nuclear Advanced Boiler Water Reactor |

341,200,360 |

0.0238 |

0.0152 |

0.0042 |

0.0433 |

0.0933 |

1,000 |

1,000,000 |

0.90 |

7,884 |

|

|

Financing |

Total O&M |

Fuel Cost |

|||||||

|

Plant Type |

Capital Costs ($/kW)a |

Capital Cost ($) |

Term (yr) |

Interest (%) |

Annual Payment ($/yr) |

Payment ($/kWh) |

($/kWh) |

($/yr) |

Fuel Cost ($/kWh) |

Fuel Cost ($/yr) |

|

Integrated Coal Gasification Combined Cycle |

1,338 |

669,000,000 |

20 |

10 |

78,580,489 |

0.0199 |

0.0052 |

20,458,980 |

0.0094 |

37,212,480 |

|

Natural Gas Combined Cycle |

590 |

295,000,000 |

20 |

10 |

34,650,589 |

0.0088 |

0.0030 |

11,668,320 |

0.0236 |

93,031,200 |

|

Pulverized Coal Steam |

1,119 |

559,500,000 |

20 |

10 |

65,718,660 |

0.0167 |

0.0077 |

30,471,660 |

0.0113 |

44,386,920 |

|

Fluid Bed Coal |

1,200 |

600,000,000 |

20 |

10 |

70,475,775 |

0.0179 |

0.0059 |

23,139,540 |

0.0120 |

47,461,680 |

|

Pulverized Coal Supercritical |

1,200 |

600,000,000 |

20 |

10 |

70,475,775 |

0.0179 |

0.0085 |

33,507,000 |

0.0113 |

44,386,920 |

|

Nuclear Advanced Boiler Water Reactor |

1,600 |

1,600,000,000 |

20 |

10 |

187,935,400 |

0.0238 |

0.0152 |

120,073,320 |

0.0042 |

33,191,640 |

|

aExcludes regional multipliers. bAssumes $0.05/kWh delivery cost, excluding line losses. |

||||||||||

TABLE D-1-6 University of Chicago Regional Cost Estimates for the New York Control Area (2003 dollars)

|

|

Total Costa |

Capacity |

||||||||

|

Plant Type |

Annual Cost ($/yr) |

Capital Cost ($/kWh) |

Operating Costs ($/kWh) |

Fuel Costs ($/kWh) |

Total Cost of Electricity ($/kWh) |

Delivery Cost ($/kWh)b |

Assumed Capacity (MW) |

Assumed Capacity (kW) |

Capacity Factor |

Hours Operated per Year |

|

Natural Gas Combined Cycle |

157,368,416 |

0.0134 |

0.0030 |

0.0236 |

0.0399 |

0.0899 |

500 |

500,000 |

0.90 |

7,884 |

|

Pulverized Coal Steam |

174,750,943 |

0.0253 |

0.0077 |

0.0113 |

0.0443 |

0.0943 |

500 |

500,000 |

0.90 |

7,884 |

|

Integrated Coal Gasification Combined Cycle |

177,113,803 |

0.0303 |

0.0052 |

0.0094 |

0.0449 |

0.0949 |

500 |

500,000 |

0.90 |

7,884 |

|

Fluid Bed Coal |

177,724,398 |

0.0272 |

0.0059 |

0.0120 |

0.0451 |

0.0951 |

500 |

500,000 |

0.90 |

7,884 |

|

Pulverized Coal Supercritical |

185,017,098 |

0.0272 |

0.0085 |

0.0113 |

0.0469 |

0.0969 |

500 |

500,000 |

0.90 |

7,884 |

|

Nuclear Advanced Boiler Water Reactor |

438,926,767 |

0.0362 |

0.0152 |

0.0042 |

0.0557 |

0.1057 |

1,000 |

1,000,000 |

0.90 |

7,884 |

|

|

Financing |

Total O&M |

Fuel Cost |

|||||||

|

Plant Type |

Capital Costs ($/kW)a |

Capital Cost ($) |

Term (yr) |

Interest (%) |

Annual Payment ($/yr) |

Payment ($/kWh) |

($/kWh) |

($/yr) |

Fuel Cost ($/kWh) |

Fuel Cost ($/yr) |

|

Natural Gas Combined Cycle |

897 |

448,400,000 |

20 |

10 |

52,668,896 |

0.0134 |

0.0030 |

11,668,320 |

0.0236 |

93,031,200 |

|

Pulverized Coal Steam |

1,701 |

850,440,000 |

20 |

10 |

99,892,363 |

0.0253 |

0.0077 |

30,471,660 |

0.0113 |

44,386,920 |

|

Integrated Coal Gasification Combined Cycle |

2,034 |

1,016,880,000 |

20 |

10 |

119,442,343 |

0.0303 |

0.0052 |

20,458,980 |

0.0094 |

37,212,480 |

|

Fluid Bed Coal |

1,824 |

912,000,000 |

20 |

10 |

107,123,178 |

0.0272 |

0.0059 |

23,139,540 |

0.0120 |

47,461,680 |

|

Pulverized Coal Supercritical |

1,824 |

912,000,000 |

20 |

10 |

107,123,178 |

0.0272 |

0.0085 |

33,507,000 |

0.0113 |

44,386,920 |

|

Nuclear Advanced Boiler Water Reactor |

2,432 |

2,432,000,000 |

20 |

10 |

285,661,807 |

0.0362 |

0.0152 |

120,073,320 |

0.0042 |

33,191,640 |

|

aIncludes a regional multiplier for capital costs only to account for higher construction costs in New York. The regional multiplier of 1.52 based on Regional Greenhouse Gas Initiative modeling assumptions. An additional regional multiplier for the variable and fixed O&M would be needed to reflect the higher costs in New York. bAssumed $0.05/kWh delivery cost excluding line losses. |

||||||||||

TABLE D-1-7 New York City Fuel Prices ($/MMBtu)

APPENDIX D-2

ZONAL ENERGY AND SEASONAL CAPACITY IN NEW YORK STATE, 2004 AND 2005Parker Mathusa and Erin Hogan1

TABLE D-2-1 Summary of Summer and Winter Capacity, Energy Production, and Energy Requirements in the New York Control Area, by Zone

|

|

Summer Capacity (MW) |

Winter Capacity (MW) |

Energy (GWh) |

Energy Requirements (GWh) |

Energy Production/ Demand Index |

||||||||||

|

Zonea |

2004 |

2005 |

% ∆ |

2004 |

2005 |

% ∆ |

2004 |

2005 |

% ∆ |

2004 |

2005 |

% ∆ |

2004 |

2005 |

% ∆ |

|

A |

5,216 |

5,083 |

–2.55 |

5,314 |

5,212 |

–1.93 |

26,963 |

32,080 |

18.98 |

15,942 |

16,106 |

1.03 |

1.69 |

1.99 |

17.77 |

|

B |

950 |

950 |

–0.07 |

971 |

972 |

0.05 |

5,738 |

6,258 |

9.07 |

9,719 |

9,911 |

1.98 |

0.59 |

0.63 |

6.95 |

|

C |

6,651 |

6,617 |

–0.51 |

6,859 |

6,884 |

0.36 |

29,821 |

27,263 |

–8.58 |

16,794 |

16,830 |

0.21 |

1.78 |

1.62 |

–8.77 |

|

D |

1,268 |

1,262 |

–0.50 |

1,182 |

1,277 |

8.08 |

8,505 |

9,153 |

7.62 |

5,912 |

5,782 |

–2.20 |

1.44 |

1.58 |

10.04 |

|

E |

886 |

871 |

–1.74 |

947 |

946 |

–0.11 |

3,165 |

1,404 |

–55.63 |

6,950 |

7,044 |

1.35 |

0.46 |

0.20 |

–56.22 |

|

F |

3,608 |

3,111 |

–13.78 |

3,720 |

3,535 |

–4.97 |

7,726 |

8,508 |

10.12 |

11,115 |

11,161 |

0.41 |

0.70 |

0.76 |

9.67 |

|

G |

3,501 |

3,421 |

–2.28 |

3,575 |

3,512 |

–1.77 |

9,327 |

9,213 |

–1.22 |

10,452 |

10,640 |

1.80 |

0.89 |

0.87 |

–2.96 |

|

H |

2,079 |

2,069 |

–0.46 |

2,102 |

2,100 |

–0.06 |

16,297 |

16,638 |

2.10 |

2,219 |

2,276 |

2.57 |

7.34 |

7.31 |

–0.46 |

|

I |

3.5 |

2.9 |

–17.24 |

3 |

3 |

–3.25 |

4 |

8 |

107.93 |

6,121 |

6,184 |

1.03 |

0.00 |

0.00 |

105.81 |

|

J |

8,894 |

8,981 |

0.99 |

9,455 |

9,705 |

2.65 |

20,352 |

21,821 |

7.22 |

50,829 |

52,073 |

2.45 |

0.40 |

0.42 |

4.66 |

|

K |

5,054 |

5,180 |

2.48 |

5,375 |

5,509 |

2.49 |

15,565 |

14,822 |

–4.78 |

21,960 |

22,203 |

1.11 |

0.71 |

0.67 |

–5.82 |

|

Statewide |

38,111 |

37,548 |

–1.48 |

39,504 |

39,655 |

0.38 |

143,463 |

147,169 |

2.58 |

158,014 |

160,210 |

1.39 |

0.91 |

0.92 |

1.18 |

|

aThe New York Control Area’s load zones are A, West; B, Genesee; C, Central; D, North; E, Mohawk Valley; F, Capital; G, Hudson Valley; H, Millwood; I, Dunwoodie; J, New York City; and K, Long Island. SOURCE: NYISO (2005). |

|||||||||||||||

TABLE D-2-2 Summer Zonal Capacity, by Fuel, 2004 and 2005

|

|

|

Total Zonal Winter Capacity (MW) |

Dual-Fuel Winter Capacity (MW) |

Single-Fuel Winter Capacity (MW) |

||||||||||||||||

|

Zone |

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

||

|

A |

2004 |

5,216 |

201 |

|

|

|

1,988 |

309.4 |

1 |

|

|

|

5 |

2,672 |

|

39 |

|

|

0.03 |

|

|

|

2005 |

5,083 |

193 |

|

|

|

|

1,902 |

307.8 |

1 |

|

|

|

5 |

2,636 |

|

38 |

|

|

0.03 |

|

|

%Δ |

–2.55% |

–3.84% |

|

|

|

|

–4.35% |

–0.51% |

0.00% |

|

|

|

3.85% |

–1.34% |

|

–4.06% |

|

|

0.00% |

|

B |

2004 |

950 |

|

|

|

|

|

240 |

132 |

14 |

|

|

|

2 |

58 |

|

|

498 |

|

6.7 |

|

|

2005 |

950 |

|

|

|

|

|

238 |

133 |

14 |

|

|

|

2 |

5 7 |

|

|

499 |

|

6.7 |

|

|

%Δ |

–0.07% |

|

|

|

|

|

–0.83% |

0.99% |

0.00% |

|

|

|

0.00% |

–1.62% |

|

|

0.20% |

|

0.00% |

|

C |

2004 |

6,651 |

1,043 |

|

|

|

|

678 |

442 |

8 |

1,667 |

|

|

17 |

122 |

|

34 |

2,611 |

|

30 |

|

|

2005 |

6,617 |

1,038 |

|

|

|

|

677 |

432 |

8 |

1,649 |

|

|

17 |

122 |

|

33 |

2,610 |

|

30 |

|

|

%Δ |

–0.51% |

–0.42% |

|

|

|

|

–0.19% |

–2.13% |

0.00% |

–1.06% |

|

|

–0.51% |

0.60% |

|

–2.07% |

–0.04% |

|

0.00% |

|

D |

2004 |

1,268 |

|

|

|

|

|

|

320.9 |

2 |

|

|

|

|

927 |

|

|

|

18 |

|

|

|

2005 |

1,262 |

|

|

|

|

|

|

320.6 |

2 |

|

|

|

|

922 |

|

|

|

18 |

|

|

|

%Δ |

–0.50% |

|

|

|

|

|

|

–0.09% |

0.00% |

|

|

|

|

–0.64% |

|

|

|

–0.55% |

|

|

E |

2004 |

886 |

|

|

|

|

|

52 |

333 |

|

|

|

|

|

471 |

|

|

|

20 |

9.9 |

|

|

2005 |

871 |

|

|

|

|

|

52 |

329 |

|

|

|

|

|

460 |

|

|

|

20 |

9.9 |

|

|

%Δ |

–1.74% |

|

|

|

|

|

0.00% |

–1.44% |

|

|

|

|

|

–2.30% |

|

|

|

1.00% |

0.00% |

|

F |

2004 |

3,608 |

405 |

356 |

|

|

|

|

1,363 |

|

|

|

|

|

1,470 |

|

13 |

|

0.5 |

0 |

|

|

2005 |

3,111 |

398 |

|

|

|

|

|

1,227 |

|

|

|

|

2 |

1,472 |

|

12 |

|

0.5 |

0 |

|

|

%Δ |

–13.78% |

–1.78% |

|

|

|

|

|

–10.01% |

|

|

|

|

|

0.18% |

|

–12.3% |

|

0.00% |

0.00% |

|

G |

2004 |

3,501 |

17 |

2,525 |

92 |

|

727 |

|

|

5 |

|

|

15.6 |

6 |

105 |

|

9 |

|

|

0 |

|

|

2005 |

3,421 |

16 |

2,446 |

91 |

|

728 |

|

|

5 |

|

|

15.6 |

6 |

105 |

|

8 |

|

|

0 |

|

|

%Δ |

–2.28% |

–3.53% |

–3.13% |

–1.95% |

|

0.15% |

|

|

0.00% |

|

|

0.00% |

0.00% |

0.67% |

|

–4.65% |

|

|

0.00% |

|

H |

2004 |

2,079 |

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

52 |

1,981 |

|

|

|

|

2005 |

2,069 |

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

52 |

1,971 |

|

|

|

|

%Δ |

–0.46% |

|

|

|

|

|

|

|

0.00% |

|

|

|

|

|

|

0.97% |

–0.50% |

|

|

|

I |

2004 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

0.48 |

0.2 |

|

|

|

|

|

2005 |

3 |

|

|

|

|

|

|

|

|

|

|

|

0.2 |

2 |

0.48 |

|

|

|

|

|

|

%Δ |

–17.24% |

|

|

|

|

|

|

|

|

|

|

|

|

–21.4% |

0.00% |

|

|

|

|

|

J |

2004 |

8,894 |

285 |

5,253 |

1,181 |

|

|

|

1,321 |

669 |

|

|

186 |

|

|

|

|

|

|

|

|

|

2005 |

8,981 |

513 |

5,181 |

1,186 |

|

|

|

1,318 |

667 |

|

|

117 |

|

|

|

|

|

|

|

|

|

%Δ |

0.99% |

80.18% |

–1.37% |

0.42% |

|

|

|

–0.20% |

–0.31% |

|

|

–36.99% |

|

|

|

|

|

|

|

|

K |

2004 |

5,054 |

567 |

2,420 |

|

|

|

|

805 |

1,126 |

|

|

|

6 |

|

18 |

114 |

|

|

|

|

|

2005 |

5,180 |

579 |

2,442 |

|

|

|

|

920 |

1,113 |

|

|

|

5 |

|

|

121 |

|

|

|

|

|

%Δ |

2.48% |

2.26% |

0.88% |

|

|

|

|

14.39% |

–1.17% |

|

|

|

–9.09% |

|

|

6.43% |

|

|

|

|

NYCA |

2004 |

38,111 |

2,516 |

10,555 |

1,273 |

0 |

727 |

2,958 |

5,026 |

1,871 |

1,667 |

0 |

202 |

36 |

5,827 |

18 |

260 |

5,090 |

39 |

47 |

|

|

2005 |

37,548 |

2,737 |

10,069 |

1,276 |

0 |

728 |

2,869 |

4,988 |

1,856 |

1,649 |

0 |

133 |

37 |

5,777 |

0 |

264 |

5,080 |

39 |

47 |

|

|

%Δ |

–1.48% |

8.78% |

–4.60% |

0.24% |

|

0.15% |

–3.03% |

–0.76% |

–0.82% |

–1.06% |

|

–34.13% |

4.28% |

–0.86% |

–97.4% |

1.25% |

–0.20% |

0.26% |

0.00% |

|

NOTE: See Table D-2-1, footnote a, for zone names. For definitions of acronyms in “Dual-Fuel” column heads, see “Single-Fuel” column heads. SOURCE: NYISO (2005). |

||||||||||||||||||||

TABLE D-2-3 Winter Zonal Capacity, by Fuel, 2004 and 2005

|

|

|

Total Zonal Summer Capacity (MW) |

Dual-Fuel Summer Capacity (MW) |

Single-Fuel Summer Capacity (MW) |

||||||||||||||||

|

Zone |

|

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

|

|

A |

2004 |

5,314 |

215 |

|

|

|

|

2,039 |

342.8 |

1 |

|

|

|

6 |

2,672 |

|

40 |

|

|

0.03 |

|

|

2005 |

5,212 |

217 |

|

|

|

|

1,937 |

337.4 |

1 |

|

|

|

6 |

2,674 |

|

40 |

|

|

0.03 |

|

|

%Δ |

–1.93% |

1.07% |

|

|

|

|

–5.01% |

–1.56% |

0.00% |

|

|

|

–1.79% |

0.07% |

|

1.77% |

|

|

0.00% |

|

B |

2004 |

971 |

|

|

|

|

|

250 |

141 |

16 |

|

|

|

2 |

58 |

|

|

498 |

|

6.7 |

|

|

2005 |

972 |

|

|

|

|

|

245 |

143 |

18 |

|

|

|

2 |

58 |

|

|

499 |

|

6.7 |

|

|

%Δ |

0.05% |

|

|

|

|

|

–2.00% |

1.92% |

12.50% |

|

|

|

0.00% |

0.21% |

|

|

0.14% |

|

0.00% |

|

C |

2004 |

6,859 |

1,184 |

|

|

|

|

675 |

482 |

8 |

1,675 |

|

|

18 |

125 |

|

33 |

2,630 |

|

30 |

|

|

2005 |

6,884 |

1,191 |

|

|

|

|

673 |

489 |

8 |

1,689 |

|

|

17 |

123 |

|

33 |

2,629 |

|

30 |

|

|

%Δ |

0.36% |

0.62% |

|

|

|

|

–0.16% |

1.49% |

0.00% |

0.83% |

|

|

–1.44% |

–1.6% |

|

0.68% |

–0.03% |

|

0.00% |

|

D |

2004 |

1,182 |

|

|

|

|

|

|

330.7 |

2 |

|

|

|

|

831 |

|

|

|

18 |

|

|

|

2005 |

1,277 |

|

|

|

|

|

|

331.2 |

2 |

|

|

|

|

927 |

|

|

|

18 |

|

|

|

%Δ |

8.08% |

|

|

|

|

|

|

0.15% |

0.00% |

|

|

|

|

11.4% |

|

|

|

–0.6% |

|

|

E |

2004 |

947 |

|

|

|

|

|

52 |

373 |

|

|

|

|

|

492 |

|

|

|

20 |

9.4 |

|

|

2005 |

946 |

|

|

|

|

|

53 |

365 |

|

|

|

|

|

497 |

|

|

|

20 |

11.1 |

|

|

%Δ |

–0.11% |

|

|

|

|

|

2.89% |

–2.28% |

|

|

|

|

|

0.85% |

|

|

|

0.50% |

18.2% |

|

F |

2004 |

3,720 |

444 |

383 |

|

|

|

|

1,392 |

|

|

|

|

|

1,487 |

|

13 |

|

0.5 |

0.02 |

|

|

2005 |

3,535 |

458 |

|

|

|

|

|

1,545 |

|

|

|

|

2 |

1,517 |

|

12 |

|

0.5 |

0.02 |

|

|

%Δ |

–4.97% |

3.08% |

|

|

|

|

|

11.00% |

|

|

|

|

|

2.07% |

|

–12.03% |

|

0.00% |

0.00% |

|

G |

2004 |

3,575 |

23 |

2,565 |

111 |

|

730 |

|

|

5 |

|

|

22.4 |

6 |

104 |

|

8 |

|

|

0 |

|

|

2005 |

3,512 |

22 |

2,504 |

112 |

|

731 |

|

|

5 |

|

|

17.7 |

6 |

105 |

|

8 |

|

|

0 |

|

|

%Δ |

–1.77% |

–2.61% |

–2.37% |

1.54% |

|

0.12% |

|

|

0.00% |

|

|

–22% |

0.00% |

0.86% |

|

–4.76% |

|

|

0.00% |

|

H |

2004 |

2,102 |

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

51 |

1,987 |

|

|

|

|

2005 |

2,100 |

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

52 |

1,985 |

|

|

|

|

%Δ |

–0.06% |

|

|

|

|

|

|

|

0.00% |

|

|

|

|

|

|

1.96% |

–0.11% |

|

|

|

I |

2004 |

3 |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

0.48 |

0.2 |

|

|

|

|

|

2005 |

3 |

|

|

|

|

|

|

|

|

|

|

|

0.2 |

2 |

0.48 |

|

|

|

|

|

|

%Δ |

–3.25% |

|

|

|

|

|

|

|

|

|

|

|

|

–4.2% |

0.00% |

|

|

|

|

|

J |

2004 |

9,455 |

324 |

5,280 |

1,436 |

|

|

|

1,385 |

833 |

|

|

197 |

|

|

|

|

|

|

|

|

|

2005 |

9,705 |

580 |

5,256 |

1,463 |

|

|

|

1,394 |

876 |

|

|

137 |

|

|

|

|

|

|

|

|

|

%Δ |

2.65% |

79.00% |

–0.45% |

1.82% |

|

|

|

0.67% |

5.18% |

|

|

–31% |

|

|

|

|

|

|

|

|

K |

2004 |

5,375 |

665 |

2,312 |

|

|

|

|

906 |

1,374 |

|

|

|

6 |

|

|

112 |

|

|

|

|

|

2005 |

5,509 |

674 |

2,355 |

|

|

|

|

980 |

1,382 |

|

|

|

6 |

|

|

112 |

|

|

|

|

|

%Δ |

2.49% |

1.29% |

1.84% |

|

|

|

|

8.24% |

0.59% |

|

|

|

0.00% |

|

|

–0.18% |

|

|

|

|

NYCA |

2004 |

39,504 |

2,855 |

10,540 |

1,547 |

0 |

730 |

3,015 |

5,352 |

2,302 |

1,675 |

0 |

220 |

37 |

5,772 |

0 |

257 |

5,115 |

39 |

46 |

|

|

2005 |

39,655 |

3,142 |

10,115 |

1,575 |

0 |

731 |

2,909 |

5,586 |

2,355 |

1,689 |

0 |

155 |

39 |

5,903 |

0 |

257 |

5,113 |

39 |

48 |

|

|

%Δ |

0.38% |

10.06% |

–4.03% |

1.80% |

|

0.12% |

–3.54% |

4.37% |

2.31% |

0.83% |

|

–30% |

4.09% |

2.26% |

0.00% |

–0.19% |

–0.04% |

0.00% |

3.68% |

|

NOTE: See Table D-2-1, footnote a, for zone names. For definitions of acronyms in “Dual-Fuel” column heads, see “Single-Fuel” column heads. SOURCE: NYISO (2005). |

||||||||||||||||||||

TABLE D-2-4 Annual Energy Production, by Fuel, 2004 and 2005

|

|

|

Total Zonal Energy (GWh) |

Dual-Fuel Summer Capacity (GWh) |

Single-Fuel Summer Capacity (GWh) |

|||||||||||||||||||

|

Zone |

|

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

||||

|

A |

2004 |

26,963 |

1,249 |

|

|

|

|

12,531 |

507.0 |

|

|

|

|

51 |

12,355 |

|

270 |

|

|

|

|||

|

|

2005 |

32,080 |

1,214 |

|

|

|

|

12,775 |

484.1 |

|

|

|

|

45 |

17,316 |

|

245 |

|

|

|

|||

|

|

%Δ |

18.98% |

–2.75% |

|

|

|

|

1.94% |

–4.52% |

|

|

|

|

–11.02% |

40.15% |

|

–8.96% |

|

|

|

|||

|

B |

2004 |

5,738 |

|

|

|

|

|

1,423 |

201 |

1 |

|

|

|

17 |

216 |

|

|

3,863 |

|

15.6 |

|||

|

|

2005 |

6,258 |

|

|

|

|

|

1,545 |

134 |

1 |

|

|

|

16 |

239 |

|

|

4,308 |

|

14.3 |

|||

|

|

%Δ |

9.07% |

|

|

|

|

|

8.60% |

–33.27% |

–56.42% |

|

|

|

–2.19% |

10.46% |

|

|

11.51% |

|

–8.3% |

|||

|

C |

2004 |

29,821 |

2,664 |

|

|

|

|

4,600 |

261 |

|

395 |

|

|

118 |

653 |

|

228 |

20,833 |

|

69 |

|||

|

|

2005 |

27,263 |

1,854 |

|

|

|

|

3,967 |

243 |

|

407 |

|

|

144 |

276 |

|

236 |

20,057 |

|

79 |

|||

|

|

%Δ |

–8.58% |

–30.4% |

|

|

|

|

–13.78% |

–6.82% |

|

2.99% |

|

|

22.12% |

–57.77% |

|

3.64% |

–3.72% |

|

14.1% |

|||

|

D |

2004 |

8,505 |

|

|

|

|

|

|

1989.9 |

|

|

|

|

|

6,417 |

|

|

|

98 |

|

|||

|

|

2005 |

9,153 |

|

|

|

|

|

|

1938.1 |

|

|

|

|

|

7,108 |

|

|

|

107 |

|

|||

|

|

%Δ |

7.62% |

|

|

|

|

|

|

–2.60% |

|

|

|

|

|

10.77% |

|

|

|

9.03% |

|

|||

|

E |

2004 |

3,165 |

|

|

|

|

|

340 |

221 |

|

|

|

|

|

2,491 |

|

|

|

94 |

18.8 |

|||

|

|

2005 |

1,404 |

|

|

|

|

|

420 |

148 |

|

|

|

|

|

714 |

|

|

|

104 |

19.4 |

|||

|

|

%Δ |

–55.6% |

|

|

|

|

|

23.39% |

–33.25% |

|

|

|

|

|

–71.34% |

|

|

|

10.4% |

2.72% |

|||

|

F |

2004 |

7,726 |

3,024 |

102 |

|

|

|

|

1,019 |

|

|

|

|

|

3,491 |

|

91 |

|

|

|

|||

|

|

2005 |

8,508 |

3,021 |

|

|

|

|

|

2,958 |

|

|

|

|

14 |

2,129 |

|

77 |

|

|

|

|||

|

|

%Δ |

10.12% |

–0.08% |

|

|

|

|

|

190.25% |

|

|

|

|

|

–39.% |

|

–15.09% |

|

|

|

|||

|

G |

2004 |

9,327 |

135 |

4,447 |

8 |

|

4,312 |

|

|

|

|

|

2.4 |

|

381 |

|

43 |

|

|

|

|||

|

|

2005 |

9,213 |

136 |

4,833 |

1 |

|

3,830 |

|

|

|

|

|

0.2 |

|

363 |

|

49 |

|

|

|

|||

|

|

%Δ |

–1.22% |

1.10% |

8.70% |

–81.9% |

|

–11.% |

|

|

|

|

|

–90.% |

|

–4.68% |

|

14.44% |

|

|

|

|||

|

H |

2004 |

16,297 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

382 |

15,915 |

|

|

|||

|

|

2005 |

16,638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

378 |

16,260 |

|

|

|||

|

|

%Δ |

2.10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

–1.02% |

2.17% |

|

|

|||

|

I |

2004 |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|||

|

|

2005 |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|||

|

|

%Δ |

107.9% |

|

|

|

|

|

|

|

|

|

|

|

|

107.93% |

|

|

|

|

|

|||

|

J |

2004 |

20,352 |

2,094 |

12,249 |

418 |

|

|

|

5,466 |

107 |

|

|

19 |

|

|

|

|

|

|

|

|||

|

|

2005 |

21,821 |

3,295 |

12,750 |

554 |

|

|

|

5,060 |

119 |

|

|

43 |

|

|

|

|

|

|

|

|||

|

|

%Δ |

7.22% |

57.37% |

4.08% |

32.71% |

|

|

|

–7.44% |

12.09% |

|

|

132.% |

|

|

|

|

|

|

|

|||

|

K |

2004 |

15,565 |

2,009 |

10,507 |

|

|

|

|

1,474 |

664 |

|

|

|

19 |

|

|

892 |

|

|

|

|||

|

|

2005 |

14,822 |

2,020 |

10,099 |

|

|

|

|

1,421 |

369 |

|

|

|

16 |

|

|

897 |

|

|

|

|||

|

|

%Δ |

–4.78% |

0.52% |

–3.89% |

|

|

|

|

–3.58% |

–44.49% |

|

|

|

–16.75% |

|

|

0.64% |

|

|

|

|||

|

NYCA |

2004 |

143463 |

11,175 |

27,305 |

425 |

0 |

4,312 |

18,895 |

11,140 |

772 |

395 |

0 |

21 |

205 |

26,008 |

0 |

1,905 |

40,610 |

192 |

103 |

|||

|

|

2005 |

147169 |

11,541 |

27,990 |

556 |

0 |

3,830 |

18,706 |

12,386 |

489 |

407 |

0 |

43 |

236 |

28,153 |

0 |

1,883 |

40,626 |

211 |

112 |

|||

|

|

%Δ |

2.58% |

3.28% |

2.51% |

30.60% |

|

–11.% |

–1.00% |

11.19% |

–36.70% |

2.99% |

|

106.% |

15.13% |

8.25% |

|

–1.13% |

0.04% |

9.71% |

8.63% |

|

|

|

|

NOTE: See Table D-2-1, footnote a, for zone names. For definitions of acronyms in “Dual-Fuel” column heads, see “Single-Fuel” column heads. SOURCE: NYISO (2005). |

|||||||||||||||||||||||

Table D-2-5 Summary of New York Control Area Generation Facilities’ Energy Production by Fuel Type as of January 1, 2005

|

|

|

Dual-Fuel Energy (GWh) |

Single-Fuel Energy (GWh) |

||||||||||||||||

|

Zone |

Total Zonal Energy (GWh) |

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

|

A |

32,080 |

1,214 |

|

|

|

|

12,775 |

484.1 |

|

|

|

|

45 |

17,316 |

|

245 |

|

|

|

|

B |

6,258 |

|

|

|

|

|

1,545 |

134 |

1 |

|

|

|

16 |

239 |

|

|

4,308 |

|

14 |

|

C |

27,263 |

1,854 |

|

|

|

|

3,967 |

243 |

|

407 |

|

|

144 |

276 |

|

236 |

20,057 |

|

79 |

|

D |

9,153 |

|

|

|

|

|

|

1,938.1 |

|

|

|

|

|

7,108 |

|

|

|

107 |

|

|

E |

1,404 |

|

|

|

|

|

420 |

148 |

|

|

|

|

|

714 |

|

|

|

104 |

19 |

|

F |

8,508 |

3,021 |

309 |

|

|

|

|

2,958 |

|

|

|

|

14 |

2,129 |

|

77 |

|

|

|

|

G |

9,213 |

136 |

4,833 |

|

1 |

3,830 |

|

|

|

|

|

0.2 |

|

363 |

|

49 |

|

|

|

|

H |

16,638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

378 |

16,260 |

|

|

|

I |

8 |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

J |

21,821 |

3,295 |

12,750 |

554 |

|

|

|

5,060 |

119 |

|

|

43 |

|

|

|

|

|

|

|

|

K |

14,822 |

2,020 |

10,099 |

|

|

|

|

1,421 |

369 |

|

|

|

16 |

|

0 |

897 |

|

|

|

|

NYCA |

147,169 |

11,541 |

27,990 |

556 |

0 |

3,830 |

18,706 |

12,386 |

489 |

407 |

0 |

43 |

236 |

28,153 |

0 |

1,883 |

40,626 |

211 |

112 |

|

|

|

Dual-Fuel Energy (%) |

Single-Fuel Energy (%) |

||||||||||||||||

|

Zone |

Total Zonal Energy (%) |

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

|

A |

21.8 |

3.8 |

|

|

|

|

39.8 |

1.5 |

|

|

|

|

0.1 |

54.0 |

|

0.8 |

|

|

|

|

B |

4.3 |

|

|

|

|

|

24.7 |

2.1 |

0.0 |

|

|

|

0.3 |

3.8 |

|

|

68.8 |

|

0.2 |

|

C |

18.5 |

6.8 |

|

|

|

|

14.5 |

0.9 |

|

1.5 |

|

|

0.5 |

1.0 |

|

0.9 |

73.6 |

|

0.3 |

|

D |

6.2 |

|

|

|

|

|

|

21.2 |

|

|

|

|

|

77.7 |

|

|

|

1.2 |

|

|

E |

1.0 |

|

|

|

|

|

29.9 |

10.5 |

|

|

|

|

|

50.8 |

|

|

|

7.4 |

1.4 |

|

F |

5.8 |

35.5 |

3.6 |

|

|

|

|

34.8 |

|

|

|

|

0.2 |

25.0 |

|

0.9 |

|

|

|

|

G |

6.3 |

1.5 |

52.5 |

0.0 |

|

41.6 |

|

|

|

|

|

0.0 |

|

3.9 |

|

0.5 |

|

|

|

|

H |

11.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.3 |

97.7 |

|

|

|

I |

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

100.0 |

|

|

|

|

|

|

J |

14.8 |

15.1 |

58.4 |

2.5 |

|

|

|

23.2 |

0.5 |

|

|

0.2 |

|

|

|

|

|

|

|

|

K |

10.1 |

13.6 |

68.1 |

|

|

|

|

9.6 |

2.5 |

|

|

|

0.1 |

|

0.0 |

6.1 |

|

|

|

|

NYCA |

100.0 |

7.8 |

19.0 |

0.4 |

0.0 |

2.6 |

12.7 |

8.4 |

0.3 |

0.3 |

0.0 |

0.0 |

0.2 |

19.1 |

0.0 |

1.3 |

27.6 |

0.1 |

0.1 |

|

NOTE: See Table D-2-1, footnote a, for zone names. For definitions of acronyms in “Dual-Fuel” column heads, see “Single-Fuel” column heads. SOURCE: NYISO (2005). |

|||||||||||||||||||

TABLE D-2-6 Summary of New York Control Area Generation Facilities’ Winter Capacity, by Fuel Type, as of January 1, 2005

|

|

Total Zonal Winter Capacity (MW) |

Dual-Fuel Winter Capacity (MW) |

Single-Fuel Winter Capacity (MW) |

||||||||||||||||

|

Zone |

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |

Wood WD |

Wind WND |

|

|

A |

5,212 |

217 |

|

|

|

|

1,937 |

337.4 |

1 |

|

|

|

6 |

2,674 |

|

40 |

|

|

0 |

|

B |

972 |

|

|

|

|

|

245 |

143 |

18 |

|

|

|

2 |

58 |

|

|

499 |

|

6.7 |

|

C |

6,884 |

1,191 |

|

|

|

|

673 |

489 |

8 |

1,689 |

|

|

17 |

123 |

|

33 |

2,629 |

|

30 |

|

D |

1,277 |

|

|

|

|

|

|

331.2 |

2 |

|

|

|

|

927 |

|

|

|

18 |

|

|

E |

946 |

|

|

|

|

|

53 |

365 |

|

|

|

|

|

497 |

|

|

|

20 |

11.1 |

|

F |

3,535 |

458 |

|

|

|

|

|

1,545 |

|

|

|

|

2 |

1,517 |

|

12 |

|

0.5 |

0 |

|

G |

3,512 |

22 |

2,504 |

112 |

|

731 |

|

|

5 |

|

|

17.7 |

6 |

105 |

|

8 |

|

|

0 |

|

H |

2,100 |

|

|

|

|

|

|

|

64 |

|

|

|

|

|

|

52 |

1,985 |

|

|

|

I |

3 |

|

|

|

|

|

|

|

|

|

|

|

0 |

2 |

0 |

|

|

|

|

|

J |

9,705 |

580 |

5,256 |

1,463 |

|

|

|

1,394 |

876 |

|

|

137 |

|

|

|

|

|

|

|

|

K |

5,509 |

674 |

2,355 |

|

|

|

|

980 |

1,382 |

|

|

|

6 |

|

|

112 |

|

|

|

|

NYCA |

39,655 |

3,142 |

10,115 |

1,575 |

0 |

731 |

2,909 |

5,586 |

2,355 |

1,689 |

0 |

155 |

39 |

5,903 |

0 |

257 |

5,113 |

39 |

48 |

|

|

Total Zonal Winter Capacity (%) |

Dual-Fuel Winter Capacity (%) |

Single-Fuel Winter Capacity (%) |

||||||||||||||||

|

Zone |

NG/FO2 |

NG/FO6 |

NG/KER |

NG/JF |

NG/BIT |

Coal BIT |

Natural Gas NG |

No. 2 FO2 |

No. 6 FO6 |

Jet Fuel JF |

Kerosene KER |

Methane MTE |

Water WAT |

Other OT |

Refuse REF |

Uranium UR |