7

Labor Force Withdrawal of the Elderly in South Africa

David Lam, Murray Leibbrandt, and Vimal Ranchhod

INTRODUCTION

The elderly in South Africa face a complex set of challenges. South Africans over age 50 have spent most of their lives under the system of apartheid. Levels of inequality in education between races and within races are far greater among these older cohorts than they are for younger South Africans. Elderly black South Africans have lived their most productive years under the restrictions on employment, residence, and other opportunities that apartheid imposed. As they now enter retirement, they face new pressures caused by the impact of HIV/AIDS and high unemployment on the next generation. At the same time, South Africa’s elderly have access to an old age pension system that is among the most generous in the developing world. The old age pension helps lift many older South Africans out of the most extreme forms of poverty, putting many of them in a position to support their children and grandchildren.

Decisions of the elderly about work and retirement are made in this complex set of circumstances. Older workers face an increasingly competitive labor market characterized by high unemployment, with limited opportunities for those with poor education and training. They often live in large extended households in which their own resources may be an important source of economic support. The pension provides such a source without necessarily competing with work.

The state old age pension program has spawned a considerable body of research. This research is reviewed in the next section of the paper. The review shows that the state old age pension is the key plank of South Africa’s

social safety net, that these pensions are well targeted to the poor, and, because of the large number of three-generation and skipped-generation households in South Africa, they reach many poor children. In addition, it seems that many of the unemployed survive through their links to related pensioners. More recent research has begun to explore the impact of these pensions on labor participation behavior.

Given all of the above, the dearth of research on the elderly themselves is surprising. We know very little about the circumstances of the elderly, their health, and how they cope with the pressures placed on them by the importance of their pension income to their extended families. Two recent studies have begun to address these issues (Møller and Devey, 2003; Møller and Ferreira, 2003). The first of these studies compares older and younger households on the basis of data from 1995 and 1998 national surveys, defining older households as those that include at least one member age 60 or older. The second study is based on a 2002 survey of the living conditions and financial and health situations of 1,111 older nonwhite households in Cape Town and the rural Eastern Cape. Here, older was defined as households containing 1 person age 55 or older.

The first study confirms that older households are larger and include larger numbers of dependents and unemployed members than younger households. In both 1995 and 1998, roughly half of older black households included three or more generations. Such households tend to be concentrated in rural areas. The Møller and Ferreira (2003) study shows that among black older households, the percentage of household members under age 25 was 58 percent in rural areas and 51 percent in urban areas. In contrast, less than a quarter of these household members were actually age 55 or older. Less than 10 percent of older people lived alone.

Møller and Devey (2003) show that many older black households are poor. However, access to state old age pensions strongly decreases the probability that such households fall into the lowest expenditure quintile. Pensioner households have better access to services and express significantly higher levels of satisfaction with their living conditions than nonpensioner older households.

Møller and Ferreira (2003) confirm the dominance of the state old age pension as the primary income source in older households. They found that pension income is often the sole income in these households, especially in rural areas. They describe three elements of a “gradient of disadvantage” that makes older rural households worse off than older urban households. First, household well-being as measured by income or expenditure per capita is lower in the rural households. Second, the drain on the resources of the rural elderly through expenditures on other members of the household is higher in rural areas. Third, urban households are far more successful at accessing other government grants, such as the child support grants and

disability grants for which the members of their household may be eligible. All in all this leads to a situation in which the elderly in urban areas are better placed to use their pensions for their own support.

Aside from work on the old age pension, the magnitude of South Africa’s unemployment problem has spawned a growing body of work on labor force participation in the country. This work shows that South African participation rates are low by international standards, especially for women (Winter, 1998). However, participation rates, and female participation rates in particular, rose sharply in the 1990s, despite the fact that many of these new participants did not move into employment but joined the ranks of the unemployed (Casale and Posel, 2002; Klasen and Woolard, 2000). Research by Mlatsheni and Leibbrandt (2001) and Leibbrandt and Bhorat (2001) highlights the importance of education as a factor affecting female participation rates.

However, this literature on participation has given very little specific attention to the labor market behavior of the elderly. Given the considerable focus on the impact of the old age pension on the work activity of the nonelderly, it is surprising that the labor force behavior of those who actually receive these pensions has received so little attention. The fact that it is the elderly who are facing a retirement decision as part of this participation behavior would seem to make their labor force behavior especially interesting.

This paper provides a broad overview of the labor force activity of older workers in South Africa. We begin the paper with a discussion of important features of the social and economic environment that provide a background for the analysis. Drawing on excellent microdata, we then analyze the age profile of participation, focusing in particular on the possible effects of the old age pension on retirement. We look at several important variables that may affect the economic activity of the elderly, including marital status, living arrangements, the pension system, and education. We estimate probit regressions in order to look at key determinants of labor force activity.

SOCIAL AND ECONOMIC BACKGROUND

A number of features of South African society and economy are important to keep in mind in analyzing the economic activity of the elderly. In this section of the paper we discuss some of these important features, with particular focus on the old age pension system and patterns of household structure.

South Africa’s Old Age Pension

No analysis of the elderly in South Africa would be complete without a discussion of the country’s old age pension system. Social assistance in South Africa consists of three main programs: pensions for the elderly, grants for the disabled, and grants for the support of poor children. Old age and disability pensions are set at generous levels. The 2005 level is R780 per month, about $120. Relative to this amount, the child support grant is set at a meager R180 or about $28 per month and is payable for children up to and including the age of 14. All three grants are supposedly means-tested, but in practice the means test is rarely administered for applicants who appear poor. A total of between 4 and 5 million people (or 10 percent of the total population) receive one or the other grant. South Africa’s public welfare system is exceptional among developing countries and is a major pillar in its highly redistributive social policies (Seekings, 2002; Van der Berg, 2001; Van der Berg and Bredenkamp, 2002).

The state old age pension system is unique and the most important aspect of the South Africa social assistance system. It has an interesting history, as it evolved from a grant that was paid exclusively to white South Africans to one that was paid to all South Africans regardless of racial categorization. The grant was first introduced in 1928 as a form of income support for poor elderly whites (Sagner, 2000). Only in 1944 did the preapartheid state extend the social pension to include members of other race groups, and, even then, pension payment size was legally determined by race at a ratio of 4:2:1 for whites, Indians/coloreds, and blacks/Africans, respectively. Beginning in the late 1970s, the racial gap in pensions was significantly reduced through the allocation of large additional funds to this scheme by the apartheid state. During the 1980s, the size of pensions more than doubled for Africans, while it declined by 40 percent (in real terms) for whites (Ferreira, 1999). By 1985, white pensions were only 2.5 times higher than those of blacks and 1.5 times higher than those for those categorized as coloreds and Indians (Schlemmer and Møller, 1997). Take-up rates, particularly among elderly black South Africans, increased markedly during this time. The Social Assistance Act of 1992 provided steps to deracialize pensions and achieve pension parity, which was finally achieved in 1993, just one year prior to the first democratic elections. By 1993, the take-up rate among eligible black South African men and women stood at 80 percent.

Case and Deaton (1998) provide a comprehensive analysis of the workings of the South African pension system. The key features of the system are that it is paid to women age 60 and over and men age 65 and over, with a means test that allows 80 percent of age-eligible black South Africans to receive the pension. Most receive the maximum benefit. The benefit was

about 2.5 times the median per capita income by 2000. The 2005 pension of R780 per month can be compared to the minimum wage for domestic workers, which was set at R754 in rural areas in 2005.

The means test for the pension in 2004, if enforced, would have applied at annual income levels of about R18,000 for single individuals and about R34,000 for married couples. This implies that many elderly could receive the full value of the pension while continuing to work full time, even with the means test (below we show that some elderly do in fact work while receiving the pension, although the percentages are low). Given the weak enforcement of the means test, the receipt of the pension does not have a direct negative incentive on work for many low-income elderly. The impact of the pension on labor supply is thus primarily an income effect.

Considerable research has been done on the impact of the old age pension. Duflo (2003) found a positive effect of the pension on the health outcomes of young girls in the household. Jensen (2004) found that the pension tends to “crowd out” private transfers from family members living away from home. Looking at the impact of the pension on labor supply, Bertrand, Mullainathan, and Miller (2003) found that the pension tends to reduce the labor supply of working-age adults. Posel, Fairburn, and Lund (2004) found a more complex effect of the pension on labor supply, with the pension increasing the probability that prime-age adults migrate for work. Edmonds (2005) found a negative effect of the pension on the work activity of children. Given the attention focused on the pension’s impact on the labor supply and other outcomes of prime-age adults and children, it is surprising that little attention has been given to the pension’s impact on the labor supply of the elderly themselves. This is an issue we analyze in detail below.

Household Structure

As noted above, another dimension of South African society that is important in analyzing the economic activity of the elderly is the complex extended household structure that is common among black South African households. As noted by Case and Deaton (1998), one of the reasons the pension system is so effective in reducing poverty in South Africa is that the elderly recipients of the pension often live in households with young children. While these complex extended household patterns have long historical roots in South Africa, they have taken on new importance as HIV/AIDS and high unemployment have weakened the ability of prime-age adults to support their families. Edmonds, Mammen, and Miller (2005) remind us how unusual this situation is when they note that the standard literature on old age pensions focuses on how pensions enable the elderly to maintain their independence. They conclude that the arrival of a state old age pen-

sion into a black South African household leads to the departure of primeage working women and the arrival of children under age 5 and women of childbearing age. They see this behavior as evidence of the household’s making use of the pension to reshape itself according to the comparative advantage for work inside and outside the household. In line with this behavior, we would expect that the labor supply decisions of the elderly are therefore often being made simultaneously with decisions about living arrangements. We look at the links between household structure and the labor force activity of the elderly in some detail. Although we do not identify the causal links between household structure and the work activity of the elderly, we show that there appear to be important links between these variables.

DATA

We use two main data sets for our analysis, each with strengths and weaknesses. We use the 10 percent sample of the 2001 census for many of our estimates, taking advantage of the large sample size. With roughly 4 million total observations, the census gives us thousands of observations at single years of age, even at ages from 60 to 70. For example, the number of individuals in the 70-74 age group in the census sample is over 12,800 black South African men, 25,000 black South African women, 4,500 white men, and 6,000 white women. The census provides standard information on employment status, along with information on schooling, household structure, and marital status. For comparative purposes we also use the 10 percent sample of the 1996 census.

The other important data set used in our analysis is the South Africa Labor Force Survey (LFS), a nationally representative household survey of about 30,000 households collected by Statistics South Africa. We use the September 2000 LFS for some of our analysis because it has greater detail than the census for such variables as work activity and pension receipt. The drawback of the LFS is the smaller sample size. For example, in the 50-79 age group there are roughly 4,000 black South African men and 6,000 black South African women, making it difficult to look at fine age detail and making it almost impossible to look at any population group other than black South Africans. For certain parts of our analysis, we pool the LFS data for September 2000 and September 2001, giving us a larger sample size. Although the LFS is designed with a rotating panel structure, a new sample was introduced in September 2001. There is therefore no overlap in the two waves that we pool. We also merge the September LFS with the 2000 Income and Expenditure Survey (IES), allowing us to look at the impact of pension income on total household income.

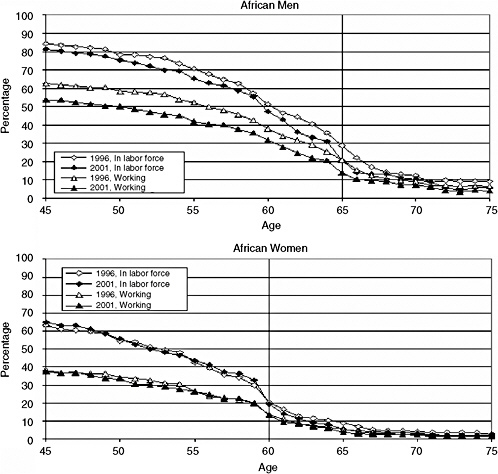

AGE PROFILES OF LABOR FORCE PARTICIPATION

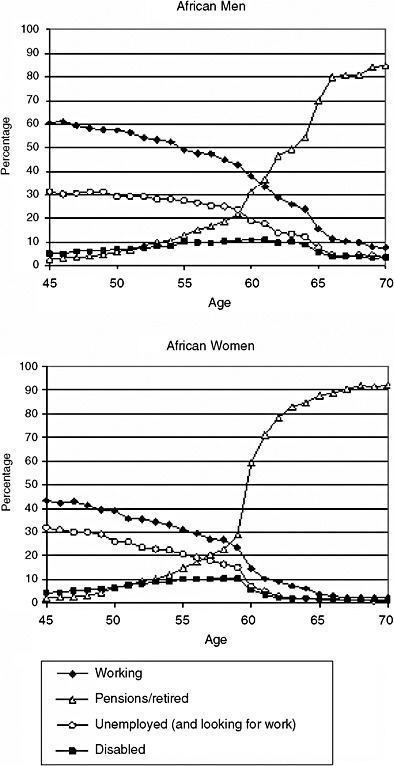

Figure 7-1 shows the age profile of labor force participation and employment for men and women ages 45-75 who identify themselves as black/ African in the 1996 and 2001 census.1 The ages of eligibility for the state old age pension (65 for men and 60 for women) are indicated on the figure for reference. The measure of labor force participation used in Figure 7-1 follows standard international definitions, counting labor force participants as those who were either working, on vacation or sick leave from work, or looking for work. The “working” series includes those who were working and those who were on vacation or sick leave during the week before the census. Work is defined broadly, including any work for pay, profit, or family gain.2 One of the stark features of Figure 7-1 is the large gap between the “in labor force” and “working” series, confirming the high rates of unemployment for both men and women in South Africa. The unemployment rate at age 50 in 2001, for example, is 34 percent for men and 40 percent for women.3

Figure 7-1 shows a relatively rapid rate of withdrawal from the labor force for both men and women after age 50. In the 2001 census, male participation rates fall from around 75 percent at age 50 to 47 percent at age 60 and 10 percent at age 70. Participation rates for women in 2001 fall from around 55 percent at age 55 to about 20 percent at age 60 and below 5 percent at age 70. The percentage who are actually working is well below the participation rate for both men and women around age 50, but, like the participation rate, it falls steadily with age. The percentage of men working in 2001 is about 50 percent at age 50, falls to 30 percent at age 60, and is below 10 percent at age 70. Put another way, if we could interpret this cross-sectional relationship as the life-cycle work profile of a cohort of men, it would imply that over half of the men who were working at age 50

FIGURE 7-1 Percentage working and participating in the labor force, 1996 and 2001 censuses.

stopped working several years before they reached the age of eligibility for the state old age pension.

Comparisons between 1996 and 2001 census data are interesting for a number of reasons. First, it helps to disentangle age and cohort effects that would be impossible to separate in a single cross-section. In this paper we often interpret the age patterns in labor force activity as indicating changes over the life cycle. But it is important to remember that the age patterns we observe may be affected by differences in the behavior of different cohorts. For example, as we document below, younger cohorts are considerably better educated than older cohorts, especially among Africans. This may lead to differences in life-cycle labor force behavior that will show up in the age profile of participation at any given point in time. By looking at two cen-

suses five years apart, we can be clearer about age and cohort effects and more certain about whether we are seeing life-cycle labor force behavior. The age profiles from the 1996 census shown in Figure 7-1 suggest that the basic shape of the age profile in work and labor force participation did not change much between 1996 and 2001, although both rates for men dropped at all ages. Looking at the figure for women, the 1996 and 2001 lines are almost indistinguishable for both labor force participation and work.

Figure 7-1 shows that there are sharp drop-offs in labor force participation and work for both men and women around the age of eligibility for the old age pension (age 60 for women and age 65 for men). These declines around the pension age are larger in 2001 than they are in 1996. The decline in labor force participation rate for men between ages 64 and 66 is 13.6 percentage points in 1996 and 16.9 percentage points in 2001. This implies that 54.5 percent of those still in the labor force at age 64 have left it by age 66 in 2001. Exit from work is at a similar rate, with the percentage of men working at age 66 roughly half of the percentage working at age 64. The figure for women shows a similar discontinuity around the pension age in rates of labor force participation and employment. The decline in labor force participation rates for women between ages 59 and 61 is 18.4 percentage points, or 57 percent of the age 59 rate. The decline in the percentage working is 10.3 percentage points, or 52 percent of the age 59 rate.

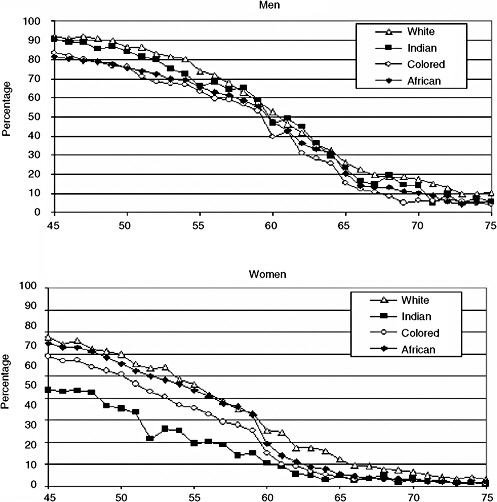

Figure 7-2 shows participation rates for all four of the major population groups. As this figure shows, there are relatively small racial differences in participation rates for men at all ages. Participation rates are somewhat lower for African and colored men from ages 45 to 55, with similar rates of decline in participation for all groups from ages 55 to 65. Participation rates for women are considerably lower at all ages, falling from around 60 percent at age 45 to 20 percent at age 60 and under 5 percent at age 70. Racial differences in participation rates are larger for women than for men, with Indian women having the lowest rates. Participation rates for African and white women are almost identical up to age 59, with the participation of African women showing a larger drop in participation at age 60. Participation rates above age 65 are between 10 and 20 percent for men, rates that are much lower than the 65 percent participation rate reported for Southern Africa in a cross-national analysis of 1980 data (Clark and Anker, 1993). Participation rates of older men in South Africa are somewhat higher than those for most European countries, however. As shown in the cross-national study of retirement in Organisation for Economic Co-operation and Development (OECD) countries coordinated by the National Bureau of Economic Research (NBER), participation rates for men ages 60-64 were below 20 percent in France, Belgium, and the Netherlands around 1995 (Gruber and Wise, 1999). We discuss comparisons to OECD countries in more detail below.

FIGURE 7-2 Labor force participation rates by age and population group, 2001 South Africa census.

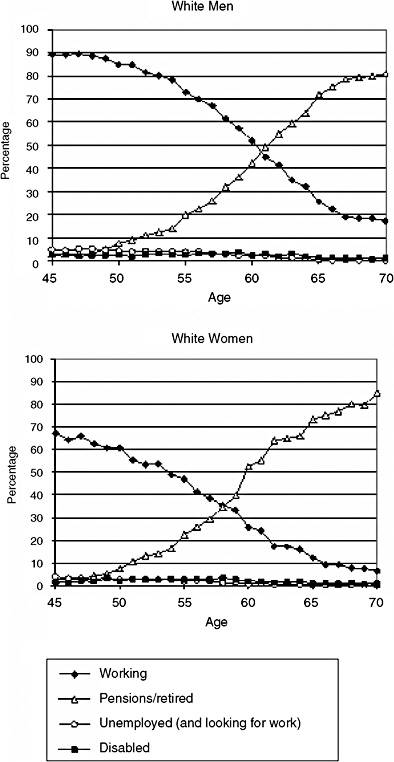

COMPONENTS OF LABOR FORCE ACTIVITY

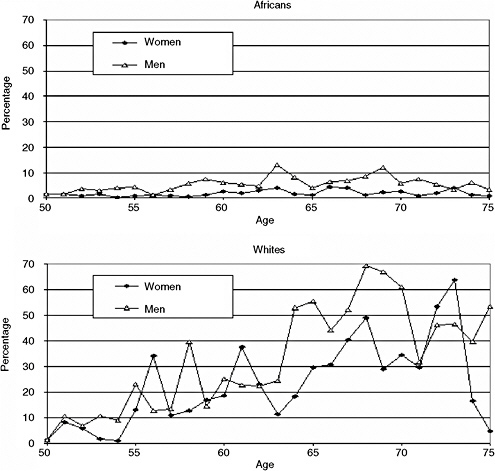

Figure 7-3 shows the 2001 distribution of labor force activity in more detail for African men, white men, African women, and white women. Four categories of activity are shown. The two components of labor force participation—working and unemployed—are shown separately. In the 2001 census, respondents were asked to give the reason for not working for all those who were not working in the previous seven days. Two of these categories are included in Figure 7-3: the percentage reported as being a “pensioner or retired person/too old to work” and the percentage reported as “unable to work due to illness or disability.” Additional possible reasons

for not working that are not included in the figure include student, housewife/homemaker, and “does not choose to work.” Figure 7-3 once again shows the high rate of unemployment for African men and women, even in what would usually be considered prime working years. Over 20 percent of both African men and African women ages 45-55 reported that they were unemployed and looking for work in 2001. These high rates of unemployment are an important characteristic of the South African labor market that must be kept in mind throughout our analysis.

The percentage of African men and women who are unemployed declines steadily with age, with many of these individuals presumably reclassifying themselves as retired as they get older. The percentage of men who are reported as “pensioner or retired/too old to work” climbs steeply after age 65, reaching about 80 percent by age 66. Women show an even sharper jump in the percentage reported as being retired around age 60, with the percentage jumping from 30 to 70 percent between ages 59 and 61. The age profiles for white men and women show steady declines in participation and steady increases in the percentage retired with increasing age, but the changes around age 60 and age 65 are less sharp than the changes for Africans.

The percentage of men and women of either racial group reported as disabled is relatively low, reaching highs of around 10 percent for African men and women approaching retirement age. It is interesting to compare this to the significantly higher rates of disability reported for many OECD countries in the NBER study (Gruber and Wise, 1999). For example, in the Netherlands, a country with generous disability insurance, well over 20 percent of men ages 60-64 were reported as being disabled in 1994 (Kapteyn and de Vos, 1999). Disability rates for Africans drop at the retirement ages, as men and women presumably reclassify themselves from disabled to retired.

Further detail on the economic activity of older workers is provided in the LFS, which asks a series of separate questions about specific types of economic activity. In addition to providing greater detail than the census, these questions may elicit higher levels of economic activity than the single question used in the census. Table 7-1 shows detailed breakdowns of work activity for African men and women in 5-year age groups using the merged September 2000 and September 2001 LFS. Due to small cell sizes, we do not attempt this breakdown for other population groups. Column 2 shows the percentage engaged in work for pay, excluding domestic workers. About 54 percent of men are in this category in the merged 2000-2001 LFS data. This percentage drops to 41 percent in the 55-59 age group, then drops sharply to 26 percent in the 60-64 age group and 11 percent in the 65-69 age group. Column 3 shows the percentage employed as domestic workers, an occupation that is, not surprisingly, concentrated among women. Com-

bining the first two columns for women, about 37 percent are engaged in work for pay in the age group 45-49. There is a sharp drop from 29 percent to under 10 percent between the 55-59 and 60-64 age groups.

Column 5 in Table 7-1 shows the percentage reporting that they work on a family plot or farm.4 This is an activity that is counted as economically active in many surveys, including the LFS and the census. While under 4 percent of men report that they work on a family plot in the 45-49 age group, this rises to about 10 percent among 65-69-year-olds and remains at about that level through the 75-79 age group. Column 7 shows the percentage working in any of the categories in Columns 2-6. Although the categories in Columns 2-6 are not mutually exclusive, the total percentage working in Column 7 is calculated to eliminate double counting. Comparing the estimates of the percentage working from the LFS in Table 7-1 with the estimates from the census in Figure 7-3, it appears that the specific questions about work on a family plot in the LFS lead to higher estimates of work activity for older workers than the census, even though the census question should theoretically include the same components as those included in Table 7-1. For example, the total percentage of men working in the 65-69 age group is 25 percent in the LFS figures in Table 7-1, while the percentage is under 20 percent for the census in Figure 7-3. We suspect that the difference is the result of higher response to the specific question directed at work on a family plot in the LFS.

Hazard Rates for Withdrawal from Labor Force

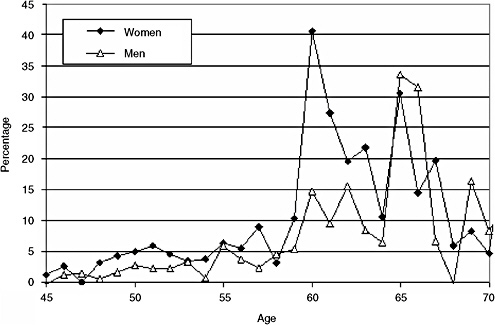

A useful way of focusing on withdrawal from the labor force is to calculate hazard rates for exit from the labor force. Figure 7-4 shows hazard rates of leaving the labor force for African men and women. These are calculated using the proportions who are economically active (those working and those unemployed by the narrow definition) at each age shown in Figure 7-1. The hazard rate can be thought of as an estimate of the probability of leaving the labor force at a given age, conditional on being in the labor force in the previous year. It is important to keep in mind that it is being estimated from cross-sectional rather than longitudinal data, and therefore it does not show the actual retirement experience of individuals. In our data it is simply the percentage decline in the proportion who are economically active between age x and age x + 1.

TABLE 7-1 Percentage in Various Categories of Labor Market Status, African Men and Women, 2000-2001 South Africa Labor Force Survey

Figure 7-4 shows the annual hazard rate of retirement for African men and women in the 2001 census. For African women the hazard rate has a very sharp peak of about 40 percent at age 60, the age at which women become eligible for the old age pension. If we estimated this hazard rate for women between ages 59 and 61, the rate would be 57 percent. That is, the labor force participation rate for women at age 61 is 57 percent smaller than the rate at age 60. The hazard rate for women remains at over 20 percent at ages 61-63, drops to 10 percent at age 64, then rises again to a second peak of around 30 percent at age 65.

For African men the hazard rate for leaving the labor force is below 5 percent until age 60, reaches 10 to 15 percent between ages 60 and 64, then jumps to over 30 percent at ages 65 and 66. Calculated between ages 64 and 66—one year before the pension age to one year after—the probability of retiring, conditional on being in the labor force at age 64, is 55 percent. As Figure 7-1 shows, these hazard rates would be very similar if estimated

|

Percentage Unemployed |

Percentage in Labor Force |

||

|

Narrow (8) |

Broad (9) |

Narrow (10) |

Broad (11) |

|

14.4 |

22.1 |

83.3 |

91.0 |

|

11.9 |

20.9 |

75.8 |

84.8 |

|

10.5 |

17.8 |

70.4 |

77.7 |

|

5.1 |

10.6 |

51.4 |

56.8 |

|

1.5 |

5.0 |

27.2 |

30.7 |

|

0.7 |

2.2 |

19.0 |

20.5 |

|

0.6 |

1.5 |

16.1 |

16.9 |

|

13.1 |

27.4 |

66.2 |

80.5 |

|

8.4 |

19.7 |

58.7 |

70.0 |

|

5.7 |

14.5 |

47.8 |

56.6 |

|

1.6 |

4.1 |

23.8 |

26.4 |

|

0.7 |

2.4 |

14.5 |

16.2 |

|

0.1 |

0.8 |

9.8 |

10.5 |

|

0.3 |

0.6 |

7.9 |

8.2 |

for employment rather than labor force participation. The proportion of men working and the proportion of men in the labor force both fall by over 50 percent between ages 64 and 66.

These hazard rates can be compared with the rates estimated in NBER’s cross-national comparative study of OECD countries (Gruber and Wise, 1999). One of the striking results in that study is the very high hazard rates of labor force exit at particular ages in many countries. These high hazard rates are typically observed at ages associated with strong incentives to retire due to features of the retirement system. For example, they estimate hazard rates of over 60 percent at age 60 in France and hazard rates of almost 70 percent at age 65 in Spain and the United Kingdom. The South African hazard rates at the age of eligibility for the old age pension are not quite as high as those observed at key pension policy age thresholds in France, Spain, and the United Kingdom. The South African spikes in retirement at age 60 for women and 65 for men are very high, however, in spite

FIGURE 7-4 Hazard rate for leaving employment by age, African men and women, South Africa, 2001 census.

of the fact that the direct incentive to retire (or tax on continuing to work) associated with South Africa’s old age pension is much lower than in the OECD countries. The sharp increases in retirement for both men and women around the age of pension eligibility suggest that South Africa’s elderly do adjust their labor market behavior in response to the old age pension.

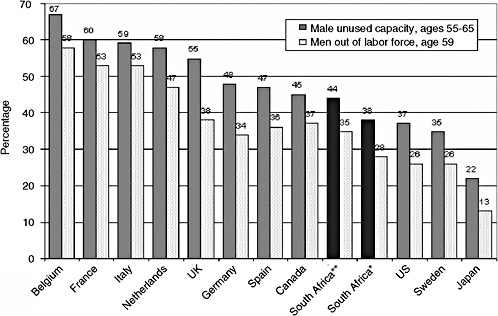

Comparative Estimates of Unused Productive Capacity

A useful summary measure of the labor force participation rates of older workers is the measure of unused productive capacity used in the Gruber and Wise (1999) NBER study. Figure 7-5 plots this measure for 11 OECD countries included in the NBER study, along with two measures for South Africa. The measure is calculated by summing the proportions out of the labor force between ages 55 and 65 and dividing by 11. The measure of 60 for France in Figure 7-5, for example, can be interpreted as meaning that a cohort experiencing the participation rates of France would work only 40 percent of the potential number of person-years available for work between ages 55 and 65. As emphasized in the Gruber and Wise volume, this measure of unused capacity varies substantially across OECD countries, from a low of 22 percent in Japan to a high of 67 percent in Belgium. A major

FIGURE 7-5 Measures of unused productive capacity for OECD countries and South Africa.

NOTES: OECD estimates taken from Gruber and Wise (1999); South Africa estimates are based on the 2000-2001 Labor Force Survey.

*Narrow measure of participation.

**Broad measure of participation.

focus of the NBER project is to document a strong positive relationship between this measure of unused capacity and a measure of the implicit tax on working built into each country’s pension system.

Above we document very high unemployment rates for South Africans in this age range. In the South African case, it is therefore not correct to assume that all retirees would have been productively employed if they had continued their participation in the labor market. This makes the notion of unused capacity more problematic in the South African context than it is in the OECD countries. While we need to bear this caution in mind, it remains a useful comparative exercise to calculate these measures of formal retirement from the labor market in South Africa. Two measures of participation for South Africa are used to compare with the OECD countries. The narrow measure of participation is a standard measure that should be similar to that used in the OECD countries. It corresponds to the measure used in Figure 7-1, counting labor force participants as those who report that they are employed or unemployed and looking for work. The broader measure

of participation also includes those who report that they would be willing to work, even though they are not actively looking for work. Using either of these measures, South Africa compares favorably to Canada and the United States, two countries on the lower end of unused capacity in the NBER study, with between 38 and 44 percent of men ages 55-65 out of the labor force.

A second simple measure of labor force withdrawal shown in Figure 7-5 is the percentage of men who are out of the labor force at age 59. This measure gives a fairly similar picture to that of the unused labor capacity measure. South Africa is once again between Canada and the United States, with less than 40 percent of men having withdrawn from the labor force by age 59 by either the broad or the narrow measures of participation. South Africa would presumably fare worse in these comparisons if we use the proportion working rather the proportion in the labor force. The high unemployment rates shown in Figure 7-3 imply that the percentage of unused capacity between ages 55 and 65 would be much higher if the unemployed were included in unused capacity. We do not attempt to address this issue here, in part because many OECD countries also have fairly high unemployment rates, and in part because we want to maintain comparability with the estimates in the Gruber and Wise study. While any estimate of unused capacity will have limitations, we present these comparisons here simply to demonstrate that the age profile of withdrawal from the labor force observed in South Africa is not unusual in its shape or in the level of participation observed in the 55-65 age group.

DETERMINANTS OF THE ELDERLY LABOR SUPPLY

We now look at some of the important variables that are likely to be related to the economic activity of the elderly. These include household structure, marital status, public and private pensions, and education. After discussing these variables in isolation, we estimate probit regressions to estimate the relationship between these variables and the work activity of the elderly. It is important to keep in mind that a number of these variables may be endogenous outcomes of joint decisions about living arrangements and residential location. The point of our analysis is not necessarily to identify causal determinants of the elderly labor supply, but to identify the important patterns that are associated with the economic activity of elderly South Africans.

Household Structure and Marital Status

One of the important differences between the elderly in South Africa and the elderly living in the United States or Europe is that South Africa’s

elderly often live in large extended households. Table 7-2 presents details on household living arrangements and marital status for African and white men and women using the 2001 census. The table documents large differences in living arrangements for Africans and whites. African women ages 60-64, for example, live in households with 5.5 household members, compared with 2.6 household members for white women of the same ages. Especially striking is the number of children living with elderly Africans. African women age 60-64 have an average of 2.3 coresident household members under age 18, compared with an average of 0.25 such members living with white women ages 60-64. This tendency to live in extended households is further demonstrated in the proportions living alone or with only a spouse. For African women the percentage living alone stays at around 6-7 percent in all age groups from ages 30-34 to ages 70-74. White women, by contrast, show the kinds of large increases in the probability of living alone that are observed in the United States. The percentage of white women living alone stays around 5 percent or less until the age group 50-54, then rises steadily with age, reaching over 30 percent for the 70-74 age group.

The last three columns of Table 7-2 show the distribution of marital status. Marriage is defined broadly, including any kind of formal or informal cohabiting partnership. African men and women are less likely to be married than whites at all ages. The combined effect of higher male mortality and the age gap between husbands and wives is evident in the proportions married and widowed at older ages. Men of both races who are still alive in the older age groups are very likely to be married. Only about 14 percent of African men and 10 percent of white men ages 70-74 are widowed, while 55 percent of African women and 45 percent of white women ages 70-74 are widowed.

Looking at age groups around the age when many men and women leave the labor market, Table 7-2 indicates that the great majority of men still have living partners at these ages. About 80 percent of African men and 85 percent of white men are still married in the 60-64 and 60-65 age groups. The situation for women is considerably different. Only 45 percent of African women are married at age 60-64, with 36 percent widowed and 5 percent divorced or separated (the remainder were never married). Among white women ages 60-64, 67 percent are married, 20 percent widowed, and 9 percent divorced or separated.

Public and Private Pensions

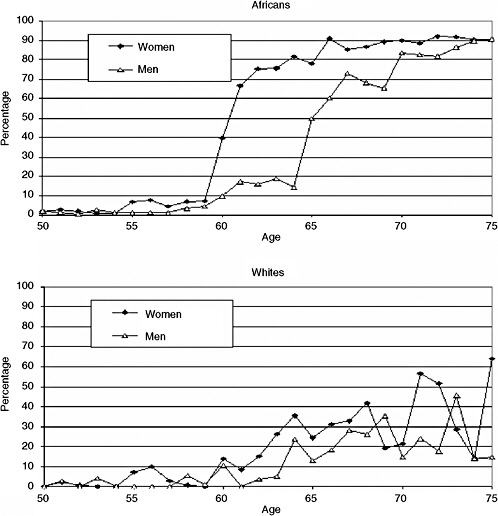

As noted above, South Africa’s state old age pension program plays an important role in the lives of elderly South Africans. Figure 7-6 shows the percentage of African and white men and women who report in the Septem-

TABLE 7-2 Household Living Arrangements and Marital Status, 2001 Census

|

Age Group |

Number Living in Household |

||||

|

Number (N) |

Total |

Under 18 |

Age 18-59 |

||

|

African Women |

|

|

|

|

|

|

|

30-34 |

111,649 |

5.22 |

2.40 |

2.57 |

|

|

35-39 |

104,057 |

5.20 |

2.49 |

2.49 |

|

|

40-44 |

85,041 |

5.24 |

2.31 |

2.73 |

|

|

45-49 |

69,747 |

5.23 |

2.13 |

2.92 |

|

|

50-54 |

51,689 |

5.33 |

2.10 |

2.99 |

|

|

55-59 |

37,598 |

5.40 |

2.13 |

2.94 |

|

|

60-64 |

38,096 |

5.51 |

2.29 |

1.88 |

|

|

65-69 |

30,209 |

5.52 |

2.33 |

1.89 |

|

|

70-74 |

25,055 |

5.50 |

2.36 |

1.89 |

|

African Men |

|

|

|

|

|

|

|

30-34 |

94,925 |

4.40 |

1.45 |

2.70 |

|

|

35-39 |

84,697 |

4.38 |

1.67 |

2.48 |

|

|

40-44 |

70,770 |

4.51 |

1.80 |

2.52 |

|

|

45-49 |

56,565 |

4.68 |

1.80 |

2.73 |

|

|

50-54 |

43.290 |

4.86 |

1.77 |

2.95 |

|

|

55-59 |

29,538 |

5.03 |

1.80 |

3.08 |

|

|

60-64 |

24,179 |

5.28 |

1.95 |

20.6 |

|

|

65-69 |

16,413 |

5.46 |

2.06 |

1.94 |

|

|

70-74 |

12,759 |

5.57 |

2.14 |

1.88 |

|

White Women |

|

|

|

|

|

|

|

30-34 |

13,063 |

3.76 |

1.43 |

2.18 |

|

|

35-39 |

12,946 |

3.98 |

1.62 |

2.19 |

|

|

40-44 |

13,068 |

3.90 |

1.26 |

2.47 |

|

|

45-49 |

12,144 |

3.47 |

0.66 |

2.65 |

|

|

50-54 |

11,373 |

3.04 |

0.33 |

2.49 |

|

|

55-59 |

9,884 |

2.68 |

0.22 |

1.99 |

|

|

60-64 |

8,442 |

2.57 |

0.25 |

0.64 |

|

|

65-69 |

6,714 |

2.42 |

0.23 |

0.56 |

|

|

70-74 |

5,815 |

2.30 |

0.20 |

0.58 |

|

White Men |

|

|

|

|

|

|

|

30-34 |

12,218 |

3.50 |

1.11 |

2.25 |

|

|

35-39 |

11,767 |

3.84 |

1.49 |

2.18 |

|

|

40-44 |

12,061 |

3.94 |

1.42 |

2.36 |

|

|

45-49 |

10,948 |

3.77 |

0.95 |

2.67 |

|

|

50-54 |

10,558 |

3.33 |

0.50 |

2.69 |

|

|

55-59 |

9,156 |

2.96 |

0.29 |

2.51 |

|

|

60-64 |

7,602 |

2.71 |

0.22 |

1.07 |

|

|

65-69 |

5,726 |

2.58 |

0.20 |

0.66 |

|

|

70-74 |

4,521 |

2.46 |

0.16 |

0.49 |

|

Marital Status |

|||||

|

Pension Eligible |

Percentage Living Alone |

Percentage Living Only with Spouse |

Percentage Married |

Percentage Widowed |

Percentage Divorced |

|

0.23 |

5.9 |

7.3 |

52.0 |

1.9 |

2.5 |

|

0.20 |

5.9 |

6.9 |

58.5 |

3.8 |

4.5 |

|

0.18 |

5.9 |

6.8 |

59.1 |

6.9 |

6.4 |

|

0.15 |

6.4 |

6.9 |

58.5 |

11.1 |

7.4 |

|

0.16 |

6.7 |

6.3 |

55.5 |

17.4 |

7.3 |

|

0.20 |

6.6 |

5.9 |

51.2 |

24.8 |

6.3 |

|

1.26 |

5.9 |

4.9 |

44.8 |

35.5 |

4.7 |

|

1.27 |

5.8 |

4.1 |

38.6 |

46.1 |

3.5 |

|

1.23 |

5.9 |

3.5 |

32.7 |

55.2 |

2.4 |

|

0.22 |

15.6 |

9.7 |

47.7 |

0.4 |

1.2 |

|

0.20 |

15.2 |

9.9 |

63.6 |

0.8 |

2.4 |

|

0.18 |

15.0 |

9.8 |

71.1 |

1.3 |

3.7 |

|

0.14 |

14.5 |

10.1 |

75.7 |

1.9 |

4.5 |

|

0.13 |

13.8 |

10.0 |

77.7 |

3.1 |

4.6 |

|

0.14 |

13.0 |

9.8 |

78.7 |

4.6 |

4.4 |

|

0.26 |

11.4 |

9.5 |

78.5 |

7.2 |

3.8 |

|

1.45 |

9.3 |

9.0 |

77.8 |

10.2 |

3.6 |

|

1.54 |

8.6 |

8.4 |

75.7 |

13.7 |

3.0 |

|

0.11 |

4.4 |

11.7 |

79.2 |

0.9 |

7.3 |

|

0.14 |

3.9 |

7.7 |

80.9 |

1.5 |

9.5 |

|

0.15 |

3.8 |

8.7 |

80.4 |

2.6 |

11.2 |

|

0.14 |

5.1 |

17.3 |

79.4 |

4.3 |

11.5 |

|

0.14 |

7.3 |

30.4 |

77.6 |

7.4 |

11.2 |

|

0.19 |

11.1 |

43.3 |

74.8 |

11.7 |

9.8 |

|

1.41 |

16.2 |

44.8 |

67.0 |

20.2 |

9.2 |

|

1.58 |

22.7 |

43.8 |

59.4 |

31.0 |

6.4 |

|

1.50 |

30.9 |

36.5 |

47.1 |

45.1 |

4.8 |

|

0.11 |

6.5 |

16.6 |

76.8 |

0.2 |

4.5 |

|

0.14 |

5.7 |

9.7 |

82.7 |

0.4 |

6.0 |

|

0.15 |

5.1 |

8.6 |

85.7 |

0.6 |

6.9 |

|

0.14 |

4.6 |

12.8 |

86.2 |

0.8 |

7.9 |

|

0.13 |

5.5 |

25.4 |

87.0 |

1.6 |

7.0 |

|

0.15 |

5.9 |

40.6 |

87.9 |

2.2 |

6.2 |

|

0.41 |

6.3 |

52.9 |

87.8 |

3.6 |

5.2 |

|

1.72 |

8.2 |

58.9 |

85.9 |

6.7 |

4.6 |

|

1.80 |

9.7 |

62.5 |

84.3 |

9.4 |

3.6 |

ber 2000 LFS that they were receiving the state old age pension. The top panel shows the high prevalence of the pension among elderly Africans, with over 80 percent of men and women age 70 and above receiving it. The age eligibility rules appear to be fairly strictly enforced for women, with sharp increases in the percentage receiving the pension at ages 60 and 61. Something over 5 percent of women in the 55-59 age group report receiving the pension, in spite of not having reached the official age of eligibility of 60. Possible explanations for these anomalies, as noted by Case and Deaton (1998), are age misreporting in the census or exercise of local discretion in eligibility criteria. The percentage of African women receiving the pension

FIGURE 7-6 Percentage receiving old age pension, September 2000, South Africa LFS.

increases to 40 percent at age 60 and 70 percent at age 61, rising to about 90 percent from age 66 and higher. An even larger discrepancy between the technical age eligibility rules and the report of pension receipt is observed for African men. About 15 percent of men are reported as receiving the pension between ages 60 and 64, in spite of not having reached the official age of eligibility of 65. The proportion of men receiving the pension jumps to 50 percent at age 65, then continues rising until it reaches a peak of 90 percent at age 75.

The bottom panel of Figure 7-6 shows the percentage of whites receiving the state old age pension. These percentages are much smaller than those for Africans, although they are not inconsequential. Small cell sizes make these estimates at single years of age for whites somewhat erratic, but about 30 percent of women and 25 percent of men report receiving the pension above age 64.

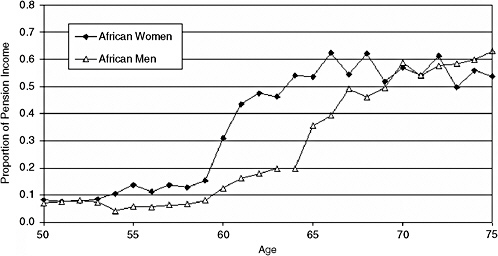

Figure 7-7 documents the importance of pensions in the economic situation of African households. The figure shows the proportion of total household income attributable to the old age pension for individuals at every age from 50 to 80. It is derived by merging the September 2000 LFS with income data for the same households from the October 2000 IES. The pension income of all household members is included in the calculation. The figure shows that pension income accounts for more than 50 percent of household income for both men and women beginning around age 70. There is a sharp increase for women beginning at age 60, the age at which they

FIGURE 7-7 Mean proportion of household income derived from old age pension, South Africa LFS/IES, September 2000.

themselves begin receiving the pension. Similarly, we see a sharp increase in the proportion of household income attributable to pension income for men beginning at age 65, the age at which they begin receiving the pension. Recalling from Figure 7-6 that at least 10 percent of African men and women do not receive the pension, the levels in Figure 7-7 suggest that pension income accounts for an even higher fraction of household income in those households that do receive the pension.

Figure 7-8 shows the percentage of African and white men and women receiving employer-provided pensions. The top panel shows that employer-provided pensions are very uncommon for Africans, with fewer than 10 percent of men and 5 percent of women receiving them at most ages. The bottom panel shows that private pensions are much more important for whites. The percentage of white men receiving private pensions rises from around 10 percent at age 54 to well over 50 percent above age 64. The percentage of women receiving private pensions (presumably in the form of spouse benefits in many cases) is also high, reaching levels of around 40 percent above age 65. The most pronounced age spike in receipt of private pensions for white men occurs at age 64, where there is an increase from about 20 to 50 percent receiving pensions.

An important feature of the South African old age pension system is that receiving the pension is not necessarily incompatible with working. This is true both because the means test does not preclude work and because the rules of the system may be somewhat flexibly applied. Table 7-3 analyzes the extent to which African individuals work and receive the pension at the same time, as reported in the September 2000 LFS. Two definitions of work are used in Table 7-3. One is a broad definition that includes the family plot category used in Column 5 of Table 7-1. The second is a narrower definition that excludes those working only on a family plot.

Looking at men ages 65-69, a group in which all men have reached pension age, Table 7-3 shows that the employment rate among men who are not receiving the pension is 47 percent by the broad definition and 41 percent by the narrower definition. The employment rate among men ages 65-69 who are receiving the pension is considerably lower, 22 percent by the broad measure and 7 percent by the narrow measure. At older ages almost 20 percent of men receiving pensions are reported as working by the broad measure, but these men are almost all working only on a family plot. A similar result is observed for women. Although 21 percent of women receiving the pension in the 60-64 age group are working by the broad definition, only 7 percent are working by the narrow definition.

These results suggest that while we do observe individuals working and receiving the pension at the same time, employment rates are much lower among pension recipients than among nonrecipients. Using the narrow em-

FIGURE 7-8 Percentage receiving employer-provided pension, September 2000 South Africa LFS.

ployment measure, we estimate employment rates of less than 10 percent for pension recipients.

Schooling

Schooling is an important determinant of employment at all ages, affecting both labor demand and labor supply. In many countries it is observed that better educated workers have later ages of retirement (Peracchi and Welch, 1994). There is a strong effect of schooling on both wages and the probability of employment for prime age workers in South Africa (Anderson, Case, and Lam, 2001; Mwabu and Schultz, 1996). It is there-

TABLE 7-3 Percentage Working by Pension Status, African Men and Women, September 2000, South Africa LFS

fore natural to look at the impact of schooling on the work activity of the elderly.

Table 7-4 shows summary statistics for the distribution of schooling for African men and women by 5-year age groups. As the table clearly shows, levels of schooling among the elderly in South Africa are very low. Over 45 percent of men and over 50 percent of women age 60 and above in the 2001 census had 0 years of schooling. The percentage completing 7th grade is under 30 percent for those age 60 and older, and the percentage completing secondary school is below 5 percent for all age groups age 55 and older. Although men have more schooling than women in older age groups, the gender gap is relatively small compared with many African countries and narrows substantially at younger ages. As shown by Anderson and colleagues (2001), a female advantage in schooling has clearly emerged among younger cohorts. Table 7-4 shows the substantial improvements in schooling that have taken place in South Africa over time, with mean years of schooling more than doubling from the 60-64 to the 30-34 age group.

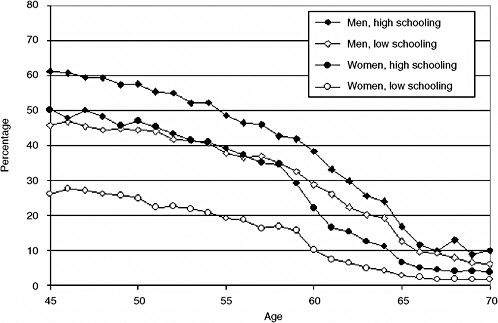

Figure 7-9 shows the age profile of employment for African men and women, dividing the sample into those with less than 7 years of schooling and those with at least 7 years of schooling. The better educated group has higher rates of employment at all ages for both men and women. Less educated men begin to withdraw from employment at a faster rate in their late 50s, dropping to employment rates below 30 percent by age 60. The gap in employment between the schooling groups is much larger for African women, for whom there is about a 20 percentage point difference in employment rates between the education groups at ages up to 60. The better educated women appear to have a steeper rate of decline in employment beginning at age 60, with both groups falling to employment rates of below 10 percent by age 65. The combination of large improvements in schooling over time and the strong positive relationship between schooling and employment should create a tendency for increasing employment rates for older South Africans over time. This may be especially true for women, for whom the impact of schooling on employment is particularly large.

PROBIT REGRESSIONS

In order to get a clearer picture of the variables affecting the work activity of the elderly in South Africa, we use the 2001 census data to estimate probit regressions of the probability of employment. The dependent variable is one if the individual was working in the week prior to the census and zero for everyone else, whether or not they are in the labor force. The regressions are estimated for the sample of Africans ages 50-75, with separate regressions estimated for men and women. Two specifications are used in the regressions. The first includes years of schooling,

TABLE 7-4 Schooling Attainment of African Men and Women by Age Group, 2001 Census

|

Age Group |

Mean Years of Schooling |

Percentage Completing |

||

|

Zero Schooling |

||||

|

Women |

Men |

Women |

Men |

|

|

30-34 |

8.20 |

8.33 |

14.4 |

11.9 |

|

35-39 |

7.03 |

7.38 |

20.1 |

15.9 |

|

40-44 |

6.06 |

6.54 |

25.7 |

20.2 |

|

45-49 |

5.18 |

5.70 |

30.9 |

25.2 |

|

50-54 |

4.42 |

4.86 |

37.2 |

31.9 |

|

55-59 |

3.97 |

4.29 |

41.7 |

37.0 |

|

60-64 |

3.04 |

3.56 |

53.1 |

45.8 |

|

65-69 |

2.66 |

3.16 |

58.0 |

51.5 |

|

70-74 |

2.12 |

2.64 |

65.4 |

57.9 |

dummy variables for marital status, a flexible parameterization of age, and dummy variables for province and urban residence. The second regression adds measures of household composition. As noted above, living arrangements are likely to be endogenous, determined jointly with decisions about labor supply, so these variables are included simply to indicate the association between living arrangements and the elderly labor supply and not as indicators of causation.

Table 7-5 presents the estimates of these probit regressions. Regressions 1 and 2 present estimates of the first specification for women and men, respectively. As suggested by Figure 7-9, the coefficient on years of schooling is positive and highly significant for both men and women. The marginal effects (dF/dx) column indicates that 1 year of additional schooling is associated with about a 1 percentage point increase in the probability of working for both men and women, evaluated at the sample means of the independent variables. This translates into a similar percentage point increase in schooling for men and women, although it is a smaller proportional change for men given their higher levels of employment.

The marital status dummies, with married as the omitted category, indicate that unmarried women are significantly more likely to work, controlling for all of the other variables in the regression, with the largest effect for divorced women. Evaluated at sample means, the percentage increase in the probability of work compared with married women is 0.5 percentage points for widows, 8 percentage points for divorced women, and 4 percentage points for women who have never married. The effects of marriage for men go in the opposite direction, with married men having significantly higher probabilities of employment than widowed, divorced, or never married men. Married men have probabilities of employment at least 10 percentage points

|

At Least 4 Years |

At Least 7 Years |

At Least 12 Years |

|||

|

Women |

Men |

Women |

Men |

Women |

Men |

|

82.0 |

83.7 |

70.8 |

71.1 |

30.5 |

31.4 |

|

74.7 |

78.5 |

60.0 |

62.7 |

20.6 |

22.4 |

|

67.7 |

72.5 |

50.6 |

54.6 |

14.7 |

16.6 |

|

61.1 |

66.1 |

42.8 |

46.9 |

9.8 |

12.0 |

|

54.1 |

58.5 |

35.5 |

39.0 |

6.6 |

8.2 |

|

49.6 |

52.8 |

31.7 |

33.9 |

5.1 |

6.3 |

|

38.6 |

44.0 |

23.0 |

27.1 |

3.5 |

4.9 |

|

33.8 |

39.0 |

19.9 |

24.0 |

2.9 |

4.5 |

|

27.0 |

32.4 |

15.2 |

19.3 |

2.2 |

3.8 |

higher than men in any of the other categories of marital status, even with very flexible controls for age.

We use a cubic function of age to permit a flexible shape for the age-employment profile. We also include two dummy variables, permitting shifts in the age profile at ages 60 and 65. The age 60 dummy is equal to one for age 60 and above; the age 65 dummy is equal to one for age 65 and above. For women we estimate a decline of 3.4 percentage points in employment probabilities at age 60, the age at which women become eligible for the state old age pension. We also estimate a positive effect of the age 65 dummy for women, with a decline in the probability of employment of 2.9 percentage points. For men the coefficient on the age 60 dummy is not statistically significant, but we estimate a significant negative effect of the age 65 dummy. This suggests that men speed up their withdrawal from employment when they reach the age of pension eligibility, with a predicted drop of 7.2 percentage points in the probability of employment at age 65.

The coefficient on the urban dummy indicates that both men and women are significantly more likely to work in urban areas, with a larger coefficient for women. We observe substantial differences in employment across provinces with significantly lower probabilities of employment for both women and men in Eastern Cape, Northern Cape, KwaZulu-Natal, and Northern Province when compared with Western Cape. Gauteng has higher rates of employment than Western Cape for women, but differences between Gauteng and Western Cape are not statistically significant for men. We caution that none of the locational variables can be considered exogenous, since the decision about where to live may be made jointly with the decision about whether to retire.

FIGURE 7-9 Percentage working by years of schooling, 2001 census.

NOTE: High schooling is 7 or more years of schooling; low schooling is under 7 years.

Regressions 3 and 4 add three household composition variables to the regression—the number of household members under the age of 18, the number of men ages 18-59, and the number of women ages 18-59. The number of household members under age 18 is negatively associated with the employment of both men and women, with a larger coefficient for women. This may reflect a trade-off between labor market work and caring for grandchildren, especially for women. The number of adult men in the household is negatively associated with the employment of women but positively associated with the employment of men, although both effects are extremely small. The effect of the number of adult women in the household is slightly positive on the employment of women and statistically insignificant in its effect on the employment of men. Since we have controlled for the presence of children, the positive effect of women ages 18-59 on the employment of women may indicate that older women are less needed for child care responsibilities if the children’s mother is in the household.

As with the locational variables, we caution again that household living arrangements are likely to be endogenous with respect to the labor supply decisions of potential household members. Unobserved variables, such as the health of elderly household members, are likely to affect both living

arrangements and work activity. Since the living arrangements of the elderly are likely to be influenced by many of the same unobservable variables that affect labor supply, the coefficients on these household composition variables should not be given a causal interpretation.

CONCLUSIONS

We have referred to the large literature showing the importance of the noncontributory old age pension for poor households in South Africa. Those elderly who do not have pension income are among the poorest South Africans. Many of those with a pension live in three-generation or skipped-generation households. Indeed, we have made reference to a literature arguing that this extended household structure may in part be a response to the pension. Leaving aside these difficult issues of endogenous household structure, the fact remains that the African elderly are usually in the minority in their own households, and their pension income is available to support large numbers of children and working-age adults. This makes the state old age pension a key element in South Africa’s social safety net and a central plank in overall social welfare policy. It also implies that an unusual burden is placed on South Africa’s elderly. Given this, it strikes us as an omission that the existing literature has devoted so much attention to the impact of the pension on labor supply and other outcomes of the nonelderly without interrogating the impact on the elderly themselves. This paper has sought to fill in this gap by examining the labor supply behavior of the elderly.

Our analysis of South African census and survey data indicates that withdrawal from the labor force occurs at a fairly rapid rate above age 45. According to the 2001 census, male participation rates fall from around 80 percent at age 45 to 50 percent at age 60 and 10 percent at age 70, with only modest differences across the four main population groups. Participation rates for women are lower at all ages, with participation rates for African women falling from around 60 percent at age 45 to 20 percent at age 60 and 5 percent at age 70. Using the metric of unused productive capacity developed by Gruber and Wise (1999) this pattern of labor force withdrawal leads to somewhat less unused capacity than most European countries and slightly more unused capacity than the United States.

For black South Africans, the noncontributory old age pension system is triggered almost entirely by simple age eligibility rules, with women becoming eligible at age 60 and men becoming eligible at age 65. The fraction of women receiving the pension jumps from under 10 percent at age 59 to almost 70 percent at age 61, with the pension becoming almost 50 percent of household income for women age 61. Although the pension does not necessarily imply a tax on work, especially for low-wage workers, we find that the age of pension eligibility is associated with increased rates of retire-

TABLE 7-5 Probit Regressions for Employment, Africans Ages 50-75, 2001 Census

ment. Reaching the age of pension eligibility leads to an increase in the hazard rate of leaving employment for women from 5 percent at age 58 to over 40 percent at age 60. Men also retire at a faster rate when they reach the pension-eligibility age of 65, with the hazard rate rising to over 30 percent at ages 65 and 66. While this is a sharp jump in retirement, it is not as large as observed in many European countries, where hazard rates can be as high as 60 percent at key program eligibility ages.

We found large effects of schooling on employment of the elderly. Our probit regressions imply about a 1 percentage point increase in the probability of employment for each year of schooling for both men and women. Since schooling levels rise rapidly from older to younger ages, especially for

|

Female Regression 3 |

Male Regression 4 |

||||

|

b |

SE |

dF/dX |

b |

SE |

dF/dX |

|

0.062 |

(0.001)*** |

0.010 |

0.031 |

(0.001)*** |

0.010 |

|

0.030 |

(0.011)*** |

0.005 |

−0.345 |

(0.019)*** |

−0.102 |

|

0.370 |

(0.021)*** |

0.074 |

−0.463 |

(0.031)*** |

−0.129 |

|

0.181 |

(0.012)*** |

0.032 |

−0.678 |

(0.015)*** |

−0.182 |

|

−0.206 |

(0.023)*** |

−0.034 |

−0.011 |

(0.022) |

−0.004 |

|

−0.188 |

(0.030)*** |

−0.029 |

−0.228 |

(0.027)*** |

−0.072 |

|

0.021 |

(0.008)*** |

0.003 |

0.001 |

(0.008) |

0.000 |

|

−0.008 |

(0.001)*** |

−0.001 |

−0.005 |

(0.001)*** |

−0.002 |

|

0.000 |

(0.000)*** |

0.000 |

0.000 |

(0.000)*** |

0.000 |

|

0.244 |

(0.011)*** |

0.041 |

0.025 |

(0.011)** |

0.008 |

|

−0.344 |

(0.028)*** |

−0.048 |

−0.647 |

(0.026)*** |

−0.182 |

|

−0.256 |

(0.050)*** |

−0.035 |

−0.079 |

(0.043)* |

−0.025 |

|

−0.035 |

(0.029) |

−0.005 |

−0.117 |

(0.027)*** |

−0.037 |

|

−0.170 |

(0.027)*** |

−0.026 |

−0.377 |

(0.026)*** |

−0.114 |

|

−0.158 |

(0.028)*** |

−0.023 |

−0.156 |

(0.026)*** |

−0.049 |

|

0.104 |

(0.026)*** |

0.017 |

0.012 |

(0.025) |

0.004 |

|

0.064 |

(0.030)** |

0.011 |

0.031 |

(0.027) |

0.010 |

|

−0.083 |

(0.029)*** |

−0.013 |

−0.325 |

(0.027)*** |

−0.098 |

|

−0.058 |

(0.007)*** |

−0.009 |

−0.037 |

(0.004)*** |

−0.012 |

|

−0.009 |

(0.005)* |

−0.002 |

0.003 |

(0.000)*** |

0.000 |

|

0.004 |

(0.001)*** |

0.001 |

0.000 |

(0.003) |

0.001 |

|

−0.807 |

(0.036)*** |

|

0.174 |

(0.030)*** |

|

|

|

172,241 |

|

|

118,858 |

|

|

|

0.214 |

|

|

0.160 |

|

|

|

−56569 |

|

|

−61759 |

|

Africans, this implies that employment rates at older ages may increase in the future. Employment rates at older ages may also be pushed upward by the fact that younger cohorts are more likely to live in urban areas, since we estimate a substantial positive effect of urban residence on employment.

It is beyond the scope of this paper to fully explain the patterns in labor force withdrawal that we have documented. While some factors, such as the age eligibility for the old age pension, appear to play an important role, many questions remain. For example, even if the pension helps explain sharp drops in labor force participation immediately around the pension age, it presumably cannot explain the steady declines in participation that begin around age 45. Health may be important in these declines, but existing data

sources provide limited information on health and disability. The lack of panel data also complicates interpretation of our results, especially as they relate to the high level of unemployment. Does the decline in participation result from individuals retiring from their jobs, or from individuals losing their jobs and deciding not to search for a new one? Further research on the labor supply of the elderly in South Africa would clearly benefit from longitudinal data that includes data on health and disability.

REFERENCES

Anderson, K., Case, A., and Lam, D. (2001). Causes and consequences of schooling outcomes in South Africa: Evidence from survey data. Social Dynamics, 27(1), 1-23.

Bertrand, M., Mullainathan, S., and Miller, D. (2003). Public policy and extended families: Evidence from pensions in South Africa. World Bank Economic Review, 17(1), 27-50.

Casale, D.M., and Posel, D.R. (2002). The continued feminization of the labor force in South Africa: An analysis of recent data and trends. South African Journal of Economics, 70(1), 156-184.

Case, A., and Deaton, A. (1998). Large cash transfers to the elderly in South Africa. Economic Journal, 108, 1330-1361.

Clark, R.L., and Anker, R. (1993). Cross-national analysis of labor force participation of older men and women. Economic Development and Cultural Change, 41(3), 489-512.

Duflo, E. (2003). Grandmothers and granddaughters: Old age pension and intra-household allocation in South Africa. World Bank Economic Review, 17(1), 1-25.

Edmonds, E. (2005). Child labor and schooling responses to anticipated income in South Africa. Journal of Development Economics. Available: http://72.14.209.104/search?q=cache:I0wPhNpkmh4J:www.dartmouth.edu/~eedmonds/liquidity.pdf+child+labor+and+schooling+responses+to+anticipated+income+in+South+Africa&hl=en&gl=us&ct=clnk&cd=1 [accessed September 2006].

Edmonds, E., Mammen, K., and Miller, D. (2005). Rearranging the family? Household composition responses to large pension receipts. Journal of Human Resources, 40(1), 186-207.

Ferreira, M. (1999). The generosity and universality of South Africa’s pension system. The EU Courier, 176.

Gruber, J., and Wise, D.A. (1999). Social security and retirement around the world. Chicago, IL: University of Chicago Press.

Kapteyn, A., and de Vos, K. (1999). Social security and retirement in the Netherlands. In J. Gruber and D.A. Wise (Eds.), Social security and retirement around the world. Chicago, IL: University of Chicago Press.

Klasen, S., and Woolard, I. (2000). Unemployment and employment in South Africa, 1995-1997. Report to the Department of Finance, South Africa.

Jensen, R.T. (2004). Do private transfers displace the benefits of public transfers? Evidence from South Africa. Journal of Public Economics, 88(1-2), 89-112.

Leibbrandt, M., and Bhorat, H. (2001). Modeling vulnerability in the South African labor market. In B. Haroon, M. Leibbrandt, M. Maziya, S. van der Bberg, and I. Woolard (Eds.), Fighting poverty: Labor markets and inequality in South Africa. Cape Town, South Africa: University of Cape Town Press.

Mlatsheni, C., and Leibbrandt, M. (2001, September). The role of education and fertility in the participation and employment of African women in South Africa. (DPRU Working Paper No 01/54). Cape Town, South Africa: School of Economics, University of Cape Town.

Møller, V., and Devey, R. (2003). Trends in the living conditions and satisfaction among poorer older South Africans: Objective and subjective indicators of quality of life in the October Household Survey. Development Southern Africa, 20(4), 457-476.

Møller, V., and Ferreira, M. (2003). Getting by … benefits of noncontributory pension income for older South African households. Cape Town, South Africa: Institute of Ageing in Africa, University of Cape Town.

Mwabu, G., and Schultz, P.T. (1996, May). Education returns across quantiles of the wage function: Alternative explanations for returns to education by race in South Africa. American Economic Review, 86(2), 335-339.

Peracchi, F., and Welch, F. (1994). Trends in labor force transitions of older men and women. Journal of Labor Economics, 12(2), 210-242.

Posel, D., Fairburn, J., and Lund, F. (2004, July). Labor migration and households: A reconsideration of the effects of the social pension on labor supply in South Africa. Paper presented at the National Research Council Conference on Aging in Africa, Johannesburg.

Sagner, A. (2000). Ageing and social policy in South Africa: Historical perspectives with particular reference to the Eastern Cape. Journal of Southern African Studies, 26(3), 523-553.

Schlemmer, L., and Møller, V. (1997). The shape of South African society and its challenges. Social Indicators Research, 41(1-3), 15-50.

Seekings, J. (2002). The broader importance of welfare reform in South Africa. Social Dynamics, 28(2), 1-38.

Van der Berg, S. (2001). Redistribution through the budget: Public expenditure incidence in South Africa, 1993-1997. Social Dynamics, 27(1), 140-164.

Van der Berg, S., and Bredenkamp, C. (2002). Devising social security interventions for maximum policy impact. Social Dynamics, 28(2), 39-68.

Winter, C. (1998). Women workers in South Africa: Participation, pay and prejudice in the formal labor market. Unpublished manuscript, World Bank, Washington, DC.