2

The Evolution of the U.S. Telecommunications Industry and Effects on Research

The structure of the U.S. telecommunications industry has changed dramatically over recent decades, with consequences for research. Major changes over the past several decades have included the breakup of the Bell System, especially the 1984 divestiture, the 1995 creation of Lucent Technologies, and the advent of long-haul competitors such as MCI and Sprint; the transformation of cable system operators into telecommunications providers as they adopted the hybrid fiber/coaxial cable digital architecture, which supports digital, high-capacity, two-way communications; the development and mainstream adoption of the Internet, including the rise of a whole new class of industry players (e.g., Cisco, Microsoft, Google, and so on); and the creation and growth of a competitive wireless services market resulting in broad penetration of cellular voice and data services.

These changes have yielded many benefits, including a much broader array of telecommunications services, a more diversified and competitive market, and an environment in which new innovations move more quickly to the marketplace. But they have also led to decreased industry support for long-term telecommunications research and a general shift in research focus from the long term to the short term. As has been observed by many others, there has been an overall downturn in many areas of U.S. industry research.1 Along similar lines, a report released earlier this year by the National Academies concluded that the nation’s commitment to basic research in science and engineering needs to be sustained and strengthened.2

The full impact of these trends on long-term telecommunications research is probably not yet evident, as the industry continues to exploit fundamental knowledge gained over the past

|

1 |

This phenomenon is not new. See, for example, Rosenbloom et al., Engines of Innovation, Harvard Business School Press, Cambridge, Mass., 1996. |

|

2 |

See National Academy of Sciences, National Academy of Engineering, and Institute of Medicine of the National Academies, Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future, prepublication, The National Academies Press, Washington, D.C., 2006, available online at <http://www.nap.edu/catalog/11463.html>. |

several decades. The concern is that without substantial renewed investment in fundamental, long-term telecommunications research, the United States will eventually consume its own intellectual “seed corn” and thus run out of new ideas within the next decade or perhaps even sooner. Chapter 3 examines further some of the implications of curtailed research investment.

BELL SYSTEM RESEARCH AND CONSEQUENCES OF THE BELL SYSTEM’S BREAKUP

For roughly a century, the U.S. telecommunications infrastructure was largely defined by the Bell System, a telephony monopoly regulated under a series of consent decrees that gave it the right to operate, maintain, and expand the U.S. telephone system. The chief research and development arm of the Bell System, Bell Laboratories, was created in 1925, following demonstration in 1915 of the feasibility of coast-to-coast long-distance service and realization of the importance of a viable research and development laboratory to effective deployment. Successful nationwide implementation of long-distance service required, for example, a device with sufficient gain to offset the signal losses in the 3000-mile stretch of the U.S. transcontinental cable. The development of the vacuum tube amplifier for use in telephone circuits, which started in the 1910s, took many years of fundamental research and required extremely close cooperation between the research community that had originally invented the vacuum tube technology and the development community that introduced the vacuum tube amplifier into the telephone network.

Bell Laboratories relied heavily on managers who understood the benefits to the company (and society) of fundamental research and were able to provide a work environment that fostered world-class research in virtually every aspect of telecommunications technology. Stable funding for research was provided via a tax levied on the service revenues of most of the Bell operating companies, an approach approved by state regulators. The revenue from the services tax was more than sufficient to fund unfettered investigations over almost 6 decades into almost every aspect of telecommunications, from basic materials (and the associated physics and chemistry) to large-scale computing and networking platforms and systems. Over time, Bell Laboratories’ support for basic science and engineering led to major advances in telephony spanning terminals, switching, transmission, services, and operations. Out of the Bell System research program also came many world-famous innovations, including the transistor, information theory, the laser, the solar cell, communications satellites, and fiber-optic communications. Perhaps the most notable benefit of the research was the creation of the semiconductor industry as a result of the mandatory public licensing of Bell’s patent for the transistor. In addition, research in basic science at Bell Labs was recognized by six Nobel prizes for strides in quantum mechanics, solid-state physics, and radio astronomy.

A number of other companies were also involved at the time in developing new telecommunications technologies and equipment. The work of companies like GTE Automatic Electric, TRW Vidar, and Northern Telecom, along with Bell’s own Western Electric, pushed telephony forward through advances in handset design and digital switching, for example.

Bell Labs also served as an important nucleus for the broader telecommunications research community: in the predivestiture era, university researchers and telecommunications research leaders from around the world commonly spent summers or sabbaticals at Bell Labs, where they could conduct exploratory research that could not have been undertaken elsewhere.

Despite its many successes, there were many criticisms of the predivestiture regulated monopoly (and this report is certainly not calling for a return to the Bell System structure). For instance, until government actions forced a change, the Bell System prohibited the attachment of third-party equipment on customer premises, which many viewed as stifling innovation. Monopoly status also meant that there were few pressures on the Bell System for rapid innovation in its services, and a number of innovative technologies developed by Bell Labs either were not adopted or were adopted very slowly.

Divestiture and Its Effects

The Bell System ended in 1983. Divestiture resulted in the separation of the local Bell System operating companies (which provided local telephone service to large regions of the United States) from the long-distance parts of the network (known as long-lines communications) and ended the license fee arrangement through which the regional operating companies supported Bell Labs. At the time of the separation, Western Electric (the equipment manufacturing part of the Bell System) was assigned to the part of the company that would be called AT&T), along with most of the research and development resources of Bell Labs. The regional Bell operating companies (RBOCs), the providers of local phone service, formed an R&D consortium called Bellcore (Bell Communications Research, later renamed Telcordia Technologies) and agreed to fund Bellcore to do the majority of the R&D needed to support them— at least for an initial period on the order of 5 to 7 years. Subsequently the RBOCs sold Bellcore to SAIC, causing the new lab to seek support outside the RBOCs and subsequently make radical changes in the scope and direction of its research program.

As a result of divestiture, the fundamental split in the Bell System propelled AT&T (and its R&D arm Bell Labs) into a competitive landscape for the first time, with aggressive competitors such as MCI and Sprint seeking to compete for long-distance services—for both residential and business customers. Thus although a tax on telecommunications revenue remained as a source for funding R&D at Bell Labs, the prospects for increased competition, lower telecommunications prices, and decreasing telecommunications revenues for AT&T, as well as the regulatory pressures to lose market share to new competitors, led to the beginning of the reduction in the long-term, unfettered, fundamental research done at Bell Labs. Additionally, divestiture marked the beginning of a process of transforming the telecommunications industry in the United States from a vertically organized structure (where one body, the Bell System, had control over every aspect of the telecommunications process, from components, to boards, to systems, to services, to operations) to a horizontally organized structure (where multiple competitors existed at every level of the hierarchy and where no single entity had full responsibility for the network architecture, end-to-end network operations, or long-term fundamental research that would enable the creation of an evolutionary path into the future).

Subsequent Splits and Spin-offs and Research Cutbacks

The second stage of the breakup of the Bell System occurred at the end of 1995 when the existing AT&T (which had acquired the computer services company NCR several years earlier) made the decision to divest both the computer operations part of the business (selling it back to NCR) and the equipment manufacturing part of the business (with the creation of Lucent Technologies) in order to compete more actively in the areas of wireless and cable

services. As part of this trivestiture a large percentage of the resources of Bell Labs (as well as the rights to use of the Bell Labs name) went to Lucent Technologies for research and development in support of the creation of new products. About one-fourth of the research component of Bell Labs (along with significant development resources) joined AT&T and formed AT&T Labs, with the goal of conducting research and development that would be most appropriate to a services company that was venturing into the areas of wireless and broadband communication services.

Former Bell System entities continued to evolve. Over time Lucent Technologies spun off the component manufacturing part of the company as Agere Labs and the enterprise business systems part of the company as Avaya Labs. Telcordia was acquired by SAIC and later purchased by two private equity firms. AT&T spun off the wireless services part of the business (as AT&T Wireless, subsequently acquired by Cingular in 2004) and sold the cable services part to Comcast Communications. SBC and AT&T then merged in early 2005 under the AT&T name. Early 2006 saw a proposed acquisition by AT&T of Bell South.

It initially appeared as though research might continue to grow and prosper within the former Bell family laboratories—Lucent Bell Labs, Bellcore research, the new AT&T Labs, Agere Labs, and Avaya Labs—as well as within new telecommunications firms. Indeed, figures gathered by Michael Noll showed that the number of former Bell family company researchers grew from about 1000 in 1960 to 1200 in 1981 to about 1920 in 1997, but then fell off to 1570 in 2001. Data reported by Noll on research and development expenditures by the Bell family companies showed significant growth from 1981 ($3.2 billion) to 2001 ($6 billion).3

One of the Bell System offshoots, Lucent, continued to make a significant commitment to research, albeit one that decreased in total dollar terms as Lucent shrank. It has continued to fund Bell Laboratories at a rate of roughly 1 percent of revenue, further supplemented by some support from government research and development contracts. That allocation of 1 percent, which might be viewed as a best practice for a large equipment vendor, funds a mix of research in basic sciences, exploration of disruptive technologies, and more incremental work for meeting current customer needs.

THE EMERGENCE OF NEW TELECOMMUNICATIONS PLAYERS

Cable

The cable industry began in the 1940s and 1950s as a way to get television signals into remote areas. Antennas were placed in advantageous locations (e.g., the top of a mountain) and the signals were distributed along coaxial cable lines to local homes. As cable systems grew in size and number, and in the types of signals or services they provided, a full-fledged, wide-reaching industry began to take shape. According to the National Cable and Telecommunications Association (NCTA), by 1962 there were already nearly 800 cable systems with almost 900,000 subscribers in the United States.4

|

3 |

A. Michael Noll, “Telecommunication Basic Research: An Uncertain Future for the Bell Legacy,” Prometheus, 21(2):184-185, June 2003. |

|

4 |

National Cable and Telecommunications Association, “History of Cable Television,” 2005, available online at <http://www.ncta.com/Docs/pagecontent.cfm?pageID=96>. |

A good deal of organized, focused research and development work has enabled the evolution of cable as a telecommunications industry. In the late 1980s a group of cable company executives formed CableLabs, a nonprofit consortium of cable system operators, to pursue new cable telecommunications technologies, improve the business capabilities of cable operators, and help cable companies develop and take advantage of new technologies. For example, CableLabs was involved in the development and specification of cable modem technology (work initially funded by MCNS Holdings—composed of TCI, Time Warner Cable, Cox, and Comcast), eventually administering the specifications and performing certification and qualification of products. In addition, the early 1990s saw CableLabs involved in developing fiber-optic trunking and work to develop fiber-optic regional rings to link individual municipal cable systems. This work drew on earlier, more fundamental telecommunications research, such as work on fiber-optic communications, that had been developed at such places as Bell Labs. CableLabs work cuts across the layers from device and equipment standards through applications.

CableLabs—while not doing fundamental research itself—continues to play other important roles for the cable industry, such as helping to facilitate specification development, providing testing facilities to ensure quality equipment, and generally serving as a clearinghouse for information on current and prospective technological advances. More recently, CableLabs has been involved in the development of high-definition television systems, VoIP packet networking, interoperable interface specifications for real-time multimedia, and standards to create a common platform for interactive services.5,6

The Internet

In the early 1960s, the vision for a research program aimed at networking computers took shape at the Defense Department’s Advanced Research Projects Agency (ARPA, later DARPA). As early as 1965, ARPA was sponsoring research into cooperative time-sharing computers and packet switching. Plans for the ARPANET began to take shape in 1966, and in 1968 DARPA awarded a key contract to Bolt Beranek and Newman Inc. (BBN) to produce a key component in implementing the network, interface message processors (or IMPs). A year later, the first nodes in the ARPANET became active, allowing research in host-to-host protocols and how best to utilize network resources. By 1971, the ARPANET included 15 nodes, and work was underway on e-mail. As noted in an earlier CSTB report, however, the ARPANET was not DARPA’s only networking research activity—the organization also supported related research on terrestrial and satellite packet radio networks.7

|

5 |

The committee received a briefing from CableLabs’ David Reed at a meeting in Washington, D.C., on Nov. 3, 2003. For more information about CableLabs and its history, see Cable Television Laboratories Inc., “A Decade of Innovation: The History of CableLabs 1988-1998,” 1998, available online at <http://www.cablelabs.com/about/overview/History.html>. |

|

6 |

More general information regarding the development of the cable industry is available from the following two resources: Congressional Research Service, “Cable Television: Background and Overview of Rates and Other Issues for Congress” (RS21775), 2004, available online at <http://www.opencrs.com/rpts/RS21775_20040405.pdf>; and FCC, “Evolution of Cable Television,” 2000, available online at <http://www.fcc. gov/mb/facts/csgen.html>. |

|

7 |

Computer Science and Telecommunications Board, National Research Council, Funding a Revolution: Government Support for Computing Research, National Academy Press, Washington, D.C., 1999, available online at <http://newton.nap.edu/html/far/>, p. 174. |

Other key DARPA-funded work concerned the protocols used for communicating over the network. As work progressed on the ARPANET, it became clear that a replacement for the original Network Control Protocol would be needed to address the vision of an open architecture enabling a network of networks, a concept that called for a different approach to disseminating information, ensuring interoperability, and dealing with errors and transmission quality. The early 1980s saw the adoption of Transmission Control Protocol/Internet Protocol (TCP/IP) as a Defense Department standard, and the cutover of the ARPANET to the new protocol. DARPA not only funded and managed a research portfolio; it also facilitated the development of a vision and served as a convener for industry and academia, notably through the Internet Engineering Task Force.

The Internet’s development continued with the spin-off of MILNET to support DOD operations and new mission-focused computer networks developed by the Department of Energy, NASA, and NSF, together with broader networks such as USENET and BITNET. In 1986, NSF launched its NSFNet program, an effort to link (among other things) a number of U.S. academic supercomputing centers.8 NSFNet was envisioned as a general high-speed network that could link many other academic or research networks (including the ARPANET) using the research results and operational experience obtained from ARPANET. The NSFNet proved very successful. Its upgrade to handle growing demand and other subsequent changes opened the door for the participation of the private sector in the network.9

The mid to late 1980s saw continuing DARPA-supported research and development in areas such as routers and their protocols. Meanwhile, the speed of the NSFNet’s backbone saw great improvement, and the Domain Name System, a critical component facilitating Internet growth and reliability, was introduced. NSF support was also critical to the development of the first widely used graphical Web browser, Mosaic, which was developed in 1993 by a researcher at the National Center for Supercomputing Applications.

The Internet was highly successful in meeting the original vision of enabling computers to communicate across diverse networks and in the face of heterogeneous underlying communications technologies.10 Its success—measured in terms of commercial investment, wide use, and large installed base—is also widely understood to have made innovation in the Internet much harder over time. (Innovation in the Internet’s architecture proper should be distinguished from innovative uses of the network, which have flourished as a direct consequence of the Internet’s flexible, general-purpose design.) CSTB’s Looking Over the Fence at Networks: A Neighbor’s View of Networking Research11 characterized this problem in terms of three types of potential ossification: intellectual (pressures to be compatible with the current Internet risk stifling innovative ideas), infrastructural (an inability to affect what is deployed in commercial

|

8 |

For more detailed information on NSFNet, see National Science Foundation, “The Launch of NSFNet,” [undated], available online at <http://www.nsf.gov/about/history/nsf0050/internet/launch.htm>. |

|

9 |

For more background on Internet commercialization, see Brian Kahin, ed., “Commercialization of the Internet: Summary Report” (RFC 1192), 1990, available online at <http://www.ietf.org/rfc/rfc1192.txt>. |

|

10 |

Additional information about the Internet’s early years and development is available from the following resources: Leiner et al., “A Brief History of the Internet,” 2003, available online at <http://www.isoc.org/internet/history/brief.shtml>; and Robert H. Zakon, “Hobbes’ Internet Timeline (v8.1),” 2005, available online at <http://www.zakon.org/robert/internet/timeline/>. |

|

11 |

Computer Science and Telecommunications Board, National Research Council, Looking Over the Fence at Networks: A Neighbor’s View of Networking Research, National Academy Press, Washington, D.C., 2001, available online at <http://books.nap.edu/html/looking_over_the_fence/report.pdf>. |

networks makes it hard for researchers to experiment with new capabilities), and system (problems tend to be addressed with short-term fixes that are easier to deploy than with solutions that would be more desirable in the long run).

Concerns of these sorts—together with an appreciation that the Internet’s design, though highly successful, has a number of shortcomings—have served as the inspiration for new networking research initiatives, such as the National LambdaRail initiative and new research programs at the National Science Foundation.

Cellular and Wireless

In the early 1970s, following years of resistance to the idea, the Federal Communications Commission (FCC) began setting aside a range of radio frequencies for radio telephony. Near the end of that decade, a trial of cellular phone technology had been conducted in Chicago, and the world’s first commercial cellular phone service was introduced in Tokyo, Japan.

By the early 1980s, the FCC was issuing wireless telephony licenses and setting up metropolitan and rural jurisdictions (so-called metropolitan statistical areas and rural service areas), and, by the middle of the decade, first-generation wireless systems were being deployed in the United States. These systems were based on analog cellular technology using the advanced mobile phone system (or AMPS) technology that had been developed by Bell Labs. Cellular technology was being deployed in other countries, as well, although the technology and standards adopted internationally were very different from those used in the United States. Thus began one of today’s most vibrant and competitive industries—competition among wireless providers in today’s market is fierce, and new products and services emerge almost on a daily basis now.

Growing consumer demand and the need to make better use of available spectrum resources fueled the development of a second generation of wireless technologies (also commonly referred to as 2G technologies). This second generation marked the transition to a fully digital technology, providing enhanced quality and enabling better use of spectrum resources. While the European wireless industry settled on global system for mobile communications (GSM) for its 2G standard, two major wireless standards emerged in the United States: time division multiple access (TDMA), a technology standard adopted by the Telecommunications Industry Association in 1989; and code division multiple access (CDMA), a newer, competing technology developed and championed by Qualcomm. 2G technology included many improvements over first-generation technology; for example, 2G included such advanced digital features as compression, network control techniques, bandwidth conservation measures, and full support for voice mail.

The next generation of wireless technology (so-called 3G technology) promises to add even greater speed, capacity, and services—indeed, one recent report describes 3G as “bringing Internet capabilities to wireless mobile phones.”12 Along the way to 3G, there has also been a good deal of work on 2.5G technologies (e.g., CDMA2000, 1xRTT, and GPRS) to help bridge the fairly large gap between 2G and 3G, as well as to build out the networks and infrastructure required by the newer technologies.

|

12 |

Linda K. Moore, Congressional Research Service, Wireless Technology and Spectrum Demand: Advanced Wireless Services (RS20993), 2006, available online at <http://opencrs.cdt.org/document/RS20993/>. |

IMPACTS OF THE CHANGING LANDSCAPE ON INVESTMENT IN RESEARCH

Increased Competition and the Pressure on Research Investment

One result of the divestiture of the Bell System, subsequent splits and spin-offs, and the entry of new types of telecommunications services providers was a much more competitive telecommunications industry. The cost—and retail price—of long-distance calls fell rapidly between 1984 (the initial divestiture) and 2004 (when carriers began offering voice over IP service broadly to consumers). Wireless telephony grew rapidly, reaching nearly 208 million accounts in the United States by the end of 2005.13 Broadband access to the Internet became widely available. Cable system operators started introducing their own local telephone services over their new digital, two-way infrastructure. Business data service prices fell steadily as well.

A consequence of increased competition at every level of the telecommunications value chain was that the industry players found themselves operating with tighter margins and lower revenues.

The 1996 Telecommunications Act and subsequent FCC decisions led to a further evolution of the regulatory environment. The impact of these developments on innovation and R&D—and on the industry more broadly—has been the subject of much debate. Some caution, for example, that such policies as unbundling and the use of total element long-run incremental costs in the regulation of incumbent local exchange carriers had the effect of dampening investment by the local exchange carriers because competitors could appropriate some of the investment made by the carriers. Others cite significant benefits of these policies to the consumer (reduced prices) and the market (lower barriers to market entry).

From about 1990 to 2000, the period of high growth in the telecommunications industry meant that there were sufficient revenues to attract many new entrants into the telecommunications market, each of which invested heavily in creating new network facilities. This time period also saw venture capital play a more prominent role in the telecommunications industry (Box 2.1). Capital expenditures by these new carriers provided significant revenue streams to equipment vendors, and it appeared that research in telecommunications was continuing at a pace comparable to that of the Bell System prior to divestiture. But once this large build-out had been completed, and as the Internet bubble popped, investment declined significantly.

Reductions with the Bursting of the Internet Bubble

When the so-called Internet bubble burst at the end of the 20th century, much of the telecommunications industry was faced with a glut of infrastructure investments as the demand for these facilities slowed, leading to wholesale failures of major companies throughout the industry. During the boom years, companies had accumulated debt on the order of several trillion dollars across all players in the industry and suddenly had to service the debt with rapidly decreasing revenues. A result was wide-scale layoffs of workers, failures of several major telecommunications players, and drastic reductions in capital spending by carriers,

|

13 |

CTIA, Wireless Quick Facts, April 2006, available online at <http://files.ctia.org/pdf/Wireless_Quick_Facts_April_06.pdf>. |

|

BOX 2.1 The Role of Venture Capital in Innovation and Research Although it is sometimes argued that the venture capital invested in industry is supplanting traditional mechanisms for achieving innovation, venture capital represents development funding, not research funding. Leading-edge developers that have a profit requirement will quickly curtail their research directions in favor of achieving corporate financial goals. Moreover, the surge in funding that peaked in 2000 has fallen off almost as quickly as it appeared. Total telecommunications venture funding peaked at nearly $5 billion in the second quarter of 2000 before dropping back down to roughly $560 million per quarter just 2 years later—a level that has remained fairly constant into 2006.1 Despite venture capital’s important role in the U.S. innovation system and its many contributions to U.S. leadership in high technology, including telecommunications, its role is not to supply the basic and applied R&D that has fueled many of the major telecommunications advances mentioned in this report and elsewhere. Instead, it seeks to fund specific product innovation that can deliver short-term returns. Venture capital funds typically have a lifetime of 5 to 7 years, and investors seek significant commercial returns in that time frame. In contrast, major telecommunication advances can require longer-term efforts often continuing for a decade or more and requiring risk-taking, broad-based, interdisciplinary, multifaceted support—such as that historically provided by the Bell System or provided today when federal agencies fund long-term academic research. Over the long term, the venture capital model itself depends heavily on being able to select promising areas for investment from a stream of results from long-term research.

|

along with associated significant reductions in the funding for existing research programs at places like Lucent Bell Labs, AT&T Labs–Research, Telcordia, and other major telecommunications players.

Shifts from the High-Margin Public Telephone Network to New, Lower-Margin Services as a Source of Revenue

Another major change in the telecommunications industry has been a major shift from basic, high-margin, wireline telephony services provided by the public switched telephone network (PSTN) to wireless and broadband services that both complement and compete with the traditional services and are associated with lower margins.14 As a result, revenue is shifting

from the local exchange carriers (e.g., Verizon, SBC (now called AT&T), and Bell South) and interexchange carriers (e.g., AT&T, MCI, and Sprint) to wireless and broadband access service providers (e.g., Comcast, Time-Warner, AOL, Cingular, Verizon Wireless, T-Mobile, and Sprint PCS). Unfortunately almost none of the wireless or broadband service providers have been funding long-term research, nor are there indications at present that any will undertake to do so in the foreseeable future.

Increased Emphasis on Vendors’ Role in Supporting Research

All of the participants in the telecommunications value chain could, in principle, invest in research, but the nature of those investments would likely differ because of varying motivations and incentives. Traditionally, investments in research by end users (the demand side)15 seeking to improve the technologies available from providers and vendors (the supply side) have been the primary source of fundamental and long-time-horizon results that are much more likely to enter the public domain, making them available to all and increasing their impact. Open access to such results is particularly important for telecommunications, given that the value of a communications network grows with the number of its users, with more widely adopted and standardized technologies bringing greater benefits to all users.

As a result of the structural changes in the telecommunications industry, the source of funds for investing in research has shifted from the demand side—telephone customers who paid for Bell System research via a tax on telephony usage—to the vendors of equipment, software, and chips, although the U.S. military (through DARPA, the Army, the Navy, and the Air Force) continues to be a major source of investment in telecommunications research. Currently, end-user organizations and commercial intermediaries are investing very little in research (an exception is AT&T, which has maintained a vestige of Bell Labs but has cut that back substantially, due to dramatic reductions in traditional telecommunications revenues over the past 3 years, from a support level of close to $140 million in 2001 to a support level of below $60 million in 2004).

Today, for commercial technologies, most of the investment is made by supply-side equipment vendors and semiconductor and software companies. Service providers and equipment vendors primarily support research leading to near-term incremental additions to their own products and services, and are likely to keep the results of their short-term research programs proprietary in the interest of gaining competitive advantage.

Although demand-side entities are generally more likely to direct their research investments toward more fundamental and long-time-horizon opportunities, a major economic impediment to doing so is so-called free-riding. Since the goal of a demand-side entity is typically not to gain proprietary advantage, but to make innovative solutions available through the totality of its suppliers, demand-side investments in research usually benefit everybody, that is, all suppliers and other demand-side entities. Thus, companies or entities failing to invest in research can still benefit from the investments of others, and there is a temptation to gain a free ride on those investments—and a disincentive to invest in results that become largely a public good.

|

15 |

For more perspective on user-centered innovation, see Eric Von Hippel, Democratizing Innovation, MIT Press, Cambridge, Mass., 2005, available online at <http://web.mit.edu/evhippel/www/democ.htm>. |

The problem of free-riding is not new. Predivestiture, non-Bell telephone companies like MCI and Worldcom—but with the notable exception of GTE—invested little in research. Other areas of telecommunications such as cable television, which was able to exploit optical transmission technologies for its new hybrid fiber-coaxial cable deployments in the 1990s, similarly depended on and benefited from new technologies arising from Bell Labs and from government-sponsored research. Today this trend has been accentuated as the fragments of the divested Bell System have greatly curtailed or eliminated research investments, especially those targeted at advancing the general telecommunications technologies available through their suppliers.

Another increasingly used mechanism or trend involves larger companies acquiring smaller innovative start-ups (perhaps in lieu of funding or otherwise supporting in-house research and development work) to stimulate their own growth and innovation. While this trend does seem more oriented toward short-term goals, it underscores the importance of early support or funding for the often high-risk research and development that contribute to the creation of these smaller spin-off companies.

Moving responsibility for research to suppliers increases the volatility of funding. The capital expenditures of service providers are dependent on the rate of change of their revenues, which can fluctuate rapidly, often owing to cyclical technology changes. For example, recent years have seen a sharp downturn in traditional wireline telephony revenues and purchases of new equipment by carriers. Sustaining a high-quality research organization requires stable funding, and volatility and uncertainty can have significant consequences. For example, in recent years, a number of prominent researchers have moved from industry research laboratories to universities as they seek a more stable environment in which to conduct their research.

The Decreasing Time Horizon of Research

The decline in attention to long-term research is quite evident when looking at the history of Bell Labs, the institution that for decades was most closely associated with long-term telecommunications research. Long-term research supported advances in areas such as switching, transmission, and services, and shorter-term research was aimed at operating and improving existing technologies and systems. Although most of the system building and systems engineering and integration were done by developers and system architects, researchers were traditionally heavily involved in the process since they were the ones who had created the fundamental technology on which the new systems were based.

It has become clear that even as the number of researchers was growing in the late 1990s, the former Bell family research enterprise was undergoing significant changes. Because internal corporate management decisions about research and development are proprietary and detailed historical data were not maintained, quantifying this shift is very difficult. However, testimony to the committee and comments received from a number of researchers clearly indicate a qualitative shift in the time horizon for research. Long-term, fundamental research aimed at breakthroughs has declined in favor of shorter-term, incremental and evolutionary projects whose purpose is to enable improvements in existing products and services. This evolutionary work is aimed at generating returns within a couple of years to a couple of months and not at addressing the needs of the telecommunications industry as a whole in future decades. Insiders and outsiders have observed in comments to the committee that the

TABLE 2.1 Sources of Papers Presented at the 2005 International Conference on Communications and the 2005 IEEE Global Telecommunications Conference (Globecom)

|

Source |

Number of Papers |

Percentage |

|

U.S. universities |

470 |

34.8 |

|

U.S. industry |

50 |

3.7 |

|

Asia |

332 |

24.6 |

|

Europe |

278 |

20.6 |

|

Other (majority from Canada) |

222 |

16.4 |

|

TOTAL |

1,352 |

100 |

focus of 80 to 90 percent of research at the Bell family labs is now concentrated on short-term innovation rather than long-term fundamental research. Although a closer alignment of the interests of research laboratories and companies benefits U.S. industry, the often associated reduction in fundamental, long-term research hurts the telecommunications industry in the long run.

Decline in Industry Participation in Publishing Research

Additional evidence for the decline in research spending and the shift from longer- to shorter-term research in the U.S. telecommunications industry is seen in the number of technical papers authored by industry researchers. At two recent major international conferences held annually in the field of communications (which represent at least part of the telecommunications landscape), there was a dramatic decrease in the number of conference papers authored by industry researchers. Table 2.1 lists the sources of the 1352 papers presented at the 2005 International Conference on Communications (ICC) and the 2005 IEEE Global Telecommunications Conference (Globecom). Only a handful of U.S. industry research labs were represented by more than one paper at the two conferences (see Table 2.2).

Although it could be the case that U.S. telecommunications companies have decided to restrict presentations of work by their researchers (and developers) at such conferences, the committee considers it much more likely that the statistics on publication by author affiliation shown in Tables 2.1 and 2.2 do reflect a dramatic decline in industry efforts in long-term research.16

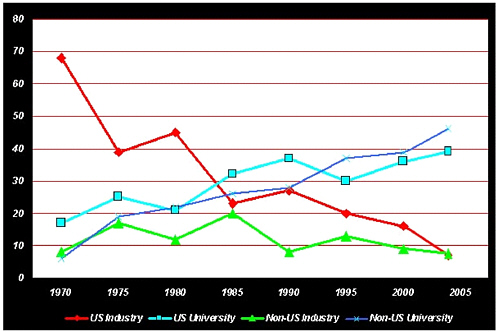

A decline in publication by industry authors is also suggested by the decreasing fraction of industry-researcher-authored papers in the IEEE Transactions on Communications (Figure 2.1),

TABLE 2.2 Number of Papers Presented by U.S. Industry Research Laboratories (for companies with more than one paper) at the 2005 International Conference on Communications and the 2005 IEEE Global Telecommunications Conference (Globecom)

|

U.S. Industrial Research Laboratory |

Number of Papers |

|

Qualcomm |

9 |

|

Lucent |

6 |

|

Telcordia |

4 |

|

IBM |

4 |

|

Marvell Semiconductor |

3 |

|

Mitsubishi Research U.S. |

3 |

|

Motorola |

2 |

|

Conextant |

2 |

FIGURE 2.1 Percent authorship of papers in the IEEE Transactions on Communications, 1970 to 2005.

arguably the most prestigious journal in the communications area. In 1970 approximately 70 percent of the papers in the transactions were authored by industry; in 2003 that percentage had fallen by an order of magnitude to about 7 percent. The reduced contributions from industry have been partially offset by an increase in the number of academic papers—both from U.S. and foreign universities.

U.S. Participation in Publishing Research

It can also be seen that publications from universities outside the United States are greater in number than publications from universities within the United States—albeit by a small amount. In addition, the level of publication from industry outside the United States is now roughly the same as the level from U.S. industry.

Within U.S. universities, there are multiple indications that much U.S. academic research in telecommunications is being carried out by foreign national graduate students. In the papers published in Globecom 2005, 459 of the 675 authors from U.S. universities (68 percent) have apparently Asian surnames. This observation is consistent with data showing that roughly 60 percent of the Ph.D.s in engineering and 50 percent of the Ph.D.s in computer science awarded in the United States are being awarded to non-U.S. citizens.17

GOVERNMENT SUPPORT FOR TELECOMMUNICATIONS RESEARCH

Overall Investment

Government support for telecommunications research has been small compared with support for other areas of IT, arguably because of the spending on research by the Bell System (until divestiture) and by its progeny. Precise figures are, unfortunately, difficult to come by. Perhaps because telecommunications has not been considered a strategic area for investment, telecommunications research activities do not fall neatly into programs labeled as “telecommunications” nor is telecommunications research funding across the U.S. government tracked as a separate category by NSF’s Division of Science Resources Statistics.

However, a top-down indication of the level of investment can be obtained from Networking and Information Technology Research and Development: Supplement to the President’s Budget for FY2006,18 a report of the National Coordination Office for Networking and Information Technology Research and Development. It describes the networking and information technology research spending by its 11 participating agencies—NSF, NIH, DOE (Office of Science), NASA, DARPA, the National Security Agency, the Agency for Healthcare Research and Quality,

|

17 |

Based on data compiled by the Computing Research Association; see <http://www.cra.org/info/education/us/phd.citizenship.html>. |

|

18 |

Subcommittee on Networking and Information Technology Research and Development, Committee on Technology, National Science and Technology Council, Networking and Information Technology Research and Development: Supplement to the President’s Budget for FY2006, National Coordination Office for Networking and Information Technology Research and Development, Arlington, Va., February 2005, available online at <http://www.nitrd.gov/pubs/2006supplement/>. |

NIST, NOAA, EPA, and DOE/National Nuclear Security Agency—that provide the bulk of federal research in these areas. The report divides federal research spending into seven categories—high-end computing infrastructure and applications, high-end computing R&D, human computer interaction and information management, large-scale networking (LSN), software design and productivity, high-confidence software and systems, and social, economic, and workforce). The total research spending across these agencies and areas for FY 2006 is $2.1 billion, whereas for LSN—the area likely to contain the most telecommunications-related research—it is $328 million, or 16 percent of the total.

The numbers are not definitive: there might, for example, be some physical sciences work that supports telecommunications, and (similarly uncounted) physical sciences work that supports IT as well. Also, not all of the LSN budget supports networking research per se. For example, the biggest contributor to support for LSN is NIH, at least some of which appears to be for networks for health sciences research rather than for networking research itself. Considering funding for all agencies except for NIH funding, the FY 2006 spending on LSN is $230 million out of $1.7 billion, or 14 percent. Also, the second largest supporter of LSN research is NSF ($95 million); some of NSF’s LSN budget also supports research infrastructure rather than networking research, making the percentage for research itself even lower.

National Science Foundation

There are elements of programs in NSF’s Computer and Information Science and Engineering (CISE) and Engineering (ENG) directorates that address aspects of telecommunications research. The CISE directorate has, for example, long been an important supporter of networking research (as noted in “The Internet,” the section above on the development of the early Internet). Over the years the ENG directorate has made investments in various areas including wireless and optical communications, and it has established several engineering research centers related to telecommunications. In the view of the committee, however, these efforts as a whole have not represented a major programmatic emphasis by NSF on telecommunications nor reflected a comprehensive, coordinated research strategy in telecommunications.

Today, as outlined above, telecommunications programs in total see only a modest level of funding. In addition, testimony provided to the committee indicated that overall proposal acceptance rates for most NSF programs related to telecommunications (in the CISE and ENG directorates) have been 10 percent or less for the past several years.19

In 2004, NSF announced a new $40 million per year program called Network Technology and Systems (NeTS), which represents a significant new investment in telecommunications research and education projects and will focus on the following four areas: programmable wireless networks, networking of sensor systems, networking broadly defined, and future Internet design.20 The program has latitude for interdisciplinary work that could also involve physical devices and could suggest a wide range of research topics in the control, deployment,

|

19 |

In his May 2004 testimony to this committee, Guru Parulkar of NSF indicated that proposal acceptance rates “in the single digits” were typical for CISE networking research programs. |

|

20 |

For more information on NeTS and its four focus areas, see <http://www.nsf.gov/pubs/2006/nsf06516/nsf06516.htm>. |

and management of future networks. However, although the NeTS program is a welcome source of additional support and programmatic emphasis on telecommunications research, its relatively modest size is likely to have little overall impact on low proposal acceptance rates.

In 2005, NSF announced the Global Environment for Networking Investigations (GENI) initiative, a program still in the planning stage that will focus on new concepts for networking and distributed system architectures and on experimental facilities to investigate them at large scale. Envisioned as encompassing a broad community effort that engages other agencies and countries, as well as corporate entities, the GENI initiative will emphasize the creation of new networking and distributed system architectures that, for example:

-

Build in security and robustness;

-

Enable the vision of pervasive computing and bridge the gap between the physical and virtual worlds by including mobile, wireless, and sensor networks;

-

Enable control and management of other critical infrastructures;

-

Include ease of operation and usability; and

-

Enable new classes of societal-level services and applications.21

Defense Advanced Research Projects Agency Support

Long a source of support for research on large-scale problems, DARPA has led in computer networking (via the ARPANET and its derivatives) and in the creation of the Internet (via its support of TCP/IP protocols and related computer networking services such as e-mail, ftp, gopher, and others) and remains committed today to advances in telecommunications-focused research. In the early 1990s, DARPA was involved in the research on and adoption of asynchronous transfer mode (ATM) technology, as well as research into packet technologies for voice and video. Along with nearly 40 other organizations, DARPA also completed work on the Gigabit Testbed Initiative, an effort by a host of universities, telecommunication carriers, industry, national laboratories, and computer companies to create a number of very-high-speed network testbeds and explore their use for scientific research and other applications.22 In the late 1990s, DARPA also funded the All Optical Networking Consortium, which was formed by the cooperation of Bell Laboratories, Digital Equipment Corporation, and the Massachusetts Institute of Technology to examine the unique properties of fiber optics for advanced broadband networking. DARPA has also been a long-standing, significant funder of wireless research.

Currently, telecommunications research programs in support of battlefield communications continue to be a focus of DARPA’s work. Examples include the Information Processing Technology Office’s (IPTO’s) Situation Aware Protocols in Edge Network Technologies (SAPIENT) program,23 and the Advanced Technology Office’s (ATO’s) Information Theory

|

21 |

National Science Foundation, Directorate for Computer and Information Science and Engineering, The GENI Initiative, 2005, available online at <http://www.nsf.gov/cise/geni/>. |

|

22 |

The final results of this initiative were captured in the following report: Corporation for National Research Initiatives, The Gigabit Testbed Initiative: Final Report, 1996, available online at <http://www.cnri.reston.va.us/gigafr/>. |

|

23 |

More information about IPTO’s work can be found online at <http://www.darpa.mil/ipto/>. |

for Mobile Ad-Hoc Networks, Mobile Network MIMO, Rescue Transponder, Networking in Extreme Environments, and NeXt-Generation Communications programs.24

DARPA has had a long and illustrious history of funding high-risk, high-reward projects, many of which have changed the face of military systems, computing environments, networking, other military technologies, and ultimately technologies in private industry.25

Other Federally Funded Telecommunications Research

The previous sections highlight several of the more prominent federal funding programs related to telecommunications. But there have been many other important areas of investment over the years. Within DOD itself, the service laboratories (Office of Naval Research, Air Force Office of Scientific Research, and the Army Research Office) as well as other military R&D centers (such as MIT Lincoln Laboratory, Rome Air Development Center, Army Satellite R&D at Ft. Monmouth, and so on) have made significant investments in a wide array of telecommunications technologies. Another mission-driven investment was made by NASA in support of satellite and space missions. Finally, programs at the National Telecommunications and Information Administration’s Boulder laboratory have helped advance the field of wireless propagation.

HISTORICAL CHALLENGES TO DOING MORE TELECOMMUNICATIONS RESEARCH IN ACADEMIA

An indirect consequence of the traditionally high levels of funding for research by the Bell System and by its progeny has been modest attention to telecommunications in academia compared to many other areas of information and communications technology. Since almost every aspect of telecommunications was provided by monopoly carriers (both in the United States and abroad), it was difficult to create viable telecommunications courses in academia and to attract professors who were knowledgeable about the changing telecommunications environment.

More recently, corporate investment in academic work has been quite modest and confined largely to a few successful consortium research programs that have attracted industry support and have also, in some cases, been funded by state initiatives. Several state programs, notably in California and Georgia,26 support academic telecommunications research and interactions with industry.

Another challenge in teaching telecommunications or carrying out a relevant research program in universities is that the facilities and resources at academic institutions are not adequate to address the architectural and operational issues of large-scale telecommunications networks. Since there has never been any pressure or financial incentive to create the resources

|

24 |

Likewise, more information about ATO’s work can be found online at <http://www.darpa.mil/ato/>. |

|

25 |

For a history describing the transition of DARPA research into the military, other government organizations, and private industry, see DARPA, “Technology Transition,” [undated], available online at <http://www.darpa.mil/body/pdf/transition.pdf>. |

|

26 |

For more information on these programs, see <http://www.calit2.net> and <http://www.gcatt.org>, respectively. |

and infrastructure for such research (since these have traditionally and historically been the domain of the monopoly carriers), most university researchers have opted instead to focus on core technologies like semiconductors, computing, signal processing, and communication theory, where meaningful research can be done at a much smaller scale with fewer resources, and where both industry and government have been more willing to provide the support needed to create long-range academic programs.

INTERNATIONAL SUPPORT FOR TELECOMMUNICATIONS RESEARCH AND DEVELOPMENT

In the course of its work the committee developed a keen sense of the increasing competition from international telecommunications industries (in terms of both technology and price). However, it is very difficult to collect comprehensive information on international R&D investment related to telecommunications or to assess how such investments affect a given industry. Still, there is ample evidence that a number of other nations place considerable emphasis on R&D in this sector. Three member countries of the Organisation for Economic Co-operation and Development, for example, have legal or regulatory mandates for such research:27

-

Japan’s NTT law requires NTT to conduct research relating to telecommunications technologies and makes NTT (including the regional companies NTT East and NTT West) responsible for promoting and disseminating the results of telecommunications research.

-

Korea’s telecommunications basic law allows the Ministry for Information and Communications (MIC) to recommend that service providers contribute a percentage of total annual revenues to telecommunications research. R&D investments by carriers may be internal or external; external contributions are made to an MIC-administered fund that is then distributed to Korean research institutes.

-

In 2003, France’s telecommunications regulations required France Telecom to spend 4 percent of its unconsolidated revenues on research and development.

In addition, several nations and regions conduct major research programs with significant government investment. It is, of course, difficult to compare research programs in detail because of differences in program structure, definitions of telecommunications, and so forth. However, several examples of investments made outside the United States provide a compelling illustration of the high priority being placed on telecommunications R&D outside the United States. Major initiatives include the following:

-

The European Union Sixth Framework Programme includes nearly $300 million in funding for telecommunications research under the Information Society Technologies program: €138 million for mobile and wireless systems and “platforms beyond 3G,” €65 million for “broadband for all,” €63 million for “networked audiovisual systems and home platforms,” and €18 million for research networking testbeds.28

|

27 |

OECD, OECD Communications Outlook 2005, OECD Publishing, Paris, 2005, p. 75. |

|

28 |

Budgets for 2004-2005 annual calls for proposals; see <http://www.cordis.lu/ist/activities/activities.htm>. |

-

Japan’s National Institute of Information and Communications Technology has an almost entirely government-funded budget of over $500 million that supports nearly 500 employees, 60 percent of whom are researchers.29 Another government-supported institution, the Research Institute of Telecommunications and Economics, carries out economics and policy research related to telecommunications.

Another development is that some U.S. academic telecommunications researchers have turned to foreign corporations for funding and have, according to information available to members of the committee, received funding from companies such as Toshiba (Japan), Huawei (China), and Samsung (Korea)—which have become formidable competitors of U.S. firms. To gain such support, academic institutions have sometimes been asked to surrender ownership or agree to co-ownership of intellectual property stemming from the research.

Finally, beyond research programs, many nations have signaled their commitment to telecommunications as a critical societal and economic element. In particular, China has fostered a strong and growing telecommunications industry. Briefers to the committee and reviewers of this report noted the increasing technical sophistication and competitiveness in pricing of Chinese equipment vendors.30 Countries such as Japan (e-Japan), Korea (e-Korea Vision 2006), and Taiwan (e-Taiwan) have launched national programs that aim to broadly promote the deployment, adoption, and use of information and telecommunications technologies. They feature a variety of elements ranging from research funding to policy reforms to incentives for broadband deployment to national standards and standards-development processes that (if only indirectly) aim to strengthen domestic industries.

|

29 |

See <http://www.nict.go.jp/overview/> or overview pamphlet at <http://www.nict.go.jp/overview/news/pdf-box/NICT-e.pdf>. |

|

30 |

A 2004 Business Week article profiled one such prominent Chinese company, Huawei, noting that the company was spending 10 percent of its revenues on R&D. See Bruce Einhorn, “Huawei: More Than a Local Hero,” BusinessWeek Online, 2004, available online at <http://www.businessweek.com/magazine/content/04_41/b3903454.htm>. Also, for more insight into Chinese competitiveness and its implications for U.S. entrepreneurs, see Reed Hundt, In China’s Shadow: The Crisis of American Entrepreneurship, Yale University Press, New Haven, Conn., 2006. |