3

Research and Policy Perspectives on the Benefits of Business Data Sharing

Business data from the U.S. statistical system and various private-sector sources form the country’s economic informational infrastructure, on which millions of policy and business decisions, including cost-of-living adjustments, monetary policy, and wage and investing decisions, are based. Shortcomings or inconsistencies in measures of economic activity can hinder decision making in a multitude of ways. Steering committee chair Charles Schultze introduced the afternoon session by taking up this topic, noting that a lack of data sharing and coordination can contribute to problems of discrepant data. One notable example is the aggregate employment statistics, specifically, the (perhaps cyclical) pattern of differences in employment changes as measured by the Current Employment Statistics (CES) and the Current Population Survey (CPS). Schultze cited the widely held view that, in the short to medium run, the CES payroll series is the best measure for judging cyclical strength or weakness of the economy, but he suggested that policy makers and analysts should pay attention to the employment estimates in the CPS household survey as well and support efforts to reconcile the two series.

The discrepancy in employment data has recently received a good deal of attention. Schultze cited a paper by George Perry (2005) evaluating the CES and the CPS (adjusted for conceptual comparability) in terms of their usefulness for measuring the short-run employment behavior of the overall economy. He also cited the work of John Schmitt and Dean Baker (2006), economists at the Center for Economic and Policy Research, which found that the CPS may be overstating the share of working Americans by 1.4 percentage points (roughly 3 million people).

The choice of how much reliance to place on either of the two employment series affects measured growth of unit labor costs and productivity, which carries important policy implications. For example, the higher unit labor costs derived from the CPS (relative to the CES) would support a stronger case for increasing interest rates. Schultze agreed with the position that both data series contribute relevant information, but he added that the reasons underlying the inconsistencies need to be more fully understood. If it were possible to integrate Census Bureau data on the self-employed and nonemployers with employment statistics from the Bureau of Labor Statistics (BLS), one element of the discrepancy in establishment- and household-based employment statistics could be studied more carefully.

The afternoon session featured the perspectives of data users outside the statistical agencies. Carol Corrado opened the discussion of user needs and concerns related to data sharing with a presentation on monetary policy and research at the Federal Reserve Board (FRB). Dale Jorgenson and George Plesko provided additional researcher perspectives with presentations on productivity and real output measurement and on tax data needs for estimating corporate profits, respectively. The session concluded with a presentation on the use of data and the potential value of data sharing for budget forecasting by Douglas Holtz-Eakin, former director of the Congressional Budget Office (CBO).

MONETARY POLICY AND RESEARCH AT THE FEDERAL RESERVE

Carol Corrado spoke from the perspective of the FRB—perhaps the most important policy consumer of economic statistics—about the value of accurate data and how improved coordination among the statistical agencies might enhance that value. Her comments focused on how business list reconciliation would provide a more consistent source of data for use in the analysis and forecasting of productivity—particularly multifactor productivity. Real-time economic statistics, imperfect by nature, play an important role in the Federal Reserve’s assessment of underlying trends in gross domestic product (GDP) and gross domestic income (GDI), payroll and household-based estimates of employment, industry productivity, and business inventories. Corrado cited these and several other examples as cases in which alternative data sources do not typically align. Sometimes one source is more revealing than another; for example, data from the income side of the national accounts captured the 1990s acceleration in productivity considerably sooner than did data from the product side.

In some cases, alternative measurement instruments reveal different elements of a phenomenon, thereby allowing richer analyses; in other cases, they do not. Payroll and household employment statistics, which frequently diverge, are useful in revealing different aspects of the labor picture. However, Corrado argued, maintaining two business establishment lists is not a good example of complementary data sources. She emphasized the point that there is a distinction between data consistency and data integration and the way each relates to statistical discrepancies. Consistency has to do with definitions and classification, which is what the reconciliation of the two lists should aim to achieve. She suggested that the methods by which the Bureau of Economic Analysis (BEA) reconciles its industry accounts with the expenditure side of GDP is an example of integration eliminating informative discrepancies. Fixler noted that, from a national income accounting perspective, BEA analysts need to be able to draw as much information from one account toward the other as possible. If the differences were fully understood between the inputs, the decision to integrate or distribute discrepancies between accounts would be unnecessary, as the differences would be small and relatively manageable. Corrado suggested there may be problems with the way discrepancies get redistributed in the national income and product accounts, and that noise in the data needs to be eliminated before they can be used to detect changes in productivity at the industry level.

Corrado used the striking productivity measurement case to illustrate problems that arise from maintaining two business lists. At the FRB, aggregate productivity is directly linked to monetary policy decisions because productivity affects inflation trends. Conventional industry-based productivity studies rely on output data from the Census Bureau and input measures from the BLS. Corrado pointed out that a calculation in which the numerator and the denominator are derived from the same survey or survey frame would have obvious statistical advantages.

One example of the importance of industry-level information for assessing prospects for aggregate productivity surfaced during the late 1990s. Initially, in late 1996, the FRB’s view of productivity was based on analyses of sectoral and industry trends captured using BEA’s data on GDP by industry. These analyses, along with other academic and agency research, suggested that prices in some industries were mismeasured. As the role of changes occurring in the high-technology industries became clear, a strong case emerged for improving industry-level data. Still later, evidence grew that the step-up in multifactor productivity was fairly broadly based by industry. Although these developments are now apparent in retrospect, at the time these new trends were emerging, when the FRB needed to examine what was happening in productivity in real time,

much of the available evidence of the changes in multifactor productivity was anecdotal.

When measuring productivity, most macroeconomists do not spend a lot of time with the Census Bureau employment data, mainly because those figures are not comprehensive (even in Census years). Macroeconomists more typically rely on BLS industry-level employment measures, which at times diverge significantly from Census Bureau-based measures. For example, in 1997, 2.6 million persons were categorized as working in the management of companies (North American Industry Classification System, or NAICS, Code 55) according to the Census Bureau, but only 1.7 million persons worked in the occupation according to BLS. A reconciliation of the Census Bureau and BLS business lists has the potential to create more uniform and comparable measures of output, employment, and, in turn, productivity. Although anecdotal information will always be used to some extent, Corrado argued that a system that includes a consistent historical time series is vital to research and policy at the FRB.

Corrado commented on additional data hurdles that inhibit analysis at the Federal Reserve, citing lags in data, the impact of the switch to NAICS on productivity analysis (particularly for the services industries), and BEA changes in its industry accounting methods. She noted that the FRB is engaged in a project to review disaggregate productivity measurement using industry data from BEA, as well as aggregate measures for six sectors believed to illuminate key trends. Inconsistencies in employment by NAICS-defined industries have limited what the project is able to do in terms of studying trends in multifactor productivity. Project researchers built a Standard Industrial Classification (SIC)-to-NAICS concordance in an effort to bridge some gaps and, in Corrado’s view, fully reconciling the business lists would advance the goal of creating time series of consistent historical industry productivity data. Once current employment data discrepancies are addressed, she would like to see a historical revision of industry output and productivity data.

Corrado concluded her presentation by stating that the statistical agencies should reorient their programs to avoid duplicative effort required to maintain two systems, which ultimately makes detecting trends in the economy more difficult. During the open discussion, John Haltiwanger noted that it would be difficult to choose (or to get BLS and the Census Bureau to agree) on one list over another, and he urged that the strengths and weaknesses of each would need to be captured to construct an ideal downstream reconciliation of the two. Historical estimates could continue to rely on the Census Bureau employment data because they conform to the Census Bureau output data but, looking ahead, the list would benefit from the timeliness of BLS data. Agreeing that this

would be an appropriate strategy, Corrado expressed the hope that, in the near future, there would be a system going forward that has reconciled the differences in employment by industry.

PRODUCTIVITY AND REAL OUTPUT MEASUREMENT

Dale Jorgenson presented his views on the role of data sharing in the measurement of productivity and real output and on data integration issues related to the “new architecture” he helped design for the U.S. national accounts. A goal of the new architecture is to provide an internally consistent and comprehensive set of national accounts to measure the large, complex U.S. economy with a statistical system that is highly decentralized. He argued that an accurate set of accounts depends on a consistent set of data. One goal of the new architecture program is to have a unified register of firms and establishments, collecting data in a way that reflects the common records that are maintained for these units; some of this can be accomplished through more effective data sharing by the statistical agencies. Such a system would work to achieve greater internal consistency of data at the micro level, helping to identify the sources of discrepancies.

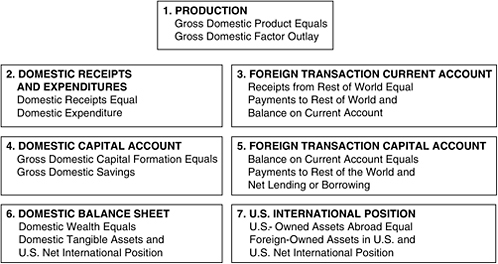

The new architecture framework has seven main accounts: production, domestic receipts and expenditures, foreign transaction current account, domestic capital account, foreign transaction capital account, domestic balance sheet, and U.S. international position (see Figure 3-1 for

FIGURE 3-1 Blueprint for an expanded and integrated set of accounts for the United States.

detail on components of each account). The majority of Jorgenson’s presentation focused on the production account, which sets GDP equal to Gross Domestic Factor Outlay or Income (GDI).

The production account consists of output, input, and productivity, in which output and input shares add up to one (1.0) in the GDP. Consumption and investment outputs make up the output shares, and when one rises, the other falls. GDI reveals how individuals divide their money among resources for consumption (which includes immediate consumption goods) and savings (which includes housing and financial assets). GDP and GDI should agree, but in order for those to match, the source data must be internally consistent. When these are consistent, they can be used to measure the effects of events like Hurricane Katrina on the economy. However, when the components of the accounts do not agree, errors within the accounts and among the seven accounts occur. For example, consumption expenditures show up as part of the national product. An error in the product account leads to an error in expenditures and income, which in turn creates an error in production. In addition, discrepancies in the measurement of the savings rate cause problems in the capital formation and wealth area. Thus, error propagates error.

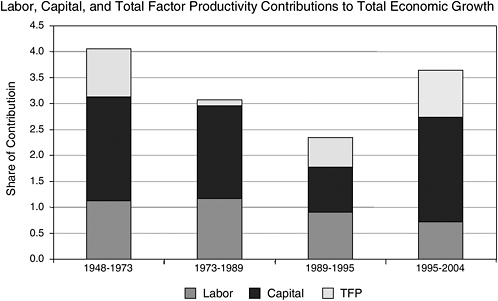

BEA is responsible for the production accounts at both aggregate and industry levels. Input shares to productivity include capital and labor inputs. The estimates of labor inputs are based on BLS data from the Quarterly Census of Employment and Wages and have remained fairly constant. If the Census Bureau figures were used rather than BLS numbers, the result would be a share of labor about 5 percent lower and the share of capital would increase. This would affect the estimate of economic growth on the input side and, in turn, the productivity number. In terms of contributions to growth, capital investments are primary sources of economic growth, because labor growth has been slow relative to capital and investment growth since 1995 (see Figure 3-2). If adjusted to Census Bureau data, where the labor share is even smaller and the capital share larger, over time productivity estimates would decrease. Jorgenson provided these examples to illustrate how data choice (in this case, the Census Bureau versus BLS data on shares of labor and growth measures) affects the internal consistency of the accounts and the ability to obtain accurate macroeconomic measures.

Additionally, the output data produced from different data sources by BLS and BEA are not comparable, and it is important to be able to reconcile these differences. One way to do that is to go to the registers of individual firms and establishments and make sure the data are collected from common sources. Jorgenson reiterated that accurate measurement of output, productivity, and saving requires extending data-sharing arrangements. He argued that it is necessary to work toward a unified reg-

FIGURE 3-2 The production account—output, input, and productivity.

ister so that the national accounts can rest on a firm foundation of a common set of data sources. He added that having a centralized statistical system, such as Statistics Canada, is not necessary, if the problem of internal consistency is addressed. In order to have a common register that is used across the government and to share data among agencies, the statutory authority to do so must exist.

Jorgenson stated that data sharing is not an academic problem or an issue for the statistical agencies alone. It is a problem for the policy makers and the politicians who rely on the agencies for information. He speculated that policy makers are hamstrung by the fact that the data system involves inconsistencies that arise through the lack of data sharing and through the absence of statutory authority to share data among the statistical agencies. Jorgenson stated that it is absolutely essential that these uncertainties be resolved, and he suggested starting at the most fundamental levels.

For monetary and economic policy purposes, understanding the current state and future outlook for the American economy depends on getting the numbers right. One of the most important factors in determining the economic outlook is the contribution of information technology and other industries to past—and future—growth and productivity. To illustrate, Jorgenson calculated differences in productivity growth implied by the Census Bureau and BLS data. Differences at the industry level are typically much higher than the 5 percent that he found in the aggregate

estimate. For manufacturing as a whole, the share of labor calculated using the Census Bureau data is 15 percent lower than the statistic calculated using BLS data. For some industries, such as oil and gas extraction, the Census Bureau figure is 50 percent lower than the BLS figure.

At the industry level, one of the most dramatic differences between value-added growth, as estimated using the Census Bureau data rather than BLS data on wages and salaries, is for the computer and office equipment industry. Estimates provided by Landefeld and Fixler indicate significant differences in the growth rate and level of activity in this industry and the broader information technology industry, depending on whether the BLS or Census Bureau data are used (see Table 7-2 in Chapter 7).

During the open discussion, Haltiwanger made the point that there seems to be a clear distinction between informative discrepancies and inherent, nonmeaningful inconsistencies that are costly in terms of time and resources. He suggested that the sectors of the economy experiencing large amounts of change might also be the most problematic. In considering whether the agencies are performing their statutory duty to provide the most accurate statistics possible, Jorgenson’s two biggest concerns are with measuring output at the industry level and measuring the income side. He concluded with a clarification of an important discrepancy: if the macro number and the number calculated by adding up the industries do not match, that is an important indicator of discrepancies in the industry-level data across sources. In order to understand the future of the economy, he argued, the macro picture will not suffice, and the industry data from the FRB, BLS, and BEA are vital. Finally, he noted that, while not all of the issues can be solved by data sharing, such arrangements are essential to improving economic data and statistics.

TAX DATA NEEDS FOR IMPROVING ESTIMATES OF CORPORATE PROFITS

George Plesko of the University of Connecticut discussed the availability and role of various kinds of corporate profit information for research and analysis. He focused on discrepancies and measurement differences between financial reporting profits and cash reported profits, as well as how each relates to the other. His paper (Chapter 8) discusses how tax return data can be used to improve estimates of corporate profits. Corporate income can be measured in two ways, through financial (more commonly called “book”) reporting and through tax reporting. Book reporting provides income measures and other information for investors, creditors, and other users; however, such information is available only for publicly traded companies. Tax reporting provides a measure of income for tax collection, and it is generally characterized as providing less dis-

cretion to management regarding the choice and application of accounting rules. Fuller data sharing might allow researchers to examine the relationship between tax and book data and the viability of using the latter in tax-estimate modeling.

Tax-based and book-based calculations of corporate income are different for two primary reasons—one causing a temporary difference and one a permanent difference. Tax depreciation is typically faster than book depreciation, leading to less income in the short term, but more in later periods—thus creating a temporary difference in the measurement concepts. Second, tax-exempt interest is not included as part of taxable income but is considered income for financial reporting purposes, which creates a permanent difference in measurement. These differences are important to outside investors, creditors, and policy analysts for understanding the operations of a firm. Recent research (U.S. Department of the Treasury, 1999) has also identified large and increasing differences in book versus tax income as supporting evidence of increased tax sheltering activities (see Table 8-1). The book and tax reports attempt to measure the same thing but the methods are conceptually different, and each adds something to what outside analysts can learn about a firm.

Financial statements provide an opportunity for analysts to augment information about a firm’s operation that is not required to be disclosed through tax reporting. The information from each is useful to investors, and ideally these two sources would be complementary. However, the information is not useful for inferring income and payments. When examining pretax book income and the amount of income subject to tax from the two sources, Plesko found that, over time, the two diverge. In terms of nonpublicly traded firms, tax return information may be the only source of financial information.

The timeliness of book reporting is important to note, as information provided through this type of financial reporting is filed publicly by March 30 for the preceding year. Tax return information from Statistics of Income (SOI) tabulations lags behind by nearly three years when taking into consideration extensions and audits. Given the earlier access to book statements, if the relationship between a firm’s tax returns and the book financial statements is clear, then the latter should enable analysts to begin modeling a year or two ahead of the release of SOI figures. A problem arising from using financial statements is that more than one, and possibly several hundred, matching tax returns may exist. The new IRS Schedule M-3, which replaced Schedule M-1, allows fuller reconciliation of book income with tax net income. The form delineates differences between book and tax income as temporary or permanent, allowing every tax return to be identified with the appropriate accounting parent.

When combined, financial and tax return information provides a more

complete picture of a business’s operations. Access to multiple data sources also allows for more timely estimation of economic events because various sources become available on different schedules. The ablity to reconcile book and tax income at the back end creates benefits as well. For example, financial statement data are useful in augmenting tax filings by providing information on firms’ operations that are not captured in the tax reporting system.

The new IRS schedule, the M-3 (see http://www.irs.gov/pub/irs-utl/2005f1120sm3.pdf), is coming online beginning with tax year 2004 for firms that have assets of $10 million and more. Benefits of the Schedule M-3 include reconciliation of income from the worldwide consolidated financial statement and from the income statement of includible corporations; reconciliation of book income of includible corporations with tax net income; and delineation of differences between book and tax income as temporary or permanent. The new form should help the IRS, Treasury, and BEA better understand how financial reporting can inform tax administration.

Plesko cited the national accounts as an example of how the new data that incorporates both financial and tax return information will be useful. The detail captured by the M-3 will provide more data on the contemporaneous finances and the operations and organization of firms, including specific decisions related to tax planning. Plesko argued that the improved financial data that can be generated from the M-3 will be helpful in measuring the effects of tax policy, as well as for constructing preliminary national income estimates of corporate profit (see Chapter 8 for further examples). During the open discussion, steering group member Daniel Feenberg suggested that BEA and the Census Bureau think about cooperating on a reconciled form that would allow BEA to ask respondents to reconcile their answers with those provided to the Census Bureau.

THE IMPORTANCE OF ACCURATE DATA AND DATA SHARING FOR BUDGET FORECASTING

The CBO is charged with providing Congress with the information it needs to address budgetary and economic policies. CBO produces approximately 900 cost estimates per year, on tight time schedules and for difficult and disparate questions. CBO gathers data from agencies, including administrative data, and it relies on confidentially supplied private-sector data. It is often difficult to reconcile the different pictures of a program’s performance portrayed by administrative data from the agencies and by data based on the Current Population Survey or other surveys. CBO has indirectly experimented with data sharing in the sense that

it has made attempts to reconcile confidential private-sector data with data from other agency sources.

CBO uses data in a number of ways: for monitoring the state of the economy at both the macro and micro levels; for near-term forecasting (18 to 24 months) of overall movement and composition of output and income; and for medium-term forecasting for the economy over the next 10 years. CBO also engages in long-term modeling to produce estimates of the future path of various programs, such as Social Security and Medicare, analyzing changes in program finances and their impact on the federal unified budget deficit and the path of the U.S. economy.

In his presentation, Douglas Holtz-Eakin began by asserting that, of course, CBO would be better served if it had more accurate and timely data, and he suggested that an important consideration in evaluating the strength and accuracy of data is the underlying expertise in its production. To the extent that it is possible to enlarge the effective sample sizes through sharing of existing resources, budget analysts might be able to anticipate and answer questions before they arise. Holtz-Eakin suggested that timeliness of input data improves budget forecasting in an important way: when budget forecasts can be based on timely data, fewer revisions are required, leading to more consistent histories.

Revisions of historical information impede forecasting efforts. To the extent that revisions can be minimized through better accumulation of data, Holtz-Eakin suggested that the entire process will be improved, because attention will focus on the judgments that were actually made in doing the forecasts rather than the accuracy of the information going into them. If the data are revised less often, CBO and others will have more confidence in the forecast estimates they pass on to Congress.

The question for the workshop concerns the extent to which data integration permits better forecasting. Of course, there is a trade-off at some level between getting things quickly and getting them reliably. The issue is how much CBO can move away from human intelligence and heavy dependence on anecdotal evidence, particularly in the policy world, to data that are more reliably gathered. Landefeld noted that BEA strives to produce better early estimates that hold up over time. The question then shifts from more timely data to producing more accurate early estimates in order to make the trade-off between timeliness and accuracy less stark.

Holtz-Eakin noted that, recently, federal fiscal policy has been reactive. If better data were provided for monitoring the economy in real time, some activities in the federal government would see tremendous benefits. This might allow analysts to sharpen near- and medium-term economic forecasts. For example, real-time economic data would help to better elucidate shifts in productivity, inflation, core consumer prices, income and receipts, corporate profitability, bonuses and options, the composition of

employee compensation, and labor force participation. Simply knowing, on a timely basis, when money comes into the Treasury—and whether it is income tax or payroll tax—would allow for better understanding of wage and salary movements.

Holtz-Eakin noted the importance of providing access to data used by CBO in order to improve the transparency of the processes, since the ability to explain how forecasting is done is just as important as doing it. For example, allowing outside analysts to produce a parallel set of estimates facilitates two important kinds of comparisons: comparisons that are “prickly and uncomfortable” but that provide information from the mistakes, and ones that provide transparency to the policy process. More important than the numbers themselves is the need to inspire confidence that they are constructed fairly, distributed in a timely fashion, and used in a manner that allows the policy process to evolve smoothly.

In Holtz-Eakin’s view, it is not enough to give the people making economic and budget estimates carte blanche access. No one would know how to assess the relative merit of competing estimates unless the process of constructing those estimates is transparent. He suggested the need to push hard for the private sector to have access to data, not only for their own use, but also as a way to support work of the government.

In response to a comment that extending data sharing is not politically popular, a participant asked if members of Congress had an interest in this topic. Holtz-Eakin responded that a number of members of Congress do have an understanding of the sources of difficulty in making budget projections, and that they, in fact, were sympathetic. He added that there was political interest in improving data but conceded that confidentiality is a major concern. He suggested that the argument for access should be framed so that the benefits (such as improving the ability to accurately decompose sources of economic activity) are clear and expressed in a practical way.