1

Overview

The energy problem now faced by the United States began to be recognized 10 years or more ago. Still, the occasional symptoms (the oil embargo of 1973, the natural gas shortage of 1976–1977, and the gasoline lines of the summer of 1979) are frequently mistaken for the problem itself. As each symptom is relieved, the public sense of crisis fades. The seeds of future crisis, however, remain.

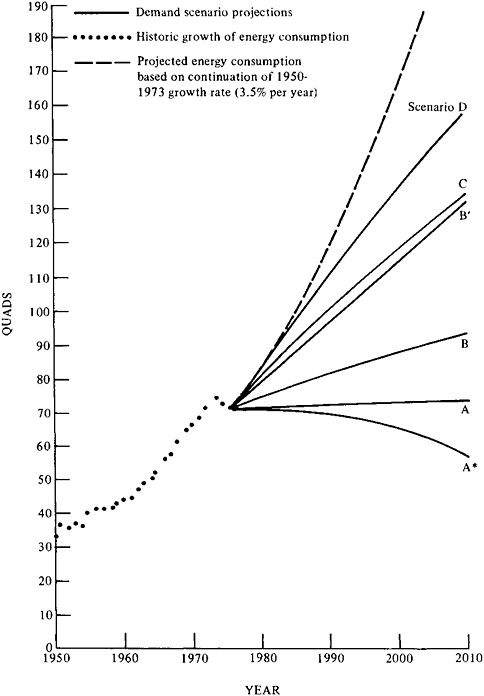

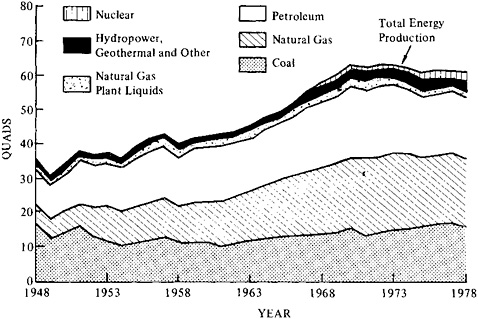

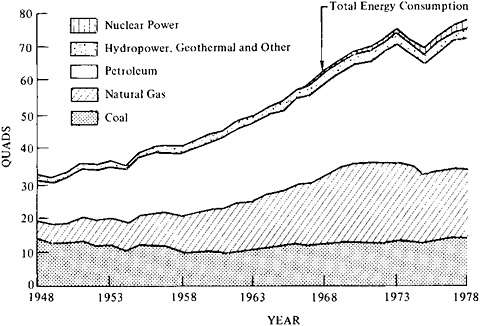

Resolution of the problem demands a systematic examination of energy supply and demand in the context of existing policies, and articulation of a coherent set of policies for the transition to new sources of energy and new ways of using it. The essential difficulty is that these policies must be as consonant as possible with other, often conflicting, national objectives—protecting the environment and public health and ensuring national security, economic growth, and equity among different regions and classes. The nation’s energy problems are exemplified by two simple facts: stagnant domestic production and rising demand. Total energy production in the United States in 1978 was about 3 percent less than in 1972, the last full year before the oil embargo and OPEC price rise of 1973–1974 (Figure 1–1). In the same period, energy consumption rose by 9 percent (Figure 1–2). The difference is made up by increasing oil imports at continually rising prices. Imports now provide about half of all the oil consumed in the United States, up from about 30 percent in 1972. The total cost has jumped from $4.77 billion in 1972 to $41.46 billion in 1978.1

In the meantime, total world demand for oil has risen even more rapidly2–4 while exporting nations, with an eye to the ultimate depletion of what is in many cases the sole source of wealth, have exercised strict

FIGURE 1–1 Energy production in the United States from 1948 to 1978, by energy source (quads). Source: U.S. Department of Energy, Energy Information Administration, Annual Report to Congress, 1978, vol. 2, Data (Washington, D.C.: U.S. Department of Energy (DOE/EIA-0173/2), 1979).

control over production. Thus, the United States is forced to compete for supplies in an increasingly tight world market. The inevitable result is upward pressure on prices and enhanced opportunities for the control of prices by cartel.

The United States is a key factor in the world oil situation. U.S. oil consumption is huge, amounting to almost 30 percent of world consumption. At the same time, its domestic production is declining, probably irreversibly (except for some temporary help from Alaskan production, which will peak in the 1980s). Natural gas production is also on a downward trend. These production trends might be arrested by higher prices and favorable public policies, but any increase above current production levels is likely to be small and to decline after the year 2000. The only readily available large-scale domestic energy sources that could even in principle reverse the decline in domestic energy production over the next three decades—coal and nuclear fission*—face a variety of technical, political, and environmental obstacles, and will be difficult (though not impossible) to expand very rapidly.†

|

* |

See statement 1–1, by H.Brooks, Appendix A. |

|

† |

See statement 1–2, by J.P.Holdren, Appendix A. |

FIGURE 1–2 Energy consumption in the United States from 1948 to 1978, by energy source (quads). Source: U.S. Department of Energy, Energy Information Administration, Annual Report to Congress, 1978, vol. 2, Data (Washington, D.C.: U.S. Department of Energy (DOE/EIA-0173/2), 1979).

The implications are serious. First of all, rising dependence on increasingly costly foreign oil tends to degrade the value of the dollar and exacerbates inflation. The heavy and growing involvement of the United States in the world oil market not only worsens the domestic problem, but puts less affluent importing countries at a growing disadvantage in competing for supplies. The foreign policy consequences of this strained situation are twofold: Oil-producing countries find it increasingly feasible to exact political concessions from importers, and U.S. relations with other oil importers are weakened.

The United States has been a net importer of energy since the early 1950s. Energy was cheap, and it grew cheaper throughout the 1950s and 1960s; little concern was expressed as consumption more and more outpaced domestic production. In constant 1948 dollars, the price per barrel of crude oil at the wellhead fell from $2.50 in 1948 to $1.85 in 1972; imported oil was even cheaper. Most other forms of energy—notably electricity and coal—declined even more in price than oil. Net energy imports rose on the average more than 10 percent annually throughout the 1960s, more than doubling in that decade. Sources of supply became increasingly concentrated in the Middle East and Africa.

In 1970 domestic oil production peaked, and growth in imports accelerated. From 1970 until the fourfold OPEC price rise in 1973–1974, oil imports rose at rates exceeding 30 percent annually—almost doubling again in 3 years. The price rise brought in its wake a serious economic recession; energy consumption, and therefore imports, dipped in response. They rebounded sharply afterward, though rates of increase are now less than in the early 1970s. The nation now imports more than a fifth of its primary energy in the form of foreign oil.

The solution to this problem is not simply to produce more energy, and not simply to conserve, but rather to find a new economic equilibrium between supply and demand.* Higher prices are inevitable, and the nation must take advantage of the resulting new opportunities for both enhanced supply and greater efficiency in energy use.

Ordinary market forces will play important roles here. In some cases, however, such as the international oil market, they will be relatively ineffective and must be supplemented by government incentives to conserve and by federal aid in developing new technologies that can allow wider use of domestic resources such as coal, to allay the growth in demand for oil.

All in all, conservation deserves the highest immediate priority in energy planning. In general, throughout the economy it is now a better investment to save a Btu than to produce an additional one.† On the supply side, the most important short-term measure is to enhance domestic oil and gas production by exploiting unconventional sources and enhanced-recovery techniques. The most important intermediate-term measure is developing synthetic fuels from coal, and perhaps from oil shale, to serve where coal and nuclear power (which are most suitable now for electricity production) cannot directly replace oil and gas, as in transportation. Perhaps equally important is the use of coal and nuclear power to produce electricity for applications such as space heating, where such replacement is possible.

While these measures are being taken, the research and development necessary to bring truly sustainable energy sources—nuclear fission, solar energy, geothermal energy in places, and perhaps fusion—into place for the long term must receive continued attention. The relative merits of the principal long-term choices, and the timing of their execution, are discussed in subsequent sections of this chapter and in the body of the report

MODERATING DEMAND GROWTH

Slowing the growth of energy demand will be essential, regardless of the supply options developed during the coming decades. In fact, the demand element of the nation’s energy strategy should be accorded the highest priority. Some reduction in growth will inevitably result from rising energy prices, and this reduction could be accelerated by such explicit government policies as taxes and tariffs on energy and standards for the performance of energy-using equipment. In any event, studies by the CONAES Demand and Conservation Panel indicate that the growth of demand for energy in this country could be reduced substantially—particularly after about 1990—by gradual increases in the technical efficiency of energy end-use and by price-induced shifts toward less energy-intensive goods and services.5

In this analysis the Demand and Conservation Panel explored the dynamics and determinants of energy use by performing detailed economic and technological analyses of the major energy-consuming sectors: buildings, industry, and transportation. The projected energy intensities for each sector were based on (1) expected economic responses to price increases and income growth and (2) technical changes in energy efficiency that would be economical at the prices assumed and would minimize the life cycle costs of automobiles, appliances, houses, manufacturing equipment, and so on. No credit was taken for major technological breakthroughs; only advances based on currently available technology were considered.

A major conclusion from this analysis is that technical efficiency measures alone could reduce the ratio of energy consumption to gross national product (for convenience, the energy/GNP ratio) to as little as half* its present value over the next 30–40 years. (This conclusion is sensitive to the prices assumed in the analysis, and a result of this magnitude is attained only if prices for energy increase more rapidly than is probable in a market at equilibrium.) Similar conclusions were reached by the CONAES Modeling Resource Group,6† whose work suggests that such reductions are possible without appreciable impacts on the consumer market basket.

In some cases the price increases necessary to reach such reductions in demand would have to be secured by taxes that would open up a wedge between consumer prices and the costs of producing and delivering energy. Whether this would be politically tolerable or not may be open to question. It is possible, however, that if such price increases are not imposed

|

* |

Statement 1–5, by R.H.Cannon, Jr.: It would be wrong to depend on so large an improvement. Calculations using other models and assumptions predict severe economic impact for smaller energy/GNP reductions. |

|

† |

See statement 1–6, by E.J.Gornowski, Appendix A. |

domestically, they will be imposed by the international oil market with considerably greater abruptness.

These findings are embodied in the panel’s “scenarios,” or estimates of energy demand under a range of different assumed circumstances involving the price of energy and the consequent technological responses in terms of energy consumption. (A scenario is a kind of “what if” statement, giving the expected results of more or less plausible assumptions about future events, according to some self-consistent model.) The Demand and Conservation Panel’s scenarios are intended to project—given certain unvaried assumptions about population growth and income growth, labor productivity, and the like—the effects on energy demand between 1975 and 2010 of various price schedules for delivered energy. The assumed prices range from an average quadrupling by 2010 to a case in which the average price of delivered energy actually decreases by one third. Table 1–1 lists the generalized assumptions and postulated prices for each of these demand scenarios. (The specific assumed prices for individual fuels in each of these demand scenarios can be found in Table 11–2 of chapter 11.) Obviously, high-priced energy evokes greater efficiency in use and thus lower consumption.

One of the key assumptions in the panel’s scenarios is that the U.S. gross national product grows at an average rate of 2 percent between 1975 and 2010*; a variant of one scenario explores the implications of 3 percent growth. More rapid economic growth, as might be expected, implies higher energy consumption.†

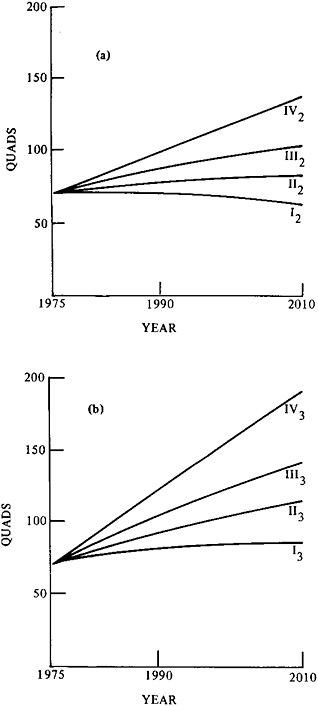

The panel found that the economically rational responses of consumers to this range of energy prices would result in a broad range of energy consumption totals for the year 2010.‡ Figures 1–3 and 1–4 illustrate the width of this range. Chapters 2 and 11 explain more about the assumptions and methods used in making these projections.

A WORD ABOUT THE STUDY’S PROJECTIONS

The Demand and Conservation Panel’s scenarios are only one of a variety of scenarios developed and used in this study to aid in visualizing the complex interplay among policies, prices, and technologies in the supply and demand of energy. Table 1–2 summarizes the main features and

|

* |

Statement 1–7, by R.H.Cannon, Jr.: Over the entire 33-yr period 1946 to present, 3.4 percent GNP growth, not 2 percent, has been consistent with a healthy economy and reasonably low unemployment. |

|

† |

See statement 1–8, by H.S.Houthakker and H.Brooks, Appendix A. |

|

‡ |

Statement 1–9, by R.H.Cannon, Jr.: Assuming 3.4 percent GNP growth would make the 2010 quad figures (roughly) for scenario A 125, for scenario B 160, for scenario C 230, and for scenario D 270. |

TABLE 1–1 Essential Assumptions of Demand and Conservation Panel Scenarios

|

Scenario |

Energy Conservation Policy |

Average Delivered Energy Price in 2010 as Multiple of Average 1975 Price (1975 dollars) |

Average Annual GNP Growth Rate (percent) |

|

A* |

Very aggressive, deliberately arrived at reduced demand requiring some life-style changes |

4 |

2 |

|

A |

Aggressive; aimed at maximum efficiency plus minor life-style changes |

4 |

2 |

|

B |

Moderate; slowly incorporates more measures to increase efficiency |

2 |

2 |

|

B′ |

Same as B, but 3 percent average annual GNP growth |

2 |

3 |

|

C |

Unchanged; present policies continue |

1 |

2 |

|

D |

Energy prices lowered by subsidy; little incentive to conserve |

0.66 |

2 |

purposes of each set. Chapter 11 deals in some detail with all the scenario projections made in this study, but brief descriptions of the most important ones will be vital to an understanding of much of what follows.

The Supply and Delivery Panel, in its scenarios, estimated the availabilities of various energy forms between 1975 and 2010 under three progressively more favorable sets of assumed financial and regulatory conditions. These are denoted “business as usual,” “enhanced supply,” and “national commitment.” This exercise provided the committee with an idea of the problems and potentials of the nation’s major energy supply alternatives. Table 1–3 lists, as an example, the supplies of energy that might be made available if all energy sources could be accorded the incentives implied by the panel’s enhanced-supply assumptions.

With the scenarios of these two panels as a basis, the staff of the study attempted to develop a self-consistent set of projections for the consumption of the various energy forms between 1975 and 2010; the method in brief was to use the demand scenarios as a framework, and to fill the demands thus established by entering the available supplies of each major energy form as given by the Supply and Delivery Panel’s scenarios. Some interfuel substitutions were made, and the resulting differences in

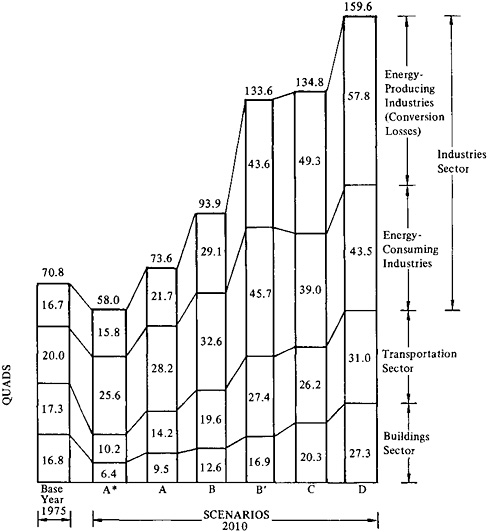

FIGURE 1–4 Demand and Conservation Panel projections of primary energy use by energy-consuming sectors to 2010 (quads). Energy demand projections for different assumptions about GNP or population growth can be roughly estimated by scaling the scenario projections. For example, for a crude idea of the effect of 3 percent average annual GNP growth (rather than the 2 percent assumed in constructing the scenarios), one would multiply the demand total by 3/2.

conversion and distribution losses and the like cause the projected totals to vary somewhat from the Demand and Conservation Panel’s framework. These scenarios offer a 3 percent GNP growth variant for each of the Demand and Conservation Panel’s scenarios. Figure 1–5, showing the primary energy totals for these scenarios, illustrates the difference varying GNP growth assumptions might make.

Yet another set of scenarios was developed by the CONAES Modeling

TABLE 1–2 Scenario Projections Used in the CONAES Study

|

Scenario |

Source |

Description |

|

Demand scenarios: A*, A, B, B′, C, D |

Demand and Conservation Panel |

A, B, C, and D explore the effects of varied schedules of prices for energy at the point of use, from an average quadrupling between 1975 and 2010 (scenario A) to a case (scenario D) in which the average price of energy falls to two thirds of its 1975 value by 2010. Basic assumptions include 2 percent annual average growth in GNP, and population growth to 280 million in the United States in 2010. Scenario A* is a variant of A that takes additional conservation measures into account. Scenario B′ is a variant of B, projecting the effect on energy consumption of a higher annual average rate of growth in GNP (3 percent). |

|

Supply scenarios: Business as usual, enhanced supply, and national commitment |

Supply and Delivery Panel |

Projections of energy resource and power production under various sets of assumed policy and regulatory conditions. Business-as-usual projections assume continuation without change of the policies and regulations prevailing in 1975; enhanced-supply and national-commitment projections assume policies and regulatory practices to encourage energy resource and power production. |

|

Study scenarios: I2, I3, II2, II3, III2, III3, IV2, IV3 (correspondence between study scenarios and demand scenarios: I2=A*, II2=A, III2=B, III3=B′, IV2=C; scenario D was not used) |

Staff of the CONAES study |

Based on the demand scenarios; integrations of the projections of demand from the demand scenarios and projections of supply from the supply scenarios. A variant of each price-schedule scenario was projected for 3 percent annual average growth of GNP. |

|

MRG scenarios |

Modeling Resource Group |

Estimates of the economic costs of limiting or proscribing energy technologies in accordance with various policies. |

Resource Group in its econometric investigation of various determinants of energy supply and demand. Unlike the three sets of scenarios thus far described, those of the Modeling Resource Group do not proceed from prices (or, equivalently, policies) given at the outset. They are based instead on equilibration of supply and demand, so that prices come as outputs, rather than being given as inputs. Generally speaking, these scenarios contain much less sectoral detail than the other scenarios used in the study; in exchange for this simplification, they permit a more extensive exploration of different policies (including special constraints or moratoria on particular technologies).

It should always be borne in mind, in dealing with scenarios and other projections, that they cannot pretend to predict the future. All scenarios require great oversimplification of reality, and many judgments enter into their assumptions. The value of scenarios is in their self-consistency, which allows an approximate view of relationships between supply and demand, trade-offs among different energy sources, and the possible impacts of broadly defined policies.* The temptation to take this kind of projection too literally should be resisted, but as means of illustrating certain gross features of the nation’s energy system and its possible evolution, this study’s scenarios have value.

THE ECONOMIC EFFECTS OF MODERATING ENERGY CONSUMPTION

According to the analyses of the Demand and Conservation Panel, the kinds of energy conservation that offer the greatest promise of substantially moderating in the growth of energy consumption involve replacing equipment and structures with those that are more energy efficient. To avoid economic penalties, the rate of replacement must generally depend on the normal turnover of capital stock—about 10 years for automobiles, 20–50 years for industrial plants, and 50 years or more for housing—though rising energy prices will accelerate this turnover in most cases. The effects of conservation will become evident only over the long term,† but these long-term benefits require many actions that must be begun immediately, and sustained consistently over time.

As Table 1–1 and Figure 1–3 illustrate, the panel found that any of a range of primary energy consumption totals (varying by a factor of more than 2) could be compatible with the same rate of growth in GNP. Thus, energy consumption may exert less influence on the size of the economy than often has been supposed.

These findings were borne out by the work of the Modeling Resource

|

* |

See statement 1–10, by E.J.Gornowski, Appendix A. |

|

† |

Statement 1–11, by J.P.Holdren: An oversimplification. Many approaches to conservation—such as retrofitting existing equipment—produce big short-term gains. |

TABLE 1–3 Supply of Major Energy Forms Under Supply and Delivery Panel’s Enhanced-Supply Assumptions (quads)a

|

Energy Form |

Annual Supply |

|||

|

1977 |

1990 |

2000 |

2010 |

|

|

Crude oil |

19.6 |

20.0 |

18.0 |

16.0 |

|

Natural gas |

19.4 |

15.8 |

15.0 |

14.0 |

|

Oil shale |

0 |

0.7 |

1.0 |

1.5 |

|

Synthetic liquidsb |

(0) |

(0.4) |

(2.4) |

(8.0) |

|

Synthetic gasb |

(0) |

(1.7) |

(3.5) |

(4.8) |

|

Coal |

16.4 |

26.6 |

37.2 |

49.5 |

|

Geothermal |

0 |

0.6 |

1.6 |

4.1 |

|

Solar |

0 |

1.7 |

5.9 |

10.7 |

|

Nuclear |

2.7 |

13.0 |

29.5 |

41.7 |

|

Hydroelectric |

2.4 |

4.1 |

5.0 |

5.0 |

|

aFor specific assumptions underlying estimates, see the report by the National Research Council, U.S. Energy Supply Prospects to 2010, Committee on Nuclear and Alternative Energy Systems, Supply and Delivery Panel (Washington, D.C.: National Academy of Sciences, 1979) and Chapter 11, Table 11–14. bSynthetic fuels are produced from coal and oil shale and are not included in totals. |

||||

Group7—work undertaken by different methods and for different purposes. This group sought, among other aims, a first approximation of the cost of limiting the energy available from specific technologies, the cost being measured as the size of the resulting effect on cumulative GNP. The group also assessed the feedback effect on GNP of imposing a blanket tax on all primary sources of energy to reduce energy consumption to specific levels below a base case.

The group found this feedback surprisingly small, assuming that the economy is given time to adjust by shifting capital and other resources from the processes of energy production and use to less energy-intensive processes, activities, and products. Subsequent work8,9 has tended generally to confirm these conclusions.*

The size of the feedback depends critically, however, on the parameter that describes the quantitative effect of all these substitutions taken together: the long-term price elasticity of demand for primary energy. This value is the ratio of the percentage change in demand to the percentage change in price that evokes it. For example, if demand falls 5 percent in

response to a 10 percent increase in price, the price elasticity of demand is equal to −5÷10, or −0.5.

The Modeling Resource Group reports that for the case in which primary energy consumption is reduced by 58 percent below the market-equilibrium “base case,” cumulative GNP between 1975 and 2010 decreases just 2 percent if the price elasticity of demand for primary energy is −0.5, but 29 percent if the value of this parameter is −0.25. The elasticity parameter thus is a key source of uncertainty in the Modeling Resource Group’s work, because its true value is not well known. More detailed discussions can be found in chapters 2 and 11.

It should be noted that even for the higher elasticity value, achieving this reduction is estimated by the Modeling Resource Group to require a tax on electricity rising by 2010 to 126 mills per kilowatt-hour (kWh) and a tax on oil and gas rising to $8.90 per million Btu (both measured in 1975 dollars). This implies a price for oil of more than 4 times the 1978 OPEC price. For electricity it implies about an eightfold increase over 1975 prices.* (See notes to Table 11–38.)

The work of the Demand and Conservation Panel and the Modeling Resource Group points up the importance of allowing the economy sufficient time to make the substitutions and institute the changes necessary to accommodate higher prices for energy or limitations on supply (or both). Sudden supply curtailments or changes in energy prices can disrupt the economy. The same changes introduced gradually over several decades may have only minor economic effects.

DOMESTIC ENERGY SUPPLIES FOR THE NEAR TERM

The supply of fluid fuels—gas and oil—which together provide about 75 percent of the nation’s energy, will be critical in the 1980s and 1990s. Petroleum supplies worldwide will be severely and increasingly strained as world production approaches its probable peak near the end of the century. This probably would be true even if there were no OPEC; the possibilities of politically controlled prices and production cutbacks are greatly enhanced by such a situation. Domestic production of oil and natural gas has already peaked and begun to decline, and U.S. demand for imports already imposes rather serious strains on the world oil market. Oil production from Prudhoe Bay in Alaska will provide only temporary relief before beginning to fall off in the 1980s. Even the most optimistic projections of the CONAES Supply and Delivery Panel10 show irreversible

|

* |

See statement 1–13, by J.P.Holdren, Appendix A. |

declines in domestic oil and natural gas production in the future. Coal and nuclear power are the only large-scale alternatives† to oil and gas in the near term (before about 2000), as the use of fluid fuels begins to wane.‡ Both are best suited to the generation of electricity in this period. As such they are limited as replacements for fluid fuels, but will have uses in other applications.

A balanced combination of coal- and nuclear-generated electricity is preferable, on environmental and economic grounds, to the predominance of either. The principal points that favor nuclear electricity in its present form (light water reactors (LWR’s) operated with a once-through fuel cycle without fuel reprocessing) are as follows.

-

In most regions, the average cost of nuclear electricity is less than that of coal-generated electricity, and the difference is likely to continue in the future.*

-

The cost of nuclear energy is less sensitive than that of coal to future increases in fuel prices and to changes in environmental standards, Because of this, the use of nuclear power could reduce future regional disparities in electric power costs.

-

Nuclear fuel supplies are more readily stockpiled than coal, and nuclear electricity is thus less subject to interruption by strikes, bad weather, and transportation disruptions.

-

The environmental and health effects of routine operation of nuclear reactors are substantially less than those of coal per unit of electric power produced.

-

If the effect of carbon dioxide (CO2) accumulation on climate becomes a major global environmental issue in the early years of the twenty-first century, it will be aggravated by utility commitments to the use of coal, because power plants have lives of 30–40 years.

The principal points in favor of coal are the following.

-

Coal power plants and the coal fuel cycle are not subject to low-probability, high-consequence accidents or sabotage, which are inherently uncertain and unpredictable. The hazards of coal can be made relatively predictable, given sufficient research on such matters as the health effects of coal-derived air pollutants. (This research will take perhaps 15–20 years to complete, however.)

|

† |

See statement 1–14, by E.J.Gornowski, Appendix A. |

|

‡ |

Statement 1–15, by J.P.Holdren: My longer dissenting view, statement 1–2, Appendix A, also applies here. |

|

* |

Statement 1–16, by J.P.Holdren: This point and the next one may well depend on a lower incidence of safety-related nuclear plant shutdowns than is likely. |

-

Coal burning in utilities has no major foreign policy implications, as does nuclear power via the problems of nuclear weapons proliferation and safeguards. The outlook for political acceptance of coal may thus be more favorable than that for nuclear energy.

-

Coal is better adapted to generation of intermediate-load power, and in this sense is complementary to base-load nuclear plants. In addition, the lead time for planning coal-burning power plants is less than that for nuclear plants.

-

Coal-generated electricity has a much larger resource base than light water reactors operated on a once-through fuel cycle, which will be important if fuel reprocessing and the development of more resource-efficient reactor systems and fuel cycles are further delayed.

-

In the absence of a demonstrated, licensable plan for high-level waste management, the nuclear fuel cycle may be considered an incompletely proven technology, which is therefore subject to uncertainties as to whether its continued growth will be permitted. To the degree that this is so, nuclear energy runs a greater risk than coal of future capacity shortfalls due to unexpected technical developments.

After 1990, coal will likely be increasingly demanded for conversion to synthetic fuels, and nuclear generation may thus be required for continued growth in generating capacity. The amount of nuclear capacity needed is sensitively dependent on the profile of electricity growth after 1990, and especially after 2000. The several issues surrounding coal- and nuclear-generated electricity are discussed in chapters 4, 5, and 9. Chapter 11 compares various rates of installation for both coal-fired and nuclear power plants under assumed rates of growth for electricity consumption.

Electricity can be provided from almost any primary fuel and thus adds a good deal of flexibility to energy supply. However, probably even in comparison with synthetic liquids and gases, it has high capital costs.11 There is a complex trade-off between fuel flexibility, which favors electricity, and cost, which favors fluid fuels in applications such as heating and cooling buildings and providing most industrial heat. Electricity prices are considered likely to rise less rapidly than the prices of oil, gas, and synthetic fuels, owing to technological progress in the generation of electricity and to the large fraction of electricity cost attributable to fixed capital charges, which remain constant once a plant is built but for future plants tend to increase at the same rate as the general price level. The CONAES Demand and Conservation Panel, however, assumed delivered electricity prices would rise nearly as quickly as other

fuel prices. These differences may result in underestimated electricity growth in the CONAES projections.*

For the intermediate term, conservation of fluid fuels is an urgent necessity. Even in the projections embodying vigorous energy conservation, limited supplies of fluid fuels could lead to rapid price rises, especially if imports are constrained or subject to cartel pricing. If prices rise too rapidly, there will be insufficient time for development and investment to adjust, and economic dislocation will result.

The constraints on supplies of fluid fuels could probably not be fully relieved by a high-electrification policy depending on coal and nuclear fission, except at a considerably increased total cost.† However, accelerated electrification could contribute significantly to relieving future fluid fuel problems. Commitment to rapid nuclear development, for example, could be regarded as fairly expensive insurance against rapid increases in fluid fuel prices, but domestic oil and gas exploration and development of a strong synthetic fuel industry‡ should be accorded the most urgent priorities in energy supply (next in importance to conservation).

DOMESTIC OIL AND GAS

Production of both petroleum and natural gas in the United States is on the decline, and according to the analysis of this study, will continue to decline. Oil production in this country peaked in 1970 at 3.5 billion barrels, and by 1978 had fallen to 3.2 billion barrels. Domestic natural gas production shows a similar pattern; production peaked in 1973 at 21.7 trillion ft3, and by 1978 stood at 18.9 trillion.

These trends reflect the fact that domestic oil and gas are rapidly becoming more difficult and expensive to find and produce, as development moves toward deeper wells and the exploitation of deposits in such relatively inaccessible locations as the Alaskan North Slope and the Outer Continental Shelf. Reserves of both oil and natural gas have been falling since about 1970, though exploration has expanded rapidly in that time. Reserves now equal about 10 times annual production—the lowest level since the Prudhoe Bay field was added to reserves in 1970.

Under the policies prevailing until recently, the CONAES Supply and Delivery Panel projected that domestic production of oil would fall from 20 quadrillion Btu (quads) in 1975 to only 6 quads in 2010 (production in 1977 was 17.5 quads). Moderately enhanced conditions for oil production (including removal of price controls, accelerated offshore leasing, and somewhat advanced exploration and production technology) would bring production in 2010 to 16 quads, according to the projections, and a national commitment (relaxation of some environmental standards and permit requirements, along with federal priorities on labor and materials for oil development) might raise this to 18 quads in 2010. Under no plausible conditions does it appear possible even to maintain current domestic oil production, much less increase it.*

Gas production projections of the Supply and Delivery Panel show an even more severe decline than the oil projections. Under prevailing policies, extrapolated to 2010, gas production falls from a 1975 total of 19.7 quads to 5 quads in 2010. Moderately enhanced conditions yield a 2010 production level of 14 quads, and a national commitment results in 16 quads of gas production in 2010. Not all experts (including several participants in the CONAES study) agree with these conclusions, however. There is a considerable body of opinion that the potential for new natural gas sources, including several types of “unconventional” sources, is much higher than the study’s supply projections indicate. This opinion has gained a considerable number of new adherents since 1976, when the supply projections were made.

In the light of the Demand and Conservation Panel’s projections for liquid and gaseous fuels12 (which suggest that demand is likely to continue rising until at least 2010), this outlook for production is disturbing. It suggests that the nation will become increasingly dependent on imports of oil from a world market that is already strained and that the oil situation will worsen before improving.

The situation for natural gas is not so serious, because there is a large amount of unmarketed (flared or reinjected) gas in the world. However, even sustaining current domestic natural gas consumption will probably require imports larger than the current 1 quad/yr. Most of these imports are likely to come by pipeline from Canada and possibly from Mexico, but the remainder may have to be in the form of liquefied natural gas (LNG), the landed price of which reflects the costs of liquefaction, transportation, and storage. World supplies of gas are larger compared to demand than those of oil, and their production can be expanded more readily. The international implications of importing gas are correspondingly less severe.

However, the cost, and its effect on our trade balance, will not be negligible. It would be obviously unwise for the nation to become as dependent on imported gas as it now is on imported oil.*

The response of the United States to this challenge must be two-sided. Every reasonable effort must be made to conserve both oil and natural gas by using them more efficiently, by substituting alternative domestic energy forms (initially coal and conventional nuclear power for the most part, and later synthetic liquids and gases, solar energy, breeder reactors, and other long-term energy sources),† and by reducing growth in overall energy demand. An equally determined effort must be made to sustain and encourage domestic production to the extent consistent with environmental protection.

This committee does not believe that oil shale, despite the huge energy content of the domestic resource, will be a major source of energy.‡ First, the resource is concentrated in a very small and relatively primitive region, where large-scale development is likely to face resistance on environmental grounds. Second, water supplies are a serious constraint.13 Third, the amount of solid waste that must be handled is very large relative to the energy extracted, even with in situ processing. However, these conclusions should not be interpreted as justifying the neglect of oil shale development. Every new source helps, and oil from shale will probably become economically competitive earlier than other synthetic fuels.

These efforts to deal with the problem of fluid fuels—it must be stressed—deserve high national priority in energy policy. The longer a commitment is delayed, the more likely it will be that pressures for hasty and ill-considered crash programs will build up. Such programs would involve high technological risks and possibly compromise of environmental and safety standards.

PROSPECTS FOR COAL

Coal is the nation’s (and the world’s) most abundant fossil fuel. Domestic recoverable reserves amount to 6,000 quads, part of a total domestic resource of about 80,000 quads and world resources crudely estimated at 300,000 quads. Of this huge supply, we consume about 14 quads each year in the United States, or less than 0.3 percent of domestic recoverable coal

|

* |

See statement 1–21, by H.Brooks, Appendix A. |

|

† |

Statement 1-22, by J.P.Holdren: I reject the implication of this wording that the need to replace oil and gas justifies the use of every alternative, including breeders. |

|

‡ |

Statement 1–23, by R.H.Cannon and E.J.Gornowski; Despite the problems foreseen, we believe that the huge oil shale reserves in the United States will be developed to produce very large quantities of fluid fuel. |

reserves. In contrast, the nation extracts almost 10 percent of its 420-quad recoverable reserves of oil and natural gas each year.

The substitution of coal for natural gas and oil on a large scale, either directly or through synthetic coal-derived substitutes, would on these grounds seem a ready-made solution to the nation’s energy problems. The simple arithmetic of availability, however, does not tell the whole story. Doubling or tripling the use of coal will take time, investments amounting over the years to hundreds of billions of dollars, and coordinated efforts to solve an array of industrial, economic, and environmental problems.

Unlike oil and gas consumption, coal use is limited not by reserves or production capacity, but by the extraordinary industrial and regulatory difficulties of mining and burning it in an environmentally acceptable, and at the same time economically competitive, manner. Coal is chemically and physically extremely variable, and it is relatively difficult to handle and transport. Its use produces heavy burdens of waste matter and pollutants. Even at its substantial price advantage, Btu for Btu, it cannot compete with oil and natural gas in many applications, because of the expense of handling and storing it, disposing of ash and other solid wastes, and controlling emissions to the air. Only in very large installations, such as utility power plants and large industrial boilers, is coal today generally economic and environmentally suitable as a fuel. Domestic coal production capacity today exceeds domestic* demand, and this may well remain true until the end of the century.14

The health problems associated with coal affect both its production and its use. The health of underground miners presents complex and costly problems, for example, and is in need of better management; black lung is the notable instance. At the other end of the fuel cycle, the evolving state of air pollution regulations to deal with the emissions of coal combustion complicates planning for increased demand and thus in turn inhibits investment in mines, transportation facilities, and coal-fired utility and industrial boilers.

The future is obscured also by a number of more speculative problems, which may result in further regulatory restrictions on the use of coal. Chief among these is the risk that before the middle of the next century, emissions of carbon dioxide, an unavoidable (and essentially uncontrollable) product of fossil fuel combustion, may produce such concentrations in the atmosphere that large and virtually irreversible alterations may occur in the world’s climate. (See chapter 9.) Also worrisome is the water-supply situation, which could limit synthetic fuel production or electricity generation unless large-scale and possibly expensive measures are taken to

minimize water consumption and manage water supplies. The location of these industrial activities, even in the East, will require regional hydrological studies to determine where they can best be supported, with due attention to the needs of other water consumers, including ecosystems. Water shortage in the West is already a well-known difficulty. Both of these problems deserve very high research priorities.

Over the coming 10–20 years, some of these obstacles will weaken as new technologies increase the efficiency and convenience of coal use, and as the prices of oil and gas rise while their reliability of supply declines, Current expectations for some of these technologies are indicated in Table 1–4.

A number of the advanced electric power cycles for coal, now under development, would be suitable for smaller installations, and their relatively clean environmental characteristics would make it possible to locate them near users of their power. For smaller industrial users, fluidized-bed combustion and synthetic fuels could provide additional new markets for coal.

Department of Energy regulations under the Powerplant and Industrial Fuel Use Act of 1978 (Public Law 95–620), when implemented and enforced, will further improve the outlook for coal by banning oil and natural gas use in most new power plants and large industrial heating units.

This is not to imply that all the problems of coal use are solvable or that coal can become the mainstay of the domestic energy sector over the long term. Its environmental costs will remain high; mining and burning 2–3 times the present coal output, even if done efficiently and with care, will be difficult (and increasingly expensive) if the contributions of this energy source to air and water pollution and land degradation are to be kept from increasing.

With the foregoing in mind, we see the following as the prime objectives of national coal policy in the coming decades.

-

Provide the private sector with strong investment incentives to establish a synthetic fuel industry in time to compensate for declining domestic and imported oil supplies (probably some time near 1990),

-

Continue the broad federal research and development program in fossil fuel technology to widen the market for coal by increasing the efficiency and environmental cleanliness with which it can be used.

-

Improve health in the mines by strengthening industrial hygiene and by performing the necessary epidemiological research. The black lung problem especially should be clarified. (See chapter 9.)

-

Devote the necessary resources to supporting long-term epidemiological and laboratory studies of the public health consequences of coal-derived air pollutants, thus putting air quality regulation on a firmer

TABLE 1–4 Advanced Technologies for the Use of Coal

|

Technology |

Characteristics |

Status of Development |

Possible Date for Introduction at Commercial Scale |

|

Atmospheric fluidized-bed combustion |

Applicable to small power plants and small-scale industrial uses |

Pilot plants now operating |

1980s |

|

Pressurized fluidized-bed combustion |

Applicable to larger units than atmospheric version, more efficient, better control of nitrogen and sulfur oxide emissions |

13-MWe pilot plant planned |

1990s |

|

Gasification combined-cycle (gas and steam turbines) generating units |

Burn medium-Btu gas produced from coal at generating site; require operation at high temperatures |

Demonstration plant now being built to generate and burn low-Btu gas |

1990s |

|

Molten-carbon. ate fuel cells |

Essentially noiseless, pollution-free, and efficient; could possibly use low- or medium-Btu gas as source of hydrogen ions for fuel |

5–10 years from demonstration with synthetic gas from coal |

Late 1990s; lags other fuel cell development by 5 years |

|

Magnetohydrodynamics |

Potential 50 percent conversion efficiency from coal to electricity; sulfur can be separated out in operation; high-temperature exhaust could be used directly or to generate steam |

Pilot plant in U.S.S.R., fueled by natural gas; coal system still experimental |

2000 or later |

|

Synthetic gas |

Low- and medium-Btu gas from coal now technically feasible, but expensive; |

|

|

|

|

High-Btu gas (methane) also feasible, but even more expensive today; new processes now being developed |

Second-generation technologies now being tested in pilot plants Third-generation technologies in design stage |

1990s for second-generation processes |

|

Technology |

Characteristics |

Status of Development |

Possible Date for Introduction at Commercial Scale |

|

Synthetic oil |

Indirect liquefaction technology; complicated, expensive, and inefficient |

Used commercially in South Africa |

|

|

|

Pyrolysis: range of products, including refinable heavy high-sulfur oils and char (for which there is no ready market); not favored in current program |

Small experimental unit operating since 1971 |

1980s |

|

|

Solvent extraction and catalytic hydrogenation: catalysts expensive; burden of hazardous wastes and control of nitrogen |

Pilot plants now testing several processes |

1990s |

-

scientific basis that allows more confident and efficient setting of standards, on which industry can depend in its long-range planning. (See chapter 9.)

-

Develop a long-range plan, recognizing that coal presents some serious environmental and occupational health and safety problems, and that it does not relieve the nation of its need to develop truly sustainable energy sources for the long term.

By 1985, given reasonably coherent policy and successful research and development, domestic demand for coal should approach 1 billion tons/yr (about 20–25 quads). Some new synthetic fuel and direct combustion technologies will be on the verge of commercialization. Knowledge of the environmental and public health effects of coal production and use should be improved to the point that the current regulatory uncertainties can be reduced.

As the year 2010 is approached, coal use in the United States may reach 2 billion tons annually.* Some of the cleaner, more efficient coal-use techniques now being developed should attain full commercialization. Knowledge of the environmental and public health characteristics of coal

may be sufficient for confident standard setting. At the same time, however, water supply will be increasingly critical, and, if the hypothesis of climatic change due to carbon dioxide accumulation proves correct, the first signs of climatic effects from carbon dioxide emissions may be appearing. But it is possible that at about this time indefinitely sustainable energy sources may begin to become available.

For now, however, there is little room for maneuver. Coal must be used in increasing quantities, and mainly with current technologies, until at least the turn of the century, regardless of what happens with respect to such alternatives as nuclear fission or solar energy. However, because of the variety of environmental and social problems it presents, it cannot indefinitely provide additions to energy supply. To keep these problems under control until truly sustainable energy sources can be deployed widely, it would be wise to approach coal as conservatively as possible under the circumstances, with an eye especially to its environmental risks,

PROSPECTS FOR NUCLEAR POWER

Nuclear power could serve as both an intermediate- and long-term source of energy. Its prospects and problems are unique. For example, energy that can be extracted from the available nuclear fuel depends extremely heavily on the fuel cycle used. The light water reactors now in use in the United States, with their associated fuel cycle, make very inefficient use of uranium resources, and could exhaust the domestic supply of high-grade uranium in several decades. By contrast, if breeder reactors were to be developed and used, the domestic nuclear fuel supply could last for hundreds of thousands of years. An intermediate class of reactors and fuel cycles—advanced converters—could, under certain circumstances, extend domestic nuclear fuel supplies for perhaps a half century. These subjects are taken up in chapter 5 under the heading “Availability of Uranium.”

Decisions about nuclear power have precipitated debate about the role of citizen participation in technological policy. Opposition to nuclear power in the United States has been expressed in legal and political challenges to the siting and licensing of specific power plants, and in protests over the lack of a waste disposal program and alleged deficiencies in federal regulation and management of nuclear power.15 The resulting delays and uncertainty have contributed to rapid escalation of the capital costs of nuclear installations and to considerable difficulty in predicting their future costs and availability.

While many of these protests have centered on specific issues, social scientists suggest that the sources of public concern with the technology are broader and deeper, and thus that concern is unlikely to subside with

the resolution of specific issues.16 The technical and scientific community is itself divided, and debates among experts have heightened public awareness of the uncertainty surrounding many of the technical issues bearing on nuclear power. Very briefly, the principal issues for nuclear power as an intermediate-term energy source are as follows.

-

The future role of nuclear energy, in general, and the relative roles of different nuclear options, in particular, depend on the extent of domestic and worldwide uranium resources, and on the rates at which these resources could be produced at reasonable levels of cost.

-

The choice between a breeder reactor and an advanced converter reactor and the timing of development and introduction depend on a complicated integration of a number of technical factors. Most prominent among these are the rate of growth of electricity use, the supply of fuel, and the relative capital costs of advanced converters and breeders. Relatively low electricity growth rates and large supplies of low-cost uranium would generally favor the advanced converter.* It should not be forgotten, however, that the breeder and its fuel cycle are probably in a more advanced state of development worldwide than any high-conversion-ratio converter alternative, and that moderate to high electricity growth rates and/or rather limited supplies of uranium would favor the breeder alternative.

-

There is a need for early action on a workable program of nuclear waste management, which has until very recently been neglected by the federal government. Adequate technical solutions can probably be found, but some particularly difficult political and institutional problems will have to be solved.

-

Public appraisal of nuclear power is of vital importance. Among the most important public concerns are the potential connection of commercial nuclear power with international proliferation of nuclear weapons, the safety of the nuclear fuel cycle (a concern heightened by the recent nuclear reactor accident near Harrisburg, Pennsylvania), and the question of nuclear waste treatment and disposal.

Uranium Resources

According to the CONAES Supply and Delivery Panel’s Uranium Resource Group,17 only those uranium deposits considered, technically, “reserves” or “probable additional resources” should be taken as a basis for prudent planning. They further state that the availability of uranium ore at

estimated forward costs (the costs of mining and milling once the ore has been found) of more than $30/lb, is known with such little certainty that it cannot be used for planning. They estimate at about 1.8 million tons the uranium available in these categories at forward costs below $30/lb. This committee believes that estimates of reserves and probable additional resources at forward costs of up to $50/lb are reliable enough to plan on; according to the U.S. Department of Energy,18 the quantity of uranium in these categories and at this forward cost is about 2.4 million tons. If, however, less reliably known uranium supplies (listed as “possible” or “speculative” additional resources) are included, the estimate would rise to about 4 million tons.

A typical 1-gigawatt (electric) (GWe) light water reactor with once-through fueling requires about 5600 tons of fuel for a 30-yr useful life. Thus, only about 400 such reactors could be built before the estimated 2.4-million-ton resource base of uranium would be completely committed. The limits on capacity could be extended somewhat (without major alterations in the fuel cycle such as recycling spent fuel) by optimizing the design of light water reactors for fuel efficiency (up to 15 percent improvement in uranium oxide (U3O8) consumption), and by lowering the uranium-235 (235U) concentration in enrichment plant tails. The additional reactor capacity that could be available in 2000 as a result of these measures depends on how soon they could be introduced. The most optimistic estimate would probably not exceed 500 GWe (insufficient for the highest-growth projections of the CONAES study but adequate for other projections).

In brief, if the pessimistic estimates of the Uranium Resource Group are borne out by experience, more efficient reactors and fuel cycles probably will be needed in the United States by the first decade of the next century. Otherwise, the use of nuclear fission will have to be curtailed, beginning at about that time. This will occur when coal demand for synthetic fuels could be increasing rapidly to offset the decline in domestic oil and gas production, and when the first evidence of climatic change (due largely to CO2 emissions from fossil fuel combustion) may be appearing. Unless various solar options could be introduced and spread very rapidly, this phasing out of nuclear energy would come therefore at a particulary awkward time.

Alternative Fuel Cycles and Advanced Reactors

Light water reactors with the current once-through fuel cycle use only 0.6 percent of the energy potential in uranium as mined. By contrast, breeder reactors are capable of converting the abundant “fertile” isotope 238U to fissile plutonium-239 (239Pu), and of regenerating more plutonium than

they use. They can eventually make use of more than 70 percent of the energy potential of uranium ore. There are also conceptual reactors and fuel cycles capable of converting fertile thorium-232 (232Th) to another fissile isotope of uranium, 233U. These could in principle make use of nearly 70 percent of the energy in thorium, which is believed to be 4 times as abundant as uranium in the earth’s crust.

Thus, the ability to unlock the energy potential of the fertile isotopes 238U and 232Th has a tremendous multiplying effect on available resources—much more than the approximate factor of 100 implied by the numbers just quoted. This is because the use of breeder reactors reduces the contribution of resource prices to the price of electricity by a factor of 100, thus making available ores that are too low in grade, and thus too expensive, to be used as fuel for conventional reactors. For practical purposes, the resource costs for breeders make a negligible contribution to the cost of electricity. Thus, the economics of breeders are closer to those of renewable resources than to those of nonrenewable resources.

As explained earlier, the present generation of light water reactors can be relied on as an energy source only until the early twenty-first century, even if optimized for fuel efficiency. The resource base may be extended 20–30 percent by working enrichment plants harder (to recover a larger fraction of the 235U in the natural uranium). Another 35–40 percent extension could be achieved by reprocessing spent fuel in a chemical separation process to recover fissile plutonium and uranium for refabrication into new fuel elements. Either measure, however, would significantly extend the life of a nuclear industry based on light water reactors only if electricity growth leveled off after 2000.

Unfortunately, during fuel reprocessing, plutonium appears briefly in a form that can be converted into nuclear weapons much more readily than can the fissile and fertile material in the spent fuel elements themselves. This gives rise to the fear that a nation in possession of fuel reprocessing facilities might be tempted to manufacture clandestine nuclear weapons, or that a determined and well-organized terrorist group could steal enough material to manufacture a nuclear bomb, It is possible that the recycling process could be modified to make it much less vulnerable in this respect, but both the desirability and the effectiveness of such modifications are still matters of debate. (See chapter 5 under the heading “Reprocessing Alternatives.”) These considerations bear heavily on decisions to deploy advanced, more efficient reactors, because all advanced reactors require reprocessing and refabrication of fuel to realize their maximum potential for more efficient resource use. (However, there are several advanced converter designs that could realize substantial, though not the greatest possible, resource savings over improved light water reactors even with a once-through fuel cycle.)

This difficulty has spurred consideration of substantial improvements in nuclear fuel use that do not require reprocessing. One option that might be available, for example, is the Canadian CANDU heavy water reactor fueled with slightly enriched uranium—perhaps 1 percent 235U. (The CANDU as now operated is fueled with natural, unenriched uranium.) With a once-through fuel cycle (that is, without reprocessing), this could in principle reduce the fuel requirements per unit of power by nearly 40 percent as compared to an unmodified light water reactor of existing design. Although this might be worthwhile under some circumstances, it would still not be sufficient to preserve the option of supplying electricity by nuclear power much beyond 2000, unless the rate of growth in demand for electricity diminished greatly after that date. Uranium resources could be extended an additional 20 percent if some method such as laser isotope separation is developed for stripping the fissile material from the tailings at uranium enrichment plants (though this is unlikely before the 1990s at the soonest). The benefits of these measures would become important, however, only if the nuclear power industry were not called upon to expand significantly; growth in capacity would otherwise consume the extra supplies within a few years.

Until recently, the nuclear research and development program in this country concentrated on the liquid-metal fast breeder reactor (LMFBR) and the plutonium-uranium fuel cycle. The advantage of this approach is that the LMFBR offers the greatest degree of independence from the continuing need for natural uranium. For times of the order of hundreds of years, the LMFBR could use as fertile material the stored tails left over from the enrichment process for weapons material and reactor fuel. Such breeders could extend the life of the uranium resource indefinitely, for practical purposes, and they could be fueled initially with plutonium separated from the spent fuel of light water reactors, as well as with natural uranium. Thus, they offer electrical energy independence to the United States and other nations that have access to even small quantities of enrichment tails. (Nations that operate their light water reactors with fuel enriched in the United States are legally entitled to enrichment tails; these tails are worthless unless they can be used in breeder reactors or stripped for their remaining fissile content by laser isotope separation or another technique.)

Because the LMFBR generates almost 20 percent more fissile isotopes than it consumes, it can be used as the basis for a growing nuclear capacity without requiring the mining of new ore.* For this reason, it appears attractive for a wide range of projected growth rates in electrical capacity.

Breeders, in the course of their operation, produce more fissile isotopes

than they consume. Converters such as light water reactors and CANDU produce a good deal less. Advanced converters produce almost as much as they consume. If their spent fuel is reprocessed and reloaded into the reactors, they can be run with much less fresh fissile material than is needed to run light water reactors or CANDU’s. There are many possible advanced converters.

The principal advanced-reactor alternatives are listed in Table 1–5, along with indications of their relative developmental maturity.

Thus, as between breeders and advanced converters, the following conditions (not all of equal weight) would favor the use of fast breeder reactors over advanced converters in the United States for nuclear-generated electricity.

-

The demand for electricity in the United States grows steadily after the year 2000.

-

Total domestic uranium resources are found to be at the low end of recent estimates.

-

Very little intermediate-grade uranium ore that can be produced at costs in the range of $100–$200/lb is found.

-

The world growth of nuclear capacity in conventional light water reactors exerts pressure on the United States to export some of its uranium or enriched fuel (or both) to offset the balance-of-payments deficit from oil imports, to discourage recycling of fissile isotopes or installation of breeder reactors elsewhere, or for other reasons.

The following conditions would generally favor the use of advanced converters for nuclear-generated electricity.

-

The demand for electricity in the United States grows slowly, especially after 2000.

-

Sufficient uranium resources are found to fuel advanced converters at their projected rate of introduction and installation, particularly intermediate-grade ores producible at costs around $100–$200/lb.

-

Capital costs of advanced converters turn out to be significantly less than those of breeders.

-

The operation of advanced converters and their fuel cycles offers advantages in safeguarding against proliferation or diversion.

-

New enrichment technologies that permit economic operation at low tails assays become available early.

As has been noted, economics and the type of measures adopted by the world to slow proliferation of nuclear weapons could dominate the choice. Both are highly uncertain factors; we can only estimate future costs

TABLE 1–5 Nuclear Reactors and Fuel Cycles; Development Status

|

Reactor Type |

Fuel Cycles |

Development Status |

Possible Commercial Introduction in the United Statesa |

|

Light water reactor (LWR) |

Slightly enriched U (~3 percent 235U) |

Commercial in United States |

1960 |

|

Spectral-shift-control reactor (SSCR) |

Th-Ub |

Conceptual designs, small experiment run; borrows LWR technology |

1990; fuel cycle, 1995 or laterc |

|

Light water breeder reactor (LWBR) |

Th-Ub |

Experiment running; borrows LWR technology; fuel cycle not developed |

1990; fuel cycle, 1995 or laterc |

|

Heavy water reactor (CANDU or HWR) |

Natural uranium |

Commercial in Canada, some U.S. experience |

1990 |

|

|

Slightly enriched U (~1.2 percent 235U) |

Modification of existing designs |

1995 |

|

|

Th-Ub |

Modification of designs; fuel cycle not developed |

1995 |

|

High-temperature gas-cooled reactor (HTGR) |

Th-Ub |

Demonstration running; related development in Germany; fuel cycle partly developed |

1985; fuel cycle, 1995 or laterc |

|

Molten-salt (breeder) reactor (MSR or MSBR) |

Th-Ub |

Small experiment run; much more development needed |

2005 |

|

Liquid-metal fast breeder reactor (LMFBR) |

U-Pub |

Many demonstrations in the United States and abroad* |

1995 |

|

|

Th-Ub |

Fuel cycle not developed |

1995 |

|

Gas-cooled fast breeder reactor (GCFBR) |

U-Pub Th-Ub |

Concepts only; borrows LMFBR and HTGR technology |

2000 |

|

aBased on the assumption of firm decisions in 1978 to proceed with commercialization. No institutional delays have been considered except those associated with adapting foreign technology. On the basis of light water reactor experience, it can be estimated that it would take about an additional 15 years after introduction to have significant capacity in place. bIndicated fuel cycles demand reprocessing. cThorium-uranium fuel reprocessing is less developed than uranium-plutonium reprocessing. Indicated reactors could operate for several years before accumulating enough recyclable material for reprocessing. *Statement 1–28, by J.P.Holdren: Fuel reprocessing with the short turnaround time, high throughput, and high plutonium recovery needed to make the LMFBR perform as advertised remains undemonstrated. |

|||

qualitatively, and we can rely on surprises in international decision making.

This committee could not reach a consensus on whether the likelihood of the circumstances favoring advanced converters is great enough to warrant their development as insurance against difficulties and delays in LMFBR development. Nor was it able to reach agreement on how much the availability of the breeder option might be delayed by a parallel effort on advanced-converter development, and whether such a delay would be justified by a greater ultimate chance for the success of at least one advanced-reactor alternative. It did, however, reach general agreement that the LMFBR dominates the nuclear alternatives over the widest range of assumed future circumstances, provided that its cost goals and other technical objectives can be realized. Those who believe that low growth in demand for electricity is desirable and can be achieved after 1990 argue that a U.S. program to develop the LMFBR sets a poor example to other nations whose development of the LMFBR would increase the danger of proliferation, The LMFBR, they argue, would be needed only for unnecessarily high rates of growth in electricity demand, which could be avoided in this country by sensible conservation policies.* In this view, the advanced converter provides sufficiently improved resource efficiency over present reactors to fill the gap until sustainable nonnuclear long-term technologies become available. These arguments underscore the importance of energy demand considerations in planning energy supply systems for the United States.†

The Demand for Electricity

It is obvious from the foregoing that the rate of growth in electricity use will largely determine how much nuclear power is needed and will govern the strategy of nuclear development.‡ Some pertinent quantities are set out in Table 1–6, which uses the CONAES study scenarios (described in detail in chapter 11) to indicate the trade-offs between nuclear power and other sources of electricity.

Study scenario III3, for example, shows nuclear power providing about 35 percent of the nation’s electricity in 2010. Its contribution of 1670 billion kWh is about twice what the U.S. Department of Energy19 forecasts nuclear power will contribute in 1990. Thus the scenario involves a modest rate of nuclear growth over the 20-yr period 1990–2010. Coal-generated

|

* |

See statement 1–29, by H.S.Houthakker, E.J.Gornowski, and L.F.Lischer, Appendix A. |

|

† |

See statement 1–30, by L.F.Lischer and E.J.Gornowski, Appendix A. |

|

‡ |

Statement 1–31, by L.F.Lischer, E.J.Gornowski, and H.I.Kohn: This, in our opinion, is neither obvious nor a foregone conclusion. |

electricity in this scenario is at about twice the 1978 level. Coal and nuclear power together generate some 3.8 trillion kWh.

If nuclear power were unavailable in 2010, and the entire amount of energy were generated by coal, this would represent a fourfold increase in coal-based generation over the 1978 level, approaching the threshold of serious environmental risks, and in some mining areas introducing or exacerbating problems of water supply. (See chapters 9 and 4, respectively.)

In the high-growth case represented by study scenario IV3, 3 times the present electrical capacity would be required. Assuming that 1 GWe of nuclear capacity generates 6 billion kWh in the course of 1 year’s operation, 470 GWe of nuclear capacity would be required to generate the 2810 billion kWh specified for nuclear power by this scenario. Together, nuclear power and coal generate nearly 6 trillion kWh. If coal-based generation were restricted to, say, 2 trillion (or about twice its 1978 level) and the remaining 4 trillion were supplied by nuclear power, an extraordinary national commitment to nuclear capacity additions would be necessary. With the above assumption about the productivity of 1 GWe unit of nuclear capacity, some 670 GWe of nuclear capacity would be needed, including breeders or other advanced reactors.†

These examples illustrate the limited mutual substitutability of nuclear energy and coal in the high-growth cases and suggest that if growth in demand for electricity is underestimated, shortages of energy may begin to appear during the first decade of the twenty-first century.*

Nuclear Weapons Proliferation and Breeder Development

Two interrelated issues concerning the breeder reactor are the scale and pace of development and the relationship of breeders to the problem of nuclear weapons proliferation and diversion (chapter 5). Regarding proliferation of nuclear weapons, sharply different and irreconcilable views emerged in this study. One view holds that plutonium reprocessing would be a major step toward proliferation, and advocates that the United States forgo for a considerable period the benefits of reprocessing and the breeder to demonstrate how seriously this nation regards the proliferation problem. This view acknowledges that proliferation can thus be only delayed, not prevented, but asserts that deferral of reprocessing and breeder deployment could provide time to develop international institutions and procedures to safeguard the nuclear fuel cycle. In this view, the

|

† |

See statement 1–32, by H.Brooks, Appendix A. |

|

* |

Statement 1–33, by J.P.Holdren: The narrow emphasis on high-growth futures in this passage and the accompanying table is unwarranted and gives an unbalanced impression of the possibilities. |

TABLE 1–6 Electricity Generated, by Source (billions of kilowatt-hours)

|

|

Actual 1978a |

CONAES Study Scenarios for 2010 |

||

|

II2 |

III3 |

IV3 |

||

|

Nuclear |

276 |

670 |

1670 |

2810 |

|

Coal |

976 |

1460 |

2110 |

3140 |

|

Other |

954 |

730 |

940 |

1080 |

|

TOTAL |

2206 |

2860 |

4720 |

7030 |

|

aSource: 1978 data are From U.S. Department Of Energy, Annual Report to Congress 1978, vol. 2. Data, Energy Information Administration (Washington, D.C.: U.S. Government Printing Office. 1979). |

||||

LMFBR should be treated primarily as a long-term technology of last resort, to be used only if research in the coming decades indicates that other long-term options are much more costly or will not be available in time to offset the phasing out of light water reactors.

The contrary view holds that the breeder has been demonstrated to be the most promising option for the long-term future, with favorable economics and minimal ecological effects, and that therefore a national commitment to large-scale development should be made now, so that LMFBR’s can be available before the twenty-first century. It is argued that the commercial nuclear fuel cycle is the least likely and most expensive of several possible paths to proliferation, and that inexpensive means for producing weapons-grade material by isotope separation are likely to be widely available by the time commercial reprocessing of plutonium becomes widespread.

The response by those favoring deferral of reprocessing is that, whereas there are indeed other routes to proliferation, they require more deliberate political decisions, while a weapons capability could be “backed into” rather easily once commercial reprocessing and refabrication facilities have been installed in a given country. The critical consideration in this view is not the availability of cheaper and less elaborate routes to weapons (which certainly exist) but the reduced warning time between a decision to divert material from the commercial fuel cycle and the production of the first weapons.*

The view that breeder development should proceed rapidly holds that deferral would increase the potential pressures of the United States on the world petroleum market and on the limited world uranium supply for light water reactors. This would in turn stimulate other countries that are much more dependent than the United States on outside energy sources to pursue the breeder reactor—the one option close to availability that promises a degree of energy independence. Moreover, this argument asserts, world conflict over limited petroleum supplies appears more likely to lead to nuclear war than weapons proliferation resulting from reasonably safeguarded commercialization of plutonium.

Management of Radioactive Wastes

The current plans for managing nuclear wastes involve underground burial. The technical aspect of the problem has two parts: first, to find the best technology for packaging and isolating the wastes and, second, to secure a geological environment that would itself be proof against the failure of containers after one or two hundred years, so that migration of the waste nuclides in groundwater would be slow enough and accompanied by so much dilution that the radioactivity of the water when it reached the biosphere would be a small fraction of the natural background.

There is no lack of potential disposal methods. There is enough knowledge about the bedded salt disposal option, for example, to warrant a full-scale engineered test of this option with an initial sample of commercial waste. The engineering of such a test would require mainly acquisition of site-specific geological and hydrological data for a few chosen sites. There is, however, no data base adequate for a final choice among the proposed solutions, nor proof that a given choice of sites and waste forms poses the lowest possible risk to the public. Waste disposal is often used as a basis for the political expression of more generalized opposition to nuclear power and to the whole decision-making mechanism for nuclear power.

Two points should be kept in mind. First, it is not necessary to look upon waste disposal as a problem to which the perfect solution must be found before any action can be taken. Caution is necessary, of course, but the risks should not be a bar to the continued use of nuclear power. The maximum hazard resulting from inadequate waste disposal is much smaller than that which could be postulated as the result of a reactor accident or sabotage. Indeed, the maximum exposures involved can almost certainly be kept below those associated with routine exposures to radioactivity in nuclear operations, which are themselves very small compared to exposure to natural background radiation. Caution is dictated not by the magnitude of the risks but by their long duration. The principal risks extend for about a thousand years, and the presence of actinides in

the wastes adds a very small continuing risk for millions of years. In this respect, however, nuclear waste disposal is not entirely unique. Elevated CO2 concentrations in the atmosphere, once established, will persist for many hundreds of years, and over this extended period could have devastating effects, if the hypothesis of climatic changes due to CO2 accumulation proves correct.

The following specific conclusions and recommendations represent the consensus view of CONAES.

-