5

Strengthening Traditional Tobacco Control Measures

During the 1990s, substantial progress was made in laying the foundation for an effective tobacco control policy, but that progress has stalled for at least three reasons. First, it is difficult to sustain public attention on endemic problems; in particular, on the challenges of prevention and cessation. Public attention (including the priority-setting driven by public opinion) is easily diverted to the crisis of the moment, and in times of austerity, expenditures on prevention and cessation efforts always seem to be the most dispensable. These tendencies explain in part why the political commitment needed for a sustained effort is lacking. Second, the political and commercial power of the tobacco industry remains substantial, even following the disclosures of past misconduct arising out of recent state reimbursement litigation, the Master Settlement Agreement (MSA), and the U.S. Justice Department’s suit under the Racketeering Influenced and Corrupt Organization Act. Third, all the tobacco control measures described in Chapter 3 have had to be implemented in the context of a largely unregulated market in which tobacco products continue to be aggressively promoted. These promotion efforts are still at work, and it is difficult for public health programs to keep up, especially when the economy falters and public revenues fall short. The behavioral potential of aggressive prevention and cessation efforts is amply illustrated by the successes achieved in California, Massachusetts, and other states. So, too, however, is the fragility of these efforts—when the money disappeared, so did the programs.

The nation needs to muster the political will to intensify the efforts implemented so successfully during the 1990s and to build on them. These

comprehensive state programs, as well as their individual components, have been shown to be effective. Failure to sustain these efforts will cost lives. This chapter of the committee’s report outlines the core components of tobacco control as they have been implemented within the existing legal structure. It should be emphasized, however, that one of the constraints on the current legal structure is that no federal agency has regulatory jurisdiction over tobacco products. Another constraint is that the federal statute regulating the labeling and advertising of cigarettes forecloses state regulation of advertising and marketing of cigarettes “based on smoking and health.” This unfortunate circumstance, addressed in Chapter 6, preempts most state efforts to regulate the appearance, display, promotion, and placement of cigarettes in retail outlets.

Chapter 5 begins with a discussion of the effectiveness of comprehensive state programs, as well as the states’ current approaches toward funding these programs. The states’ expenditures for tobacco control are placed in the context of the revenue streams generated by tobacco excise taxes and payments received under the MSA.

The remainder of the chapter focuses on seven key substantive elements of comprehensive state programs:

-

Tobacco excise taxes

-

Smoking restrictions with broad coverage

-

Youth-access restrictions with adequate enforcement

-

Prevention programs based in schools, families, and health care systems

-

Media campaigns

-

Cessation programs

-

Grassroots community advocacy

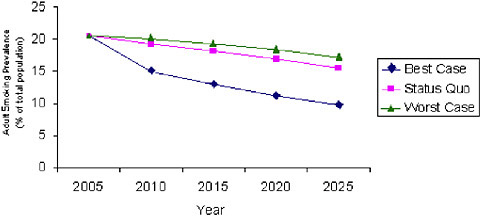

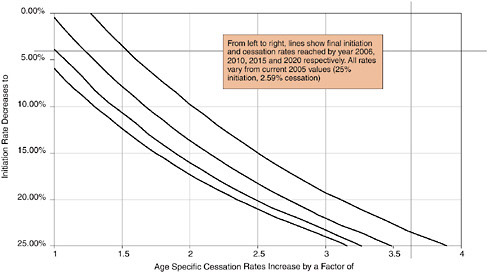

The recommendations made throughout the chapter are meant to set forth a blueprint for strengthening and intensifying current tobacco control policies and programs, assuming that the current legal structure of tobacco control remains unchanged. The chapter closes with a projection of the likely impact of following (or not following) this blueprint on the national prevalence of tobacco use over the next 20 years.

COMPREHENSIVE STATE PROGRAMS

During the early days of tobacco use prevention, after the publication of the 1964 Surgeon General’s report (HEW 1964), many state health departments relied on the funds in their state budgets for tobacco control and treatment. Interventions tended to be targeted toward smoking cessation for individuals. By the late 1980s, however, funding for comprehensive state

tobacco control programs increased, beginning with California and then expanding to all states.

California launched the first statewide comprehensive tobacco control program in 1990, one and a half years after the passage of Proposition 99. This landmark referendum mandated an increase in state tobacco taxes and directed 20 percent of the revenues to tobacco control programs (Bal 1998; Glantz and Balbach 2000; Najera 1998). At that time, the National Cancer Institute (NCI) was already preparing to launch the seven-year national American Stop Smoking Intervention Study (ASSIST) program. In 1991, the ASSIST program funded community-level interventions to prevent tobacco use in 17 states (NCI 2005; Stillman et al. 2003).

By the mid-1990s, every state in the United States had some funding for comprehensive tobacco control, either from the ASSIST program or from the Initiatives to Mobilize for the Prevention and Control of Tobacco Use (IMPACT) program, funded by the Centers for Disease Control and Prevention (CDC). In addition, from 1994 through 2000, some states1 also received funding for tobacco control efforts from the Robert Wood Johnson Foundation’s (RWJF) SmokeLess States program (Gerlach and Larkin 2005; Tauras et al. 2005). In addition to educational and cessation programs, the funding supported statewide coalitions of individuals and organizations that pursued action strategies to strengthen tobacco control policies.

The ASSIST program promoted three types of interventions: program services, policy changes, and mass media. However, the ASSIST program guidelines stated that “efforts to achieve priority public policy objectives should take precedence over efforts to support service delivery” (NCI 2005, p.23). Mass media initiatives were intended to support those policy changes. The four ASSIST program priority policy areas were eliminating environmental tobacco smoke (ETS), increasing tobacco excise taxes, limiting tobacco advertising and promotion, and reducing youth access (NCI 2005).

Evaluation of Comprehensive State Programs

In 2005, the CDC’s Office on Smoking and Health (OSH) released a summary of the literature on evidence of the effectiveness of state tobacco control programs (Kuiper et al. 2005). Organized by major reviews and five outcome indicators (tobacco-related mortality, prevalence, consumption, cessation, and smoke-free legislation and policy), the results are generally organized by state. The evidence provided can be considered a guide to state health departments for measuring the success of their comprehensive

tobacco control programs. Of the five indicators of success, one is a health outcome—tobacco-related mortality—and three are markers that lead to improved health outcomes: decreases in smoking prevalence, decreases in consumption of tobacco products, and smoking cessation. The fifth indicator, smoke-free legislation and policy, is an intermediate outcome that alters the environment that supports tobacco use.

This review appeared six years after the publication of the CDC’s Best Practices for Comprehensive Tobacco Control Programs. Published in 1999, Best Practices had concluded that the evidence was sufficiently compelling to encourage all states to pursue comprehensive programs. This conclusion was drawn on the basis of analyses of the excise tax-funded state programs in California, Massachusetts, Oregon, and Maine, as well as the agency’s experience in providing assistance to four other states: Florida, Minnesota, Mississippi, and Texas. The 2005 review reiterates the effectiveness of these programs, while also documenting the successes of other state programs that have appeared since 1999.

Over the past decade and a half, a number of investigators have tried to assess the contribution of comprehensive state programs to policy changes and reductions in smoking (DHHS 2000; Elder et al. 1996; Siegel 2002; Stillman et al. 2003; Tauras et al. 2005; Wakefield and Chaloupka 2000; Warner 2000). By design, a comprehensive tobacco control program consists of several elements (e.g., antismoking media campaigns, counseling services, and school-based prevention initiatives), and some authors have focused on evaluating the effectiveness of individual program components. Later in this chapter, the committee refers, for instance, to several studies that have assessed the impacts of state-sponsored antismoking media campaigns on smoking prevalence and changes in smoking-related beliefs. This section reviews studies that have looked at the effects of comprehensive programs as a whole.

One study that evaluated state programs throughout the country found that a program’s intensity had a very large negative correlation with the prevalence of current smoking (r = −0.81, p < .0001) and a large positive correlation with the quit rate (r = 0.82, p < .0001) among adults 30 to 39 years of age (Jemal et al. 2003). Another study determined that states with better-funded programs have lower prevalence and consumption rates (Tauras et al. 2005). However, many states have substantially cut their tobacco control programs’ budgets in recent years.

Description of Programs

Over the course of the 1990s, several other states—including Arizona, Florida, Massachusetts, and Oregon—followed California’s lead and developed their own comprehensive tobacco control programs (Wakefield

and Chaloupka 2000). Studies reviewing the effects of each of these states’ efforts have been published, and many of these are listed in CDC’s 2005 literature summary (Kuiper et al. 2005). As the first two states in the country to implement comprehensive programs, California and Massachusetts have received a particularly large amount of attention. A specific examination of these two states’ pioneering efforts reveals that comprehensive state programs can be effective in reducing tobacco use and tobacco-related disease, especially when they are fully-funded and operational.

California

In November 1988, California voters passed Proposition 99, which increased the state tobacco tax by 25 cents per pack of cigarettes. One year later, the California Assembly passed legislation that distributed the revenue earned from the tobacco tax increase as follows: 35 percent for hospital services, 20 percent for a health education account, 10 percent for physician services, 5 percent for research, and 5 percent for environmental conservation concerns (25 percent of the funds remained unallocated). Funds from the health education and research accounts were used for the creation of a statewide tobacco control program. The California Tobacco Control Program (CTCP), the first of its kind in the country, debuted in the spring of 1990 (Bal 1998; Najera 1998; TEROC 2000).

Together, the California Department of Health Services (CDHS) and the California Department of Education (CDE), along with the University of California, support a decentralized network of local health departments (LHDs), schools, researchers, and competitive grantees that forms the core of the CTCP. The CDE’s Healthy Kids Program Office oversees the program’s school-based components, whereas the University of California administers various research activities through its Tobacco Related Disease Research Program. The Tobacco Control Section of CDHS, which receives approximately two-thirds of the available funds from the Health Education Account, coordinates the public health elements of the program. These elements include programs conducted at the local level by LHDs and community organizations; a statewide media campaign; cessation counseling services (such as the California Smokers’ Helpline); a materials clearinghouse; and four networks that seek to better integrate California’s African American, American Indian, Asian and Pacific Islander, and Hispanic populations into the state’s tobacco control efforts. California has also coordinated its efforts with other tobacco control initiatives, including the RWJF’s SmokeLess States program (CDHS 1998; State of California 2004; TEROC 2000, 2003).

Throughout the 1990s, the CTCP’s funding fluctuated dramatically. Between 1989–1990 and 1995–1996, for instance, the program experienced

a 60 percent reduction in funding (from $131.3 million to $53.4 million). In addition, although the CTCP’s budget more than doubled between 1995–1996 and 1997–1998 (from $53.4 million to $140.7 million), funding declined yet again in 1998–1999 as well as in 1999–2000 (Independent Evaluation Consortium 2002).

In its first few years, before these major budget fluctuations, the CTCP embraced a mix of policy, media, and program interventions to address a range of factors contributing to tobacco use (CDHS 1998). By 1993, however, looming budget cuts necessitated a more focused approach. Anticipating funding reductions, program administrators revised the CTCP’s structure and priorities to streamline the state’s tobacco control efforts. Administrators refocused the program’s activities into four clearly defined areas: (1) reducing exposure to secondhand smoke, (2) countering the influence of the tobacco industry, (3) reducing youth access to tobacco products, and (4) providing cessation services (CDHS 1998). Since then, however, the CTCP has suffered additional reductions in funding, including a budget cut of 30 percent ($46 million) in FY 2002. Consequently, the gap between tobacco control funding and tobacco industry spending has widened considerably, especially in comparison to the more intensive and better-funded early years of the program. By 2002, California—once the trailblazer in comprehensive tobacco control programming—had fallen to 20th in state rankings for per-capita funding for tobacco control (TEROC 2003).

Massachusetts

Massachusetts modeled much of its tobacco control program after that of the CTCP. In November 1992, Massachusetts voters passed a ballot initiative (commonly known as Question 1) that—like Proposition 99 in California four years earlier—increased the state tobacco tax by 25 cents per pack of cigarettes. Although the Massachusetts Constitution prohibits the earmarking of tax revenue (as the California legislature had done with money earned from its tobacco tax increase), the drafters of Question 1 composed language that urged—but did not mandate—the state to allocate revenue collected from the tobacco tax to a statewide tobacco control program. Following passage of the initiative, Massachusetts legislators soon allocated revenue from the tobacco tax to a newly created Health Protection Fund for the financing of a tobacco-control program (Cady 1998; Connolly and Robbins 1998; Nicholl 1998).

Administered by the Massachusetts Department of Public Health, the Massachusetts Tobacco Control Program (MTCP) began operating in October 1993 with the launch of a mass media campaign, which used a wide spectrum of media, including television, radio, newspapers, and billboards, to disseminate its antismoking message throughout the state. In the follow-

ing months, the MTCP started implementing additional tobacco control initiatives with an emphasis on three priority areas: (1) preventing youth from starting to smoke, (2) reducing smoking prevalence among adults, and (3) reducing nonsmokers’ exposure to ETS. Massachusetts, like California, embraced a localized approach to achieve these goals. Although the MTCP first managed local programs by program type, it soon restructured its operations by organizing localities into six regional networks. Representatives from local tobacco control programs, along with MTCP representatives, began meeting monthly within their respective regional networks to ensure statewide cohesion and better facilitate exchanges of information. In addition, the MTCP has funded community coalitions to organize mobilization efforts, as well as boards of health and LHDs, to enact and enforce tobacco control regulations. Statewide programming, meanwhile, has included the media campaign and the Try to Stop Resource Center, which offers the Smoker’s Quitline, a website (www.trytostop.org) for smokers seeking cessation support, and educational materials. The Center for Tobacco Prevention and Control at the University of Massachusetts Medical School performs research on tobacco use and nicotine dependence (Connolly and Robbins 1998; Hamilton et al. 2002; MDPH 2002a, 2002b).

Massachusetts has also mirrored California in coordinating its activities with other tobacco control initiatives. From 1991 through 1999, for instance, Massachusetts was 1 of 17 states in the country to participate in the NCI’s ASSIST program. Massachusetts participated in various training programs and information exchanges with its fellow ASSIST states, as well as with California and other states with tobacco control programs (Celebucki et al. 1998).

As with the CTCP, the MTCP’s early years represented its most intensive period of funding and activity. From 1994 to 1997, for example, the $7.09 per-capita spent on tobacco control in Massachusetts represented the highest investment of its kind in the country. Budgetary cuts have threatened the effectiveness of the MTCP throughout its history, however, and even in the first 3 years of its existence, the MTCP experienced a pattern of decreasing expenditures (Wakefield and Chaloupka 2000). These early reductions, however, pale in comparison with the cuts that occurred at the beginning of the 2000s. Although funds from the MSA helped increase the MTCP’s budget in FY 2000, funding levels dropped again in FY 2001. In addition, between FY 2002 and FY 2003, as the state faced acute budget shortfalls, it decreased the MTCP’s budget from $34 million to $5.5 million. These cuts resulted in a serious reduction of the MTCP’s activities, including the elimination of almost all local programming and the discontinuation of the media campaign. Since these cuts occurred, surviving elements of the program have operated at a level far below that of the previous decade (Hamilton et al. 2003; MDPH 2002a, 2006).

Description of Evaluations

From the start, both California and Massachusetts incorporated evaluation mechanisms into their tobacco control programs. California developed a multidimensional evaluation structure that comprised local program assessments, in-house surveys, and an independent review. Through the “10 percent” clause, which requires local grantees to devote 10 percent of their program budgets to evaluation, the state can review the effects of programs carried out at the local level, where most CTCP activities take place. The CDHS’s in-house data-gathering efforts, meanwhile, have included the Behavior Risk Factor Survey, the California Adult Tobacco Survey, and the California Youth Tobacco Survey. CDHS contracts with the University of California San Diego (UCSD) to operate the much larger California Tobacco Survey (CTS). UCSD conducts this survey every 3 years through interviews of individuals from randomly selected households, and reaches approximately 78,000 adults and 6,000 youth. The CTS provides CDHS with statewide smoking prevalence rate estimates (broken down into county and regional estimates) as well as data on attitudinal changes (Russell 1998).

The CTCP’s enabling legislation mandated an independent evaluation of the program. The Gallup Organization has conducted this independent review, subcontracting various elements of its evaluation to Stanford University and the University of Southern California (USC). In their reviews, Gallup and its subcontractors have examined the overall impact of the program as well as the relative effectiveness of its various components (media campaigns, local initiatives, school-based programs, etc.). Other surveys used in the evaluation of the CTCP include the CDHS’s annual survey of the rate of illegal sales of tobacco products to minors and occasional surveys targeting specific issues, such as the Field Institute poll on the number of smoke-free bars in the state. The Evaluation Task Force, with members from across the United States and Canada, advises the state on evaluation efforts (Independent Evaluation Consortium 2002; Russell 1998).

Massachusetts has used a similar multidimensional approach to evaluating the MTCP’s success in reducing tobacco use. From October 1993 through March 1994, MTCP conducted the Massachusetts Tobacco Survey, a baseline survey that collected data on tobacco use among adults and youth through randomized telephone interviews. Beginning in March 1995, MTCP began conducting the Massachusetts Adult Tobacco Survey, a monthly follow-up cross-sectional survey, to monitor changes in tobacco use and related attitudes. In addition, along with the RWJF, the MTCP funded longitudinal surveys to evaluate the program’s impact on adults and youth. Finally, like California, Massachusetts commissioned an independent assessment of its tobacco control program. In evaluating the success of the

MTCP, Abt Associates Inc. has reviewed data on smoking prevalence, quit attempts, smoking cessation, exposure to ETS, incidents of tobacco sales to minors, and changes in attitudes regarding tobacco use and tobacco-control policy (Hamilton et al. 2002). Frequent budget cuts, however, have impacted the regularity of the MTCP’s surveillance efforts, restricting the extent and consistency of program evaluation (Hamilton et al. 2002).

Findings Regarding Effects

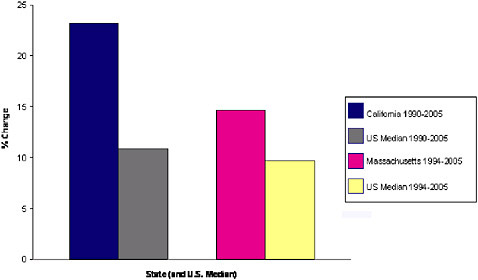

The results of the evaluations and surveys mentioned above, along with the findings from a number of peer-reviewed studies, indicate that California and Massachusetts have made progress in their tobacco control efforts; this progress is most notable when the respective programs have been well-funded and fully-implemented. On the basis of data from the CDC’s Behavior Risk Factor Surveillance System, Figure 5-1 illustrates the successes that both states have had in reducing tobacco use in comparison with the rest of the country. Figure 5-1 shows that a 23.2 percent reduction in the prevalence of current smoking in California took place between 1990 (the first full year of the state’s tobacco control program) and 2005, whereas the reduction in the U.S. median during the same period was

FIGURE 5-1 Percent reduction in current adult smokers in California and Massachusetts from the first year of their tobacco control programs (1990 and 1994, respectively) to 2005 (the year for which the most current data are available) compared with the percent reduction in the U.S. median for the same two time periods, based on data from the Behavior Risk Factor Surveillance System.

SOURCE: (CDC 2006a).

10.9 percent. In Massachusetts, meanwhile, a 14.6 percent reduction took place between 1994 (the first full year of the implementation of its tobacco control program) and 2005. During those same years, the U.S. median experienced a smaller reduction of 9.7 percent.

California

During the CTCP’s early years, California experienced significant declines in the prevalence rate of smoking among adults. To determine whether the declines could be attributed to the program or to alternative factors (e.g., national trends or demographic changes) Siegel and colleagues (2000) compared data for California with data for the rest of the country. They found that California’s rate of decline in adult smoking prevalence between 1990 and 1994 was 0.39 percent per year, whereas the rate of decline in the rest of the United States was only 0.05 percent per year. Restriction of the analysis to various demographic groups did not significantly affect the results. Consequently, Siegel and colleagues suggested that the greater reduction in adult smoking prevalence in California in comparison to that of the rest of the country in the early 1990s could be due to the implementation of the CTCP (Siegel et al. 2000).

It is important to note, however, that California’s adult smoking prevalence rate has remained relatively level since the mid-1990s (CDHS 2002).2 In an evaluation of the CTCP’s activities from 1989 to 1996, Pierce and colleagues (1998) divided the program’s first 7 years into two distinct periods. They found that during Period 1 (January 1989 to June 1993), adult smoking prevalence and per-capita cigarette consumption declined more than 50 percent faster than in previous years and more than 40 percent faster than in the rest of the United States. During Period 2 (July 1993 to December 1996), however, the rate of decline for both adult smoking prevalence and per-capita cigarette consumption slowed, with the prevalence declining at only 15 percent and consumption declining at only 34 percent of the Period 1 rate of decline. Furthermore, although the rate of decline in cigarette consumption remained substantially higher than the rate recorded in the rest of the United States during Period 2, California’s rate of decline in adult smoking prevalence no longer exceeded that of the rest of the United States. This slowdown coincided with decreased financing of tobacco control programs by the state (Pierce et al. 1998).

Fichtenberg and Glantz (2000), meanwhile, analyzed the CTCP’s effectiveness in relation to the rate of decline of deaths attributable to heart

disease in California. They found that between 1989 and 1992, both percapita cigarette consumption rates and the annual rate of mortality from heart disease declined significantly more in California than in the rest of the country. Reflecting the trends noted above, however, the rates of decline slowed noticeably after 1992. Consequently, Fichtenberg and Glantz concluded that the CTCP was initially effective in reducing deaths from heart disease but that cutbacks in the scale and funding of the program weakened further progress (Fichtenberg and Glantz 2000).

The last independent evaluation of the CTCP to be released by the Gallup Organization and its partners (Stanford and USC) assessed the program’s overall impact in relation to Californians’ exposure to its various elements and messages, as reported in surveys conducted in 1996–1997, 1998, and 2000. The evaluation concluded that the CTCP has had an impact on behavior, as counties with greater exposure to the program showed better outcomes than counties with less exposure, including a greater decline in adult smoking prevalence between 1996 and 2000, lower perceived access to cigarettes among 10th graders, and an increase from 1996 to 2000 in the proportion of adults with complete smoking bans in their homes (Independent Evaluation Consortium 2002).

The CTCP has also had success in reducing tobacco use among youth. A study released in 2005 associated the CTCP with reduced uptake and smoking rates among adolescents and young adults. The authors found that the rate of “ever puffing” declined by 70 percent among 12- to 13-year-olds from 1990 to 2002, by 53 percent among 14- to15-year-olds from 1992 to 2002, and by 34 percent among 16- to 17-year-olds from 1996 to 2002. The study identified similar patterns for smoking experimentation (smoking one or more cigarettes ever) and established smoking (smoking more than 100 cigarettes in a lifetime). Although the smoking prevalence among young adults (ages 18 to 24 years) remained constant in the rest of the country from 1992 to 2002, the prevalence among young adults in California decreased significantly (by 18 percent) from 1998–1999 to 2001–2002 (Pierce et al. 2005). Gilpin and colleagues found a similar behavioral trend when they compared the results of two 3-year longitudinal studies (1993–1996 and 1996–1999) that measured smoking initiation rates at the baseline among California adolescents who had never smoked. The authors identified a lower rate of initiation at follow-up in the cohort of the second study than in that of the first study (Gilpin et al. 2005).

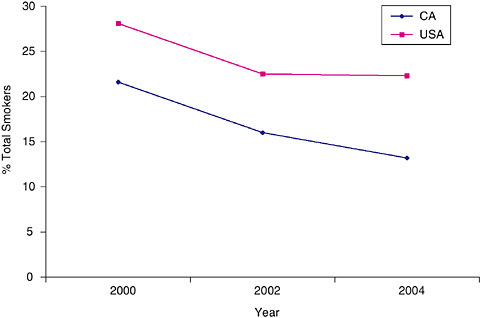

Data published by CDHS indicate that California has continued to make progress in reducing tobacco use among youth. According to CDHS, from 2000 to 2004, the 30-day smoking prevalence rate among high school students in California decreased from 21.6 percent to 13.2 percent (CDHS 2005). Figure 5-2 shows that although the rate of decline in smoking prevalence among youth in California mirrored the rate of decline in the rest of

FIGURE 5-2 Thirty-day smoking prevalence among high school students (9th to 12th grades) in California and the United States between 2000 and 2004. Data for 2000 are from the National Youth Tobacco Survey, and data for 2002 and 2004 are from the California Student Tobacco Survey.

SOURCE: (CDHS 2005).

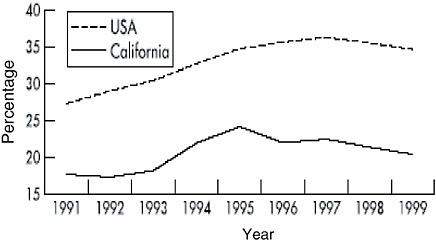

the country from 2000 to 2002, the smoking prevalence rate among youth declined at a greater rate in California than in the United States as a whole from 2002 to 2004. Figure 5-3 depicts the smoking rates among youth over the course of the 1990s in both California and the United States (excluding California). Although the rates rose in California as well as in the rest of the country in the early part of the decade, by the mid-1990s the smoking prevalence rate among youth in California began to decline, whereas the prevalence nationwide continued to increase for several more years.

Massachusetts

Like California, Massachusetts has made progress in reducing tobacco use, with both adult smoking prevalence and per-capita cigarette consumption trending downward since the implementation of the MTCP. Figure 5-1 illustrates Massachusetts’s success in reducing the prevalence of smoking among adults, showing that from 1994 to 2005 Massachusetts experienced

FIGURE 5-3 Smoking rates for high school seniors in California and the United States excluding California, 1991 to 1999 Monitoring the Future.

SOURCE: (Farrelly et al. 2003).

a greater percent change in the prevalence of current adult smokers than did the U.S. median.

In its last independent evaluation of the MTCP, Abt Associates Inc. similarly assessed the program by comparing state and national data. Controlling for demographic characteristics and comparing current smoking prevalence rates in Massachusetts with those in 41 states without comprehensive tobacco control programs, Abt Associates found that adult smoking prevalence rates declined more rapidly in Massachusetts than in the comparison states. According to the Abt analysis, the adjusted prevalence rate in Massachusetts declined between 1990 and 2000, from 22.7 percent to 20.5 percent (an annual rate of 0.9 percent), whereas the adjusted prevalence rate in the comparison states declined from 22.0 percent to 21.7 percent (an annual rate of 0.4 percent). Consequently, Abt Associates concluded (like Siegel and colleagues in the case of California) that the decline in the adult smoking prevalence rate in Massachusetts could be attributed to the existence of the MTCP and not to national trends or demographic changes. Abt also noted that Massachusetts experienced a drop (40 percent) in per-capita cigarette consumption from 1992 to 2001, two times greater than the drop (20 percent) experienced in the rest of the country, excluding California. Furthermore, the decline in youth smoking prevalence in Massachusetts was found to be greater than that in the rest of the United States (Hamilton et al. 2003). The results of a similar analysis that reviewed data obtained through 1999 were published in 2002 (Weintraub and Hamilton 2002).

An earlier review (the results of which were published by the CDC in 1996) sought to determine the impact of the state’s excise tax and tobacco control program on per-capita cigarette consumption and adult smoking prevalence. In doing so, the authors compared the rates in Massachusetts with those in the rest of the United States during two time periods: the 3 years leading up to the passage of Question 1 on the state ballot initiative (1990 to 1992) and the years immediately following the implementation of the excise tax and establishment of the MTCP (1993 to 1996). Although they determined that smoking prevalence rates in Massachusetts required further study, they found that per capita cigarette consumption decreased significantly from the first period to the second. During the first period, consumption in Massachusetts declined by 6.4 percent, whereas that in the rest of the country declined by 5.8 percent (except for California, where consumption declined by 11.0 percent). From 1992 to 1996, however, per-capita consumption declined by 19.7 percent in Massachusetts, 15.8 percent in California, and just 6.1 percent in the remaining states and the District of Columbia. The authors reasoned that because real cigarette prices actually fell in 1993 (because of price reductions by the tobacco industry), the excise tax alone could not account for the decline in cigarette consumption that continued through 1996. Consequently, they concluded that Massachusetts’s tobacco control program played a role alongside tax increases in reducing the rate of tobacco use in the years immediately following the passage of Question 1 (CDC 1996).

Biener and colleagues (2000a) confirmed and added to the findings of the 1996 CDC study. They found that although Massachusetts and 48 comparison states experienced similar declines (15 percent and 14 percent respectively) in per-capita cigarette consumption from 1988 to 1992, Massachusetts experienced a greater annual decline (more than 4 percent) than the comparison states (less than 1 percent annually) following the establishment of excise tax and the establishment of the MTCP. As the authors of the CDC study had already observed, the decline in Massachusetts occurred even though price reductions for cigarettes effectively negated the potential effects of the excise tax increase. The authors also determined that after 1992 Massachusetts experienced a greater rate of decline in adult smoking prevalence than did the comparison states. The prevalence of smoking declined by 0.43 percent per year in Massachusetts but by only 0.03 percent in the comparison states. On the basis of these findings, the authors concluded that tobacco control programs such as the MTCP can reduce the rates of tobacco use and the related health risks (Biener et al. 2000a).

Massachusetts’s success in reducing the rates of tobacco use among youth has fluctuated over time, however. In its last review of the MTCP, Abt Associates reported that although the prevalence of smoking among youth in Massachusetts and the United States as a whole actually grew during

the early 1990s, Massachusetts managed to reverse this trend in the second half of the decade, with the prevalence of smoking among youth falling more rapidly in Massachusetts from 1995 to 2001 (from 36 to 26 percent) than in the rest of the country (35 to 29 percent) (Hamilton et al. 2003). A separate study conducted by Soldz and colleagues (2002) identified similar trends. On the basis of data from the triennial Massachusetts Prevalence Study, Soldz and colleagues found that although the prevalence increased at both the state and national levels from 1990 to 1993, Massachusetts managed to reverse this trend in the latter half of the decade. Comparing data from the 1996 and 1999 surveys, the authors determined that over the 3-year period, the rate of cigarette use among students in grades 7 through 12 dropped from 30.7 percent to 23.7 percent. The percent decline in Massachusetts, they found, was greater than the declines seen in neighboring states and in the nation as a whole. Furthermore, the decrease in the rate of cigarette use was broad-based, occurring in numerous subsets of the youth population in Massachusetts. The prevalence rate declined among students in middle school as well as high school, boys and girls, and African Americans and whites. Soldz and colleagues concluded that the scale of this decline, especially in comparison with the smaller regional and national declines, strongly demonstrated the effectiveness of the MTCP in reducing the rate of cigarette use among Massachusetts youth (Soldz et al. 2002).

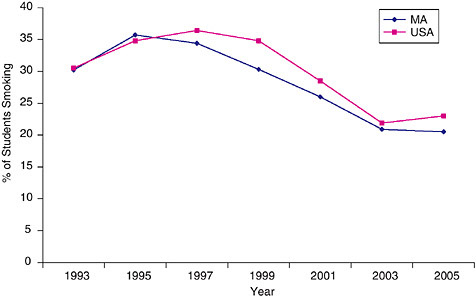

On the basis of data from the CDC’s Youth Behavior Risk Survey, Figure 5-4 illustrates the progress that Massachusetts made during the mid-to-late 1990s in reducing the rate of tobacco use among youth, reflecting the conclusions reached by the independent evaluation as well as by Soldz and colleagues (2002). Figure 5-4 also shows, however, that after these two studies were conducted, the smoking prevalence rate among youth in the state began to decline at a slower rate than that among youth in the country as a whole. This slowdown coincides with the sharp reductions made to the MTCP’s budget during the early part of the 2000s. Although, in light of 2005 data, the smoking prevalence rate among youth in Massachusetts once again compares favorably with that among youth in the United States at large, the prevalence of smoking among youth in the state has essentially stalled, indicating an end to the declines seen in the latter half of the 1990s.

Summary

The evidence presented and reviewed above shows that comprehensive state programs have achieved substantial reductions in the rates of tobacco use in both California and Massachusetts. This is particularly true of the early years of the CTCP and MTCP, when both states aggressively funded and implemented their tobacco control programs. Evaluations of Florida’s

FIGURE 5-4 Comparison of the rate of current cigarette use among high school students (grades 9 to 12) in Massachusetts with the U.S. median, based on data from the Youth Risk Behavior Surveillance System.

SOURCE: (CDC 2006b).

youth-themed “truth” campaign, as well as programs in other states, such as Arizona, Oregon, and—most recently—New York, also indicate that statewide tobacco control programs can be effective in reducing the rates of tobacco use (Bauer et al. 2000; CDC 1999a; 2001; RTI International 2005; Siegel 2002; Sly et al. 2001a; Wakefield and Chaloupka 2000). In recent years, however, large budget cutbacks to many states’ tobacco control programs, including that of Massachusetts, have jeopardized continued success. To effectively reduce tobacco use, states must maintain, over time, a comprehensive and integrated tobacco control strategy.

FUNDING FOR COMPREHENSIVE STATE PROGRAMS

After the end of the ASSIST program, when the responsibility for tobacco prevention shifted from NCI to OSH at CDC, OSH implemented a Tobacco Control Program to sustain comprehensive state tobacco control programs. Under that program each state can receive approximately $1 million per year for comprehensive tobacco control efforts (CDC 2003). Suggested levels of funding per capita are included to assist states in allocating funds from various sources. However, state governments are not funding

such efforts at the levels that the CDC recommends for best practices (Tauras et al. 2005), either from general funds or from payments under the MSA (revenues received under the MSA have typically been siphoned off by state governments to support programs other than those for tobacco control). In this section, the committee summarizes state expenditures on tobacco control and the sources of revenues that are funding these programs.

State Tobacco Control Expenditures

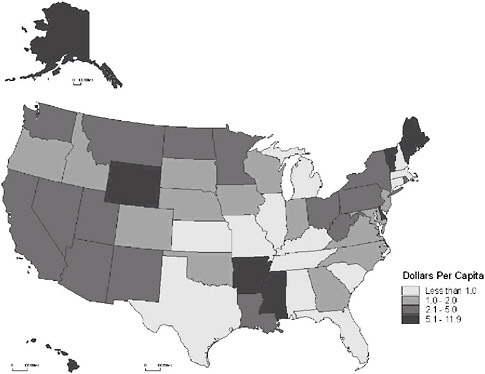

Expenditures on tobacco control vary widely among states (Figure 5-5 [Prevention Spending Dollars per person] and Table 5-1). In FY 2005, per-capita state expenditures on tobacco control varied from more than $11 in Delaware ($11.87) and Maine ($11.14) to nothing (aside from the CDC grant) in the District of Columbia, Michigan, Missouri, New Hampshire, South Carolina, and Tennessee. The mean per-capita state expenditure was $2.76.

FIGURE 5-5 FY 2005 state tobacco control spending per capita (based on 2000 census data).

TABLE 5-1 Per-Capita State Tobacco Control Revenues and Expenditures, 2005

|

State |

MSA Payment Received per Capita ($) |

Net Excise Tax Revenue per Capita ($) |

Prevention Spending per Capita ($) |

|

Alabama |

22.91 |

33.63 |

0.08 |

|

Alaska |

34.71 |

77.06 |

6.70 |

|

Arizona |

19.48 |

54.99 |

4.50 |

|

Arkansas |

19.74 |

47.51 |

6.58 |

|

California |

12.01 |

30.23 |

2.18 |

|

Colorado |

20.31 |

26.74 |

1.00 |

|

Connecticut |

34.74 |

74.61 |

0.02 |

|

Delaware |

32.17 |

103.60 |

11.87 |

|

District of Columbia |

66.95 |

35.43 |

0.00 |

|

Florida |

24.48 |

27.38 |

0.06 |

|

Georgia |

19.11 |

27.66 |

1.40 |

|

Hawaii |

31.66 |

68.62 |

7.35 |

|

Idaho |

17.89 |

34.87 |

1.47 |

|

Illinois |

23.88 |

51.38 |

0.89 |

|

Indiana |

21.38 |

53.94 |

1.78 |

|

Iowa |

18.94 |

29.88 |

1.74 |

|

Kansas |

19.76 |

43.79 |

0.28 |

|

Kentucky |

27.77 |

12.35 |

0.67 |

|

Louisiana |

32.35 |

31.11 |

2.53 |

|

Maine |

38.46 |

72.09 |

11.14 |

|

Maryland |

28.56 |

50.51 |

1.79 |

|

Massachusetts |

40.54 |

65.01 |

0.60 |

|

Michigan |

27.60 |

109.67 |

0.00 |

|

Minnesota |

37.56 |

32.58 |

3.80 |

|

Mississippi |

42.54 |

15.24 |

7.03 |

|

Missouri |

25.91 |

17.74 |

0.00 |

|

Montana |

30.01 |

62.72 |

2.77 |

|

Nebraska |

22.16 |

39.14 |

1.69 |

|

Nevada |

19.45 |

64.58 |

2.20 |

|

New Hampshire |

34.31 |

75.61 |

0.00 |

|

New Jersey |

29.29 |

92.84 |

1.31 |

|

New Mexico |

20.90 |

33.04 |

2.75 |

|

New York |

21.64 |

49.32 |

2.08 |

|

North Carolina |

18.47 |

4.89 |

1.86 |

|

North Dakota |

36.32 |

28.23 |

4.83 |

|

Ohio |

28.28 |

48.86 |

4.69 |

|

Oklahoma |

19.14 |

30.37 |

1.39 |

|

Oregon |

21.38 |

63.65 |

1.02 |

|

Pennsylvania |

29.82 |

83.79 |

3.75 |

|

Rhode Island |

43.71 |

123.70 |

2.38 |

|

South Carolina |

18.29 |

6.41 |

0.00 |

|

South Dakota |

29.46 |

34.85 |

1.99 |

|

Tennessee |

27.54 |

19.70 |

0.00 |

|

Texas |

24.74 |

23.60 |

0.35 |

|

Utah |

12.70 |

24.33 |

3.22 |

On average, states spend about half of CDC’s recommended minimum level for comprehensive state tobacco control programs including the nine components specified in Best Practices for Comprehensive Tobacco Control Programs community programs to reduce tobacco use, chronic disease programs to reduce the burden of tobacco-related diseases, school programs, enforcement, statewide programs, countermarketing, cessation programs, surveillance and evaluation, and administration and management (CDC 1999c). In 1995, the CDC’s recommended range of per-capita spending for the nation as a whole was $5.85 to $15.85. The CDC identified such an expenditure range to take into account important variations among states, including overall population (and therefore the possibility of achieving economies of scale), as well as tobacco use prevalence and demographic factors.

According to the CDC, “approximate annual costs to implement all of the recommended program components have been estimated to range from $7 to $20 per capita in smaller states (population under 3 million), $6 to $17 per capita in medium-sized states (population 3 million to 7 million), and $5 to $16 per capita in larger states (population over 7 million)” (CDC 1999c). In recommending funding ranges for each state, CDC generally works within these estimates, although it should be noted that for the states with smaller populations, CDC recommends an upper estimate higher than $20 (for example, in Delaware, the District of Columbia, Montana, North Dakota, Rhode Island, South Dakota, Vermont, and Wyoming). California has the lowest lower estimate of $5.12 per capita, and Wyoming has the highest upper estimate of $30.01.

The committee reviewed the methodology that CDC uses to calculate

these estimated general ranges. The agency first identified best practices for each of the nine components of a comprehensive program and then calculated funding ranges (in millions) for each program component for each state—taking population, tobacco-use prevalence, and demographic factors into account—totaled the lower and upper estimates of each component on a state-by-state basis to find a total state program cost, and then calculated the per-capita ranges for each state. The scientific evidence that has emerged since 1999 appears to have substantiated CDC’s judgment regarding best practices in each of the relevant domains, and the committee sees no reason to question the CDC’s expert judgments regarding the likely costs of implementing these practices in various states. Accordingly, the committee has decided to use the CDC estimates as a template for its recommendations regarding state tobacco control expenditures.

Revenue Sources for State Tobacco Control Programs

What are the revenue sources of state funding for tobacco control? It might be expected that a certain percentage of revenues produced by tobacco excise taxes and the Master Settlement Agreement would be “earmarked” or set aside for tobacco control. However, few states have adopted this strategy, and there is very little correlation between the amounts generated by these two tobacco-related revenue streams and the amount expended on tobacco control.

State Tobacco Excise Taxes

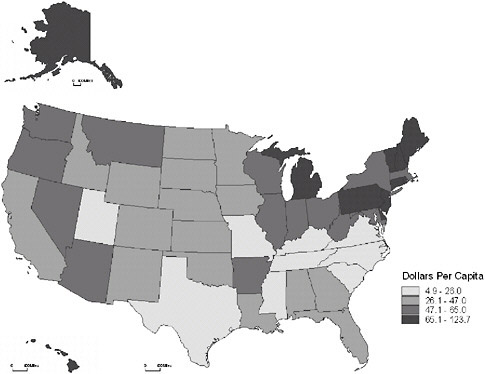

States vary widely in their tobacco excise tax rates and in the amount of revenue that those taxes produce per capita (Table 5-1), ranging in FY 2005 from more than $80 per capita in Rhode Island ($124), Michigan ($110), Delaware ($104), New Jersey ($93), and Pennsylvania ($84) to less than $15 per capita in North Carolina ($5), South Carolina ($6), and Kentucky ($12). As these numbers suggest, and as Figure 5-6 shows, per-capita excise tax revenues are the highest in the Northeast and the lowest in the Southeast. The average per-capita excise tax revenue in all states was $47.80, and two-thirds of the states had revenues of at least $32 per capita.

In recent years, largely in response to state budget shortfalls, there has been a dramatic increase in the average tobacco excise tax rates and the number of states increasing their tax rates. According to Farrelly and colleagues (2003), in 2002 alone, 21 states raised their cigarette taxes, more states than in the past 5 years combined, and the average state cigarette excise tax rate increased significantly from 31 cents per pack (in 2002 dollars) in 1990 to 62 cents per pack in early 2003. These increases have exacerbated what were already substantial disparities in tobacco excise tax

FIGURE 5-6 Per-capita tobacco excise tax revenues collected by state 2005, based on 2000 census data.

rates across the country and the attendant problems of interstate smuggling (Farrelly et al. 2003).

California was the first state to earmark a portion of its excise tax revenues for tobacco control efforts. As noted, a voter initiative, Proposition 99, increased the state tobacco tax by 25 cents per pack of cigarettes in 1988, and in 1990 the California Assembly enacted legislation distributing the revenue earned from the tobacco tax increase. The legislation directed that 20 percent of the revenues be allocated to a health education account, and funds from the health education and research accounts finance a statewide tobacco control program. Only in California, Oregon, and Utah have excise taxes served as a major designated source of funding for tobacco control.

Whether tax revenues should be earmarked for specific purposes is a controversial issue in public finance, and there is no compelling reason why tobacco control activities should be funded from any particular source of revenues (in fact, as noted above, Massachusetts was constitutionally precluded from earmarking the revenues generated by its 1992 tobacco excise tax increase to tobacco control). In addition, earmarking of a specified

proportion of revenues represents a pre-commitment to prioritize tobacco control expenditures in a way that would preclude the weighing of other priorities. However, the argument for earmarking a presumptive (but reversible) portion of tobacco excise tax revenues to tobacco control does have a common-sense persuasive force (Hamilton et al. 2005), and a decision to link tobacco excise tax revenues to tobacco control efforts represents a modest political commitment to sustain these activities.

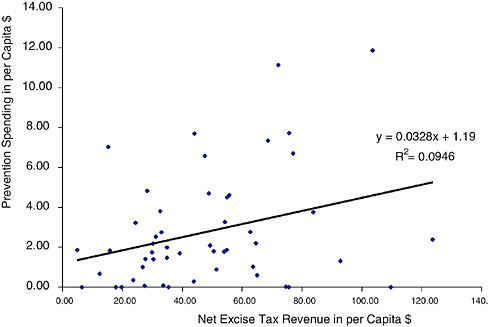

In light of the traditional political separation between decisions about revenues (including excise tax rates) and expenditure decisions, it is perhaps unsurprising that per-capita state excise tax revenues and per-capita tobacco control expenditures are only modestly correlated (Figure 5-7).

Master Settlement Agreement Allocations

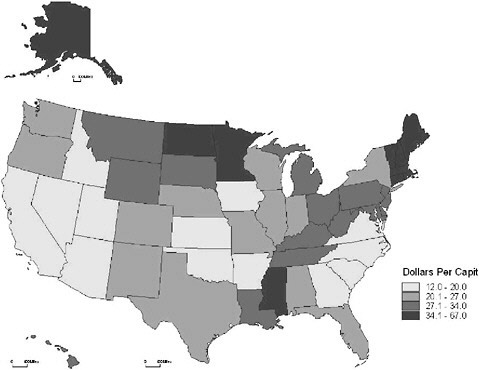

Another important element in the political economy of tobacco control is the MSA. On average in 2005, the states received $27.46 per capita from the proceeds of the MSA. Because these calculations were based on projected Medicaid expenditures for tobacco-related diseases, they varied substantially (Table 5-1), from a low of $12.01 per capita in California to a high of $66.95 in the District of Columbia (Figure 5-8).

FIGURE 5-7 Correlation between per-capita tobacco control spending and per-capita excise tax revenues.

FIGURE 5-8 Per-capita payments received from the MSA, by state, in FY 2005 (based on 2000 census data).

The MSA does not stipulate how the states should spend the settlement funds. Consequently, the 46 states, the District of Columbia, and the five territories party to the MSA have developed various regulations, structures, and mechanisms for allocating settlement payments. A November 2005 report jointly issued by the American Cancer Society, the American Heart Association, the American Lung Association, and the Campaign for Tobacco-Free Kids illustrates the diverse approaches that the states have used to administer these funds over the past several years (AHA et al. 2005). Although some states regularly apply payments directly to their general budgets, others have established specific funds to which they direct their MSA allotments. Delaware law, for instance, mandates that all settlement payments be deposited into the Delaware Health Fund, which finances health-related programs, including the state’s tobacco control efforts. Kansas law, meanwhile, directs the entirety of the state’s MSA payments (after the first $70 million, which was placed into the state’s general fund) into the Kansas Endowment for Youth fund, which finances a range of youth-related programs. And Michigan and Nevada direct portions of their MSA allotments to education

scholarship funds. Just a few states, however, such as Nevada and Virginia, explicitly require portions of their settlement funds to be applied to tobacco control efforts.

Several tobacco-producing states apply large portions of their MSA payments to funds that assist citizens and businesses traditionally dependent on the tobacco industry. North Carolina law requires that 50 percent of the state’s annual MSA receipts be placed in a fund that provides assistance to tobacco-dependent communities. An additional 25 percent is allocated to a separate fund that directly aids tobacco farmers and tobacco manufacturing workers, among others. Similarly, Virginia law allocates 50 percent of the commonwealth’s MSA-derived funds to the Tobacco Indemnification and Community Revitalization Trust Fund, which provides economic assistance to tobacco growers and tobacco-dependent communities (AHA et al. 2005).

In recent years, budget shortfalls have compelled a number of states to divert MSA payments from tobacco-control–related funds and programs, such as those listed above (AHA et al. 2005). Largely to address such shortfalls, 15 states have also opted to securitize future MSA proceeds (GAO 2006). California, for instance, securitized its future settlement payments to fund its FY 2003 and FY 2004 budgets (AHA et al. 2005). In electing to securitize MSA proceeds, states receive advance income by issuing bonds backed by future MSA payments. States must pay to service the debt accrued through securitization, however; and in FY 2005 four states, including California, applied 100 percent of their MSA payments to servicing this debt (in addition, New Jersey allocated 99.9 percent of its MSA payments to debt servicing). In an April 2006 review of how states spend their MSA payments, the U.S. Government Accountability Office (GAO) calculated that servicing of securitization debt represented 24 percent of the total MSA funds allocated by states in FY 2005 (GAO 2006).

GAO also reported that between FY 2004 and FY 2005, the portion of MSA payments allocated to cover budget shortfalls decreased dramatically, from 44 to 4 percent, with states applying the largest portion of MSA-derived funds (32 percent) in FY 2005 to health-related programs (e.g., health care services, health insurance, and health research). It should be noted, however, that although the portion of funds allocated to such programs increased, the actual dollar amount decreased between FY 2004 and FY 2005, because fewer states obtained money up front through securitization. Allocations of MSA payments to tobacco control programs, meanwhile, remain extremely low, averaging just 4.7 percent of total MSA payments in FY 2005. In fact, since GAO began reviewing state allocations of MSA money, the percentage apportioned to tobacco control efforts has not exceeded 6 percent (GAO 2006). GAO does not anticipate any change in allocations to tobacco control programs for FY 2006.

Sloan and colleagues (2005) found that the mean total annual spending from settlement funds was $30.65 per capita from FY 2000 to FY 2004. Median spending was about $25 per capita. However, less than half of that money was spent on health-related activities, and very little of it was spent on tobacco control efforts. Approximately one-fourth of the state budgets reported during this period allocated no money to tobacco control. Among budgets that allocated anything to tobacco control, the usual allocation was less than $2.50 per capita (see Figure 3 in the article by Sloan and colleagues 2005). States tended to spend less on tobacco control if they had more seniors, more individuals under the age of 18 years, and higher per-capita incomes. Not surprisingly, tobacco-producing states tended to spend smaller amounts of their MSA proceeds on tobacco control (Sloan et al. 2005).

In sum, only a small proportion of MSA revenues is devoted to tobacco control, and MSA revenues are specifically earmarked for this purpose in only a handful of states. In some states, however, the modest appropriations from MSA payments have accounted for a significant proportion of tobacco-control–related expenditures. Gross and colleagues (2002), for instance, determined that even though the percentage of MSA funds directed to tobacco control was very low, “when the tobacco-control-program expenditures from all 50 states were considered in aggregate, over half of the funding was derived from settlement income” (Gross et al. 2002). This proportion is probably much lower now because so many states have used their MSA funds to shore up budget gaps.

Summary and Recommendation

In the committee’s view, states should adopt a funding strategy designed to provide stable support for the level of tobacco control funding recommended by the CDC. MSA payments are not a reliable source of funds in most states. The most sensible approach would be to allocate a suitable share of tobacco excise tax revenues to tobacco control efforts. History suggests that these taxes are not likely to be reduced once they have been increased; moreover, high excise taxes also serve the goal of reducing tobacco use (see below) while raising revenues for tobacco control efforts and other public purposes. In most states, the CDC’s recommended expenditure target (about $16 per capita for the nation as a whole) could be achieved by setting aside about one-third of the proceeds from the tax. The committee recognizes that explicit earmarking is forbidden by some state constitutions and is presumptively unacceptable in other states. However, even if formal earmarking is unacceptable, legislators responsible for public health expenditures should embrace a political strategy of linking the amount of the tobacco control budget line to a percentage of tobacco excise tax revenues.

Recommendation 1: Each state should fund state tobacco control activities at the level recommended by the CDC. A reasonable target for each state is in the range of $15 to $20 per capita, depending on the state’s population, demography, and prevalence of tobacco use. If it is constitutionally permissible, states should use a statutorily prescribed portion of their tobacco excise tax revenues to fund tobacco control programs.

EXCISE TAX

It is well established that an increase in the price of cigarettes decreases their use and that raising tobacco excise taxes is one of the most effective policies for reducing the use of tobacco. From a policy perspective, one of the unresolved questions is whether price increases act synergistically with other tobacco control interventions to decrease consumption. After a brief review of the literature on these topics, the committee addresses the proper level of excise taxation solely on the basis of tobacco control considerations and comments on the practical difficulties presented by disparate levels of state excise taxes.

Price Increases Decrease Cigarette Use

Over a period of more than three decades, economists and health policy analysts have accumulated a large body of evidence on the effect of price on cigarette consumption. The effect of price on cigarette use has also been the subject of numerous recent reviews (Chaloupka 1999, (Chaloupka and Warner 2000; Leverett et al. 2002; Pinilla 2002) and meta-analyses (Gallet and List 2003). The conclusion reached by virtually every study of every demographic group in both developed and developing countries is that an increase in cigarette price reduces the level of cigarette use. A recent cross-sectional study of 70 countries based on aggregate consumption data found a price elasticity in the range of −0.49 to −0.57 percent (Blecher and van Walbeek 2004).

Price has been found to affect virtually every measure of cigarette use, including per-capita consumption, as derived from aggregate macrolevel data, as well as smoking prevalence and the number of cigarettes smoked daily, as derived from individual microlevel data (Hu et al. 1995a). Recent studies with microlevel data have found that higher cigarette prices increase the probability that a current adult smoker will make an attempt to quit (Levy et al. 2005) and that a young adult smoker will stop smoking (Tauras 2004b). In a study of adult smokers, access to low-taxed cigarettes was found to deter cessation attempts (Hyland et al. 2005). The June 2006 National Institutes of Health (NIH) state-of-the-science panel on tobacco

use (NIH 2006b) found that an increase in the unit price of tobacco products increases the rate of tobacco use cessation and reduces the level of consumption among individuals across a wide spectrum of racial and socioeconomic groups.

Just as increases in cigarette taxes deter consumption, declines in cigarette prices have been found to increase the level of consumption. In one Canadian study, for example, tax cuts in certain provinces slowed the rate of decline of smoking by inducing more smokers to start and leading fewer smokers to quit (Hamilton et al. 1997). Another study suggested that the price decrease in Canada in the early 1990s may have contributed to an increase in the rate of smoking among youth in the province of Ontario (Waller et al. 2003). In the United States, the increase in the rate of smoking among youth in the early 1990s has been attributed to declines in cigarette prices (Gruber 2001).

Cigarette Price Increases Reduce Cigarette Use by Adolescents

Although some studies have reported mixed or negative findings, the most recently published research generally supports the finding that higher cigarette prices discourage youth from smoking (Chaloupka 1999; Chaloupka and Pacula 1998; Chapman and Richardson 1990; Ding 2003; Gruber 2001; Harris and Chan 1999; Liang et al. 2003). Increased cigarette prices have been found to deter smoking among young people when investigators controlled for peer effects (Powell et al. 2005).

Some recent research has attempted to distinguish between the effects of price on adolescent experimentation with cigarettes and the effects of price on cigarette use among established adolescent smokers. One recent study, based on microlevel data from a 1993 national youth survey, found that cigarette price affects the latter group but not the former group (Emery et al. 2001). However, another study, based on the Growing Up Today Study of 1999, found that adolescents residing in states with the highest quartile of cigarette tax rates had a lower probability of experimental smoking (Thomson et al. 2004). Still another recent study suggested that cigarette prices do affect the probability that adolescent males, but not adolescent females, will initiate smoking. Adolescent female smoking initiation was found to depend on perceptions of being overweight or the desire to lose weight (Cawley et al. 2004).

Some of the inconsistencies in past research may have resulted from inaccurate measurement of the actual prices that teenagers paid for cigarettes. One study suggested that region-specific average retail prices or tax rates may incorrectly gauge the actual prices paid by youth smokers and that perceived price is a more specific measure of the smoker’s actual out-of-pocket costs (Ross and Chaloupka 2003).

The June 2006 NIH state-of-the-science panel on tobacco use (NIH 2006b) determined that increases in excise taxes are effective in preventing tobacco use among adolescents and young adults, even though recent studies have found that increases in cigarette tax induce smokers to seek out tax-exempt cigarettes, to take advantage of coupon offers, and to avoid the impact of tax hikes in other ways (Hyland et al. 2004).

Do Cigarette Price Increases Act Synergistically with Other Antismoking Interventions?

Researchers have attempted to untangle the effects of price increases from those of other antitobacco policies, including informational campaigns and restrictions on public smoking, that are often carried out concurrently with governmental tax increases (Scollo et al. 2003; Stephens et al. 2001). Although many studies have established that cigarette price increases and other antismoking policies act independently to suppress demand, the question of a possible synergistic effect remains unanswered. Put differently, could antismoking policies raise the price elasticity of demand, or could price increases enhance the effectiveness of other antismoking interventions?

A number of studies have identified the independent effects of cigarette price increases and local restrictions on smoking at work sites or public places, in both the United States and Canada (Chaloupka 1999; Keeler et al. 1993; Stephens et al. 1997; Tauras 2004a; Yurekli and Zhang 2000). Other studies have identified the independent effects of tax increases and state or local tobacco control campaigns. Early research in this area was based on the antismoking campaigns in California and Massachusetts. Thus a study of quarterly cigarette sales data from 1980 to 1992 in California found that the antismoking campaign and cigarette taxation both contributed to the decline in the level of cigarette use (Hu et al. 1995b). Likewise, a study of the Massachusetts tobacco control campaign found declines in consumption greater than those expected from tax increases alone (CDC 1996).

Recent work on the interaction between price changes and other anti-smoking policies has extended beyond the initial experiences of California and Massachusetts. In one cross-sectional study, increases in state tobacco control funding were found to reduce smoking, even when prices are taken into account (Farrelly et al. 2003). Another study reported independent effects of cigarette price and state-level media campaigns on the probability of making a quit attempt of at least 3 months’ duration (Levy et al. 2005). The combination of antismoking programs and increased tobacco taxes reduced the level of cigarette consumption among youth more than expected as a result of price increases alone (Wakefield and Chaloupka 2000).

Some studies have noted the combined effect of price increases and other antismoking measures, but made an attempt to identify specific contribution of each strategy. Thus cigarette smoking among adults declined after New York City raised local cigarette taxes, made available cessation services, distributed nicotine patches for free, and instituted legal action to ban smoking in public places in 2002 (Frieden et al. 2005). A study in the state of Oregon, reported in Morbidity and Mortality Weekly Report, found that the combination of an excise tax increase and the state’s Tobacco Prevention and Education Program diminished the level of cigarette use (CDC 1999a).

A recent study focused on the impact of the 1998 MSA in the United States, specifically, the effect of the agreement on retail cigarette prices and aggregate cigarette consumption (Sloan et al. 2004). By 2002, the MSA was estimated to have reduced the rate of cigarette consumption by 13 percent among 18- to 20-year-olds, 5 percent among 21- to 65-year-olds, and 13 percent among those 65 years of age and older. The decline in consumption was mediated primarily through the effect of the MSA on cigarette prices, but there was evidence that MSA-associated policies, aside from increased prices, reduced consumption among younger smokers.

How High Should Tobacco Excise Taxes Be?

At the present time, state governments are the primary taxing authorities for tobacco products. During 2005, the consumption-weighted average state excise tax was 76.73 cents per pack (Capehart 2005). By contrast, the federal excise tax has been 39 cents per pack since 2002. Of an estimated total consumption of 388 billion cigarettes in 2004, only 5 billion (or 1.3 percent) were sold through federally tax-exempt outlets, including Indian reservations, military bases, and shipments to Puerto Rico (Capehart 2005).

Tax Evasion

When cigarette excise taxes are evaluated solely from a public health perspective (i.e., exclusively as an instrument for deterring consumption), the level to which the tax might justifiably be raised is limited only by concerns that higher taxes stimulate tax avoidance, such as by creating a demand for nontaxed or lower-taxed cigarette products or for other tobacco product substitutes. Broadly speaking, there are at least three avoidance strategies: (1) producing cigarettes at home, (2) ordering cigarettes to be shipped by mail or package delivery service from sellers who do not collect the tax, and (3) physically purchasing and importing cigarettes from a lower-tax jurisdiction.

The first cigarette tax evasion strategy, home production, has traditionally constituted a negligible fraction of the overall market and, until that situation changes, all that is required is basic monitoring to make sure that the market is not growing substantially. The second cigarette tax evasion strategy, interstate shipping, has become an increasing concern with the proliferation of internet sites selling untaxed cigarettes. The committee addresses this problem below and recommends legislation prohibiting both online tobacco sales and direct shipment of tobacco products to consumers.

The third cigarette tax evasion strategy, smuggling from states with low excise taxes to states with high excise taxes, has traditionally been the greatest concern due to the great variation in state-level excise taxes and the porosity of state borders with respect to commerce. Even if the price within the United States were uniform, policymakers would still have to consider the prospect of smuggling from other countries. International black markets could develop in which foreign cigarettes are smuggled into the country to avoid equalizing excise taxes, or U.S.-manufactured cigarettes could be exported and then illegally re-imported. International smuggling, however, does not appear to be a substantial concern at the present time. The committee will address the smuggling problem later in this chapter.

External Costs

Aside from the impact on consumption, other factors may be relevant to policymakers in selecting the proper level of an excise tax. One key concern is the “efficient” level of taxation that requires smokers to fully internalize the social costs of their smoking (Chaloupka and Warner 2000). From an economic perspective, the main purpose of excise taxes is to make the cigarette consumer who decides to buy cigarettes pay not only for the cigarettes themselves but also pay an amount equivalent to the costs that their smoking imposes on the rest of society. Such a “Pigouvian tax” raises the price of cigarettes to an economically efficient level by internalizing the external costs of consumption.

Computations of the external cost per pack of cigarettes, however, have hinged on exactly how the external costs of smoking are defined. As Chaloupka and Warner observed, “there is no complete consensus on precisely what consequences warrant inclusion, and even for those for which there is consensus, estimates of the magnitude of the true social externalities vary widely” (Chaloupka and Warner 2000, p. 1579). For example, some economists would regard the injury that a smoking mother confers on her children as an internal cost within the family, whereas others would count it as an external cost. Thus a study by Hay (1991) estimated that the costs

of the long-term intellectual and physical consequences of smoking-related low-birth-weight disabilities implied a tax of $4.80 per pack (Hay 1991). Although economists would generally agree that the effects of ETS outside the family should be considered an external cost, an earlier estimate of the external costs (15 cents per pack) by Manning and colleagues (1989) was later criticized because the authors did not have full information on the consequences of ETS exposure at the time (Chaloupka and Warner 2000).

Other economists have pointed out that many smokers would like to quit and regret having made the decision to become a smoker. As discussed in Chapter 2, individuals typically become smokers when they are adolescents, at a time when the costs of smoking are not fully understood or anticipated. In this sense, the adolescent did not take into account the “costs” being imposed on the older addicted smoker who now regrets his or her earlier decision. From that standpoint, many current smokers favor higher prices, and that very fact should be taken into account in analyzing the most efficient level of taxation. In general, it takes a peculiarly strong faith in consumer rationality to apply the standard Pigouvian calculus to an inherently hazardous product to which people become addicted as teenagers.

Regressivity

Whatever the most efficient level of taxation, another concern is that higher taxes may be regressive; that is, poorer people may pay more per capita than would people with higher incomes because the prevalence of smoking is considerably higher among people with lower incomes and less education than among people with higher incomes and more education (see Chapter 1). Ordinarily, there might well be a legitimate concern when a tax increases the price of a good, simply because increases in the prices of goods particularly affect those who are the least able to pay. Tobacco is not an ordinary good, however. Its consumption is (and is perceived to be) a harm to many of its consumers. To the extent that the pool of smokers includes a disproportionate number of less educated and lower-income people, a tax may well benefit them rather than harm them. To the extent that an excise tax decreases smoking initiation and helps to spur decreases in smoking, its beneficial effects may well be concentrated among the poorer members of society. For this reason, the concern about the regressivity of any tax increase seems to the committee to be somewhat overstated, even misplaced. Nevertheless, the main implication of concern regarding the regressivity of tobacco excise taxes, in the committee’s view, is that distributional concerns should be taken into account and that higher taxes should be coupled with state financing of cessation programs and services, especially for lower-income smokers.

New Measures

The states and the federal government should use tobacco excise taxes for the dual purposes of reducing consumption and funding tobacco control programs. Taking into account only tobacco control considerations, the committee believes that the ideal situation would be a uniform level of tobacco excise taxation for the entire nation at the highest feasible level. Feasibility here refers to the need to minimize cross-border smuggling and to minimize an unfair and politically unacceptable impact on current smokers, especially disadvantaged populations. A uniform tax would presumably be most efficiently administered at the federal level, although the revenues could be distributed to the states according to a mutually agreeable formula that would lead the states to refrain from exercising their own taxing authority; however, a plan under which the federal government “preempts” the field of tobacco excise taxation may be regarded as too radical at the present time.3 Another possibility would be for the federal government to coordinate a system that creates incentives for states to reduce the disparities in state excise taxes. In Chapter 6, the committee presents the outline of a plan under which the federal government would link the availability of federal subsidies for a state’s tobacco control expenditures to the amount of these tobacco control expenditures and the level of the state’s tobacco excise tax. Among other purposes, this plan is designed to use federal spending leverage to induce states with lower tobacco excise taxes to raise them, reducing the disparities in state excise taxes.

Unless and until the federal government takes on such a coordinating role, cross-state smuggling is likely to remain a serious problem. For the purposes of the policy blueprint being outlined in this chapter, the committee’s assumption is that the current legal structure of tobacco control will remain unchanged. On the basis of that assumption, the states will retain the responsibility to coordinate their own efforts. To help them do that, while increasing the overall level of tobacco excise taxation, the committee recommends the tobacco excise tax rates of the states in the top quintile become the target for the remaining states. (Currently, the lower bound rate for the top quintile is about $1.25 per pack. If states with lower rates were to move their tax rates toward those in the top quintile, the variation

in state excise tax rates—and the frequency of smuggling—would be substantially lowered.) As noted earlier, all states should earmark a statutorily prescribed portion of their excise tax revenues sufficient to fund tobacco control programs at a level recommended by the CDC.

Recommendation 2: States with excise tax rates below the level imposed by the top quintile of states should also substantially increase their own rates to reduce smuggling and tax evasion. State excise tax rates should be indexed to inflation.

The federal tobacco excise tax has traditionally served as a tool for raising revenue rather than as an instrument of tobacco control. However, for the reasons summarized above, the committee thinks that the federal tobacco excise tax rate should be increased substantially—at least on the order of $1.00 per pack—even if the federal government’s overall role in tobacco control remains a supportive one. The possibility of a more substantial federal role in tobacco control is explored in Chapter 6.

Recommendation 3: The federal government should substantially raise federal tobacco excise taxes, currently set at 39 cents a pack. Federal excise tax rates should be indexed to inflation.

SMOKING RESTRICTIONS

As noted in Chapter 3, grassroots advocacy for clean air laws was the first major achievement of contemporary tobacco control efforts. Despite continuing progress in expanding the reach of legislation restricting smoking in venues with significant public exposure, the task remains incomplete. Coverage of the existing state “smokefree indoor air” laws varies significantly. Table 5-2 summarizes the coverage of state laws as of the first quarter of 2005 (CDC 2005c). This section reviews current smoking restrictions and their effects in nonresidential indoor locations (workplaces and public accommodations), group residential locations (hospitals, nursing homes, and correctional facilities), private residences, and public outdoor areas.

Workplaces and Public Accommodations

The CDC data presented in Table 5-2 indicate that as of late 2005, most states now have some restrictions on smoking on public transportation, with 23 states banning it completely and 19 states requiring either separate ventilated areas or designated smoking areas. Similarly, 44 states have placed restrictions on smoking in government work sites. 16 of these states have enacted complete smoking bans in government workplaces.

TABLE 5-2 Scope of State Indoor Air Restrictions as of 4th Quarter, 2005

|

Location |

Banned (100% Smoke Free) |

Separate Ventilated Areas |

Designated Areas |

Any Restriction |

No Restrictions |

|

Bars |

6 |

2 |

4 |

12 |

39b |

|

Commercial day care centers |

29a |

3 |

6b |

38 |

13 |

|

Enclosed arenas |

12 |

3 |