J

Report of the Panel on DOE’s Natural Gas Exploration and Production R&D Program

INTRODUCTION

As part of the study by the Committee on Prospective Benefits of DOE’s Energy Efficiency and Fossil Energy R&D Programs, Phase Two (the committee), the Panel on Benefits of DOE’s Natural Gas Exploration and Production Program (the panel; see Attachment A) was appointed by the National Research Council in September 2005. The primary focus of the panel was to apply the committee’s prospective benefits methodology to R&D activities for natural gas exploration and production (E&P) in the Office of Oil and Natural Gas, which is part of DOE’s Office of Fossil Energy.

As noted in the next section, “Overview of the Natural Gas Exploration and Production Program,” the Office of Oil and Natural Gas will be impacted by the Energy Policy Act of 2005 (EPACT-2005, P.L. 109-58), Section J, Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Resources. Under EPACT-2005, royalties of $50 million per year will fund the E&P program, and a private consortium will be formed that will select R&D projects, which may result in a portfolio of projects different from those currently in the DOE program and being reviewed here by the panel. In addition, EPACT-2005 authorizes appropriations of up to $100 million per year. Nevertheless, Section J includes unconventional natural gas resource E&P technology, as well as the technology challenges of small producers. Both of these areas are covered in the existing E&P program. As a result of discussions among the committee chairperson, the panel chairperson, and DOE, the committee and panel chose to focus on four key subprograms of the Office of Oil and Natural Gas E&P program, which encompass DOE’s unconventional natural gas R&D projects: (1) existing fields; (2) drilling, completion, and stimulation; (3) Deep Trek; and (4) advanced diagnostics and imaging. The committee and panel believe that even with the changes that are expected to occur under EPACT-2005, a portion of the program will still focus on the areas addressed by the panel, so that any insights provided by the panel could help the Office of Oil and Natural Gas even as it transitions under EPACT-2005. It reviewed DOE’s estimates of the benefits of its program, reviewed projects in the portfolio, made judgments about technical risks and market risks, and worked with the committee’s consultant to apply the committee’s methodology to estimate overall technical and market risks and prospective net benefits to the nation for the E&P program as a whole. The four subprograms are discussed in more detail in the next section. In addition, like the other panels formed under the committee, the panel beta tested the committee’s methodology, and it offered comments to the committee about the efficacy of the methodology, noting what works well, what its limitations are, and what improvements may be necessary.1

OVERVIEW OF THE NATURAL GAS EXPLORATION AND PRODUCTION PROGRAM

As noted in the Office of Fossil Energy’s Natural Gas Technologies Program Plan (DOE, 2004b), the mission of the program is to develop environment-friendly technologies through R&D and policy options that will diversify natural gas supply options and steadily expand the nation’s economically recoverable gas resource base. The program, broadly speaking, includes three main areas: domestic supply, supply from global resources, and delivering America’s energy. The panel focused its review and evaluation efforts on DOE’s E&P activities to increase domestic supply but did not include methane hydrates;2 it also does not address “supply from global resources” or “delivering America’s en-

TABLE J-1 DOE’s Performance Targets for Expanding Domestic ERR by 50 Tcf Through 2015

|

Year |

Performance Milestones |

Contribution to Target (Tcf) |

|

2006 |

Develop technologies to increase gas finding efficiency, increase well productivity, reduce well abandonment, and address excessive water production from existing fields |

7 by 2015 |

|

2008 |

Develop technologies to reduce the cost of drilling for unconventional and other gas by 5% |

13 by 2015 |

|

2008 |

Provide technologies for hydrate avoidance or seafloor stability mitigation to assure the safety of ongoing deepwater hydrocarbon exploration |

2 by 2015 |

|

2011 |

Develop improved reservoir imaging systems to increase finding efficiency in unconventional gas reservoirs |

11 by 2015 |

|

2013 |

Develop reliable E&P systems for gas located 20,000 ft below the earth’s surface |

5 by 2015 |

|

2015 |

Develop integrated deep drilling system that reduces drilling cost by 30% |

10 by 2015 |

|

2007-2015 |

Develop environmentally sound approaches that minimize the gas E&P footprint, enabling expanded access to gas in environmentally sensitive areas |

2 by 2015 |

|

SOURCE: DOE. 2004b. Natural Gas Technologies Program Plan. Washington, D.C.: Office of Fossil Energy. |

||

ergy.” The objective shown in the Program Plan is to develop technologies by 2015 that expand the nation’s economically recoverable resources (ERR) by 50 trillion cubic feet (Tcf) while minimizing environmental impact.3 Table J-1 lists the performance targets for expanding the domestic ERR by 50 Tcf through 2015.

A variety of R&D projects are carried out in the three areas, which range widely in funding levels and duration; their descriptions are available on the National Energy Technology Laboratory (NETL) Web site.4 As noted in the “Introduction,” even though the E&P program may change as a result of Section J of the EPACT-2005, it is likely that R&D will continue in a number of the areas covered in the panel’s evaluation.5 In the President’s Budget Request (PBR) for 2007, the administration proposes to cancel the requirements in Section J of the Energy Policy Act of 2005 by means of a future legislative proposal.

The FY05 budgets for the key subprograms for enhancing domestic supply in DOE’s program were as follows:

-

Existing fields subprogram, $1.6 million;

-

Drilling, completion, and stimulation, $7.3 million;

-

Advanced diagnostics and imaging, $3.8 million; and

-

Deep Trek, $1.5 million.

These subprograms are described in more detail in the following sections. The PBR for FY06 did not ask for money for subprograms assessed by the panel; it requested $10 million for closeout of the natural gas technologies program. Nevertheless, the Congress appropriated a total of $33 million to the program. For the subprograms addressed by the panel, these appropriations include $9 million for advanced drilling, completion, and stimulation, including Deep Trek; $4 million to continue work aimed at expanding the recoverability of natural gas from low-permeability formations; and $2 million for stripper wells and technology transfer.

ASSESSMENT OF THE NATURAL GAS EXPLORATION AND PRODUCTION PROGRAM

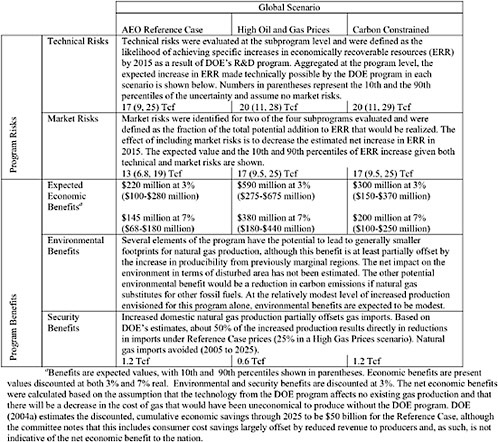

The committee’s methodology suggests that an assessment of the benefits of a specific subprogram should explicitly consider the role of DOE funding and the technical risks and market risks that can affect the outcome and the value of that subprogram’s activities. The methodology also requires that benefits be estimated under three different global scenarios representing possible future states of the world.

Role of DOE Funding

DOE defines the goals for its natural gas exploration and production R&D program in terms of additions to ERR that can be attributed to the success of DOE-funded research.

The panel adopted this definition as the basic metric to use in assessing technical and market success of the research program, and it developed estimates of the likely outcomes in each of the four subprograms in terms of the probability of adding specific amounts of ERR as a direct result of DOE’s R&D program. This framing of the goal created several complexities:

-

What is determined to be “economically recoverable” depends on assumptions about future gas prices. The panel addressed this by making separate estimates of the probability of reaching different levels of increased ERR for the three different global scenarios.

-

Several panelists felt that their estimate of DOE’s contribution to increases in ERR would be more informed if they had estimates of the total increase in ERR attributable to all R&D, but such estimates are not available nor are they readily attainable. After discussion, the panelists agreed to estimate the net benefit of DOE’s research directly rather than attempt to estimate separately the increase in ERR from all R&D (including DOE’s) and from all R&D except for DOE’s. DOE personnel provided an estimate that 20-25 percent of the total increase in production and reserves estimated by the Energy Information Agency (EIA) in its National Energy Modeling Systems (NEMS) analyses could be attributed to the DOE program. The panel interpreted that as meaning that the total anticipated increase in ERR is about four times the increase DOE estimates from its program.

Consideration of Global Scenarios

The panel considered the three global scenarios (defined in Appendix F) in estimating the probability of technical and market success: the AEO Reference Case scenario; the High Oil and Gas Prices scenario, where gas prices are assumed to be twice those in the AEO Reference Case; and a Carbon Constrained scenario, where a $100 per ton carbon emissions tax is assumed to be put in place in 2012. The scenarios affect the probability of technical success, in that higher gas prices and constraints in carbon emissions are believed to impact the quality and focus of the research, as well as the definition of what is economically recoverable. The scenarios affect the economic benefits by virtue of their impact on natural gas prices: at higher gas prices, more gas is economically recoverable.

The next four subsections cover the four main subprograms in the natural gas R&D program and present the panel’s assessment of the activities, issues, and technical and market risks in each subprogram.

Existing Fields Subprogram

Near-term efforts by DOE focus on maximizing the efficiency of recovery from existing wells and fields that are operating near the bottom margin of profitability. Generally speaking, these are low-volume stripper gas wells, defined by the Interstate Oil and Gas Compact Commission (IOGCC) as a natural gas well that produces 60 thousand cubic feet (Mcf) per day or less. This amount of gas is approximately the energy equivalent of the better known oil stripper wells, which produce fewer than 10 barrels of oil per day.

The IOGCC statistics indicate that marginal gas wells account for 8 percent of the total natural gas produced in the United States. This amount is approximately equal to coal-bed methane production and is therefore an important component of the nation’s domestic gas supply. An estimated 271,856 stripper wells produced from them 1.54 Tcf in 2004. The number of marginal wells and gas production from them have both increased each year from 2001 to 2004. Current marginal wells also represent a significant increase over 1995 figures of 159,669 wells and a production of 0.92 Tcf.

Although the number of stripper wells has increased, the average daily production per well, and therefore the production baseline that DOE R&D has to build up from, has stayed steady at 15+ Mcf/day for the last 10 years. Abandoned natural gas wells, like abandoned marginal oil wells, are those that have been permanently plugged. The IOGCC statistics show a significant trend: The total number of plugged stripper wells in 2004 increased for the fourth consecutive year, while demand for natural gas continued to rise.

DOE efforts have progressed: Previous research in secondary gas recovery in conventional fields has become advanced diagnostics research on optimal infill drilling practices to maximize recovery in tight and fractured accumulations. Additionally, an ultra-short-radius composite drill pipe is being developed that can be used to efficiently reenter existing wells and drill horizontally to maximize recovery. It is unclear to the panel how much of this research on infill drilling and composite drill pipe is directed at marginal wells.

Ongoing efforts focused at the well level (through NETL’s Stripper Well Consortium) are expected by DOE to result in the commercialization of an array of technologies in 2006 that will significantly reduce the incidence of premature plugging and abandonment of producing wells in existing fields. According to the Program Plan, p. 3, the performance target for existing fields is to “develop technologies to increase gas finding efficiency, increase well productivity, reduce well abandonment and address excessive water production.” These efforts are forecast to contribute approximately 7 Tcf of additional ERR by 2015. The 7 Tcf target is to be reached with a budget of $7.4 million over 5 years for the Stripper Well Consortium (with an additional $1.85 million dollars cost-share). An earlier project, Advanced Technologies for Stripper Wells, was funded at $245,714, with an additional cost-share of $141,000.

The benefits expected by DOE appear to the panel to be unrealistically high, given the relatively small research budgets, high market risks, and—but to a lesser extent—the technical risks. The technical risks are small compared to those

of other programs that emphasize exploration or drilling. The marginal wells exist and are currently productive. Some subset of the wells, however, could have problems with well bore stability, casing, and tubing because of age, corrosion, and lack of maintenance. In some instances, these problems may cost more to repair than could be realized by applying newly developed technology. Innovations and breakthroughs will require R&D that allows significant, inexpensive, incremental improvements in the life and/or production rates of the existing wells. It is not clear to the panel that the DOE Stripper Well Consortium is the most effective approach to funding the bulk of this R&D.

Marginal gas wells are operated (for the most part) by small independent operators, not major oil and gas companies. These operators number in the thousands and may have little access to research funds or even, perhaps, to technical literature. Market risks are primarily affected by (1) the unavailability of capital for some of the producers, (2) the lack of a mechanism to effectively transfer information on improved/advanced technology to the thousands of producers, and (3) no way to make small producers aware of the benefits their investment would bring.

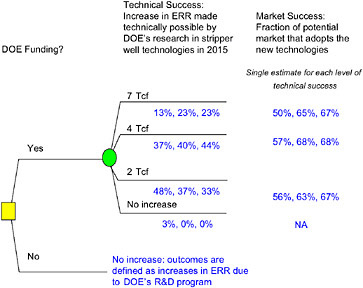

The panel was asked to evaluate the probability of DOE achieving technical success defined as the increase in ERR by 2015 made possible by DOE’s research in stripper well technologies. It identified four possible outcomes, illustrated in the decision tree in Figure J-1. The panel defined market success as the fraction of the potential market that would implement the technologies at a given level of technical success. Combining these assessments yields an estimate of the expected increase in ERR attributable to the existing fields subprogram, as shown in the first row of Table J-2. The table shows estimates of the increase in ERR for each of the subprograms—first DOE’s estimates and then the average of the panel’s estimates under each global scenario. A range of individual opinions was offered by panel members, with the table also showing the lowest and the highest ERR estimates. The panel discussed the range of assessments and felt that an average value would best represent the expertise of the group and should be the basis for the benefits calculations described below.

Drilling, Completion, and Stimulation Subprogram

Drilling is the most costly item in producing unconventional gas resources and makes it uneconomical to develop many unconventional gas fields. DOE is working on new tools that will drill faster and instruments that help avoid expensive drilling problems, including laser-, percussion-, and hydraulically pulsed drills that have the potential to drill faster and to significantly reduce drilling costs.

Work is also under way on improving surface and down-hole instruments and on speeding up data transmission from the bottom of the well. These tools will allow drillers to optimize drilling operations, to drill into higher temperature environments, and to detect well problems before they become major.

Lightweight, flexible composite drill pipe will increase the depth to which vertical and horizontal wells can be drilled and allow the drilling of horizontal wells of smaller

FIGURE J-1 Decision tree for the existing fields subprogram. Values under each branch are the average of the panelists’ estimates of the probability of that technical outcome for the Reference Case, the High Oil and Gas Prices, and the Carbon Constrained scenarios, respectively.

TABLE J-2 Panel Assessments of Technical and Market Risks for Each Subprogram (trillion cubic feet)

radius to intersect natural fractures and thereby increase gas production. Work is also under way on a horizontal drilling system to improve gas production from highly fractured and faulted complex gas reservoirs that are difficult to produce economically with current drilling systems.

DOE is participating in a joint industry project to improve ultra-deep-water drilling through the development of better subsea data processing, composite production risers, and deepwater casing drilling systems. DOE partners on this project include two large operators and four large service companies, so this technology should be quickly applied once developed. The potential payout for this project is very high because of the high costs and high risks associated with ultra-deep-water drilling.

This novel drilling R&D has the potential to make breakthrough improvements rather than the incremental improvements typically made by oilfield service companies. Drilling improvements made by DOE are also applicable to conventional oil and gas wells, so the potential payouts are much larger than improvements applicable to unconventional gas wells alone.

The technical risk for any one of these breakthrough drilling projects is high, but the probability of succeeding on one or two of these high-payout projects is also high. On the other hand, the market risk for such projects is low, because new drilling technology is quickly implemented throughout the industry. The fact that operators jointly develop many offshore fields leads to widespread technical interchange throughout the industry.

Well completions are extremely important, because improper completions can damage well bores and reduce gas production by up to 50 percent. This is especially important with unconventional gas reservoirs, because many of them have very low permeability, resulting in low gas production rates and marginal economics.

DOE is conducting R&D on the use of Aphron drilling and completion fluids that will temporarily seal off fractures and pores so that gas pay zones are not permanently damaged while drilling. These fluids allow the fractures and pores to open up once the wells have been drilled and put into production.

Essentially all of the unconventional gas wells are in tight reservoirs where the permeability of the rock is low, limiting gas flow toward the well bore. In many cases these wells cannot produce natural gas economically unless there are natural fractures that allow the gas to flow more readily to the well bore. DOE has a project to improve mapping natural fractures so that horizontal wells can be drilled through the most productive parts of the reservoirs.

Work is also under way on a down-hole power generation and wireless communications system for intelligent completions that will allow gas production to be optimized throughout the life of wells. This wireless system continuously measures down-hole temperatures and eliminates the electrical cables used with existing systems, reducing their cost and improving reliability.

A down-hole fluid analyzer is being developed that will measure the fluid fractions (water, oil, gas) produced down-hole in real time as the well is produced so that the well’s production can be optimized and remedial actions taken if problems develop. This system transmits data from the well bottom to the surface of the well using a fiber-optic cable for data transmission.

Stimulation of unconventional gas reservoirs is important because of the low permeability of many of these reservoirs. The fracture mapping systems described in the foregoing dis-

cussion on completions are a key to drilling horizontal wells into the most productive parts of reservoirs to maximize gas production. These stimulation projects relate primarily to the detection and mapping of natural fractures. The panel encourages the DOE to initiate projects to develop improved hydraulic fracturing techniques or novel drilling techniques to connect existing natural fractures to well bores.

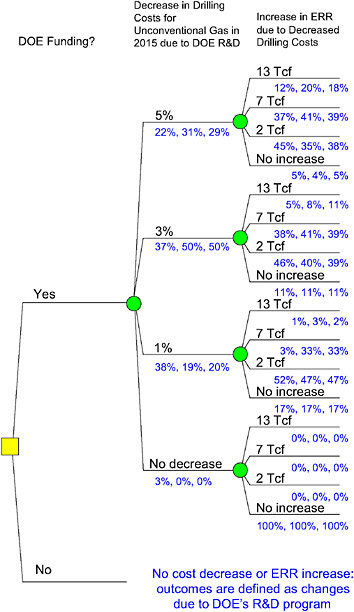

As shown in Table J-1, the goals defined by DOE for drilling, completion, and stimulation for unconventional resources are to reduce the cost of drilling for unconventional and other gas by 5 percent, resulting in a 13 Tcf increase in ERR by 2015. The panel characterized uncertainty about technical success for this program in terms of the decrease in drilling costs and the increase in ERR that would result from specific decreases in drilling costs, as shown in the decision tree in Figure J-2. The panel does not believe there are any significant barriers to market adoption of these technologies, so no market risks were evaluated. The second row of Table J-2 shows the results of the panel’s assessments.

Advanced Diagnostics and Imaging Subprogram

Seismic imaging of the subsurface geologic structures is widely used for oil and gas E&P. Most of the imaging is done with arrays of seismic sources and receivers at the surface and highly advanced processing of the data to obtain a 3-D image of the subsurface. Through diagnostic analysis of seismic phases (e.g., attributes), the seismic imaging not only detects potential reservoirs but also determines their fluid (oil, gas, brine) content. By repeating the imaging of the same reservoir at successive times (called 4-D seismic for the three dimensions of space and one dimension of time), it has been possible to monitor the changes in oil-water contact and other fluid properties in the reservoir. In that sense, 4-D seismic has become an important part of reservoir monitoring.

Most advanced applications of seismic imaging have been used for conventional oil and E&P. Offshore prospects have been the favored targets because it is relatively easy to acquire seismic data in the marine environment. Seismic imaging on land has lagged because of the cost and the difficulties arising from the topographic and near-surface geologic heterogeneities. In addition, unconventional gas E&P made up a smaller market share than the conventional oil and gas E&P. As a result, geophysical service companies have not moved aggressively to develop imaging and diagnostic techniques for the unconventional gas prospects.

The DOE natural gas R&D program has been playing a very important role in applying advanced seismic imaging methods to unconventional gas fields. The DOE program directed its limited resources wisely to get the most for its investment. First, it supported meetings and consortia to bring new developments and technologies to the attention of the small producers without large R&D budgets. Second, it cofinanced with industry some new technologies relevant to unconventional gas and helped to implement them. Third, they financed some well-chosen advanced R&D efforts directly relevant to unconventional gas. Without the DOE funding it was unlikely that this R&D would have started.

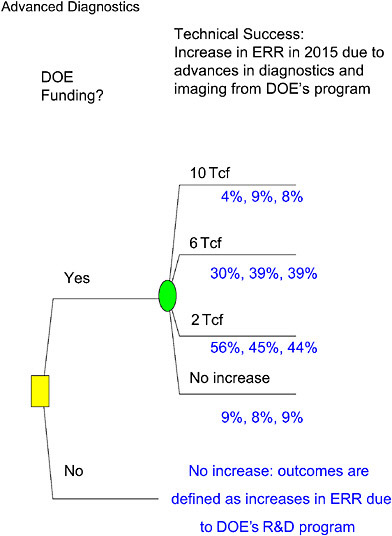

The projects were chosen well and assigned to competent groups. Overall, they were very successful technically. The performance milestone for this program is to increase ERR by 11 Tcf by 2015, as shown in Table J-1. The panel characterized uncertainty about technical success for this program directly in terms of the increase in ERR that would result from the research sponsored by the DOE, as shown in the decision tree in Figure J-3. In the past, industry was eager for technological innovations to improve productivity, and since the industry was directly involved in most DOE-sponsored imaging projects, new developments were adopted naturally. The panel does not believe there are any significant barriers to market adoption of the technologies currently under development, and so it did not evaluate market risks.

The third row of Table J-2 shows the panel’s assessment of the ERR increase attributable to the DOE program in advanced diagnostics and imaging.

The panel commends DOE for its subprogram on advanced diagnostics and imaging.

Deep Trek

The goal of the DOE/NETL Deep Trek subprogram is to develop technologies that lower the cost and improve the efficiency of drilling and completing deep wells. New tools and technologies that help operators safely drill faster, deeper, cheaper, and cleaner will help ensure an adequate supply of clean-burning natural gas for the nation.

According to the Office of Fossil Energy’s Natural Gas Technologies Program Plan (DOE, 2004b, p. 5), targets for Deep Trek are as follows:

to provide fundamental advances in high-temperature, highpressure materials and electronics (target 2007) that will enable the construction of durable deep drilling tools (2010). These tools will then be integrated into a field-tested and demonstrated deep drilling system (target 2015) that will result in major reductions in the cost … and risks … of deep drilling (target 2013). In addition, a new initiative in improved diagnostic and imaging technologies tailored for deep gas exploration and development … further improving deep gas economics. Together, these two initiatives will result in the expansion of the ERR [economically recoverable reserves] by approximately 15 TCF through 2015.

Currently budgeted at $1.5 million for FY05, Deep Trek will benefit industry with a diverse number of program areas that enable access to resources below 20,000 feet, including but not limited to

-

Imaging superdeep gas plays across the Gulf of Mexico shelf,

-

High-temperature down-hole electronics,

FIGURE J-2 Decision tree for the drilling, completion, and stimulation subprogram. Values under each branch are the average of the panelist’s estimates of the probability of that technical outcome for the Reference Case, the High Oil and Gas Prices, and the Carbon Constrained scenarios, respectively.

-

High-temperature/high-pressure measurement while drilling (MWD) tool,

-

Supercement,

-

Down-hole vibration monitoring and control, and

-

In-house high-temperature drilling laboratory.

Funding to date for the Deep Trek program has totaled over $16 million, with nearly $9 million contributed by research partners.

All of these technology areas are priority items for private industry and would probably eventually be developed anyway, but DOE’s R&D program could still have a significant

FIGURE J-3 Decision tree for the advanced diagnostics and imaging subprogram. Values under each branch are the average of the panelist’s estimates of the probability of that technical outcome for the Reference Case, the High Oil and Gas Prices, and the Carbon Constrained scenarios, respectively.

impact. Though industry projects long-term economic value for development of the technology, the present-day value of expenditures may be an even greater consideration. When prices are high, drilling becomes more economical. Companies tend to accept more drilling risk when they expect the return on investment to be greater. Though R&D continues during such times, drilling outpaces it. In low-price environments, drilling activity decreases, and funds available for R&D typically decrease as well. R&D by DOE to achieve long-term technological advances during low-price environments would bear fruit during future high price environments, when drilling activity increases. Assuming the resource does exist in substantial amounts, the question is whether DOE-funded research will be both successful and well-timed relative to industry-funded research to claim credit for a significant proportion of the resources that are ultimately discovered.

Though its R&D will certainly have a beneficial impact

on recovering resources at depths greater than 20,000 feet (and more likely down to 30,000 feet in the Gulf of Mexico shelf), DOE probably takes more credit for the future success of this program than it deserves. On the other hand, DOE’s investment in Deep Trek encourages deep gas exploration by keeping it up to speed and facilitating R&D with industry through technology transfer and exchange. It is the opinion of the panel that DOE’s policy role is just as important as the dollars it spends. DOE should keep up its investment in this important R&D area.

The potential benefits of Deep Trek depend on whether a substantial gas resource exists in the United States at depths below 20,000 feet. Currently, there are only two substantial very deep gas plays in the nation: (1) the deep Norphlet play around Mobile Bay in the eastern Gulf of Mexico, with 7 Tcf, and (2) the deep Madison in Wyoming’s Wind River Basin (Madden field), with 2 Tcf. Both were discovered in the 1980s. Uncertainty about the existence of very deep gas is caused by two factors: the adverse effects of the high pressures and high temperatures at great depths on reservoir quality and the adverse effects of high temperatures on gas quality. Gas below 20,000 feet is likely to be found only where the thermal gradient is low and where early migration and the characteristics of the reservoir matrix permit porosity and preserve permeability. That such resources are limited was indicated by drilling activity on the Gulf of Mexico Outer Continental Shelf (OCS) in 2004. Of 1,050 total shelf completions in what is considered the most promising area in the country for very deep exploration, there were only 15 completions between 16,000 and 18,000 feet true vertical depth, 3 between 18,000 and 20,000 feet, and none below 20,000 feet.

The EIA estimated that 7 percent of all U.S. natural gas production came from deep formations between 15,000 and 20,000 feet in 1999 and said that was expected to increase to 14 percent by 2010. The new production will come from the Rocky Mountains, the Gulf Coast, and the Gulf of Mexico. Seismic imaging techniques utilize ocean-bottom-cable technology for data acquisition. The benefit is that sensors can be deployed close to platform legs, wellheads, and other obstacles and receivers can be extended to greater offset distances. This allows flexibility in placing receiver stations at optimal positions for imaging superdeep geologic targets. Data are being collected to demonstrate both the capabilities and limitations of the technology. This project is making considerable progress and has been tested to 30,000 feet, at which depth it provides excellent images.

In many of the deep drilling applications progress has been made toward developing prototypes of wireless communications, stimulation, and completions, or of other technologies. These prototypes have been tested in the laboratory and, in some instances, in the field. For example, a harshenvironment solid-state gamma detector for down-hole gas and oil exploration was tested in the first phase and a decision is pending on whether to proceed with the second phase.

DOE R&D promotes shared development of technology. Primarily, industry relies on service companies for drilling technologies in hazardous high-temperature, high-pressure environments. When provided by service companies as a product, the technology is available to all consumers. However, the cost may be so high that only large companies can afford to utilize the technology. Technologies that are developed by DOE could be made available to a greater portion of the market at a lower cost, enabling more industry competitors to utilize the technology. Technologies developed in-house, held as proprietary, and not shared would give their owners a competitive advantage, and fewer companies would be able to participate in drilling for deeper gas resources without DOE R&D, fewer resources would be developed for consumers, and gas prices would probably be higher.

Industry is concentrating new efforts on drilling deep gas plays both onshore and across the Gulf of Mexico OCS. A multitude of challenges are encountered in this newly evolving prospective arena. As very few wells have been drilled to 30,000 feet, seismic data are the primary tool for exploration, and seismic imaging techniques become critical. Already, industry has taken advantage of partnering with universities in seismic imaging techniques. This partnership also should be a driver supporting university geoscience department enrollment, a critical but declining skill set. The mean age of geoscientists in industry is 47. By 2008, 80 percent of the oil and gas industry’s workforce will be eligible for retirement. Geoscience enrollment in universities has steadily declined since 1985 from approximately 12,000 graduates per year to fewer than 8,000, of whom only 2,000 or so are enrolled in graduate research programs, where the R&D partnership with universities is focused (Hill, 2002). DOE partnering with universities in R&D projects will help develop and sustain a workforce with the critical skills required for continued exploration and development of oil and gas resources.

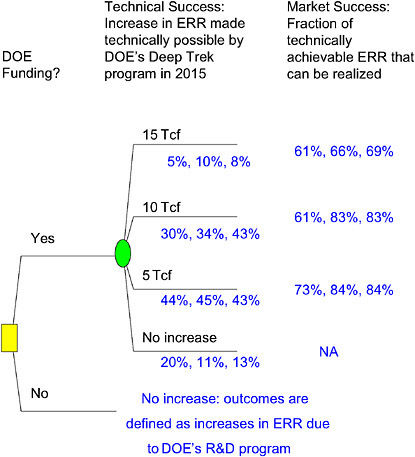

As described previously, the performance milestone for the program is an addition of 15 Tcf to ERR by 2015. The panel identified both technical and market risks associated with this goal. Uncertainty about technical success was characterized directly in terms of the estimated increase in ERR that would result from the program. Four different levels of ERR addition were identified, as illustrated in the decision tree in Figure J-4, and the panelists estimated the likelihood that DOE’s R&D program would result in each of the specified levels of ERR increase. Owing to the highly exploratory nature of the Deep Trek program and the anticipated difficulties of accessing deepwater resources even if the Deep Trek program is successful, the panel believes market penetration of the technologies is a significant uncertainty. The panel defined market success as the fraction of the technically achievable ERR that will ultimately be achieved.

The fourth row of Table J-2 shows the panel’s assessment of the technical and market risks associated with the Deep Trek program.

FIGURE J-4 Decision tree for the Deep Trek subprogram. Values under each branch are the average of the panelist’s estimates of the probability of that technical outcome for the Reference Case, the High Oil and the Gas Prices, and the Carbon Constrained scenarios, respectively.

RESULTS AND DISCUSSION

The assessments described above and illustrated in the decision trees result in an estimate (with uncertainty) of the increase in ERR attributable to each specific subprogram. Because the benefits of the R&D program will be estimated for the program as a whole (see following section), these subprogram-level assessments were combined to generate an estimate of the total increase in ERR attributable to the R&D program.

Table J-2 summarizes the results of all the technical and market success assessments at the subprogram level. Each of the three global scenarios is represented, with the expected value (the probability weighted average) of the increase in ERR attributable to the R&D program. The final row of Table J-2 shows both the average and the highest and lowest individual estimates of increase in ERR attributable to the program.

Benefits Estimation

Increases in ERR for natural gas resources result directly in economic, environmental, and security benefits for the nation. The panel relied heavily on DOE’s own evaluation and quantification of the benefits associated with its natural gas R&D program in estimating those benefits6 but also made several important modifications.

Economic Benefits

The primary economic benefits that result from increases in ERR come in the form of reduced costs of production and increased domestic natural gas production. Based on DOE’s benefits analysis, about 23 percent of the total increase in ERR over the 2003 to 2025 time period translates into increases in expected production. Of the total estimated increase in expected production, roughly 58 percent is realized as increased production and the remainder is added to proved reserves (DOE, 2004a, pp. 41 and 102). Using these scaling factors and the average of the panel’s estimates of the ERR increase due to the R&D program (13 Tcf by 2015) results in an estimated increase in cumulative domestic natural gas production of about 1.7 Tcf by 2015 in the AEO Reference Case scenario. The panel also notes that DOE incorporates estimates of risk into its benefits calculations based on the assessments of its program managers in the various technology areas.

DOE estimates the economic benefits of its R&D program as the total consumer energy savings resulting from the increased domestic natural gas production attributed to the program. For each year, DOE estimates a change in natural gas price that results from the increase in supply and multiplies the reduction in gas price by the total gas consumption for that year to yield the reduction in consumer expenditures on natural gas.

As pointed out in the Phase One report, these benefits—savings to consumers—do not measure the economic benefits to the nation of the program. If the research being evaluated changes the cost of production only for the natural gas that would not otherwise be produced—that is, if the cost of production for the vast majority of domestic gas produced in a given year is unchanged by the research—then the consumer savings from reduced prices are offset by the reduced revenues to producers. This is a transfer payment rather than an economic benefit to the nation.

Both the Phase One committee and DOE have noted that a more appropriate economic benefits measure would include not only the cost savings to consumers but also the reduced revenues of the producers—that is, the economic benefit measure should be the net consumer and producer surpluses. DOE has developed a framework for evaluating the net surplus associated with a change in the supply curve for natural gas and presented this method both to the panel and to the Phase Two committee.7 DOE’s net surplus evaluation requires multiple evaluations with NEMS, which the panel was not able to implement independently, and existing preliminary analyses by DOE could not be modified to extract the benefits of the natural gas E&P program alone. The panel implemented a simplified version of this approach to estimate economic benefits.

The details of the economic basis and the calculations are included in Attachment B. To implement this approach for estimating economic benefit, the panel estimated two quantities: (1) the amount of domestic natural gas production (and the fraction of total domestic natural gas production) in each year that is produced at reduced costs due to DOE’s E&P research and (2) the reduction in the costs of production for that natural gas.

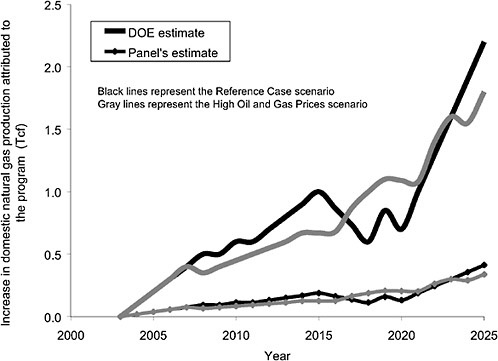

First, because the research being evaluated addresses only a small fraction of the total domestic natural gas production (stripper wells and unconventional resources), the results of such research are assumed to reduce the costs of production for only a small fraction of the total domestic natural gas produced in any given year—just the portion that would not have been produced otherwise. Figure J-5, derived from DOE (2004a), illustrates DOE’s and the panel’s estimates of the annual increase in domestic natural gas production attributed to the natural gas R&D program. The panel’s estimates are a simple scaling of DOE’s estimates, based on the ratio of DOE’s estimate of increased ERR to the panel’s estimate of increased ERR attributable to the program, and the fraction of increased ERR assumed to become increased production from DOE’s benefits analysis. The Reference Case and High Oil and Gas Prices scenarios are shown. DOE does not have a projection for a scenario analogous to the Carbon Constrained scenario, so the Reference Case projections for increased production were used to estimate benefits for that scenario.

The change in the costs of production for natural gas that is produced as a result of advances from the drilling, completion, and stimulation subprogram was estimated directly by the panel, as described previously and shown in the decision tree in Figure J-2. Cost reductions due to the other subprograms were not estimated directly, and simplifying assumptions were made to derive an estimate of those cost reductions. Noting that the magnitude of ERR in each of the programs is reasonably close to that of the drilling, completion, and stimulation subprogram, a reasonable estimate of the cost reduction was assumed to be the middle value provided for that program, or 3 percent for all incremental production attributed to the other three subprograms.

The resulting estimated economic benefits of the program from 2006 through 2025 are $220 million, $590 million, and $300 million in the Reference Case, High Oil and Gas Prices, and Carbon Constrained scenarios, respectively, with annual benefits discounted at 3 percent as recommended by the Phase Two committee. DOE’s estimate of the discounted cumulative economic savings through 2025 from reduced natural gas prices for the Reference Case scenario is about $50 billion, assuming the program goals are met (DOE, 2004a, p. 105), but the panel notes again that this is an estimate of consumer cost savings rather than an economic benefit to the nation and thus is not directly comparable with the panel’s estimate.

Figure J-6 summarizes the panel’s estimates of the risks

FIGURE J-5 Estimated increase in domestic natural gas attributed to the program by year.

and benefits of DOE’s natural gas exploration R&D program. Benefits are calculated as described in Chapter 3 and are reported for all three global scenarios.

Environmental Benefits

In many ways natural gas is the ideal fuel for residential and commercial heating and for generation of electricity. It is also a very important feedstock for the chemical industry. Natural gas is the cleanest burning fossil fuel; of all fossil fuels produces the least carbon dioxide per unit of energy generated and the least amount of other noxious by-products. It also requires less capital investment for combustion equipment than coal or oil. The distribution system is well developed in most parts of the country and relatively safe. Whenever natural gas can be substituted for coal or oil, the result is less emissions of greenhouse gases and cleaner air and generally a cleaner and safer environment. Truck traffic and rail traffic are reduced. Every increase in the use of natural gas at the expense of other fossil fuels results in environmental benefits.

Improvements in the quality of geophysical exploration and in drilling technology, and in the technologies that enhance recovery, result in more gas produced per well and, overall, in a smaller footprint for the production activity, reducing the total impact on the environment. This is somewhat offset by the increased capacity to produce from more remote regions and by the consequent increase in wells in such regions.

Security Benefits

According to a report by the NRC (2002b), which included attention to the security of energy systems in the United States, the U.S. economy and quality of life require a plentiful and continuous supply of energy. Though energy accounts for less than 10 percent of the GNP, much of the remaining economy will not function without energy assets.

FIGURE J-6 Results matrix of the Panel on DOE’s Natural Gas Exploration and Production Program.

Oil products provide 97 percent of the energy used in the transportation sector, while natural gas provides over 25 percent of residential and industrial energy needs. A significant disruption to either of these basic resources for more than a few days would have serious consequences for the U.S. economy and the health and well being of the population (NRC, 2002b). (Interruptions in oil supply can be mitigated for a time by the Strategic Petroleum Reserve, but there is no such reserve to mitigate interruptions to natural gas supplies.) At the present time the United States still imports a relatively small amount of natural gas, but projections call for this to increase. To the extent that domestic production can be increased, imports can be lessened. Every additional cubic foot that is produced domestically means a cubic foot less imported from overseas. Reducing the number of LNG tankers delivering natural gas improves the balance of trade and reduces the security risk of disruptions in the supply from abroad, as well as security risks to LNG facilities.

The vulnerability of key infrastructure components is an important component of the energy security issue. Industry is not capable of handling extensive organized acts of terrorism with weapons or explosions, cyberattacks on control systems via the Internet, or natural disasters that impact key elements of the energy system. Each of the natural gas R&D subprograms examined by the panel is designed to enhance exploration for and development of additional resources. Though DOE R&D could enhance national security, none of these subprograms has a goal of decreasing the vulnerability of the U.S. natural gas economy vulnerability to disruptions in supply. Although it did not have the resources and task

to investigate the area of vulnerability and infrastructure security, the panel believes there is a need for government (probably through the Department of Homeland Security) and industry to share the cost and execution of the needed R&D, with the government contributing, as appropriate, its expertise in this matter.

Increased domestic natural gas production partially offsets natural gas imports. Based on DOE’s estimates, about 50 percent of the increased production directly reduces imports under Reference Case prices, and about 25 percent of increased production offsets imports in the High Oil and Gas Prices scenario.

SUMMARY AND RECOMMENDATIONS

The panel reviewed four subprograms of DOE’s natural gas activities: existing fields; drilling, completion and stimulation; advanced diagnostics and imaging; and Deep Trek. It considered three global scenarios in estimating the probability of technical and market success: the AEO Reference Case scenario; a High Oil and Gas Prices scenario, where gas was assumed to cost twice as much as in the AEO Reference Case; and a Carbon Constrained scenario, where a $100 per ton carbon tax was assumed to be in place in 2012.

DOE natural gas R&D budgets are small compared to industry natural gas R&D budgets and are likely to consist of early development and seed funding efforts as opposed to complete R&D through to final development and commercialization. This makes assessment of the ultimate benefit of the research efforts of DOE relative to that of private sector efforts particularly difficult, in that numerous additional steps must be funded and taken beyond the R&D projects being evaluated before benefits will actually be realized. For this program, it is also difficult to separate gas from oil R&D in many cases: For example, drilling is relatively similar whether for oil or for gas, and gas drilling R&D has the potential to reduce drilling costs for oil resources as well. Nevertheless, the panel found that the decision tree probabilistic assessment approach was a well-organized way to convert the expert knowledge of the panel members into quantifiable measures. The utility of the decision tree approach was that (1) it provided a logical template for experts in quantifying their evaluations and (2) the results for different scenarios could be compared since they are arrived at following a uniform methodology.

While the panel’s estimates of ERR and the resulting economic benefits were substantially lower than DOE’s estimate, the panel’s estimates show, nonetheless, a significant and justifiable return on the modest R&D investments of DOE, both in terms of ERR added to the nation’s resources base and the economic benefits resulting therefrom. This is especially true in the High Oil and Gas Prices scenario, which seems the most likely scenario for the United States. In addition, although it is difficult to value, the DOE program sponsors of university research in the natural gas E&P area, which in turn fosters the development of a high-level technical workforce.

The panel recognized the substantial benefits of increased consumption of natural gas relative to that of other fossil fuels and notes that the United States, and indeed the world, is at the threshold of a methane economy, where natural gas, both as a clean, efficient fuel and as a source of hydrogen, is the transition fuel to a carbon-free fuel economy. In the United States the bulk of future additions of natural gas from the resource base will come from so-called unconventional natural gas resources. Whether these resources can be available at an affordable price will depend heavily on the development and application of advanced technology. This is particularly significant in North America, where production will be less and less able to meet needs, and more and more natural gas will be purchased by the United States. Much of this LNG will be landed in the Gulf Coast area, and the hurricanes of 2005 have had an impact. Operational dates for much LNG landing capacity in the Gulf Coast area are likely to be as much as 5 years as new locations, designs, regulations, and hurricane requirements are included. This may increase the cumulative price of North American gas over the next decade.

In North America, the only two large, yet (relatively) untapped gas resources are low-permeability shales and ultradeep gas. Both have major uncertainties. For low-permeability shales, industry estimates are currently that 8-12 percent of the gas in place can practically be recovered in the next decade or two. If this were 2-3 percent, the quantity of gas recovered would be very small; if it were 25-30 percent, the quantity would be very large. For the recovery of ultradeep gas, how to create and maintain permeability for gas recovery under the extremely high stresses that prevail remains an unsolved problem. Therefore, gas R&D opportunities are significant, so successful R&D would also be significant. The panel concludes that the DOE program now in place is geared to such development and application.

The panel is mindful that as the Energy Policy Act of 2005 makes itself felt, the future funding structure for federally supported R&D in natural gas will likely differ from the structure in place and evaluated by the panel, but it judges that the program for developing unconventional natural gas will follow the same basic thrust.

Finally, the matter of the accrued value of DOE’s R&D continues to be the subject of many studies, panel discussions, technical associations, and other groups. None of these efforts—even those looking back on completed R&D and technology successes that have occurred since the R&D was performed—can quantify precisely the dollar return on the R&D investment. Nevertheless, because they seem to be the best way to grasp the benefits, such attempts at quantification continue and their value seems to be well recognized, as is demonstrated by the large voluntary investments that continue to be made by industry. At a minimum, industry apparently believes that investment in R&D returns at least as much as capital spending on ongoing or new business devel-

opment—otherwise resources would go to capital spending as opposed to R&D investments. The panel commends the DOE natural gas program on including risk in its estimate of benefits but urges DOE to continue to pursue its proposed approach to evaluating the net benefits to the nation. Following up on and refining what the panel and the Phase Two committee have done will help in focusing the new efforts that come out of the EPACT-2005, Section J, initiative.

Recommendation: The DOE Office of Natural Gas should continue to pursue its proposed methodology for evaluating the “net benefits to the nation” of their R&D programs, so as to develop more accurate estimates of R&D benefits.

Recommendation: As the natural gas program changes under the EPACT-2005, DOE, in following up on the methodology of the full committee, should use its more accurate method of estimating R&D benefits to help focus its new R&D efforts.

ATTACHMENT A

PANEL MEMBERS’ BIOGRAPHIES

William L. Fisher (NAE), Chair, holds the Leonidas Barrow Chair in Mineral Resources, Department of Geological Sciences, University of Texas at Austin. His previous positions at the University of Texas at Austin have included director and state geologist of Texas, Bureau of Economic Geology; director, Geology Foundation; chairman, Department of Geological Sciences; and Morgan J. Davis Centennial Professor of Petroleum Geology. He has been assistant secretary, energy and minerals, U.S. Department of the Interior and deputy assistant secretary, Energy, U.S. Department of the Interior. He is a fellow of the Geological Society of America, Fellow of the Texas Academy of Science, Fellow of the Society of Economic Geologists, and member of the National Academy of Engineering. He has served on numerous federal government committees and councils and NRC committees. He served on the NRC Committee on Benefits of DOE’s R&D in Energy Efficiency and Fossil Energy, a precursor to the current study. He has expertise in energy policy, oil and gas resources and recovery, fossil fuel exploitation and technology, geology, and mineral resource policy. He has a Ph.D. in geology from the University of Kansas.

John B. Curtis is a professor in the Department of Geology and Geological Engineering and director, Petroleum Exploration and Production Center/Potential Gas Agency at the Colorado School of Mines. Dr. Curtis has been at the Colorado School of Mines since July 1990. Before that, he had 15 years experience in the petroleum industry with Texaco, Inc., SAIC, Columbia Gas, and Exlog/Baker-Hughes. Dr. Curtis serves on and has chaired several professional society and natural gas industry committees, which included the Supply Panel, the Research Coordination Council, and the Science and Technology Committee of the Gas Technology Institute (Gas Research Institute). He co-chaired the American Association of Petroleum Geologists (AAPG) Committee on Unconventional Petroleum Systems from 1999-2004 and is an invited member of the AAPG Committee on Resource Evaluation and its Committee on Research. He was a counselor to the Rocky Mountain Association of Geologists from 2002 to 2004. He is an associate editor of the AAPG Bulletin and The Mountain Geologist. He has published studies and given numerous invited talks on hydrocarbon source rocks; exploration for unconventional reservoirs; and the size and distribution of U.S.; Canadian and Mexican natural gas resources, and comparisons of methodologies for resource assessment. As director of the Potential Gas Agency, he directs a team of 145 geologists, geophysicists and petroleum engineers in their biennial assessment of remaining U.S. natural gas resources. He teaches petroleum geology, petroleum geochemistry, and petroleum design and stratigraphy at the Colorado School of Mines, where he also supervises graduate student research. He received a B.A. (1970) and M.Sc. (1972) in geology from Miami University and a Ph.D. (1989) in geology from the Ohio State University.

Sidney J. Green (NAE) is chairman and chief executive officer of TerraTek in Salt Lake City, a geotechnical research and services firm focused on natural resource recovery, civil engineering, and defense problems. Previously, he worked at General Motors and at the Westinghouse Research Laboratory. He has an extensive background in mechanical engineering, applied mechanics, materials science, and geoscience applications. He has extensive experience in rock mechanics, particularly as related to oil and gas and other natural resource recovery. Expertise includes research and development, multidisciplinary problem solving, management, and corporate structure organization. He has experience in taking research to commercial application and in entrepreneurial high-technology business development. He is a former member of the NRC Geotechnical Research Board. He was named Outstanding Professional Engineer of Utah and received the ASME Gold Medallion Award and the Society of Experimental Mechanics Lazan Award. Mr. Green received a Degree of Engineer from Stanford University in engineering mechanics, an M.S. degree from the University of Pittsburgh, and a B.S. degree from the University of Missouri at Rolla, both in mechanical engineering.

Patricia M. Hall is currently BPs geoscience recruiting manager and early development program coordinator. Earlier she was a senior geologist for BP, where her primary assignment was evaluating complex subsalt regional basins and the frontal fold belt in the Gulf of Mexico Deep Water Exploration Group. Ms. Hall has held numerous positions as a geologist with Shell, Amoco, and the Gulf Exploration and Preproduction Co. Ms. Hall is the chairperson of the National Association of Black Geologists and Geophysicists and a member of NASA’s Minority Education Awareness Committee.

Previously she was co-chair of the annual conference of the National Association for Black Geologists and Geophysicists in 2001 and chair of the Geological Society of America’s Committee for Women and Minority Geoscientists in 1996. Ms. Hall received her B.S. in earth sciences and her M.S. in geology from the University of New Orleans.

Martha A. Krebs is director, Energy R&D Division, California Energy Commission. Prior to that she was a consultant with Science Strategies. She was a senior fellow at the Institute for Defense Analyses (IDA), where she led studies in R&D management, planning and budgeting. She has extensive experience in DOE’s basic and applied energy programs. Dr. Krebs also served as DOE assistant secretary and director, Office of Science, where she was responsible for the $3 billion basic research programs that underlay DOE’s energy, environmental, and national security missions. She also had the statutory responsibility for advising the secretary on the broad R&D portfolio of DOE and the institutional health of its national laboratories. She has been associate director for planning and development, Lawrence Berkeley National Laboratory, where she was responsible for strategic planning for research and facilities, laboratory technology transfer, and science education and outreach. She also served on the House Committee on Science, first as a professional staff member and then as subcommittee staff director, responsible for authorizing DOE non-nuclear energy technologies and energy science programs. She is a member of Phi Beta Kappa, a fellow of the American Association for the Advancement of Science, a fellow of the Association of Women in Science, and received the Secretary of Energy Gold Medal for Distinguished Service (1999). She is a member of the National Academies Committee on Scientific and Engineering Personnel and the Navy Research Advisory Committee. She is also a member of the Committee on Prospective Benefits of DOE’s Energy Efficiency and Fossil Energy R&D Programs (Phase Two). She received a bachelor’s degree and a Ph.D. in physics from the Catholic University of America.

William C. Maurer (NAE) is president of Maurer Enterprises Inc. His previous positions include senior research specialist for Jersey Production Research Company and senior research specialist for Exxon Production Research. His primary area of interest is advanced drilling, including novel drills such as lasers, electric beams, and high-pressure water jet drills. Other areas of interest include oil-field horizontal drilling techniques, which significantly increase oil and gas production, and advanced drilling software, which improves drilling operations and reduces drilling costs and environmental impact. Another area of interest is applying Russian oil-field technology in the United States to allow more economical production of marginal oil and gas fields. This technology includes electrodrills, percussion drills, geared turbodrills, and retractable drilling systems that can be removed from deep wells without removal of the drill pipe from the well. He holds 32 U.S. patents and 6 foreign patents and is author or co-author of over 50 publications and two books. He is a member of the National Academy of Engineering and a fellow of the American Society of Mechanical Engineers. He has extensive knowledge of market risk, having started 18 successful oilfield service companies. He has a Ph.D. in mining engineering and an M.S. in engineering from the Colorado School of Mines and a B.S. in mining engineering from the University of Wisconsin, Platteville.

Richard Nehring is president of NehRinG Associates (aka NRG Associates), in Colorado Springs. Prior to that, he was a project director in the Energy Policy Program of the Rand Corporation in Santa Monica, where he led or participated in numerous projects studying various fossil fuel supply issues. Since 1983 at NRG Associates, he designed the Significant Oil and Gas Fields of the United States Database and its subsequent expansions, directed the initial development and subsequent updates, upgrades, and expansions of the database; planned the three editions of the Oil and Gas Plays of the United States (the play description book accompanying the database) and directed their preparation; composed all database documentation; designed and directed the development of Significant Oil and Gas Pools of Canada Database; and marketed both databases and handled most customer relations. Mr. Nehring has served on several national committees dealing with oil and gas resource and supply issues, including the Resource Subgroup, Supply Task Group, NPC Committee on Natural Gas (2002-2003); the Committee on Resource Evaluation, American Association Of Petroleum Geologists; and the NRC Committee on Undiscovered Oil and Gas Resources. At Rand, he consulted in the energy supply area, for clients such as Atlantic Richfield, General Motors, McDonnell Douglas, the Office of Technology Assessment, Paine Webber, and Sohio. He has a B.A. in history, Valparaiso University; a B.A. in philosophy, politics and economics (as a Rhodes scholar), Oxford University, and was a Danforth fellow, Stanford University, in political science and economics for 4 years.

Michael E. Q. Pilson is professor emeritus of oceanography at the University of Rhode Island (URI). He was director of the Marine Ecosystems Research Laboratory at URI for 20 years. His current research interests include the chemistry of seawater, biochemistry and physiology of marine organisms, and nutrient cycling. He received a B.Sc. in chemistrybiology from Bishop’s University, in Canada, an M.Sc. in agricultural biochemistry from McGill University, and a Ph.D in marine biology from the University of California, San Diego. He is a member of the American Association for the Advancement of Science; Sigma Xi; the American Geophysical Union; the American Society of Mammalogists; the American Society of Limnology and Oceanography; and the Oceanography Society. He has published extensively,

including the text book An Introduction to the Chemistry of the Sea.

Reginal Spiller is executive vice president, exploration and production, Frontera Resources Corporation. Mr. Spiller has been a senior executive of the Company since May 1996 and has been responsible for Frontera’s exploration and production activities. Mr. Spiller has over 25 years’ of experience working in the United States and international oil and gas industries. From 1993 until joining the company, Mr. Spiller was deputy assistant secretary for Gas and Petroleum Technologies at DOE. For 5 years before that, he was the international exploration manager for Maxus Energy Corporation, which held properties in Bolivia, Bulgaria, Czechoslovakia, and Indonesia. He is a member of the NRC Committee on Earth Resources. He also serves as a director of Osyka Corporation and is an active member of the American Association of Petroleum Geologists and the National Association of Black Geologists and Geophysicists. Mr. Spiller is a graduate of Penn State University with an M.S. in geology and of the State University of New York with a B.S. degree in geology.

M. Nafi Toksöz is professor of geophysics and director, George R. Wallace, Jr., Geophysical Observatory, Department of Earth, Atmospheric, and Planetary Sciences, Massachusetts Institute of Technology. His interests and expertise are in the seismology and tectonics of the eastern Mediterranean caused by the collision of the Arabian and Eurasian Plates; and seismic tomography for characterization of Earth’s crust and petroleum reservoirs. He has a Ph.D. in geophysics from the California Institute of Technology.

ATTACHMENT B

ESTIMATING ECONOMIC BENEFITS FOR NATURAL GAS EXPLORATION AND PRODUCTION

The DOE natural gas E&P program aims to increase the supply and production of domestic natural gas. DOE reports its goals and predicts the outcomes of the program in terms of increases in economically recoverable resources (ERR). In its benefits analyses, DOE translates the changes in ERR into changes in expected production, as described in the main text of this panel report. Economic benefits accrue from changes in the supply curve for domestic natural gas.

This attachment describes the simplified approach used by the panel to evaluate the net consumer and producer surplus that results from the change in the supply curve. The approach is consistent with recommendations from the full committee and with the preliminary approach being proposed by DOE.8

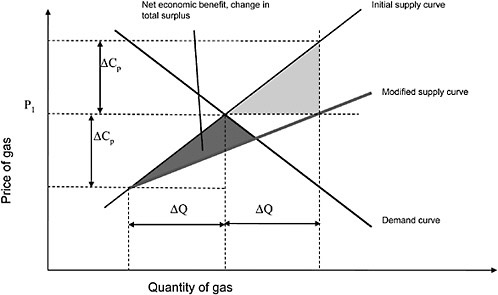

Economic Basis

Figure J-7 shows a demand curve and two supply curves for natural gas, where Q is the quantity of gas produced and P is the market prices of the gas. The initial supply curve represents the supply of gas absent any technical improvements from the program. The modified supply curve represents the impact of making some natural gas (∆ Q) less costly to produce. The lower portion of the supply curve is unchanged: It represents all natural gas production that cannot or does not benefit from the technological advances being evaluated in the program—that is, gas for which production costs are unchanged. The supply curve bends, as represented by the dotted line, at some point, representing the amount of natural gas production that does benefit from the technologies being evaluated—that is, gas for which production costs have decreased.

P1 and P2 represent the market prices of gas given the original and modified supply curves. The area between the P1 and P2 curves represents the benefits calculated by DOE for the natural gas program: the change in the market price of gas multiplied by the quantity consumed. To the extent that the costs of production for most of the gas have not decreased, this quantity represents a transfer from producers to consumers rather then a net economic benefit to the nation.

The net economic benefit is the difference in total surplus (the area between the supply and demand curves) with and without the program. The program causes a change in the supply curve, increasing the total surplus. The additional surplus is represented in the Figure J-8 by the area of the dark gray triangle formed by the demand curve and the initial and modified supply curves. The area of the dark gray triangle is approximated by the area of triangle shown in light gray in Figure J-8. The area of the triangle depends on (1) the amount of gas produced at lower cost due to technical advances from the program (∆ Q) and (2) the reduction in the cost of production for that gas (∆ Cp). The area of the blue triangle is 0.5*∆ Q*∆ Cp. The area of the light gray triangle represents an upper bound on the area of the dark gray triangle: The two areas would be equal if the market price of gas were insensitive to the small change in supply.9

So for each year t, the economic benefits can be approximated as

|

8 |

John Pyrdol, economist, DOE Office of Oil and Gas, “Assessing the benefits of R&D: A framework of analysis and an application using NEMS,” Presented to the panel on October 12, 2005. |

|

9 |

Equality follows from construction: The change in the supply curve is due to reduced cost of producing gas that was previously uneconomic. The pre-DOE program cost of this marginal gas is shown in Figure J-8 on the supply curve to the right of the preprogram equilibrium price (P1), and its total area is given by the light gray triangle. The cost reduction shifts the location of this gas to the left, and. the net change in total consumer and producer surplus is equal to the area of the dark gray triangle. Note that the area of the shaded triangles will not necessarily be equal, differing by the area of the triangle formed by the demand curve, the modified supply curve, and the horizontal line corresponding to the price P1. Note further that if there is no change in price—that is, the demand curve is horizontal—the shaded triangles are equal. |

FIGURE J-7 Demand curve and two supply curves for natural gas.

where Et are economic benefits in year t, ∆ Qtt is the incremental gas produced in year t, and ∆ Cpt is the change in the costs of production for the incremental gas resulting from the program. Total economic benefits are the discounted sum of annual benefits.

Implementation

Estimates of ∆ Qt can be derived from DOE’s estimates of incremental production attributed to the program, scaled down to match the panel’s estimate of the increases attributable to the program. These estimates are shown in Figure J-5.

Estimating ∆ Cpt requires some assumptions. The section on the drilling, completion, and stimulation subprogram (decision tree shown in Figure J-2) provides a starting point. Each branch on the tree corresponds to a different benefit. Consider the top branch, or most optimistic result. The branch posits that a 5 percent decrease in drilling costs will result in a 13 Tcf increase in ERR in 2015. Using the scaling factors defined in that section on drilling, completion, and stimulation would lead to a cumulative increase in production of about 1.7 Tcf. Since none of this gas was produced absent the program, its initial cost of production must have been at least as high as the market price of gas; thus, with the program, the cost of this gas is at least 95 percent of the price of gas, or ∆ Cp in 2015 is 0.05 multiplied by the market price of gas in 2015.

For branches on the tree with a smaller reduction in drilling costs, the ∆ Cp would be smaller (specifically, 3 percent, 1 percent, or 0 times the market price of gas for the other branches).

While ERR estimates are given for each of the other three subprograms, the cost reductions due to the drilling, completion, and stimulation subprogram were not estimated directly. It can be noted that the magnitude of ERR in each of the programs is reasonably close to that of the drilling, completion, and stimulation subprogram. A reasonable estimate of the cost reduction thus may be the middle value provided for that subprogram, or 3 percent for all incremental production attributed to the other three subprograms.

Note on Domestic Versus Foreign Production of Gas

The savings to consumers may be considered an economic benefit to the U.S. economy to the extent that producers are

FIGURE J-8 Change in total surplus from the change in the supply curve. The DOE program is assumed to result in a decrease in the costs of production for Δ Q units of gas that were not economic to produce absent the DOE program. The cost of this marginal gas assuming no technical improvements from the program is shown by the initial supply curve to the right of the preprogram equilibrium price (P1). The reduction in costs of production for gas that was previously uneconomic results in a change in the supply curve (the “modified supply curve”), and the net change in total consumer and producer surplus that results is equal to the area of the dark gray triangle. For the benefits calculations, this area is approximated by the area of the light gray triangle, with the change in production costs, Δ Cp, taken from the panel’s assessment of the potential changes in costs attributable to DOE research.

foreign and hence their loss does not offset consumer gains. However, if a substantial share of gas consumed in the United States is imported (LNG), then the price elasticity assumption that underlies the DOE analysis is incorrect. According to the NEMS statistics, ERR (in the most optimistic case) adds 5 percent to the 2015 gas supply in the United States and results in a price decrease of at least 5 percent (a savings of $0.40 out of $7 to $8), implying a total price elasticity (supply plus demand) of, at most, 1. If LNG accounts for a substantial share of the market, then the price of gas is determined by world supply and demand. The contribution of the natural gas E&P program is then small relative to supply, and the market price will be much less sensitive to small changes in domestic supply. Thus, the savings to consumers, represented by a price change times the quantity of imported gas consumed, is, at best, trivial. As in the domestic case, the economic benefits of the program remain contingent on the value added by the additional gas produced by the program.