Findings and Recommendations

INTRODUCTION

The findings and recommendations found in this section reflect the Committee’s consensus based on its own deliberations as well as on the proceedings of five previous conferences that explored the operation of the new, information-based economy. The Committee’s aim is to understand the sources of productivity growth in this new economy, to measure more accurately the contributions of different components of growth, and to develop policies to encourage and increase that growth.

A.

THE NATURE OF THE NEW U.S. ECONOMY

Findings

-

The New Economy refers to technological and structural changes in the U.S. economy as individuals capitalize on new technologies, new opportunities, and national investments in computing, information, and communications technologies. These structural changes have resulted in a long-term positive productivity shift of major significance.1

-

Despite differences in methodology and data sources, a consensus has emerged among economists that the remarkable behavior of information technology (IT) prices provides the key to the surge in U.S. economic growth after 1995.

-

The relentless decline in the prices of information technology equipment has steadily enhanced the role of IT investment across the economy.2 Productivity growth in IT-producing industries has risen in importance and a productivity revival is under way in the rest of the economy.

-

The decline in IT prices refers to more than just a reduction in the price of a key economic input. The widespread use of IT, made possible by this price reduction, has changed and continues to change how individuals and businesses in the economy work, consume, communicate, and transact. New products and capabilities made possible by lower-cost computing and communications facilities are already restructuring the economy and accelerating the globalization of manufacturing and trade in services, with major positive implications for productivity growth.

-

New information technologies have a broad and positive impact on U.S. productivity growth through industries that produce new information technologies and the many more that apply them. New IT applications are also contributing to enhanced workplace productivity as a wide variety of firms adapt to changes in information flows and take advantage of new organizational structures made possible by these innovations.3 These developments are changing the structure of firms, creating more innovative and more agile enterprises, with positive indirect and long-term implications for productivity growth.4

-

Cheaper information technology has given greater importance to more productive forms of capital. The rising contribution of investments in information technology since 1995 has been a key contributor to the U.S. growth resurgence and has boosted growth by close to a percentage point.

-

The contribution of investment in information technology accounts for more than half of this increase. Within information technology, computers have been the predominant impetus for faster growth. Communications equipment and software have also made important contributions to growth.

-

Altogether, 31 industries (out of the 44 industry categories that make up the U.S. economy) contributed to the acceleration in economic growth after 1995. The four IT-producing industries discussed here are responsible for only 2.9 percent of the Gross Domestic Product (GDP) but a remarkable quarter of the U.S. growth resurgence.5 The 17 IT-using industries account for another quarter of the surge in growth and about the same proportion of the GDP, while the non-IT industries with 70 percent of value added are responsible for half the resurgence. The contribution of the IT-producing industries is far out of proportion to their relatively small size in relation to the economy as a whole. These industries have grown at double-digit rates throughout the period 1977-2000, but their growth jumps sharply after 1995, when the GDP share of these industries also increases.6

-

The accelerated IT price decline also signals faster total factor productivity growth in IT-producing industries.7 The four IT-producing industries contributed more to the growth of total factor productivity during the period 1977-2000 than all other industries combined.8

-

-

Gains in the U.S. terms of trade, especially for information technology products, may have contributed to the acceleration in U.S. productivity in the late 1990s.9

-

Information technology is one of the most globally engaged sectors of the U.S. economy. Liberalization of information technology trade began in the 1980s, helping to decrease the cost of semiconductors and increase the availability of IT products and services.10 The International Technology Agreement of 1996 also eliminated all world tariffs on hundreds of IT products in four stages from early 1997 through 2000, helping to lower the prices of imported intermediate IT products.11

-

While such trade effects are likely to explain only a small portion of the productivity speed-up, foreign trade practices do appear to matter for the measurement of productivity.

-

-

Improved productivity associated with the introduction of advanced information and communications technologies appears to have raised the long-term growth trajectory of the U.S. economy. This gain appears to be robust, having survived the dot-com crash, the short recession of 2001, and the tragedy of 9/11. Since the end of the previous recession in 2001, productivity growth has been running at about two-tenths of a percentage point higher than in any recovery of the post-World War II period.12

-

A structural change most associated with the New Economy today is the transformation of the Internet from a communication media to a platform for service delivery.13 This has contributed to the remarkable growth of the U.S. service

|

9 |

Robert C. Feenstra, Marshall B. Reinsdorf, and Michael Harper, “Terms of Trade Gains and U.S. Productivity Growth,” paper prepared for NBER-CRIW Conference, July 25, 2005. |

|

10 |

For a detailed analysis of trade in semiconductors, see Kenneth Flamm, Mismanaged Trade, Washington, D.C.: Brookings Institution Press, 1996. For a review of the impact of the 1986 semiconductor trade agreement on the revival of the U.S. semiconductor industry, see National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2003, p. 82. The report points out that the resurgence of the U.S. semiconductor industry was based in part on the success of the SEMATECH consortium, in part on the 1986 Semiconductor Trade Agreement, and in part on the repositioning of the U.S. industry away from DRAM chips and towards microprocessor design and production. The recovery of the U.S. industry was thus like a three-legged stool; it is unlikely that any one factor would have proved sufficient independently. |

|

11 |

For an overview of the Information Technology Agreement and its implementation, access the World Trade Organization Web site at <http://www.wto.org/english/tratop_e/inftec_e/itaintro_e.htm>. |

|

12 |

Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh, “Will the U.S. Productivity Resurgence Continue?” Federal Reserve Bank of New York Current Issues in Economics and Finance, 10(13), 2004. |

|

13 |

This transformation is sometimes referred to as “Web 2.0.” For a description of this new version of the Web, see Tim O’Reilly, “What Is Web 2.0—Design Patterns and Business Models for the Next Generation of Software” September 30, 2005. Accessed at <http://www.oreillynet.com/pub/a/oreilly/tim/news/2005/09/30/what-is-web-20.html>. |

-

economy, as companies like Google and eBay increasingly exploit information services in new ways. As new business models, enabled by the Web, continue to emerge, they will contribute to sustaining the productivity growth of U.S. economy.

Recommendations

-

Given the benefits of rapid technical innovation, the measurement issues associated with this change should be addressed on a systematic basis by the responsible agencies of the federal government in a coordinated fashion.

-

Swiftly falling IT prices provide powerful economic incentives for the diffusion of information technology. Given that the rate of the IT price decline is a key component of the cost of capital, it is essential to develop constant quality indexes, such as those for computers, for use in the U.S. National Income and Product Accounts (NIPA).

-

Substantial resources to develop price indexes and related analyses are needed to understand the sources of productivity growth in the economy and to develop the policies to sustain it.

-

-

The growing synergies and new economic opportunities of the New Economy need to be understood better if they are to be sustained through appropriate policies. The rapid pace of these changes means that they require regular and systematic monitoring in order to bring significant changes to the attention of policy makers.

-

The rapid business and workplace transformations made possible by information technology are not only a product of globalization but also a factor that is advancing globalization.14 For the United States, success in this new global paradigm requires technological leadership as well as strategic use of information technology.

-

To remain a leader in information and communications technologies, the United States must foster and attract the best human resources. Both the federal and state governments must also adequately support research funding, and maintain a superior business environment and encourage the public-private partnerships that foster innovation and the timely transition of research to the marketplace.15 It must also update regulations that inhibit wider access to and use of information networks.16

-

B.

MOORE’S LAW AND THE NEW ECONOMY

Findings

-

Faster and cheaper semiconductors are a key driver of the productivity gains associated with the recent growth of the U.S. economy.17

-

Price-performance improvement in semiconductors has been a major source of price-performance improvement in information technology. Declines in cost for electronics functionality embedded in semiconductors are the linchpin of improvement in price-performance for computers and communications, which in turn has been a major factor in the increase in long-term growth performance.18

-

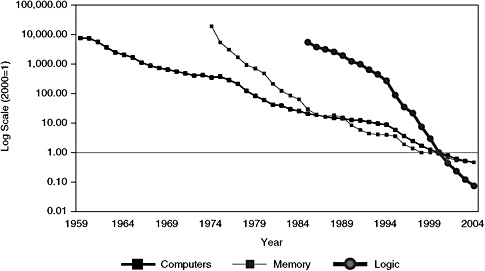

A substantial acceleration in the pace of IT price decline occurred in 1995, triggered by a much sharper acceleration in the price decline of semiconductors—the key component of modern information technology.19 (See Figure 1.20) This acceleration can be traced to a shift in the product cycle from 3 years to 2 years as a result of intensifying competition in markets for semiconductor products.21

-

|

17 |

Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh, Productivity, Volume 3: Information Technology and the American Growth Resurgence, op. cit. |

|

18 |

Jack E. Triplett, “High-Tech Productivity and Hedonic Price Indexes,” in Organisation for Economic Co-operation and Development, Industry Productivity, Paris: Organisation for Economic Cooperation and Development, 1996; Kenneth Flamm, “Technological Advance and Costs: Computers vs. Communications,” in Changing the Rules: Technological Change, International Competition, and Regulation in Communications, Robert C. Crandall and Kenneth Flamm, eds., Washington, D.C.: The Brookings Institution, 1989; Ana Aizcorbe, Kenneth Flamm, and Anjum Khurshid, “The Role of Semiconductor Inputs in IT Hardware Price Declines” in Hard to Measure Goods and Services: Essays in Honor of Zvi Griliches, E. Berndt, ed., Chicago, IL: National Bureau of Economic Research, forthcoming. |

|

19 |

Using industry estimates on Intel’s operations to decompose a price index, Ana Aizcorbe finds that virtually all of the declines in a price index for Intel’s chips can be attributed to quality increases associated with product innovation, rather than declines in the cost per chip. She adds that consistent with the inflection point that Jorgenson noted in the overall price index for semiconductors, the Intel price index falls faster after 1995 than in the earlier period, but that the decomposition attributes virtually all of the inflection point to an acceleration in quality increases. These increases in quality push down constant quality costs. See Ana Aizcorbe, “Why Are Semiconductor Price Indexes Falling So Fast? Industry Estimates and Implications for Productivity Growth,” op. cit. See also Dale W. Jorgenson, “Information Technology and the U.S. Economy,” American Economic Review, 91(1), 2001. |

|

20 |

The output price index referred to in Figure 1 is the GDP deflator, but differs from the typical Bureau of Economic Analysis (BEA) GDP deflator due to methodology. We impute a capital service flow for government and consumer durable capital and use Tornqvist aggregation to add components of GDP. |

|

21 |

For an analysis of the break points in prices of microprocessors, see Ana Aizcorbe, Stephen D. Oliner, and Daniel E. Sichel, “Shifting Trends in Semiconductor Prices and the Pace of Technological Progress,” mimeo, Federal Reserve Board, April. Other analyses focus on an acceleration in the pace of technological innovation in semiconductor manufacturing as accelerating the decline in prices: see Kenneth Flamm, “Microelectronics Innovation: Understanding Moore’s Law and Semiconductor |

-

FIGURE 1 Relative prices of computers and semiconductors, 1959-2004.

NOTE: All price indexes are divided by the output price index.

-

-

Although the decline in semiconductor prices has been projected to continue for at least another decade, the magnitude of recent acceleration may be temporary.

-

-

Moore’s Law has played a significant role in the expectations and development of the semiconductor industry. While by no means dictating an actual law, Gordon Moore correctly foresaw in 1965 the rapid doubling of the feature density of a chip, now interpreted as approximately every 18 months.22

-

While not pretending to be deterministic, Moore’s formulation has endured in part by setting expectations among participants in the semiconductor industry of the pace of innovation and the introduction of

-

-

-

new products to market.23 Each firm believes that its competitors will release the next model in an 18-month timeframe, leading each to set the pace of its own work on this basis—in effect making Moore’s Law a self-fulfilling prophecy.24 Currently, the industry expects to remain on the trajectory envisioned by Moore’s Law for another 10 to 15 years.25

-

Making additional assumptions, an economic corollary to Moore’s Law is a rapid fall in the relative prices of semiconductors. With the acceleration in manufacturing innovation in the late 1990s came an increase in the rate of price decline—from roughly 15 percent annually in the early 1990s to 28 percent annually after 1995 until 2003. The increase in chip capacity and the concurrent fall in price—the “faster-cheaper” effect—have created powerful incentives for firms to substitute information technology for other forms of capital. These investments, when effectively integrated, have led to the productivity increases that are the hallmark of the phenomenon known as the New Economy.26

-

-

The Semiconductor Industry Roadmap has helped to sustain Moore’s Law.

-

The International Technology Roadmap for Semiconductors (ITRS) helps set the competitive pace of the semiconductor industry. By identifying common research challenges and reducing costs by identifying redundancies and technical “showstoppers,” the ITRS process helps the semiconductor industry commit to the investments necessary to stay on the growth trajectory of Moore’s Law.27

-

In 1997, the ITRS reported the presence of a faster two-year semiconductor cycle beginning in 1995 that has helped to accelerate the pace of Moore’s Law. However, the 2003 edition of the ITRS has predicted that (given the difficulties encountered at the 90 nm technology node among other reasons) chipmakers will soon return to a 3-year cycle between technology nodes, significantly slowing the pace of semiconductor development.28

-

|

23 |

These expectations are reflected in the International Technology Roadmap for Semiconductors. Accessed at <http://public.itrs.net/>. |

|

24 |

See Kenneth Flamm, “Moore’s Law and the Economics of Semiconductor Price Trends,” op. cit., 2004, and “Microelectronics Innovation: Understanding Moore’s Law and Semiconductor Price Trends,” op. cit., 2003. See also Ana Aizcorbe, “Moore’s Law, Competition, and Intel’s Productivity in the Mid-1990s,” BEA Working Paper WP2005-8, September 1, 2005. |

|

25 |

See remarks by Robert Doering, “Physical Limits of Silicon CMOS Semiconductor Roadmap Predictions,” in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit. |

|

26 |

Dale W. Jorgenson, “Information Technology and the U.S. Economy,” op. cit. |

|

27 |

William Spencer, Linda Wilson, and Robert Doering, “The Semiconductor Technology Roadmap,” Future Fab International, 18, January 12, 2005. |

|

28 |

Access the ITRS homepage at <http://public.itrs.net/>. |

-

The semiconductor industry is characterized by high annual growth averaging around 15 percent per annum.29 This high growth rate is accompanied by considerable market volatility, reflected in significant cyclical swings in production.

-

In large part, this volatility is because the semiconductor industry is highly capital-intensive, requiring significant capital expenditures for each fabrication facility and a very high intensity of R&D (sometimes up to 20 percent of revenue). This high level of investment underpins the high rate of innovation evident through increased performance, miniaturization, cost reduction, and short design cycles.30

-

High sunk costs, steep learning curves, and rapid shifts in product cycles all contribute to a high level of industry cyclicality, which is one of the semiconductor industry’s distinguishing features.31

-

A further aspect of the industry’s steep learning curves is the need for the research and at least some of the production facilities to be in close geographic proximity. This permits the many adjustments required to improve performance and yields and to adapt new equipment, production processes, and design features while adjusting to changing market conditions. The learning and synergies among university research, private laboratories, production and changing customer needs is a recognized feature of the semiconductor industry.32

-

This does not mean that the benefits of proximity require all production to be located within a particular geographic area. This would imply a freezing of the allocation of global semiconductor production that would be neither possible nor desirable. On the other hand, having no on-shore production would inevitably erode the quality and robustness of research, design, equipment and materials production in the United States.

-

|

29 |

Despite industry cyclicality, the semiconductor industry achieved a 16.1 percent compound annual growth rate (CAGR) from 1975 to 2000. Growth during this period was driven by technological advances, the increasing pervasiveness of electronics in society, and the increasing capability of the semiconductors that powered new products and systems. This growth rate began to slow gradually starting in the mid-1980s, reaching about 15 percent in 1998. The severity of the 2001 downturn then prompted a reevaluation of the industry’s long-term growth rate. With semiconductor sales of $213 billion in 2004, the rate is now expected to be in the 8-10 percent range. The Semiconductor Industry Association forecast, released in June 2005, reflects this consensus and predicts a CAGR for the industry of 9.2 percent from 2004 to 2008. Accessed on the Semiconductor Industry Association Web site at <http://www.sia-online.org/iss_economy.cfm>. |

|

30 |

European Semiconductor Industry Association, The European Semiconductor Industry: 2005 Competitiveness Report, op. cit. |

|

31 |

Kenneth Flamm, “Factors Underpinning Cyclicality in the Semiconductor Industry,” in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., pp. 61-64. |

|

32 |

See, for example, European Semiconductor Industry Association, The European Semiconductor Industry: 2005 Competitiveness Report, op. cit. |

-

-

The rapid rate of innovation means that products embedding semiconductor devices often have short life cycles. At the same time, the rate of price-performance improvement in the semiconductor industry is very rapid. Consequently, changes in the semiconductor market can occur very quickly, and established markets—and market leaders—can be swiftly displaced. In order to adjust constantly to this rapid pace of change, the semiconductor industry needs to be highly flexible and able to rapidly adopt new designs and new technologies. In this way, the rapid rate of innovation translates into high-capital requirements.33

-

The high capital costs for fabrication facilities and the high R&D intensity make the industry sensitive to incentive schemes to attract and retain foreign and domestic semiconductor investment. Major competitors such as China, Japan, Korea, Malaysia, Singapore, Taiwan, and Europe have developed such incentive schemes. In the United States, these have been generated primarily at the state level (e.g., New York and Texas). It is important to recognize that lower wages and lower social costs are not determining factors in locational choices for semiconductor investments, whereas the existence of favorable incentive schemes, in particular tax regimes, is often the main source of competitive advantage.34

-

Recommendations

-

Data and Modeling Challenges: Policies to foster continued improvement in the nation’s productivity and growth can be best developed with better data on prices and better models for prediction.

-

Serious gaps in data prevent a full accounting of semiconductor-related prices.

-

Although information technology is altering product markets and business organizations, a fully satisfactory model of the semiconductor industry remains to be developed. Such a model would derive the demand for semiconductors from investments in information technology in response to rapidly falling IT prices. An important objective is to determine the product cycle for successive generations of new semiconductors endogenously.

-

-

Investments in Research and Training: Substantial investments in research and a well-trained workforce are needed if we as a nation are to continue to benefit from the growth and technological development offered by a vibrant, internationally competitive semiconductor industry.

-

National Investments: National investments are necessary to provide the research and development facilities as well as a trained workforce well grounded in the disciplines—especially physics, chemistry, mathematics, computer science, and engineering—that underpin research and manufacturing in the semiconductor, computer component, and software industries.35 Such investments are also necessary for the nation to realize its substantial investments in nanotechnology, given its potential impact on computing, telecommunications, and semiconductor technology. National investments in these IT-related disciplines also continue to be important to capitalize on potential advances in biotechnology and related biomedical research. Scientific advances are increasingly multidisciplinary efforts and information technologies are often a key element in such advances.36

-

Acquiring and Retaining Talent: Continual progress is also necessary in visa processing in order to attract and retain qualified foreign engineers and scientists. This includes increases in the number of H-1B visas; automatic visa extensions for international students who receive advanced degrees in science, technology, engineering, mathematics, and other fields of national need from U.S. institutions; as well as more permanent opportunities for science and engineering graduates to remain and contribute to the United States economy.37 Compensation packages

-

-

-

for technology workers are also a factor for remaining competitive in attracting and retaining qualified scientists and engineers.38

-

-

Partnering for Innovation: To sustain the technology trajectory envisaged by Moore’s Law requires advanced research to overcome emerging technological “brick walls” that threaten continued rapid advance. Substantial public funding and cooperative partnerships in semiconductor research are necessary if we are to continue to reap the benefits of remaining on the trajectory set out by Moore’s Law and for the United States to remain a robust global center for the research, development, and production of semiconductors.

-

Sustained research and development is necessary for the semiconductor industry to overcome the limits of CMOS (complementary metal-oxide semiconductor) and develop post-CMOS technologies. Initiatives in this regard include fostering research and developments in nanotechnology and molecular electronics to replace and/or extend the life of advanced CMOS manufacturing technologies.39

-

To maintain the innovative pace of the industry, with the attendant benefits for the U.S. economy, national investments in university research programs that explore and develop promising technologies are needed.

-

Additional government investments in university research for programs that support and move promising technologies closer to commercialization are increasingly important to maintain the innovative pace of the semiconductor industry.40

-

Public-private partnerships, involving cooperative research and development activities among industry, universities, and government laboratories can play an instrumental role in accelerating the development

-

|

human capital. See Wall Street Journal, “Lopsided Immigration Policy Could Induce Brain Drain,” June 22, 2005, p. A17. |

-

-

of new technologies and products.41 Industry experts believe that such partnerships provide the most promising strategy for sustaining Moore’s Law, given that the semiconductor industry’s ability to make smaller, faster, and cheaper integrated circuits is limited by the growing inability of individual firms to pay for the increasingly expensive research needed to achieve needed innovations.42

-

In addition to pre-competitive research partnerships at the horizontal level (e.g., among semiconductor device manufacturers), vertical partnerships focused on integrated capacities along the supply chain are seen as increasingly important. The objective of the vertical partnerships is to ensure competitiveness across the development and production chain through synergistic relations among suppliers, manufacturers, and users of semiconductors.43

-

Finally, it is important to recognize that innovation partnerships are increasingly international efforts, even as global markets for high-technology industries are increasingly competitive. Governments can serve as a facilitating agent to create the necessary credibility, commitment, and mutual trust among private firms in the formation of research consortia.44 International research consortia, such as SEMATECH and IMEC, demonstrate the benefits of such global cooperation by reducing the risks and costs associated with the development of new semiconductor technologies and the standards for their application.

-

-

Wider adoption of road-mapping exercises by the computer and computer component industries (along the lines of the ITRS conducted by the semiconductor industry) can contribute to the industries’ ability to remain on the

|

41 |

Public-private partnerships involving cooperative research and development among industry, government, and universities can play an instrumental role in introducing key technologies to the market. For an overview of the conditions necessary for successful partnerships (including industry leadership, development and use of technology roadmaps, shared costs, and regular assessment) see National Research Council, Government-Industry Partnerships for the Development of New Technologies: Summary Report, op. cit., pp. 13-16. |

|

42 |

A recent study by SEMI estimates that research required for continued scaling of integrated circuit devices, even without another wafer size increase, will cost some $16.2 billion by 2010. However, the equipment and materials suppliers, to whom the burden of research has shifted from chipmakers, are predicted to be able to afford an annual R&D budget of $10.4 billion, creating a $6 billion gap. SEMI, “Semiconductor Equipment and Materials: Funding the Future,” October 2005. Accessed at <http://content.semi.org/cms/groups/public/documents/homepervasive/p036611.pdf>. See also Phil LoPiccolo, “The Six Billion Dollar Gap,” Solid State Technology, February 2006; and Robert Haavind, “Chipmaking’s Tough Economic Road Ahead,” Solid State Technology, March 2006. |

|

43 |

European Semiconductor Industry Association, The European Semiconductor Industry: 2005 Competitiveness Report: Executive Summary, op. cit., p. 51. |

|

44 |

For an assessment of the limits and challenges of international cooperation, see HWWA, IfW, and NRC, Conflict and Cooperation in National Competition for High-Technology Industry, Washington, D.C.: National Academy Press, 1996, pp. 54-61. |

-

growth path predicted by Moore’s Law with its contribution to the pace of innovation and growth.45

C.

MAINTAINING U.S. TECHNOLOGY LEADERSHIP IN SEMICONDUCTORS

Findings

-

The semiconductor industry is a key driver for the future of advanced technologies in the United States. The distinctive features of this industry enable it to foster new opportunities for economic growth and support the global competitiveness of the U.S. products and services.

-

As a technology enabler, the semiconductor permits the invention and use of a variety of valuable applications. Semiconductor-based information technology is also a general purpose technology, shared across a wide variety of uses. There is also the possibility of substantial network effects that can amplify the impact of advances in semiconductor technology.46 Indeed, semiconductor technologies already underpin a variety of products ranging from personal computers and mobile phones, to solutions and services, especially those provided through the Internet. Taken together, these features of information technology mean that advances in semiconductor technology can have substantial impacts on long-run economic growth.

-

Through their pervasiveness, semiconductors have become keys to the competitiveness of the products of a broad range of new and “traditional” industries. For example, the automobile industry uses semiconductor-based information technologies to design and manufacture vehicles at lower cost. In addition, onboard microprocessors increasingly monitor fuel use and driver safety. By improving quality, lowering costs, creating new features, and increasing customization, microelectronics can help differentiate the products of traditional industries, helping make U.S. firms more globally competitive.47

-

|

45 |

An example is the roadmap exercise by the U.S. Display Consortium, which develops platform technologies for flat-panel displays. See <http://www.usdc.org/> for additional information. |

|

46 |

On the role of general purpose technologies, see Timothy Bresnahan and Manuel Trajtenberg, “General Purpose Technologies: Engines of Growth?” Journal of Econometrics, 65(1):83-108, 1995. See also Elhanan Helpman, “General Purpose Technologies and Economic Growth: Introduction” in General Purpose Technologies and Economic Growth, Elhanan Helpman, ed., Cambridge, MA: The MIT Press, pp. 1-13, 1998. |

|

47 |

Similarly, for the role information technology is playing in reviving the competitiveness of the U.S. textile and apparel industry, see Lenda Jo Anderson et al., “Discovering the Process of Mass Customization: A Paradigm Shift for Competitive Manufacturing,” National Textile Center Annual Report, 1995. |

-

-

The unique contributions of this industry are reflected in the policies and programs of almost all major global participants. The perceived importance of the industry to long-term economic growth and technological competency has resulted in an impressive array of policies, partnerships, subsidies, and investments that are intended to create, nurture, and retain the design, development, production, and refinement of semiconductors and related technologies.48

-

-

Even as some production moves offshore, semiconductors remain important for the U.S. economy. The production and use of semiconductors are major contributors to the growth and dynamism of the U.S. economy. Access to and use of advanced semiconductors contribute to many national missions, not least national security.49

-

Ever faster and cheaper semiconductors are recognized as key components in sustaining the productivity growth that the U.S. economy has experienced since 1995. The end of a two-decade slowdown in U.S. productivity growth that took hold in the 1970s and that coincided with a significant erosion of the country’s industrial power can be traced to a sudden speed-up in the rate of decline of semiconductor and computer prices.50

-

The semiconductor industry is U.S. manufacturing’s star performer. In 2003, the industry saw worldwide sales of $166 billion, of which $80 billion were sales in the United States. (The U.S. semiconductor industry invests $14 billion in R&D, an amount that represents 17 percent of sales, with another 14 percent of sales [$10 billion] going towards the acquisition of capital equipment.) The industry provides about 226,000 jobs in the United States. While relatively small compared to the total U.S. workforce, these jobs are well-paid and have a disproportionately positive impact on the U.S. economy because of their remarkable productivity levels.51

-

In light of the unique contributions of semiconductors to national growth and technical capacity in this information age, fostering a vigorous semiconductor industry in the United States is important for the nation’s

-

|

48 |

These multiple programs and incentives are documented by Tom Howell, “Competing Programs: Government Support for Microelectronics,” in National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, op. cit. |

|

49 |

National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., 2004. See also National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, op. cit. |

|

50 |

Dale W. Jorgenson, Mun S. Ho, and Kevin J. Stiroh, Productivity, Volume 3: Information Technology and the American Growth Resurgence, op. cit., 2005, Chapter 9. |

|

51 |

Ibid. See also Semiconductor Industry Association, Industry Facts and Figures. Accessed at <http://www/sia-online.org/ind_facts.cfm> on December 13, 2005. |

-

-

long-term security and for its contributions to economic growth, productivity, and technological know-how.

-

-

Structural Change: The structure of the semiconductor industry is changing, creating new vulnerabilities and challenges for U.S. leadership in this strategically important industry, while at the same time creating new opportunities.

-

The semiconductor industry is characterized by a very high intensity of R&D and high levels of capital expenditures in semiconductor fabrication facilities. A modern fabrication facility is now in the $2 billion to $3 billion range, increasingly out of the reach of many manufacturers. Reflecting these high forced capital costs, the industry is highly sensitive to both the global research infrastructure and the incentives and disincentives that condition the financial returns on its investments.52

-

The foundry model is now a significant component of the industry, having begun with Taiwanese government encouragement and investment in 1987.53 Foundry-based companies tend to spend a smaller percentage of their sales on R&D than do traditional integrated device manufacturers.54 Consequently, one potential impact of the growth in the foundry model maybe a fall-off in industry-sponsored research into process engineering, possibly posing long-term challenges to the pace of innovation in semiconductor manufacturing techniques. A shortfall in R&D directed to process improvements is unlikely to be made up by semiconductor design firms, which are smaller with less commitment to process technologies.

-

At the same time, the foundry model permits easier entry and greater competition through the development and commercial application of

-

|

52 |

The European Semiconductor Industry Association (ESIA) estimates a 220 percent higher return on a facility in East Asia as a result of revenue incentives. ESIA, “The European Semiconductor Industry 2005 Competitiveness Report.” Accessed at <http://www.eeca.org/pdf/final_comp_report.pdf>. Locational competition continues to accelerate. In 2005, Germany attracted an AMD fab with very substantial incentives, including $700 million in loan guarantees, $500 million in grants and allowances, and $320 million in equity contributions. Recently, the State of New York provided about $1 billion in incentives for AMD to locate near Albany a new 300-mm wafer plant. It will make chips based on a 32-nm process and will take about $3.2 billion in capital to build. See PC Magazine, “AMD to Build Factory in New York,” June 26, 2006. |

|

53 |

According to Wikipedia.org, in microelectronics, a foundry refers to a factory where devices such as integrated circuits are manufactured. The foundry model describes how businesses separate the design process from the manufacturing of these microdevices. For an account of the modern evolution of the foundry model, see Jon Sigurdson, “VSLI Revisited—Revival in Japan,” Working Paper No. 191, Tokyo: Institute of Innovation Research of Hitotsubashi University, p. 50, April 2004. |

|

54 |

See comments by George Scalise on “The Foundry Phenomenon,” National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., p. 15. |

-

-

semiconductors with new cost and performance features that would otherwise not be available as rapidly or as attractively priced.55

-

While globalization offers many benefits, if design, materials and equipment, and manufacturing capabilities move outside the United States, the United States risks losing the critical mass necessary for its leadership and autonomy in semiconductor technologies and equipment.56

-

-

The movement of the semiconductor industry offshore is not uniquely the result of market forces. Semiconductors are produced and traded in a globally integrated market, and firms have significant interest in locating facilities in rapidly growing markets. Yet at the same time, national policies often condition international competition in semiconductors. Indeed, the policies of other nations and regions may well pose challenges to U.S. leadership in this sector.57

-

Publicly supported, location-based competition for high-value-added, high-growth industries is one of the hallmarks of the global economy. Many governments in East Asia and Europe have adopted comprehensive and effective policies to attract, create, and retain semiconductor firms and related industries within their national economies.58 Governments adopt and finance these policies in order to secure national capacity and autonomy in this enabling technology, as well as the increased competitiveness and future government revenue associated with the semiconductor industry.59

-

The United States has no current comparable national effort to retain and maintain the industry. SEMATECH, the government-industry partnership, was founded in 1987 at the height of the Japanese industry’s challenge to U.S. producers, and it proved effective in improving U.S. manufacturing capabilities.60 SEMATECH’s major international efforts

-

-

-

began in 1996, and since 1998 SEMATECH has been a fully international research consortium. International SEMATECH receives no federal funding, though it has recently benefited from significant state support from Texas and more recently for its expansion in New York State.61 It now faces competition from IMEC, located in Flanders, a novel and effective research consortium supported with European Union, national government, and Flanders regional funds as well as contributions from private companies from all major regions.62

-

Also fundamental to the development of the globally competitive semiconductor industry has been the opening of global markets that are relatively free from unfair trade practices. U.S.-led trade initiatives to open foreign semiconductor markets played a key role in establishing the conditions for international competition based on price and quality among multiple vendors.63

-

Recommendations

-

To better address the technical challenges faced by the semiconductor industry and to better ensure the foundation for continued progress, more attention to the conditions and policies shaping locational decisions for this enabling industry is warranted.

-

Renewed attention to encouraging and retaining a capable high-tech workforce is necessary.64 Most importantly, additional resources for university-

|

Securing the Future: Regional and National Programs to Support the Semiconductor Industry, op. cit., pp. 254-281. |

-

based research in related disciplines, such as physics, chemistry, materials sciences, and engineering, are required.65

-

The federal and state governments should undertake measures that strengthen the attractiveness of the United States as a location for semiconductor research and production.

-

Three-way partnerships among industry, academia, and government are needed to catalyze progress in the high-cost area of future process and design. These partnerships would:

-

Sponsor more initiatives that encourage collaboration between universities and industry, especially through student training programs, in order to generate research interest in solutions to impending and current industry problems.

-

Increase funding for successful current programs. For example, the Focus Center Research Program developed by the Semiconductor Research Corporation could usefully be augmented through increased direct government funding.66 These centers also represent opportunities for collaborative research with other federal outreach programs, such as those supported by the National Science Foundation.

-

Create incentives for students. Augmented federal support for programs that encourage research in semiconductors would attract professors and graduate students. In addition, specific incentive programs could be established to attract and retain talented graduate students.67

-

-

Active, rapid, and effective enforcement of international trade rules through the World Trade Organization (WTO) and other forums is needed to maintain

|

Future of the U.S. Economy, op. cit. See also remarks by Craig Barrett at a Semiconductor Industry Association event commemorating the 40th anniversary of Moore’s Law. Access news release at <http://www.sia-online.org/pre_release.cfm?ID=355>. |

|

65 |

See the corresponding recommendation in National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, op. cit., pp. 88-89. See also more recent related recommendations concerning strengthening the nation’s traditional commitment to science and engineering in NAS/NAE/IOM, Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future, op. cit. |

|

66 |

The Microelectronics Advanced Research Corporation (MARCO) funds and operates university-based research centers in microelectronics technology. Its charter initiative, the Focus Center Research Program (FCRP), is designed to expand pre-competitive, cooperative, long-range applied microelectronics research at U.S. universities. Each Focus Center targets research in a particular area of expertise. In addition to strengthening ties between industry and the university research community, this model concentrates resources on the areas of microelectronics research that are critical in maintaining industry growth. More information can be accessed at <http://fcrp.src.org/Default.asp?bhcp=1>. |

|

67 |

NAS/NAE/IOM, Rising Above the Gathering Storm: Energizing and Employing America for a Brighter Economic Future, op. cit. |

-

a competitive global market in semiconductors.68 The successful U.S. case against the Chinese value-added tax (VAT) rebate is a case in point.69

D.

DECONSTRUCTING THE COMPUTER

Findings

-

Computers are widely recognized to be important components of economic growth and improved productivity associated with the New Economy, with the upward shift in economic growth coincident with declines in the prices of computers and related equipment.

-

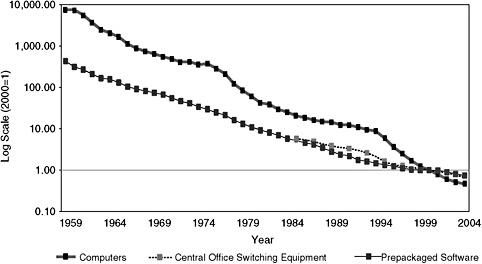

Indeed, it seems that the upward shift in the rate of economic growth in the mid-1990s coincided with a sudden, substantial, and rapid decline in the prices of computers (from 15 percent annually to about 28 percent annually after 1995, per the data graphed in Figure 270) accompanied by significant increases in computing power and function.

-

This upward shift in growth also coincided with a shift in the rate of decline in price for memory and logic devices (from 40 percent annually to about 60 percent annually after 1995 per the data graphed in Figure 1).71

-

Indeed, recent estimates suggest that between 40 and 60 percent of the decline in computer prices in the late 1990s, and perhaps 20 to 30 percent of the declines in communications equipment and consumer

-

|

68 |

WTO and other trade rules do not include a mandate for the enforcement of competition/antitrust policy; they only permit it. Enforcement of competition policy is necessary. Recently, Samsung Electronics of South Korea has agreed to plead guilty to charges of participating in an international conspiracy to fix prices in the DRAM market to the tune of $300 million, settling with the U.S. Department of Justice Antitrust Division. See Electronic News, “Samsung Faces $300M DoJ Fine for Price Fixing,” October 13, 2005. |

|

69 |

In rapidly evolving industries, such as semiconductors, it is important that remedial trade actions to correct merchantalistic policies (e.g., through discriminatory taxation) be both prompt and effective. For example, the United States and China agreed in 2004 on a resolution to their dispute at the World Trade Organization (WTO) regarding China’s tax refund policy for integrated circuits. U.S. exports of integrated circuits to China were subject to a 17 percent value-added tax (VAT). However, China taxed domestic products significantly less, allowing firms producing integrated circuits in China to obtain a partial refund of the 17 percent VAT, lowering the effective VAT rate on domestic products to as low as 3 percent in some cases. These measures contributed to a very significant competitive advantage and a powerful incentive for inward investment, reflected in the surge in new production facilities in China. |

|

70 |

The output price index referred to in Figure 2 is the GDP deflator, but differs from the typical BEA GDP deflator due to methodology. We impute a capital service flow for government and consumer durable capital and use Tornqvist aggregation to add components of GDP. |

|

71 |

Dale W. Jorgenson and Kevin J. Stiroh, “Raising the Speed Limit: U.S. Economic Growth in the Information Age,” in National Research Council, Measuring and Sustaining the New Economy, op. cit. |

-

FIGURE 2 Relative prices of computers, communications equipment, and software, 1959-2004.

NOTE: All price indexes are divided by the output price index.

-

electronics, are directly attributable to declines in price for the semiconductor inputs used in these products.72

-

-

The Moore’s Law phenomenon of “faster, cheaper, better” semiconductors is also present in the computer and computer component industries, accelerating the pace of technological innovation and lowering costs to consumers.

-

Increased computing power enables a wider and more complex range of applications for both the specialist as well as the general user.

-

The increased computing power in new and improved computer microprocessors is readily apparent to those “power users” who use their computers for scientific computing or modeling, games, and video and audio processing.

-

It also of advantage to less demanding household computer users, improving the quality of their interface to their computers and enhancing their ability to handle high-resolution audio, video, and image files that are increasingly available over the Internet. Increased computing power also improves the speed and responsiveness of household computer

-

-

-

users in executing traditional applications (like word processing and spreadsheets), their ability to use features available in these traditional applications, and their ability to run multiple other applications (like anti-virus checkers, firewalls, multimedia plug-ins, messaging software, and search engines) concurrently with traditional applications without significantly degrading performance.

-

-

Economists require accurate measures of the performance of computers and computer components in order to understand their contributions to economic growth.

-

Developing a useful measure of computer performance through time is a challenge because the nature of the computer is changing in many ways. For example, some experts forecast that the emergence of grid computing and Web-based services will change information technology from assets that firms own—in the form of computers, software, and other devices—to a service they purchase from utility providers.73

-

Hedonic price indexes provide a proven method for adjusting for quality differences in computers across time. Using this method requires improved performance measures for computers and computer components.74

-

-

Microprocessors are the single largest semiconductor expenditure in computers, and there are some signs that quality-adjusted price declines for this input have recently slowed significantly. This slowdown appears to be linked to a recently struck “brick wall” that now limits continuing improvements in microprocessor operating speeds.75 If this continues, it suggests the pos-

-

sibility that we may soon see a lessening of the pace of price declines for computers, which ultimately will have negative economic implications for the wider economy as a whole.

Recommendations

-

The computer component industry has developed a variety of formal and informal measures to gauge the relative performance of its products. Further development of these measures and subsequent incorporation into the National Income and Product Accounts should enable improved analysis and policies to sustain the contributions of computers and computer components to economic growth.

-

Wider adoption of technology roadmaps and enhanced government-industry cooperation can improve our capacity to reinforce the growth path predicted by Moore’s Law in the computer and computer component industries.

-

Given the apparent slowdown in microprocessor speeds, accelerated research investment in methods and tools to lessen the cost of writing software that can utilize multiple computer processor cores “in parallel” would seem to be a priority, particularly given the potentially large economic payoffs in maintaining the pace of technological advance in IT.76

E.

SOFTWARE’S CRUCIAL ROLE

Findings

-

Software is the means by which we interface with the information and communications technologies that underpin the modern economy.

-

The United States economy is highly dependent on software, with businesses, public utilities, and consumers among those integrated within complex software systems.

-

Computer systems, such as those used by businesses, integrate software and hardware with detailed knowledge about the context of the application. A workforce that understands both the nature of business processes

-

|

data showing that there has been a substantial slowdown in the rate of decline of prices for microprocessors. This is NAICS 334413 (Semiconductor and Related Device Manufacturing) and can be found in the BLS detailed report on the Producer Price Index (PPI). Accessed at <http://www.bls.gov/ppi/ppidr_t01-09.pdf>. |

-

-

as well as information technology is necessary to develop and maintain such systems.

-

-

The structure of software is highly complex. While better software permits operations at unparalleled levels of sophistication, this complexity also creates significant economic and national security vulnerabilities.

-

As software has become more complex, safeguarding it has become more difficult. Attacks against software—in the form of both network intrusions and infection attempts—have also grown substantially in recent times. Moreover, the economic impact of such attacks is increasingly significant.

-

Thus, a major challenge lies in creating software code that is relatively error free, virus-resistant, robust against change, and capable of scaling reliably to incredibly high volumes while ensuring that it can integrate seamlessly and reliably to many other software systems in real time.

-

-

Tracking software prices and aggregate investments in software, and hence their impact on the economy, is a challenge given the unique and embedded nature of software.77

-

Software is complex in structure, and the market for software is different from that of other goods and services. Software can be easily duplicated (often at low cost) and the service life of software is often hard to anticipate. The nature and functions of software also evolve over time, requiring the development of quality-adjusted price indexes for various types of software.

-

In addition, most of the nation’s software capability is embedded in firms that are not classified as the software industry. These sectors include financial services, health care informatics, telecommunications, defense, aerospace, and automobiles. Tracking the value contribution of software in these sectors is challenging because the capability is thoroughly integrated into the organization, and despite this, that capability depends closely on technologies developed in the information technology sectors, including software, computers, and IT services.

-

The Bureau of Economic Analysis (BEA) distinguishes among three types of software—prepackaged, custom, and own-account software. Prepackaged software is sold or licensed in standardized form and is delivered in packages or electronic files downloaded from the Internet.

-

-

-

Custom software is tailored to the specific application of the user and is delivered along with analysis, design, and programming services required for customization. Own-account software consists of software created for a specific application. However, at present, only price indexes for prepackaged software hold performance constant.78

-

Given that only the prices of prepackaged software are adequately represented in the official system of price statistics, software prices are in a statistical blind spot. A major challenge lies in constructing constant quality price indexes for custom and own-account software.

-

-

Open-source software is promising. Open-source software development has proven to be a significant and successful way of creating software that is more robust.79

-

The policy challenge lies in fostering incentives for individuals to develop basic software components through open-source coordination, while ensuring that once they are built, they will be widely available at low cost so that future development can be stimulated.80

-

Measuring open-source software in the national accounts is a challenge given the distribution in prices and value-added services and the need to separate business services from software.

-

-

Software suffers from relatively slow measured productivity growth. In contrast to trends found in other information technology sectors, productivity growth in software development does not appear to be as significant.

-

There is limited progress in automating the production of software. Software writing—particularly at the creative or high end—remains in many respects a cottage industry.

-

Complementarities among skill sets needed to develop software mean that scaling up and speeding up production are difficult.

-

|

78 |

Robert P. Parker and Bruce T. Grimm, “Recognition of Business and Government Expenditures on Software as Investment: Methodology and Quantitative Impacts, 1959-1998,” Washington, D.C.: Bureau of Economic Analysis, November 2000. |

|

79 |

For example, Apple Inc. notes that “using Open Source methodology makes Mac OS X a more robust, secure operating system, as its core components have been subjected to the crucible of peer review for decades. Any problems found with this software can be immediately identified and fixed by Apple and the Open Source community.” See <http://www.apple.com/opensource/>. For an empirical analysis showing fewer and more rapid bug fixes with open-source software, see Jennifer Kuan, “Open Source Software as Lead User’s Make or Buy Decision: A Study of Open and Closed Source Quality,” Palo Alto, CA: Stanford Institute for Economic Policy Research, 2002. |

|

80 |

See comments by Hal Varian in National Research Council, Software, Growth, and the Future of the U.S. Economy, op. cit. |

-

The software workforce is highly differentiated and includes computer scientists and engineers of varying caliber. Increasingly, this labor pool is dispersed around the world.

-

There are a relatively small number of high-quality software developers. Industry participants suggest that there are only a very limited number of such “superstars”—those with productivity that is 20 to 100 times better than that of average software developers—and that this talent is scattered worldwide.81

-

Competition for high-quality software developers is accelerating. The international competition for this limited pool of highly skilled labor is acute and is expected to accelerate.82

-

-

Software and hardware play interdependent roles in enhancing the productivity of information technology. More widespread use of multiple-core processors, needed to overcome the apparent slowdown of processor clock rates, will require additional software development.

-

The apparent slowdown in improvement of processor clock rates means that much continuing price-performance improvement in computer hardware will increasingly require harnessing the power of microprocessors with multiple cores. Making effective use of such multi-core processors is likely to be less difficult for business computers (like servers) that serve applications to many different users and can make easy use of this greater processor power to serve more users.

-

However, harnessing multiple processor cores on a single more powerful application is much more complex, and requires writing or reengineering software to split it up into multiple threads that can operate in parallel.

-

Recommendations

-

Software price indexes, especially for own-account and custom software, must be upgraded to hold software performance constant. Without adjustment for quality, these indexes present a distorted picture of software prices as well as software output and investment.

-

Advances in developing software price indexes, including current work by BEA on function points, hedonic techniques, and other methodologies, should be supported.83 These advances can improve statistical

-

-

-

information on firm investments in customized software applications such as own-account and custom software.84

-

Adoption of common standards across the Organisation for Economic Co-operation and Development (OECD) and beyond should also be further encouraged. Wider use of standards can improve our knowledge about investments in software in what is a global industry and facilitate the tracking of software outsourcing.85

-

Active and informed participation by standards organizations such as the National Institute of Standards and Technology (NIST), in close consultation with industry associations, are necessary if the United States is to participate effectively in the process.

-

-

The United States needs to foster the expert workforce needed to develop and maintain the computer systems so critical to the nation’s economy and security.

-

Developing the basis for a better-trained workforce begins with strengthening K-12 education. At the secondary level and beyond, scholarships are needed to attract more U.S. students, including women and minorities, to pursue training in computer science and related fields.86

-

More adaptive immigration policies are also required to attract and retain in the United States foreign students who have been trained in American universities—especially those who are exceptionally talented.87 In addition, visa restrictions that prevent or impede highly talented software developers from working in the United States should be revised.

-

The nature of the market for software superstars is poorly understood.88 Given the increasingly apparent “bottleneck” role of software development in limiting the continued growth in the New Economy, a major research effort aimed at understanding the economics of the software industry and software labor markets would seem highly desirable.

-

-

Sustaining the productivity gains from information technology includes maintaining existing computer systems and, given the limited lifespan of such systems, investing in the development of future systems.

-

Computer systems have a limited lifespan. Improved metrics are necessary if firms are to properly capitalize their software expenses, anticipate the liabilities at the end of the software system’s life cycle, and plan for future systems.

-

Improvements in custom coding, software-oriented architecture, and Web-based services will be necessary to sustain the productivity gains from software.

-

Interdisciplinary training that combines computer science with business management, finance, and other application fields is necessary to develop the expertise required to build and maintain the information technology systems of the future.

-

-

The slowdown in the improvement of processor clock rate, which historically has been the focus for applications running on supercomputers, will soon become vastly more important on desktop computers containing new, multi-core microprocessors. Significant national investment in basic research on software development methodologies and tools for “parallelizing” applications to make use of multiple processors would seem to be a very worthwhile endeavor, with potentially significant economic impacts in maintaining the pace of the New Economy.89

F.

THE TELECOMMUNICATIONS CHALLENGE

Findings

-

Communications technology is crucial for the rapid development and diffusion of the Internet, perhaps the most striking manifestation of information technology in the American economy. By storing, sorting, and distributing vast information very quickly and at very low cost over communications networks, the Internet may be potentially very important in the longer run for the continued growth in output and improved productivity of the United States and other knowledge economies.90 Communications equipment is also

-

an important market for semiconductors. Switching and terminal equipment rely heavily on semiconductor technology, so that product development in communications often reflects improvements in semiconductors.

-

Advances in telecommunications equipment, however, are derived from a variety of sources. Technological advance in fiber optics, microwave broadcasting, and communications satellites, as well as for switches and routers that are used to send and receive data, have progressed at rates that in some cases outrun even the dramatic pace of semiconductor development.91 The convergence of these advanced technologies is a powerful source of innovation.

-

For example, phenomenal progress has been made possible in part by advances in Dense Wavelength Division Multiplexing (DWDM), a technology that sends multiple signals over an optical fiber simultaneously. Installation of DWDM equipment, beginning in 1997, has doubled the transmission capacity of fiber optic cables every 6 to 12 months.

-

Prices for communications gear have also been estimated to have fallen by about 8 to 10 percent per year between 1994 and 2000, although this is about half as fast as the decline in the price for computers.92

-

-

The United States recently witnessed significant investments in telecommunications equipment, corresponding with the dot-com boom of the late 1990s. Much of this communications investment was in the form of the transmission gear, connecting data, voice, and video terminals to switching equipment.

-

Investments in communications equipment in the United States are on par with those for computers. Over the course of the 1990s and continuing into the present decade, expenditure on communications has been around $100 billion per year, representing a little over 10 percent of total equipment investment in the United States.

-

|

but also potentially contribute resources available to other users, increasing the value and choices of the network. |

-

-

At the same time, there have been large swings in the U.S. investment in communications, with investment in communications gear falling 35 percent during the recession of the early 2000s.

-

-

Although massive investments in the nation’s high-capacity Internet backbone have created excess capacity in long-haul facilities, a variety of factors—regulation among them—have slowed the build-out of the crucial last mile.

-

By creating highly technology-specific industry rules, and by attempting to promote competition by requiring incumbents to share the local loops of their network with rivals, the Telecommunications Act of 1996 may have, according to some experts, inadvertently inhibited investment needed to diffuse high-bandwidth access over the last mile.93

-

While broadband adoption has grown quickly in recent years, demand for broadband adoption appears to be slowing. A recent survey by the Pew organization shows that 32 percent of the adult population in the United States does not use the Internet, a number that held steady for the first 6 months of 2005.94

-

According to the International Telecommunications Union, the United States significantly lags other advanced nations in high-speed broadband access, ranking sixteenth in the world in broadband penetration in 2005.95 However, these data relate to diffusion to households, whereas information about diffusion to businesses (which has important consequences for productivity) is limited.

-

Our limited knowledge about the scope of broadband diffusion and adoption inhibits policies needed to better capitalize on the nation’s

-

|

93 |

Robert Litan and Roger G. Noll, “The Uncertain Future of the Telecommunications Industry,” Brookings Working Paper, December 3, 2003, Washington, D.C.: The Brookings Institution. Interpretations vary on the impact of the 1996 Telecommunications Act. Some experts believe that competition for the provision of broadband was already taking place in most major downtown areas in many of the largest cities of the United States before the Telecommunications Act. See Glenn Woroch, “Local Network Competition,” in Handbook of Telecommunications Economics, Martin Cave, Sumit Majumdar, and Ingo Vogelsang, eds., New York, NY: Elsevier, 2002. Others believe that the Act did not deter the build-out of the nation’s cable network. For example, see Jonathan E. Nuechterlein and Philip J. Weiser, Digital Crossroads: American Telecommunications Policy in the Internet Age, Cambridge, MA: The MIT Press, 2005. |

|

94 |

John B. Horrigan, “Broadband Adoption at Home in the United States: Growing but Slowing,” Pew Internet and American Life Project, paper presented to the 33rd Telecommunications Policy Research Conference, September 25, 2005. |

|

95 |

The International Telecommunication Union (ITU) reports that in 2005 the five top nations for broadband network market penetration were Korea, Hong Kong, the Netherlands, Denmark, and Canada. The ITU ranked the United States sixteenth in broadband penetration. ITU Strategy and Policy Unit Newslog, August 8, 2005. Accessed at <http://www.itu.int/osg/spu/newslog/CategoryView,category,Broadband.aspx>. |

-

-

substantial investments in information technology and infrastructure, limiting the potential for sustained growth in the economy.

-

-

Wireless broadband can help overcome some of the limitations associated with traditional wired broadband access—not least the costs associated with wiring the last mile.

-

While wireless broadband has been in limited use to date due to relatively high subscriber costs and technological challenges such as those related to obstacle penetration, rapid advances in technology are likely to overcome such challenges.

-

Some industry experts believe that the emerging WiMAX standard promises to resolve a number of problems that confront existing wireless protocols such as WiFi.96

-

-

The convergence of data, voice, video, wireless, and public and private networks into an end-to-end infrastructure, now under way, is challenging business models and regulatory frameworks alike. The commoditization of information is ushering a major shift from distinct vertically integrated industries that are focused on particular products or services towards a more horizontal platform that supports the movement of content and application services moving across IT networks.97

-

This convergence is changing the terms of competition across industries. While there was once a major separation between the telecom and cable industries, for example, these businesses are likely to overlap and offer similar kinds of services.

-

Regulators face new challenges as telecommunications services are increasingly becoming blended, with voice, data, and video transmitted in commoditized packets over the air or through a wire. The end of “stovepiping” also poses new challenges for consumers.98 Consumers confronted with a proliferation of Internet services, operating systems, and devices may look for service that is integrated and easy to use.99

-

Replacing “silo” or sector-specific communications regulation with a policy framework that address the emerging horizontal technology plat-

-

|

96 |

David Lippke, “The Wireless Wildcard,” in National Research Council, The Telecommunications Challenge: Changing Technologies and Evolving Policies, op. cit. |

|

97 |

William Raduchel, “The End of Stovepiping,” in National Research Council, The Telecommunications Challenge: Changing Technologies and Evolving Policies, op. cit. |

|

98 |

Stovepiping refers to the retrieval of information from unconnected databases—in particular the situation that exists when it is necessary to “climb out” of one database in order to climb down into another. |

|

99 |

Lisa Hook, “Serving Consumers on Broadband,” in National Research Council, The Telecommunications Challenge: Changing Technologies and Evolving Policies, op. cit. |

-

-

forms is needed to complement the networked characteristic of the New Economy.100

-

-

The value of intellectual property is increasingly recognized, and the use of patents has increased dramatically. Yet, businesses have faced serious challenges of protecting intellectual property in the era of digital distribution. Recently available technologies, for example, have allowed consumers to share music and content with each other for free.101 The trend towards improved security of intellectual property, such as the recent success of the iPod and related legitimate forms of on-line music diffusion, is encouraging and can help stimulate the creation of new content and applications.102

-

The move towards virtualization, grid computing, and Web services is leading to a major shift in the nature of information technology assets from computers, software, and myriad related components that companies own to services that firms purchase from on-line utility providers.103

Recommendations

-

The varying complexity and rates of technical innovation make the contribution of telecommunications equipment to productivity growth a challenge to measure. Current BEA methodologies for making intertemporal comparisons in price and quality understate true price declines in communications equipment because they do not fully track evolving technological changes.104

-

For most of the 1990s, manufacturers focused on features such as greater port density, faster speeds, and support for an increasing number of communication protocols in designing new switches and routers. After the 2001 collapse in demand for telecommunications equipment, manufacturers began to differentiate their products in new and innovative ways that are difficult to quantify on a quality-adjusted basis. Better data and analysis are needed to get a clear idea of what happened with regard to

-

-

-

technological change in and prices of communications equipment from 2001 on.

-

Valuing the improvements built into new switches and routers is difficult. While the Producer Price Index has tried to address some of these changes using hedonic techniques, data that consistently identify important current period product characteristics and transaction prices are not yet readily available.105 Research into alternative quality valuation techniques and improved data transparency is required to respond to the technological changes in telecommunications equipment. BEA and other statistical agencies require increased funding to follow evolving trends in the communications arena with more accuracy.

-

-

As noted above with regard to software, greater attention to standards and the national and international process of their establishment is required. The economic stakes of standard setting are of great consequence. Some nations and regions see standards as a competitive tool and devote substantial resources to this end. The role and resources of the National Institute of Standards and Technology have to be seen in this light. The standard-making process must be recognized as a key component of U.S. competitiveness and provided commensurate resources and policy attention.

-

Uncertainty created by a multiplicity of standards and a lack of clarity in regulatory policy are retarding progress in the growth of wireless and fiber networks needed to convey this commoditized information to the curb.106

-

Technical standards, especially for wireless devices, are an important element in sustaining U.S. success in the global economy. Without effective standard-making capabilities and active U.S. participation in international standard-making bodies, the United States will not be able to maximize its advantages.107

-

-

The supply as well as the demand side of the market for high-speed Internet access needs to be elaborated. While international comparisons show that U.S. broadband adoption for households lags that of other countries, relatively little is known about factors that affect the broadband adoption path

-

in the United States, particularly for businesses. Further data are required to understand the scope and nature of broadband use by businesses, and more study is required to understand why a significant percentage of households are not linked to the computer and Internet culture that is central to the new, more productive U.S. economy.108

-

Revising outdated regulation and addressing issues of security and intellectual property protection are necessary for the nation to realize productivity gains from advances in communications technology.

-