The NRC Conferences on the New Economy

Faster, better, and cheaper semiconductors and computers as well as software and telecommunications equipment have led, especially over the past decade, to the widespread adoption and use of modern information and communications technologies. This, in turn, is rapidly ushering fundamental changes to the way in which (and the rapidity with which) goods and services are developed, manufactured, and distributed around the world and the way in which individuals and businesses everywhere consume, interact and transact. This “New Economy” poses new challenges, requiring new approaches to economic measurement and policy analysis.

To this end, the National Academies’ Board on Science, Technology, and Economic Policy (STEP) has since 2000 held a series of workshops to better understand the New Economy phenomenon and to develop policies needed to sustain the positive contribution of modern information and communications technologies to U.S. growth and competitiveness. This section of the report summarizes and provides background for some of the key issues raised over the course of the five conferences hosted by the STEP Board (listed in the Preface) on Measuring and Sustaining the New Economy.

The proceedings of each of these conferences have been published in separate volumes by The National Academies Press. Although the technologies of the industries considered at these conferences continue to evolve rapidly, the reports nonetheless capture conceptual issues of continued policy relevance to the industry leaders, academics, policy analysts, and others who participated in these workshops.

MOORE’S LAW AND THE NEW ECONOMY

At the time of the STEP Board’s first conference in 2000, many economists were still reluctant to proclaim a technology-driven New Economy if only because there were few or no data reflecting economy-wide returns to the substantial investments made by U.S. business in new information and communications technologies.1 Throughout the 1970s and 1980s, Americans and American businesses regularly invested in ever more powerful and cheaper computers and communications equipment. They assumed that advances in information technology—by making more information available faster and cheaper—would yield higher productivity and lead to better business decisions.

The expected benefits of these investments did not appear to materialize—at least in ways that were being measured. Even in the first half of the 1990s, productivity remained at historically low rates, as it had since 1973. This phenomenon was called “the computer paradox,” after Robert Solow’s casual but often repeated remark in 1987: “We see the computer age everywhere except in the productivity statistics.”2

Raising the Speed Limit

At the National Academies first conference on the New Economy, however, Dale Jorgenson pointed to new data that showed that the U.S. economy was undergoing a fundamental change.3 While growth rates had not returned to those of the “golden age” of the U.S. economy in the 1960s, he noted, new data did reveal an acceleration of growth accompanying a transformation of economic activity. This shift in the rate of growth by the mid-1990s, he added, coincided with a sudden, substantial, and rapid decline in the quality-adjusted prices of semiconductors from an average of 15 percent annually before 1995 to 28 percent annually after 1995.4

In response to the rise in capability of computers and drop in price, investment in semiconductor-based technologies exploded, leading to a positive impact on economic growth. Jorgenson and Stiroh have calculated that computers’ con-

tribution to growth rose more than five-fold, to 0.46 percent per year in the late 1990s. Software and communications equipment contributed an additional 0.30 percent per year for 1995-1998. And their preliminary estimates through 1999 revealed further increases for all three categories.5 Jorgenson thus made the case for “raising the speed limit”—that is, for revising upward the intermediate-term projections of growth for the U.S. economy.6

The Role of Moore’s Law

Moore’s Law describes the speed at which semiconductor technology develops. Semiconductors are the core enablers for the wide array of information and communications technology. The pace of semiconductor development is, therefore, critical to the development of the broader range of computing and telecommunications technologies that are the basis for modern economic processes.

Moore’s Law is based on a prediction made by Gordon Moore in a 1965 paper titled “Cramming More Components onto Integrated Circuits,” where he noted:

The complexity for minimum component costs has increased at a rate of roughly a factor of two per year. Certainly, over the short term, the rate of increase is a bit more uncertain, although there is no reason to believe it will not remain nearly constant for at least 10 years. That means by 1975, the number of components per integrated circuit for minimum cost will be 65,000.7

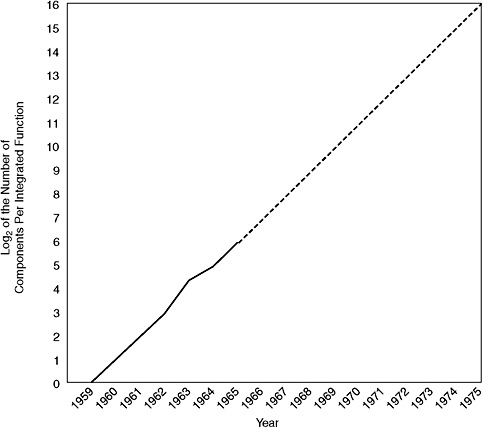

Extrapolating this trend (see Figure 1), Gordon Moore predicted an exponential growth of chip capacity at 35 to 45 percent per year through 1975.8

Gordon Moore revised his original prediction in 1975 (the endpoint of his earlier projection) stating that increases in components per chip would continue, approximately doubling every 2 years, rather than every year.9 Believing that human ingenuity would further sustain the growth of chip capacity, he noted that manufacturers were using “finer scale microstructures” to engineer higher density of components per chip.

As Kenneth Flamm pointed out at the National Academies’ 2001 conference on semiconductors, the idea popularly known today as “Moore’s Law” (drawn from but not identical to Gordon Moore’s predictions) anticipates the doubling of

FIGURE 1 The original “Moore’s Law” plot from Electronics, April 1965.

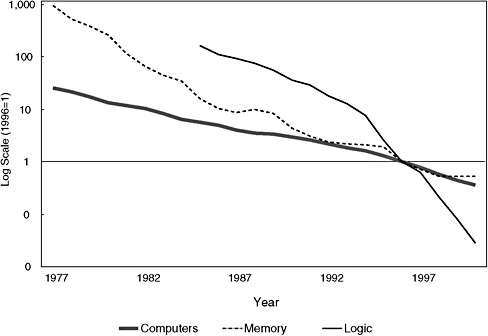

the number of transistors on a chip every 18 months.10 While not deterministic, Moore’s Law accurately reflects the pace for growth in the capacity of memory chips and logic chips from 1970 to 2002, as shown in Figure 2.11

FIGURE 2 Transistor density on microprocessors and memory chips.

As Kenneth Flamm further noted, Moore’s Law also captures an economic corollary that successive generations of semiconductors and related information technology products will not only be faster but also successively cheaper. Data from the Bureau of Economic Analysis (BEA), depicted in Figure 3 (and displayed by Dale Jorgenson at the conference on software), shows that quality-adjusted semiconductor prices have been declining by about 50 percent a year for logic chips and about 40 percent a year for memory chips between 1977 and 2000. This is unprecedented for a major industrial input.

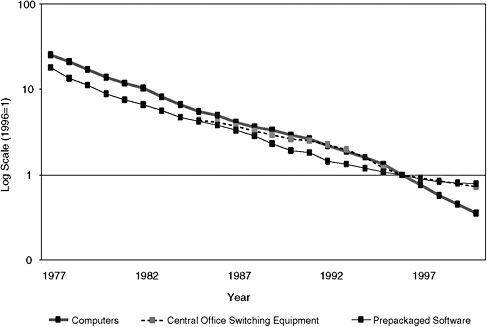

The Moore’s Law phenomenon also appears to extend from microprocessors and memory chips to high-technology hardware such as computers and communications equipment. BEA figures highlighted by Dale Jorgenson reveal also that computer prices have declined at about 15 percent per year since 1977. (See Figure 4.)

FIGURE 3 Relative prices of computers and semiconductors, 1977-2000.

NOTE: All price indexes are divided by the output price index.

While Moore’s Law appears to predict ever “faster, better, cheaper” semiconductors and computers, it is not a deterministic law of nature, enduring instead by setting the expectations among participants in the semiconductor and computer industry of the pace of innovation and the introduction of new products to market. Before describing the basis of Moore’s Law and what is required to sustain this remarkable phenomenon, we first summarize some of the discussion of the economic implications of Moore’s Law and the challenges they pose to measuring the New Economy.

MEASURING THE NEW ECONOMY

Measuring the New Economy is a challenge given the fast-changing nature of information and communications technology and the complex and often-invisible roles it plays in economic processes. This means that current data collection methods have to be updated to stay relevant to new products, new categories, and new concepts.

FIGURE 4 Relative prices of computers, communications, and software, 1977-2000.

NOTE: All price indexes are divided by the output price index.

The Challenge of Measurement

As several participants at the initial conference noted, conventional statistical methods are not adequately adapted to capture what is happening in the economy. Illustrating the challenges facing the federal statistical system, Timothy Bresnahan of Stanford University noted the discrepancy between measures of output in the information technology sector (which he noted are adequate) and measures of output where information technology is used as an input in other sectors (which are not).12 Shane Greenstein of Northwestern University added that conventional measures of Gross Domestic Product (GDP) provide good data on established channels by which goods and services are distributed, but fail to capture such information about goods and services when there are concurrent changes in the distribution methods.13

Illustrating the implications of asymmetries in data availability, Lee Price (then of the Department of Commerce) observed that data on the value of pre-

|

Box A: Challenges in Measuring of the New Economy Key challenges to measuring the New Economy—as noted by several of the participants at the initial conference on Measuring and Sustaining the New Economy—include:

|

packaged software (which is more easily measured in terms of both nominal value and price) might not be as important to productivity as custom and own-account software whose value is more difficult to capture—resulting in their under-valuation. He stressed the need to refine statistical methods to better quantify the value of information technology.14

Several participants at the initial conference also emphasized the problems in valuing information technologies. Kenneth Flamm observed that it is difficult to calculate the percentage of improvement in computers that come from semiconductors.15 Eric Brynjolfsson of the Massachusetts Institute of Technology (MIT) further noted some hazards in equating price with value for computers, particularly given that many consumers are not price-sensitive, valuing service, brand loyalty, and perceived quality instead.16 Further to the issue of value, David Mowery of the University of California at Berkeley noted that it is statistically difficult to see the contributions of the semiconductor industry since it is hard to measure the output of “user” industries. He added that the economy outside the computer industry has become “a bit of a black planet” in terms of understanding quality improvements in its products.17 This value issue was further elaborated at the conference on Deconstructing the Computer.

Additional measurement challenges deal with how well information technologies are integrated and adopted across the economy. There were divergent views on where the United States was on the technology adoption curve at the turn of the century: Some argued that the United States was near the bottom of the S-shaped curve and about to take off; others suggested that the United States was in the middle and thus enjoying rapid productivity gains from the widespread adoption of information technologies; still others believed that marginal productivity gains from information technologies might be declining, signifying that the United States was already near the top of the technology adoption curve. This diversity of opinion, and the contrasting policy actions that it implies, pointed to a need to better measure the distinctive features of today’s economy.

Another major constraint in sustaining the growth in productivity is the rate of technology absorption. Sid Abrams of AT Kearney noted that business organizations often face challenges in reengineering themselves to take better advantage of the technologies available. While the cutting edge of technologies may advance, their potential to advance business productivity may depend on the extent to which executives and others are aware of the possibilities and/or uncertain of the effects of adopting new technologies in their organization.18 Indeed, as Ralph Gomery of the Alfred P. Sloan Foundation noted in the roundtable discussion that concluded the initial conference, the ability to absorb rapid advances in technology and the cost of re-doing the business organization to take advantage of these advances are, in many cases, more significant for sustaining productivity-led growth than the rate of technological advance. In essence, the question is not merely one of better or cheaper technology, but rather one of how enterprises can integrate productivity-enhancing technologies into the way business is conducted.

Sustaining the benefits of new technologies requires that we better understand the nature of these technologies and the circumstances that promote their development and deployment. STEP’s series of conferences on the New Economy has thus sought to bring together leading economists and also to draw on the knowledge and experience of industry leaders and other experts to describe current trends and their origins, with the challenge to economists to identify data and tools required for measuring and modeling key facets of the New Economy.

Modeling the Productivity and Cyclicality of the Semiconductor Industry

Reflecting the centrality of semiconductors to the information technologies, STEP’s conference of September 24, 2001, examined the rapid evolution of semiconductor technologies and a possible modeling strategy that could be used to predict the effects of alternative policy choices for the semiconductor industry.

|

Box B: Semiconductor Product Cyclicality and the New Economy Intensifying competition in markets for semiconductor products ↓ Shift in product cycle for semiconductors from 3 to 2 years ↓ Sharp acceleration in price decline in semiconductors ↓ Substantial acceleration in information technology (IT) price declines, signaling faster productivity growth in IT-producing industries ↓ Powerful incentives for firms to substitute IT equipment for other forms of capital ↓ Boost in growth by nearly a full percentage point, with IT contributing more than half of this increase SOURCE: Adapted from Dale Jorgenson, “Information Technology and the U.S. Economy,” American Economic Review, 91(1):1-32, 2001. |

Semiconductors and the New Economy

Participants at this conference noted that semiconductors are the basis of today’s computing, information, and communications technologies. Rapid increases in the power of semiconductors, foreseen by Moore’s Law, and corresponding rapid declines in the price of semiconductor-based information technologies have lead to their swift diffusion across the economy and propelled their adoption across an array of applications.19

Drawing on his 2001 presidential address to the American Economics Association, Dale Jorgenson reminded the conference participants that the resurgence in the U.S. economic growth trajectory since 1995 is associated with a “relentless” fall in semiconductor prices and coincident with a shift in product cycle for semiconductors from 3 to 2 years.20 Jorgenson drew attention to a series of documented events—summarized in Box B—between an intensifying pace of competition in the market for semiconductor products and the boost in the aggregate growth rate of the U.S. economy.

Given that a disproportionate share of growth appears to be generated by increased efficiencies related to the production and use of information technology (IT), the economic consequences of a two-year product cycle—as opposed to a three-year product cycle—are significant. Jorgenson noted that the contribution of IT to growth from 1995 to 1999 was about 1.3 percent; by comparison, the annual growth of the U.S. economy over the same period was about 4 percent. A third of that is attributed to IT, meaning that 7 percent of the economy accounted for about a third of its economic growth. This is evidence, Jorgenson concluded, that the behavior of prices of IT, and the behavior of prices of semiconductors in particular, are of “momentous” importance to the economy.21

Explaining Productivity and Cyclicality in the Semiconductor Industry

Given its importance, how can economists better predict semiconductor price behavior? Participants at the conference highlighted the high sunk costs, steep learning curves, and rapid product cycles found in the semiconductor industry as factors affecting the industry’s cyclicality. To predict price behavior, a successful industry model would have to take the effects of these features into account.

-

High Sunk Costs: Sunk costs are costs already incurred that cannot be recovered regardless of future events. In his conference presentation, Minjae Song of Harvard University noted that semiconductor firms face significant sunk costs in building and upgrading of new fabrication plants (often called “fabs”) where a midsized fab today costs at least $1.5 billion to $2 billion to build. In addition, very large research and development (R&D) investments are required to enter this industry—typically as much as 10 to 15 percent of annual sales—with the R&D often specific to a particular market segment.22

-

Steep Learning Curves: Learning curves in semiconductor production are steep—approximately 70 percent. This means that a doubling of output drops unit costs by about 30 percent. In the semiconductor industry, however, these economies are not generated so much by greater labor productivity as by incremental changes to the automated technology. As Kenneth Flamm noted, improvements over the lifetime of a product’s production come from more efficient die shrinks, which increase the chip density of a silicon wafer, and from yield learning, where the number of good chips on a wafer

-

increases over time as a percentage of the total number of chips that are manufactured.23

-

Rapid Product Cycles: The semiconductor industry is distinctive in its continuous and rapid introduction of new generations of products (i.e., chips) and the dramatic difference in performance from one generation of product to the next. It is also characterized by very large R&D investments—typically as much as 10 to 15 percent of annual sales—with this R&D often specific to the segment of the market that the firm is entering. Over the past 10 years, the industry has produced five to six generations of semiconductors. When a firm puts a frontier product on the market, existing products become non-frontier. For example, when both the Pentium 2 and the Pentium 3 processors were on the market, the Pentium 3 was at the market frontier. Pentium 3 subsequently became the non-frontier product with the introduction of the Pentium 4 processor. According to Minjae Song, this rapid product cycling has meant that stocks of the current frontier product can quickly lose value with the introduction of the next-generation product.24

These features, taken together, affect the semiconductor industry’s cyclicality. Conference participants described a variety of pathways in this regard:

-

Drawing Down Inventories: Fast technological change in the semiconductor industry means that a semiconductor firm cannot reserve inventories as a way of smoothing out demand fluctuations if it hopes to remain competitive. Instead, given the short lifetimes of semiconductor products, firms expect that their inventories will lose value, even become obsolete, if held for too long. Considering the need to recoup high sunk costs, semiconductor firms face strong incentives to sell existing stocks of products as quickly as they can. This need to draw down inventories rapidly is thought to contribute to more pronounced industry cycles.25

-

Excess Capacity: Attempts to capture the economies of the learning curve can also exacerbate the industry cycle. While, as noted above, the learning economies related to more efficient die shrinks and yield learning help cut costs, the hidden added capacity that results can also contribute to a chip

-

glut. Faced with excess supply, firms may have to close older fabrication facilities and/or lower prices.26 These measures can add to the cyclicality of the industry.

-

Time to Build: Finally, semiconductor fabrication plants take time to build— typically up to 2 years—and lag times between spikes in demand and sale can also play a significant role in the industry’s cyclicality. Unanticipated surges in chip demand may be prompted by shocks such as those related to the mid-1990s boom in the PC market, the subsequent popularity of the Internet, and the rapid expansion (and later collapse) of the wireless communications market. Given that time is needed to build new manufacturing capacity, however, it is possible that demand fades just as the new capacity to meet this anticipated demand comes on stream. These lags between demand and supply, thus, can exacerbate cyclicality in the market for semiconductors.

In all, as David Morgenthaler of Morgenthaler Ventures observed at the conference, technological developments that decrease the cost per function and subsequently expand the depth and diversity of the market do not seem to translate into smoother industry cycles.

A Possible Model of the Semiconductor Industry

Models of the semiconductor industry that reflect its characteristic cyclicality can be a useful tool to predict semiconductor price behavior. In his conference presentation, Ariel Pakes of Harvard University described a modeling strategy that he has developed that he said can capture key features of complex and dynamic industries.27 This model is based on “primitives” that determine each firm’s profits conditional on the qualities of the products marketed, the costs of production, and the prices charged by all firms. This model could then be extended to include additional features of the specific industry being studied. Participants at the conference then examined the Pakes model to see if it could capture the salient features of the semiconductor industry.

A simple, static version of the Pakes model consists of a demand system, cost functions for each producer in the model, and an equilibrium assumption to solve reasonable pricing and quantity-setting decisions. Profits for each firm could then be calculated based on the price, the quality of each product sold, and the firm’s cost function. The hope is that this type of model could be further extended to

consider some dynamic investment decisions that result from those profit estimates and their likely impact on the industry and on consumers.28

Deconstructing the Computer: Measuring Computer Hardware Performance

The next National Research Council (NRC) conference on the New Economy sought to deconstruct the computer into its components as a way of understanding its sources of growth and to discover how best to measure this growth. To this end, conference participants considered how the Moore’s Law phenomenon of rapidly expanding capabilities applies to the various computer component industries.29

Although Gordon Moore’s initial prediction pertained to changes in the semiconductor capacity, Moore’s Law today more popularly captures the phenomenon of “faster” as well as “cheaper” development across a variety of computer components.30 The conference brought together industrialists from leading computer hardware firms to explain how Moore’s Law applied to their products and described the types of internal measures that industry had developed to track this change.

-

Microprocessors: William Seigle of AMD, a microprocessor manufacturer, compared the Am386, introduced by his company in 1991, with the Opteron, introduced in April 2003. Performance, he noted, had jumped 50 times from 33 MHz to 2 GHz, offering significant improvements in the efficiency of instruction processing, memory hierarchy, and branch prediction.31

-

Hardware Storage: Remarking on the performance improvements in computer storage, Robert Whitmore of Seagate Inc. noted that performance, measured as input/output transactions per second, had accelerated significantly between the late 1980s and late 1990s. Meanwhile, he noted that the price

|

28 |

C. Lanier Benkard of Stanford University illustrated how Dr. Pakes’ framework has been adapted to model the U.S. aircraft industry. See C. Lanier Benkard, “The Case of the Aircraft Industry,” in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., pp. 26-30. For additional detail, see C. Lanier Benkard, A Dynamic Analysis of the Market for Wide Bodied Commercial Aircraft, Graduate School of Business, Stanford University, June 2001. |

|

29 |

The nature of Moore’s Law is described later in this chapter in the section on “Sustaining the New Economy.” |

|

30 |

Kenneth Flamm, “Economic Growth and Semiconductor Productivity,” in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., pp. 43-45. |

|

31 |

William Seigle, “Processor Evolution,” in National Research Council, Deconstructing the Computer, Dale W. Jorgenson and Charles W. Wessner, eds., Washington, D.C.: The National Academies Press, 2005. |

-

of rotating magnetic memory on a dollar-per-gigabyte basis had eroded at an annual compound rate of minus 45 percent between 1995 and 2002. In addition, mean time between failures, a measure of reliability, had grown at a phenomenal compound annual rate of 25 percent from 1977 to 2001.32

-

Software Storage Systems: Mark Bregman of Veritas Software (a company that develops software to help store, access, and manage data) noted the apparent observance of Gilder’s Law, which states that the total bandwidth of communication systems triples every 12 months.33 Further, he noted that storage devices achieve 100 percent growth in density annually, a reality that translates into better cost at a dramatic rate.34

-

Graphics: Chris Malachowsky of NVIDIA documented product performance improvements in graphics from the second half of 1997 to the first half of 2003 at an annualized rate of 215 to 229 percent. Rapid technological advances in graphics technology, he noted, rendered moviemaking chores, previously requiring farms of thousands of machines, to be possible using consumer PCs, dramatically lowering prices.35

Developing Hedonic Price Indexes

Several participants at the conference on computers emphasized the need to develop appropriate categories and performance measures to capture the growth of these dynamic and complex industries. The Brookings Institution’s Jack Triplett underscored this point in his conference presentation, emphasizing that economists need to learn more about the contributions of hardware component technologies to the increase in computer performance.36

Dr. Triplett noted that while the cost of computing today is projected to be about one-thousandth of one percent of what it cost 50 years ago, this estimate still does not account for all aspects of computer performance. An exciting

research agenda, he noted, is to account for the determinants of the great decline in computer price/performance over the last 50 years.

This research agenda is very challenging because it has to account for the qualitative changes in computers. How do we measure, for example, the performance of the computer and its components through time? Dr. Triplett acknowledged that the question is complicated by the dynamism and complexity of the technological change characterizing the evolution of the modern computer. To be sure, the cost, capabilities, and size of a 1952 UNIVAC are significantly different from those of a modern laptop. Since direct comparisons of price are not feasible—the proverbial apples and oranges problem—a key challenge for economists is to adjust their price data for quality differences. Indeed, identifying such “true price change” has long been a goal of price statisticians and national accountants.

One way of adjusting prices for quality differences is to use hedonic price indexes. Developed 40 years ago by Zvi Griliches and enhanced since, this econometric method takes into account an array of characteristics possessed by a product and their functional relation to price.37 Many economists regard hedonic price indexes to be a theoretically promising way of adjusting for quality when measuring the price of computing power through time, while recognizing the need for further development.38

Methodological Challenges and Opportunities for Hedonic Pricing

In practice, however, the continued dynamism and complexity of the relevant industries will make the task of developing robust measures of computer performance highly challenging. Rapid supply-driven evolution of products and concepts, as well as changing consumer behavior, keeps the industry in flux, rendering the economist’s task more difficult. Swift technological change can change and, in some cases, even make obsolete the relative importance of particular quality characteristics used in hedonic estimates.39 A further prob-

lem arises because, if things change enough, no price methodology will give accurate estimates.40

Illustrating this technological dynamism, Dalen Keyes of DuPont Displays noted that the U.S. display industry sees its future in moving away from LCD (liquid crystal display) technologies and towards Organic LED (light-emitting diode) technologies. OLED display technology, based on a roll-to-roll manufacturing concept, integrates components from the flex-circuitry industry with inkjet printing from the graphic arts industry to get rolls of material that could be “sliced and diced” into displays. Flexible and versatile, OLEDs, he predicted, will possess qualities and applications quite different from today’s displays.41

Tracing the evolution of technology in the printer industry, Howard Taub of Hewlettt-Packard noted that “we are pretty much at a point where the quality of the image that you can print is about as good as you’re going to get.” As a result, he noted, the quest for “better” had gone on to pursue other dimensions including connectivity and ease of use. He also noted that the computer printer industry is looking to create new markets beyond those for office printing and duplication. New printer technologies, he noted, could enable the production of limited-run custom magazines and advertisements, changing the way consumers think about desktop printers.42

Indeed, for displays and printers, as with other computer components, the use of hedonic indexes to control for quality of a product is likely to be a challenge as continuing rapid innovation changes not just the features of the product but even the concept of the product itself.

Another challenge to developing robust hedonic price indexes arises when—as David McQueeney of IBM put it—“faster, better, cheaper,” collides with the “good enough phenomenon.”43 He noted, for example, that many current models of displays and home computers have crossed the “good enough” threshold for most of today’s home computing needs—the point also raised by Dr. Taub, above. Displays used for everyday desktop home-PC applications have become so good, observed Dr. McQueeney, that “further technological improvements aimed at more pixels per inch could not be detectable to the end user.” Similarly, he noted that disk capacity has become so large that most ordinary users never fill the hard

drive in the 2 or 3 years they normally keep a computer. So, although research and development do not stop at a certain point, their benefits may begin to show up in price reduction and cost-performance reduction rather than in performance measures. “The raw capabilities of technology have in some cases gotten to the point where either the economics of how you sell them and how you ascribe value to them is changing,” he explained, “or you are forced to look elsewhere in the system performance stack to get real improvements.”44

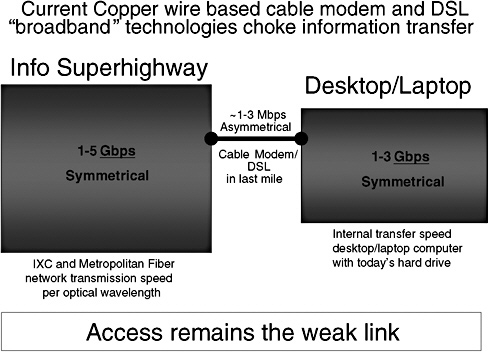

Dr. McQueeney also noted that the value of “faster and better” might remain unrealized pending additional developments in technology and finance. Looking ahead to the conference on the Telecommunications Challenge, he observed that there is at present enough fiber capacity to “connect every person in North America to every person in Eastern and Western Europe and to allow all to have a phone conversation at the same time.” He also noted that a tremendous capacity in optical fiber has been installed between various cities and within metropolitan areas of the United States. Yet, “the intelligence needed to light up those fiberoptic networks and make them actually do something useful—the servers, the routers, the switches—is in fact quite expensive,” he stated, “and we’re still struggling with a good investment model that will let us build out that control infrastructure to use the fiber capacity we have.”45 This need to realize necessary complementarities was also echoed by Dr. Siegle, who noted that “while micro-processors are important, you can’t make meaningful systems and applications if there are advances in just the microprocessor.”46

These conceptual challenges to measuring performance aside, industry experts at the conference described a variety of formal and informal measures currently used by computer component industries to gauge performance. Dr. Whitmore noted that for the hardware storage industry, capacity in bytes, price, performance, and reliability remain the main factors for measurement, although additional metrics are appearing on the horizon. In the printer industry, “faster and better” is measured in terms of printer speed, resolution, reliability, and usability, according to Dr. Taub. Mr. Malachowsky noted that there is a marketing view of performance in addition to internal and external views in the graphics industry. He noted that his company, NVIDIA, measures itself internally on “very engineering-specific, design-specific things” such as bandwidth utilization factors and externally according to particular application benchmarks. Echoing the common theme, Dr. Keyes noted that the display industry relies on an extensive list of technical specifications, including diagonal size of the display, pixel count, and power consumption. Performance measures include luminants

and switching speed, which indicates whether a product could do video-grade displays. Another metric, he added, is the size of the substrate used in the manufacture displays.

Citing these and other performance measures made note of by the participants, Dr. Jorgenson concluded that measuring progress in the computer and computer component industries is not only possible, but that such measurement is increasingly more sophisticated and, in fact, “quite successful.” He recalled that a set of measures for computers and peripherals begun in the late 1960s—grounded in economics research at IBM—achieved incorporation into the U.S. national accounts for the first time in the mid-1980s. These have continued to be in use (while also being enhanced and developed) to the present day. He expressed optimism that similar progress on data measurement and analysis can be made based on what he had heard at this conference—and that this could help improve the economic understanding needed to develop the policies necessary to sustain the New Economy.47

Measuring Software Performance

Within the U.S. national accounts, software is broken down into three categories: prepackaged, custom, and own-account software. Prepackaged (or shrinkwrapped) software is packaged, mass-produced software. It is available off-the-shelf, though increasingly replaced by on-line sales and downloads over the Internet. In 2003, BEA placed business purchases of prepackaged software at around $50 billion. Custom software refers to large software systems that perform business functions such as database management, human resource management, and cost accounting.48 In 2003, BEA estimated business purchases of custom software at almost $60 billion. Finally, own-account software refers to software systems built for a unique purpose, generally a large project such as an airlines reservation system. In 2003, BEA estimated business purchases of own-account software at about $75 billion.49

Dr. Jorgenson, in introducing the New Economy conference on Software, noted that while there is sufficient price information on prepackaged software, this category is only thought to make up about 25 to 30 percent of the software

market.50 Consequently, he noted, “there is a large gap in our understanding of the New Economy.”51

Measurement Challenges: The Complexity of Software

Before we can develop appropriate measures of software performance, we first need to understand the nature of software itself. As William Raduchel of the Ruckus Network explained at the conference on software, software comprises millions of lines of code, operated within a stack.52 The stack begins with the kernel, which is a small piece of code that talks to and manages the hardware. The kernel is usually included in the operating system, which provides the basic services and to which all programs are written. Above this operating system is middleware, which “hides” both the operating system and the window manager. For the case of desktop computers, for example, the operating system runs other small programs called services as well as specific applications such as Microsoft Word and PowerPoint.

Thus, when a desktop computer functions, the entire stack is in operation. This means that the value of any part of a software stack depends on how it operates within the context of the rest of the stack.53 The result, as Monica Lam of Stanford University suggested, is that software may be the most intricate thing that humans have learned to build. Software grows more complex as more and more lines of code accrue to the stack, making software engineering much more difficult than other fields of engineering.54

The way software is written also adds to its complexity and cost. As Anthony Scott of General Motors pointed out, the process by which corporations build software is “somewhat analogous to the Winchester Mystery House,” where accretions to the stack over time create a complex maze that is difficult to fix or change.55

This complexity means that a failure manifest in one piece of software, when added to the stack, may not indicate that something is wrong with that piece of software per se, but quite possibly can cause the failure of some other piece of the stack that is being tested for the first time in conjunction with the new addition.56 In short, the complexity of software makes measuring software performance very challenging.

Tracking Software in National Accounts

The unique nature of software also poses challenges for national accountants who are interested in data that track software costs and aggregate investment in software and its impact on the economy. This is important because over the past 5 years, investment in software has been about 1.8 times as large as private fixed investment in computers’ peripheral equipment and was about one-fifth of all private fixed investment in equipment and software.57 Getting a good measure of this asset, however, is difficult because of the unique characteristics of software development and marketing, as well as the conventions by which it is reported.

According to Shelly Luisi of the Securities and Exchange Commission (SEC), some data about software come from information that companies report to the SEC.58 These companies follow the accounting standards developed by the Financial Accounting Standards Board (FASB).59 Luisi noted that the FASB developed these accounting standards with the investor, and not a national accountant, in mind. As a result of these accounting standards, she noted, software is included as property, plant, and equipment in most financial statements rather than as an intangible asset.60

|

starting in 1886 and continuing over nearly four decades with no master architectural plan, created an unwieldy mansion with a warren of corridors and staircases that often lead nowhere. |

Given these accounting standards, how do software companies actually recognize and report their revenue? Taking the perspective of a software company, Greg Beams of Ernst & Young noted that while sales of prepackaged software are generally reported at the time of sale, more complex software systems require recurring maintenance to fix bugs and to install upgrades, causing revenue reporting to become more complicated. In light of these multiple deliverables, software companies come up against rules requiring that they allocate value to each of those deliverables and then recognize revenue in accordance with the requirements for those deliverables. How this is put into practice results in a wide difference in when and how much revenue is recognized by the software company, he noted—making it, in turn, difficult to understand the revenue numbers that a particular software firm is reporting.61

Mr. Beams noted that information published in software vendors’ financial statements is useful mainly to the shareholder. He acknowledged that detail is often lacking in these reports, and that distinguishing one software company’s reporting from another and aggregating such information so that it tells a meaningful story can be extremely challenging.

Gauging Private Fixed Software Investment

Although the computer entered into commercial use some four decades earlier, the Bureau of Economic Analysis has recognized software as a capital investment (rather than as an intermediate expense) only since 1999. Describing BEA methodology, David Wasshausen of BEA noted that his organization uses a “commodity flow” technique to measure prepackaged and custom software. Beginning with total receipts, BEA adds imports and subtracts exports, which leaves the total available domestic supply. From that figure, BEA subtracts household and government purchases to come up with an estimate for aggregate business investment in software.62 By contrast, BEA calculates own-account software

as the sum of production costs, including compensation for programmers and systems analysts and such intermediate inputs as overhead, electricity, rent, and office space.63

According to Dr. Wasshausen, BEA is striving to improve the quality of its estimates. While BEA currently bases its estimates for prepackaged and custom software on trended earning data from corporate reports to the SEC, it hoped to benefit soon from Census Bureau data that capture receipts from both prepackaged and custom software companies through quarterly surveys. Among recent BEA improvements, Dr. Wasshausen cited an expansion of the definitions of prepackaged and custom software imports and exports, and better estimates of how much of the total prepackaged and custom software purchased in the United States was for intermediate consumption. BEA, he said, was also looking forward to an improved Capital Expenditure Survey by the Census Bureau.64

Dirk Pilat of the Organisation for Economic Co-operation and Development (OECD) noted at the same conference that methods for estimating software investment have been inconsistent across the countries of the OECD.65 One problem contributing to the variation in measures of software investment is that the computer services industry represents a heterogeneous range of activities, including not only software production, but also such things as consulting services. National accountants have had differing methodological approaches (for example, on criteria determining what should be capitalized) leading to differences between survey data on software investment and official measures of software investments as they show up in national accounts.

Attempting to mend this disarray, Dr. Pilat noted that the OECD Eurostat Task Force has published its recommendations on the use of the commodity flow model and on how to treat own-account software in different countries.66 He noted that steps were under way in OECD countries to harmonize statistical

|

working to expand its survey to include own-account software and other information not previously captured, according to David Wasshausen. |

|

Box C: The Economist’s Challenge: Software as a Production Function Software is “the medium through which information technology expresses it-self,” says William Raduchel. Most economic models miscast software as a machine, with this perception dating to the period, 40 years ago, when software was a minor portion of the total cost of a computer system. The economist’s challenge, according to Dr. Raduchel, is that software in not a factor of production like capital and labor, but actually embodies the production function, for which no good measurement system exists. |

practices and that the OECD would monitor the implementation of the Task Force recommendations. This effort would then make international comparisons possible, resulting in an improvement in our ability to ascertain what was moving where—the “missing link” in addressing the issue of offshore software production.

Despite the comprehensive improvements in the measurement of software undertaken since 1999, Dr. Wasshausen noted that accurate software measurement continued to pose severe challenges for national accountants simply because software is such a rapidly changing field. He noted, in this regard, the rise of demand computing, open-source code development and overseas outsourcing, which create new concepts, categories, and measurement challenges.67 Characterizing attempts made so far to deal with the issue of measuring the New Economy as “piecemeal”—“we are trying to get the best price index for software, the best price index for hardware, the best price index for LAN equipment routers, switches, and hubs”—he suggested that a single comprehensive measure might better capture the value of hardware, software, and communications equipment in the national accounts. Indeed, information technology may best be thought of as a “package,” combining hardware, software, and business-service applications.68

Tracking Software Price Changes

A further challenge in the economics of software lies in tracking price changes. Drawing on Microsoft Corporation data, Alan White of Analysis Group and Ernst Berndt of MIT presented their work on estimating price changes for prepackaged software.69 Dr. White noted that an investigator faces several important challenges in constructing measures of price and price change. These include ascertaining which price to measure because software products may be sold as full versions or as upgrades, stand-alones, or suites. An investigator has also to determine what the unit of output is, how many licenses there are, and when price is actually being measured. Another key issue, he added, concerns how the quality of software has changed over time and how that should be incorporated into price measures.70

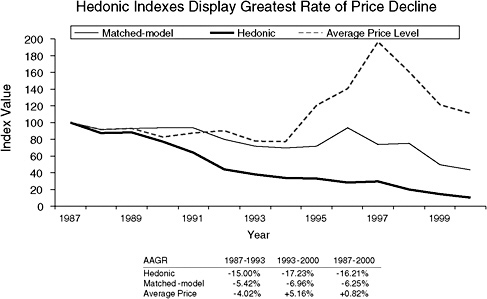

Surveying the types of quality changes that might come into consideration, Dr. Berndt gave the example of improved graphical interface and “plug-‘n-play,” as well as increased connectivity between difference components of a software suite.71 Referring to their study, Dr. Berndt noted that he and Dr. White compared the average price level (computing the price per operating system as a simple average) with quality-adjusted prices levels using hedonic and matched-model econometric techniques. They found that while the average price, which does not correct for quality changes, showed a growth rate of about 1 percent a year, the quality-adjusted matched model showed a price decline of around 6 percent a year and the hedonic calculation showed a much larger price decline of around 16 percent.

These quality-adjusted price declines for software operating systems, shown in Figure 5, support the general thesis that improved and cheaper information technologies contributed to greater information technology adoption leading to productivity improvements characteristic of the New Economy.72

Measuring Telecom Prices

How do new information and communications technologies translate into prices and hence consumer welfare? Mark Doms of the Federal Reserve Bank of San Francisco provided the participants in the STEP conference on the Tele-

FIGURE 5 Quality-adjusted prices for operating systems have fallen, 1987-2000.

SOURCE: Jaison R. Abel, Ernst R. Berndt, Cory W. Monroe, and Alan White, “Hedonic Price Indexes for Operating Systems and Productivity Suite PC Software,” draft working paper, 2004.

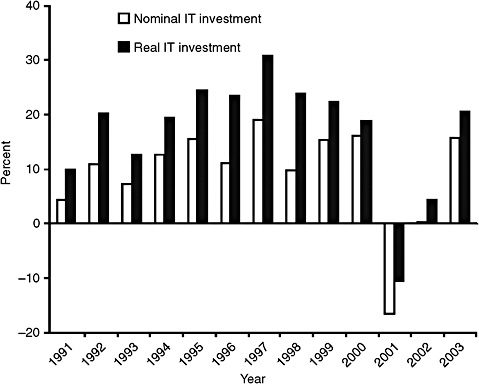

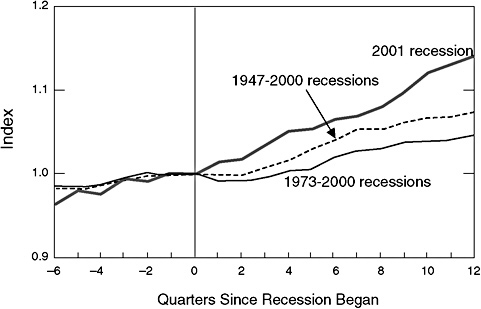

communications Challenge an overview of what the current official numbers say, and the challenges of coming up with good price indexes for communications equipment and services. He noted that while investment in communications in the United States had been substantial—around $100 billion per year, representing a little over 10 percent of total equipment investment in the U.S. economy—it had also been highly volatile. During the recession of the early 2000s, he noted, IT investment fell about 35 percent from peak to trough (see Figure 673). Dr. Doms noted that this recession might well be remembered as the high-tech recession, adding that “certainly what happened to communications played a major role in what happened to the high-tech sector.”

Measuring the dollars spent on communications in the United States every year is difficult because technology is rapidly changing. As we noted earlier, a computer costing a thousand dollars today is a lot more powerful and versatile than a similarly priced one of 10 years ago—and this improvement is no less true for communications equipment. Similarly, most long-distance communications 25 years ago was handled through landline phones, in stark contrast to the diver-

FIGURE 6 Annual percent change in IT investment.

SOURCE: Bureau of Economic Analysis.

NOTE: Percent changes based on year-end values.

sity of means of communications in use today. The technology is also in rapid flux. Dr. Doms noted that between 1996 and 2001 alone, there were tremendous advances in the amount of information that could travel down a strand of glass fiber, adding that the price of gear used to transmit information over fiber fell, on average, by 14.9 percent a year over this five-year period.

The fast speed of technological change renders the job of tracking prices (which enables us to see how much better off society is as a result of technological changes) a complex one. Whereas money spent on telecommunications was relatively easier to track 25 years ago when most purchases were of telephone switches, today’s telecommunications equipment includes a wide array of technologies related to data, computer networking, and fiber optics.

Current methodologies for making inter-temporal comparisons in price and quality understate true price declines because they do not fully track these technological changes. While BEA has estimated that prices for communications gear fell an average of 3.2 percent per year between 1994 and 2000—in sharp

contrast to the 19.3 percent fall in computer prices—Dr. Doms noted that more a complete estimate that he had developed shows that communications equipment prices actually fell on the order of 8 to 10 percent over that period.74

Towards Improved Measures of the New Economy

While this new estimate is a step in the right direction, Dr. Doms acknowledged that more refinement is necessary in measuring telecom prices. Echoing a refrain heard at each of the conferences in the series on Measuring and Sustaining the New Economy, he noted that the job of keeping track of rapid developments in information and communications technologies was growing increasingly difficult for statistical agencies, especially in light of their limited budgets and the rapid development of technology. “Unless the statistical agencies get increased funding, in the future, they are not going to be able to follow new, evolving trends very well,” he concluded.

SUSTAINING THE NEW ECONOMY

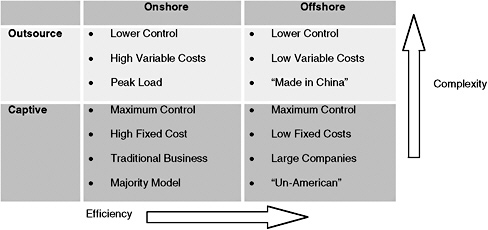

The second theme of the NRC conferences on the New Economy concerned public polices needed to sustain the New Economy. A major focus of these conferences was on polices to sustain Moore’s Law, the driver of faster and more widely affordable computers and other productivity-enhancing technologies. Participants at the conferences on software and telecommunications also examined the new challenges in globalization emerging from the possibility of sending voice and data at very low costs around the world.

To be sure, the challenge of measuring the New Economy and policies needed to sustain the benefits of the New Economy are two sides of one coin. Better data on what is moving where in offshoring are likely to permit more informed policy debate.

Challenges to Sustaining Moore’s Law

As noted at the outset, Moore’s Law is not a deterministic law but a self-fulfilling prophecy that needs to be sustained if the economy is to continue to benefit from the advantages of faster and cheaper information technologies.75 Moore’s Law works by setting expectations about the pace of competition in the semiconductor industry. Each firm, believing its rivals to develop and market

a faster and cheaper product within the 18-month timeframe, steps up its own work—leading, overall, to the faster pace at which new semiconductor products are brought to market. Upholding Moore’s Law, thus, requires keeping up the belief among industry participants that this pace of “faster and cheaper” is sustainable. Continuing this virtuous cycle of expectations requires that each firm in the industry believes that impediments to continuing technological advance can be overcome well in time.

Overcoming Technological Brick Walls

While Moore’s Law is currently forecast to hold for the next 10 to 15 years (not least by Gordon Moore himself76), there remain potential technological showstoppers down the road. In the case of CMOS (complementary metal-oxide semiconductor) technology, as explained by Bob Doering at the conference on semiconductors, tunneling problems could arise when a gate insulator gets so thin that it loses its insulating capacity and becomes a new leakage path through the transistor.77 This current flow is dominated by quantum mechanical tunneling of electrons through the barrier.78

While Dr. Doering noted that continued advances in CMOS device scaling are expected to continue for another 10 to 15 years, Randall Isaac of IBM, also speaking at the same conference, was more pessimistic, observing that progress from scaling could tail off more rapidly.79 He noted that the surge in performance, achieved through deep ultraviolet (UV) technologies, is likely not to be sustainable over a long period. He also warned that extreme ultraviolet lithography (EUV), often cited as the next emerging technology, might not prove to be as pervasive as its predecessor has been.

Such technological brick walls apply not only to semiconductors but more broadly to computer components as well. For example, Kenneth Walker, of Philips Electronics, noted at the conference on Deconstructing the Computer that while DVD and CD readers had become standard on personal computers, we are starting to reach certain limits in these devices.80 Current top-of-the-line CD devices, he noted, rate at 48X to 52X—the equivalent of spinning at about 200 kilometers per

hour. This speed approaches the reigning physical limit for CDs, since operating at higher speeds would cause the disc to shred within the device.

Dr. Walker noted that human ingenuity would extend the scope and pace of improvements for hard disks over the near future. The next generation of improvements, he noted, may be realized not by spinning DVDs faster, but by adopting blue lasers to replace red lasers. Since blue lasers are more focused, more information can be stored on a single disk. Newly discovered ways of writing and rewriting information on disks will also enhance the device’s functionality, he predicted—although these innovations postpone but do not eliminate a reckoning with the brick wall.

Resource Challenges to Sustaining Moore’s Law

In addition to technological impediments, participants at the conference on Productivity and Cyclicality in Semiconductors also reviewed a variety of resource challenges that may jeopardize Moore’s Law. These are summarized below.

-

High Costs of Manufacturing: Could the high costs of technical advance be the Achilles heel of the New Economy? Dr. Doering noted that progress on CMOS technology could slow, not because engineers run out of ways to make smaller or faster chips, but because the costs of manufacturing could outstrip the advantages of such miniaturization. Referring to EUV technology, Dr. Isaac noted that at $40 million to $50 million per tool, the economic challenges of investing in such equipment are daunting.

Dr. Isaac added that the real “fly in the ointment” to computing that is faster and cheaper might well be the cost of power. As engineers place more components closer together, power consumption and heat generation become systemic problems.81 Though few technologists or economists have factored the cost of power for computing, the energy consumption of server farms is increasing exponentially. To convey a sense of scale, he noted that a server farm uses more watts per square foot than a semiconductor or automobile manufacturing plant.

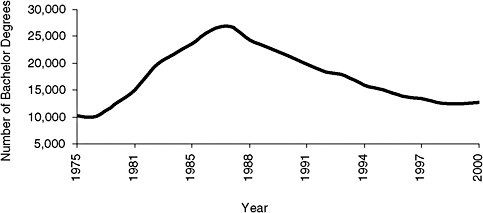

FIGURE 7 Electrical engineering graduates: bachelor’s degrees earned, 1975-2000.

SOURCE: National Science Foundation, Science and Engineering Indicators 2000, 1975-1987 Engineering Workforce Commission.

-

Workforce Issues: Sustaining Moore’s Law will require creativeness and ingenuity in overcoming these technological and economic challenges. George Scalise pointed out that this requires a trained workforce well grounded in the disciplines—such as physics, mathematics, and engineering—that underpin research and manufacturing in the semiconductor industry.82 Given this need, he listed some recent trends that appear troubling, including:

-

recent evaluations that place American K-12 students below their foreign peers in mathematics and science;83 and

-

a decline in the number of bachelor’s degrees in electrical engineering awarded in the United States (see Figure 7). While this decline (of about 40 percent over the last several years) seems to have recently flattened out, he said that this trend remains a source of concern.84

-

-

Funding for Research: Bob Doering and George Scalise, along with Clark McFadden of Dewey Ballantine LLP, noted that declines in federal R&D funding makes it harder for the semiconductor industry to overcome loom-

|

82 |

George Scalise, “The Industry Perspective on Semiconductors,” in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit. |

|

83 |

For twelfth grade students in the most recent Third International Mathematics and Science Study (TIMSS), the average score of international students was 500 versus 461 for U.S. students. For additional information on TIMSS, see <http://nces.ed.gov/timss/>. |

|

84 |

For a detailed discussion of the challenges of maintaining sufficient human capital to sustain the productivity of the semiconductor industry, see National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2003. |

-

ing technological challenges.85 They added that the semiconductor industry’s ability to do its own long-term research has diminished with the demise of the large industrial laboratory.86 As noted below, several participants called for additional federal investments in research to help maintain the innovative pace of the semiconductor industry.

Strategies to Sustain Moore’s Law

Changes in the structure of the semiconductor industry may impact the competitive environment associated with Moore’s Law.87 Kenneth Flamm noted at the conference on Productivity and Cyclicality in Semiconductors that the growth of the foundry model in semiconductor manufacture might have implications for industry-sponsored research, given that foundry-based companies (often called fabs) often spend a smaller percentage of their sales on R&D than do traditional integrated device manufacturers.88 As George Scalise further noted, fabs have also affected the competitive environment by creating a surge in manufacturing capacity. This surge has led to price attrition beyond levels against which many traditional firms that integrate design and manufacture can compete successfully.

Cooperative Ventures in Semiconductor Research

According to George Scalise and Kenneth Flamm, these developments highlight the importance of sustaining a variety of cooperative efforts to strengthen the

|

85 |

National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit. |

|

86 |

For example, Dr. Doering noted, “Based on physical limits, we need a big R&D effort on many levels to come up with new ideas and take them to a point—even in academic research—where they can be picked up by industry. Where that point of transition between academia and industry is located has shifted today towards academia, because we don’t have as many large industrial labs that work at the breadth and depth they used to.” Robert Doering, “Physical Limits of Silicon CMOS and Semiconductor Roadmap Predictions,” in National Research Council, Productivity and Cyclicality in Semiconductors, op. cit. |

|

87 |

Dr. Jorgenson asked Dr. Doering at the conference on Productivity and Cyclicality in Semiconductors why the semiconductor roadmap, in predicting product cycles of 3 years, had underestimated the speed at which successive generations of technology are evolving. Dr. Doering responded that the adoption of the two-year cycle was based on “purely competitive factors.” See National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, op. cit., p. 14. |

|

88 |

The foundry model separates the electronic design process and the fabrication of physical integrated circuit (IC) devices. In the foundry model, a high-tech company without any semiconductor manufacturing capability (called the fabless company) orders wafer production from a manufacturer (called the merchant foundry.) The fabless design company concentrates solely on the electronic research and development of an IC product, while the foundry concentrates solely on the aspect of fabricating and testing the physical product. See <http://en.wikipedia.org/wiki/Foundry>. |

research base and to propel advance in semiconductor platform technologies.89 Positive examples of such cooperative partnerships highlighted at the conference on Productivity and Cyclicality in Semiconductors were:

-

The Semiconductor Research Corporation (SRC), whose mission is to provide low-overhead generic semiconductor research and related programs that meet the needs of the semiconductor industry for technology and relevantly educated talent. It currently disburses approximately $40 million per year on directed research carried out in universities by 800 to 900 graduate students worldwide.

-

International SEMATECH, a global research consortium, whose role is to develop new manufacturing technologies and methods and transfer them to its member companies, which in turn manufacture and sell improved chips. Member companies cooperate pre-competitively in key areas of semiconductor technology, sharing expenses and risk. Their common aim is to accelerate development of the advanced manufacturing technologies needed to build future generations of semiconductors.

-

The Focus Center Research Program, which sponsors a multi-university effort to address major basic research challenges.90 This includes the design and test program led by the University of California at Berkeley, the interconnect team led by the Georgia Institute of Technology, the circuit systems and software team led by Carnegie Mellon University, and a materials and devices team led by the Massachusetts Institute of Technology. Each program has seven to eight partners, and funding for the four-year program, which now totals $22 million a year, is expected to grow to $60 million a year over the next few years.

Expanding the Use of Technology Roadmaps

Technology roadmaps are another important mechanism for sustaining Moore’s Law. Providing a graphical portrayal of the structural relationships among science, technology, and applications over a period, a technology roadmap is a tool for firms in an industry to identify potential technical showstoppers and cooperate

in developing (at a pre-competitive level) solutions to these technical challenges. Roadmap strategy areas include technology and product marketing, identifying gaps in R&D programs, and identifying obstacles to rapid and low-cost product development. Moreover, as companies believe that competitive success lies in staying ahead of the Roadmap, the existence of a published Roadmap itself enhances the pace of competition and, hence, the robustness of Moore’s Law.

At the conference on Productivity and Cyclicality in Semiconductors, Kenneth Flamm noted that although the international semiconductor roadmap is often described as a descriptive or predictive process, its role is to coordinate a complex technology with different pieces and multiple suppliers.91 “What you really have is people identifying potential showstoppers and trying to mobilize people at choke points.” Clark McFadden added that the roadmap is not a “solution” to technological problems but rather a description of various options, challenges, and gaps in charting the future course of a technology. The role of the roadmap, he said, is to communicate information about these options, challenges, and gaps to the industry in a way that suppliers, manufacturers, and customers can appreciate and use.

There are of course limits to the usefulness of roadmaps. As roadmap pioneers William Spencer and T. E. Seidel have acknowledged, roadmaps are expensive and time consuming to develop and are, by definition, out of date as soon as they are written.92 As they note, however:

Today, with research and development budgets under pressure in every nation, it’s important that redundancy in non-competitive research and development be minimized wherever possible. This is particularly true in major basic research programs in physics, biology, chemistry, and probably computer science. It certainly has been a major help to the U.S. semiconductor industry and the equipment supplier industry for cooperation in pre-competitive technology development.93

Crediting the Semiconductor Roadmap for the speed of the information technology industry’s recent advance at the conference on Deconstructing the Computer, William Siegle offered two reasons why the road-mapping process is linked to accelerations in the decline of logic cost. First, he noted that making

|

Box D: Drafting the First Semiconductor Roadmap Given the complexity of the technology and the multiple participants involved, the need for coordination among the members of the SEMATECH semiconductor consortium arose concerning how best to identify those science and technology areas that have promise and how best to accelerate the transfer of the technology to those useful applications. Following on the footsteps of industry-wide roadmap workshops in June 1987 and March 1988, the Semiconductor Industry Association sponsored a Semiconductor Technology Workshop in 1992, held in Irving, Texas, to develop a comprehensive 15-year roadmap. As recounted by Spencer and Seidel, “The charter of the workshop was to evaluate the likely progress of CMOS technology in key areas relative to expected industry requirements and to identify resources that might best be used to ensure the industry would have the necessary technology for success in competitive world markets.”a There were 200 participants at the 1992 workshop, including members of 11 technological working groups assigned to identify issues on specific aspects of semiconductor technology. In preparation for the workshop, these groups developed a “strawman” draft, which was refined through successive review iterations. A revised draft of the roadmap was then issued, with key issues highlighted for review at the actual workshop. The workshop itself included a plenary session, followed by breakout sessions that permitted cross-coordination among the different working groups. The working format improvised in Texas—“a pretty rushed job compared to how we do it now,” as Dr. Doering, an original participant, put it—served as a template for the subsequent 1994 and 1997 roadmaps updates.b With the internationalization of SEMATECH, the International Technology Roadmap for Semiconductors (ITRS) was formed in 1998, with a schedule of reports with alternating semi-annual updates and semi-annual full revisions. Under the leadership of the Semiconductor Research Corporation (SRC), the ITRS brings together chipmakers, suppliers, and representatives from SEMATECH and other consortia, along with participants from universities, government, and other relevant organizations to identify future challenges and directions. |

meaningful improvements in capability requires the coordination of many different pieces of technology, and the Semiconductor Roadmap has made very visible both what those pieces are and what advances are required in different sectors of the industry to achieve that coordination. Second, he noted, as companies believe that success lies in staying ahead of the Roadmap, the existence of a published Roadmap enhances the pace of competition.

In these ways, Roadmaps can help sustain the momentum of “faster, better, cheaper” in industries that produce computer components. While welcoming the development of roadmaps for the different computer component industries—such as that recently published by the U.S. Display Consortium94—Dale Jorgenson cautioned that successful models, such as the semiconductor industry roadmap, must be adapted to the operational exigencies of the computer component industry in question.

Software and the New Economy

The next conference in the New Economy series examined the importance of software in the New Economy and the vulnerability of the U.S. economy to software failures and attacks. Software is an encapsulation of knowledge in an executable form that allows for its repeated and automatic applications to new inputs.95 It is the means by which we interact with the hardware underpinning information and communications technologies.

The U.S. economy, today, is highly dependent on software, with businesses, public utilities, and consumers among those integrated within complex software systems. Participants at the NRC Conference on Software, Growth, and the Future of the U.S. Economy, examined how this dependence exposes the economy to vulnerabilities in the production and execution of software—major concerns in sustaining the New Economy.

Almost every aspect of a modern corporation’s operations is embodied in software. Anthony Scott of General Motors noted that a company’s software embodies a whole corporation’s knowledge into business process and methods, adding that “virtually everything we do at General Motors has been reduced in some fashion or another to software.”96

In addition, much of our public infrastructure relies on the effective operation of software, with this dependency also leading to significant vulnerabilities. As Dr. Raduchel observed, it seems that the failure of one line of code, buried in an energy management system from General Electric, was the initial source

|

Box E: Component-Based Software Production At the conference on Deconstructing the Computer, David McQueeney of IBM recounted the case of a credit card company whose computer system had grown, through a series of ad hoc software patches, so complicated that only three of the company’s employees worldwide understood it well enough to manage it when it showed signs of breaking down. He added, however, that added computer complexity is possible if simpler computer architecture makes maintenance easier. A promising way of addressing this problem of complexity is through component-based software production, which focuses on building large software systems by assembling readily available components. Such components can be used to build both custom enterprise-critical software as well as prepackaged software. Migrating a complex, monolithic system like a credit card system to a newer component-based system, in which updates are handled quickly and efficiently, could lower maintenance costs for firms—and (not least) provide greater security for the nation’s financial system by strengthening a critical infrastructure. However, many of the companies involved in developing component-based software are small start-ups facing severe financing constraints. Because the bulk of their expenditures occur prior to earning any revenues, indeed before technical feasibility has been established, these firms often have difficulty obtaining capital from loans or equity participation. Funding by federal innovation award programs like the Advanced Technology Program (ATP) may be the only way that such technology development projects can be undertaken. Indeed, ATP’s focused program in component-based software development is an effort to change the paradigm of custom application to a “buy, don’t build” approach for most software projects.a |

leading to the electrical blackout of August 2003 that paralyzed much of the northeastern and midwestern United States.97 Smaller, everyday failures are no less expensive; according to the National Institute for Standards and Technology (NIST), national annual costs of software failures lie in the range of $22.2 billion to $59.5 billion.98

Despite the pervasive use of software, and partly because of the relative youth of the science of computer engineering, understanding the economics of software presents an extraordinary challenge. Many of the challenges relate to measurement, econometrics, and industry structure. Here, the rapidly evolving concepts and functions of software as well as its high complexity and context-dependent value make measuring software difficult. This frustrates our understanding of the economics of software—both generally and from the standpoint of action and impact—and impedes both policymaking and the potential for recognizing technical progress in the field.

Given that the infrastructure of the New Economy is based on software, participants at the conference on software considered the vulnerability of this infrastructure and policies that can strengthen this infrastructure.

Making Software More Robust Against Errors and Attacks

Software grows more complex as more and more lines of code accrue to the stack, making software engineering much more difficult than other fields of engineering, according to Monica Lam of Stanford University.99 This complexity means that the failure of any given piece of software, when added to the stack, may not indicate that something is wrong with that piece of software per se, but quite possibly a failure of some other piece of the stack that is being tested for the first time in conjunction with the new addition. This complexity of software makes it inherently error prone as well as vulnerable to attack.

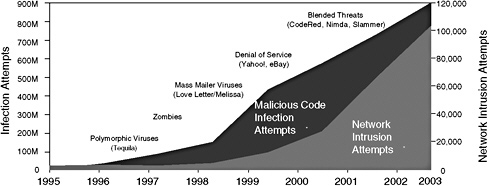

Indeed, attacks against that code—in the form of both network intrusions and infection attempts—have grown substantially over the past decade, according to Kenneth Walker of Sonic Wall.100 (See Figure 8.101) The perniciousness of the attacks is also on the rise. The Mydoom attack of January 28, 2004, for example, did more than infect individuals’ computers producing acute but short-lived inconvenience. It also reset the machine’s settings leaving ports and doorways open to future attacks.

The economic impact of such attacks is increasingly significant. According to Kenneth Walker of Sonic Wall, Mydoom and its variants infected up to half a million computers. The direct impact of the worm includes lost productivity owing to workers’ inability to access their machines, estimated at between $500 and $1,000 per machine, and the cost of technician time to fix the damage. According to one estimate cited by Mr. Walker, Mydoom’s global impact by February 1, 2004,

|

99 |

Monica Lam, “How do we make it?” in National Research Council, Software, Growth, and the Future of the U.S. Economy, op. cit. |

|

100 |

Kenneth Walker, “Making Software Secure and Reliable, “ in National Research Council, Software, Growth, and the Future of the U.S. Economy, op. cit. |

|

101 |

Figure 8 is based on analysis by Symantec Security Response using data from Symantec, IDC, and ICSA. |

FIGURE 8 Growing attacks against code.

SOURCE: Analysis by Symantec Security Response using data from Symantec, IDC, and ICSA.

alone was $38.5 billion.102 He added that the E-Commerce Times had estimated the global impact of worms and viruses in 2003 to be over one trillion dollars.

Enhancing Software Reliability

Acknowledging that software will never be error free and fully secure from attack or failure, Dr. Lam suggested that the real question is not whether these vulnerabilities can be eliminated, raising instead the issue of the role of incentives facing software makers to develop software that is more reliable.

One factor affecting software reliability is the nature of market demand for software. Some consumers—those in the market for mass client software, for example—may look to snap up the latest product or upgrade and feature addons, placing less emphasis on reliability. By contrast, more reliable products can typically be found in markets where consumers are more discerning, such as in the market for servers.