Panel III

New Models in Japan, Taiwan, and China

Moderator:

Alice H. Amsden

Massachusetts Institute of Technology

Dr. Amsden opened the session by stating that, given the history of Japan, Panel III’s examination of China, Taiwan, and Japan would offer a look at how innovation or technology systems differ from developed to developing countries. She said that in listening to the previous discussion of Finland and Canada, as well as to Dr. Marburger’s luncheon address, she had been struck by how little was said about industry. In contrast, she noted, a consideration of China’s technology policy always revolves around an industry; there, the theme might be “technology policy and how it develops the telecommunications industry,” or, in the case of its neighbor, “the technology policy in Taiwan and how it developed the computer industry.” These countries would, of course, be much more focused on industry because they do not yet have industry fully in place and so were catching up. The acquisition of technology is therefore very instrumental to their innovation policies, with such underpinning concerns as: How can we get the technology? Should we make it ourselves or buy it? How can we get the technology in order to make an industry competitive internationally?

Developing countries do seem to have stopped there. However, offering Taiwan and Korea as examples, Dr. Amsden noted that some are moving into a more exploratory area, where the relevant questions become:

-

How can we create new technology that spawns new industries, or that allows us to introduce mature high-tech industries like thin-film transistor liquid-crystal displays (TFT-LCD)?

-

How do we get the technology that allows us to produce these products and go around existing patents, or to compete in world markets, when this technology is changing so fast?

Suggesting that one of the differences between developing and developed countries (when it came to innovation or technology systems) might be the degree of emphasis on industry, she speculated that the panel’s speakers might shed some light on the issue.

Dr. Amsden then introduced Dr. Hsin-Sen Chu of Taiwan’s Industrial Technology Research Institute (ITRI). She characterized the organization as one of that country’s very best research institutes and noted that Dr. Chu is well known for his clarity of vision and his interesting take on technology and development.

THE TAIWANESE MODEL: COOPERATION AND GROWTH

Hsin-Sen Chu

Industrial Technology Research Institute (ITRI), Taiwan

Dr. Chu said that it was his honor to describe Taiwan’s model of and experience with technology development and innovation. Like Finland, he said, Taiwan is a country that is small in population and area whose resources are sufficiently limited such that they must be used with a maximum of efficiency and effectiveness. His presentation comprised five parts:

-

a brief introduction to the transformation of Taiwan’s economy over the previous 50 years;

-

a discussion of the major elements in Taiwan’s industrial evolution;

-

a brief introduction to ITRI, covering the role it had played in that evolution and the nature of its relationship with Taiwan’s industries;

-

a description of the opportunities before Taiwan; and

-

a very brief conclusion.

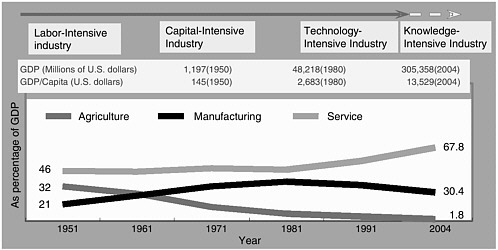

To begin, Dr. Chu projected a graph illustrating the change in the composition of the Taiwanese economy between 1951 and 2004 (Figure 16). The country’s per capita GDP had grown from $145 at the start of that period to $13,529 by its end, a nominal increase approaching two orders of magnitude.11 The service-industry

FIGURE 16 Transformation of Taiwan’s economy.

sector accounted for about 46 percent of the economy from the 1950s through the 1970s, when a steady rise began that brought its share to 67.8 percent by 2004. Agriculture’s contribution had moved in the opposite direction, dwindling from about 32 percent in 1951 to less than 2 percent currently. Manufacturing, meanwhile, displayed two contrasting phases: Its slice of the economy climbed from 21 percent in 1951 to near 40 percent by the end of the 1970s, only to fall back to 30.4 percent by 2004 as it was overshadowed by the continuously growing service sector.

Transformation of Taiwan’s Economy

If technology-based manufacturing was the engine driving Taiwan’s economic growth over the previous half-century, the country expects services to act as a “twin engine” in the future. Similarly, while labor-intensive industry characterized industrial growth in the late 1940s through the 1950s and 1960s, followed by capital-intensive industry the 1970s and 1980s and technology-intensive industry the 1980s and early 1990s, the knowledge-intensive industry that came onto the scene in the mid-1990s is expected to expand further in the future. Describing the economic evolution in Taiwan, Dr. Chu said that the food and textile industries emerged in the 1950s and 1960s, followed by bicycles, motorcycles and selected basic industries in the 1970s and 1980s. It was in the late 1970s that Taiwan’s semiconductor and other information-technology industries started to take root. Optoelectronics made its appearance in Taiwan in the early 1990s.

Currently, Taiwan ranks among the top three in the world for products over a wide range of sectors. In the computer and peripherals category, it is the world leader in notebook computers, small and medium-sized TFT-LCD modules, as Dr. Amsden had mentioned, but also in both CD/DVD drives and disks. In network products, Taiwan is a leader in wireless LANs, hubs, and SOHO routers; in the integrated-circuit (IC) sector, it leads in the foundry, mask, IC design, and DRAM areas. And it retains some world-leading products in the consumer sector, among them bicycles, hand tools, and textiles.

The evolution of traditional sectors and the development of new industries can be illustrated by examples below.

Example One: Textiles

Charting a half-century of progress in the textile industry, Dr. Chu reported that, in the beginning, Taiwan simply imported such raw materials as cotton, wool, and silk for processing. The next step was to move from natural to artificial fibers and into the apparel industry while also developing the manufacture of textile-fabrication machinery. Over the previous 10 years, the government had supported R&D efforts that he characterized as “tremendous” in the areas of functional fabrics and industrial textile fabrication technology. Encompassing nanotechnology, these efforts have yielded many new products in recent years, some of them in the field of fashion design. In 2004 Taiwan was the world’s sixth-ranked textile exporter with export revenues of $11.9 billion.

Example Two: Electronics

Taiwan is the world’s fourth-largest IC manufacturer, having posted 2004 revenues of $33.3 billion. Its chip industry, begun when RCA transferred 7 micron technology in 1976, has progressed to 90 nm line-width by 2005. In 1979, 6 years after ITRI was founded, the semiconductor maker UMC became the institute’s first spin-off company. ITRI spun off another chip manufacturer, TSMC, 8 years later, in 1987, followed by the Taiwan Mask Company in 1988. Today, TSMC and UMC together have 70 percent of the world’s IC foundry business. It was ITRI’s role, Dr. Chu stated, “to continuously spin off and create new companies in Taiwan.” Meanwhile, Taiwan’s information industry, which posted $67.2 billion in 2004 revenues, has developed a wide variety of industries and products, led by such firms as Acer and BenQ.

Major Elements in Taiwan’s Industrial Evolution

Behind Taiwan’s industrial evolution, in ITRI’s analysis, were four major elements: government policies; industrial infrastructure; foreign investment; and augmentation of technology. Dr. Chu explained each element in turn.

Government Policies

Dr. Chu related a timeline showing policies aimed at enhancing industrial development that Taiwan’s government had implemented between 1950 and the present. Stressing certain points along the continuum, he said that in the early 1960s a duty-free export zone for manufacturing was established; around 1980, the Hsinchu Science Park was developed, followed in the late 1990s by the Southern Taiwan Science Park and the Southern Taiwan Innovative Park. Also reflecting government policy, a Food Industry Research and Development Institute was established as that industry developed in the early 1960s; ITRI’s founding followed in 1973. The government had meanwhile built up basic infrastructure through 10 major public construction projects, and innovative programs were in store for the future as well.

Narrating how the government goes about allocating research resources in the service of technology development, Dr. Chu said the process begins with investment in infrastructure through the purchase either of a common facility and common equipment or of tools for strengthening existing facilities. Next, a promising new concept may be granted a small amount of seed money within the framework of the innovation plan of a university or other research institution. If it takes root there, additional project funding may be available under one of numerous programs dedicated to key technologies and components; although resources granted at this point may scale higher by an order of magnitude, the effort is still considered high-risk. If this further research is successful, the emerging technology is transferred to private industry in hopes that it will bear fruit through commercialization.

Industrial Infrastructure

Taiwan’s industrial infrastructure is divided into four geographic zones. In the Northern zone are five cities, including Taipei; the country’s international airport; and Hsinchu Science Park, with ITRI located nearby. It is about an hour’s trip from Taipei to Hsinchu, which is 50 miles away. There are a number of universities and 38 incubators in the area. The zone has become a stronghold of ICT and IC sectors, owing to the industrial clusters there. Similarly, the other three zones have their transportation and education network, incubators, and industrial emphases.

Foreign Investment

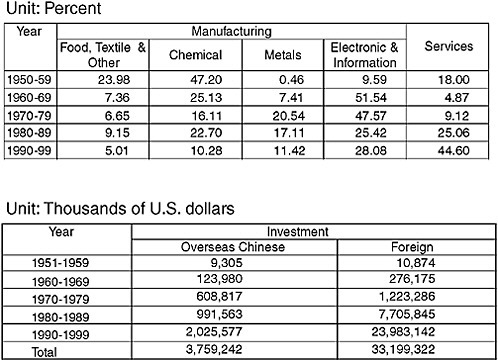

Posting a table summarizing foreign investment coming into Taiwan in the latter half of the 20th century (Figure17), Dr. Chu pointed out that the share of the total accounted for by the electronics and information-technology manufacturing sector, around 50 percent in the 1960s and 1970s, had fallen back to around 25 percent in the two subsequent decades. In contrast, the contribution of the

FIGURE 17 Foreign investments.

service industries had risen significantly since 1980, as the sector accounted for one-quarter of foreign investment in the 1980s and 44.6 percent in the 1990s.

Augmentation of Technology

There were three different paths to the augmentation of Taiwan’s technology, Dr. Chu said: indigenous R&D programs, licensing and transfer from overseas companies or universities, and international cooperation. He displayed a graph (Figure 18) charting cases of international technical cooperation from 1950 through the end of the last century, which showed a peak in the 1980s. From decade to decade, it was Japan that had been Taiwan’s leading partner, with the United States a distant second and Europe in third place. Over the previous 5 years, Taiwan developed numerous multinational R&D centers of various sorts and involving a wide variety of foreign companies.

Dr. Chu then explained the division of labor between Taiwanese academic institutions and industrial R&D organizations. The domain of the former, in addition to basic research, is the development of high-quality personnel to staff the country’s research institutes and industry. The mission of the latter, of which there were more than 10, is not only to engage in technological innovation,

FIGURE 18 International technical cooperation.

development, and implementation, but also to facilitate the creation of new industries. Besides ITRI, which is the largest of these industrial R&D organizations, he named the Information Industry Institute, Food Industry Research Institute, Textile Industry Research Center, and Bicycle R&D Center from this category.

ITRI’s Role in Taiwanese Growth

Focusing on ITRI, a not-for-profit R&D institute, Dr. Chu listed its tripartite mission: to create economic value through innovative technology and R&D; to spearhead the development of high-value industry in Taiwan; and to enhance the competitiveness of its industries in the global market.

ITRI has 13 research units—7 research labs and 6 research centers—divided into five areas: information and communications technologies; advanced manufacturing and systems; biomedical technology; nanotechnology, materials, and chemicals; and energy and environment. In 2004, the institute employed 6,540, of whom 14 percent had doctorates and just over 50 percent held master’s degrees. Its goal for 2008 is to reach one Ph.D. for every five employees while maintaining the level of master’s degree holders among employees at one-half. In addition to its current employees, ITRI has sent 17,000 alumni into Taiwan’s workforce, 5,000 of whom are working at the Hsinchu Science Park, and this personnel transfer has been responsible for the creation of many new companies.

Of ITRI’s $579 million budget in 2004, 52 percent came in the form of government R&D funding; the institute devoted between 20 and 25 percent

of that to the development of high-risk technologies. Another 40 percent of ITRI’s revenue came from technology transfer to industry, which the institute classifies as “knowledge-based services,” while 6.6 percent was derived from its intellectual property.

ITRI’s Hsinchu Chung Hsin Campus is a large complex housing its main headquarters, research laboratories, library, conference rooms, classrooms, dormitories, and dining, exercise, and medical facilities. Dr. Chu made special mention of the ITRI Incubation Center, known as the “Open Lab,” which is also on the premises. The architecture is intended to promote integration, particularly among different areas of technology, as a tool for the development of new products and industries. In the previous 18 years, more than 100 new companies have originated there.

ITRI enjoys access to Taiwanese technological activity at every level: that of the universities, of other industrial R&D organizations, and of commercial enterprises. It engages in significant cooperation with universities and builds relationships to enterprises through technology transfer, international cooperation, human-resource development, and spin-off. As more than 90 percent of Taiwanese companies fall into the small and medium-sized categories, many lack the funding to do research independently, and ITRI helps them meet their needs for both knowledge-based services and research and technology development. ITRI links science parks, universities, and companies throughout Taiwan.

Cooperative arrangements connect ITRI not only with such major Taiwanese entities, but also with many important research institutions in the United States and Europe. As examples, Dr. Chu cited cooperation with the University of California at Berkeley focusing on nanotechnology and energy-technology development and with Carnegie Mellon University focusing on communications-technology research. He also mentioned ITRI links to Stanford University and SRI in the United States, the Netherlands’ Organization for Applied Scientific Research, Russia’s Ioffe Physico-Technical Institute, and Australia’s Commonwealth Scientific and Industrial Research Organisation. Cooperating with MIT’s Media Lab was ITRI’s “Creativity Lab,” established 3 years earlier to “link technology to the lifestyle” by focusing on the demand side in pursuit of new concepts in the consumer-applications sector.

Taiwan’s Future Opportunities

Taiwanese policy makers see the country’s future opportunities as grouped in three major areas—high-value advanced manufacturing, novel applications and products, and knowledge-based service industries—and believe that integration and innovation will be essential to taking advantage of them. To enhance its national innovation system in the era of the knowledge economy, Taiwan’s government is pursuing the creation of basic infrastructure and an innovative business environment in order to strengthen relationships among the country’s

industry, academic institutions, and industrial R&D organizations. Some of the numerous industrial partnerships and alliances already in existence are the Taiwan TFT-LCD Association; Next-Generation Lighting Alliance; New Nylon & Polyester Textile R&D Alliance; Fresh Food Logistic Service Industrial Alliance; RFID System; Advanced Optical Storage Research Alliance; and Environmentally Friendly Manufacturing Technology Alliance. These entities’ activities include resource deployment, standardization, patent pooling, market development, multidisciplinary integration, and coordinated development.

Still, Dr. Chu stated, Taiwan’s “mindset and approach” are in need of adjustment in a variety of domains. When it comes to technology R&D, he said, the country was trying to move from optimization to exploration, from ordering work by single discipline to multidisciplinary integration, from conducting research in-house to collaborations and partnerships, and from developing components to developing system solutions. The value of a system solution was one to two orders of magnitude higher than that of a component, and the value of a comprehensive service system is higher still. Taiwan’s intention is to proceed from components through systems to the service industries.

Summary and Conclusion

Recapping, Dr. Chu noted that Taiwan has moved from an agriculture-based society to an industrial economy in 50 years, creating many industries with significant global standing in the process. A key issue for Taiwan’s continued success is close cooperation among industry, the government, and the academic and industrial R&D institutions. For the future, Taiwan will focus on new value creation through innovation to upgrade industry, while also trying to unify and align regional resources. The aim is to form productive clusters and facilitate the development of new service-sector industries by implementing innovative business models.

Dr. Chu invited those interested to seek information on ITRI at its Web site, www.itri.org.tw, and thanked the audience for its attention.

Discussion

Dr. Amsden opened the question period by inquiring about the criteria according to which firms are chosen to be admitted to Hsinchu Science Park. “How do you decide which firms to encourage?” she asked Dr. Chu. “Are you influenced by industry [or] simply by the quality of the firm?” She then invited a Swedish science reporter who was in the audience to step to the microphone. This reporter, asked Dr. Chu to describe further the innovative business model that he had recommended.

New Business Models, New Service Industries

Dr. Chu began by warning that the Taiwanese government’s use of the term “service industry” may diverge from that of individuals and entities from other countries: It includes such activities as logistics, finance, and research consulting but not, for example, health care. One of the most important of ITRI’s projects in the field of service-industry R&D concerns the innovative business model referred to by the questioner. In fact, after 30 years of technology development, ITRI’s focus is to shift to developing new business models with the power to create new service industries.

As an example, Dr. Chu offered a logistical model that covers the manufacture of food from the delivery of raw materials through processing and on to distribution. New technology has emerged in the course of work on such value chains—in this instance, equipment was developed capable of keeping multiple temperatures constant for more than 24 hours—that in turn has led to the development of more new service-industry business models.

Selecting Technologies to Support

Kathy McTigue of the Advanced Technology Program, referring to Dr. Amsden’s question about how firms are chosen for admission to Hsinchu Science Park, asked whether technology areas were chosen as well. She noted that Taiwanese innovation policy appeared to focus on promising technology areas. Research in these areas was supported through the Science Parks, and then transferred to private business. She asked if Taiwanese R&D is driven by the private sector (in the sense that private business initiates the projects and then comes to the government with requests for funding) or if the government itself chooses the domains for research. She also inquired about the relationship of ITRI to the Taiwanese government.

Dr. Chu answered that the government does provide private companies with funding to “encourage” them to embrace research projects chosen as the result of an evaluation process conducted by a committee. This “encouragement” usually takes the form of granting a company 25 percent of the research budget; the company is to put up 50 percent of the financing itself, with the remaining 25 percent covered by a government or bank loan. Similarly, when ITRI transfers technology it has developed to a company so that it can undertake product development, the government provides around 20 to 25 percent of the research budget in recognition of the risk involved; in these cases, a committee at the Ministry of Economic Affairs reviews the projects and decides where to place resources.

Concluding the presentation by Dr. Chu and the discussion that followed, Dr. Amsden introduced the next speaker, David Kahaner of the Asian Technology Information Program, to speak on Japan. Japan and its neighbors have had a very stormy relationship, she said, recalling that Japan had once held a great deal of East Asia under occupation. Yet when it comes to learning, technology transfer,

and doing business in general, Japan’s relationship with her neighbors is close. Many regard Japan as the hub of Asia’s IT industry. Currently, Americans are looking very closely at Japan’s innovation policies in an effort to learn from it. They are also asking how competition from China and other East Asian countries will affect Japan and, by implication, the United States. She then relinquished the podium to Dr. Kahaner.

JAPANESE TECHNOLOGY POLICY: EVOLUTION AND CURRENT INITIATIVES

David K. Kahaner

Asian Technology Information Program

Dr. Kahaner noted that he would begin by listing many of challenges confronting Japan today. Despite this list, he said, it should be “obvious to everyone that Japan is still a global technology powerhouse, a place where an incredible amount of extraordinary, world-class technology is produced and distributed.” The prospect for Japan, therefore, is by no means entirely negative.

According to Dr. Kahaner, Japan’s current challenges include:

-

An Anemic Economy. Growth in the Japanese economy has been anemic for years. It is now showing some signs of turnaround, but the long-term trend is still unclear and the economy cannot be characterized as healthy.

-

An Aging and Shrinking Population. Not only is the Japanese population aging, its growth is far from robust—if not, in fact, in decline.

-

Increased Global Competition. Japanese firms face strong competition from low-wage countries like China as well as from more advanced countries like Korea, Taiwan, and Singapore. Japanese firms are engaged in outsourcing and insourcing alike, and some small manufacturers have brought their manufacturing back to Japan from lower-wage countries because they did not feel the quality they were getting abroad to be adequate.

-

A Less Favorable Business Climate. Japan’s business climate is not very good relative to that of other countries, as benchmarked in a variety of ways.

-

A Perception of Low Creativity. A Western perception that Japan is suffering from a lack of creativity and from an associated lack of competition in its education system has, to a certain extent, “bled over to the Japanese themselves.”

-

A Strong Currency. The yen is appreciating against some currencies, making it more difficult for Japan to export.

-

Less Efficient Research. R&D is not viewed as being very efficient.

-

Bureaucratic Obstacles. Not only were there rivalries among Japan’s ministries, there are also walls separating them.

-

Regulatory Burdens. A large number of regulatory problems exist.

-

A Lack of Openness. Japan is still viewed as a closed society by many in the United States.

Japanese Wrestle with the Role of Technology

The Japanese have long been wrestling with the questions of whether and how science and technology can help their country deal with some of these problems. Dr. Kahaner alluded to a variety of initiatives within Japan, ranging from more automation to the development of human capital from outside Japan, to new industry-academia-government collaboration. He called the preoccupation with creating knowledge-based industries “a kind of mantra” throughout East Asia, saying it could be seen in Korea, Singapore, and Taiwan as well as in Japan.

Japan’s Science & Technology Basic Law

Beginning his discussion of Japanese policy, Dr. Kahaner evoked the promulgation in November 1995 of Japan’s S&T Basic Law, which he described as an effort to “help the Japanese get their hands around where they were going in technology.” Behind the law, he believed, is the goal not only of contributing to the country’s economic development and social welfare by improving its technology, but also of contributing to the sustainable development of human society through the progress of S&T internationally. By the early 1990s, he explained, Japan was perceived by the United States and, perhaps, the countries of Europe as simply not pulling its weight in terms of international science and technology. “One could argue whether that’s true or not,” he said, “but the Japanese believed it,” and they undertook to equalize their S&T investments with those of other countries relative to the size of the economy.

The Basic Law is one of the outgrowths of that effort, and it in turn resulted in the founding in January 2001 of Japan’s Council for Science and Technology Policy (CSTP), which might be loosely compared to the United States’ Office of Science and Technology Policy (OSTP). Chaired by the prime minister, the council is made up of six cabinet ministers, five academics, and two representatives of industry. It is, in effect, charged with developing the “grand design” for Japanese S&T policy; among other things, CSTP discusses new types of budget items, and its decisions influence each ministry’s budget.

One of the council’s most important duties is drafting the country’s 5-year S&T Basic Plan, which sets guidelines for the comprehensive and systematic implementation of Japan’s overall S&T promotion policy. The goal of the first Basic Plan, which went into effect in 1996 and thus predated CSTP’s creation, was to double government spending on R&D. The second Basic Plan, whose budget was set at $212 billion over 5 years, was a part of an effort to double the amount available for competitive funding through the end of 2005. The main

thrust of the third Basic Plan, to go into effect in 2006, was still under discussion at the time of the conference.

Allocating the Research Budget

Japan’s total 2005 S&T budget was $36 billion, an amount 2.6 percent higher than in the previous year. Of that, around $13 billion was for research expenses including researchers’ salaries, the remainder for infrastructure. In the budget’s structure an umbrella function, called “systematization and integration” and denoted by an “S,” overarched four key areas being developed for the future, each of which was denoted by a letter so that the whole formed the acronym “SMILE”: nanotechnology and materials, “M,” allotted 4.9 percent of resources; information technology, “I,” 10.4 percent; life sciences, “L,” 22.7 percent; and environment, “E,” 7.5 percent. Again Dr. Kahaner pointed to a similarity between the Japanese approach and that of Taiwan as outlined by Dr. Chu.

Most important about the third Five-Year Plan, in his opinion, is that some form of aerospace-technology R&D is likely to take its place beside the four key research fields already mentioned. In addition, foreigners and women—the latter termed by Dr. Kahaner “the incredible untapped resource” of Japan—are to be sought out for a larger role in university research.

He pointed to a “new emphasis on efficiency” expected to be associated with a variety of policies, some involving collaboration. One locus of collaboration is to involve industry, academia, and government more actively—where, according to his personal perception, the Japanese saw the United Kingdom as more efficient than the United States. Another locus of collaboration, which is to receive greater emphasis in the third Basic Plan, is situated between the national government and local governments—once more, “quite consistent” with Dr. Chu’s description of Taiwan.

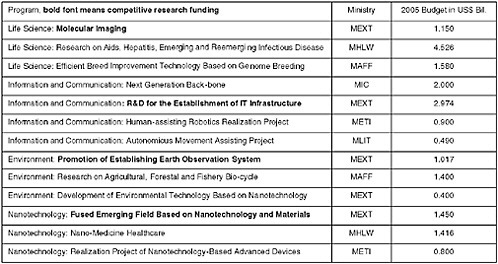

Also of significance is a “big jump”—amounting to a 30-percent increase over 2004—in the money to be awarded through peer-reviewed competitions. To show the extent to which such competitions were already being employed, he displayed a table listing programs in the second Basic Plan’s four key areas, with those granting funds on a competitive basis indicated in bold type (Figure 19).

Grant Competitions Heralding Change?

Dr. Kahaner suggested that the increase in funding granted competitively is in line with an emphasis on better integrating universities into the innovation system. Relatively few companies have spun out of the Japanese university system and relatively few patents have been produced by it—“a clear indication,” he said, “that something was wrong.” For this reason, the national universities have been converted over the previous few years into “independent administrative agencies,” the rough equivalent of National Laboratories in the United States.

FIGURE 19 Major R&D Programs in 2005.

While still funded by the government, these agencies now have more autonomy and more flexibility than traditional universities, exemplified by the ample opportunity they now have to seek competitive funds and now reflected in their increased cooperation with industry. Faculty and industry have in fact always cooperated, Dr. Kahaner said, but in a very informal manner; cooperation has recently become much more formalized. Laws have been enacted that allowed Japanese professors to “become millionaires if they’re good enough and they have good enough ideas,” he said.

There is also an effort to develop “Silicon Valleys” around the universities in keeping with the concept of local or regional clusters, as seen in Taiwan. In a development dating back only 5 years, each Japanese university has established a technology-licensing office; technology management as a discipline is also now receiving attention at a level unprecedented at Japanese universities.

Promotion of faculty based on performance has been adopted in some instances, although Dr. Kahaner said its full implementation in Japan “would be an incredible thing.” More non-Japanese faculty are receiving regular appointments, in contrast to the traditional practice of taking on foreigners almost exclusively under one-year contracts. An “overt goal” to make 30 Japanese universities world-class according to objective international criteria has brought about both alliances and consolidations among institutions. The country, he noted in passing, has around half as many colleges and universities as the United States, so that on a per capita basis the two nations were on an equal footing.

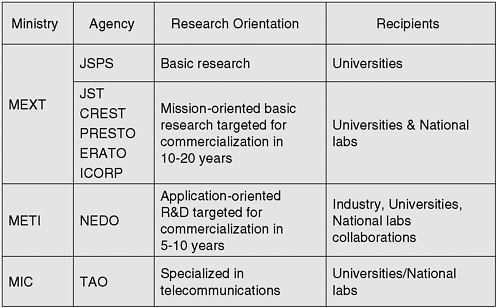

FIGURE 20 Funding agencies and missions in Japan.

Administering S&T at the Cabinet Level

Returning to the subject of interministerial rivalry, Dr. Kahaner noted that in 2001 essentially all Japanese ministries were reorganized. For example:

-

The former Education Ministry and Science & Technology Agency are now merged into the new Ministry of Education, Science, Culture, Sports, and Science & Technology (MEXT).

-

A Ministry of Public Management, Home Affairs, Posts and Telecommunications was renamed in 2004 to Ministry of Internal Affairs and Communications (MIC).

-

The Ministry of International Trade & Industry (MITI) is now reborn as the Ministry of Economy, Trade & Industry (METI).

Most significant about these mergers is that they have made Japan’s central government smaller. This has strengthened Japan’s Cabinet Office, which in turn both lends more weight to the decisions of organizations like the Council for Science and Technology Policy and puts more power of coordination into their hands. See Figure 20 for a summary.

Under the most recent Basic Plan, Japan’s ministries are being encouraged to collaborate on work taking place within eight specific R&D groupings. These

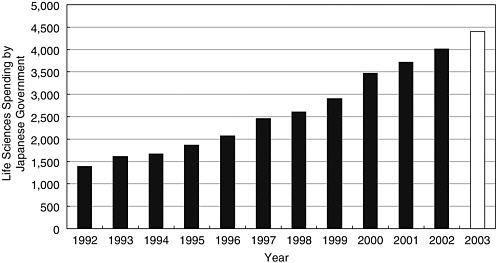

FIGURE 21 Life sciences—biotech: Japanese government spending in life sciences.

groupings include post-genomic research, hydrogen utilization and fuel cells, nano and bio technologies, and ubiquitous networks. Recent research thrusts for METI are fuel cells, robotics, health, IT in the home, energy, and nanotechnology, the last three of which would, Dr. Kahaner predicted, be crucial in Taiwan and Korea as well. In another recent development, Japan has begun taking much the same approach as Taiwan in nurturing knowledge clusters by emphasizing specific fields of technology; CSTP is establishing more than a dozen of these clusters around the country over the previous several years.

Japan’s Leading Endeavors in Science

Dr. Kahaner then turned to what he termed Japan’s “big-time science efforts”:

Biotechnology

According to a graph he projected, the government tripled its funding for the life sciences in the decade beginning in 1992 (Figure 21), with the goal of increasing the number of biotech companies in the country to 1,000 by 2010. The number of Japanese biotech companies has grown from 60 in the late 1990s to 250 in September 2001.

FIGURE 22 Spending on nanotechnology.

Nanotechnology

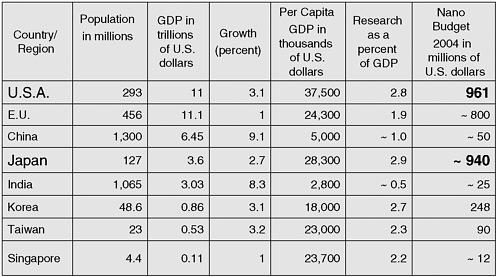

Japan is spending almost as much in nanotechnology ($940 million) as the United States ($961 million) on an absolute basis in 2004 (Figure 22), and much of the funding is granted competitively.

Fuel cells

All Japanese electronics companies are working in this area, which is a focus of government funding because of the ever-growing use of portable devices. Dr. Kahaner pointed to an announcement, made only a few days before the conference, that IBM and Sanyo were to develop a fuel-cell power system for the new-generation Think Pad; it was his understanding that most of the basic technology development would take place at Sanyo.

Robotics

Unlike in the United States, there is a very high level of interest in Asia—and particularly in Japan—in humanoid robots, the first of which, Honda’s Osimo, had come out in the late 1990s. Of interest to the Japanese, Dr. Kahaner suggested, is not so much the robot as the development of capabilities associated with its attributes: power-source technology; recognition technology, including voice, tactile, vision, and translation; activator technology, pertaining to the robot’s mechanics; structure, of possible relevance for prosthesis technology;

control-system technology; and software. “Think about all of this as component technology, and about the impact that developments in these technologies can have across the industry spectrum,” he advised. “Don’t think of it in terms of this walking robot.”

Synchrotron radiation

SPring-8 was the largest synchrotron radiation facility in the world when it opened in 1997 and is still among the biggest. Its $1 billion price tag is comparable to that of the U.S. Department of Energy’s Spallation Neutron Source at Oak Ridge, Tenn.

Computing

Japan’s Earth Simulator, the world’s fastest scientific computer when it opened in 2003, required a $450 million investment and “still sends shudders through many people in the U.S. science community,” Dr Kahaner said.

Concluding, he said that Japan will place emphasis in the future on competition within the country for research money; collaboration among Japanese organizations and the associated coordination of research efforts; ways of being more efficient and of measuring efficiency; and increasing internationalization with respect to human talent.12

Discussion

Opening the question period, Jim Mallos of Heliakon observed that the point of all innovation was to make new products and that, in the 21st century, “it won’t do us any good to come up with new products that are like the failed competitors of the iPod: perfectly good, but not quite magical in the way they put together design and technology.” His question was whether Japan’s esthetic culture and skill at miniaturization positions it as well as any nation to succeed at modern product design.

Dr. Kahaner said that the answer is “obviously” affirmative and that the Japanese themselves believe that they were very well positioned in this regard. In not only Japan but also Taiwan a vast array of products that differ only slightly among one another are “being pushed out the door in very, very great numbers [as] a way of experimenting with what the public finds suitable.” While such products got “filtered out” before they reach the United States market, he remarked, they are greatly in evidence in Akihabara and similar places throughout Asia. So it was indeed likely that Japan will be a strong competitor.

|

12 |

See the related presentation on Supercomputing by Kenneth Flamm in Panel IV of these proceedings. |

On the specific question of whether the Japanese would produce “the next-generation iPod,” however, Dr. Kahaner declined to guess. He stated his personal view that devices like the iPod would lose out in the future to a telephone-based technology. Noting that there were hundreds of millions of cell phones in use but “only a handful of iPods,” he said that market pull would best be achieved by starting with the cell phone and innovating from there rather than by innovating on the basis of the iPod.

Dr. Amsden then called on the next speaker, Tom Howell, to talk on China’s semiconductor industry.

NEW PARADIGMS FOR PARTNERSHIPS: CHINA GROWS A SEMICONDUCTOR INDUSTRY

Thomas R. Howell

Dewey Ballantine

Referring to Dr. Amsden’s observation that in developing countries industry comes first and innovation later, Mr. Howell said he would allow that progression to structure his presentation.

Over the previous 5 years, China’s technology level and the scale of Chinese industry has grown on a very fast trajectory. In 2000, conventional wisdom had it that China would lag behind the world leaders in semiconductors for quite a long time; according to the current conventional wisdom, it has become an “unstoppable juggernaut.” In Mr. Howell’s view the conventional wisdom is most likely wrong in both cases, but he acknowledged that the speed of the country’s development has surprised almost everyone. In the course of his talk, he was going to examine some of the government policies that have contributed to it.

Overcoming a Legacy of Obstacles

A snapshot of China’s microelectronics industry taken in the early 1990s would have shown that the country had destroyed its science infrastructure during the Cultural Revolution. The universities had been closed, many people had been driven out, and an entire generation was still feeling the effects of not having received an education. All Chinese semiconductor enterprises and research organizations were owned by the government and administered by bureaucrats. They were 10 to 15 years behind the global state of the art; at that time this was attributed to what was called the “Western technology embargo,” but the fact was that Chinese firms were very far behind technologically.

Because the industry’s infrastructure was primitive, Western companies had very little interest in building facilities in China. The level of excellence in Chinese semiconductor manufacturing was reflected in a comment by a Texas Instruments employee: “I’ve seen clean rooms with open windows.” Virtually all

of the integrated circuits imported into China were smuggled through “various shady trading companies” in Hong Kong. To the extent that foreign investors were invited in, they were subjected to crude pressure from the government to transfer technology. In sum, “it was not a very welcoming environment for foreign investment.”

One element of the Chinese effort, however, has been a continual study of successful systems abroad, particularly those in the United States, accompanied by constant critical self-appraisal. The analysis of what China was doing wrong was applied over and over again, Mr. Howell said, and “managed to trump all the other disadvantages eventually.” This process is still going on.

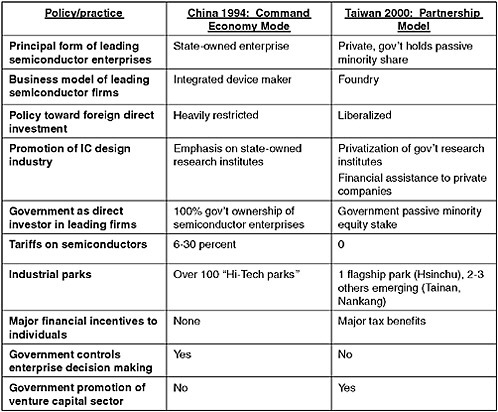

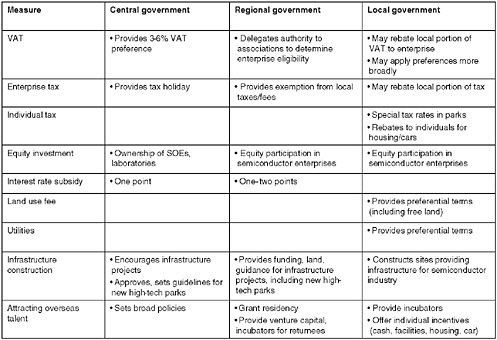

The Structure of China’s Development Policy

Projecting a table listing domestic policies and practices that have affected China’s development in microelectronics (Figure 23), Mr. Howell characterized as “all stick, no carrot” the traditional Communist policies current in 1994 (center column). “You have state-owned enterprises, and the government tells them what they’re supposed to do, and they’re expected to do it,” he summarized. Foreign investment was restricted to the point that China “was essentially a closed market,” and tariffs on semiconductors as well as many other electronics products were high. There were about 100 “high-tech parks,” none of them very sophisticated.

But while China, with its billion people, was lagging technologically, nearby Taiwan—a resource-poor Chinese society of 20 million people—was building one of the foremost semiconductor industries in the world. “That fact was not lost on planners across the Fujian Straits,” Mr. Howell remarked. “As they were doing their self-criticism, one could point out that ‘we’re doing things wrong that the Taiwanese are doing right; perhaps we could learn something from them.’ ”

Recalling Dr. Chu’s summary of Taiwanese policies and referring to his own chart (right-hand column), Mr. Howell said that Taiwan’s government basically functioned (and continues to function) as a partner with industry. Rather than making decisions it encourages the formation of enterprises, in some cases spinning them off from government research institutes. A passive equity investor in many enterprises, the Taiwanese government becomes involved when it is needed to create infrastructure or where there is some task or risk that the private sector can not undertake on its own, such as the pioneering of the pure-play foundry. Intervening at such points but not at others, Taiwan has presided over “an all-carrot system” in contrast to the previous Chinese system, which was “all stick.”

China Adopts a New Policy System

Around the beginning of its tenth Five-Year Plan in 2001, and concurrent with joining the World Trade Organization (WTO), China undertook a funda-

FIGURE 23 China 1994, Taiwan 2000.

mental reappraisal of what it was doing and “essentially decided to jettison [its] whole system.” While retaining the economic nationalism that had suffused all its earlier Five-Year Plans, it largely abandoned the command method in favor of a system using Western promotional measures permitted under the WTO: subsidies, tax measures, targeted government procurement, and the like. Simultaneously taking place was a thorough decentralization, with most of the policies being implemented locally rather than at the national level; a fundamental redefinition of the industry-government relationship, with an emphasis on the independence of enterprises’ decision making; and liberalization of inward investment permitting foreign companies to establish fully owned subsidiaries. Tariffs on semiconductors were eliminated. And pressure to transfer technology eased, although that pressure had not ceased entirely.

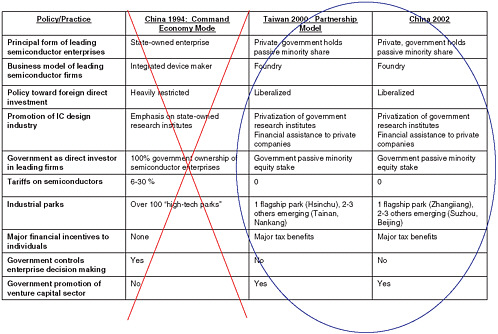

This added up to a “paradigm shift” in which Chinese planners abandoned their own system and embraced Taiwan’s. Mr. Howell displayed a table showing that virtually every Chinese policy current in the semiconductor field had a Taiwanese antecedent (Figure 24).

FIGURE 24 Microelectronics: China embraces Taiwan’s model.

Many of them were implemented with the assistance of Taiwanese advisers; for example, one of the leaders who had set up Hsinchu Park, Irving Ho, acted as a consultant on the industrial parks that had been built on the Mainland in the previous 5 years. The function of China’s central government in policy had become “mostly hortatory,” with the actual benefits and promotional measures implemented largely by the regional governments and local governments in line with the central government’s intentions (Figure 25).

China’s Market Pull Restructures the Industry

A policy not copied from Taiwan was the leveraging of China’s market. When Mr. Howell spoke in 2000 with government and industry planners in Taiwan, their expectation was that 30 new semiconductor fabrication plants would be built in the Mainland by 2008 and that there would be no Taiwanese investment in semiconductor manufacturing on the Mainland. Two years later, the picture had changed radically: Seven Taiwan-invested fabs were envisioned for Taiwan, 20 for China. Two of the Mainland fabs were already operational in 2005, the rest either under construction or planned by companies that were managed and, in many cases, capitalized by Taiwanese entities.

FIGURE 25 Layering of Chinese promotional policies in microelectronics.

Although this shift had been attributed by some to an advantage in manufacturing costs that China is assumed to enjoy over Taiwan, these costs—not counting government incentives—are in fact very similar, even close to identical. Richard Chang of the Semiconductor Manufacturing International Corporation (SMIC), one of the foundries on the Mainland, places the differential at less than 10 percent and probably closer to 5 percent. Cost considerations are not behind this locational shift in Taiwanese investment, Mr. Howell asserted.

Incentives Create a Cost Differential

Very strong, however, is the draw of the Chinese market, and China’s government has emphasized its market’s pull by putting a differential value-added tax (VAT) into effect in 2000 that gave devices manufactured in domestic fabs a 14-percent advantage over imports in the Chinese market. Taiwanese investors, seeing that they might be shut out of China’s growing market unless they invested there, rushed across the Strait as a result. Although the VAT measure was subsequently withdrawn, that Mainland investment has remained—providing an example of China’s use of its market to leverage inward foreign investment.

That market is expanding faster than any other of the world’s major markets: It has grown at a rate of 40 percent in 2004 and is expected to achieve a compound annual growth rate of more than 20 percent for the period 2002-2008, compared to 7.3 percent for the United States and 13.8 percent for Taiwan. Mr. Howell put its current size at around $24 billion and said it was expected to grow to something on the order of $65 billion by 2007.

The bulk of the country’s capital stock in semiconductor manufacturing still falls within the category of technologies that are “essentially obsolete.” Yet, while 8-inch fabs are predominantly being built, there is also a 12-inch fab located in Beijing that had gone into operation in the second quarter of 2005, and still more growth is to be expected at the high end of the scale.

A “Leap Forward” for Chinese Technology

According to the U.S. General Accounting Office (renamed the General Accountability Office in 2004), China closed the wide technology gap in IC line-width capability that had existed in 1986 and by 2001 approached the U.S. state of the art.13 The most advanced SMIC fab, in Beijing, is currently using design rules of 110 nm. While this is “not state of the art,” Mr. Howell said, it is “not that far behind,” as much of the U.S. industry is at 90 nm and moving to 65 nm. China has thus made “quite a leap forward.”

Mr. Howell observed that while the old-style, 100-percent government-owned companies Huajing and Hua Yue are still in existence, they are “not doing much that is of much interest.” China first moved to 50-50 joint ventures that it still essentially controls, but are partially capitalized by (mostly) Japanese investors; while “not failures,” these ventures did not “chase the state of the art” either. However, the new-model China-based semiconductor ventures more closely resemble a typical multinational corporation with some government investment, but basically backed by a diverse array of stockholders, including foreign investors.

Pulling in Foreign Capital

Commenting next on the financial structure of SMIC, currently the largest foundry operator in China, Howell noted that, as of 2002, Chinese banks helped get SMIC up and running with close to $500 million in loans. The Industrial and Commercial Bank of China, China Construction Bank, Shanghai Pudong Development Bank, and Bank of Communication are policy banks and lend for policy reasons; the lenders were simply commercial banks. Contributing equity

along with the PRC Government and Shanghai Industrial Holdings (the investment division of the Shanghai municipal government) were the government of Singapore, Toshiba, Chartered Semiconductor, and a number of offshore venture-capital companies, many of them with Taiwanese-sourced money. SMIC was subsequently listed on the New York Stock Exchange in 2004; Mr. Howell estimated its current equity ownership at 58 percent American.

As for the tax rates applying to enterprises operating in China, he said “there is essentially no tax.” Allowing companies to exist in a tax-free environment was a duplication of Taiwanese policy.

Modernization of China’s High-Tech Parks

Mr. Howell then traced the evolution of high-technology parks in China. “In the old days,” he recalled, “if you went into a [Chinese] high-tech park, you wouldn’t even know you were there: You’d just be in some kind of ramshackle urban environment that had been designated as a park and was run … by an administrative committee appointed by the municipal government.” Taking a first step away from this, the Chinese began setting up development corporations that negotiated with investors and tried to start their own businesses. “But if you went in to meet with them,” he said, “you’d find that the person who met with you had two business cards: an administrative committee card and a development corporation card.” Because these officials wore both hats, it was helpful as part of negotiating a deal with a corporation to get a permit approved by the administrative committee, “because it was the same guy.” Many Chinese parks are still run in this manner, although it is not conducive to a very dynamic, entrepreneurial environment.

The latest-model high-tech park is a sophisticated development corporation with a venture-capital arm, a real estate development corporation that sells land in the park, high-tech incubators, and many other support functions. The administrative committee manages the park’s utilities and services. The Beijing Technical Development Area is an example of this genre, resembling what one might find in California. Mr. Howell noted that similar parks are located at Shanghai and Suzhou. They amount to clusters of relatively advanced semiconductor manufacturing facilities that incorporate all the necessary infrastructure: materials companies, equipment companies, design centers, and the design houses of various OEMs. There is also plenty of land.

China Aims to Innovate in Microprocessors

Finally, Mr. Howell said that, having been successful in drawing industry in, the Chinese are now seeking “very vigorously” to develop their domestic innovative capability. Chinese officials have been making statements in recent years that Intel has a relative monopoly in semiconductors, that Microsoft has a

monopoly in software, and that both monopolies are bad. In addition, Chinese officials have said that their response to the U.S. hardware monopoly is to try to design an indigenous microprocessor and have set in motion five projects whose goal it is to accomplish this capability. One of these projects is run by a government institute that is part of the Chinese Academy of Sciences—The Institute for Computer Technology—that in 2002 spun off a microprocessor company. He rated its product as “pretty good—not as good as a Pentium, obviously, but they’re closing the gap.”

The country’s end-use industries have been organized as well and are being encouraged by the government to buy the output through the “Dragon Chip Industrialization Alliance,” with their purchases to be complemented by military procurement. Since China did not sign the WTO procurement code when it joined the organization, the Chinese can practice discrimination in procurement when doing so conforms to their interest. “They feel now that buying systems that have Chinese-developed microprocessors in them is not in their interest,” he observed. “But the minute that the Chinese model gets to be as fast as an Intel model, they will all switch at one time to the Chinese model.” Considering the current and projected growth of the Chinese market, such an occurrence could be expected to have “quite an impact.”

Assessing the Challenges Facing China

In conclusion, Mr. Howell presented a list of “concerns and challenges”:

-

He all but dismissed oft-expressed fears of overcapacity, suggesting that China’s government could take such demand-boosting measures as requiring each citizen to have an I.D. card with an embedded microprocessor if it needed to absorb excess output as the number of fabs in the country grew.

-

The use of preferential government procurement as an industrial policy tool is, he said, a concern.

-

Intellectual property rights, although growing, are not yet a major concern, because China’s technological level has not reached that of the United States.

-

Standards setting is a concern because it can be used to shut out American and other foreign designs.

-

Government pressure to transfer technology, although more subtle than before, has not gone away.

Mr. Howell rated as the biggest challenge (what he called) the “gravitational pull” that increasingly draws all levels of semiconductor industry activity to China. As the bulk of wafer-fab investment moves to China—and projections indicate that China will boast some 30 new fabs in the ensuing 3 years compared to 6 new fabs in the United States—science and engineering graduates from

universities around the world would increasingly find the opportunities they were seeking in China. Combined with the growing location of design capacity in China, “a tipping point has been reached that we can’t easily turn around,” he warned.

Discussion

While agreeing with Mr. Howell about the importance of foreign-owned firms to China’s semiconductor industry, Dr. Amsden cautioned that it would create the wrong impression to say that foreign firms are important in all Chinese industries. One of the Chinese government’s major policies is to create nationally owned firms, private or not, in virtually every major industry, including semiconductors. “The idea is that you have joint ventures,” she said, “but unlike in other countries they have a finite life span: After 10 years they’re dissolved.” China’s emphasis on nationally owned firms as opposed to relying on multinational firms is an extremely important element in its development, a subject on which, she suggested, Mr. Howell might comment later on.

Then, informing the audience of their good fortune at having him present, she ceded the rostrum to Mr. Shindo.

INNOVATION POLICIES IN JAPAN

Hideo Shindo

New Energy and Industrial Technology

Development Organization (NEDO)

Japan

Mr. Shindo expressed his pleasure at having the opportunity to introduce some of Japan’s activities in the domain of innovation policy at the symposium.

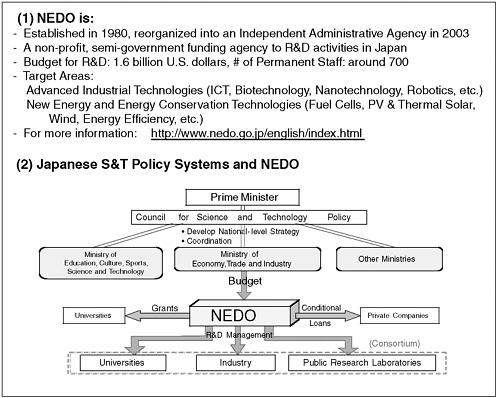

He began by projecting a diagram illustrating the nature of the relationship between NEDO and METI (Figure 26), the former being a funding agency closely connected to the latter, as Dr. Kahaner had explained earlier. He reported that the term “innovation” is very popular in Japan and is regarded as highly important. Japan’s Basic Science and Technology Plan has addressed innovation from a science and technology perspective. In addition, the Nakagawa Report: Toward a Sustainable and Competitive Industrial Structure has addressed innovation from the viewpoint of industrial policy. Published in 2004, this report was named after Shoichi Nakagawa, Japan’s Minister of Economy, Trade & Industry.

Mr. Shindo focused on two key questions, one centering on invention, the other on innovation. The first concerns how new ideas are created and casts the spotlight on how to provide a good environment for R&D, whether at the basic stage or on technologies progressing through the Valley of Death. The second concerns how to introduce such ideas to the market. It focuses on what he called

FIGURE 26 What is NEDO in the S&T policy system in Japan?

“the virtuous cycle of demand and innovation.” He interpreted the “innovation ecology” referred to by Secretary Marburger as a way of thinking about the cycle involving innovation and the market in order to enable more sustainable growth for innovative technologies.

Key Questions for Japan’s Next Five-Year Plan

After briefly providing background information on Japan’s Basic Science and Technology Plan, Mr. Shindo highlighted a number of possible key questions regarding the third Basic Plan:

-

How to develop and maintain S&T human resources?

-

How to establish a creative, high-quality R&D system?

-

How to prioritize strategic S&T areas?

-

How to develop a virtuous cycle of knowledge creation and application, through the acceleration of innovation and value creation? This virtuous cycle would be based on R&D results at universities and public research organizations

-

on the one hand, and through industry-university cooperation, the activation of entrepreneurs, and human resource development in management of technology areas on the other.

The Nakagawa Report, concerned above all with the activities of METI, seeks to identify policies needed to establish and accelerate a virtuous cycle of demand and innovation in order to bring about Japan’s economic recovery and to create its future industrial structure. Taking a “very traditional” approach to drafting this report METI staff conducted rigorous interviews with over 700 people from more than 300 companies and institutions, asking all what they felt to be important.

METI Looks at Japan’s Future

The report provides three key questions and as many key solutions. The questions center on how to ensure global competitiveness, how to respond to the demands of society, and how to encourage regional economic development. The potential solutions are to identify cutting-edge areas of industry that promise strong global competitiveness industrial areas that can meet market needs arising from changes to society, and industry clusters that can support regional revival.

Also contained in the report is a “very comprehensive” list of policy priorities. The first identifies promising industrial areas, among which, as mentioned earlier by Dr. Kahaner, are fuel cells and digital consumer electronics. Second are policies for regional revitalization. A third category includes so-called cross-sectional policies, pertaining to such issues as the development of industrial human resources, intellectual property rights, research and development, standardization, development of new businesses by small and mid-sized enterprises.

Turning to the implementation of these potential solutions and policies, Mr. Shindo said that “fortunately” several policy responses to the report have been initiated in the year since its publication. Notably, a “Technology Strategy Map” that has been developed by his organization together with METI and the National Institute of Advanced Industrial Science and Technology (AIST), Japan’s largest public research organization.

Ending his presentation, he thanked those attending for their attention and offered to provide more details to all who might be interested.

DISCUSSION

Dr. Wessner opened the question period by referring to the “tipping point” mentioned by Mr. Howell and asking whose semiconductor industry was most vulnerable to it—that of the United States, Europe, Taiwan, or Japan? While he was posing the question primarily to Mr. Howell, Dr. Wessner said, he would value the response of others on the panel as well.

Mr. Howell responded that, in his opinion, Taiwan’s semiconductor industry is the most vulnerable. A “huge exodus” from Taiwan to the Mainland has already taken place, and hundreds of thousands of Taiwanese are how living in China, especially in the Shanghai area. Companies are springing up there that are run by Taiwanese managers and staffed in the main by Taiwanese engineers. The Chinese have figured out that even if companies can not be lured to the Mainland, individuals can be lured there and brought together, along with investment and other elements needed to create companies. “It’s a very attractive environment if you’re Taiwanese,” he commented. “You speak the language; and Shanghai is pretty nice, really; and opportunities are there for many Taiwanese that they may not see for themselves in the long run in Taiwan.” What Taiwan’s strategy was for responding might be, he said, has not yet become clear.

Comparing Costs in Taiwan, on the Mainland

In answer to a question about the extent to which cost levels differed between Taiwan and the Mainland, Mr. Howell said that labor costs for semiconductor manufacturing are about 40 to 50 percent lower on the Mainland and that the cost of water is lower as well. But these are very small components of semiconductor manufacturing costs; the main expenses are equipment and other items whose costs are equivalent or close to equivalent in the two locations and were in some cases lower in Taiwan.

In addition, the Taiwanese fabs on the Mainland have the extra costs associated with bringing in expatriates to work. Housing and education might need to be provided to hundreds of people coming from Taiwan, while those from Europe, the United States, and Japan have “expectations of a certain lifestyle,” and catering to these expectations raise labor costs. A 2002 Dewey Ballantine survey comparing costs in the United States, Taiwan, and China found manufacturing costs to be very similar in all three locations: “a little bit lower in China and little bit higher in the United States, but not that much if you take incentives out of the picture.”

Adding incentives, however, changes everything, as demonstrated by China’s erstwhile VAT policy, which pushed cost significantly lower. It was thus an artificial cost advantage created by the Chinese government that motivated companies to move from Taiwan to the Mainland. “Right away you got a 13-percent cost advantage just based on that,” Mr. Howell pointed out. “And there was a sense that you would have the market to yourself if you moved over there with advanced technology: Nobody could export into that market and meet that cost advantage. It sucked in just an incredible amount of investment, and people and skills and everything else.”