C

Intermediate-Term Feature Descriptions

This appendix has in-depth descriptions of the innovative banknote features that could be implemented in a time frame of fewer than 7 years and that are discussed in Chapter 4 of this report. Each feature description includes subheadings dealing with various aspects of the feature:

-

Description—An explanation of the physical principle(s) on which the feature is based. Also, the feature application as visible, machine-readable, applicable to the visually impaired, forensic applicability, and so on, is described. Furthermore, the benefits and limitations of the feature are presented; graphics may be included to depict the feature and its operation.

-

Feature Motivation—A summary of the reasons why the feature is highly rated by the committee and reference to its uniqueness.

-

Materials and Manufacturing Technology Options—A summary of the materials and manufacturing process that could be used to produce the feature, as well as initial thoughts on how the feature could be integrated into a Federal Reserve note.

-

Simulation Strategies—A discussion of potential ways in which a counterfeiter could simulate or duplicate the feature and the expected degree of difficulty in attempting to do so.

-

Key Development Risks and Issues—A discussion of the durability challenges, feature aesthetics, anticipated social acceptability, and description of the key technical challenges that must be addressed during the first phase of the development process to demonstrate the feasibility of the feature idea,

-

that is, to demonstrate feature capabilities and determine the usefulness of the feature in counterfeit deterrence. (The development phases are defined in Chapter 6.)

-

Phase I Development Plan—A characterization of the current maturation level of the feature technology, key milestones to be achieved during the first development phase, and known current and planned related developments external to the Bureau of Engraving and Printing (BEP).

-

Estimate of Production Cost—An initial assessment of additional BEP operational steps that would be required at the BEP to produce a banknote with the feature, incremental cost (higher, lower, the same) relative to the cost of the current security thread, and an indication of whether additional BEP capital equipment would be required for production.

-

References and Further Reading—Selected references related to the feature and its associated components. Such references could include, for example, papers and conference proceedings for background on any work done relating to this feature. These lists are not exhaustive but are intended to provide a snapshot of current work related to the feature concept.

The features described in this appendix are as follows:

-

Color Image Saturation

-

Fiber-Infused Substrate

-

Fresnel Lens for Microprinting Self-Authentication

-

Grazing-Incidence Optical Patterns

-

High-Complexity Spatial Patterns

-

Hybrid Diffractive Optically Variable Devices

-

Metameric Ink Patterns

-

Microperforated Substrate

-

Nanocrystal Pigments

-

Nanoprint

-

Refractive Microoptic Arrays

-

See-Through Registration Feature

-

Subwavelength Optical Devices

-

Tactile Variant Substrate

-

Thermoresponsive Optically Variable Devices

-

Window

COLOR IMAGE SATURATION

Description

By watermarking an image, its authenticity can be assessed. In most cases, watermarking is done in one or more of the various data channels of the image. The luminance, or brightness, channel of the image has been used, as well as the frequency space of the image. Since the eye is very sensitive to luminance variations, using the luminance channel results in any image degradation or manipulation being very obvious, and watermarks—even authentic ones—are often noticeable to a human observer. The frequency channel requires considerable processing if it is used, and it can also contain image-degrading artifacts.

The technique on which this proposed currency feature—color image saturation— is based uses the saturation channel of color images to embed watermarking or other secure data. Color images are usually captured via red (R), green (G), and blue (B) data channels. Saturation is data derived from the RGB channels using various computational techniques already known in the imaging industry and does not require the development of any new technology. In watermarking via the saturation channel, no visible artifacts would generally be realized, and hence the image can be watermarked without impacting its quality in any noticeable way. The human visual system is much less sensitive to saturation channel variations (essentially color intensity) than to pure luminance variations as previously described. With the BEP capability to create, process, and print such a watermarked image, the counterfeiter would not know how the watermarking was done and, as a consequence, would be at a considerable disadvantage in attempting to create a passable note utilizing this feature.

The paper cited in the “Further Reading” section below outlines the techniques used in performing this type of watermarking. One key benefit of this approach is that it should be very robust, and it is noteworthy that only an instrument can determine the authenticity of the image so marked, since unassisted visual inspection of the note would not be adequate to authenticate it. The complexity of the authentication hardware and software is not expected to be so costly or complex that it would incur prohibitive hardware or software implementation costs.

Implementing a color-saturation feature requires that the image being used is in more than one color rather than being pure monochrome. Depending on the color model chosen for the image or on how the data are created and stored, there should be a hue, value, and chroma channel—for example, the chroma channel might be used for the watermarking. Hue, for example, is the color of the image, such as red, green, blue, cyan, magenta, and so on. Value is the brightness of the color and can be similar to luminance. The chroma channel is the intensity of the color, such as its “redness,” for example. The eye is about 10 times less sensitive to

chroma variations than to luminance variations. Color images in other encodings can be converted to have a saturation channel as required; it is just a matter of image preparation. The choice of whether the image is full color, pseudo-color, or just multicolor is optional and can be made at the time of note design. However, the image chosen would require selection based on its color characteristics and suitability for saturation channel watermarking use.

Feature Motivation

This feature would deter counterfeiting owing to the need to make an acceptable image with watermarking in the saturation channel. Also, it is expected that a watermarking scheme that would permit copying detection could be implemented. Thus, if a counterfeiter copied real currency and attempted to place the image on a counterfeit, the copied image would be detectable via the appropriate analysis mechanism. While this complete capability has yet to be verified, it would, if successful, be a very robust feature indeed. This feature is quite unique in that it uses the saturation channel of a color image to encode data; since this channel is not generally observable, a secure method of authenticating the note is provided. Furthermore, since the image is usually watermarked as a multibit-per-pixel image and then rendered as a binary image for printing via a halftoning or other binarization scheme, the would-be counterfeiter would not have access to the original image and would have great difficulty in determining from the binary image on the authentic currency the pixel values of the original image.

It is expected that this feature would deter the opportunist and the petty criminal counterfeiter and that many professional criminal counterfeiters would be highly challenged in attempting to duplicate or simulate the feature. Furthermore, the would-be counterfeiter would have to reverse-engineer the authentication hardware and software. This multitiered robustness of challenging image modification and detection methodology replication would be highly frustrating and time-consuming. Perhaps one of the strongest values of this technique is for forensic detection. The value for other users would depend on whether the technology to detect and authenticate the watermark would be shared with commercial banks or retail outlets.

Materials and Manufacturing Technology Options

A color-saturation watermark feature would be printed on the note similar to the other Federal Reserve note (FRN) features. No special processes or ink would be required. The feature’s strength lies in the data encoded in the image. Since most notes do not have a full-color ink set such as cyan, magenta, yellow, and black, some effort would be necessary to develop a production process and an

image that employs the inks that the Bureau of Engraving and Printing uses or is planning to use. These requirements are not restrictions but do represent design and manufacturing choices to be made.

Simulation Strategies

Duplication of this feature would require the capability of at least a criminal of professional level. The opportunist or petty criminal would be easily prohibited from making this feature work by copying. Additionally, the data encoded in the saturation watermark would be unknown to the counterfeiter, since the data would be verified by a scanning and analysis mechanism only. The design of this mechanism would not generally give away the data that it processed in order to determine authenticity.

A key characteristic of most images is that they exist in a continuous-tone or multibit-per-pixel data format. However, the printing process, such as intaglio, is a binary process in that there is either ink or no ink deposited on the substrate. There can be substantial proprietary technology in turning the continuous-tone image into the proper binary image that is capable of being rendered from a device such as an intaglio or offset printer. Again, the would-be counterfeiter would have no knowledge of the original image’s continuous-tone data and hence could not readily determine either the binarization process used by the BEP or the original image data. Without this information, the would-be counterfeiter would have no idea what the original data looked like and hence could not readily determine what an acceptable forgery would look like to an analysis instrument. This kind of feature would, therefore, provide the note with substantial security advantages that are not accessible by the criminal from the currency itself. A visually similar appearance would be no guarantee that a counterfeit note would pass an authenticity examination via the scanner and processor at the point of use.

Key Development Risks and Issues

Durability

The durability of this feature should be high, since it is contained in a printed image and the image should be quite robust, as any printed feature would be. Therefore, durability is not an issue.

Aesthetics

The look and feel of the currency should not be negatively impacted by the use of this feature. The images would have to be in color or pseudo-color, and color is already present on U.S. FRNs.

Social Acceptability

There should be no issues regarding social acceptability, since the feature is just an image. However, it is conceivable that the scanning and processing of the note might cause some concern about maintaining the anonymity of currency. This feature would only facilitate the authentication of the note, however, and would not be used as a tracking feature.

Key Technical Challenges

The first key technical challenge would be to make sure that the embedding of the required data in the saturation channel did not noticeably deteriorate the image being watermarked.

The second key challenge would be to make sure that the watermark data were detectably altered if the image was copied in an unauthorized fashion. In this way, any attempt to copy and reproduce the image would cause detectable errors that would flag the currency as counterfeit.

Lastly, a scanning and processing mechanism would need to be designed that properly analyzed the note and did so at an acceptable speed coupled with tolerable cost and complexity.

Phase I Development Plan

Maturity of the Technology

This technology is modestly mature. Any required scanners and data-processing schemes are already known and tested. The only remaining issue is how well the embedded data degrade upon copying so that forgeries are easily detectable. The state of this knowledge is unknown.

Current and Planned Related Developments

No related developments in the public domain are known to the committee except as described in the reference work cited in “Further Reading,” below.

Key Milestones

The key milestones required are as follows:

-

Select an image or images suitable for use on currency.

-

Watermark the images, scan them or copy them, and process the data.

-

Investigate how well the saturation watermark passes through the currency engraving and generation process.

-

In approximately 1 year following the achievement of the above results, currency could be in production, depending on resources and priorities.

Development Schedule

The committee estimates that the development of Phase I of this feature could be completed well within 2 years.

Estimate of Production Cost

Compatibility with Current BEP Equipment and Processes

The production cost should be very minimal owing to the fact that watermarking is only a printed feature. The cost impact of printing an image in more than one ink needs to be assessed, but this is likely already known.

Incremental Production Cost

The cost of this feature should be very minimal, since it is just another printed feature on the currency. For the required color image, color inks and a more complex printing process are involved, but the additional cost impact should be low to very low in the volumes of currency produced.

Required Capital Equipment

There is little in expected capital cost incurred with this feature. The need to process the watermark and scan the image would require some capital equipment, but it should be a relatively small amount. The software processing required should be capable of being developed on systems already in-house.

Further Reading

Huang, P.S., and C.-S. Chiang. 2005. Novel and robust saturation watermarking in wavelet domains for color images. Optical Engineering 44(11): 117002.

FIBER-INFUSED SUBSTRATE

Description

This proposed feature involves fiber-infused paper—that is, small-diameter optical fiber segments placed in the currency substrate. These fiber segments could be glass, acrylic, or other materials. Even metallic fibers could be placed in the substrate to radiate signals when illuminated by radio-frequency (RF) signals, for example. Optical-fiber segments, when illuminated by laser light or narrow-spectrum illumination, create a signature pattern that would be easily recognizable. This feature is envisioned as an upgrade to the current fiber content of the substrate of U.S. FRNs. To employ this feature, optical fibers, or more preferably fiber segments, are placed in the substrate. As the substrate is manufactured, these fiber segments are mixed in before the paper is dried. When the finished substrate is illuminated with light, especially laser light, the fibers light up as the incident light emanates from the ends of the fibers.

The first deterrent example would be for a user to notice the speckles of light from the substrate when it is illuminated. The mere speckles of the substrate with its embedded fibers would be somewhat complex for counterfeiters to reproduce, since the counterfeiters would have to create their own substrate. This elevates the complexity of their counterfeiting task considerably. The limitation of this approach is that anything that causes the substrate to produce visible speckles might be misconstrued as authentic. One key element of this feature is that the substrate is no longer passive when illuminated by optical or other electromagnetic radiation. The way that the substrate responds can be highly controlled.

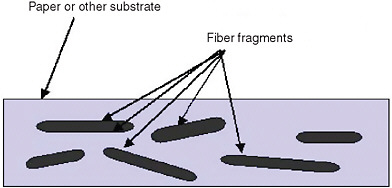

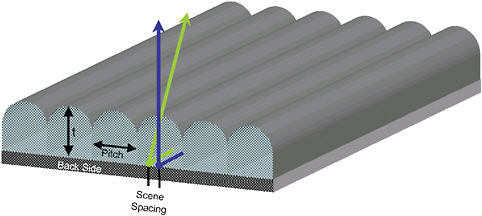

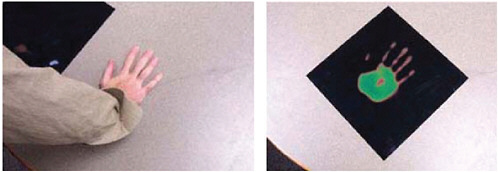

Figure C-1 illustrates the fibers embedded in the substrate. The references in “Further Reading,” below, give additional illustration of the concept and use of this technique.

FIGURE C-1 Fiber-infused substrate.

A more robust feature would be to authenticate a note by a scan or digital photograph of the substrate and compare it with the known speckle pattern from a registered original or from data encoded on the note—this kind of longer-term feature is discussed in Appendix D.

Feature Motivation

The fiber-infused substrate feature has a good rating in the committee’s analysis owing to the difficulty of implementing the cause of the feature—that is, the fibers in the substrate—and the utility of visual inspection. Furthermore, this feature would not be reproducible using electronic printing and scanning techniques and hence would frustrate a large number of would-be counterfeiters. The feature idea is also compelling owing to its requiring both the design and manufacture of the currency substrate. A counterfeiter would be challenged not only to provide a good paper substitute for authentic currency but also to build the special fibers into the substrate. This process is most likely well beyond the capabilities of all but the most dedicated and resourced operations.

This feature is quite unique, although similar techniques were used for missile verification in the Strategic Arms Limitation Treaty—SALT 1—of 1993 when fiber-embedded placards that could not be duplicated were placed on missiles. Furthermore, the costs associated with this technique would be quite low, since the cost of the materials is low, and it is their being embedded randomly that gives the technique value.

Materials and Manufacturing Technology Options

The manufacturing requirements for this feature would involve paper manufacturing and integrating the fiber fragments into the paper or other substrate material. Since the BEP’s paper supplier produces the authentic substrate, it would be tasked with implementing this feature. It is not expected that this would be a difficult operation, although some tooling and process changes would no doubt be required. Once the substrate had been produced, further note production would proceed as usual.

Simulation Strategies

Simulation of this feature by would-be counterfeiters would not be easy. Furthermore, only the professional criminal or state-sponsored counterfeiter might be able to do a decent job of embedding fibers in the substrate and doing it well enough to make the operation a profitable one. Since the BEP could also control

the fiber materials in the substrate, the counterfeiter would be faced with the difficult task of creating the fibers as well as making the substrate, eliminating the vast majority of criminals from attempting to do this.

Key Development Risks and Issues

Durability

The durability of this feature is unknown, but it would be dependent on the lengths of fiber embedded in the currency. If the currency was folded, the fibers could break if they were too long. Thus, the fibers would have to be short. No degradation of the fibers themselves is expected, and the only deterioration would be from breakage of the fibers if they were too long.

Aesthetics

There should be no aesthetic issues with the fiber-infused substrate feature. Unless illuminated, the note would look and feel identical to one without the feature. Even when illuminated, the feature should not detract from the note’s appearance. Furthermore, the speckles that would be generated by illumination would be a comforting feature to the receiver of the note. Thus, the feature is aesthetically neutral and conforms to the look and feel of current notes, as far as is known.

Social Acceptability

There should be no issues of social acceptability surrounding this feature.

Key Technical Challenges

The key technical challenge would be the incorporation of the fiber-infusing process into the substrate production process. A key technical challenge of this feature would be the development and use of instrumentation for the analysis of the fibers. Such instrumentation could range from the simple, such as a solid-state laser diode in a penlight configuration, to the more complex, such as a small scanner that reads the currency and produces a result that could be read by a user or that gives a “go” or “no-go” signal. Such an instrument should be simple, reliable, and cost-effective, which may require a development effort, depending on what requirements are placed on the instrument itself.

Phase I Development Plan

Maturity of the Technology

The maturity level of this technology is relatively low for currency-related efforts. The science behind its use and verification is known and highly reliable, but this technique has not been implemented in high-volume, low-cost applications such as that envisioned here.

Current and Planned Related Developments

There are currently no known programs that use this feature. The papers cited below in “Further Reading” describing its use are the only ones known to relate to this effort. There may be related proprietary efforts in companies, but this is not known at present. A key issue regarding this feature is one of feature-assessment methods such as instrumentation. There may be levels of authentication methods that are desired and that are improved over time. With the increasing miniaturization of instrumentation and sensors via technologies such as microelectromechanical systems (MEMS), the state of the art is advancing rapidly and should only enhance the usability and value of this feature.

Key Milestones

The expected key milestones for Phase I would be as follows:

-

Place fiber fragments in paper substrates to determine the applicability of the technique and any operational or manufacturing difficulties that might arise.

-

Assess authentication techniques for a phased development of passive and active instrumentation methods over time.

Development Schedule

It is expected that achieving Phase I development would take between 2 and 3 years.

Estimate of Production Cost

Compatibility with Current BEP Equipment and Processes

Other than obtaining the substrate from the supplier, the currency-manufacturing operation should remain unchanged. The conventional intaglio printing currently used would not be impacted.

Incremental Production Cost

The capital cost of this feature on a per note basis should be quite small—likely less than $0.02—since only the cost of the fibers used would impact the substrate cost. The visual check method would have no additional cost.

Required Capital Equipment

Although there should be no capital costs for the BEP, there might be costs for the substrate manufacturer. Equipment that would prepare, add, and mix any fiber materials with the pulp would be required. The fiber material could be provided in bulk from a supplier. Post-processing of the fiber materials, such as doping and so on, could occur at the substrate manufacturer for security purposes if required. The fibers could be glass, plastic, micro, or nano materials, with custom design of the properties as required. It is unclear what the capital equipment costs would be until an acceptable fiber material design is realized. The development of the fibers would likely be coordinated with authentication technologies so that the maximum benefit from the investment is realized.

Further Reading

Chen, Y., M.K. Mihcak, and D. Kirovski. 2005. Certifying authenticity via fiber-infused paper. ACM SIGecom Exchanges 5(3): 29-37.

DeJean, G., and D. Kirovski. 2006. Certifying authenticity using RF waves. Presented at IST Mobile Summit.

National Research Council. 1993. Counterfeit Deterrent Features for the Next-Generation Currency Design, Washington, D.C.: National Academy Press, pp. 74-75 and 117-120.

FRESNEL LENS FOR MICROPRINTING SELF-AUTHENTICATION

Description

Microprinting is currently impossible to replicate using ink-jet and laser printers, but its effectiveness in deterring counterfeits is hampered by the difficulty for cash handlers—including the public, cashiers, and tellers—of verifying the authenticity of an FRN by checking for the presence and quality of microprinting. A simple loupe is probably the best way to easily distinguish counterfeit from genuine notes because of very marked differences in microprinting and fine-line details between the two. A thin lens embedded within the banknote itself can provide a simple means of self-authentication for microprinting and fine-line detail. This feature would be most useful for the general public as protection against opportunist and petty criminals. The benefit of this feature would be to make it easy to see poor-quality printing.

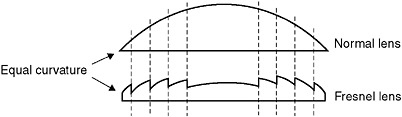

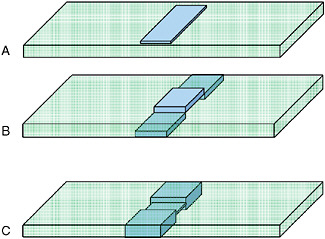

This feature works by cutting a hole in the paper substrate and bonding a transparent Fresnel lens over the hole. The lens is fabricated from plastic and has a curved sawtooth profile, providing the refractive index variations of a lens without the bulk (see Figure C-2). The banknote has to be bent, not folded, to position the lens about an inch above the microprinting to be viewed. Note that microprinting does not have to be text; the clock face on the $100 note is a good example of an image that can be verified with a lens. The time on the clock can be easily read using a lens on a genuine note, but ink-jet counterfeits cannot accurately reproduce the hands or the numerals on the clock. Public education would be required to alert people about what to look for and where.

FIGURE C-2 The Fresnel lens shown here resembles a planoconvex lens that is cut into narrow rings and flattened. If the steps are narrow, the surface of each step is generally made conical and not spherical. The convex surface is reduced to concentric ridges. Fresnel lenses are flat rather than thick in the center and can be stamped out in a mold.

Feature Motivation

This Fresnel lens feature is intended for unassisted use by the general public. Cashiers and bank tellers could also use the feature, but most likely as a second line of defense because of the time required to bend the note. This feature could also assist visually impaired people in denominating their currency by using differently shaped or sized lenses for each denomination, and it could help deter “note washing” by using progressively smaller-area lenses on higher denominations. Opportunist and petty criminals should be deterred because they lack access to printing technology with sufficient spatial resolution to reproduce microprinting.

There are two risks associated with this feature: (1) home printers will be able to achieve sufficient spatial resolution to reproduce microprinting and fine-line details accurately, and (2) robust embedding of a plastic lens into the paper substrate may be difficult. The lenses themselves are robust and will work effectively even with substantial scratching and mild dirt.

This feature is expected to be cost-effective, since the cost of the mass-produced plastic lens and the cost to add a window are expected to be low.

This feature was highly rated in the committee’s systems evaluation because of the likelihood that it could be easily used by the general public without requiring an external device and because it is currently difficult for opportunist and petty criminals to reproduce microprinting and fine lines. It also has potential benefit for cashiers, tellers, and the visually impaired, and could prevent banknote washing for the reuse of $5 notes as counterfeit $20s or higher. It is not expected that this feature would be of benefit to machine readers.

This feature is unique among banknotes, although a patent exists for a similar feature applied to credit cards. Plastic Fresnel lenses are commonplace as inexpensive magnifiers and are easily available in hobby stores and drugstores, although they are too thick to be embedded within current banknote substrates.

Materials and Manufacturing Technology Options

Molded plastic Fresnel lenses are commercially available and can be currently used to inspect banknotes. Fresnel lenses are commonly injected molded from PMMA plastic and are typically ~½ mm thick. Microfabrication techniques have been used to make very thin lenses (10 microns thick) but not for use in the visible spectrum.

Fresnel lenses are in common use in a variety of industries but not in banknotes. They are commercially available at craft stores and drugstores for less than $1. Holes in paper substrates have been manufactured by De La Rue, Ltd., which has also bonded metal films across these holes. This company believes that plastic can be robustly applied across paper windows. Two new processes would be required for

the BEP: cutting a hole and bonding the lens to the paper. This feature enhances the effectiveness of two existing features: microprinting and fine-line printing.

Simulation Strategies

This feature can be crudely simulated by buying a cheap Fresnel lens, cutting a hole in forged paper, and gluing the lens over the hole. However, the quality of this means of reproduction is likely to be low, since available lenses are relatively thick. Microprinting cannot now be easily replicated, so even if the lens could be simulated, the magnified image would still be poor, exposing the counterfeit. If microprinting becomes easily reproducible, this feature would lose much of its effectiveness as a deterrent.

Opportunist criminals cannot simply use a computer to reproduce this feature, and therefore it may be harder for them to rationalize their actions because of the extra effort required to manually add the lens. Opportunist and petty criminals are currently limited in their ability to print with high spatial resolution, so while it might be easy for them to embed a lens, by doing so they would be adding a means for the general public to see easily the low quality of their printed note.

Professional and state-sponsored criminals should have little trouble reproducing this feature.

Key Development Risks and Issues

Durability

The key durability issue is the attachment of the lens over a hole in the substrate. Commercial banknote vendors have recently demonstrated the feasibility of attaching metallic foils over holes in paper substrates. The adhesion process should be similar for a thin plastic sheet (lens), with similar performance in durability tests. This feature looks promising as a durable feature in the short term.

Aesthetics

This feature can enhance the existing banknote by enabling users to look closely at the fine detail of the notes, but adding a plastic window may be considered unattractive by some.

Social Acceptability

No problems of social acceptability are anticipated with this feature.

Key Technical Challenges

The key technical challenge is the ability to manufacture a sufficiently thin Fresnel lens (on the order of 40 microns thick) and to attach it reliably across a hole in the banknote.

Phase I Development Plan

Maturity of the Technology

Commercially available Fresnel lenses are about 0.5 mm thick and so are unsuitable for application within banknotes. Microfabricated, thin lenses have been demonstrated in the laboratory. The committee knows of no plastic films that have yet been adhered to a paper substrate. The manufacturing readiness level is currently low.

Current and Planned Related Developments

Researchers at the University of California at Los Angeles (UCLA) have manufactured Fresnel lenses in silicon for use in the infrared using microfabrication techniques (Lin et al., 1994). Researchers at the University of Maryland have manufactured Fresnel lenses for use with x-rays using deep reactive ion etching (Morgan et al., 2004). These are not suitable for use as visual lenses as required by this feature, but they represent the current state of microfabrication. If the lenses can be manufactured from embossed plastic, microfabrication techniques may not be necessary.

Key Milestones

-

Demonstrate fabrication of a Fresnel lens with appropriate dimensions. Reasonable targets are thickness equal to or less than 40 microns, aperture equal to or greater than 10 mm, and focal length about 25 mm, operating in the visible spectrum.

-

Demonstrate an approach for integrating the lens over a hole in the substrate such that it passes all durability tests.

-

Define a lens-fabrication process that has the potential to be affordably scaled up.

Development Schedule

The committee believes that Phase I of the development of this feature could be completed within 2 to 3 years.

Estimate of Production Cost

Compatibility with Current BEP Equipment and Processes

The committee expects that this feature would be provided by the manufacturer of the paper substrate, therefore minimally affecting BEP operations. The substrate would be delivered to the BEP with the lens already attached, and the BEP would continue to add microprinting using existing processes.

Incremental Production Cost

Microfabrication techniques should be able to provide this feature at a low incremental cost. This capability would be dependent on successful research, as outlined above.

Required Capital Equipment

The substrate provider would likely subcontract the manufacture of the lens, requiring no special equipment for the BEP or the bureau’s paper suppliers. The paper supplier would need to develop a process to produce the hole.

References and Further Reading

Finkelstein, A., D.A. Dixon, and R.H. Boede. 1995. Credit Card with a Fresnel Magnifying Lens Formed in a Section of the Transparent. U.S. Patent 5,434,405. July 19, 1995.

Kingslake, R. 1992. Optics in Photography. Bellingham, Wash.: SPIE Optical Engineering Press. [Fresnel lens explanation on p. 53.]

Lin, L.Y., S.S. Lee, K.S.J. Pister, and M.C. Wu. 1994. Three-dimensional micro-Fresnel lenses fabricated by micromachining technique. Electronics Letters 30(5): 448-449.

Morgan, B., C.M. Waits, J. Krizmanic, and R. Ghodssi. 2004. Development of a deep silicon phase Fresnel lens using gray-scale lithography and deep reactive ion etching. Journal of Microelectromechanical Systems 13(1): 113-120.

GRAZING-INCIDENCE OPTICAL PATTERNS

Description

The evaluation of many optical features on currency employs the reflection of light. Most often, the light illuminating the feature impinges on the currency at near-normal incidence—that is, vertical to the plane of the substrate. The concept behind a grazing-incidence optical pattern feature is that it is intended to use light that impinges on the substrate at very high angles of incidence—that is, at about 85 to 90 from the normal—and to exploit substrate-surface irregularities, either incidental or intentional, and the patterns that they generate from the reflected light. Substrates have fairly unique characteristics at the microscopic scale and, when illuminated with either spectrally narrow or coherent light, such as from a laser, particular substrate characteristics could enable differentiation between substrates. An example of a substrate feature that could be probed this way would be an impress watermark for which the pressure from the intaglio process or other mechanical impression on the substrate used to make the watermark produced a surface relief on the substrate.

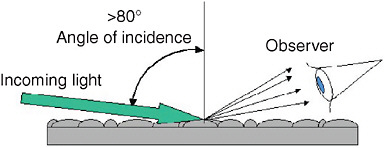

Figure C-3 illustrates the grazing-incidence model. The illumination of the substrate could be either coherent or incoherent, and the scattered light as seen by the observer could be seen as a pattern or, in the case of a watermark, as a relief image. Since substrates have unique properties that are under the control of the BEP, the scattered pattern from a banknote could be customized in a unique and secret way that would deter duplication by the counterfeiter. For instance, the intaglio process could impress highly complex depressions into the currency substrate. Additionally, the substrate surface microscopic profile could be prepressed into the substrate material so as to minimize any negative impact on the FRN production process.

FIGURE C-3 Concept behind the grazing-incidence optical pattern feature.

Public use of this feature would require a gadget, and use by a cashier or bank teller would also be assisted.

Feature Motivation

The most compelling aspect of this proposed feature is that most counterfeiters do not produce their own substrates and therefore would be unable to begin to duplicate or simulate this feature. The currency paper supplier could properly design patterns and materials into their substrate that would make its reproduction or simulation highly complicated for all but the most determined and well-resourced counterfeiters. Different customization for different denominations would also deter the use of one FRN substrate for the counterfeiting of higher-denomination notes. This type of feature would be a deterrent for the opportunist and petty criminal counterfeiter in particular and somewhat of a deterrent for the professional criminal counterfeiter.

Another compelling aspect is that this feature is quite unique in its use of the z-axis or vertical dimension of the substrate to produce the salient effect of the feature, not ink absorption or other x, y schemas to produce the pattern or other feature characteristic.

Materials and Manufacturing Technology Options

A grazing-incidence feature is simple in that it is just an additional designed characteristic of the substrate and not produced in the printing process.

Simulation Strategies

The dedicated, very motivated, and patient counterfeiter could attempt some form of simulation of this feature, but it would require an expensive pressure plate that was engraved with a pattern that simulated the authentic feature. It is expected that only the professional criminal or state-sponsored counterfeiter would have any hope of creating even a poor facsimile of the substrate properties necessary to produce the right pattern. But it is clear that anyone wanting to re-create this feature would be greatly challenged.

Key Development Risks and Issues

Durability

This feature should have excellent durability if properly implemented. If the substrate was impressed with micro patterns over its surface, occasional crushing or folding of the currency would not damage the entire surface—making the note

quite durable for general use. Only the crushing of the substrate surface, which would be hard to do completely, would abrogate the use of this feature.

Aesthetics

This feature should be aesthetically neutral, since it would not be generally observable without shining some form of illumination on it at a grazing-incidence angle on the note. Thus, normal viewing of the note would not reveal any observable pattern in general. The look and feel of the note would likely be unchanged, since the pattern or its roughness would not be noticeable to the casual user.

Social Acceptability

There should be no issues with this feature relative to privacy or environmental concerns. Properly designed, it might have characteristics that would enable visually challenged persons, since features for their benefit could also be placed on the note as part of the impression process.

Key Technical Challenges

The key technical challenges are the development of appropriate patterns and patterns that are compatible with tolerable analysis procedures. Once the patterns have been properly designed and analyzed, the production of such patterns in the currency substrate should not be difficult.

Phase I Development Plan

Maturity of the Technology

The current technology is somewhat in its operational infancy. No known implementations of this type of feature have been found in the literature.

Current and Planned Related Developments

No known development programs exist. As discussed above, most features are x, y features—that is, features such as printed patterns in the plane of the substrate. A grazing-incidence feature uses the z or vertical axis of the substrate. The committee is unaware of currency development or production programs that employ such features, other than watermarks, which use depressions in the surface of the substrate to cause images to appear when viewed vertically or nearly vertically. This feature is both illuminated and viewed at high angles of incidence.

Key Milestones

There are some key milestones to consider in the development and use of this feature:

-

Design test impressions for implementation and evaluation.

-

Generate impressions in substrate material using equipment that would be used for production of the substrate or note.

-

Develop evaluation systems for analysis of the feature.

-

Design production feature setup and testing.

Development Schedule

The first of the milestones listed above should require about a 1-year effort to design and evaluate the proper feature configuration; thus, the committee estimates that Phase I of the development of a grazing-incidence feature could be completed within 2 years, since some efforts could overlap in the development and testing process.

Estimate of Production Cost

Compatibility with Current BEP Equipment and Processes

The production cost for this feature should be quite low, since only the impression of the substrate before, during, or after printing is required. Producing this impression could be an additional step, but it is not much of a complication since the impression process is already known and operational via the intaglio printing already used.

Incremental Production Cost

The incremental production cost should be very low. Only the amortization of the wear and tear on the impression equipment incurs cost, and it is expected that this cost is already well known, since the intaglio process is well understood.

Required Capital Equipment

A small amount of optical bench equipment would be required to experiment with the use and evaluation of this feature.

Further Reading

No additional reading is suggested.

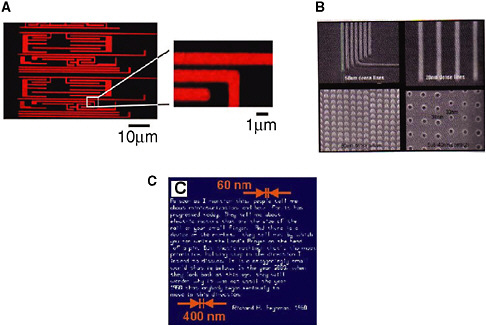

HIGH-COMPLEXITY SPATIAL PATTERNS

Description

One basic high-value attribute of current currency production is the use of intaglio presses for the printing operation. The intaglio process uses engraved or otherwise produced “masters” with which to impress the currency substrate and print the pattern. As discussed in Chapter 3 of this report, with the advent of electronic printing, scanning, and image processing, many of the high-quality features of new currency can be reasonably scanned, processed, and reproduced on ink-jet, laser-printer, and other electronic output devices. Such electronic printing, scanning, and image processing are only going to improve in the future, although the current high-quality capabilities available result in less motivation for improving these capabilities significantly in the foreseeable future. Desktop and professional publishing markets are demanding but do not require significantly higher quality than is already available. Therefore, development resources will not press current technology beyond what commercial markets require, and hence a natural performance limit has been set by market needs.

However, there is one key difference between currency production and the electronic imaging tools used by would-be counterfeiters. That difference is the analog versus digital production of the final result. Intaglio is an analog technique. One can engrave or create on the master virtually any pattern at any location on the master within the limits of the creator’s art. This process is not a digital process. The electronic printer, however, is a digital process and as such has specific addressability limits. For example, a 2,500 pixel per inch printer can only lay down a pixel every 0.0004 inch. A pixel cannot be laid down 0.00027 inch from the last one because of the digitized nature of the device. Therefore, it is intended with this feature to place patterns at locations and in arrays of patterns that particularly frustrate digital printers of all kinds.

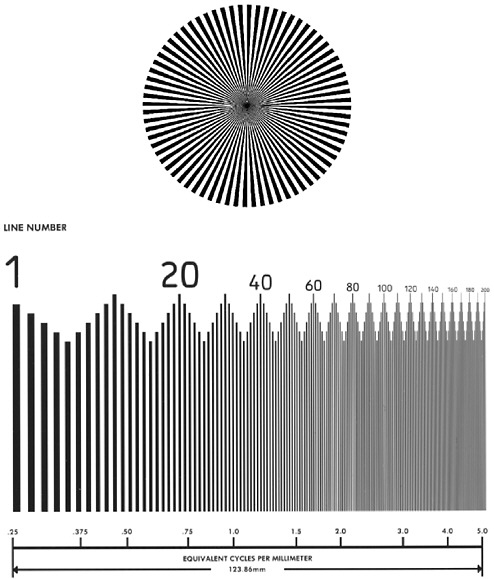

Examples of two possible patterns are shown in Figure C-4, which illustrates patterns often used for testing purposes in facsimile systems and photographic systems. While it is not necessarily suggested that these particular patterns be used, they are shown here as examples of patterns in which the gradually decreasing spacing, whether radial or lineal, will at some point cause the addressability limits of the digital printer to place two lines together without a space or two spaces without a line, and so on. With proper design and adequate intaglio/substrate printing quality, the analog system should be able to frustrate the digital system consistently.

One should notice that this feature is visible and does not require instrumentation, although a magnifier might be of some help depending on the quality of the user’s visual capabilities. These features are optical in nature, and the usefulness of this high-complexity spatial pattern will depend on superior intaglio performance, line-width control, and minimum permissible line width and/or line spacing of

FIGURE C-4 Examples of possible high-complexity features. Upper: Starburst pattern. Lower: Sayce target.

the original currency production equipment. The basic intent with this feature is to use patterns whose full spatial bandwidth cannot be reproduced completely by digital systems and hence will show a visible defect on such systems, regardless of the image processing used. In the past, wavy patterns, chevrons, and so on could

often be simulated well enough not to show errors without close examination. The type of feature discussed here is intended to create patterns in the intaglio master that cannot be reproduced in full fidelity by digital systems available on the market today or in the near future.

Feature Motivation

The high-complexity spatial patterns feature is both unique and nonunique in the following ways. The pattern is spatial and hence similar to those already included on present currency. However, it differs from current features because rather than having a fixed shape or fixed spatial frequency, this feature is composed of a multiplicity of spatial frequencies and line spacings that digital printers would be unable to reproduce all at the same time.

Currently, if counterfeiters fake a currency pattern, they might “tune” the pattern to work on their printers. Even though the resulting fake pattern does not have the same exact frequency, the ordinary user could not discern the differences without instrumentation. The inherent characteristics of this new feature prevent counterfeiters from accurately reproducing the pattern, since they cannot reproduce all the frequencies in the pattern without degrading the appearance of the pattern. Thus, the spatial band pass of the intaglio printing system exceeds that of the electronic printer owing to the latter’s digitized pixel positioning requirements. The digital system is challenged by the analog nature of the original currency pattern. Clearly, a digital system could be specifically designed to have sufficient spatial bandwidth to reproduce the highly complex feature, but the current and future performance of intaglio printing and the foreseen improvements of commercial digital printer performance are such that this feature will remain a deterrent into the foreseeable future.

Should the counterfeiter decide to hand-engrave the patterns used or simulate them, he or she might succeed, with enough patience, but the effort would be detectable via pattern matching by investigators. There is the risk that digital imaging equipment will advance to the point that this feature would not have value, but if the intaglio printing process is of sufficiently high quality, as it appears to be, this is unlikely.

This feature is compelling because of several salient characteristics. First, the addition of the feature to currency uses the present intaglio printing process and hence requires little change to the present production methodology. Second, by its very nature, the pattern is designed to challenge digital scanners and printers attempting to reproduce the pattern by means other than the original intaglio technique. Third, the quality of the pattern is assessed by means of human visual capabilities and hence no equipment—just the human observer—is needed. An

optical magnifier could be used for assistance, but this is a fairly simple and easily obtained tool should the user wish to have one.

The characteristics listed above make this feature a considerably attractive approach. The BEP production process would not need to be changed, and the increasing quality goals being driven by the BEP only enhance the utility of this feature. It is also a feature that does not “wear out,” so to speak, and would last the life of the currency. As discussed earlier, this feature deters counterfeiting by being patterned in such a way as to frustrate digital reproduction methods. Any digital reproduction system has an inherent spatial bandwidth. When this bandwidth is exceeded, either the system cannot reproduce the signal or the signal is degraded in visually obvious ways. By creating special patterns in the analog masters for the intaglio process, it is intended to stress digital reproduction systems, which are the preferred scheme of most counterfeiters.

Materials and Manufacturing Technology Options

This feature would be an additional printed pattern on currency and hence its production would integrate well into the current manufacturing process. Few if any changes would be required to the current manufacturing process for banknotes to employ this deterrent method. Perhaps most advantageous is that as printing quality increases, the value of this feature would increase, since its complexity can be upgraded as the manufacturing quality of the currency is upgraded. Capabilities such as line-width control, line-space control, edge raggedness of printed lines, and so on all enhance the usefulness of this feature as they are improved.

Simulation Strategies

Simulating this feature would be done by using the best digital scanning and printing equipment available. However, it would be expected that the counterfeiter would be constantly frustrated by the scanning and printing system’s inability to replicate the pattern in its entirety. The pattern could be designed to maximize the difficulties faced by those wishing to copy this pattern other than by re-creating it. Every imaging system has quality capabilities and noise characteristics. Building a pattern that capitalizes on the weaknesses of digital-scanning and especially digital-printing systems is key to the success of this approach. It is expected that all classes of counterfeiters would find replication of this feature difficult. Only those willing to re-create the pattern and print it using intaglio printing would have any chance at success. Therefore, state-sponsored counterfeiters might attempt to re-create the pattern, but it is expected that no one else would.

Key Development Risks and Issues

Durability

Durability should not be an issue with this feature, since it would be printed on the same currency using the same techniques now used.

Aesthetics

This feature should not degrade the aesthetics of the banknote, since the pattern can be used to print any desired image and does not need to look like a test target such as those illustrated in Figure C-4. Thus, this feature should be aesthetically neutral, would conform to the current look and feel of FRNs, and could even enhance the aesthetics of the banknotes.

Social Acceptability

There should be no issues regarding social acceptability with the use of this feature.

Key Technical Challenges

The key technical challenge with this feature is the differential quality of the intaglio spatial bandwidth and that of current and expected digital printers. If the two processes were to come to parity, this feature would have less value than if the printing process of the authentic currency continued to exceed that of digital printers. The higher the differential quality between intaglio and a counterfeiter’s digital printer, the more compelling the use of this feature. Line-width control, line spacing, edge raggedness, and so on are quality metrics that would play an important role in the use of this feature. Both the jetting of ink in ink-jet printers and the fusing of toner in laser electrophotographic printers cause edge raggedness and line-width variations, weaknesses that could be exploited in the design and use of this feature.

Phase I Development Plan

Maturity of the Technology

The technology readiness of this approach is high because of the maturity of the intaglio process and its current use in FRN production. Patterns would need to be identified and tested with both the currency production equipment and the

relevant electronic printers to determine the ability of the feature to perform as expected. It should be possible to perform these tests quickly and economically.

Current and Planned Related Developments

There are no known development programs for evaluating this feature, but since the process is fairly straightforward, testing its utility should be straightforward. Appropriate pattern generation could be conducted by optical test target producers already operating in the imaging industry.

Key Milestones

There are three key milestones in evaluating this feature’s usefulness:

-

Develop the images and evaluate the targets containing the desired spatial patterns.

-

Render the desired target in a form that can be printed with the intaglio process on substrates of interest.

-

Attempt to reproduce the pattern using current high-quality digital copying and/or reproduction methods.

Development Schedule

The Phase I development and evaluation of this feature should easily be carried out within a 2-year time frame. Using current high-quality digital printers and scanners would result in low development costs in the feasibility phase. The evaluation would be partly conducted using already available production equipment, so the transition from prototype to production should be fairly swift since only the creation of the intaglio masters would be required for production use.

Estimate of Production Cost

Compatibility with Current BEP Equipment and Processes

The effect on current BEP processes would be minimal, since the current process would generate the feature required. Only the costs associated with creating or engraving the original pattern would be additional. The usefulness of this feature would improve with the increased quality of output from the BEP process.

Incremental Production Cost

The cost of this feature should be very low, since it is just another printed pattern. No special inks or other equipment would be required if this feature works as envisioned.

Required Capital Equipment

For a thorough evaluation of this feature’s usefulness, access to high-quality digital reproduction equipment would be required. This feature could be in one or more colors and hence color digital reproduction equipment should be available. Using the latest in reproduction equipment would allow an assessment of the robustness of this feature; it may be that this equipment is already available in-house at the BEP. If so, no special purchases would be required. Certainly, microscopes and so on would be needed to assess the feature’s quality, but it is assumed that such equipment is already available to those requiring it in the BEP.

Further Reading

Johnson, J.L. 1986. Principles of Non Impact Printing. Irvine, Calif.: Palatino Press.

Smith, W. 1990. Modern Optical Engineering. New York: McGraw-Hill.

HYBRID DIFFRACTIVE OPTICALLY VARIABLE DEVICES

Description

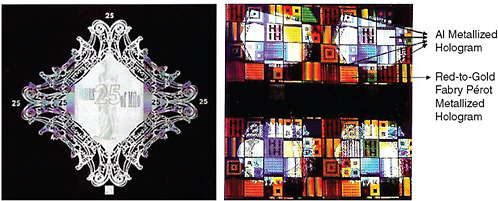

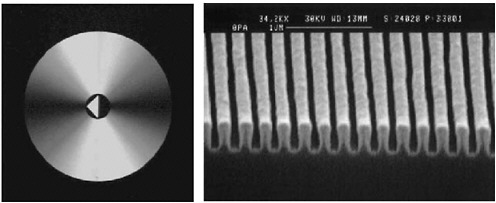

In the most general sense, hybrid diffractive optically variable devices (h-DOVDs) appear different depending on viewing angle, and at least one part of the device operates on the basis of diffractive effects. These elements consist of diffractive optically variable devices (DOVDs)—holograms, kinegrams, exelgrams, pixelgrams, or similar structures—that also incorporate patterned reflective layers, moiré patterns, color images, nonuniform coatings, interference filters, or other features to create optical effects that are more elaborate and difficult to simulate or duplicate than those achievable with conventional DOVDs. Figure C-5 shows two examples of h-DOVDs. In sophisticated embodiments, the devices include encrypted information or hidden features that can be observed with specialized equipment, light sources or optics (for example, systems capable of retrieving phase information from a reflected or transmitted image).

The DOVD part of the device uses relief structures and/or spatial variations in the index of refraction or absorption of a material to produce diffraction patterns that create images whose appearance depends on viewing angle. The DOVD can operate in transmission or reflection modes or in both modes simultaneously. Reflection-mode surface-relief DOVDs are often coated with thin layers of metal to increase their brightness. Protective coatings are used to prevent a gradual wearing away of the relief during circulation of the note.

The other components of the h-DOVD can include printed patterns of colored

FIGURE C-5 Representative hybrid diffractive optically variable devices. Left: Thin aluminum patterns on a hologram. Right: Thin aluminum patterns and Fabry-Pérot interference filters on holograms. SOURCE: R.W. Phillips and A. Argoitia. 2005. Using roll coaters to produce anti-counterfeiting devices. Vacuum and Coating Technology 6(10):46-54.

inks, thin-film interference filters, or patterns of reflective metal formed on top of reflection-mode DOVDs or on the top or bottom of transmission-mode DOVDs. Advanced integration might involve combining color-shifting technologies such as optically variable interference-based pigments and Zero Order Devices with the DOVD.

Feature Motivation

An h-DOVD can provide both visible and hidden features to deter counterfeiting. The striking optical appearance of the device provides a distinctive visual indicator of the authenticity of a currency note. Also, the phase and other information in the images produced by the devices can be encoded and retrieved using specialized equipment that is very difficult for even sophisticated replicas or simulating structures to reproduce. All of the functionality is integrated into the currency note in a single feature, the h-DOVD, so clutter and feature proliferation are minimized.

The deterrence occurs at several levels:

-

Visual inspection of a counterfeit note by the recipient can prevent its passing.

-

The striking appearance and the possibility of hidden encoded information can deter attempts to generate counterfeit notes.

-

The feature provides forensic information that can aid law enforcement against sophisticated counterfeiters who might be able to simulate some of the overt visual features of the devices.

Conventional DOVDs are used in more than 200 currency denominations from 78 issuing authorities worldwide, and they are widely employed in software packaging, audio and video media, tickets, and other products in which security is a concern. The implementation of more sophisticated versions that include polarization-dependent effects, encrypted images, three-dimensional volume optical effects, and other features appears to be straightforward but less well developed for commercial applications.

The nondiffractive components of h-DOVDs are also well established (for example, interference structures are used in optically variable inks, patterned reflective layers on holograms have been demonstrated, and so on), although they are typically not implemented directly with DOVDs. The combination of these features into a single device with visible and hidden functionality is less well explored. The attractiveness of this combination is that it increases the functionality and visibility of the feature while avoiding the clutter associated with separate features placed on different parts of the currency note.

Materials and Manufacturing Technology Options

The DOVDs are either created through optical exposures of photosensitive materials or through physical embossing of relief structures in thermoplastics or thermosets. Most implementations are of the surface-relief type, owing to the ease of low-cost manufacturing. Silver halide films, dichromated gelatin films, and certain classes of photopolymers are typically used for index or absorption DOVDs. In these cases, the DOVDs are written directly using an optical recording process.

For surface-relief-type DOVDs, optically or lithographically produced embossing tools can be used with many different thermoplastics or thermosets (for example, polyvinyl chloride, polyester, and so on). The metal coatings for reflective DOVDs are usually deposited by physical vapor deposition. The additional features to create h-DOVDs could consist of conventional inks (for color images, moiré patterns, and so on), vapor-deposited thin-film stacks (for interference filters), or patterns of metal deposited by physical vapor deposition (using, for example, lift-off processes with flexographically printed patterns of volatile oils). These features could be added immediately after or before the fabrication of the DOVDs. The DOVDs can be very low in cost, especially for the surface-relief type.

The additional features needed to create h-DOVDs can also be low cost, since most rely on well-established processes. The h-DOVDs can exist in the form of patches (50 percent of holograms used for currency worldwide are this type), stripes (40 percent), and threads (10 percent). These elements, like DOVDs, can be applied to the currency substrates prior to printing.

Simulation Strategies

In their conventional form, DOVDs can be simulated, at a crude level, by the use of off-the-shelf holograms (obtained from packaging materials, tickets, art supply stores, and other sources and items) that are integrated with a counterfeit by simple cutting and pasting by primitive and opportunist counterfeiters. Although not readily amenable to large-scale production, this procedure can provide, in some cases, an effective simulation strategy. The more sophisticated classes of counterfeiters can use readily available hot stamping presses and laminating equipment for the attachment of the simulated shiny strips. The hybrid nature of h-DOVDs offers an opportunity to achieve designs that provide a more unique and striking visual appearance than is possible with conventional DOVDs, thereby degrading the effectiveness of crude simulations. Also, the integration of an h-DOVD into the note substrate, for example as a woven strip, might add even more challenge to the counterfeiter.

Actual copies of the DOVD component of an h-DOVD feature can be made in several ways. For example, surface-relief-type DOVDs, which represent the

lowest-cost and most widely used form of DOVDs, can be copied relatively easily by separating them from their protective coatings and then using them as tools to create copies by embossing other substrates. This method cannot be used with DOVDs that involve modulations in the index or absorption of a material. In these cases, copies can be made by using the diffracted light from a DOVD to write a new DOVD in a photosensitive material. The h-DOVD’s design includes nondiffracting structures that serve to frustrate such duplication techniques and to render the simple simulation strategy ineffective.

Other countermeasures include the use of encrypted information, hidden features, polarization-dependent effects, imposed distortions, phase encoding, and other (mostly covert) features. Such attributes (both overt and covert) would make h-DOVDs difficult or impossible to reproduce accurately for all but state-sponsored organizations.

Key Development Risks and Issues

Durability

The durability of an h-DOVD is expected to be comparable with that of a DOVD or an optically variable image (OVI). Common degradation modes include wearing away of the protective coating and surface relief structures, for the case of relief-based DOVDs, and debonding from the currency substrate. Index-modulation-based diffractive elements avoid the former degradation pathway. Additional work is needed to explore issues related to durability.

Aesthetics

The emerging widespread use of DOVDs in various currencies around the world and their implementation in product packaging provide some evidence of the good aesthetic value for h-DOVDs. Suitable implementation can conform to the look and feel of U.S. currency while still providing an attention-getting feature with striking appearance.

Social Acceptability

No social concerns have been raised about the use of DOVDs in packaging, currency, or other applications. The materials used to produce these features pose no environmental concern. The same conclusions apply to h-DOVDs.

Key Technical Challenges

Technical challenges include developing optimized designs that have suitable lifetime and acceptable manufacturing cost.

Phase 1 Development Plan

Maturity of the Technology

The separate components of h-DOVDs have already been demonstrated for currency applications. Research and design are needed to define an optimized way to integrate these elements into a single currency feature that provides the desired level of overt and covert protection against counterfeiting and with acceptable manufacturing costs and aesthetics.

Current and Planned Related Developments

The production of h-DOVDs can exploit existing manufacturing capacities for DOVDs, OVIs, and other features now used in currency applications. Optimized designs for h-DOVDs are needed. Study of the primary degradation modes and lifetime of the elements is required to establish durability.

Key Milestones

There are two key milestones:

-

Establish the designs and layouts and implement them in the currency substrates.

-

Conduct durability tests to study the effects of wear and tear on these devices.

Development Schedule

If acceptable durability is demonstrated, this technology can complete Phase I within 2 to 3 years.

Estimate of Production Costs

Compatibility with Current BEP Equipment and Processes

The h-DOVD feature could be incorporated into the paper by the substrate manufacturer. Alternatively, some of the nondiffractive components of the feature

could conceivably be overprinted by the BEP using existing processes (for example, printing for an OVI feature). The effects on the BEP operations could, therefore, be minimal, especially in the former scenario.

Overprinting with intaglio ink, for example, might require ink and/or DOVD development to ensure good adhesion to both the plastic and the cloth fibers simultaneously.

Incremental Production Cost

The cost of an h-DOVD is expected to be incrementally more than that of a conventional DOVD.

Required Capital Equipment

The capital equipment would be the same as that used for DOVDs and systems, like those for the OVI inks, that can provide the additional functionality. For patterned metallization, for example, continuous reel-to-reel systems that use flexographic printers, metal sputtering chambers, and a lift-off process could be used.

Further Reading

Chesak, C.E. 1995. Holographic counterfeit protection. Optics Communications 115: 429-436.

Colburn, W.S. 1997. Review of materials for holographic optics. Journal of Imaging Science and Technology 41(5): 443-456.

Javidi, B., and T. Nomura. 2000. Securing information by use of digital holography. Optics Letters 25(1): 28-30.

Lancaster, I.M., and A. Mitchell. 2004. The growth of optically variable features on banknotes, in Optical Security and Counterfeit Deterrence Techniques V, R.L. van Renesse (ed.), Proceedings of SPIE-IS&T Electronic Imaging, Vol. 5310, pp. 34-45.

Phillips, R.W., and A. Argoitia. 2005. Using roll coaters to produce anti-counterfeiting devices, Vacuum and Coating Technology 6(10): 46-54.

METAMERIC INK PATTERNS

Description

Patterns printed with metameric ink appear different under different illumination sources. In other words, a pattern’s appearance can change depending on the color of light shining on it. In the commercial printing industry such effects are problematic and to be avoided, since having two nearby colors appear the same under one light source (for example, a fluorescent lamp) and different under another source (for example, a conventional tungsten lamp) can be quite frustrating. The currency feature proposed here would employ metameric inks to enhance any difference in appearance when the feature is illuminated with, for example, a simple light-emitting diode (LED) penlight or tungsten penlight to get patterns to show or disappear. A metameric ink feature would not always require special instrumentation for the average user, since the patterns could be designed to allow for evaluation in the home or a place of business using fluorescent or tungsten lights, both of which are commonly found.

The property on which a metameric ink feature would depend is the inks’ spectral reflectances which, when combined with different illuminants, produce different colors. An extreme example of metamerism, but perhaps most illustrative of the effect, can be seen when a maroon or red car is parked in a lot that has sodium vapor lighting. Sodium vapor is used for its efficiency, since its spectral output is mainly in the yellow range, and in such illumination maroons and reds often look gray.

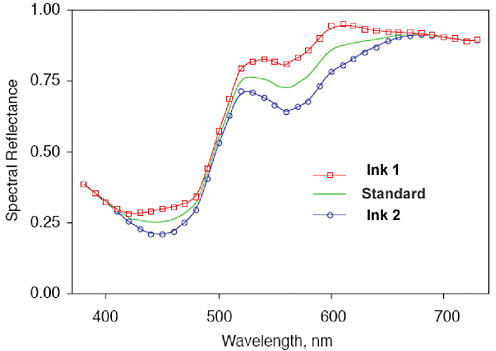

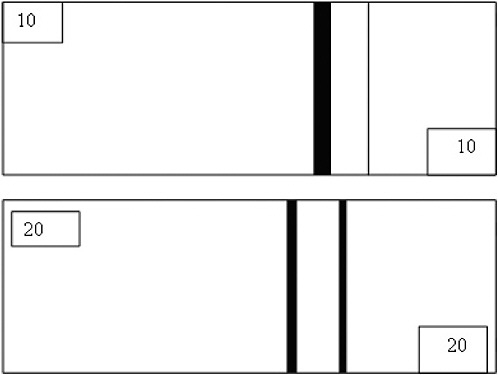

Figure C-6 illustrates a metameric ink pair along with a “standard” color that these inks attempt to reproduce. As described in more detail below, electronic color printers can reproduce a color that results from a metameric ink under a particular illuminant, but such printers cannot reproduce the metameric effect because the same primary colorants are used in these printers for all imaging purposes. The need to provide special inks or toners to simulate the real metameric inks would be a significant deterrent to most counterfeiters.

Feature Motivation

The idea of using inks that display metameric effects in visible light is compelling, because most counterfeiters use digital printing systems such as color ink-jet or color laser printers to generate their illicit output. However, a metameric feature is highly problematic for the counterfeiter using equipment that often uses only four printing dyes—cyan (red absorber), magenta (green absorber), yellow (blue absorber), and black. In printing a picture or other pattern and attempting to reproduce a color that is perceived as maroon, the printer combines two and

FIGURE C-6 Spectral reflectance of a metameric ink pair and a standard color ink. Notice that there are spectral differences in the 400 nanometer (nm) to 500 nm region and the 550 mm to 650 nm region. Depending on the spectral content of the illuminant—that is, its color—these inks can generate different perceived colors. In some spectral regions the lines touch or nearly touch, and in that illumination the dyes appear to be the same color. But if the inks are illuminated with 600 nm (orange) light, for example, they appear to be different colors. SOURCE: Viggiano (2004). Reprinted with permission of the Society for Imaging Science and Technology, sole copyright owners of Proceedings of the Second European Conference on Colour in Graphics, Imaging, and Vision.

perhaps three of the colored inks in some proportion to achieve the desired color. The printer might be able to produce different-looking maroon colors, but since the printing “primaries,” that is, the four inks used by the printer, are the same as any other maroon, no metamerism would result. The cyan dye, for instance, is the same for all images. Unless users created their own special inks or toners in the case of electrophotographic laser printers, reproducing metameric inks would be very troublesome.

The major benefits of visible metameric features are that they use inks which already function within the BEP manufacturing process, and they could be specially designed with novel materials and chemistry to act as a significant deterrent to those who might try to duplicate the color without being able to duplicate the

metameric effects. While the metameric patterns would also be useful to machine readers that could detect detailed data such as their spectra, the main advantage here is that ordinary users with little additional equipment, using either environmental illumination or inexpensive penlights, could verify the authenticity of a banknote, even in low-light conditions. The only limitation of this feature is that it would require two light sources so that the metameric effects could be seen by human observers with normal vision—either using a penlight kind of device against ambient lighting or using two common light sources in the home or workplace. It is also possible that patterns could be designed so that an observer with deficient color vision could generally detect the effects. The major color-vision deficiency in humans is red-green color blindness. Green would not need to play a role in most metameric designs.

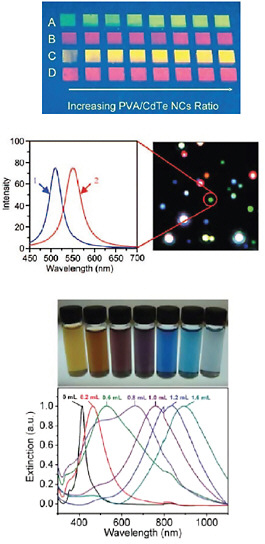

Materials and Manufacturing Technology Options

This feature is fairly unique in that one would expect to use the latest in materials technology to create the inks for printing the metameric currency pattern(s). The use of nanocrystals and other novel chemistry for making the inks would be difficult to reproduce because a wide range of different materials would be required. While metameric inks have been used for certificates and some currency, the approach suggested here goes beyond standard metameric inks.

A compelling characteristic of this proposed feature is that including it in the manufacture of an FRN is merely a matter of printing the desired pattern with special inks using existing printing presses at the BEP. The use of special inks may or may not require an additional printing step. However, the inks would integrate well into the intaglio printing process currently used and would not require a significant change in tooling or major production processes. Laying down ink on the currency substrate is already a well-controlled process, and whether the ink is metameric or not would not alter the basic process steps in producing the currency.

Simulation Strategies

This feature would deter most counterfeiters because access to the exact inks would be problematic and simulation of this feature would require the very inks used in the currency itself. The professional criminal and state-sponsored counterfeiter would likely have access to resources for duplicating or simulating this feature; however, the other classes of counterfeiters, using digital imaging tools such as scanners, printers, and their associated software, could not print patterns that would simulate the unique characteristics of a custom-designed metameric pattern. Furthermore, trace elements in the inks or their novel nanostructure could

be exploited as a forensic feature and would greatly complicate the reproduction or simulation process for most counterfeiters.

Key Development Risks and Issues

Durability

The durability of this feature should not be an issue—it is just ink on the currency substrate and would only have to tolerate ultraviolet and other types of exposure similar to what currency inks must already be able to endure. The feature would have an expected durability that does not vary much from today’s ink durability.

Aesthetics

The aesthetics of the note should not be altered by the use of this feature, since the ink could be used in portraits on the currency, in chevron patterns, and so on. In fact, this feature should be aesthetically neutral and would conform to the look and feel of U.S. currency today. It is even possible that this feature might enhance the note’s appearance.

Social Acceptability

This feature should be very innocuous to most users. It would be designed intentionally to look like just another printed pattern. As far as is known, there would be no privacy or environmental hazards. The actual ink chemistry might not be a foodstuff but would be designed not to emit or give off harmful effluents. Any metameric inks used would have to conform to the same safety standards that apply to current currency inks. It is not expected that this would be a debilitating issue for this feature or its proper use.

Key Technical Challenges

The key technical issues to be addressed with respect to this feature would be the design of inks that stress many if not most electronic printers to the greatest extent possible. Also, the custom-designed inks should display metameric effects under simple and available light sources, such as a portable penlight, an LED penlight, commonplace indoor lighting, and so on. Little ink would be needed per note, so the ink cost would not be expected to be an issue even if exotic materials were used in the ink chemistry. Such materials might cause the ink to fluoresce.

Phase I Development Plan

Maturity of the Technology

Little needs to be developed for this feature beyond the special metameric inks to be used—a development process that could take a few months, as the general knowledge about inks is currently at a high level. Placing special requirements on the inks could require more development time, since any such requirements are unknown at this time and they cannot be readily assessed until specified.