Appendix C

The Relationship Between Impairments and Earnings Losses in Multicondition Studies

John F. Burton, Jr., Seth Seabury, Michael McGeary, and Robert T. Reville

The purpose of this study is to provide assistance to the Institute of Medicine (IOM) Committee on Medical Evaluation of Veterans for Disability Compensation, and, in particular, to help address portions of the committee’s first task:

How well do the medical criteria in the VA Rating Schedule and VA rating regulations enable assessment and adjudication of the proper levels of disability to compensate both for the impact on quality of life and impairment in earnings capacity? Provide an analysis of the descriptions associated with each condition’s rating level that considers progression of severity of condition as it relates to quality-of-life impairment and impairment in average earnings capacity.

This study focuses on the aspect of task 1 concerned with the relationship between the medical criteria used to determine the level of disability and the impairment (or limitation) in earning capacity associated with that level of disability. More specifically, this study examines the relationship between impairments (the medical consequences of injuries or diseases) and the actual loss of earnings (the economic consequences of the impairments). We also discuss the intermediate consequences between impairments and actual earnings losses, such as the loss of earning capacity. The relationships will be examined with evidence from multicondition studies (that is, studies involving two or more medical conditions). The study will not examine the relationship between impairments (the medical consequences of injuries and diseases) and quality-of-life impairment (sometimes referred to as “noneconomic losses” or “nonwork disability”). The study will rely

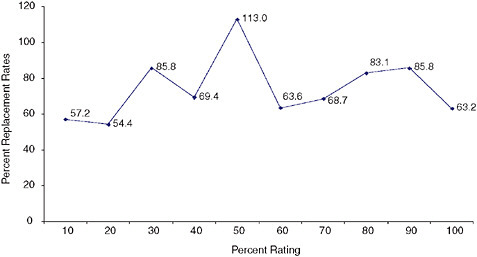

FIGURE C-1 Three time periods in a workers’ compensation case where the injury has permanent consequences.

on selected previous studies from workers’ compensation, on new data from the Californian workers’ compensation program, and on the 1971 Economic Validation of the [Veterans Administration] Rating Schedule (ECVARS) study.

CONCEPTUAL FRAMEWORK1

Three Time Periods

As shown in Figure C-1, three time periods are pertinent in compensating a worker with an injury serious enough to result in permanent disability benefits. The preinjury period is relevant because inter alia the employee’s average weekly wage is used to calculate the cash benefits after the worker is injured. The temporary disability period refers to the time from the onset of the injury or disease until the date of maximum medical improvement (MMI) has been reached; and the permanent disability period refers to the period following MMI. The distinction between the temporary and disability periods is important because workers’ compensation programs provide different types of cash benefits in the two periods.

The permanent disability period is the crucial period for our study of the veterans disability compensation program because we are examining the benefits provided to veterans with permanent consequences of their injuries or diseases.

The Permanent Consequences of an Injury or Disease

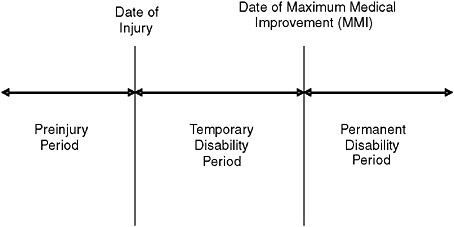

The study will rely on the conceptual relationship shown in Figure C-2 because this provides a useful framework for presenting the evidence on the relationship between impairment ratings and earnings losses. Figure C-2 differs from the model of disability presented in Chapter 3 of this report in two ways. First, Figure C-2 is only concerned with work disability, while the report also considers losses in quality of life, which are defined as “the consequences of an injury or disease other than work disability.” Second, Figure C-2 divides both impairment and work disability into subcomponents in order to facilitate the analysis in this study.

The concepts in Figure C-2 described below correspond to the operational measures currently used to determine the amount of cash benefits provided by workers’ compensation programs and to the outcome measure used in the research on disability programs examined in this study.

IA. Medical impairment: Anatomical loss—The American Medical Association’s (AMA’s) Guides to the Evaluation of Permanent Impairment, Fifth Edition (Cocchiarella and Andersson, 2001, hereafter referred to as the Guides) provides impairment ratings for certain medical conditions based on the anatomical loss. For example, Table 17-32 at page 545 of the Guides indicates that amputation of the leg above the knee at the midthigh is rated at 90 percent of the loss of the leg and 36 percent impairment of the whole person.

IB. Medical impairment: Functional loss—The Guides provides impairment ratings for certain medical conditions based on the extent of the functional loss. Example 16-78 at page 514 explains how to determine the rating for a person who sustained a Colles’ fracture of the right distal radius: “The factors to be rated are the loss of motion of the wrist and forearm rotation.”

FIGURE C-2 The consequences of an injury or disease resulting in work disability.

II. Limitations in activities of daily living—These are the limitations in the activities of daily living resulting from the impairment. These can be measured by some of the questions in the SF-36. (For example, Question 8 asks if the person’s health now limits bending, kneeling, or stooping.)

IIIA. Work disability: Loss of earning capacity—This is the presumed loss of earning capacity resulting from the functional limitations. This can be measured by some of the questions in the SF-36. (For example, Question 13 asks if during the past four weeks the person cut down the amount of time spent on work or other activities as a result of his or her physical health.) The loss of earning capacity approach is used in a number of workers’ compensation programs for certain types of injuries.

IIIB. Work disability: Actual loss of earnings—This is the actual loss of earnings resulting from the injury or disease and its consequences (e.g., impairment).

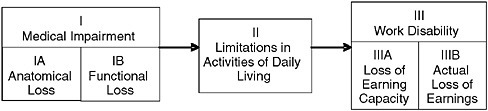

The actual loss of earnings is measured by the difference between the worker’s actual earnings and the earnings the individual could have been expected to earn if he or she had not been injured (potential earnings) as shown in Figure C-3. In this example, prior to the date of injury, wages increased through time from A to B, reflecting the worker’s increasing productivity and other factors that caused wages to increase, such as inflation. At point B, the worker experiences a work-related injury that permanently reduces his or her earnings. Had the worker not been injured, his or her

FIGURE C-3 Actual losses of earnings for a worker with a permanent disability.

earnings would have continued to grow along the line BC. The worker’s actual earnings in this example dropped from B to D and continued at this zero earnings level until point E, when the worker returned to work at wage level F. Thereafter, actual earnings grew along the line F to G. In this example, it is assumed the worker’s actual earnings never returned to the potential earnings (line BC) that he or she would have earned if the injury had not occurred. The worker’s “true” wage loss due to the injury is equal to his or her potential earnings after the date of injury (BC) minus the actual earnings after the date of injury (BDEFG).

The calculation of potential earnings (line BC) is a crucial step in the analysis. Different researchers have used different methods to estimate potential earnings. We will describe these methods in connection with the research on the two workers’ compensation programs and the veterans disability compensation program examined in this study.

The Causes of the Injury or Disease

Both workers’ compensation programs and the veterans disability compensation program provide benefits only when specified causation requirements are satisfied. For workers’ compensation, the injury or disease must be work-related, which in most states requires several legal tests to be met.2 For veterans benefits, the injury or disease must be incurred or aggravated during active military service. We assume for this study that the injuries and diseases and the resulting impairment and disability meet the causation requirements of the programs we are examining.

The distinction between causes and consequences of injuries and diseases is important. For example, work disability is a consequence of an injury or disease, but the cause may or may not be work-related. Indeed, one of our central inquiries is the relationship between injuries and diseases caused by military service and the consequences of those injuries and diseases on the loss of earnings (i.e., work disability).

The Purpose of Cash Benefits

A fundamental issue is which of the consequences of injuries and diseases shown in Figure C-2 provide the reasons or purpose of the cash benefits provided by workers’ compensation programs and by the veterans disability program.

Workers’ Compensation

The possible reasons for workers’ compensation program cash benefits were examined by Burton:

To the extent that the rationale for benefits is discernable … two schools of thought can be identified. One view considers lost wages due to the injury (work disability) as the sole justification for workers’ compensation benefits….

An alternative view of the rationale for benefits workers with permanent consequences of their injuries accepts work disability as the primary basis for benefits, but argues there is a secondary role for benefits paid for nonwork disability. Arguments for these “impairment benefits” indicate that the purpose is not only to compensate impairment per se but to also use permanent impairment as a convenient proxy for the functional limitations and nonwork disability that result from the impairment. A variant of this alternative view is to argue that nonwork disability merits compensation, and that the degree of permanent impairment serves as a proxy for the extent of nonwork disability.

The dominant view probably is that the only permanent consequences that warrant benefits in a workers’ compensation program are medical care, rehabilitation, and work disability (Burton, 2005:80).

The view that the only purpose of workers’ compensation cash benefits is to compensate for work disability is explicitly or implicitly adopted in almost all research on the program. Studies of the relationship between earnings losses and cash benefits, for example, use the entire amount of cash benefits to evaluate the performance of the system of cash benefits.3 We assume for this study that the sole purpose of cash benefits in workers’ compensation is to compensate for work disability and not for the other consequences shown in Figure C-2.

Veterans Disability Compensation Program

The statement of tasks for the IOM committee asks for an evaluation of VA’s Schedule for Rating Disabilities (Rating Schedule) and rating regulations for both quality-of-life impairment and impairment in average earning capacity. However, the sole purpose of the cash benefits specified by § 4.1 of the Code of Federal Regulations dealing with VA’s Rating Schedule is limited to work disability (as that term is used in this study):

The percentage ratings represent as far as can practicably be determined the average impairment in earning capacity resulting from such diseases and injuries and their residual conditions in civil occupations.

We assume for the purposes of this study that the sole purpose of the cash benefits provided by the VA Rating Schedule and rating regulations is to compensate for work disability and not for the other consequences of injuries and disease shown in Figure C-2.

The Operational Basis for Cash Benefits

The generally accepted view is that the sole or dominant purpose of cash benefits in workers’ compensation and in the VA disability compensation program is to compensate for work disability. Ideally, the extent of work disability would be determined by measuring each worker’s actual loss of earnings. However, it is impractical and probably inappropriate to directly measure actual loss of earnings for each worker and to determine the amount of cash benefits based on the measure of actual wage loss.4 As a result, one of the other consequences shown in Figure C-2 is used as a proxy (or predictor) of actual loss of wages.

There are several possible reasons why disability compensation programs use proxies, such as the extent of the applicant’s impairment, to provide benefits for which the purpose is actual loss of earnings. The first reason is administrative convenience: It is easier to conduct a medical examination of an applicant than to monitor the worker’s actual labor market experience over an extended period of time. The second reason is that linking benefits to actual loss of earnings may result in incentive effects for some beneficiaries, who may limit their extent of participation in the labor force if higher earnings result in reduced benefits. Despite these reasons for the use of proxies, one possible drawback is that they may not provide accurate estimates of the actual loss of earnings. We examine how well proxies predict the amount of actual wage loss in this study.

One possible objection to using the amount of actual wage loss as the test of the accuracy of the predictions of the disability rating systems is that the stated purpose of the veterans disability compensation program is average impairment in earning capacity, not the average loss of actual earnings. However, there is no meaningful test of the accuracy of the current Rating Schedule if a comparison is made between (1) the ratings produced by application of the criteria for evaluating medical conditions in the Rating Schedule and (2) the average reduction in earning capacity, since in practice

they are the same thing. The only meaningful test is whether the ratings produced by the Rating Schedule (which are estimates of the loss of earning capacity) are closely related to the actual losses of earnings.

THE 1987 STUDY OF THE WISCONSIN WORKERS’ COMPENSATION PROGRAM

The Wisconsin Workers’ Compensation Program

Berkowitz and Burton (1987) conducted a wage-loss study of Wisconsin, Florida, and California workers who were injured in 1968. The results for one of the two samples from Wisconsin are shown in Table C-1. The sample consists of male Wisconsin workers who received permanent partial disability (PPD) benefits without a legal contest.

The system of cash benefits in Wisconsin relied on several distinctions found in most (although not all) state workers’ compensation programs.5 As shown in Figure C-1, three time periods were relevant for determining benefits for workers who received PPD benefits. During the temporary disability period, most Wisconsin workers in the study qualified for temporary total disability (TTD) benefits. In 1968, the TTD benefits were 66-and-two-thirds percent of the workers’ preinjury wages, subject to a maximum weekly benefit. Once the worker reached the date of MMI, the TTD benefits stopped and most workers with permanent disabilities qualified for permanent partial disability (PPD) benefits.6

Scheduled PPD benefits were paid to workers who had an injury included in a list (or schedule) of body parts included in the Wisconsin workers’ compensation statute. The statute also specified the number of weeks of PPD benefits associated with the total loss of each body part. The complete loss of an arm, for example, entitled a worker to 400 weeks of PPD benefits. A 50 percent loss of an arm meant the worker received 200 weeks of PPD benefits.

Nonscheduled PPD benefits were paid to workers who had an injury not included in the list of body parts in the statute. The seriousness of the nonscheduled injury—typically a back condition—was rated “as the nature of the injury bears to one causing permanent total disability.” A 40 percent rating for the back was multiplied by 1,000 weeks to determine the duration of the PPD benefits.

TABLE C-1 Wisconsin Uncontested Permanent Partial Disability Cases for Men with 1968 Injuries

|

|

|

Percent Rating |

|||||||

|

|

Classification of Workers |

1–2 |

3–5 |

6–10 |

11–15 |

16–50 |

51–100 |

Mean Ratings |

Total |

|

Panel A |

Weighted counts of workers and mean disability ratings |

||||||||

|

1 |

Workers ages 20–59 |

941.0 |

467.0 |

177.0 |

52.0 |

48.0 |

|

3.70 |

1,685.0 |

|

2 |

Workers ages 20–29 |

294.0 |

105.5 |

36.0 |

15.0 |

14.0 |

|

3.54 |

464.5 |

|

3 |

Workers ages 30–39 |

226.0 |

122.0 |

39.5 |

10.0 |

14.0 |

|

3.69 |

411.5 |

|

4 |

Workers ages 40–49 |

219.5 |

140.5 |

53.5 |

11.0 |

13.0 |

|

3.68 |

437.5 |

|

5 |

Workers ages 50–59 |

201.5 |

99.0 |

48.0 |

16.0 |

7.0 |

|

3.71 |

371.5 |

|

6 |

Upper extremities |

785.0 |

192.0 |

82.0 |

20.0 |

20.0 |

|

2.80 |

1,099.0 |

|

7 |

Trunk cases |

17.0 |

93.0 |

42.0 |

10.0 |

0.0 |

|

5.83 |

162.0 |

|

8 |

Lower extremities |

120.0 |

150.0 |

34.0 |

9.0 |

4.0 |

|

3.76 |

317.0 |

|

9 |

All other cases |

19.0 |

32.0 |

19.0 |

13.0 |

24.0 |

|

9.62 |

107.0 |

|

Panel B |

Mean potential earnings (1968–1973, in dollars)a |

||||||||

|

1 |

Workers ages 20–59 |

42,567 |

43,938 |

43,320 |

42,472 |

37,960 |

|

|

42,892 |

|

2 |

Workers ages 20–29 |

40,144 |

44,412 |

38,743 |

41,693 |

32,671 |

|

|

40,829 |

|

3 |

Workers ages 30–39 |

43,641 |

46,232 |

47,880 |

52,464 |

42,605 |

|

|

44,995 |

|

4 |

Workers ages 40–49 |

45,298 |

44,383 |

48,995 |

48,364 |

41,628 |

|

|

45,414 |

|

5 |

Workers ages 50–59 |

41,925 |

39,973 |

36,673 |

32,905 |

32,434 |

|

|

40,159 |

|

6 |

Upper extremities |

42,740 |

44,084 |

41,644 |

39,699 |

35,516 |

|

|

42,706 |

|

7 |

Trunk cases |

37,364 |

44,193 |

45,224 |

44,276 |

|

|

|

43,748 |

|

8 |

Lower extremities |

42,497 |

43,123 |

43,355 |

37,036 |

37,720 |

|

|

42,670 |

|

9 |

All other cases |

40,529 |

46,136 |

46,279 |

49,113 |

40,036 |

|

|

44,159 |

|

Panel C |

Mean earnings losses (1968–1973, in dollars)a |

||||||||

|

1 |

Workers ages 20–59 |

1,554 |

2,759 |

*4,292 |

* 7,483 |

*7,175 |

|

|

*2,519 |

|

2 |

Workers ages 20–29 |

1,714 |

1,890 |

1,337 |

6,627 |

8,757 |

|

|

*2,096 |

|

3 |

Workers ages 30–39 |

3,009 |

7,595 |

*6,399 |

*13,028 |

*9,611 |

|

|

*5,162 |

|

4 |

Workers ages 40–49 |

2,822 |

954 |

4,647 |

*4,131 |

4,241 |

|

|

2,520 |

|

5 |

Workers ages 50–59 |

−1,694 |

287 |

4,379 |

7,124 |

*4,586 |

|

|

117 |

|

6 |

Upper extremities |

1,535 |

1,688 |

2,913 |

5,098 |

7,503 |

|

|

*1,838 |

|

7 |

Trunk cases |

4,583 |

5,417 |

*3,395 |

8,916 |

|

|

|

5,022 |

|

8 |

Lower extremities |

1,808 |

2,307 |

9,349 |

*11,740 |

1,984 |

|

|

3,137 |

|

9 |

All other cases |

−1,978 |

3,581 |

3,178 |

7,102 |

*7,766 |

|

|

*3,889 |

|

Panel D |

Standard deviation of mean earnings losses (1968–1973, in dollars)a |

||||||||

|

1 |

Workers ages 20–59 |

860 |

1,150 |

1,138 |

2,236 |

2,046 |

|

|

662 |

|

2 |

Workers ages 20–29 |

1,482 |

2,057 |

2,987 |

4,479 |

3,398 |

|

|

1,237 |

|

3 |

Workers ages 30–39 |

2,194 |

2,449 |

2,272 |

6,193 |

3,059 |

|

|

1,559 |

|

4 |

Workers ages 40–49 |

1,768 |

1,951 |

1,760 |

5,321 |

5,055 |

|

|

1,228 |

|

5 |

Workers ages 50–59 |

1,294 |

2,596 |

2,248 |

2,250 |

4,129 |

|

|

1,213 |

|

6 |

Upper extremities |

875 |

1,952 |

1,726 |

2,754 |

2,328 |

|

|

809 |

|

7 |

Trunk cases |

4,430 |

1,364 |

2,132 |

5,040 |

|

|

|

1,115 |

|

8 |

Lower extremities |

1,639 |

1,160 |

2,351 |

8,283 |

4,188 |

|

|

935 |

|

9 |

All other cases |

2,613 |

3,354 |

3,767 |

3,513 |

3,436 |

|

|

1,596 |

|

|

|

Percent Rating |

|||||||

|

|

Classification of Workers |

1–2 |

3–5 |

6–10 |

11–15 |

16–50 |

51–100 |

Mean Ratings |

Total |

|

Panel E |

Proportional earnings losses |

||||||||

|

1 |

Workers ages 20–59 |

0.036 |

0.063 |

0.099 |

0.176 |

0.189 |

|

|

0.059 |

|

2 |

Workers ages 20–29 |

0.043 |

0.043 |

0.035 |

0.159 |

0.268 |

|

|

0.051 |

|

3 |

Workers ages 30–39 |

0.069 |

0.164 |

0.134 |

0.248 |

0.226 |

|

|

0.115 |

|

4 |

Workers ages 40–49 |

0.062 |

0.021 |

0.095 |

0.085 |

0.102 |

|

|

0.055 |

|

5 |

Workers ages 50–59 |

−0.040 |

0.007 |

0.119 |

0.216 |

0.141 |

|

|

0.003 |

|

6 |

Upper extremities |

0.036 |

0.038 |

0.070 |

0.128 |

0.211 |

|

|

0.043 |

|

7 |

Trunk cases |

0.123 |

0.123 |

0.075 |

0.201 |

|

|

|

0.115 |

|

8 |

Lower extremities |

0.043 |

0.053 |

0.216 |

0.317 |

0.053 |

|

|

0.074 |

|

9 |

All other cases |

−0.049 |

0.078 |

0.069 |

0.145 |

0.194 |

|

|

0.088 |

|

Panel F |

Mean benefits of legal fees (1968–1973, in dollars) |

||||||||

|

1 |

Workers ages 20–59 |

696 |

2,479 |

4,957 |

7,807 |

10,980 |

|

|

2,150 |

|

2 |

Workers ages 20–29 |

742 |

2,316 |

5,078 |

8,388 |

12,846 |

|

|

2,047 |

|

3 |

Workers ages 30–39 |

626 |

2,509 |

5,451 |

7,224 |

10,286 |

|

|

2,136 |

|

4 |

Workers ages 40–49 |

706 |

2,316 |

4,999 |

7,360 |

10,327 |

|

|

2,201 |

|

5 |

Workers ages 50–59 |

696 |

2,846 |

4,412 |

7,934 |

9,851 |

|

|

2,234 |

|

6 |

Upper extremities |

593 |

2,057 |

4,503 |

6,716 |

11,641 |

|

|

1,453 |

|

7 |

Trunk cases |

1,288 |

3,141 |

5,371 |

8,410 |

|

|

|

3,850 |

|

8 |

Lower extremities |

1,261 |

2,636 |

5,803 |

10,254 |

13,537 |

|

|

2,809 |

|

9 |

All other cases |

842 |

2,348 |

4,485 |

7,326 |

10,003 |

|

|

4,782 |

Both scheduled and nonscheduled PPD beneficiaries received weekly benefits that were 66-and-two-thirds percent of the workers’ preinjury weekly wages, subject to a maximum weekly benefit. As of 1968, the ratings for both the scheduled and nonscheduled PPD benefits were based on an evaluation of medical impairment, corresponding to the extent of anatomical loss (IA) or functional loss (IB) shown in Figure C-2. In short, while the purpose of the Wisconsin PPD benefits was to compensate for work disability, in 1968 the operational approach for the benefits was to measure the extent of medical impairment and to use the rating as a proxy for work disability.

As discussed by Berkowitz and Burton (1987), Wisconsin began to base nonscheduled PPD benefits on the loss of earning capacity (corresponding to consequence IIIA in Figure C-2) beginning in the 1970s. Thus the results in this section probably would not be applicable to workers who receive PPD benefits from the current Wisconsin workers’ compensation program.

Summary of the Wisconsin Results

The male Wisconsin workers who were injured in 1968 and received PPD benefits were separated into two categories. Most workers were paid benefits without litigation or use of compromise and release (C&R) agreements. These uncontested cases are shown in Table C-1 (which corresponds to Table 10.1 in Berkowitz and Burton [1987]). Other workers were paid benefits after a contest (litigation or use of C&R agreements). The results for the contested cases are not shown in this report. Table C-1 contains seven panels of information.

Panel A. The Wisconsin uncontested cases were selected using a stratified sampling procedure that selected a higher proportion of cases in cells with fewer workers. The sample represented a total of 1,685 workers from ages 20 to 59 (line 1). The sample was placed into columns based on the permanent disability ratings and into rows corresponding to 10-year age categories (lines 2 to 5) and into rows corresponding to four locations of injury (lines 6 to 9). The numbers of the various types of injuries ranged from upper extremities (1,099) to all other cases (107). The mean disability rating for the entire sample was 3.70 percent. The mean ratings varied by age (from 3.54 percent for workers ages 20–29 to 3.71 percent for workers ages 50–59) and by location of injury (from 2.80 percent for upper extremities to 9.62 percent for all other cases).

Panel B. The potential earnings for each worker were calculated by multiplying the worker’s actual earnings in 1966–1967 by his expected earnings growth ratio (EGR). The EGR was derived from the ratio of the

actual earnings in 1968–1973 to the actual earnings in 1966–1967 of workers in the control group, as shown in Social Security earnings records.

The control group workers were matched to the injured Wisconsin workers in the sample on the basis of each worker’s sex, age in 1968, and level of actual earnings in 1966–1967. The potential earnings in Panel B correspond to the potential earnings in Figure C-3 calculated for the six years between 1968 and 1973, and represent the estimate of what the workers in the sample would have earned if they had not been injured in 1968. The mean potential earnings for all workers in the sample were $42,892. (All dollar figures in Table C-1 are in 1968 dollars.) For workers with injuries to the upper extremity rated at 1–2 percent, the mean potential earnings were $42,740.

Panel C. The actual earnings for each worker from 1968 to 1973 were determined based on Social Security earnings records. The actual earnings used to calculate the results in Panel C correspond to the actual earnings shown in Figure C-3. The actual earnings were subtracted from the potential earnings to determine the earnings losses shown in Panel C. The mean earnings losses for all workers in the sample were $2,519. For workers with injuries to the upper extremity rated at 1–2 percent, the mean earnings losses were $1,535. Of interest, there are two entries in Panel C in which the mean earnings losses are negative: The mean actual earnings exceeded the mean potential earnings for workers in those categories.

Panel D. The earnings losses varied significantly for workers in the sample of Wisconsin workers. The standard deviations (a measure of dispersion) of the mean earnings losses are shown in Panel D. The standard deviation for all workers in the sample was $662. The mean for all workers was $2,519. The ratio of the standard deviation to the mean is low enough that we can be 95 percent certain that the mean earnings losses for all workers in the sample were greater than zero. The significance at the .05 level is shown by the asterisk by the $2,519 entry in Panel C. In contrast, the standard deviation for workers with injuries to the upper extremity rated at 1–2 percent was $875, and so we cannot be 95 percent certain that the mean earnings losses of $1,535 were greater than zero. A perusal of Panel C shows that a number of entries are not significant.

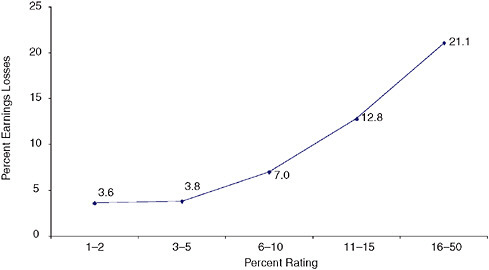

Panel E. The proportional earnings losses are shown in Panel E. These figures represent the mean earnings losses in Panel C divided by the mean potential earnings in Panel B. The proportional earnings loss for all workers in the sample was 0.059 ($2,519 divided by $42,892), which means that all workers had earnings losses that were 5.9 percent of potential earnings. For workers with injuries to the upper extremities rated at 1–2 percent, the

proportional earnings loss was 0.036 ($1,535 divided by $42,740), which means that the earnings losses for workers with this type of injury were 3.6 percent of potential earnings.

Panel F. The mean workers’ compensation benefits net of legal fees are shown in Panel F. These include all temporary disability benefits as well as PPD benefits received between 1968 and 1973. The mean benefits for all workers in the sample were $2,150. For workers with injuries to the upper extremity rated at 1–2 percent, the mean benefits net of legal fees was $593.

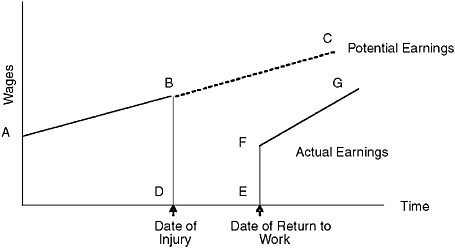

Panel G. The replacement rates are shown in Panel G. The replacement rates are the mean benefits net of legal fees received by the Wisconsin workers between 1968 and 1973 (Panel F) divided by the mean earnings losses for these workers during those six years (Panel C). For all workers in the sample, the replacement rate was 0.85 ($2,150 divided by $2,519), which means these workers received benefits that replaced 85 percent of their earnings losses. For workers with injuries to the upper extremity rated at 1–2 percent, the replacement rate was 0.39 ($875 divided by $1,535), which means these workers received benefits that replaced 39 percent of their earnings losses. A perusal of Panel G indicates there were great variations in replacement rates, ranging from 21 percent for workers ages 30–39 with injuries rated at 1–2 percent to 991 percent for workers ages 50–59 with injuries rated at 3–5 percent. There were also two entries (shown in Panel G with “b”) where the workers in the category received workers’ compensation benefits but on average had no earnings losses.

The Wisconsin Disability Rating System and Equity

Background on the Equity Criteria

The concepts of horizontal and vertical equity have a long history in the public finance literature. Musgrave provides an example:

A proper definition of income is important, not only to establish equity in a vertical sense—that is, to plan taxes and transfers so as to adjust relative positions; it is important also to establish equity in a horizontal sense— that is, to give equal treatment to people in equal positions (Musgrave, 1959:20).

The equity criteria were used to evaluate a disability benefits program in The Report of the National Commission on State Workmen’s Compensation Laws:

equitable: delivering benefits and services fairly as judged by the program’s consistency in providing equal benefits or services to workers in identical circumstances and its rationality in providing benefits and services in proportion to the impairment or disability for those with different degrees of loss (The National Commission, 1972:137).

We expand the use of the horizontal and vertical equity criteria to evaluate the performance of the rating system used to provide benefits to people who experience loss of earnings as a result of injuries or diseases.7 The balance of this section discusses a series of figures derived from the information in Table C-1 pertaining to the Wisconsin workers’ compensation program. (The figures transform the proportions in Table C-1 into percentages in order to expedite exposition.)

Vertical Equity for Ratings

The data in Figure C-4 can be used to explain vertical equity. Vertical equity requires that actual wage losses increase in proportion to the increase in disability ratings. In this instance, there is reasonably good vertical equity in the ratings of the upper extremity injuries. With the exception of the lowest and highest disability category, the percentage earnings losses are close to the midpoint of the corresponding category of disability ratings. For example, workers with disability ratings of 11–15 percent experienced 12.8 percent earnings losses.8

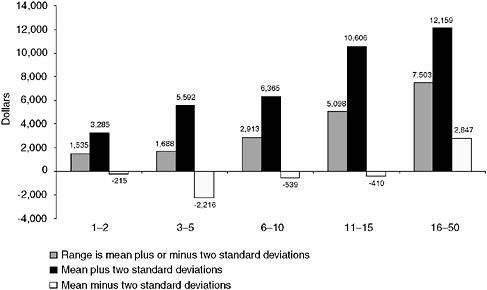

Intra-Injury Horizontal Equity for Ratings

Intra-injury horizontal equity for ratings requires that the actual wage losses for workers with the same disability ratings and the same type of injury should be the same or similar. The data for upper extremities shown in Figure C-5 indicates there are substantial variations in earnings losses for these workers with the same disability ratings. The entries include the mean amount of earnings losses for workers in each rating category, plus the earnings losses associated with plus or minus two times the standard deviation for the earnings losses. As can be seen, the range of earnings losses contains some workers who had negative earnings losses in the six years after their

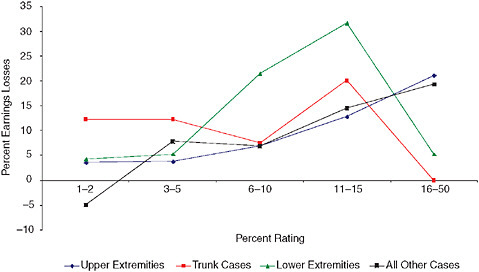

FIGURE C-6 Percentage earnings losses for Wisconsin workers with four types of injuries.

injuries.9 Indeed, the earnings losses are only statistically significantly different than zero for workers with injuries of the upper extremities with ratings of 16–50 percent.

One “lesson” of Figure C-5 in conjunction with Panels C and D of Table C-1 is that the Wisconsin workers’ compensation program did a reasonably good job on vertical equity for upper extremity cases when the emphasis is placed on mean values of losses, but that the program did not do as well on intra-injury horizontal equity, as shown by the considerable variability in lost wages for workers with similar disability ratings.

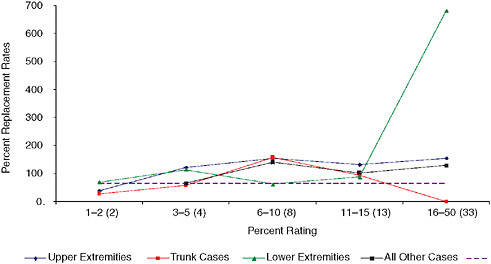

The relationships between disability ratings and earnings losses for four types of injuries are shown in Figure C-6.

Inter-Injury Horizontal Equity for Ratings

Inter-injury horizontal equity for ratings requires that the actual wage losses for workers with the same disability ratings, but different types of injuries, should be the same or similar. However, the results in Figure C-6 suggest there are significant differences among the types of injuries in the relationships between disability ratings and lost earnings. For example,

for workers with disability ratings of 11 to 15 percent, earnings losses ranged from 31.7 percent for lower extremities to 12.8 percent for upper extremities.

Vertical Equity for Ratings—Revisited

Figure C-6 is also useful in illustrating the challenges of achieving vertical equity for particular types of injuries. As shown earlier in Figure C-4, there is a reasonably close relationship between higher ratings for workers with upper extremity injuries and higher earnings losses. However, the data in Figure C-6 “tell” a somewhat different story. For two types of injuries (upper extremities and all other cases), earnings losses generally increase with higher disability ratings. However, for trunk cases and lower extremities, earnings losses are much lower for workers in the most serious rating category than in most of the categories with lower disability ratings.

Vertical Equity for Ratings—Revisited Again!

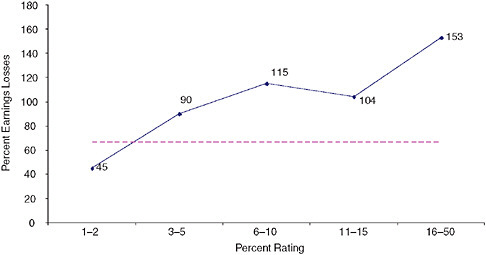

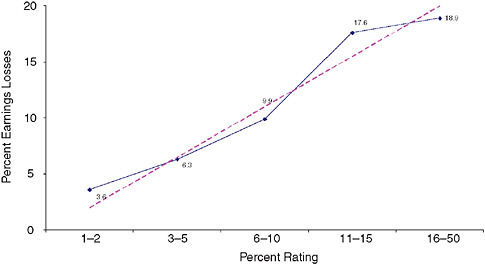

Shall we look at the trees (represented by Figures C-5 and C-6) or the forest (represented by Figure C-7)? As shown in Figure C-7, for all Wisconsin workers, there is a very close relationship between rating categories and percentage earnings losses. The dashed line represents an exact correspondence between ratings and losses (for example, an 8 percent disability rating equals an 8 percent earnings loss). At this level of aggregation, the Wisconsin rating system does an excellent job of providing vertical equity.

The Wisconsin Replacement Rates and Adequacy

It is useful to separate the analysis of the ability of the rating system to predict earnings losses from the analysis of the ability of the compensation system to replace an appropriate portion of lost earnings with benefits. It is possible, for example, that the rating system does an excellent job in predicting earnings losses, but that the design or implementation of the benefit system results in a poor match between benefits and lost wages. The next set of figures looks at the equity and adequacy of the Wisconsin workers’ compensation benefits for workers with PPD benefits.

Background on the Adequacy Criterion

There is also a long history of the use of the adequacy criterion to assess social insurance programs, including those providing benefits to persons with disabilities. One possible standard is the Social Adequacy Model, which requires that benefits provide at least enough income to assume the

FIGURE C-7 Percentage earnings losses for all Wisconsin workers.

beneficiary is not living in poverty (Hunt, 2004). Other standards rely on replacement rates, which represent the proportion of lost wages replaced by the cash benefits from a program.

The National Commission argued that workers’ compensation should replace a substantial proportion of the worker’s lost income.

Replacement of a substantial proportion is justified by a feature of workmen’s compensation which distinguishes the program from other forms of social insurance. In exchange for the benefits of workers compensation, workers renounced their right to seek redress for economic damages and pain and suffering under the common law. In no other social insurance program, such as Social Security or unemployment compensation, did workers surrender any right of value in exchange for benefits (The National Commission, 1972:36).

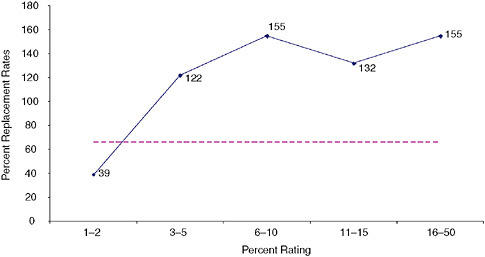

The generally accepted standard of adequacy for workers’ compensation is that the benefits should replace two-thirds of lost wages (Hunt, 2004). This replacement rate, which is shown by the horizontal line 66.67 percent in Figures C-8 to C-10, can be used to assess the adequacy of benefits provided by the Wisconsin workers’ compensation program for workers receiving permanent partial disability benefits. One meaning of adequacy is to consider the replacement rate for the entire sample of injured workers. In Wisconsin, cash benefits replaced 85 percent of earnings losses for the entire sample, as shown in Panel G of Table C-1, which clearly met the adequacy test.

The Wisconsin Replacement Rates and Equity

Vertical Equity for Benefits

The data in Figures C-8 through C-10 can also be used to examine vertical equity of the PPD benefits. Vertical equity requires that the same proportion of lost wages should be replaced for workers at all disability ratings. (This definition is refined in the next paragraph.) In Figure C-8, there is fairly good vertical equity for the benefits for upper extremity injuries. The least serious category (1–2 percent ratings) has a replacement rate of only 39 percent, but the other categories have replacement rates that are within the range of 122 to 155 percent. The results for the four types of injuries in Figure C-9 suggest that there was a reasonable degree of vertical equity for the four lowest rating categories, but there were serious equity problems for the highest rating category.

Vertical Equity for Benefits—Revisited

Vertical equity has two possible meanings. A narrow view asserts that all levels of severity should have the same proportion of earnings losses replaced by benefits. An alternative view is that more serious injuries should have a higher replacement rate. Those who subscribe to the alternative view can take some comfort from Figure C-10, which indicates the Wisconsin

FIGURE C-8 Replacement rates (benefits as a percentage of earnings losses) for Wisconsin workers with upper extremity injuries.

workers’ compensation program was in general replacing a higher proportion of earnings loss for workers with more serious disability ratings.

Inter-Injury Horizontal Equity for Benefits

Inter-injury horizontal equity for benefits requires that the replacement rates for workers with the same disability ratings and different types of injuries should be the same or similar. The results in Figure C-9 suggest there are significant differences among the types of injuries concerning the relationships between benefits and lost earnings.

Observations on the Wisconsin Results

-

It is important to distinguish between the ability of the disability rating system to accurately predict earnings losses (discussed in entries 2 through 5 below) and the ability of the benefit system to match benefits to earnings losses (discussed in entries 6 through 8). These are related, but different, matters. The former is of greater interest for this study because an assessment of the accuracy of the disability ratings produced by the VA Rating Schedule is part of the assignment for the IOM committee for which this study is being prepared.

-

At the most aggregate level—the entire sample of Wisconsin workers—the Wisconsin rating system did an excellent job of providing vertical equity. As shown in Figure C-7, there is a close correspondence between higher disability ratings and greater earnings losses.

-

When the Wisconsin sample is separated into the four injury types, the Wisconsin rating system does not do as well in terms of vertical equity. As shown in Figure C-6, the earnings losses generally increase with higher ratings for two types of injuries, but there are serious problems with vertical equity for two other types of injuries.

-

There are also serious problems with the Wisconsin rating system in terms of inter-injury horizontal equity. As shown in Figure C-6, there are significant differences among the four types of injuries in the relationships between disability ratings and lost earnings.

-

There are also serious problems with the Wisconsin rating system in terms of intra-injury horizontal equity. As shown in Figure C-5 (and in Panels C and D of Table C-1), with cells defined by injury type (or age) and percent rating, there are large variations in earnings losses among different workers.

-

The Wisconsin cash benefits system met the generally accepted test of adequacy, since the average replacement rate for the entire sample was more than 66.67 percent.

-

The Wisconsin rating system did a fairly good job of providing vertical equity for benefits. As shown in Figure C-9, the replacement rates generally were roughly the same for workers with different ratings for the same injury (although there were some important exceptions).

-

Finally, the Wisconsin benefit system had serious problems with inter-injury horizontal equity. As shown in Figure C-9, there were significant differences among the types of injuries concerning the relationships between benefits and lost earnings.

A CURRENT STUDY OF THE CALIFORNIA WORKERS’ COMPENSATION PROGRAM

The California Worker’s Compensation Program

The workers’ compensation programs in California and several other states have been examined in a series of studies conducted by the RAND Corporation in recent years.10 Boden et al. (2005) provide a summary of the results for California, New Mexico, Oregon, Washington, and Wisconsin. Reville et al. (2005) examined various aspects of the California program for permanent disability rating system; we rely on material from that study. We produced new empirical results for this study involving workers who were injured between January 1, 1991, and December 31, 1993, and who received permanent partial disability benefits in California.11

The California workers’ compensation benefit system applicable to the workers in this study had some similarities to the Wisconsin workers compensation program described in the previous section. California used different benefit formulae during the temporary disability period and the permanent disability period (Figure C-1). During the temporary disability period, most California workers in the study qualified for TTD benefits, which were 66-and-two-thirds percent of the worker’s preinjury wages, subject to a maximum weekly benefit. Once the worker reached the date of MMI, the TTD benefits stopped and most California workers with permanent disabilities qualified for PPD benefits. The weekly benefit for PPD

was 66-and-two-thirds percent of the worker’s preinjury wages, subject to a maximum weekly benefit. These attributes of the California system were basically the same as in Wisconsin.

There were also significant differences between the PPD benefits in California and Wisconsin. In Wisconsin, a distinction was made between scheduled injuries (those involving injuries to body parts listed in the workers’ compensation statute) and unscheduled injuries (those involving injuries to other body parts, such as backs), whereas in California all injuries were rated using a rating schedule adopted by the administrative director of the Division of Workers’ Compensation.

Another major distinction between the states pertained to the basis for the permanent disability ratings.12 In Wisconsin, both the scheduled and nonscheduled injuries were rated based on an evaluation of medical impairment, corresponding to the extent of anatomical loss (IA) or functional loss (IB) shown in Figure C-2. In California, there were several sets of criteria that could be used to apply the “standard rating” for permanent disabilities. Objective factors roughly corresponded to IA or IB in Figure C-2, and were largely based on information the rating physician could directly observe or measure. Subjective factors could be based on the worker’s description of the severity or frequency of pain and the resulting limitations on his or her ability to perform various activities. Such subjective factors roughly correspond to IB or limitations in activities of daily living (II) in Figure C-2. Work-capacity Guidelines were developed to rate spines and then were extended to other medical conditions. The guidelines in part correspond to II in Figure C-2 (“contemplates the individual has lost approximately half of his pre-injury capacity for performing such activities as bending, stooping, lifting”). The guidelines in part also correspond to loss of earning capacity (IIIA) in Figure C-2 (“disability precluding heavy work”).

An additional complication of the California permanent disability rating system is that the objective factors, subjective factors, and work-capacity guidelines were not mutually exclusive categories. Rather, it was quite common for an injury to have rating factors from more than one category, such as an injury to the wrist that causes immobility plus pain. Finally, a distinctive attribute of the California rating system is that the standard rating was modified on the basis of the individual worker’s age and occupation. The ultimate basis for the rating was provided in the workers’ compensation statute: namely, “the diminished ability of such injured employee to compete in an open labor market.” In essence, the California rating system used measurements of a variety of consequences of an injury or disease to

serve as proxies or predictors of the loss of earning capacity and/or actual loss of earnings.

The California rating system for permanent disabilities was significantly changed in 2004, subsequent to the period when the injuries analyzed in this section occurred. One significant change was the adoption of the Guides as the basis for rating permanent impairments. Therefore, the results in this section likely would not be applicable to workers who receive PPD benefits from the current California workers’ compensation program.

Summary of the California Results

The California workers who were injured between 1991 and 1993 and who received PPD benefits were classified into 21 impairment categories based on the California permanent disability rating system, which are shown in Table C-2.

There are four panels of data for California, which roughly correspond to four of the seven panels of data presented for Wisconsin. There are no California data on the standard deviation of mean earnings losses corresponding to Panel D in the Wisconsin data in Table C-1. In addition, the only benefits data readily available for California are confined to PPD benefits and do not include temporary disability benefits, as in Wisconsin, and so there are no Panels F and G in Table C-2. Because we lack data on all types of cash benefits, we will not evaluate the adequacy and equity of the California cash benefits.

Panel A. There are 78,696 California PPD cases shown in Table C-2.

Panel B. The potential earnings for each worker were determined by matching the injured worker to a control group, which consisted of other workers in the same firm who had similar earnings in the four quarters prior to the date of injury and who did not experience workplace injuries.13 The uninjured workers’ actual earnings in the five years after the date of injury as recorded in the California unemployment insurance database correspond to the potential earnings shown in Figure C-3. For workers with injuries that resulted in general lower extremity impairments rated at 1 to 5 percent, the mean potential earnings for the five years were $222,772. (The figures are in 2003 dollars discounted to the present value of the potential earnings at the date of injury.14)

TABLE C-2 California Permanent Partial Disability Cases

|

|

|

Percent Rating |

||||||||

|

|

Classification of Workers |

1–5 |

6–10 |

11–15 |

16–20 |

21–25 |

26–50 |

51–100 |

Mean Ratings |

Total |

|

Panel A |

Counts of workers |

|||||||||

|

1 |

General lower extremity impairment |

299 |

134 |

152 |

136 |

117 |

147 |

65 |

18.7 |

1,050 |

|

2 |

Hip impairment |

65 |

44 |

44 |

17 |

26 |

42 |

25 |

20.6 |

263 |

|

3 |

Knee impairment |

2,549 |

1,500 |

1,313 |

843 |

690 |

825 |

206 |

14.6 |

7,926 |

|

4 |

Ankle impairment |

988 |

473 |

335 |

253 |

134 |

218 |

100 |

13.7 |

2,501 |

|

5 |

Impaired function in toe(s) |

196 |

35 |

23 |

23 |

11 |

13 |

10 |

9.4 |

311 |

|

6 |

Vision impairment |

93 |

22 |

12 |

8 |

28 |

7 |

1 |

10.2 |

171 |

|

7 |

Hearing impairment |

732 |

255 |

227 |

103 |

74 |

62 |

79 |

11.0 |

1,532 |

|

8 |

Hand/fingers |

2,322 |

615 |

507 |

233 |

102 |

273 |

17 |

8.7 |

4,069 |

|

9 |

Loss of grasping power |

1,721 |

2,421 |

1,167 |

771 |

234 |

511 |

85 |

11.3 |

6,910 |

|

10 |

Chronic lung impairment |

19 |

68 |

9 |

13 |

4 |

15 |

16 |

20.4 |

144 |

|

11 |

Heart disease |

6 |

34 |

26 |

43 |

10 |

64 |

47 |

32.0 |

230 |

|

12 |

General impairment to shoulder or arm |

895 |

886 |

1,187 |

621 |

272 |

1,003 |

75 |

17.9 |

4,939 |

|

13 |

Impaired function in shoulder |

1,808 |

1,023 |

930 |

410 |

109 |

106 |

14 |

9.8 |

4,400 |

|

14 |

Impaired function in elbow |

760 |

388 |

292 |

107 |

43 |

59 |

1 |

9.3 |

1,650 |

|

15 |

Impaired function in wrist |

1,244 |

711 |

716 |

334 |

115 |

437 |

18 |

13.0 |

3,575 |

|

16 |

Impaired function of neck, spine, or pelvis |

3,414 |

4,664 |

4,771 |

3,290 |

3,534 |

4,572 |

687 |

19.6 |

24,932 |

|

17 |

General impairment to abdomen |

57 |

77 |

41 |

37 |

16 |

33 |

10 |

17.3 |

271 |

|

18 |

Psychiatric impairment |

135 |

201 |

162 |

108 |

49 |

181 |

77 |

22.2 |

913 |

|

19 |

Posttraumatic head syndrome |

6 |

18 |

9 |

17 |

1 |

17 |

4 |

24.4 |

72 |

|

20 |

Headaches |

70 |

18 |

8 |

2 |

2 |

3 |

1 |

7.7 |

104 |

|

21 |

Other |

155 |

82 |

41 |

17 |

14 |

20 |

13 |

13.6 |

342 |

|

22 |

Multiple impairments |

478 |

1,310 |

1,765 |

1,679 |

1,381 |

4,266 |

1,512 |

27.9 |

12,391 |

|

23 |

Total |

18,012 |

14,979 |

13,737 |

9,065 |

6,966 |

12,874 |

3,063 |

17.6 |

78,696 |

|

Panel B |

Mean potential earnings (5 years in dollars) |

|||||||||

|

1 |

General lower extremity impairment |

222,772 |

212,342 |

201,888 |

191,640 |

210,192 |

193,088 |

173,165 |

|

205,757 |

|

2 |

Hip impairment |

216,122 |

222,054 |

186,194 |

255,052 |

202,375 |

172,636 |

152,215 |

|

200,246 |

|

3 |

Knee impairment |

248,030 |

226,808 |

219,113 |

225,184 |

221,475 |

206,545 |

181,574 |

|

228,436 |

|

4 |

Ankle impairment |

213,040 |

210,958 |

225,356 |

183,737 |

213,007 |

183,213 |

159,130 |

|

206,574 |

|

5 |

Impaired function in toe(s) |

226,615 |

171,619 |

250,608 |

158,705 |

165,986 |

187,296 |

302,528 |

|

215,831 |

|

6 |

Vision impairment |

179,462 |

163,693 |

182,941 |

152,001 |

214,175 |

173,203 |

907,883 |

|

186,080 |

|

7 |

Hearing impairment |

327,325 |

298,036 |

286,521 |

300,473 |

322,791 |

263,565 |

342,879 |

|

312,602 |

|

8 |

Hand/fingers |

209,404 |

212,214 |

192,877 |

201,203 |

181,845 |

188,842 |

173,162 |

|

205,078 |

|

9 |

Loss of grasping power |

202,594 |

197,372 |

184,260 |

182,303 |

171,652 |

187,648 |

206,208 |

|

193,295 |

|

10 |

Chronic lung impairment |

209,446 |

187,187 |

172,809 |

236,983 |

161,239 |

199,785 |

216,351 |

|

197,553 |

|

|

|

Percent Rating |

||||||||

|

|

Classification of Workers |

1–5 |

6–10 |

11–15 |

16–20 |

21–25 |

26–50 |

51–100 |

Mean Ratings |

Total |

|

11 |

Heart disease |

230,212 |

321,699 |

386,182 |

296,066 |

441,916 |

320,496 |

271,779 |

|

316,501 |

|

12 |

General impairment to shoulder or arm |

221,518 |

212,543 |

192,945 |

186,673 |

179,654 |

186,235 |

160,057 |

|

198,256 |

|

13 |

Impaired function in shoulder |

229,916 |

218,578 |

224,585 |

191,834 |

177,413 |

201,546 |

181,857 |

|

220,468 |

|

14 |

Impaired function in elbow |

244,375 |

236,635 |

217,595 |

217,276 |

211,776 |

187,296 |

25,710 |

|

233,035 |

|

15 |

Impaired function in wrist |

196,603 |

204,600 |

191,931 |

187,747 |

173,689 |

195,437 |

205,847 |

|

195,597 |

|

16 |

Impaired function of neck, spine, or pelvis |

211,659 |

201,228 |

198,319 |

193,793 |

186,691 |

181,240 |

185,695 |

|

194,965 |

|

17 |

General impairment to abdomen |

298,018 |

283,966 |

202,290 |

252,706 |

351,237 |

173,110 |

219,259 |

|

258,382 |

|

18 |

Psychiatric impairment |

252,582 |

203,768 |

209,605 |

199,731 |

233,809 |

215,352 |

231,894 |

|

217,825 |

|

19 |

Posttraumatic head syndrome |

109,461 |

133,884 |

254,696 |

199,530 |

199,818 |

132,797 |

215,269 |

|

167,631 |

|

20 |

Headaches |

171,730 |

216,163 |

215,627 |

66,244 |

70,903 |

136,991 |

221,950 |

|

178,310 |

|

21 |

Other |

222,476 |

172,208 |

268,260 |

352,335 |

194,575 |

211,438 |

218,442 |

|

220,426 |

|

22 |

Multiple impairments |

232,058 |

205,536 |

191,462 |

193,938 |

188,114 |

184,851 |

190,298 |

|

192,060 |

|

23 |

Total |

224,315 |

209,364 |

202,352 |

197,457 |

192,891 |

187,224 |

193,817 |

|

204,505 |

|

Panel C |

Mean earnings losses (5 years in dollars) |

|||||||||

|

1 |

General lower extremity impairment |

33,533 |

35,278 |

37,981 |

51,788 |

68,946 |

85,767 |

82,942 |

|

51,081 |

|

2 |

Hip impairment |

39,905 |

55,351 |

37,400 |

114,564 |

76,527 |

32,562 |

76,796 |

|

52,850 |

|

3 |

Knee impairment |

37,506 |

33,523 |

44,222 |

55,132 |

75,147 |

81,495 |

103,220 |

|

49,303 |

|

4 |

Ankle impairment |

27,987 |

29,882 |

54,860 |

35,299 |

67,201 |

63,883 |

72,010 |

|

39,675 |

|

5 |

Impaired function in toe(s) |

32,144 |

27,913 |

73,854 |

−7,694 |

31,962 |

90,456 |

174,570 |

|

38,817 |

|

6 |

Vision impairment |

1,518 |

27,353 |

24,981 |

−31,339 |

50,294 |

81,007 |

769,050 |

|

20,680 |

|

7 |

Hearing impairment |

97,275 |

105,490 |

106,834 |

134,188 |

147,299 |

112,385 |

126,603 |

|

107,081 |

|

8 |

Hand/fingers |

30,674 |

40,465 |

47,015 |

53,352 |

62,070 |

76,110 |

117,422 |

|

39,687 |

|

9 |

Loss of grasping power |

29,904 |

35,871 |

46,702 |

48,068 |

49,262 |

72,625 |

83,994 |

|

41,338 |

|

10 |

Chronic lung impairment |

53,569 |

62,087 |

14,616 |

49,687 |

−41,265 |

51,094 |

151,581 |

|

62,804 |

|

11 |

Heart disease |

54,910 |

80,954 |

62,862 |

135,073 |

222,307 |

131,962 |

191,720 |

|

131,322 |

|

12 |

General impairment to shoulder or arm |

41,267 |

47,078 |

51,570 |

60,893 |

58,731 |

74,778 |

89,442 |

|

55,752 |

|

13 |

Impaired function in shoulder |

41,217 |

56,103 |

74,430 |

65,240 |

64,813 |

94,681 |

94,728 |

|

55,980 |

|

14 |

Impaired function in elbow |

43,771 |

48,292 |

59,764 |

49,634 |

72,154 |

54,021 |

9,145 |

|

49,130 |

|

15 |

Impaired function in wrist |

30,876 |

48,626 |

44,769 |

51,796 |

46,014 |

69,838 |

107,651 |

|

44,779 |

|

16 |

Impaired function of neck, spine, or pelvis |

34,857 |

37,488 |

46,577 |

50,187 |

58,597 |

67,237 |

103,985 |

|

50,822 |

|

17 |

General impairment to abdomen |

106,332 |

96,965 |

45,454 |

121,247 |

165,557 |

53,324 |

120,402 |

|

94,057 |

|

|

|

Percent Rating |

||||||||

|

|

Classification of Workers |

1–5 |

6–10 |

11–15 |

16–20 |

21–25 |

26–50 |

51–100 |

Mean Ratings |

Total |

|

18 |

Psychiatric impairment |

114,519 |

107,346 |

105,382 |

103,634 |

136,278 |

146,619 |

189,275 |

|

123,867 |

|

19 |

Posttraumatic head syndrome |

60,075 |

17,161 |

86,519 |

53,981 |

−75,641 |

85,629 |

200,984 |

|

63,190 |

|

20 |

Headaches |

39,739 |

66,326 |

98,959 |

−32,016 |

50,423 |

20,066 |

−12,946 |

|

46,647 |

|

21 |

Other |

41,070 |

13,888 |

38,994 |

170,609 |

61,545 |

114,093 |

152,655 |

|

50,093 |

|

22 |

Multiple impairments |

54,613 |

41,508 |

39,885 |

57,043 |

57,888 |

74,409 |

104,045 |

|

64,671 |

|

23 |

Total |

38,687 |

42,198 |

49,856 |

55,293 |

62,038 |

73,530 |

106,482 |

|

53,623 |

|

Panel E |

Proportional earnings losses |

|||||||||

|

1 |

General lower extremity impairment |

0.15 |

0.17 |

0.19 |

0.27 |

0.33 |

0.44 |

0.48 |

|

0.25 |

|

2 |

Hip impairment |

0.18 |

0.25 |

0.20 |

0.45 |

0.38 |

0.19 |

0.50 |

|

0.26 |

|

3 |

Knee impairment |

0.15 |

0.15 |

0.20 |

0.24 |

0.34 |

0.39 |

0.57 |

|

0.22 |

|

4 |

Ankle impairment |

0.13 |

0.14 |

0.24 |

0.19 |

0.32 |

0.35 |

0.45 |

|

0.19 |

|

5 |

Impaired functionin toe(s) |

0.14 |

0.16 |

0.29 |

−0.05 |

0.19 |

0.48 |

0.58 |

|

0.18 |

|

6 |

Vision impairment |

0.01 |

0.17 |

0.14 |

−0.21 |

0.23 |

0.47 |

0.85 |

|

0.11 |

|

7 |

Hearing impairment |

0.30 |

0.35 |

0.37 |

0.45 |

0.46 |

0.43 |

0.37 |

|

0.34 |

|

8 |

Hand/fingers |

0.15 |

0.19 |

0.24 |

0.27 |

0.34 |

0.40 |

0.68 |

|

0.19 |

|

9 |

Loss of grasping power |

0.15 |

0.18 |

0.25 |

0.26 |

0.29 |

0.39 |

0.41 |

|

0.21 |

|

10 |

Chronic lung impairment |

0.26 |

0.33 |

0.08 |

0.21 |

−0.26 |

0.26 |

0.70 |

|

0.32 |

|

11 |

Heart disease |

0.24 |

0.25 |

0.16 |

0.46 |

0.50 |

0.41 |

0.71 |

|

0.41 |

|

12 |

General impairment to shoulder or arm |

0.19 |

0.22 |

0.27 |

0.33 |

0.33 |

0.40 |

0.56 |

|

0.28 |

|

13 |

Impaired function in shoulder |

0.18 |

0.26 |

0.33 |

0.34 |

0.37 |

0.47 |

0.52 |

|

0.25 |

|

14 |

Impaired function in elbow |

0.18 |

0.20 |

0.27 |

0.23 |

0.34 |

0.29 |

0.36 |

|

0.21 |

|

15 |

Impaired function in wrist |

0.16 |

0.24 |

0.23 |

0.28 |

0.26 |

0.36 |

0.52 |

|

0.23 |

|

16 |

Impaired function of neck, spine, or pelvis |

0.16 |

0.19 |

0.23 |

0.26 |

0.31 |

0.37 |

0.56 |

|

0.26 |

|

17 |

General impairment to abdomen |

0.36 |

0.34 |

0.22 |

0.48 |

0.47 |

0.31 |

0.55 |

|

0.36 |

|

18 |

Psychiatric impairment |

0.45 |

0.53 |

0.50 |

0.52 |

0.58 |

0.68 |

0.82 |

|

0.57 |

|

19 |

Posttraumatic head syndrome |

0.55 |

0.13 |

0.34 |

0.27 |

−0.38 |

0.64 |

0.93 |

|

0.38 |

|

20 |

Headaches |

0.23 |

0.31 |

0.46 |

−0.48 |

0.71 |

0.15 |

−0.06 |

|

0.26 |

|

21 |

Other |

0.18 |

0.08 |

0.15 |

0.48 |

0.32 |

0.54 |

0.70 |

|

0.23 |

|

22 |

Multiple impairments |

0.24 |

0.20 |

0.21 |

0.29 |

0.31 |

0.40 |

0.55 |

|

0.34 |

|

23 |

Total |

0.17 |

0.20 |

0.25 |

0.28 |

0.32 |

0.39 |

0.55 |

|

0.26 |

Panel C. The actual earnings for each injured worker in the five years after the date of injury were determined based on California unemployment insurance earnings records. These actual earnings correspond to the actual earnings shown in Figure C-3. The actual earnings were subtracted from the potential earnings to determine the earnings losses shown in Panel C. For workers with injuries that resulted in general lower extremity impairments rated at 1 to 5 percent, the mean earnings losses for the five years were $33,533.15 Of interest, there were five entries in Panel C in which the mean earnings losses are negative: The mean actual earnings exceeded the mean potential earnings for workers in those categories.

Panel D. There are no data on the standard deviation of the earnings losses for California workers; therefore, this panel is missing in Table C-2.

Panel E. The proportional earnings losses are shown in Panel E. These figures represent the mean earnings losses in Panel C divided by the mean potential earnings in Panel B. For workers with injuries that resulted in general lower extremity impairments rated at 1 to 5 percent, the proportional earnings loss was 0.15 ($33,533 divided by $222,772), which means these workers experienced earnings losses that were 15 percent of potential earnings.

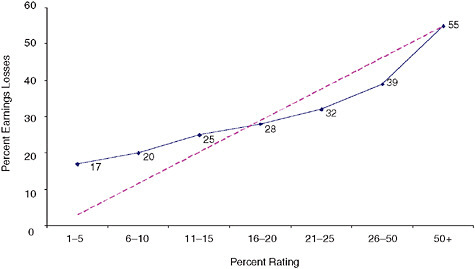

The California Disability Rating System and Equity

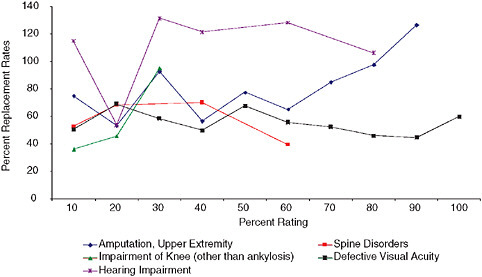

The results from the study of California workers can be used to illustrate the use of the equity criterion to evaluate the performance of a system providing benefits to persons experiencing loss of earnings as a result of injuries or diseases. The balance of this section discusses a series of figures derived from the information in Table C-2. (The figures transform the proportions in Table C-2 into percentages in order to expedite exposition.) We have selected eight medical conditions from Table C-2 for this discussion.

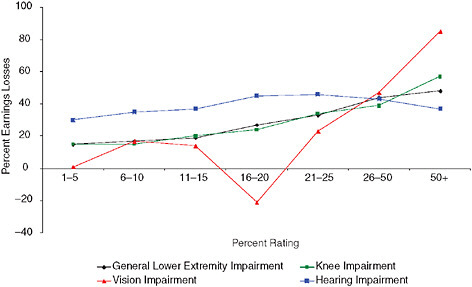

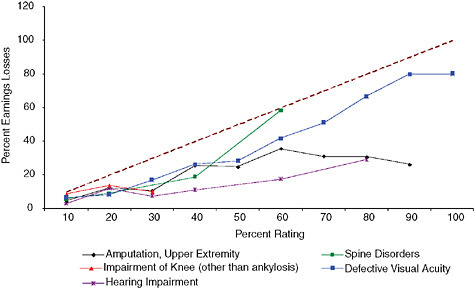

Vertical Equity for Ratings

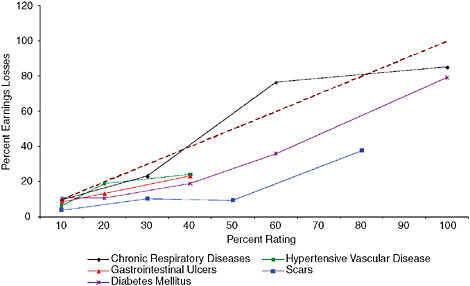

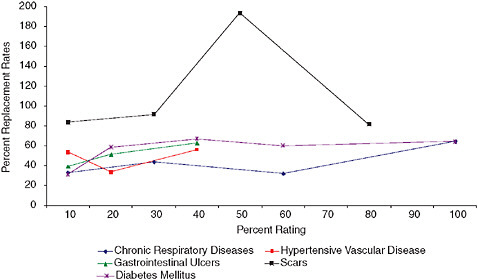

The data in Figures C-11 and C-12 can be used to evaluate vertical equity. Vertical equity requires that actual wage losses increase in proportion to the increases in disability ratings. There are some conditions for which earnings losses consistently increase as the permanent disability rating increases. These are condition 1 (general lower extremity impairment) and condition 3 (knee impairment) in Figure C-11, and condition 12

(general impairment to shoulder or arm) and 16 (impaired function of neck, spine, or pelvis) in Figure C-12. With one or two exceptions, the earnings losses increase with higher disability ratings for condition 6 (vision impairment) and condition 7 (hearing impairment) in Figure C-11 and condition 18 (psychiatric impairment) in Figure C-12. (The vertical equity for psychiatric impairment must be qualified, however, since workers with a 1 to 5 percent rating experienced a 45 percent loss of earnings, which increases very little until the condition receives a disability rating of at least 21 percent.) The condition for which vertical equity for ratings is clearly lacking is condition 10 (chronic lung impairment) in Figure C-12.

Vertical Equity for Ratings—Revisited

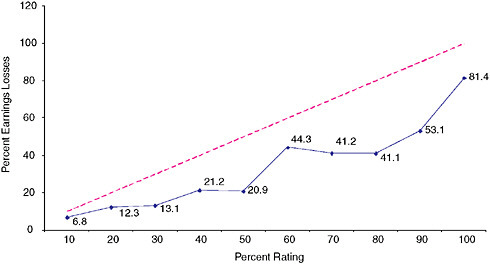

Shall we look at the trees (represented by Figures C-11 and C-12) or the forest (represented by Figure C-13)? As shown in Figure C-13, for all California workers, there is a monotonic relationship between rating categories and percentage earnings losses: They consistently increase together. However, the magnitudes of the ratings and the losses are not particularly close. The dashed line represents an exact correspondence between ratings and losses (for example, an 8 percent disability rating equals an 8 percent earnings loss). For the three lowest rating categories, earnings losses clearly exceed the ratings, while for the 21–25 and 26–50 percent rating categories, the earnings losses are clearly less than the ratings. At this level of aggrega-

FIGURE C-13 Percentage earnings losses for all California workers.

tion, the California rating system does a moderately good job of providing vertical equity.

Intra-Injury Horizontal Equity for Ratings

Intra-injury horizontal equity for ratings requires that the actual wage losses for workers with the same disability ratings and the same type of injury should be the same or similar. This test cannot be used for the California workers’ compensation program because we lack information on the extent of variation within each cell (which is why Table C-2 does not contain Panel D).

Inter-Injury Horizontal Equity for Ratings

Inter-injury horizontal equity for ratings requires that the actual wage losses for workers with the same disability ratings and different types of injuries should be the same or similar. The results in Figures C-11 and C-12 suggest there are significant differences among the types of injuries concerning the relationships between ratings and lost earnings. For example, for the five lowest rating categories, hearing impairment (condition 7) has the highest earnings losses for each rating category in Figure C-11, and without exception, psychiatric impairment has the highest earnings losses for each rating category in Figure C-12.

Observations on the California Results

-

We confine our observations to the ability of the disability rating system to accurately predict earnings losses, because we do not have the data necessary to assess the ability of the benefit system to match benefits to earnings losses.

-

We have data on disabled workers with 22 medical conditions, which constitute a significant portion, but not the universe, of California workers who received permanent partial disability benefits during the years covered by our study.

-

At the most aggregate level—the total experience of workers with all 22 conditions—the California rating system did a moderately good job of providing vertical equity. As shown in Figure C-13, the earnings losses increase monotonically with higher disability ratings, but the correspondence between the magnitudes of the disability ratings and the earnings losses is far from perfect. For lower disability ratings, the earnings losses are much higher than the ratings.

-

We selected eight medical conditions for particular scrutiny and, at this level, the California system also does a moderately good job of providing vertical equity. As shown in Figures C-11 and C-12, earnings losses generally increase with higher ratings for most medical conditions, but there are serious vertical equity problems for two conditions.

-

There are serious problems with the California rating system in terms of inter-injury horizontal equity. As shown in Figures C-11 and C-12, there are significant differences among the eight types of injuries in the relationships among disability ratings and lost earnings.

-

As previously noted, the results in this section involve injuries that occurred well before the 2004 reforms to the California workers’ compensation program. These reforms introduced a new method for rating the severity of permanent disability, beginning with the use of the Guides. However, the new disability rating system continued to use proxies to predict the loss of earning capacity or actual loss of earnings. A distinctive feature of the new California system is a provision designed to incorporate empirical data on wage losses into revisions of the permanent disability rating system in order to reduce the types of horizontal and vertical inequities discussed in this section. This adjustment feature bears watching, although currently there are insufficient data on post-injury outcomes for workers who were recently injured to evaluate whether the 2004 reforms have been successful.

THE 1971 REPORT ON THE ECONOMIC VALIDATION OF THE [VA] RATING SCHEDULE STUDY

The Veterans Disability Compensation Program

Disability compensation is a cash benefit paid to veterans who are disabled by injuries or diseases incurred or aggravated during active military service. The benefit amount is graduated according to the degree of the veteran’s disability rated on a scale from 10 to 100 percent (in increments of 10 percent). The monthly benefit depends on the veteran’s disability rating and dependency status. As of December 2006, the monthly benefit for a veteran with no dependents ranged from $115 for a 10 percent rating to $712 for a 50 percent rating to $2,471 for a 100 percent rating. The monthly benefit is higher for veterans with dependents; for example, as of December 2006, a veteran with a 50 percent disability rating with a spouse and one child received $832 per month.

Purpose of the Cash Benefits in the Veterans Disability Compensation Program

As discussed above, the sole purpose of the cash benefits specified by §4.1 of the Code of Federal Regulations dealing with the VA’s Rating Schedule is to compensate for work disability (as that term is used in this study):

The percentage ratings represent as far as can practicably be determined the average impairment in earning capacity resulting from such diseases and injuries and their residual conditions in civil occupations.

The Operational Basis for the Cash Benefits in the Veterans Disability Compensation Program

While the purpose of the cash benefits in the veterans disability compensation program is to compensate for work disability, the program is similar to the Wisconsin and California programs in the use of a proxy or proxies for work disability as the operational basis for the benefits. The Rating Schedule used for the program is contained in the Code of Federal Regulations (38 CFR Ch.1). The general guidance for the basis of the ratings is contained in

§4.10 Functional impairment.