2

Projections for U.S. and World Coal Use

This chapter summarizes current projections for U.S. and worldwide coal use over the next 25 years and beyond, and identifies the key factors that influence this outlook. This information provides the context and perspective for later chapters where the components of the coal use fuel cycle are examined in greater detail.

The outlook for future coal production and use presented here is based on recent studies and analyses by government and private organizations in the United States and elsewhere, and results are summarized for a range of scenarios reflecting the key factors that will influence future coal production. Because different organizations employ different methods, assumptions, and scenarios, the results are presented first for each of the major studies or sources of coal production and use projections. Then, the committee’s overall findings are presented based on its analysis of the full spectrum of studies reviewed.

COAL PRODUCTION SCENARIOS FOR THE UNITED STATES

This section summarizes estimates of future U.S. coal production and use for a range of scenarios developed by the Department of Energy’s Energy Information Administration (DOE-EIA) and the Pacific Northwest National Laboratory (PNNL). These scenarios reflect a range of assumptions about technical, economic, and policy variables that will influence future coal production and use; they are intended to be illustrative of recently published work by a variety of public and private organizations involved in energy and environmental modeling.

U.S. Energy Information Administration Projections

A principal source for projections related to energy use in the United States is the Annual Energy Outlook (AEO), updated each year by the EIA. The AEO is based on the National Energy Modeling System (NEMS) developed by the EIA and used to project energy use over the next 25 years for a range of scenarios. The “reference case” scenario is arguably the most widely cited of EIA cases. It reflects EIA’s best estimate of trends for a “business-as-usual” case that assumes continuation of all current laws, regulations, and policies. Other scenarios published by EIA use different assumptions about factors such as economic growth rates, fuel cost or price trends, and rates of technological change in different sectors of the economy (Table 2.1).

TABLE 2.1 Summary of Cases Used in EIA 2006 Projections of U.S. Coal Use Assuming No Change in Current Policies

|

Scenario |

Description |

|

Reference case |

Baseline economic growth (3%/yr), increased world oil price, and assumptions about adoption of renewable, nuclear, and other energy technologies. Gradual decline of minemouth coal price |

|

Low coal cost |

Productivity for coal mining and coal transportation assumed to increase more rapidly than in the reference case. Coal mining wages, mine equipment, and coal transportation equipment costs assumed to be lower than in the reference case |

|

High coal cost |

Productivity for coal mining and coal transportation assumed to increase more slowly than in the reference case. Coal mining wages, mine equipment and coal transportation equipment costs assumed to be higher than in the reference case |

|

Low economic growth |

Gross domestic product grows at an average annual rate of 2.4% for 2004 through 2030 |

|

High economic growth |

Gross domestic product grows at an average annual rate of 3.5% for 2004 through 2030 |

|

Low O&G price |

Prices for worldwide crude oil and natural gas (O&G) resources are lower than in the reference case. World oil prices are $28 per barrel in 2030, compared to $50 per barrel in the reference case, and lower-48 wellhead natural gas prices are $4.96 per thousand cubic feet in 2030, compared to $5.92 in the reference case. |

|

High O&G price |

Prices for worldwide crude oil and natural gas resources are higher than in the reference case. World oil prices are about $90 per barrel in 2030 and lower-48 wellhead natural gas prices are $7.72 per thousand cubic feet in 2030, compared to $5.92 in the reference case. |

|

Slow O&G technology |

Cost, finding rate, and success rate parameters adjusted for 50% slower improvement than in the reference case |

|

Rapid O&G technology |

Cost, finding rate, and success rate parameters adjusted for 50% more rapid improvement than in the reference case |

|

SOURCE: EIA (2006d). |

|

The EIA is precluded from analyzing alternative policy scenarios as part of the AEO. For example, the AEO does not include any cases in which U.S. greenhouse gas emissions are constrained over the next 25 years, since there is currently no policy that restricts such emissions. However, EIA does publish the results of policy analysis studies performed at the request of members of Congress, and these studies provide an important complement to the AEO because they explore a wider range of factors relevant to energy use projections. Table 2.2 shows additional EIA cases developed recently for a congressionally requested

TABLE 2.2 GHG Policy Cases Modeled by the EIA for Congressionally Requested Studies

|

|

GHG Intensity Reduction Goal (% per year)a |

Safety-Valve Price (2004 dollars per tonne CO2 equivalent)b |

|

||

|

Case Name |

2010-2019 |

2020-2030 |

2010 |

2030 |

Descriptionb |

|

Cap-Trade 1 |

2.4 |

2.8 |

$6.16 |

$9.86 |

|

|

Cap-Trade 2 |

2.6 |

3.0 |

$8.83 |

$14.13 |

GHG cap-and-trade system with safety valve |

|

Cap-Trade 3 |

2.8 |

3.5 |

$22.09 |

$35.34 |

|

|

Cap-Trade 4 |

3.0 |

4.0 |

$30.92 |

$49.47 |

|

|

Cap-Trade 3 Low Other |

2.8 |

3.5 |

$22.09 |

$35.43 |

Cap-Trade 3 with 50% reduction in “other than energy-related CO2 GHG abatement” |

|

Cap-Trade 3 Low Safety |

2.8 |

3.5 |

$8.83 |

$14.13 |

Cap-Trade 3 with lower assumed safety-valve price |

|

Cap-Trade 3 High Tech |

2.8 |

3.5 |

$22.09 |

$35.34 |

Cap-Trade 3 with more optimistic technology assumptions |

|

NOTE: These scenarios are illustrative of a range of policy proposals that would limit emissions of CO2 from coal combustion. aGHG intensity refers to annual GHG emissions per dollar of gross domestic product for a given year. bA cap-and-trade program places an overall limit on total GHG emissions from all emission sources in a given year. The annual cap is determined by the required GHG intensity reduction. Each source is required to hold one emissions “allowance” for each ton emitted, with the total number of annual allowances set by the government to be equal to the total tons in the cap. Allowances may be freely traded, offering sources the option of complying either by reducing emissions, by buying more allowances in the market, or by a combination of both strategies. The “safety valve” allows total emissions to exceed the cap if the market price for allowances exceeds the specified safety-valve price. In effect, the safety-valve price is the maximum price for allowances in the market. All permit safety-valve prices shown in Table 2.2 are in 2004 dollars. The range requested for this study was $10 to $35 in 2010 dollars (corresponding to $8.83 to $30.92 in 2004 dollars shown in the table). The safety valves are assumed to increase by 5 percent annually in nominal dollars from 2010 through 2030. SOURCE: EIA (2006e). |

|||||

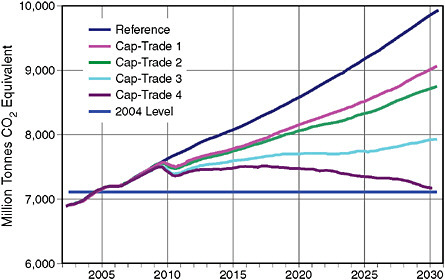

study of alternative cap-and-trade policies that would restrict U.S. greenhouse gas (GHG) emissions over the next several decades. These cases explore different levels of reduction in GHG intensity (defined as GHG emissions per unit of gross domestic product), beginning with the level proposed by the National Commission on Energy Policy (NCEP, 2004). These scenarios are illustrative of a variety of congressional proposals that would limit carbon dioxide emissions from fossil fuel combustion. Such scenarios are especially relevant to the present study since they explore the impact of policy measures that directly affect future U.S. coal production and use. Figure 2.1 shows the trends in GHG emissions associated with the scenarios in Table 2.2.

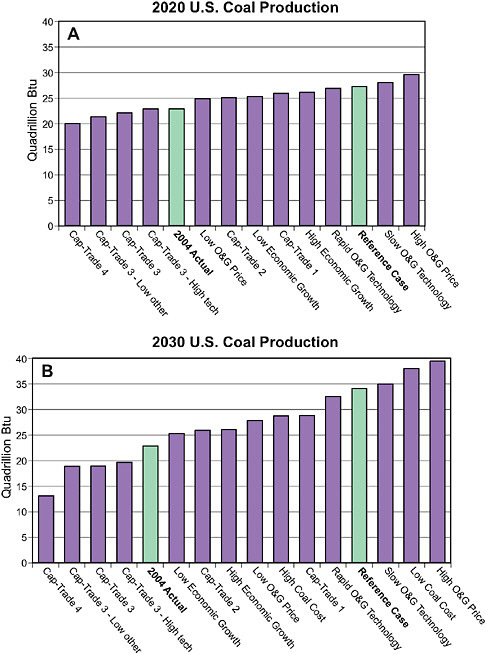

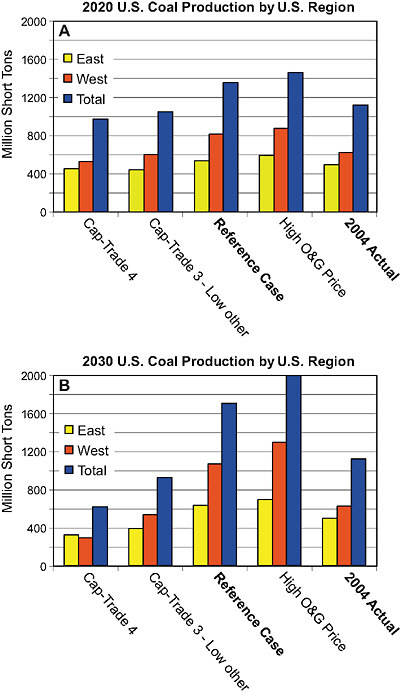

Figure 2.2 summarizes the range of total coal use projections in British thermal units (Btu) for the years 2020 and 2030 as reported by EIA, and Figure 2.3 summarizes the corresponding range of regional coal production figures (in units of tons rather than energy) projected by EIA for each of the scenarios shown in Tables 2.1 and 2.2. The results of these cases show a very wide range of future U.S. coal production estimates. Relative to the reference case scenario, which projects an approximately 50 percent increase in coal energy use by 2030 (relative to 2004), sustained high oil and gas prices yield an even greater increase of about 70 percent above present levels. The latter scenarios, however, assume no future constraints on GHG emissions. In contrast, scenarios that do limit future GHG emissions show dramatically different results. In these scenarios, coal use is curtailed significantly and falls below 2004 levels in the most restrictive cases. Coal production in the western states is impacted more severely than eastern coal

FIGURE 2.1 GHG emission trends for the policy scenarios in Table 2.2. SOURCE: EIA (2006e).

production, because most of the growth in the reference case is projected to occur in the West in the absence of a GHG emission constraint.

The impacts of these EIA scenarios on projected changes in coal imports and exports are summarized in Table 2.3. U.S. coal imports have been increasing at a relatively rapid rate, from less than 10 million tons in 2000 to more than 30 million tons in 2005. This trend has been driven mainly by the low sulfur content and lower delivered cost to the eastern U.S. markets of coals from Colombia, Venezuela, and Indonesia. Coal imports are expected to increase further over current levels and to exceed declining levels of exports by 2020 (Table 2.3). While the magnitude of imports and exports remains small relative to total coal use, the relative changes in Table 2.3 project that imports will increase by 50 to 240 percent while exports decline by 47 to 68 percent. In its reference case scenario, EIA projects that in 2030 the United States will import 91 million tons (2.37 quadrillion Btu) of coal, approximately three times as much as in 2005 (EIA, 2006d). In contrast, current U.S. coal exports are about 50 million tons per year, a little less than half of the record export tonnages in the 1980s. Exports are expected to decrease in the future, primarily due to the anticipated availability of low-cost coal supplies from South America, Asia, and Australia. The EIA predicts that the U.S. share of total world trade will fall from 6 percent in 2003 to 3 percent in 2025.

The range of energy sources for electric power generation is shown in Table 2.4; the three cases shown span the range of coal use projections in Tables 2.1 and 2.2. Significant changes in the amount of coal used for power generation also are seen in Table 2.4. In the AEO high oil and gas price scenario (which gives the largest increase in coal production), the fraction of electricity generated from coal climbs from its current (2004) share of 50 percent to 55 percent in 2020 and 64 percent in 2030. These values are slightly greater than the reference case scenario in the absence of a carbon constraint. However, under the Cap-Trade 4 scenario, coal’s share of electricity production declines to 37 percent in 2020 and

TABLE 2.3 Actual and Projected Coal Imports and Exports for Selected EIA Scenarios

|

|

Actual 2004 |

2020 |

2030 |

|||

|

Scenario |

Imports |

Exports |

Imports |

Exports |

Imports |

Exports |

|

Cap-Tradea |

0.79 |

1.25 |

1.25 |

0.72 |

1.19 |

0.66 |

|

AEO Reference Casea |

0.79 |

1.25 |

1.31 |

0.46 |

2.37 |

0.40 |

|

AEO High O/Gb |

0.79 |

1.25 |

1.61 |

0.46 |

2.69 |

0.40 |

|

NOTE: All values in quads (quadrillion Btu). aImports include coal and coke (net). bImports include coal, coke, and electricity (net). SOURCES: EIA (2006d, 2006e). |

||||||

TABLE 2.4 Actual and Projected Relative Contributions of Different Energy Sources for Electricity Production for Selected EIA Scenarios

|

|

Actual 2004 |

2020 |

2030 |

|||

|

Scenario |

Quad Btu |

% of Total |

Quad Btu |

% of Total |

Quad Btu |

% of Total |

|

Cap-Trade 4 |

|

|

|

|

|

|

|

Coal |

20.26 |

52.4 |

18.49 |

40.1 |

11.63 |

22.6 |

|

Nuclear |

8.23 |

21.3 |

9.86 |

21.4 |

18.39 |

35.8 |

|

Gas and Oil |

6.57 |

17.0 |

6.70 |

14.5 |

6.21 |

12.1 |

|

Renewable & Other |

3.60 |

9.3 |

11.03 |

23.9 |

15.21 |

29.6 |

|

Total |

38.67 |

|

46.09 |

|

51.44 |

|

|

AEO Reference Case |

|

|

|

|

|

|

|

Coal |

20.26 |

52.4 |

25.02 |

51.9 |

30.74 |

57.2 |

|

Nuclear |

8.23 |

21.3 |

9.09 |

18.8 |

9.09 |

16.9 |

|

Gas and Oil |

6.57 |

17.0 |

8.62 |

17.9 |

7.61 |

14.2 |

|

Renewable & Other |

3.60 |

9.3 |

5.52 |

11.4 |

6.27 |

11.7 |

|

Total |

38.67 |

|

48.24 |

|

53.71 |

|

|

AEO High O/G Prices |

|

|

|

|

|

|

|

Coal |

20.26 |

52.4 |

27.30 |

56.1 |

32.57 |

61.3 |

|

Nuclear |

8.23 |

21.3 |

9.09 |

18.7 |

9.09 |

17.1 |

|

Gas and Oil |

6.57 |

17.0 |

6.27 |

12.9 |

5.11 |

9.6 |

|

Renewable & Other |

3.60 |

9.3 |

5.98 |

12.3 |

6.37 |

12.0 |

|

Total |

38.67 |

|

48.64 |

|

53.14 |

|

|

SOURCES: EIA (2006d, 2006e). |

||||||

22 percent in 2030, according to EIA models. The shares of nuclear and renewable energy increase significantly in that scenario.

While EIA scenarios are widely cited and provide detailed information that is publicly available, other organizations also publish energy forecasts or scenarios.

Pacific Northwest National Laboratory Projections

Given the importance of carbon constraints and fuel prices to projections for future coal use revealed by the EIA scenarios, the committee presents recent findings from Pacific Northwest National Laboratory that project future U.S. coal use for a longer period of time under different policy scenarios. PNNL, one of the 17 national government research laboratories supported by DOE, has the mandate to conduct research and develop technology to support DOE’s Office of Science and other DOE offices. Large-scale energy models developed at PNNL have been used extensively to analyze alternative energy futures and policy scenarios for GHG reductions, both globally and domestically. Recent PNNL studies examined the effects of carbon constraints and fuel prices on future U.S. coal use from

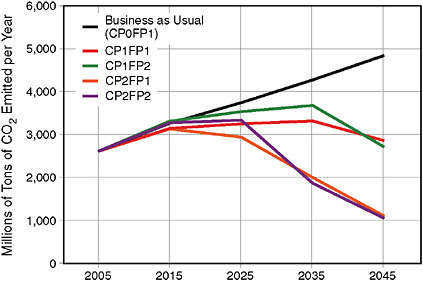

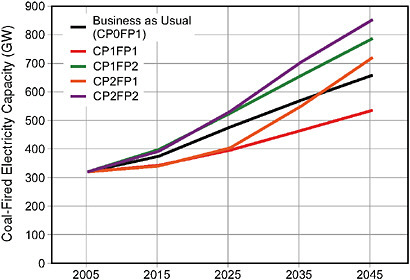

2005 to 2045 (Wise et al., 2007). The two carbon price (CP) scenarios modeled by PNNL assumed future market prices for CO2 allowances growing at different rates. In one case (called CP1), allowance prices per tonne of CO2 increased from an initial $12 in 2015 to $20 by 2035 and $25 in 2045. The second case (CP2) started at the same $12 per tonne in 2015, but increased more sharply to $32 by 2035 and $52 in 2045. Each CP case was combined with two fuel price (FP) cases based on EIA’s Annual Energy Outlook. The “base case” fuel prices (FP1) were the same as EIA’s Reference Case values, while the second case (FP2) represented EIA’s “constrained supply” case in which natural gas prices for power generation rise to $7 to $9 per million Btu (MBtu) by 2030 (compared with $5 to $7/MBtu for the base case). Figure 2.4 shows the resulting CO2 emissions from U.S. power plants for the four scenarios, and Figure 2.5 shows the impact on utility coal use, expressed in terms of the installed capacity of coal-fired power plants. Also shown is a “business-as-usual” reference case, which uses the EIA’s base case energy prices but does not impose any CO2 emissions control policy (CP0FP1).

Figures 2.4 and 2.5 show that the lower CO2 allowance prices (up to about $25 per tonne of CO2) result in reduced CO2 emissions, as well as decreased use of coal, relative to the base case, as in the EIA cap-and-trade scenarios shown earlier. However, for higher natural gas prices (FP2 cases), coal use actually exceeds the reference case value, even with higher carbon prices. In these scenarios, carbon capture and sequestration (CCS1) plays an increasingly important role in reducing CO2 emissions and enabling coal to remain economically viable. The combination of high carbon prices and high natural gas prices (scenario CP2FP2) brings about the largest long-term reduction in CO2 emissions as well as the greatest increase in coal use—exceeding even the business-as-usual (CP0FP1) reference case scenario projections. In large part, this is because the PNNL scenarios have much smaller increases in the use of nuclear and renewable energy for power generation compared to the earlier EIA Cap-Trade 4 scenario. Most of the fuel substitutions in the PNNL cases occur between coal (with and without CCS) and natural gas (Wise et al., 2007).

INTERNATIONAL COAL PRODUCTION PROJECTIONS

This section summarizes results of scenarios developed by a number of different organizations to estimate future international coal production and use. Again, results are intended to be illustrative of the range of technical, economic, and policy variables that will influence future coal production and use.

FIGURE 2.4 Effect of different carbon and fuel price scenarios on annual CO2 emissions from electricity generation for PNNL scenarios. SOURCE: Wise et al. (2007).

FIGURE 2.5 Effect of different carbon and fuel price scenarios on coal-fired capacity for electricity generation in gigawatts (GW) for PNNL scenarios. SOURCE: Marshall Wise and James Dooley, Joint Global Change Research Institute, Pacific Northwest National Laboratory, personal communication, 2007.

U.S. Energy Information Administration Projections

Along with domestic projections, the EIA also publishes scenarios for international energy use in its annual International Energy Outlook. Figure 2.6 summarizes the most recent EIA projections of world coal use in 2010, 2020, and 2025, for three groups of countries—mature market economies (including most Organisation for Economic Co-operation and Development [OECD] countries), emerging economies (such as China and India), and transitional economies (including the former Soviet Union, non-OECD Europe, and Eurasia). Again, these scenarios reflect variations in different growth rate parameters, but do not include policy scenarios such as future GHG constraints. In the absence of such policy constraints, world coal use is projected to grow dramatically in the emerging economies, primarily China and India. Much smaller tonnage growth is projected in the rest of the world, although relative growth rates are projected to be high in several other countries. By 2025, worldwide coal use increases by approximately 60 percent over 2002 levels in the reference case and by nearly 80 percent in the high economic growth scenario.

World Energy Council Projections

The World Energy Council (WEC) is an independent organization that draws on national studies and data from member countries to project worldwide energy consumption. Recently, it developed six scenarios for future global primary energy supply and the associated carbon dioxide emissions (expressed as emissions of carbon) to 2050 (WEC, 2006): Case A1, high growth with emphasis on increased use of oil and gas; Case A2, high growth and coal intensive; Case A3, high growth with emphasis on natural gas, new renewables, and nuclear energy; Case B, a middle-course reference case most often cited for comparison purposes; Case C1, an “ecologically driven” climate policy scenario involving carbon constraints together with a phase-out of nuclear energy; and Case C2, which is similar to C1 but with nuclear power playing an expanded role.

The major factors considered in the WEC projections are world population, world economic growth, and world primary energy intensity. The product of these three factors results in a primary energy demand that is from 1.7 to 2.8 times greater in 2050 than the 1990 world energy demand (Table 2.5). An absolute reduction in coal consumption is projected for the two scenarios (C1, C2) in which a carbon dioxide emission constraint is included. For these two scenarios, worldwide carbon emissions in 2050 fall to below 1990 levels. A third scenario, which emphasizes natural gas, renewables, and nuclear energy (A3), results in no gain or loss in the amount of coal utilized in 2050. The remaining cases project world coal use to roughly double (A1, B) or nearly quadruple (A2) in the absence of a carbon constraint.

TABLE 2.5 Projections of the Components of Global Primary Energy Supplya and Carbon Emissionsb in 2050 for Six Scenarios, Compared to 1990 Values

|

|

1990 Value |

2050 Scenarios |

|||||

|

|

A1 |

A2 |

A3 |

B |

C1 |

C2 |

|

|

Coal |

2.2 |

3.8 |

7.8 |

2.2 |

4.1 |

1.5 |

1.5 |

|

Oil |

3.1 |

7.9 |

4.8 |

4.3 |

4.0 |

2.7 |

2.6 |

|

Gas |

1.7 |

4.7 |

5.5 |

7.9 |

4.5 |

3.9 |

3.3 |

|

Nuclear |

0.5 |

2.9 |

1.1 |

2.8 |

2.7 |

0.5 |

1.8 |

|

Hydro |

0.4 |

1.0 |

1.1 |

1.1 |

0.9 |

1.0 |

1.0 |

|

New renewables |

0.2 |

3.7 |

3.8 |

5.7 |

2.8 |

3.8 |

3.2 |

|

Traditional biomass |

0.9 |

0.8 |

0.7 |

0.8 |

0.8 |

0.8 |

0.8 |

|

Total (Gtoe) |

9.0 |

24.8 |

24.8 |

24.8 |

19.8 |

14.2 |

14.2 |

|

Carbon emissions (GtC) |

6.0 |

11.7 |

15.1 |

9.2 |

10.0 |

5.4 |

5.0 |

|

aGigatons of oil equivalent (Gtoe). bGigatons of carbon (GtC). SOURCE: Used by permission of World Energy Council, London, http://www.worldenergy.org. |

|||||||

ExxonMobil Projections

ExxonMobil Corporation prepares an annual energy outlook that currently presents projections to 2030 (ExxonMobil, 2005). The primary drivers for its energy projections are population growth and gross domestic product (GDP). ExxonMobil estimates a rapid growth in GDP in the developing countries, especially China and India. Secondary factors are efficiency improvements (which reduce energy intensity), changing trends in future consumption patterns, and competition between fuels and available supply. This outlook does not include a carbon constrained case. The growth rate for total energy from 2003 to 2030 is projected to be 1.6 percent, and the growth rate for coal for that period is slightly higher at 1.8 percent per annum. This gain in coal production would result in a 62 percent increase in world coal utilization in the 27 years from 2003 to 2030.

The increase in world coal consumption is also projected on a regional basis, with coal demand in North America and Europe increasing at a modest annual rate of 0.4 and 0.1 percent, respectively, while the Asia Pacific region increases at a much greater rate of 3.1 percent per annum driven by economic growth and large indigenous coal resources.

International Energy Agency Projections

The International Energy Agency (IEA) regularly monitors global energy developments and periodically publishes a World Energy Outlook (WEO) (e.g., IEA, 2006a) as well as other special studies. Its most recent study uses the IEA Energy Technology Perspectives model to project world energy use to 2050 for

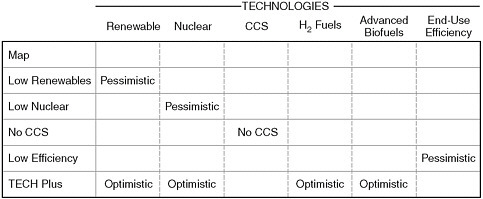

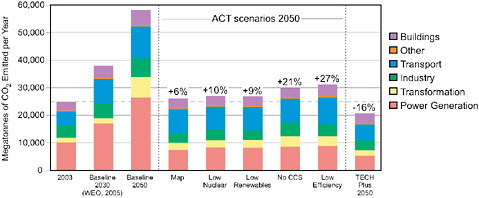

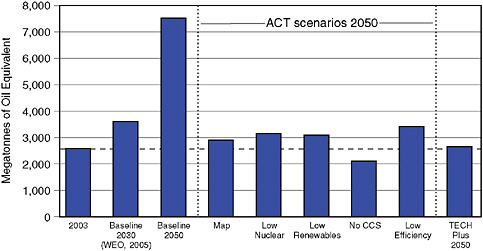

six cases called the Accelerated Technology (ACT) and TECH Plus scenarios that are intended to reduce the growth in global CO2 emissions relative to the IEA Baseline Scenario (IEA, 2006b). Figure 2.7 describes the nature of the six energy technology scenarios. “ACT Map” refers to an accelerated technology development scenario that is relatively optimistic across all technology areas and results in stabilization of future CO2 emissions; the remaining scenarios are compared (or “mapped”) to the ACT Map scenario. Figure 2.8 shows the resulting effect on global CO2 emissions, and Figure 2.9 shows the impacts on global coal use relative to the WEO reference case scenario.

FIGURE 2.7 Overview of scenario assumptions for the International Energy Agency ACT and TECH Plus scenarios compared to the ACT Map scenario. SOURCE: Energy Technology Perspectives © IECD.UEAM 2996, Table 2.1, p. 43.

FIGURE 2.8 International Energy Agency projections of global CO2 emissions for the Baseline, ACT, and TECH Plus scenarios. SOURCE: Energy Technology Perspectives © IECD.UEAM 2996, Figure 2.1, p. 46 (as modified).

FIGURE 2.9 International Energy Agency projections of global coal use for the Baseline, ACT, and TECH Plus scenarios. SOURCE: Energy Technology Perspectives © IECD. UEAM 2996, Figure 2.12, p. 66 (as modified).

In the IEA Baseline Scenario, world coal use in 2050 is nearly three times greater than in 2003, and its share of world energy demand grows from 24 percent in 2003 to 34 percent in 2050. With the accelerated technology scenarios, the increase in coal use is much smaller, exceeding 2003 levels by no more than about 25 percent by 2050. In the absence of CCS technology, 2050 coal use falls below 2003 levels. In all but one of the six technology scenarios in Figure 2.8, global CO2 emissions still exceed 2003 levels but are sharply reduced relative to the Baseline Scenario.

European Commission Projections

In 2003, the European Commission (EC) published World Energy, Technology, and Climate Policy Outlook (WETO), an extensive analysis that includes projections to 2030 for the use of all forms of energy (EC, 2003). The EC developed two scenarios—a business-as-usual case (the reference scenario) and a carbon abatement scenario.

For the reference scenario, worldwide energy demand in 2030 is projected to be 17.1 Gtoe (gigatons of oil equivalent), based on a 1.8 percent annual rate of increase. For the carbon abatement scenario, the energy demand is projected to be 15.2 Gtoe, based on an annual 1.3 percent rate of increase. The worldwide demand for coal in 2030 is projected to be 4.7 Gtoe in the reference scenario and 2.7 Gtoe in the carbon abatement case. These projections indicate that world coal consumption would nearly double from 2000 to 2030 in the reference case,

TABLE 2.6 Comparison of Projections for World Coal Demand by Different Organizations

but would increase by only 13 percent in the carbon abatement case. The WETO projection for primary coal production in North America in 2030 is 1,011 Mtoe (million tons of oil equivalent), representing a growth rate of 1.7 percent per annum from 2010 to 2030 in the absence of a carbon constraint.

The European Commission report compares the WETO projections to those made by the EIA, IEA, and WEC (using the WEC high-growth, coal-intensive scenario A2). The projections from the four agencies do not vary significantly (Table 2.6), and the two that project to 2030 both indicate a doubling of worldwide coal utilization by that time. There would be a much greater difference in projected coal consumption estimates if scenarios with carbon abatement had been included.

Projections by the Intergovernmental Panel on Climate Change

The Intergovernmental Panel on Climate Change (IPCC) has examined a broad range of world energy scenarios (IPCC, 2001) and used selected scenarios in a recent evaluation of CCS and renewable energy sources as a potential climate change mitigation measure for fossil fuel power plants and other major CO2 sources (IPCC, 2005). IPCC comparison of results from two large-scale models used to project future world energy trends shows that both models project future coal use to remain relatively constant, with increasing use of CCS over time, for a policy scenario aimed at stabilizing atmospheric CO2 concentrations at 550 parts per million by volume (approximately twice the pre-industrial level) by the end of this century (IPCC, 2005).

HOW WELL DO MODELS PREDICT REALITY?

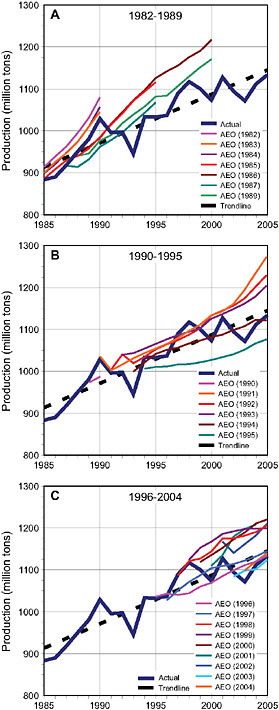

Comparisons of actual coal production in the United States with projections produced by the U.S. Energy Information Administration illustrate the uncer-

tainties inherent in such forecasts. EIA reference case forecasts are based on conditions prevailing at the time they were made and do not take into account alternative policy scenarios such as those discussed above.

EIA coal production projections made during the period of rapid growth between 1982 and 1989 significantly overestimated actual production, as well as rates of production increases, over a 10-year period (Figure 2.10A). Coal production projections were more realistic during the 1990 to 1993 period of recession and more pessimistic in 1994 and 1995 after three years of rapid decrease in production (Figure 2-10B). Projections made between 1996 and 2004 overestimated production during and following a period of sustained economic growth (1994 to 1998) (Figure 2-10C). Data were not available to compare actual versus projected coal production over longer periods (e.g., 25 years).

These historical EIA reference case projections indicate that there is a tendency to overestimate future production when production is rapidly increasing and to underestimate future production when production is decreasing. When projections are made 10 years ahead, these estimation errors are of the order of 50 to 100 million tons per year of coal production, or approximately 5 to 10 percent of total U.S. production. These errors are likely to increase when longer periods and other scenarios are considered. Thus, while the trends predicted by the future scenarios described earlier are indicative of how coal production may be influenced by various factors, actual values could be significantly higher or lower than projected.

FINDINGS—PROJECTIONS FOR FUTURE COAL PRODUCTION AND USE

While many factors will affect the future use of coal in the United States and globally over the next 25 years or more, recent analyses of coal production and use over the next few decades indicate the following key conclusions:

-

Projections show that future coal use depends primarily on the timing and magnitude of potential regulatory limits on CO2 emissions, on the future demand for electricity, on the prices and availability of alternative energy sources for electric power generation, and on the availability of carbon capture and sequestration technology.

-

Over the next 10 to 15 years (until about 2020), coal production and use in the United States are projected to range from about 25 percent above to about 15 percent below 2004 levels, depending on economic conditions and environmental policies. By 2030, the range of projected coal use in the United States broadens considerably, from about 70 percent above to 50 percent below current levels.

-

At present, coal imports and exports represent small fractions of total U.S. coal production and use. Projections indicate that imports and exports are expected to remain relatively small.

-

Globally, the largest tonnage increases in coal use are expected in the emerging economies of China and India. Much smaller tonnage growth is projected in the rest of the world, although relative grow rates are projected to be high in several other countries. Again, however, there is great uncertainty in global coal use projections, especially beyond about 2020.