4

SBIR Program Outputs

4.1

INTRODUCTION

Congress has tasked the National Academies to assess whether and to what extent the Small Business Innovation Research (SBIR) program has met the congressionally-mandated objectives for the program, and to suggest possible areas for improvement in program operations. Congress has, over the years, identified a number of objectives for the program, and these mandated objectives can be summarized as follows:

-

Supporting the commercialization of federally funded research.

-

Supporting the agency’s mission.1

-

Supporting small business and, in particular, woman- and minority-owned businesses.

-

Expanding the knowledge base.

Congress has not prioritized among the four objectives, although report language and discussions with congressional staff suggest that commercialization has become increasingly important to Congress. Still, it remains important to assess each of the four objectives, and each should therefore be taken as equally important in evaluating the achievements and challenges of the SBIR program. These four objectives help to define the structure and content of this chapter.

Assessing program outcomes against these four objectives entails numerous methodological challenges. These challenges are discussed in detail in the National Research Council’s (NRC) Methodology Report.2

4.1.1

Compared to What?

Assessment usually involves comparison—comparing programs and activities, in this case. Three kinds of comparison seem possible: with other programs at each agency, between SBIR programs at the various agencies, and with early-stage technology development funding in the private sector, such as venture capital activities. Yet, the utility of each of these three types of comparison is limited.

Other award programs at the agencies have fundamentally different objectives, such as promoting basic research through grant programs (at the National Institutes of Health [NIH] and the National Science Foundation [NSF]), developing capacity (awards for university infrastructure), or training. There are often no other dedicated programs for innovative small businesses. And no other programs for small businesses have as a primary goal the commercial exploitation of research. This fundamental difference in objectives makes it difficult to usefully compare an SBIR program with other programs at the relevant agency.

Comparisons between SBIR programs at different agencies appear superficially more useful, but must be regarded with considerable caution. As discussions in Chapter 1 of this volume and in the separate agency volumes indicate, the widely differing agency missions have shaped the agency SBIR programs, focusing them on different objectives and on different mechanisms and approaches. Agencies whose mission is to develop technologies for internal agency use via procurement—notably the Department of Defense (DoD) and the National Aeronautics and Space Administration (NASA)—have a quite different orientation from agencies that do not procure technology and are instead focused on developing technologies for use outside the agency.

Finally, SBIR might be compared with venture capital (VC) activities, but there are important differences. VC funding is typically supplied later in the development cycle when innovations are in, or close to, market—most venture investments are made with the expectation of an exit from the company within three years. VC investments are typically larger than SBIR awards—the average investment made by VC firms in a company was over $7 million in 2005,

|

BOX 4-1 Multiple Sources of Bias in Survey Response Large innovation surveys involve multiple sources of bias that can skew the results in both directions. Some common survey biases are noted below.a

|

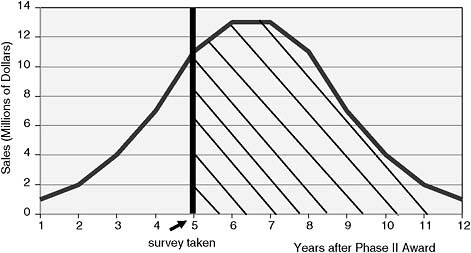

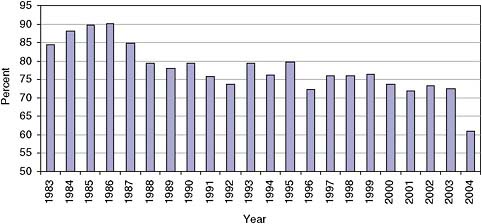

FIGURE B-4-1 Survey bias due to commercialization lag. These sources of bias provide a context for understanding the response rates to the NRC Phase I and Phase II Surveys conducted for this study. For the NRC Phase II Survey, of the 4,523 firms that could be contacted out of a sample size of 6,408, 1,916 responded, representing a 42 percent response rate. The NRC Phase I Survey captured 10 percent of the 27,978 awards made by all five agencies over the period of 1992 to 2001. See Appendix A and B for additional information on the surveys.

|

compared to less than $1 million for SBIR over a two to three year cycle.3 VC investments are also focused on companies, not projects, and often come both with substantial management support and influence (e.g., through seats on the company’s board). None of this is true for SBIR.

The lack of available comparators means that we must assess each program in terms of the benchmarks developed to review the program in the Methodology report described below.4

4.2

COMMERCIALIZATION

4.2.1

Challenges of Commercialization

Commercialization of the technologies developed under the research supported by SBIR awards has been a central objective of the SBIR program since its inception. The program’s initiation in the early 1980s, in part, reflected a concern that American investment in research was not adequately deployed to the nation’s competitive advantage. Directing a portion of federal investment in R&D to small businesses was thus seen as a new means of meeting the mission needs of federal agencies, while increasing the participation of small business and thereby the proportion of innovation that would be commercially relevant.5

Congressional and Executive branch interest in the commercialization of SBIR research has increased over the life of the program.

A 1992 GAO study6 focused on commercialization in the wake of congressional expansion of the SBIR program in 1986.7 The 1992 reauthorization specifically “emphasize[d] the program’s goal of increasing private sector com-

|

3 |

2005 saw some 3,000 deals worth an average of $7.35 million according to data from National Venture Capital Association. See National Venture Capital Association Web site, <http://www.nvca.org/ffax.html>. |

|

4 |

For a discussion of this and related methodological challenges, see, National Research Council, An Assessment of the Small Business Innovation Research Program: Project Methodology, op. cit. |

|

5 |

A growing body of evidence, starting in the late 1970s and accelerating in the 1980s indicates that small businesses were assuming an increasingly important role in both innovation and job creation. See, for example, J. O. Flender and R. S. Morse, The Role of New Technical Enterprise in the U.S. Economy, Cambridge, MA: MIT Development Foundation, 1975, and David L. Birch, “Who Creates Jobs?” The Public Interest, 65:3-14, 1981. Evidence about the role of small businesses in the U.S. economy gained new credibility with the empirical analysis by Zoltan Acs and David Audretsch of the U.S. Small Business Innovation Data Base, which confirmed the increased importance of small firms in generating technological innovations and their growing contribution to the U.S. economy. See Zoltan Acs and David Audretsch, “Innovation in Large and Small Firms: An Empirical Analysis,” The American Economic Review, 78(4):678-690, September 1988. See also Zoltan Acs and David Audretsch, Innovation and Small Firms, Cambridge, MA: The MIT Press, 1990. |

|

6 |

U.S. General Accounting Office, Federal Research: Small Business Innovation Research Shows Success But Can be Strengthened, GAO/RCED-92-37, Washington, DC: U.S. General Accounting Office, 1992. |

|

7 |

PL 99-443, October 6, 1986. |

mercialization of technology developed through federal research and development.”8 The 1992 reauthorization also changed the order in which the program’s objectives are described, moving commercialization to the top of the list.9

The term “commercialization” means “reaching the market,” which some agency managers interpret as “first sale”—that is, the first sale of a product in the market place, whether to public or private sector clients. This definition, however, misses significant components of commercialization that do not result in a discrete sale. It also fails to provide any guidance on how to evaluate the scale of commercialization, an important element in assessing the degree to which SBIR programs successfully encourage commercialization. The metrics for assessing commercialization can also be elusive,10 and it is important to understand that it is not possible to completely quantify all commercialization from a research project:

-

The multiple steps needed after the research has been concluded mean that a single, direct line between research inputs and commercial outputs rarely exists in practice; cutting edge research is only one contribution among many leading to a successful commercial product.

-

Markets themselves have major imperfections, or information asymmetries so high quality, even path-breaking research, does not always result in commensurate commercial returns.

-

The lags involved in the timeline between an early stage research project and a commercial outcome mean that for a significant number of the more recent SBIR projects, commercialization is still in process, and sales—often substantial sales—will be made in the future. The current “total” sales are in this case just a “snapshot half way through the race,” and will require updating as the full impact of the award becomes apparent in sales.

-

Yet the impact of SBIR awards also needs to be qualified. Research rarely results in stand-alone products. Often, the output from an SBIR project is combined with other technologies. The SBIR technology may provide a critical element in developing a winning solution, but that commercial impact—the sale of the larger combined product—is not captured in the data.

-

In some cases, the full value of an “enabling technology” that can be used across industries is difficult to capture.

All this is to say that commercialization results must be viewed with caution, first because our ability to track them is limited (indeed it appears highly likely that our efforts at quantification of research awards may understate the true commercial impact of SBIR projects) and because an award, and a successful project, cannot lay claim to all subsequent commercial successes, though it may contribute to that success in a significant fashion.

These caveats notwithstanding, it is possible to deploy a variety of assessment techniques to measure commercialization outcomes.

4.2.2

Commercialization Indicators and Benchmarks

This report uses three sets of indicators to quantitatively assess commercialization success:

-

Sales and Licensing Revenues (“sales” hereafter, unless otherwise noted). Revenues flowing to a company from the commercial marketplace and/or through government procurement constitute the most obvious measure of commercial success. They are also an important indicator of uptake for the product or service. Sales indicate that the result of a project has been sufficiently positive to convince buyers that the product or service is the best available solution.

Yet if there is general agreement that sales are a key benchmark, there is no such agreement on what constitutes “success.” Companies, naturally enough, focus on projects that contribute to the bottom line—that are profitable. Agency staff provide a much wider range of views. Some view any sales a substantial success for a program focused on such an early stage of the product and development cycle, while others seem more ambitious.11 Some senior executives in the private sector viewed only projects that generated cumulative revenues at $100 million or more as a complete commercial success.12

Rather than seeking to identify a single sales benchmark for “success,” it therefore seems more sensible to simply assess outcomes against a range of benchmarks reflecting these diverse views, with each marking the transition to a greater level of commercial success:

-

- Reaching the market—a finished product or service has made it to the marketplace

-

Reaching $1 million in cumulative sales (beyond SBIR Phases I and II)—the approximate combined amount of standard DoD Phase I and Phase II awards

-

Reaching $5 million in cumulative sales—a modest commercial success that may imply that a company has broken even on a project

-

Reaching $50 million in cumulative sales—a full commercial success.

-

Phase III Activities Within DoD. As noted above, Phase III activities within DoD are a primary form of commercialization for DoD SBIR projects. These activities are considered in Section 4.3 (Agency Mission) of this report and Chapter 5 (Phase III Challenges and Opportunities) of the DoD report.13

-

R&D Investments and Research Contracts. Further R&D investments and contracts are good evidence that the project has been successful in some significant sense. These investments and contracts may include partnerships, further grants and awards, or government contracts. The benchmarks for success at each of these levels should be the same as those above, namely:

-

Any R&D additional funding

-

Additional funding of $1 million or more

-

Additional funding of $5 million or more

-

Funding of $50 million or more

-

-

Sale of Equity. This is a clear-cut indicator of commercial success or market expectations of value. Key metrics include:

-

Equity investment in the company by an independent third party

-

Sale or merger of the entire company

-

4.2.3

Sales and Licensing Revenues

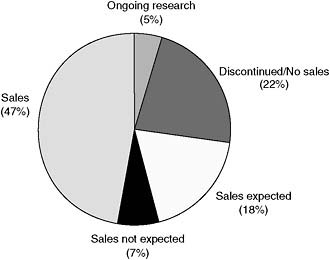

The most basic of all questions on commercialization is whether results from a project reached the marketplace. The NRC Phase II Survey14 indicates that just under half (47 percent) of respondents had generated some sales, and that a further 18 percent still expected sales, though they had none at the time of the survey. In addition, 5 percent were still in the research stage of the project.

|

13 |

National Research Council, An Assessment of the SBIR Program at the Department of Defense, Charles W. Wessner, ed., Washington, DC: The National Academies Press, 2009. |

|

14 |

Much of the primary data in this section of the report was derived from the NRC’s Phase II Survey. See Appendix A for additional information about the NRC’s Phase II Survey, including response rates. |

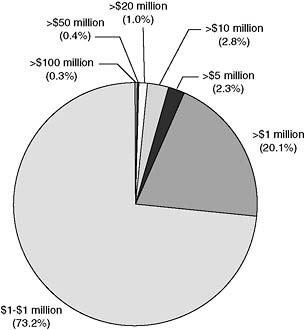

FIGURE 4-1 Sales from Phase II projects.

SOURCE: NRC Phase II Survey.

There is variation among the agencies, but these data are consistent with program objectives.15

4.2.3.1

Distribution of Sales

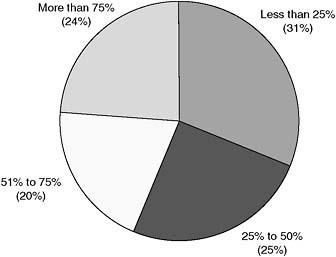

Research on early-stage financing strongly suggests a pronounced skew to the results, and this turns out to be the case. Most projects that reach the market generate minimal revenues. A few awards generate substantial results, and a small number bring in large revenues.

Of the 790 SBIR Phase II projects reporting sales greater than $0, average sales per project were $2,403,255. Over half of the total sales dollars were due to 26 projects (1.4 percent of the total), each of which had $15,000,000 or more in sales. The highest cumulative sales figure reported was $129,000,000.

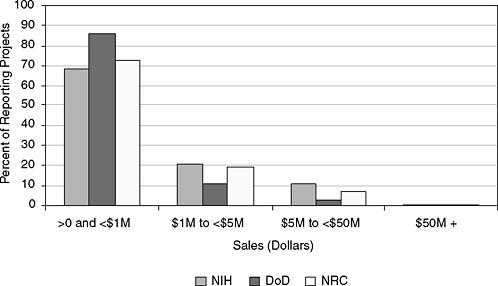

This distribution is reflected in Figure 4-2.

Almost three quarters of the projects reporting sales greater than zero had $1 million or less in sales; two projects reported sales greater than $100 million. The latter by themselves accounted for 16.5 percent of all the revenues reported; together, the 1.7 percent of respondents reporting sales greater than $20 million accounted for 43.7 percent of all revenues reported.

These distributions are similar to those reported from other SBIR data

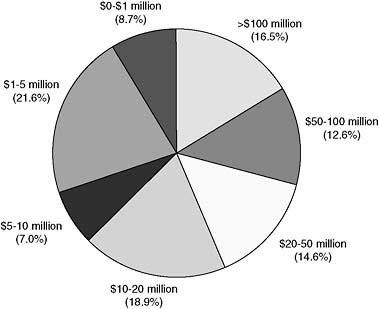

FIGURE 4-4 NIH sales by sales range (percent of projects in each range). Total for 1992-2002.

SOURCE: NIH data, NRC Phase II Survey, and DoD Commercialization database.

sources.16 For example, at NIH, sales data are available from the NRC survey, a previous NIH survey, and the DoD commercialization database.17 These data in Figure 4-4 show that about 10 percent of NIH projects that report any revenues report more than $5 million.

4.2.3.2

Sales Expectations

Because it may take years after the end of a Phase II for a commercial product to reach the market, many projects that do not yet report sales still expect them eventually. About 36 percent of NRC survey respondents with no sales (19 percent of all projects) still expected sales in the future. Analysis elsewhere suggests that these expectations are often optimistic, and that a considerably smaller number of these projects will, in the end, reach the market.

However, it is equally important to note that a complete accounting of all sales from the projects funded during 1992-2001 (the focus of the NRC survey) will be possible only some years in the future. Many projects have only recently reached the market, so the bulk of their sales will be made in the future and are

|

16 |

See National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, op. cit., Chapter 4, where data from the DoD Commercialization database and the NIH Phase II Survey are compared with the NRC data. |

|

17 |

The DoD database captures commercialization data from NIH projects where the firm subsequently applied for a DoD SBIR award. |

TABLE 4-1 Most Important Customer (Percent of Responses)

|

Most Important Customer |

Percent of Responses |

|

Domestic private sector |

35 |

|

Department of Defense (DoD) |

32 |

|

Prime contractors for DoD or NASA |

10 |

|

NASA |

2 |

|

Other federal agencies |

1 |

|

State or local governments |

4 |

|

Export markets |

14 |

|

Other |

2 |

|

SOURCE: NRC Phase II Survey. |

|

not captured in these survey data, which effectively capture initial sales (see Box 4-2).

4.2.3.3

Sales by Sector

The NRC Phase II Survey asked respondents to identify the customer base for the products. There are substantial differences between agencies. Only 1 percent of NIH respondents, for example, reported sales to DoD, in contrast to 38 percent for DoD respondents.18

4.2.3.4

Licensee Sales and Related Revenues

The indirect impact of licensee sales, where survey respondents report sales not made by their own company, is an important measure of success. These data are important as an indicator of the extended effects of SBIR beyond the immediate awardee company. However, they should be treated with an additional degree of caution, as respondents do not necessarily have as accurate information about another company as they have about their own.

Licensing activity within the program is significant: Just over 35 percent reported a finalized licensing agreement or ongoing negotiations towards one.19

Just over 5 percent of respondents reported licensee sales greater than $0, with three licenses reporting more than $70 million in sales each and accounting for more than half of all reported licensee sales. One project alone reported more than $200 million in licensee sales.

As the case study in Box 4-3 indicates, in some cases licensing has been pivotal in the commercialization of a successful technology: In some industries, there are no alternatives to using established channels.

|

18 |

See Chapter 4 in National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, op. cit. |

|

19 |

Eighteen percent of responding projects (242 firms) reported finalized licensing agreements, and 19 percent (249 firms) reported ongoing negotiations. NRC Phase II Survey, Question 12. |

|

BOX 4-2 Underestimating Commercial Outcomes from the SBIR Program: The Impact of Systematic Characteristics of Survey Analysis Among the SBIR agencies, only DoD requires that firms enter commercialization data into a database when applying for subsequent awards. This detailed database is a powerful source of information, primarily about DoD-oriented firms and projects. We would recommend that other agencies consider making the same requirement, and utilizing the existing DoD database for this purpose to minimize costs. In the absence of such data, analysis of commercialization at the other SBIR agencies continues to rely on survey data. These data have important strengths and weaknesses. The NRC survey and the NIH survey instruments were sent to all SBIR Phase II recipients from 1992 onward. This is the first effort to generate responses from the entire population of winning firms. The data generated are the best available for these agencies. However, there are two key sets of limitations, both of which have the effect of understating—perhaps very substantially—the amount of commercialization achieved. These two limitations can be called the “multiple awards effect” and the “snapshot effect.” The Multiple Awards Effect Because some firms have received many awards, it is not feasible or reasonable to expect them to answer a similar questionnaire about each award that they received. As a result, both the NIH and NRC surveys limited the number of questionnaires sent to multiple winners. NIH sent one survey per firm, allocating one randomly to a specific project at multiple award firms. The NRC sent questionnaires about all projects to firms that had won three awards or less. It sent questionnaires to a sampling of the awarded projects for firms with more than three awards. In both cases (somewhat less so for the (NRC), the effect has been to bias survey responses away from firms with multiple awards. This matters when there are systemic differences between the results provided by these different groups of firms. And the NRC survey indicates that firms with multiple awards are, in fact, likely to generate significantly higher levels of commercialization than are firms with smaller numbers of awards. Using data from the DoD commercialization database to test this hypothesis, we found that firms receiving more than 15 awards generated an average of $1.39 million in sales per project; firms with fewer than 15 awards generated only $0.75 million per project. Firms with more awards generated on average 85 percent more sales per project. Thus, the response bias in both NIH and NRC Phase II Surveys appear likely to have a significant downward impact on commercialization estimates. The Snapshot Effect Well-designed surveys provide an important insight into outcomes from SBIR projects. Necessarily, however, they provide a view of outcomes at the moment that the survey was completed. For almost all products and services, sales follow some form of bell-shaped curve: |

|

relatively slow sales as they begin market penetration, growth in sales until the market is saturated or competing products emerge, and decline until the product has been superseded. The shape of the curve differs between products, of course, and the entire curve can be completed in a matter of months for some software sales, or in decades for niche products in extremely long cycle industries (e.g., weapons platforms). The survey, however, essentially takes a cross-section of the bell curve. It asks about levels of commercialization at a particular point in time. In essence, it asks about past sales, but can generate little reliable data on future sales. Thus the average sales data generated by surveys reflects average sales to date. Using some simple analytic techniques, it is possible to suggest that on average, the NIH and NRC surveys excluded approximately 50 percent of the total lifetime sales of the products and services generated from SBIR awards. And this hypothesis is at least supported by recent data from NIH, where the first resurvey of firms was done in 2005, three years after the initial 2002 survey. Results from the survey indicate that the number of firms with some sales increased from 29 percent of surveyed firms to 63 percent (this reflects the number of firms still in precommercialization at the time of the first survey). The Recent Awards Effect The snapshot effect is further complicated by the distribution of responses to the surveys. Two factors help tilt responses toward awards from more recent years. First, the number of awards has been rising rapidly, especially at NIH and DoD since the late 1990s. As a result, a larger number of awards are concentrated in recent years. Second, firms with awards from many years ago are harder to find, and are less likely to respond to surveys. As one commentator notes, “there are no SBIR shrines” at SBIR recipient companies—no one may remember receiving an award 10 years ago; the company may be out of business; the principal investigator (PI) may have left. As a result, more recent awards generate a higher percentage response rate. The results of the factors are clear. At the NIH, of the original 758 survey respondents, 258—34 percent of all respondents—reached the market after the date of the first survey. The first survey captured less than half of the projects that had reached the market three years later, in 2005. This is unsurprising (although it is important). Responses come preponderantly from projects where awards were made relatively recently—and where the snapshot effect is particularly important, as many are still in the early commercialization or even late development (precommercialization) phases of their projects. Thus the recent awards effect too tends to reduce commercialization estimates. Conclusions It is at this stage not possible to provide accurate estimates for the impact of these effects on commercialization estimates drawn from surveys. The limited evidence available to date, notably the analysis of the NIH second snapshot discussed above, suggests that the effect may be to substantially reduce commercialization estimates. This analysis strongly suggests that follow-up surveys will be especially important, as they provide critical data for making precisely the assessments and modifications to the analysis that will be necessary to improve accuracy in the future. |

|

BOX 4-3 Licensing Case Study Applied Health Science and the Wound and Skin Intelligence System™ Applied Health Science (AHS) received a Phase I award to validate and automate the Pressure Sore Status Tool, a standardized assessment instrument for use in field settings for describing and tracking status changes in chronic wounds (e.g., pressure ulcers). The WSIS (Wound and Skin Intelligence System™ or WSIS™) provides clinicians with the ability to assess risk and request a “case specific” prevention plan for reducing the probabilities that a wound will develop. The system tracks prevention and treatment outcomes over time, and relates these outcomes to individual risk and wound profiles and interventions employed. Thus, the system has the capacity to “learn” from its own experience. The product was commercialized through the sale of rights to ConvaTec, a wholly owned unit of Bristol Myers-Squibb that is the largest wound products company in the world. ConvaTec funded commercialization, receiving in exchange licensing rights. This merged AHS technology and research capabilities with ConvaTec’s global marketing power—the brand has a presence in about 80 countries worldwide. ConvaTec subsequently bought all rights to the software. AHS retained the worldwide data “pipelines,” warehouse, and analytical functions. AHS also has a right-to-first-review for any elaborations of, or changes in the system. AHS has announced current projections of $30 million in annual sales from the U.S. market alone, and expects to add one employee for each 75 users of the system. AHS and ConvaTec are also forming a series of strategic alliances with companies prepared to supply or develop add-on capabilities. SOURCE: National Institutes of Health, <http://grants1.nih.gov/grants/funding/sbir_successes/sbir_successes.htm>. |

4.2.4

Additional Investment Funding

Further investment in a recipient company related to the SBIR award project is another indication that the project work is of value. On average, SBIR projects received almost $800,000 from non-SBIR sources, with over half of respondents (51.6 percent) reporting some additional funds for the project from a non-SBIR source.20

Focusing just on the 839 projects that reported receiving more than $0 in additional funding, these projects reported average additional funding of $1,538,438, with almost $260,000 from federal agencies themselves, mostly from DoD. Three hundred eighteen projects reported some federal funding, averag-

TABLE 4-2 Sources of Additional Investments in SBIR Projects

|

Source |

Average Amount ($) |

|

a. Non-SBIR federal funds |

259,683 |

|

b. Private Investment |

|

|

(1) U.S. venture capital |

164,060 |

|

(2) Foreign investment |

40,682 |

|

(3) Other private equity |

125,690 |

|

(4) Other domestic private company |

64,304 |

|

c. Other sources |

|

|

(1) State or local governments |

9,329 |

|

(2) College or universities |

1,202 |

|

d. Not previously reported |

|

|

(1) Your own company |

113,454 |

|

(2) Personal funds |

15,706 |

|

Total |

$794,110 |

|

SOURCE: NRC Phase II Survey. |

|

ing just under $1.6 million per project. At DoD, just over 30 percent of projects (205) reported additional federal funding outside SBIR, averaging just over $1.6 million per project.

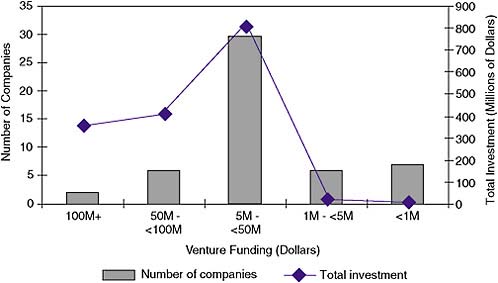

About $165,000 per project came from venture capital sources. However, in those cases where venture funding was present, the amounts of funding were substantial: For the 50 responding projects with VC funding, the average per project was just under $8.3 million.

These figures reflect the well-known concentration of venture funding on a few, highly desirable projects. They also show that SBIR supports a wide range of projects which do have commercial prospects (as well as other possible benefits) that are not likely to be funded by venture capital.

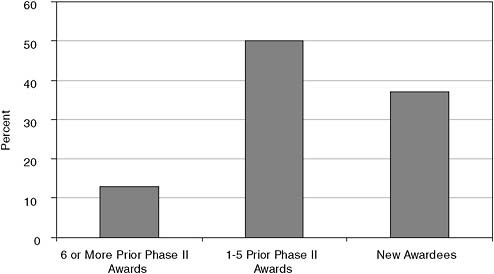

Focusing more closely on venture funding at NIH, initial research indicates that approximately 50 of the 200 companies that won the most Phase II awards at NIH have received some venture funding.21 This is reflected in Figure 4-5.

Total VC investment is approximately $1.59 billion in these 50 companies, a total that dwarfs the $272 million NIH SBIR investment in these companies.

In addition, the NRC Firm Survey determined that 15 firms had had initial public offerings, and that a further six firms planned such offerings for 2005-2006. SBIR firms also generate a significant number of new companies. Fourteen percent of responding firms indicated they had formed a spin-off company, with a total of 242 spin-off companies reported.

In contrast to the tightly concentrated distribution of venture funding, inter-

|

21 |

Venture funding of awardees at NIH is discussed in more detail in Chapter 4 of the NIH report, National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, op. cit. |

FIGURE 4-5 Distribution of venture funding for NIH top 200 Phase II winners.

SOURCE: VentureSource and other venture capital databases; National Institutes of Health awards database. See also National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, Charles W. Wessner, ed., Washington, DC: The National Academies Press, 2009.

nal funding was by far the most widespread form of support, being reported by almost 50 percent of all respondents. Average internal funding ($113,000), was much lower than average venture funding.

About 7 percent of all respondents reported receiving “other private equity.” This funding averaged $1.9 million per project for those projects receiving this kind of funding. Investments from government and academic sources were relatively scarce (less than 5 percent of respondents), and provided relatively small amounts (just over $225,000 per respondent receiving these funds).

4.2.5

Additional SBIR Funding

Aside from providing non-SBIR funds, the federal government in many cases makes further investments via the SBIR program itself. The NRC surveys asked respondents how many additional Phase I and Phase II awards followed each initial award, related to the original project.

About 40 percent of respondents reported receiving at least one additional related Phase II award, and slightly over half (53.8 percent) reported at least one additional Phase I award.

Relatively few projects received many related awards: Only 8.4 percent of respondents reported at least 5 related Phase I awards, and 9.7 percent received at least three related Phase IIs. This suggests that the “clustering” hypothesis—that

TABLE 4-3 Related SBIR Awards

SBIR type projects often require multiple awards, sometimes looping back to Phase I, before reaching the market—only applies to a limited number of projects, although case studies (e.g., SAM Technologies22) indicate that there are also important cases where such clustering does occur. In short, the data suggest that some companies and projects do attract a cluster of SBIR awards, but most do not. It may be, however, that this concentration of clustered awards reflects the limited number of commercial successes as well. Just under one half of respondents (47 percent) reported no additional related Phase I awards, and 60 percent reported no related Phase II.

4.2.6

SBIR Impact on Further Investment

Both the NRC and NIH Surveys sought additional information about the impact of the SBIR program on company efforts to attract third party funding—the

“halo effect” mentioned by some interviewees, who suggested that an SBIR award acted as a form of validation for external inventors.23

The fact that two-thirds of SBIR respondents did not attract outside funding, and that only 3.5 percent received venture funding, suggests that receiving a Phase II SBIR award does not in itself guarantee external funding. Survey responses from other surveys did, however, paint a more positive picture of these effects: 78 percent of NIH respondents said that they believed that additional capital had “resulted from” their SBIR participation—a strong statement.24

Case study interviews provided mixed views on this, with some interviewees strongly supporting the view that SBIR helps to attract investment and others suggesting that SBIR awards had had relatively little impact, although these views obviously reflect individual company experiences.

4.2.7

Small Company Participation and Employment Effects

Employment is another indicator of commercial success and also that the program is supporting small business.

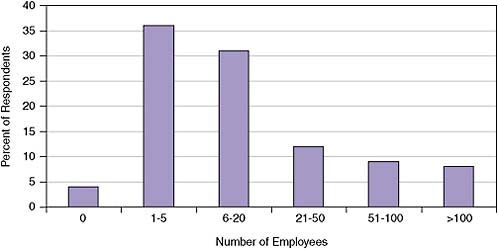

The median size of a company receiving SBIR awards is relatively small—far lower than the 500-employee limit imposed by the SBA (see Figure 4-6).

The program focuses the bulk of its awards on very small companies. More than a third of awardees had between one and five employees at the time of award. A very substantial number (seventy percent) of respondent companies had 20 employees or fewer at the time of the Phase II award.

The NRC Survey sought detailed information about the number of employees at the time of the award and at the time of the survey and about the direct impact of the award on employment. Overall, the survey data showed that the average employment gain at each responding firm from the date of the SBIR award to the time of the survey was 29.9 full-time equivalent employees. Of course, very few of the companies that went out of business responded to the survey, so this question is particularly skewed toward firms that have been at least somewhat successful.

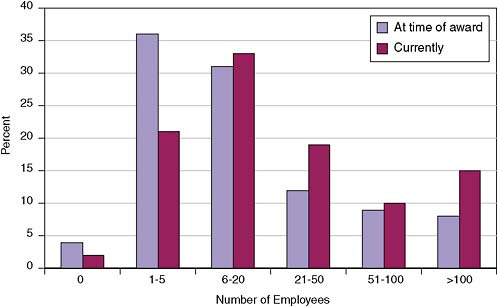

Most responding companies have expanded since the date of the Phase II award. The NRC Phase II Survey also shows that respondents enjoyed strongly positive employment growth after receiving a Phase II award. Table 4-4 shows that the percentage of companies with at least 50 employees more than doubled,

|

23 |

For a discussion of the “halo effect” from awards by the Advanced Technology Program, see Maryann Feldman and Maryellen Kelley “Leveraging Research and Development: The Impact of the Advanced Technology Program,” in National Research Council, The Advanced Technology Program: Assessing Outcomes, Charles W. Wessner, ed., Washington, DC: National Academy Press, 2001. |

|

24 |

See the Chapter 4 in National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, op. cit. |

FIGURE 4-6 Distribution of companies, by number of employees at time of award.

SOURCE: NRC Phase II Survey.

from 16.5 percent to 35.4 percent of all respondents. Overall, survey respondents reported gains of 57,808 full time equivalent employees, with the top five respondents accounting for 18.4 percent of the overall net gain.

The NRC survey also sought to directly identify employment gains that were the direct result of the award. Respondents estimated that specifically as a result

FIGURE 4-7 Employment distribution at responding companies, at time of award and currently.

SOURCE: NRC Phase II Survey.

TABLE 4-4 Employment at Phase II Respondent Companies, at the Time of Award and Currently

|

At Time of Award |

Currently |

||||

|

Number of Employees |

Number of Responses |

Percent |

Number of Employees |

Number of Responses |

Percent |

|

0 |

73 |

4.3 |

0 |

39 |

2.3 |

|

1-5 |

609 |

35.9 |

1-5 |

357 |

20.9 |

|

6-10 |

273 |

16.1 |

6-10 |

274 |

16.1 |

|

11-20 |

257 |

15.1 |

11-20 |

282 |

16.5 |

|

21-50 |

207 |

12.2 |

21-50 |

327 |

19.2 |

|

51-100 |

144 |

8.5 |

51-100 |

165 |

9.7 |

|

>100 |

135 |

8.0 |

>100 |

263 |

15.4 |

|

Total |

1,698 |

100 |

Total |

1,707 |

100 |

|

SOURCE: NRC Phase II Survey. |

|||||

TABLE 4-5 Company-level Activities

|

Activities |

U.S. Companies/Investors |

Foreign Companies/Investors |

||

|

Finalized Agreements (percent) |

Ongoing Negotiations (percent) |

Finalized Agreements (percent) |

Ongoing Negotiations (percent) |

|

|

Licensing agreement(s) |

16 |

16 |

6 |

6 |

|

Sale of company |

1 |

4 |

0 |

1 |

|

Partial sale of company |

2 |

4 |

0 |

1 |

|

Sale of technology rights |

5 |

9 |

1 |

3 |

|

Company merger |

0 |

3 |

0 |

1 |

|

Joint Venture agreement |

3 |

8 |

1 |

2 |

|

Marketing/distribution agreement(s) |

14 |

9 |

8 |

4 |

|

Manufacturing agreement(s) |

5 |

7 |

2 |

2 |

|

R&D agreement(s) |

14 |

13 |

3 |

4 |

|

Customer alliance(s) |

11 |

13 |

4 |

2 |

|

Other Specify____________ |

2 |

2 |

0 |

1 |

|

SOURCE: NRC Phase II Survey. |

||||

of the SBIR project, their firm was able to hire an average of 2.4 employees, and to retain 2.1 more.25

4.2.8

Sales of Equity and Other Company-level Activities

Company-level activities offer another set of indicators for measuring commercial activity, as these suggest that something of commercial value is being

developed, even if no sales have as yet resulted. For example, although Neurocrine, an NIH SBIR awardee has yet to produce a product, it achieved an IPO that raised more than $100 million.26

The NRC Phase II Survey explored whether SBIR awardees had finalized agreements or ongoing negotiations on various company-level activities. The data show that marketing-related activities were most widespread. Activities with foreign partners were lower than similar activities with U.S. partners. Note, however, that the question asked specifically for outcomes that were the “result of the technology developed during this project”—a tight description.27

The impact of these activities is hard to gauge using quantitative assessment tools only. Box 4-4 illustrates how research conducted using SBIR funding seeded an entire generation of spin-off companies and joint ventures in a technology of potential significance for homeland security.

4.2.9

Commercialization: Conclusions

While accepting the view that there is no single, simple metric for determining the commercial success of an early stage R&D program such as SBIR, numerous metrics do provide the basis for making a broad determination of commercial outcomes at SBIR.

These data, taken together, strongly support the view that the program has a strong commercial focus, with considerable efforts to bring projects to market, with some success. Even though the number of major commercial successes has been few, that is normal for early stage high-risk projects, and the overall commercialization effort is substantial. Products are coming to market quickly, significant licensing and marketing efforts are under way for many projects, and approximately 30-40 percent of projects generate products that do reach the marketplace. These data all paint a picture of a program that is successful in commercializing innovative technologies in a variety of ways.

4.3

AGENCY MISSION

Each agency with an SBIR program has a different mission, and the contribution of SBIR to each specific mission must be assessed individually. These assessments, found in the individual agency reports, conclude that SBIR is indeed supporting each agency’s pursuit of its specific mission.

Some more general observations can be made, however. An assessment of the extent to which SBIR supports agency mission can be divided into two areas:

-

procedural alignment—the extent to which the procedures of the agency SBIR program are aligned with the needs of the agency

-

program outcomes—the extent to which outcomes from the program have the effect of supporting the agency mission.

It is important to note that the different missions of the agencies mean that some agencies define agency mission support more narrowly, or at least have much tighter metrics for assessing this element of the program. In particular, the procurement agencies—primarily DoD and NASA—assess contribution to agency mission primarily against the extent to which the agency itself uses outputs from the SBIR program. In contrast, the non-procurement agencies—NIH, NSF, and, to a great extent, the Department of Energy (DoE)—see support for

|

BOX 4-4 Intelligent Optical Systems: Intelligent, Distributed, Sensitive Chemical and Biochemical Sensors and Sensor Networks Intelligent Optical Systems has developed a system for using the entire length of a specially designed fiber-optic cable as a sensor for the detection of toxins and other agents. This bridges the gap between point detection and standoff detection, making it ideal for the protection of fixed assets.a SBIR-supported research has been followed by a focus on the development of subsidiaries and spin-offs at Intelligent Optical Systems. This activity has generated private investments of $23 million in support of activities oriented toward the rapid transition to commercially viable products. Since January 2000, IOS has formed two joint ventures, spun out five companies to commercialize various IOS proprietary technologies, and finalized licensing/technology transfer agreements with companies in several major industries. Optimetrics manufactures and markets active and passive integrated optic components based on IOS-developed technology for the telecommunication industry. Maven Technologies was formed to enhance and market the Biomapper technologies developed by IOS. Optisense manufactures and distributes gas sensors for the automotive, aerospace, and industrial safety markets, and will be providing H2 and O2 optical sensor suites designed to enhance the safety of NASA launch operations. Optical Security Sensing (OSS), which is IOS’s newest spin-off company, was formed to commercialize chemical sensors for security and industrial applications. IOS currently employs 40 scientists, and almost 80 percent of its revenues come from non-SBIR sources. The company currently holds 13 patents, with an additional 13 applications pending. |

mission much more broadly: For NIH, for example, support for mission can be construed as anything that improves medical knowledge or public health.

4.3.1

Procedural Alignment of SBIR Programs and Agency Mission

A procedural assessment reviews the steps taken by each agency program to ensure that the design and procedures of their SBIR program are aligned with the needs of the agency.

Agencies do this in different ways, but the following areas of analysis are broadly shared by all the agencies.

4.3.1.1

Topics and Solicitations

SBIR proposals are received by the agencies in response to published solicitations for proposals. These solicitations are the primary vehicle through which the agency expresses its areas of research interest to the scientific and technical community of small businesses. Within each solicitation, specific subject areas of interest are defined by individual topics. Topics can be focused tightly on a specific problem or requirement, or they may broadly outline an area of technical interest to the agency.

Aside from NIH, which expressly indicates that its topics are guidelines, not mandatory limits or boundaries on research that could be funded, all the agencies use topics to specify boundaries. In doing so, they are specifically delimiting areas of technical interest to the agency.

This is prima fascia confirmation that the SBIR programs support agency mission: Unless there is evidence that agencies are generating topics that are not aligned with the agency mission—and our analysis and interviews with staff and awardees found no trace of this—the use of topics and solicitations indicates that agencies are working to ensure that awards are aligned with the stated scientific and technical needs of the agency.

4.3.1.2

Topic Development Process—DoD

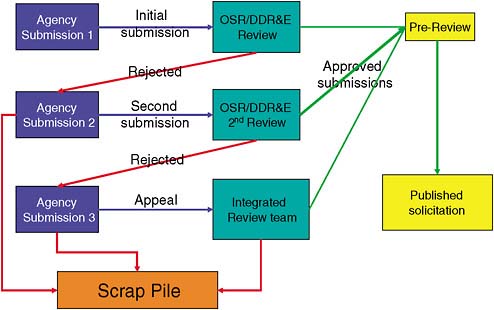

The agencies—notably DoD but, to a lesser extent, all the SBIR agencies—have an elaborate process for developing proposals for topics, sifting and assessing these proposals, and then finally deciding which topics should be published in the solicitation.

Agency procedures differ, and are described in the agency volumes. At DoD, for example, the topic selection process includes multiple levels of review. While this process has been criticized for adding considerable time between the initial identification of an agency’s needs and the first dollars flowing to those needs, the process also seeks to ensure that all of the stakeholders feel that they have had a say. This is particularly important for DoD because it has a number of different stakeholder communities.

FIGURE 4-8 Topic review process.

SOURCE: NRC chart developed from interviews with Department of Defense staff.

Ultimate decision authority on the inclusion of topics in a DoD solicitation lies with the Integrated Review Team, which contains representatives from each of the awarding components. Topics are reviewed initially at DDR&E and are then returned to the agencies for correction of minor flaws, for revision and resubmission, or as discards.

DoD has also made considerable efforts to improve the topic selection process. In the late 1990s, DoD determined that topics were not being linked closely enough to the users of SBIR technologies in the acquisition community, and a conscious effort was made to ensure that more topics were “owned” by that community (with considerable success—see DoD report, Chapter 5: Program Management, for details28).

4.3.1.3

Topic Development Process—NSF

Under the 2005 NSF strategic plan, SBIR solicitation topics fit into three broad areas: (A) investment business focused topics, (B) industrial market driven topics, and (C) technology in response to national needs. (A, B, and C below). The topics list given in the strategic plan includes seven topics:

-

Investment Business Focused Topics

-

Biotechnology (BT)

-

Electronics Technology (EL)

-

Information Based Technology (IT)

-

-

Industrial Market Driven Topics

-

Advanced Materials and Manufacturing (AM)

-

Chemical Based Technology (CT)

-

-

Technology in Response to National Needs

-

Security Based Technology (ST)

-

Manufacturing Innovation (MI)

-

It appears that areas A and B above are expected to be relatively stable, and that area C is expected to have more frequent changes in specific topics as national needs change.

Even at NIH, where topics are viewed as guidelines, not boundaries for permissible research, the topic selection process is designed to ensure that area specialists within the agency’s Institutes and Centers have substantial input. Area specialists are regularly encouraged to ensure that their wider research agendas are reflected in their selection of SBIR topics for publication.

Overall, agencies appear to be well aware that the topic/solicitation process is the primary mechanism through which the SBIR program is aligned with the agency’s S&T objectives and its overall agency missions. Topics appear to be aligned with agency missions.

4.3.1.4

Award Selection Process

The selection of awards can also support an agency’s mission, to the extent that the process reflects the agencies’ priorities. A wide range of awards procedures are used at the various agencies, and these may differ substantially even between components of the same agency. For example, within DoD, Army, and Navy use different approaches, staff, and methodologies for selecting awardees.

All of these agency procedures share some basic characteristics: They assign considerable weight to the technical merit of proposals; They seek to ensure that selectors are, to some extent, independent of sponsoring agency components; and they have a set of written standards against which proposals are supposed to be measured. They differ in the nature of the reviewers (internal or external), the type of scoring (quantitative or qualitative), the extent of appeal and resubmission for nonawarded proposals, the degree to which scores are binding, and the discretionary powers of agency staff to make full or supplementary awards.

It is also in general fair to say that the point of reference with regard to agency mission reference at the point of award is not the agency’s overall mission statement, but the specific expression of that statement in the form of the topic. Topics are used as expressions of the agency’s mission. For example, DoE’s

overall mission is to “advance the national, economic, and energy security of the United States; to promote scientific and technological innovation in support of that mission; and to ensure the environmental cleanup of the national nuclear weapons complex.”29 Specific SBIR awards are made in relation to topics that support that mission—for example, to generate better battery cell technology. A high-quality, effective selection process, one that effectively identifies and funds projects that will help meet agency needs expressed via the topic, is therefore a process that supports the agency mission overall.

While selection procedures could potentially be improved, our analysis concludes that at every agency, the current selection processes largely succeed in aligning the technologies chosen with the expressed needs of the agency.30

4.3.2

Program Outcomes and Agency Mission

In contrast to the discussion above, the program outcomes for agency mission are both more difficult to assess and also more specific to individual agencies. All of the methodological difficulties in assessing outcomes discussed at the beginning of this chapter apply here; moreover, (unlike commercialization) there are no obvious and widely understood benchmarks that apply across agencies.

All agencies maintain a list of “success stories,” describing SBIR awards that meet congressional goals. Some of these are focused on agency mission. However, the stories themselves, while illustrative of the power of the program to help develop new technologies, are of variable quality. Some agencies, such as NIH, use success stories written by the company in question without validating them. Even agencies that take a more systematic approach to case studies do not appear to have clear and transparent criteria for determining what should count as a “success story.”

Each agency has found different ways to explore and describe outcomes related to agency mission. As a result, our overview must reflect these agency differences. Below, we provide a brief summary of agency approaches to identifying and measuring ways in which the SBIR program supports the agency mission.

4.3.2.1

NIH

For NIH, the primary mission is the development of fundamental knowledge and its application for improving health.

|

29 |

Department of Energy Web site, accessed at <http://www.energy.gov/about/index.htm>. |

|

30 |

More details about each agency’s selection procedures can be found in the individual agency volumes. |

|

The NIH mission is science in pursuit of fundamental knowledge about the nature and behavior of living systems and the application of that knowledge to extend healthy life and reduce the burdens of illness and disability. SOURCE: National Institutes of Health, <http://www.nih.gov/about/ndex.html#mission>. |

A more detailed assessment of outcomes related to these objectives can be found in Chapter 3 of the NIH Report.31 Data on patents and peer-reviewed publications resulting from awards can be used as an indicator of the development of fundamental knowledge. Commercialization measures are another possible indicator of the transfer of knowledge, as commerce marks a transaction that reflects that transfer.

Still, more direct measures would be useful. NIH has tried to develop these in several ways. Like other agencies, NIH maintains a Web page filled with “success stories.” Unfortunately, these are entirely self-posted by companies, and reflect no selection or even verification by staff.

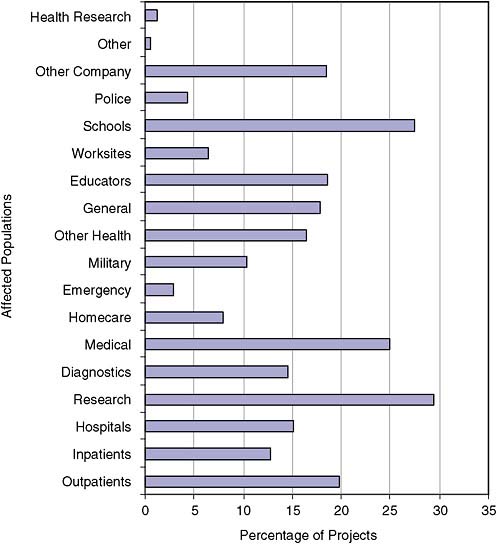

The NIH SBIR program has also led the way at NIH in developing metrics through the implementation of a recipient survey, with the first survey being deployed in late 2003. In this survey, the agency has sought to identify the populations targeted by SBIR projects. Figure 4-9 shows the distribution of projects by sector, for both projects that have already reached the market and those still being commercialized.32

The NIH survey also sought to quantify the number of people affected by a technology, asking respondents to place their project within ranges of affected populations by size. Such information, if accurate, would be useful. Unfortunately, respondents have wide latitude in answering, and are given no guidelines that might help to explain how to structure their answers. The responses are essentially guesses—perhaps biased guesses, as respondents may have a tendency to overestimate their projects’ importance.

Still, the data categories show the wide variety of mission-related areas into which SBIR projects can be categorized—and all clearly fall within the broad mission definition of NIH. Responses can also indicate the distribution of projects between mission areas and can be used as a proxy for the degree of NIH interest in these different areas.

FIGURE 4-9 Distribution of NIH projects, by type of affected population.

SOURCE: National Institutes of Health, National Survey to Evaluate the NIH SBIR Program: Final Report, July 2003.

4.3.2.2

DoD

The DoD SBIR program’s primary goal is the provision of technologies that are employed as part of defense systems being developed, acquired, or maintained to meet DoD mission needs. In effect, that acquisition stream defines, for operational purposes, agency needs, and the extent to which SBIR is, in fact, part of the acquisition process has become an important indicator of support for agency mission.

|

The mission of the Department of Defense is to provide the military forces needed to deter war and to protect the security of our country. SOURCE: Department of Defense, <http://www.defenselink.mil/admin/about.html>. |

This was not always the case. As discussed in the DoD volume, the program’s objectives have evolved since the late 1990s. Some elements of the management have recently focused on finding ways to more closely align SBIR projects and programs with the acquisition process of the Services.

Much of the discussion that follows will focus on acquisitions and on Phase III at DoD. However, it is still important to remember that, even at DoD, not all outcomes that support the mission result in acquisitions and Phase III. For example, agency staff have indicated that SBIR can be an important way of assessing technologies that in the end do not pan out. The awards thus act as a low-cost probe of the technological frontier. So, even when no acquisition occurs, SBIR can still provide valuable support for the agency mission in terms of information on technological dead ends, promising technological options, or use resulting from the award itself.

Still, even with these multiple functions, as participants at the NRC’s Phase III Symposium affirmed, Phase III and acquisitions are regarded by DoD as the core focus of the SBIR program, and the key indicator for measuring success in supporting agency mission. Many speakers at the NRC’s Phase III Symposium made clear that the take-up of SBIR-funded technologies into the DoD acquisitions program was the benchmark against which DoD’s SBIR program should be judged.

DoD has made a more conscious effort to measure SBIR impacts on agency performance than any of the other agencies under study. Because DoD is a procurement agency, there is also one clear set of indicators which, if properly captured, could provide critical benchmarks and feedback to the agency.

DoD has two tools for measuring follow-on Phase III contracts. The first is the DD350 contracting forms, which is supposed to capture whether a contract is a follow-on to an SBIR award. However, only well-trained contracting officers who understand SBIR are likely to correctly fill out the form. Internal assessment of the DD350 by DoD suggests that not all contracting officers use the form correctly. Consequently, at many DoD components, SBIR follow-on contracts are only erratically reported, if at all.33 The other tool for measuring follow-on Phase III contracts is the DoD SBIR/STTR Commercialization Database. This database is used to calculate firms’ Commercialization Achievement Index and

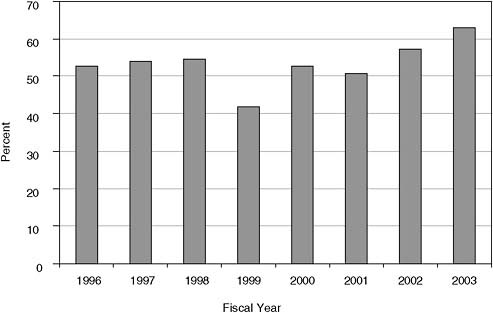

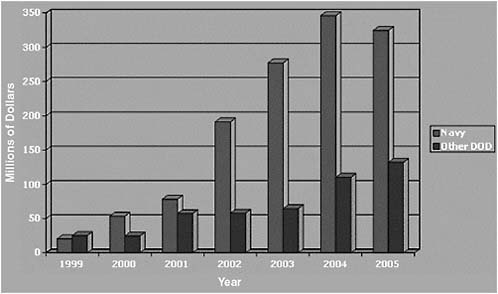

FIGURE 4-10 Phase III awards, annual totals, 1999-2005.

SOURCE: DoD SBIR/STTR Commercialization Database, provided by John Williams, U.S. Navy, April 7, 2005.

to generate the Company Commercialization Reports that are packaged with proposals to evaluators.

The Navy has recently made efforts—including the investment of external program dollars—to improve the quality of DD350 data. This effort is reflected in recent DD350 results, which show Navy as accounting for more than 70 percent of all DoD Phase III awards.34

The DD350 results do show that the amount of Phase III contracts generated have been climbing steadily in recent years, particularly at the Navy (see Figure 4-10).

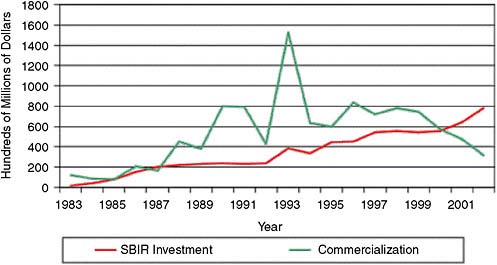

These data also show that the amount of Phase III contracts being identified is greater than the amount of funding expended on SBIR, once commercialization has been appropriately lagged.

A fuller discussion of DoD’s efforts regarding Phase III can be found in Chapter 5 of the study of SBIR at DoD.35 Leaving complexities aside, however, it is possible to draw the following general conclusions:

FIGURE 4-11 Reported commercializations versus SBIR budget.

SOURCE: Michael Caccuitto, DoD SBIR/STTR Program Administrator, Presentation to SBTC “SBIR in Rapid Transition” Conference, Washington, DC, September 27, 2006.

-

DoD is increasingly making an effort to measure support for agency mission.

-

Part of this assessment is increasingly quantitative, with the Navy leading the way in utilizing data from the DD350 forms. Nonetheless, there are barriers and difficulties that tend to reduce the number and amount of Phase III contracts counted in the DD350 tracking forms.

-

The demonstration effect of the Navy program and growing awareness of SBIR’s potential has increased senior management’s awareness of SBIR’s contributions to the Defense mission.36

-

The growing interest and dedicated management attention by Prime contractors is enhancing the potential for insertion of SBIR outputs into the acquisition process.

-

The reluctance of other agencies to provide management funding at the level of the Navy’s effort remains a constraint on maximizing the return on the nation’s SBIR investment.

In short, recent improvements in DoD activities related to Phase III do suggest a slow but significant change in attitude toward SBIR within DoD. SBIR is seen less as a tax imposed by Congress on otherwise useful R&D activities, and

more as an opportunity to bring innovative ideas and products to meet mission objectives.

4.3.2.3

DoE

DoE has, to a considerable extent, relied on process and procedures to ensure that its mission is being supported by the SBIR program. The agency has developed topic and award selection procedures that ensure that the primary driver of the program will be R&D managers within the agency, rather than either external peer reviewers or SBIR program managers. The latter play a minimal role in topic and award selection.

|

Mission Discovering the solutions to power and secure America’s future Vision The Department’s vision is to achieve results in our lifetime ensuring: Energy Security; Nuclear Security; Science-Driven Technology Revolutions; and One Department of Energy—Keeping our Commitments. SOURCE: Department of Energy, <http://www.cfo.doe.gov/strategicplan/mission.htm>. |

In FY2005, this process resulted in 49 technical topics, from within the 12 program areas (see Table 4-6).

TABLE 4-6 DoE Phase I Awards by Program Area

|

Program Area |

Number of Topics |

Number of Grant Applications Submitted |

Number of Phase I Awards |

|

Fossil Energy |

7 |

247 |

29 |

|

Advanced Scientific Computing Research |

3 |

47 |

9 |

|

Basic Energy Sciences |

9 |

247 |

56 |

|

Biological and Environmental Research |

6 |

182 |

47 |

|

Environmental Management |

0 |

0 |

0 |

|

Nuclear Physics |

4 |

47 |

25 |

|

High Energy Physics |

5 |

111 |

46 |

|

Fusion Energy Sciences |

3 |

80 |

18 |

|

Nuclear Energy |

1 |

11 |

3 |

|

Energy Efficiency and Renewable Energy |

6 |

470 |

38 |

|

Nonproliferation and National Security |

3 |

61 |

11 |

|

Electric Transmission and Distribution |

2 |

48 |

8 |

|

TOTALS |

49 |

1,551 |

290 |

|

SOURCE: Department of Energy Web site. Accessed at <http://www.science.doe.gov/sbir/awards_abstracts/sbirsttr/statisticsinfo.htm>. |

|||

There does not appear to be a systematic effort under way at DoE to determine whether the SBIR program supports agency mission. As with all other agencies, to the extent that agency mission involves the development of technical knowledge, there are indicators for whether SBIR companies are producing this knowledge.

4.3.2.4

NSF

NSF is similar to DoE in its reliance on procedures to ensure that agency mission is supported. As with DoE, technical managers are involved in the development of SBIR topics, and there is a strong focus on ensuring that awards are made only within defined topic areas. Topic development also aims to involve technical area program managers.

|

The National Science Foundation (NSF) is an independent federal agency created by Congress in 1950 “to promote the progress of science; to advance the national health, prosperity, and welfare; to secure the national defense …” SOURCE: National Science Foundation, <http://www.nsf.gov/about>. |

The SBIR program has taken on the specific role and mission of being the commercialization arm of NSF; the NSF program manager has been explicit in focusing the program on commercialization, arguing that the remaining 97.5 percent of NSF is focused on basic science and other primarily noncommercial aspects of scientific inquiry. While at one level this is correct, most of the rest of the NSF budget is largely focused on university research and is not open to small company-based research.

Thus in one sense, support for agency mission is best measured in terms of commercialization (discussed in Section 4.2). In another sense, NSF is indeed focused on support for the generation of new scientific knowledge. Here traditional metrics include patents and peer-reviewed publications. These aspects of mission support for NSF are discussed below. Both topics, and the program as a whole, are covered in more detail in the NSF volume.

4.3.2.5

NASA

NRC used a unique approach to address the question of support for NASA’s agency mission. NRC surveyed agency technical managers (COTRs), who are in charge of the research areas within which SBIR awards are made. The survey sought to measure the quality of the research from the perspective of technical staff who managed both SBIR and non-SBIR programs.

|

NASA’s mission is to pioneer the future in space exploration, scientific discovery, and aeronautics research. SOURCE: National Aeronautics and Space Administration, <http://www.nasa.gov/about/highlights/what_does_nasa_do.html>. |

The research found that the COTRs believed that 68 percent of surveyed projects generated useful information and found that results from 58 percent of the projects were sufficiently positive to encourage the COTR to seek out additional funding, within or outside the SBIR program.

It is especially encouraging that over 30 percent of projects were sufficiently positive that technical managers sought non-SBIR funding within NASA for further development.

Agency mission at NASA can also be measured in terms of agency take-up of SBIR-funded technologies. This may be especially important at NASA, as the commercial market for space-related technologies is likely to be small. NASA does maintain a set of success stories, but Phase III activities do not appear to be tracked in any coordinated fashion.

FIGURE 4-12 NASA staff perspectives on SBIR awards.

SOURCE: NRC Project Manager Survey.

4.4

SUPPORT FOR SMALL, WOMAN-OWNED, AND DISADVANTAGED BUSINESSES

4.4.1

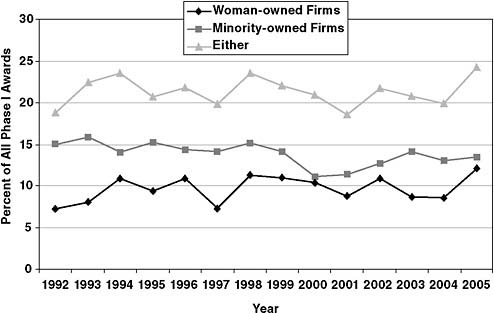

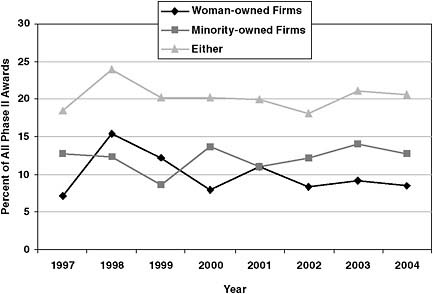

Support for Woman- and Minority-owned Firms

Support for women and disadvantaged persons is one of the four primary congressional objectives for the SBIR program. Unfortunately, there are significant concerns regarding the collection of data related to the participation of woman- and minority-owned firms in the program. More importantly, the data that does exist raises questions about whether agencies adequately meet the needs of such firms.

4.4.1.1

Data Concerns

There are problems with the collection of data related to woman- and minority-owned firms at the two largest SBIR agencies. In both cases, these difficulties make it hard to determine how well each agency is meeting this element of the congressional mandate.

At DoD, the problem lies in the collection of data about applications. Even though DoD publishes an annual report which includes data on the number of applications and the success rates of women- and minority-owned firms in winning Phase I and Phase II awards, these data suffer significant deficiencies. For example, the demographic status of applications is entirely self-determined by applicants, and it is likely that in some cases this data is not reported accurately. BRTRC (a data contractor) has identified 53 firms that listed minority or women ownership on some, but not all of the proposals they submitted during FY2005. Looking across years, firms were identified that showed women ownership some years, then no status, then women ownership again. One firm that submitted about 10 proposals annually first listed itself as minority-owned, then for several years claimed no special ownership, then claimed to be woman-owned.

After awards are made and moved to a separate database table, DoD works to correct errors in the demographic status, so the awards data are much more accurate in this regard. Since firms get no preference in selection for being minority- or woman-owned, they may not be motivated to ensure that this part of the application is correct.

Because the applications data are not accurate, conclusions about success rates are also uncertain. And, as discussed below, it is hard to determine what the data mean—and why certain outcomes occur.

At NIH, the NRC study identified anomalies which, on closer inspection, indicated that for some years, NIH was not capturing women- and minority-ownership data accurately. Following discussion with the NRC, NIH made a significant effort to recalculate the data for women and minority participation in the NIH SBIR program. However, apparent anomalies in the NIH data for 2001 and 2002 could not be resolved by the time of publication of this report.37

In addition, it would be helpful if all agencies captured and regularly reported data about the demographics of principal investigators (PIs), as well as company ownership, as many company founders have prior experience as PIs, so PI demographics may be a useful leading indicator of minority- and women-owned businesses in the program.

4.4.1.2

Award Patterns

Of the five agencies studied by the NRC, one—NASA—has no apparent issues in relation to awards to woman- and minority-owned firms. That is to say, their pattern of awards matches those for other firms, and their share of awards is in line with the average for all agencies, and shows no obvious negative trends in any area.

This is not the case for the remaining four agencies. At DoD, there has been a substantial decline in the award shares of minority-owned firms. The share of awards to woman-owned firms has been relatively low at NSF, and the application success rates for woman-owned firms have been lower than those for other businesses. At DoE, success rates for both woman- and minority-owned firms have been lower than for other small businesses. At NIH, issues focus on award shares for minority-owned firms, and on the discordance between the award share to woman-owned firms and the number of female scientists and engineers working in the life sciences. And, as noted the lack of quality data suggest that this issue is not adequately monitored or analyzed, reflecting a need for greater management attention.

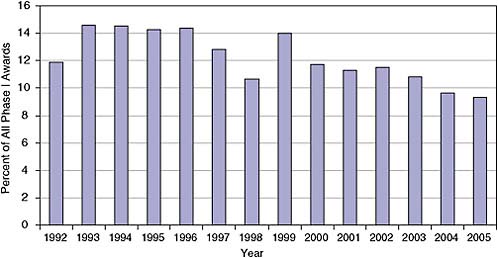

DoD

While Phase I awards to woman-owned firms have continued to increase as a percentage of all Phase I awards, the percentage of Phase I awards being made to minority-owned firms has declined since the mid-1990s. The percentage fell below 10 percent for the first time in 2004, and is down by a third since the early 1990s.

The absence of reliable data on the demographics of applications makes it impossible at this point to determine why minority-owned businesses are getting a declining share of Phase I awards. We do not know whether minority-owned business applications are down, whether the success rate of those applications has fallen, or both.

NSF

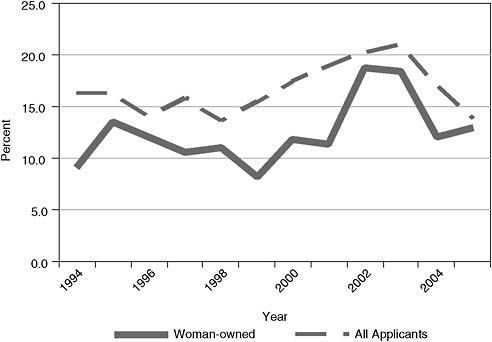

At NSF, the existence of good applications data makes it relatively easy to determine why woman-owned firms have been doing less well in recent years. Woman-owned businesses have been less successful in getting applications approved than have all applicants in every year since 1994. In half the years, the success rate of woman-owned businesses was less than 70 percent the rate of

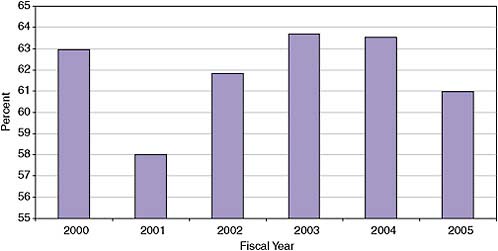

FIGURE 4-13 Minority-owned business shares of Phase I awards at DoD, 1992-2005.

SOURCE: Department of Defense Awards Database.

FIGURE 4-14 NSF: Comparative success rates for woman-owned and for all applicants in having their Phase I applications approved, 1994-2005.

NOTE: This is a correction of the prepublication version released on July 27, 2007.

SOURCE: Developed from data provided by the NSF SBIR program.

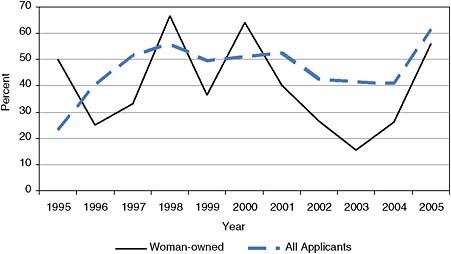

FIGURE 4-15 NSF: Comparative Phase II success rates for woman-owned and for all applicants, 1995-2005.

NOTE: This is a correction of the prepublication version released on July 27, 2007.

SOURCE: Developed from data provided by the NSF SBIR program.

all applicants. Over the period 1994-2005, woman-owned businesses accounted for 12 percent of all Phase I applications but received less than 10 percent of all Phase I awards.

Low success rates occur during Phase II as well. In all except three of the ten years from 1995 through 2005, the success rate of woman-owned businesses fell below that of all businesses in having their Phase II applications funded. Woman-owned businesses contributed 9 percent of all Phase II applications submitted from 1995 to 2003 (203/2,299) and received 7.5 percent of all Phase II grants (79/1,059). From 2002 to 2003, the success rate of woman-owned businesses in getting Phase II grants was particularly low but recently has recovered significantly.

DoE

At DoE, success rates are also an area of interest. Woman-owned businesses accounted for almost 8 percent of all DoE Phase I awards during 1992-2003, and for 10.5 percent of Phase I applications. During the same period, woman-owned businesses accounted for 7.8 percent of Phase II applications in 1995-2003 and for 6.7 percent of actual Phase II awards.

Data on minority-owned firms was similar. They submitted 16.5 percent of all Phase I applications in 1992-2003 and received 13.2 percent of all Phase I awards. Between 1995 and 2003, they accounted for 13.7 percent of Phase II applications and 11.8 percent of Phase II awards.38

DoE is the only agency where minority-owned firms apply more and receive more awards than woman-owned firms.

NASA

The relatively steady trends for both Phase I and Phase II awards at NASA for both woman- and minority-owned businesses are shown below (see Figures 4-16 and 4-17).

The absence of detailed applications data for woman- and minority-owned businesses means that we currently are not able to determine whether these trends are the result of a faster increase in these firms’ number of proposals than other small businesses, improved success rates, or a combination of both.

4.4.2

Small Business Support

At one level, the SBIR program obviously provides support for small business, in that it gives funding only to businesses with no more than 500 employees—the SBA definition of a small business. However, it has been less clear whether SBIR has provided additional support for small business, or simply aggregates existing small business research dollars under the program’s umbrella.

FIGURE 4-16 Phase I awards at NASA: woman- and minority-owned businesses’ share of all awards.

NOTE: This is a correction of the prepublication version released on July 27, 2007.

SOURCE: National Aeronautics and Space Administration Awards Database.

FIGURE 4-17 Phase II awards at NASA: woman- and minority-owned businesses’ share of all awards.

NOTE: This is a correction of the prepublication version released on July 27, 2007.

SOURCE: National Aeronautics and Space Administration Awards Database.

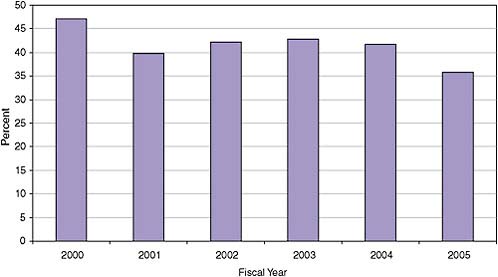

The most direct way to address the question is to review the amount of R&D funding going to small business at the agency as a whole, and then compare that with trends in SBIR funding. Unfortunately, this comparison is publicly available only for one agency, NIH, which publishes separate data on small business shares of research funding.

NIH data (Figure 4-18) show that the share of all NIH small business funding being disbursed through the SBIR program has fallen steadily since soon after the 1983 inception of the NIH program. After peaking at 90 percent of all small business research funding in the mid-1980s, SBIR’s share fell steadily to about 72 percent, before falling further in 2004 (the most recently available data).

At NIH, the rapid growth of SBIR in recent years has supplemented, not supplanted, small business funding through other mechanisms at NIH. Increasing amounts—and shares—of small business research funding are available outside the SBIR program.

4.4.3

Project-level Impacts

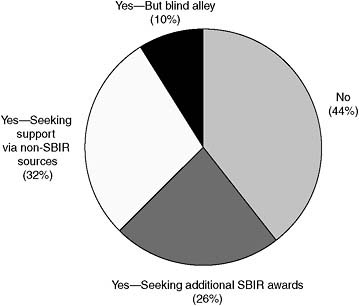

One way of measuring SBIR’s impact is to ask awardees whether their projects would have been implemented without SBIR program funding. Data from the

FIGURE 4-18 SBIR share of small business research funding at NIH

SOURCE: National Institutes of Health Awards database.

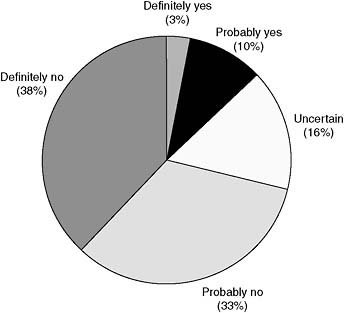

NRC Phase II Survey shown in Figure 4-19 strongly suggest that SBIR provides funding that plays a determinant role to most of the projects that receive it.

According to the respondents, more than 70 percent of projects would likely not have proceeded at all without SBIR. This finding reflects the known difficul-

FIGURE 4-19 Would the project proceed without SBIR funding? (Percent of respondents.)

SOURCE: NRC Phase II Survey, Question 13.