6

Program Policies and Practices

This chapter addresses the second specific item in the committee’s charge: “learn whether the representative payment policies are practical and appropriate.” After a brief discussion of a systems perspective of the program, there are five major sections that correspond to stages in the representative payee appointment process: establishing the need for a representative payee, selection of payees, training and support for payees, monitoring and accountability, and termination and transitions. The final major section of the chapter considers state laws and programs that are relevant to the Representative Payee Program, and we end with observations about the variation in the management of local offices.

A SYSTEMS PERSPECTIVE

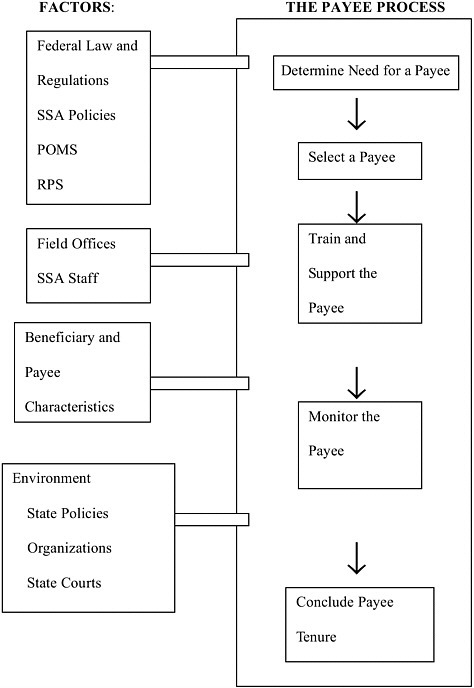

The Representative Payee Program involves a complex interactive system of people, policies, and procedures. As such, the performance of the program is best viewed as the outcome of many interactions among Social Security Administration (SSA) staff, payees, beneficiaries, and, on occasion, other people, such as beneficiaries’ family members and legal guardians and conservators (who are not payees). We therefore adopted a systems perspective in our assessment of program policies and practices by examining each step in the process in terms of the (1) interactions that occur, (2)

the factors that influence those interactions, and (3) the effect on service to beneficiaries.

The Representative Payee Program is dynamic, and it is influenced by a complicated environment of policies and interactions between the beneficiaries and their representative payees. The amount of the Social Security benefit and the circumstances of the beneficiaries (e.g., health status, living situation, availability of additional beneficiary income or resources) may also affect the relationship between beneficiaries and representative payees. Figure 6-1 depicts a systems view of the program, in which many factors, interactions, and policies influence the implementation and the outcome of each stage. In Figure 6-1 these factors are shown to the left of the process schematic. To understand the complexity of the system, consider the first stage of the process, establishing a beneficiary’s need for a representative payee. Program policies, promulgated publicly through the SSA’s Program Operations Manual System (POMS), establishes protocol and guides SSA claims representatives through the determination process. In addition to the formal policies, however, the effectiveness of claims representatives is also influenced by their training and experience and by the impact of SSA management policy on their motivation and performance (e.g., rewards for productivity, effectiveness). Beneficiary characteristics are critical as well (e.g., lucidity, cognitive ability, institutionalization, mental disability status, health), and input from a beneficiary’s family can come into play. The determination made by the Disability Determination Service office can influence a claims representative’s determination of need. Even a state court’s assignment of a legal guardian or conservator for the beneficiary must be a consideration for a claims representative. Overall, a wide variety of factors both internal and external to SSA affect the determination of need of a representative, and similarly complex scenarios occur with all the other stages of the program.

The rest of this chapter evaluates SSA policies and practices for each stage of the process using data from the committee’s survey, the site visits, and SSA administrative data. The conclusions and recommendations are included in the section for each stage of the process.

ESTABLISHING THE NEED FOR A REPRESENTATIVE PAYEE

Process for Determining Need

The SSA has broad responsibility and discretionary authority to determine whether to pay benefits directly to the beneficiary or to pay a representative payee on the beneficiary’s behalf (42 U.S.C. §§ 405(j), 1007, & 1383(a)(2)). The law and regulations specify that a payee should be appointed for

-

beneficiaries under the age of 18,

-

beneficiaries whom state courts find are lacking capacity, and

-

beneficiaries determined by SSA to need a payee.

In assessing a beneficiary’s capability to manage or direct the management of benefit payments, federal regulations stipulate that court determinations, medical evidence, and any other helpful information may be considered. SSA’s operating policies in the POMS emphasize the principle that adult beneficiaries are deemed capable unless there is evidence to the contrary. These policies require SSA to consider the beneficiary’s ability to meet daily needs and manage money.

In this section we discuss the effectiveness of this flexible system of protocols to evaluate the need for a representative payee, particularly the extent to which payees are appointed for beneficiaries who are able to manage their own payments and the types of conditions that lead SSA to determine there is a need for a payee.

Accuracy of Need Determinations

In the committee’s field office site visits, some staff said that some beneficiaries with payees do not need them. This situation can result from either a prior temporary need for assistance that is no longer applicable, for example, due to a beneficiary’s short-term convalescence or mental incapacity, or because the initial determination of need may simply have been incorrect. The POMS provides a set of questions for a claims representative to use as a guide in determining a beneficiary’s capability of managing his or her financial benefits. The POMS further states that if there is no legal determination or medical evidence to establish the lack of capability, then SSA staff must document the need for a payee through the use of lay evidence (POMS GN 00502.030).

Estimates based on our survey of beneficiaries who are 18 years or older suggest that the problem of incorrectly appointing a payee is relatively minor. The survey showed that beneficiaries and payees agreed the beneficiaries could manage their payments on their own in only 4.4 percent (0.7)1 of cases (see Table 6-1). The percentage of beneficiaries who agreed with their payees that they could manage their own funds was higher for beneficiaries who were 18-64 years old, who were parents of payees, who

TABLE 6-1 Representative and Beneficiary Agreement on Ability of Beneficiary to Manage Own Benefits, for Beneficiaries 18 Years or Older

|

Beneficiary or Payee |

N |

Percent (SE)a |

Number of Beneficiaries (SE) |

||

|

Beneficiary |

|

|

|

|

|

|

All beneficiaries |

1,402 |

4.4 |

(0.8) |

78,800 |

(13,900) |

|

18 to 64 years old |

1,037 |

4.9 |

(0.9) |

71,600 |

(13,100) |

|

65 years or older |

365 |

2.2 |

(1.3) |

7,100 |

(4,400) |

|

Payee |

|

|

|

|

|

|

Parent of beneficiary |

295 |

3.0 |

(1.1) |

25,100 |

(9,600) |

|

Child of beneficiary |

162 |

9.0 |

(3.4) |

19,900 |

(8,300) |

|

Other relative |

268 |

4.6 |

(1.8) |

23,700 |

(9,100) |

|

Nonrelative |

548 |

7.6 |

(1.1) |

10,100 |

(1,400) |

|

Lives with beneficiary |

651 |

2.0 |

(0.8) |

23,000 |

(9,200) |

|

Lives separately from beneficiary |

751 |

8.6 |

(2.0) |

55,700 |

(13,100) |

|

Individual with one to four beneficiaries |

1,170 |

4.7 |

(0.8) |

78,600 |

(13,900) |

|

Individual with five or more beneficiaries |

98 |

0.3 |

(0.3) |

100 |

(100) |

|

Organization |

147 |

0 |

|

0 |

|

|

aFor all estimates in this chapter, the number in parentheses following the estimate is the standard error of the estimate. As a general rule, users can approximate a 95-percent confidence interval for the estimate by adding and subtracting two standard errors to the estimate. When two estimates have confidence intervals that overlap, the two estimates are not statistically different at the .05 level of significance. SOURCE: Data from the national survey of representative payees and beneficiaries conducted for the National Academies Committee on Social Security Representative Payees (2006). |

|||||

were unrelated to their payees, and who did not live with their payees (see Table 6-1). At the same time, 8.3 percent (0.7) of payees would like to talk to SSA about their beneficiaries’ managing their own funds.

Although the prevalence of what may be erroneous payee assignment is relatively low, there was broad interest among field office staff in establishing a more effective relationship between the Disability Determination Service offices and the SSA field offices. At issue were perceived disparities between the assessments by SSA claims representatives of the need for payees and the evaluations of the Disability Determination Service offices of disability and how that evaluation related to the need for a payee. The committee agrees with many field staff that a joint determination process may lead to better assessments. We also agree with what we heard from many in the field that there is also a need to check with other community agencies and reporting authorities about the credibility of potential payees.

Occasionally, there are beneficiaries who are assigned a temporary

payee, or who are temporarily put into direct payment status despite needing a payee, e.g., because no payee can be identified or the payee has died or been terminated. These situations should be closely monitored or consideration should be given to setting up a process to regularly evaluate the continuation of the payee status and beneficiary capability.

Another potential error in the process involves undetected need: the situation in which a beneficiary without a payee needs one. However, the scope of our study did not include beneficiaries without payees assigned to them, and thus we cannot estimate the number of beneficiaries in need of a payee but currently lacking one.

CONCLUSION A small fraction of beneficiaries aged 18 or older are potentially capable of managing their own payments. This is an acceptable level of accuracy in determining beneficiary need for a representative payee, given the complexity of the determination task and the size of the system.

SELECTION

Recruitment

Selecting appropriate payees is a critical factor in meeting beneficiaries’ needs to manage their SSA payments. The committee’s site visits to SSA field offices indicated that current definitions and policies in the POMS adequately describe desirable characteristics of a payee. However, inconsistencies were reported in the criteria used for payee selection. For instance, one staff member reported augmenting minimal requirements in POMS with criteria that focus on the personal relationship between a payee candidate and the beneficiary. Other “additional” characteristics reported by staff as selection criteria are shown in Box 6-1. Some staff also attempt to tailor payee selection to the specific needs and situation of a beneficiary, such as the beneficiary’s living arrangements or evidence of beneficiary alcohol or substance abuse.

Many of these factors appear in the POMS preference lists for minor beneficiaries, adult beneficiaries without substance abuse problems, and adult beneficiaries with substance abuse problems (see below). The lists are tailored to specific beneficiary types and establish (but do not require) a recommended priority for selecting a payee. With regard to recruitment of payees, it appears that different claims representatives emphasize different factors in the POMS preferences lists and use them as requirements rather than preferences.

It is also worth noting that some claims representatives used an intangible criterion—intuition, a “gut feeling”—in the selection of a payee.

|

BOX 6-1 Criteria for Identifying Payee Candidates as Reported by SSA Field Staff Is financially capable Understands that the primary job is to see that the money is spent for the beneficiary’s needs Can manage his or her money Has enough financial savvy to know how to keep beneficiary funds separate from own funds Knows how to manage money Has a close relationship with beneficiary Has frequent contact with the beneficiary Is most likely a family member (e.g., parent, spouse, other) Shows concern for the beneficiary Possesses an in-depth knowledge of the beneficiary Knows the beneficiary—at least first and last name, perhaps also date of birth Lives with the beneficiary Lives very close to the beneficiary Can check in on the beneficiary once a day Knows what is going on with the beneficiary Has no or very few risk factors for potential to misuse funds Should not be a felon—but if it happened twenty years ago, it is probably okay now Is gainfully employed or has his or her own sources of income Has no criminal record Is not a fugitive felon Is not owed money by the beneficiary Has a stable employment record Has a high school or equivalency diploma Has had no encounter with law enforcement Has no record of alcohol or drug abuse |

The meeting between an SSA staff person and a payee candidate affords an important opportunity for the staff person to interact with the payee candidate and observe physical and nonverbal cues (e.g., nervousness, cognitive ability, coherence, physical condition, potential drug or alcohol use, sincerity). Especially among the seasoned veteran staff, the personal interview provided them with a sense of whether or not a specific candidate would be appropriate as a particular beneficiary’s payee.

The survey defined payees who were related to their beneficiaries as blood relatives, relatives by marriage or marriage-like partnerships, and

close friends. The vast majority of beneficiaries were related to their payees, 94.7 percent (0.1). The selection process is likely to be relatively easy when beneficiaries know related persons who are willing to serve as payees. However, for adult beneficiaries who did not have related persons available to act as their payees—4.7 percent (0.1) or 214,300 (4,400) beneficiaries—the payee identification and selection process can be more challenging.

Among adult beneficiaries with unrelated payees, almost one-half did not personally ask someone to be their payees, 43.9 percent (2.5); their payees were obtained through other means. Families were not involved in the selection decision for nearly one-half of adult beneficiaries with nonrelative payees, 43.5 percent (2.6). SSA was responsible for identifying and recruiting the payees for about one in six adult beneficiaries with unrelated payees, 14.8 percent (2.6). For nearly two-thirds of beneficiaries with unrelated payees, the payees had volunteered to serve them. Thus, SSA had to recruit and secure payees for more than one-third of beneficiaries with nonrelative payees, 35.2 percent (2.4). These results give rise to concern about the amount of time needed by SSA staff to identify appropriate payees as well as the need for tighter links to organizations that offer volunteer payees to serve beneficiaries with challenging circumstances (such as the absence of a relative to act as payee).

To handle the more difficult cases of finding appropriate payees, SSA field offices are required by the Social Security Act (Section 205(j)(3)(G)) to keep a list of local payee sources. In addition, the POMS (GN 00502.100) encourage field offices to develop ongoing, cooperative relationships with community social service providers who can often provide payee contacts. However, the committee’s site visits suggest that staff resources for carrying out these required and recommended activities are severely limited: we found no such lists of payee sources in the field offices, and there appeared to be few strong community relationships with social service providers.

Another source of support for the selection process comes from non-governmental agencies and organizations that train and monitor volunteer payees. Such services have been or are currently being provided by national nonprofit organizations as well as local community organizations. For example, the AARP Foundation began a volunteer representative payee trainee program in 1981; in 2004, approximately 5,000 beneficiaries were served nationally by this program (AARP, 2005). However, an organization must be willing to contribute funds as well as staff to coordinate a volunteer payee program, and many local community and national organizations cannot support such activities in perpetuity. SSA investment in promoting such programs may improve the supply of volunteer or community payees, particularly for handling difficult cases.

SSA staff appear to be tailoring the payee selection to the specific needs and situation of a beneficiary, which is ultimately advantageous to

beneficiaries. Although flexibility is appropriately part of the payee selection process, there is significant variation in how local staff apply criteria to select payees, both within and between field offices. For example, the recommended preferences provided by POMS are often used as requirements. Although such efforts to improve the selection of payees can be considered laudatory, they also suggest a need to standardize the payee selection process.

SSA policy requires the maintenance of a source of payee volunteers and community organizations with payee volunteer programs to address situations in which payee candidates are not readily available for a given beneficiary in need. However, in some local offices such volunteer pools were limited or did not exist, and staff resources for developing them were insufficient. The lack of resources for ensuring the development and maintenance of payee volunteer pools severely hampers the program in some offices.

RECOMMENDATION 6.1 To help mitigate shortages of payees, the Social Security Administration should create a program to identify, train, certify, and maintain a pool of voluntary, temporary payees that are available on an as-needed basis. If such a program is authorized, the Social Security Administration should work with and obtain help from the courts and volunteer organizations in designing it.

Recruitment of Payees for At-Risk Beneficiaries

At-risk beneficiaries are those with precarious health, behavioral, or living situations. Such beneficiaries include but are not limited to those who are homeless, have alcohol or substance abuse problems, are mentally unstable, or have chronic health conditions that require special living or treatment arrangements. SSA staff expressed concern with recruiting payees for such at-risk beneficiaries, noting that the needs of these beneficiaries far exceed the fiduciary service that could be provided by an individual payee or by SSA. Staff told the committee that at-risk beneficiaries deserve special payee arrangements that currently do not exist in the system. For instance, homeless beneficiaries have daily needs of food and shelter, yet their benefits are either insufficient, unavailable, or are not being used for those needs. Mentally ill beneficiaries are often left to fend for themselves in the community and would benefit from an organizational assisted living arrangement, yet affordable choices are not always available to them. A third example concerns substance abusers. These beneficiaries often seek to maximize their cash allocations from payees—to the detriment of basic needs—in support of their addiction.

The POMS provides detailed guidelines for the selection of a payee

for certain classes of at-risk beneficiaries, such as known alcohol- and substance-abusing beneficiaries (POMS GN 00502.105).

Select the best payee available from this list of preferred applicants: a community-based nonprofit social service agency bonded and licensed (if required) by the State; a Federal, State or local government agency whose mission is to carry out income maintenance, social service, or health care-related activities; a State or local government agency with fiduciary responsibilities; a designee of an agency (other than of a Federal agency) referred to above, if appropriate; or a family member. When none of the preferred payees above are available, select the best payee available from this list of alternate sources: a legal guardian with custody who shows strong concern for the beneficiary’s well-being; a relative or friend with custody who shows strong concern for the beneficiary’s well-being; a public or nonprofit agency or institution with custody; a private, for-profit institution with custody and is licensed under State law; or anyone not listed above who is qualified and able to act as payee, and who is willing to do so; an organization that charges a fee for its service.

A representative payee’s responsibilities for these and other at-risk beneficiaries require special training and professionalism that transcends the current model of a “suitable representative payee,” as well as the guidance provided by the POMS. SSA staff reported that finding payees for at-risk beneficiaries tends to be the most challenging selection task. Such payees tend to be nonrelative friends or acquaintances, and payee tenure tends to be short in comparison with the tenure of payees for other beneficiary types. Finding appropriate payees for at-risk beneficiaries is perceived as a significant challenge, and at-risk beneficiaries are believed to be at higher risk for payees’ misuse of funds.

The use of payees from volunteer groups or for emergency situations was discussed in some of the committee’s site visits. As mentioned above, SSA staff are sometimes unable to identify suitable payees despite their charge to maintain a pool of such candidates. Staff reported to us that sometimes a less-than-optimal candidate is selected simply because there is no other choice, and the beneficiary’s needs for a payee are urgent. For such situations, the staff suggested the development of a pool of trained, willing payees that could be tapped as needed for emergency or other temporary situations.

Some field office staff said that they believe that at-risk beneficiaries are better served by fee-for-service payees who are professionals and may be better acquainted with the payee system and rules. Yet these types of payees are at the end of the POMS list of “preferred” payees for substance-abusing beneficiaries who need payees. Staff noted that although small group institutions that provide high-quality care are often better suited than indi-

viduals to serve at-risk beneficiaries who suffer from substance or alcohol abuse or have mental disabilities, the bonding requirement can be too high a burden for these small commercial payees.

Finally, the changing demographics of the United States are worth mentioning here. The number of beneficiaries with mental illness, mental retardation, and developmental disabilities; the homeless; and persons in the end stages of HIV/AIDS will continue to increase in the coming years (see Teaster, 2003). Thus, the problem of identifying payees for at-risk beneficiaries can be expected to increase and worsen if the current system is not changed.

CONCLUSION It is difficult to find appropriate payees for at-risk beneficiaries. Fee-for-service payees may be better for at-risk beneficiaries because they are professionals and may be licensed and are better equipped to deal with situations posed by at-risk beneficiaries.

RECOMMENDATION 6.2 Congress should authorize the Social Security Administration to expand the fee-for-service part of the program to include appropriate small organizations and individuals who are willing to serve as payees for at-risk beneficiaries: people with mental illness, alcohol or substance abuse problems, severe disabilities, and those who are homeless.

Suitability

Once a representative payee candidate is identified, SSA must determine the person’s suitability to serve as a payee. The process of determining suitability involves

-

completion of an application by the candidate;

-

verification of candidate’s identity;

-

assessment of the candidate’s exclusion factors (see below); and

-

in most but not all cases, a personal interview with an SSA field office staff person.

SSA policy (in the POMS) provides explicit guidance on those who should be prohibited from selection as payees (POMS GN 00502.132):

-

fugitive felons,

-

representatives or health care providers who have committed Social Security fraud, and

-

individuals having an unsatisfied felony warrant (or in jurisdictions

-

that do not define crimes as felonies), a crime punishable by death or imprisonment exceeding 1 year.

The POMS also identifies individuals that generally should be avoided as payees, yet are ultimately eligible to serve as representative payees:

-

convicted felons other than those convicted of violations of felonies involving fraudulent action in relation to a benefits applications and misuse of Social Security numbers under the Social Security Act (defined in the Act);

-

applicants found guilty of fraud related to the Representative Payee Program;

-

applicants with a prior history of misuse;

-

people who have been imprisoned for more than 1 year; and

-

creditors of the beneficiary.

SSA policy sets priorities for candidates in representative payee preference lists. The POMS provides separate preference lists for payee candidates according to three beneficiary types: minors (children), adult beneficiaries, and beneficiaries with known substance abuse problems (POMS GN 00502105).

When the beneficiary is a minor child, select the best payee available from this list of preferred applicants: a natural or adoptive parent with custody; a legal guardian; a natural or adoptive parent without custody, but who shows strong concern; a relative or stepparent with custody; a close friend with custody and provides for the child’s needs; a relative or close friend without custody, but who shows strong concern; an authorized social agency or custodial institution; or anyone not listed above who shows strong concern for the child, is qualified, and able to act as payee, and who is willing to do so. For non-substance abusing adult beneficiaries, the preferred list is: a spouse, parent or other relative with custody or who shows strong concern; a legal guardian with custody or who shows strong concern; a friend with custody; a public or nonprofit agency or institution; a Federal or State institution; a statutory guardian; a voluntary conservator; a private, for-profit institution with custody and is licensed under State law; anyone not listed above who is qualified and able to act as payee, and who is willing to do so; a friend or relative without custody, but who shows strong concern for the beneficiary’s well-being; or an organization that charges a fee for its service.

On the whole, it is clear that SSA policy on payee candidate suitability promotes three seeming principles:

-

Only the most egregious circumstances result in exclusion from appointment to payee.

-

Flexibility in payee selection is critical, especially with respect to beneficiary needs.

-

A less than ideal (“bad”) payee is preferable to not having a payee.

Data from the committee’s survey provide a useful glimpse of the appointment process. The vast majority of payees actively expressed a willingness to serve their beneficiaries, 96.8 percent (0.5). For the small pool of reluctant payees, their concerns included the responsibility of being a payee, 72.1 percent (5.1), and what SSA required of payees, 66.3 percent (7.0), as well as the time commitment, 38.5 percent (7.4), and the potential impact on the payee’s relationship with the beneficiary, 35.6 percent (6.0).

Although it is a very positive sign that nearly all payees serve willingly, a critical dimension of performance is the ability of payees to serve their beneficiaries. Survey results suggested a reasonably large proportion of payees may be in economically unstable circumstances. As discussed in Chapter 2, more than one-half of payees reported individual annual incomes of less than $15,000, although this indicator may not reflect potentially much larger household incomes. The estimated 5-year bankruptcy rate for active payees, 6.4 percent (0.8), appears to be higher than the national rate.2

The rate of changing residences for the representative payees is similar to the rate in the general U.S. population. More than 28 percent of the payees had moved residence in the last 2 years, 28.4 percent (1.5); in comparison, nationally in 2003, about 15 percent of the population (over 1 year old) reported moving in the previous year (U.S. Census Bureau, 2004).3

During the committee’s site visits we also considered the fraction of payees with a history of criminal activity or substance abuse (given that some felons are allowed to be payees under SSA policy). The estimated prevalence of payees who had been convicted of a felony is reasonably low, and the fraction of payees who had served in prison is about the same as the estimated national rate of 2.7 percent (Bureau of Justice Statistics, 2004). A very small percentage of payees admitted that they had undergone drug or alcohol rehabilitation in the last 5 years. Thus, it appears that a small seg-

ment of the payee population may have characteristics that are associated with reduced ability to effectively serve beneficiaries and with increased risks of program violations or misuse.

Even though the prevalence rate of risk indicators for payees is similar to that of the U.S. adult population, such instability poses a potential conflict of interest and increases the risk of misuse. If people with these characteristics are chosen to be payees, it seems reasonable that additional monitoring would then take place. Such monitoring can occur either from the office that made the appointment or by a designated person in the district or region who is chosen to monitor difficult cases.

Some of the findings in Chapter 5 on misuse deserve repetition. The determination of payee suitability should include the consideration of such factors as felony status, any time spent in jail, previous history of misuse, employment status, credit rating, mobility, whether or not the payee resides with the beneficiary, and whether or not the payee is a creditor for the beneficiary. These factors are currently absent from the exclusion rules in the POMS, but the data collected by the committee showed that most of them are associated with misuse.

Although criminal activity or substance abuse among payees is similar to that of the U.S. adult population, such instability poses a potential conflict of interest and increases the risk of misuse. SSA must be more judicious in establishing the suitability of representative payee candidates for at-risk beneficiary populations.

CONCLUSION The Social Security Administration appoints some payees with characteristics that raise questions about their suitability as payees.

RECOMMENDATION 6.3 The Social Security Administration should screen potential payees (including organizational payees) for suitability on the basis of specified factors associated with misuse, particularly credit history and criminal background.

RECOMMENDATION 6.4 The payees of at-risk beneficiaries should be monitored more frequently and intensively than current protocols provide.

“Individual” Payees with Multiple Beneficiaries

SSA policy allows for an individual to serve up to 14 beneficiaries at a time. The committee’s study of possible misuse found several cases in which individuals were payees for numerous beneficiaries and also affiliated with organizations that serve the beneficiaries, possibly fee-for-service.

Such situations constitute conflicts of interest. Although SSA definitions designate these people as “individual” payees, some are clearly operating as organizations or as group homes and some are concurrently defined by the state to be in charge of organizations providing assisted living, board and care, or foster care. In many of these cases, the representative payee is not only the disburser of SSA benefits, but also the provider of services, including shelter and food.

In some cases, the state provides a regulatory schema for monitoring the facility with which the individual payee is affiliated, including rules for the fiscal management of SSA benefits. Some states set the provider’s rate for services; in others, the state does not exercise any oversight over the way the beneficiaries were charged. In the latter situation, the payee is free to charge whatever she or he deems appropriate for the services rendered and to deduct the charges from a beneficiary’s monthly payments.

The committee’s study showed questionable practices regarding the charges levied by payees in such situations: some payees adjusted the monthly room-and-board charges to the total check amount received by a beneficiary so that no additional funds remained (or reserved a nominal weekly cash allotment for the beneficiary’s spending money). Such fee policies were used even when different beneficiaries in the same facility received different levels of payment, meaning a different “price” was charged for the same service. Other payees appeared to charge above-market rates in order to ensure the complete exhaustion of monthly checks. In many of these cases, the payees were able to provide detailed records of charges, complete with receipts, so that from an accounting standpoint, the payee was performing according to program policies. However, when a payee is a creditor of a beneficiary, either as a landlord or as a provider of board and care, it is unclear whose interests are being served. When a representative payee is the payee for several people in her or his care (as a landlord or a facility), it is inappropriate for the payee to be considered an individual payee.

Selection of an appropriate payee is the most important way of ensuring that a beneficiary’s needs are met. Individual payees who are administrators of care organizations or who serve several beneficiaries in some other organized capacity should be treated differently from payees who truly serve beneficiaries as individuals. Such groups are in need of monitoring similar to that provided to organizational payees, and SSA should consider a new category that properly classifies organized care providers.

CONCLUSION The current designation of “individual payee” is too broad a category. The designation mixes payees who serve a single or even a few beneficiaries with payees who operate group homes for up to 14 beneficiaries. Individual payees who are owners or administrators

of group homes have an inherent conflict of interest. Payees of this type require special monitoring.

RECOMMENDATION 6.5 The Social Security Administration should develop policies that define and treat as an organizational payee an individual who serves multiple, unrelated beneficiaries and who is also the owner, administrator, or provider of a room-and-board facility.

More thorough investigation and monitoring are needed for such payees than for truly individual payees. The committee suggests that SSA develop performance standards specifically for this type of payee.

RECOMMENDATION 6.6 The Social Security Administration should reevaluate its policies that permit creditors and administrators of facilities to serve as payees.

Dual Roles and Fees for Payees

Several issues may arise when individual payees also have roles as conservators or guardians or hold a power of attorney for their beneficiaries. One issue involves the need for a separate “appointment.” For example, under current policy, a person who holds a beneficiary’s power of attorney must apply to be the payee if she or he wishes to serve in that role. This application is necessary because SSA does not recognize guardians or court-appointed conservators as a substitute for a representative payee. If they do not apply, SSA may appoint someone else to be payee. Sometimes they are unaware that they need to apply to be a payee at the same time that SSA is unaware of their existence and so is seeking a payee. This situation suggests the need for improvement in communication between state courts and SSA about SSA beneficiaries.

To facilitate communication and information exchange between state courts and the Representative Payee Program, there may be a need to clarify an issue related to the Privacy Act (5 U.S.C. § 552a(b)(11)). The issue is whether the exception to the Privacy Act, which permits disclosure of records maintained by an agency “pursuant to the order of a court of competent jurisdiction,” applies to orders of state courts seeking access to records about individuals appearing before such courts in guardianship proceedings and who have served or are serving as representative payees. State guardianship courts, for instance, might wish to access or obtain data on payees (e.g., from the Representative Payee System [RPS]) in order to verify the credentials, integrity, and capabilities of guardian candidates with former experience as representative payees. The committee assumes that state courts are “courts of competent jurisdiction” within the scope of

the exception to the Privacy Act. The viability of this Privacy Act exception, and the SSA’s acceptance of state court orders as within its scope, is an important element in information exchange and cooperation to assure responsibility and appropriate transparency in the activity and conduct of fiduciaries serving incapacitated individuals, such as guardianship wards and beneficiaries dependent on representative payees.

Another issue regarding dual roles involves fees for serving beneficiaries. The committee’s study of misuse revealed a discrepancy between two kinds of payees. There were payees who were “given” fees by the beneficiaries for taking care of them and guardian and conservators who took fees under court authority. Misuse clearly occurs when a beneficiary “gives” a payee a monthly fee (taken from the benefits payments) as compensation for the payee’s service as the beneficiary’s money manager. However, when a payee takes court-sanctioned fees from SSA beneficiary payments in return for services, the issue of misuse becomes murky.

The issue of “court-approved” fees for guardianship and representative payee services is complicated. There is no legislative or regulatory authority to allow court-sanctioned fees for service as a representative payee. The Social Security Act (42 U.S.C. §§ 405(j)(4(A) & 1383(a)(2)(D)) stipulates that only a few types of payees may draw a fee from Social Security benefits, and an organization must apply and be authorized by SSA in order to collect a fee. To qualify as a fee-for-service payee, an organization must

-

be a state or local government agency, or

-

be a community-based, nonprofit social service agency, that is bonded and licensed by each state in which it serves as a representative payee (if available), and

-

regularly provide payee services to at least five beneficiaries and demonstrate that it is not a creditor of the beneficiary.

Despite this statutory language, SSA told the committee that court-appointed guardians may deduct fees from Social Security benefits (see Appendix C). The basis for this statement is found in the POMS (GN 00602.040):

Guardianship Fee: When an individual is appointed a legal guardian for a competent or incompetent beneficiary, part of the beneficiary’s funds may be used for customary guardianship costs (or proceedings) and court-ordered fees, provided

-

the guardianship appears to be in the beneficiary’s best interests,

-

the beneficiary’s personal needs are met first, and

-

the beneficiary’s funds would not be depleted by the guardianship costs.

The federal courts have ruled that relying entirely on program management directives is not sufficient to establish regulatory requirements. In cases brought before the federal courts in recent years they have found that the POMS and the HALLEX4 are internal documents and do not have the force of law.5 They may indicate a direction, but they do not have regulatory or statutory authority. In the case of fees for service for representative payees, the acceptability of courts of general jurisdiction to allow fees to be taken out of Social Security dollars by guardians who are also acting as representative payees is in direct opposition to the legislation regarding individuals’ ability to accept fees.

CONCLUSION The guardianship and fee-for-service aspects of the program conflict with the congressional intent that individual payees not receive fees from Social Security funds. Although the Social Security Administration Program Operating Manual System provides policy guidance for allowing fees when there is court oversight, this broad allowance of such a practice is not in the best interests of beneficiaries and conflicts with legislative intent.

CONCLUSION Some beneficiaries have Social Security Administration-appointed payees who are different from the people who hold their power of attorney or serve as legal guardian or conservator. This causes potential conflicts, violations of Social Security Administration rules, inefficiencies and inaccuracy in reporting, delays in payee selection, and duplication of effort.

CONCLUSION There is a lack of communication between the Social Security Administration and state courts with regard to beneficiaries who might have both a guardian and a representative payee. This lack of communication has led to misunderstandings as to the authority, or lack thereof, for paying fees for representative payee services.

RECOMMENDATION 6.7 The Social Security Administration should change the Program Operating Manual System to state that when a beneficiary already has an individual with power of attorney, a legal

guardian, or conservator, there is a preference (with flexibility) for selecting that individual as the beneficiary’s representative payee.

RECOMMENDATION 6.8 The Social Security Administration, in consultation with the states, should eliminate inconsistencies between state and federal practices regarding the calculation of payee fees and financial oversight.

The committee suggests that SSA consider several changes in policies regarding payees who are in dual roles:

-

Should individuals who are payees and also guardians or conservators be allowed to calculate and take a fee from funds that include SSA funds?

-

Is there a need for legislation or a regulation that specifies that such fees should only be allowed if there is oversight of this practice by a state court of general jurisdiction and they do not exceed what a fee-for-service organizational payee is allowed to take from benefit funds (as is the case in Illinois)?

-

If a state regulates providers, such as group homes that are also serving as payees, should SSA develop a procedure for determining that the state’s requirements for such regulation cover financial oversight of SSA funds so that SSA could substitute state regulation for federal oversight?

TRAINING AND SUPPORT FOR PAYEES

Training

Training is a key factor for developing a cadre of effective representative payees. Data from the committee’s survey show that most payees have an adequate understanding of their duties and responsibilities as payees (see Chapter 3). However, field office staff told the committee that many payees do not appear to understand the details of their responsibilities, such as how to keep records, the need to deposit benefits into a separate account, and the need to save money (see Chapter 3). There was a general consensus among the staff that better payee training is needed. As discussed in Chapter 3, the brochure for payees and Internet resources lack specificity and practical knowledge that can train a payee for effective service. One suggestion is to compile best practices for payees and hands-on examples, review them with new payees, and disseminate them to all payees on a regular basis. One field staff member stated:

The pamphlet is good but you need hands-on examples. You need to talk to them [payees] a lot to get them to understand how they might do a good job. Talk to the payees about how to go grocery shopping for the beneficiary. Have two baskets, don’t intermingle the contents with your own groceries. Tell them how to work with the bank. Show them how to do a ledger. Give them a ledger book. Send them some in the mail—this also verifies the address. I would give the payee a CD (DVD) to take home and watch. The CD would remind them of their duties and responsibilities.

Refresher training was also mentioned by staff as important but lacking. For instance, it would be useful to remind payees of their obligation to notify SSA of changes in a beneficiary’s living arrangements because it may affect the benefit amount. Another strategy is to follow the lead set by state courts that mandate training of conservators and guardians. If SSA policy designates conservators and guardians as payees, then perhaps the trainings could be consolidated.

SSA staff noted that some payees are innumerate, and others have difficulty reading. The existence of payees with limited skills raised the question of whether some minimal skill thresholds should exist for payee candidates. Payees with limited skills may put their beneficiaries at risk for sub par service, but thresholds may eliminate as payees people who would look after the beneficiary beyond the basic stipulations of payee responsibilities, e.g., parents of child beneficiaries. The committee believes that it is possible to develop and implement training for payees with limited skills but who are otherwise suitable payees. The principle would be one of inclusion with regard to payee selection. And it would rely on field office staff being assiduous in their efforts to train and support payees.

In 1996, the Representative Payment Advisory Committee (U.S. Social Security Administration, 1996) also raised related issues that the committee found are still fundamentally unaddressed:

-

Lack of a designated person in the SSA field offices to be responsible for and be the contact for representative payee issues.

-

Absence of ongoing workshops and seminars for training and supporting payees.

-

Lack of ongoing and periodic communication from SSA field staff to payees.

-

Absence of materials containing specific examples or workbooks of how payees should carry out their responsibilities.

RECOMMENDATION 6.9 The Social Security Administration should provide comprehensive and formal training for representative payees.

The committee suggests that an enhanced training system might include a more intensive initial training session than exists in current practice and regular refresher sessions. The training might include mandatory oral briefings, enhanced yet simplified hard-copy materials, and examples of best practices, Internet-based training, and a dedicated toll-free hotline for payee assistance.

Support

A component of the Representative Payee Program that seems underdeveloped is an organized system for ongoing support for payees. The committee’s survey showed that only a small fraction of payees sought assistance from SSA in relation to their role as payee, and relatively few had used the SSA’s Internet site (see Chapter 3). Regardless of whether a payee had previously contacted the SSA office, a significant number of payees were interested in additional SSA assistance.

The SSA website (www.ssa.gov/payee/index.htm) provides the principal source of ongoing support to representative payees. As noted in Chapter 3, only about 1 in 10 have used SSA’s payee website, even though nearly two-thirds of representative payees had access to the Internet. This suggests that the effectiveness and perhaps awareness of the site could be improved.

The site visit reports suggested that ongoing training of payees was needed. As mentioned earlier, one idea was to provide DVDs to payees as a visual aid the payee could reference in the privacy and comfort of his/ her own home. Another suggestion was to schedule “refresher” training sessions.

RECOMMENDATION 6.10 The Social Security Administration should provide payees access to various types of well-advertised support in their activities. Such support could include: (1) dedicated field staff who can serve as contact persons for payees; (2) toll-free telephone numbers specifically for use by payees to seek assistance from SSA; (3) easily comprehensible brochures containing examples and explanations; (4) enhanced, easy-to-use FAQs and online learning tools; (5) guidance on how to meet accounting and document retention requirements; and (6) online guidance for payees to complete the annual accounting form.

MONITORING AND ACCOUNTABILITY

If the Representative Payee Program is to be effective, performance of payees needs to be monitored, and problems should be addressed expeditiously. Currently, there appears to be very little performance monitoring

and accountability for individual payees who serve fewer than 15 beneficiaries and for nonfee organizational payees that serve fewer than 50 beneficiaries. The current methods for monitoring are the accounting form, handling of ad hoc complaints by field staff, and the RPS. The committee found these resources to be inadequate and/or ineffectively targeted, as detailed below.

The Accounting Form

SSA created an annual accounting form for payees after a court case and legislation mandated equal treatment and annual accounting for all payees.6 The legislation also required the commissioner of the SSA to establish and implement statistically valid procedures for reviewing such reports in order to identify instances in which such persons are not properly using such payments (42 U.S.C. § 1383(c)(i)).

The first monitoring milestone involves flagging the payee’s submission of (or failure to submit) an annual accounting form, as required by SSA policy. However, not all payees realize that an annual accounting form is mandatory: the committee’s survey showed that 7.1 percent (0.7) of payees did not understand the requirement (see Chapter 3). Although failure to submit the form can be an indicator of improper use or misuse, SSA told the committee that resources are inadequate for fully pursuing and investigating payees who fail to submit annual accounting forms (Appendix B):

The sheer volume of required annual accountings creates an extremely large administrative burden and prevents SSA from being able to develop an in-depth review of a smaller population of possible higher risk payees.

Although there may be legitimate reasons for some failures to file the form—for instance, a beneficiary’s payee may change several times in a year so that no single payee is responsible for a full year—the committee’s study of misuse shows that such failure is a useful indicator of potential misuse or improper use.

Once the form is submitted, SSA assesses whether benefit funds are being properly used for the beneficiary. This assessment is largely an exercise in determining whether the entered amounts are consistent and plausible. However, as discussed in Chapter 4, the form can be completed impeccably, yet misuse can still be occurring. And at the other end of the spectrum, a completed form can have illogical or questionable entries, yet further investigation shows that misuse did not occur.

When irregularities or errors do trigger a follow-up with a payee, the

forms are retrieved and forwarded to local field offices. The SSA staff then contact the payees to investigate further. However, after an annual accounting form is forwarded to a local field office for resolution, the form is not necessarily returned to the designated repository (the Wilkes-Barre Data Operations Center). To the extent that forms are not ultimately returned to the Data Operations Center, a potential indicator of payee misuse—an erroneous or incomplete annual accounting form—is thus not available for further use and analysis. In particular, the RPS will not have information on the completion status of the annual accounting forms that have been questioned and investigated.

Beyond the case-by-case review, SSA does not have an appropriate method for systematically evaluating and validating the material it receives on the annual accounting forms. The forms are now optically scanned at the Wilkes-Barre Data Operations Center for electronic storage, but financial data provided by payees are not entered into a database that can be analyzed for compliance and tabulated to produce an indicator of possible violations. As such, this method does no more than preserve a hard-copy version in electronic form; it does not allow for statistical tabulation or analysis of the reports’ contents, as required by legislation.

As part of an examination of lump-sum payments, we requested annual accounting forms for 50 Old Age, Survivors, and Disability Insurance (OASDI) payees and 50 Supplemental Security Income (SSI) payees: 18 percent of the forms for the OASDI payees could not be retrieved, and 28 percent could not be retrieved for the SSI payees. It is not clear if the reports were lost in some local office or were never submitted by the payees. Since many beneficiaries change payees on an almost regular basis (with some payees cycling in and out of the system for the same beneficiaries), it is possible for many months, maybe even years, to pass without a particular payee responding to the annual accounting process.

Another issue associated with the annual accounting form is perceived paperwork burden on payees. Some field office staff expressed concern about the burden placed on payees. However, the committee’s survey showed that 80.9 percent (1.2) of payees said the form was easy to fill out, and only 10.6 percent (0.9) reported some difficulty completing it.

On average, representative payees spent 14.8 (0.4) minutes completing the annual form. The vast majority of payees, 82.4 percent (1.2), spent less than 1 hour and only 12.2 percent (1.0) spent 1-2 hours to complete the form. The apparent ease of completing the annual accounting form, combined with the fact that one-third of payees did not keep financial records (and many more did not organize their records), indicates that the current annual accounting form is not an effective or trustworthy tool for monitoring.

Although the accounting form is thought to be a psychological deterrent (at best) for ensuring that funds are spent on beneficiary needs, in

its present form it does not provide sufficient information to determine if benefit funds are used appropriately. The committee believes the form can provide much better needed information and proposes a redesign for SSA consideration: See Chapter 5 for discussion and Appendixes E and F. Another revision to the process would be online filing (see Chapter 5).

During its site visits, the committee encountered a larger problem of the lack of effective training and tools for payees to track expenses. In fact, there are no guidelines as to which receipts payees must keep to verify appropriate use of beneficiaries’ funds. More generally, there is no standardized bookkeeping or accounting method that is required of payees.

CONCLUSION The statutory provision (42 U.S.C. § 405(j)(3)(A) (OASDI); 42 U.S.C. § 1383(a)(2)(C) (SSI)) that requires the Commissioner of the Social Security Administration to establish and implement statistically valid procedures for reviewing the annual accounting forms creates a concomitant obligation to provide information for understanding and monitoring the performance of representative payees. This obligation is not being fulfilled.

CONCLUSION The filing of annual accounting forms (or the failure to file them) is not reconciled with any other administrative record so that a failure to file would bar a payee from continuing to serve in such a capacity.

CONCLUSION It is too easy for representative payees to learn that if they just fill out the accounting form with some plausible, but possibly inaccurate information, they will have complied with the program’s reporting requirement and that there will be no follow-up or other consequences. Essentially, the current monitoring process is an “empty threat” that can easily be subverted and is an expensive administrative tool that does not yield the sort of data that are necessary to uncover misuse.

CONCLUSION The Social Security Administration does not have a method for systematically evaluating and validating the material it receives on the annual accounting forms. The data on the accounting form are not retrievable for statistical analysis and therefore, empirically based policies and regulations cannot be formulated. In addition, the Social Security Administration’s legislative obligation to statistically tabulate the annual accounting form remains unfulfilled.

RECOMMENDATION 6.11 The Social Security Administration should reengineer the annual accounting form to ensure the usefulness of the data and their transferability into the Representative Payee System and other Social Security Administration information systems.

RECOMMENDATION 6.12 The Social Security Administration should store data from the annual accounting forms in an electronic database suitable for analysis.

RECOMMENDATION 6.13 The Social Security Administration should provide the option for payees to complete the annual accounting form online.

Review of Ad Hoc Complaints

A second monitoring strategy in the program is the review of ad hoc complaints of potential misuse by field office staff. Typically, misuse complaints are lodged against a payee by the beneficiary or nonpayee relatives or friends of the beneficiary. A claims representative is charged with investigating such complaints. The initial inquiry typically leads to a complex array of facts, events, assertions, and interactions among the accuser, the payee, and the beneficiary (see below). However, as discussed in Chapter 4, the claims representative has little incentive to pursue a formal investigation. The amount of time, analysis, and paperwork that is required to establish misuse, coupled with a malleable definition of misuse, leads claims representatives to avoid the difficult task of documenting misuse. The usual approach is for the claims representative to determine whether or not the beneficiary should have a new payee, and if so, to “deselect” the current payee and identify and appoint a new one. Although most cases of formal misuse do arise from complaints, the vast majority of complaints do not result in a formal finding of misuse. Rather, they usually result in the replacement of a payee (see Chapter 4). Thus, potential and likely misuers are not held accountable, and they can—and frequently are—appointed again as a payee to the original beneficiary or to another beneficiary.

We illustrate this scenario with a situation we found many times in our site visits: custody changes for minors with parents who do not live together. Claims representatives reported that they devote a substantial amount of their time to sorting out child custody issues. Each time a custody change occurs, they must verify the child’s residence through administrative data, such as school records. Shared custody situations lend themselves to conflicts between parents (or other custody sharers). One claims representative reported that a parent continued receiving the child’s benefit checks even though the child had moved to the other parent’s residence. Another reported finding that in checking a parent’s claim for a resident child, an approved claim had already been filed by the other parent who was receiving the child’s checks as the payee which constitutes misuse. It is clear that shared custodial beneficiary situations may facilitate or mask misuse and require continuous and careful monitoring by SSA staff.

The difficulty of defining misuse in specific complaint situations was

reported repeatedly in the site visits. Explicit definitions and guidelines appear in the Social Security Act and the POMS (see discussion in Chapter 5). In response to a committee question, SSA stated:

The (SSA) technicians need to use information contained in the POMS and use their own judgment and expertise to resolve the problems or issues presented to them in each particular case. It would be impossible to cover by written instruction every conceivable situation the field will run into given the size and diversity of this population.

Site-visit reports note that as a result of this difficulty, field staff tend to deselect and replace payees instead of a formal finding of misuse, and the standards used to determine misuse are inconsistent across local offices and staff. For instance, some claims representatives included as misuse instances in which a payee did not know whether or not the beneficiary’s needs were being met, regardless of how the funds were being spent. Others included as misuse the practice of a payee taking a small fee from the beneficiary payments, although SSA allows this in specific circumstances (e.g., court approved fees to conservators), or a failure by a payee to respond to contact attempts by SSA.

CONCLUSION Factors such as lack of incentives for staff to investigate misuse, perceived vagueness in the definition of misuse, and the complexity of interpersonal relationships between beneficiaries and their payees often lead claims representatives to find a more suitable payee rather than to formally determine misuse.

CONCLUSION Frequently changing custodial arrangements for beneficiaries who are children involve complicated situations that may facilitate payee misuse.

RECOMMENDATION 6.14 The Social Security Administration should establish mandatory protocols for payee replacement when misuse is suspected.7 When misuse or suspected misuse is the reason for a change of payee, staff should provide full documentation.

The use of phrases such as “more suitable payee found” should not be allowed as formal documentation.

The Representative Payee System

The RPS is a database system used to enter and maintain information about representative payees and the beneficiaries they serve. The RPS is mandated by statute and requires SSA to establish and maintain a centralized file, readily retrievable by SSA offices, which contains the names of payees who have had their status revoked by reason of misuse of funds or because of a program violation. The RPS is thus a critical part of the system to administer the payee program, and it is heavily used by SSA offices to document payee relationships and evaluate potential payees for service. However, our attempts to use the RPS as a research tool and information from field office staff during our site visits indicate that the system could be greatly improved to more effectively facilitate SSA’s mission, both for monitoring individual payees and for agency-level studies of the program. We note that SSA is in the very early planning stages for a revision to the RPS. Thus, our discussion in this section is based on our study of the current system.

A critical problem with the RPS is that it does not contain entries for all payees: SSA estimates that several thousand active payees are not included in the system (Appendix B). In some, but not all cases, the omissions are due to a systematic barrier. In particular, payees without a Social Security number (SSN) (e.g., undocumented alien parents, foreign nationals) cannot be registered in the system. This situation provides an opening for field staff to avoid entering other cases because of the difficulties encountered with the RPS, something that was observed during site visits. SSA acknowledged this problem (Appendix B):

There are a significant number of cases missing from the RPS. Bypassing the payees is of great concern because it prevents SSA from affording protections as designed. Because some rep payee applications cannot be taken in (undocumented alien parent payee without an SSN), we had to have processes in place so these cases could be processed outside of the RPS, a situation which also allows abuses to occur.

A second significant problem is the difficulty of using the RPS to record information on payees at time of application. The process for doing so is laborious, in part due to the outdated interface design for the RPS. Essentially, users are required to navigate through irrelevant screens on their way to a target screen and then to back out of screens to pursue a new query; this is cumbersome and illogical to users. Moreover, the office workload does not allow much time for each visit with a potential payee so inefficiencies in the system discourage complete and detailed data entry.

Because specific RPS conventions for entering data fail to facilitate efficient and accurate data entry, field staff are often uncertain about what

additional information to provide and the amount of detail to enter into the system. For example, the RPS does not require entry for many important variables even though policy dictates that they be recorded. If the claims representative does not do forced entry of the variables—using a mutually exclusive and exhaustive set of response options—there will be missing data that can hamper later investigations about a payee’s service.

There are also many instances in which critical data are entered as free text, which make it difficult to achieve consistency across offices and staff and relatively easy to forget to record important information or omit important details. For example, as discussed above and in Chapter 4, “more suitable payee” is frequently entered as the reason for terminating a relationship and choosing a new payee. This phrase communicates very little to the next staff person who may need to evaluate the terminated payee. Since a lot is known about payees and the reason for their terminations, it would be possible to create forced choices—a checklist—for many data elements that would provide more meaningful and simpler response options for users. The current situation enables “office shopping” by some payees because problematic histories are difficult to uncover. Furthermore, although the RPS has automatic edit checks for some entries, without forced entry and closed-ended responses for critical variables, effective data checks cannot be implemented.

A third problem related to the outmoded design of the RPS is that the system is not being effectively used by all offices, and some of its features are not used by any of the offices. For example, some field staff do not enter enough notes to describe situations observed during interactions with beneficiaries and payees. Such notes are not enforced by the software, yet they could alert staff to repeat issues and complaints or provide valuable background for new payee selections or a change in payee. It also appears that staff training on the RPS would be valuable: for example, some staff believe that they must reenter a name and SSN, although the system does not require this.

Updating the RPS is a fourth important problem. Updates are entered on an ad hoc basis by field staff in response to notification from a payee or beneficiary that circumstances have changed. When the committee attempted to use the RPS to understand the circumstances surrounding misuse cases, current information about a payee’s employment, financial circumstances, or family living arrangements was repeatedly absent. Although payees are responsible for reporting updates, there is no formal system to ensure that this occurs. This is another factor that reduces the currency and quality of payee and beneficiary data. Ideally, the RPS should also be updated with information on the annual accounting forms to establish which payees submit annual accounting forms and which do not. This is a critical

linkage because the failure to submit the form can be used to monitor payee performance and to investigate potential violations and misuse.

CONCLUSION The Representative Payee System is a badly flawed tool for case-by-case field use to evaluate prospective representative payees and to investigate problems with payees. Office-to-office autonomy regarding procedures for making entries into the Representative Payee System and a cumbersome and inefficient interface create an environment that encourages inconsistencies in the amount and quality of information available in the database. In addition, data quality concerns and incompleteness compromise the potential for the Representative Payee System to be used for research and analysis with aggregate data, such as summarizing characteristics of the payee population, investigating factors associated with misuse, and drawing samples for monitoring payees.

RECOMMENDATION 6.15 The Social Security Administration should redesign the Representative Payee System.

The committee suggests that SSA consider the following changes to the RPS:

-

inclusion of all payees into the system;

-

creation of data elements in the system with respect to a payee who is identified as a potential or suspected misuser;

-

addition of data elements in the system for various types of violations by payees;

-

addition of data elements in the system for relevant results of investigations by the Office of the Inspector General;

-

inclusion of the Employer Identification Numbers of all organizational payees in the system;

-

addition of a lump-sum indicator and amount to enable the local field office to better monitor how such money is spent for a specific beneficiary;

-

easy access and use by all field office staff;

-

streamlined linkage to annual accounting form data; and

-

an easy-to-use interface that has undergone usability testing.

The committee suggests that SSA require entry of important data elements—standardized values that ensure consistency of responses across offices and support institutional analysis of the full population or special populations of payees. A new RPS should undergo usability testing to ensure that it effectively supports office staff in entering and updating the

system. These improvements could be logical considerations under SSA’s currently planned revision of the RPS.

RECOMMENDATION 6.16 The Social Security Administration should implement a process that regularly updates information in the Representative Payee System, both by field office staff and through the annual accounting form. The Social Security Administration should also implement a quality control program that periodically checks the integrity of the information in the Representative Payee System.

TERMINATIONS AND TRANSITIONS

There are many reasons that a payee might cease to serve a particular beneficiary, including:

-

The beneficiary requests a change in payee.

-

The payee requests termination.

-

Payee misuse is determined.

-

SSA identifies a more suitable payee.

-

The beneficiary no longer needs a payee (e.g., an emancipated minor, a minor aging into adulthood, or a beneficiary’s recovery from a period of incapacitation).

-

There is a change in custody for the beneficiary.

-

The representative payee or beneficiary dies.

When there is a transition from one payee to another, the selection of a new payee is required to be conducted with the same level of scrutiny as an initial selection of a payee (POMS GN 00504.100). Also, when there is a transition, POMS (GN 00605.360) states that a final accounting of beneficiary funds must be conducted.

In addition to voluntary transitions from one payee to another, SSA has the authority to terminate any payee who is not performing according to the standards outlined in the representative payee brochure. Changes in payees, for whatever reason, are not a common occurrence. In the committee’s survey, more than three-fourths of payees, 79.9 percent (1.2), had never experienced a termination of their tenure. An estimated 15.0 percent (1.0) of payees reported it happened once, and 3.3 percent (0.6) reported two terminations. Only 1.8 percent (0.9) reported being terminated more than twice.

The committee investigated the reasons for the terminations reported in our survey. On the whole, the reasons reflected understandable, logical circumstances for ending the payee appointment. More than one-half, 55.8 percent (2.6), occurred because of a change in beneficiary eligibility (the

beneficiary died or otherwise became ineligible for benefits). Among payees associated with an organization, 60.4 percent (6.5) were terminated because the beneficiary had been discharged or was no longer receiving services.

A smaller fraction of payees initiated their own termination because they did not wish to continue being a payee, 10.4 percent (1.3), or because they could not meet the beneficiary’s needs, 6.5 percent (1.1). About the same percentage of payees were terminated at the beneficiary’s request, 10.9 percent (1.7). In a small number of cases for current payees who had previously been terminated, SSA initiated a termination, 3.6 percent (0.9).

As discussed above, the committee found that when an ad hoc complaint of misuse was filed, a formal investigation was regularly bypassed and replaced with deselection of the payee under suspicion and appointment of a more suitable one. To explore the prevalence and circumstances surrounding this practice, the committee investigated reasons that payees were terminated, using a 1-percent sample of just under 143,000 records drawn randomly from the RPS. We note again the 58 percent of the terminations noted in the RPS carry the notation “more suitable payee found.” The next most common reason for termination was “other,” in 24 percent of cases. Unfortunately, neither of these reasons provides any useful interpretive information that can be used in the specific case or for statistical analysis. The only other common reason cited was “benefit ceased,” 6.5 percent.

Payees who are terminated due to suspicions of misuse but without a formal investigation and finding, remain available for appointment to another beneficiary or to continue serving as the payee to other beneficiaries. We also note that the committee found that when misuse was suspected and a more suitable payee found, a final accounting was not always conducted as required (POMS GN 00605.360).

CONCLUSION Whenever suspected cases of misuse are not subjected to a formal investigation but handled by use of the phrase “more suitable payee found,” potential misusers are not held accountable for their actions; this approach may actually promote reentry to payee status (for some other beneficiary) and consequently future misuse.

CONCLUSION Lack of the required final accounting for terminations may cover up misuse, especially in cases in which a “more suitable payee” was found.

RECOMMENDATION 6.17 The Social Security Administration should revise the current regulations that require a final accounting whenever a payee is terminated to ensure, so far as practicable, that all funds are accounted for.

STATE-RELATED ISSUES

State policies substantially influence the administration of the Representative Payee Program across the United States. The variations in state-specific program implementation are due to such policies as:

-

State courts allow fees to be paid to guardians who also administer SSA funds as representative payees.

-

State courts have oversight over guardians and conservators who also are payees and impose bonding, training, and accountability requirements that are generally greater than SSA has for those who serve only as payees.

-

Mandatory provisions for providers of assisted living or boarding homes to be the representative payee for those who reside in those homes.

-

Former residents of state mental health institutions are housed in boarding houses where the owner/administrator of the facility is also acting as the payee.

Over the past few decades there has been an increase in the monitoring and oversight that state courts exercise over guardianships and conservatorships, through both legislation and court rules. On an individual level, the amount of increased scrutiny depends on the specific court and its resources.

State-appointed guardians who are also payees, in general, must report all of their financial activity to the court. Although there may be greater oversight of payees by state courts than by SSA, SSA still has responsibility to beneficiaries to ensure that there is no misuse of Social Security benefits. Nevertheless, the committee’s study suggested that payees were deferring to state courts for guidance and authority on how to spend and report financial information for their beneficiaries, including stipulations on how the guardians were to be paid from beneficiaries’ funds that included Social Security benefits (see Chapter 5). Fees have been authorized on the basis of the time spent on guardianship services, as well as time spent filing lawsuits, filing taxes, and other services. Guardians reported that as long as there was “approval” by the state court that would be acceptable to SSA. Yet there is no place on the annual accounting form (or any other required payee paperwork) to show what has been filed with the state court or the court’s acceptance of the filing. There is currently no “deemed status” between SSA and state courts that would lead SSA to accept the reports filed with a court in lieu of the SSA annual accounting form.

CONCLUSION Funds from both the Old Age, Survivors, and Disability Insurance (OASDI) Program and from the Supplement Security Income (SSI) Program are used to pay fees for representative payee services without regard for legislative limitations because of the way in which the Social Security Administration defers to state court oversight of guardianship and conservatorship financial reporting.