CHAPTER 4

Applying the Matrix

USING THE MATRIX TO EVALUATE MINERAL CRITICALITY

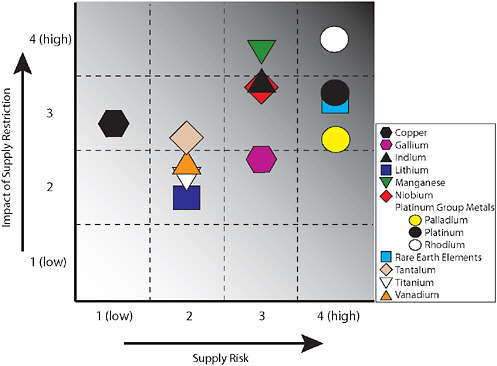

The criticality matrix, introduced in Chapter 1, emphasizes that importance in use and availability (supply risk) are the key considerations in evaluating a mineral’s criticality. This chapter evaluates the criticality of 11 minerals, selected on the basis of two considerations. First, the set of minerals the committee examined had to illustrate the range of circumstances that the matrix methodology accommodates and considers. For example, in the selection of the minerals examined, the committee considered minerals used in large quantities throughout the economy in traditional applications and others used in limited quantities in a small number of (often emerging) applications, minerals produced largely as by-products, and other minerals for which recycling of scrap is an important source of supply. Second, the set of minerals had to consist of those that, in the professional judgment of committee members, would likely be included in a more comprehensive assessment of all potentially critical minerals.

The next section examines in detail 3 of the 11 selected minerals or families of minerals: copper, platinum group metals (PGMs), and rare earth elements (REs). The section thereafter assesses in a more general manner the eight additional minerals that the committee considered potential candidates for criticality: gallium, indium, lithium, manganese, niobium, tantalum, titanium, and vanadium. The committee did not have the time or resources to provide a comprehensive assessment of all potentially critical minerals. The analysis rather focused on establishing the framework and

criteria that might be considered by decision makers and mineral experts is determining a mineral’s criticality and, subsequently, on assessing the type and frequency of information needed at a federal level to mitigate economic impacts should the mineral’s supply become restricted. As a prelude to the criticality assessments, the committee reviews here the materials presented in Chapters 2 and 3 on mineral use and availability. These two chapters inform the “scoring” of the matrix for a specific mineral, or where in the matrix a specific mineral might fall at a given time.

The Vertical Axis: Importance in Use or Impact of Supply Restriction

The vertical axis, as noted previously, represents increasing importance in use, or analogously, the increasing impact of a supply restriction for a particular mineral. The methodology uses a relative scale of 1 (low) to 4 (high) to represent different degrees of importance or impact (Figure 4.1).

The key concept in locating a mineral on the vertical axis is substitution—the ease or difficulty of substituting for a mineral that becomes unavailable or too expensive. The position of a mineral on this axis depends on the context, the definition of which considers two important aspects. The first is scale. Are we concerned about a particular product and the impact a supply restriction would have on the performance of a product? Are we concerned about the effects on a local, regional, or national economy should the supply of a mineral essential to a local, regional, or national industry become restricted? Are we concerned about the effect of a supply restriction on a national priority, such as defense? For example, a mineral that is essential to the performance of a product (i.e., no ready substitutes exist to provide the same or similar performance) would be scored as a 4 by the manufacturer of the product. However, if this industrial sector was only a very small part of the national economy, it might be scored a 1 from the perspective of the U.S. economy. The second aspect of the context in placing a mineral on the vertical axis is time. The longer the period of time a user has to adjust to a supply restriction, typically the smaller is the consequence (substitution becomes easier). With a sufficiently long adjustment period, scientists and engineers usually can identify or develop a substitute

FIGURE 4.1 Criticality matrix diagram showing the two main factors that determine the scoring of a mineral’s criticality: the impact of supply restriction (importance in use and ability to substitute for the mineral), and the supply risk (potential factors affecting the availability of the mineral). The axis scales are guides for the purpose of developing a weighted score for a mineral in terms of its criticality.

material with satisfactory or perhaps even better chemical and physical properties than the material whose supply was disrupted.

In the analysis that follows, the committee took a predominantly national perspective and one that is short to medium term (an adjustment period of one or several years, and no more than a decade). This framing

of the analysis would not preclude someone else from evaluating a mineral from a local or regional perspective or over longer adjustment periods. As long as the context is established at the start of the analysis, the matrix concept can ideally be applied by anyone interested in evaluating a mineral’s criticality.

It is important to recognize that the degree of a mineral’s importance is likely to vary from one end use to another. Substitution is likely to be easier in some applications than others. The committee, therefore, evaluates the degree of importance (or impact of supply disruption) for each important application or end use of a specific mineral.

The committee asked a number of questions in placing a mineral on the vertical axis. What is the technical substitution potential in a particular end use? If technical substitution is possible, what are the economic consequences (in other words, by how much will production costs rise)? How vital is the end use for national considerations (e.g., national security)? How vital to the nation’s economy is the industrial sector encompassing the dominant use of the mineral? How important to society is the dominant use of the mineral? What portion of the mineral will be used in emerging technologies or in applications expected to experience substantial growth? In the end, the actual placement of a mineral on the vertical axis represents the judgment of the committee considering these questions rather than the result of quantitative analytical assessment. Nonetheless, as shown below, the scoring is semiquantitative in that it attempts to weight the various application sectors for the mineral against the risk to the mineral’s availability.

Finally, to facilitate consistency from one application of the matrix to another, the committee presents three indicators for each mineral it assesses: (1) estimated value of U.S. consumption of the mineral, giving an indication of the economic size of the sector (large or small); (2) the percentage of U.S. consumption in existing uses for which substitution is difficult or impossible (measured as the percentage of consumption; a score of 4 in this analysis indicates a high degree of impact from a supply disruption); and (3) the committee’s professional judgment about the importance

of growth in emerging uses that could overwhelm existing raw material production capacity in the short term (Table 4.1).

The Horizontal Axis: Availability and Supply Risk

The horizontal axis of the criticality matrix represents increasing risk (or probability) of supply disruption, which could exhibit itself not only in the form of physical unavailability of a mineral input but even more likely in the form of sharply higher prices for the mineral. As with the vertical axis of the matrix (importance in use), the way in which a specific mineral is placed on the horizontal axis depends on context. For supply risk, time is the essential aspect on which to focus. Are we concerned about availability in the longer term, over periods of a decade or more? Alternatively, are we concerned about the likelihood of short-term disruptions lasting weeks, months, or a few years?

In either case, analysis depends on considering the five fundamental determinants of a mineral’s availability: geologic, technical, environmental and social, political, and economic. How these determinants are assessed depends on whether the analysis is short term or long term. For purposes of this chapter, as noted in the previous section, the committee primarily assesses short- to medium-term supply risks, while commenting on longer-term issues as appropriate.

When locating a mineral on the vertical axis, it is important to evaluate each significant application of a mineral separately because the degree of importance (ease or difficulty of substitution) typically varies from one application to another. When it comes to supply risk, however, the committee does not attempt to estimate different degrees of supply risk for different applications. At one level, especially when markets are large and well functioning, the supply risk is the same for all users. A supply disruption typically will exhibit itself in the form of higher prices that all end users face. The committee realizes that there may be circumstances in which different end use sectors face different supply risks. Such a situation might occur, for example, when one or a few large and powerful buyers are able to

TABLE 4.1 Criticality Indicators for Selected Minerals and Metals

|

|

Copper |

PGMs |

REs |

Niobium |

Gallium |

|

Relevant for Vertical Axis |

|

|

|

|

|

|

U.S. consumption (million $, 2006)a |

16,625 |

1832 |

>1000 |

173 |

10 |

|

Percent U.S. consumption in existing uses for which substitution is difficult or impossible (4 in matrix) |

15 |

55-90 depending on which PGM considered |

44 |

32 |

~40 (indium-dependent) |

|

Importance of growth in emerging uses that could overwhelm existing global production capacity (1 = low; 4 = high) |

1 |

2 |

3 |

3 |

3 |

|

Relevant for Horizontal Axis |

|

|

|

|

|

|

Percent U.S. import dependence (2006)b |

40 |

95 (Pt) 82 (Pd) |

100 |

100 |

99 |

|

Ratio of world reservesc-to-production |

31 |

139 |

715 |

73 |

NA |

|

Ratio of world reserve based-to-production |

61 |

156 |

1220 |

87 |

NA |

|

Indium |

Lithium |

Manganese |

Tantalum |

Titanium Mineral Concentrates |

Titanium Metal |

Vanadium |

|

107 |

Not estimated |

314 |

164 |

Not estimated |

3255 |

68 |

|

~10 (partly gallium-dependent) |

0 |

90 |

90 |

10 (for pigments) |

90 |

11 |

|

3 |

2 |

1 |

2 |

1 |

2 |

2 |

|

100 |

>50 percent |

100 |

87 |

71 |

Net exporter |

100 |

|

6 |

194 |

40 |

33 |

122 |

NA |

208 |

|

13 |

521 |

473 |

116 |

241 |

NA |

609 |

|

|

Copper |

PGMs |

REs |

Niobium |

Gallium |

|

World by-product productione as percent of total world primary production |

Small |

Primarily coproducts |

Primarily coproducts |

NA |

~100 |

|

U.S. secondary productionf from old scrap, as percent of U.S. apparent consumption |

7 |

Significant |

Small |

~20 |

0 |

|

NOTES: NA = not available. aEstimated either as (1) the value cited in U.S. Geological Survey (USGS) Mineral Commodity Summaries, or (2) the product of U.S. consumption and price. bNet import reliance as a percentage of apparent consumption. Net import reliance is defined as imports minus exports plus adjustments for changes in government and industry stocks. cDefined by the USGS (2007) as “that part of the reserve base which could be economically extracted or produced at the time of determination. The term does not signify that extraction facilities are in place and operative.” |

|||||

obtain supply preferentially, even while other, less powerful end users are unable to buy a mineral at all or must pay a sharply higher price.

As with the vertical axis, the actual placement of a mineral on the horizontal axis represents the judgment of the committee, rather than the result of a quantitative analytical method. To assist in this evaluation, five indicators for each mineral that relate to current or future supply were also assessed (Table 4.1): (1) U.S. import dependence, which provides a starting

point for evaluating short-term political risks, although one that is subject to many caveats; (2) the worldwide ratio of reserves to current production, giving an estimate of the lifetime of reserves; (3) the ratio of worldwide reserve base to current production, providing a longer-term perspective on geologic availability; (4) the relative importance of world by-product production in world primary production; and (5) the relative importance of U.S. secondary production from old scrap in overall U.S. consumption.

U.S. imports support investment in the exporting countries and generate social and economic benefits there. A high degree of import dependence for certain minerals is not, in itself, a cause for concern. Increased trade and investment flows contribute to economic growth and prosperity, both for the United States and for its trading partners. However, import dependence can expose a range of U.S. industries to political, economic, and other risks that vary according to the particular situation, including the country or countries concerned, the structure of the industry, and other factors.

The world reserve-to-production ratio integrates certain aspects of geologic, technical, and economic availability and is expressed in years. This term does not signify that extraction facilities are in place and operative. The world reserve base-to-production ratio is also expressed in years and integrates aspects of geologic, technical, and economic availability, but with less restrictive economic constraints. The ratio represents that part of an identified resource that meets certain physical and chemical criteria but includes resources that are currently economic (reserves), marginally economic (marginal reserves), and currently uneconomic (subeconomic resources). These two ratios represent high-level assessments based on an inventory of identified resources and key assumptions. Neither is based on a detailed, site-specific analysis of technical and economic feasibility. Classification of reserves and resources does not necessarily correspond to definitions used by regulatory agencies and relied on by investors. The ratios therefore provide an indication of the long-term availability of a mineral from primary sources. It is difficult to anticipate future exploration success, prices, costs, exchange rates, or production levels, all of which affect the resulting ratios. The underlying database may provide insight into the economic outlook for existing mines, but the ratios provide little insight into market dynamics.

Other sources of data, information, and analysis are required to assess the outlook for supply, demand, inventories, and prices of minerals over the short to medium term. Because such analyses are based on actual investment intentions and project evaluation activity, they provide a clearer indication of short- to medium-term availability, based on recent technical and economic assessments that take technical, political, economic, and

other risks into consideration.1 Project proponents and investors attempt to identify and mitigate project risks and secure insurance coverage against residual risks that cannot otherwise be controlled, but supply restrictions can arise from technical, environmental and social, political, economic, or other disruptions that were unforeseen, were unforeseeable, or could not be mitigated effectively.

Overall Assessment

The overall placement of a mineral on both the vertical and the horizontal dimensions of the matrix thus defines the degree of criticality of the mineral. The most-critical minerals are both essential in use (difficult to substitute for) and prone to supply restrictions. In the committee’s view, criticality is best regarded as a continuum of possible degrees. There might, however, be specific situations in which a company or government agency would desire to create a list of “critical” minerals for the purpose of undertaking specific actions or policies to ensure supply or facilitate substitution away from highly critical minerals. The exact definition of what is critical (and by implication what is not critical) would depend on the specific context. Conceptually, however, a list of critical minerals would contain those minerals in one or more of the boxes in the upper right-hand portion of the matrix (Figure 4.1).

CRITICALITY ASSESSMENTS

This section applies the criticality matrix to three minerals or families of minerals: copper, REs, and PGMs. The committee selected these minerals because they exhibit a range of characteristics and serve to demonstrate the ability to differentiate levels of criticality for minerals with a variety of

properties and applications. Table 4.1 contains the criticality indicators for these three minerals (as well as eight additional candidates for criticality assessed in the next section).

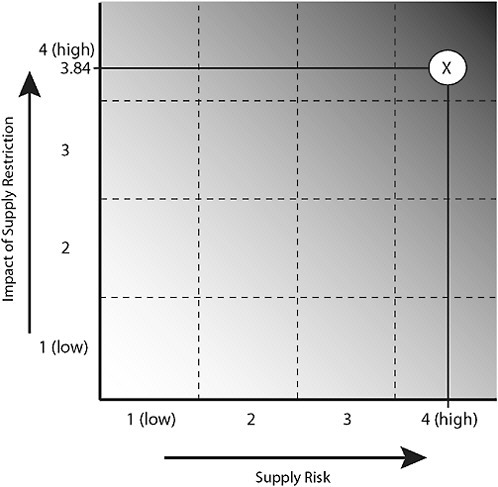

A criticality matrix for a mineral can be constructed by first combining groups of applications and their percentage share of the total U.S. market for the mineral being evaluated (Table 4.2, columns 1 and 2 for example mineral X). The relative importance of the impact of a restriction in that mineral’s supply for each application is then determined. The scale for this determination ranges between 1 and 4 (see also Figures 4.1 and 4.2), where 1 signifies the lowest impact for each application and 4 represents the highest impact for each application in the event of a restriction in mineral supply (Table 4.2, column 3). A composite “score” for the mineral for all applications is then determined using a simple weighting procedure, with the weighting factor based on the proportion (or percentage) of demand for that mineral. The composite score in column 4 for mineral X in the example of Table 4.2 would be (0.27 × 4) + (0.65 × 4) (0.08 × 2) = 3.84.

TABLE 4.2 Scoring the Vertical Axis of the Criticality Matrix for Example Mineral X

|

Application Group (End Uses) for Mineral X |

Proportion of Total U.S. Market for Mineral X in Application |

Impact of Supply Restriction (values of 1 to 4) |

Weighted Score (product of columns 2 and 3) |

|

Aerospace propulsion |

0.27 |

4 |

1.08 |

|

Pigments |

0.65 |

4 |

2.60 |

|

Biomedical devices |

0.08 |

2 |

0.16 |

|

Overall importance in use |

1.00a |

NA |

3.84b |

|

NOTE: NA = not applicable. aTotal proportion will always equal 1. bFinal weighted score. |

|||

FIGURE 4.2 Matrix placement for example mineral X (see Table 4.1). The mineral’s weighted composite score on the vertical axis of 3.84 (impact of supply disruption) coupled with a score of 4 on the availability axis (difficult to obtain due to technological impediments) place the mineral clearly in the critical range on the matrix.

This is essentially a weighted score between 1 and 4 for mineral X for all applications on the vertical axis of the matrix. As demonstrated below, the relative impact of a restriction in supply of a particular mineral has several dependencies. The relatively simple approach to the composite, weighted score for the vertical axis for a given mineral allows important end uses and end uses that command a high portion of the total use of that mineral

to carry their weight into the evaluation. The scoring for the vertical axis considers not just impacts on products with a restriction, but also the ease of substitution for a mineral (in the event of a supply restriction) in a technical sense and the broader market consequences of a supply disruption.

The horizontal axis of the matrix is scored by assessing a value from 1 (low supply risk) to 4 (high supply risk) for each of the five areas of availability discussed in Chapter 3 for the mineral (not for each application sector) and then using the highest single availability factor score as the final horizontal axis score. The rationale for this approach is that any difficulty in a single area of availability will likely be a deciding factor in the availability of that mineral. For example, if the technological aspects of extracting a particular type of ore become so difficult (score of 4) as to hinder the ore’s (and its constituent mineral’s) extraction, then the fact that the mining of the ore may have low or no adverse environmental and social impacts (score of 1) and may be geologically known and abundant (score of 1) in numerous countries (political availability of 1) will not overcome the “unavailability” of the mineral in the short term due to the likely inability to bypass the technological barrier (Figure 4.2).

The examples below evaluate the criticality of individual minerals using data and assessments of the various factors influencing mineral use and availability. The treatments of each of the three detailed assessments are necessarily different in length because copper, as a single metal, is relatively more straightforward to discuss than groups of minerals such as the REs or PGMs. The committee was fairly certain that copper would not fall into the critical field before the analysis was conducted, but felt that an example with a high-volume, common metal such as copper could usefully illustrate application of the matrix and aid the reader in differentiating between the ideas that a mineral can be important, fundamental, or essential for many purposes, but may not be critical in the sense defined in this report. Other minerals likely to fall in this category include, but are not limited to, uranium (Box 4.1), bauxite (the mineral raw material for aluminum; Box 4.2), iron ore, and construction aggregate (Box 2.2) for which the committee did not undertake a detailed examination in this study.

|

BOX 4.1 Uranium Ore, Yellowcake, Enriched Uranium, and Nuclear Power The abundance of uranium in the Earth’s crust is similar to that of metals such as tin and tungsten, and many common rocks in different geological settings around the world, including granites and shales, contain fairly high uranium concentrations. Uranium ores are fairly easily removed from their host rocks and are treated by a variety of leaching solutions applied either through in situ wells or to mineralized rock that has been crushed and ground. In situ leaching does not impact deep aquifers because only uranium deposits submerged in shallow aquifers are mined in situ. The aquifer provides containment for the leaching solutions and is gradually drawn inward toward the extraction wells. After a well pattern is exhausted, aquifer water is extracted to flush the depleted deposit; the water is continuously treated and reinjected at impurity concentrations below regulatory (U.S. Nuclear Regulatory Commission) requirements. A uranium compound, usually yellowcake (ammonium diuranate), is precipitated from the purified leach solution, dried, and shipped to a conversion plant where uranium hexafluoride is made. The hexafluoride, containing about 99.3 percent 238U isotope and only 0.7 percent 235U isotope, is then sent to an enrichment facility that generally uses gaseous diffusion to enrich 235U to a fissionable concentration in the range of 3-6 percent. The United States has 103 operating nuclear reactors in 64 power generating plants producing about 21 percent of its electric power. The operating cost of this power averages about 1.72 cents per kilowatt-hour compared to 2.21 cents for coal, 7.51 cents for natural gas, and 8.09 cents for oil. However, the capital cost for a nuclear plant can be as much as 1.5 times higher than a coal-fired plant and 2.5 times more than a natural gas-fired plant. The annual domestic refueling cycle requires about 70 million pounds of uranium, but U.S. production currently is only about 2 million pounds. Globally, the consumption of uranium is 170 million pounds, but 2005 production was only 108 million pounds, the balance deriving from a diminishing secondary supply of deactivated nuclear weapons. In reaction to this supply issue and to problems in overseas mines and mills, the price of yellowcake rose from $10 per pound in mid-2003 to $113 per pound in April 2007. These price increases have also spurred increased exploration activity for primary uranium sources around the world. Aided by advanced geophysical exploration tools, exploration for and discovery of new uranium deposits will likely maintain the sources that are otherwise being depleted through use. SOURCE: Edwards and Oliver, 2000; Newton et al., 2006; World Nuclear Association, 2005. |

|

BOX 4.2 Bauxite Bauxite is an earthy mineral with approximate composition Al2O3•2H2O. Mined bauxite is treated at high temperature and pressure (Bayer Process) to produce an aluminum hydroxide precipitate that is dried and calcined, yielding highly purified alumina, Al2O3. Alumina is then reduced to molten aluminum metal (Al) by fused-salt electrolysis (Hall-Héroult Process). Bauxite, which is also used for the manufacture of refractories and abrasives, was mined for alumina production in Arkansas, Alabama, and Georgia until the 1970s when reserves of high-grade material were exhausted. However, importation of bauxite and alumina had already begun and duties on both were abolished in 1971 by Public Law 92-151. Bayer plants continued to operate in the United States. Since electrolytic reduction of alumina is very energy intensive, approximately 6 kilowatt-hour per pound of aluminum, the U.S. aluminum industry developed in the Pacific Northwest with the advent of cheap and abundant hydroelectric energy. That industry sector then became fully dependent on imported bauxite from Guinea, Jamaica, Guyana, and Brazil and imported alumina from Australia, Jamaica, and Suriname. During the 1960s and 1970s, the domestic aluminum industry became concerned about potential economic strangulation by the “Bauxite Cartel.” Every major producer invested tens of millions of dollars in the development of processes for production of alumina from non-bauxitic sources including kaolin clays from Georgia and alunite and anorthosite from the western United States. All production processes were successfully tested, but none was commercialized. |

Copper

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

Copper was one of the first metals ever used by humans and continues to be extensively employed today. The uses of copper can be divided into five groups, as follows (see also Table 4.3; Joseph, 1999):

-

Building and construction (about 55 percent of copper use): electrical wire, plumbing and heating, air conditioning, commercial refrigeration, builder’s hardware, and architectural uses;

-

Generation and transmission of energy (about 15 percent of copper use): electrical cable, step-up and step-down transformers;

-

Transportation equipment (about 15 percent of copper use): electrical distribution, alloys and cast components for road, rail, marine, air, and space vehicles;

-

Machinery and equipment (about 10 percent of copper use): computers, appliances, utensils, military ordnance, and industrial valves and fittings; and

-

Telecommunications (about 5 percent of copper use): communications cables and drop wiring; electronics.

In the building sector, the use of copper wiring is strongly increasing as energy use increases with new electronics and appliances and as buildings become larger on a per capita basis. Substitutes are not very satisfactory; thus copper appears to be a crucial component for the maintenance of modern building amenities. During the 1970s, attempts to substitute aluminum in residential wiring failed for reasons of reliability and safety.

TABLE 4.3 Relative Importance of End Use Applications for Copper

Copper demand for hardware and architectural uses is stable, while that for plumbing is decreasing as plastics take an increasing market share. On the whole, building sector use of copper is increasing moderately, and for this reason, the committee evaluates the importance of an impact in supply restriction for this end use to be somewhat high (3) (see Table 4.3). In the energy sector, copper use is increasing strongly as a function of increased energy demand. Aluminum can capture some of the long-distance transmission use at decreased efficiency, but not the vital and copper-intense transformation use. Because of the great reliance at present on energy supply to the United States, we evaluate the importance of an impact in supply restriction for this end use to be high (4).

In the transport sector, copper use is flat to slightly increasing, as vehicles of all kinds become increasingly computer-controlled and as small motors for myriad uses are added. There are no good substitutes for copper in these uses, but good design can minimize the quantities required. Hybrid vehicles are an emerging use and increased demand for these vehicles would require an increase in the quantity of copper to satisfy current electrical and battery power design (see also Chapter 2). Although it is difficult to evaluate the total demand for hybrid vehicles in the future and, as a consequence, any increase in the demand for copper, the committee assesses the impact of a supply disruption for the transport sector as a whole to be somewhat low (2) at present. In the machinery and equipment sector, copper use is flat to slightly increasing. Excess use of material is being minimized, but this is balanced by increasing levels of computer control. Copper is important to these uses, but has potential substitutes; thus the committee suggests the impact to be somewhat low (2) for a disruption in the supply for this sector. In the telecommunications sector, copper use is flat to slightly decreasing. Around the world, more wireless telecommunications equipment is being installed. This is offset by the gradual replacement of copper cables with fiber optics. The criticality of copper in this sector is decreasing over time and is given a relatively low value (1) (Table 4.3).

Electricity drives every facet of today’s society, and copper is the only reasonable metal for delivering electricity. As such, should a shortage occur,

it would ripple quickly through the economy. The relatively high composite weighted score of 2.8 for copper reflects the magnitude of this effect.

HORIZONTAL RANKING—RISK TO COPPER SUPPLY OR COPPER AVAILABILITY

-

Geologic availability. As discussed in Chapter 3, copper mining is concentrated in Chile, with Australia, Indonesia, Peru, and the United States also having significant operations. Many other countries mine copper at somewhat lower levels. This diversity of supply indicates that there are no immediate concerns for copper availability from a geologic perspective.

-

Technical availability. Both open-pit and underground copper mining are as well developed for copper as for any nonrenewable resource. Recycling is generally straightforward because a large fraction of copper is used in pure form. Thus, no immediate concerns exist about copper availability from a technical perspective.

-

Environmental and social availability. The regulatory environments in Chile and the other principal copper-producing countries are basically supportive of the industry, and copper mining and processing are less challenging environmentally than those for some other metals (e.g., gold, aluminum). This regulatory environment suggests that there is little significant concern for copper availability from an environmental perspective. The local communities in many of the principal copper-producing countries have not had a history of regarding mining activities as particularly problematic, although there is a moderate level of awareness of the operations. In the United States, some cases have been documented of differences between community interests and those of real estate, environmental, and mining interests (see also Chapter 3), and have led to mining being restricted in certain areas, and allowed in others. The use of recycled copper would be enhanced if personal electronics were recycled to a greater degree, which suggests the need for

-

more societal awareness worldwide. Overall, there are only modest concerns for copper availability from a social or environmental perspective.

-

Political availability. With the possible exception of Indonesia, the principal copper-producing countries are politically stable. Particularly in view of the diverse set of countries capable of producing significant amounts of copper, there are no immediate concerns about copper availability from a geopolitical perspective.

-

Economic availability. The diversity of copper producers dispels concerns of a few producers controlling prices, but the demand for copper has been strong in recent years as various large nations undergo industrial expansion. As a consequence, prices have risen accordingly.

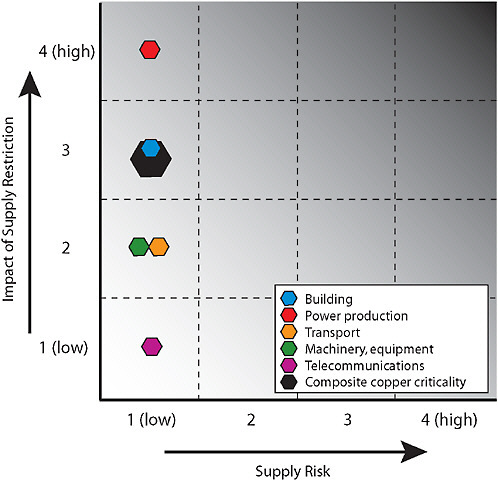

On the basis of this information, the supply risk of copper is regarded as low to moderate and a value of (1) is suggested for all availability categories, yielding a value of (1) on the horizontal axis for each end use and for the composite use of copper. Combined with its weighted composite score of 2.8 on the vertical axis, Figure 4.3 shows that although copper is important to many aspects of daily activities and technologies, its availability does not make it a critical mineral at this time.

Rare Earths

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

The REs are subdivided into “light” and “heavier” elements reflecting their atomic numbers. The light REs, mainly cerium and lanthanum, comprise about 95 percent of the weight of all REs produced. The heavier REs command much higher prices and the commercially important ones include europium, neodymium, samarium, and gadolinium. Technically, all of the elements with atomic numbers 57 through 71 are REs, but some are not usually refined and occur simply as impurities in others. Although

FIGURE 4.3 Criticality assessments for end use applications of copper and the composite criticality score for copper (black hexagon). Based on the committee’s evaluation, copper is important, but not critical.

not a true RE according to its position in the periodic table of the elements, yttrium usually occurs with and is commonly included in the RE grouping.

End uses of REs and compounds in 2006 total a value in excess of $1 billion (Table 4.4; USGS, 2007).

TABLE 4.4 End Uses of Rare Earth Metals and Compounds

|

End Use |

Percentage |

|

Automotive catalytic converters |

32 |

|

Metallurgical additives and alloys |

21 |

|

Glass polishing and ceramics |

14 |

|

Phosphors (television, monitors, radar, lighting) |

10 |

|

Petroleum refining catalysts |

8 |

|

Permanent magnets |

2 |

|

Other |

13 |

|

SOURCE: USGS, 2007. |

|

In 1986 and 1996, end uses were essentially the same, but there has been a steady decline in use for catalytic fluid cracking of petroleum, while other applications have generally increased in volume and value. The diversity of end uses is primarily a reflection of the fact that the RE family includes many elements, some with only a few important applications. For the purposes of simplifying the evaluation of the impact of supply restriction of REs, the seven end uses for REs are here grouped into four categories having somewhat similar applications (Table 4.5).

TABLE 4.5 Relative Importance of End Use Applications for REs

The chemical and physical properties and applications of REs make them sometimes important in the pure state as a metal or as the oxide, but usually one or more REs are used as alloys or compounds with non-RE elements (USGS, 2002). The following examples are offered in hopes of clarifying the remarkable characteristics of the RE family:

-

Europium (Eu), as its oxide Eu2O3, serves as the red phosphor in color cathode ray tubes and liquid crystal displays and there is no substitute, despite prices on the order of $2000 per kilogram.

-

Fiber-optic telecommunication cables incorporate periodically spaced lengths of erbium (Er)-doped fiber that function as laser amplifiers. Despite prices in the $1000 per kilogram range, there is no substitute because of erbium’s unique optical properties.

-

Cerium (Ce), as its oxide CeO2, is one of the most abundant and cheapest REs, at a few dollars per kilogram, but it is used to polish virtually all mirrors and lenses because of its unique combination of physical and chemical attributes in an aqueous medium.

-

One or more of the group of neodymium (Nd), samarium (Sa), gadolinium (Gd), dysprosium (Dy), and praseodymium (Pr), when alloyed with non-RE metals, can be used to make very-high-performance permanent magnets for miniaturized electronic and electrical devices with applications in automobiles, audio and video equipment, and military devices. There is no non-RE substitute in these cases or in multigigabyte portable disc drives (“memory sticks”) or DVDs (digital versatile discs).

The growing high-tech applications were made possible by the extraordinary properties of combinations of REs (e.g., energy-efficient fluorescent lamps for industrial and institutional lighting that contain yttrium, lanthanum, cerium, europium, gadolinium, and/or terbium). Magnetic refrigeration is being developed as a potential replacement for gas-compression refrigeration and depends on the unusually high magnetic moments possessed by the trivalent ions of gadolinium, terbium (Tb), dysprosium, holmium (Ho), erbium, and thulium (Tm). If this technology is commercialized, it will enable reductions in energy consumption.

The use of cerium and other RE compounds grew in automotive catalytic converters in 2006. Demand also increased for mixed RE compounds and for RE metals and their alloys used in permanent magnets (USGS, 2007). Greater use of yttrium compounds in superconductors was noted as well. The USGS predicts that demand for REs will continue in many applications, particularly for automotive catalytic converters, permanent magnets, and rechargeable batteries (see also Chapter 2). In this first application category, substitutions may be possible for some electronic applications, but required performance parameters simply cannot be obtained with substitutes—for example, for neodymium or samarium in permanent magnets (see also Chapter 2). Given the increasing importance attached by our society to clean and healthful air, improved medical diagnostic tools, and electronic data transfer and communication, we suggest that the highest level of impact of supply restriction or importance in use (4) applies to the first application category, emission control, magnets, and electronics (see also Table 4.1).

The use of cerium compounds also grew in 2006 in the second application area for glass additives and polishing of optical glass. Higher consumption of yttrium compounds in 2006 was also noted for the manufacture of fiber optics, lasers, oxygen sensors, fluorescent lighting phosphors, color television screens, electronic thermometers, X-ray intensifying screens, and pigments. Demand increased for mixed RE compounds and for RE metals and their alloys used in base metal alloys, superalloys, pyrophoric alloys, lighter flints, and armaments. While insufficient information is available to make an accurate analysis of the ability of substitutes to perform satisfactorily in the second family of applications—metallurgical, optical, and ceramics—the committee suggests that growth in consumption of REs in these applications is powerful evidence that significantly improved performance has accrued from their adoption, yielding a ranking of (3).

A moderate degree of importance in use (2) reflects an admission that the committee is uncomfortable with either a high or a low assignment of criticality to an ill-defined application category (“other”). The use of RE chlorides in petroleum refining is decreasing, which is the primary rationale behind the assignment of a low value (1) to that use category.

The relatively high composite weighted score for REs of 3.15 (Table 4.5) reflects the diversity of applications for the RE family, the importance of those applications, and the steady growth in consumption and has led our committee to suggest that disruptions in the availability of REs would have a major negative impact on our quality of life. The relative importance ranking does not necessarily represent the average unit value of REs used in a particular application group. Also, the ranking does not reflect the potentially high intrinsic importance of the lowest-ranked applications. In our view, most of the applications are somewhat to very important since substitutes are generally less effective.

HORIZONTAL RANKING—RISK TO RE SUPPLY OR RE AVAILABILITY

-

Geologic availability. The most important RE mineral families are monazite and bastnäsite, after Bastnäs, Sweden (also bastnaesite). Monazite, a by-product of beach sand, is a complex phosphate that can contain a variety of REs, along with thorium. Monazite is a by-product from mining carried out for the recovery of titanium and zirconium minerals. Minor amounts of monazite have been produced along the eastern seaboard of the United States. Bastnäsite is a complex fluorocarbonate that may contain either cerium and lanthanum or cerium and yttrium, along with an assortment of other REs. The less common and higher-unit-valued REs are by-products of cerium, lanthanum, yttrium, and titanium minerals (ilmenite and rutile) and/or zircon. The only recent domestic RE production has been from the cerium or lanthanum-type bastnäsite deposit at Mountain Pass, California. The Mountain Pass mine was last in operation in 2002 and has since been on a “care-and-maintenance” basis.

-

Technical availability. The crustal concentrations of the REs are relatively high, rendering the term “rare earth” a practical misnomer; even the two least abundant, thulium and lutetium, are nearly 200 times as abundant as gold. However, in contrast to ordinary base and precious metals, the geochemical behavior of REs has

-

made concentration into exploitable mineral deposits a rare event. Discovering and developing a new, viable U.S. domestic RE production capability would be relatively difficult. Even if RE production at the Mountain Pass property resumes and continues, the product spectrum is narrow, chiefly comprising yttrium, cerium, europium oxide, a lanthanum-rich mixture of RE metals including praseodymium and neodymium, and a mixture of mainly samarium and gadolinium. The Mountain Pass carbonatite deposit is very depleted in RE elements heavier than dysprosium, compared with some Chinese deposits. Furthermore, the number of potentially viable RE deposits has been limited further by environmental and regulatory factors. For instance, monazite, which is the single most common RE-bearing mineral and one that occurs in the United States, contains elevated levels of thorium. Although thorium is only slightly radioactive, natural decay produces radium, which is highly radioactive, as are some subsequent decay daughters. The potential for accumulation of these products during processing poses significant challenges to the development of an economic mining and processing facility in the United States that could achieve fully permitted status. Largely due to the fact that most RE applications rely on alloying with other metals and because there are small quantities each of a broad spectrum of scrap types and compositions, recycling is not widely practiced, being confined primarily to magnet scrap, so secondary sources cannot easily be invoked.

-

Environmental and social availability. Since 2002, some lanthanum concentrate has been produced from stockpiled ore at the Mountain Pass mine and has been sold to oil refineries as a cracking catalyst. In July 2004, a reclamation permit was approved, allowing some processing to take place, but RE separation facilities “are temporarily closed subject to the resolution of wastewater disposal issues” (Kohler, 2007, p. 73). According to the USGS (2002), “Even after the regulatory situation has been resolved, however, the

-

long-term viability of Mountain Pass as a supplier of separated RE for high-technology applications is threatened by market factors.” The USGS further points out that labor and regulatory costs are much lower in China than in the United States; the committee notes, however, that to some degree these costs differences will likely narrow as the Chinese economy develops and, in so doing, Chinese workers are able to command higher wages and salaries and as Chinese citizens demand stricter regulations for environmental quality and worker health and safety. Separation of REs at Mountain Pass is accomplished by a complex liquid ion exchange process with high operating costs; little is known about Chinese separation technology, but it may be simpler due to mineralogical and chemical differences between the plant feedstocks.

-

Political availability. The United States is essentially 100 percent dependent on imported REs, with sources of refined metals and compounds as follows: China, 76 percent; France, 9 percent; Japan, 4 percent; Russia, 3 percent; and other, 8 percent. The predominance of U.S. importation of REs from a single country, coupled with that country’s (in this case, China’s) own growing demand for minerals (see also Chapter 2, Box 2.1), represents the potential for restrictions regarding future U.S. access to REs at any price.

-

Economic availability. While the world reserve-to-annual production ratio is high at 715 (Table 4.1), it is deceptive because China accounted in 2006 for 97.6 percent of global mine production and the Chinese ratio of reserves to production is significantly lower, although still ample, at 225. Also, 21 percent of world reserves are in countries (United States and Australia) with no RE production and 25 percent are in countries accounting for only 0.3 percent of global mine production.

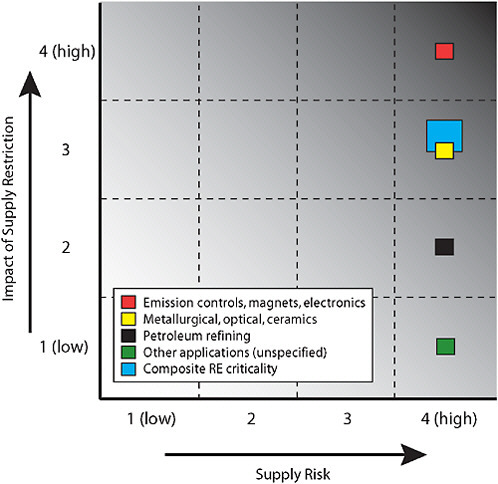

On the basis of the above considerations of the availability of REs, the committee considers supply risk for REs to be high for all applications, placing each of the above vertical rankings into the 4 category on the horizontal scale. These individual scores, combined with the vertical

scores for each application, yield positions in the criticality matrix for each application area as shown in Figure 4.4. The composite, weighted criticality for REs is represented by the yellow circle and reflects the composite vertical score of 3.15 (Table 4.5) and the overall horizontal score for REs of 4. The final placement of REs on the diagram leads the committee to suggest that REs be considered critical minerals.

FIGURE 4.4 Criticality assessments for end use applications of REs and the composite criticality score for REs (blue square). Based on the committee’s evaluation, REs are critical minerals.

Platinum Group Metals

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

The PGMs are platinum, palladium, rhodium, ruthenium, iridium, and osmium. The latter three see limited use and are not discussed here. PGMs and their alloys are characterized by high melting point, exceptional corrosion resistance, high strength, and ability to catalyze chemical reactions.

Current uses of PGMs can be classified in four main application groups: autocatalysts; industrial and other applications; fuel cells; and jewelry, dental, and electronics applications. Table 4.6 summarizes current PGM use (application) patterns, and these are described in more detail below.

Platinum and palladium are used in oxidative catalysts, aiding carbon monoxide and residual hydrocarbons to combine with oxygen to produce carbon dioxide and water vapor. Rhodium is used as a reducing catalyst to control nitrogen oxide emissions. In the automotive sector, catalyst composition depends on price, supply, fuel, and other factors. Palladium may be partially substituted for platinum in catalytic converters for gasoline vehicles. Reports indicate that some manufacturers had made progress in partially substituting palladium for platinum in catalytic converters for diesel vehicles, but the platinum:palladium ratio is now being increased in order to reduce particulate emissions (USGS, 2007). The committee was informed that palladium cannot be substituted for platinum in converters for diesel engines and there is no substitute for rhodium to control NOx emissions (Herring, 2007). PGM use in this application has been reduced with the introduction of certain REs (USGS, 2007), but the supply of REs could also be vulnerable to disruptions (see previous section). An interruption in the supply of catalytic converters is a “no-build” condition since vehicles cannot be sold without a catalytic converter. Autocatalyst use, net of recycling, accounted for the majority of platinum, palladium, and rhodium used in 2006. This application group is expected to grow as governments and industry seek to improve air quality and fuel efficiency using lean-burn engine technologies that operate at higher temperature;

TABLE 4.6 Relative Importance of End Use Applications for PGMs

|

|

Proportion of Total U.S. Market (2006)a |

Relative Cost of Disruption |

Weighted Score |

||||

|

Application Group |

Platinum |

Palladium |

Rhodium |

Platinum |

Palladium |

Rhodium |

|

|

Autocatalysts for motor vehicle emission control |

0.50 |

0.50 |

0.84 |

4 |

2.0 |

2.0 |

3.36 |

|

Industrial and other applications |

0.25 |

0.05 |

0.16 |

4 |

1.0 |

0.20 |

0.64 |

|

Fuel cells for transportation or stationary applications |

— |

— |

— |

2 |

— |

— |

— |

|

Jewelry, dental, and electronics applications |

0.25 |

0.45 |

— |

1 |

0.25 |

0.45 |

— |

|

Overall score |

|

|

|

|

3.25 |

2.65 |

4.00 |

|

aJohnson Matthey, 2007. |

|||||||

in the committee’s judgment this application receives a high score (4) on the vertical axis.

In various industrial applications, PGMs are used to produce several high-volume industrial chemicals. Platinum and platinum-rhodium gauzes are used to catalyze partial oxidation of ammonia to nitric oxide, a raw material for fertilizers, explosives, and nitric acid. Platinum is also used in the production of sulfuric acid. The petrochemical industry uses platinum-supported catalysts in crude oil refining, reforming, and other processes to produce high-octane gasoline and aromatic compounds. Ruthenium dioxide is used to coat dimensionally stable titanium anodes used to produce chlorine, caustic soda, and sodium chlorate. For the industrial sector, PGM catalysts are essential determinants of product quality and yield for many high-volume chemicals. Supply disruptions could affect the availability and cost of materials, products, and fuels used by downstream industries, agribusinesses, and consumers. Other applications are being developed, for example, for electrowinning of copper. The committee suggests that the highest level of impact of supply restriction or importance in use (4) also applies to industrial applications for PGMs.

In fuel cells for transportation or stationary applications, platinum catalysts are used to help facilitate the production of electricity and water vapor by combining hydrogen and oxygen. Finely divided palladium is also used as a catalyst for hydrogenation and dehydrogenation reactions. At room temperature it can absorb up to 900 times its own volume of hydrogen, while hydrogen passes easily through heated palladium—a property that allows for purification and storage of hydrogen. Use data are not available for these emerging applications, which do not represent an important source of current demand. Because of the lack of data on these emerging applications, the committee was not comfortable in ranking the immediate impact of a supply restriction for these end uses higher than 2, but the committee acknowledges that demand could very well increase in the future. The committee also notes that supply restrictions could postpone the development and implementation of technologies that could reduce fossil fuel consumption, increase energy efficiency, reduce greenhouse gas emissions, and improve air quality.

Platinum is used in fine jewelry and is a constituent of white gold, a gold-platinum alloy. In jewelry, dental, and electronics applications, materials compete on the basis of absolute and relative prices, technical performance, aesthetics, exclusivity, and other factors. Platinum use in jewelry has decreased as a result of higher prices, while palladium use is growing as a result of lower prices. Substitutes are readily available for PGMs in jewelry and dental applications. Palladium alloys are used in dental applications, surgical instruments, watch springs, and jewelry. Palladium use in jewelry (as a substitute for white gold) is growing, particularly in China, and palladium is replacing rhodium-plated white gold in some luxury Swiss watches. The compound platinum dichloride is used in carbon monoxide detectors. Platinum, platinum alloys, and iridium are used as crucible materials to grow silicon, metal oxide, and other single crystals for semiconductor applications. A range of PGM alloys is used in low-voltage and low-energy contacts, thick- and thin-film circuits, thermocouples, furnace components, and electrodes. Less common PGMs are used to strengthen platinum, palladium, and other metals, including titanium. A low value (1) or low impact of supply restriction for PGMs is suggested for this application category.

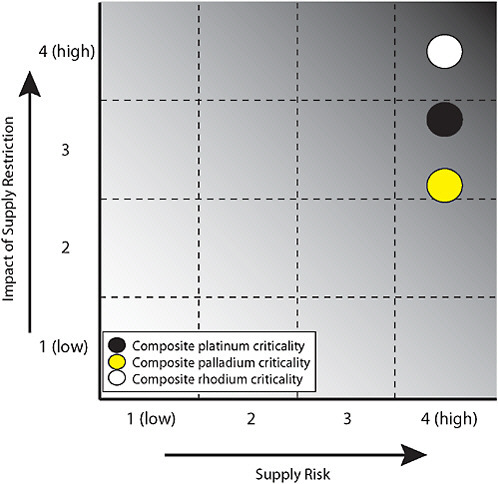

U.S. PGM consumption in 2006 is estimated to have been approximately $1.83 billion (Table 4.1). PGMs are used in a range of essential applications, so a supply restriction would affect multiple industrial sectors that together represent an important proportion of U.S. economic activity. Barring a protracted supply restriction, autocatalyst and other existing uses for which substitution would be difficult or impossible that account for a substantial proportion of current global demand are expected to continue to grow. Emerging uses in hydrogen production and storage and fuel cell applications are also expected to grow. Because use patterns vary for each of the PGMs, calculating a composite, weighted score representative of all PGMs is not considered realistic. Calculating a composite score would also have to take into account the fact that data do not exist for some of the applications, although data are available for the more important applications (Table 4.6). Thus, the committee opted to derive a composite, weighted score for each of the three PGMs for which it has data. Based on the assigned scores and data for use in each sector, rhodium achieves a

composite score of 4, platinum a score of 3.25, and palladium a composite score of 2.65, for the vertical axis.

HORIZONTAL RANKING—RISK TO PGM SUPPLY OR PGM AVAILABILITY

-

Geologic availability. The relative abundance of PGMs in the Earth’s crust is orders of magnitude lower than that of base metals. Together with gold, rhenium, and tellurium, PGMs are among the rarest metals. PGMs occur in close association with one another and with nickel and copper, but economic concentrations are rare. From a geological perspective, concerns for PGM availability are assessed as relatively high (4).

Platinum and palladium have the greatest economic importance of the PGMs and are found in the greatest quantities. Most primary production is from PGM ores in which the platinum content exceeds the palladium content and from which minor amounts of nickel, copper, and cobalt may be recovered. The other four PGMs are produced only as coproducts. Coproduct PGM recovery from nickel-copper-cobalt ores is a significant source, particularly in the Russian Federation and Canada.

-

Technical availability. Technologies for primary extraction, processing and refining, and secondary recovery of PGMs are generally well established. Deep ore bodies can require advanced ground control and increased ventilation and air conditioning to provide a safe and hospitable environment for workers and equipment and ensure the physical integrity of the mine. Travel time for underground workers increases with depth, reducing labor productivity. The recycling technology for PGMs is among the most advanced of the metals, especially as far as industrial catalysts are concerned. Overall, there are no immediate concerns for PGM availability from a technical perspective (1), but technical factors are likely to increase capital and operating costs for new mines.

-

Environmental and social availability. Regulatory environments in principal PGM-producing countries are generally supportive of

-

the industry. Local communities in the vicinity of mines, smelters, and refineries may bring social, environmental, or other impacts to the attention of operators and senior governments. Issues concerning the distribution of social and economic benefits or the mitigation of impacts may sometimes arise, but local communities are generally supportive of continued production and favor solutions that do not compromise current employment or future investment. Some deposits may not be developed as a result of resource or other conflicts, but most new mines are likely to be developed in established mining camps with a long history of PGM production, limited economic development alternatives, and a public consensus in favor of further mineral development. Labor availability is not a concern at this time, but the South African industry employs a significant number of workers from other African countries. Governments, industries, and communities throughout the region must confront a number of challenges, including HIV/AIDS awareness and treatment.

-

In the case of secondary supplies, PGM recycling from auto catalysts, electronics, and industrial catalysts is largely outside public view, and social factors are not involved.

-

From an environmental and social perspective, concerns for PGM availability are assessed as moderately low at this time (2).

-

Political availability. Current PGM supply patterns (Table 4.7) show that, together, South Africa and the Russian Federation accounted for well over 80 percent of the 2006 global supply of platinum, palladium, and rhodium. Both countries have proven to be reliable suppliers.

PGMs are not transported by sea and are not vulnerable to maritime interdiction, but supplies could be restricted by local, regional, or other geopolitical developments. Inventories tend to be low, because of their high value and significant price and other risks. North American production would be inadequate to supply critical needs if the supply of platinum and rhodium from South Africa was interrupted. While the supply

TABLE 4.7 Current PGM Supply Patterns

|

|

2006 Supply (%) |

||

|

Region |

Platinum |

Palladium |

Rhodium |

|

South Africa |

78 |

34 |

89 |

|

Russian Federation |

13 |

51 |

7 |

|

North America |

5 |

11 |

2 |

|

Others |

4 |

4 |

2 |

|

SOURCE: Johnson Matthey, 2007. |

|||

of palladium is somewhat more diversified, North American production would likely be inadequate to supply critical needs in case the supply of palladium from the Russian Federation or South Africa was interrupted. Furthermore, the only current U.S. producer of platinum and palladium, Stillwater Mining Company, is 55 percent owned by Norilsk Nickel, headquartered in Russia.

Significant refining, value-added processing, and recycling take place in Belgium, Norway, and the United Kingdom. Environmental concentrations have been attributed to autocatalyst applications, and these observations, together with the implementation of European Union legislation for the Registration, Evaluation and Authorization of Chemicals, are likely to trigger ecological and human health risk assessments that could lead to additional restrictions on emissions from production and recycling facilities. Use restrictions seem unlikely at this time due to the lack of known substitutes, but regulatory costs are likely to be passed on to users.

A high degree of import dependence for PGMs or other minerals and metals is not, in itself, cause for concern (see also Table 4.1). Increased trade and investment flows contribute to economic growth and prosperity, for both the United States and its trading partners. In the particular case of PGMs, the United States is highly dependent on imports that originate largely in the Russian Federation and South Africa. As outlined earlier in this chapter, U.S. imports support investment in those countries and

generate social and economic benefits there, but they expose a range of U.S. industries to political, economic, and other risks that vary according to the particular situation.

From a political perspective, concerns about PGM availability are assessed as relatively high at this time (4).

-

Economic availability. About 10 mining companies and a smaller number of smelting and refining companies account for substantially all primary PGM production. The same smelters and refineries play an important role in the recovery of PGMs from secondary sources. PGM coproducts are an important source of revenue for certain nickel-copper-cobalt producers in the Russian Federation and Canada. Production of PGMs from those sources is largely nondiscretionary and is driven primarily by decisions related to the main products. The largest nickel producers in both countries have sufficient reserves to support continued operation for decades. Although production of PGMs is unlikely to be reduced in response to lower prices, it is equally true that higher prices are unlikely to stimulate increased production from those sources. Although coproduction is a factor for all PGMs, base metal production accounts for a higher proportion of palladium than platinum production. Since the supply is relatively insensitive to price, the result can be greater price volatility for palladium. A growing proportion of nickel production will originate from lateritic deposits (containing little or no PGMs) in the future, so new nickel mine developments will not necessarily increase PGM production.

As noted above, technical factors are tending to increase capital and operating costs for new mines. Producers will take a disciplined approach to new capital investment to achieve targeted rates of return despite significant price, foreign exchange, and other risks. Finally, the largest producers operate in jurisdictions with legal requirements that may not promote market transparency and disclosure or discourage anticompetitive or monopolistic behavior.

-

Production of PGM alloys and value-added PGM products is controlled by a very small number of companies that may be in a position to exercise considerable market power, although to a large extent those activities are conducted in countries with legal requirements in place to discourage anticompetitive behavior.

-

For all of these reasons, from an economic perspective concerns for PGM availability are assessed as relatively high (4).

The world reserve-to-production ratio and the world reserve base-to-production ratio integrate certain aspects of geological, technical, and economic availability. The ratios therefore provide an indication of the long-term availability of PGMs from primary sources. It is difficult to anticipate future exploratory success, prices, costs, exchange rates, or production levels, all of which affect the resulting ratios. The underlying database may provide insight into the economic outlook for existing mines, but the ratios provide no insight into market dynamics.

As Table 4.1 shows, platinum is produced primarily by primary platinum mines with by-products that may include other PGMs, nickel, copper, and cobalt. Significant platinum production is a by-product of nickel-copper-cobalt and palladium production. In contrast, palladium is produced primarily as a by-product of platinum and nickel-copper-cobalt production, with limited production from primary palladium mines; other PGMs are produced exclusively as by-products. Short-term platinum supply and price are driven primarily by fundamental factors such as cash operating costs, exchange rates, demand, and inventory. By-product dependence makes the supply of palladium and other PGMs less price sensitive and the prices more volatile, as production levels respond primarily to prices of the main product. If demand for palladium and other PGMs was to grow more rapidly than demand for platinum, this could lead to higher prices for palladium and other PGMs. Since demand for nickel is increasingly supplied from lateritic deposits, the supply of palladium and other PGMs should gradually become more closely linked to primary platinum production in South Africa and to recycling activity.

U.S. secondary production from old scrap, as a percentage of U.S. apparent consumption, is assessed as significant for PGMs. The high value of PGMs, the controls on disposal of solid waste that exhibits hazard characteristics, and the concerns about potential liability are important drivers for PGM recycling and for collection and regeneration of spent catalysts. Available data indicate that a higher proportion of current autocatalyst demand for platinum and palladium is satisfied by recovered PGMs in North America than in Europe, Japan, or the rest of the world (Johnson Matthey, 2007). The development of an infrastructure to collect and recover PGMs in North America has led to the development of a new economic activity that reduces import dependence and the associated risks. While this may suggest that opportunities for improvement are limited in North America, an opportunity could exist to further increase collection and recovery and to lever this strength by working with other countries to establish an efficient collection infrastructure, importing PGM scrap for processing in the United States or another country and developing offshore recycling capacity as the supply of scrap grows. While such an initiative could best be undertaken by companies, government action may be needed in the case of existing international agreements between nations. Because certain materials may be subject to the Basel Convention, for example, parties to the convention may be unable to ship scrap to a U.S. facility for processing because the United States has not ratified the convention; an exception could occur under the terms of an agreement or arrangement that conforms to Article 11 to the convention.2 Alternately, a business could site a facility in Asia or in another country that is a party to the Basel Convention. Although secondary production from old scrap leaves the U.S. economy less exposed to political, economic, and other risks than it might otherwise be, and opportunities may exist to increase this activity, the United States remains vunerable to the risk of a restriction in the supply of PGMs.

On the basis of these assessments of geologic, technical, environmental and social, political, and economic availability, the probability of a restriction in the supply of PGMs is assessed as relatively high (4). Based on the impacts of a potential PGM supply restriction, which are assessed as relatively high (4), and the relatively high probability of a PGM supply restriction, PGMs are considered to be critical minerals (Figure 4.5).

FIGURE 4.5 Criticality assessments for PGMs platinum, palladium, and rhodium.

OTHER CRITICAL MINERAL CANDIDATES

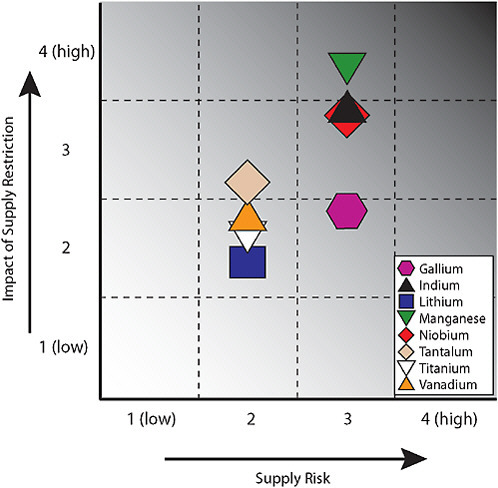

In addition to the minerals discussed above, a number of other minerals have been suggested as potentially critical in the recent past. In less complete fashion than has been done above, the committee presents a discussion of the criticality aspects of eight of these minerals.

Gallium

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

Gallium is a soft, silvery metal with many unusual properties. It is stable in air and water but reacts with acids and alkalies and has a very low melting point. Gallium is also a liquid over a greater temperature range than any other element and is one of the few substances that expands as it freezes, making solid gallium less dense than liquid gallium.

Gallium has a very high boiling point, making it useful for high-temperature thermometers. It is also used in mirror making and alloying with other metals. Gallium is used in research—for example, solar neutrino detection experiments. Some gallium compounds have semiconductor characteristics and are used in light-emitting diodes (LEDs) and transistors. A gallium-arsenic compound (gallium arsenide) can convert electricity directly into laser light.

The main uses of gallium are in high-technology, defense, and medical applications. Substitutes for gallium tend to be confined and very specific, including indium phosphide components in laser applications; some organic compounds in LED applications; and silicon in solar cell applications. Domestic recycling is not widely practiced, with the main source of recycling resulting from the reprocessing of new scrap generated in the manufacture of gallium arsenide devices. End use applications, their weighted scores, and the composite score for gallium are presented in Table 4.8.

TABLE 4.8 Relative Importance of End Use Applications for Gallium

|

Application Group |

Proportion of Total U.S. Market (2006)a |

Impact of Supply Restriction |

Weighted Score |

|

Integrated circuits (technology) |

0.63 |

3 |

1.89 |

|

Optoelectronic devices (cell phones, backlights, flashes) |

0.22 |

2 |

0.44 |

|

Research, specialty alloys, other |

0.15 |

1 |

0.15 |

|

Overall importance in use |

|

|

2.48 |

|

aUSGS, 2007. |

|||

HORIZONTAL RANKING—RISK TO GALLIUM SUPPLY

Gallium rarely occurs in minerals except in trace amounts. Bauxite and the mineral sphalerite, as well as coal, often contain gallium as an impurity. No gallium is mined; it is obtained as a by-product of mining and processing other metals—notably aluminum, zinc, and copper—and is produced in any nation that produces these metals. In 2006, the United States was 99 percent reliant on foreign sources for gallium. Import sources include China, 37 percent; Japan, 17 percent; Ukraine, 12 percent; Russia, 10 percent; and other, 24 percent (USGS, 2007). In 2000, foreign reliance was quantified as “some.” In 2004, it was 99 percent, maintaining that level into 2006.

We consider supply risk for gallium to be elevated to high (3), based on supply sources, substitutability, and recycling constraints. The composite criticality for gallium is located together with the other seven “criticality candidates” on Figure 4.6.

Indium

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

Indium is a very soft, stable metal, being unaffected by water and air, but it does react with most acids. Its major use has come to be as a coating material for flat-panel displays, for which no adequate substitutes are currently available. The very rapid increase in the production of these displays has led to some supply shortages.

Indium is also used to make mirrors, often replacing silver because of its noncorroding characteristics. It has a low melting point and is used in making low melting alloys for safety devices and solders. Indium, like gallium, remains a liquid over a large temperature range. Some indium compounds are used in transistors, photoconductors, photocells, and thermistors.

Indium has substitutes for most of its applications, although the substitutes lead to loss in efficiencies and/or product characteristics. Silicon has largely replaced indium (and germanium) in transistors. Gallium (more expensive) can replace indium in some alloys; silver-zinc oxides or titanium oxides can substitute for indium in glass coatings. Indium phosphide can be replaced by gallium arsenide in solar cells and in many semiconductor applications. Gold-tin is the only substitute for indium-tin solders used in printed circuitry (e.g., for tunable lasers). Most of the substitutions occur with other commodities that are challenged by their own supply source constraints (gallium, for example). The amount of indium recycling in the United States is very small due to the lack of infrastructure to collect indium-bearing products. End use applications, their weighted scores, and the composite score for indium are presented in Table 4.9.

HORIZONTAL RANKING—RISK TO INDIUM SUPPLY

Some indium is found in pure form, and it occurs in only a few minerals, such as indite. However, almost all indium is obtained as a by-product of zinc processing and is recovered from residues left from electrolytic refin-

TABLE 4.9 Relative Importance of End Use Applications for Indium

|

Application Group |

Proportion of Total U.S. Market (2006)a |

Impact of Supply Disruption |

Weighted Score |

|

Coatings |

0.70 |

4 |

2.80 |

|

Electrical components; semiconductors |

0.12 |

3 |

0.36 |

|

Solders and alloys |

0.12 |

2 |

0.24 |

|

Research; other |

0.06 |

1 |

0.06 |

|

Overall importance in use |

|

|

3.46 |

|

aUSGS, 2007. |

|||

ing of zinc. Worldwide distribution of indium-bearing ores and deposits includes Asia (China and Russia, primarily), Europe, North and South America, Australia, and South Africa (Stevens, 2007). Because zinc, copper, lead, and tin ores, among others, are the common ores that also host indium, the technology for extraction of indium is dependent on development in these mining sectors, and indium availability is not currently considered a problem. As a by-product of zinc (or other) ores, the technical challenges, particularly with higher prices for indium, arise in making the refining process as efficient as possible. By-product extraction, enhanced recovery from this extraction, purification, and refinement before the indium is incorporated in its end applications are all technologically established processes that are undergoing continued improvements to increase the efficiency of the recovery of indium from the virgin ore, tailings, and recycling of end products (Stevens, 2007). In 2006, the United States was 100 percent reliant on foreign sources for indium. Import sources include: China, 44 percent; Canada, 22 percent; Japan, 15 percent; Russia, 5 percent; and other, 14 percent (USGS, 2007). In 2000, there was considered to be some foreign reliance; in 2001, it was 95 percent; and by 2006, the United States was 100 percent reliant on foreign sources. The risk of supply restriction through export quotas from one or another supplier to the

United States is important to consider in evaluation of indium’s continued availability.

Indium production rose from 60 metric tons annually in 1970 to 400 metric tons in 2005 in response to increased demand, although industry production was not always able to anticipate the rate of increase in demand and sometimes lagged behind (Stevens, 2007). In partial response to the increase in demand, between 2003 and 2006, the price of indium rose from about $100 per kilogram to $980 per kilogram, attributed largely to the great increase in demand for indium tin oxide—a compound used for liquid crystal displays (Stevens, 2007; USGS, 2007). Although Stevens (2007) suggested that indium would be both available and economical in the long term, the committee considers the short-term volatility to add considerably to the supply risk for indium. The short-term supply risk for indium is therefore considered to be elevated to high (3), based on supply sources, substitutability, and recycling constraints. The composite criticality for indium is located together with the other seven criticality candidates on Figure 4.6.

Lithium

VERTICAL RANKING—EASE OF SUBSTITUTION AND IMPACT OF SUPPLY RESTRICTION ON USER SECTORS

Lithium is important in the manufacture of glass, ceramics, and aluminum. It is also used in making synthetic rubber, greases, and other lubricants. In these applications, potassium can be substituted for lithium. Nonrechargeable lithium batteries are used in products such as calculators, cameras, and computers. The largest potential for growth is in the manufacture of batteries, especially rechargeable batteries used in video cameras, portable computers, and telephones.

It is in future applications that supplies and costs of lithium will be more important. Lithium is a key to the development of new battery technology. Lithium ion batteries have an exceptionally good energy-to-weight ratio and are therefore valuable in reducing overall automobile weight and

thereby improving fuel efficiency. Lithium ion batteries are not used in current hybrid car models, but this technology, available at a reasonable cost, may be particularly important if hybrid vehicles become an important factor in our transportation system. End use applications, their weighted scores, and the composite score for lithium are presented in Table 4.10. At present we conclude that the current importance of lithium would be low, but believe that this element must be followed closely as this situation could change in the future.