CHAPTER 2

Minerals and Materials Uses in the United States

NONFUEL MINERALS AND SOCIETY

The nation recognizes the importance of an adequate supply of fossil fuels—oil, natural gas, and coal—which have formed the energy base for much of Europe and North America for the past two centuries. As we have experienced recently, changes in availability, or the perceived availability, of these fossil fuel minerals generate significant price fluctuations and thereby impact the full range of individual and industrial energy consumers in the United States where current technologies do not allow massive substitution of renewable or alternative energy sources for fossil energy. Less visible is our reliance on the large number of minerals that are fundamental ingredients in the manufactured products used in the United States—from cell phones and flat-screen monitors to paint and toothpaste. A large number of the products manufactured or used domestically contain natural mineral resources that either are mined in the United States or are imported from abroad as raw materials or as fully manufactured or semifinished products. Estimates suggest that current lifestyles in the United States require per capita annual consumption of more than 25,000 pounds (11.3 metric tons) of new nonfuel minerals to make the things that we use every day (MII, 2007a).

In addition to their intrinsic, practical value as part of a manufactured

product, minerals also have a significant general value to the U.S. economy from both a financial standpoint and an employment standpoint (discussed in some detail at the close of this chapter). Globally the demand for minerals is also important and is increasing. In the emerging economies of countries such as China and India, where industrial output has surpassed

|

BOX 2.1 Emerging Economies: An Example in China The emergence and growth of several foreign economies have been of interest to U.S. industries and economic analysts for a number of years. Recent international media attention to the very rapid rates of economic and industrial growth particularly in China and India, relative to Europe, North America, and Japan, indicates that the emerging economies and their global influence are also gaining public interest. Nonfuel minerals factor directly into this situation as key inputs to continued industrialization and manufacturing output for emerging economies, as these nations satisfy both their own, growing domestic consumer needs and the large international demand for their exported products. As one example, China has become a leading global consumer of products such as cell phones, televisions, and refrigerators and will soon surpass the United States in the consumption of personal computers and automobiles in absolute terms (McCartan et al., 2006). The U.S. trade deficit with China indicates that China is not only a consumer nation, but also a producer of many types of goods for export. The increase in consumer purchases in China has been fueled by industrialization that has triggered a better national standard of living, which in turn feeds further demand for manufactured goods and the infrastructure to power and use those goods. The same can also be said of emerging economies in other nations and represents the path of industrialization that was followed during the past century by North America, Japan, and Europe, among others. China is endowed with abundant natural mineral resources. Whereas in 1973 the United States was the world’s leading nonfuel mineral producer, today China is the world’s leading producer and consumer of minerals, but it no longer has the domestic capacity to satisfy its demands for minerals such as iron ore, nickel, copper, and cobalt (McCartan et al., 2006; Reynolds, 2007). China’s dominance as a global mineral supplier, coupled with its own demand for minerals, gives it a very direct global market influence on the supply of minerals. In 2004, China also increased its own mineral production capacity and appar- |

that of Europe or the United States in many sectors, increased standards of living have encouraged greater demands for consumer goods containing processed minerals (Box 2.1). Furthermore, the ability to design and manufacture new materials and to characterize, predict, and exploit the chemical and physical properties of minerals as components of those materials

|

ently issued 13,000 exploration licenses and 40,000 mining permits. The same year, more than half of China’s direct investments in foreign nations went to mining projects (McCartan et al., 2006). China’s demand for minerals affects both the “traditional” and the “emerging” materials markets. With more traditional materials such as steel, Chinese steelmakers compete with Japanese and American steelmakers for raw iron ore (primary) and steel scrap (secondary) supplies globally. Aside from direct influences on the purchase and use of feedstock for U.S., Japanese, and Chinese steelmakers, the effects of greater competition for iron ore and steel scrap will also impact the industries supplied by steelmakers and may affect issues ranging from construction costs for new power plants (Wald, 2007) to the selection or development of new automobile designs. China’s growing mineral demand also affects emerging materials and technologies, such as those requiring rare earth elements (REs). China is the world’s leading producer and consumer of REs, holding a 97 percent market share of processed REs (USGS, 2007a). The uses of REs are discussed in more detail later in this chapter and in Chapter 4. As mineral demand has increased in China and other emerging economies in this century, mineral prices have risen—the third significant boom in mineral commodity prices since World War II. Emerging economies and their needs for minerals underscore the fact that the U.S. economy is affected by global production and consumption demands, the satisfaction of which requires manufacturing, industrial capacity, and supporting infrastructure. Nonfuel minerals are key inputs to the manufacturing process both domestically and abroad, and their availability to U.S. industry and manufacturers has emerged as a much more competitive process than previously. Consistent, accurate, and current information on global mineral trends is a foundation for U.S. domestic industry and government to make effective plans and decisions regarding mineral supply. SOURCES: McCartan et al., 2006; Reynolds, 2007; Wald, 2007; USGS, 2002, 2007a. |

continues to advance and improves the technical performance, durability, and reliability of products. These improvements deliver greater value to businesses and consumers, and in some cases to the environment, but also serve to increase demand for specific types of minerals.

Understanding the importance of minerals in the products from different sectors of the U.S. economy forms the basis for the vertical axis of the criticality matrix described in Chapter 1 (Figure 1.2). As discussed in Chapter 1, end uses or applications for minerals will have varying levels of importance depending on the demand for that particular end use. Importance in use carries with it the concept that some minerals will be more key or fundamental for specific uses than others, depending on a mineral’s chemical and physical properties. Focusing on a mineral’s properties emphasizes the role of substitutability as a factor in determining criticality. A mineral that has ready substitutes—that is, substitute minerals that provide similar properties or performance at a comparable price—is less critical than a mineral with few substitutes. The concept of substitutability has both technical and economic meaning. A technical substitute provides the same or similar performance compared to the mineral it replaces. To be an economic substitute, however, the mineral needs to provide the same or similar performance at similar or lower costs, or better performance at the same costs. Ease of substitution, in turn, determines the degree of a mineral’s importance in use—the vertical axis of the criticality matrix (see also Figure 1.2). A useful concept to consider also is that the demand for minerals is a derived demand. That is, users demand minerals for the chemical and physical properties they and the elements extracted from them provide. Copper, for example, provides electrical conductivity. Zinc, when used for galvanized steel, provides corrosion protection. Aluminum provides light weight, coupled with strength and metallurgical formability.

This chapter begins with an introduction to minerals and the properties that make them important for specific applications. The chapter then describes key uses of the minerals in four major industrial sectors—automotive, aerospace, electronics, and energy—before concluding with a general discussion on the potential impacts of restrictions in the supply of minerals on the domestic economy. These four sectors were chosen

as useful examples for purposes of the discussion on mineral criticality, but similar arguments could be made for other important sectors such as health care, construction, utilities, or the transportation infrastructure. All sectors of the economy rely on the services provided by minerals and the committee was limited in its time and resources to selecting a few industry examples. Discussion of the critical mineral candidates in Chapter 4 includes examples of mineral applications from many additional industry sectors.

CHEMICAL AND PHYSICAL PROPERTIES OF MINERALS

Chemical elements are the building blocks of all minerals. Of the 111 authenticated elements in the periodic table, the first 92 (up to uranium) occur naturally (Appendix D). Of these, the ones relevant to this study are those that occur as solid minerals. Few are found in nature in their pure form; “native copper” and the precious metals gold, silver, and platinum, for example, are exceptions in that they occur in pure metallic form (although not as pure elements). Some elements occur as simple compounds with oxygen, for example, iron oxides (a key component of steel), titanium dioxide (a key component in pigments), or silicon dioxide (quartz, or silica, which is important in many computing applications), or they may combine with several other elements to form one of many naturally occurring minerals. The wide range of elements (or minerals or compounds in which they are found) can be classified broadly into one of several basic categories that largely represent the key mechanical, electrical, magnetic, or optical properties specific to similar elements in that group (Table 2.1).

The unique properties of elements and the minerals in which they are found allow some minerals to be used directly on extraction from the Earth, or after relatively limited processing, whereas others must undergo extensive transformation and processing to produce metals, metal alloys, inorganic metal compounds, electronic materials, manufactured parts, and construction materials. Metals are used almost exclusively in the form of alloys, in which one metallic element is combined with one or more metallic or nonmetallic elements to improve properties such as strength,

TABLE 2.1 Classification and Properties of Some Elements

|

Group |

Elements |

|

Precious metals including platinum group metals (PGMs) |

Gold, silver; PGMs: ruthenium, rhodium, platinum, palladium, osmium, iridium |

|

Base metals and ferrous metals |

Copper, nickel, aluminum, tin, zinc; iron (ferrous metal) |

|

Rare earths (lanthanide series onlya) |

Lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium |

|

Transition (T), alkaline and alkaline earth (A), and other metals (O), metalloids (Md) and nonmetals (NM) |

Tb: Scandium, titanium, vanadium, chromium, manganese, cobalt, zirconium, cadmium, niobium, molybdenum, tantalum, tungsten, rhenium, mercury A: Lithium, sodium, potassium, beryllium, magnesium, calcium, strontium, barium Oc: Gallium, indium, lead Md: Boron, silicon, germanium, arsenic, antimony, tellurium NM: Carbon, oxygen, phosphorus, sulfur, selenium |

|

NOTE: Properties of the minerals have been highly simplified and serve as basic examples of the concept of importance in mineral chemical and physical properties for applications. |

|

light weight, conductivity, durability, or corrosion resistance. Minerals that can be extracted and used after relatively limited processing include sand, gravel, dimension stone, agricultural limestone, and clays (Box 2.2). Another category of materials includes ceramics, which can be broadly defined as inorganic nonmetals and includes such diverse materials as silicon dioxide-based glasses, crystalline oxides (e.g., aluminum oxide, Al2O3),

|

Properties |

|

Scarce, corrosion and tarnish resistant, malleable, ductile, high luster and high electrical conductivity |

|

Reasonably abundant, high electrical conductivity, high heat conductivity, some may corrode fairly easily |

|

Extremely diverse metallurgical, chemical, catalytic, electrical, magnetic, and optical properties (see also Chapter 4) |

|

T: Ductile and malleable; conduct electricity and heat; some are magnetic A: Malleable, ductile, and are good conductors of heat and electricity; softer than most other metals; very reactive O: Ductile and malleable; high density Md: Properties of both metals and nonmetals; some such as silicon and germanium are semiconductors making them useful in computers and calculators NM: Often exist as gases; not able to conduct electricity or heat very well; very brittle |

|

aREs also include the actinide series which is not discussed further here. Scandium and yttrium are sometimes also considered REs. bSome transition metals are base metals (nickel, copper, zinc, iron) or precious metals (silver, gold, palladium, platinum, osmium). cSome nontransition, nonalkaline metals are also base metals (aluminum, tin). |

carbides (e.g., silicon carbide, SiC), and nitrides (e.g., aluminum nitride, AlN); carbon-based products such as graphite; and some semiconductor materials such as zinc selenide (ZnSe) and gallium arsenide (GaAs). Ceramic applications can range from traditional products such as whitewares and structural clays to recent product developments in cellular communication, aerospace, and health care.

|

BOX 2.2 Aggregates In 2006, the United States used 2.69 billion metric tons of crushed stone, sand, and gravel (referred to here as aggregates; USGS, 2007b). Aggregates used for construction perform three major functions. The first is as a structural component of portland cement concrete (often called ready-mix concrete) and bituminous cement concrete (often called asphalt), used in the construction of streets, highways, and parking lots. Ready-mix concrete is also used in the construction of residential and nonresidential buildings, bridges, dams, and water and sewage treatment plants. The second general function is applications in which their high bulk specific gravity is important for uses such as erosion control and nuclear reactor containment structures. Aggregates perform a third general function in which they are used without addition of other materials to take advantage of their properties such as strength (for road base, under concrete slabs, foundations), permeability (used behind retaining walls, French drains, sewage treatment plants, septic drain fields), and volume (backfill in pipe trenches). Aggregates are ubiquitous in the United States and their applications are a fundamental part of the nation’s infrastructure. While these minerals are very important and may be critical to local industries and governments, their domestic supply is relatively secure and they would fall in the criticality matrix of Chapter 1 as low-risk, high-impact minerals. On the supply side, this is illustrated by the fact that the 3 billion tons of aggregates produced in the United States in 2006 derived from more than 10,000 locations operated by more than 6000 companies. On the use side, although aggregates have limited or no readily available or suitable substitutes, the impact of a supply disruption at any one or even several operations is likely to be minimal because of the proximity or number of other potential supply points in the country. However, two situations—one in Florida and one in California—illustrate the idea of aggregate criticality within a specific geographical area, which could in turn affect that local (or state) economy. In March 2006 in Miami-Dade County, Florida, a district court judge ruled that permits to allow the mining of limestone and lime rock had been issued improperly in 2001 by the U.S. Army Corps of Engineers. The ruling stated that the Corps would have to conduct further studies to substantiate its decision that mining in the affected acres would not damage wetlands, degrade groundwater, or threaten endangered species. The affected operations in the area, called the Lake Belt, represent approximately 56 percent of the total aggregate production in Florida. If an injunction is issued to prohibit further mining until the completion of a new environmental impact study, the price of aggregate could rise an estimated 61 percent to 124 percent (Morrell, 2006). This estimate assumes that replace |

|

ment aggregate can be obtained from existing sources, some of which are 500 to more than 1000 miles away. The high bulk density of aggregates makes them very expensive to transport. In addition, the existing transportation infrastructure would have to adjust quickly to handle the increased shipments of aggregates from distant, as opposed to local, sources. To date, a Florida judge has ruled to shut down 3 of 12 permits for operations in the area (Associated Press, 2007), one of which is the largest in the United States. The Lake Belt example illustrates the potential short-term consequences of a restriction in aggregate supply. The second situation in California relates to the long-term reliability of supply and results from years of high production and consumption coupled with strong environmental resistance to permitting of new aggregate operations. A report (Kohler, 2002) compared the projection of permitted reserves on January 1, 2005, to actual permitted reserves as of January 1, 2001, and indicated a decline in permitted reserves from 6.8 billion to 4.3 billion tons over that period. Projected demand for the same period went from 12.0 billion to 13.5 billion tons. While the permitted reserves will last an average of 17 years, 4 of the 31 aggregate study areas—North San Francisco Bay, Sacramento County, Fresno County, and northern Tulare County—are projected to have less than 10 years of permitted aggregate resources remaining. The California Geological Survey has expressed concern that California will increasingly experience shortages in the future. Alternate supply sources exist, but with California aggregate consumption reaching 235 million tons in 2005, imports from Canada and Mexico would have to be considered to overcome some of the deficit in production from permitted reserves. In each of the above cases, aggregate supply to fill the anticipated demand in the event of restrictions in local supply will have to come from neighboring states or be imported from Canada, Mexico, or Caribbean islands. With a commodity such as aggregate that has a very high cost of transportation and a practical limitation to distributing large quantities of material from ports to the point of consumption, imports are difficult to envision as realistic alternative sources of aggregate supply. The basic issue to consider is that local regions or states can have their aggregate supplies restricted to the point at which even a relatively “common” material such as aggregate can become critical. With aggregates, situations can develop that cause a supply interruption that cannot easily or quickly be remedied. While each state is monitoring the status of its aggregate supply and demand, and their balance relative to environmental concerns, the states and aggregate operating companies require continuous, accurate, and unbiased information on aggregate production and supply throughout the country and internationally to be able to make appropriate decisions to meet a state’s aggregate demands. |

MINERAL USES

Most minerals are used in long-lived products that provide benefits to consumers over extended periods. The most important sectors of the economy for mineral demand are transportation, including automobiles and airplanes; capital equipment such as industrial machinery; residential and commercial construction; and consumer durables such as washing machines, refrigerators, cellular telephones, and televisions. This section presents some of these common and widely used products and their constituent minerals from four key sectors of the U.S. economy. The discussion emphasizes chemical and physical properties of minerals and their substitutability and the dynamic or changing demand for minerals through time. Substitutability and dyna-

|

BOX 2.3 Defense The defense of the United States presents its own special issues in terms of the availability of minerals and materials. This particular set of minerals is viewed by the committee as “strategic” in nature (see Chapter 1 for definitions). Some minerals that are particularly strategic to the defense sector include some of the rare earths (REs) as well as rhenium, cobalt, and beryllium. The REs have various applications, including neodymium in high-strength magnets and as dopant for lasers, samarium in samarium-cobalt magnets, yttrium in laser rods and superalloys, and scandium in aluminum alloys and refractory ceramics. Rhenium is a rare metallic element of importance to the defense community because of its contribution to the properties of high-temperature alloys and coatings (Sloter, 2007). Rhenium is obtained almost exclusively as a by-product of the processing of a special type of copper deposit known as a porphyry copper deposit. Specifically, it is obtained from the processing of the mineral molybdenite (a molybdenum ore) that is found in these copper deposits. Even though the United States has significant rhenium reserves, the majority of this mineral consumed in the United States has been imported, primarily from Chile and Kazakhstan (USGS, 2007a). Beryllium is perhaps the best example of a strategic defense mineral because of its unique combination of mechanical and nuclear properties and issues with its production and |

mism are important factors to consider when evaluating the importance of end use in determining mineral criticality. Defense applications constitute a special sector in terms of national security because they require products from many industrial sectors. The committee addresses some of the mineral needs of the defense sector briefly in Box 2.3 and refers the reader to the more detailed treatment of the defense sector and strategic minerals in the report of the National Research Council (NRC) Committee on Assessing the Need for a Defense Stockpile (NRC, 2007). The vast numbers of uses for the minerals in the United States are too numerous for the committee to describe in detail, and only a few examples are provided in this report of the common products in which minerals are components.

|

supply. It is a lightweight metal possessing relatively high stiffness and strength, making it a material of choice for a wide range of defense systems including sensors, aircraft, missiles, satellites, and nuclear warheads. The U.S. Defense Department is concerned because Brush Wellman, Inc. (BWI), the only U.S. producer of beryllium, closed its production facility in the year 2000 because of economic and health and safety issues. Since then, BWI has relied on a dwindling supply of beryllium ingot that it purchased from the National Defense Stockpile. The stockpile also has uncommitted beryllium inventories of hot-pressed powder billets being held in reserve, but these could extend the depletion date for only a few years (http://www.acq.osd.mil/ott/dpatitle3/projects/bp.htm). Other supplies of beryllium are obtained from Kazakhstan, but the purity of these imports is insufficient for a number of critical defense applications. A report to Congress noted that it would take a minimum of 3 to 5 years to complete a new primary beryllium facility. The report also indicated that even if the purities of the imports from Kazakhstan were to reach acceptable levels, the risks of sole source dependence on that country for production would be unacceptable. Authorization for BWI to transfer its beryllium manufacturing technology to Kazakhstan to improve the quality of its imports introduces other risks—namely, the sale of pure beryllium metal to third world countries seeking to produce nuclear weapons (http://www.acq.osd.mil/ip/docs/annual_ind_cap_rpt_to_congress-2005.pdf). |

Automotive

The automotive industry has been an important sector of the U.S. economy, especially in regions where this industry is concentrated. Moreover, from the perspective of households, automobiles are integral to our way of life. The automotive industry uses large amounts of material each year and a modern automobile can contain at least 39 different minerals. Table 2.2 lists some of the primary minerals and metals, their content by weight in an average automobile, and the properties that make the minerals useful for specific parts or functions. Each of these minerals performs a special function alone or in alloys, to enhance performance, durability, safety, and comfort, or to reduce environmental impact or weight, all of which are important features to the automobile owner and, thus, to the industry.

In contrast to the list of minerals in today’s automobiles (Table 2.2), the earliest automobiles contained a very small suite of materials, including steel, wood, rubber, glass, and brass. The properties of steel made it a natural replacement for wood in cars through time. Vanadium-steel alloy used by Henry Ford in the first Model T autos rendered the material lighter and stronger than the standard steel of the early 1900s and was an early example of material modification on a mass production scale to improve the overall technical performance and durability of the automobile (Gross, 1996).

The desire for increased strength with decreased weight encouraged the development and use of various steel alloys containing a variety of important minerals including molybdenum, chromium, nickel, and manganese, in addition to vanadium. Molybdenum is important as an alloying element in stainless and other steels and imparts strength and toughness to the material. It is worth noting that a sharp increase in the price of molybdenum during the late 1970s led to the development of high-strength, low-alloy (HSLA) steels, which required less or no molybdenum. Chromium alloyed with steel makes it both corrosion resistant and harder. Nickel imparts strength at elevated temperatures, and manganese is also important as a hardener of steel or when alloyed with aluminum and copper. Vanadium hardens and strengthens iron when alloyed with it—of particular importance now in the manufacture of piston rods and crankshafts.

TABLE 2.2 Some Minerals and Their Weights and Properties in Today’s Automobile

|

Mineral |

2006 Weight (pounds/kilograms)a |

Property |

|

Iron and steel |

2124/963 |

High strength, durability (frame, motor) |

|

Aluminum |

240/109 |

Light weight (frame, motor) |

|

Carbon |

50/23 |

Bond strengthener (tires and other rubber parts) |

|

Copper |

42/19 |

Electrical conductivity |

|

Silicon |

41/19 |

Bonding properties (windshields and windows) |

|

Lead |

24/11 |

Conductor (storage batteries) |

|

Zinc |

22/10 |

Galvanizer; strengthens in metal alloys (die cast parts and galvanized metal) |

|

Manganese |

17/8 |

Hardens as metal alloy |

|

Chromium |

15/7 |

Corrosion resistance and hardness as metal alloy |

|

Nickel |

9/4 |

Strength at elevated temperature and corrosion resistance as metal alloy |

|

Magnesium |

4.5/2 |

Alloying element with other metals such as aluminum |

|

Sulfur |

2/0.9 |

Strengthens rubber tires |

|

Molybdenum |

1/4.5 |

Strength and toughness as metal alloy |

|

Vanadium |

<1/<0.45 |

Strengthens, hardens, lighter weight as metal alloy |

|

Platinum |

0.05-0.10 troy ounce/1.5-3.0 grams |

Catalytic properties (catalytic converters) |

|

NOTE: In addition to the minerals and metals listed above, the average automobile also contains trace amounts of phosphorus, niobium, antimony, barium, cadmium, cobalt, fluorspar, gallium, gold, graphite, halite, limestone, mica, palladium, potash, strontium, tin, titanium, and tungsten. The category “iron and steel” includes cast iron (435 pounds), conventional steel (1382 pounds), high-strength, low-alloy steel (263 pounds), and stainless steel (45 pounds); rubber (140 pounds) and plastics (250 pounds) also constitute an enormous proportion of the total composition of an automobile. aMII (2007b). |

||

Aluminum and steel overlap in such applications as the frame or engine. The average weight of an automobile is 2600 to 3000 pounds. The desire to reduce weight and contribute to improved fuel economy has led to an increased use of aluminum, which is less dense than steel. The amounts of aluminum and steel, particularly as part of the frame of an automobile, are thus evaluated not as a strict function of direct substitutability, but also as a function of the desired features of automobile design.

Like aluminum, the demand for copper in automobiles has increased through time in response to its properties as an excellent electrical conductor. In 1948, the average family car contained only 55 copper wires with a total combined length that averaged 45 meters (150 feet). Continuing improvements in electronics and the consumer’s desire for power accessories in automobiles led to today’s automobiles, which contain up to 1500 copper wires that total about 1.6 kilometers (1 mile) in length. A typical midsized automobile contains about 22.5 kilograms (50 pounds) of copper, including some 18 kilograms (40 pounds) of electrical components (http://www.copper.org/education/c-facts/c-trans_industry.html). Because of a greater amount of electrical wiring, fuel-efficient hybrid cars require more copper than conventional cars—potentially up to an added 12 kilograms (circa 26 pounds; Stablum, 2007), as well as larger quantities of other metals such as cobalt, nickel, and/or lithium with electrochemical and thermal properties that make them important as components (electrodes) of the rechargeable battery system for hybrid vehicles (either lithium ion or nickel-metal hydride batteries) (Chavasse, 2005).

The platinum group metals (PGMs) are used primarily for their excellent catalytic properties; their resistance to chemical attack, wear, and tarnish; stable electrical properties; and stable behavior at temperature. Of the PGMs, platinum, palladium, and rhodium are crucial to the operation of automotive catalytic converters and, at a time when reduction in air pollution is a primary goal, are therefore crucial to the manufacture of the automobile itself (Herring, 2007). Platinum in the catalytic converter leads to a reduction in carbon monoxide and hydrocarbon emissions. Palladium is an adequate substitute for platinum in gasoline catalytic converters, but in diesel engines only platinum will work as a suitable catalyst. Rhodium,

for which there is no known substitute in catalytic operation, is used to reduce NOx emissions.

In assessing the impact of these materials on the automotive industry one must consider not just availability, but also price. The PGMs are among the rarest metals in the world. The price of platinum has increased about sixfold in the past 3 years, creating additional considerations for the automotive industry as well as other applications, including catalysts, films for electronic circuits, jewelry, and dental crowns.

The rare earth elements (REs) are important to a number of applications. Catalytic converters will not operate without cerium and lanthanum, for which no substitutes are known. One of the REs, neodymium, also plays a significant role as a component in high-strength magnets, important to the automotive industry as a major part of power windows. RE use in catalytic converters ranks highest in proportion to the total annual market for REs in the United States, garnering 46 percent of the total RE market annually (USGS, 2007a) (see also Chapter 4).

Aerospace

The aerospace industry is another sector that depends on the availability of critical materials. Aerospace manufacturing is important to the economic health of the United States; in 2006, the country exported $28 billion in aircraft and $16 billion in jet engines (Marder, 2007).

There are three primary systems on modern aircraft: the propulsion system, the structure, and the avionics (the electronics, computing, radar systems; Schafrik and Sprague, 2004a). The first two are discussed in terms of the historical perspective of material development, as a way of illustrating the minerals important for current and future aircraft performance.

The first patent on a jet engine propulsion system was filed in 1929, and in 1941 the first jet aircraft flew with an engine based on this patent, with routine operation of jet fighter aircraft by the Germans by the end of World War II (Schafrik and Sprague, 2004a). The improvement in jet engines over the years can be measured in terms of their thrust-to-weight ratio. The aircraft based on the original patent had a thrust-to-weight ratio

of 1.5:1 compared to 6.8:1 in modern aircraft, and the industry desires to reach 10:1 in the future. These modern propulsion systems are possible only because of the improvement in the high-temperature properties of materials. The first jet engines were made of steels whose high-temperature properties placed severe limitations on operation. New alloys employing nickel, such as Inconel and Nimonic, greatly improved these properties (Schafrik and Sprague, 2004a). So-called superalloys based on nickel or cobalt had significantly improved mechanical properties at elevated temperatures. These improvements were based on additions of titanium and aluminum, which caused the formation of precipitates in the materials. Further improvements came from the introduction of titanium-base alloys (Schafrik and Sprague, 2004b).

Because of its much lower density compared to earlier alloy materials, titanium has become a preferred material for a number of gas turbine components, lending a significant reduction in weight. However, one of the drawbacks and continuing issues with respect to titanium is its higher cost (Schafrik and Sprague, 2004b). Titanium ore (which is reasonably abundant) is obtained primarily from Australia in the mineral rutile (TiO2) or ilmenite (Marder, 2007). A chlorination process that leads first to what is termed titanium sponge produces titanium metal. The sponge is then crushed and made into pure particles, mixed with alloying elements, consolidated, and melted (Schafrik and Sprague, 2004b). The United States has some titanium processing capability, but for economic reasons, companies are increasingly relying on foreign sources of titanium metal (Marder, 2007). This factor affects not only the commercial aerospace but also the defense aerospace industry.

A development that has further enabled higher engine temperature operation, important for the extra power requirements during aircraft take-off, is the use of thermal barrier coatings on the metal alloy blades. These coatings, based on yttrium oxide-stabilized zirconium oxide, are applied by plasma spraying or by physical vapor deposition (Schafrik and Sprague, 2004c).

When examining the aircraft structure, an interesting point is that the first aircraft to fly, built by the Wright brothers in 1903, was constructed

largely from wood and fabric, both of which are composite materials. Over the next 20 years aircraft were built mostly from wood and fabric; metals were used only for engines, bracing, controls, and landing gear (http://www.au.af.mil/au/awc/awcgate/vistas/match3.pdf).

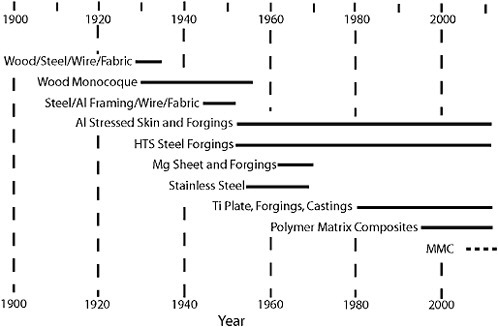

However, enhanced performance required new materials that were based on high-strength steels and aluminum alloys. Creation of suitable alloys, optimization of their heat treatment techniques, inexperience with their fabrication, and their cost were the main reasons for developmental difficulties in the metal airplane structure (Nye, 1935). The development of a corrosion-resistant aluminum alloy, duralumin, was a major breakthrough in the use of metals in aircraft construction, and other aluminum alloys followed. Figure 2.1 illustrates the time line for the development of aircraft materials. Interestingly, only two new major structural materials,

FIGURE 2.1 Aerospace frame materials and time of their introduction. Al: aluminum; HTS: high tensile steel; Mg: magnesium; Ti: titanium; MMC: metal matrix composites. SOURCE: Adapted from Air Force Scientific Advisory Board, 1996.

titanium and polymer matrix composites, have been introduced over the last 50 years.

Composite materials including both metal-matrix and polymer-matrix materials play an increasingly important role in aerospace construction. Reinforcements in these composites can consist of carbon or other fibers. As for automobile bodies, the future may well be the use of reinforcements consisting of carbon nanotubes having significantly enhanced stiffness and strength.

Electronics

The electronic age is here and the electronics sector, which includes computing, communication, entertainment, and dozens of other applications, is demonstrative of the dynamic nature of changing mineral and mineral suite applications that have facilitated technological advances. Miniaturization, energy efficiency, and increased processing or operating speed are some of the product performance goals that have driven research to optimize the properties of minerals or mineral products to meet new performance specifications.

On the basis of weight, steel and plastics are the two dominant materials used in electronic products. From the value distribution perspective, precious metals account for a significant part of the value for computers, cell phones, and calculators, television boards, and digital versatile disc (DVD) players. However, the electronic performance of the huge range of products in this sector relies on properties of elements derived from as many as 60 minerals (Hageluken, 2006). A large number of these elements are used as compounds formed with other solid or gaseous elements. These chemical compounds possess unique electrical, dielectric, or optical properties based on their atomic structure. In Chapter 1, the use of tantalum in cellular communications was mentioned (Box 1.1). Tantalum is employed as the complex compound barium-zinc-tantalum oxide (Ba3ZnTa2O9) in this application; the compound has unique electronic properties that enable it to act as a resonator in the cellular telephone base stations. Substitutes for tantalum in this compound have proved ineffective. Another example in

the electronics sector is indium, employed as a compound semiconductor, indium-gallium-arsenide (InGaAs), as well as an oxide in the manufacture of electroluminescent panels (“flat screens”). A third example is the use of hafnium as hafnium oxide in high-dielectric-constant films on silicon, important for the operation of microelectronic chips. The exciting new area of high-temperature superconductivity makes use of REs as well as other minerals to form complex compounds that possess unique electrical conductivity properties at temperatures far above those for superconducting metals (Hageluken, 2006).

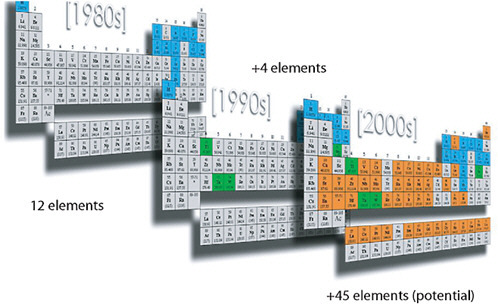

Computer chip technology developments during the past 25 years (Figure 2.2) illustrate the increase in the number of minerals or their derivatives used in chip manufacturing as technological advances have captured increasingly more specialized mineral properties. The result is a dynamic view of mineral products through time and a view of the global perspective needed by computer chip manufacturers to secure the raw materials for chip production.

Energy

Energy production is currently receiving considerable attention, in part because of the increasing cost of fossil fuels, but also because of a growing desire to avoid generating greenhouse gases. While minerals are clearly important in current energy production—for example, in oil and gas extraction, refining, and mining of fossil fuels—the development of alternative energy sources will demand new materials and minerals. A few examples are presented below.

Solar electricity has experienced a global surge of popularity over the past 5 years as a source of renewable energy for private and industrial purposes. Photovoltaics (PVs; conversion of sunlight to electricity) are popular partly because of their adaptable power outputs, low environmental impact (noise- and pollution-free energy production), and low operating costs (Benner, 2007). Although PVs presently provide only 1 percent of domestic energy consumption from all renewable energy sources, and renewables themselves comprise only 6 percent of all sources of domestic energy con-

FIGURE 2.2 The dynamics of two decades of computer chip technology development and its mineral and element impacts. In the 1980s, computer chips were made with a palette of twelve minerals or their elemental components. A decade later, 16 elements were employed. Today, as many as 60 different minerals (or their constituent elements) may be used in fabricating the high-speed, high-capacity integrated circuits that are crucial to this technology. SOURCE: Used with permission from Intel Corporation.

sumption (EIA, 2007), accelerated growth in solar systems as an electricity source is projected to take place over the next several decades given specific levels of national and state investment (Table 2.3). Global PV cell production has increased six times since 2000, and some projections suggest PVs will provide half of new U.S. electricity capacity by 2025 (Benner, 2007).

The material requirements for a PV installation include construction materials such as copper, steel, concrete, aluminum, and glass. However, the PV cell is the specialized feature of the system, with the majority of cells manufactured as silicon wafers; cadmium-telluride (CdTe) or copper-indium-gallium-selenide (CIGS: Cu(In,Ga)Se2) thin film; and very high-performance cells made of gallium-arsenide (GaAs) compounds, for example, constitute the other cell types. To accommodate the anticipated increase in demand for PV cells, high-purity silicon production is slated to double by 2010. Better processing technology and advances in the use of thinner silicon films and wafers will likely preclude any disruption in the supply of domestic refined silicon for this application. Similarly, despite the spike in price of 9 to 15 times between 2002 and 2006 for indium and tellurium, respectively, the small quantity of these materials used in PV wafers has caused only a slight increase in the cost of module production until the present. The rapid growth in use of indium tin oxide to produce liquid crystal displays has partly fueled the price increase of indium in this 4-year period. Stable or falling prices for cadmium, selenium, and gallium over the same period have contributed positively to their use in the manufacture of PV wafers.

Price volatility for tellurium and indium may impede their more wide-spread use as a thin-film option for PVs (Benner, 2007), although indium, as a by-product of zinc processing, is always subject to swings in price that are not related directly to raw indium supply. Differences have been noted between official U.S. government and industry sources with regard to data on supply and occurrence of tellurium and indium (Benner, 2007) and highlight the need, particularly during times of volatile price swings, to maintain unbiased, independent public mineral data sources that are cross-referenced to available industry data reports.

Batteries are ubiquitous power sources for many hand-held appliances, information technology and telecommunication devices, computers, motor vehicles, and aerospace applications. Lithium ion and nickel-metal hydride rechargeable batteries are preferred in many applications largely because of their long life cycles and high energy densities. Recycling of lithium batteries is considered important with regard to this supply outlook. Recycling or disposing of lead-acid or nickel-cadmium batteries requires handling potentially toxic substances more often than would be the case with long life-cycle rechargeable lithium ion or nickel-metal hydride rechargeable batteries.

Nickel-metal hydride batteries have a slightly lower energy density compared to lithium ion batteries but are currently the most commonly used battery in hybrid electric vehicles. Nickel hydroxide forms the cathode of the battery, while the anode is composed of a metallic compound of REs (particularly lanthanum and cerium) and another metal (often cobalt, nickel, manganese, or aluminum) (http://www.cobasys.com/pdf/tutorial/inside_nimh_battery_technology.pdf). Estimates of about 20 kilograms (44 pounds) of REs are used in a hybrid car, between the rechargeable battery pack and the permanent magnet motor and regenerative braking system (http://www.gwmg.ca/aree/faq.php).

Lithium ion batteries have become a common substitute for nickel-cadmium batteries in many hand-held electronic devices, largely because of a high energy-to-weight ratio and slow charge loss when not in use (Olson et al., 2006). Although safety issues with lithium ion battery volatility have

inhibited wider implementation of the batteries (Olson et al., 2006), they are viewed by some as a potential future substitute for nickel-metal hydride batteries (Herring, 2007), particularly in hybrid vehicles.

Some Minerals Decline in Use While Others Increase

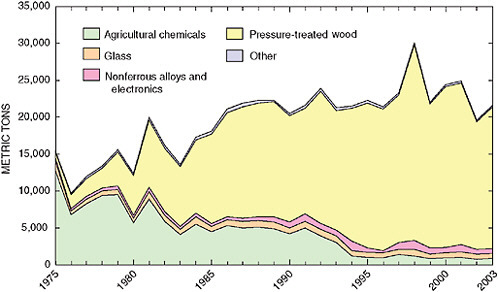

Not all minerals have increased in use over time. Changes in technologies as well as concerns regarding the environment, health, and safety, combined with new government regulations, have resulted in a significant decrease in the use of certain mineral products including arsenic, lead, and mercury in specific applications (Matos, 2007). Examination of some of these minerals is also illustrative of the importance of substitutability in determining a mineral’s criticality. Arsenic has historically been used in the United States as a pesticide and fungicide. This use in agriculture was essentially eliminated in 1993. Another important use has been as a wood preservative, but since 2003 its use in this arena has been supplanted by other materials. Although arsenic continues to be used in a number of nonferrous alloys, electronic components, and glasses (Figure 2.3), the protection of groundwater from arsenic is so important that even naturally occurring concentrations are considered unacceptable and require removal before water can be consumed by the human population.

Lead is another example of a material in which concerns over health issues have led to its decline in use in some applications in the United States, although the overall consumption of lead continues to grow (1.6 million metric tons in 2006 versus 1.3 million metric tons in 2003; USGS, 2007a). At one time lead was an important additive to gasoline. However, its use in gasoline interfered with the operation of catalytic converters, leading to its complete elimination in 1995 through federal legislation. The use of lead in paints and pigments has also been considerably reduced; in the United States, lead has been banned from house paints since 1977. There is now considerable international pressure to eliminate lead from solders as well. This latter case is a good example of how a critical mineral can seriously affect performance; considerable effort has been expended in finding suit-

FIGURE 2.3 End uses of arsenic from 1975 through 2003. Rapid decline in use in the agricultural sector is clear after 1993. Since 2003, use of arsenic in pressure-treated wood has been curtailed. SOURCE: Matos, 2007.

able substitutes for lead-tin solders. Lead continues to be used extensively in lead-acid storage batteries, particularly for automobiles. In this application, the lead itself is recycled after the battery is spent.

Finally, until 1989, mercury was used extensively in nonrechargeable alkaline primary batteries. Although the amount of mercury per battery was small, the number of batteries sold made these the largest source of mercury in the municipal waste stream. Use of mercury in other applications has declined as well. Since 1992, mercury has not been mined as a principal product in the United States. Any mercury needs have been met through reclamation from fabricated products and as a by-product of gold production.

In contrast to these declines in demand, Matos (2007) notes a significant increase in the use of several other elements in specific applications:

-

Gallium is used in integrated circuits, light-emitting diodes

-

(LEDs), photodetectors, and solar cells. Gallium arsenide has semiconducting properties and can convert electricity to light for use in LEDs. Gallium consumption in the United States rose 168 percent from 1975 to 2003.

-

Germanium, used extensively because of its semiconducting properties in electronics, as well as optical glass fibers, is retrieved as a by-product of zinc and copper-zinc-lead ores, in which it is a trace element. Germanium also can be found in some coal deposits. An interesting new use of germanium is in chemotherapy for some types of cancer. Two companies in the United States produce pure germanium; the rest is imported from Belgium, China, and Russia. About one-fourth of the germanium consumed comes from recycling.

-

Indium, of increasing importance for liquid crystal displays as the compound indium tin oxide, is a by-product of zinc ores. All of the indium in the United States is obtained from imports.

-

Strontium is an element present in all television picture tubes in order to block X-ray emissions. However, as the use of flat screens, which do not require strontium, gradually increases, this use of strontium will decline.

IMPACTS ON THE U.S. ECONOMY

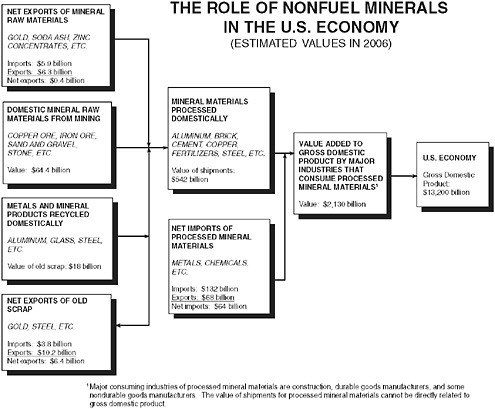

Minerals—along with air, water, energy, and other natural resources—are essential directly or indirectly to every sector of the economy. In purely economic terms, data from the U.S. Department of Commerce and the U.S. Geological Survey (USGS) suggest that the value added to the gross domestic product (GDP) by major industries that use processed mineral products in 2006 was $2.13 trillion compared to the total U.S. GDP of $13.2 trillion (Figure 2.4). So it is clear that the industries that use minerals and mineral products form a significant portion of the U.S. economy; however, it also should be noted that industries using any particular mineral or critical mineral represent a much smaller portion of the overall economy.

Related data for 2005 from the Bureau of Economic Analysis of the

FIGURE 2.4 The role of nonfuel minerals in the U.S. economy. SOURCE: USGS, 2007a.

U.S. Department of Commerce (http://www.bea.gov/industry/xls/GDPbyInd_VA_NAICS_1998-2006.xls; accessed July 28, 2007) show how value is added to the U.S. economy prior to the actual use of minerals and mineral products in construction, manufacturing, and other sectors. Mining—excluding oil and gas extraction, but including mining support activities—constituted about $74 billion (~0.6 percent of total GDP) in value added; this compares to value added in oil and gas extraction of about $160 billion (1.3 percent of GDP). Durable goods manufacturing, including manufacture with nonmetallic mineral products, primary metals, and fabricated metal products, added $244 billion more to GDP (~2 percent of total GDP) from the mineral sector, whereas the comparable sector in

energy (petroleum and coal products) constituted value added of $63 billion (~0.5 percent of GDP). A similar comparison to full- and part-time employment in these areas showed 128,000 persons employed in the oil and gas extraction sector and 437,000 employed in mining. An additional 1.5 million people were employed in the durable good manufacturing part of the mineral sector in 2005. Although it is difficult to estimate the partial, but important, direct fiscal or employment contributions of either petroleum products or minerals to the construction, plastics, transportation, automotive, aerospace, electronic, or general energy sectors, some estimates place that total contribution at approximately $2 trillion in value added to the GDP by industries that consume processed mineral materials (USGS, 2007a). These figures indicate that overall mineral use and associated employment are important to the U.S. economy. However, as discussed below, not all mineral use is subject to supply disruption; thus these figures ought not to be interpreted as indicators of how much of the U.S. economy is at risk should the supply of a specific mineral be restricted.

The information presented above illustrates the role of mineral production and use overall in the U.S. economy. Clearly a supply restriction for a specific critical mineral will affect only a part (typically a small part) of the overall U.S. economy. A supply restriction for any particular critical mineral will have a much smaller effect on the overall economy than would a restriction in the supply of oil, for example. Supply restrictions may come in one or a combination of two forms. First, demand may increase sharply in a short period of time; once producers are operating close to their production capacities, they find it difficult to increase output over the short term, even if demand exists for additional output (a demand shock). Second, on the supply side, supply may not be forthcoming for any one of a number of reasons described in Chapter 3 (a supply shock). In either case, if a mineral is not available to a user in a physical sense, the product that the user makes with the mineral or mineral product cannot be manufactured, sold, and then used by the purchaser of the product. In most cases, however, the consequences of a supply restriction of either form are more nuanced than simply whether a mineral or mineral product is available physically. Rather, a supply restriction represents an imbalance between

supply and demand, which normally leads to higher prices, a reallocation of available supply toward those users who are willing to pay more for a mineral or mineral product and away from lower-valued uses, and finally an incentive for higher-cost sources of output to begin supplying the market. The magnitude of impact of a supply disruption on the domestic workforce and economy will depend on the ease or difficulty of (1) substituting for the mineral or mineral product that has become unavailable or more expensive and (2) quickly drawing on alternative, previously higher-cost sources of supply.

The specific impacts will clearly depend on the circumstances: Is the mineral physically unavailable? A physical shortage of a mineral is more likely to occur when the mineral is used in relatively small quantities in a limited number of applications (situations that Chapter 3 describes as thin markets). Have prices increased, which is more typical for minerals used in large quantities in many applications throughout the economy? If prices rise, by how much have they risen? How flexible or inflexible is demand (i.e., how easy or difficult is it to substitute for the restricted mineral)? How flexible or inflexible is supply (i.e., how easy or difficult is it to bring new sources of supply into production)? The types of possible effects include impacts on the following:

-

Domestic production of minerals: opportunities may arise for increased domestic production of the mineral whose supply has been restricted, unless the supply restriction is caused by disruption at domestic production facilities; increased domestic production might incorporate previously uneconomic primary or secondary production.

-

Domestic users of minerals: production might be lost due to lack of mineral availability and/or higher costs as a result of that lack of availability; in such a case, applications might be concentrated in higher-valued uses of minerals and entail higher-cost production; emerging use industries might experience slower growth; some industries might see lower profits.

-

Domestic employment: domestic employment impacts might be reg-

-

istered in research and development, manufacturing, and engineering (Marder, 2007), as well as in extraction and processing, with the level of the impact depending on the scale and duration of the restriction.

SUMMARY AND FINDINGS

This chapter demonstrates that minerals are used throughout the economy. Some, such as iron and steel, are used in large quantities in a large number of end-use sectors. Others, such as the PGMs and REs, are used in much smaller quantities and often in a limited number of applications. In all cases, minerals are the material components whose chemical and physical properties are essential for performance in each application. In this sense, all minerals are critical. Minerals, in effect, compete with one another to provide material properties. Over time, substitution of one mineral for another has occurred as technologies evolve. Substitution is easier in some situations than others (e.g., substituting for arsenic, as opposed to finding a replacement for PGMs in catalytic converters). In this sense, the more difficult substitution is in a particular circumstance, the more critical the mineral is to the performance and success of the material or product.

Importance in use embodies the idea that some minerals are more important than others. Substitution is the key concept here. If substitution of one mineral for another in a product is technically easy or relatively inexpensive, for example, one can say that its importance is low; the cost or impact of a disruption in the supply of the mineral would be low. If, on the other hand, substitution is technically difficult or costly, its importance is high; the cost or impact of a disruption would be high. This concept of importance at a product level also includes the net benefits consumers receive from using a product—the benefits to human health of nutritional supplements or pollution-control equipment, the convenience of cell phones, the durability of an automobile, and so on. A mineral can thus be important at the level of a product, either technically or economically. A mineral also can be important at a scale larger than a product. A mineral might be important to the commercial success of a company and its profitability (importance at

a company level). A mineral might be important in military equipment and national defense; production of a mineral—or products that use a mineral as an input—might be an important source of employment or income for a local community, a state, or the national economy (importance at a community, state, or national level). Again, the greater the cost or impact of a supply restriction, which depends greatly on the ease or difficulty of substitution, the more important is the mineral.

It is likely that U.S. dependence on a broad spectrum of minerals will continue to grow as more sophisticated and complex applications develop—for example, in the area of nanotechnology. Each application may not require large quantities of a given material but will put more stringent demands on purity, cost, and accessibility. With the growing realization of the potential impact of global warming, new technologies will be developed that mitigate the output of greenhouse gases. PVs, hybrid vehicles, and the rechargeable batteries to power them all require mineral inputs, often from sources that currently lie outside the United States. Continuing social and economic progress nationally and internationally in an environment of increasing global competition for financial, human, and natural resources requires the United States to maintain a competitive stance with regard to materials science and engineering; mineral information, analysis, and activity to supply the manufacture of these materials; and sustainable approaches to extraction, processing, and use of natural resources.

Specifically the committee has found the following:

-

Most common products in the domestic economy owe their function and form to various minerals and mineral products;

-

The importance of various minerals in these products has changed over time with changing technology;

-

The “dynamism” of mineral importance through time means that mineral criticality at a given moment is a snapshot, rather than an enduring constant; and

-

Direct domestic impacts on individual consumers, and the extractive and manufacturing sectors supplying those products, can be estimated if a restriction in supply of a critical mineral occurs.

REFERENCES

Air Force Scientific Advisory Board, 1996. New World Vistas: Air and Space Power for the 21st Century, Materials in the Current Air Force. Available online at http://www.au.af.mil/au/awc/awcgate/vistas/match3.pdf (accessed July 11, 2007).

Associated Press, 2007. Judge blocks mining in key Miami-Dade area, industry to appeal. St. Augustine Record. July 15. Available online at http://www.staugustine.com/stories/071507/state_4715191.shtml (accessed August 7, 2007).

Benner, J., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 7.

Chavasse, R., 2005. Developments in hybrid vehicles and their potential influence on minor metals. Minor Metal Trade Association and Metal Pages. Minor Metals 2005, Lisbon, Portugal. Available online at http://www.evworld.com/library/hybrids_minormetals.pdf (accessed October 29, 2007).

EIA (Energy Information Administration), 2007. Annual Energy Review 2006. Report No. DOE/ EIA-0384(2006). Washington, D.C. Available online at http://www.eia.doe.gov/emeu/aer/contents.html (accessed June 27, 2007).

Gross, D., 1996. Forbes Greatest Business Stories of All Time. New York: John Wiley & Sons, Inc., 358 pp.

Hageluken, C., 2006. Improving metal returns and eco-efficiency in electronics recycling—a holistic approach for interface optimisation between pre-processing and integrated metals smelting and refining. Proceedings of the 2006 IEEE International Symposium on Electronics and the Environment. San Francisco, Calif., May 8-11, 2006. Available online at http://ieeexplore.ieee.org/xpl/tocresult.jsp?isnumber=34595&isYear=2006&count=79&page=1&ResultStart=25 (accessed July 19, 2007).

Herring, I., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 7.

Kohler, S., 2002. Map Sheet 52, Aggregate Availability in California. Sacramento: California Department of Conservation, California Geological Survey.

Marder, J., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 7.

Matos, G.R., 2007. Effects of Regulation and Technology on End Uses of Nonfuel Mineral Commodities in the United States. U.S. Geological Survey Scientific Investigations Report 2006-5194. Available online at http://pubs.usgs.gov/sir/2006/5194/pdf/sir20065194.pdf (accessed October 29, 2007).

McCartan, L., W.D. Menzie, D.E. Morse, J.F. Papp, P.A. Plunkert, and P.-K. Tse, 2006. Effects of Chinese mineral strategies on the U.S. minerals industry. Mining Engineering (March):37-42.

MII (Mineral Information Institute), 2007a. Every American Born Will Need. Golden, Colo.: Mineral Information Institute. Available online at http://www.mii.org/pdfs/2007_mii_Baby_Info.pdf (accessed June 28, 2007).

MII, 2007b. Why Do We Mine? Golden, Colo.: Mineral Information Institute. Available online at http://www.mii.org/pdfs/every/why1.pdf (accessed May 17, 2007).

Morrell, S., 2006. The Initial Price Impact of Closing the Production of Crushed Rock in the Lake Belt Region of Miami-Dade County. Tallahassee: Florida Taxwatch. Available online at http://floridataxwatch.org/resources/pdf/LakeBeltMiningImpact.pdf (accessed July 19, 2007).

NRC (National Research Council), 2007. Managing Materials for a 21st Century Military. Washington D.C.: The National Academies Press, 144 pp.

Nye, W.L., 1935. Metal Aircraft Design & Construction. San Francisco, Calif.: Aviation Press, 227 pp.

Olson, J.B., N.E. Smith, C.R. Sheridan, and P.C. Lyman, 2006. Lithium-ion batteries for electric and hybrid electric vehicles. Proceedings of the 4th International Energy Conversion Engineering Conference and Exhibit (IECEC). San Diego, Calif.: American Institute of Aeronautics and Astronautics Inc., pp. 198-202.

Reynolds, J., 2007. China’s hunger for African minerals. BBC News, International version. Available online at http://news.bbc.co.uk/2/hi/asia-pacific/6264476.stm (accessed July 2007).

Schafrik, R., and R. Sprague, 2004a. Saga of gas turbine materials, Part I. Advanced Materials and Processes (March):33-36.

Schafrik, R., and R. Sprague, 2004b. Saga of gas turbine materials, Part II. Advanced Materials and Processes (April):27-30.

Schafrik, R., and R. Sprague, 2004c. Saga of gas turbine materials, Part III. Advanced Materials and Processes (May):29-33.

SEIA (Solar Energy Industries Association), 2004. Our Solar Power Future: The U.S. Photovoltaics Industry Roadmap Through 2030 and Beyond. Washington, D.C. Available online at http://www.seia.org/roadmap.pdf (accessed September 13, 2007).

Sloter, L., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 8.

Stablum, A., 2007. Catch 22 for Hybrid Cars—Price vs. Volume. Reuters, March 27. Available online at http://www.reuters.com/article/reutersEdge/idUSL2767808920070327 (accessed August 3, 2007).

USGS (U.S. Geological Survey), 2002. Rare Earth Elements—Critical Resources for High Technology. USGS Fact Sheet 087-02. Available online at http://pubs.usgs.gov/fs/2002/fs087-02/ (accessed August 3, 2007).

USGS, 2007a. Mineral Commodity Summaries 2007. Reston, Va.: U.S. Geological Survey, 195 pp.

USGS, 2007b. Mineral Industry Surveys Crushed Stone and Sand and Gravel in the Fourth Quarter 2006. Reston, Va.: U.S. Geological Survey, 11 pp.

Wald, M.L., 2007. Costs surge for building power plants. New York Times, July 10, Section C, p. 1.