CHAPTER 3

Availability and Reliability of Supply

INTRODUCTION

The availability and reliability of the supply of mineral commodities relate to the horizontal axis of the criticality matrix described in Chapter 1. Availability is dynamic but is generally considered to be a long-term issue, whereas reliability of supply is a shorter-term issue. Part of the mineral resource endowment that is often overlooked is the amount of material that is landfilled or scrapped but could be recycled. Net imports and exports of scrap for recycling should also be taken into consideration. In addressing the availability of critical minerals and materials the availability of both the virgin resource (primary availability) and the previously processed resource (secondary availability) must be considered.

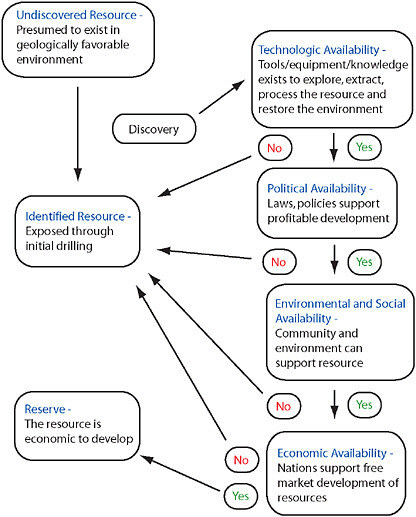

The committee defines five dimensions of primary availability in this study: geologic (does the mineral resource exist), technical (can we extract and process it?), environmental and social (can we produce it in environmentally and socially accepted ways?), political (how do governments influence availability through their policies and actions?), and economic (can we produce it at a cost users are willing or able to pay?). Geologic availability includes consideration of the geologically appropriate terrains for a given mineral, mineral associations, depths, grade, tonnage, and geometry of the deposit. Technical availability considers the state of technology and knowledge to find, extract, and process the mineral resource. Environmental and social availability includes attributes of the environment in which the

mineral is found or processed, such as endangered species, water and air quality, and scenic beauty. Social availability accounts for the community acceptance of resource development and may be more commonly referred to as “social license to operate.” Political availability applies at local, national, and international levels and is a function of the predictability of laws, the independence of the judiciary, the limits on litigation, the protection of land tenure, the willingness of the host country to allow or facilitate development of the resource and repatriation of profits, and the military and economic stability of a region and the availability of an appropriate workforce. Economic availability considers the cost to discover the mineral deposit; to extract the minerals; and to process, concentrate, and purify the minerals balanced against the market value of the product. The availability of technical and skilled workforces is also a factor in economic availability. This chapter discusses the dimensions of primary and secondary availability and additional indicators of risk to the supply to clarify the input used to evaluate the risk to the availability of a mineral as a determinant of that mineral’s position in the criticality matrix.

THE FIVE DIMENSIONS OF PRIMARY AVAILABILITY

Geologic Availability

Mineral deposits often have specific associations with geologic terrains and vary in abundance as a function of geologic time; a few examples of minerals and their global geologic associations are listed here. The major source of copper from deposits, known as porphyry copper deposits, are most prevalent around the Pacific Ocean, along the west coasts of South and North America and in the South Pacific islands of Indonesia, and in Papua New Guinea (Figure 3.1). The deposits in the United States formed 50 million to 75 million years ago, while the deposits in the South Pacific can be as young as 1 million to 3 million years old. Porphyry copper deposits are low grade (0.3-1.0 percent copper) and large tonnage (often greater than 1 billion tons), with the copper-bearing minerals finely disseminated throughout the large volume of rock. Platinum group metal

(PGM)-bearing minerals (those containing platinum, palladium, osmium, iridium, or rhodium) tend to occur in narrow veins that can exist as part of layered igneous complexes. PGM deposits in the layered igneous complexes of the Bushveld Complex in South Africa or the Stillwater Complex in Montana are around 2 billion years old (Figure 3.1), while those of the Nor’ilsk-Talnakh district in Russia are between about 240 million and 260 million years old. Carbonatite deposits (calcium-rich igneous rocks), some of which host rare earth (RE) metals, can range in age from 1.9 billion years at Palabora, South Africa, to 1.2 billion years at Mountain Pass, California (Figure 3.1). Until recently, the two main mining locations for REs had been Bayan Obo in China and Mountain Pass in California; Mountain Pass was closed to active operation in 2002 (see Chapter 4). Carbonatite deposits such as Eden Lake, Manitoba, are also being explored for REs. There are hundreds of occurrences of RE-bearing mineralizations and several locations at which some RE metals could be produced as by-products from other minerals with the right economic, technological, and regulatory conditions.

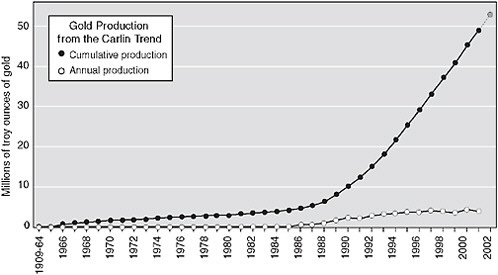

A common exploration approach is to look for mineral deposits in familiar terrain, in known geologic settings although new discoveries in unconventional areas are also made (Shanks, 1983). Additional research in an area of new mineral discoveries is completed to aid in the understanding of mineral and geologic controls on the deposit’s distribution with the potential to lead to emergence of new mineral trends or a complete map of the extent of the initial discovery. For example, in the world-class gold belt of the Carlin Trend in Nevada, more than 180 million ounces of gold have been identified since the late 1960s. New discoveries continue to be made as our knowledge and understanding of the mineral deposits advances (Figure 3.2).

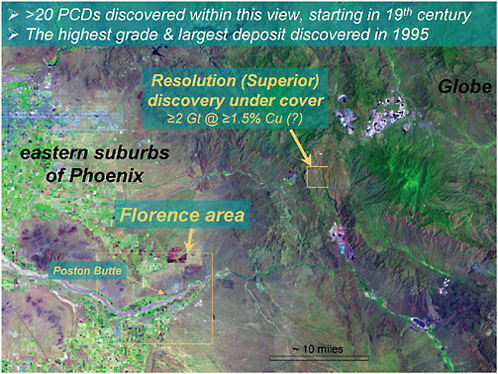

Even in districts or around mines that have been explored for a century, the knowledge of the geology can still be very incomplete and major discoveries of new resources have been made a hundred years after the original, due in part to improved mapping technologies and better understanding of mineral and ore systems. BHPBilliton discovered the 1.5 billion ton Resolution copper mineral deposit in 1995 underneath the Magma

FIGURE 3.1 Distribution of porphyry copper deposits (red), PGM deposits (black squares), and magmatic RE deposits (black stars); RE deposits are only those reported to have greater than 1 × 106 metric tons of contained RE oxides. Deposit locations after Singer et al. (2005), Sutphin and Page (1986), and Jackson and Christiansen (1993). Numerous other types of sediment-hosted copper and placer-RE deposits also exist globally but are not plotted on this map. SOURCE: http://veimages.gsfc.nasa.gov/2433/land_shallow_topo_2048.jpg.

FIGURE 3.2 Annual and cumulative gold production from the Carlin Trend, Nevada. The trends from the late 1980s and early 1990s illustrate the effects on gold production of the discovery of deeper, sulfide-bearing gold deposits on the trend. SOURCE: Thompson and Teal, 2002.

ore body in Superior, Arizona. This area had been mined for copper since 1911 (Paul and Knight, 1995); however, the Resolution deposit remained undiscovered until exploitation methods and mining technology allowed more efficient and accurate exploration for deposits in unconventional areas at great depth. The Superior area has seen a resurgence of exploration activity, with additional copper resources being identified since the Resolution discovery. Thus, in addition to mineral exploration and discovery in new regions, new deposits may also be discovered in places where mines already exist.

Technical Availability

Mineral commodities can become more available over time if the cost-reducing effects of new technologies offset the cost-increasing effects of

depletion (Tilton, 2003, 2006). Changes in mineral production technology have been dramatic and very important to the availability and cost of minerals, and they are likely to continue to be important (Box 3.1).

Over the last 130 years, new technologies have kept the adverse effects of depletion in check, despite both population growth and a surge in the consumption of mineral commodities (Tilton, 2006). With many nations such as China, India, and Brazil emerging as principal drivers of material consumption, and the price surges and reduced stockpiles that have resulted for many commodities, we must now question both the availability and the reliability of mineral supply. Mineral depletion and its effects tend to be

|

BOX 3.1 History of Advances in Mineral Production Technology Mining and mineral processing have generally been at the forefront of industrial innovation for millennia and, through development of extraction and refining technologies, were responsible for major improvements in lifestyle, beginning with the Bronze Age and the Iron Age. Copper smelting, for example, began at least 4000 years ago. Until the mid-1800s, most aspects of mining and processing underwent progressive evolutionary improvements in technologies that had been applied successfully for centuries. However, the mineral industry then became a leading participant in the Industrial Revolution with important innovations in underground mining methods, improved gravity concentration equipment, and grinding mills. Cyanidation of precious metal ores was commercialized in the early 1890s and led to rapid improvements in such areas as solid-liquid separation that soon spread to other industries such as waste water treatment. Open-pit mining was developed early in the twentieth century, enabling low-cost bulk mining of ore bodies with grades too low otherwise to support the costs of underground mining. Concurrently, the introduction of modern electric hoists made underground mining cheaper and safer. Selective froth flotation of metal sulfide ores quickly supplanted gravity concentration and significantly reduced processing costs and increased metal recoveries. Through the remainder of the twentieth century, advances continued in all aspects of mining and processing, but with periodic lulls in the pace of innovation that were usually |

key drivers in increasing the costs of and prices for mineral commodities, although these increases may be mitigated in response to new technologies (Tilton, 2003).

The mineral resources of many mining districts or geologic regions are not known with certainty. As exploration technology advances and new geologic interpretations are produced, areas that were previously considered thoroughly explored are being revisited with new models and technologies at hand. For example, new drilling technology allows for deeper recovery of core and for holes to be drilled at subvertical angles. New analytical chemistry techniques allow more elements to be assayed at lower detection

|

caused by cyclical metal markets. A notable exception was the global gold industry, which was very active until World War II when War Production Board Order L-208 closed primary U.S. gold mines in October 1942. Little happened technologically in the gold industry until the 1970s when a gradual positive response to decontrolling of the gold price began to take place. Since the 1960s, we have seen sweeping changes in production technology typified by the following brief list:

These innovations and many others have enabled the mining industry to produce minerals, metals, and other elements at lower costs while making products of higher purity and greatly reducing the release of airborne and waterborne pollutants. |

levels. The QEMScan™ technoloy, for instance, uses a sophisticated scanning electron microscope with four X-ray detectors and a microanalyzer to map bulk mineralogy, mineral textures, and metallurgical properties. New satellite data and imagery, including those from hyperspectral reflectance surveys, allow for more refined coverage of Earth’s surface, contributing to better “remote” mapping of minerals. This type of technology assists in identifying regional mineral controls and trends, and zones of alteration that are prospective for certain types of minerals. Advances in many different geophysical techniques allow deeper exploration, higher resolution, or more accurate interpretations. One such advance is the Falcon™ the first airborne gravity gradiometry system, developed by BHPBilliton. Bell Geospace transferred submarine technology from the U.S. Navy to develop a full tensor airborne gravity gradiometry system. Both have provided significant advances in imaging potential mineral deposits at depth.

In 2002, the RAND Science and Technology Policy Institute published New Forces at Work in Mining—Industry Views of Critical Technologies (Peterson et al., 2002). The report said, “The United States has the largest mining industry in the world, with a raw material production of $52 billion in 1997. Yet many industry representatives noted that … mining is relatively small in comparison with other industries, and its ability to finance R&D [research and development] specific to mining is limited. As a result, many technology innovations in mining are adopted from other sectors such as construction, automobiles, and aerospace” (pp. 9-10). Technological advances are increasingly imported from countries such as Australia and Canada where public investment in mining-related research is at present greater than in the United States. The volatility of mineral commodity markets, the long delay in return on investment, and the unique requirements of mining equipment contribute to the financial risks for the mining industry and create difficulties for private companies to invest in research and development projects (Peterson et al., 2002). Tilton (2003) has suggested that, like exploration projects, a few highly successful research projects can more than compensate for the many less successful efforts. Opportunities for research and technology development in exploration, mining, in situ mining, and mineral processing are presented in

the Peterson et al. (2002) report and ample discussion accompanies the recommendations.

Environmental and Social Availability

Objections to the development of mineral resources often focus on the disruption to the local environment and the impacts on communities related to the boom-and-bust nature of historic mining districts. Stories of the gold rushes in California and the Klondike and the resulting shifts in population, inflated prices, environmental damage, and social problems still resonate with the public. The growing development of the oil sands in northern Alberta, Canada, and the rapid growth in population in Fort McMurray, Alberta, highlight the issues that are faced when resource production expands faster than urban planning in an isolated community: housing may be in short supply, prices may become inflated, and the population may begin to feel torn between the improved economic prosperity and the disruption to the environment. Conflicts over land use in the rapidly urbanizing areas of the western United States often mean that the community must choose between the use of mineralized land for housing or recreation and its use for mineral resource development.

The Bureau of Land Management (BLM) and U.S. Forest Service administer 38 percent (393 million acres) of the land area in 12 western states, ranging from 76 percent of all land in Nevada to 23 percent in Washington State (NRC, 1999). In 1999, 0.06 percent of BLM land was affected by mining activity (current or planned) (NRC, 1999). However, not all public land is open to mineral entry and estimates from 1995 indicated that about 65 percent of western federal lands, or about 360 million acres, were restricted from mineral entry (Gerhard and Weeks, 1996). Since 1999, an additional 3.9 million acres have been withdrawn from mineral entry, and an additional 40 million acres have been proposed to be withdrawn. Wilderness areas are examined for their mineral inventory prior to withdrawal, but generally speaking, detailed mineral exploration is not conducted.

In some cases in the intermountain western United States, land with known ore deposits is effectively removed from mineral exploration by the

development of surface rights for housing or other uses. Many western cities were located to take advantage of natural resources such as water, minerals, or timber. As these cities have grown to be major metropolitan centers over the last half century, conflict between development of natural resources and preservation or urban use of land containing the resources has sometimes occurred. Figure 3.3 shows eastern Maricopa and western Pinal Counties in Arizona, with 20 known copper deposits located within the area of the satellite image. The urbanization of the area has begun to overlap many discovered copper reserves such as the Poston Butte deposit near Florence, Arizona. The Poston Butte deposit was initially planned as

FIGURE 3.3 Satellite image of eastern Maricopa County and western Pinal County in Arizona covering an area with more than 20 discovered copper deposits. Urbanization has effectively removed copper reserves near Florence from mining development. Source: Barton, 2007. Used with permission.

an in situ leach operation of a deposit that contained 730 million tons at 0.38 percent copper (approximately 2 years of U.S. consumption), but when copper prices fell, the land was sold to a land developer.

From a mining company’s perspective, the social availability of a mineral resource can be viewed as the need to obtain a license to operate. From a community’s perspective, the goal of discussions about social availability is to break the boom-and-bust impact of mining on a community by developing a parallel economy and building independent capacity for development with power, water, transportation, communication, health care, and education infrastructure. Sustainable resource development is described by the Mining, Minerals, and Sustainable Development Project (MMSD, 2002) as the integration of economic activity with environmental integrity, social concerns, and effective governance systems.

Even with the implementation of sustainable development principles, a challenge for the mining industry is overcoming its often-negative legacy of distrust among some communities and stakeholders, and although the legal system may provide authorization for mineral exploration and development, social tension and conflict in a community can negate those rights. The relative rights of the local community versus the national community to benefit from the development of mineral resources are unresolved in many countries. The committee concurs with the MMSD in that the social license to operate at the local community level should ensure that “interactions between the mine and community should add to the physical, financial, human, and information resources—not detract from them” (MMSD, 2002, p. 198).

Sustainable development definitions abound and are best defined at the local level, integrating social, economic, environmental, and governance concerns with a basis in the local needs. No “one-size-fits-all” definition exists, and any definition must account for the unique needs at local scales. Sustainable development likely encompasses elements of all of the following: (1) the concept that the present generation behaves in a way that does not impede future generations from enjoying a standard of living at least comparable to its own; (2) the protection of an ecosystem, a community, an indigenous culture, and biodiversity; (3) assistance to communities that

host mines to remain economically viable after the mineral resources have been mined; and (4) the equitable distribution of goods, income, and resources among the host communities and affected people.

Political Availability

The concept of environmental and social availability, the subject of the last section, leads naturally into, and in fact overlaps, the concept of political availability, which looks more directly at how actual government policies and actions influence mineral availability. The concept of political availability encompasses (1) legislation, rules, and regulations that influence investment in mineral exploration and mine development and (2) the risks and results of change in these policies. The former include rules about land access, security of tenure, permission to mine, and mineral taxation, as well as broader rules dealing with environmental and land access issues not designed with mining specifically in mind. The latter might be termed political risk—the likelihood of political decisions that alter the government rules under which mining occurs.

One of the most important issues related to development of the U.S. mineral endowment is the evolution of U.S. permitting regulations (NRC, 1999). Maintaining regulatory and leasing standards that keep pace with research on groundwater systems, soil chemistry, adaptability of plant and animal species, and engineering designs of the mine, for example, is difficult. Lack of planning and zoning in rapidly growing communities can result in differences of opinion over the juxtaposition of new residents and existing mines.

Environmental compliance and protection is not just a design consideration for new and existing mines but a necessity for operation from the time reconnaissance exploration is considered. The permitting process in the United States requires compliance with a body of laws administered through federal agencies and state and local authorities. Groundwater protection is one of the most cited reasons for protesting the development of a new mine. Hardrock mines and coal mines have a legacy of groundwater contamination, the most noticeable of which is acid-rock drainage in which

the mineral pyrite oxidizes to form sulfuric acid, which lowers the pH of streams and causes iron to precipitate in stream sediments. Manganese, arsenic, uranium, and mercury may occur naturally in the groundwater but can be concentrated to potentially unacceptable levels by mining activity. Mining technology has advanced over the years to limit emissions into the environment as a result of mining activity in the United States. However, environmental protection regulations were established and have undergone subsequent revision within the last 30-40 years in most cases, and it remains important today to balance environmentally conscious mining practices and mine and environmental regulation. Mining companies do find it practical to work within the framework of today’s environmental regulations, but permitting issues, overcoming the industry’s past legacy of less environmentally friendly practices, and addressing community concerns in its development of new mines continue to offer time and resource challenges to the mining industry (Heig, 2007).

In addition to the legal framework for mineral development, the willingness of a nation to allow foreign commercial development of a resource affects its political availability. Nationalization of mines dates back to ancient Greece after the war between Athens and Sparta, and many similar examples have occurred around the world in the last 40 years. In this period of high commodity prices, resource nationalism tends to experience resurgence, raising the issue of supply disruptions in certain circumstances depending, for example, on government reinvestment in the mines, retention or departure of a technical mining workforce, and potential lapses in environmental and safety issues as mines change operational procedures and ownership.

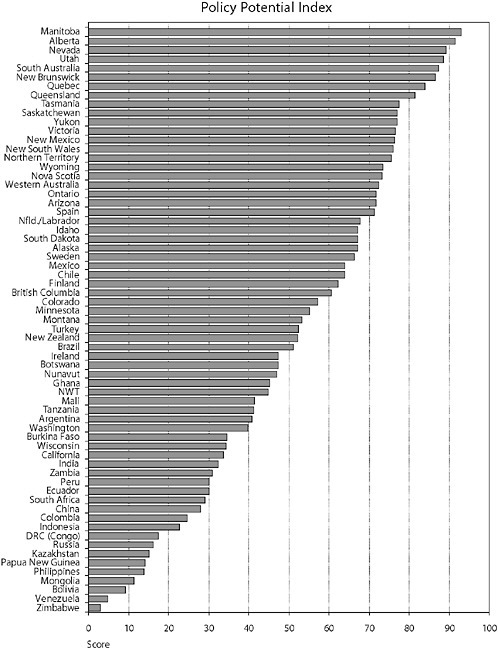

The political challenges of mine nationalization inspired the founding of the Fraser Institute in 1974 as an independent research and education organization based in Vancouver, British Columbia. Since 1997 the Fraser Institute has published an annual survey on exploration and mining companies to evaluate how public policy influences exploration investment. The survey covers 65 countries and states on every continent but Antarctica and represents the opinions of exploration managers and company executives. The data reduction results in a metric called the Policy Potential Index

(PPI; see Figure 3.4). A perfect score of 100 means that a jurisdiction is perceived to be best in all measured aspects of public policy. A score of 0 means it is the worst in all categories. The Current Mineral Potential (CMP) index measures the mineral potential or endowment in a jurisdiction and whether the current policy environment encourages or discourages exploration. The Best Practices Mineral Potential Index (BPMI) measures whether policies conform to best practices. A room-for-improvement score is calculated by subtracting the BPMI score from the CMP. High positive scores on the room-for-improvement metric indicate that the jurisdiction is far from best practices. Details of the survey are in the report Fraser Institute Annual Study of Mining Companies, 2006/2007 (McMahon and Melhem, 2007). While interpretation of the PPIs for a country (or a U.S. state or Canadian province) entails some subjective judgments and is somewhat dependent on available data, such a ranking is one means to try to quantify the rather qualitative term “political risk” with respect to mineral availability. Because it uses the same types of information over successive years to generate these evaluations, in a relative sense the PPI allows a company, government, or individual to gain some idea of the potential political risk entailed in mining exploration activities conducted in, or with, another country, state, or province.

Economic Availability

The manufacture of materials and products requires the availability of the raw mineral at a required time, quantity, and purity—at a price the manufacturer is willing and able to pay. Economic availability is the idea that a mineral is available at a price users are willing to pay and encompasses all of the previous dimensions of availability through the effects of these dimensions on costs.

Costs are fundamentally influenced by the abundance and availability of minerals, which are defined in terms of the level of detail of knowledge we have of a particular occurrence. A mineral occurrence is defined as an unusual concentration of a mineral or element that is of interest or value to someone (Cox and Singer, 1987). A mineral deposit is defined to mean that

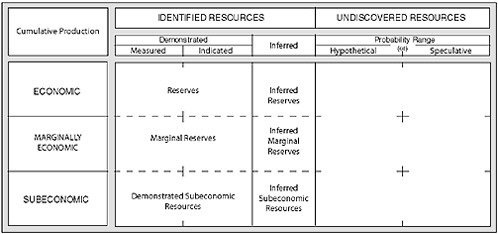

the mineral concentration is worthy of further investigation as to economic grade and tonnage. An ore deposit is a mineral deposit of such grade (see Box 3.2), tonnage, or value that the minerals can be extracted, processed, and distributed at a profit. Mineral resources are categorized as measured (volume and tonnage well established), indicated (volume and tonnage estimated with less precise information), or inferred (deposit is assumed to occur past known boundaries), depending on the level of exposure of the deposit (Craig et al., 2001). A mineral reserve is a class of resource that is identified as economic as shown in Figure 3.5. A marginal reserve is “marginally economic.” A change in the price of a commodity, exploration, extraction, or processing technology and changes in legal and regulatory policies can move a resource to a reserve and vice versa (Figure 3.6).

|

BOX 3.2 Grade Two numbers often quoted with regard to resources and reserves are grade and tonnage. Tonnage is the amount of material containing the mineral commodity of interest. Grade is the relative quantity or percentage of the commodity or element of interest in a unit volume of mineralized rock. For example, in a porphyry copper deposit, the primary economic mineral may be chalcopyrite (CuFeS2). The mineral contains copper, iron, and sulfur. By weight percent, about 35 percent of chalcopyrite is copper and the remainder is iron and sulfur. If 10 percent of the rock in the deposit contains chalcopyrite, 100 kilograms of chalcopyrite could be extracted from 1 metric ton (1000 kg) of mineralized rock. Since only 35 percent of the 100 kilograms is copper, one could expect, at best, to recover 35 kilograms of copper from that tonne of mined rock. This results in a grade of 35/1000 kilograms or 3.5 percent copper. A typical copper grade is between 0.5 and 1.0 percent which means that at a grade of 0.5 percent copper, we can extract a maximum of only 5 kilograms of copper from 1000 kilograms of mineralized rock. The actual amount of copper recovered is less because we are not able to extract all of the chalcopyrite from the rock, nor do we recover all of the copper from the chalcopyrite. |

FIGURE 3.5 Classification of resources and reserves. SOURCE: USBM/USGS, 1980.

The definitions of mineral resources and reserves have legal implications for public companies filing financial statements. According to the Canadian Institute for Mining Standards, mineral reserves are “those parts of mineral resources which, after the application of all mining factors, result in an estimated tonnage and grade which, in the opinion of the Qualified Person(s) making the estimates, is the basis of an economically viable project after taking account of all relevant processing, metallurgical, economic, marketing, legal, environment, socio-economic and government factors. Mineral Reserves are inclusive of diluting material that will be mined in conjunction with the Mineral Reserves and delivered to the treatment plant or equivalent facility. The term ‘Mineral Reserve’ need not necessarily signify that extraction facilities are in place or operative or that all governmental approvals have been received. It does signify that there are reasonable expectations of such approvals” (CIM, 2005, p. 5). The U.S. Securities and Exchange Commission (SEC) defines a reserve as “that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination” (SEC Industry Guides; available at http://www.sec.gov/about/forms/industryguides.pdf; p. 34).

FIGURE 3.6 The availability of a mineral resource is dynamic in the five dimensions of geologic, technologic, environmental and social, political, and economic availability. Only if the extraction and processing of the resource is proved to be economically profitable is it considered a reserve.

A commodity is a physical substance such as grain, fuel, or a mineral that is interchangeable with a product of the same type and that investors buy and sell, often through futures contracts. There are risks associated with commodities because the producer does not know what the price will be in

the future when the product is actually made and ready for sale. Mineral commodity prices are cyclical, but mining companies use long-term price predictions when planning new mines. “Price indexes developed by the U.S. Geological Survey (USGS) indicate that the long-term constant dollar price of key U.S. mineral raw materials declined over the last century, even though the need for mineral raw materials increased during the same period. Technologies and reduced production costs have allowed mineral production to remain profitable, while lower priced mineral products from domestic and foreign sources helped fuel growth in other sectors of the economy” (Sullivan et al., 2000, p. 2).

The USGS has analyzed the price trends of several mineral commodities using the Consumer Price Index for a constant-dollar comparison. The USGS calculates a U.S. mine price index using values for five metals (copper, zinc, lead, gold, and iron ore) and eight industrial minerals (cement, clay, crushed stone, lime, phosphate rock, salt, sand, and gravel). These commodities account for nearly 90 percent of U.S. metal and industrial mineral production. The overall price of mineral commodities declined in the twentieth century despite increases in consumption: supply and competition were adequate and technology improvements decreased the cost of production and increased the supply (Sullivan et al., 2000). Note that not all mineral commodities necessarily follow the downward trend in prices over time, although all of the industrial minerals included in the index exhibit a downward trend.

The implementation of bulk tonnage mining and processing methods at the turn of the twentieth century by Daniel Jackling allowed lower-grade porphyry copper deposits such as Bingham Canyon, Utah, to be developed. Jackling was an engineer working in the Bingham Canyon mines in 1899 who formed the Utah Copper Company, the predecessor of today’s Kennecott Utah Copper Company. The use of large shovels and rail or truck haulage, coupled with froth flotation to produce copper concentrate, shepherded in the era of large open-pit metal mines with production costs that decreased as equipment size increased. The first commercially successful froth flotation process for sulfide minerals was the Potter-Delprat Process, which was first used (and not used much elsewhere because better processes

soon appeared) at the Broken Hill Proprietary Mine in New South Wales, Australia, in 1903 (Taggart, 1927). Increasingly, new deposits will be discovered at depths that preclude surface mines. The twenty-first century will be characterized by the development of deep, high-production (100,000 metric tons per day) metal mines. Such mines have the benefit of limited surface impact and less visual surface impact. Although underground mines may be extremely expensive to develop and take 10-15 years of design and construction before any production occurs, they generally will have limited or no impact on water resources, because the dewatering requirements are restricted to smaller areas. Dewatering footprints will be reflective of the geometry of the aquifer as defined by structures, where present. The water in mineralized zones is often geologically and geographically separated from the water aquifers in valleys where drinking water is typically derived. Underground deposits are economic to develop when the long-term forecast for commodity prices is high and the developer can meet the economic requirements to move from resource to reserve. Technological challenges associated with equipment automation, ventilation, and hoisting still exist. The Resolution ore body underneath the old Magma Mine at Superior, Arizona, is one such example of a high-grade (1.5 percent copper) large-tonnage (1.5 billion metric tons) mine at 7000 feet (2134 meters) and rock temperatures of 180°F (82°C) (Heig, 2007). Examples of underground copper mines in the planning, construction, or production stages include Oyo Tolgoi, Mongolia; Grasberg, Indonesia; Pebble, Alaska; Superior, Arizona; Bingham Canyon, Utah; and Kidd Creek, Canada.

THE FOUR DIMENSIONS OF SECONDARY AVAILABILITY

The magnitude of the secondary resource in a particular region depends on past inflows and outflows from the stock of material available for recycling. Additions reflect historical use patterns within the region, product service lives, and imports of scrap for recycling, while removals reflect flows of material recycled within the region or exported to other regions for reuse or recycling. The secondary resource includes material discarded in landfills as well as material that is no longer in service but remains in place,

material hoarded in anticipation of future shortages or price increases, and stockpiles of material awaiting reuse or recycling. The quantity and quality of the secondary resource is the result of many decisions, made by businesses, individuals, and governments over a very long period of time, that influence technical, economic, environmental and social, and/or political availability.1

The flow of material that becomes available for recycling in a particular time must be estimated to assess collection and recycling systems. The magnitude of this flow reflects more recent use patterns within the region and the distribution of product service lives. For each product or application it is necessary to determine the service life of products removed from service, the number of units sold in the year those products entered service, and the amount of material contained in each unit. Imports and exports of end-of-life products and scrap must also be considered. The flow of material available for recycling and the proportion that is actually recycled are the result of many decisions, made over an extended period of time, that influence technical, economic, and environmental and social availability. Decisions that affect product retirement and end-of-life management are especially important.

Technical Availability

Product use patterns and designs evolve over time. Some applications, by their nature, entail material losses over the life of the product that could potentially affect the quality of air, water, soil, or sediments. Examples include past use of tetraethyl lead in gasoline and a number of current uses, including the addition of micronutrients to fertilizers and animal feed supplements, use of zinc coatings to protect steel from corrosion, and

use of inorganic copper compounds in friction products. Product stewardship and regulatory decisions require an understanding of the magnitude of losses and a comparative assessment of benefits and risks. Material that is dispersed will not be available for recycling in the future and will not increase the secondary resource. Past and current use patterns affect technical availability and must be taken into consideration in estimating the stock of secondary resources and the flow of material available for recycling (Box 3.3; e.g., Wilburn and Buckingham, 2006).

The service life for each application is a key determinant of the time that material becomes available for recycling and the extent to which societal needs could be satisfied through increased collection for recycling. Some applications such as beverage containers have comparatively short lives, and in principle, the demand for aluminum alloys, steel, and other materials used in beverage containers could be satisfied to a substantial degree by recycled material. In contrast, many applications of minerals, metals, and alloys in construction and infrastructure, transportation, and communications remain in service for decades. Even in a country such as the United States with a mature economy, well-established infrastructure, and modest growth rates, the quantity of material available for recycling may meet only a modest proportion of future demand. Material that is either not collected or not recovered augments the stock of secondary resources and increases the demand for primary material, unless total demand has declined significantly.

The range of opportunity for supplanting virgin ores with recycled material is controlled by the dynamic balance between the availability of the secondary materials for recycling and the total demand. If, for example, the rate of use of a mineral steadily increases over time and the material’s in-use lifetime is finite, even complete recycling will be insufficient to meet continuously increasing demand for the mineral in various applications. If the rate of use of the mineral stabilizes, recycled material will be adequate to meet the demand if none is lost when discarded (a very unlikely scenario). If the rate of use of the mineral decreases, recycled material can, in principle, be the sole source needed to meet demand.

In most cases in the United States, mineral use has continued to increase over time. There are no known examples of saturation at the country

|

BOX 3.3 Pollution Control Technology and Motor Vehicle Fuels A change in product use can profoundly affect demand for materials and availability of secondary resources. A mandate to reduce tailpipe emissions from vehicles to improve local and regional air quality drove the adoption of catalytic converters. This required elimination of tetraethyl lead use as an octane enhancer and antiknock compound. The change substantially reduced lead demand by eliminating its use in a dispersive application that represented the largest end use and had no potential for lead recovery. The major end use today is in lead-acid batteries, an application that does not result in material losses during the life of the product. A well-developed infrastructure for battery collection and recycling has improved end-of-life management. Industry efforts have been supported by federal and state government actions. Most states have adopted laws to ban disposal of lead-acid batteries in landfills which has provided additional groundwater protection. Collection, storage, transportation, and recycling are controlled by the Resource Conservation and Recovery Act, but a conditional exemption provides relief from certain requirements for shipments destined to a permitted facility. For 1999 through 2003, the recycling rate of lead available from lead-acid batteries in the United States was 99.2 percent. A typical new lead-acid battery now contains 60 to 80 percent recycled lead and plastic (BCI, 2005; Wilburn and Buckingham, 2006). The difference between these statistics reflects relatively slow growth in the domestic vehicle fleet and the size of each battery, as well as net exports of batteries and battery scrap. Catalytic converters now represent the dominant use of platinum, palladium, and rhodium. Initially that demand could be satisfied only by primary material. As converters and vehicles reached the end of their lives, a new infrastructure was established to collect converters and recover these valued PGMs. Available data indicate that the United States leads other regions in recovery rates for PGMs from autocatalyst, but new autocatalyst demand (net of recycled PGMs) is the major use. Continued demand growth is anticipated, as discussed in Chapter 4. |

level, although Müller et al. (2006) concluded that U.S. iron use saturated in about 1980 on a per capita basis. For a few toxic materials such as arsenic and mercury, use has decreased sharply over time, as discussed in Chapter 2 (see also Matos, 2007). Reasonably well-functioning recycling

infrastructures exist for some materials and some product groups. For example, a substantial industry sector has developed to support the reuse and refurbishment of used auto parts and to recover materials from end-of-life vehicles. Among metallic materials, steel is produced and recycled in the greatest quantities. American steelmakers have invested to build electric arc furnace (EAF) capacity that accounted for 56 percent of domestic steel production in 2005 (Fenton, 2006), and those plants and downstream customers depend upon a steady supply of ferrous scrap from automobiles and other sources; about 90 percent of the feed to EAF facilities is from ferrous scrap (Steel Recycling Institute, 2005). Other enterprises have developed and applied a range of technologies to recover nonferrous metals from autoshredder residue, to add value by sorting particular aluminum alloys, and to recover metals and other materials from end-of-life electronic equipment.

Notwithstanding these examples, it is clear that technologies for materials recovery and recycling are much less well developed than those for processing primary materials. The Department of Energy and other agencies have supported the development and assessment of some promising technologies for sortation of aluminum alloys, among others. It is clear that although further technological development could enhance material recovery, perhaps the major obstacle to increased recovery from secondary sources is the lack of coherent policies and programs at the local, state, and national levels to increase waste diversion of end-of-life products for material recovery. For example, although recycled aluminum is used increasingly in other applications, recycling of used beverage containers has declined significantly due to lower collection rates (Das, 2006).

Environmental and Social Availability

Social attitudes toward resource conservation and recycling generally support more rather than less recycling, although these attitudes sometimes are not reflected in the behavior of individual consumers. For most types of postconsumer waste, consumers are the weakest link in the recycling value chain. Increased attention to public awareness and education could

improve the economic and environmental performance of existing waste diversion programs and provide a more supportive environment to increase the recovery of materials and energy.

Political Availability

In principle, the United States has relatively few barriers that would preclude increased waste diversion for material recovery. However, federal government departments and agencies have not been given a mandate to lead a national effort, with the result that local municipalities and states have developed a patchwork of policies and programs. In practice, this uncoordinated approach makes it difficult for businesses to identify and assess investment opportunities and risks. For most types of postconsumer products, an efficient collection network and a small number of state-of-the-art recycling facilities would be sufficient to process all of the material available for recycling. An ad hoc approach that does not permit economies of scale or encourage collaboration at a national or regional level cannot maximize the economic, environmental, and other benefits of waste diversion for material recovery. In practice, the recovery and reprocessing of secondary material represent operational approaches that range from small, local facilities to large-capitalization, high-technology industrial facilities; note that the Institute of Scrap Recycling Industries represents 1200 different companies in the United States. An effort to increase the amount and efficiency of recycling in this country could benefit from a combination of government policies that encourage the existing industry to upgrade and integrate its facilities and networks.

Although the United States has not assigned a high priority to the recovery of secondary materials, other countries have taken a number of steps to address concerns about material availability and the reliability of supply. Because the United States has not ratified the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal (hereafter called the Basel Convention) and parties to the convention are prohibited from trading in hazardous wastes (as defined by the convention) with nonparties in the absence of an Article 11 agreement

or arrangement, U.S. businesses may be unable to source sufficient feed to supply new or existing recycling facilities, particularly if domestic supplies decline as a result of changes in global markets and the value chains that supply emerging markets. The United States may thus lag behind the European Union, Japan, South Korea, and other countries as these nations strengthen their ability to access secondary resources, while the most rapidly growing economies secure access to primary resources.

Economic Availability

Unlike other types of materials, minerals and metals largely retain their chemical and physical properties and can generally be recycled repeatedly. While recycled metal may not meet technical specifications for all applications, it is priced in relation to virgin material and does not trade either at a significant discount or at a premium. Recyclable materials that contain minerals and metals are commodities with well-established commercial specifications and trade at prices that reflect both the current price of the recoverable components and the costs that must be incurred in order to recover them. For most metals and many mineral-based products, reduced transportation, processing, and energy requirements provide a significant cost advantage that could increase in the future if avoided greenhouse gas emissions can be monetized. Similar factors may increase the beneficial use of mineral-based materials in the future that are generally managed as waste at present, including slags from ferrous and nonferrous metal production and flyash from thermal power generating stations. Slags from new and old blast furnace ferrous metal production are used as a substitute for natural aggregates in a variety of applications, and new blast furnace slag is increasingly converted to a granulated cementitious material that is a substitute for portland cement. Slag from steel production has more limited uses as aggregates because of quality issues (USGS, 2007). Flyash from thermal power generation—graded according to its residual carbon content—is a substitute for portland cement in ready-mix concrete. Lower-quality flyash can be used as a stabilizer in highway construction applications. While power plant bottom ash is generally considered a waste product, it also is often used as a

base product in highway construction (see also NRC, 2006). Minerals and metals represent a significant proportion of the residual value of many end-of-life products, such as motor vehicles, large appliances (“white goods”), commercial and residential heating, ventilating, and air conditioning equipment, and electrical or electronic products (“brown goods”). They provide an important economic driver for material recovery from end-of-life products that often contain a complex mix of materials.

Market forces provide a sufficient and ongoing driver for many resource conservation and recycling activities, generally within a well-established legislative and regulatory framework. Fabricators and manufacturers are motivated to increase material efficiency and minimize waste in order to improve profitability and reduce material input costs, waste disposal costs, and potential liability. Material that cannot be reused within the process, known as “prompt scrap” or “new scrap,” generally retains significant value that can be recovered. Even when transportation and processing costs exceed the resulting revenue, firms will favor recycling if the net cost is less than the cost of disposal. Waste generators are required to identify and characterize wastes and to track waste volumes in order to satisfy legislative, regulatory, or other requirements, including corporate policy requirements, or to conform to environmental management system standards. Management systems and competitive pressures also drive continual improvement. For the most part, government interventions focus on high-risk areas, such as the treatment, storage, and disposal of hazardous waste.

The value of end-of-life products, or the cost to ensure their sound management, reflects the cost of collection, transportation, and initial processing (sortation). For the most part, physical processes are used to separate various types of scrap of merchantable quality (old scrap). In some cases, residual material with low or negative value is generated and must be sent for energy recovery or disposal in a landfill or incinerator, with the scrap processor paying transportation costs that may exceed any revenue. In some cases a residue may meet technical requirements for beneficial use (such as clay cover material for a landfill or energy recovery) and may be viewed as a product, but may represent a net cost to the generator because negotiated prices are influenced by the next best alternative for each party.

Recycling metals from postconsumer (municipal solid) waste generally is more costly than recycling materials from junked automobiles, demolished buildings, industrial machinery, and similar goods. The metal content of postconsumer waste is lower and more variable per unit of material that has to be processed. A market system, therefore, is less effective in dealing with postconsumer waste, if the objective is to maximize the amount of recycling that occurs. Citizens demand services and lower taxes from local authorities, while municipal waste managers and elected officials view waste diversion as an added cost, rather than an opportunity to avoid waste disposal costs and generate revenue. As a result, the metal content of recycled municipal solid waste varies widely, depending on programs put in place at a state or local level. With a range of approaches, there is an opportunity to examine the economic and environmental costs and benefits of alternative measures, including material recovery from unsorted municipal solid waste, source segregation by householders with curbside collection of recyclable materials, depositrefund schemes for beverage containers, a variety of design alternatives for extended producer responsibility programs, and other models. In short, although recycling is already an important economic activity, there is a need to investigate whether more effective incentives and disincentives are necessary to increase recycling and reduce the rate of accumulation of secondary resources in landfills.

Economic availability can be reduced substantially when different materials are mixed. There is a need to carefully weigh collection and transportation cost savings that may result from combining different waste streams against the revenue losses and cost increases that result from additional handling, processing, and impurities. In some cases, existing infrastructure can be used with limited pre-processing. For example, white goods can be shredded together with automobiles, provided that ozone-depleting substances and components that contain polychlorinated biphenyls are removed first. In other cases, collection and transportation cost reductions may eliminate the potential for profitable recycling activities unless other funding is available to support responsible material management. Policy measures may also be needed to ensure an economic incentive for respon-

sible recycling within the United States, including landfill bans, advanced disposal fees, export restrictions, or other measures.

SUPPLY RISK

The previous section discusses primary and secondary availability over the longer term. This discussion now considers more specifically the factors useful in assessing the degree of supply risk for a mineral in the short and medium terms from a national perspective, and in the context of the global trends in the sources and production status of minerals.

Short- and Medium-Term Factors for Supply Risk

In the short to medium term (periods of a few months to a few years, but no more than a decade), there may be significant restrictions of supply, leading either to physical unavailability of a mineral, or more likely, to higher prices—for a number of reasons. First, as noted previously, demand may increase significantly and unexpectedly, and if production already is occurring at close to capacity, then either a mineral may become physically unavailable or its price will rise significantly. Demand can increase more quickly than production capacity can respond.

Second, relatively thin (or small) markets are another indicator of possible supply risk. The key insight here is that small markets may find it difficult to increase production quickly if demand increases significantly. This issue could be important when evaluating supply risk for some so-called minor metals—such as gallium, tantalum, or vanadium—that at present have demand concentrated in a small number of applications but could experience rapid demand growth with development of a new application for the mineral or metal.

Third, supply may be prone to restriction if production is concentrated. If concentrated in a small number of mines, supply may be prone to restriction if unexpected technical or labor problems occur at a mine. If concentrated in the hands of a small number of producing countries, supply may be prone to restriction due to political decisions in the producing country.

The previous discussion in this chapter of political availability and growing resource nationalism is relevant here. If concentrated in the hands of a small number of companies, supply may be prone to restriction from opportunistic behavior by companies with market power. Market power may allow a powerful firm to raise prices opportunistically to take advantage of a weak buyer. The Herfindahl-Hirschman Index (HHI) provides a measure of market concentration or power and is used by the U.S. Department of Justice when investigating possible monopolistic behavior. This index is the sum of the squared market shares of all firms in a particular market—for example, an industry with three firms with market shares of 40, 40, and 20 percent would have an index of 402 + 402 + 202 = 3600. Likely index scores range from about 1 to 10,000: the greater the concentration in a market, the higher the index number (and vice versa). The U.S. Department of Justice considers markets with index numbers between 1000 and 1800 to be moderately concentrated and those with numbers greater than 1800 to be concentrated. If a merger leads to an increase of more than 100 points in the index, the Department of Justice presumptively has concerns about possible anticompetitive consequences of the merger (U.S. Department of Justice, “Horizontal Merger Guidelines,” available at http://usdoj.gov/atr/public/guidelines/horiz_book/hmg1.html; accessed June 21, 2007). Unfortunately, lack of sufficient data on company market shares made it impossible for the committee to calculate and evaluate HHIs for the minerals examined in this study.

Fourth, the supply of minerals that come significantly from by-product production may be fragile or risky. The key idea here is that the availability of a by-product is determined largely by availability of the main product (e.g., gallium as a by-product of bauxite mining). Thus, by-product production is relatively insensitive in the short term to changes in demand for the by-product. An increase in the demand for and, in turn, the price of a by-product may not result in significant additions to production capacity for the by-product. Likewise, a significant drop in demand for a by-product also may not result in significantly lower by-product production. As in the case of thin markets, minerals whose supply consists predominantly of by-products may not respond as quickly to demand increases as other-

wise might occur. One exception would be a situation in which a significant amount of by-product mineral is not recovered at the time demand increases.

Finally, markets for which there is not significant recovery of material from old scrap may be more prone to supply risk than otherwise. As discussed earlier in this section, old scrap consists of discarded products, whereas new scrap is created during the manufacture of products. Recovery of material from old scrap influences supply risk in the following way: significant recycling of old scrap means that there is a pool of available old scrap from which material can be recovered. Part of this pool represents material in products discarded this period, and part represents material in products discarded in the past but not recycled previously. Material in the pool of old scrap exhibits a wide range of recycling costs; some material is of relatively uniform quality and is located close to recycling facilities, and thus has low costs; other material is of uneven quality, perhaps contaminated with other metals, is located at a distance from processing facilities, and thus has higher costs of recycling. As a result, recovery of material from scrap is particularly sensitive to price changes. When prices are high, it makes sense to recover material from the high-cost part of the pool of available scrap. When prices are low, much of the pool of available scrap remains unprocessed and is available for recycling later. In other words, the pool of available old scrap is an alternative source of supply should other sources become restricted and prices rise. The same argument does not apply to new scrap; almost all new scrap is recycled when or shortly after it is created because it tends to be of uniform quality, is not contaminated with other materials, is located close to reprocessing facilities, and thus tends to have very low costs of reprocessing.

There are two other possible indicators of supply risk, which are commonly cited and possibly useful—but only if interpreted with care. Both are commonly misinterpreted. The first is import dependence. The idea has been suggested that imported supply may be less secure than domestic supply. In fact, import reliance may be good for the U.S. economy, if an imported mineral has a lower cost and/or similar or better quality than an alternative domestic mineral. This is not to suggest that U.S. consumers should rely

on foreign supplies if the source of the foreign cost advantage is a result of policies regarding environmental quality or worker health and safety that are below minimum international standards. At the same time, the United States needs to be cautious in imposing its environmental and labor standards on other countries; there may be good, local reasons for differences among countries in these standards. Thus import reliance is a potentially useful indicator but one that must be interpreted with care. Analysts must understand the definition. The USGS reports U.S. net import reliance as a percentage of U.S. consumption for a large number of minerals and metals. Net imports represent the physical quantities of imports less exports, adjusted for changes in inventories held by industry or government. In essentially all cases, dependence is measured either at the stage of mineral ore or concentrate or as refined metal. Thus, measured import reliance represents the dependence of mineral processors (in the case of ores and concentrates) or product manufacturers (in the case of refined metal)—and not the import dependence of final consumers. The perspective of the final consumer would have to include mineral quantities embodied in imported goods and exclude mineral quantities in exported goods.

One also needs to be cautious in interpreting actual estimates of import dependence. Just because measured import reliance is high does not necessarily imply that supply is at risk. In fact, in several situations, high measured import reliance may be no less risky than domestic supply if imports come from a diverse set of countries and firms or imported mineral or mineral product simply represents intracompany transfers within the vertical chain of a firm (e.g., imported concentrate to be smelted at a company’s domestic smelter, imported refined metal to be transformed into a semifabricated shape or form at a domestic plant).

The second possible indicator of supply risk is the reserve-to-production ratio. As described earlier in this chapter, reserves are that portion of the Earth’s stock of resource for a specific mineral that is known to exist and technically capable of being extracted at a profit under current market conditions. Dividing a mineral’s reserves by current (annual) production gives a measure of how long reserves will last at current rates of production. The interpretation would be that the shorter the estimated lifetime of

reserves, the greater is the supply risk. However, just as in the case of import dependence, this indicator of supply risk easily can be misinterpreted and must be used with care. As reserves become limited, firms have the incentive to explore for and develop additional reserves. Given that it costs time and money to develop reserves, firms do not fully explore and develop a mineral deposit at the time of initial development. Reserve development is an ongoing activity at mines, and mineral exploration for previously unknown mineral deposits is an ongoing activity as well. Moreover, technological innovation often makes it technically and economically feasible to extract minerals from what previously was geologically interesting but uneconomic rock—in effect, converting a mineral resource into a reserve. Changing economic conditions (prices and extraction costs) also continually influence what is—and what is not—a mineral reserve. With these qualifications, nevertheless, reserve-to-production ratios provide some useful insight into a mineral’s availability and supply risk. A related measure is the ratio of a mineral’s reserve base to production, which provides a similar but slightly longer-term view of a mineral’s availability and supply risk. The USGS defines reserve base as the inplace demonstrated (measured plus indicated) resource from which reserves are estimated. The reserve base includes resources that are currently economic (reserves), marginally economic (marginal reserves), as well as some demonstrated subeconomic resources (USBM/USGS, 1980). The same caveats apply to this possible measure of supply reliability.

SUMMARY AND FINDINGS

This chapter has focused on the horizontal axis of the criticality matrix—the availability and reliability of mineral supply. The committee considered both primary and secondary supply in its assessment. The five dimensions of primary availability over the longer term (greater than about 10 years) include geologic (does the mineral resource exist?), technical (can we extract and process it?), environmental and social (can we produce it in environmentally and socially accepted ways?), political (how do governments influence availability through their policies and actions?), and economic

(can we produce it at a cost users are willing or able to pay?). Secondary availability incorporates the same set of factors with the exception of geologic availability. Instead of virgin ore, secondary availability must rely on inflows and outflows from the stock of material available for recycling, which includes material discarded in landfills, material that is no longer in service but remains in place, material hoarded in anticipation of future shortages or price increases, and stockpiles of material awaiting reuse or recycling.

In addition to these longer-term factors, the short- to medium-term (a few months to no more than 10 years) risks to mineral supply include significant and unexpected increase in demand for a mineral; relatively thin (or small) markets; concentration of mineral production (in the hands of a small number of mines or producing countries); significant derivation of the mineral as a by-product (of the production of another mineral); lack of significant recovery from old scrap; import dependence; and a mineral’s reserve base-to-production ratio.

Whether evaluation of the mineral supply risk is with respect to long-, medium-, or short-term interests, several of the availability factors often interact to varying degrees, and the associated data used to interpret these factors and their interactions require cautious analysis. The committee reaffirms the conclusion of the report Mineral Resources and Sustainability: Challenges for Earth Scientists (NRC, 1996) that the federal government should facilitate activities that sustain mineral supplies with respect to exploration, development, technology, and recycling because these may be longer-term issues to which the private sector and market forces alone are likely not sufficient to meet challenges of sustainability. Finally, efficient and environmentally conscious development of mineral supplies can be accomplished in a regulatory framework that is adaptive to change, including advances in technological capabilities and sound environmental and mining research.

With respect to the availability and reliability of mineral supply, the committee found the following:

-

The uncertainties in knowledge of the nature of inferred mineral

-

resources lead to uncertainty about the actual resource base for critical minerals.

-

The stocks and flows of materials are inadequately characterized and difficult to determine, especially import and export as components of products and losses upon product discard (e.g., Wilburn and Buckingham, 2006). This lack of information impedes planning on many levels.

-

Of the short- to medium-term supply risk factors, those most difficult to interpret are import dependence and a mineral’s reserve base-to-production ratio; the data available to evaluate these factors are neither easily collected nor always quantifiable.

-

Remanufacturing and recycling technology is a key component in increasing the rate and efficiency of material reuse, yet little research effort has been expended on developing this technology.

REFERENCES

Barton, P., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 7.

BCI (Battery Council International), 2005. National Recycling Rate Study: Chicago, Illinois, Smith, Bucklin, and Associates, Inc. Available online at http://www.batterycouncil.org/BCIRecylingRateStudyReport.pdf (accessed August 7, 2007).

CIM (Canadian Institute of Mining ), 2005. CIM Definition Standards for Mineral Resources and Mineral Reserves: Prepared by the CIM Standing Committee on Reserve Definitions. Adopted by CIM Council on December 11, 2005. Available online at http://www.cim.org/committees/StdsApprNov14.pdf (accessed October 31, 2007).

Cox, D., and D. Singer, 1987. Mineral Deposit Models. USGS Bulletin 1693. Washington, D.C.: U.S. Government Printing Office. 379 pp.

Craig, J., D. Vaughan, and B. Skinner, 2001. Resources of the Earth. New York: Prentice Hall, 395 pp.

Das, S.K., 2006. Emerging trends in aluminum recycling: Reasons and responses. In T.J. Galloway (ed.), Light Metals. Warrendale, Pa.: The Minerals, Metals, and Materials Society, pp. 911-916. Available online at http://www.secat.net/docs/resources/Emerging_Trends_in_Aluminum_Recycling06.pdf (accessed September 2007).

Fenton, M.D., 2006. Iron and Steel Scrap; chapter in Minerals Yearbook 2005, U.S. Geological Survey. Available online at http://minerals.usgs.gov/minerals/pubs/commodity/iron_&_steel_scrap/fescrmyb05.pdf (accessed October 31, 2007).

Gerhard, L.C., and W. Weeks, 1996. Earth resources data: A basis for resource analysis and decision-making. Environmental Geosciences 3(4):76-82.

Heig, R., 2007. Presentation to Committee on Critical Mineral Impacts on the U.S. Economy. Washington, D.C., March 7.

Jackson, W.D., and G. Christiansen, 1993. International Strategic Minerals Inventory Summary Report—Rare-Earth Oxides. U.S. Geological Survey Circular 930-N, 68 pp.

Matos, G.R., 2007. Effects of Regulation and Technology on End Uses of Nonfuel Mineral Commodities in the United States. U.S. Geological Survey Scientific Investigations Report 2006-5194. Available online at http://pubs.usgs.gov/sir/2006/5194/pdf/sir20065194.pdf (accessed October 29, 2007).

McMahon, F., and A. Melhem, 2007. Fraser Institute Annual Survey of Mining Companies, 2006/2007. Vancouver: Fraser Institute, 91 pp.

MMSD (Mining, Minerals, and Sustainable Deveopment Project ), 2002. Breaking New Ground. London: EarthScan Publications in association with the International Institute for Environment and Development, 441 pp.

Müller, D.B., T. Wang, B. Duval, and T.E. Graedel, 2006. Exploring the engine of anthropogenic iron cycles. Proceedings of the National Academy of Sciences 103(44):16111-16116.

NRC (National Research Council ), 1996. Mineral Resources and Sustainability Challenges for Earth Scientists. Washington, D.C.: National Academy Press.

NRC, 1999. Hardrock Mining on Federal Lands. Washington, D.C.: National Academy Press, 247 pp.

NRC, 2006. Managing Coal Combustion Residues in Mines. Washington, D.C.: The National Academies Press, 256 pp.

Paul, A., and M. Knight, 1995. Replacement ores in the Magma Mine, Superior, Arizona. Pp. 366-372 in F. Pierce and J. Bolm (eds.), Porphyry Copper Deposits of the North American Cordillera. Tucson: Arizona Geological Society, 656 pp.

Peterson, D., T. LaTourrette, and J. Bartis, 2002. New Forces at Work in Mining—Industry Views of Critical Technologies. Santa Monica, Calif.: RAND Science and Policy Technology Institute.

Shanks, W., 1983. Cameron Volume on Unconventional Mineral Deposits. New York: Society of Economic Geologists, Society of Mining Engineers, American Institute of Mining, Metallurgical, and Petroleum Engineers, 246 pp.

Singer, D.A., V.I. Berger, and B.C. Moring, 2005. Porphyry Copper Deposits of the World: Database, Map, and Grade and Tonnage Models. U.S. Geological Survey Open File Report 2005-1060. Available online at http://pubs.usgs.gov/of/2005/1060/of2005-1060.pdf (accessed October 31, 2007).

Steel Recycling Institute, 2005. The Inherent Recycled Content of Today’s Steel, Fact Sheet. Available online at http://www.recycle-steel.org/PDFs/Inherent2005.pdf (accessed August 8, 2007).

Sullivan, D., J. Sznopek, and L. Wagner, 2000. Twentieth Century U.S. Mineral Prices Decline in Constant Dollars. USGS Open File Report 00-389. Available online at http://pubs.usgs.gov/of/2000/of00-389/of00-389.pdf (accessed October 31, 2007).

Sutphin, D.M., and N.J. Page, 1986. International Strategic Minerals Inventory Summary Report—Platinum-Group Metals. U.S. Geological Survey Circular 930-E, 34 pp.

Taggart, A.F., 1927. Handbook of Ore Dressing. New York: John Wiley & Sons, 1679 pp.

Thompson, T.B., and L. Teal, 2002. Preface to Gold Deposits of the Carlin Trend. Reno: Nevada Bureau of Mines and Geology, p. 8.

Tilton, J.E., 2003. On Borrowed Time? Assessing the Threat of Mineral Depletion, Washington, D.C.: Resources for the Future.

Tilton, J.E., 2006. Depletion and the long-run availability of mineral commodities. In M.E. Doggett and J.R. Parry, (eds.), Wealth Creation in the Minerals Industry: Integrating Science, Business and Education. Littleton, Colo.: Society of Economic Geologists Special Publication 12, pp. 61-70.

USBM/USGS (U.S. Bureau of Mines and U.S. Geological Survey), 1980. Principles of a resource/reserve classification for minerals: U.S. Geological Survey Circular 831. Reston, Va.: U.S. Geological Survey, 5 pp.

USGS, 2007. Mineral Commodity Summaries 2007. Reston, Va.: U.S. Geological Survey, 195 pp.

Wilburn, D.R., and D.A. Buckingham, 2006. Apparent Consumption vs. Total Consumption—A Lead-Acid Battery Case Study. U.S. Geological Survey Scientific Investigations Report 2006-5155. Available online at http://pubs.usgs.gov/sir/2006/5155/sir20065155.pdf (accessed October 31, 2007).