2

The Electric Power System Today

The electric power delivery system in North America encompasses a wide diversity of institutions, technologies, organizational structures, economic mechanisms, and regulatory oversight. Some parts of the system are provided by federal, state, or municipal governments; others are customer-owned cooperatives. Much of the power supply is from privately owned, regulated utilities. Functionally, many of those traditional utilities were vertically integrated, i.e., providing generation, transmission, and end-use sales to customers over their own distribution system—although some federal agencies, like the Tennessee Valley Authority and the Bonneville Power Administration, provide only generation and transmission services, and many rural cooperatives provide only distribution and transmission services. In areas with deregulated, market-based supplies, different entities may furnish each of the three services through marketing agents who negotiate between generators and customers for their energy purchases, and in other jurisdictions, the generators are separated from combined transmission and distribution utilities. Regulatory oversight responsibility also varies by utility and location and is divided between federal and state agencies, with franchises for placing lines along public roads being granted by local municipalities.

Many generators are now independent producers without normal rate-of-return regulation, but they are still subject to federal antitrust laws and, in many instances, the market-monitoring oversight of the Federal Energy Regulatory Commission (FERC) and the independent system operator/ regional transmission operator (ISO/RTO) that coordinates their wholesale market. These ISO/RTOs, many of which have been authorized by FERC, conduct the wholesale markets and clear transactions (that in some instances are also subject to Federal Commodities Exchange Commission oversight). They also have responsibility for operating the bulk power system reliably, dispatching power that results in flows over transmission lines that are owned by other public or private regulated entities. Six ISO/RTOs in North America are subject to FERC oversight of their wholesale markets, and 8 of 10 come under FERC's reliability oversight, with the remaining 2 being subject to Canadian regulation.

Technological differences are also widespread. Different voltages are used by different companies for their distribution and transmission systems. Also, two conceptually different physical configurations are used among utilities for their three-phase electrical systems governing how faults are grounded, the number of wires strung on poles, and therefore their relaying, control, and maintenance procedures. These different voltage standards and electrical configurations among suppliers require different equipment, which has implications for manufacturing costs and the size of inventories for spare components that are usually available. Furthermore, many systems use a radial spatial configuration of lines, whereas others, primarily in densely populated urban areas, have a network configuration with parallel interconnected paths. Each of these different system designs implies different operating and emergency response procedures.

Early electricity supply systems in the late 19th century were private, unregulated entities that competed for customers at their borders. The rapid technological advances in generation (economies of scale) and in transmission (higher voltages) quickly led to the aggregation of small companies into larger entities that had effective monopoly power over wide regions. Economic regulation or (in places) government acquisition of assets and public provision of services were natural responses.

In most of the country, adjacent suppliers interconnected their facilities with neighboring supplier facilities to provide redundancy of supply at lower cost, and to engage in occasional transfers of power if one utility had spare generating plants that had lower costs than its neighbor. Many of these exchanges were bilateral arrangements, but in some instances multilateral arrangements were formalized into power pools (e.g., the New England Power Pool). In all instances cohesive electrical zones were identified where the lines of responsibility for reliability were clearly established. In most urban centers, electric utilities were investor-owned,

for-profit corporations that were given legal rights to be the exclusive provider of electricity in a specified geographic area. In exchange for these franchise rights, the utility typically agreed to (1) pay franchise taxes based on assets in place within the area and (2) serve all customers reliably at a reasonable cost. In most jurisdictions these franchises are exclusive, thereby granting a monopoly status to the supplier, but in some states it is possible to grant multiple franchises to serve the same location.

After World War II, the process of interconnection and integration continued—leading to extensive integrated systems and large regional interconnections between electrical zones. The combination of economies of scale in generation, achieved by building larger units that were frequently grouped in larger power stations, with scale economies in transmission, gained through the use of higher transmission voltages, that facilitated this integration and allowed the delivery of large amounts of power over great distances at low cost. These cost reductions spurred demand and provided a ready market for the increased supply capacity, thus setting the stage for the next wave of cost-reducing innovation. Thus it frequently proved economical to locate large generating plants close to fuel sources, rather than transport fuel to generators located near customers. This trend was facilitated also by the lower land costs and easier approvals to locate power plants in rural areas. But it was the large interconnected systems that made possible these economies of scale in providing both energy and reliability. Thus, over time very large power markets and huge interconnected regions have developed in the United States and elsewhere in North America.

The power delivery system includes four components: (1) the grid, or high-voltage transmission system that connects the bulk power generation system with the distribution systems; (2) the distribution system, which delivers power to consumers (or electrical “loads”); (3) the operations system, which handles interconnections; and (4) the customers or consumers. (Some large industrial consumers are connected directly to the grid.) In North America, the system contains more than 200,000 miles of lines operating above 230 kV serving over 120 million customers and nearly 300 million people.

Electricity is generated at 13 to 25 kV from a variety of energy sources. Most U.S. electricity is generated from coal, nuclear energy, natural gas, and hydro power; but recently wind generation has been growing rapidly.

Alternating current (AC) circuits predominate in the U.S. power delivery system. AC circuits allow the use of transformers to step up voltage to a higher level for economical transmission with small losses and to step the voltage down for distribution to consumers. U.S. transmission voltages are typically 115, 230, 345, or 500 kV. Voltages of 765 kV and higher are considered extra-high voltage (EHV). In most regions of the United States, 230-500 kV systems are the backbone of the U.S. electricity grid, although in some areas, lines with voltages up to 765 kV are employed.

Prior to the 1960s, the loosely connected, cohesive electrical zones offered modest reliability at a reasonable cost to the nation's consumers. But following a massive blackout in the Northeast in 1965, an increasing concern evolved among policy makers and industry executives alike about the power system's reliability. In response, the electric utility industry voluntarily formed regional reliability organizations to coordinate activities related to the transmission system's performance, most notably the North American Electric Reliability Council (NERC). Reliability is now administered by over 100 control area operators in North America and coordinated by regional reliability organizations (RROs) as members of NERC, which has established operating and planning standards based on seven concepts:

• Keep generation and demand in balance continuously.

• Balance reactive power supply (necessary to maintain system voltage) and demand.

• Monitor flows over grid circuits.

• Maintain system stability.

• Operate the system so it is able to sustain stability even if one component fails.

• Plan, design, and maintain the system to operate reliably.

• Prepare for emergencies.

Controlling the dynamic behavior of interconnected electricity systems presents a great engineering and operational challenge. Demand for electricity is constantly changing as millions of consumers turn on and off appliances and industrial equipment. The generation and demand for electricity must be balanced over large regions to ensure that voltage and frequency are maintained within narrow limits (usually 59.98 to 60.02 Hz). If not enough generation is available, the frequency will decrease to a value less than 60 Hz; when there is too much generation, the frequency will increase to above 60 Hz. If voltage or frequency strays too far from its prescribed level, the resulting stresses can damage power systems and users” equipment, and may cause larger system outages.

A variety of techniques and processes are used to keep the system safe—such as sensors, circuit breakers, and relays—to ensure that component failures and electrical faults are quickly isolated. If protection systems are poorly designed or do not operate properly, faults or equipment failures can cause outages and may cascade or propagate into blackouts. Once an overloaded circuit or transformer in the system either fails or is intentionally removed from service, the power flows through other available circuits in proportion to

the paths of least resistance. These alternative circuits may in turn become overloaded and either fail or be taken out of service by the protection system. This repeated, possibly uncontrolled, cycle of overload and equipment removal/failure is a dynamic, frequently oscillating phenomenon that can lead to a cascading outage. A local failure can escalate into a cascading failure in a matter of a few minutes, potentially leading to a wide-area blackout.

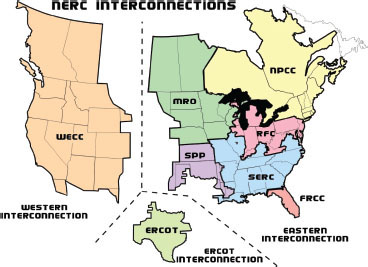

Operationally, the electric system of the United States and Canada is divided into four sections, known as “interconnections,” linked mainly by direct current (DC) transmission, with transmission within each section using largely AC transmission. The DC ties between interconnection areas allow each interconnection to operate assets independently of the other sections. Within each interconnection, electricity is produced the instant it is used and flows over the path of least resistance (using virtually all transmission lines within each interconnection) from generators to loads (i.e., customers). Figure 2.1 shows the four basic North American interconnections with the underlying regional reliability councils responsible for operational coordination in the sub-areas within the interconnections. Generation and loads are constantly being balanced within each interconnection.

NOTE:

ERCOT: Electric Reliability Council of Texas (RRO)

FRCC: Florida Reliability Coordinating Council (RRO)

MRO: Midwest Reliability Organization (RRO)

NERC: North American Electric Reliability Council NPCC: Northwest Power Coordinating Council (RRO)

RFC: Reliability First Corporation RRO: Regional Reliability Organization (regional member of NERC)

SERC: Southeastern Electric Reliability Council (RRO)

SPP: Southwest Power Pool Inc. (RRO)

WECC: Western Electricity Coordinating Council (RRO)

FIGURE 2.1 The NERC regions, along with the interconnection areas. (Note that the Quebec Interconnection within Canada and the Eastern U.S. Interconnection are shown here as the Eastern Interconnection.) SOURCE: NERC Interconnections, available at http://www.nerc.com/regional/NERC_Interconnections_color.jpg, accessed June, 11, 2007.

The advent of competition in the wholesale electricity market in North America has increased the operational complexity of the power delivery system. Power generators in one area are able to sell power in another area so long as adequate transmission interconnections are available. Initiatives by the U.S. Congress and FERC to unleash a competitive wholesale electricity market have led to an enormous increase in the number of power transactions that are carried over the electric power transmission system.

The existing power system, however, was designed to handle the needs of individual integrated utilities, with transfers between utilities mainly to improve the reliability of supply. It was not originally designed for handling common-carriage interconnections, which require different controls and regulation. Merchant generators want to sell their electricity to buyers who are willing to pay the highest price. These generally are in high-priced regions, which may be distant from the generation facility. Control areas for the power system, which previously may have had a few dozen transactions between buyers and sellers before the advent of wholesale markets, now attempt to settle hundreds, if not thousands, of transactions per day. This has led to a system already under stress, even in the absence of any homeland security concerns.

An additional challenge to the power delivery systems is the evolving nature of electricity demand due to digital technology. Billions of microprocessors have been incorporated into industrial sensors, home appliances, and other devices. These digital devices are highly sensitive to even the slightest disruption (an outage of a small fraction of a single cycle can disrupt performance), as well as to variations in power quality due to transients, harmonics, and voltage surges and sags. Today about 10 percent of total electrical demand in the United States feeds or is controlled by microprocessors. By 2020 this level is expected to reach 30 percent or more (EPRI, 2003).

The electric power system was designed to serve analog electric loads—those without microprocessors—and is largely unable to consistently provide the level of digital quality power required by digital manufacturing assembly lines and information systems, and, soon, even our home appliances. Achieving higher power quality places an additional burden on the power system even before homeland security issues are considered.

A more positive aspect regarding the development of power markets and microprocessor technology derives from the advent of publishing widely varying prices when market or associated system capability conditions change. This provides some natural damping in the system as more and more customers are provided with electronic sensors and real-time pricing. This natural modulation of extreme

operating conditions may ease some operating issues as a result of well-designed markets that vary the prices that retail customers pay in real time.

Regional Differences Among Electric Power Systems in the United States

Notwithstanding the many technical similarities, many differences also exist in the electric system within and across sub-regions. The differences stem from numerous factors, including asset ownership, operational control, indigenous natural resources, market development, topography, weather conditions affecting energy production and use, regulatory practices and traditions, business differences (e.g., business configuration), and so forth.

For example, energy use peaks at different times of the day in different regions. Some regions have generation capacity surpluses, whereas others are generation constrained. Some regions have adequate transmission capacity to allow for economic and reliable transfer of energy to other regions; others are transmission constrained, preventing otherwise economic generation to serve customer demand. Because of social and political factors and environmental, health, and public safety concerns (not to mention perceived adverse impacts on property values), some regions have great difficulty adding new transmission capacity on new or even existing rights-of-way; others are able to build new transmission readily.

Likewise, regions with plentiful coal have a history of reliance on coal-fired generation, whereas other regions burn less coal because it must be transported great distances, or because air pollution problems have inhibited significant coal use, or because there is adverse public reaction to the use of coal because of global climate change concerns. In a number of instances, different states have enacted more stringent environmental regulations than has the U.S. government, most notably in the area of carbon emissions, but these regional differences in environmental standards can also lead to greater problems for systems operators in meeting their reliability objectives. Public concerns about conventional energy sources have lead to some states and communities promoting the use of renewable-energy-based resources for generation, like wind and hydropower, but these energy sources are frequently located far from the customers and may not be available when demand for electricity is greatest, so their use imposes even greater complications on system design and operation.

Again, some regions have large, investor-owned utilities, while others have many small publicly owned utilities (known as cooperative utilities and municipal utilities). Some regions have vertically integrated electric utilities that own generation, transmission, and distribution systems, while other regions have ownership patterns that focus on one part of the business or another. Some regions have regional transmission organizations (RTOs) that administer central wholesale markets, whereas others do not.

Such differences in system configuration, generation and fuel mix, ownership, and so forth create complexities in the operation of the system, even though all parts of the country's electric grid operate according to industry norms and standards.

In the United States, a variety of entities exercise some form or other of operational control or coordination over parts of the grid. For example, in most regions, owners of transmission facilities operate them according to standards set by NERC with the input of companies participating in regional reliability councils. In other regions, particularly where market mechanisms determine wholesale power transfers, entities such as ISOs or RTOs carry out some operating functions on behalf of the transmission asset owners and other users of the system.

Real-time monitoring of the transmission system is performed using telemetry along with other data and analytic tools, such as state estimators, to evaluate system conditions on a continuing basis. Conditions monitored include power flows, various physical limits on transmission and other facilities, interchange with adjacent regions, and demand drivers such as weather.

The enforcement of NERC standards is still evolving. Until the passage of the Energy Policy Act of 2005, the electric industry's standards were entirely voluntary.1 In the absence of federal legislation mandating compliance with NERC rules, programs were developed to encourage compliance with NERC reliability standards. These were “enforced” by peer pressure, regulatory pressures, “enforcement contracts,” regional enforcement programs of the reliability councils, and industry norms for best practices, but no penalties were imposed for noncompliance with NERC standards. The Energy Policy Act of 2005 led to these standards becoming mandatory with substantial financial penalties imposed for non-compliance.

Electric Power Industry Institutions and Organizations

The U.S. electric power industry today is composed of a wide variety of players, entities, and institutions, all of which play different roles, and the actions of individual asset owners and operators affect each other. It is a highly regulated industry, and facilities need to operate according to common standards and in coordinated operations. The “system” may behave as one large electrical machine, but its parts are owned and operated by more than 3,000 entities. Table 2.1 highlights the major industry players that own and operate electric power systems. Still, there are numerous

_____________________

1Changes in reliability enforcement as a result of the Energy Policy Act of 2005 are discussed below in this chapter.

TABLE 2.1 Major Industry Players in the U.S. Electric Industry

|

|

||||

| Asset Owners | Institutional Structures of Asset Owners | Other Asset Operators and Coordinators | Government Entities and Regulatory Authorities | Industry Associations and Institutions |

|

|

||||

| Vertically integrated utilities (owning generation, transmission, and distribution) | Investor-owned electric utilities (IOUs) | North American Electric Reliability Council (NERC) | State regulatory commissions | Electric Power Research Institute (EPRI) |

| Generation and transmission utilities | Rural electric cooperatives (RECs or Co-ops) | Independent system operators (ISOs) | Power marketing authorities (PMAs) | National Regulatory Research Institute (NRRI) |

| Transmission utilities or companies | Municipal utilities (MUNIs) | Regional transmission operators (RTOs) | Federal Energy Regulatory Commission (FERC) | Edison Electric Institute (EEI) |

| Distribution utilities | Federal power agencies | Regional reliability organizations (RROs) | U.S. Department of Energy (DOE) | National Rural Electric Cooperative Association (NRECA) |

| Generation companies | Energy Information Administration (EIA) | Electric Power Supply Association (EPSA) | ||

| Marketing companies | Bonneville Power Administration (BPA) | National Association of Regulatory Utility Commissioners (NARUC) | ||

| Tennessee Valley Authority (TVA) | Association of State Energy Research and Technology Transfer Institutes (ASERTTI) | |||

| Western Area Power Administration (WAPPA) | National Association of State Utility Consumer Advocates (NASUCA) | |||

|

|

||||

other stakeholders who actively participate in electric power industry activities.

Regulatory Activities

Due to its technical and economic structure, the U.S. electric power industry is one of the most highly regulated in the nation. While other nations have adopted state-owned or national utilities to provide electric service, the United States early on adopted an approach that included a large number of private firms operating in natural monopoly settings and whose actions (e.g., determining rates, defining terms of electric service) were overseen by public regulatory commissions.

State Regulatory Commissions

Nearly all states have public utility commissions and/ or energy offices that govern certain activities of regulated utilities operating pursuant to laws in that state. These commissions govern the rates, terms, and conditions of service of investor-owned utilities in the state and, in a few cases, also regulate the rates of rural electric cooperatives. The scope of regulatory authorities varies by state but often includes approving tariffs, allowed return on investment, and service standards. In many jurisdictions, the most important powers held by state public service commissions are the ability to (1) set consumer prices, (2) impose penalties for noncompliance with rules and regulations, and (3) require prior approval of all financing.

Federal Energy Regulatory Commission

Various activities of entities in the electric power industry are also regulated by FERC, the federal agency authorized to implement, among other things, the Federal Power Act, the Natural Gas Act, parts of the Energy Policy Act, and other federal statutes. FERC regulates the terms and conditions of power delivery and transactions in interstate commerce and, with the enactment of the Energy Policy Act of 2005, is responsible for ensuring enforceable reliability standards for the electric power industry.

In general, users ultimately pay the electric supplier's cost of providing them with service. There is a longstanding tradition of cost-based rates for the parts of the industry not considered competitive, such as transmission and delivery service. In many parts of the country, much generation service is also provided and paid for on the basis of cost, rather than market-based rates.

In the 60 percent of the United States where markets are used to allocate power at the wholesale level, ISO/RTO-type organizations act as regulatory intermediaries under the jurisdiction of FERC and to a lesser extent state regulatory commissions. Their objectives are to administer fair and

efficient markets and maintain bulk power system reliability. For these organizations, reliability concerns take precedence over efficient market operation in periods of insufficient supply and/or system instability.

IMPLICATIONS FOR SYSTEM RELIABILITY OF AN INDUSTRY IN TRANSITION

Structural Changes in the Industry

The electric power industry has undergone considerable changes in the last two decades that have affected how the electricity infrastructure operates. Some of the once vertically integrated electric utilities that supplied generation, transmission, and distribution services have undergone restructuring that separated them into distinct entities with responsibility for only one or a few such services. In 1996, to mandate and facilitate competition at the wholesale level, FERC required transmission-owning utilities to “Unbundle” their transmission and power-marketing functions and provide nondiscriminatory, open access to their transmission systems by other utilities and independent power producers. Some utilities pursued unbundling by creating separate divisions within their companies, others spun off certain assets into separate but affiliated companies, and others sold off assets to separate owners (primarily generating facilities). Some states required—or created powerful incentives for—utilities to divest their generation assets as part of a restructuring effort. Others required vertically integrated utilities to divest their transmission assets to independent entities. In addition, power marketers—who often do not own generation, transmission, or distribution facilities—how buy and sell power on wholesale markets and market electricity directly to customers. All of these changes created even greater variations of the operational landscape within the industry.

Competition in the electric power industry has led to significant changes in the operation of the system. More electricity is being shipped longer distances over a transmission system that was initially designed only to provide limited power and reserve sharing among neighboring utilities. However, in some regions of the country, neighboring utilities have long collaborated to operate, and to a lesser extent to plan and design, their combined systems as integrated power pools (e.g., PJM Interconnection in 1926, New York in 1965, and later on, New England). Centralized dispatch of generating capacity to meet demand led these utilities to devise mechanisms to exchange power among themselves in ways that resulted in the smallest production costs (economic dispatch). Electric utilities that were once solely responsible for ensuring that they owned adequate generation to meet the demand of the consumers within their own system now purchase a substantial amount of the power they need from the wholesale market, in some cases relying on independent power producers and other electric suppliers to build and operate plants (NEPDG, 2001).

Over the last 15 years, greater competition has been introduced into the wholesale portion of the electric business by the addition of non-utility power plants. The Energy Policy Act of 1992 made it possible for competitive power producers to be entitled to access and use a utility's transmission system. In some regions, these requirements put new demands on an already stressed power system. In 1996, FERC issued regulatory policies (FERC Orders 888 and 889) that formally required transmission owners to provide open and nondiscriminatory access to the competitive wholesale generation market, and to provide comparable terms and conditions to all market participants, including the generation used to serve a utility's own customers.2

FERC policies, in combination with technological and economic changes in the industry, placed extraordinary new demands on transmission systems. Utilities that previously planned and operated their systems for the benefit of their own customers’ requirements were now required to take other market interests into account.

In the parts of the country where the traditional vertically integrated industry structure has been retained, there are really two predominant business models for ownership of transmission:

• Ownership separate from the control of transmission (whereby the control functions are handled by a third-party “system operator” and transmission assets are owned by the utility or other entities), which is basically the system that exists in the Northeast, parts of the Midwest, and in California and Texas); and

• Combined ownership of transmission assets and control of the grid (whereby the functions of the transmission service provided are combined in a single, vertically integrated entity—such as principally exists for utilities located in the Southeast).

In the Midwest, the committee believes that the gradual transition from the joint ownership model to the separate ownership and control model will continue.

_____________________

2The long-distance telephone system is sometimes used as an analogy for the electric grid, in that a product can be generated in one place and delivered over a network of wires to the final consumer. From a technical operating point of view, however, an electric power transmission system is very different from the long-distance telephone system because power flows cannot be directed over specific predetermined paths, nor can the loading over any particular path be precisely limited by the system operator. There are limited modulating switches that can be opened or closed like throttles for AC transmission lines, so attempts to wheel power directly from one utility to another may in fact overload the lines of a mutually interconnected neighbor, creating serious operating problems (Linke and Schuler, 1988).

Industry Practice—Normal Planning and Operations

Dealing with Normal Disturbances in System Operations

The reliable operation of the power grid is complex and demanding for two fundamental reasons. First, electricity moves at close to the speed of light (186,000 miles per second, or 297,600 kilometers per second) and is not economically storable in large quantities. Therefore, electricity must be produced the instant it is used. Second, pending the development of affordable control devices, the flow of AC electricity cannot be controlled like a liquid or gas by opening or closing a valve in a pipe, or switched like calls over a long-distance telephone network. Electricity flows freely along all available paths from the generators to the loads in accordance with the laws of physics—dividing among all connected flow paths in the network (U.S.-Canada Power System Outage Task Force, 2004).

A defining feature of the electric power industry is that reliable operations are universally considered to be essential and a central design, operation, and planning challenge. The delicate operational features of the system require that the industry explicitly plan for and operate with the expectation that there will be disturbances that must be addressed to keep the system operating reliably. Planning for and operating around constant variations of conditions in the system is the norm.

NERC’s basic reliability standard requires that the bulk power system be operated so that it can survive the single largest contingency—designated N—1—such as the failure of a major generating unit or transmission facility. Many utilities actually plan their system to operate somewhere between N—1 (at a minimum) and N—2 (meaning that the system would continue to operate reliably without two elements).

Causes of Disruptions

There are many reasons why disruptions occur on the electric system. These include human error, natural hazards, design flaws, and deliberate attack on the system. For example, human error can be a factor that contributes to the cause of a blackout. Therefore, electric industry employees must be highly trained to be able to tackle the complex and highly technical nature of power system planning and operations. Natural hazards with the potential to cause extended blackouts include earthquakes, hurricanes, tornados, ice storms, and severe thunderstorms. Such hazards are a major contributor to outages on the system. Various types of design flaws can occur in equipment, plans, procedures, regulations, policy, and response. Where lines are located adjacent to roads, vehicular accidents are a frequent cause of local outages, and stray animal incursions occasionally lead to short circuits in transformers. The industry goes through routine and episodic exercises to improve these systems to address such flaws.

Finally, disturbances can and do occur as a result of direct attack on the system. Insulators on distribution lines are a frequent target for vandals with guns. To date, no long-term blackouts have been caused in the United States by sabotage. However, this observation is less reassuring than it sounds. Electric power system components have been targets of numerous isolated acts of sabotage in this country. Several incidents have resulted in multimillion-dollar repair bills. In several other countries, sabotage has led to extensive blackouts and considerable economic damage in addition to the cost of repair (OTA, 1990).

Norms of Mutual Assistance

The utility industry has a long history of responding to various kinds of emergencies, be they relatively small, such as an outage of a transmission circuit or a generator unit, or more serious, due to tornado damage, hurricanes, or earthquakes. Most utilities have plans in place for restoring service after a total shutdown. These plans involve cooperative agreements and cultural norms in which utility crews from one company assist those in another area that need their assistance. Such cooperation allows much faster restoration of service following extensive damage from hurricanes or other major storms.

Reliability Coordinators

Historically, vertically integrated utilities established “control areas” to operate their individual power systems in a secure and reliable manner and provide for their customers' electricity needs. The traditional control area operator has exclusive operational authority to balance load with generation in its own area, to implement interchange schedules with other control areas, and to ensure transmission reliability (Functional Model Review Task Group, 2003). In sections of the country with integrated power pools, the control area spans several utilities’ operating centers, and the pool’s system operator maintains control over the facilities of all member companies.

As utilities began to provide transmission service to other competitive entities, the control area also began to perform the function of transmission service provider through tariffs or other arrangements. NERC’s operating policies and standards have reflected this traditional electric utility industry structure and ascribed virtually every reliability function to the control area (Functional Model Review Task Group, 2003).

Beginning in the early 1990s with the advent of open transmission access and restructuring of the electric utility industry to facilitate the operation of wholesale power markets, the functions performed by control areas began to change to reflect the newly emerging industry structure. These changes occurred for several reasons. Some utilities separated their transmission from their “merchant

functions” (functional unbundling) and even sold off their generation. Some states and Canadian provinces instituted “customer choice” options for selecting energy providers. The developing power markets often required wide-area transmission reliability assessment and dispatch solutions, which were beyond the capability of many control areas to perform. In fact, even some control areas themselves unbundled some of the functions that they had traditionally performed (Functional Model Review Task Group, 2003). As a result, the then-current NERC Operating Policies, which are centered on control area operations, began to lose their focus and became more difficult to apply and enforce (Functional Model Review Task Group, 2003). Regions where contractually enforced compliance was the norm due to their previously having operated under a collaborative power pool arrangement were exceptions in this regard. In other regions, control-area protocols needed to adjust to the emerging market-driven changes.

The NERC Operating Committee formed the Control Area Criteria Task Force in 1999 to address these coordination problems (Functional Model Review Task Group, 2003). Realizing that there was no longer a “standard” reliability organization, the task force built a “functional model” consisting of the functions that ensure reliability and meet the needs of the marketplace. The functions performed by traditional, vertically integrated control areas; regional transmission organizations; independent system operators; independent transmission companies; and so on were “rolled up,” and organizations registered with NERC as one or more of the following:

• Generator owners,

• Generator operators,

• Transmission service providers,

• Transmission owners,

• Transmission operators,

• Distribution providers,

• Load-serving entities,

• Purchasing-selling entities,

• Reliability authorities,

• Planning authorities,

• Balancing authorities,

• Interchange authorities,

• Transmission planners,

• Resource planners,

• Standards developers, and/or

• Compliance monitors.

This approach enabled NERC to rewrite its reliability standards in terms of the entities that perform the reliability functions (Functional Model Review Task Group, 2003).

Reliability coordinators must have the authority, plans, and agreements in place to be able to immediately direct (and count on the compliance of) reliability entities within their reliability coordinator areas to re-dispatch generation, reconfigure transmission, or reduce load to mitigate critical conditions in order to return the system to a reliable state. A reliability coordinator may delegate tasks to others, but it retains its responsibilities for complying with NERC and regional standards. Standards of conduct are necessary to ensure that the reliability coordinator does not act in a manner that favors one market participant over another.

NERC has a Reliability Coordinator Working Group (RCWG) that provides a forum for coordinating system-operating procedures in all four interconnections. This involves the following:

• Coordinating implementation of reliability standards to ensure consistency across the interconnections;

• Assessing fuel supply adequacy;

• Reviewing operating experiences from the previous peak demand season and planning for the upcoming operating peak demand season;

• Reviewing system disturbances and transaction curtailments for “lessons learned” and compliance with NERC reliability standards;

• Recommending new or revised reliability standards; and

• Providing advice to the Operating Reliability Subcommittee as it debates new or revised reliability standards.3

These reliability standards are based on calculations independent of the triggering incident. Under some conditions, other simultaneous surrounding events and risks to society that exacerbate the effect of particular power outages must be considered. One example might be the greater harm to society were an extended power outage to occur during subfreezing weather or in conjunction with widespread terrorist attacks. Thus, in the implementation of these reliability standards, specific procedural mechanisms should take into account the likely particular nature of terrorist assaults, which may differ from customary triggering events. And as an example, were multiple simultaneous terrorist assaults to become likely, consideration might be given to changing the system's design criterion from withstanding any single insult to having the bulk power system impervious to two or even three simultaneous losses on the system.

Changes Introduced with the Enactment of the Energy Policy Act of 2005: New Requirements for Mandatory Reliability Standards

For decades, the electric power industry operated under voluntary compliance with NERC's reliability standards. But in the past few years, the restructuring changes described above led to a consensus within the industry that new

_____________________

3See Reliability Coordinator Working Group (RCWG), available online at http://www.nerc.com/~oc/rcwg.html.

statutory authority requiring mandatory compliance with national reliability standards was needed. In August 2005, Congress passed the Energy Policy Act (EPAct), which authorized FERC to issue rules governing the certification of an electric reliability organization (ERO) and procedures for establishing, approving, and enforcing electric reliability standards. EPAct amended the Federal Power Act to include a new section requiring FERC to certify an ERO that would develop, administer, and enforce reliability standards, subject to FERC oversight.

FERC’s new regulations, finalized in February 2006, require that the FERC-certified ERO must submit each proposed reliability standard to FERC for its approval. Only FERC-approved reliability standards are enforceable. In addition to the ERO, there are roles anticipated for regional reliability entities, which may propose reliability standards through the ERO and then administer and enforce such standards if delegated to do so by the approved ERO. The final rule applies to all users, owners, and operators of the bulk electric power system in the United States (other than Alaska and Hawaii).4

NERC applied in April 2006 to be certified to become the ERO, and in July 2006 that application was approved by FERC. NERC also filed with FERC for approval of a series of proposed reliability standards in 15 categories, most of which are the same as those that have already been in effect for several years on a voluntary basis. As of March 31, 2007, FERC had approved 83 reliability standards, and another 24 were pending (FERC, 2007). NERC has stated to FERC that the proposed reliability standards are consistent with ensuring acceptable performance with regard to operation, planning, and design of the North American bulk-power system. The reliability standards became effective on June 18, 2007.

Under Section 215, FERC must either (1) approve a proposed reliability standard if it determines the standard is just, reasonable, not unduly discriminatory or preferential, and in the public interest, or (2) remand a proposed standard back to the ERO for further consideration when FERC determines that the proposed standard fails to satisfy this test. FERC has stated its expectation that even after an initial set of reliability standards is approved, the process of proposing, reviewing, and approving standards will be continual in order to accommodate changes in the electric system and subsequent improvements in the standards. Additionally, FERC has stated that although uniformity across the United States is a goal, it expects a certain amount of regional variation in standards in order to accommodate regional differences and unique features of specific systems in the electric power industry. This would suggest there will be both greater stringency in the national standard and particular approaches as appropriate given the physical characteristics of a region. Since the United States is interconnected electrically with Canada and Mexico, FERC expects that it and the ERO will need to work directly with regulators and electric industry participants from these countries to ensure the successful implementation of mandatory reliability standards (Moot, 2006).

Long-range planning has always been essential to providing reliable, economic electricity service. Coordinated planning is still needed, even where wholesale markets prevail and investment decisions are profit-motivated. Three factors make coordinated planning essential: (1) the capital-intensity of the electric power industry, (2) the long lead times required to get new facilities online, and (3) the absolute necessity of having adequate facilities installed for reliability in recognition that electricity cannot be stored. A fourth important factor for large-scale systems is the interplay between decisions to construct transmission and generation facilities, since both are necessary to get power to market, or to provide supply alternatives.

Over time, the scope and identity of who does the planning for power supplies and who identifies the requisite investments as societal concerns have evolved. In the emerging quasi-market-supply structure that exists for the industry in many sections of the country today, the very nature of and responsibility for that planning are open questions.

Vertically integrated electric utilities, either private-regulated or government-run, are, by necessity, a planned industry with exclusive supply rights and obligations to serve in particular areas. These have been the predominant institutional forms for providing electricity service in the United States since 1900, so it is not surprising that each supply entity has engaged in careful strategic long-range planning, given its desire to maintain and enhance service reliability and thereby customer satisfaction. Over the past 100 years, however, the scope of those plans has gradually expanded in a number of ways:

1. Geographically, as the size of individual firms increased and voluntary power-pooling organizations were formed among firms;

2. Contextually, to reflect social concerns, as environmental quality, then public health and safety, and finally regional economic well-being were recognized as being linked in consequential ways with the operation of electricity supply facilities; and finally,

3. Economically, to consider the type and primary source of energy supply, following the oil supply shortages of the 1970s when “integrated resource planning” became the popular process for public involvement in a democratic society.

_____________________

4Groups covered include regional transmission organizations and independent system operators, independent power producers, investor-owned electric utilities, public power and rural electric cooperatives, and other load-serving entities.

Thus, a long and ever-more comprehensive planning process has evolved both within and external to this industry. Supplying institutions have tolerated the increasing external intervention in their own internal planning processes because without that public approbation, the legal right to site new generation facilities, and generally, transmission facilities also, could be denied.

The time and the cost of acquiring necessary regulatory approvals have become the major impediments to the siting and construction of new facilities in many regions of the country. In some instances, those approval costs can be an appreciable portion of the total project costs, including those for land and construction. “Deciding how to decide” has become an institutional art-form, involving legal, political, economic and behavioral insights on how to design efficient and fair decision processes. It also can be used to effect for parties intent on using those processes to block particular projects.

In the wake of the restructuring and deregulation of the electric power industry, firms must now determine whether or not to invest based on market-related criteria, but also must bear the risk of public-policy-type decisions concerning siting. A regulated or public firm could be reasonably assured of recovering those decision-related costs sometime in the future; the prospects are far less certain for a firm in a competitive market. While firms in other competitive capital-intensive industries also face siting approvals before they can expand their capacity, they can minimize their risk simply by waiting to construct until supply shortages have driven prices in the marketplace high enough to warrant the risk. Because modern societies have an utter dependence on real-time delivery of reliable electricity supplies, they simply may not be willing to rely on market forces alone to determine whether suppliers are willing to invest in a siting decision. Some degree of public participation and subsidy in recognition of the public nature of the decision may be warranted.

However, in the current transition to market-based wholesale electricity supply in many regions of the country, the allocation of responsibility for and the sharing of the risk of this decision making in the planning process have yet to be worked out.5 Rationalizing the private and public nature of these approval processes is particularly important for electric transmission lines where authorizations must be acquired from many political jurisdictions that might be spanned by the desired new facility. If those approvals are not granted simultaneously, there is a tremendous incentive for jurisdictions to delay their individual decisions so that they are last in line, and therefore able to extract the most favorable concessions. The private merchant builder must factor all of these considerations into a decision on whether or not to try to invest and to begin to seek the necessary approvals; they are also factors the public sector must consider if it desires a market-driven process that serves the public interest.

Problems to be resolved abound. With the traditional regulated vertically integrated industry structure, the utility would decide whether it was more efficient to build new transmission or new generation (as well as where, when, and of what fuel source) in order to minimize costs while meeting reliability standards. In this context, the entity might even consider the value in terms of the economic risk reduction of maintaining a stable of diverse generation sources, in terms of their primary fuels. In the evolving market context, a generator must decide whether and where to build based on the going market price in different locations. A competitive transmission company must base investment decisions on price differences in electricity between regions, plus any fixed delivery contracts it can assemble ahead of time from buyers and sellers. Note that decisions to invest by either type of firm are likely to reduce the original price levels or price gaps, and so each firm must take that market effect of its investment into account. Firms must also consider how the interaction between likely new generation and transmission investments will affect their revenues in the future. However, these firms have little incentive to consider the effects of their investment choices on system reliability or fuel diversity risk without public intervention. This is one reason why many jurisdictions are establishing subsidization mechanisms for bringing renewable-resource-based generation online—although in some instances the transmission requirements to bring that remote energy to the load locations are neglected.

These anomalies all suggest at least an equal need for planning under a wholesale market supply scenario. Such planning would be somewhat different in type and scope from that practiced in an environment of regulated, vertically integrated institutions. FERC has recognized this by mandating that one of the requirements for ISOs/RTOs is for each to establish a planning process to identify needs and to initiate market-driven investments that might be required first, and if these prove inadequate, to then initiate regulatory-based investments.

In many ISO/RTO jurisdictions, however, a legal semantic distinction is being made between facilities needed for reliability purposes and those that might further some economic benefit (e.g., lower wholesale electricity prices). Since both functions are served over the same transmission network, this distinction is arbitrary, in terms of both the laws of physics and economic principles. Almost any transmission line that is built to enhance reliability will most probably also reduce congestion at certain times of the year, thereby reducing wholesale costs. Similarly, any line constructed to facilitate economical transfers of power most likely will have effects on reliability somewhere on the system. It may also facilitate access to diverse sources of generation further away, thus enhancing reliability and security. In fact, FERC seems to have recognized these relationships through its recently

_____________________

5As an example, in New York State, a one-stop siting law had been in place, requiring that all public permits be reviewed and provided through a single integrated process. Since the advent of competitive wholesale markets, that law has been allowed to lapse, compounding the risk for private investment as piecemeal approvals must be sought.

issued Order 890 that mandates economic-based planning in all jurisdictions.

If public concerns about robust resilience to possible terrorist attacks are also considered, the required public overview of the planning process becomes further complicated. Moreover, additional factors to be considered are whether a competitive wholesale marketplace for electricity is a decentralizing force for the ultimate evolving configuration of the system. If so, the system may be inherently more resilient to failures, whether due to natural or human causes. However, the first requirement is that an integrated planning process exist to guide and offer benchmarks for the future evolution of the industry.

INCENTIVES FOR TRANSMISSION AND DISTRIBUTION FACILITY INVESTMENT

Except for those areas served by public power agencies, transmission and distribution facilities in the United States are built under the expectation of earning a competitive rate of return on investment through the prices charged for using those facilities. In the case of transmission, FERC usually sets the target rate of return that is factored into the maximum allowable price, whereas in the case of distribution, the state regulatory bodies approve the allowable rates for service. Point-to-point merchant transmission might be constructed without a regulated rate set by public monitors if sufficient price-differentials exist between the end points, and if there is little likelihood that new lower-cost generation facilities might be built at the high-priced end of the line. However, in many areas of the country, the risks involved in getting the necessary simultaneous approvals by many property owners and municipal agencies to site a lengthy line are usually prohibitive to private capital investment. Even government-built facilities face prolonged political fights over siting, compounded by debates over who is to pay for the line and who is the beneficiary, if user fees do not completely cover the costs.

Because the usual practice by most state public utility commissions is to establish a uniform price for service throughout a particular company’s service territory, an increased cost incurred by a regulated entity to build a new transmission line will usually raise the rates for all its customers, even though a small subset may be the only ones to benefit from lower energy charges as a result of the new line. The disincentives to utilities regulated in this traditional manner are compounded when another utility is located between the generator and its customers and that third utility would need to add a line to connect the two. The third utility’s customers gain no immediate benefit from the new line, but they may bear the cost. As an incentive to undertake the risks, FERC may approve a price for transport over that new line that is substantially greater than what many state regulators have been offering. FERC may also authorize the line-building utility to pass those charges on only to the line's users. However, if this utility also owns substantial distribution assets that are governed solely by a state commission, it runs the risk of having the state regulators offset the higher award by FERC for its transmission venture by lowering its price for distribution services.

These equity and fairness issues associated with cost-recovery practices become even more complex when the planned transmission line spans the borders of several states. Consequently, planning for and gaining the political approval for the construction of new lines become even more difficult. Some jurisdictions like Texas have sought to reduce these contentious issues by effectively declaring all transmission a public good (like the interstate highway system) and recovering the costs over all customers in the state. In other regions like the Southeast, where the utilities have remained vertically integrated and the opposition to siting new facilities is less vehement than in older urbanized areas, costs are again “socialized” over all users and integrated with prices for all components of service. In still other regions of the country like the upper Midwest, separate transmission-only companies have been formed. Such entities do not have to worry about state regulators offsetting their FERC-approved transmission rates since they offer no state-jurisdictional services.

• There are major aspects of the electric system that are common to all parts of the country, but there are also those that differ considerably by region—electrically, institutionally, economically, and in terms of regulatory oversight. Many historical factors account for these differences, and it is unlikely that this situation will change any time soon.

• Although there is ultimately a single operator responsible for each portion of the electric system, there are many such operators around the United States, and there are many more participants in the whole electric power delivery enterprise. In many respects, this is a highly decentralized but interconnected system.

• Power systems have always faced multiple sources of routine and persistent threats to reliable operations. Some kinds of threats are harder to deal with than others because of their diffuse nature, because they are associated with new technological developments, because they arise from regulatory incentives misaligned with investment requirements, or because they spring from new and not-well-understood sources of terrorist ingenuity and motivation.

• The transmission system is much more stressed, and thus more vulnerable, than it was a few decades ago. This is principally the result of two factors: (1) years of underinvestment in system upgrades due in part to ambiguities and changed incentives introduced by electric power restructuring and associated changes in the regulatory environment; and (2) the growing

amounts of power that must be moved between sellers and buyers in new competitive power markets have added complexity in the operation of the bulk power system.

• Improving system reliability comes at a cost. Decisions to reduce the level of risks—through the adoption of stricter standards or through investment to protect against various types of risks—have to take into account (implicitly or explicitly) the question of whether the benefits of reducing a risk is worth the expense.

• Typically, customers of electric service end up paying the costs for reliable operations, although non-customers also may benefit if there are external social effects or broader macroeconomic consequences. These aspects of reliability concerning the public good, including increased immunity from terrorist attacks, cannot be properly accounted for through market-based supplies of electricity, and standards must be set and enforced by a central authority such as the ERO. Once those supply standards are set, their actual provision can be decentralized through markets if the proper payments are made to the providers.

• As with all public goods where different individuals receive different levels of service or value reliability differently, who pays what is a contentious issue. Questions of fair cost allocations are one reason that investments in strengthening the transmission grid have lagged in many regions of the country. A compounding factor is the continual political pressure to keep electricity rates low, despite the demands by some customers for higher power quality and reliability.

• One mandate of the ERO is to establish regional advisory boards that might coordinate the different political perspectives of federal, state, and local governments and their regulatory bodies, but how that dialog is translated into capital investment and revised operating practice has still to be worked out.

Constable, G., and B. Somerville. 2003. A Century of Innovation: Twenty Engineering Achievements That Transformed Our Lives. Washington, D.C.: Joseph Henry Press.

EPRI (Electric Power Research Institute). 2003. Electricity Technology Roadmap: Meeting the Critical Challenges of the 21st Century: 2003 Summary and Synthesis. Palo Alto, Calif.: EPRI.

FERC (Federal Energy Regulatory Commission). 2007. Electric Reliability: NERC Standards. Available at http://www.ferc.gov/industries/electric/indus-act/reliability/standards.asp. Accessed June 2007.

Functional Model Review Task Group. 2003. NERC Reliability Functional Model: Function Definitions and Responsible Entities: Version 2. Available at http://www.nerc.com/pub/sys/all_updl/oc/fmrtg/Functional_Model_Version_2.doc. Accessed August 2007.

Linke, S., and R.E. Schuler. 1988. “Electrical-Energy-Transmission Technology: The Key to Bulk-Power-Supply Policies.” Annual Review of Energy 13: 23” 5.

Moot, J.S. 2006. “Testimony of John S. Moot, General Counsel, Federal Energy Regulatory Commission” before the Committee on Energy and Natural Resources of the United States Senate, May 15, 2006. Available at http://www.ferc.gov/EventCalendar/Files/20060515151838-SENR%20EPAct%2005%20Electric%20Reliability%20Provisions%20(Moot)%2005-15-06.pdf. Accessed August 2007.

NEPDG (National Energy Policy Development Group). 2001. “America’s Energy Infrastructure: A Comprehensive Delivery System.” Chapter 7 in National Energy Policy: Reliable, Affordable, and Environmentally Sound Energy for America's Future. Washington, D.C.: U.S. Government Printing Office.

OTA (Office of Technology Assessment). 1990. Physical Vulnerability of Electric System to Natural Disasters and Sabotage. OTA-E-453. Washington, D.C.: U.S. Government Printing Office.

U.S.-Canada Power System Outage Task Force. 2004. Final Report on the August 14, 2003 Blackout in the United States and Canada: Causes and Recommendations. Available at http://www.nrcan.gc.ca/media/docs/final/fnalrep_e.htm. Accessed October 2007.