7

Fossil-Fuel Energy

Total U.S. primary energy consumption in 2007 was about 100 quads, with fossil fuels—natural gas, petroleum, and coal—supplying about 85 percent, as shown in Table 7.1 (EIA, 2008a).1 Liquid fuels (derived primarily from petroleum) were the main contributors, accounting for 40 percent of total consumption (see Figure 1.2 in Chapter 1). This fossil-fuel dominance has held steady for decades.

Even more striking, each of the fossil fuels accounts for a major segment of an important end-use market. Petroleum supplies 98 percent of the energy used in the transportation market, natural gas provides 74 percent of the nonelectric energy used in the residential and commercial market, and coal furnishes 52 percent of the energy used to generate electricity. Only in the electricity market, where nuclear and renewable energy sources account for 29 percent of the total energy supply, do serious competitors to fossil fuels exist.2 Despite considerable efforts to expand biofuel production, for example, ethanol from corn provided only about 3 percent of the U.S. gasoline supply in 2005.

These distinctive structures exist because the attributes of liquid, gaseous, and solid fossil fuels closely match the needs of their respective end-use markets:

TABLE 7.1 U.S. Energy Consumption by Energy Source in 2007

-

Petroleum is easily stored and transported and has a relatively high energy density. These characteristics are well suited to the transportation market.

-

Natural gas burns cleanly, is easily transported by pipeline, and can be stored in salt domes and old gas fields for peak use. As a result, it is a desirable fuel for the geographically distributed residential and commercial markets.

-

Coal is abundant in the United States, is easily stored, and is less expensive, with lower price volatility than other fuels—attractive attributes for electricity generation.

Although the market-based reasons for using fossil fuels are thus very strong, U.S. reliance on this energy source carries some potentially adverse consequences. For one, reserves of petroleum—and, increasingly, of natural gas—are concentrated in only a few countries. In some cases, supplier nations have restricted supplies for nonmarket reasons. Moreover, such concentrations of production capacity, and the limited number of transportation routes from these facilities to their markets, create targets by which hostile states or nonstate actors may disrupt supplies. In either case, the security of petroleum and natural gas supplies is at risk, probably increasingly so.

A second concern is that the longer-term global demand for petroleum and

natural gas is projected to grow faster than increases in production, resulting in tight market conditions and rising prices. The U.S. Energy Information Administration (EIA) and the International Energy Agency (IEA), along with other forecasters, do not anticipate that the factors underlying these market conditions will change anytime soon.3 Under such conditions, maintaining significant spare production capacity is difficult.

From the point of view of net consuming nations, the resulting price increases could accelerate an economically disruptive wealth transfer from consumers to producers. While the dependence of the U.S. economy on oil has changed little in recent decades—in 1990, 39.7 percent of U.S. energy consumption was petroleum; in 2007, it was 39.2 percent—U.S. dependence on imports has doubled over this period.

Finally, fossil fuels pollute the atmosphere when burned, and they have other adverse environmental effects as well. While emissions of SOx, NOx, particulates, and other atmospheric contaminants have been reduced (albeit with an increase in solid, liquid, or recyclable wastes, including ash residuals), little has been done so far to address carbon dioxide (CO2) emissions. U.S. energy use in 2007 was responsible for emissions of 6 billion tonnes of CO2 (6 Gt CO2). Of that amount, 43 percent came from petroleum, 36 percent from coal, and 21 percent from natural gas (EIA, 2008c). By market, the largest source was electric power generation (using coal and natural gas); it emitted some 2.4 Gt CO2. Transportation, dominated by petroleum but also including some natural gas, accounted for 2 Gt CO2. The remainder of the emissions resulted from industrial (1 Gt CO2), residential (0.35 Gt CO2), and commercial uses (0.25 Gt CO2).4 (See Figure 1.11 in Chapter 1.)

Thus the future of fossil fuels presents a serious dilemma for energy policy. On the one hand, because fossil fuels are well adapted to the needs of the market, a huge energy infrastructure has been put in place to take advantage of their value. The existing stocks of vehicles, home and business heating systems, and electric power stations were created with the expectation that petroleum, natural gas, and coal would be readily and reliably available. On the other hand, the

extraction and use of fossil fuels entail growing security, economic, and environmental risks. A crucial question, therefore, is whether this existing energy infrastructure can be supplied with liquid, gaseous, and solid fuels in the future at acceptable levels of such risks. If so, much of it can remain in place. If not, the embedded capital stock of technologies for energy production and use will need to change through a combination of market forces and policy choices.

Other chapters of this report discuss alternative pathways for providing the energy services that modern society demands. For example, the chapter on alternative transportation fuels (Chapter 5) provides an assessment of the technologies and environmental impacts of liquid fuels derived from biomass feedstocks, coal, or natural gas. This present chapter focuses on alternative ways of using fossil fuels to serve the existing energy-use infrastructure. Specifically, it explores:

-

The extent to which the U.S. endowment of fossil fuels is limited in its ability to meet future needs for liquid, gaseous, and solid fuels by means of conventional pathways.

-

New technologies that may become available for producing the desired form of fossil fuels. The focus in particular is on the generation of electricity from coal and natural gas with sharply reduced emissions of greenhouse gases, especially CO2.

-

Technologies and geologic settings suitable for the storage of CO2 produced from electricity generation and other industrial processes.

-

Environmental concerns that affect the future of fossil-fuel supply and use.

Given constraints on time and resources, the AEF Committee chose not to address issues relating to the current energy infrastructure, for example, the status of natural gas pipelines, oil refineries, rail and barge transportation for coal, and liquefied natural gas terminals.

OIL, GAS, AND COAL RESOURCES

Worldwide, the amount of oil, gas, and coal that can ultimately be produced is very large. Estimates of ultimately recoverable resources are uncertain, however, because they include not only those that are discovered though not yet economically or technically recoverable but also those that are yet to be discovered. Nev-

ertheless, the potential is impressive. Roughly 3.3 trillion barrels of oil and 15,000 trillion cubic feet (Tcf) of natural gas are thought to be ultimately recoverable. By comparison, in 2006, world consumption of these resources was about 30 billion barrels of crude oil and 100 Tcf of gas. (See Tables 7.2, 7.3, and 7.4 for summaries of oil, gas, and coal statistics.)

Resources that are discovered, recoverable with current technology, commercially feasible, and remaining in the ground are classified as reserves. The size of

TABLE 7.2 Conventional Oil Resources, Reserves, and Production (billion barrels, variable years as noted)

|

|

United States |

World |

U.S. Percent of World Total |

|

Resources |

430a |

3345b |

13.0 |

|

Reservesc |

29 |

1390 |

2.1 |

|

Annual production |

2.5/yr |

29.8/yr |

8.4 |

|

Annual consumption |

7.5/yr |

31.1/yrd |

24.1 |

|

aDOE, 2006a, available at fossil.energy.gov/programs/oilgas/eor/Undeveloped_Domestic_Oil_Resources_Provi.html. bNPC, 2007, p. 97. c2007 data from British Petroleum, 2008. dAccording to British Petroleum, 2008, discrepancies between world production and consumption “are accounted for by stock changes; consumption of nonpetroleum additives and substitute fuels; and unavoidable disparities in the definition, measurement, or conversion of oil supply and demand data.” |

|||

TABLE 7.3 Natural Gas Resources, Reserves, and Production (trillion cubic feet, variable years as noted)

|

|

United States |

World |

U.S. Percent of World Total |

|

Resources |

1,525a |

15,401b |

9.4 |

|

Reservesc |

211 |

6,263 |

3.4 |

|

Annual production |

19.3/yr |

104.1/yr |

18.5 |

|

Annual consumptionc |

23.1/yr |

103.5/yrd |

22.3 |

|

aPGC, 2006, available at www.mines.edu/research/pga/. bNPC, 2007, p. 97. c2007 data from British Petroleum, 2008. dAccording to British Petroleum, 2008, discrepancies between world production and consumption are “due to variations in stocks at storage facilities and liquefaction plants, together with unavoidable disparities in the definition, measurement or conversion of gas supply and demand data.” |

|||

TABLE 7.4 Coal Reserves and Production (million tonnes, variable years as noted)

|

|

United States |

World |

U.S. Percent of World Total |

|

Resources |

3,968,000a |

9,218,000b |

43.0 |

|

Reservesc |

242,721 |

847,488 |

28.6 |

|

Annual productionc |

1,039.2/yr |

6,395.6/yr |

16.2 |

|

Annual consumptionc |

1,015.3/yr |

6,481.1/yr |

15.7 |

|

aEIA, 1999. bHermann, 2006. c2007 data from British Petroleum, 2008. |

|||

known reserves, while considerably smaller than the more speculative estimates of ultimately recoverable resources, is also large. British Petroleum has reported that proved reserves of oil in 2006 amounted to 1390 billion barrels and that proved natural gas reserves were 6263 Tcf (British Petroleum, 2007). World coal reserves were 900 billion tonnes, which is about 300 times the 2006 world coal consumption (British Petroleum, 2007).

Technology plays an important role in turning speculative resources into proved reserves. Sophisticated exploration and production methods for recovery of oil and natural gas are already commercially available, and the private sector is developing advanced versions of these techniques. The cumulative effect of continuing advances in exploration and production technology for oil and gas is that over the next 20 years much of the current resource base will become technically recoverable. (See Table 7.5 for a discussion of this technology.)

As noted previously, world reserves are annually producing about 30 billion barrels of oil and 104.1 Tcf of natural gas. The United States is the third-largest oil-producing country and the second-largest natural gas producer. Nevertheless, this country imports about 56 percent of its oil and about 14 percent of its natural gas.5 Import dependence, especially for oil, creates serious economic and security risks, as global oil and gas supplies may be influenced by restrictions imposed by governments, by the actions of the Organization of the Petroleum Exporting Countries (OPEC), or by disruptions due to political instability or regional conflict. For this reason, the capacity to maintain or increase domestic production is

TABLE 7.5 Summary of Highly Significant Oil Exploration and Production Technologies

|

Technology |

Timeframe |

Discussion |

|

Big increase in controlled reservoir contact |

2015 |

Technologies allowing a continuing increase in the number of strategically placed horizontal wells will allow a much greater commercial access to reserves. |

|

Horizontal, multilateral, and fishbone wells |

2020 |

Multiply placed drainholes from a main wellbore will further extend commercial access to reserves. |

|

Arthroscopic well construction |

2025 |

The ability to place drain holes to within feet of every hydrocarbon molecule in the formation allows the ultimate recovery. |

|

SWEEP (see, access, move) |

2020 |

The combined technologies (including the four immediately below) allowing us to see, access, and move the hydrocarbons in the optimum way will bring a big increase to recoverable reserves. |

|

Smart well (injection and production) |

2015 |

The ability to control what fluids go where (at the wellbore). |

|

Reservoir characterization and simulation |

2015 |

Extending current technology to include simultaneous inversion of all measurements with a forward model. |

|

Reservoir vision and management in real time |

2020 |

Combining reserve scale measurements (pressure, seismic, electromagnetic, and gravity) in a joint inversion, with uncertainty and without bias. |

|

Mission control for everything |

2020 |

A full representation and control of the full system (subsurface and surface) allowing true optimization. |

|

CO2 flood mobility control |

2020 |

Measurement and control of the CO2 flood front is critical to successful implementation. |

|

Artificial lift |

2030 |

Produce only wanted fluids to surface. |

|

Drilling efficiency |

2015 |

A further extension of gains already made. |

|

Steam-assisted gravity drainage (SAGD) or steam and alkaline-surfactant-polymers (ASPs) |

2030 |

Technologies to perfect and optimize SAGD operations (including the use of ASPs) will be key to widespread economic exploitation of heavy oil. |

|

Arctic subsea-to-beach technology |

2020 |

Ice scouring of the seafloor surface presents a huge challenge to conventional approaches to subsea and subsea-to-beach operations. |

|

Faster and more affordable, higher-definition 3D seismic |

2015 |

Quicker, better, cheaper, could extend the already impressive “specialized” technology in universal use. |

|

Source: NPC , 2007, Topic Paper 19, “Conventional Oil and Gas,” Table V.1. |

||

a major concern for energy policy. Technical, environmental, and economic uncertainties, however, constrain the pace at which domestic oil and gas production can or will be increased. Accordingly, the following sections focus on the ability of domestic oil, natural gas, and coal sources to maintain or increase production. Tables 7.2 and 7.3 summarize the current levels of resources, reserves, and production for domestic oil and natural gas, and Table 7.4 reports reserves and production for coal.

Oil

While Table 7.2 summarizes estimates of the quantities of various types of oil resources in the United States, Table 7.6 disaggregates them. “Proved reserves” in Table 7.6 are those that can reasonably be recovered at costs low enough to allow economic production of the resource. The remaining estimated resources listed are called “technically recoverable”—that is, they are generally expected to be recoverable using currently available technology, but without regard to economic viability. In some cases, the estimates are for oil that is yet to be discovered. These estimates are obviously less certain than for those resources already discovered.

Table 7.6 lists estimates of the range of costs that might be incurred to produce each of the resources. The wide ranges of estimated costs reflect considerable uncertainty; costs vary widely, depending on the location, size, and depth of the resource and on many other factors. Finally, Table 7.6 also estimates the time period in which a reasonable quantity of the resource might be available for use. Here again, there is considerable uncertainty because of costs and other limitations, such as access to drilling or mining and environmental impacts.

The resources listed in Table 7.6 for light oil enhanced oil recovery (EOR) are those that could be recovered primarily by CO2 injection. Whereas conventional oil recovery processes (primary production under the natural pressure in the reservoir and water injection) typically recover about a third of the oil in place, this resource estimate is based on an assumption that total recovery in fields suited to CO2 injection would reach 50 percent. The total amount recovered in some reasonable time period is likely to be lower than the total listed, however. Not all fields will be large enough to warrant the investment required, and sufficient CO2 may not be available. Even so, the experience gained in operating CO2 EOR projects in west Texas over the last three decades has advanced the technology significantly. EOR projects can now be undertaken with confidence that high-pressure injected CO2 can displace oil efficiently in the zones that it invades.

TABLE 7.6 U.S. Oil Resources and Reserves

|

|

Barrels (billion) |

Estimated Cost Range ($/bbl) |

Time Period for Significant Recovery |

|

Oil Reserves (2007 annual U.S. production: 2.5 billion bbla) |

|

|

|

|

Conventional light oil proved reservesb |

22 |

10–20 |

<2020 |

|

Natural gas liquid proved reservesc |

8 |

|

<2020 |

|

Technically Recoverable Resources |

|

|

|

|

Light oil EORd |

90 |

20–45 |

<2020 |

|

Heavy oil EORb |

20 |

25–60 |

<2020 |

|

Residual zone EORc |

20 |

60–130 |

2020–2035 |

|

Undiscovered conventional (onshore)b |

43 |

40–60 |

2010–2035 |

|

Undiscovered conventional (offshore)b |

76 |

75–95 |

2020–2035 |

|

Undiscovered EOR (onshore)b |

22 |

50–75 |

>2035 |

|

Undiscovered EOR (offshore)b |

38 |

105–145 |

>2035 |

|

Reserve growth (conventional recovery)b |

71 |

10–20 |

<2020 |

|

Reserve growth (EOR)b |

40 |

20–45 |

2020–2035 |

|

Tar sandsb |

10 |

40–95 |

>2035 |

|

Oil shalese |

500 |

40–95 |

>2035 |

|

aBritish Petroleum, 2008. bDOE, 2006a. cBritish Petroleum, 2008. dDOE, 2006b. eBartis et al., 2005. |

|||

An extensive infrastructure of pipelines in west Texas delivers CO2 to numerous oil fields. Much of that CO2 is transported by pipeline from natural CO2 sources in Colorado and New Mexico, though there are also significant EOR projects in west Texas, Wyoming, and Colorado that make use of CO2 separated from natural gas (instead of venting it to the atmosphere). The pipeline infrastructure demonstrates CO2 transport technology that would be needed to support large-scale geologic storage of CO2. These projects also allow assessment of whether injected CO2 has been retained in the subsurface (Klusman, 2003). For example, measurements of CO2 seepage at the surface above the Rangely Field in Colorado indicate that the rate of CO2 escape from the storage formation is very low (less than 170 tonnes per year over an area of 72 km2). Currently, CO2 injection for EOR is limited mainly by the availability of CO2 at a reasonable cost. If CO2 were more widely available in the future at a reasonable distance from existing oil fields as a result of limits on CO2 emissions, more widespread use of CO2 EOR could be

anticipated. (See the section titled “Geologic Storage of CO2” later in this chapter and the section titled “Oil and Gas Reservoirs” in Annex 7.A for additional discussion of the potential for CO2 EOR to contribute to geologic storage of CO2.)

Heavy oils are difficult to displace; hence, typical primary recovery of oil from such reservoirs is much lower than that of lighter oils. Heavy oil is typically recovered by injecting steam, which warms the oil and reduces its viscosity so that it can flow more easily into production wells. Steam for injection is typically generated by burning a portion of the oil produced or by burning natural gas in areas where air-quality restrictions limit use of the crude oil as a fuel. This technology is now relatively mature and has been applied widely in heavy-oil fields in California, for example. Dissolving CO2 in heavy oil also reduces its viscosity, but the use of CO2 to recover heavy oil has not been tested in field projects.

Residual zone EOR refers to the possibility that some of the oil that is found in the transition zone between water and oil at the base of a reservoir can also be recovered by CO2 injection. This process is less well proven and likely more expensive than CO2 injection in zones that have less water and more oil present.

The estimates of undiscovered conventional and EOR resources in Table 7.6 are based on assessments by the U.S. Geological Survey (USGS) and the U.S. Minerals Management Service (MMS). The estimates shown for technically recoverable resources are 33 percent of those amounts for conventional recovery and an additional 17 percent for EOR. Reserve growth refers to the observation that the amount of oil listed as proved reserves often increases over time; information obtained through development drilling in the field is used to refine initial estimates of oil in place.

There is currently no significant production of oil from tar sands in the United States, as the U.S. tar sand resource is modest. There is a much larger resource of tar sands in Canada, however, and it has shown significant growth in production. The technically recoverable Canadian resource is estimated at 173 billion barrels (RAND, 2008), and the EIA projects production rates of 2.1–3.6 million barrels per day in 2020 and 4 million barrels per day in 2030, depending on oil price.

The largest oil resource listed in Table 7.6 is from oil shales, but it is among the most uncertain. The estimated overall resource is very large (1.5–1.8 trillion barrels); one source has estimated that as much as a third of it could eventually be recovered by some combination of mining followed by surface retorting or in situ retorting (Bartis et al., 2005). There is currently no production of oil from shale in the United States, though a new process for in situ retorting based on electric

heating of the shale in the subsurface is being tested (Shell, 2006). Environmental impacts associated with mining, limitations on availability of water for processing, and potential demand for electricity to be used for in situ retorting must be assessed before better-constrained estimates of recoverable quantities of oil from shales can be assembled. Also, current cost estimates for shale oil recovery are not well defined.

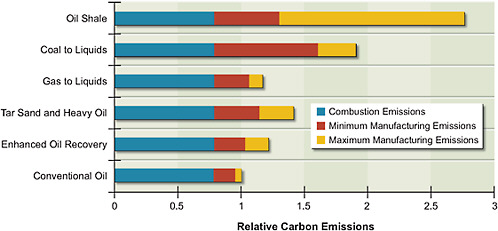

In the absence of CO2 capture and storage, production of oil either by enhanced oil recovery methods or by conversion from tar sands or oil shales emits more CO2 than does conventional oil production. This is shown in Figure 7.1, which provides estimates of the potential emissions that result from production and use of fuels from various primary fossil-fuel resources (Farrell and Brandt, 2006).6 The fuels all have about the same CO2 emissions when they are burned, but the energy requirements to recover and upgrade the hydrocarbons vary significantly. As an example, fuels from tar sands may ultimately emit about 40 percent more CO2 than do fuels from conventional oil,7 though the ranges of estimated emissions indicate that there are significant uncertainties in the values reported. These emissions can in principle be mitigated by large-scale carbon capture and storage (CCS), as noted above, or by the use of low-carbon technologies for process heat and hydrogen production. In addition, both surface mining and in situ production of tar sands disrupt large land areas, as would surface mining of oil shales, and the amounts of water required to process the fuels will also be a constraint in some areas. Thus, there are significant environmental issues associated with the recovery and processing of some of the unconventional hydrocarbon resources.

Although the U.S. oil resource base is large, future domestic production will depend on two factors. One is the decline in production from existing fields. The decline rate varies from field to field, but it is everywhere significant. For example, the EIA assumes that currently producing fields decline at the rate of 20 percent per year. New fields are assumed to peak after 2 to 4 years, stabilize for a period, and then decline at the 20 percent rate (EIA, 2008b). While the National Petro-

|

6 |

For a discussion of emissions associated with various fuel conversions, see Chapter 5. |

|

7 |

Emissions of CO2 result from the use of significant quantities of natural gas to provide process heat for separating the hydrocarbons from the sand and for making the hydrogen needed to upgrade the oils. These emissions could be reduced significantly in the future if nonfossil sources of electricity and process heat, such as nuclear, were used in the recovery and conversion processes. |

FIGURE 7.1 Estimated relative CO2emissions of alternative sources of hydrocarbon fuels.

Source: Farrell and Brandt, 2006.

leum Council (NPC) does not specify a decline rate, its report also notes the significance of declining production as fields mature (NPC, 2007).

The other factor that determines production is the ability to develop the resources listed in Table 7.6. This, in turn, depends on three key variables:

-

The pace at which technology can access increasingly challenging types of resources. After 2020, the application of new methods will be required to offset the inevitable decline in production from existing large fields in the United States. NPC (2007) cites 11 significant technologies under development that should be available between 2015 and 2020 to meet this need (see Box 7.1). The expansion of CO2 EOR is technically feasible, but it will depend on the availability of significant additional quantities of CO2 (see the discussion on carbon capture from power plants, for example, elsewhere in this chapter) and on whether the infrastructure to deliver that CO2 to the oil fields can be built.

|

BOX 7.1 Continuing Advances in Oil and Gas Exploration and Production Technology Developing U.S. oil and natural gas resources depends critically on technology. The domestic resource base is lodged in geologic formations that make extraction more difficult, and they are often smaller (and therefore harder to find) than the more easily developed fields of the past. Substantial advances in technology have been made in the past few years, however. For example, deepwater offshore oil production has compensated for declines in shallow water offshore and in Alaska production. Natural gas production from unconventional resources now accounts for more than half of total domestic production. And the shift from two-dimensional to three-dimensional seismic technology has increased exploration-drilling success rates by 50 percent over a 10-year period (Bohi, 1998). This trend toward more sophisticated technology must continue if domestic production rates of oil and gas are to be maintained, much less increased. Because essentially all of the technology that will be relevant before 2020 is being developed by the private sector, the AEF Committee has not conducted an independent assessment of the oil exploration and production technology. However, relying on the topic papers prepared for the National Petroleum Council report Facing the Hard Truths About Energy (NPC, 2007), it appears that appropriate development is under way.1 The critical technology need in oil production is the ability to manage fluids in complex underground reservoirs. These fluids involved are both the crude oil itself and materials such as CO2 that are used in enhanced oil recovery. Table 7.5 summarizes the “highly significant” technologies that are currently being developed for conventional oil exploration and production (NPC, 2007, Topic Paper 19). In the view of committee members familiar with oil exploration and production, this summary table (and the more detailed discussion in the topic paper) is a reasonable reflection of the status of development. In general, it appears that these technologies, if developed successfully, will support the pace of resource development shown in Table 7.7. In the case of natural gas, the chief technical challenge is to develop the resources contained in gas shale and other low-porosity formations. The necessary technologies involve the ability to drill horizontal wells and to fracture the shale formation to allow the natural gas to flow to the bore hole. These technologies advanced very significantly in the early years of this decade, which led to substantial increases in natural gas production from shale. |

-

Economic feasibility. The cost of exploiting alternative resources increases as they become more challenging (essentially from the top to the bottom of Table 7.6). Oil prices are set in a world market, even though the world price may be influenced by the actions of major producers, and historically, oil prices have been quite volatile. Such volatility can be a disincentive to the large and long-term investments needed to find and produce oil from technically challenging and increasingly costly resources.

-

Access to resources. The resources listed in Table 7.6 include quantities of oil estimated to occur in the coastal plain of the Arctic National Wildlife Refuge (ANWR-1002 area), which is currently off limits to exploration and production, and parts of the outer continental shelf (OCS), for which policies on access for exploration and production are currently in flux (see “The Access Issue” subsection that follows for additional discussion).

Although predicting the level of domestic production that results from the confluence of these factors could be considered speculative, the EIA has estimated how oil production might be affected by changes in them. Table 7.7 summarizes the agency’s most recent figures for several alternatives.8

Notwithstanding the considerable uncertainties involved in these estimates, it seems clear that the level of net domestic oil production is relatively insensitive to favorable developments in technology, higher world prices, and access to new resources. This is not to say that these factors are unimportant. Rather, it seems appropriate to conclude that because of the decline in currently (and future) producing oil fields, maintaining domestic production at something like current levels is a very challenging assignment. As a result, reducing consumption is likely to be the most important factor in decreasing domestic dependence on oil as an energy source.

|

8 |

Considerable caution should be used in interpreting Table 7.7. For one thing, the cases are not additive. In some instances, they involve arbitrary changes to parameters in the reference case, and assumptions about physical properties are not explicit. The high-oil-price case is not built up from a cumulative supply curve in the EIA estimating procedure and thus should not be thought of as representing actual economics. Other sources offer different projections, but because the EIA reference case appears to lie near the middle of the range it is useful for comparison purposes. See the National Petroleum Council Data Warehouse (available on CD with the NPC report Hard Truths [NPC, 2007]) for a collection of forecasts from a variety of sources. |

TABLE 7.7 Projected U.S. Crude Oil Production in Various Years

|

EIA Alternative Casesa |

Projected Production (million bbl/d) (2007 annual U.S. production: 5.1 million bbl/d, not including natural gas liquids) |

||

|

2010 |

2020 |

2030 |

|

|

Reference case |

5.9 |

6.3 |

5.6 |

|

High oil price |

5.9 |

6.4 |

6.4 |

|

Rapid technology |

6.0 |

6.5 |

6 |

|

ANWR 1002 access |

5.9 |

6.5 |

6.3 |

|

Access to all OCS |

5.9 |

6.4 |

5.8 |

|

aThe “Access to all OCS” case comes from EIA, 2007, while the other cases are from EIA, 2008a. See Appendix E of each document for a description of assumptions. |

|||

For the foreseeable future, U.S. reserves and production are likely to remain a modest fraction of world reserves and production.9 Indeed, none of the changes in Table 7.7 would lift U.S. production above about 8 percent of current world totals.

Although this committee has not attempted to evaluate non-U.S. oil reserves and production, it should be noted that the tension between declining production from existing reserves and investment in new production exists worldwide. The 2008 World Energy Outlook published by the IEA (2008b) reviews the status of the world’s largest existing oil fields and concludes that “field-by-field declines in oil production are accelerating … and barriers to upstream investment could constrain global oil supply.” Referring to its scenario analysis, the report observes that “the projected increase in global oil output hinges on adequate and timely investment. Some 64 million barrels per day of additional gross capacity—the equivalent of almost six times that of Saudi Arabia today—needs to be brought on stream between 2007 and 2030” (IEA, 2008b). These uncertainties are reflected in the range of production estimates from various publicly available sources. According to an NPC review of estimates for 2030, world oil production could range from 90 to 120 million barrels per day, as compared with about 85 million barrels

per day today. The 2008 World Energy Outlook reference scenario projects 2030 oil production at 106 million barrels per day (IEA, 2008b).

In any case, countries that have much larger production potential than the United States does can more easily increase (or decrease) oil production by the amount potentially obtainable from U.S. areas, both restricted and unrestricted. It is for this reason that this country is more likely to be a price taker than a price setter.

Natural Gas

Unlike the situation with oil, the United States currently produces most of the natural gas it consumes (see Table 7.3). Moreover, its imports are almost entirely from Canada, with the result that North American production is able to meet North American demand. If increased U.S. production of natural gas were able to maintain this balance, the United Staes could limit imports of natural gas (in the form of liquefied natural gas, or LNG). If not, natural gas imports would increase and at some point could result in significant economic and security risks, much like those that presently exist in the oil market. As noted in the following discussion, whether the United States can or cannot increase its domestic production of natural gas is not yet clear.

Table 7.8 shows the various types of U.S. natural gas resources. Significant conventional gas resources are located both offshore and onshore, although much of the offshore resource is in deep water. Nonassociated conventional resources are not physically mingled with oil deposits. Unconventional gas resources are of three types. Tight gas sands and gas shales are formations with low porosity and thus require technology to fracture the structures for the gas to flow to producing wells. Coal-bed methane is natural gas trapped in coal deposits.

Natural gas hydrates (not included in Table 7.8) are a potentially large but poorly defined resource. Estimates of the total global resource range from 1 to 100 times the world resource of conventional natural gas (NPC, 2007, Topic Paper 24; Ruppel, 2007). Hydrates are materials in which water molecules form cages that can contain a guest molecule, in this case methane. Forming at temperatures above the freezing point of water and at high pressures, they are found in many ocean sediments around the world and in locations in the Arctic where land temperatures are low. Methods for recovery of hydrates are under investigation. Whether any recovery method can produce at rates large enough to allow commercial production over an extended period and with acceptable environmental

TABLE 7.8 U.S. Natural Gas Resources

|

|

Trillion Cubic Feet (Tcf) (2007 annual U.S. production: 19.3 Tcf) |

|

Proved reserves |

204 |

|

Conventional gas resources |

|

|

Onshore (nonassociated) |

286 |

|

Offshore (nonassociated) |

214 |

|

Associated dissolved gas |

130 |

|

Unconventional gas resources |

|

|

Tight gas sands |

304 |

|

Coalbed methane |

71 |

|

Gas shales |

125 |

|

Source: EIA, 2008b, Table 50. Based on USGS and MMS data with adjustments for recent information. Does not include Alaska or off-limits OCS areas. While the Potential Gas Committee (PGC, 2006) uses somewhat different categories, the PGC aggregate estimate is consistent with the EIA estimate. |

|

consequences has yet to be established (see Annex 7.A for additional discussion). Thus, while the resource is potentially large, it is unlikely to contribute significant production of natural gas by 2035 unless significant progress is made on developing economically feasible and environmentally acceptable recovery processes.

As is the case with oil, natural gas production levels are constrained by the tension between declining production from existing fields and the difficulty of bringing on new production. The EIA estimates that declines in natural gas fields are typically 30 percent per year, somewhat greater than the estimate for oil. And as with oil, the issues of technology, economics, and access determine the ability to bring on new production.

-

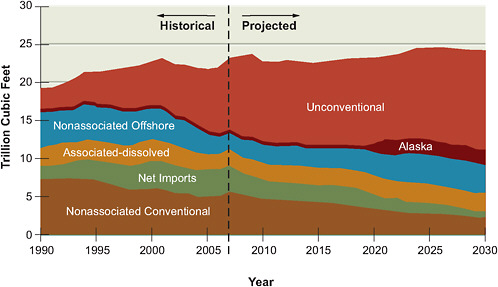

Included in the proved reserves and estimates of technically recoverable resources are significant amounts of natural gas from unconventional geological formations (tight gas sands, gas shales, and coal-bed methane). Better than half of current natural gas onshore production comes from these resources, and they will remain the principal source of new production for the foreseeable future (see Figure 7.2).

-

Producing from these formations does require advanced technology, though many of the methods being developed for oil production also are useful for natural gas production. Especially important for natural

FIGURE 7.2 U.S. Energy Information Administration reference case for U.S. natural gas production, showing the projected increase in the proportion of gas from unconventional sources along with the decline in gas from conventional sources. “Associated” refers to gas produced as a result of oil production.

Source: EIA, 2009b.

-

gas are technologies for well drilling and completion in deep water and technologies for producing natural gas from low-porosity formations such as tight sands and shales.

-

The price of natural gas has been volatile and will likely remain that way. This committee has not been able to develop a supply curve for natural gas production from publicly available data. However, it appears that at the lower end of the recent natural gas price range the production of gas shales and perhaps of some deepwater offshore resources is not economic. At the high end of the range, the private sector seems willing to invest in all of these types of gas resources.

-

Potential natural gas reserves have until recently been off-limits along the Atlantic and Pacific coasts and in the eastern Gulf of Mexico. Their current status is in flux. Because limited data are available for evaluation of these areas, estimates of future production are necessarily uncertain, as with any estimate of undiscovered resources. The subsection titled “The Access Issue” addresses this issue and reports potential future-production estimates that do exist.

TABLE 7.9 Projected U.S. Natural Gas Production (trillion cuibic feet) in Various Years

|

EIA Alternative Casesa |

2010 |

2020 |

2030 |

|

Reference case |

19.8 |

20.2 |

20.0 |

|

High gas price |

19.8 |

20.3 |

20.4 |

|

Rapid technology |

19.8 |

21.0 |

21.3 |

|

Access to all OCS |

19.8 |

21.5 |

21.6 |

|

Note: These estimates are subject to the same cautions as those regarding the earlier estimates for oil. Note also that private-sector estimates reported in the NPC database seem somewhat less optimistic. For example, the maximum estimate for 2020 among international oil companies is 18.9 trillion cubic feet. aThe “Access to all OCS” case comes from EIA (2007), while the other cases are from EIA (2008a). See Appendix E of each document for a description of the case assumptions. |

|||

Although the level of domestic production resulting from the confluence of these factors remains speculative, the EIA has estimated how natural gas production might be affected by changes in them. Table 7.9 summarizes EIA estimates regarding four alternatives.

According to these EIA estimates, maintaining domestic natural gas production, much less raising it above current levels, is challenging. However, resources in the OCS and new gas shale formations may have a significant upside production potential. Technology has recently made feasible the production of natural gas from shale formations in the Rockies, Mid-Continent, and Appalachian regions. Wood Mackenzie data (Snyder, 2008), for example, suggest a possible increase on the order of 3 Tcf per year by 2012, a level that can be maintained for several years. In the early release of the 2009 Annual Energy Outlook, the EIA reference case shows Lower 48 production of 21.6 Tcf in 2030. Thus, the upside potential for the deployment of new technology to exploit shale gas may be higher than the EIA’s 2007 projections in Table 7.9.10

In any case, it is very important that domestic natural gas production keep

|

10 |

Note that Figure 7.2 reflects EIA’s 2009 early release projections (EIA, 2009b). Table 14 of EIA’s updated reference-case forecast for the 2009 Annual Energy Outlook (AEO 2009) (April 2009) projects 23.03 Tcf of U.S. natural gas production in 2030. Shale gas is projected to contribute 3.66 Tcf of the total. This represents a doubling of shale gas production from 2007. Table A1 of the update shows declining natural gas imports between 2007 and 2030, suggesting that domestic supplies are robust over the period. |

pace with domestic demand. Unlike oil, U.S. natural gas prices are not presently determined in a world market. But there is a growing world market in LNG, and if growth in domestic demand for natural gas exceeds growth in supply (even with expanded natural gas production from gas shales, for example), the United States may find itself beholden to that global market. In that case, increases in domestic demand would have to be satisfied, increasingly, by imports. Most of these imports would likely be in the form of LNG, which would require large capital investments in port facilities and regasification infrastructure. Moreover, global movements of LNG would increasingly result in a globally determined price for natural gas. At this writing, the delivered price of LNG in Japan (more than $17.10/GJ, or $18/million Btu),11 roughly at parity with the price of oil based on energy content, and this is more than twice the U.S. price (~$7.60/GJ, or $8/million Btu).12

The Access Issue

Oil and gas exploration and production have been off-limits in some parts of the United States for a variety of policy reasons. Some 12 percent of U.S. petroleum resources and 20 percent of natural gas resources are believed to lie in these restricted areas. In late 2008, the president and Congress removed restrictions on access to previously restricted sections of the U.S. offshore resources, though a 2006 law banning drilling in the eastern Gulf of Mexico remains in effect (www.mms.gov/ooc/press/2008/FactSheet-MMSGOMSecurityActMARCH202008.htm). But how quickly offshore development will proceed, if it proceeds at all, is difficult to determine. For one thing, Congressional or Executive Branch action to reimpose the access ban remains a possibility. For another, individual states can intervene in development programs even without overriding a federal approval of a project—by preventing the oil or gas from coming on shore, for example. And the cost and technical difficulty of developing many of these resources can be significant (Durham, 2006). Thus the offshore access issue may remain an open policy question, at least for a while. Accordingly, this section provides background to help address that question.

TABLE 7.10 Estimated Undiscovered but Technically Recoverable Onshore Oil and Gas Resources on Federal Lands

|

|

Oil (billion bbl) |

Gas (Tcf) |

|

Inaccessiblea |

19 |

94 |

|

Accessible with restrictionsa |

9.3 |

113 |

|

Accessible standard leasea |

2.3 |

24 |

|

Total resourcesa |

30.5 |

231 |

|

Northern Alaska total |

17 |

67 |

|

National Petroleum Reserve-Alaska |

9.3b |

60c |

|

Alaska National Wildlife Refuge (1002 Area) |

7.7c |

7d |

|

aBLM, 2008. bUSGS, 2002. cUSGS, 1998. dEIA, 2004. Source: See www.blm.gov/wo/st/en/prog/energy/oil_and_gas/EPCA_III/EPCA_III_faq.html. |

||

Table 7.10 reports estimates, compiled by the Bureau of Land Management from USGS and MMS sources, of the volumes of technically recoverable oil and gas for federal lands. The amounts shown are for 11 sedimentary basins, including the National Petroleum Reserve-Alaska (NPRA) and the Alaska National Wildlife Refuge 1002 (ANWR-1002) areas. The NPRA and ANWR-1002 estimates shown separately (but included in the 30.5 billion barrel estimate) in Table 7.10 are the largest components of the onshore, undiscovered, and technically recoverable resources. The NPRA estimate (9.3 billion barrels) is part of the estimate of undiscovered oil that is accessible with restrictions, and the ANWR-1002 estimate (7.7 billion barrels) is in the inaccessible category.

Comparison of these numbers with the scale of oil use is instructive: 2007 world oil consumption was about 85 million barrels per day (31 billion barrels per year); U.S. oil consumption was about 20.7 million barrels per day (7.6 billion barrels per year); and U.S. oil production was 6.9 million barrels per day (including natural gas liquids), which amounts to 2.5 billion barrels per year (British Petroleum, 2008). For natural gas, the corresponding 2007 numbers are world natural gas consumption at 104 Tcf, U.S. consumption at 23 Tcf, and U.S. production at 19.3 Tcf (British Petroleum, 2008).

The estimated undiscovered oil resources, which total 30.5 billion barrels, are included in the 76 billion barrels of undiscovered offshore resources listed in Table 7.6. The total gas resources listed, however, are not included in the natural

gas resource estimates of Table 7.8. The resources listed as inaccessible are those that are estimated to lie within areas where exploration and production have been prohibited. These include lands that cannot be leased as a result of congressional or presidential action (including national parks, national monuments, and wilderness areas); lands that are not available for leasing based on decisions by the federal Bureau of Land Management (historical sites and endangered species habitats, for example); lands that are undergoing land-use planning or National Environmental Policy Act review; and areas that can be leased but with no surface occupancy (directional drilling might be able to access some resources, in which case they are included in the category of accessible with restrictions). Restrictions may include limits on drilling during a portion of the year or stipulations that require mitigation plans or exclude some areas within the lease from drilling. Operations in areas for which standard lease terms apply must observe pertinent environmental laws and regulations.

Table 7.11 gives related estimates for offshore resources that are located in areas that have not been open for leasing for exploration and production (NPC, 2007, Topic Paper 7, www.npchardtruthsreport.org/topic_papers.php). The largest undiscovered resources are estimated to be located in the restricted portions of the federal OCS. These estimated gas resources are in addition to those listed in Table 7.8. The estimated oil resources in Table 7.11 are included, however, in the estimates of Table 7.6.

The combined estimates of conventional onshore and offshore oil in areas that are now inaccessible or have been so until very recently comprise 32 percent (19 billion barrels onshore oil [Table 7.10], plus 19.3 billion barrels offshore oil [Table 7.11]) of the total estimated undiscovered conventional technically recov-

TABLE 7.11 Estimated Undiscovered but Technically Recoverable Offshore Oil and Gas in Areas Covered by Moratoriums

|

|

Oil (billion bbl) |

Gas (trillion cubic feet) |

|

Eastern Gulf of Mexico OCS |

3.7 |

22 |

|

Atlantic OCS |

3.8 |

37 |

|

Pacific OCS |

10.4 |

18 |

|

Great Lakes |

0.4 |

5 |

|

State waters |

1.0 |

2 |

|

Total resources |

19.3 |

84 |

|

Source: NPC, 2007, Topic Paper 7, available at www.npchardtruthsreport.org/topic_papers.php. |

||

erable oil shown in Table 7.6 (43 billion barrels onshore, plus 76 billion barrels offshore). As Table 7.6 indicates, however, the relatively high costs of developing some of the resources may limit the rate of development, though these costs are comparable to or lower than some of the costs of making liquid fuels from alternate sources (see Chapter 5). The estimates of undiscovered gas resources in the inaccessible areas (94 Tcf onshore [Table 7.10], plus 84 Tcf offshore [Table 7.11]) are about 28 percent in addition to the total conventional gas resources listed in Table 7.8 (630 Tcf) or about 16 percent in addition to the total of conventional and unconventional gas resources listed in Table 7.8 (1130 Tcf).

There is considerable uncertainty in these estimated volumes, as with any figures that purport to measure undiscovered resources. Geophysical data used to refine such estimates were last collected 25 or more years ago for the Pacific coast, the Atlantic coast, and portions of the eastern Gulf of Mexico. Since then, significant advances have been made in seismic technology, which could allow more accurate estimates of the size and location of potential accumulations. There is similar uncertainty in the rate of production that might be obtained from these areas if exploration and production were permitted. Offshore developments in deep water typically require extended time periods during which to begin production (5–7 years or more) if exploration is successful and more time to ramp up to full-scale production.

But even without considering new producing provinces, the substantial technology development for production in deep waters of the OCS—where leasing and drilling have been under way for some time—is projected to have a significant impact on U.S. oil production in the next decade. For example, in its 2008 reference case, the EIA projects that deepwater Gulf of Mexico conventional oil production will increase from about 1 million barrels per day in 2006 to a peak of 2 million barrels per day sometime between 2013 and 2019, declining thereafter to 1.6 million barrels per day in 2030 (EIA, 2008a, p. 79). (These quantities are similar to those being contemplated for production of liquid fuels from coal or biomass—see Chapter 5.) That increase in production, in turn, leads to a projected increase in total U.S. production from 5.1 million barrels per day in 2007 to a peak of 6.3 million barrels per day in 2018. Thus the increase in deepwater production more than offsets continuing declines in Alaska production and shallow offshore production, but only for a time. If leasing and development proceed in OCS areas that were previously off-limits, the technology improvements that have proved successful in deepwater Gulf of Mexico areas could be applied in those OCS areas as well.

EIA estimates (EIA, 2008a) of production rates from access to ANWR-1002 and the OCS showed increased U.S. production—more than the reference-case production of 6.3 and 5.6 million barrels per day—of about 200,000 and 100,000 barrels per day, respectively, in 2020 and about 700,000 and 200,000 barrels per day in 2030 (see Table 7.7). It is important to recognize that these estimated increments reflect both the increased production in the specified areas and the declines in production elsewhere. Mean production estimates cited in the NPC study (NPC, 2007, Topic Paper 7) for the ANWR-1002 area are 539,000 barrels per day in 2020 and 576,000 barrels per day in 2030. EIA estimates made in 2004 (EIA, 2004) showed somewhat larger estimated production for ANWR-1002, with assumed production starting in 2013 and peaking at 874,000 barrels per day in 2024.

While any additional oil production has some impact on oil price, as well as an obvious impact on the amount of oil imported into the United States, most observers have argued that the impact on oil price of net incremental U.S. production due to the opening of restricted areas will be small. Projected total production increases are modest compared to world demand (about 85 million barrels per day at present); they are projected by the EIA to grow to 96 million barrels per day in 2015 and 113 million barrels per day in 2030 (EIA, 2008d).

Oil prices are set in a global market, and both supply and demand depend on price, though supply responds slowly to high prices and demand usually responds faster. Short-term oil price volatility observed in recent months is a reflection of this dynamic, at least in part. But it is not known whether remote or offshore production will compete on costs with other sources of supply around the world, nor whether such resources will be developed in the first place, given the uncertainty as to future oil prices supporting development. As the EIA noted in its analysis of the impact of ANWR-1002 production, “Assuming that world oil markets continue to work as they do today, the Organization of Petroleum Exporting Countries could countermand any potential price impact of ANWR coastal plain production by reducing its exports by an equal amount” (EIA, 2004). Similar reasoning suggests that the impact of increased OCS production on world oil price in the long term would also be small.

It is possible that natural gas markets, which are becoming more global but still maintain regional differences, will respond differently to the potentially higher production quantities, although the magnitude of any response is uncertain (Baker Institute, 2008). The EIA estimates summarized in Table 7.9 suggest that access to restricted OCS, for example, might provide increased gas produc-

tion of about 1.3 Tcf per year in 2020 and 1.6 Tcf in 2030 (U.S. consumption is about 23 Tcf per year at present), which could offset the need for some LNG imports.

A related discussion is under way concerning the potential environmental risks of developing oil or gas resources in locations such as the ANWR-1002 area, the National Petroleum Reserve, or the formerly restricted OCS. Technology improvements such as long-reach directional drilling have reduced the area required by surface facilities for drilling and production, but some surface impact is inevitable. Similarly, the use of subsea completions for deepwater oil and gas production, pipeline delivery of fluids to shore in place of tankers, and attention to modern MMS environmental regulations governing platforms have reduced the potential for adverse impacts in offshore production. However, there will always remain some risk, whether at the platform or at the land end of the undersea pipeline. In addition, close-in platforms have visual impacts.

In addition to the OCS and federal land resources discussed in this section, the increased interest in natural gas production from shale formations may create a need to balance energy and environmental values regarding this resource. Large shale formations in the mid-Continent and the Gulf Coast (e.g., Barnett and Haynesville) are located in areas where oil and gas are currently produced. Infrastructure exists in these areas, and public opinion is probably open to additional gas production. However, the Marcellus shale in Appalachia is spread over a wide area, where lack of infrastructure and fragmented land ownership make production from this area more challenging (Snyder, 2008).

Coal

Table 7.12 provides estimates of coal resources by coal rank. Anthracite and bituminous coals have the highest energy and carbon content, whereas subbituminous coals and lignites have lower energy content and larger moisture and ash content (NRC, 2007, Box 4.1). The table indicates that the United States has about 20 years of reserves in active mines, but a much larger resource would be available for production if new mines could be opened and if the rail infrastructure required to deliver coal—or, alternatively, if sufficient long-distance transmission lines for delivery of electricity generated at the mine mouth—could be put in place. Costs of coal production vary widely with geographic setting and the type of mining, but it is clear that costs are low enough that substantial quantities of coal can be produced at current coal prices.

TABLE 7.12 U.S. Coal Resources and Reserves

|

Coal (2005 Annual U.S. Production: 1 billion tons)a |

Billion Tons |

|

Recoverable reserves in active minesa |

17.3 |

|

Recoverable reservesa |

227 |

|

Demonstrated reserve basea |

200 |

|

Identified resourcesa |

1200 |

|

Proved Reservesb |

|

|

Anthracite and bituminous |

123 |

|

Subbituminous and lignite |

144 |

|

aNRC, 2007. bBritish Petroleum, 2008. |

|

The National Research Council has recently assessed the status of domestic coal resources (NRC, 2007). It concluded that:

Federal policy makers require accurate and complete estimates of national coal reserves to formulate coherent national energy policies. Despite significant uncertainties in existing reserve estimates, it is clear that there is sufficient coal at current rates of production to meet anticipated needs through 2030. Further into the future, there is probably sufficient coal to meet the nation’s needs for more than 100 years at current rates of consumption. … A combination of increased rates of production with more detailed reserve analyses that take into account location, quality, recoverability, and transportation issues may substantially reduce the number of years of supply. Future policy will continue to be developed in the absence of accurate estimates until more detailed reserve analyses—which take into account the full suite of geographical, geological, economic, legal, and environmental characteristics—are completed.

Even given the uncertainties in resource estimates, the United States likely has sufficient coal to meet projected needs. However, of all the fossil fuels, coal produces the largest amount of CO2 per unit of energy released by combustion—about twice the emissions of natural gas, but can vary depending on coal rank—and mining has significant environmental impacts, which will limit its suitability for some locations. In any case, the estimates in Table 7.12 suggest that resource availability is not likely to be the constraint that sets the level of coal use.

Findings: Oil, Gas, and Coal Resources

Fossil-Fuel Resources and Production

The United States is not running out of oil anytime soon, but domestic oil production rates are unlikely to rise significantly. U.S. technically recoverable con-

ventional oil resources are large relative to the country’s liquid fuel demand. However, U.S. production capacity is limited by declining production in existing fields. Even with new technology, higher prices, and access to currently off-limits resources—none of which is certain—maintaining current production levels will be challenging.

The United States is not running out of natural gas anytime soon, and with favorable circumstances, domestic production could meet most of the domestic natural gas demand for many years. U.S. natural gas resources are large relative to demand, and current domestic production meets most of the domestic demand. Unconventional sources of natural gas are technically recoverable and appear to be large enough to meet domestic demand for several years. Doing so, however, would require both relatively high prices and moderate demand growth.

Unconventional oil from U.S. resources is not likely to result in significant new production volume before 2020. A large oil shale resource exists in some of the western states, but production from these reserves awaits technology demonstration and is highly unlikely before 2020. The U.S. tar sands resource is not large.

Crude oil production from Canadian tar sands is feasible now and likely to grow before 2020, but this resource has a larger carbon footprint than conventional resources have. Canadian tar sands production was 1.3 million barrels per day of crude oil in 2006, and it could grow to 4 million barrels per day by 2030. But with current technology, fuels derived from tar sands ultimately emit 15–40 percent more CO2 than do fuels derived from conventional crude oil (see Farrell and Brandt, 2006).

Coal is abundant in the United States. Despite significant uncertainties in existing reserve sizes, there is sufficient coal at current rates of production to meet anticipated needs through 2030 and well beyond. More detailed analyses will be required, however, to derive accurate estimates of the impact of enhanced production on reserve life. There are also geographical, geological, economic, legal, and environmental constraints on the future use of coal.

Fossil-Fuel Supply and Demand

Changes in U.S. oil production—including from areas currently off-limits to drilling—are not likely to have a leading influence on world oil production.

Because U.S. crude oil reserves and production will remain a modest fraction of world reserves and production, the actions of other countries could have a greater impact. However, because U.S. oil demand is a large fraction of world oil demand, changes in U.S. demand are a significant factor in the market.

Greater domestic natural gas demand could boost U.S. reliance on LNG imports and cause a significant rise in domestic prices, though sustained significant increases in production of natural gas from shales could limit that reliance. If gains in production of natural gas from shales are not sufficient to meet heightened U.S. demand (such as for natural gas for electric power production), LNG could become the marginal supply to meet that demand. Eventually, LNG imports could grow to a point that linked the U.S. natural gas market to world LNG prices, which would be much higher than current U.S. prices.

Although domestic coal reserves are ample to 2030 and beyond, upward price pressures may exist. Growth in demand for electricity from coal-fired power plants, potential use of coal for producing liquid and gaseous fuels, the cost of opening new mines, and growth in export markets are examples of such pressures.

ELECTRIC POWER GENERATION WITH FOSSIL FUELS

Background on Electricity Generation and Carbon Dioxide Emissions

According to the EIA, U.S. electricity production in 2006 was 3727 terawatt-hours, with coal supplying 52 percent and natural gas 16 percent for a combined total of 68 percent, as shown in Table 7.13. The EIA has also made a projection of electricity generation in 2020 using its computer models, assuming a continuation of trends that were evident as of 2008.13 Its reference scenario projects that total electricity generation in 2020 will be up about 16 percent from 2006, with a similar fuel breakdown.14

TABLE 7.13 U.S. Electricity Generation by Fuel Type in 2006

|

Fuel Type 2006 |

Terawatt-Hours (percent) |

|

Coal |

1930 (52) |

|

Petroleum |

55 (01) |

|

Natural gas |

608 (16) |

|

Nuclear power |

787 (21) |

|

Renewable sources |

347 (09) |

|

Conventional hydro |

265 (07) |

|

Other renewable |

82 (02) |

|

Total |

3727 |

|

Source: EIA, 2008a, p. 131. |

|

Table 7.14 shows data gathered by the U.S. Environmental Protection Agency (EPA) on 2006 U.S. greenhouse gas emissions, broken down by fuel type. Total emissions of all such gases were just over 7 gigatonnes of CO2 equivalents, of which CO2 itself accounted for about 85 percent; methane and nitrous oxide accounted for most of the rest. CO2 emissions associated with energy consumption (as distinct from agricultural and other sources) accounted for 80 percent of all U.S. greenhouse gas emissions, of which 59 percent resulted from direct combustion as fuel (dominated by petroleum use in transportation) and 41 percent from fossil-fuel use in electricity generation. CO2 emissions from electricity generation were dominated by coal (83 percent), but overall, the burning of coal for electricity accounted for only 27 percent of all U.S. greenhouse gas emissions in 2006.

Dividing the figures in Table 7.14 by those in Table 7.13, the committee finds that approximately 1.0 tonne of CO2 was emitted per megawatt-hour of electricity produced from coal, and about 0.56 tonne of CO2 was emitted per megawatt-hour of electricity produced from natural gas.

Looking Forward

Investor-owned utilities and independent power producers face difficult choices at present. They must invest in new power-generation assets to meet future demands for electricity and to replace some portion of the existing fleet of power plants as they are retired, but they must also consider what will happen if constraints

TABLE 7.14 U.S. CO2 Emissions by Fuel Type in 2006

|

Source |

Million Tonnes CO2 Equivalent |

|

Total U.S. greenhouse gas emissions |

7054 |

|

Total CO2 emissions |

5983 (~85% of all greenhouse gas emissions) |

|

CO2 emissions from energy |

5638 |

|

combustion |

3310 (59%) |

|

Electricity generation |

2328 (41%) |

|

Combustion CO2 emissions by fuel |

3310 |

|

Coal |

133 (04%) |

|

Natural gas |

816 (25%) |

|

Petroleum |

2361 (71%) |

|

CO2 emissions from electricity generation, by fuel |

2328 |

|

Coal |

1932 (83%) |

|

Natural gas |

340 (15%) |

|

Petroleum |

56 (02%) |

|

Source: EPA, 2008. |

|

are placed on carbon emissions. Financial institutions are wary of lending for coal-fired power plants that do not include provisions for capturing CO2, and some states have recently indicated that they will not approve the construction of coal-fired power plants without CCS. But some public utility commissions, which see their role as protecting consumers from unwarranted price increases, are reluctant to include the cost of such facilities in the rate base, absent a regulatory requirement.

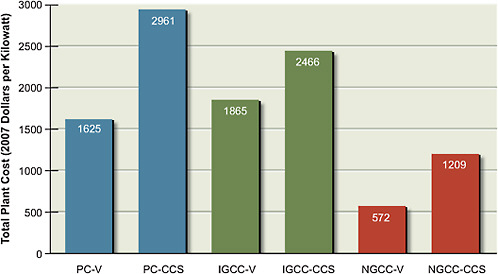

Construction costs have risen rapidly in recent years, thereby increasing the capital cost of any power plant. The U.S. Department of Energy (DOE)-sponsored project FutureGen, which was to have demonstrated a coal gasification plant with carbon capture, was canceled at this writing because of high projected costs in favor of an alternative vision of supporting incremental carbon capture projects at several plants. At present there are no obvious choices as to the best designs for CO2 capture. Meanwhile, although capital costs for natural gas plants are a fraction of those for coal or nuclear plants, the price of natural gas has increased substantially above historic levels and has shown some of the volatility of recent oil prices. Thus, the best choices among options for generating electricity are not at all clear at present.

The answers to the following three questions will determine the future of fossil-fuel power in the United States over the coming decades:

-

Will the United States undertake a large effort to reduce CO2 emissions?

-

Will the technologies of CCS become commercially viable?

-

Will the domestic natural gas price be close to its highest recent value or its lowest recent value?

By 2020, decision makers will probably have sorted out the first question. It is inconceivable that CCS will prosper if there is not a large effort to reduce CO2 emissions, because unless a significant cost is imposed on CO2 emissions at a power plant it will nearly always be less expensive to vent the CO2. The committee assumes here that government will formulate policies to reduce CO2 emissions, thereby spurring already-existing technologies for generating electric power with reduced CO2 emissions. The committee focuses here on pathways that deploy such technologies.

With a significant suite of demonstration plants, the country can also sort out the second question. Not enough is known yet to demand that all new plants be equipped with CCS, but much can be learned in the next decade.

The answer to the third question depends in part on the extent to which the U.S. market for natural gas links to the international market. That, in turn, depends, again in part, on the future role of natural gas in electric power generation. Thus the future mix of uses of natural gas and coal for electric power generation will depend sensitively on a combination of the constraints on carbon emissions, the costs of fuels, and the costs of conversion technologies. In particular, whether coal plays a larger or a smaller role in future electric power generation will depend strongly on whether CCS can be applied at the scale of many large power plants.

To examine these questions, the committee considers below three types of power plants: supercritical pulverized coal (PC), integrated gasification and combined cycle (IGCC) coal, and natural gas combined cycle (NGCC).

The PC/IGCC Competition

For large U.S. power generation projects, utilities and independent power producers are evaluating two ways of producing power from coal: PC and IGCC.15

PC plants use boilers to produce steam, which drives turbines to produce electricity. In its current form, this technology has been in use for over 50 years and continues to be improved. PC technology has progressed from subcritical to supercritical to the latest ultrasupercritical boilers; this is a designation that refers to the temperature and pressure of the steam, with higher values bringing higher efficiencies. As power plant conversion efficiencies increase, the amount of CO2 emitted per unit of electricity generated declines.

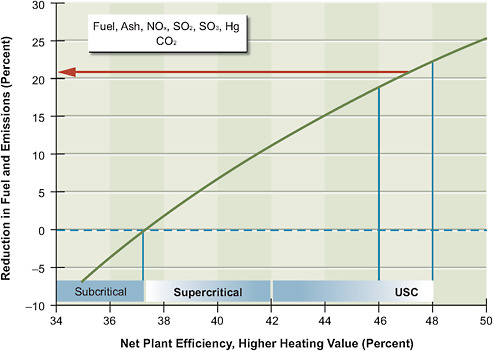

Typical subcritical PC plants have thermal efficiencies of 33–37 percent (based on higher heating value of the fuel, 33–37 percent of the energy stored in the fuel is converted to electricity) and operate at temperatures up to 1025°F and typical steam pressures of 2400–2800 psi. Supercritical PC plants can achieve efficiencies of 37–42 percent at temperatures and pressures of 1050°F and 3530 psi, while ultrasupercritical PC plants are capable of 42–45 percent energy conversion at 1110–1140°F and 4650 psi (Katzer, 2008; MIT, 2007).

In the future, with advances in high-temperature materials and operating temperatures of 1400°F and above (Viswanathan et al., 2008), efficiencies could reach as high as 48 percent, though this would require major R&D breakthroughs.16 In addition, operating plants often do not realize their full design efficiency, so a more realistic actual efficiency of a pulverized coal plant is likely closer to 40–44 percent without CCS, and perhaps 30 percent with CCS. Figure 7.3 shows that an ultrasupercritical boiler with an efficiency of 42 percent would reduce CO2 emissions by about 12 percent compared with a standard subcritical boiler. Efficiency improvements of 1–3 percent are also possible through modernization at existing coal plants, but the required capital investment may not be attractive given other priorities. A succinct discussion of these and other variations

|

for gasification without coal. In either case, any CO2 captured and stored leads to a reduction in atmospheric CO2 concentration because the carbon present in the biomass was removed from the atmosphere by photosynthesis. A power plant that uses a mix of coal and biomass can therefore have zero net carbon emissions, or even negative net emissions. See the section “Future Biomass Power” below in this chapter, which addresses biomass-fueled power generation. |

|

16 |

This is a potential efficiency that might be achieved with steam pressures and temperatures of 5000 psi and 1400°F main steam, 1400°F reheat; however, the most robust current “ultrasupercritical” plants operate at pressures of around 4640 psi and temperatures of 1112–1130°F. The U.S. Department of Energy’s National Energy Technology Laboratory, in collaboration with industrial consortia, is conducting research on advanced high-temperature materials (e.g., coatings and nickel-based alloys) for use in ultrasupercritical boilers and turbines (www.netl.doe.gov/technologies/coalpower/advresearch/ultrasupercritical.html). |

FIGURE 7.3 An ultrasupercritical (USC) boiler with an efficiency of 46–48 percent would reduce CO2emissions by 20 percent compared with a standard subcritical boiler.

Source: John Novak, Electric Power Research Institute, 2008.

on technologies currently in use for electric power generation from coal can be found in MIT (2007).

In principle, CO2 can be captured from any of these PC power plants. Doing so requires use of some of the energy that would otherwise have been used to generate electricity; this fact is reflected in a reduction of the conversion efficiency of the plant. The diverted energy is used to separate CO2 from the solvents used to capture it, to compress the CO2, and for the power needed to move CO2 and solvents through the plant. (See Annex 7.A for a description of some of the processes used to capture CO2 from power plant combustion-product gases.)

The second approach, IGCC, is a technology for electricity generation that produces gas from coal to drive a high-efficiency gas turbine, whose hot exhaust then drives a smaller steam cycle similar to that of PC. The high-efficiency gas turbine process, which evolved from jet engine technology, can use either air or oxygen; the separation of oxygen from air at the front end creates a gas stream

without nitrogen and leads to smaller and lower-cost plant components. Thus, for capture plants, there is no nitrogen to separate from the CO2. Coal is converted in a reducing atmosphere to a gas known as synthesis gas, or syngas, which contains carbon monoxide (CO), CO2, hydrogen (H2), water vapor (H2O), and traces of other components such as H2S arising from the sulfur in coal.

In an IGCC power plant that does not capture CO2, cleaned syngas goes directly to a gas turbine. To add a capture capability at a power plant, the syngas undergoes further chemical processing in a “shift” reactor, which converts most of the carbon into CO2 rather than CO—thereby creating, in effect, a mixture of H2 and CO2. The two gases are then separated, power is obtained from a gas turbine burning the H2 (with a diluent added to reduce the combustion temperature), while the CO2 is pressurized and sent off-site for storage.17

Oxygen gas from an air separation unit can also be used to burn pulverized coal directly, a process that is known as oxyfuel combustion. In that case, the combustion products from electric power generation are CO2 and water, plus small amounts of contaminants. In effect, the cost of air separation at the front end to produce O2 for combustion is traded off against the cost of separation of CO2 from N2 at the back end. Both separations require additional capital and reduce net electricity generation. Removing the N2 from the flow reduces the amount of flue gas, but some recycling of CO2 is required to control combustion temperature. Another option, known as chemical looping, is also being investigated as a way to separate O2 from N2 and thus to avoid a subsequent separation of CO2 from N2 (see Annex 7.A for a description of this approach).

Chemical separations—CO2 from N2, CO2 from H2, or O2 from N2—lie at the heart of all these carbon capture schemes. At present, the separations are thermodynamically rather inefficient, and they represent the largest component of the incremental costs for CCS (Dooley et al., 2006; IPCC, 2005) (see Figure 7.A.6 in Annex 7.A for examples that compare capture costs with those of compression, CO2 transportation, and injection). Because there is significant potential for improving the efficiency of capture and reducing both the costs and the energy penalties associated with capture, this area is an important component of research on CCS. For example, the current DOE program for research to improve separation technologies includes work on improved solvents, materials for mem-

|

17 |

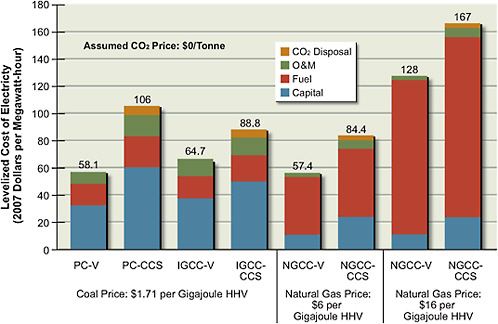

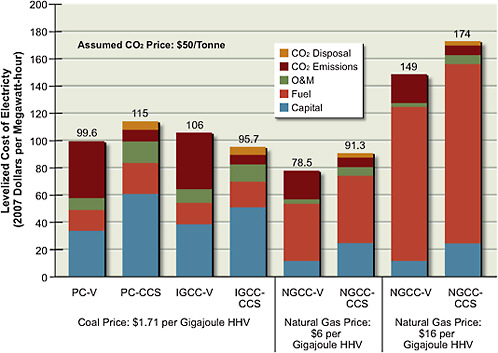

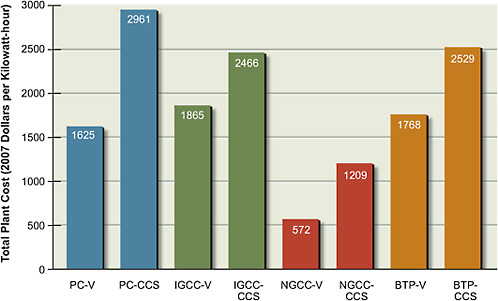

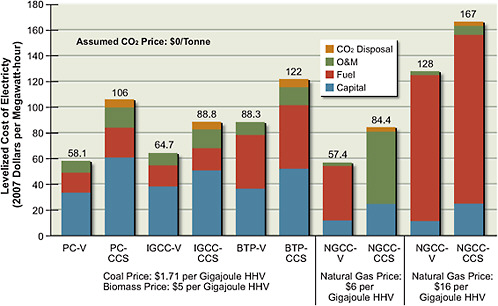

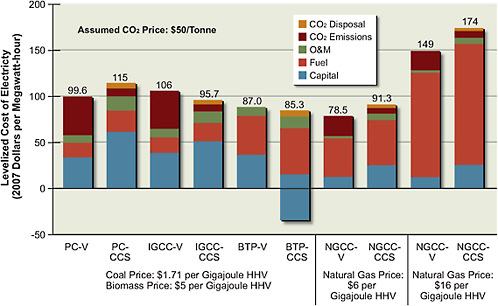

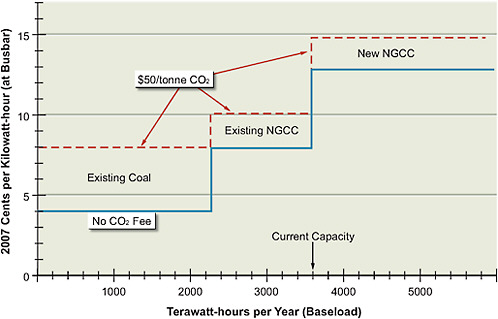

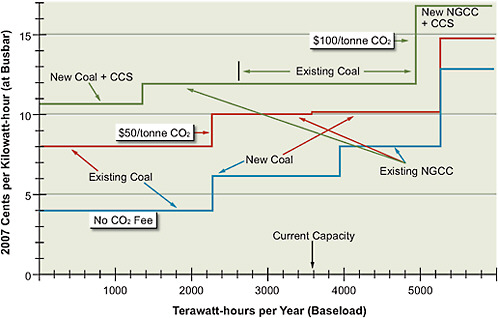

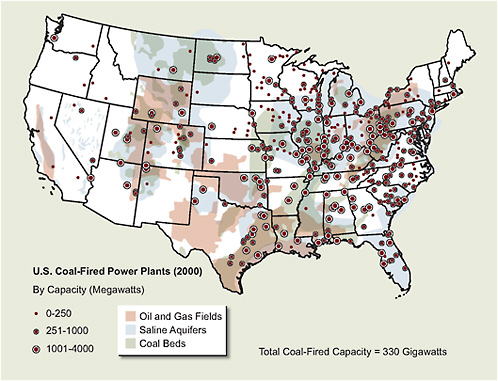

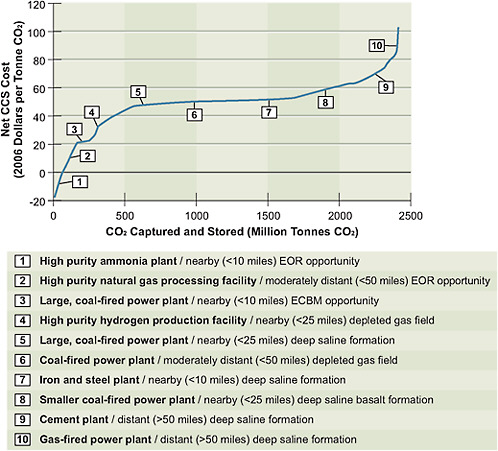

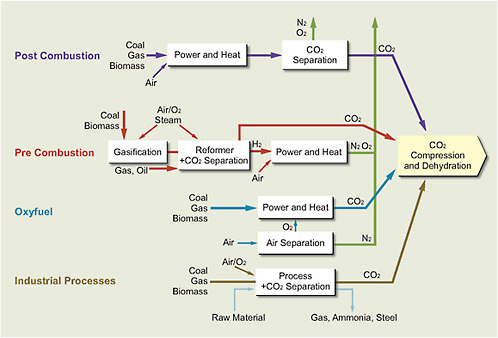

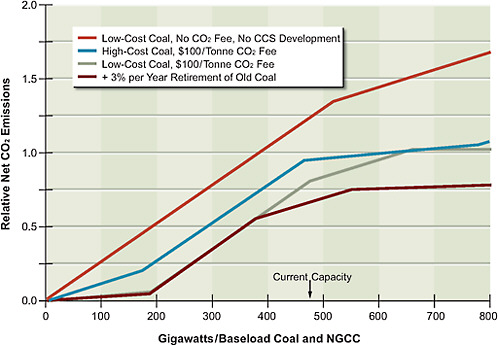

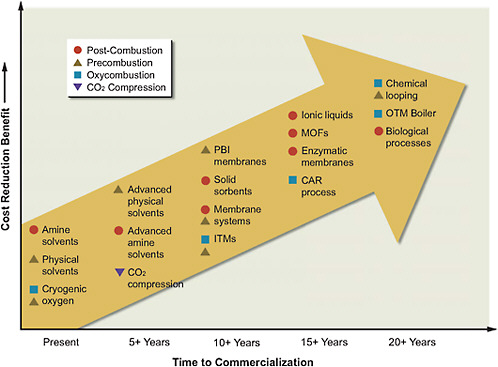

Gasification can also be the first step toward the production of synthetic transportation fuels (synfuels) or synthetic natural gas (SNG). In these cases, the shift reactor is used to tune the H2:CO ratio for optimal synthesis. See Chapter 5. |