8

Nuclear Energy

Utilities in the United States have recently expressed renewed interest in adding new nuclear power plants to their mix of electricity generation sources. As of July 2009, the U.S. Nuclear Regulatory Commission (USNRC) had received 17 applications for combined construction and operating licenses1 for 26 units, and it expects to receive a total of 22 applications for 33 units by the end of 2010.2 The 104 currently operating nuclear plants (largely constructed in the 1970s and 1980s) contribute substantially to the U.S. electricity supply: nuclear power provides 19 percent of U.S. electricity as a whole and about 70 percent of electricity produced without greenhouse gas emissions from operations. These plants provide electricity safely and reliably, and they have operated with capacity factors greater than 90 percent over the last few years.3 Still, hurdles remain, and no new nuclear plants have been ordered in the United States in more than 30 years.

This chapter discusses the prospects for the future use of nuclear power in the United States, including an assessment of future technologies, deployment

|

1 |

Previously, the licensing process had two steps, construction and operation, each of which required a different license to be issued. The Combined Construction and Operating License is a part of the USNRC’s new “streamlined” application process. |

|

2 |

The USNRC’s lists of received and expected applications are available at www.nrc.gov/reactors/new-reactors/col.html and at www.nrc.gov/reactors/new-reactors/new-licensing-files/expected-new-rx-applications.pdf, respectively; accessed July 2009. |

|

3 |

The net capacity factor of a power plant is the ratio of the actual output of a power plant over a period of time and its projected output if it had operated at full nameplate capacity the entire time. |

costs, and the barriers to and impacts of increased nuclear power plant deployments by 2020, by 2035, and by 2050.

Interest in new nuclear construction has also been growing around the globe, and with a new element: interest among countries that do not currently have nuclear plants. According to the International Atomic Energy Agency (IAEA), in excess of 40 new entrant countries have expressed interest, of which 20 are actively considering construction (IAEA, 2008a).

In addition, the IAEA has recently estimated that 24 of the 30 countries with existing nuclear plants intend to build new reactors—a departure from policies of the past few decades in many countries (IAEA, 2008a). Following the Chernobyl accident in 1986, Italy banned construction of new nuclear reactors; the governments of Sweden and Germany pledged to phase out their own nuclear plants; resistance to new construction in the United Kingdom was strong; and Spain put in place a moratorium on new construction. These attitudes are now changing, likely as a result of subsequent uneventful nuclear operations and growing concerns about climate change and future energy needs.

Thus, Italy has announced plans to build nuclear plants; Sweden, after shutting down two plants, intends to reverse the planned phase-out and construct new nuclear plants; and the Labor government in the United Kingdom has recently announced plans to replace 18 nuclear plants retiring by 2023 with new ones.4 But this new outlook is not universal. The current head of the Spanish government remains opposed to nuclear power, and the current government in Germany still intends to shut down its 17 remaining nuclear plants. Meanwhile, new construction is planned or under way in Finland, France, and Japan, countries that never wavered in their support of nuclear power.

Overall, the IAEA projects that by 2030, world nuclear capacity could

|

4 |

Press articles discussing these developments in more detail include “Recalled to half-life,” The Economist, Feb. 12, 2009 (www.economist.com/world/europe/displaystory.cfm?story_id=13110000); “What Sweden’s nuclear about-face means for Berlin,” Der Spiegel, Feb. 6, 2009 (www.spiegel.de/international/world/0,1518,605957,00.html); “Italy seeks nuclear power revival with French help,” Reuters, Feb. 24, 2009 (uk.reuters.com/article/oilRpt/idUKLO72469220090224); “Spain must reconsider nuclear energy,”La Vanguardia, Feb. 25, 2009 (www.eurotopics.net/en/search/results/archiv_article/ARTICLE458-0); “Governments across Europe embrace nuclear energy,” ABC, Mar. 4, 2009 (www.abc.net.au/pm/content/2008/s2507565.htm); and “Europe looking set for a Nuclear Revival,” Your Industry News, Mar. 6, 2009 (www.yourindustrynews.com/europe+looking+set+for+a+nuclear+revival_26046.html). These articles were accessed in July 2009. |

increase by 27 percent under business-as–usual conditions, or in the agency’s “high case,”5 to nearly double, after accounting for retirements (IAEA, 2008b). Nonetheless, even in the high-case projections, nuclear power would rise only slightly as a percentage of total electricity generated worldwide—from 14.2 percent in 2007 to 14.4 percent in 2030—assuming business as usual for construction of fossil-fueled plants.

The handful of plants that could be built in the United States before 2020, given the long time needed for licensing and construction, would need to overcome several hurdles, including high construction costs, which have been rising rapidly across the energy sector in the last few years, and public concern about the long-term issues of storage and disposal of highly radioactive waste.6 If these hurdles are overcome, if the first new plants are constructed on budget and on schedule, and if the generated electricity is competitive in the marketplace, the committee judges that it is likely that many more plants could follow these first plants. Otherwise, few new plants are likely to follow.

Existing federal incentives7 for the first few nuclear plants may hasten initial construction. Even if this occurs, nuclear power’s share of U.S. electricity generation is likely to drop over the next few decades. In fact, for nuclear power to maintain its current share—19 percent of U.S. electricity—the equivalent of 21

|

5 |

The IAEA’s high estimates (IAEA, 2008b) “reflect a moderate revival of nuclear power development that could result in particular from a more comprehensive comparative assessment of the different options for electricity generation, integrating economic, social, health and environmental aspects. They are based upon a review of national nuclear power programmes, assessing their technical and economic feasibility. They assume that some policy measures would be taken to facilitate the implementation of these programmes, such as strengthening of international cooperation, enhanced technology adaptation and transfer, and establishment of innovative funding mechanisms. These estimates also take into account the global concern over climate change caused by the increasing concentration of greenhouse gases in the atmosphere, and the signing of the Kyoto Protocol.” |

|

6 |

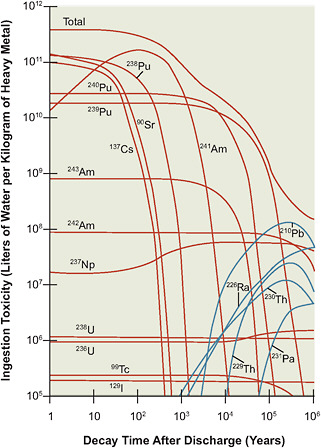

Both nuclear plants and coal plants with carbon capture and storage (CCS) present intergenerational issues: nuclear plants because of the very long-lived radioactive waste, and coal with CCS because of the need for stored CO2 to remain underground for long periods. However, the timescales differ by orders of magnitude. For radioactive waste, this timescale is on the order of a million years; for CO2 it is likely significantly less because of the availability of natural mechanisms for removing CO2 from the atmosphere (see Ha-Duong and Keith, 2003; Hepple and Benson, 2005). |

|

7 |

In addition to federal incentives for construction, the first few nuclear plants benefit from incentives for operation, such as the production tax credit. This is discussed in more detail in Box 8.5 in this chapter. |

new 1.4 GW plants would need to be built by 2030 (not including new plants built to replace any that may be retired during this period), according to the reference-case projections of the U.S. Energy Information Administration (EIA, 2008).8

The amount of new U.S. nuclear generating capacity that could reasonably be added before 2020 is limited; however, if the first handful of new evolutionary plants (about 5 plants) are constructed and are successful, the potential for nuclear power after 2020 will have much increased. Thus, deployment of the first few nuclear plants would be an important first step toward ensuring a diversity of sources for future electric supply. It may prove to be important to keep the option of an expanded nuclear deployment open, particularly if carbon constraints are applied in the United States in the future.

TECHNOLOGIES

The existing nuclear plants in the United States were built with technology developed in the 1960s and 1970s. In the intervening decades, ways to make better use of the existing plants have been developed, as well as new technologies that are intended to improve safety and security, reduce cost, and decrease the amount of high-level nuclear waste generated, among other objectives. These technologies and their potential for deployment in the United States are explored in the following sections.

Improvements to Existing Nuclear Plants

Over the last few decades, there have been significant technical and operational improvements in existing nuclear power plants. These improvements have allowed nuclear power to maintain an approximately constant share of U.S. electrical capacity, even as demand has grown and no new plants have been constructed. This trend of increasing output from current plants is likely to continue over the coming decades and, before 2020, could result in additional nuclear capacity comparable to what could be produced by new plants. The potentials for improvements are focused in the following three areas:

|

8 |

According to the EIA, U.S. electricity demand could rise by as much as 29 percent between 2008 and 2030. The reader is referred to footnote 14 of Chapter 7 of this report (“Fossil-Fuel Energy”) for a discussion of uncertainty in EIA projections. |

-

Existing plants can be modified to increase their power output;

-

Existing plants’ operating lives can be extended; and

-

Downtimes (periods when the plant is not producing power) can be further reduced.

Such improvements, which are far less expensive than constructing new nuclear plants and can be implemented comparatively rapidly, are discussed below.

Power Uprates

A plant’s power output can be significantly increased (uprated) by replacing the fuel with higher-power-density/longer-lived fuel and by modifying major plant components. The latter includes, for example, replacing turbines and major heat exchangers with more efficient versions. Uprates are a cost-effective way to increase energy production: they typically cost hundreds of dollars per added kilowatt (kW) of capacity, compared to as much as $3000–6000 (overnight cost9) per kilowatt of electricity for new nuclear plants (see section on “Costs”). To date, 7.5 gigawatts-electric (GWe)10—amounting to about 7.5 percent of the current U.S. nuclear generating capacity—have been added through uprates.11

Many plants have already planned capacity additions. In 2008 alone, the USNRC approved 10 upgrades to existing plants, adding a total generating capacity equivalent to about half of one new nuclear plant. Eleven applications are pending, and the USNRC expects 40 more applications through 2013.12 If

|

9 |

Overnight cost is the cost of a construction project if no interest was incurred during construction, as if the project was completed “overnight.” All costs are expressed in 2007 dollars. |

|

10 |

The electric power output of a nuclear power plant is often described in gigawatts-electric (or simply gigawatts [GW]). Similarly, the thermal power output of a nuclear plant is stated in gigawatts-thermal (GWt). The thermal power output is typically about three times the electric power output. This is because the thermal efficiency of nuclear plants (the efficiency of converting heat to electricity via a steam turbine generator) is typically around 33 percent. |

|

11 |

The USNRC’s list of approved uprate applications is available at www.nrc.gov/reactors/operating/licensing/power-uprates/approved-applications.html; accessed July 2009. |

|

12 |

In 2008, applications were approved for capacity additions of about 2178 MWt. This would result in about 720 MWe of new electric generating capacity. New plants are assumed to have a capacity of 1.35 GWe. Pending applications represented a total of 973 MWe of capacity additions as of July 2009, and applications expected at that time represented 2075 MWe of capacity additions. The USNRC’s lists of pending and expected applications are available at www.nrc.gov/reactors/operating/licensing/power-uprates/pending-applications.html (pending) and www.nrc.gov/reactors/operating/licensing/power-uprates/expected-applications.html (expected); accessed July 2009. |

approved and undertaken, these uprates would add about 3 GWe—the equivalent of about 2 new nuclear plants—in the near term.

Operating License Extensions

More power can be also be generated over the lifetimes of existing plants by extending their operating licenses. In the United States, the initial license term for a nuclear power plant—40 years—is subject to extensions in increments of up to 20 years.13 In the 1990s, the USNRC established a regulatory system to assess applications for such extended licenses.

In the majority of cases, the owners of the currently operating U.S. plants will seek to extend plant licenses for an additional 20 years, to 60 years’ service in total. As of July 2009, 56 plants had received 20-year extensions, 16 plants were in the queue for approval, and 21 more had announced their intent to seek license extensions.14 The original 40-year limit was not technically based, but some technical challenges are involved in extending operating licenses because some structures and components may have been engineered assuming a 40-year operating life. This limitation will be avoided in new plants, which are being designed to ensure that components with expected lifetimes of less than a projected plant life of 60 years can be replaced readily.

The industry has begun to assess whether it would be technically feasible and economic to extend current plant operating licenses for an additional 20-year period beyond 60 years (to 80 years). The plant modifications that might be required for another 20-year extension are potentially more difficult and expensive than those for the first 20-year extension. Degradation phenomena that affect the performance of plants operating for as long as 80 years are not well understood at a fundamental level, and further research is needed prior to decisions about further license extensions. At this point, it is not clear whether the option will be practical, although there will be strong economic incentives to pursue it.

The USNRC, the U.S. Department of Energy (DOE), and industry are considering what research and development (R&D) will need to be done to prepare for the possibility of extending plant operating licenses beyond 60 years. Although participants in an USNRC/DOE workshop held in February of 2008 “did not

|

13 |

This was provided for in the Atomic Energy Act of 1954. |

|

14 |

The USNRC’s list of current and expected operating life extensions is available at www.nrc.gov/reactors/operating/licensing/renewal/applications.html; accessed July 2009. |

believe there is any compelling policy, regulatory, technical or industry issue precluding future extended plant operation” (USNRC/DOE, 2008), many areas were identified where R&D should begin soon. They included irradiation effects on primary structures and components (such as the reactor vessel, reactor coolant system piping, steam generators, pressurizer, and coolant pumps), aging effects on safety-related concrete structures, aging effects on safety-related cable insulation, and inspection capabilities for aging mechanisms.

Much of the equipment that is of concern is embedded in the structure of the plant and would be expensive and time-consuming to replace. Thus many of the issues imposed by plant lifetime extensions and materials aging require ways of nondestructively assessing the status of operating plants. New scanning systems are being developed, but further research is needed, particularly in light of the regulatory decisions that could rely on these inspections.

Decreasing Downtimes

Finally, more power can be generated over the course of a year by reducing the periods when the plants are not producing electricity. Existing plants have been operated with increasing efficiency over time, and average plant capacity factors (averaged across all operating nuclear plants) have increased markedly, from 66 percent in 1990 to 91.8 percent in 2007 (NEI, 2008). Nuclear plant operators in the United States have succeeded in reducing downtimes primarily through increased on-line maintenance as well as through efforts to plan outage times so as to ensure that necessary work is done quickly and efficiently.

As a result of such improvements, refueling outages—which are also used to perform necessary maintenance on the reactor—were reduced to an average of 40 days in 2007 (averaged across all currently operating U.S. plants) from 104 days in 1990. Based on the accomplishments of the best-performing plants to date, in the future these downtimes may be reducible to an average of 25–30 days while maintaining currently high levels of safety and reliability.

Nuclear Reactor Technologies15

A nuclear reactor generates heat by sustaining and controlling nuclear fission, and that heat is converted to electricity. The dominant use of nuclear reactor technol-

|

15 |

For a more thorough treatment of many of the issues reviewed briefly in this section, see Annex 8.A. |

ogy is in commercial nuclear power plants, which contribute baseload16 electric power generation.17 Nuclear plants can each include one or more nuclear reactors.

The waste heat18 from nuclear reactors can be utilized as well. For example, several countries, including Russia and the Ukraine, use nuclear reactors for cogeneration (or combined heat and power [CHP]). Particularly effective in cold regions, CHP uses waste heat from nuclear reactors to create steam, which is piped to heat surrounding areas. Such systems in nuclear plants have been discussed in the United States, but they are not currently deployed. In other countries (for example, Japan, India, and Pakistan), waste heat from nuclear plants is used for desalinization of seawater.

The majority of reactors used for electricity generation around the world are pressurized water reactors (PWRs) and boiling-water reactors (BWRs), reactors that are collectively referred to as light-water reactors (LWRs)—that is, they are thermal reactors (see Box 8.1) that use ordinary water both as the coolant and as the neutron moderator. These are the only reactor technologies currently used in the United States for commercial power production, where 69 PWRs and 35 BWRs are currently in service.

New nuclear reactor designs have been developed in the decades since these plants were deployed. In the sections that follow, the committee discusses these new designs, which are grouped into two categories:

-

Evolutionary reactor designs, which are modifications that have evolved from LWR designs currently operating in the United States

-

Alternative reactor designs, which range from more significant modifications of currently deployed designs to entirely different concepts

|

BOX 8.1 Fast Reactors and Thermal Reactors Nuclear reactors are often classified as “fast” or “thermal” reactors. This nomenclature refers to the energy of the neutrons that sustain the fission reaction. In fast nuclear reactors, the fission reaction is sustained by neutrons at higher energies (“fast” neutrons); in commonly deployed thermal reactors, such as light-water reactors, the fission reaction is sustained by lower-energy (“thermal” neutrons). Fast and thermal reactors are distinguished by the presence or absence of a material known as a “neutron moderator,” or simply “moderator.” This material is present in thermal reactors but not in fast reactors. Collisions with the moderator slow the neutrons emitted by fissioning nuclei to thermal energies. |

In the next few decades, the majority of the new nuclear plants constructed in the United States will be based on evolutionary reactor designs. In most cases, alternative reactor designs will require significant development efforts before they can be ready for deployment.

Evolutionary Reactor Designs

Any new nuclear plants constructed before 2020 will be evolutionary designs that are modifications (often significant) of existing U.S. reactors. These designs are intended to improve plant safety, security, reliability, efficiency, and cost-effectiveness. Some evolutionary designs include passive safety features that rely on natural forces, such as gravity and natural circulation, to provide cooling in the case of an accident. These features are intended to reduce capital cost while further enhancing safety margins.

Several evolutionary reactor designs will be ready for deployment in the United States after the USNRC completes design certification.19 In some cases, this could occur as soon as 2010 or 2011. Evolutionary reactors have already been built in Japan and South Korea, and they are under construction in India, France, and Finland. U.S. utilities have expressed potential interest in building plants with the following designs in the United States: the U.S. evolutionary power reactor (USEPR), the economic simplified boiling-water reactor (ESBWR), the advanced boiling-water reactor (ABWR), the AP-1000, and the advanced pressurized water

reactor (APWR). These designs are all modifications of current-generation LWR designs.20

Because construction of new nuclear plants is likely to require a long lead time, the first deployment of evolutionary nuclear reactors in the United States is unlikely to be until after 2015. Typical construction times for foreign plants have ranged from 4 to 7 years for plants that began construction in the last decade (IAEA, 2008c). Lead times for licensing and large component fabrication can also run to years. Current plans (as of July 2009) suggest that about 5–9 new nuclear plants could be on line in the United States by 2020, and a more substantial deployment of these plants may occur after 2020 if these first plants built in the United States meet cost, schedule, and performance targets. Moreover, actual construction will also depend on many other factors, including comparative economics and electrical demand.

Further R&D over the next decade could lead to efficiency improvements both in existing reactors and in evolutionary LWRs. Some of the key areas for continuing research include the following:

-

Improved heat transfer materials, such as high-temperature metal alloys, are being developed to improve efficiency by allowing for higher operating temperatures. Some of these materials may be available after 2025. Widespread application is likely between 2035 and 2050.

-

Coolant additives, such as very dilute additions of nanoparticles, can improve the heat transfer capabilities of the coolant in current and evolutionary LWRs. Twenty years or more are likely needed to develop the additives and redesign current reactors for their use.

-

Annular fuel rods could allow plants to produce significantly more power than traditional cylindrical fuel rods do. At least 10 years of work will be needed for regulatory approval and commercial-scale deployment in existing LWRs.

|

20 |

The ABWR and AP-1000 designs are currently certified by the USNRC, but applications for amendment have been received for the AP-1000 and are expected for the ABWR. The USNRC is currently reviewing design certification applications for the ESBWR, the USEPR, and the US-APWR designs. The review of the amended AP-1000 design and the ESBWR is targeted for completion in 2010, and for the USEPR and US-APWR in 2011. Available at www.nrc.gov/reactors/new-reactors/design-cert.html; accessed July 2009. |

-

Higher burn-up fuel would allow a larger percentage of the fissionable content of the fuel to be used. Thus operating cycles could be prolonged, and the heat load21 and total amount of used nuclear fuel22 to be stored or disposed of could be reduced.23 This is a program of continuous improvement, but for significant breakthroughs, basic research will be required, particularly on fuel-rod swelling due to buildup of fission products and the resulting risk of cladding breach.

-

Digital instrumentation and control (DI&C) research offers opportunities to improve control systems and to enhance control-room designs so as to facilitate appropriate operator action when needed. New LWRs will have fully integrated DI&C, and more research will be needed on the safety implications of an increased reliance on digital systems. Understanding the full implications of DI&C is likely to prove to be a long-term effort, despite the reliance on DI&C in the near term.

These types of R&D could improve both current and evolutionary reactors. However, evolutionary reactor technology is technically ready for deployment, and no major additional R&D is needed for an expansion of nuclear power through 2020, and likely through 2035.

Alternative Reactor Designs

In addition to the evolutionary reactor designs just discussed, alternative nuclear reactor designs are being developed (and, in some countries, have been used).24

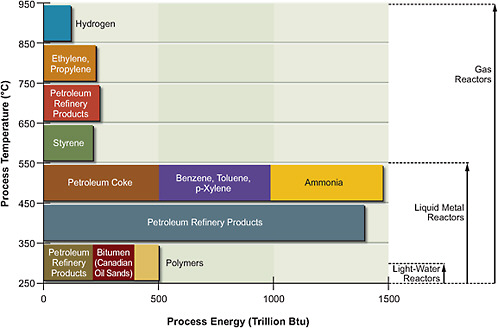

These reactors range from more significant modifications of currently operating U.S. reactors to completely different concepts. Many new alternative reactor designs are intended to increase safety and efficiency and improve economic competitiveness, as well as to perform missions beyond electricity production.

The alternative reactor technologies that could be deployed in the United States include fast and thermal reactor designs. Both include modular designs as well as designs modified for high-temperature heat output (potentially for applications such as hydrogen production). Alternative fast reactor designs also include “burner” reactors—reactors intended to reduce the long-lived high-level radioactive waste burden by destroying transuranic25 elements—and “breeder” reactors—reactors intended to create more fissile material than is consumed.

Some alternative thermal reactor designs, including small modular LWRs, could be deployed in the United States shortly before or after 2020. For example, NuScale, Inc., has expressed interest in deploying a 45-MWe design before 2020. In addition, under the Next Generation Nuclear Plant (NGNP) program, the DOE is continuing to develop a commercial-scale prototype very-high-temperature reactor (VHTR)26 that would produce not only electricity but also process heat for industry. Hydrogen production is a possibility as well if materials—particularly for the heat exchangers and hydrogen process equipment—able to withstand the necessary high temperatures can be developed.27 The DOE requested expressions of interest in April 2008 for a demonstration high-temperature nuclear plant that could produce hydrogen and electricity;28 current plans are for start-up in 2018–2020.

|

25 |

“Transuranic elements” (also known as transuranics or TRU) are elements with an atomic number greater than uranium—that is, having nuclei containing more than 92 protons. Examples of transuranics are neptunium (atomic number 93), plutonium (94), and americium (95). |

|

26 |

The NGNP will have somewhat lower outlet temperatures than originally envisioned for a VHTR. |

|

27 |

At a briefing of the Nuclear Energy Advisory Committee (NEAC) in September 2008, DOE staff stated that they had reduced their high-temperature goal to 700–800°C because they did not have materials suitable for operation at higher temperatures. This situation makes hydrogen production problematic for the near term. |

|

28 |

The DOE’s request for expressions of interest for high-temperature nuclear plants is available at nuclear.gov/pdfFiles/NGNP_EOI.pdf; accessed July 2009. |

In contrast, many R&D issues must be successfully addressed before fast reactors—particularly fast burner reactors—can be expected to make a contribution to U.S. energy production. A great deal of engineering development work will be required to move these reactor designs from the drawing board through prototypes and pilot plants to full-scale facilities. In addition, further study will be needed to improve reliability and reduce costs (some experts have estimated fast reactors may cost between 10 and 30 percent more than LWRs, as discussed in the section titled “Cost of Alternative Plant Designs and Fuel Cycles” later in the chapter).

While other types of fast reactors are under investigation, fast burner reactor technology has been emphasized in the United States because of concerns about high-level radioactive waste management. In principle, by using alternative fuel-cycle technologies, transuranics from used fuel can be incorporated into burner reactor fuel and then fissioned, as discussed in more detail in the following section. This option has the potential to reduce the volume and heat load of residual high-level radioactive waste that needs to be managed for very long times.29 Fast reactor technologies are not new, and historically, those that have been deployed have experienced problems.30 But it is the committee’s judgment that, although deployment should not be pursued at present, the long-term potential provides justification for a continued R&D program on fast burner reactors and associated fuel-cycle technologies.31 If this R&D is undertaken, the committee judges that the first generation of fast burner reactors to transmute nuclear wastes has the technological potential to come on line after 2025, and they could be deployed commercially after 2035 if they prove economically competitive.

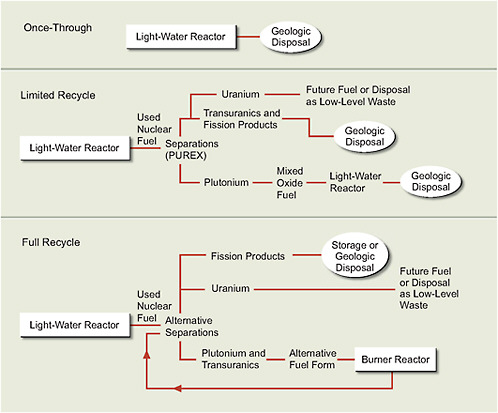

Alternative Fuel Cycles32

Nuclear fuel cycles are divided into two major categories: once-through, in which the fuel is removed from the reactor after use and disposed of, and closed, in which the used fuel is recycled to extract more energy or to destroy undesirable isotopes. Recycling used fuel requires several steps, including chemical or electrochemical processing to separate the fissionable parts of the used fuel and to enable the fabrication of new fuel,33 which can then be utilized in a reactor. To achieve high efficiency for burning or breeding, multiple repetitions of this process are required.

The United States currently uses a once-through fuel cycle, though U.S. policy on closing the nuclear fuel cycle has varied over time.34 As of the writing of this report, the Obama administration had announced plans to pursue “long-term, science-based R&D … focused on the technical challenges of the back end of the nuclear fuel cycle” but not to pursue near-term commercial demonstration projects for closed fuel cycle technologies at present.35

Closed fuel cycle technologies (for either burning or breeding) are not needed to enable the near-term expansion of nuclear power in the United States, at least until 2050. Uranium supplies are sufficient to support a worldwide expansion of nuclear power using a once-through fuel cycle for the next century. Moreover, used fuel from even a greatly expanded nuclear fleet can be safely stored for up to a century (APS, 2007; Bunn, 2001), with or without a licensed geologic repository. In addition, a closed fuel cycle raises proliferation issues that

|

32 |

The term “fuel cycle” describes the life cycle of a nuclear reactor’s fuel. For a more thorough treatment of many of the issues reviewed in this section, the reader is referred to Annex 8.B (“Alternative Fuel Cycle Technologies”). |

|

33 |

In addition to new fuel, it is also technically possible to form transuranic targets, which are specialized assemblies designed for burning transuranics in thermal reactors. This possibility is discussed in Annex 8.B. |

|

34 |

The Nixon administration supported closing the fuel cycle. The Ford and Carter administrations opposed it. Under the Reagan administration, reprocessing again became a possibility, but industry concluded that it was not economic. The first Bush administration followed the lead of the Reagan administration, but the Clinton administration opposed the use of reprocessing. The policy of the second Bush administration was to establish a geologic repository at Yucca Mountain, Nevada, for the disposal of used fuel, and it also wished to implement a program that would explore closing the fuel cycle in the longer term while pursuing a limited recycle option in the near term. As part of this program, a specific closed fuel cycle was selected for investigation by the DOE. There is no legal bar to reprocessing in the United States today. |

|

35 |

Available at www.neimagazine.com/story.asp?sectionCode=132&storyCode=2052719; accessed July 2009. |

have not been resolved.36 The benefits and drawbacks of deploying closed fuel cycles in the United States are currently being debated, as discussed in Box 8.2.

To implement closed fuel cycles, separations technologies are needed to process the used fuel so that it can be formed into new fuel. The current-generation technology for such recycling is plutonium and uranium extraction (known as PUREX), which is well understood and could be deployed in the United States after 2020,37 but it carries a significant proliferation risk.38 Alternatives to PUREX currently under investigation include both evolutionary modifications of PUREX and entirely different separations technologies. A modified PUREX technology currently under development that allows some amount of uranium to remain in the plutonium stream would be somewhat more proliferation resistant than is PUREX,39 but it would not likely be commercially deployable until well after 2020.40 Other separations technologies, intended to further improve proliferation resistance as well as to reduce the volume and long-term radioactivity of the waste, are even farther from the commercial deployment stage. These technologies include UREX+ (a suite of aqueous processes best suited for oxide fuels such as those used in LWRs) as well as electrochemical separations.41 Neither process is likely to be available for commercial-scale deployment before 2035.

|

BOX 8.2 Recycling of Used Nuclear Fuel Concerns about proliferation could discourage the United States from pursuing the commercialization of used fuel recycling at present.1 Current technology for separations, plutonium and uranium extraction (PUREX), poses a proliferation risk, and modifications of PUREX to increase proliferation resistance do not greatly improve the situation. Some suggest that if the United States were to deploy recycle technologies (or, some argue, even pursue further R&D on them), it would become more difficult to stop other countries from doing the same. But others argue that the United States could positively influence recycling elsewhere by developing and deploying technologies that are more proliferation resistant than PUREX. Although future R&D may develop more proliferation resistant options, these options are highly unlikely to be entirely proliferation resistant. True proliferation control will require strong international arrangements to supplement technical advances, and developing such arrangements will require considerable time and effort. It is the judgment of the committee that, at present, used fuel recycling does not appear to be a promising option for commercialization in the United States before 2035. However, the committee believes that a continuing R&D program on alternative fuel cycles is justified, as there may be a need for such technologies in the future. |

Further R&D will help to clarify the trade-offs between the risks and benefits involved in the use of recycle technology. For example, if proven technically successful and economic, burning fuel cycles (intended to reduce the volume of long-lived high-level radioactive waste) could, over the long term, substantially change the discussion on storage and disposal of radioactive waste. If a major fraction of the transuranics in high-level waste could be transmuted into shorter-lived fission products with half-lives of 1000 years or fewer, the waste-disposal challenge would involve managing the waste for thousands of years rather than hundreds of thousands of years. In addition, the number of geologic repositories needed to isolate long-lived high-level radioactive waste has the potential to be significantly reduced.42 However, significant technology challenges must be overcome before

burning fuel cycles could be ready for commercial deployment. Overall, it is the judgment of the committee that the potential benefits of burning fuel cycles are sufficient to justify continuing long-term R&D, but that the technologies are not yet ready for near-term deployment. Two major categories of burning fuel cycles—full recycle and limited recycle—as well as associated technology challenges are briefly discussed in the paragraphs that follow.43

A full recycle program (such as that envisioned by the second Bush administration) would involve processing used fuel, making new fuel using some of the recovered material, and using that fuel in fast burner reactors (discussed in the section titled “Nuclear Reactor Technologies”). This sequence would be repeated multiple times to destroy transuranics.44 A fully closed fuel cycle would be designed to significantly reduce the volume of long-lived waste produced per kilowatt-hour, but this transmutation would never burn 100 percent of the long-lived isotopes. Hence a repository, or repositories, capable of sequestering very long-lived high-level civilian waste might still be needed.45 In addition, a larger quantity of low-level waste46 would be produced, primarily during used fuel processing and new fuel fabrication. Further R&D is needed in order for any fully closed fuel cycle to be ready for deployment, with long-term goals of this effort being reduction of the cost and proliferation risk of fuel cycle processes and their associated facilities. If such R&D were initiated, the committee judges that a fully closed fuel cycle could be reasonably deployed sometime after 2035 if shown to be economically competitive.

|

43 |

Many of these technologies are discussed in more detail in Annex 8.B as well as in a previous National Research Council report on the DOE’s nuclear energy R&D program (NRC, 2008). |

|

44 |

A large number of burner reactors would be required to enable full recycle; however, such a system has not been planned in detail, and the exact ratio of fast reactors to LWRs required is not well known. |

|

45 |

A repository for managing waste over hundreds of thousands of years would almost certainly be required for high-level defense waste. |

|

46 |

Low-level waste is a general term for a wide range of wastes having generally lower levels of radioactivity. See www.nrc.gov/reading-rm/basic-ref/glossary; accessed in July 2009. |

Alternatively, options for burning transuranics using limited recycle in thermal reactors—such as inert matrix fuel and transuranic targets47—are also currently being investigated. Under these options, the used fuel from LWRs would be processed to separate plutonium and uranium from transuranics and other elements. In principle, new fuel or targets would then be formed (incorporating the transuranics to be destroyed), and some fraction of the transuranics would be burned in thermal reactors.48 If successfully demonstrated and shown to be cost-effective, limited recycle could reduce the long-lived high-level waste burden without introducing the complication of fast reactors. (However, with repeated passes, a state of diminishing returns would be reached, and ultimately, a fast neutron spectrum would be required to continue to destroy transuranics.) For these technologies, more R&D as well as subsequent regulatory approval will be required if they are to be deployable between 2020 and 2035. As is the case with many of the alternative concepts, the economic viability of the approach is very uncertain.

Based on the preceding discussion, it is clear that pursuing alternative fuel cycle options (including burning fuel cycles) will require a resource-intensive and time-consuming R&D program. This finding is consistent with the conclusions of a recent National Research Council study that examined the DOE’s nuclear energy R&D programs (NRC, 2008). Initially, further research would need to be done in comparing the various architectures for closing the fuel cycle; this effort would enable judicious selection of any specific architecture for eventual deployment. Moreover, the architecture for the fuel cycle would have to be coupled with a waste-disposal regime, and R&D would be needed before any of these fuel cycles would be ready for deployment, with the exception of mixed oxide (MOX)/PUREX. But that fuel cycle has significant proliferation risks. Indeed, any closed fuel cycle based on current designs is likely to be more expensive and to result in more proliferation risk than a once-through fuel cycle. Closed fuel cycle R&D should be directed toward solving these problems, and any alternative fuel cycle that is ultimately deployed should be designed to minimize stockpiles of separated weapons-usable materials.

|

47 |

These options are discussed in more detail in Annex 8.B. |

|

48 |

Limited recycle is currently being applied outside the United States, where mixed-oxide (MOX) fuel is formed from used LWR fuel and utilized in commercial reactors. However, MOX fuel as currently implemented is not effective for destroying long-lived transuranics such as americium and neptunium, which are included in the waste stream. Under the limited recycle option, used MOX fuel is disposed of as high-level waste. |

Fusion Energy

In principle, nuclear fusion49 could offer a virtually unlimited supply of energy with significantly reduced (and shorter-lived) quantities of radioactive waste. Over the last 50 years, many countries (the United States, Russia, Japan, the United Kingdom, and others) have investigated the concept of controlled fusion for electricity production (NRC, 2004). There is a multinational effort under way to develop a “burning plasma”50 machine, the International Thermonuclear Experimental Reactor (ITER), by 2025.51 ITER is intended to provide the information needed to assess the practicality and cost of a fusion reactor. If successful, fusion reactors would be unlikely to be ready for commercial deployment until after 2050, absent some major breakthrough.

COSTS

The cost of uprating an existing nuclear plant to increase its power output can be reasonably well estimated; however, the costs of new nuclear technologies are uncertain. There has been recent interest in building evolutionary nuclear plants, for example, but companies’ estimates of costs for construction vary widely. And the costs of alternative plants and fuel cycles are even less clear at this point. These cost issues are discussed in the following sections.

Costs of Improvements to Current Plants

Improving current nuclear plants for the purpose of increasing power output or extending operating lifetimes is significantly less expensive per kilowatt of capacity than constructing a new plant. Depending on the type of uprate, plant uprates can cost from hundreds of dollars to about $2000 per added kilowatt of capacity, while new plants could cost as much as $6000/kW (overnight cost), as noted in the section to follow. For a plant license extension to 60 years, there is the expense of developing the associated documentation (approximately $50–60 million), and

in many cases there also are costs associated with replacing or modifying structures or components for longer operating life. As in the case of uprates, these expenses are small in comparison to those of new plants.

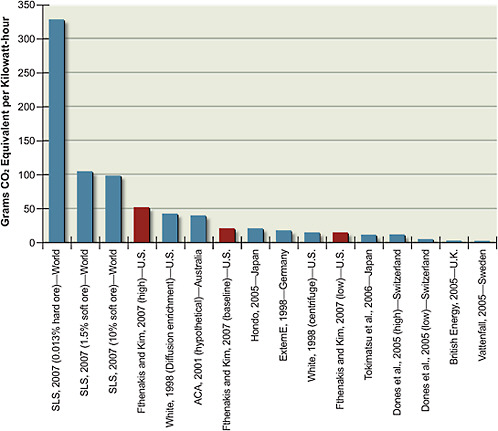

Costs of Electricity from Evolutionary Plants52

While the costs of building a nuclear power plant are relatively high, the costs for fuel, operations, and maintenance are relatively low. Because most nuclear power plants in operation in the United States have been fully amortized, the average operating cost of electricity from the current fleet of plants is modest—1.76¢/kWh in 2007—less on average than all other sources, with the exception of hydropower.53 Although operating costs are likely to be low for new plants as well, the levelized cost of electricity (LCOE)54 is likely to be relatively high because of the substantial construction costs. (See Box 8.3 for a discussion of the distinction between electricity cost and price.)

Recent cost estimates55 for new nuclear plant construction differ by over a factor of two, in part because of the recent dramatic escalation in construction and materials costs that have affected construction costs for all types of energy facilities. Thus there is considerable uncertainty regarding any estimates now in the literature, as present conceptions of future costs are in flux. Another part of the uncertainty reflects the absence of recent U.S. experience.

The AEF Committee has developed estimates of the LCOE for new evolutionary nuclear plants using these recent cost estimates as a starting point and

|

52 |

For a more thorough discussion of the committee’s cost estimates, reviewed briefly in this section, the reader is referred to Annex 8.C (“Projected Costs for Evolutionary Nuclear Plants”). The estimates discussed in this section are limited to evolutionary reactor designs and assume a once-through fuel cycle. |

|

53 |

This information is available at www.nei.org/resourcesandstats/documentlibrary/reliableandaffordableenergy/graphicsandcharts/uselectricityproductioncosts/. |

|

54 |

The levelized cost of electricity at the busbar encompasses the total cost to the utility—including interest costs on outstanding capital investments, fuel costs, ongoing operation and maintenance (O&M) costs, and other expenses—of producing the power on a per-kilowatt-hour basis over the lifetime of the facility. This is not the same as the price of electricity to the consumer, particularly in states that have restructured their electricity markets. |

|

55 |

The range of estimates for the levelized cost of electricity is discussed in more detail in Annex 8.C. Multiple primary cost estimates were relied on by the committee (including Scroggs, 2008; Moody’s Investor’s Service, 2008; NEI, 2008b; Keystone Center, 2007; Harding, 2007). |

|

BOX 8.3 Levelized Cost of Electricity Versus Electricity Price In restructured markets, the price of electricity to the consumer is related to the cost of electricity to the distribution utility—as opposed to the cost to the merchant owner of the plant to produce that electricity. Utilities can either negotiate long-term contracts with independent power producers (IPPs) or buy electricity in the spot market from the IPPs.1 In that market, the electricity price the utility must pay reflects the price of the most expensive electricity in the dispatched mix (the clearing price), rather than the levelized cost of electricity (LCOE) for a given plant. Thus for lower-priced sources of electricity, the utility may have to pay significantly more than the LCOE to the IPP, if the IPP can provide the power from a low-cost source. In recent years, the use of nuclear power plants has generally been very profitable for merchant producers because the prices they have obtained have generally been the much higher prices for electricity produced by natural gas plants. |

assuming that the plants come on line in 2020.56 Estimates were obtained for two distinct cases: plants built by investor-owned utilities (IOUs) and those built by independent power producers (IPPs).57 The cost of nuclear power at the busbar58 is sensitive to the return on investment because of the high capital costs associ-

|

56 |

The committee gathered ranges for the key modeling parameters from a variety of sources, with the help of a workshop that was convened in March 2008. Stakeholders in attendance reflected diverse viewpoints, including those prevalent in industry, nonprofits, and academia. The committee used these parameter ranges (discussed in detail in Annex 8.C) in a spreadsheet calculation based on the economic model developed for the 2007 study by the Keystone Center (2007) and supplemented by a Monte Carlo analysis. Thus, these costs are not forecasts or predictions, but rather the result of an analytical exercise based on available but imperfect data. |

|

57 |

Vertically integrated (typically investor-owned, but also municipal and public) utilities own generating plants as well as the transmission and distribution system that delivers the power to their customers. In the past, this was the dominant model, but restructuring of the electricity market in some states has transformed the industry. In restructured markets, generation, transmission, and distribution may be handled by different entities. For example, independent power producers (IPPs) may sell power to distribution utilities or even directly to end users. |

|

58 |

The “cost at the busbar” refers to the cost to the electricity producer; it does not include transmission or distribution costs. |

ated with nuclear power.59 In addition, a risk premium is likely to be expected by investors in plants built by IPPs because of the absence of the financial protections afforded to a regulated entity. For baseload electricity, cost comparisons between different options can be helpful to decisionmakers. The committee used different but comparable methods to estimate the LCOE for future nuclear and fossil plants (see Box 8.4).

For new nuclear plants that may be constructed between 2008 and 2020 the committee estimates that the LCOE from plants built by IOUs will fall between 8¢/kWh and 13¢/kWh and that the LCOE for plants built by IPPs will also be 8¢/kWh to 13¢/kWh, in 2007 dollars.60 These ranges assume an overnight construction cost of between $3000 and $6000 per kilowatt, and a 4–7 year construction period.61 These cost estimates also rely on several financial parameter ranges listed in Annex 8.C of this report, including a central debt-to-equity ratio of 60:40 for IPPs and 50:50 for IOUs. These estimates do not account for any current or future federal incentives for new plant construction.

In some cases, companies interested in building nuclear power plants have stated that their financial assumptions include an 80:20 debt-to-equity ratio (Turnage, 2008). Such a financing structure is likely to require federal loan guarantees—for example, those included in the Energy Policy Act of 2005 (discussed in more detail in Box 8.5). The committee estimated the LCOE of new nuclear plants using an 80:20 debt-to-equity ratio, and assuming that federal loan guarantees for 80 percent of the eligible project costs are acquired. These incentives could result in a significant reduction in financing costs, and ultimately a lower LCOE at the busbar: the estimated range decreases to 6–8¢/kWh both for

|

59 |

The financial parameter ranges used for the cost calculations are shown in Table 8.C.1 in Annex 8.C. |

|

60 |

Although the costs of equity capital are likely to be cheaper for investor-owned utilities (IOUs), they are likely to take on a larger equity share than IPPs. For this and other reasons, including differences in the duration of equity repayment, the levelized cost of electricity (LCOE) for IOUs and IPPs turn out to be in the same range. However, it should be borne in mind that the ability of an IPP to compete in a restructured market depends more on the early year costs of electricity than the LCOE. Because the cost in the early years is generally greater than the LCOE, the IPP numbers here are not definitive in assessing the market competitiveness of IPP nuclear plants. |

|

61 |

These ranges encompass most of the values found in the open literature. A factor of 0.8 (derived using the Keystone spreadsheet used by the committee) was used to convert some all-in cost estimates to overnight costs, where appropriate, for comparison. |

|

BOX 8.4 Comparing the Methodologies Used to Determine Costs of New Nuclear and Fossil-Fuel Power Plants Nuclear and fossil-fuel-fired power plants provide baseload electricity supply, and a comparison of their potential cost ranges is likely to be helpful in guiding decision making. However, when making these comparisons using the data shown in this report, it should be noted that slightly different (but comparable) methodologies and assumptions have been used to estimate the ranges of potential LCOE from new fossil-fuel-fired power plants (with and without carbon capture and storage [CCS]) and from new nuclear power plants. (A discussion of the LCOE for intermittent renewable electricity sources, as well as of other energy technology options, such as energy efficiency technologies, can be found in Chapter 2.) The methodologies for estimating the LCOE for nuclear plants and fossil-fuel plants differ, at least in part because different consultants assisted the committee in developing the LCOE estimates. Although both nuclear and fossil-fuel plants provide baseload electricity and both of them are capital intensive, several of the underlying assumptions needed to calculate the LCOE are not identical. For example, a 20-year financing period was used to estimate the LCOE for new coal plants with CCS, while a 40-year financing period was used for new nuclear plants. A 20-year financing life is appropriate for a new technology such as CCS (whereby the first few plants may not operate for as long as later versions), while evolutionary light-water reactors are a more mature technology and thus more likely to operate for 40 to 60 years or beyond. In addition, the LCOE for coal plants with CCS drops between 2020 and 2035 as more experience is gained in building plants in the United States. The same reasoning has not been applied to nuclear plants, although some vendors expect that construction costs will be reduced over time, as there is more experience in constructing them. The LCOE for new nuclear plants does not change in current-year dollars between 2020 and 2035. Overall, the LCOE ranges for new coal plants with CCS and new evolutionary nuclear power plants appear to be comparable, as shown in Chapter 2 of this report. |

IOUs and for IPPs.62 The IPP first-year cost in this case is estimated to be between 7¢/kWh and 9¢/kWh. When the full 80 percent is guaranteed by the federal gov-

|

62 |

With the exception of the debt-to-equity ratio (80:20), the value used for return on debt (4 percent), and the addition of the loan guarantee fee required by the DOE, the assumptions are the same for this calculation as for the previous ranges. The details of these calculations can be found in Annex 8.C. |

|

BOX 8.5 Federal Incentives for New Nuclear Construction There are many policies that influence the viability of nuclear power in the United States.1 In particular, several federal incentives for nuclear power are in place that could affect the potential for nuclear power plant construction. The primary ones are the federal loan guarantees and production tax credit (PTC) included in the Energy Policy Act of 2005 (EPAct05).2 This law allows for a 1.8¢/kWh PTC for new nuclear power facilities for an 8-year period after the plant is placed in service (and before 2021) for the first 6000 MWe of installed capacity brought on line before 2021. This PTC could help the first few nuclear plants compete, but it does not change the cost of generating electricity. The loan guarantees are likely to have a larger effect. EPAct05 allows the Secretary of Energy, after consultation with the Secretary of the Treasury, to provide loan guarantees for up to 80 percent of eligible project costs for nuclear plant construction. It is not yet clear if the $18.5 billion loan guarantee allocation for nuclear projects contained in the 2008 Energy and Water Development Appropriations Act will be sufficient to guarantee four to five new plants, which is the number the committee judges would be needed to demonstrate that new nuclear plants can be built on schedule and on budget in the United States. The DOE issued a loan guarantee solicitation announcement in June 2008, and the Part 1 applications that were filed in response to this solicitation requested a total of $122 billion. To obtain a loan guarantee the licensee must pay a fee that is designed to cover the default risk, given a licensee’s credit rating. This “loan guarantee subsidy fee” covers the estimated long-term cost to the government of the loan guarantee,3 calculated on a net present value basis. The exact value of these fees has not been released by the DOE, but according to the agency’s website (www.lgprogram.energy.gov, accessed May 12, 2009), they will be in accordance with the methods for calculating loan guarantee subsidy costs outlined in OMB Circular A-11, part 185.4 Using information from that circular, Standard and Poor’s has attempted to estimate potential ranges for the subsidy fee (although the precise methods of calculation of the fee are not publicly available). It found that, “[f]or example, if a 1,000 MW nuclear unit built at $6,000 per kilowatt, with 80% financing from the FFB, is rated ’BB-’ with |

ernment, the standard government loan-guarantee rules require that the government itself allocate and provide the capital for the investment, which is repaid by the entity receiving the guarantee; presumably over a 30-year period in this case. A fee is also charged (loan guarantee fee) to cover the risk of failure to repay the loan. The magnitude of this fee is to be estimated by the DOE based on guidance from credit rating agencies.

|

a recovery of 70%, the subsidy cost would be a substantial $288 million while a ’BB’ rated project at the same recovery may have to pay about $192 million”5 (Standard and Poor’s, 2008). These guarantees will allow a high percentage of debt compared to equity (as much as 80 percent), which means lower average financing costs, for two reasons. First, the cost of debt is less than the cost of equity. Second, a loan guarantee means that the interest on the debt will be less than the interest that would otherwise be required. The total reduction in financing costs could result in a significantly lower levelized cost of electricity (LCOE) at the busbar, as discussed in more detail in the “Costs” section of this chapter. |

Overall, these costs seem very high compared to average wholesale electricity prices (5.7¢/kWh in 2007),63 but they may not seem so high in the future if price trends for primary fuels continue or if constraints or fees are placed on carbon

emissions.64 Finally, it should be reemphasized that such calculations, while useful, are not predictions of the future.

Cost of Alternative Plant Designs and Fuel Cycles

It is difficult to project the cost of electricity generated from plants using alternative advanced nuclear plant designs and fuel cycles. Some alternative plant designs may offer cost decreases resulting from reduced quantities of steel and concrete used in construction (Peterson, 2008), but in general, plants incorporating alternative reactor designs are likely to be significantly more expensive to construct than LWRs are. For example, a Russian expert estimated that construction costs for sodium-cooled fast reactors could be 10–15 percent more expensive than LWRs, although this range was based on limited analysis (Ivanov, 2008); the DOE estimated that fast reactors (intended to be deployed as part of the Advanced Fuel Cycle Initiative program under the Bush administration) could be as much as 30 percent more expensive than LWRs (Lisowski, 2008). As for any electricity source, in addition to construction costs, the LCOE will also depend on the capacity factor of the deployed fast reactors and other considerations. If the decision is made to pursue fast reactors, further R&D to reduce costs will be valuable.

The LCOE for plants using alternative fuel cycles is likely to be higher than for those using once-through fuel cycles, though how much higher remains uncertain. For example, the LCOE for plants using limited recycle with current-generation technology is likely to be higher than from plants using the once-through fuel cycle; however, different studies have come to different conclusions about limited recycle’s economic feasibility. In general, limited recycle using MOX/PUREX is likely to be competitive with a once-through fuel cycle only if the price of uranium is high and if the cost of reprocessing is relatively low. A study by the Massachusetts Institute of Technology concluded that limited recycle could cost approximately four times more than the once-through fuel cycle (MIT, 2003), and another study by Bunn et al. (2003) noted that at current uranium prices, limited recycle could increase the costs attributable to used fuel management by more than 80 percent. In contrast, a study by the Boston Consulting Group

|

electricity markets. See DOE/Energy Information Administration, available at www.eia.doe.gov/cneaf/electricity/wholesale/wholesalet2.xls; accessed July 2009. |

|

64 |

A comparison of the LCOE from various generating technologies (including coal, gas, and renewable technologies) can be found in Chapter 2 of this report. See especially Figure 2.10. |

(BCG, 2006), which was funded by Areva, found that the cost of limited recycle using MOX/PUREX in the United States could be comparable to the cost of the once-through fuel cycle, and an earlier study by OECD/NEA (1994) found that reprocessing was about 14 percent more expensive per kilowatt-hour of generated electricity than was the once-through fuel cycle.

Another example discussed earlier in this report is the case of a system using a fully closed fuel cycle (including fast reactors as well as fuel cycle plants). The LCOE for such a system remains speculative, but it is likely to be more expensive than the once-through approach, as a large number of fast reactors and reprocessing plants will be required. On the other hand, as discussed in the section on “Alternative Fuel Cycles,” such a closed cycle would produce a smaller volume of long-lived high-level waste than the once-through fuel cycle produces, and the long-term heat load could be reduced owing to the destruction of a large fraction of transuranics in the used fuel. If fission products were also removed from the fuel and handled separately, the short-term heat load could also be reduced, potentially allowing closer packing of waste in a repository. In this case—although a quantitative analysis has yet to be done—the increased expense for the reprocessing, the fuel fabrication, and the fast reactors might be counterbalanced by reduced cost for waste disposal if one or more future repositories become unnecessary.

POTENTIAL FOR FUTURE DEPLOYMENT

The AEF Committee’s estimates of the potential supply from nuclear power in 2020, 2035, and 2050 are discussed in this section and tabulated in Table 8.1. The committee has estimated the maximum deployment of new nuclear plants that could be built under an accelerated deployment program, as described in Part 1 of this report; however, no attempt has been made to predict what will in fact be built. Any such prediction is intrinsically uncertain because it depends on many factors, including the economic conditions in the United States and around the world over the coming decade.

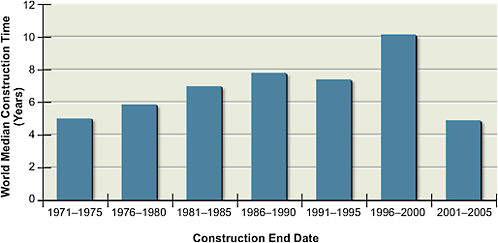

The contribution of new nuclear power plants to the U.S. electricity supply before 2020 is likely to be limited because new plant construction requires a long lead time: it can take some 4 years to obtain a construction and operating license and 4–7 years to build the plant (consistent with current world trends, as shown

TABLE 8.1 Potential Supply of Nuclear-Generated Electricity in 2020, 2035, and 2050

|

|

Additional Electric Supply Compared to 2009 (TWh/yr) |

LCOE (¢/kWh) |

Maximum Net U.S. Electric Supply from Nuclear Powera (TWh) |

|

|

Many New Plants After 2020 (“Nuclear Renaissance”) |

No New Plants After 2020 (“Nuclear Stall”) |

|||

|

2020 |

Uprates of current plants: 39–63 (Capacity: 5–8 GWe) |

Uprates: negligible additional cost |

810 (current) + 94–158 (new) − 0 (retirements) Total Supply: 904–968 |

810 (current) + 94–158 (new) − 0 (retirements) Total Supply: 904–968 |

|

New Plants: 55–95 (Capacity: 7–12 GWe) |

New Plants: IOU: 8–13 IPP: 8–13 With federal loan guarantees and 80/20 financing: IOU: 6–8 IPP: 6–8 |

|||

|

2035 |

Uprates of current plants: 39–63 (Capacity: 5–8 GWe) |

New Plants:b IOU: 8–13 IPP: 8–13 With federal loan guarantees and 80/20 financing: IOU: 6–8 IPP: 6–8 |

810 (current) + 780–851 (new) − 204–209 (retirements) Total Supply: 1381–1452 |

810 (current) + 94–158 (new) − 204–209 (retirements) Total Supply: 695–759 |

|

New Plants: 741–788 (Capacity: 94–100 GWe) |

||||

in Figure 8.1).65 Thus, if the prospective owner/operator of a nuclear plant applied for a combined construction and operating license (COL) in 2009, the plant would be unlikely to produce electricity before 2017.66

|

|

Additional Electric Supply Compared to 2009 (TWh/yr) |

LCOE (¢/kWh) |

Maximum Net U.S. Electric Supply from Nuclear Powera (TWh) |

|

|

Many New Plants After 2020 (“Nuclear Renaissance”) |

No New Plants After 2020 (“Nuclear Stall”) |

|||

|

2050 |

Uprates of current plants: 39–63 (Capacity: 5–8 GWe) |

Unknown |

810 (current) + 1545–2381 (new) − 798–814 (retirements) Total Supply: 1541–2393 |

810 (current) + 94–158 (new) − 798–814 (retirements) Total Supply: 90–170 |

|

New Plants: 1545–2381 (Capacity: 196–302 GWe) |

||||

|

Note: New plants are assumed to be evolutionary designs and to have an average capacity of 1.35 GWe, except for the completion of the 1180 MWe Watts Bar-2 reactor. New plants are assumed to operate with an average capacity factor of 90 percent, and currently operating plants are assumed to continue to operate at an average capacity factor of 91 percent. Five to 9 new plants are assumed completed between 2009 and 2020; 3 per year between 2021 and 2025; 5 per year between 2026 and 2035; and 5–10 per year between 2036 and 2050. Retirements reflect the assumption that all currently operating plants receive operating license extensions to 60 years. PWRs are uprated by 10–12 percent and BWRs by 20–25 percent before being retired. All costs are expressed in constant 2007 U.S. dollars. GWe = gigawatts-electric; IOU = investor-owned utility; IPP = independent power producer; LCOE = levelized cost of electricity; TWh = terawatt-hours. aExtending the operating licenses for a fraction of currently operating plants to 80 years would decrease the number of plants retired between 2035 and 2050. Without license extensions allowing for 80-year operating lifetimes, the last currently operating plant will retire before 2056. bAfter 2020, the uncertainties in the parameter ranges are so large that costs cannot be reliably estimated. For illustrative purposes, the committee assumes no net change in real costs per kilowatt-hour after 2020. However, after 2020, many factors could affect the actual LCOE: construction costs may be reduced as experience is gained with the new designs; high rates of escalation in construction costs are likely to stabilize; and the successful construction and operation of several plants may cause financing to become more favorable. On the other hand, delays and other difficulties during construction could significantly increase costs. |

||||

It is the judgment of the committee that as many as 5–9 additional nuclear plants could be constructed by 2020.67 This projection is based on two factors: first, the Tennessee Valley Authority recently approved a project to complete the Watts Bar-2 nuclear reactor, expected to be online by 2013;68 second, the committee estimates that as many as 4–8 new evolutionary nuclear plants could be constructed by 2020, with a number of follow-on projects that would lag the initial plants by 2 or 3 years.

FIGURE 8.1 Average construction times for nuclear plants around the world, 1971–2005. Construction times have been decreasing worldwide for plants started since the 1990s, with recent averages over the last 5 years between 4 and 6 years from first concrete to connection to the grid.

Source: IAEA, 2007.

There are several reasonable scenarios that, in the short term, could result in 4–8 new plants. For example, each of the four major supplier teams could initiate one or two projects—one or two units of the same reactor design on a single site—once the licensing process was complete. Alternatively, several utilities could focus on one design to begin to build a fleet of standard plants; in this case, one vendor might build more than one pair of plants in the first wave. Given the currently announced plans, either scenario is plausible. These 4–8 new plants (with an average rating of 1350 MWe69) and the 1180 MWe Watts Bar completion project could increase the total U.S. nuclear generating capacity by 7–12 percent.70

Power uprates on existing plants could add another 5–8 percent to the U.S.

nuclear generating capacity by 2020, for a total increase (with new plant construction) of 12–20 percent by 2020. The maximum uprate likely with readily available technologies is estimated at 20–25 percent of the plant’s power for BWRs and 10–12 percent for PWRs. If each currently operating plant in the United States is uprated by this maximum amount reasonable71 (accounting for uprates that have already been performed), as much as 5–8 GW of additional power could be added in total. Nearly all of these capacity additions are likely to occur before 2020. As noted previously, the USNRC currently projects that it will receive applications for 3.0 GW of uprates by 2013.

It is likely, given the COL applications received by the USNRC as of July 2009, that most of the new units will be added at existing sites.72 The advantages are significant, including reduced costs (because existing infrastructure is already available); the ability to connect to existing transmission lines (although the capacity of these lines may need to be expanded); and the existence of an operating organization. In addition, local populations and governments are more likely to be supportive.

However, existing sites may not be where the demand for power exists. Building at new sites will entail extra costs to purchase the site and prepare it for construction, as well as to build new transmission lines. Also, public concerns about safety and security may need to be addressed in the regions surrounding the new plant.

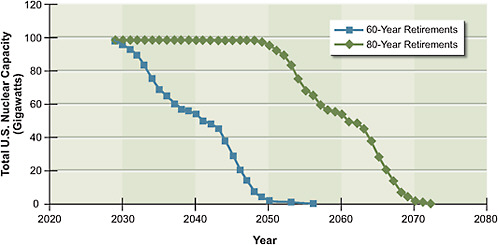

After 2020, there is significantly more uncertainty in the estimated supply from nuclear power plants. Assuming that all currently operating plants receive 20-year license renewals (for total service lives of 60 years), their operating licenses will begin to expire in 2028. Because the current nuclear plants are such low-cost power producers, there is a large economic incentive to extend their operating lives even further, by an additional 20 years, to 80 years. But, as noted earlier, because many technical challenges are still to be overcome it is not clear whether extending the lifetimes of current plants to 80 years will be possible.

If not, there will be a rapid drop in nuclear capacity between 2030 and 2050, as shown in Figure 8.2. By 2035, about 30 GW will be retired; by 2050, nearly all currently operating nuclear plants will be retired. Because of the long lead times

|

71 |

Improvements or efficiency gains not yet identified have not been included in the calculation, and further improvements to existing plants may be possible. |

|

72 |

The USNRC’s current list of received COL applications is available at www.nrc.gov/reactors/new-reactors/col.html; accessed July 2009. |

FIGURE 8.2 Effect of operating life extensions on current U.S. nuclear generating capacity. Blue squares represent the generation capacity of currently operating nuclear power plants assuming license extensions to allow for 60-year operating lives. Green diamonds represent the capacity of the current fleet of plants assuming that all 104 plants receive license extensions to allow for 80-year operating lives.

Source: USNRC, 2008.

involved in nuclear plant construction, companies will need to decide, by 2020 or shortly thereafter, whether to replace many of these plants with new nuclear reactors. However, companies are unlikely to be in a position to make such decisions with assurance at that time, unless several new U.S. nuclear plants will already have been added. It is likely that investors would want to observe whether they could be built in the United States on schedule and on budget while demonstrating safe and cost-effective operation. Thus, one purpose of providing federal loan guarantees is to acquire information needed by 2020 to make these decisions that will affect long-term U.S. electrical capacity.

If the first handful of new nuclear plants are constructed on schedule and on budget, and if they demonstrate safe and cost-effective operation, significantly more plant construction could follow between 2020 and 2050. However, if these first plants do not meet these requirements, few additional new plants are likely to be built.73 To estimate the maximum number of nuclear power plants that could

be added after 2020, the AEF Committee relied on the historical build rates in the United States: about 5 reactors per year were constructed between 1965 and 1985 as nuclear power expanded its share of electric power generation and power demand grew rapidly. In the committee’s judgment, a construction rate averaging 3 plants per year from 2021 to 2025 (to allow for learning) followed by a rate of 5 plants per year from 2026 to 2035 seems achievable. After 2035, assuming that electricity demand continues to expand, a construction rate of 5–10 plants per year could be sustained. Ultimately, however, the number of plants built will be influenced by future electricity demand, public attitudes about nuclear power, and the economic competitiveness of nuclear power compared to alternative sources of electricity.

POTENTIAL BARRIERS

Although there are several potential barriers to deployment of new nuclear power plants, the committee judges that these barriers can be reduced or eliminated if the first handful of plants are constructed on schedule and on budget, and they demonstrate initial safe and secure operation.

Economics

The large initial or upfront capital investment required for construction of new nuclear power plants could present a barrier to the expansion of nuclear power in the United States. Even for larger utilities, such a plant can represent a significant fraction of the company’s net worth,74 potentially putting the entire company at risk should the project be delayed substantially or costs escalate significantly. In addition, the substantial cost of constructing new plants is associated with a relatively high cost of electricity produced by these plants (in comparison to the cost

associated with existing plants). The significance of this barrier will depend on the growth in demand for electricity, the cost of electricity from alternative sources, and what price (if any) is placed on carbon.

Financial markets are likely to be wary of investments in new nuclear plants until it is demonstrated that they can be constructed on budget and on schedule. Nuclear plants have not been built in the United States for decades, but there are unpleasant memories, because construction of some of the currently operating plants was associated with substantial cost overruns and delays. There is also a significant gap between when construction is initiated and when return on investment is realized.

Thus, it is likely that subsidies or financial guarantees that protect investors (as discussed in Box 8.5) will be required for the first few plants. But if these investments turn out to be financially favorable, the means to support construction of additional new plants is likely to be found. Innovative financial arrangements such as joint ventures, consolidation, and risk sharing among the participants may be required, however, and difficulties involved in working out these new financial structures (particularly in regulated utilities) could affect progress toward new construction.

Regulatory and Legislative Issues

All of the existing nuclear power plants in the United States were licensed using a two-step process: first, the USNRC issued a construction permit once it was satisfied with the preliminary plant design and the suitability of the site; second, USNRC staff undertook a detailed study of the plant after construction to determine whether to issue an operating license. This process has sometimes been blamed for extensive delays in operations and expensive retrofits of constructed plants.

In recent years, the licensing process for U.S. nuclear plants has been extensively revised. The new process allows reactor design certifications, early site permits, and COLs to be granted before the plant is constructed.

Utilities have shown interest in proceeding with applications for combined licenses, to the point that the processing of the current surge of applications could cause short-term delays in beginning new plant construction. In addition, the USNRC had initially expected that, in most cases, plant designs and sites (via early site permits) would be certified before a COL was sought for a plant.