3

Venture Funding for NIH Phase II Winners, 1992-2002

Using the methodology and approach outlined above, we provided VentureSource with a list of the 1,536 firms that had won Phase II awards at NIH, 1992-2002 inclusive.1 VentureSource compared these company names with those in its database, using wildcards to ensure that the widest possible net of possible matches was identified.2

The resulting VentureSource list of 296 firms with identified venture capital funding was cross-checked against address data of the firms and other sources to ensure that the firms that VentureSource identified as venture-funded were in fact the same firms as those identified as receiving NIH Phase II funding. As a result of this review, 62 VentureSource names were eliminated, leaving a final list of 234 firms with both Venture funding and NIH Phase II funding.

The 234 firms identified here include all firms identified as receiving any venture capital funding. These 234 firms constitute the possible pool for firms that might be excluded from future NIH awards by the SBA ruling. However, not all of these firms are excluded by the implementation of the SBA ruling.

TABLE 3-1 Phase II Awards and Venture Funding

|

|

Number |

|

Total Firms Winning NIH Phase II Awards 1992-2002 |

1,536 |

|

Firms Identified as a Match by VentureSource |

296 |

|

Firms Excluded from Match after Further Review |

62 |

|

Revised List of Venture-funded Firms Winning NIH Phase II Awards |

234 |

|

SOURCE: U.S. Small Business Administration Tech-Net Database; VentureSource. NOTE: Table 3-1 shows all firms receiving NIH SBIR Phase II funding, and firms receiving venture capital funding as identified by VentureSource. |

|

3.1

CONTROL AND INDIVIDUAL OWNERSHIP3

Venture funding is not in and of itself disqualifying for firms seeking SBIR funding. In order for a firm to be eligible for SBIR funding under the SBA’s revised eligibility tests, a firm must be effectively controlled by U.S. individuals, or be controlled by another firm or firms that are themselves majority-owned by U.S. individuals. It has been argued—by venture capitalists and other experts—that most firms receiving venture funding cannot meet these criteria.4

A first issue concerns control of the SBIR firm. Given the high risks involved in funding early-stage companies, and the low existing capitalization relative to the investment being made in the firm, venture capitalists often make substantial investments in a firm, but do not always acquire control of the firm at an early stage. It is often the case that there are multiple venture capital investors who invest in a single small biotechnology firm that in combination make up a

majority stake, though each individual venture capital investor almost always has a minority share. Control may shift in the course of the very first investment in the firm, or it may come later. In some cases, individual owners retain their control until an IPO or even in some exceptional cases afterwards. This question is addressed in the next section.

A second issue concerns the firms that are still owned by 51 percent individuals but would be deemed ineligible under the 500 employee limit as interpreted by the SBA, whereby an investor’s portfolio companies can be included under the ‘informal’ aspects of control used by SBA to determine affiliation. There appears to be no useful way to develop a proxy that could differentiate between VC funds that breach this component of the SBA interpretation and those that do not.5

3.2

ELIMINATION I: EFFECTIVE CONTROL

The issue of control in majority venture-funded firms is exceptionally complex. There are both formal and informal aspects to control, and the question of control is often the subject of very carefully defined and tightly worded legal contracts.6 The difficulties in identifying controlling interests are of course compounded because privately-held companies in many cases do not publicly reveal their share owning structure. As a result, it is not possible to determine directly which firms are now ineligible under the 51 percent rule. Yet at the same time, any analysis of the impact of the SBA ruling must develop a good estimate for that number.

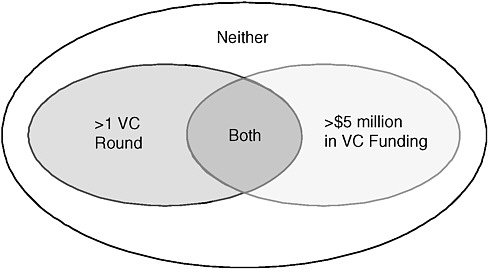

If direct access to relevant information is not available, it becomes necessary to turn to the identification of proxy indicators that we have determined to be closely associated with “control.” Upon deliberation, the Committee determined that it was reasonable to assume that firms that meet either of the following criteria are in fact venture-controlled for purposes of analyzing the impact of the SBA ruling7:

-

They received more than one round of venture funding; or

-

They received at least $5 million in venture funding.

This approach is captured in the Venn Diagram shown in Figure 3-1.

FIGURE 3-1 Venn Diagram of Criteria for Elimination.

Firms that have less than two rounds of venture capital funding and less than $5 million in venture capital investments are excluded from the list of venture capital-funded companies because this evidence is insufficient to support the claim that on balance of probability they are venture capital-controlled.

While some firms with less than $5 million in venture funding may have exceeded 51 percent or more of share ownership to venture investors, it is also possible that founders or other individuals still retain ownership of more than 50 percent at some firms which received more than $5 million in investment from venture funders. Similarly, in some cases, venture investors making a single major investment may acquire more than 50 percent of firm ownership; in other cases, firms that have received several small rounds of venture investment may remain predominantly in private hands. Thus while these criteria are not accurate in all cases, they represent the best available proxies for institutional ownership.

The Committee further assumed that all venture capital firms fail to meet the individual ownership criterion themselves. This assumption is used in this study to meet the possible objection that a venture capital firm that raised more than half of its funding from U.S. individuals would find that even firms in which it owned 51 percent would remain eligible. As venture funds typically do not reveal their sources of funding, it is not practical to differentiate between venture capital firms in terms of their ability to meet the eligibility criteria. Thus, we assume that all firms meeting either a) or b) criteria above are excluded from the NIH SBIR program.

Using these assumptions, we generate the following results from further analysis of the VentureSource data.

TABLE 3-2 Exclusion of Venture-funded Firms

|

|

Number |

|

SBIR Phase II Winners Receiving VC Funding |

234 |

|

>$5 Million |

154 |

|

>1 Round |

166 |

|

>$5 Million or >1 Round |

183 |

|

SOURCE: Thomson VentureSource. |

|

The 183 firms meeting one or both of the criteria constitute our pool of potentially excluded companies. They constitute 11.9 percent of all the 1,536 NIH Phase II winners 1992-2002 reported by SBA.

For the remainder of this report, we define “Venture-funded firms” as those 183 firms that would, based on the criteria above, have been excluded from the SBIR program.

3.3

ELIMINATION II: FIRM SIZE AND OWNERSHIP

However, these firms have not all in practice been excluded from eligibility by the SBA ruling. Some have gone out of business. Others have been acquired, still others have gone public (see below for a more detailed discussion of the last).

We performed an individual review of each of the 183 firms identified above, using the individual company pages of the Hoover’s database of small firms, data from the SEC, and web searches for firms that appear to be out of business or otherwise no longer operating. The results of this analysis are shown in Table 3-3.

As a result of this analysis, we can identify three groups of firms:

-

Those that are definitely excluded from the program on grounds other than venture ownership (out of business, acquired, or foreign-owned).8

-

Those apparently still eligible aside from venture ownership (privately held).

-

Those possibly excluded on other grounds (publicly traded companies).

TABLE 3-3 Status of Venture-funded Firms

|

Status |

|

Number of Firms |

Percentage of Firms |

|

Likely Excluded by SBA Ruling |

|||

|

|

Still privately held |

63 |

34.4 |

|

Excluded Also by Other Factors |

|||

|

|

Out of business |

19 |

|

|

|

Now foreign owned |

4 |

|

|

|

Acquired |

46 |

|

|

|

Total |

69 |

37.7 |

|

Possibly Excluded |

|||

|

|

NASDAQ |

45 |

|

|

|

AMEX |

3 |

|

|

|

NYSE |

1 |

|

|

|

OTC |

1 |

|

|

|

IPO |

1 |

|

|

|

Total |

51 |

27.9 |

|

Total Venture-funded Firms |

183 |

|

|

|

SOURCE: VentureSource, Hoover’s Small Business Database. |

|||

TABLE 3-4 Exclusion Status of Venture-funded Firms

Privately held excluded firms. The privately held firms meet our criteria for being excluded and hence their exclusion is regarded as a direct impact of the SBA ruling. These firms account for about one-third of all the VC-funded firms, or 4.1 percent of all firms receiving NIH Phase II awards 1992-2002.

Otherwise excluded firms. Firms that meet our criteria, but which are also excluded on other grounds, constitute the second group of firms. This group presents a conceptual challenge: These firms would be excluded from the program based on the SBA ruling, although they are, in any event, no longer eligible for the program. However, in seeking to determine the impact of the SBA ruling, we assume that the ruling would at a minimum have had some short term impact on these firms, because it would have excluded them between the time of the ruling and the time at which they became ineligible for other reasons.9

Publicly traded companies—possibly excluded. The third group is made up of publicly traded companies. These firms seem likely to fail the individual ownership criterion, because the preponderance of stock ownership in U.S. capital markets is through institutional owners, pension funds, investment entities of various kinds, and other companies.10 However, there are also cases where publicly traded firms are still owned and controlled by a group of U.S.-based individuals. In addition, some publicly owned firms have continued to apply for and receive Phase II funding at NIH, although it is also worth noting that these numbers have declined substantially in recent years, a trend that may indicate that the impact of the ruling is only now becoming apparent. This point is discussed further in Section 3.4 below.

These publicly owned firms also pose conceptual challenges for the analysis. One question concerns the extent to which their exclusion is in fact based on the ruling. Some firms self-excluded on the grounds that they were not individually owned long before the SBA ruling. Others however may have responded directly to the ruling itself. This distinction is pursued below, in Section 5.1.

Overall, publicly traded firms cannot be assumed as a group to be either included or excluded from the program based on these ownership criteria. To identify firms definitively that specifically breach the individual ownership criteria, it would be necessary to undertake an extensive analysis of each firm’s share ownership structure, including an analysis of the ownership structure of each significant shareholder. This however is beyond the scope of this study.

Conclusions—Excluded firms. Altogether then, we conclude that using our criteria, a minimum of 4.1 percent (63 firms) of firms that received Phase II awards 1992-2002 have been excluded because of the SBA ruling; a further 4.5 percent (69 firms) would have been excluded by the ruling, but were also

TABLE 3-5 Awards to Venture-funded firms 2003-2006

|

Status |

Number of Firms |

Percent of Category |

|

Foreign |

1 |

25.0 |

|

Private |

15 |

23.8 |

|

Acquired |

2 |

4.3 |

|

Publicly Traded |

11 |

21.6 |

|

Out of Business |

0 |

0.0 |

|

SOURCE: VentureSource; Hoover’s Small Business Database; U.S. Small Business Administration Tech-Net Database. |

||

excluded on other grounds. Finally, 3.3 percent (51 firms) became publicly traded, which may have required that they cease applying for SBIR funding as they would no longer meet the 51 percent individual ownership requirement. In short, between 4.1 percent and 11.9 percent of firms that won SBIR Phase II awards between 1992 and 2002 are excluded from the program as a result of the SBA ruling.

It should be noted that 11.9 percent reflects the upper bound of firms from this period that were potentially excluded. It includes firms that were acquired, and that became ineligible for other reasons. The 4.1 percent reflects the lower bound—the percentage of NIH SBIR Phase II winners 1992-2002 firms that appear to have been excluded by the ruling, and are not potentially excluded by other factors.

3.4

FURTHER AWARDS TO POSSIBLY EXCLUDED FIRMS

One way to test the effectiveness of our exclusion criteria is to examine whether potentially excluded firms have continued to operate within the NIH Phase II SBIR program.

We found that 29 of the 183 venture-funded firms had in fact received an award during 2003-2006.

It is possible that we are simply seeing lags here: There appears to be a substantial drop-off in awards in the most recent year for which data are available: In 2006, only six of the 183 potentially excluded firms received awards; five of these were privately held, one was publicly traded. This may indicate that the status of the firms changed over time or that firms now have a better understanding of the eligibility requirements and are no longer applying to the program.11

This last point is significant. It suggests that the excludability criteria we have used are broadly effective, in that by 2006, only six of the 183 firms that we iden-

|

11 |

However, there has also been a substantial decline in overall applications for NIH SBIR funding, which may not be related to the venture capital issue (see Section 5.1). |

tified as potentially excluded were still receiving funding. The five still in private hands can be regarded as examples of the imprecision of our assumptions—they may, as discussed in Section 3.2, be firms that received more than $5 million or more than one round of venture funding, but did not for various reasons cede a controlling interest. The fact that only one of the 51 firms identified as publicly traded was still applying suggests even more strongly that these firms have been largely excluded.