1

Introduction

1.1

SBIR AND THE INNOVATION “VALLEY OF DEATH”

Created in 1982 through the Small Business Innovation Development Act, the Small Business Innovation Research (SBIR) is the nation’s largest innovation program. It provides competitively awarded grants to small high-technology firms with technically sound and commercially promising but unproven ideas.1 In this way, SBIR helps small businesses bring pioneering technologies to market and advances the missions of federal agencies.2

Because new ideas are by definition unproven, the knowledge that an entrepreneur has about his or her innovation may not be fully appreciated by prospective investors.3 This means that new ideas with commercial potential often do not attract sufficient private investment. SBIR awards provide this seed capital and a positive signal to private venture markets, helping entrepreneurs to secure the funds needed to bring new ideas to market. The term “Valley of Death” has come to describe the period of transition when a developing technology is deemed

promising, but too new to validate its commercial potential and thereby attract the capital necessary for its continued development.4

SBIR is an important source of early-stage funding in the United States. Although business angels and venture capital firms, along with industry, state governments, and universities provide funding for early-stage technology development, the federal role is significant. Overall, SBIR awards provided over $2.3 billion in research and seed funding in 2007 to the nation’s innovative small businesses. In comparison, private venture markets provided $1.2 billion in seed stage funding in 2007 in the course of only 414 deals.

There are often useful synergies between angel and venture capital investments and SBIR funding. In many cases, small business entrepreneurs use SBIR awards in close conjunction with funds from other sources, often at the most vulnerable stages of their firm’s development. Reflecting this synergy, an initial NRC review showed about 25 percent of the top 200 NIH Phase II award winners (1992-2005) have acquired some venture funding in addition to the SBIR awards.5 In addition, angel investors often find SBIR awards to be an effective mechanism to bring a company forward in its development to the point where risk is sufficiently diminished to justify investment.6

Today, venture capital markets are retrenching as a result of the current financial crisis.7 Venture capital firms are undertaking fewer investments, especially at

|

4 |

As the September 24, 1998, Report to Congress by the House Committee on Science notes, “At the same time, the limited resources of the federal government, and thus the need for the government to focus on its irreplaceable role in funding basic research, has led to a widening gap between federally-funded basic research and industry-funded applied research and development. This gap, which has always existed but is becoming wider and deeper, has been referred to as the ‘Valley of Death.’ A number of mechanisms are needed to help to span this Valley and should be considered.” See U.S. Congress, House Committee on Science, Unlocking Our Future: Toward a New National Science Policy: A Report to Congress by the House Committee on Science, Washington, DC: U.S. Government Printing Office, 1998. Accessed at <http://www.access.gpo.gov/congress/house/science/cp105-b/science105b.pdf>. For an academic analysis of the Valley of Death phenomenon, see Lewis Branscomb and Philip Auerswald, “Valleys of Death and Darwinian Seas: Financing the Invention to Innovation Transition in the United States,” The Journal of Technology Transfer, 28(3-4), August 2003. |

|

5 |

National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, Charles W. Wessner, ed., Washington, DC: The National Academies Press, 2009. |

|

6 |

See the presentation “The Private Equity Continuum” by Steve Weiss, Executive Committee Chair of Coachella Valley Angel Network, at the Executive Seminar on Angel Funding, University of California at Riverside, December 8-9, 2006, Palm Springs, CA. In a personal communication, Weiss points out the critical contributions of SBIR to the development of companies such as Cardio-Pulmonics. The initial Phase I and II SBIR grants allowed the company to demonstrate the potential of their products in animal models of an intravascular oxygenator to treat acute lung infections and thus attract angel investment and subsequently venture funding. Weiss cites this case as an example of how the public and private sectors can collaborate in bringing new technology to markets. Steve Weiss, Personal Communication, December 12, 2006. |

|

7 |

See The New York Times, “In Silicon Valley, Venture Capitalists Turn Cautious,” January 5, 2009. |

|

BOX 1-1 How Small Biotechnology Firms Typically Use SBIR Small biotechnology companies usually have three to five research projects ongoing at one time. The venture capital funding that they raise is usually tied to specific research milestones for a given project.a SBIR often plays a key role in providing small biotechnology firms funding for other research projects that are more early-stage and higher-risk and are, thus, not yet attractive to venture or even angel capital investors. Such research projects may include new alternate applications of a lead project or a completely new project. Given the extraordinary high risk of biomedical product development, SBIR provides an avenue for small companies to create a more diversified pipeline that can be essential for the success of small biotechnology businesses. Most small biotechnology companies do not base their business plans on the SBIR program alone. Their goal is to raise capital in order to advance product development to the point of becoming a publicly traded, acquired, or stand-alone company with actual products in the market. The SBIR program is an important part of this process, but the focus of the business model is to commercialize a product—and to graduate out of the SBIR program.

|

the early stage, and conserving capital to preserve existing investment portfolios.8 In this environment, small innovative businesses find SBIR awards to be a stable and less cyclical source of early-stage innovation funding. Easing, rather than restricting access to capital is essential for economic recovery and would be consistent with other actions now being taken by the federal government to address the current economic crisis.

1.2

SBIR PROGRAM STRUCTURE

Eleven federal agencies are currently required to set aside 2.5 percent of their extramural research and development budget exclusively for SBIR awards. Each year these agencies identify various R&D topics, representing scientific

|

BOX 1-2 Venture Capital Contraction and the Financial Crisis of 2008-2009 “Venture investments dropped across almost all sectors in the [fourth] quarter [of 2008] compared with the prior year. For biotechnology and medical device industries, $1.6 million was invested in 185 companies, which is a 31 percent decline in dollars and a 22 percent drop in deals.” SOURCE: Rachel Metz, “Venture Capital Investments Fall 33 Percent in 4Q,” Associated Press, January 24, 2009. |

and technical problems requiring innovative solutions, for pursuit by small businesses under the SBIR program. These topics are bundled together into individual agency “solicitations”—publicly announced requests for SBIR proposals from interested small businesses. A small business can identify an appropriate topic it wants to pursue from these solicitations and, in response, propose a project for an SBIR award. At NIH, topics are treated as guidelines, and the agency does fund projects that do not address specific topics in the solicitation.

The Small Business Administration (SBA) coordinates the SBIR program across the federal government and is charged with directing its implementation at all 11 participating agencies. Recognizing the broad diversity of the program’s operations, SBA has traditionally administered the program with commendable flexibility, allowing the agencies to operate their SBIR programs in ways that best address their unique agency missions and cultures.

Reflecting this flexibility, the required format for submitting a proposal is different for each agency. Proposal selection also varies, though peer review of proposals on a competitive basis by experts in the field is typical. Each agency then selects the proposals that are found best to meet program selection criteria, and awards contracts or grants to the proposing small businesses.

Despite these differences, as conceived in the 1982 Act, the SBIR award-making process is structured in three phases at all agencies:

-

Phase I awards essentially fund feasibility studies in which award winners undertake a limited amount of research aimed at establishing an idea’s scientific and commercial promise. Today, the legislation anticipates Phase I awards as high as $100,000. Average award size at NIH is significantly higher (approximately $150,000).9

-

Phase II awards are larger—typically about $750,000—and fund more extensive R&D to develop further the scientific and commercial promise of research ideas. Again, average award size at NIH is significantly higher (over $1 million).

-

Phase III. During this phase, companies do not receive additional funding from the SBIR program. Instead, award recipients should be obtaining additional funds from a procurement program at the agency that made the award, from private investors, or from the capital markets. The objective of this phase is to move the technology from the prototype stage to the marketplace.

1.3

THE NRC ASSESSMENT OF SBIR AT NIH

As the SBIR program approached the two decade mark in 2002, the U.S. Congress requested that the National Research Council (NRC) of the National Academies conduct a “comprehensive study of how the SBIR program has stimulated technological innovation and used small businesses to meet Federal research and development needs,” and make recommendations on improvements to the program at the National Institutes of Health and other major agencies of the federal government.10

Based on extensive research, a Committee of the NRC found that the NIH SBIR program is “making significant progress in achieving the congressional goals for the program.” It added that “the SBIR program is sound in concept and effective in practice at NIH.”

The NRC report on the SBIR program at NIH also noted that for firms seeking to capitalize on the progress made with SBIR awards, “venture funding may be the only plausible source of funding at the levels required to take a product into the commercial marketplace.”11

The controversy over the issue of majority venture capital funding notwithstanding, SBIR has been a highly successful program.

1.4

THE SBA RULING ON VENTURE PARTICIPATION IN SBIR FIRMS

During the first two decades of the SBIR program, majority venture-funded companies participated in the program, receiving SBIR awards in conjunction with outside equity investments. During this lengthy period, the participation of majority venture-funded firms was not an issue.

In a 2002 directive, the Small Business Administration ruled that to be eligible for SBIR the small business concern should be “at least 51 percent owned and controlled by one or more individuals who are citizens of, or permanent

resident aliens in, the United States, except in the case of a joint venture, where each entity to the venture must be 51 percent owned and controlled by one or more individuals who are citizens of, or permanent resident aliens in, the United States.”12

During the period when SBA was developing the proposed rule, the SBA’s Office of Hearings and Appeals received an appeal from a Cognetix, a Utah biotechnology company that was majority venture-funded and, thus, ineligible for the SBIR program.13 In denying the appeal, an Administrative Judge of the SBA Office of Hearings and Appeals ruled that venture capital firms were not “individuals,” i.e., “natural persons,” and therefore SBIR agencies could not allocate SBIR awards to companies in which venture capital firms had a controlling interest.14 The ruling in the Cognetix case signified a change in practice, not in law.15 In effecting this change, the SBA did not attempt to analyze the impact of the exclusion of such firms on the operation of the SBIR program at NIH.

|

12 |

SBA Policy Directive, published in the Federal Register, September 24, 2002. Access the SBA’s 2002 SBIR Policy Directive, Section 3(y) (3) at <http://www.zyn.com/sbir/sbres/sba-pd/pd02-S3.htm>. |

|

13 |

See Federal Register, Proposed Rules, 69(232), Friday, December 3, 2004. |

|

14 |

In his decision, Administrative Judge Blazsik stated that “The term ‘individuals’ in 13 C.F.R. Section 121.702(a) means only natural persons and does not include venture capital funds, pension funds, and corporate entities for purposes of an SBIR award. Thus, a firm that is otherwise eligible for an SBIR award is disqualified because it is less than 51 percent owned by natural persons.” Access this decision at <http://www.sba.gov/aboutsba/sbaprograms/oha/allcases/sizecases/siz4560.txt>. |

|

15 |

See statement by Administrator Steven C. Preston before the House Small Business Committee on the Reauthorization of the Small Business Innovation Research Program, March 13, 2008. See Appendix H of this report. |

|

BOX 1-4 SBA Basis for Venture Disqualification in SBIR Why does venture firm ownership or control disqualify a firm from SBIR funding? According to the SBA ruling, there are two issues here: Breaching the size requirement. Venture capital firms own stakes in many companies. The 500 employee limit is measured by aggregating the size of the applying firm, the employees of venture capital firm(s), and all the other firms in which that limited partnership has a controlling interest. Breaching the individual ownership requirement. SBIR firms must be owned by individual U.S. citizens, or by a firm that is itself owned by U.S. individuals. Venture capital firms are often more than half owned by the institutional investors who fund them, and hence in those cases these firms fail the individual ownership test. SBA on a regular basis aggregates venture capital investors’ other firms in which it has not only a controlling interest but a minority interest. The SBA uses tests such as affirmative control (majority ownership, control of board etc.) as well as negative control which is less clearly defined and can often lead to exclusion of small biotechnology companies, even if they are 51 percent owned by individuals. |

1.5

OVERVIEW OF REACTIONS TO THE SBA RULING

The administrative ruling has since generated both considerable support and criticism.16 The claims made by advocates on both sides of this issue are summarized below. On closer examination, many of these claims appear to be overstated and lack compelling evidence. In reviewing these claims, it is worth noting that the SBIR program operated successfully for over twenty years without the benefit of this “clarification” by SBA.17 However, the impact of this ruling will very likely change the character of the SBIR program.

Those who support the SBA ruling predict that its elimination could lead to the participation of firms controlled by large venture capital firms, including venture capital arms of major industrial corporations such as General Electric

|

16 |

The issue of whether small businesses can participate in the SBIR program if venture firms hold some ownership of the firm was addressed by both proponents and opponents in the congressional hearings to renew the SBIR program. See Small Business Innovation Research Reauthorization on the 25th Program Anniversary, Hearings before the Subcommittee on Technology and Innovation, 110th Congress, First Session, April 26, 2007, and June 25, 2007, Serial No. 110-23 and Serial 110-43, Washington, DC: U.S. Government Printing Office, 2008. Hearings were also held by the House Small Business Committee and the Senate Committee on Small Business and Entrepreneurship. |

|

17 |

The NRC Committee assessing the SBIR program found it overall to be “sound in concept and effective in practice.” See National Research Council, An Assessment of the SBIR Program, op. cit., Chapter 2. |

or Intel, and argue that this outcome is contrary to the mission of the SBIR program.18 Arguing against this position, the National Institutes of Health and many biotechnology companies have argued that the new eligibility requirements have a negative impact on the NIH mission and on the ability of high technology firms to develop and commercialize promising new biomedical technologies.

Supporters of the Ruling Foresee a Negative Impact on the SBIR Program from Participation by Majority Venture-funded Small Businesses

Supporters of the SBA ruling argue that the SBA ruling is needed to prevent large venture capital firms and corporate venture firms from exploiting the SBIR program for their benefit to the detriment of the SBIR mission.19 They claim that the ruling is necessary on a variety of grounds. These include financial need, the risk of crowding out, and the attraction of firms backed by corporate venture capital to the program, especially as “super-sized” awards become more prevalent.20 Key arguments made by supporters of the SBA ruling are listed below:

-

Firms that have venture funding do not need SBIR.

-

Venture-funded firms have access to the capital and resources they need; so scarce SBIR resources should be focused on the firms that cannot or have not obtained venture funding and are therefore most in need these resources.21

-

-

Venture-funded firms “crowd out” deserving small firms.

-

Venture-funded firms have more resources and are likely to be in a better position to apply for SBIR awards, so they could “crowd out” deserving firms that are not venture-funded.22

-

-

Venture-funded firms have unfair advantages in the application process, so that these firms will be able to capture a disproportionate role in the program because of their superior resources.

-

These resource rich firms will be able to submit better prepared applications to the SBIR agencies.

-

As a result, their applications will be seen to be superior and hence selected by the eleven different agencies that participate in SBIR.23

-

|

18 |

See, for example, testimony by Mr. Robert N. Schmidt at the April 26, 2007, hearing before the House Subcommittee on Technology and Innovation. |

|

19 |

See testimony of Jere Glover, Executive Director, SBTC, before the Subcommittee on Rural Enterprise, Agriculture and Technology Policy, House Small Business Committee, July 27, 2005. |

|

20 |

Super-sized awards are actually on the decline. |

|

21 |

Ibid. |

|

22 |

See testimony of Michael Squillante of RMD, Inc., before the Senate Committee on Small Business and Entrepreneurship, July 12, 2006. |

|

23 |

See, for example, testimony by Robert N. Schmidt on April 26, 2007 before the Subcommittee on Technology and Innovation of the House Committee on Science and Technology. In his testimony, Mr. Schmidt noted that “Thanks to their deep-pocket backing, the companies that the VCs fund will |

-

Corporate venture capital can capitalize on SBIR grants.

-

Large corporations that have set up venture capital arms can use small firms they control to apply for SBIR. This would have the effect subsidizing large firms, which is not the objective of the legislation that established the SBIR program.24

-

The large grants made on occasion by the NIH SBIR program are likely to motivate large venture capital firms to apply for SBIR awards.25

-

-

Venture capital capture of the SBIR program will change the character of the SBIR program to its detriment by:26

-

Shifting the program toward lower-risk technologies that are closer to the market;

-

Increasing the geographic concentration of the program (in states like California and Massachusetts, where venture capitalists are most active);

-

Changing the profile of successful and unsuccessful SBIR companies; and

-

Leading to calls for a further change in the SBIR rules—for example, to allow large institutions such as universities to own SBIR companies.

-

Whatever the merit of these observations, and these impacts remain to be documented, it remains the case that the predicted capture of the program by venture capital did not take place over the twenty years that the restrictions on majority venture-funded firms were not in place (or were not enforced.)27 It remains possible, however, that changing patterns of awards, especially significantly larger awards, could change the level of participation of venture-funded firms.

|

be able to submit multiple proposals per solicitation. They won’t necessarily be more life-saving, but they will be more polished. They will also have features that do well under NIH’s scoring system—like impressive looking ‘teams’ and extensive preliminary research. It costs money to submit multiple proposals, to make them polished, to keep impressive teams on hold until an award decision is reached, and to conduct preliminary research. That is exactly where large VC-backed companies will have the edge.” |

|

24 |

In 2000, at the peak of the Internet bubble, more than $100 billion in venture capital was disbursed, of which about 20 percent was from corporations. See Joseph A. LiPuma, “Corporate Venture and the Intensity of Portfolio Companies,” Small Business Research Summary, No. 306, June 2007. Access at <http://www.sba.gov/advo/research/rs306tot.pdf>. This participation ebbs and flows with the size of the venture capital market. See Hank Chesbrough and Christopher Tucci, “Corporate Venture Capital in the Context of Corporate Innovation,” DRUID Summer Conference, 2004. More recently, Venture Capital funding has been level at about $28 billion in 2007. |

|

25 |

See testimony of Michael Squillante of RMD, Inc., before the Senate Committee on Small Business and Entrepreneurship, July 12, 2006. |

|

26 |

See testimony of Jere Glover, Executive Director, SBTC, before the Subcommittee on Rural Enterprise, Agriculture and Technology Policy, House Small Business Committee, July 27, 2005. |

|

27 |

See National Research Council, An Assessment of SBIR at the National Institutes of Health, op. cit., Chapter 2, Finding G on “Venture Funding and SBIR.” |

|

BOX 1-5 Characteristics of Majority-owned Venture-funded and Non-venture-funded SBIR Firms Captured below are some expected general differences between SBIR firms that have secured venture funding and those that have not secured venture funding. Making such analytical distinctions sharpens the unique feature of each. In practice, however, these distinctions may not be as distinct. Financial constraints. Businesses that receive venture capital support are often believed to face fewer financial constraints than non-venture-funded firms. This support is thought to give venture-funded firms greater resources in:

Focus on high returns. Venture-funded firms are expected to “swing for the fences” more of the time. In other words, we would expect venture capitalists to identify and fund firms that are working on technologies with large market potential. By comparison, non-venture-funded firms are more likely to work on technologies that, while important, are not seen to have market potentials that are as large. While some technologies may address specific and important mission needs of a sponsoring agency, they may have a smaller potential for widespread commercialization. Possible selection effects. Given these advantages and focus, it is possible that venture-funded firms are more likely to identify and seek to win competitions for SBIR topics with high commercialization potential topics than non-venture-funded firms. |

Critics of the SBA Ruling Predict That It Will Deter Small Business Innovation, Especially in Biomedicine

Critics of the SBA ruling believe that the ruling does not take proper account of the real world challenges of financing early-state funding in innovation research, especially the high risk and long horizon needs of biomedical research.

Impact on the NIH Mission

Perhaps most telling is the criticism of this ruling by the leadership of the National Institutes of Health. In a letter to the Small Business Administration,

Dr. Elias A. Zerhouni, then the NIH director, noted the new eligibility rules “unduly restrict the ability of the National Institutes of Health (NIH) fund high quality, small companies that receive venture capital (VC) investment.” 28 This, he claimed, will have a negative impact on the mission of the National Institutes of Health and on the goals of the SBIR program.

Impact on Small Biotechnology Firms

Some high technology industries, notably the biotechnology industry, and representatives of the venture capital community have also expressed dismay at this ruling, calling it a new interpretation of the venture capital-small business relationship by SBA.29 The Biotechnology Industry Organization (BIO) and the National Venture Capital Association (NVCA), as well as some individual biotech firms, have testified before congressional committees against the new interpretation.30 Criticisms of the SBA ruling center on the following arguments:

-

The ruling does not take into account the realities of biotechnology research.

-

The scale of biotechnology research calls for multiple sources of funding. For firms seeking to capitalize on the progress made with SBIR awards, venture funding may be the only plausible source of funding at the levels required to take some products into the commercial marketplace. It can take several hundred million dollars and an average of eight years to develop a drug from concept through to

-

|

28 |

See Dr. Zerhouni’s letter to H. Barreto, Small Business Administration, June 28, 2005. See Appendix G. |

|

29 |

See National Venture Capital Association, “NVCA Supports Clarifications to SBIR Eligibility Requirements,” November 9, 2005. Access at <http://www.nvca.org/policy.html>. Mark Heesen, president of the National Venture has noted that “by eliminating venture-backed companies from the pool of SBIR applicants, the SBA is effectively dismissing the most promising organizations—ones that have been vetted by professionals and have the most chance of succeeding as viable, ongoing businesses. The current dynamic is now hobbling young companies across the country, particularly in the life sciences sector, where the cost and time associated with bringing a discovery to market is colossal.” |

|

30 |

See, for example, testimony by Thomas Bigger of Paratek Pharmaceuticals before the U.S. Senate Small Business Committee, July 12, 2006. See the statements by Ron Cohen, CEO of Acorda Technologies, and Carol Nacy, CEO of Sequella, Inc., at the House Science Committee Hearing on “Small Business Innovation Research: What is the Optimal Role of Venture Capital,” July 28, 2005. Dr. Nacy’s testimony captures the multiple sources of finance for the 17-person company (June 2005). They included—founder equity investments; angel investments; and multiple, competitive scientific research grants, including SBIR funding for diagnostics devices, vaccines, and drugs. SBIR funding was some $6.5 million out of a total of $18 million in company funding. Dr. Nacy argues that SBIR funding focuses on research to identify new products while venture funding is employed for product development. |

-

-

the market.31 In the absence of product revenue, biotechnology firms are almost entirely reliant on capital markets and other sources of financing during this period. As a result, biotechnology companies often seek venture investment to push products towards the market while relying on grants, e.g., SBIR as funding sources, to fund their early-stage, high-risk research and development.32

-

Small biotechnology companies must often develop multiple lines of research. Representatives of small biotechnology companies point out that sustaining multiple lines of research is necessary for an innovative small business to diversify its risks. The venture capital funding raised by a small business to support its lead product is often tied closely to milestones in that product’s development.33 In order to develop secondary or tertiary candidates or therapies, a company has to find secondary sources of capital. SBIR grants can and do play an instrumental role in supporting projects at the very earliest stages of development.34

-

-

The SBA ruling is based on a misunderstanding of the roles and objectives of venture funding.

-

Venture capital does not focus on very early-stage funding. It is this type of activity that the SBIR program has historically supported in the past. Venture capital dollars are normally applied later in the life cycle, and are used to bring promising discoveries to market.35

-

SBIR and venture funding address the needs of small businesses at different stages of the innovation process. And as noted, small innovative businesses often have multiple projects in their development

-

|

31 |

See, for example, testimony by Gary McGarrity , a member of BIO, on April 26, 2007, before the Subcommittee on Technology and Innovation of the House Committee on Science and Technology. Dr. McGarrity noted in his testimony that “Promising biotechnology research has a long, arduous road from preclinical research, through Phase I, safety, Phase II, efficacy, and Phase III broader population clinical trials, and ultimately to FDA approval of a therapy. It is estimated that it takes 97.7 months, or 8 years to bring a biotechnology therapy to market and costs between $800 million and $1.2 billion. For the majority of biotechnology companies that are without any product revenue, the significant capital requirements necessitate fundraising through a combination of angel investors and venture capital firms. The role and importance of private equity fundraising in the biotechnology industry cannot be understated.” |

|

32 |

See testimony by Douglas Doerfler of Maxcyte, Inc., before the House Committee on Small Business, January 29, 2008. |

|

33 |

See testimony by Mark G. Heeson of the National Venture Capital Association before the House Committee on Small Business, March 13, 2008. |

|

34 |

See testimony by James C. Greenwood, President of BIO, before the House Committee on Small Business, March 13, 2008. |

|

35 |

See testimony by Mark G. Heeson of the National Venture Capital Association before the House Committee on Small Business, March 13, 2008. For a comparison of the trajectories of venture-funded firms with those without venture funding, see Manju Puri and Rebecca Zarutskie, “On the Lifecycle Dynamics of Venture-Capital- and Non-Venture-Capital-Financed Firms,” EFA 2007 Ljubljana Meetings Paper, June 2007, available at SSRN: <http://ssrn.com/abstract=967841>. |

-

-

portfolio at different stages of maturity. They may need to draw on a variety of different types of funding to succeed.36

-

Venture capital firms are most often small businesses themselves. Contrary to some popular characterizations, venture capital firms are almost entirely private partnerships that are typically comprised of less than a dozen professionals.37

-

Venture-funded companies are normally not controlled by venture capitalists, even where they own 51 percent or more of the company. Most small biotechnology companies have multiple venture capital investors with minority ownership status. The entrepreneur often selects the investors. These investors normally they do not exert day-to-day control over the firm. In fact, partners at venture funds typically work with a portfolio of several companies at once, making it impractical (if not impossible) to exert effective control of day-to-day management. They do work with the management team to make the strategic level decisions needed for the firms to grow.38

-

-

The ruling results in a set of confusing SBA eligibility rules that deter small business innovation.

-

Counting venture capital firm employees: If SBA determines that a venture capital company has a controlling interest in a small business, not only are the employees of the venture capital company included in the size determination but so are the employees of all other businesses in which the venture firm has a controlling interest.39

-

The rules do not reflect the reality that micro small businesses often rely on a syndicate of investors: According to the current SBA interpretation “a private company with 400 employees, $200 million in venture capital from multiple venture capital firms that equal 49 percent of equity with additional angel investment dollars” is eligible, whereas “a private company with 20 employees, $50,000 in annual revenue and $8 million in venture capital by multiple venture capital funds equaling 56 percent of equity—even though no one venture capital firm has more than 35 percent of total equity—is ineligible.”40

-

|

36 |

See testimony by Mark G. Heeson of the National Venture Capital Association before the House Committee on Small Business, March 13, 2008. SBIR more actively supplements angel round funding where the funding levels are comparable (in the order of $100,000). By the time a company is looking for venture funding, it typically seeks larger amounts (in the order of $1,000,000). SBIR is at this stage in a firm’s evolution a relatively smaller component of funding. |

|

37 |

Ibid. |

|

38 |

Ibid. |

|

39 |

See testimony by James C. Greenwood, President of BIO, before the House Committee on Small Business, March 13, 2008. |

|

40 |

See testimony by Douglas Doerfler of Maxcyte, Inc., before the House Committee on Small Business, January 29, 2008. |

-

The ruling may be reducing the pool of applicants to the NIH SBIR program.

-

Excluding potential applicants: It may be that an unintended consequence of the ruling is to exclude a portion of applicants who might otherwise be able to participate in the SBIR program. Following the SBA ruling, some biotech companies have been denied grant money. Others have opted to delay SBIR submission in the hope that the issue will be resolved. Representatives of the Biotechnology Industry Organization (BIO) argue that by reducing the applicant pool, the ruling reduces the program’s ability to award projects with high scientific merit and commercialization potential.41

-

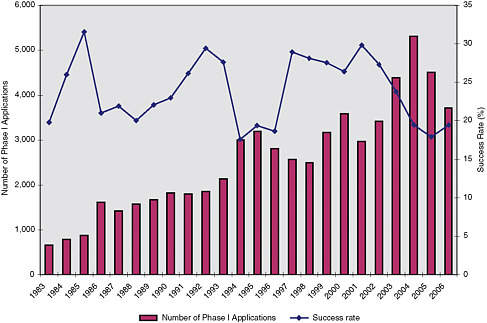

Decline in NIH SBIR applications: BIO cites the decline in SBIR applications at NIH, which declined by 11.9 percent in 2005, 14.6 in 2006, and by 21 percent in 2007, as evidence of the negative impact of this ruling.42 (See Figure 1-1.) Such a correlation, of course, does not necessarily imply a causal link and there may be other factors at play for this decrease in applications. BIO also notes that the NIH Program Coordinator has testified that the number of new small businesses participating in the program has decreased to the lowest proportion in a decade.43

-

1.6

THE NATIONAL RESEARCH COUNCIL’S STUDY OF THE VENTURE CAPITAL ELIGIBILITY RULING

While the SBA ruling concerning eligibility alters the way the program operated, at least on a de facto basis, from the program’s origin until 2002, no empirical assessment of its potential impact was made before the ruling was implemented.

The GAO did conduct a study of venture capital activity within the NIH and DoD SBIR programs, and while this study broke some important new ground and

|

41 |

See testimony by James C. Greenwood, president of BIO, before the House Committee on Small Business, March 13, 2008. According to the organization’s Web site, “BIO is the world’s largest biotechnology organization, providing advocacy, business development and communications services for more than 1,200 members worldwide. Our mission is to be the champion of biotechnology and the advocate for our member organizations—both large and small.” Access Web site at <http://bio.org/>. According to an Ernst & Young report, “Beyond Borders: Global Biotechnology Report 2008,” there are approximately 1,500 public and private U.S. biotechnology companies. Therefore, BIO represents over half of the biotechnology companies in the United States. See Ernst & Young, “Beyond Borders: Global Biotechnology Report 2008,” New York: Ernst & Young, 2008. |

|

42 |

Ibid. |

|

43 |

See testimony of Jo Anne Goodnight to the House Subcommittee on Technology and Innovation, Committee on Science and Technology, June 26, 2007. |

FIGURE 1-1 NIH SBIR application and success rates.

SOURCE: NIH SBIR Program.

provided the first estimate of the number of firms affected by the ruling, it did not address two key questions that bear on the policy issue at hand.44 These are:

-

How many firms would appear to be excluded by the ruling from participation in the NIH SBIR program?

-

What is the likely effect of this exclusion on these firms and on the NIH SBIR program?

These questions may be of particular importance in the biotechnology sector, where there is a substantial concentration of venture capital funding. (See Box 1-6.) However, these are not easy questions to answer. Data on venture fund-

|

44 |

U.S. Government Accountability Office, Small Business Innovation Research: Information on Awards Made by NIH and DoD in Fiscal Years 2002 through 2004, GAO-06-565, Washington, DC: U.S. Government Accountability Office, April 2006. The GAO report provides the number and characteristics of all awards, the number and characteristics of awards above the size guidelines, changes in award characteristics after 2002, the factors agencies consider in deciding awards, and the data they collect on SBIR awards. The GAO report, however, does not provide grounds to determine whether firms identified as venture-funded are in fact excluded from the SBIR program based on majority ownership grounds. |

|

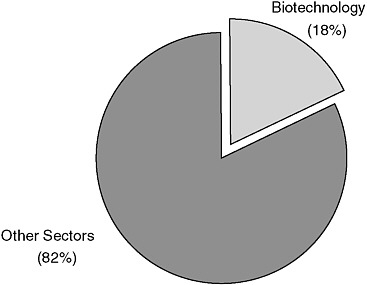

BOX 1-6 Venture Capital Investments in Biotechnology The MoneyTree Survey indicates that venture capital deals in biotechnology are larger than average. The biotechnology sector accounts for 18 percent of all venture capital deals in 2007 and the average size of a deal for the year was $10.9 million. By comparison, the software sector accounted for 17.9 percent of venture capital funding for 2007, with average deal size of $5.8 million. If we combine venture investments in medical devices with biotechnology into a category called “life sciences,” they would together account for over 30 percent of all venture funding in 2007. Given NIH’s focus on life sciences, this data indicates that the SBA ruling on venture capital participation has a major impact on its capacity to use SBIR to advance its mission to develop knowledge about living systems, extend healthy life, and reduce the burdens of illness and disability.  FIGURE B-1-5 2007 Venture capital dollars invested. SOURCE: Based on data from PriceWaterhouse MoneyTree Survey 2007. |

ing for individual firms can be hard to find in a systematic fashion—and data on the impact of this funding is even harder to establish.

To better understand the impact of the SBA exclusion of firms receiving majority venture funding (resulting in majority ownership), the NIH commissioned this empirical analysis by the National Research Council. In this report,

we seek to illuminate the ramifications of the SBA ruling on the participation of majority-owned venture capital based firms in the SBIR program.

The analysis in this report complements the Academies’ recent assessment of the SBIR program at NIH, the Department of Defense, the Department of Energy, NASA and the National Science Foundation.45 Covering the approximately twenty years of the program’s existence (over which period, the restrictions of the SBA ruling were not in place) this comprehensive study found that the program is meeting its congressional objectives and is effective in practice. Moreover, the Academies’ study did not detect any effect (positive or negative) from the participation of a limited but significant number of small innovative firms that were majority owned by venture capital firms in the SBIR program.46

|

45 |

For a summary report of this first comprehensive assessment of the SBIR program, see National Research Council, An Assessment of the SBIR Program, op. cit. |

|

46 |

See National Research Council, An Assessment of the SBIR Program at the National Institutes of Health, op. cit., Chapter 2, Finding G on “Venture Funding and SBIR.” |