4

Energy Efficiency in Industry

Building on improvements in energy efficiency in U.S. industrial manufacturing that have occurred over the past several decades in response to volatile fossil-fuel prices, fuel shortages, and technological advances is essential to maintaining U.S. industry’s viability in an increasingly competitive world. The fact is that many opportunities remain to incorporate cost-effective, energy-efficient technologies, processes, and practices into U.S. manufacturing. This chapter describes the progress made to date and the magnitude of the untapped opportunities, which stem both from broader use of current best practices and from a range of possible advances enabled by future innovations. It focuses on the potential for improving energy efficiency cost-effectively in four major energy-consuming industries—chemical manufacturing and petroleum refining, pulp and paper, iron and steel, and cement—and discusses the role of several crosscutting technologies as examples. In addition, this chapter identifies major barriers to the deployment of energy-efficient technologies, outlines the business case for taking action to improve the energy efficiency of U.S. manufacturing, and presents the associated findings of the Panel on Energy Efficiency Technologies.

4.1

ENERGY USE IN U.S. INDUSTRY IN A GLOBAL CONTEXT

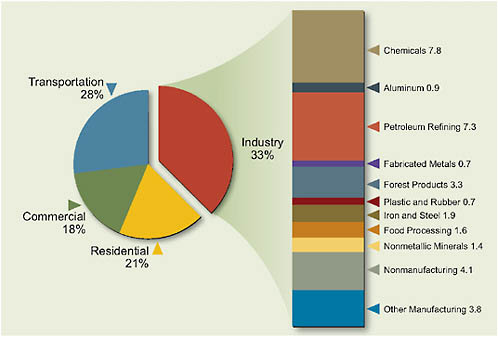

As shown in Chapter 1, Figure 1.1, industry is responsible for 31 percent of primary energy use in the United States. Figure 4.1 illustrates how this energy use was distributed among industries, particularly the most energy-intensive ones, in 2004.

FIGURE 4.1 Total energy use in the U.S. industrial sector in 2004, quadrillion Btu (quads). Values include electricity-related losses. Total U.S. energy use in 2004 was 100.4 quads; total U.S. industrial energy use in 2004 was 33.6 quads.

Source: Craig Blue, Oak Ridge National Laboratory, based on EIA (2004) (preliminary) and estimates extrapolated from EIA (2002).

Globally, industry is the largest consumer of energy—the energy that it consumes exceeds that devoted to transportation, the residential sector, and commercial buildings combined. According to the International Energy Outlook 2009, the industrial sector worldwide used 51 percent of the total delivered energy (or 50 percent of the primary energy) in the year 2006, and its demand was projected to grow by an annual rate of 1.4 percent between 2006 and 2030 (EIA, 2009a).1 Before 1973, manufacturing was the largest energy consumer in most member countries of the Organisation for Economic Cooperation and Development (OECD), but in recent years its dominance has subsided as industrial output has slowed, energy efficiency has increased, and other sectors have surged ahead (Schipper, 2004). As a result, industrial energy demand in OECD countries was anticipated to grow only 0.6 percent annually. In contrast, industrial-sector energy

consumption in non-OECD countries was projected to increase by 2.1 percent per year over the same period, with the most rapid growth occurring in China and India.

As of 2006, industry accounted for 33 percent of the primary energy consumed in the United States and 28 percent of carbon dioxide (CO2) emissions (EIA, 2008). Overall, the quantity of energy used by U.S. industries is huge, estimated at 32.6 quadrillion British thermal units (quads) of primary energy in 2006 at a cost of $205 billion. About 5 quads, or 21 percent of this total, was for nonfuel uses of coal, gas, and oil—for example, the use of oil refining by-products in asphalt, natural gas employed as a feedstock for petrochemicals, and petroleum coke used in the production of steel (EIA, 2009b). U.S. industries use more energy than the total energy used by any other Group of Eight (G8) nation and about half of the total energy used by China (DOE, 2007b).

The average annual rate of growth of energy in the U.S. industrial sector is projected to be 0.3 percent out to 2030, while CO2 emissions from U.S. industry are projected to increase more slowly, at 0.2 percent annually (EIA, 2008). These low rates are due partly to the presumed introduction of energy-efficient technologies and practices in industry. They also reflect the projected restructuring of the economy away from energy-intensive manufacturing and toward service and information-based activities. Many of the commodities that were once produced in the United States are now manufactured offshore and imported into the country. The energy embodied in these imported products is not included in the standard energy metrics published by the Energy Information Administration (EIA) of the Department of Energy (DOE). According to an analysis by Weber (2008), products imported into the United States in 2002 had an embodied energy content of about 14 quads, far surpassing the embodied energy of exports from the United States (about 9 quads).

The most energy-intensive manufacturing industries are those producing metals (iron, steel, and aluminum); refined petroleum products; chemicals (basic chemicals and intermediate products); wood and glass products; mineral products such as cement, lime, limestone, and soda ash; and food products. As shown in Figure 4.1, these industries are responsible for more than 70 percent of industrial energy consumption. Industries that are less energy-intensive include the manufacture or assembly of automobiles, appliances, electronics, textiles, and other products.

4.1.1

Recent Trends in Industrial Energy Use

Primary-energy use in the industrial sector declined in the 1970s following the run-up of energy prices. Energy consumption bottomed out in the mid-1980s and then increased steadily through the turn of the century, exceeding its previous peak. Table 4.1 shows energy use for selected years within this period (excluding nonfuel uses). In recent years, industrial energy use has declined partly as a result of the economic restructuring noted above. Energy use in the manufacturing sector continues to be significantly higher than in the nonmanufacturing sectors, which include agriculture, forestry and fisheries, mining, and construction. Energy-use trends in some sectors have been relatively stable, such as in chemical manufactur-

TABLE 4.1 Total U.S. Industrial Energy Use (Excluding Nonfuel Uses of Coal, Oil, and Natural Gas), in Selected Years from 1978 to 2004 (in quadrillion Btu)

|

Usea |

1978 |

1985 |

1990 |

1995 |

2002 |

|

Food Manufacturing, Beverage, and Tobacco (311/312) |

1.36 |

1.4 |

1.35 |

1.72 |

1.77 |

|

Textile Mills, Textile Mill Products (313/314) |

0.53 |

0.43 |

0.46 |

0.54 |

0.44 |

|

Apparel, Leather and Allied Products (315/316) |

0.19 |

0.10 |

0.11 |

0.16 |

0.66 |

|

Wood Product Manufacturing (321) |

0.64 |

0.52 |

0.59 |

0.67 |

0.70 |

|

Paper Manufacturing (322) |

2.38 |

2.66 |

3.16 |

3.17 |

3.14 |

|

Printing and Related Support Activities (323) |

0.16 |

0.15 |

0.20 |

0.22 |

0.23 |

|

Petroleum and Coal Products Manufacturing (324) |

3.09 |

2.01 |

3.37 |

3.37 |

3.92 |

|

Chemical Manufacturing (325) |

4.20 |

3.05 |

4.22 |

4.22 |

4.06 |

|

Plastic and Rubber Products Manufacturing (326) |

0.45 |

0.44 |

0.52 |

0.67 |

0.86 |

|

Nonmetallic Mineral Product Manufacturing (327) |

1.62 |

1.16 |

1.29 |

1.23 |

1.32 |

|

Primary Metal Manufacturing (331) |

5.01 |

2.43 |

2.73 |

2.74 |

2.70 |

|

Fabricated Metal Product Manufacturing (332) |

0.66 |

0.58 |

0.65 |

0.75 |

0.72 |

|

Machinery Manufacturing (333) |

0.50 |

0.38 |

0.43 |

0.44 |

0.39 |

|

Computer and Electronic Product Manufacturing (334) |

0.29 |

0.39 |

0.47 |

0.47 |

0.38 |

|

Electrical Equipment, Appliance, and Component Manufacturing (335) |

0.24 |

0.23 |

0.29 |

0.34 |

0.27 |

|

Transportation Equipment (336) |

0.73 |

0.66 |

0.70 |

0.77 |

0.82 |

|

Furniture and Related Product Manufacturing (337) |

0.12 |

0.09 |

0.12 |

0.13 |

0.14 |

|

Miscellaneous Manufacturing (339) |

0.14 |

0.11 |

0.12 |

0.14 |

0.17 |

|

Total (Manufacturing) |

22.3 |

16.8 |

20.8 |

21.7 |

22.1 |

|

Total (Non-Manufacturing) |

Not available |

6.0 |

4.8 |

5.5 |

3.3 |

|

aNorth American Industry Classification System codes are given in parentheses. Totals may not equal sum of components due to independent rounding. Source: U.S. Department of Energy, U.S. Energy Intensity Indicators, Trend Data, Industrial Sector. Available at http://www1.eere.energy.gov/ba/pba/intensityindicators/. |

|||||

TABLE 4.2 Primary Energy Consumption by Type of Fuel in the U.S. Industrial Sector (quadrillion Btu, or quads)

|

|

1978 |

1985 |

1990 |

1995 |

2002 |

|

Petroleum |

9.87 |

7.74 |

8.28 |

8.61 |

9.57 |

|

Natural gas |

8.54 |

7.08 |

8.50 |

9.64 |

8.67 |

|

Coal |

3.31 |

2.76 |

2.76 |

2.49 |

2.03 |

|

Renewable energy |

1.43 |

1.91 |

1.67 |

1.91 |

1.68 |

|

Source: U.S. Department of Energy, U.S. Energy Intensity Indicators, Trend Data, Industrial Sector. Available at http://www1.eere.energy.gov/ba/pba/intensityindicators/. |

|||||

ing and wood product manufacturing. In other sectors, however, energy use has increased significantly. For example, energy use in the plastic and rubber products manufacturing sector almost doubled between 1978 and 2002.

Petroleum and natural gas are the two most common fuels consumed by the industrial sector (Table 4.2). While the use of petroleum and natural gas increased by 24 and 22 percent, respectively, from 1985 to 2002, coal consumption dropped by approximately 27 percent. The use of renewable energy has fluctuated over the years, totaling 1.43 quads in 1978, rising to 1.91 quads in 1985, and then retreating to 1.68 quads in 2002.

4.1.2

Energy-Intensity Trends and Comparisons

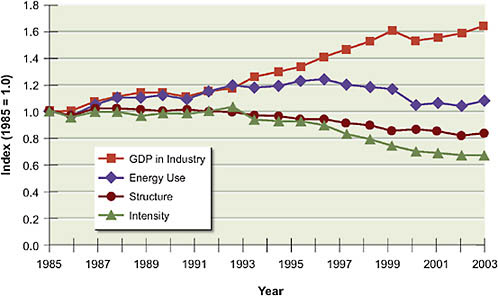

Between 1985 and 2003, industrial-sector gross domestic product (GDP) increased by 64 percent, while industrial energy use increased by only 12 percent (Figure 4.2), resulting in a significant decline in the energy intensity of the industrial sector (DOE/EERE, 2008). As previously noted, over the past decade structural factors (the change in manufacturing output relative to industrial output and the shift among manufacturing sectors to less energy-intensive industries) have caused a decline in energy intensity and in total industrial energy use.

By comparing the energy intensity of manufacturing across 13 countries that are members of the International Energy Agency (IEA), Schipper (2004, p. 18) provides a glimpse into the relative efficiency of U.S. manufacturing. A simple comparison of manufacturing energy use per dollar of output suggests that the United States has a slightly higher than average manufacturing energy intensity. This is corroborated by statistics from the IEA (2004, p. 69) on energy use per unit of manufacturing value added in countries that are members of the OECD.

FIGURE 4.2 Trends in U.S. industrial sector gross domestic product (GDP), energy use, structure, and energy intensity, 1985–2003. Industrial GDP increased 64 percent between 1985 and 2003; energy intensity (energy use per dollar of GDP) declined by 19 percent over the same period, with most of the decline occurring since 1993. “Structure” represents the change in manufacturing as a fraction of total industrial output, and the changes that have occurred within manufacturing.

Manufacturing, which is more energy-intensive than nonmanufacturing, has seen a growth in GDP relative to total industrial GDP, with most of that change occurring since 1995. This factor has added about 6 percent to energy use, most of this effect occurring after the recession in the early 1990s. Manufacturing industries that are less energy-intensive have grown relative to those manufacturing industries that are highly energy-intensive, thus reducing the energy intensity of manufacturing as a whole.

Source: DOE/EERE, 2008.

The United States is considered a country with medium energy intensity country along with Finland, Sweden, and the Netherlands. High-energy-intensity countries include Norway, Australia, and Canada. At the same time, the United States has a less energy-intensive manufacturing sectoral structure relative to the other 12 IEA member countries, many of which are big producers of raw materials (e.g., Australia, Canada, the Netherlands, Norway, and Finland).2 Correcting for this difference raises the U.S. energy-intensity index compared with that of other IEA coun-

TABLE 4.3 “Business as Usual” Forecast of U.S. Industrial Energy Consumption (quadrillion Btu, or quads)

|

Industry |

2006 |

2020 |

2030 |

|

Refining |

3.94 |

6.07 |

7.27 |

|

Aluminum |

0.39 |

0.36 |

0.33 |

|

Iron and steel |

1.44 |

1.36 |

1.29 |

|

Cement |

0.45 |

0.43 |

0.41 |

|

Bulk chemical |

6.83 |

6.08 |

5.60 |

|

Paper |

2.18 |

2.31 |

2.49 |

|

Total |

32.6 |

34.3 |

35 |

|

Source: EIA, 2008a. |

|||

tries. While the analysis by Schipper is based on somewhat dated statistics (focusing on 1994), the panel’s assessment is that its fundamental conclusion regarding the relative energy inefficiency of U.S. manufacturing remains valid.

The EIA’s Annual Energy Outlook 2007 forecasted that U.S. industrial energy consumption would increase from approximately 34.1 quads in 2006 to 35.8 quads in 2020 and 38.7 in 2030 (EIA, 2007). This baseline forecast assumed the continuation of current policies and some autonomous, or naturally occurring, efficiency improvement (see Section 4.2.1.4).

The EIA’s Annual Energy Outlook 2008 reduced the 2007 forecast’s projected increase in U.S. industrial energy consumption substantially to reflect the nation’s economic slowdown, rising energy prices, and the passage of the Energy Independence and Security Act of 2007 (P.L. 110-140) (EIA, 2008). With rising prices and more policy levers encouraging energy efficiency, greater energy efficiency improvement is anticipated to occur naturally as part of the 2008 baseline forecast. Specifically, the 2008 EIA estimate of U.S. industrial energy consumption for 2006 is 32.6 quads, 34.3 quads for 2020, and 35.0 quads for 2030 (Table 4.3). With a lower anticipated rate of growth in energy consumption, the potential for further cost-effective efficiency improvements must be recalibrated. This has been done by scaling the percentage savings for 2007 to the 2008 projections (see Section 4.2.1.1).

4.2

POTENTIAL FOR ENERGY SAVINGS

4.2.1

Review of Studies of Energy Efficiency Potential

Two major studies that have attempted to assess the potential for cost-effective energy efficiency improvements across the U.S. industrial sector—Scenarios for a Clean Energy Future (IWG, 2000) and The Untapped Energy Efficiency Opportunity in the U.S. Industrial Sector (McKinsey and Company, 2007)—are described below. In addition, many studies have examined the potential for energy efficiency in individual manufacturing industries such as aluminum, chemicals, and paper; others have focused on the potential impact of specific technologies (such as membranes or combined heat and power [CHP]) or families of technologies (e.g., sensors and controls, fabrication and materials). Such cross-sectional studies are the subject of Section 4.3 (focusing on major energy-consuming industries) and Section 4.4 (focusing on crosscutting technologies and processes). Because they do not treat the industrial sector comprehensively, these studies do not enable a sector-wide estimation of economic energy efficiency potential. However, they provide valuable benchmarking of the two comprehensive studies discussed below. In addition, there are state-level and international assessments of industrial energy efficiency potential, which are also drawn on below.

4.2.1.1

U.S. Industrial-Sector Assessments

In the DOE-sponsored study Scenarios for a Clean Energy Future (CEF), prepared by the Interlaboratory Working Group on Energy-Efficient and Clean Energy Technologies (IWG), a portfolio of advanced policies3 was estimated to reduce energy consumption in the industrial sector by 16.6 percent relative to a business-as-usual (BAU) forecast, at no net cost to the economy (IWG, 2000; see also Brown et al., 2001, and Worrell and Price, 2001). The assumptions made in the study regarding cost-effectiveness are detailed in Box 4.1. The policies were assumed to be implemented in the year 2000; the 16.6 percent reduction was the difference between the BAU forecast for 2020 and the scenario trajectory

|

BOX 4.1 Cost-Effectiveness of Industrial Energy Efficiency Investments Investment decisions can be characterized by the internal rate of return (IRR), also called the hurdle rate, used to trigger an expenditure. The IRR involves a discounted cash flow analysis that is based on a firm’s cost of capital plus or minus a risk premium to reflect the project’s particular risk profile. McKinsey and Company (2007, 2008) assumes that investments with an IRR greater than 10 percent are cost-effective. In their studies, each investment opportunity is treated individually; no integrated analysis is conducted to determine whether investments in one technology might impact the economics of other investment options. The CEF study, Scenarios for a Clean Energy Future (IWG, 2000), does not use a single hurdle rate. Rather, it draws on a variety of best-in-class modeling approaches that employ economic metrics seen as appropriate to particular sectors and technologies. For example, in the buildings sector, the business-as-usual hurdle rate is assumed to be about 15 percent (in real terms). In the advanced scenario, the potential impact of individual policies on energy demand was assessed in detailed spreadsheets using lower discount rates (typically about 7 percent), reflecting the influence of supporting policies that remove barriers to the adoption of energy-efficient technologies. The hurdle rates and other parameters inside the buildings-sector modules of the National Energy Modeling System (NEMS; the energy modeling system used by the U.S. Department of Energy’s Energy Information Administration) were then changed so that the model replicates the energy savings calculated from the CEF spreadsheets (IWG, 2000). In the industrial sector, the business-as-usual hurdle rate was generally assumed to be approximately 30 percent. In the advanced scenario, industrial subsectors were assessed using a hurdle rate of 15 percent to reflect the impact of the policy instruments that reduce transaction costs and financial risks. Combined heat and power (CHP) was modeled separately using Resource Dynamics Corporation’s DISPERSE model because of limitations of the NEMS model (IWG, 2000). As a final step, the NEMS integration model was used to assess the full range of effects of the economy-wide technology and policy scenarios. The integration step allows technology trade-offs and allows the effects of changes in energy use in each sector to be taken into account in the energy-use patterns of other sectors (IWG, 2000). |

in 2020 as defined by advanced policies. The annual energy cost savings from the advanced scenario was estimated to exceed the sum of the annualized policy implementation costs and the incremental technology investments. (See Box 4.2 for further description of the CEF study.)

|

BOX 4.2 The Scenarios for a Clean Energy Future Study The study Scenarios for a Clean Energy Future (CEF; IWG, 2000) was conducted by scientists at five U.S. Department of Energy (DOE) national laboratories with more than $1 million in funding from the DOE and the U.S. Environmental Protection Agency. Published in November 2000, it involved a comprehensive analysis of U.S. technology and policy opportunities, using a combination of engineering-economic analysis and a modified version of the DOE Energy Information Administration’s National Energy Modeling System (CEF-NEMS). In the study the major sectors of the economy (buildings, industry, transportation, and electricity) were analyzed separately to identify the most cost-effective energy policy and technology alternatives for addressing multiple energy-related challenges facing the nation. Using CEF-NEMS, an integrated assessment of technology and policy options was produced. Seven supplemental studies are published in the CEF report’s 600-page appendix (e.g., an assessment of combined heat and power opportunities). The appendix also contains details of the engineering-economic analysis so as to enable full public disclosure and replication by others. The report had extensive peer review, including that of a blue-ribbon advisory committee, and the results were the subject of a special issue of Energy Policy published in 2001 (see Brown et al., 2001). |

Taken from the Annual Energy Outlook 1999, the BAU forecast used in the CEF study (IWG, 2000) estimated that the U.S. industrial sector would require 41.2 quads of energy in 2020. In contrast, the advanced portfolio of policies (defined earlier in the CEF study and assumed implemented by 2020) produced a scenario with industry requiring only 34.3 quads of energy (saving 6.9 quads of energy, a 16.6 percent reduction). The 2008 EIA projection (EIA, 2008) forecasts a BAU industrial-sector consumption of only 34.3 quads of energy in 2020. Scaling the 16.6 percent savings estimate to this lower level of future baseline industrial energy consumption suggests a savings of 5.7 quads, or a possible policy-induced reduction in industrial energy use to 28.4 quads.4 These sector-wide

savings estimates do not account for the possible efficiencies available from CHP systems, because at the time of the Annual Energy Outlook 1999, the model used by the EIA—the National Energy Modeling System—was unable to model CHP technology in an integrated manner.

The Scenarios for a Clean Energy Future study commissioned an off-line analysis of the economic energy-savings potential of new CHP under “advanced” policies. This assessment concluded that CHP could reduce the energy requirements of the industrial sector by 2.4 quads in 2020 (IWG, 2000; Lemar, 2001). Scaling this estimate to reflect the downward forecast of future industrial energy consumption suggests an economic savings potential of 2 quads.5 In combination with the sector’s other energy efficiency opportunities identified in the CEF study, this brings the total estimate of economic energy-savings potential to 7.7 quads, or 22.4 percent of the Annual Energy Outlook 2008 (EIA, 2008) forecasted consumption of 34.3 quads in 2020.

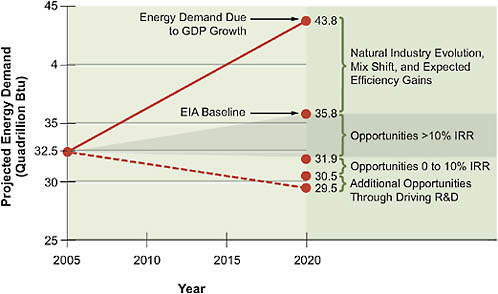

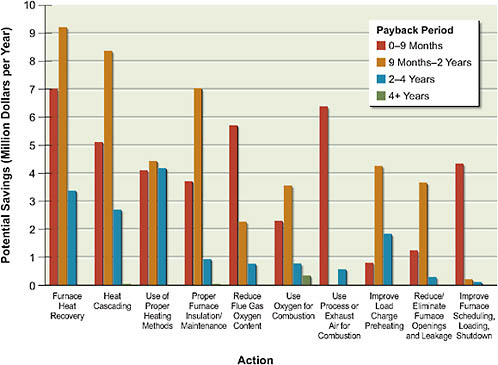

Building on the CEF study, on other assessments, and on original research, a more recent publication by McKinsey and Company (2007)6 concurred that U.S. industries have a significant opportunity for energy efficiency gains (Figure 4.3). Financially attractive investments (defined as those with internal rates of return [IRRs] of 10 percent or greater) are estimated to offer 3.9 quads in energy-usage reduction in 2020, compared with the business-as-usual forecast based on the reference case of the Annual Energy Outlook 2007 (EIA, 2007). These investments are estimated by McKinsey and Company (2007) to generate $30–$55 billion in increased earnings, before interest and taxes, by 2020; this earnings growth would, in turn, generate a $210–$385 billion increase in the market value of industrial companies. As shown in Figure 4.3, an additional 1.0 quad is identified by McKinsey and Company (2007) as “additional opportunities through driving R&D,” bringing the estimated energy efficiency potential in the industrial sector to 4.9

|

arise each year as infrastructure and equipment age and as new and improved technologies are introduced into the marketplace. |

FIGURE 4.3 Summary of industrial energy efficiency opportunities through 2020 identified by McKinsey and Company.

Note: GDP = gross domestic product; IRR = internal rate of return; R&D = research and development.

Source: McKinsey and Company, 2007.

quads. Lower-returning projects with positive IRRs below 10 percent are also acknowledged by McKinsey and Company.

Contained within the 3.9 quads of energy efficiency potential are several crosscutting energy-saving opportunities totaling 1.5 quads. CHP represents 46 percent of this opportunity (or 0.7 quad) and is characterized by McKinsey and Company (2007, p. 3) as “the leading cross-segment opportunity.” This estimate for CHP is considerably less than the 2.0 quad estimate from Scenarios for a Clean Energy Future (IWG, 2000). Because McKinsey and Company (2007) does not publish its background data, it is not possible to reconcile these two results. A recent National Research Council (NRC) study concluded that CHP economics are likely to improve in the near term through technology advancements and new niche applications for which CHP offers an economic advantage (NRC, 2007). Perhaps some of this future potential for CHP is included in the McKinsey and Company estimate of savings from new research and development (R&D) investments. There may also be differences in the more limited potential assigned to small (<5 MW) projects by McKinsey and Company (2007, p. 47) compared

with the CEF study and others (Pace Energy Project, 2002).7 An additional study by Bailey and Worrell (2005) provides estimates of the opportunity for “nontraditional” CHP technologies. It identifies 7.4 quads of potential savings relative to 2002 U.S. energy consumption. However, only 5 of the 19 technologies identified are related to CHP technologies (i.e., advanced cogeneration, steam-injected gas turbine, gas turbine process heater, gas turbine drying, and fuel cells), resulting in an estimated technical energy efficiency potential in industry of about 4.4 quads. This is comparable to the proposition examined by Shipley et al. (2008) that the United States could create a 20 percent generating capacity from CHP by the year 2030, which would lead to a fuel savings of 5.3 quads, or approximately half of the total energy currently consumed by U.S. households. The report also estimates that such an investment in CHP would create 1 million new green-collar jobs and $234 billion in new investments across the United States.

Table 4.4 summarizes the two studies’ estimates of energy-savings potential in various industrial subsectors. It also shows estimates from other U.S. studies and global estimates from the IEA (see Section 4.2.1.2 below). The CEF study estimates a large potential for economic energy savings in pulp and paper manufacturing (6.3 percent), iron and steel (15.4 percent), and cement (19.1 percent) (IWG, 2000, Table 5.8; Worrell and Price, 2001). Applying savings at these percentages to the latest BAU forecast of energy consumption in 2020 (based on the EIA, 2008) results in savings estimates of 0.14, 0.21, and 0.08 quad, respectively.

On a segment-by-segment basis, McKinsey and Company (2007) concluded that the largest untapped opportunities for U.S. industrial energy efficiency savings reside in pulp and paper and in iron and steel. Because of the limited documentation underpinning these estimates, the panel treats them as qualitatively instructive. Relative to the McKinsey and Company study, the CEF study estimates for the iron and steel and cement industries are similar, but the estimate for the pulp and paper industry is significantly lower.

Table 4.5 summarizes the savings estimates in a different way, showing the overall range of savings identified for each energy-intensive industry, and for industry as a whole, and the baseline for the analysis.

TABLE 4.4 Economic Potential for Energy Efficiency Improvements in Industry in the Year 2020: Sector-wide and by Selected Subsectors and Technologies

|

|

Estimates for U.S. Industry |

Global Estimates from IEA (2007) (%) |

||

|

CEF Study (IWG, 2000) Scaled to AEO 2008 (quads) |

McKinsey and Company (2008) (quads) |

Other U.S. Studies (quads) |

||

|

Petroleum refining |

n.a. |

0.3 |

0.61–1.21 to 1.40–3.28a |

13–16 |

|

Pulp and paper |

0.14b |

0.6 |

0.37 to 0.85c |

15–18 |

|

Iron and steel |

0.21d |

0.3 |

0.79e |

9–18 |

|

Cement |

0.08f |

0.1 |

0.29g |

28–33 |

|

Chemical manufacturing |

n.a. |

0.3 |

13–16 |

|

|

Combined heat and power |

2.0 |

0.7 |

4.4–6.8j |

|

|

Total, industrial sector |

7.7 (22.4%) |

4.9 (14.3%) |

|

18–26 |

|

Note: This table appeared in Lave (2009) before this report was completed. The data in Table 4.4 have been updated since the Lave (2009) article was published. CEF study, Scenarios for a Clean Energy Future (IWG, 2000); AEO 2008, Annual Energy Outlook 2008, with Projections to 2030 (EIA, 2008); n.a., not available. aBased on a range of 10–20 percent savings (LBNL, 2005) to 23–54 percent savings (DOE, 2006b) from a baseline forecast of 6.08 quads. b6.1 percent of the 2.31 quads of energy consumption forecast for the paper industry in 2020 by the Annual Energy Outlook 2008 (EIA, 2008). cBased on 16 percent savings (Martin et al., 2000a) and 37 percent savings (DOE, 2006c) from the baseline forecast of 2.31 quads. d15.4 percent of the 1.36 quads of energy consumption forecast for the iron and steel industry in 2020 by the Annual Energy Outlook 2008 (EIA, 2008). eBased on 58 percent savings (AISI, 2005) from the baseline forecast of 1.36 quads. f19.1 percent of the 0.43 quads of energy consumption forecast for the cement industry in 2020 by the Annual Energy Outlook 2008 (EIA, 2008). gBased on 67 percent savings (Worrell and Galitsky, 2004) from the baseline forecast of 0.43 quads. hNational Renewable Energy Laboratory, 2002. iDOE, 2007. jBailey and Worrell, 2005. |

||||

4.2.1.2

International Assessments

The Intergovernmental Panel on Climate Change (IPCC) came to conclusions similar to those of the CEF (IWG, 2000) and McKinsey and Company (2007) studies regarding the industries with the largest carbon-mitigation potentials worldwide. Specifically, the IPCC identified the steel, cement, and pulp and paper industries as having the largest potential for energy savings (IPCC, 2007).

TABLE 4.5 Summary of Estimated Cost-Effective Energy Savings in Industry Resulting from Improved Energy Efficiency (quads)

|

Industry |

Energy Use in Industry |

||||

|

2007 |

Business as Usual (BAU) Projection (AEO 2008 reference case) |

||||

|

2020 |

2030 |

||||

|

Petroleum refining |

4.39 |

6.07 |

7.27 |

0.3–3.28 |

|

|

Iron and steel |

1.38 |

1.36 |

1.29 |

0.21–0.76 |

|

|

Cement |

0.44 |

0.43 |

0.41 |

0.29 |

|

|

Chemical manufacturing |

6.85 |

6.08 |

5.60 |

0.19–1.1 |

|

|

Pulp and paper |

2.15 |

2.31 |

2.49 |

0.14–0.85 |

|

|

Total savings—all industries (including those not shown) |

|

|

|

|

4.9–7.7c 14–22% |

|

aBased on Table 4.4, which provides results from a review of studies for specific energy-using industries and for industry as a whole, and for industry-wide combined heat and power (CHP). bSavings shown are for cost-effective technologies, defined as those providing an internal rate of return of at least 10 percent or exceeding a firm’s cost of capital by a risk premium. cIncludes CHP systems, which contribute an estimated savings in 2020 of 0.7–6.8 quads. |

|||||

Tracking Industrial Energy Efficiency and CO2Emissions (IEA, 2007), which estimates energy and carbon savings from the adoption of best-practice commercial technologies in manufacturing industries, suggests an overall level of energy-savings potential of 18–26 percent globally, with large-percentage savings from petroleum refining, pulp and paper, iron and steel, cement, and chemical manufacturing (see Table 4.4). It concluded that, on the basis of physically produced industrial output, Japan and Korea have the highest levels of manufacturing industry energy efficiency, followed by Europe and North America—levels that reflect differences in “natural resource endowments, national circumstances, energy prices, average age of plant, and energy and environmental policy measures” (IEA, 2007, p. 20).

Since the IEA’s estimated energy savings are global percentages, their applicability to the U.S. context is not exact. In particular, care is needed to avoid unrealistic assessments of the savings potential in older industrial plants as compared with new, state-of-the-art facilities. International comparisons, however, underscore the potential for efficiency upgrades by U.S. industry.

4.2.1.3

State Assessments

At least two states—New York and California—have conducted assessments of the economic potential for energy efficiency improvements in the industrial sector. These studies help to set parameters for estimation of economic energy efficiency potential at the national scale.

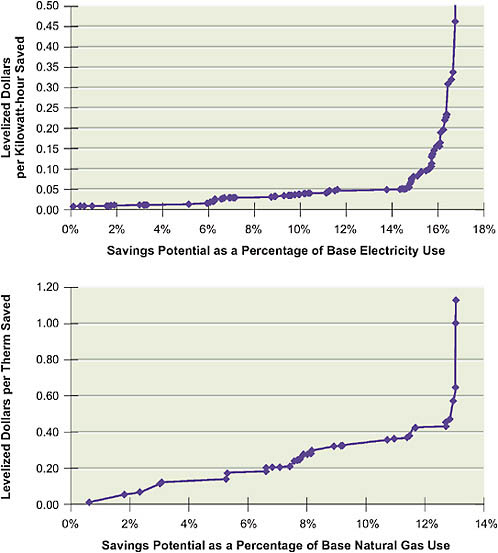

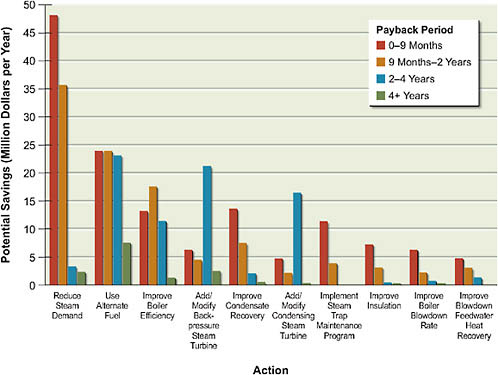

KEMA, Inc. (2006) provides an assessment of the electric and gas energy efficiency potential in existing industrial facilities in four California utility territories, focusing on the year 2016. With a base use of 32,800 GWh forecast for 2016, the study estimates that 4970 GWh of electricity use (i.e., 15.1 percent) could be eliminated by economic efficiency investments—that is, investments that are cost-competitive with supply-side options. For natural gas, 468 million therms of natural gas are forecast to be the magnitude of economic efficiency opportunity in the industrial sector, representing 13 percent of the base use of 3590 million therms in 2016. Figure 4.4 presents the two supply curves, which identify the least-expensive efficiency measures. The least-cost options are arrayed on the left side of the curve in ascending order based on levelized energy costs. The width of each line is proportional to the amount of energy that can be saved. KEMA (2006) concludes that pumping has the largest electric end-use savings potential, followed by compressed air and lighting. Similarly, boilers represent the largest source of natural gas savings potential, followed by process heating.

A similar potential for energy efficiency improvement is described in a 2003 assessment for New York State. According to Optimal Energy, Inc. (2003), the New York Energy Research and Development Authority (NYSERDA) forecasts that the industrial sector will require 33,100 GWh of electricity in the year 2022. Optimal Energy estimates that 5,000 GWh (15 percent) of this base use could be displaced by economic electricity-efficiency measures. The assessment did not evaluate natural gas or other energy-savings opportunities.

A combined heat and power market-potential study conducted by the NYSERDA identified over 5000 MW of installed CHP capacity at more than 210 sites in New York State. Close to 80 percent of this capacity is at industrial sites, represented by a few facilities that have large CHP systems (Pace Energy Project, 2002).

The New York study identified numerous commercial and emerging technologies that can be used for CHP—including the internal combustion engine, steam turbine, gas turbine, micro-turbine, and fuel cell—which constitute nearly 8500 MW of technical potential for new CHP at 26,000 sites. Near-term market-

FIGURE 4.4 Energy efficiency supply curves for California through 2016. The width of each portion of the curves is proportional to the amount of energy that can be saved. The fact that these two curves reach a maximum as the cost of efficiency options rises may simply reflect the limited set of technologies considered that have a marginal return on investment.

Source: KEMA, 2006.

penetration forecasts range from 764 MW to nearly 2200 MW over the coming decade. Close to 74 percent of remaining capacity is below 5 MW and is located primarily at commercial and institutional facilities. Achieving this remaining potential depends on the degree to which many of the obstacles outline in Section 4.5 can be overcome.

4.2.1.4

Naturally Occurring Efficiency Improvement

The McKinsey and Company (2007) analysis assumes a significant amount of energy efficiency improvement in the BAU forecast, based on EIA modeling (see in Figure 4.3 the difference between the EIA baseline and the energy demand attributable to GDP growth). The naturally occurring improvement results from capital stock turnover of outdated technologies, as well as from cost reductions and performance improvements achieved from economies of scale and advances in science and technology. Thus, the level of energy efficiency improvement anticipated in the year 2020 relative to today could be large. For example, DOE (2004) identified 5.2 quads of cost-effective energy-savings opportunities from a range of end-uses in industrial energy systems, including steam generation, fired heaters, on-site power generation, motor systems, and facility heating, ventilation, and air-conditioning (HVAC), and lighting systems. More than 35 percent of this total opportunity (1.8 quads) was identified in waste-heat recovery, such as from gases and liquids in chemicals, petroleum, and forest products, including hot gas cleanup and the dehydration of liquid-waste streams. The second largest opportunity (1.4 quads) was identified in best practices in energy management and integration. These are the kinds of potential cost savings that EIA assumes will be absorbed in the BAU case. Relative to today’s energy efficiency practices, industrial energy efficiency improvements in 2020 could save considerably more energy than the 3.9 quads estimated by McKinsey and Company (2007), if the “naturally occurring” efficiency improvements are taken into account.

Looking to the midterm (2020–2035), a wide array of advanced industrial technologies could make significant contributions to reducing industrial energy consumption and CO2 emissions. Possible revolutionary changes include novel heat and power sources and systems and innovative concepts for new products and processes that take advantage of developments in nanotechnology and micro-manufacturing. Examples include the microwave processing of materials and nanoceramic coatings, which show great potential for boosting the efficiency of

industrial processes.8 In addition, advances in recycling (resource recovery and utilization)—for example, of aluminum—could reduce the energy intensities of U.S. industry. Many of these approaches provide other benefits as well, such as improved productivity and reduced waste streams.

4.2.2

The Role of Innovation

Most of the current dialogue focuses on new technology that lowers industry’s energy use. In some cases, more important energy savings come from adapting the new technology for use in other sectors. For example, developing a new generation of fuel cells may lead to greater savings in motor vehicles. Other possibilities include “on-demand” manufacturing that applies ink-jet printing systems to three-dimensional fabrication, or new plastics that double as integrated photovoltaic systems (Laitner and Brown, 2005). This role of industry in the development of emerging technologies highlights even greater energy savings than might be apparent from looking at industry’s own energy-use patterns alone. With the growing focus on corporate sustainability, industry is adopting a much broader view of its energy and environmental responsibilities, extending its concern to issues surrounding the sustainability of the products and services that it offers, and including the sustainability of its chain of suppliers. Wal-Mart, for example, has included indicators of energy sustainability in metrics used to select product and service providers.9 Accordingly, contractors that create minimal environmental impact are preferred.

4.3

OPPORTUNITIES FOR ENERGY EFFICIENCY IMPROVEMENTS IN FOUR MAJOR ENERGY-CONSUMING INDUSTRIES

In the chemical and petroleum refining, pulp and paper, iron and steel, and cement industries, numerous opportunities exist for energy efficiency improvements. These opportunities are characterized below in three timeframes: 5–10 years, 10–25 years, and beyond 25 years. For each industry, the size of the economic energy-savings opportunity is described, along with associated costs, performance

|

8 |

See http://cleantech.com/news/3476/ceramic-nanotechnology-delivers-efficiency. |

|

9 |

Jim Stanway, Wal-Mart, personal communication, 2007. |

improvements, and environmental impacts for each.10 In addition, the discussion characterizes the opportunity for expanding best practices through reinvigorated deployment programs or by removing governmental interventions that might inhibit private-sector funding. Finally, for each of the four major energy-consuming industries, promising R&D is identified that is likely to be required for these technologies to be ready for launch into the marketplace. In each case, government partnerships that might help prepare the technologies for widespread commercialization are noted.

4.3.1

Chemical Manufacturing and Petroleum Refining

The chemical industry manufactures an extensive array of organic and inorganic chemicals and materials. Raw materials include hydrocarbons from petroleum refining, mined chemicals and minerals, and even such animal and plant products as fats, seed oils, sugars, and timber. For energy sources the industry uses petroleum-based feedstocks, natural gas, coal, and electricity—and, to a lesser but growing extent, biomass.11 Products include thousands of bulk and fine organic and inorganic chemicals, polymers, agricultural chemicals, and fertilizers. Production levels are often in million- and billion-pound quantities but do extend to such high-value, low-volume products as pharmaceutical intermediates, specialty adhesives, and even perfume ingredients. Most large chemical companies are research intensive because of the continual need to generate new and improved products, to improve quality and yields, and to conform to environmental regulations.

Companies are often concentrated near petroleum refineries, around shipping ports, or in places where cheap hydroelectric power is available. Energy costs are almost always a major part of total costs, so the need for energy efficiency is great. For some energy-intensive products, energy for fuel and power needs and feedstocks account for up to 85 percent of total production costs. Reflecting higher fuel costs during 2007, the industry spent $73 billion on purchases of fuel and power and energy feedstocks. Overall, energy costs (including feedstock costs) represent 20 percent of production costs and 10 percent of the value of industry shipments (American Chemistry Council, 2008; U.S. Census Bureau, 2007).

The petroleum industry is similar to the chemical industry in its use of

TABLE 4.6 Petroleum and Chemical Industry Energy Use, Selected Years from 1985 to 2002 (quads)

|

Year |

Fuels |

Purchased Electricity |

Net Energy for Heat and Power |

Feedstocksa |

Total Net Energy Use |

Electricity Lossesb |

Total Primary Energy |

|

Petroleum Refining Energy Use (SIC 2911, NAICS 324110) |

|||||||

|

1985 |

2.46 |

0.11 |

2.57 |

2.45 |

5.02 |

0.23 |

5.25 |

|

1988 |

2.95 |

0.10 |

2.90 |

3.26 |

6.31 |

0.21 |

6.52 |

|

1991 |

2.79 |

0.10 |

2.89 |

2.87 |

5.76 |

0.21 |

5.97 |

|

1994 |

3.87 |

0.11 |

3.98 |

2.39 |

6.26 |

0.24 |

6.50 |

|

1998 |

3.48 |

0.12 |

3.48 |

3.75 |

7.13 |

0.21 |

7.34 |

|

2002 |

3.09 |

0.12 |

3.09 |

3.31 |

6.39 |

0.12 |

6.51 |

|

Chemical Industry Energy Use (SIC 28, NAICS 325) |

|||||||

|

1985 |

1.78 |

0.43 |

1.35 |

3.57 |

0.90 |

4.46 |

|

|

1988 |

2.27 |

0.42 |

1.68 |

4.36 |

0.86 |

5.22 |

|

|

1991 |

2.25 |

0.44 |

2.36 |

5.05 |

0.91 |

5.97 |

|

|

1994 |

2.35 |

0.52 |

2.46 |

5.33 |

1.08 |

6.41 |

|

|

1998 |

3.70 |

0.58 |

2.77 |

6.06 |

0.99 |

7.05 |

|

|

2002 |

3.77 |

0.52 |

3.75 |

6.47 |

1.58 |

8.04 |

|

|

Note: SIC, Standard Industrial Classification; NIACS, North American Industry Classification System. aPetroleum feedstock used to produce nonenergy products only (e.g., petrochemicals, lubricating oils, asphalt). bElectricity losses incurred during the generation, transmission, and distribution of electricity are based on a conversion factor of 10,500 Btu/kWh. Source: Based on data in select DOE reports, 1988–2005. |

|||||||

energy sources and process equipment, but it normally produces a limited range of refined hydrocarbon products in high volume for the transportation industry. Many refining companies have a bulk-chemical arm to manufacture a limited spectrum of high-volume organic chemicals and bulk-polymer intermediates that are natural extensions of their refining operations. Petroleum companies vary in research intensiveness, but they are generally less dependent on finding new products and processes than the chemical industry is.

For these industries, energy efficiency and product yield are generally key to profitability and emissions abatement. Table 4.6 shows U.S. energy consumption for these industries from 1985 through 2002 (EIA, 2002). As can be seen, energy use from year to year was somewhat erratic, but it generally increased. These changes reflect varying industrial production levels, changing product mixes, and

efficiency gains. For example, ExxonMobil achieved a 35 percent reduction in the energy intensity of its global refining and chemical operations from 1974 to 1999 and has identified a further 10–15 percent cost-effective energy-savings opportunity in all plants around the world (Expert Group on Energy Efficiency, 2007).

Benchmarking data indicate that most petroleum refineries can economically improve energy efficiency by 10–20 percent (LBNL, 2005), and analysis of individual refining processes indicate energy savings ranging from 23–54 percent (DOE, 2006b). Common technologies include high-temperature reactors, distillation columns for liquid-mixture separation, gas-separation technologies, corrosion-resistant metal- and ceramic-lined reactors, sophisticated process-control hardware and software, pumps of all types and sizes, steam generation, and many others. In the DOE (2006b) petroleum bandwidth study, the largest potential bandwidth savings are found in crude distillation, with savings of up to 54 percent of current average energy for atmospheric distillation (39 percent for vacuum distillation). Alkylation follows closely, with a potential bandwidth savings of 38 percent, and the remaining processes also exhibit significant potential for improving energy efficiencies. According to experts working in the field of petroleum refining and energy management, identifying plantwide energy savings of approximately 30 percent would be typical. However, these savings estimates are calculated on a relative basis. The absolute energy consumption of petroleum refineries in the United States must be adjusted to account for increasingly heavy crude slates over the coming years. When one adjusts for the use of heavier crude slates, the energy consumption of a refinery increases per equivalent amount of refined product.

Numerous reports and studies are available that describe near-, intermediate-, and potentially longer-term technologies to increase energy efficiency (and decrease related carbon emissions) (Expert Group on Energy Efficiency, 2007; DOE, 2006b) for both the chemical and the petroleum-refining industries. Three recent studies provide a wide range of efficiency-potential estimates. On the low side is the estimate that 0.014 quad could be saved by five technologies included in the DOE (2006a) Chemical Bandwidth Study. These technologies are applicable to the production of ethylene, chlorine, ethylene oxide, ammonia, and terephthalic acid. On the high side is the estimate that 1.1 quads of potential energy could be saved (DOE, 2007a). This assessment is based on 16 DOE Industrial Technologies Program (ITP) portfolio technologies (0.58 quad of savings) and five additional R&D technologies from the Chemical Bandwidth Study (0.52 quad of savings). Clearly, the magnitude of energy efficiency improvement will tend to expand or

contract depending on the number of technologies that are considered. Interestingly, between these two extremes is an assessment based on a single type of technology and an estimated energy efficiency potential of 0.19 quad in the chemical industry today (DOE, 2002). This assessment is based on 12.4 percent of fuel-savings potential from steam system improvements.

As discussed in Box 4.3, in the chemical industry (as well as in petroleum refining), gaining even the so-called low-hanging fruit for increased energy efficiency faces significant obstacles. However, as is also pointed out, good management practices supported by the top levels of management aim to accomplish the savings over a reasonable time period.

One useful perspective on these risks can be seen in the NRC (2007) report Prospective Evaluation of Applied Energy Research and Development at DOE.12 Based on an examination of 22 high-payoff projects, the NRC panel found that great potential existed for energy and carbon-emissions reductions, but technical and market risks were generally quite high. From an individual company’s viewpoint, the decision to pursue any one of these technology developments could be too risky. This risk is often the reason that DOE partners with individual firms or groups of companies for technology development and demonstration.

While both the chemical and petroleum-refining industries are capable of prolonged and expensive R&D efforts for their own process improvements, advances in crosscutting technologies (such as process-control hardware and software, separation processes and equipment, and heat-management equipment) are often best accomplished by, or in collaboration with, vendors. While chemical and petroleum-refining companies typically develop process designs and specify the desired performance of technologies, they then purchase these technologies, thereby saving their R&D organizations for new-product development and specific process innovations.

In summary, the chemical and petroleum-refining industries have many similarities in raw materials, energy sources, process equipment and control, and the opportunity to achieve significant energy efficiency improvements. They differ in key ways centered around the breadth of product lines and the areas in which innovation will gain them a competitive advantage. Both purchase much of their process equipment and controls from specialty providers, which themselves carry out R&D to improve their offerings. Factors that can impede the use of technol-

|

BOX 4.3 Barriers to Plucking Low-Hanging Energy Efficiency Opportunities Many reports and studies have been written about the tremendous energy-savings opportunities that exist in U.S. energy-intensive industries (as outlined in Section 4.3 in this chapter). A large portion of these savings are often described as ready for the taking with little or no technical risk. As discussed throughout Section 4.3, these claims are true for the most part. So why doesn’t a given company move quickly to make the necessary investments, which often pay themselves back in a year or less? Why are these “sure thing” projects often spread out over years or even sometimes ignored? The answer is simple: competition for capital within a corporation and, in some situations, a lack of time and/or personnel to install the improvements. The top management of a company is responsible for the health of the corporation. A critical component of this duty is the allocation of limited capital among marketing, sales, manufacturing, research and development, and other functions. Capital allocations are further split into new plant construction, plant improvements and maintenance, office building expansions, and so on. There is tremendous demand at all times for capital in a successful company. This allocation process, as with all the other allocations, is largely decided on the basis of business need. At any given time, more product may be more important than lower energy consumption. Safety and compliance are always the number one priority. So in a given year, there may not be money for energy efficiency. But even if there is capital for energy efficiency improvements, other constraints exist. Most manufacturing plants have annual shutdowns for maintenance and other alterations. These are carefully planned, with all activities to be done in the shortest |

ogy for energy efficiency improvements include the availability of the necessary capital, which must compete with other corporate needs, and, for specific innovations, the costs and risks associated with the marketplace. Generally speaking, both industries are endowed with strong technology and engineering organizations and are aware of the status of the technologies that they need for future improvements. Both, however, are careful in allocating R&D funds. As discussed above, the criteria for such expenditures are strongly influenced by payback times, potential gains in competitive advantage, and the projected timescales and technical and marketing risks for a given innovation.

As a result of these factors, typical industry practice regarding energy-intensive facilities such as large-scale distillation columns is to maintain and use them for as long as possible, primarily because of the large capital investment that

|

time possible. The object is to get up and running so that no product shortages will be created. This shutdown period is especially constraining in times of high product demand. If an energy efficiency improvement cannot be fit into the shutdown period, either because of a long implementation period or possibly a lack of available personnel, it may be passed over for the time being. The discussion above in no way implies that energy efficiency, with its positive environmental impacts, always gets short shrift—quite the contrary. In energy-intensive industries such as chemical manufacturing, energy efficiency is often where the “big money” is. Well-run companies are usually aware of this and have implemented numerous “best practices” to ensure that they gain these savings as rapidly as possible. The Dow Chemical Company management, for example, strives to commit its entire organization to energy efficiency in manufacturing (Fred Moore, Dow Chemical Company, December 2007). Top management sets aggressive, 10-year energy efficiency goals for each process. This adds up to a publicly stated energy efficiency goal for the company. To ensure that these goals are met, the company has put into place an energy management organization that is distributed throughout the business units, with reporting lines to the top of the company. Each business unit must have specific 10-year plans that show how it intends to accomplish its part of the company goal and the schedule for doing so. These individual plans consist of three 10-year subplans covering what will be done, what the unit would like to do, and what the unit needs in terms of innovation. Frequent reporting on progress in all three plans is required. Salary, bonus, and career progression are all linked to the goal. From 1994 to 2005, Dow’s programs achieved a 22 percent reduction in energy intensity. The company’s goal for the next 10 years is an additional 25 percent. |

they represent. The consequence is that the motivation to replace them with more efficient equipment is often very low.

Three studies estimate the potential for energy savings in the chemical manufacturing industry. The highest estimate is 1.1 quads (18 percent) in 2020 (DOE, 2007a). The lowest, 0.19 quad (3 percent), comes from NREL (2002). The McKinsey and Company (2008) estimate falls within this range.

Three studies also provide estimates of energy-saving potential in the petroleum industry. The highest estimate is a range of 1.40 to 3.28 quads in 2020 (23 to 54 percent of projected energy consumption in this industry) published in a DOE (2006b) report. The lowest estimate, 0.3 quad in 2020 (5 percent), comes from McKinsey and Company (2008). An LBNL (2005) study provides an intermediate range of 0.61 to 1.21 quads saved in 2020 (10 to 20 percent).

4.3.2

Pulp and Paper Industry

Pulp and paper production, which constitutes a majority of the forest products industry, consumes about 2.4 quads of energy annually (Table 4.7). Drying and the recovery of chemicals are the most energy-intensive parts of the papermaking process. The pulp and paper sector of the forest products industry is both capital-and energy-intensive. Energy is the third-largest manufacturing cost for the forest and paper products industry (AFPA, 2007). According to the Energy Information Administration (EIA, 2004), the forest products industry consumed 3.3 quads of energy in 2004, placing it third after the chemical and petroleum-refining industries in terms of energy use. Paper and paperboard mills consume the most energy in the pulp and paper sector, and more than half of the energy source is derived from net steam (the sum of purchases, generation from renewables, net transfers, and other energy used to produce heat and power or as feedstock or raw material inputs) (EIA, 2002). Steam is needed mainly for paper drying, but it is also used for pulp digesting and other uses. In papermaking, drying is the largest energy consumer, requiring large amounts of steam and fuel for water evaporation (DOE, 2005a). Electricity is required in increasing quantities to run equipment such as pumps and fans and to light and cool buildings, among other uses.

TABLE 4.7 First Use of Energy for All Purposes in the Pulp and Paper Industry (Fuel and Nonfuel), in Primary Energy, 2002 (trillion Btu)

|

|

Net Electricitya |

Residual and Distillate Fuel Oil |

Natural Gas |

LPG and NGL |

Coal, Coke and Breeze |

Otherb |

Total |

|

Total: Pulp and Paper Industry |

223 |

113 |

504 |

6 |

240 |

1276 |

2363 |

|

Paper mills, except newsprint |

78 |

51 |

206 |

1 |

143 |

523 |

1002 |

|

Paperboard mills |

56 |

38 |

188 |

* |

84 |

542 |

908 |

|

Pulp mills |

5 |

w |

24 |

* |

w |

175 |

224 |

|

Newsprint mills |

38 |

w |

16 |

* |

w |

27 |

94 |

|

Note: LPG = liquefied petroleum gas; NGL = natural gas liquid; “w” = data withheld to avoid disclosing data for individual establishments; * = estimates lower than 0.5 trillion Btu. a“Net electricity” is defined as the sum of purchases, transfers in, and generation from noncombustible renewable resources, minus quantities sold and transferred out. It excludes electricity inputs from on-site cogeneration or generation from combustible fuels since that energy is counted under generating fuel such as coal. b“Other” is defined as net steam (the sum of purchases, generation from renewables, and net transfers), and other energy used to produce heat and power or as feedstock/raw material inputs. Source: EIA, 2002, Data Table 1.2. |

|||||||

Several energy-efficient methods of drying have been developed, many of which are cost-effective today. One of these, a systems approach, involves using waste heat from heat-generating processes, including from power generation and ethanol production, as the energy source for evaporation (Thorp and Murdoch-Thorp, 2008). These opportunities to recycle waste heat are only practical if the power production does not use condensing turbines (that is, if it is relatively inefficient), or if the ethanol distillation is conducted at relatively high temperature and pressures. Advanced water-removal technologies can also reduce energy use in drying and concentration processes substantially (DOE, 2005b). The Oak Ridge National Laboratory (ORNL) and BCA, Inc. (2005) estimated that membrane and advanced filtration methods could significantly reduce the total energy consumption of the pulp and paper industry. High-efficiency pulping technology that redirects green liquor to pretreat pulp and reduce lime kiln load and digester energy intensity is another energy-saving method for this industry (DOE, 2005b). Modern lime kilns are available with external dryer systems and modern internals, product coolers, and electrostatic precipitators (DOE, 2006c).13

In most kraft mills today, the black liquor produced from delignifying wood chips is burned in a large recovery boiler. Because of the high water content of the black liquor, its combustion is inefficient, and the possibility of electricity production from secondary steam production is limited by the steam’s low pressures. The gasification of black liquor not only allows efficient combustion but also enables the use of a gas turbine or a combined-cycle process with high electrical efficiency, thereby offering the potential for increasing the production of electricity within pulp mills. The surplus of energy from the pulp process also allows for the possible production of useful heat, fuels, and chemicals (that is, the operation of “bio-refineries”) (Worrell et al., 2004).

The Pulp and Paper Industry Energy Bandwidth Study concluded that applying current design practices for the most modern mills can reduce the energy consumption of the pulp and paper industry by 25.9 percent and that the implementation of advanced technologies could reduce mill energy consumption by even more (41 percent) (DOE, 2006c). Of course, it is unrealistic to assume that long-existing facilities can be easily upgraded to new, state-of-the-art facilities. The

largest potential energy savings in the industry are estimated to be in paper drying, liquor evaporation, and lime kilns.

Similarly, the McKinsey and Company (2007) study for the DOE Industrial Technology Program indicates that the pulp and paper industry can reduce energy consumption by 25 percent (0.6 quad) by 2020 by accelerating the adoption of proven technologies and process improvements. As shown in Box 4.4, a majority of the savings is expected to come from papermaking, multiprocess improvements, steam efficiencies, and fiber substitution.

Martin et al. (2000a) studied the opportunities to improve energy efficiency in the U.S. pulp and paper industry. Their case study results indicate that the technical potential for primary energy savings amounts to 31 percent, without accounting for an increase in recycling. The cost-effective savings potential is 16 percent. When recycling is included, the technical potential increases to 37 percent and the cost-effective savings potential remains the same.

In sum, the estimates of cost-effective energy efficiency potential in 2020 range from a low of 6.1 percent from the CEF study (IWG, 2000) to a high of 37 percent (DOE, 2006c). This range includes the 16 percent estimate produced by Martin et al. (2000a) and the 26 percent estimate produced by McKinsey and Company (2007). Applying these savings estimates to the pulp and paper industry’s current consumption of approximately 2.31 quads annually results in a range of energy savings of 0.14 to 0.85 quad by the year 2020. Additional savings are possible from the use of combined heat and power technologies.

4.3.3

Iron and Steel Industry

Iron and steel manufacturing, the fourth-largest user of energy in the industrial sector, consumes 1.4–1.9 quads per year (RECS, 2004; EIA, 2007). The energy-use breakdown by fuel is as follows: natural gas, 28.7 percent; petroleum, 7.6 percent; coal, 49.3 percent; renewables, 0.5 percent; and purchased electricity, 13.9 percent. Direct-energy costs represent 5–15 percent of the total cost of making steel, with additional energy costs embedded in expenditures for raw materials. The role of the U.S. steel industry in world markets has been eroding over the past three decades with manufacturing moving offshore, particularly to Asia. Table 4.8 indicates that between 1997 and 2006, imports of iron and steel products increased from 41 million tons per year to 65 million tons per year. During the same time period, exports of iron and steel products increased from 7.8 million tons per year to 12.7 million tons per year.

Between 2002 and 2006, U.S. production of raw steel increased from 101 million to 109 million tons per year, while China’s annual production increased from 201 million to 462 million tons (WSA, 2008). Over the 10-year period from 1996 to 2005, steel production declined in the United States at an average annual rate of 0.1 percent, while growing at an annual rate of 1.2 percent in Japan and 12.1 percent in China.

U.S. industry consumes approximately 120 million tons of metallics to produce 100 million tons of steel. There are two basic methods for producing crude steel: the blast furnace and the basic oxygen furnace (BOF), which use mainly iron ore; and the electric arc furnace (EAF), which uses mainly reduced iron and pig iron. In 2006, integrated steelmakers produced roughly 43 percent of raw steel, while EAF operations produced the remaining 57 percent. For a detailed discussion of these processes, see recent reports by the IEA (2007) and Worrell and Neelis (2006).

Energy intensities for the two steel production methods vary substantially, reflecting the fact that the BOF produces new steel, whereas the EAF uses recycled steel. In 2003, BOFs required 19.55 million Btu/ton while EAFs required 5.26 million Btu/ton. In 2002, the same uses required 21.23 million and 5.23 million Btu/ton, respectively. The calculated minimum energy requirement for ore-based steelmaking is 8.5 million Btu/ton (Fruehan et al., 2000). In 2006, yield losses totaled 8 million tons. The losses occur in many different operations and appear as “home” scrap and waste oxides; integrated producers also lose a small percentage of coal and coke.

TABLE 4.8 Change in Imports and Exports of Iron and Steel Products Between 1997 and 2006

|

Products |

1997 (thousand tons) |

2006 (thousand tons) |

Percent Change |

|

Imports |

|

|

|

|

Steel mill products |

|

|

|

|

Ingots, blooms, billets, slabs, etc. |

6,358 |

9,317 |

46.5 |

|

Wire rods |

2,237 |

3,046 |

36.2 |

|

Structural shapes and pilings |

1,141 |

1,146 |

0.5 |

|

Plates |

2,939 |

3,416 |

16.2 |

|

Rails and accessories |

238 |

352 |

47.9 |

|

Bars and tool steel |

2,627 |

5,111 |

94.5 |

|

Pipe and tubing |

3,030 |

7,545 |

149.0 |

|

Wire drawn |

655 |

903 |

38.0 |

|

Tin mill products |

638 |

749 |

17.4 |

|

Sheets and strips |

11,294 |

13,686 |

21.2 |

|

Total steel mill products |

31,157 |

45,273 |

45.3 |

|

Other steel products |

3,233 |

6,941 |

114.7 |

|

Total steel products |

34,389 |

52,214 |

51.8 |

|

Iron products and ferroalloys |

6,659 |

13,110 |

96.9 |

|

Grand Total, Imports |

41,048 |

65,324 |

59.1 |

|

Exports |

|

|

|

|

Steel mill products |

|

|

|

|

Ingots, blooms, billets, slabs, etc. |

210 |

219 |

4.3 |

|

Wire rods |

85 |

1,501 |

77.3 |

|

Structural shapes and pilings |

481 |

892 |

85.7 |

|

Plates |

780 |

1,806 |

131.7 |

|

Rails and accessories |

92 |

164 |

77.6 |

|

Bars and tool steel |

835 |

1,104 |

32.2 |

|

Pipe and tubing |

1,352 |

1,489 |

10.1 |

|

Wire drawn |

137 |

182 |

33.4 |

|

Tin mill products |

410 |

240 |

−41.3 |

|

Sheets and strips |

1,654 |

3,480 |

110.4 |

|

Total steel mill products |

6,036 |

9,728 |

61.2 |

|

Other steel products |

1,333 |

1,702 |

27.7 |

|

Total Steel Products |

7,369 |

11,430 |

55.1 |

|

Iron products and ferroalloys |

458 |

1,260 |

175.1 |

|

Grand Total, Exports |

7,827 |

12,689 |

62.1 |

|

Source: Adapted from AISI, 2006. |

|||

Yield losses reduce the overall energy efficiency of steelmaking. The industry consumes about 18.1 million Btu/ton of product, including electricity generation and transmission and distribution losses—22 percent more than the practical minimum energy consumption of about 14 million Btu/ton. These energy losses, about 4 million Btu/ton, are a result of process efficiencies and the production energy embedded in the yield losses. The BOF process itself is not a major energy user. It is the inherent energy of the charge materials that impact the overall energy intensity of the steelmaking process. To produce hot rolled steel from iron ore takes almost five times as much energy per ton as making the same product from scrap steel, as the above energy intensities show. Scrap yields roughly half the steel made and consumed (but these two are not identical).

Prior to the 1990s, steelmaking in the United States was more energyintensive than that in Germany, Japan, and Korea. It appears that, although the energy intensity of the U.S. steel industry improved significantly between 1995 and 2005, it was still higher in 2005 than that in those three countries (Table 4.9): in 1995, the steel industry in the United States was 57 percent more energyintensive than that in Korea and about 22 percent more energy-intensive than that in Japan and in Germany. In 2005, the U.S. steel industry was still more energyintensive than Korea’s and about 6 percent more energy-intensive than Japan’s and Germany’s. The report Saving One Barrel of Oil per Ton states, for example, that “energy consumption in blast furnace ironmaking has decreased by more than 50 percent since 1950” (AISI, 2005). Yet blast furnace operation uses nearly 40 percent of all the energy consumed by the iron and steel industry. One means of improving the efficiency of blast furnace ironmaking has been by recovering blast

TABLE 4.9 International Comparison—Energy Intensity of the Iron and Steel Industry of Selected Countries

|

|

Energy Intensity, 1995 (Btu/tonne) |

Energy Intensity, 2005 (Btu/tonne) |

Percent Difference Compared with the U.S., 1995 |

Percent Difference Compared with the U.S., 2005 |

|

Germany |

8,114 |

7,660 |

–22 |

–7 |

|

Japan |

8,059 |

7,743 |

–23 |

–6 |

|

Korea |

4,463 |

7,438 |

–57 |

–10 |

|

United States |

10,418 |

8,246 |

0 |

0 |

|

Source: Data from International Energy Agency, online statistical database; World Steel Association, online database. |

||||

furnace gas and using it elsewhere in the overall production process. If this recovery is taken into the evaluation, the energy intensity of the blast furnace operation is said, by a representative of the steel industry, to be 12–14 million Btu/ton, and a total of 18–21 million Btu/ton total for finished goods. Over the past 20 years, the efficiency of iron and steel manufacturing in all countries has improved substantially, but the worldwide average has not improved much. This is due to the growth of iron and steel manufacturing in China, where the overall efficiency has not changed much. In China, there is a difference of about 20 percent between the average and the best plant due to the blast furnace size and the amount of heat recovery.

It is important to use caution in comparing countries because differences can be caused by the actual efficiency of production, the amount of recycled material used, the process (BOF versus EAF) employed, and the type of final product (Schipper, 2004). Efficiency depends on the size and age of the plant—larger and newer facilities are often more energy-efficient than older ones. Savings can occur over time as a result of changes within plants or in processes and from shifts to plants and processes that are more energy-efficient; differences in resources, prices, and other factors also matter. Schipper (2004) points out as an important caveat that processes that are efficient in one country could be significantly less so in another country.

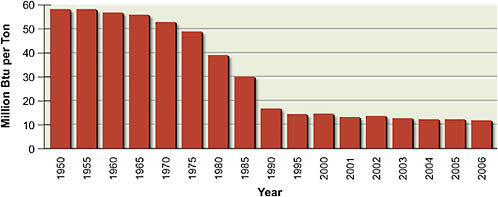

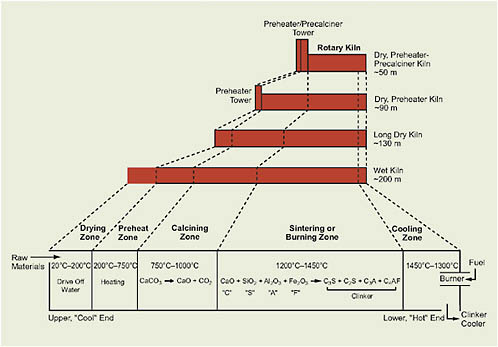

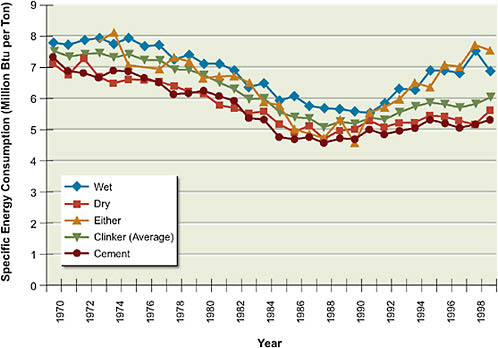

To remain competitive, the U.S. iron and steel industry must become more resource efficient and less capital intensive. Figure 4.5 shows the energy con-

FIGURE 4.5 Energy consumption in the U.S. steel industry per ton of steel shipped, 1950–2006.

Source: DOE, 2008.

sumption per ton of steel shipped by U.S. industry from 1950 to 2006. Energy consumption per ton of steel has decreased 27 percent since 1990, while CO2 emissions decreased by 16 percent. For 2002–2005, energy intensity per ton of steel decreased by 12 percent. In 2005, the American Iron and Steel Institute (AISI) announced a goal of using 40 percent less energy per ton of steel in 2025 compared to what was being used in 2003 (AISI, 2005). According to AISI, only a small portion of this reduction could be obtained by the implementation of best practices; instead, major advances would require the development and implementation of “transformational technologies.” Some of the best opportunities (in terms of cost/benefit) include EAF melting advances, BOF slag heat recovery, the integration of refining functions, heat capture from EAF waste gas, and increased direct carbon injection. The majority of these technologies would be available before 2020 assuming continued technological R&D. With standard rates of stock turnover, one could expect these technological changes to be implemented in the midterm timeframe (2020–2035).

Fruehan (2008), in a study for DOE in partnership with the industry, analyzed various combinations of technologies—including the rotary hearth furnace (RHF); the CIRCOFER process, in which coal is charred and ore is partly metallized in a single first step, and then completed in a bubbling second step; and the RHF with a submerged arc furnace (SAF)—to determine whether combinations of proven technologies could enhance the overall process. Several revolutionary new steelmaking technologies—such as the use of hydrogen as an iron ore reductant or furnace fuel (under development), or electrolytic and/or biometallurgical-based iron and steel production (in the concept definition and development stage)—could be ready in the midterm (that is, between 2020 and 2035).

McKinsey and Company (2008) identified the iron and steel industry as one of the two (pulp and paper being the other) largest opportunities to reduce energy use in the industrial sector. Box 4.5 indicates that the iron and steel industry can reduce energy consumption by 0.3 quad (22 percent) by 2020 by accelerating the adoption of proven technologies and process improvements. These technologies are consistent with those mentioned above. Many of them have IRRs greater than 20 percent. The AISI (2005) study provides a higher estimate of energy efficiency potential—0.79 quad or 58 percent of the projected energy consumption in the iron and steel industry in 2020. The CEF study (IWG, 2000) estimates a potential of only 0.21 quad (15 percent) in 2020.

The barriers to implementing energy efficiency in the iron and steel industry are similar to those of the other energy-intensive industries: lack of sustained cor-

|

BOX 4.5 Reducing Energy Consumption in the U.S. Iron and Steel Industry McKinsey and Company (2007) identified the following opportunities to reduce by 2020 the energy consumed in the U.S. iron and steel industry:

|

|||||||||||||||||||||

porate interest, reduced levels of engineering research, low energy prices, and competition for capital, which are discussed in Section 4.5.