Overview:

Partnering for Photovoltaics

Manufacturing in the United States

A. ADDRESSING THE RENEWABLE ENERGY CHALLENGE

The United States has entered a time of both urgency and great opportunity with respect to its energy generation. The urgency is driven by substantial national investments in renewable energy in the current economic downturn.1 The urgency is also driven by a growing consensus that the United States spends too much on energy, uses much of it inefficiently, and must reckon with a “nexus of concerns†related to the impact of carbon-based energy on the environment, on national security, and on economic growth.2

In his keynote remarks at the National Academies symposium on the future of photovoltaics manufacturing in the United States, Senator Mark Udall of Colorado listed some of the advantages of more widespread use of solar technologies,

____________________

1William Branigin, “Obama lays out clean-energy plans,†Washington Post March 24, 2009, p. A05.

including new economic opportunities and improved national security.3 For the economy, he said, solar energy would be able to create “millions†of new jobs and provide a key pillar of the economy for the twenty-first century. Solar energy would spur innovation, he said, and create “a pathway whereby we’re producing clean energy in our country.†From his perspective as a member of the Senate Armed Services Committee, he said, he saw the advantage of reducing the country’s dependence on foreign oil. “We have to keep reminding ourselves,†he said, “that this is a critical step.â€

National Renewable Energy Goals

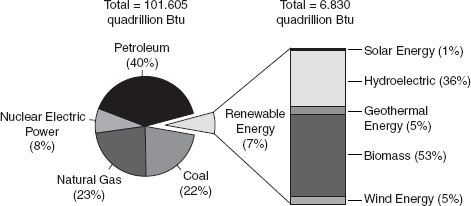

In 2009, President Obama set a goal of deriving a quarter of energy used in the United States from renewable sources by 2025 (up from seven percent in 2007—see Figure 1) and, to this end, committed $59 billion from the economic stimulus package to clean energy projects and tax incentives and a further $150 billion over ten years to develop and deploy new energy technologies.4 Elaborating on the President’s goals, Under Secretary of Energy Kristina Johnson highlighted, in her symposium remarks, the objective of conserving 3.6 million barrels of oil within 10 years, reducing U.S. greenhouse gas emissions by 83 percent of 2005 levels by 2050, and the building a world-class workforce for a sustainable green economy.5

Energy from the Sun: The Photovoltaic Challenge

According to the National Academy of Engineering, fossil fuels are not a sustainable source of energy. Moreover, it has noted, “for a long-term, sustainable energy source, solar power offers an attractive alternative. Its availability far exceeds any conceivable future energy demands. It is environmentally clean, and its energy is transmitted from the sun to the Earth free of charge. But exploiting the sun’s power is not without challenges. Overcoming the barriers to widespread solar power generation will require engineering innovations in several arenas—

____________________

2See National Academy of Sciences, Electricity from Renewable Sources: Status, Prospects, and Impediments, Washington, D.C.: The National Academies Press, 2010. See also National Research Council, The National Academies Summit on America’s Energy Future: Summary of a Meeting, Washington, D.C.: The National Academies Press, 2008. Speaking at the National Academies Summit, Dr. Steven Chu noted that reliance on the dominant sources of energy being used today poses grave risks to humans. These “hidden costs†of damages from air pollution associated with electricity generation relying on fossil fuels, motor vehicle transportation, and heat generation alone has been estimated by the National Research Council at $120 billion in the United States in 2005. Not included in this figure are damages from climate change, harm to ecosystems, effects of some air pollutants such as mercury, and risks to national security. See National Research Council, Hidden Costs of Energy: Unpriced Consequences of Energy Production and Use, Washington, D.C.: The National Academies Press, 2009.

3See the summary of Senator Udall’s remarks, delivered in the symposium of July 29, 2009, in the Proceedings section of this volume.

4The American Recovery and Reinvestment Act of 2009 includes substantial new national investments in renewable energy, smart grid, transmission, advanced vehicles, energy efficiency, and many other aspects of energy, environment, climate, and sustainability. The $787 billion U.S. economic stimulus bill includes at least $59 billion in new spending and tax credits for the development and expansion of energy technology. The Obama Administration’s $3.55 trillion budget proposal for fiscal 2010 calls for spending $150 billion over 10 years to promote clean energy and energy efficiency. It includes nearly $75 billion to make permanent a tax credit aimed at stimulating private-sector investment in research and development.

5See the summary of Under Secretary Johnson’s remarks, delivered in the symposium of July 29, 2009, in the Proceedings section of this volume.

FIGURE 1 Solar energy in the U.S. energy supply (2007).

NOTE: Sum of components may not equal 100 percent due to independent rounding.

SOURCE: Energy Information Administration, Renewable Energy Consumption and Electricity Preliminary 2007 Statistics, Washington, D.C.: U.S. Department of Energy, Table 1: U.S. Energy Consumption by Energy Source, 2003-2007, May 2008.

for capturing the sun’s energy, converting it to useful forms, and storing it for use when the sun itself is obscured.â€6

Solar power technologies can be divided into two main types: flat plates and concentrators. Flat-plate technologies include crystalline silicon and thin films of various semiconductor materials, usually deposited on a low-cost substrate, such as glass, plastic, or stainless steel, using some type of vapor deposition, or wet chemical process. Concentrator systems use only direct, rather than diffuse or global, solar radiation; therefore, their areas of best application (e.g., in the southwestern United States) are more limited than those for flat plates.7 This report focuses on the future of photovoltaic cell manufacturing technologies in the United States.8

The PV Innovation Challenge

The challenge of exploiting the power of the sun will require innovative mechanisms to facilitate bringing affordable and practical technologies to market. To help address this challenge, the National Academies Board on

____________________

6National Academy of Engineering, Grand Challenges for Engineering, Washington, D.C.: The National Academies Press, 2008.

7For an extended description and the trade-offs, benefits, and costs of each type of solar technology, see National Academy of Sciences, Electricity from Renewable Sources: Status, Prospects, and Impediments, op. cit., pp. 77–92.

8The STEP Board, in 2008, convened a meeting on the challenge of concentrated solar power generation: “Making Big Solar Work: Achievements, Challenges & Opportunities,†July 29, 2008.

BOX A

Photovoltaic Cell Technologies

When sunlight strikes the surface of a photovoltaic (PV) cell, some of the photons are absorbed and release electrons from the solar cell that are used to produce an electric current flow, i.e., electricity. A PV cell consists of “two or more layers of material designed for the dual functions of (i) absorbing light to generate free electrons and (ii) driving a current of those electrons through an external circuit. The absorbing materials can be silicon (Si), which is also used in integrated circuits and computer hardware; thin films of light absorbing inorganic materials, such as cadmium telluride (CdTe) or gallium arsenide (GaAs) that have absorptive properties well matched to capture the solar spectrum; or a variety of organic (plastic) materials, nanostructures, or combinations.

A wide range of PV technologies is now at various levels of development. Silicon flat-plate PV technologies are mature and actively deployed today. Reduction in the production cost of the cell and an increase in efficiency and reliability will make the silicon PV even more attractive to consumers. New technologies such as thin film, which has great potential to reduce the module cost, are in a relatively mature development stage, with further research and testing required to bring this technology into commercial production. Other competing technologies, such as dye-sensitized PV and nanoparticle PV are at an early stage of development, and commercialization will require much more technology development.

National Academy of Sciences, Electricity from Renewable Sources, 2010.a

____________________

aSee National Academy of Sciences, Electricity from Renewable Sources: Status, Prospects, and Impediments, Washington, D.C.: The National Academies Press, 2010, pp. 54 and 59.

Science, Technology and Economic Policy (STEP) convened two symposia, held on April and July 2009, that examined the role that a government-industry-academia partnership for PV manufacturing can play in structuring, facilitating, and leveraging the multiple abilities and perspectives needed to increase PV efficiency and reduce costs. These meetings, whose proceedings are summarized in this volume, did not focus on the technical obstacles to the deployment of solar technologies. Instead, they examined how partnerships among government, industry, and academia can accelerate innovation in concentrated solar and photovoltaic (PV) technologies and help develop a robust market and manufacturing base in the United States.

This workshop summary has been prepared by the workshop rapporteur as a factual summary of what occurred at the workshops. The planning committee’s role was limited to planning and convening the workshops. The statements made are those of the rapporteur or individual workshop participants and do not necessarily represent the views of all workshop participants, the planning committee, or the National Academies. A key feature of the meetings was to bring experts

from national laboratories, representatives of leading firms, officials from the Department of Energy, and members of Congress and their staff. This introduction captures the key themes of both these symposia.

As several participants in the two symposia noted, successful technology partnerships among industry, academia, and government has many elements, including the sharing of experience and information, the joint assumption of risk, and ultimately successful insertion into commercial markets.9 In particular, the development of roadmaps and agreements on technical standards through partnerships can enhance the PV industry’s ability to assess and address technology obstacles, gaps, and opportunities.10 As several participants at the National Academies symposia also pointed out, a partnership in the PV industry could support research more effectively through the provision of financial support, technical guidance, and performance evaluation. It could also support research directly through partners in government agencies and laboratories, universities, nonprofits, and industry.11

Part II of this introduction examines some of the major challenges facing the nation in realizing its goals for generating electricity from renewable sources. Part III reviews some of the challenges facing the PV industry in bringing new products to market. Finally, Part IV reviews how a PV industry research consortium can help accelerate the research and commercialization of PV technologies, drawing key lessons from the experience of the semiconductor industry in advancing collaborative research.

B. REGAINING U.S. LEADERSHIP IN RENEWABLE ENERGY

In her comments at the July 2009 symposium, Congresswoman Gabrielle Giffords emphasized how difficult meeting the nation’s renewable energy objectives will be. According the Energy Information Administration of the Department of Energy, summer peak electricity use in the United States is around 780 GW. By the end of 2008, approximately 1 GW of solar PV had been cumulatively installed, including 342 MW installed that year. Assuming that all installed capacity would be available on peak, meeting just 20 percent of peak demand with PV would require a more than 150-fold increase in installed capacity.12

____________________

9See, for example, remarks by Robert Margolis, summarized in the proceedings of the April 23, 2009, symposium, and Larry Sumney, summarized in the proceedings of the July 29, 2009, symposium.

10See, for example, remarks by Subhendu Guha summarized in the proceedings of the July 29, 2009, symposium.

11See the summary of remarks by Clark McFadden at the July 29, 2009, symposium in the Proceedings section of this volume.

12PV modules are generally most effective during summer peaks, when warm sunny afternoons lead to increased use of air conditioning. However, typical performance of a PV module, even under these near-ideal conditions, is less than 100 percent of its rated capacity.

Political Resistance at Home

One of the most daunting barriers, Representative Giffords said, is political resistance to investments in renewable energy. While oil and coal lobbyists have spent over $76 million during the first quarter of 2009 to advance their causes, the wind power lobby spent some $1.6 million, and SEIA, the solar energy lobbying effort, spent $410,000 over the same period. “This is what we’re up against,†she said. “I’m not putting this up so we can get discouraged, because obviously with few resources, the solar industry has made tremendous strides. But now we have to figure out how to get this technology out there and installed and making a difference for our country and our world.†To do this, she urged that supporters of renewable energy should “organize, advertise, and educate.â€

Policy Support and Increased Competition from Abroad

The United States enters the twenty-first century renewable energy challenge from behind. It currently trails other nations in the manufacture and installation of PV modules. As Ken Zweibel of George Washington University pointed out, leading European and Asian nations have created incentives for the manufacture and installation of PV systems.13 While there has not traditionally been a comparable coordinated approach in the United States to stimulate the growth of the PV industry, the 2009 American Recovery and Reinvestment Act has allocated $117 million to expand the development, deployment and use of solar energy throughout the United States.

Political action on a national level has proved crucial for the growth of PV markets in Europe where several national governments have obligated power utilities to buy renewable electricity at above-market rates. Illustrating this point, Subhendu Guha of UniSolar noted in his symposium remarks that Germany offers incentives ranging from 41 cents per kilowatt-hour to 51 cents/kWh. France offers about 40 cents/kWh and, for building integrated photovoltaic structures, they give about 70 cents/kWh.14 These incentives work, he said, because they allow construction of large manufacturing plants. As these plants bring economies of scale, their costs come down.

Indeed, as Ken Zweibel pointed out, these incentives have, within a short period, led to a rapid growth in the demand for renewable energy technologies.15 This demand, in turn, is attracting PV manufacturing and research to Europe and

____________________

13See the summary of Ken Zweibel’s remarks, delivered at the April 23, 2009, symposium in the Proceedings section of this volume. See also Vasilis Fthenakis, James E. Mason, and Ken Zweibel, “The technical, geographical, and economic feasibility for solar energy to supply the energy needs of the US,†Energy Policy 37(2):387–399, February 2009.

14See the summary of Dr. Guha’s remarks, delivered at the July 29, 2009, symposium in the Proceedings section of this volume.

15See Mario Ragwitz and Claus Huber, “Feed-in systems in Germany and Spain: A comparison,†Fraunhofer Institut für Systemtechnik und Innovationsforschung, 2005.

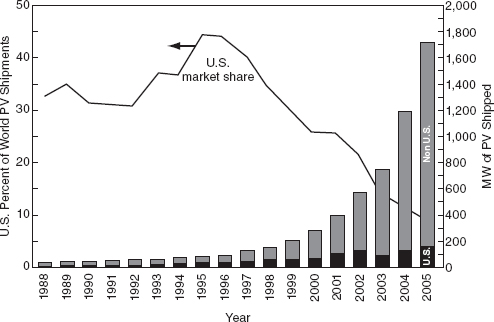

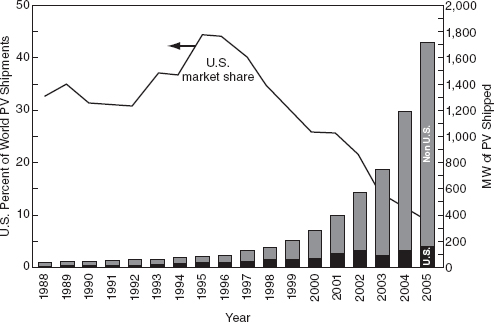

FIGURE 2 United States trails in manufacturing modules.

NOTE: World PV Cell/Module Production 1990-2007.

SOURCE: Arnulf Jäger-Waldau, PV Status Report 2008, EUR 23604 EN—2008, Joint Research Center, Luxembourg: Office for Official Publications of the European Communities, 2008, p. 5.

is creating new “green†jobs. According to Dr. Guha, Germany, which has traditionally been the auto capital of Europe, today employs fewer people in the auto industry than the PV industry, which has created 180,000 new jobs.

More recently, several Asian nations have made significant investments in renewable energy industries, funding research and development and setting ambitious targets for renewable energy use, outpacing the programs currently under consideration in the United States. For example, South Korea recently announced plans to invest about two percent of its gross domestic product annually in environment-related and renewable energy industries over the next five years, for a total of $84.5 billion. And India aims to install 20 GW of solar power by 2022, more than three times as much as the photovoltaic solar power installed by the entire world last year, the industry’s best year ever. While an admittedly ambitious target, it reflects the Indian government’s recognition of the long-term benefits and potential employment contributions of solar power.16

____________________

16See Vikas Bajaj, “India to spend $900 million on solar,†The New York Times November 20, 2009.

Significantly, China’s new stimulus plan raises the nation’s 2020 target for solar power from 1.8 GW to 20 GW.17 Calling renewable energy a strategic industry, China is also shielding its clean energy sector so that it can grow to a point where it has the capacity to export PV around the world. China has already built the world’s largest solar panel manufacturing industry. While exporting over 95 percent of its PV output to the United States and Europe, China is also requiring that at least 80 percent of the equipment for its solar power plants be domestically produced.18

Declining U.S. Market Share in PV

This growing competition from abroad has led to a decline in the U.S. market share. See Figure 3. As Robert Margolis of the National Renewable Energy Laboratory noted in the symposium, the United States was in a commanding leadership role in the PV industry until the 1980s, with more than half of global PV production. By the 1990s, Japan had begun a program of incentives and quickly became the global market leader while the U.S. share dropped to the 30 to 50 percent range.19

According to Michael J. Ahearn of First Solar, Europe is likely to hold two-thirds of the world market by the end of 2009, the United States 10 percent, Japan 7 percent, and the rest of the world 17 percent.20 On the supply side, he estimated that by year end Europe would have 30 percent of total manufacturing capacity, China 27 percent, Japan 12 percent, the rest of Asia 9 percent, the United States 9 percent, and the rest of the world 13 percent. In absolute terms, the estimated market by 2009 would be 5.6 GW versus existing and announced manufacturing capacity of 12.3 GW. “The numbers can be debated,†he said, “but the basic message is right: There’s a lot more manufacturing capacity in the world than there is demand. Absent some [policy] change, that’s not going to correct itself.â€

Dick Swanson of SunPower observed that this shift in leadership away from the United States was consistent with the message that manufacturing and the technology need to follow the markets: If we want to have manufacturing in the United States, he observed, the United States has to be a market leader.â€21 As

____________________

17See Steven Mufson, “Asian nations could outpace U.S. in developing clean energy.†Washington Post July 16, 2009.

18See Keith Bradsher, “China builds high wall to guard energy industry,†International Herald Tribune July 13, 2009.

19See remarks by Robert Margolis of the National Renewable Energy Laboratory in the Proceedings section of this volume.

20See the summary of Michael Ahearn’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

21See the summary of Dick Swanson’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

FIGURE 3 U.S. market share & world PV cell/module production (MW).

NOTE: The black curve and left (vertical) axis of the graph illustrate the relative portion the United States has contributed to annual world production. It is useful to note that world shipments increased to a record high of 1727 MW during 2005. The largest annual increase in U.S. production since data collection began—a 35 percent increase—occurred between 2003 and 2004. U.S. production reached a record of more than 153 MW in 2005.

SOURCE: National Renewable Energy Laboratory, 2009.

Ken Zweibel put it, “manufacturing will occur in the United States once we have adequate markets, unless something else drives or attracts it away.â€

C. CHALLENGES FOR PV MANUFACTURING

The future of PV manufacturing in the United States depends on both the supply of inputs into the manufacturing and installation process as well as the demand for PV technology. Participants at the National Academies symposia examined both sides of the challenge.

Addressing the Supply Side

A solar panel is made up of multiple components. For polycrystalline PV cells, the manufacturing process typically starts with highly refined polysilicon, which is grown into large single crystals, or ingots. Those ingots are sliced into wafers, which are used as solar cells that are laminated behind large glass panels

BOX B

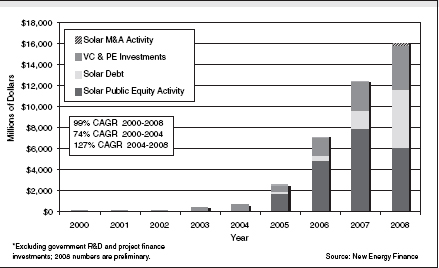

Rising Private Investments in Renewable Energy Technologies

One bright spot for the future of the U.S. renewable energy industry is the surge in private investment over the past few years in solar technologies.a Just five or six years ago, private investment in PV was on the order of tens of millions of dollars. This figure has now risen to the scale of billions a year as venture capital and private equity markets have taken on significant new investments in thin-film technologies, multijunction, concentrated PV technologies, and other next-generation technologies (See Figure B-1). According to Robert Margolis of the National Renewable Energy Laboratory, “this has been a dramatic change and [is having] a very big impact on how the industry is organized, how it does R&D, and how it interacts with the government.â€

FIGURE B-1 Total historical global investment in solar energy.

SOURCE: Robert Margolis, NREL, presentation at the April 23, 2009, National Academies Symposium on “The Future of Photovoltaics Manufacturing in the United States.â€

____________________

aDr. Margolis noted in his presentation at the April 23, 2009, symposium, that of about 200 companies that received private-sector investment in the past three years, more than 100 are in the United States. Firms in Asia have focused primarily on existing crystalline silicon technologies, with heavy investments in mono- and polycrystalline technologies, both in terms of research and in scale-up of production. See the full summary of his remarks in the Proceedings section of this volume.

and installed in a PV system. Such systems are heavy and somewhat challenging to install, so that the cost of installation is traditionally about 50 percent of the system cost. The weight, fragility, and large size often require that these panels be manufactured locally. The actual ingot is about 20 percent of the cost and the manufacturing and conversion into panels about 30 percent.22

Scaling Up to Lower Manufacturing Costs

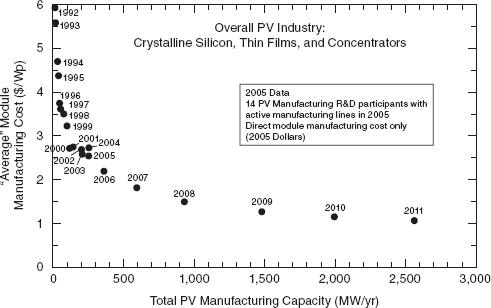

Making PV panels that are efficient and competitively priced requires lowering manufacturing costs by making the production process more efficient. The PV industry’s manufacturing costs have followed a steep downward trajectory, converging, according to NREL estimates, to about a dollar a watt produced by 2011 as manufacturing capacity expands sharply. See Figure 4.

FIGURE 4 PV industry cost/capacity (DoE/U.S. industry partnership).

NOTE: The cost/capacity graph shows the 2005 data of 14 Project participants with active module manufacturing lines in 2005. The graph shows continued progress toward meeting the Project goals of decreasing direct costs of manufacturing and increasing production capacity. From the perspective of technology learning curves, these data reflect an average 17 percent drop in direct costs of manufacturing for every doubling of production capacity.

SOURCE: National Renewable Energy Laboratory.

____________________

22See the presentation by Dick Swanson at the April 23, 2009, symposium in the Proceedings section of this volume.

Key to realizing lower costs is automation of the production process. Michael Ahearn noted that although the up-front costs of production are high, the incremental or marginal cost of producing a photovoltaic panel is minimized through automation. At first, when production was low, the average cost of production was fairly high, he noted. However, as volume increases, lower incremental cost drives the unit cost down at a rapid rate. Likewise, Eric Peeters of Dow Corning noted that realizing operational excellence and economy of scale requires increased throughput or yield through automation and process innovation.23

Mark Pinto of Applied Materials added that factory scale has increased rapidly over the last few years.24 In 1980, Arco Solar opened the world’s first factory with a production line capacity of one megawatt per year and it took 20 years to reach a capacity of 10 megawatts per year. In the next few years there will be factories that can produce gigawatts of capacity, he predicted.

These new factories will be of an enormous scale. Dr. Pinto estimated that a one-gigawatt PV factory would consume 500 tons of glass a day, enough to cover seven and a half football fields. The plant would occupy a site the size of the Magic Kingdom in Disney World. “Making scale drives down the learning curve all by itself.â€

Also driving down costs is what David Eaglesham of First Solar called “manufacturing learning.â€25 “This is boring for academics,†he said, “but critical for an industry—just regular old learning, cranking the handle, grinding on continuous improvements. It’s a key piece of why you want to stick with things that leverage existing production platforms.â€

BOX C

Investing in Improvements

“You don’t get progress by waiting for a miracle. It’s been constant investment. That’s one theme we see across multiple industries. Nor do you get a pass if you just stay on the sidelines. This doesn’t mean you should not invest in breakthroughs, but constant investment and manufacturing scale can make huge steps.â€

Mark Pinto, Applied Materials

____________________

23See the summary of Eric Peeters’ remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

24See the summary of Mark Pinto’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

25See the summary of David Eaglesham’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

The Need for Standards

Along with a high degree of automation, world-class PV manufacturing also calls for improved efficiency and manufacturing standards. Eric Daniels of BP Solar noted that the design and standards for today’s solar modules were developed early in the industry’s development.26 A manufacturer can choose to comply with these standards or not, but they are critical in building consumer confidence. In the past, the goal of the PV industry was watts, or “horsepower.†Today, he said, the emphasis has to shift to efficiency—from horsepower to miles per gallon; from watts to watt-hours.

Eric Peeters similarly noted the need for improved efficiency and standards across the production process—from the conversion of raw materials to the installation of solar panels on rooftops. He added that because the PV industry is relatively young, industry standards are still evolving, with some standards in use adopted from the electronics, semiconductor, and construction industries. “We have a lot of work to do to ensure that a homeowner installing solar panel on the roof gets the right quality,†he said, noting that “some new companies entering the market, especially from overseas, have uneven quality.â€

The National Institute for Standards and Technology mission is to “promote U.S. innovation and industrial competitiveness by advancing measurement science, standards, and technology.†Kent Rochford, Acting Director of NIST’s Electronics and Electrical Engineering Lab (EEEL), noted in his remarks at the July 2009 symposium that “to facilitate trade, the companies, vendors, and other participants have to agree on what a product is. Also, if you want to do efficient innovation, you have to be able to measure products throughout the R&D process so you can share results and perform reproducible engineering production and even reproducible research.†Eric Lin, Chief of NIST’s Polymer Division, said that his organization is working with the relevant parties to provide the infrastructure and scientific foundation for the measurements, and standards needed to support PV and other rising technologies.27 The support for the PV industry, he said, stretches from the research and prototyping of new technologies and manufacturing concepts to support for later-stage R&D cooperation.

Developing the appropriate standards for an energy transmission system adapted to renewable energy is another major challenge. As Kent Rochford pointed out, a “Smart Grid†must permit the use of intermittent and renewable sources of energy. Elaborating on this point, Eric Daniels noted that a smart grid must develop a means to forecast the impact of weather and resultant change in energy output from the solar- and wind-based energy sources. A smart grid must

____________________

26See the summary of Eric Daniel’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

27See the summary of Eric Lin’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

be able to add solar power to the transmission lines, matching the availability of sunlight with variability in demand. When there is more PV power than needed, the excess can be stored; when there is less sun, a smart grid must be able to tap and deploy this stored energy.

Training Technical Talent

The future of PV manufacturing in the United States also calls for growing and sustaining technical talent in the United States. In her remarks at the July 2009 symposium, Under Secretary Kristina Johnson warned that “60 percent of the science and engineering workforce will retire in the next five years, and these are great-paying jobs. So this is a real national crisis.†In his remarks at the April 2009 symposium, Dr. Peeters warned that a skills shortage across the value chain—from research to installation—could prove to be a bottleneck to the development of a robust solar industry in the United States.

Addressing the Demand Side

Fostering a vigorous PV manufacturing industry in the United States requires the interaction of both supply and demand factors. Participants in the National Academies symposia identified some of the conditions and incentives necessary to increase the demand for PV technology in the United States.

BOX D

Manufacturing Follows Demand for PV

“It is going to be impossible to create a U.S.-based domestic industry if there is no domestic demand. This must be stimulated at every level, from residential to utility scale.â€

Eric Peeters, Dow Corning

Achieving Grid Parity

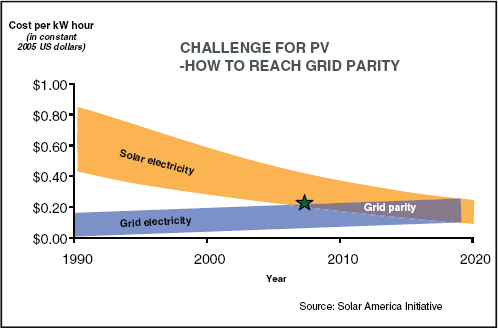

To be competitive, PV generated power has to achieve grid parity, the point at which photovoltaic electricity is equal to or cheaper than power that can currently be purchased from the power utility. This cost parity has long been a PV industry goal.

PV generated power is already competitive with conventional electricity at peak usage times in some places. In his symposium presentation, Eric Daniels explained that most current PV systems were installed at a cost of about $8 per watt. Before rebates or incentives, he said, this translates into retail costs that are becoming

FIGURE 5 A forecast for grid parity.

SOURCE: Subhendu Guha, Presentation at July 29, 2009, National Academies Symposium on “State and Regional Innovation Initiatives—Partnering for Photovoltaics Manufacturing in the United States.â€

competitive with utilities. For example, for northern California, PG&E charges 35 cents per kWh during peak hours of the day; the retail amortized cost, before rebate, of PV power is about 20 cents. “So,†he said, “the math is starting to work.â€

Subhendu Guha of UniSolar noted that the way to reduce the cost of PV is to work with the entire PV value chain. “You make the solar cell, and then you make the module, which is interconnected solar cells; then the PV array, for which you need inverters and other components to convert the DC solar electricity to AC current. Finally, you sell it to the customer,†who wants to know the cost of installing a PV system on his or her roof, and how much electricity will be produced and at what cost over the next 20 years.

Flexible Financing Options for Consumers

Even with true grid parity, the high up-front costs and the long-term return of investing in photovoltaic systems remain a significant challenge in stimulating consumer demand for PV installations. As David Eaglesham of First Solar pointed out, both interest rates and the availability of financing are key determinants of end-user adoption.

To address this challenge, Mark Pinto suggested the creation of a clean energy bank for low-interest loans: He said that solar should be considered a capital good. “Even if you put it on your house, you have to lay out the money ahead of time. So in analyses when you see levelized cost of electricity, there’s an assumed interest rate. If the prevailing bank interest rate is used, the economics of solar change dramatically. Using 8.5 percent, the rate of return of a utility, the levelized cost goes up significantly.â€

Increasing the durability of solar panels can also bring overall costs down. In his remarks at the April 2009 symposium, Eric Peeters noted that although the industry reports its output in peak watts, this is a theoretical measure, more often seen in the laboratory rather than on the rooftop. “What is really important,†he said, “is how many kilowatt-hours you can get out of the lifetime of the panel, and how do you improve that. One of the most important things is to ensure that the module lives longer.†Today the standard in the industry is that a PV module is guaranteed to maintain 80 percent of its rated power output for 20 or sometimes 25 years. He said that this standard of durability would have to be raised to 90 to 95 percent of the power output for 30 and 40 years through innovation across the PV supply chain.

Feed-in Tariffs

A feed-in tariff is an incentive structure that sets by law a fixed guaranteed price at which power producers can sell renewable power into the electric power network. The tariff obligates regional or national electricity utilities to buy renewable electricity (including electricity generated from solar photovoltaics) at above-market rates. The higher price helps overcome current cost disadvantages of renewable energy sources. By guaranteeing a price, feed-in tariffs encourage the supply of renewable energy and, in turn, the demand for PV equipment.

Given the significant costs of transporting and installing heavy glass PV panels, the manufacture of PV panels is often located close to the source of demand, spurring a domestic manufacturing industry. As David Eaglesham of First Solar noted, market location is driven not only by the decisions of regulatory agencies in each country, but also by the cost of freight, since glass products are heavy and expensive to ship. “For this reason,†he said, “glass manufacturing is almost invariably done where it is going to be installed. I already have a barrier in importing [PV] product into Europe from Malaysia.†By fostering demand, feed-in tariffs can encourage location of PV manufacturing near the home market.

In his April 2009 symposium presentation, Michael Ahearn noted that the rapid progress in adopting solar technologies in Europe was initially driven by the use of feed-in tariffs. With feed-in tariffs, producers are typically able to count on a market with predictable price points over a known number of years. Company managers and investors who build a factory and staff an organization

know they will have time in the market to recoup that investment and perhaps earn a profit.28

Mr. Ahearn acknowledged that this approach can be a cost burden that cannot be sustained over a long period by utilities. He argued, however, that the cost-reduction trajectories now present in the industry should allow such tariffs to be reduced quickly and steeply, making feed-in tariffs a viable strategy to increase demand rapidly.

The impact of feed-in tariffs is reflected in current solar market shares. Drawing on a on a consensus of 10 analysts covering solar sector, Mr. Ahearn estimated in his presentation of April 2009 that Europe, where major nations have adopted feed-in tariffs, accounted for two-thirds of the estimated 5.6 GW market for solar technologies in 2009, while the United States, which has not adopted feed-in tariffs, accounted for only ten percent.

Tax Incentives

Steven O’Rourke of Deutsche Bank Securities observed that growing the U.S. solar PV industry requires that up-front costs to the consumer be reduced.29 This can be achieved via several policy mechanisms, including investment tax credits or grants, accelerated depreciation, and state incentives.

Eric Peeters suggested that a combination of tax incentives for investment at residential level, along with a system of green certificates and electricity meters that can run in both directions, could drive growth in demand. Such incentives, he noted, led to the growth of the PV market in his native Belgium to close to 50 MW in 2008. Extrapolating this scale to the United States, he estimated that this would mean a market of 1.5 to 2 GW in 12 months. When sunlight conditions are taken into account, the United States would actually do much better than that. Every state in the United States, he said, has more sunlight than Belgium.

Mark Pinto noted that his company, Applied Materials, has many potential customers who would be willing to invest in PV factories if there were a sufficient market in the United States. They would not make money at the outset, he predicted, so that tax credits would be less helpful than refundable credits for investing in renewable energy.30

____________________

28At least 64 countries now have some type of policy to promote renewable power generation. See Michael Ahern’s presentation in the Proceedings section of this volume. Feed-in tariffs were adopted at the national level in at least five countries for the first time in 2008/early 2009, including Kenya, the Philippines, Poland, South Africa, and Ukraine. Renewable Energy Policy Network for the 21st Century, Renewables Global Status Report 2009, Paris: REN21, 2009, Accessed at <http://www.ren21.net/globalstatusreport/g2009.asp>.

29See the summary of Steven O’Rourke’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

30For an analysis of economic value of PV federal tax credits, see Mark Bolinger, Ryan Wiser, and Edwin Ing, “Exploring the Economic Value of EPAct 2005’s PV Tax Credits,†Lawrence Berkeley National Laboratory, 2006. Access at <http://escholarship.org/uc/item/9xn145qf>.

Broadening Public Awareness

Increasing the public’s knowledge about PV and the financing of PV will be essential to grow consumer demand. At her presentation at the April 2009 symposium, Representative Gabrielle Giffords said that interest in solar was certainly spreading in her Arizona district. “We find that people are curious about solar, but they don’t understand how it works—how tax credits work, how long they last. We have a ‘Solar 101’ course we do in conjunction with the Pima County Library, and the interest is tremendous. We need to get the message out to the consumer in our respective communities.â€31

D. ACCELERATING INNOVATION THROUGH COLLABORATIVE RESEARCH

Over the longer run, superior technical achievement is likely to be the key to the success of the U.S. photovoltaic industry. In his remarks at the symposium, John Kelly of IBM argued that energy output of PV panels could not be raised fast enough “through larger slices of glass or more efficient equipment; it has to be closed by leaps in technology. And then once that gap is closed, you cannot assume you can stand still there.â€32 He added that the United States cannot compete against companies and countries outside the United States by relying primarily on lower labor costs or larger, more productive equipment. “You fight that through innovation,†he said, and “you innovate faster than anyone else.â€

Some Models for Collaborative Research

Successful innovation is most often the result of highly collaborative processes that often blur the lines between basic and applied research and the development and commercialization of new technologies. Public-private partnerships, involving cooperative research and development activities among industry, universities, and government laboratories can play an instrumental role in accelerating the development of new technologies from idea to the market. A recent major study by the National Research Council found that these partnerships, when properly structured and privately led, contribute to the nation’s ability to capitalize on its R&D investments.33

Participants at the July 2009 symposium described several models of cooperative research used to advance PV technology.

____________________

31Representative Giffords participated in both National Academies symposia on the future of PV manufacturing in the United States.

32See the summary of John Kelly’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

33See National Research Council, Government-Industry Partnerships for the Development of New Technologies, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2003.

Industry-University Collaborative Research Centers (I/UCRC)

Thomas Peterson of the NSF Directorate for Engineering noted in his presentation that the NSF places heavy emphasis on research that is both basic and has industrial and commercial potential.34 Such research, he noted, is almost always interdisciplinary, involving primarily teams of universities, but also of companies and government agencies.

While the majority of NSF funding continues to support basic research, the I/UCRCs represent a means of emphasizing the application and commercialization of knowledge. The basic model for them, he said, was to enable discovery and innovation through collaboration. “The model works almost like a research franchise,†he said. “The NSF seed money is small and intended to act as catalyst, while the foundation takes a supportive role throughout the life of the center. The I/UCRCs consist of one or several universities, but they are funded primarily by industry, and its Industry Advisory Committee is the critical component. It is a specific management and structural model with independent evaluation tools.†Over the past two decades, the program has supported some 35 to 50 centers each year, with a total of about 100 sites throughout the country.

A specific example of I/UCRC, the Silicon Solar Consortium (SiSoC), consists of four universities (North Carolina State University, Georgia Tech, Lehigh University, and Texas Tech University), several national labs, and 15 industry partners. Its objective is to reduce costs and increase performance of silicon PV material, PV cells, and PV modules while developing novel breakthrough designs and processes.

Providing a university perspective, Jim Sites of Colorado State University noted that universities, after many years of focusing on fundamental contributions, were well positioned to contribute to manufacturing research needs and to the broader development of the PV industry.35 He noted that while university research, even when directed towards specific problems of industry, must allow for the thorough exploration of fundamental questions that are encountered in the course of a project. Indeed, he noted that a collective approach to PV research problems involving universities, national labs, and industry has the potential to cross-fertilize and synthesize new ideas that may elude individual investigators, thus helping to advance the role of universities to advance foundational knowledge.

The MIT-Franunhofer Center

Another model for commercializing university research is the MIT-Fraunhofer Center for Sustainable Energy Systems. Begun fifteen years ago, the Center is an alliance between the two research institutions based in Cambridge,

____________________

34See the summary of Thomas Peterson’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

35See the summary of Jim Sites’ remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

Massachusetts, that seeks to combine the strengths of MIT in basic research with the strengths of German Fraunhofer system in applied research.36 Describing this new model, Nolan Browne said that the lab has two primary foci: Solar PV modules and building efficiencies. “We find that these are two areas where we can make dramatic differences over a five-year period,â€37

In operation, the CSE begins with start-up ideas from MIT, national laboratories, or other sources. The group takes these ideas from modeling to design and has a prototyping unit that can build a technology, as well as an incubation unit to begin business development. “Our mission,†he said, “is to help grow these ideas to the point where a VC is ready to start funding.†Dr. Browne said there was a great need for such industry-university collaboration in the field of PV, as well as for nonprofit applied PV research centers. “In the past,†he said, “this lack of collaboration has led to slow or premature commercialization for some technologies. Without a smooth handoff, you can generate unrealistic expectations in the market.

Solar Product Development Center

Participants at the July 2009 symposium also considered the example of a private company that fosters collaboration to advance PV technology. Describing the need to help companies transition from a laboratory-scale prototype to a fully qualified manufacturing process that is ready for funding by the capital markets, Stephen Empedocles of SVTC Solar noted that a solar product development center like SVTC could offer companies the necessary manufacturing tools, infrastructure, and engineering expertise to help client companies advance their technologies. He noted that product development and piloting center like SVTC can “take the output of R&D—research prototypes—and convert them to final products. Eventually we hand them off to the cell and module makers who do the manufacturing.â€

Industry Research Consortia

Participants at the National Academies symposia on the future of PV manufacturing in the United States extensively discussed the potential role of a public-private partnership as a mechanism for collaborative research. An industry research consortium accelerates the development of technologies by coordinating precompetitive work among firms.38 Activities, such as those related

____________________

36The Fraunhofer Gesellschaft in Germany is a large semigovernmental research facility with 15,000 employees, mostly scientists and engineers, and a research budget of $2 billion. One of world’s largest nonprofit contract research organizations, it works in all fields of applied research.

37See the summary of Nolan Browne’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

38See Kenneth Flamm, “SEMATECH Revisited: Assessing Consortium Impacts on Semiconductor Industry R&D,†in National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2003.

to developing platform technologies and common standards, can be organized cooperatively, even as firms compete privately in their separate R&D efforts. In an R&D consortium a certain portion and type of the R&D—often involving research upstream from the market—is funneled into the organization where it is carried out collectively and is deployed by a variety of other firms. Firms also continue to compete privately through carrying on their own application-related R&D programs. In this way, firms cooperate when it is in their individual and collective interest to cooperate and compete when it is in their individual interest and the interests of consumers to compete.39

As we see next, several participants highlighted the experience of the semiconductor industry consortia, and extensively discussed the relevance of the semiconductor industry’s experience in fostering collaborative research for the PV industry.

Collaborative Research in the U.S. Semiconductor Industry

Drawing out, first, the similarities between competitive positions of today’s PV industry with the semiconductor industry in the mid-1980s, John Kelly noted that “we were seeing a loss of share in the U.S. semiconductor industry, but we were also seeing the entire equipment and materials base leaving the United States.†“That was a disaster,†he said, “to companies like Intel and IBM, who felt that our supply lines and the security of our own systems could be in jeopardy.â€

Responding to this challenge, he said, the U.S. semiconductor industry launched cooperative efforts through organizations such as the Semiconductor Research Corporation (launched in 1982) and SEMATECH (launched in 1987). These initiatives in cooperative research, he said, pooled expertise, lowered costs, and encouraged the dissemination of knowledge across the industry, contributing to a significant resurgence in the competitive position of the U.S. semiconductor industry.40

____________________

39For a review of necessary conditions for successful public-private partnerships, including research consortia, see National Research Council, Government-Industry Partnerships for the Development of New Technologies, op. cit.

40“While many believe that SEMATECH contributed to the resurgence of the U.S. semiconductor industry in the early 1990s, it was by no means the only element in this unprecedented recovery. For example, time for the industry to reposition itself was provided by the 1986 Semiconductor Trade Agreement. The U.S. industry also repositioned itself, profiting from shifts in demand, i.e., away from DRAMS (where Japanese skill in precision clean manufacturing gave significant advantage) towards microprocessor design and production (where U.S. strengths in software systems and logic design aided in their recovery.) Arguments about which of these elements were most decisive probably miss the point. The recovery of the U.S. industry is thus like a three-legged stool. It is unlikely that any one factor would have proved sufficient independently. Trade policy, no matter how innovative, could not have met the requirement to improve U.S. product quality. On the other hand, by their long-term nature, even effective industry-government partnerships can be rendered useless in a market unprotected against dumping by foreign rivals. Most important, neither trade nor technology policy can succeed in the absence of adaptable, adequately capitalized, effectively managed, technologically innovative companies. In the end, it was the American companies that restored U.S. market share.†See National Research Council, Securing the Future: Regional and National Programs to Support the Semiconductor Industry, op. cit., p. 82.

Semiconductor Research Corporation

Introducing the Semiconductor Research Corporation (SRC), Larry Sumney noted that his organization was founded to address the challenge of improving the reliability and yield of integrated circuits.41 In the early 1980s, he noted, industry did not have sufficient research capacity and universities were not interested in silicon research, or applied research in general. “It was a challenge to generate a pool of faculty with experience in manufacturing and design,†said Dr. Sumney, “or to find educated students who knew something about industry.â€

The research needs of the industry seemed to be greater than what any single company could muster on its own. Having little alternative, industry decided to organize, and to pool its resources. This was not an easy step, said Dr. Sumney, because the industry was—and still is—extremely competitive. Still, they decided they could collaborate on precompetitive, generic research that would help all of them without jeopardizing their competitive positions.

The activities of SRC are concentrated between “blue-sky†basic research and industry-level product development. In general, industry is more tightly focused on nearer-term research, while universities have more autonomy and time to pursue longer-term research. The collaborations are all governed by research contracts, with milestones jointly worked out with the principal investigator. “Negative progress is fine,†he said; “we just need to know about it. In such cases, the partnership has a choice of either changing direction or allowing the work to continue a little longer. The strategy works out well.â€

Over the years, the SRC has invested over $1.3 billion contributed by members and government; it has supported more than 7,000 graduate students through 3,000 research contracts, 1,700 faculty, and 241 universities. This support has resulted in more than 43,000 technical documents, 326 patents, 579 software tools, and work on 2,315 research tasks or themes. “The task level is really where results come from,†he said. “These may be integrated into a center, or they may be a single professor and several grad students.â€

Dr. Sumney noted that the SRC has evolved as a family of distinct but related programs:

• The Global Research Collaboration ensures the vitality of the current industry, supporting shorter-term research (a 7- to 14-year time frame) with traditional CMOS technology.42

____________________

41See the summary of Larry Sumney’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

42The complementary metal-oxide-semiconductor (CMOS) transistor is used to manufacture most of the world’s computer chips. While CMOS chips have become steadily smaller, the International Technology Roadmap for Semiconductors (ITRS) predicts that the size limit for CMOS technology is likely to be 5nm to 10 nm, which may reached in 10 to 15 years. Researchers cannot yet predict which new materials or techniques will allow the rising performance and shrinking size of computer chips to continue.

• The Focus Center Research Program, with a 14- to 20-year time frame, is focused on breaking down barriers to extend CMOS as far as it can go.

• The Nanoelectronics Research Initiative seeks to identify the next information element beyond CMOS.

• An Education Alliance provides fellowships and scholarships.

• The Topical Research Collaborations (TRC) is a new SRC research vehicle to apply the collaborative model to new technical areas. One is the Energy Research Corporation, which has a program in photovoltaic technologies. This will begin with an effort at Purdue University to model and simulate different PV structures to assess their viability. A second is the National Institute for Nanoengineering (NINE), a joint program with Sandia National Laboratory.

SEMATECH

In his symposium presentation, SEMATECH’s president, Michael Polcari noted that SEMATECH was conceived from separate proposals by the Defense Science Board and the Semiconductor Industry Association to establish a research consortium to respond to the sharp loss of market share in the 1980s to Japanese companies.43 The key goal of SEMATECH, he said, is to accelerate the commercialization of technology by putting in place the infrastructure that allows the semiconductor industry to accelerate tools and materials development and to help coordinate the elements of the technology necessary to manufacture the next generation of smaller, faster, and cheaper semiconductors.

In hindsight, he said, key factors that led to the success of SEMATECH were

• Commitment from top-level executives, both in government and industry: Without this high-level commitment, he said, nothing would have happened.

• Industry leadership: This was vital because only industry could identify the problems they needed to solve.

• A clear precompetitive mission: The group needed to work together on the U.S. technology infrastructure.

• A broad representation from industry, involvement of the national labs (including NIST), and initially the ability to leverage government funds.

A central factor leading to success, Dr. Polcari said, was that SEMATECH was member driven. Members decided what the problems were, set the research agenda, and apportioned resources. “It is essential that the people whose problems you’re trying to solve are the ones who decide what you work on,†he said.

____________________

43See the summary of Michael Polcari’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

The IMEC Model

The perceived success of cooperative research initiatives developed by the U.S. semiconductor industry has since led to the establishment of similar, often substantially better funded cooperative research organizations overseas, of which IMEC in Flanders, Belgium is a key example.44

In his symposium presentation, Johan Van Helleputte of the Flanders Inter-University MicroElectronics Centre (IMEC) in Belgium observed that a central challenge for a high-technology manufacturing industry is to deal with both very high cost research and a rapid rate of technological change.45 He said that this means that no single company can sufficiently tackle these challenges on its own. The answer, he averred, lies in partnering in R&D. Each company had a choice on how to spend the percentage of revenues it devotes to R&D: it can spend all of it on exclusive work, or it can spend part of this budget on a research platform, like SEMATECH or IMEC, and gain a much larger R&D reach.

The IMEC approach, said Dr. Van Helleputte, is to address generic problems somewhat early in a technology’s life cycle.46 It tries to create a program by defining what it intends to do for the next three years and then signs bilateral contracts with companies: partner A, partner B, partner C, and so on. IMEC asks each partner to send one or more industrial residents to do joint research within the team. The rule for intellectual property protection is that any foreground information to which the partner resident has contributed is co-owned with IMEC. If the industrial partner does not contribute to certain elements of the program, it receives a nonexclusive, nontransferable license on foreground results for its own use so there are no “blind spots†in using the technology back home. At the same time, IMEC provides a nonexclusive license for the background information required to exploit the foreground results. In return for these benefits, IMEC charges an entrance fee and a yearly affiliation fee.

Dr. Van Helleputte added that company research labs begin to form their intellectual property from a “research infrastructure†on which they build “technology platforms†of expertise and competence. In other words, a company with multiple technology programs can offer them to multiple partners and harvest greater value from the resulting partnerships, though collaboration within IMEC. “So you’re building leverage on leverage on leverage,†said Dr. van Helleputte,

____________________

44In 2008, the government of Flanders invested 44 million Euros in structural funding for IMEC. This investment saw high returns in revenues of 270 million Euros. The investment in IMEC has also positioned Flanders as a global center in semiconductor research, attracting scientists and researchers from around the world. Currently, SEMATECH receives no government support.

45See the summary of Dr. Van Helleputte’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

46For a review of the IMEC model, and the innovation strategy of the autonomous region of Flanders in Belgium, see National Research Council, Innovative Flanders: Innovation Policies for the 21st Century, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2008.

“and you reuse the mechanism of co-ownership without any accounting to each other about the foreground research.â€

Translating the Model: From Semiconductors to PV

The semiconductor and PV industries face many of the same challenges and both can benefit from collaboration by firms at the precompetitive level. According to Dr. Polcari, semiconductor companies need to know, from a strategic perspective, the most productive architecture for a factory of the future. Tactically, they need to continuously reduce costs in today’s fabs and manage ever-increasing capital, manufacturing, and R&D costs. There are also sustainability challenges, such as how to reduce the industry’s environmental footprint, find safer materials, and conserve consumables. “All of these challenges,†he said, “are also relevant to photovoltaic technologies.â€

Dr. Polcari added that the history and present activities of SEMATECH could yield numerous practical lessons for the PV industry. He said that the SEMATECH model has applications not only in technology development but also manufacturing productivity and collaborative strategies that could benefit all participants at the precompetitive level. “Certainly our experience in organizing and recruiting consortia has helped to bring a lot of cost reduction to the industry.â€

The Role of Roadmaps

The semiconductor industry’s use of technology roadmaps might also have great relevance for the PV industry.47 Steven Freilich of DuPont noted that an industry roadmap, such as the one developed by the Semiconductor Industry Association, could be a key tool to control a fast-moving technology within fast-moving markets.48 The International Technology Roadmap for Semiconductors (ITRS) sets out the objectives for each technology, performance goals, milestones, and timing. “Since everybody is working from the same page, everybody understands the same things about where the industry is going, what it needs, when, why, and how much. It gives you a chance to address shortcomings at the R&D phase, or at least before there’s been a tremendous investment.â€49

____________________

47For a description of the history of the Semiconductor Roadmap, see Robert Doering, “Physical limits of silicon CMOS and semiconductor roadmap predictions,†in National Research Council, Productivity and Cyclicality in Semiconductors: Trends, Implications, and Questions, Charles W. Wessner, ed., Washington, D.C.: The National Academies Press, 2004, p. 12.

48See the summary of Steven Freilich’s remarks, delivered at the July 29, 2009, symposium in the Proceedings section of this volume.

49The PV industry has established a roadmap that sets the deployment goal f 200GW peak in the United States by 2030. See Sandia National Laboratories, “Photovoltaic Industry Roadmap.†Access at <http://photovoltaics.sandia.gov/docs/PVRMPV_Road_Map.htm>.

Larry Sumney noted that roadmaps have also accelerated the pace of innovation in the semiconductor industry by setting the pace of competition. In this way, roadmaps have helped to sustain Moore’s Law: “You try to get from one node, or minimum feature size, to the next as fast as possible. That has served to excite the industry to beat the roadmap, and they have done that. It wouldn’t have happened without that expectation or cadence that Moore’s Law provides.†Dr. Sumney concluded that “for PV, this kind of expectation could also be used, along with a roadmap developed with the Department of Energy and others.â€

Challenges and Opportunities for Collaborative Research in PV

While there is much for the PV industry to learn from the successes of the semiconductor roadmaps and research consortium, some participants expressed caution about applying the model directly. Noting that there is no equivalent of a common CMOS technology that can be the basis for a unified technology roadmap for the PV industry as it has been for the semiconductor industry, Mark Pinto stated that any future PV consortium would have to be adapted to the exigencies of that technology.

Doug Rose of SunPower pointed out that a big difference between the PV and semiconductor industries is that processing and chip design in the semiconductor industry has a natural sharing of intellectual property because of shared interest in geometry shrinks and other advances that came on a predictable schedule. “There’s no analog to that in PV.â€50

Bettina Weiss of SEMI also added that PV industry presents unique challenges for collaborative research.51 The industry structure is still not well defined, with a mix of very small to very large companies operating in different technologies and markets and focusing on different manufacturing targets. The PV industry also suffers from deployment bottlenecks and very high logistics costs, especially for transport of modules and panels, she noted.

Setting the difference between the PV industry and the semiconductor industry in perspective, Mr. Lushetsky of the Department of Energy said that “put simply, the IC industry is one materials set with an infinite number of circuits; the PV industry is one circuit with an infinite number of materials.â€52 He acknowledged that where the IC industry was able to collaborate on materials, we clearly run into differences in PV. For other technical issues such as metrology, material handling, and deposition tooling at a high level, however, he suggested that there exist opportunities for precompetitive partnerships. Another opportunity for col-

____________________

50See the summary of Doug Rose’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

51See the summary of Bettina Weiss’ remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

52See the summary of Mr. Lushetsky’s remarks, delivered at the July 29, 2009, symposium, in the Proceedings section of this volume.

laboration, he said, lies in developing lower cost installation methods, given that installation is a major element in the cost of PV systems.

Drawing out the opportunities for collaborative research, Mark Pinto noted PV firms could share work on processes such as modeling, simulation, reliability, and characterization. Bettina Weiss added that PV firms could accelerate innovation through the collaborative development of industry standards, industry information that guides investment and planning decisions, and industry advocacy and promotion, among other arenas.

Seizing the Market

In his presentation, Bob Street of the Palo Alto Research Center warned that the United States not only needs to be a leader in materials research but also needs

BOX F

Innovation in PV Manufacturing:

The Flexible Film Opportunity

The FlexTech Alliance, formerly the U.S. Display Consortium, was initiated about 15 years ago with support from DARPA. The display consortium was structured much like that of sematech, focusing on the precompetitive aspects of the supply chain of the then-nascent flat-panel display industry. The program brought together companies that could work together and were willing to cost share more than 60 percent of the R&D.

According to Mark Hartney, the FlexTech Alliance has since evolved to focus on innovations in roll-to-roll manufacturing.a This process creates electronic devices on a roll of flexible plastic or metal foil that can be up to a few meters wide and 50 km long. Some of the devices can be patterned directly, much like an inkjet printer deposits ink. A key challenge, he said, is to use this high-throughput manufacturing technique to mass fabricate solar cells on large substrates, yielding flexible thin film solar cells at a fraction of the cost of traditional crystalline silicon manufacturing.

In today’s PV market, said Dr. Hartney, crystalline silicon predominates, with about 90 percent of PV shipments being silicon wafer-based material. However, thin-film technologies have the highest growth rate, rising from 50 MW in 2007 to a predicted 4.5 GW of power generating capacity by 2012.

Although some technologies representing this new generation of PV products are already in pilot stages, Steven Freilich of du Pont noted that developing thin film PV remains a substantial challenge. In addition to the substrate, thin-film PV also requires a flexible, durable, protective front sheet that is competitive with glass in blocking moisture transmission. “From a polymer perspective,†he said, “this is essentially unheard of.†He cautioned that progress in this technology will not be incremental and will require substantial investments and cooperative research in “radical new materials and processes.â€

____________________

aSee the summary of Mark Hartney’s remarks, delivered at the April 23, 2009, symposium in the Proceedings section of this volume.

BOX G

Building a Solar Cluster in Ohio

In her keynote address at the April 2009 symposium, Rep. Marcy Kaptur asked, “How can it be that Toledo, Ohio, ended up leading our nation in such a key area of energy independence?†She then highlighted several key factors that have helped to transform Toledo into a Solar City.

• First, she said, the high power rates charged by investor-owned utilities along Lake Erie’s south coast to Cleveland are among the most expensive in the nation. This led to interest in alternative sources of electricity generation and made renewable energy more price competitive with grid power.

• A second reason is that this region of Ohio, once known as the glass capital of the world, had established expertise in a PV related technology.a As Norman Johnson of Ohio Advanced Energy also pointed out, Northwestern Ohio was a region of high unemployment of displaced automotive and glass industry employees who had many transferable skills.

• A third reason for Ohio’s leadership in solar technology is the presence of a visionary innovator named Harold McMaster.b A lifelong resident of the region, Dr. McMaster and a group of colleagues founded Glasstech Solar in 1984 and invested generously in manufacturing and basic research at the University of Toledo and other institutions. These pioneering efforts gave rise to several of the companies and much of the research expertise that characterize the region today.

• A fourth reason is the presence of a stable, long-term funding strategy focused on basic energy research. Ohio, said Rep. Kaptur, had just recognized the fruits of a two-decade-long effort in pursuing innovation and R&D by funding the Wright Center for Photovoltaics Innovation and Commercialization at the University of Toledo.c

• Fifth, significant resources have been devoted to commercialization of energy technologies. Rep. Kaptur noted that this is extremely difficult to do from

to move new technologies rapidly from the laboratory to the marketplace.53 He observed that the science of electronic materials has been advanced over the past ten years by the fast growing display industry, but warned that the large display industry in Asia, and the substantial ecosystem of local equipment manufacturers, materials suppliers, and technology developers that supports this industry, are poised to take over the new flexible PV technology when it is ripe.

We should ask ourselves how easy it will be for these companies to just shift into solar when the time comes and be very competitive with what we can do, he remarked, adding that the focus should be not only on technological break-

____________________

53See the summary of Bob Street’s remarks, delivered at the April 23, 2009, symposium, in the Proceedings section of this volume.

a local or regional base. One way to start was to build a demonstration project now installed at the 180th Fighter Wing in Toledo, where solar cells now produce a 1-MW research base.d

• Sixth, establishing standards has played an important role. Ohio’s Advanced Energy Portfolio Standard, which mandates that at least 25 percent of Ohio’s electricity come from clean and renewable sources by 2025, is expected to advance a portfolio of clean-energy technologies.

• Finally, Rep. Kaptur cited the importance of close partnership among university, industry, and government. “They’re all working together,†she said. A group of PV enthusiasts, including Norman Johnson, founded the Ohio Advanced Energy business trade association, which has served to promote renewable technology industries statewide over the long term.

____________________

aPioneering Toledo firms included Edward Ford Plate Glass Company (1899-1930), Toledo Glass Company (1895-1931), and Libbey-Owens Glass Company (1916-1933).

bHarold McMaster (1916-2003), one of 13 children of a tenant farmer, was once called “The Glass Genius†by Fortune magazine. In 1939, he became the first research physicist ever employed by Libbey Owens Ford Glass in Toledo and went on to found four glass companies. These included Glasstech Solar, in 1984, and Solar Cells, Inc., formed to develop thin-film cadmium telluride technology. Solar Cells was later bought and renamed First Solar, currently a world leader in thin-film PV.

cIn 2007, the Ohio Department of Development awarded $18.6 million in state funding to establish the Wright Center for Photovoltaics Innovation and Commercialization (PVIC). The PVIC now has three research locations: the University of Toledo, Ohio State University, and Bowling Green State University. Matching contributions from federal agencies, universities, and industrial partners have raised this amount to $50 million.

dRep. Kaptur secured $6.4 million in federal funding for two demonstration projects in Ohio, at the 180th Fighter Wing at Toledo Airport and Camp Perry. The first is a 1-MW field, the largest in Ohio, designed for simplicity and low cost of operation. Installation began in June 2008 and is now being evaluated by the University of Toledo as the prototype of a “solar kit†that produces low-cost electricity.

throughs but on measures to secure the future of photovoltaics manufacturing in the United States.

Initiatives undertaken in states such as Michigan and Ohio show how focused and long-term investments can build a successful manufacturing base for photovoltaic technologies in the United States. At the April 2009 National Academies symposium, Norman Johnson of the Ohio Advanced Energy Association and Rep. March Kaptur of Ohio described the development of a PV technology cluster in Toledo, Ohio (see Box G).

E. WHAT IS THE ROLE FOR GOVERNMENT?

In his remarks at the April 2009 symposium, John Lushetsky said that the strategy for solar programs at the Department of Energy is not to replace anything

the private sector would do, but to find a role for government that helps to accelerate what industry can do on its own. He said that the National Academies symposia are helping to develop a better understanding of what private industry needs, and to help guide a government response that is sufficiently “prompt, effective, and strategic.â€

Several participants at the National Academies symposia offered their views of how the federal government can best support the U.S. photovoltaic industry.

Strengthening the Innovation Framework

Several participants highlighted the role of the federal government in strengthening the innovation base through support for R&D, training the future technical workforce, and setting standards.

Funding R&D: Michael Ahern affirmed the key role for the federal government in funding research and development through universities, national labs, and consortia to maintain a flow of commercially viable technologies. John Lushetsky noted that the budget for the Department’s Solar Energy Technology Program (SETP) was under $100 million for six years preceding FY2007, when it rose by more than $50 million under the Solar America Initiative. In FY2009, it rose by approximately $100 million more with the Recovery Act, and $51.5 million of that amount goes to photovoltaic technologies. He added that the request for FY2010 is similar to the 2009 total.54

Training and Attracting Technical Talent: Eric Peeters highlighted the importance of providing support for the education of “the people who are going to have those green jobs—a green-collar work force.†Steven Freilich noted further that these people are not just U.S. nationals; the government needs to ensure that international students and engineers can easily enter and stay in this country so U.S. industry has access to the best people in the world.