3

Macroeconomic Implications of Intangible Assets

How do intangibles contribute to gross domestic product (GDP) and productivity in the United States? How does this contribution compare with other industrialized countries in the global economy when efforts have been made to estimate it? And how significant are international flows of intangible assets? In this session, Carol Corrado, Jonathan Haskel, and Kyoji Fukao addressed these questions.1

3.1.

EMPIRICAL IMPLICATIONS OF CAPITALIZING INTANGIBLES IN U.S. ECONOMIC ACCOUNTS

Carol Corrado presented a set of empirical results indicating that measured patterns of growth depend significantly on how spending by firms is categorized. When expenditures made by firms to develop intangible assets are treated as investment rather than expensed, a new picture of economic growth emerges. The key idea advanced by the research of Corrado and her colleagues (Corrado, Hulten, and Sichel, 2005, 2006a, 2006b; CHS) is that an expanded view of investment—one that considers the innovation-promoting activities by firms as part of the output and capital measures used in the calculation of multifactor productivity—is grounded in economic theory.

The work of CHS recognizes that innovation is not costless; that firms invest to bring new products to the marketplace, and that the pattern of output changes with these investments. This is a departure from analyses of innovation that take

|

1 |

Brent Moulton from the Bureau of Economic Analysis at the Department of Commerce, who addressed these issues as they relate to the national income accounts, also presented during this session; most of his observations are discussed in Chapter 5. |

output as given and then seek to uncover the determinants of existing measures of labor productivity or multifactor productivity. Corrado noted that, when she was working at the Federal Reserve during the late 1990s and early 2000s, it was common to associate information technology (IT) spending with underlying productivity change. This led her to wonder about the extent to which innovation was more than this, and to think about related effects from firms coinvesting in other inputs (including workers) along with IT.2 The CHS work, as well as that by other researchers working in this area, sought to determine whether a broader set of innovation inputs could be captured and measured.

Implementing an expanded view of investment required CHS to develop a framework for measuring what is, in essence, the knowledge capital of the firm. This framework—which included three broad categories and then expanded to identify nine broad asset types (and many subcategories)—was grounded in an earlier literature that included important contributions by Leonard Nakamura and Baruch Lev.

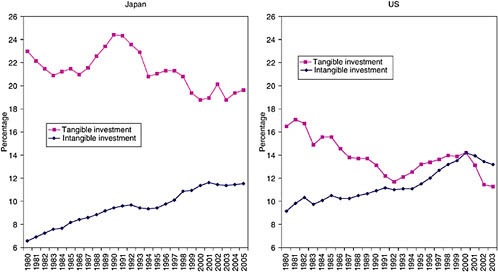

Corrado presented results, updated through 2007, that emerged from the researchers’ analytic process aimed at estimating a macroeconomic series for intangible investment. Figure 3-1 shows investment shares of output for business investment in both tangible and intangible assets. The trajectory of estimated business investments in intangible assets (the triangle plots) has a decidedly upward trend over the nearly 60-year period, whereas that for tangible investments (the diamond plots) includes extended flat and downward portions. U.S. intangible investment was more than $1 trillion in the late 1990s and, after falling off during the recession, returned to that level by 2005. In the first seven years of this decade—2001 to 2007—intangible business investment was 45 percent larger than tangible investment.

For estimating GDP, the Bureau of Economic Analysis (BEA) already capitalizes an important intangible, software, along with some other smaller items. However, nonfarm business output would have been 12 percent higher if the new intangible categories were included. And, despite the flattening of intangible investment relative to output in the early parts of this decade, if BEA were to capitalize the remaining CHS intangibles, saving rates and capital accumulation would have been higher; for example, the value of capital would have been more than $3 trillion higher in 2003; and the updated estimates show the value of intangible assets at more than $5 trillion in 2006, nearly $4 trillion higher than those currently capitalized in the national accounts.

In new work, Corrado and Hulten have built a system for producing macroeconomic estimates of output and productivity including intangibles from 1959 to 2007 (the CHS work covered the period from 1973 to 2003). Corrado referred to a forthcoming paper for technical explanations, stating that the idea was to design

FIGURE 3-1 Investment shares: Tangible and intangible investment relative to nonfarm business sector output.

SOURCE: Workshop presentation by Carol Corrado. Reprinted with permission.

a system that allows exploration of the macroeconomic implications of alternative prices for intangible output and allowance for specific intangible risk. As in the original CHS work, the new framework enables the modeling of production and capital accumulation resulting from innovative investments and knowledge appropriation, and it expresses the effects of advances in knowledge through two mechanisms rather than one. Because knowledge capital, unlike most plant and equipment, is nonrival, its benefits can diffuse through the economy without necessarily diminishing the quantity available to the original producer or to the original innovator. The first of the two mechanisms through which an investment in knowledge may diffuse is the commercially recoverable value of the research or the original investment. The second is the diffusion of the innovation to other users, an effect that is reflected in the standard growth accounting framework in total factor productivity (TFP) residual.

Corrado then showed how, in this framework, the growth of output per hour can be decomposed into multifactor productivity, capital deepening, and labor composition” components. She referred to the Bureau of Labor Statistics (BLS) website for details on the labor composition effect, noting that it is the standard way in which education is accounted for in empirical analyses of economic growth and is, in essence, what is challenged in the new view that also allows for knowledge creation by businesses to be measured.

Other results presented by Corrado involve breaking the contribution of intangible capital to economic growth into its different components. As in the original CHS work, the results indicate that nonscientific research and development (R&D) and firm-specific resources have been growing in prominence over the years. Though imprecisely estimated, these appear to be two major components driving the dynamism in their productivity results. Corrado noted that the updated results were produced using measures of own-account software adjusted for what BEA considers a double count with R&D. The results for scientific R&D are based on BEA data for performer spending deflated by the nonfarm business output price index.

The residual of the multifactor productivity calculation, which Abramovitz (1956) famously called “a measure of our ignorance about the causes of economic growth,” is lower when intangibles are accounted for. This makes sense: To the extent that intangible investments represent previously unmeasured inputs to the innovation process, a broader macro-level indicator of the innovation process has been created. Business capital investment is a key macro data series, and an updated measure including intangibles would help researchers and analysts better understand sources of and trends in productivity and innovation growth.

The other result from the analysis that Corrado is still struggling to present in a satisfying theoretical framework relates to the share that labor contributes to total output. The labor share is trendless when intangibles are treated in the conventional manner, but it falls when intangible investments are capitalized. The logical interpretation of these data is that the returns to tangible capital are relatively constant over time. The action, then, is in the returns to talent (as discussed by Wladawsky-Berger), competency, knowledge capital, or education in the workplace. Someone whose view is rooted in the Becker-Mincer thesis that all education, including professional education and experience, belongs in the production function as an augmenter of the raw labor input would have a hard time with this idea. Corrado cited the work by Richard Nelson and Edmund Phelps (1966) as among the early scholarly research on economic growth that posited a broader role for education. They claimed that advanced education (mainly college education) was necessary for managers to evaluate innovations. In this view, education plays a direct role in the innovation process and in business growth in a way that goes beyond simply augmenting raw hourly labor input. And, whether people cite that work or not, this has become a view that is widely held to this day. The CHS research takes another step and recognizes that, if long-lasting knowledge—which is more than an augmenter to the labor term in the productivity analysis—is created and funded by the firm, then that knowledge is partially appropriated as the capital of the firm and, in turn, generates capital income or profits.

Having now done the original work and gone through this extensive updating of growth numbers back to 1959 and forward through 2007, and having done some sensitivity analysis, Corrado was able to summarize the implications of the CHS work for research on economic growth and capacity:

-

The symmetric treatment of intangible and tangible assets results in a higher growth of labor productivity, an explicit role for knowledge appropriation in economic value creation, and a larger role for capital as a source of economic growth. Historically, an increasing fraction of total capital is knowledge capital.

-

The results of the earlier CHS work seem to be bolstered by subsequent research. In terms of the sensitivity of the results to the many assumptions that were needed for the analysis, what has been learned is that the choice of price deflators used to estimate intangible investment in real terms make a big difference on measured growth of real output and capital input.

-

Depreciation rates also are important, but the choices used play virtually no role in the major conclusions of the CHS research about patterns of growth and productivity.

-

Some people have questioned some of the arbitrary assumptions used to estimate economic competencies; but, when those parameters are changed, the impact on estimates of real output growth and productivity is also relatively small.

-

Estimates of the value of knowledge capital, however, are sensitive to assumptions about depreciation rates and the levels of investment.

Corrado concluded that there is a clear and compelling case for capitalizing intangibles in the nation’s economic accounts. Not only does it modernize the portrayal of business activity, it also has important macroeconomic implications. Including intangibles allows for more accurate quantification of the sources of economic growth and of the dynamics of production and capital accumulation, and the aggregate empirical analysis of productivity and innovation is improved.

3.2.

EVIDENCE FROM THE UNITED KINGDOM

Jonathan Haskel presented evidence about the role of intangible assets in the economy of the United Kingdom (UK). In the process, he identified several questions of concern to UK policy makers, business executives, and academics. In addressing the first of these questions—“In the United Kingdom, where is the new economy?”—Haskel pointed to a couple of facts. First, the investment to GDP ratio has been more or less flat since the 1950s. This has led analysts to ask, if a revolution with new information technologies is under way, where is all that investment? The second empirical observation is that the ratio of profits to GDP is more or less flat as well. So, similarly, where are the returns to this new industrial revolution? Also, in contrast to the U.S. concerns, labor productivity growth (LPG) and TFP growth both fell from the mid-1990s onward—and those numbers have been falling in most of Europe.

These statistics have created several notable policy concerns. In 2000, prime ministers of the European Union (EU) met in Lisbon and issued the statement proposing to make the European Union “the most competitive and dynamic knowledge-driven economy by 2010.” Given the immediacy of that date, Haskel noted that this is becoming a concern. Another target set was to attain a ratio of R&D spending to GDP in Europe of 3 percent. In Britain, at the moment, the figure stands at about 1.9 percent, and in most other countries it is also well below 3 percent. Given these trends, it appears that EU countries are going to have difficulty meeting this target. Kenneth Rogoff, who was chief economist of the International Monetary Fund, remarked in 2003 during his twice-yearly assessment of global prospects that the only way most Europeans were going to see an economic recovery at that time was by watching it on American television. It was a stinging comment that heightened the issue and raised further concerns about innovation in the European Union.

Another development in the United Kingdom about which Haskel reported is that calls for creation of an innovation index have increased. The idea gained momentum in part due to the influence of the innovation metrics report (in Chapter 5). Indeed, the UK equivalent to the U.S. Commerce Department stated that it was a priority to have an innovation index in the near future.

The remainder of Haskel’s presentation dealt with two topics: First, the extent to which adding intangibles to the UK data matters—Carrado argued persuasively that it matters a great deal for the U.S. case. Second, he addressed the extent to which it would be possible to develop better data on intangible investments—for example, whether European innovation-type surveys might provide some useful types of information for measuring intangibles.

Addressing the first of these topics, Haskel presented statistics indicating that, in the United Kingdom, both LPG and TFP growth (without intangibles) have been falling over the 1990-2004 period. Work to explain poor productivity performance has been carried out by a joint Federal Reserve and Bank of England project. Basu and colleagues (2003) and Oulton and Srinivasan (2005) looked at the productivity growth and total growth slowdown in the United Kingdom between 1995 and 2000 and compared the results industry by industry with the United States. In an attempt to explain the sources of the UK slowdown, the authors used industry-level data, and they reexamined the way work hours are calculated to see whether there was something unusual about UK measurement that might slow down observed rates. They also attempted to distinguish between capital services and stocks when, previously, only capital stocks had been examined. Finally, they capitalized software, a method that the official Statistics Bureau had not yet implemented.

Even with these adjustments, the authors still observed the slowdown in labor productivity growth and total factor productivity growth for 1995-2000. The question that arises, then, is whether intangibles can explain this. At the time, when Hulten briefed the UK treasury on the CHS research, people in the

department recognized that this was something that should be examined for the UK case as well.

In the research by Haskel and others, the treatment of intangibles in the United Kingdom mirrors that used by CHS for the United States (see Table 3-1). Software is treated as investment. Mineral exploration and some artistic originals are also treated as an investment—as they are in the UK national accounts (the UK Statistics Bureau has been working to capitalizing these elements). Following the U.S. lead, scientific R&D is not yet capitalized in the analysis, nor is brand equity.

In the broader economy, for the period 1970 to 2000, the United Kingdom experienced a strong increase in the percentage of market-sector gross value added, which consists roughly of nonfarm and business-sector output. The figures are similar to those found by CHS for the U.S. case; for example, in both countries, computerized information accounted for around 13 percent of GDP. For every British pound of tangible investment, the authors found, more or less, a British pound of intangible investment as well. The numbers for both nations, Haskel reported, look remarkably similar.

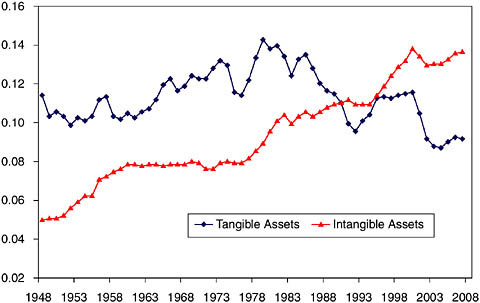

Next, Haskel and his colleagues recalculated GDP to include intangibles treated as investment. Adjustments were made to labor service quality along education, gender, and age dimensions. The results for the United Kingdom, with and without intangibles included, are shown in Figure 3-2. The left-hand side shows

TABLE 3-1 UK Treatment of Intangibles

|

Type of Investment |

Includes the Following Intangibles |

Current Treatment in UK National Accounts |

|

Computerized information |

|

Both treated as investment |

|

Innovative property |

|

Only (2) and (3) treated as investment |

|

Economic competencies |

|

None of these treated as investment |

|

SOURCE: Workshop presentation by Jonathan Haskel. Reprinted with permission. |

||

FIGURE 3-2 Labor productivity growth/total factor productivity growth, market sector, without and with intangibles.

SOURCE: Workshop presentation by Jonathan Haskel; see also Marrano et al. (2009: Table 3). Reprinted with permission.

the gradual fall in labor productivity over this period using the existing national accounts conventions (without intangibles). A good deal of capital deepening is occurring. The right-hand side figure applies the CHS methodology (with intangibles) and leads to several interesting results.

First, each bar is higher than for the corresponding measurement of the left, which means that, overall, measured labor productivity has increased. This makes sense because, again, additional items are counted as output, or, more accurately, as GDP. Second, between the early and the late 1990s, an increase in measured labor productivity is observed with intangibles included, as opposed to the decrease without intangibles. This is not surprising given that a considerable amount of investment occurred in the intangible categories during the late 1990s. However, a fall does occur for the 2000-2004 period, probably reflecting the dot-com bust.

Haskel also compared the UK and U.S. experiences for the period 1995-2003 using numbers from the (earlier) CHS paper. Ignoring intangibles, overall productivity growth over this longer period in the United States and the United Kingdom are quite similar. However, there is an important difference—more TFP growth is

detected in the U.S. data than in the UK data, whereas there is more capital deepening going on in the United Kingdom than there is in the United States. Since, in the United Kingdom, a large share of productivity growth is driven by capital deepening, there is much less of this “measure of our ignorance” to be explained. Intangibles are still important to measure accurately but, Haskel suggested, perhaps less so relative to the U.S. case. The research agenda, implied by the need to explain this large amount of TFP growth, may therefore be slightly different in the United Kingdom. Once intangibles are included in the data, more activity and more labor productivity growth is captured. Much more capital deepening is picked up in the United States (as reported by CHS) than in the United Kingdom. Total factor productivity becomes smaller, but not by as much as it shrinks in the United States, in part because there was less productivity growth accounted for by total factor productivity in the first place.

The overarching question is “Are patterns of intangible investment different in the United Kingdom than they are in the United States?” Table 3-2 breaks the amount of intangible capital deepening into the categories identified by CHS. In the United States, 32 percent of capital deepening over this period was accounted for by computerized information, 26 percent by innovative property, and 42 percent by economic competencies. The comparable numbers for the United Kingdom show similar levels of investment for many of the categories though, in the United States, there is a larger measured contribution from scientific R&D. And 10 percent of that capital deepening came from U.S. R&D and only 1 percent from UK R&D. Haskel reported that concern in the United Kingdom about the lack of spending on scientific R&D seems to be warranted by the numbers. On the nonscientific R&D side, the United Kingdom appears to spend a bit more—the data show high levels of spending on design and financial innovation. He expressed the view that design is reasonably well measured, but that financial innovation may not be.

TABLE 3-2 Contribution of Intangible Capital Deepening to the Annual Change in Labor Productivity, Nonfarm Business Sector (percentage points)

|

|

United States 1995-2003 |

United Kingdom 1995-2003 |

|

Intangible capital deepening |

|

|

|

Computerized information |

32 |

31 |

|

Innovative property |

26 |

24 |

|

Scientific |

10 |

1 |

|

Nonscientific |

17 |

24 |

|

Economic competencies |

42 |

45 |

|

Brand equity |

10 |

6 |

|

Firm-specific resources |

32 |

39 |

|

SOURCE: Workshop presentation by Jonathan Haskel; see also Marrano et al. (2009:Table 6). Reprinted with permission. |

||

Next, Haskel discussed what he called the Community Innovation Survey, a European Union–wide survey that will be used to attempt to better measure innovation. The EU innovation survey asks the following:

-

Broad questions about innovation such as, “Did you innovate in the last three years or not?” This is followed by a question about fraction of sales—a metric that businesses themselves would use. For example, it might ask, “What fraction of sales was accounted for over the last three years by your new products?”

-

Questions about level of spending on R&D, design, marketing, training—categories that look very much like the CHS intangibles categories and, in that sense, the innovation survey.

-

About information sources. Again, these are typically yes/no questions of the form: “Did you have a joint venture?” or “Did you learn from your clients? Learn from your suppliers? From trade fairs? The Internet?”

-

Questions about the barriers to innovation: “What stopped you from innovating? Too many costs? Shortage of skilled labor?” And then there is a ragbag of other questions such as: “Did you do organizational change?” and “Did you get public support?”

Haskel reported that the innovation survey was yielding mixed results in terms of the value of the data. The British Community Innovation Survey, as follow-up to the “Did you innovate?” asked firms to specify what was their most significant innovation. It can be difficult to obtain that response because it may disclose valuable information to competitors for particular types of innovations. Many firms answered that question by identifying a recent purchase of capital equipment. So it typically provides information about capital deepening. For example, a firm that produced eyeglasses specified that they had a new machine for grinding eyeglasses, and it was a piece of new technology. This may not be what economists typically think about when trying to get at disembodied types of innovation. So, Haskel concluded, that is basically a capital-deepening question.

Information on spending on R&D, design, marketing, and training have been extensively used in academic work, but it is less clear, Haskel noted, whether one could get a lot of useful information from a national accounting kind of measurement process there. The barriers-to-innovation questions are not useful, as a serious identification problem is present; he advised strongly against using these. The companies that report the most barriers to innovation are also the most innovative companies. The IBMs and other companies that are doing extensive innovation report how difficult it is to innovate. And, indeed, those questions will be dropped from the survey.

The UK Community Innovations Survey consists of about 12 pages of questions. Because the statistics authorities rightly worry about questionnaires being

too long, and therefore overly burdensome, Haskel posed the question, “If the survey could only be a half page long, what should be asked?” The response suggested asking the spending questions—and maybe that might be useful for thinking about a U.S. survey. He concluded that in the United Kingdom (1) intangibles make a big difference; (2) it is therefore of tremendous interest to construct an innovation index; and (3) some of the questions from the UK survey have turned out to be useful.

3.3.

MEASURING INTANGIBLE INVESTMENT IN JAPAN

Kyoji Fukao presented results from recent research on intangible investment in Japan, providing new estimates of their contribution to economic growth. His coauthors in this work were Tsutomu Miyagawa (Gakushuin University and RIETI), Kentaro Mukai (Cabinet Office, Government of Japan), Yukio Shinoda (Cabinet Office, Government of Japan), and Konomi Tonogi (Hitotsubashi University).

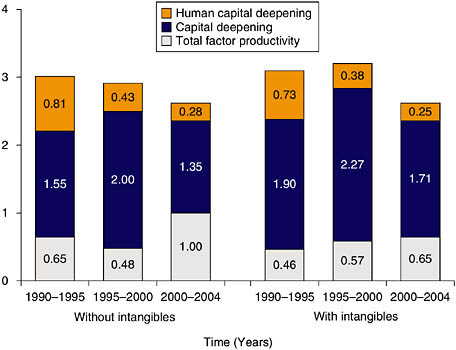

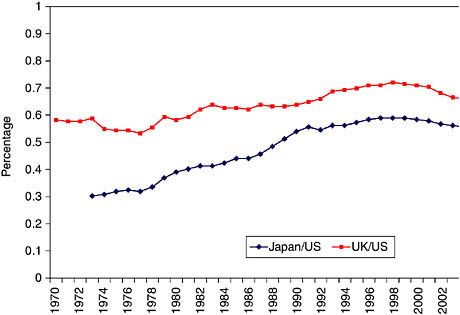

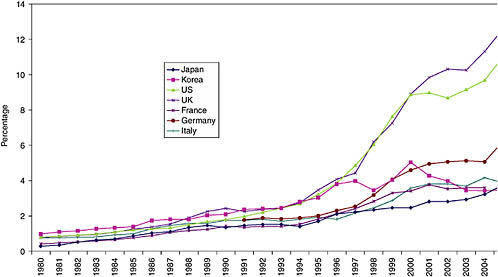

The motivation for the study was to explain why the convergence of labor productivity rates in Japan to the U.S. level came to a halt in the mid-1990s. Growth accounting shows that the cause of this phenomenon was a slowdown in capital deepening and TFP growth in Japan and an acceleration of TFP growth in the United States. This pattern can be seen in Figure 3-3. Further motivation was provided by the need to explain that, while Japan’s TFP growth was high in the information and communication technology (ICT)–producing sector, TFP growth stagnated in ICT-using sectors, such as distribution services and non-ICT manufacturing, which have much larger output shares in the economy than the ICT-producing sector. The data seemed to indicate that Japan and continental EU countries did not experience an ICT revolution on the same scale as the United States, partly because of the stagnation in ICT investment (see Figure 3-4).

Fukao reported that empirical studies and interviews show that the productivity payoff from ICT investment depends on successful reorganization and training of workers (a form of intangible investment). For example, the ratio of custom software investment to packaged software investment is much larger in Japan than in the United States. When Japanese firms introduce ICT, such as an ICT system for customer services or the management of information flows within the firm, they prefer custom software in order to get around the reorganization and training of workers. This results in a smaller measured productivity improvement from ICT investment and suggests that it is important to compare intangible investment in Japan with that in other developed economies.

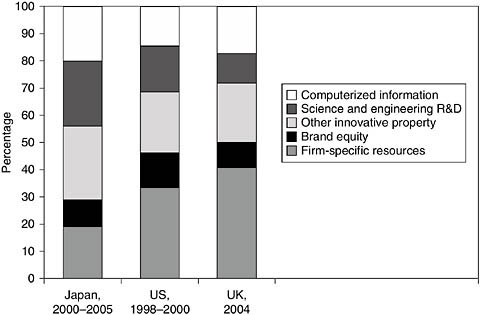

Like Haskel and colleagues, the authors measured intangible investment in Japan following the CHS approach. As shown in Figure 3-5, the principal finding was that the intangible investment/output ratio in Japan is smaller than that in United States. And, as shown in Figure 3-6, Japan invests at a high level in scientific R&D but, relative to the United States and the United Kingdom, only

FIGURE 3-3 GDP per person-hour input in Japan and the United Kingdom in comparison with the United States: 1975-2005, based on gross output purchasing power parity of 1997.

SOURCE: Workshop presentation by Kyoji Fukao (Hitotsubashi University and RIETI), based on EU KLEMS, March 2008. Reprinted with permission.

a small portion is directed toward economic competencies. Fukao suggested that the pattern of intangible investment in Japan leads to less capital deepening and lower labor productivity growth than that in the United States. The authors also conducted growth accounting of intangibles by sector, in which they found that the contribution of intangible capital deepening to labor productivity growth is relatively large in manufacturing and relatively small in the service sectors.

In discussing these results, Fukao noted that the divergent patterns of measured intangible investment between Japan and the other countries reflects, in part, differences in data sources and the definition of intangible investment. Focusing his comments on the measurement of firm-specific human capital and organizational change (an area in which there is a large gap in expenditures between Japan and other countries), Fukao noted that on-the-job training is not included in the measure of investment in firm-specific resources employed (CHS, 2005). However, Japanese firms often use on-the-job training to accumulate firm-specific human capital. According to a survey by the Cabinet Office in 2007, Japanese workers spend about 9 percent (weighted average across all types of workers and all industries) of their time in on-the-job training.

Another related issue is double counting. CHS (2006a, 2006b) uses off-the-job training cost data from BEA. If workers gain nonfirm-specific skills from

FIGURE 3-4 Information and communication technologies (ICT) investment as a percentage of GDP in the major developed countries.

SOURCE: Workshop presentation by Kyoji Fukao (Hitotsubashi University and RIETI), based on EU KLEMS database, March 2008; JIP database, 2008; KIP database. Reprinted with permission.

FIGURE 3-6 Intangible investment by category: Share in total intangible investment.

NOTE: Japan: authors’ calculations; United States: Corrado, Hulten, and Sichel (2006a, 2006b), United Kingdom: Marrano and Haskel (2006).

SOURCE: Workshop presentation by Kyoji Fukau (Hitotsubashi University and RIETI). Reprinted with permission.

off-the-job training, such accumulation of human capital will theoretically be reflected in their wage rates. Since, in standard growth accounting, wage increases by age are already taken into account as improvements in labor quality, there is a risk of double counting. According to a survey conducted by Keio University, workers answered that 63 percent of total skills gained through off-the-job training supported by their employers will be useful even if they change their jobs.

Fukao turned next to the topic of organizational structure. Referring to Nakamura (2001), the CHS work (2006a, 2006b) assumes that executives spend 20 percent of their working time on managing organizational structure; they go on to calculate investment in organizational structure by multiplying the remuneration of executives (as captured in BLS data) by 0.2 (reflecting the portion of time spent managing organizational structure). The gap in expenditure on organizational structure between the United States and Japan may reflect the difference in the levels of remuneration of executives, which are much higher in the United States. According to Robinson and Shimizu (2006), Japanese executives spent only 9 percent of their working time on strategy development, developing new business, and reorganization. This survey shows that following the approach of CHS (2005, 2006a, 2006b) leads to an overestimate of investment in organizational structure.

According to interviews conducted by the authors, in many Japanese firms, divisions specialize in corporate strategy, create plans, and conduct organizational restructuring. But there are no data about expenditures for these tasks in such divisions. Fukao concluded that a new survey was needed to capture these factors.

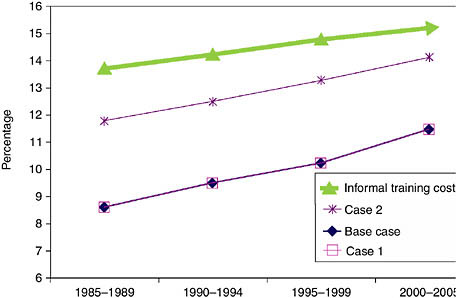

The authors conducted sensitivity analysis to examine the robustness of their results across several different cases and under different assumptions about depreciation rates of firm-specific human capital. The analysis indicates that, if on-the-job training costs are taken into account, the ratio of intangible investment to GDP in Japan is actually higher than that in the United States or the United Kingdom. Figure 3-7 shows the investment levels under different measurement scenarios. In case 1, the depreciation rate of firm-specific human capital is assumed to be 20 percent rather than the 40 percent assumed by CHS (2006a, 2006b); in case 2, the figures include on-the-job training costs + 0.37 × off-the-job training costs + 0.09 × the remuneration of executives. The results on TFP growth remain unchanged because of the stagnation of estimated firm-specific human capital in Japan. Fukao offered a number of conclusions from his team’s research:

-

Like continental EU countries, Japan’s economic growth from the mid-1990s is characterized by slow TFP growth in ICT-using sectors and relatively stagnant ICT investment.

FIGURE 3-7 Share of intangible investment in Japan’s gross domestic product (see text).

SOURCE: Workshop presentation by Kyoji Fukao (Hitotsubashi University and RIETI). Reprinted with permission.

-

Following the measurement approach of CHS (2005, 2006a, 2006b), Japan invests a lot in tangible assets but less in intangible assets relative to the United States.

-

Japan’s intangible investment is characterized by high levels of investment in R&D but very little in economic competencies. And the contribution of intangible capital deepening to labor productivity growth is relatively large in manufacturing but small in the service sector.

Fukao’s assessment of data quality was that estimates of intangible investment were relatively weak in the area of firm-specific human capital and organizational structure. Japan, he said, does not have good official statistics for on-the-job training costs. Furthermore, very little is known about expenditures on organizational restructuring by firm divisions specializing in such tasks. As for the estimation of investment in broad categories of intangible assets at the firm level, a new survey has begun in Japan. Based on data that emerges, the authors’ results can be reexamined in the near future.

During open discussion, several points were raised. Moderator Kenneth Flamm observed that the data presented showed clear increases at the national level (United States and United Kingdom) in intangible investments relative to tangible ones. He wondered whether, at the company level, the data might be capturing an offshoring effect; that is, companies may still be engaging in significant amounts of tangible investment, but many of the activities may have been shifted to other countries. Corrado responded that the increase in intangible investment in the United States is most obviously correlated with the increase in the growth of the service sector relative to manufacturing. She offered the view that, while it is hard to get at the cause and effect, offshoring is part of what is going on. For this, it would be useful to have a worldwide calculation of tangible versus intangible investment. Fukao agreed that the effects associated with internationalization of companies are difficult to pick up. For example, he noted that Toyota now produces more cars abroad than it does in Japan. However, it still conducts the majority of its R&D domestically in Japan.

Flamm asked Corrado how she would interpret the observation that, in the United States, the unadjusted labor share was roughly constant, but that it declines when intangibles are included and an adjustment made for labor quality. Corrado responded that a large and growing component is being added to income—namely the rental income, or return to, knowledge capital. She speculated that a lot of what is going on is associated with growth in the demand for workers with higher skills that has nothing to do with the labor share.

Haskel interpreted this as evidence that, if the firm is going to pay for an investment in a worker, it has to see some returns. Therefore, a gain in knowledge capital may not show up in the workers’ wages (at least not fully); otherwise, the worker would pay for it. So the numbers from which training estimates are