4

Intangibles in the Firm and in Financial Markets

Several sessions during the workshop focused on large national and global-level measurement issues. However, investment in intangibles and steps to innovate are most often taken at the firm level, so the microeconomics of the topic are essential. A series of presentations addressed questions such as: How are intangibles created and utilized by firms? How do intangibles operate in financial markets? And what efforts are being made to capture intangibles in accounting and company valuations?

Baruch Lev addressed the question raised by Senator Bingaman, “Why would private-sector firms be motivated to care about these measurement issues and participate in any sort of reporting or data collection?” Laurie Bassi focused on human capital, a topic raised a number of times during the earlier sessions. Jim Malackowski shared the work that his company, Ocean Tomo, has been doing on emerging markets for intellectual property that involve understanding and estimating the value and discovering the prices of these assets. Ron Bossio described the state of systems for reporting and recording all of this financial information from the perspective of the Financial Accounting Standards Board (FASB).

4.1.

INFORMATION DEFICIENCIES REGARDING INTANGIBLES— CONSEQUENCES AND REMEDIES

Baruch Lev opened the session by relating an anecdote about a senator who, 10 years ago, asked him who is damaged—and how—by the lack of data and reporting of financial issues by companies. This question, Lev reported, had a profound effect on his work. He identified a number of serious adverse consequences to capital markets that can arise due to deficiencies of information

at the company level about intangible assets. He then discussed what kinds of information investors need and how it can be generated. The most basic theme of his remarks was that, in capital markets (unlike life in general), no news is bad news. Without information about an asset or an investment, it will be heavily discounted, or people will simply walk away from it.

Trends in Research and Development Investment

Lev noted that studies consistently show that stock shares of intangible-intensive companies are systematically undervalued. When shares are undervalued by investors, the cost of capital for these companies is excessive, and the consequence is a suboptimal level of investment in intangibles. This can lead to substandard growth, adverse effects on employment, and even to excessive insider trading gains at research and development (R&D)-intensive companies.

Lev next illustrated some of these points using examples from his research. One study (Lev, Nissim, and Thomas, 2007) used a methodology that is commonly used in finance and economic research and in capital markets themselves to identify undervaluation or overvaluation of securities. The methodology involves ranking securities by a piece of information that, a priori, is suspected to be either overappreciated or underappreciated by investors; subsequent risk-adjusted returns on the portfolios of these securities are then examined. If investors, on average, properly price securities based on known information, there is no way, months or years after that, to gain or lose from this information. This is a clear and very powerful test of whether securities are mispriced relative to specific information.

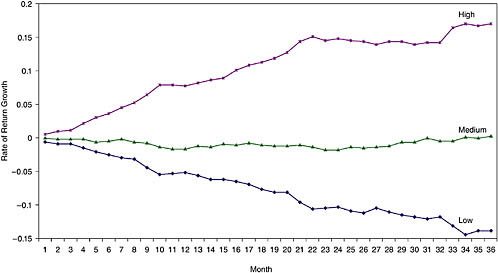

Figure 4-1 aggregrates into three categories a ranking of about 1,600 companies on the basis of R&D capital spending relative to total assets. The ranking is based on information published in the income statements of the companies. The risk-adjusted rates of return, subsequent to the ranking of 3 years of data, have been estimated for each company for the past 25 years. Stocks of companies with large R&D capital (depreciated) have systematic growth in rates of return, risk adjusted, of about 15 percent by about the 20-month mark. This is, by Lev’s assessment, an abnormally high rate of return, which means that, at the time the companies were ranked when financial reports came out, investors systematically undervalued large R&D capital and overvalued low R&D capital. This, reported Lev, is consistent across practically every study with which he is familiar.

He then pointed out other studies that directly estimate the cost of capital for R&D-intensive companies. Almost all of them reveal substantially higher costs of debt for the R&D-intensive companies relative to other companies. As an aside, R&D is the only intangible investment that is reported by companies separately in financial reports, which makes it easier to do research on it. All other investments, things like software and branding, tend to be buried in larger cost items, which make it difficult to disentangle the data to do firm-level research. Lev also

cited a set of studies showing that managers of R&D-intensive companies, not surprisingly, are able to take advantage of investor ignorance about the company and gain financially, sometimes through insider trading; he noted that they trade in the shares of their own companies at a rate four times the average of managers working in non-R&D-intensive companies.

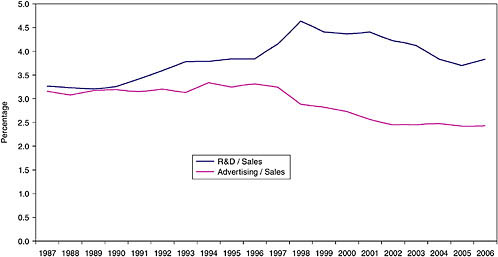

Next, Lev presented data on trends in R&D and advertising intensity of all companies covered by Compustat. Advertising, he noted, is a very rough proxy for investment in the enhancement of the brands. Figure 4-2 shows R&D-over-sales averages for the 1,600 companies in the study (there are roughly 2,400 total firms in the population). The level was below 3.5 percent in the mid-1980s and increased quite significantly to over 4.5 percent with the technology bubble in the 1990s; since then, it has declined significantly. The R&D intensity today of companies is not substantially different from what it was 20 years ago. Yet, during this period, whole industries were emerging with huge investments in R&D—software, biotechnology, Internet—which means that there was a substantial reduction in the R&D intensity of all other industries.

Firm Measurement of Intangibles

Once again, the key theme that Lev raised for the workshop is that what is not reported is not measured and is not managed. He pointed to a quote from Bamford and Ernst (2002):

Most large companies now have at least 30 alliances, and many have more than 100. Yet despite the ubiquity of alliances—and the considerable assets and revenues they often involve—very few companies systematically track their performance. Doing so is not a straightforward task…. Our experience suggests that fewer than one in four has adequate performance metrics…. Few senior management teams know whether the alliance portfolio as a whole really supports corporate strategy.

As Bamford and Ernst point out, despite this ubiquity of alliances—among manufacturing, marketing, R&D, and other firms—and the considerable assets and revenue they often involve, very few companies systematically track their performance. Lev reported that the typical reaction of chief executive officers (CEOs) and chief financial officers (CFOs) is, “Yes that’s all nice, but our financial analysts do not ask for this information.” If they do not ask for this information, Lev asserted, it does not have to be provided; if it is not provided, it is not measured.

When presented with evidence of undervaluation of subsequent high returns, finance scholars perennially raise the question: Is what one observes a compensation for risk that will be natural in capital markets? If R&D is riskier than other investments, then clearly there will be higher returns on R&D. Or is it the result of information issues? The answer emerging from the literature, Lev argued, is that it is the latter.

Jonathan Haskel, reflecting on the evidence that information about intangible investments is valuable, wondered why there is little communication within firms about these assets. Bassi noted that people are not typically rewarded in their compensation packages for doing this kind of measurement work, so it does not get done. Lev agreed, citing as an example some consulting work he did with a major chemical company. He was asked to estimate the return on product and process R&D in which the firm had been engaged. The R&D was aimed at reducing production costs and investment in brand enhancement. When he asked them for examples of previous R&D measurement projects, the company, which has existed more than 130 years, said it had never done it before.

Though measures of intangibles should be considered essential information for resource allocation within companies, they are not. Even in the case Haskel cited, the reason the company asked for the study was not so much a routine desire to know how to allocate resources, but was largely political. Previously, a consulting company had stated that brand valuation was important and that R&D was largely a waste of the company’s resources. The R&D group in the company needed counterbalancing expert analysis. Unless there are pressing issues on management, the regular need-to-know in order to inform decisions is not always there.

Lev continued, noting that many managers somehow believe that when it comes to intangibles—R&D, branding, or human resources—they more or less know what to do. CEOs have said, “We don’t really have studies, but we think we know what is adequate in this area.” He noted a study of his on a sample of biotech companies. Some of these companies disclose quite a bit of information in their initial public offering—about the drugs they are developing, the target markets, the tests they perform, at what stage the drugs first face clinical tests, second-phase clinical tests, patent coverage, etc. Other companies disclose much less.

Lev constructed a detailed index of the amount of information that is disclosed. The study showed that biotech prospectus disclosure reduces stock volatility and bid-ask spreads (which reflect uncertainty). Disclosing patent royalties increases R&D valuation. The reason for this is clear. If there are customers for a company’s patents, this means that, like a Good Housekeeping seal, it has a good technology. It is this kind of information that drives what one sees in capital markets. In addition, managers’ guidance mitigates share undervaluation. When managers regularly impart information about future prospects, a substantial amount of this undervaluation and the resulting cost of capital increase disappears.

So what, according to Lev, is the key information that is needed? First, collecting information about capitalizing R&D on the macro level, as in the national accounts, discussed earlier, is important. On the firm level, capitalizing R&D, while a step in the right direction, is not something that investors will get terribly excited about. What is needed is not haphazard, nonstandardized measures, such as employee or customer satisfaction grades, brand values, corporate reputation,

or the triple bottom line. Investors want to know about factors that drive the business. What is needed is structured input-output information on performance of the major drivers of enterprise value—these are things that accounting is not yet designed to provide. Lev provided two examples of this type of information, one prevalent in the pharmaceutical and biotech industries, the other in Internet and telecommunications firms.

Input-output linkages for these industries involve high levels of R&D. Companies may provide information about the product pipeline and the outcomes from these programs—how many products they are working on and where are they on the scale of development. These pieces of information are major value drivers of biotech companies. If a company has a few products in an advanced development stage, like Phase II clinical tests, a high value will be generated. If they are all in the preliminary stage, a very low value will emerge.

Good disclosure, by Lev’s definition, is something that relates the R&D to its consequences. Innovation revenue, a percentage of total revenue that comes from recently introduced products, is an extremely powerful measure of innovation, in that it can be indicative of two things. The first is the ability to come up with new products and services and bring them quickly to the market. Most companies provide information about the target market expected launch date and how much they intend to capture from the market. This information can be directly factored into an evaluation model. The second is something that is somewhat less prevalent. Most Internet and telecommunications companies provide a spectrum of information that explains the market value of the company, starting with the cost of acquiring customers, then the consequences. Subscribers increase in some cases and decrease in others. These variables, along with the churn rate and revenues from new customers—which are analogous to innovation revenue—allow computation of customer lifetime value.

Lev has recently examined companies with large differences between market value and book value—companies that, in some cases, show balance sheet book values on the order of one-fourth of the market value. When he computed customer’s lifetime value, which is the piece of the franchise missing from the balance sheet, it can account for 60-70 percent of the entire difference—just this one intangible. This is useful information—not haphazard indicators that are not connected to anything, but something that guides the investigator from the inputs to the outputs and, by implication, to the future.

Accounting practices are, by Lev’s estimation, a long way from including this level of detail because they are not designed to directly trace inputs to outputs. He believes that the only way to get companies to track and report this information would be through a concerted effort by an interested government agency working with the Securities and Exchange Commission (SEC) and the FASB, the accounting standards setting body, and at least some representation of accounting firms and managers, to establish well-designed disclosure templates. The idea would be not to force companies to comply—they already have a lot

to do to conform to generally accepted accounting principles—but to essentially codify successful voluntary practices.

Lev’s view is that a reasonably high level of voluntary compliance could be achieved if good disclosure templates are provided, which might vary across industries. When an influential body, particularly an organization or combination of bodies, comes out with good templates, some companies will adopt them. Others will follow suit because, in the capital market, no news is bad news. If some companies report something and others do not, investors will suspect that those that do not report have something to hide. This idea was recommended by a commission in which Lev participated, set up by Richard Marshall while he was chair of the SEC. It can be done. This is, he concluded, the way to solve this cycle of poor information—both at the capital markets level and at the firm level—which leads to undervaluation, the high cost of capital, and low investment.

4.2.

HUMAN CAPITAL AND SKILL INVESTMENT

A unique feature about human capital as a productive input and an intangible asset is that it is not owned by firms; it is owned by individuals and it is portable. Laurie Bassi’s presentation focused on this intangible asset, noting that the uncertainty created by this characteristic adds a unique element of risk for firms. It also explains why human capital depreciates more rapidly, and, in some sense, firms may be prone to underinvest in it relative to other forms of intangibles. From the perspective of employees, they are able to capture a portion of the investment that firms make in their education and training in the form of future wage premiums; it may also decrease their likelihood of unemployment.

Investments in human capital, education, and training in the workplace are of extraordinary importance both to individuals over their life cycle and to the evolution of economies and societies. Labor economists have estimated that much of the growth in productivity over the years is attributable to human capital gains. Once people leave the education system, the workplace becomes the primary source of economically consequential learning.

The tendency to underinvest in human capital intangibles carries with it some clear negatives for the workforce viewed in the aggregate. Bassi pointed out that, while data are scant on the issue, some evidence suggests that investments in workforce education and training by employers in the United States are smaller than elsewhere in the developed world. One could hypothesize that this is an indication of a highly educated, highly productive workforce and that therefore less investment is needed. Alternatively, the evidence could suggest that the United States should be concerned about falling behind countries that are making larger investments.

From the perspective of the firm, employee mobility undermines incentives to invest in developing human capital in the workplace. For a variety of reasons, the pressure to underinvest in human capital is likely to be even more severe

than it is in other forms of intangible assets. Since firms do not own human capital, investments in it are accounted for as a cost; they are hidden in general and administrative costs. Bassi asked participants to imagine two firms: Firm A invests heavily in workplace education and training, while Firm B does not make similar investments. All that the analysts can see is that Firm A is a high-cost firm with lower current earnings.

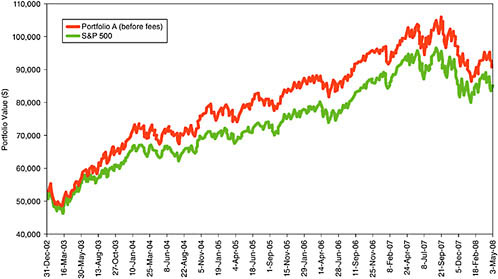

Since data on human capital are not reported, it is difficult to produce evidence to support the theoretical argument that there is underinvestment. However, Bassi and a group of colleagues have been collecting data on investments in education and training for well over a decade, and the picture is becoming less murky. From an economic point of view, evidence of underinvestment has to indicate that a supernormal risk-adjusted rate of return is attributable to the asset. The easiest way to do this is to analyze publicly traded firms for which data exist. The research by Bassi’s team has provided this evidence of underinvestment by revealing (1) very high wage premiums accruing to employees from even modest investments by their employer and (2) outperformance of publicly traded firms that (appear to) make the largest investment in human capital (education and training). Of course, past performance is no guarantee of future performance. With that caveat, Bassi presented data on a backward-tested portfolio and an actual portfolio of firms that make large investments in workplace education and training relative to the Standard and Poor’s (S&P) 500. (Bassi’s company actually runs investment funds around this idea of picking firms that make large investments in education and training relative to the S&P 500.) The top line in Figure 4-3 shows the significantly better performance for a set of high human capital investment firms.

As in Lev’s example, Bassi pointed out a situation in which markets seemed to undervalue firms at the time investments are made—in this case, firms that are making large investments in education and training. An obvious measure to begin correcting this underinvestment would be to account for and report on these investments differently. Bassi’s prescription would be to break out investments in human capital and report them separately, as is done for R&D, even if they continue to be accounted for as an expense. Lev showed that this is not sufficient to correct the underinvestment in intangibles in general, but it would be a useful first step.

Bassi concluded with three summary points. The first is that the unique nature of human capital—it is not owned by the firm—makes it more subject to underinvestment than other forms of intangibles. From a public policy perspective, human capital development is also very important to the quality of life and standard of living of employees. Second, the implications of this underinvestment are particularly problematic because of its impact on employees (as well as shareholders). Third, an important first step toward correcting this underinvestment is to modify reporting requirements to fully account for firms’ investments in people.

4.3.

INTELLECTUAL PROPERTY AND CAPITAL

Jim Malackowski spoke about intellectual property and intellectual capital assets, focusing on the emerging markets for patents. He made the point that assets related to proprietary innovation are, in some respects, the output of R&D spending and human capital development—the topics of the previous two presentations. Malackowski discussed four markets: the historical market of patent maintenance, the episodic price discovery of public auctions, global micro markets, and macro markets (intellectual property traded exchange). He pointed out that there is an active marketplace today for intellectual property and innovation, and that a form of it has existed for more than 100 years in the U.S. Patent and Trademark Office (PTO).

Patent Value

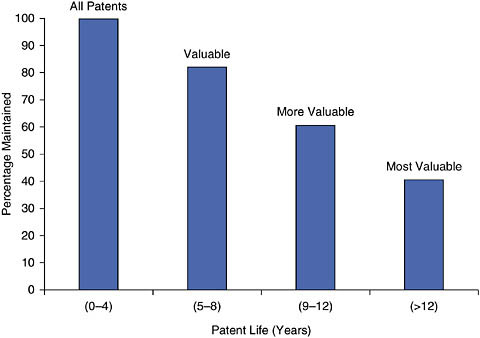

Patents are assets that are often not maintained for maturity—in fact, as Figure 4-4 shows, less than half are. Malackowski’s partner at Ocean Tomo, Jonathan Barney, a practicing patent lawyer, has sorted through every decision that was made in the U.S. PTO from 1982 forward. He divided each of the millions of observations into two groups—one in which corporations and individuals maintained their intellectual property, and one in which they cast it aside and it became public information. As expected, the data showed that the more valuable the patent, the longer it was kept by the owner.

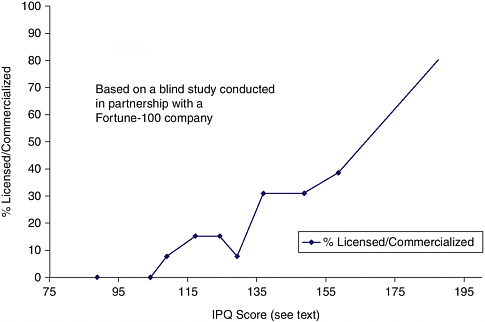

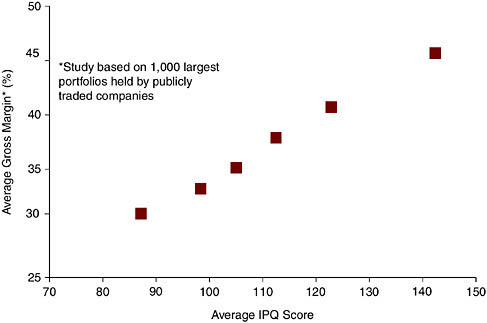

To substantiate this, Barney and his team used a large multivariate regression model to assign each patent an “IPQ” score, which objectively rates patent assets based on a set of metrics. The IPQ scoring system has a median of 100. As shown in Figures 4-5 and 4-6, patent assets with higher IPQ scores are statistically more likely to generate economic returns. IPQ scores are unique to each particular patent examined and are updated monthly. Typical metrics include such factors as number, length, and type of patent claim; amount and type of prior art cited; number of forward citations or references made by later-issued patents; presence or absence of limiting claim language; and patent prosecution history. Barney also asked a Fortune 100 company to select 200 patents at random and rank them from the most valuable in the market to the least valuable. He compared these results with the statistical output of the regressions and found similar results.

According to Malackowski, higher quality correlates with a higher probability of being licensed and commercialized—this relationship is shown in Figure 4-5. He pointed to three factors that give patents value and are reflected in a gross margin metric. Patents can allow a price premium to be charged if they lead to a unique product feature. They can also lead to cost reduction if they involve a proprietary machine or some other facet of the production process. Or, they can create a unique product altogether, thereby producing a market share apart from those of other companies. As shown in Figure 4-6, this contributes to an observed positive correlation between patent quality and gross profit margins.

FIGURE 4-6 Patent quality and gross profit margins.

SOURCE: Workshop presentation by Jim Malackowski. Reprinted with permission.

Empirical observations like these led Ocean Tomo to engage in public auctions to sell intellectual property—patents, brands, and copyrights. The idea was to establish a price reflecting the value of intellectual property in the marketplace, just like a Sotheby’s auction does for paintings, or Barrett-Jackson’s auctions do for automobiles. After two years, the company has sold approximately $80 million worth of property at an average price of between $300,000 and $600,000 per patent. In Malackowski’s view, this marketplace—though still episodic, happening three times a year—is clearly having some influence on people’s understanding of the price for intellectual property (IP). Ocean Tomo sees a global market developing that applies not to just 80 lots or 100 lots of intellectual property in a given day, three times a year, but to the millions of patents and applications in the 81 issuing jurisdictions around the world. One way to scale the selling of intellectual property is through micro markets and a voice brokerage platform.

The fourth emerging marketplace Malackowski discussed was what he called a focused macro market. The company used its historical data to identify which patents ought to be auctioned and to learn where people want to transact; it then created these markets across the world using voice brokers and a web transparency. The website patentbidask.com allows people to look up any patent—and to see if there is a bid or an ask price on the patent—without registration or fee. It also allows users to see completed transactions.

Still, according to Malackowski, these direct transfers of IP rights are not where the real potential lies. This, he posited, is a traded exchange for intellectual property rights. There are four products that the Intellectual Property Exchange International (IPXI) is in the process of building and rolling out a January 2010 market launch. The first of the products is qualified equities. These are categories of stock that, as discussed above, can be shown to be IP-intensive and IP-rich by meeting certain standards. Those stocks will trade on the IP exchange.

Then there are the equity indexes. In 2006, Ocean Tomo began a series of public equity indexes based on the quality of a firm’s patent portfolio. Malackowski presented data indicating that Ocean Tomo funds—which focus on companies that generate significant licensing revenue or earnings, that have high intellectual property value to total book value ratios, and that have intellectual property valued by an independent third-party appraiser in excess of $1 billion—have outperformed their traditional counterparts (e.g., S&P, NASDAQ, and Dow Jones).

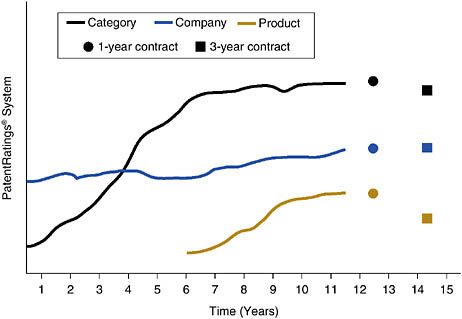

Malackowski turned next to a product on the IP exchange called tradable technology baskets, which are based on the creation of financial futures contracts related to intellectual property. An illustration of these tradable technology baskets is shown in Figure 4-7. The middle line represents the statistical patent score of an actual company’s portfolio of patents. It is relatively stable over time, increasing slightly. Like other financial futures contracts, the IP exchange will write a financial contract that predicts where that line will be in 12 months (the middle dot) or 36 months (the middle square). Based on this and other information, some traders will invest long because they think the index will outperform the square and the circle. Others will invest short if they think that the company will not meet the expectation. In this way, people can begin to trade in the intellectual property of a company, its patent portfolio, apart from its equity. The bottom line in the figure represents a patent portfolio related to a specific product belonging to the company. If it is a relatively recent product, one would expect to see the line rapidly growing. Here again, contracts can be created, but on a specific product portfolio. The top line represents the industry patent portfolio for the class of products for which, again, a market can be created.

Such a market would create for investors the opportunity to choose between owning traditional stock in a company or in its patent portfolio. For example, perhaps an investor in communications technology a couple of years ago knew that HD DVD would fail and Blu-ray would win and so would choose to go long on Toshiba but short on the HD DVD technology. In essence, what the tool allows is to begin to disaggregate IP value from the cloud of overall intangible value.

The last product identified by Malackowski to be offered on the IP exchange involves the emerging market for the issuance of license rights. As an example, Ford Motor Company has a patent related to engine valves; it is a technology for replacing old valves with new ones that allow either ethanol or standard fuel to be burned. If Ford wants to license its patent today, they must visit potential suitor companies around the world, spend months debating the patent’s merits,

FIGURE 4-7 Tradable technology baskets (see text).

SOURCE: Workshop presentation by Jim Malackowski. Reprinted with permission.

and, if it is valid, whether or not they are infringing on other patents, etc. It is very inefficient commerce.

In the IP exchange of the future, Malackowski envisions that Ford will issue an initial public offering for a license transaction. It will go to the market with unit license rights to the product at various prices. If Honda wants to use this patent, it simply calls its broker and bids on a certain number of units at the corresponding listed price. If it has that contract fulfilled, it has the right to make x vehicles using the patent. If it does not use them all, it can put back what it does not use. Speculators can go long or short based on the quality of the technology. In this way, a process can be established to begin to monetize what is now a huge notional morass of cross-licensing. Malackowski concluded by reemphasizing that he sees real progress being made—real price discovery, a real global initiative, and ultimately an efficient way to transact these assets.

4.4.

INSURING THE VALUE OF INTANGIBLES

Nir Kossovsky provided insights about valuing intangible assets from a finance management perspective. His presentation reiterated themes developed throughout the workshop. First, Kossovsky asserted that policies toward intangible asset management can make or break U.S. competitiveness and, in turn, the

economy. Second, from the perspective of his company, Steel City Re, intangible assets are the principal source of value and risk in global economies that are knowledge based. Kossovsky’s presentation emphasized how risk informs his company in its practices of valuing intangible assets. He also raised a few policy ideas for consideration.

Kossovsky began by noting that financial statements, while they can be rich in information, do not fully convey the underlying value of a company; they do not always inform investors about the drivers of value and the sources and nature of risks. Echoing the message of Lev and others: One cannot manage what cannot be seen, and this affects the competiveness of U.S. industry and the efficiency of capital markets.

Intangibles—ranging from business processes, patents, trademarks; reputations for ethics and integrity; and quality, safety, sustainability, security, and resilience—are interconnected, and each piece builds enterprise value. This, Kossovsky noted, makes it difficult to put them in well-defined boxes as would typically be done in the accounting world; that is why they are called intangibles. Again, the iPod example illustrates this point. It is the design, the distribution system, the nature of the way music can be collected, and the reputation of the company to deliver innovative products that enabled that product to be so successful. If any single element had been missing, it might not have worked.

Kossovsky reported that, when Steel City Re queries a company (and its customers) about what intangible factors contribute to its value, reputation is prominently noted. Does the company have a reputation for managing its intellectual property and being innovative? Does it have a reputation for integrity, environmental sustainability, ethical sourcing, security, and resilience? When a company is building value, it creates business processes to drive these reputations. Kossovsky cited the Walmart example. Walmart is known for its supply processes. Pallets of products move from factories around the world, to shipping containers, to distribution systems, in a process that never stops. Its processes are typically faster and more efficient and effective than the competition, which translates into greater profits—their revenues are now around $367 billion, and the cost of goods sold is about $264 billion. That’s a lot of goods bought and sold, and all they do is move things across the warehouse floor.

Kossovsky reiterated that, if a company manages its intangibles well, the markets will reward them. Looking at some 2,800 companies over 28 months, Steel City Re researchers found that the companies that are superior managers of their corporate intangible assets—their ethical reputation, their environmental sustainability, their quality, their integrity, perceived innovative and inventive, etc.—tend to outperform the market substantially. Companies ranking in the top 10 percent in the intangible asset management (reputation) index returned 19 percent to shareholders in the 28-month period ending February 2008. Those in the bottom 25 percent lost 29 percent. The median return for the broad market excluding dividends was –4 percent.

Companies with superior intangible asset management have higher gross margins because people want to buy their products; they will pay a little bit more for that cool product. Employees will work longer, they will not be as likely to quit, and they may work for less. Apple pays less than many of its competitors, indicating that people like working for the company for nonpecuniary reasons. The capital markets reward them because they have this forward-looking reputation; this is an example of a company with price earnings multiples that are higher because of superior management of intangibles. Their shareholders have a better understanding of what the company is doing, and, because of better information, their stock price volatility is lower.

Of course, there are counterexamples to Apple as well. If a company errs, the value associated with intangibles can be destroyed. One such example is ConAgra, a large industrial company that produces food items. A principal intangible that customers expect from food producers is safety (they expect that the food will not poison them—that is a requirement). In 2007, salmonella was found in the company’s peanut butter, and it took a reputational hit. Class action lawsuits followed, $30 million was spent to pull products off the market, and there were no sales for half a year or so, which amounted to another $80 million of lost revenue. The company had to retrench and rebuild an entire product line because its intangible value, as a function of safety, was compromised.

Because safety is an intangible asset with tremendous value to companies like ConAgra, the firm remodeled its peanut butter manufacturing plant to much more rigorous standards. The effort appears to have paid off, as no ConAgra products were named in the more recent peanut butter safety crisis. For these kinds of firms, much of their book value is based on intangibles. Kossovsky estimated that 96 percent of ConAgra’s trading value is based on process. That is a lot of faith in the company’s behavior. When the market is disappointed in that behavior, faith is lost.

Kossovsky cited the RC2 Corporation as another example of lost intangible asset value. This company produces the Thomas & Friends brand wooden railway toys. In 2007, 1.5 million of the Tank Engine products had to be recalled due to lead in the surface paint. The market punished RC2: The recall cost the company some $28 million, and lost sales another $30 million. Sales for the first quarter of 2008 were down by 20 percent, with legal costs still pending. Overall, this company started out managing its intangibles very well. The markets were rewarding it with a high price-earnings ratio, and it had a very stable stock price. A premium was placed on its product. Then something in operations began to slip and, as a consequence, it was penalized. Mattel experienced a similar crisis. Millions of its Barbie doll toys—which account for around 80 percent of the company’s bottom line—had to be recalled over several phases due to lead paint concerns. First-quarter 2008 sales of Barbie fell 12 percent, and the company recorded a net loss of $7 million versus a $10 million gain the previous quarter (Bloomberg). This was the first time in many years that the product produced a loss for the company.

Kossovsky closed by stating that policy goals should seek to advance the competitiveness of the U.S. industry by helping them create, manage, and protect intangible assets—particularly those that drive their ability to pursue ethical sourcing and environmental sustainability, quality, and integrity. The competitiveness of capital markets depends on transparency, controls, and forecasting, and tools are needed that help the markets understand where the value is coming from. Policies that increase information flow reduce volatility, reduce the frequency and severity of intangible asset impairment events, and lead to overall improved financial resilience and increased enterprise value.

4.5.

REPORTING INTANGIBLE ASSETS TO ENHANCE THEIR CONTRIBUTION TO CORPORATE VALUE AND ECONOMIC GROWTH

The Financial Accounting Standards Board is the major standard setter for corporate reporting, not only for business enterprises but also for many universities. Its mission is to “establish and improve standards of financial accounting and reporting for the guidance and education of the public, including issuers, auditors, and users of financial information.” Furthermore, the organization seeks to “improve the usefulness of financial reporting by focusing on the primary characteristics of relevance and reliability and on the qualities of comparability and consistency.” FASB also develops broad accounting concepts as well as standards for financial reporting and provides guidance on the implementation of standards.

Ron Bossio described the organization’s work on external financial reporting, its current projects and priorities, and made suggestions for ways to improve reporting of intangible assets. Much of FASB’s work is directed toward providing decision-useful information through general-purpose financial statements, including notes to statements and other reporting mechanisms. The organization strives for standards that are neutral so that similar kinds of transactions are accounted for consistently and so that they apply to IBM, DOW Chemical, and New York University equally. FASB also seeks to improve the relevance of information for making investment, credit, and similar resource allocation decisions and to ensure that the information not only faithfully represents an entity’s underlying economic resources, obligations, and changes in them, but also is comparable and understandable. The key users of external financial reporting information are investors and creditors, donors, and grantors of nonprofit entities.

Bossio noted that FASB is not the only player in this area. The SEC has a major role, particularly in areas beyond financial statements, such as management analysis and even note disclosure. They also serve the important function of signaling where harm can be created and bringing that to public attention. Another important player is the International Accounting Standards Board (IASB), based in London. A major initiative on FASB’s agenda is to work with IASB to promote convergence of international accounting standards across countries.

In discussing external financial reporting requirements, Bossio distinguished between financial statements and financial reporting. There are clear limits on what FASB is currently capable of including in financial statements, given that measures must be verifiable and information credible; meeting these criteria can be especially problematic for “soft” items, such as internally developed intangible assets. Management discussion and analysis affords opportunities for reporting softer information outside financial statements and SEC requirements.

Bossio added that one of the problems with financial reporting is that so much emphasis is put on earnings and earnings-per-share metrics. Intangibles involve a payout now that depresses current earnings for a payback later. People inside firms, and investors outside them, do not necessarily have longer term visions; they may have quarterly pressure to deliver earnings now, not three years from now. The most problematic intangibles are those that are difficult to value as an asset. R&D at pharmaceutical companies may realize only 1 product in 10 as something that will be a hit in the market, and maybe another 1 or 2 that become moderate hits. Some of this gets lost in the aggregate measures, and the earnings-per-share metric is not necessarily the best way to anticipate future financial performance. Bossio noted that FASB has been wrestling with how to address calls for more detailed and more accurate disclosure about expenses, whether they are put on the balance sheet or not. Much of this, he said, comes down to whether something is classified as an asset or as an expense and whether there is liability or not.

Bossio cautioned that FASB will not be able to solve all of the problems of measurement and definition. The organization’s current priorities are to work toward international convergence and joint projects with the IASB, the completion of codification of U.S. generally accepted accounting principles, and ongoing research and support activities under way in response to recommendations by the SEC advisory committee and its own valuation resource group. In December 2007, FASB and IASB considered whether to add a comprehensive project on accounting for intangible assets, including those that are internally developed. It was decided that this would not be pursued due to resource constraints. Although there will always be ongoing work to improve financial statement presentation—to better capture liabilities and equity, accounting for leases, earnings per share, income taxes, the conceptual framework, etc.—Bossio warned participants to not expect major improvements on accounting of intangibles to happen quickly in light of these recent priority decisions. In pointing a way forward, Bossio did deliver some good news. Investors, and others that FASB hears from, such as their user advisory counsel, are asking the board to develop a project on a disclosure framework. The disclosure framework may be a way to generate better information so that more accurate aggregate numbers can be produced; it may be a way to achieve more transparency about expenses or capitalized expenditures.

Bossio agreed with other participants that market players would benefit from improved financial statements. He acknowledged that the goals of the earlier

presenters—to develop better measures of spending on things like human capital and intellectual capital—are worthy. He pointed out, however, that there are still definitional issues to be resolved: What assets reside in the firm? What are the firms? What should be included as workforce or human capital? What are the assets of the firm? The conceptual framework is still developing in terms of these questions.

Another constructive move forward, though not a panacea, Bossio suggested, is the adoption of International Accounting Standard 38 (IAS 38). The objective of IAS 38 is to prescribe the accounting treatment for intangible assets that are not dealt with specifically in other international accounting standards. The standard requires an enterprise to recognize an intangible asset if, and only if, certain criteria are met. The standard also specifies how to measure the amount of intangible assets carried forward and requires certain disclosures about them.

Bossio also identified the issue of voluntary initiatives, which was raised earlier in the program by Lev. It might be possible, he suggested, to initiate progress on this front through an enhanced business consortium of financial executives, both domestic and international, that focuses on internal management reporting of key performance indicators, intellectual capital, management discussion and analysis (SEC and IASB), and inputs through the SEC advisory committee, the Financial Accounting Standards Advisory Council, and others. Managers and investors need to know what they are spending and what the payback is from that spending, and this kind of reporting has a place in a principles-based disclosure framework (such as that advocated by the Investors Technical Advisory Committee). If there is one direction that might be fruitful to push the board in, Bossio suggested, it might be to join the investor community in this area of voluntary reporting. There is potentially an opportunity to improve disclosures about the types of expenditures incurred—including, for example, costs for research, development, training, and branding—whether or not they are capitalized.

During open discussion, Lev noted that, historically, the development of financial reporting follows quite closely with what is reported in companies. However, in his view, if there is to be systematic improvement in information on intangibles for investors and for use within companies, the push must originate from outside. Although there are exceptions, the behavior inside companies has evolved as a by-product of financial accounting and reporting systems. Bossio noted that some companies are taking the initiative voluntarily to get better information on key performance indicators. Whether those will be haphazard or linked in a way that is structured has yet to be seen. And if businesses do not find their self-interest to be in managing, in developing their own strategy, in systematizing some kind of structured way to see whether they are performing against their own internal key drivers, then it is difficult to imagine that performance indicators will be successfully imposed on them by outsiders. Martin Fleming added that firms have to be able to see that the financial benefits to be gained by measuring and treating expenses associated with building intangible assets differently from

ordinary operating expenses outweigh any costs associated with disclosure of strategic information to competitors and regulators.

These points largely supported Lev’s point that the leadership to improve the value of financial disclosure has to come from government agencies or those related to government. The key role of external forces has been evident historically. In the New York Stock Exchange of the late 19th century, there were no SEC regulations. The exchange pleaded with the CEOs of major companies to disclose their annual sales, but the response was the same as that heard today from managers with respect to other types of information: The disclosure will benefit competitors, it is costly, and it is not needed. And this is with respect to sales—nothing of importance was ever disclosed without having been required.

One participant pointed out that spending by companies on intangibles is hidden in income statements. If the information is disclosed in a separate statement of detail, as is done with other kinds of management information, it would go far in promoting an understanding of investment at the firm level. It would be powerful for companies to be able to see what they are spending on, say, training, relative to their peers in the industry. It would be in the firm’s interest and also in the interest of analysts. Lev agreed with this assessment but noted that there are two aspects of disclosure: One is getting managers to disclose new information, and the other is standardizing the information—that is, making it comparable, which is as important as the first one. With respect to most intangibles, including R&D, there is little standardization.

Bossio followed up this point by noting that the chairman of the SEC has been pushing for the use of extensible business reporting language (XBRL) in an effort to get people to standardize data reporting electronically. A common taxonomy is needed; it is of little use if one firm calls a category one thing, and another firm calls the same category something else. XBRL will be helpful in getting data at a disaggregated level to conform to common definitions. Even if information is aggregate—such as cost-to-sales figures or on-the-job training within cost-to-sales—if it is tagged with a common definition, it may be possible to get useful data on expenditures, such as whether an asset is capitalized or expensed.