4

Immunization

Hepatitis B is a vaccine-preventable disease for which a safe and effective vaccine has been available for nearly three decades. The first part of this chapter reviews current federal vaccination recommendations and state vaccination requirements for hepatitis B. It also summarizes what is known about hepatitis B vaccination rates in specific populations (for example, infants, children, and adults, including subgroups of at-risk adults, such as incarcerated people and occupationally exposed people). The committee identified missed opportunities for hepatitis B vaccination and makes recommendations to increase the vaccination rate among various populations.

A vaccine for hepatitis C does not exist. The second part of this chapter summarizes current efforts to develop a hepatitis C vaccine and challenges that have been encountered. The committee makes a recommendation about hepatitis C vaccine development.

HEPATITIS B VACCINE

The first hepatitis B vaccine, a plasma-derived vaccine, was licensed by the US Food and Drug Administration (FDA) in 1981 (IOM, 1994). By the late 1980s, the plasma-derived vaccine was replaced with a recombinant version, which expresses the hepatitis B surface antigen (HBsAg) and is produced in Saccharomyces cerevisiae (common baker’s yeast). The recombinant vaccine was licensed by FDA in 1986 and is the type of hepatitis B vaccine currently used in the United States. It is an anticancer vaccine: by preventing hepatitis B, it prevents hepatocellular carcinoma.

Hepatitis B vaccine is available both as single-antigen formulations and as multiantigen formulations in fixed combination with other vaccines (Mast et al., 2005). The two single-antigen vaccines are Recombivax HB® (Merck & Co., Inc., Whitehouse Station, NJ) and Engerix-B® (GlaxoSmithKline Biologicals, Rixensart, Belgium). Of the three licensed combination vaccines, Twinrix® (GlaxoSmithKline Biologicals, Rixensart, Belgium) is used for vaccination of adults, and Comvax® (Merck & Co., Inc., Whitehouse Station, NJ) and Pediarix® (GlaxoSmithKline Biologicals, Rixensart, Belgium) are used for vaccination of infants and young children. Twinrix contains recombinant HBsAg and inactivated hepatitis A virus. Comvax contains recombinant HBsAg and Haemophilus influenzae type b (Hib) polyribosylribitol phosphate conjugated to Neisseria meningitidis outer-membrane protein complex. Pediarix contains recombinant HBsAg, diphtheria and tetanus toxoids and acellular pertussis adsorbed (DTaP), and inactivated poliovirus.

The hepatitis B vaccine is administered in a three-dose series: two priming doses administered 1 month apart and a third dose administered 6 months after the second (Mast and Ward, 2008). Alternative schedules have been used successfully. Administration of the three-dose series results in protective concentrations of anti-HBs in more than 95% of healthy infants, children, and adolescents and in more than 90% of healthy adults aged 40 years old and younger. Immunogenicity drops below 90% in adults over the age of 40 years. The hepatitis B vaccine has a pre-exposure efficacy of 80–100% and a postexposure efficacy of 70–95%, depending on whether hepatitis B immune globulin (HBIG) is given with the vaccine. The duration of immunity appears to be long-lasting, and booster doses of the vaccine are not routinely recommended (Mast and Ward, 2008).

HBIG is derived from plasma and is used prophylactically to prevent infection with the hepatitis B virus (HBV). It provides passively acquired antibody to hepatitis B surface antigen (anti-HBsAg) and temporary protection (3–6 months). HBIG is typically used as an adjunct to hepatitis B vaccine for postexposure immunoprophylaxis to prevent HBV infection (Mast et al., 2005). HBIG administered alone is the primary means of protection after an HBV exposure for people who do not respond to hepatitis B vaccination. It is also used after liver transplantation for end-stage hepatitis B to prevent recurrence of the disease in the transplanted liver.

Current Vaccination Recommendations, Requirements, and Rates

The Advisory Committee on Immunization Practices (ACIP) provides advice and guidance to the US Department of Health and Human Services and the US Centers for Disease Control and Prevention (CDC) on the control of vaccine-preventable diseases. It develops written recommendations

for the routine administration of vaccines to children and adults in the civilian population. The ACIP recommendations for who should receive the hepatitis B vaccine are summarized in Box 4-1. The American Academy of Pediatrics in its Report of the Committee on Infectious Diseases follows the ACIP recommendations for the hepatitis B vaccine (American Academy of Pediatrics, 2009).

Perinatal Vaccination

ACIP first recommended universal hepatitis B vaccination of infants in 1991 (ACIP, 1991). Despite the recommendation, each year about 1,000 newborns in the United States acquire chronic HBV infection (Ward, 2008), a number that has not declined in the last decade. That constitutes an important gap that needs to be addressed in future prevention efforts.

ACIP currently recommends that the first dose—that is, the birth dose—be administered before hospital discharge in infants born to HbsAg-negative women and within 12 hours of birth in infants born to women who are HbsAg-positive or of unknown status (Mast et al., 2005). It also recommends that infants born to HBsAg-positive mothers should be given HBIG within 12 hours of birth. There is no evidence of appreciable benefit if HBIG is administered more than 72 hours after birth. The timely identification of HBsAg-positive mothers to prevent perinatal transmission underscores the need for rapid hepatitis B tests (discussed further in Chapter 5). The hepatitis B vaccine series should be completed by the age of 18 months (see Table 4-1). Depending on which type of vaccine (single-antigen or combination) is administered, the series can consist of three or four vaccinations.

Current ACIP hepatitis B vaccine recommendations for preterm infants who weigh less than 2,000 g are summarized in Table 4-2. For preterm infants, the first dose of the vaccine is given within 12 hours of birth if the mother is HBsAg-positive or is of unknown status. If the mother is known to be HbsAg-negative, the first dose is administered at the age of 1 month or at hospital discharge (Mast et al., 2005). The preterm-infant schedule is based on the recognition that preterm infants have a decreased response to hepatitis B vaccine administered before the age of 1 month.

Data from National Immunization Surveys demonstrate that national newborn hepatitis B vaccination coverage did not change appreciably after implementation of the 2005 ACIP hepatitis B vaccination recommendation (CDC, 2009b). Using National Immunization Survey data that were collected before implementation of the 2005 ACIP hepatitis B vaccination recommendation, CDC estimated that the national newborn hepatitis B vaccination coverage was 46%, 47.9%, and 42.8% at the age of 1 day in the 2004, 2005, and 2006 surveys (CDC, 2008c, 2009b). Using data

|

BOX 4-1 Summary of ACIP Hepatitis B Vaccination Recommendations Vaccination of infants At birth

After the birth dose

Vaccination of children and adolescents

|

from the 2007 National Immunization Survey, which were collected after implementation of the 2005 ACIP recommendation, CDC estimates that the national newborn hepatitis B vaccine coverage was 46% at the age of 1 day (CDC, 2009b).

As noted above, despite the ACIP recommendation to vaccinate all newborns, about 1,000 newborns each year become chronically infected with HBV. Even with the ACIP recommendation, birth doses of the hepati-

|

Vaccination of adults Persons at risk for infection by sexual exposure

Persons at risk for infection by percutaneous or mucosal exposure to blood

Others

Abbreviations: ACIP, Advisory Committee on Immunization Practices; HBsAg, hepatitis B surface antigen; HBIG, hepatitis B immune globulin. SOURCE: Adapted from Mast et al., 2005, 2006. |

tis B vaccine are being missed or delayed, which the committee believes is due to the lack of a delivery-room policy for hepatitis B vaccination. Missing or delaying the birth dose for infants born to HBsAg-positive women substantially increases the risk that they will develop chronic hepatitis B. To reduce the incidence of perinatal HBV infections, the committee offers the following recommendation:

TABLE 4-1 Hepatitis B Vaccine Schedules for Newborns, by Maternal HBsAg Status—ACIP Recommendations

|

Maternal HbsAg Status |

Single-Antigen (Stand-alone) Vaccine |

Single Antigen (Stand-alone) + Combination Vaccine |

||

|

|

Dose |

Age |

Dose |

Age |

|

Positive |

1a |

Birth (up to 12 hours) |

1a |

Birth (up to 12 hours) |

|

|

HBIGb |

Birth (up to 12 hours) |

HBIG |

Birth (up to 12 hours) |

|

|

2 |

1–2 months |

2 |

2 months |

|

|

3c |

6 months |

3 |

4 months |

|

|

|

|

4c |

6 months (Pediarix) or 12–15 months (Comvax) |

|

Unknownd |

1a |

Birth (up to 12 hours) |

1a |

Birth (up to 12 hours) |

|

|

2 |

1–2 months |

2 |

2 months |

|

|

3c |

6 months |

3 |

4 months |

|

|

|

|

4c |

6 months (Pediarix) or 12–15 months (Comvax) |

|

Negative |

Birth (before discharge) |

Birth (before discharge) |

||

|

|

2 |

1–2 months |

2 |

2 months |

|

|

3c |

6–18 months |

3 |

4 months |

|

|

|

|

4c |

6 months (Pediarix) or 12–15 months (Comvax) |

|

aRecombivax HB or Engerix-B should be used for the birth dose. Comvax and Pediarix cannot be administered at birth or before the age of 6 weeks. bHBIG (0.5 mL) administered intramuscularly in a separate site from vaccine. cFinal dose in vaccine series should not be administered before the age of 24 weeks. dMothers should have blood drawn and tested for HBsAg as soon as possible after admission for delivery; if mother is found to be HbsAg-positive, infant should receive HBIG as soon as possible but no later than the age of 7 days. eOn a case-by-case basis and only in rare circumstances, first dose may be delayed until after hospital discharge for an infant who weighs 2,000 g and whose mother is HbsAg-negative, but only if physician’s order to withhold birth dose and copy of mother’s original HBsAg-negative laboratory report are documented in infant’s medical record. Abbreviations: HBsAg, hepatitis B surface antigen; ACIP, Advisory Committee on Immunization Practices; HBIG, hepatitis B immune globulin. SOURCE: Mast et al., 2005. |

||||

TABLE 4-2 Hepatitis B Immunization Management of Preterm Infants Who Weigh Less Than 2,000 g, by Maternal HBsAg Status—ACIP Recommendations

|

Maternal HBsAg Status |

Recommendation |

|

Positive |

HBIG + hepatitis B vaccine (within 12 hours of birth) Continue vaccine series beginning at age of 1–2 months according to recommended schedule for infants born to HBsAg-positive mothers (see Table 4-1) Do not count birth dose as part of vaccine series Test for HBsAg and antibody to HBsAg after completion of vaccine series at age of 9–18 months (that is, next well-child visit) |

|

Unknown |

HBIG + hepatitis B vaccine (within 12 hours of birth) Test mother for HBsAg Continue vaccine series beginning at age of 1–2 months according to recommended schedule based on mother’s HBsAg result (see Table 4-1) Do not count birth dose as part of vaccine series |

|

Negative |

Delay first dose of hepatitis B vaccine until age of 1 month or hospital discharge Complete vaccine series (see Table 4-1) |

|

Abbreviations: ACIP, Advisory Committee on Immunization Practices; HBIG, hepatitis B immune globulin; HBsAg, hepatitis B surface antigen. SOURCE: Mast et al., 2005. |

|

Recommendation 4-1. All infants weighing at least 2,000 grams and born to hepatitis B surface antigen-positive women should receive single-antigen hepatitis B vaccine and hepatitis B immune globulin in the delivery room as soon as they are stable and washed. The recommendations of the Advisory Committee on Immunization Practices should remain in effect for all other infants.

Administration of prophylaxis in the delivery room is not novel. In the United States, vitamin K prophylaxis for vitamin K–deficiency bleeding and tetracycline or erythromycin for prophylaxis of neonatal gonococcal infections are routinely given to infants in the delivery room (American Academy of Pediatrics, 1961, 1980; Workowski and Berman, 2006). The World Health Organization recommends that the birth dose of the hepatitis B vaccine be administered as soon after birth as possible (WHO, 2006). A pilot project in The Lao People’s Democratic Republic demonstrated almost 100% coverage when the hepatitis B vaccine was administered in

the delivery room (WHO, 2006). When mothers were asked to take their newborns to a vaccination room for their hepatitis B vaccine birth dose, vaccine coverage was low.

Childhood Vaccination

ACIP recommends that unvaccinated children and adults under 19 years old be given the hepatitis B vaccine series (Mast et al., 2005). Studies have found racial and ethnic disparities in childhood vaccination rates: Asian and Pacific Islander (API), Hispanic, and black children had lower vaccination rates than non-Hispanic white children (CDC, 2000; Darling et al., 2005; Jenkins et al., 2000; Morita et al., 2008; Szilagyi et al., 2002). However, when poverty was controlled for, the estimates did not remain significantly lower for any racial or ethnic population than for non-Hispanic white children (CDC, 2009c).

Studies have also found geographic variability in vaccination coverage (Darling et al., 2005; Morita et al., 2008; Szilagyi et al., 2002). The disparities are seen state by state and within regions. For instance, in 2008, Maryland had the highest percentage of children who were up to date1 on their vaccinations with a rate of 82.3%, compared with Montana with a rate of 59.2% (CDC, 2009c). Szilagyi et al. (2002) looked at the use of reminder and recall interventions by primary-care providers to increase immunization rates for children under 2 years old. Before the intervention, the baseline geographic disparity was an 18% difference between innercity children (55%) and suburban children (73%). Within 3 years of the establishment of the intervention, the vaccination rates had increased in all areas, including 84% in the inner city and 88% in the suburbs.

All but three states—Alabama, Montana, and South Dakota—have a childhood hepatitis B vaccination mandate for daycare or school entry (Immunization Action Coalition, 2009). A retrospective cohort study of Chicago public-school children found that the hepatitis B vaccination school-entry mandate led to an increase in the vaccination rate among all children and substantially decreased the disparity in the vaccination rate between white children and black and Hispanic children (Morita et al., 2008). Before the school-entry mandate, the study found immunizations rates in non-Hispanic white, black, and Hispanic children of 89%, 76%, and 74%, respectively. After the mandate was enacted, the rates changed to

88%, 81%, and 87%, respectively. Although a disparity in the vaccinations rates persisted, the gap was narrowed (Szilagyi et al., 2002).

Other studies also have found that school-entry mandates are effective in increasing hepatitis B vaccination rates (CDC, 2001b; Koff, 2000; Olshen et al., 2007; Zimet et al., 2008) although such mandates may not be as effective in children in daycare (Stanwyck et al., 2004). CDC (2007) found that about 75% of states reported at least 95% hepatitis B vaccination coverage of children in kindergarten in 2006–2007. Another study reported that hepatitis B vaccine series coverage for children 19–35 months old in 2000–2002 ranged from 49% to 82%, depending on the state (Luman et al., 2005).

Special attention needs to be given to vaccination coverage of foreign-born children from countries that have a high prevalence of hepatitis B; because of their high risk of prior infection, laboratory testing is indicated to determine HBV-infection status.

Recommendation 4-2. All states should mandate that the hepatitis B vaccine series be completed or in progress as a requirement for school attendance.

Parents of foreign-born children from HBV-endemic countries should be given information about testing for HBV and should have their children tested before vaccination.

Adult Vaccination

Hepatitis B vaccination for adults is recommended to high-risk populations—people at risk for HBV infection from infected household contacts and sex partners, from occupational exposure to infected blood or body fluids, and from travel to regions with high or intermediate levels of endemic HBV infection (Mast et al., 2006). The estimated chance that an acute HBV infection will become chronic decreases with increasing age (see Table 4-3). The probability that an acute HBV infection in a 1-year-old will become chronic is 88.5%, but only 9.0% in a 19-year-old (Edmunds et al., 1993). Universal hepatitis B vaccination for adults is not recommended (that is, people born before 1991 do not need to receive the hepatitis B vaccine unless they are at risk for HBV infection). It is not cost-effective; that is, the health benefits achieved do not justify the cost compared with other potential health-care interventions (Gold et al., 1996). Interventions in the United States that cost less than $100,000 per quality adjusted life year (QALY) gained are generally considered to be cost-effective (Owens, 1998; WHO, 2009). Universal hepatitis B vaccination is not cost-effective even in adult Asians and Pacific Islanders, who have a higher prevalence of HBV

TABLE 4-3 Estimated Chance That an Acute Hepatitis B Infection Becomes Chronic with Age

infection than the general US population (Hutton et al., 2007). However, ring vaccination—vaccination of the close contacts of people found to be chronically infected with HBV—is cost-effective (Hutton et al., 2007).

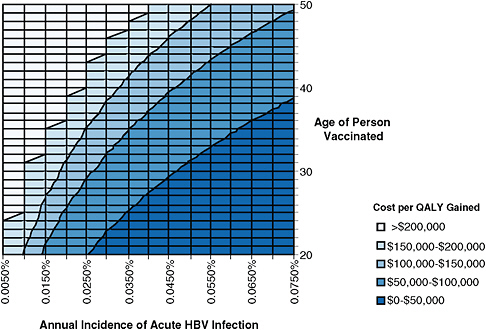

Figure 4-1 shows estimated cost effectiveness of hepatitis B vaccination for different age groups and different incidences of acute hepatitis B. The leftmost line of the graph represents a recent estimate of acute HBV incidence in the general US population (Hutton et al., 2007). This estimate is expressed as the annual percentage of people in the population who acquire acute HBV infection. At that incidence, hepatitis B vaccination of adults in the general US population costs more than $100,000 per QALY gained, and is not considered to be cost-effective.

In 2004, just over half (54.6%) the adults at high risk for HBV infection had received the hepatitis B vaccine, including about 75% of health-care workers and 64% of public-safety workers for whom vaccination is recommended (CDC, 2006; Simard et al., 2007). Of adults with acute hepatitis B, 61% reported having missed an opportunity for vaccination (Williams et al., 2005). Low coverage of high-risk adults is attributed to the lack of dedicated vaccine programs, limited vaccine supply, inadequate funding, and noncompliance by the involved populations (Mast et al., 2006).

FIGURE 4-1 Estimated cost of adult hepatitis B vaccination per quality adjusted life year (QALY) gained for different age groups and different rates of acute hepatitis B virus (HBV) infection incidence. Incidence is expressed as the annual percentage of the population becoming acutely infected with HBV (for example, incidence of 0.005% means that 5 persons per 100,000 are acutely infected with HBV each year, and incidence of 0.075% means that 75 persons per 100,000 are acutely infected with HBV each year). Shadings show different levels of cost per QALY gained. Interventions are more cost-effective as one moves down (lower age) and to the right (higher incidence). Interventions that cost less than approximately $100,000 per QALY gained are generally considered cost-effective in the United States (Owens, 1998; WHO, 2009). The leftmost line, incidence of 0.0050%, is based on a recent estimate of acute hepatitis B incidence in the general US population (Hutton et al., 2007). Analysis performed by D. Hutton using the model developed in Hutton et al., 2007.

Adults at Risk from Sexual Exposure In a national sample of 500 sexually-transmitted-disease (STD) clinics, the percentage that offered the hepatitis B vaccine increased from 25% to 45% (p = 0.02) from 1997 to 2001, and the percentage of the clinics that considered all patients eligible for the vaccine rose from 9% to 26% (p = 0.023) during the same period (Gilbert et al., 2005). However, declining hepatitis B vaccination rates were reported in a study of six STD clinics in the United States (Harris et al., 2007). The researchers collected data on patient visits and hepatitis B vaccinations for

the period 1997–2005 and found that vaccination rates declined during the later years. Possible reasons for the decline include fiscal constraints and increasing rates of prior vaccination.

Several studies have reported that when STD clinics offered the hepatitis B vaccine, many patients at high risk for HBV infection opted to be vaccinated. A study of 194 STD clinic patients found that 62% had not previously been vaccinated for hepatitis B, and 50% of the 62% elected to receive the vaccination (Samoff et al., 2004). A national program to vaccinate adults at STD clinics for hepatitis B is likely to be cost saving to society (Miriti et al., 2008). In an anonymous HIV-testing program in Madison, WI, 86% of patients were considered to be at high risk for HBV infection; 51% of the 86% initiated hepatitis B vaccination, and 80% who initiated vaccination completed the vaccine series (Savage et al., 2000).

Foreign-born people from HBV-endemic countries who reside in the United States are at risk for HBV infection from sexual exposures. Continuing sexual transmission of HBV in these communities is likely. Thus, foreign-born adults may be at high risk for acquiring hepatitis B, and women may transmit the virus to their newborns. Foreign-born adults would benefit from laboratory testing to determine their infection status and subsequent hepatitis B vaccination of susceptible people.

Adults at Risk from Injection-Drug Use CDC estimates that injection-drug users (IDUs) account for 15% of acute HBV infections in the United States (Daniels et al., 2009). The incidence of HBV infection in susceptible IDUs ranges from 10 to 30 per 100 person-years (Des Jarlais et al., 2003; Hagan et al., 1999). Hepatitis B vaccine coverage rates in IDUs are low and estimated to be 3–20% (Altice et al., 2005; Kuo et al., 2004; Lum et al., 2008) (see Table 4-4). The highest reported vaccination rate in US IDUs was 22%, in new injectors studied in 2000–2002 (Lum et al., 2003). In a study conducted in San Francisco, only 13% of IDUs over 30 years old had ever been offered hepatitis B vaccination compared with 25% of younger injectors (Seal et al., 2000).

On-site hepatitis B vaccination achieves higher success rates in IDUs than referral to other locations (summarized in Table 4-4). In a multisite study of IDUs in five US cities, IDUs participating in a randomized clinical trial to reduce HIV and HCV transmission were offered hepatitis B vaccination under a variety of conditions. Vaccine uptake was highest when it was provided on site and during the initial study visit (Campbell et al., 2007). A New Haven mobile health van at a needle-exchange program found that 66% of those initially offered the hepatitis B vaccine completed all three doses (Altice et al., 2005). Des Jarlais et al. (2001) reported a 31% completion rate in Alaskan IDUs given an off-site referral compared with 83% in

IDUs offered on-site vaccination and a $5–10 incentive at a New York City needle-exchange program.

The committee believes that the hepatitis B vaccination rate in the high-risk IDU population is unacceptably low. Studies of vaccine protocols show that completion rates are substantially higher when vaccination is offered at such a location as a needle-exchange program. Using a modeling approach, Hu et al. (2008) found that hepatitis B vaccination of IDUs who participate in needle-exchange programs in the United States is likely to be cost-saving to society.

Incarcerated Populations Hennessey et al. (2009) reported that only 12% of inmates at three jails in Chicago, Detroit, and San Francisco had serologic evidence of hepatitis B vaccination compared with a 25% self-reported vaccination rate in the US population. The study also found an unexpectedly high rate of chronic hepatitis B infections (3.6%) and the lowest rate of hepatitis B vaccination (10%) among Hispanic inmates.

Twenty states require that inmates receive at least some immunizations, including the hepatitis B vaccine (CDC, 2008a). Four of those states require vaccination of all inmates, and 16 require only that juvenile inmates be vaccinated. Several studies reported that if offered the hepatitis B vaccine, most inmates (60–93%) would agree to be vaccinated (Rotily et al., 1997; Vallabhaneni et al., 2004). Alternative vaccination schedules may be effective for inmates. In a study of inmates in Denmark, 63% completed the hepatitis B vaccination series on an accelerated 3-week schedule compared with 20% of those on a 6-month schedule (Christensen et al., 2004).

According to CDC, 28.8% of patients who had acute hepatitis B reported a history of incarceration before HBV infection (Goldstein et al., 2002). Thus, immunization of incarcerated people could potentially prevent nearly one-third of all acute hepatitis B cases in the United States. Although most prison systems in the United States do not provide universal hepatitis B vaccination for inmates, Charuvastra et al. (2001) noted that 25 of 26 states that responded to a survey reported that they would routinely vaccinate their inmates against HBV infection if funding for vaccination were available.

Although the length of stay is shorter in jails than in prisons, offering hepatitis B vaccination to jail inmates is feasible and provides a benefit to the community after the inmates are released. Using an accelerated schedule increases the completion rate (Christensen et al., 2004). Substantial protection is provided after even one or two of the three doses of the series. It is important to have a health-record system that tracks immunizations so that the vaccine series can be continued if later incarcerations occur. Ideally, immunizations administered in jails will be captured in an adult immunization registry (see discussion on immunization-information systems below) so

TABLE 4-4 Studies of Hepatitis B Vaccination Rates in Injection-Drug Users

|

Reference |

Location |

Sample; Design |

|

Cross-sectional studies of vaccination rates |

||

|

Seal et al., 2000 |

San Francisco, CA |

135 under 30 years old, 96 at least 30 years old |

|

|

|

Cross-sectional |

|

Lum et al., 2008 |

San Francisco, CA |

831 young IDUs |

|

|

|

Cross-sectional |

|

Kuo et al., 2004 |

Baltimore, MD |

324 IDUs, NIDUs |

|

|

|

Cross-sectional |

|

Additional vaccination studies |

||

|

Campbell et al., 2007 |

5 US cities |

3,181 |

|

|

|

Cohort; vaccination protocol varied by city |

|

Altice et al., 2005 |

New Haven, CT; mobile health van at SEP |

134 HBV-negative IDUs |

|

|

|

Observational |

|

Des Jarlais et al., 2001 |

Anchorage, AK; New York City |

AK cohort referred to clinic (350); New York City cohort offered on-site vaccination at SEP (36) + small cash incentives |

|

|

|

Cohort |

|

Hutchinson et al., 2004 |

Glasgow, Scotland, prison vaccination, community assessment |

In 1999, offered HBV vaccination to all inmates; surveyed new injectors (within 5 years) |

|

Abbreviations: HBV, hepatitis B virus; IDU, injection-drug user; NIDU, non-injection-drug user; SEP, syringe-exchange program. |

||

|

Percentage Previously Vaccinated |

Percentage Ever Offered Vaccination |

Percentage Completed Vaccination Series |

|

|

25% under 30 years old, 13% at least 30 years old |

|

|

22%; 18% among HCV positive |

|

|

|

10% IDUs; 14% NIDUs |

|

|

|

|

|

Vaccination highest where available on site (83% had at least one dose); incentives did not affect vaccination rates |

|

3% |

|

94% had one dose; 77% had two doses; 66% had three doses 30/36 (83%) offered on site had all three doses vs 31% of those referred to clinic |

|

1993, 16% 1994, 19% 1999, 15% 2002, 52% |

|

|

|

(56% received hepatitis B vaccine while in prison) |

|

|

that the vaccine series can be completed at other sites, such as drug-treatment centers and STD clinics.

Hepatitis B vaccination of inmates costs the correctional system $415 per HBV infection averted, but it provides additional postincarceration savings to society as a whole (Pisu et al., 2002).

Other At-Risk Adults

HIV-infected people. At a clinic that serves primarily HIV-infected patients in Jacksonville, FL, 45% of 1,576 HIV-infected patients were considered to be at risk for HBV infection (Bailey et al., 2008), and 30% of those at risk were not offered hepatitis B vaccine by their health-care providers. Routine hepatitis B vaccination at HIV clinics is highly cost-effective, with a cost of $4,400 per QALY gained (Kim et al., 2006). Similarly, hepatitis B vaccination at STD testing, counseling, and treatment sites has been demonstrated to be highly cost-effective (Miriti et al., 2008).

Institutionalized populations. Vellinga et al. (1999) reviewed the literature and reported that among institutionalized developmentally disabled people in the United States, the prevalence of anti-HBs antibody ranged from 36% to 63% in residents who had Down syndrome and from 48% to 69% in people who had other intellectual disabilities. HBsAg prevalence was very high—27–51% in people who had Down syndrome and 6–9% in people who had other intellectual disabilities—and this suggests that many residents of institutions are immunized by natural infection rather than by vaccination. The committee did not find data on rates of hepatitis B vaccination of institutionalized developmentally disabled people. Because they are at risk for hepatitis B, they would benefit from vaccination.

Occupational exposure to hepatitis B virus. Only 75% of health-care workers (HCWs) in the United States—a population at high risk for HBV infection—have received the three-dose vaccine series in 2002-2003 (Simard et al., 2007). The vaccination rate was highest in physicians and nurses (81%) and lowest among black HCWs (67.6%).

Identifying At-Risk Adults

As discussed above, recommendations regarding childhood hepatitis B vaccination are aimed at achieving universal coverage, and recommendations regarding adult vaccination focus on the identification of risk populations for targeted immunization efforts. The identification of at-risk adults has proved problematic (CDC, 2006), and current CDC recommendations have emphasized both site-based and individual-based risk assessment to

improve hepatitis B vaccine coverage (Mast et al., 2006). A key to the success of such an approach is the routine availability of hepatitis B vaccine in settings where a high proportion of persons who have risk factors are seen (such as STD clinics), in primary-care and specialty-care medical settings, and in occupational-health programs.

Identification of at-risk people is particularly challenging in medical settings in that risks must be assessed in individual patients. In many health-care settings, physicians and other providers might not be comfortable in asking direct questions to elicit risk history with respect to sexual or percutaneous exposures (Ashton et al., 2002; Bull et al., 1999; Maheux et al., 1995). Time constraints during medical appointments and inadequate provider education in the assessment of risk histories also might lead to insufficient assessment of risk history. In addition, there may be discrepancies between a patient’s self-assessment of risk and a health-care provider’s documented assessment (Fishbein et al., 2006). Therefore, the ACIP recommends that hepatitis B vaccination be offered to any adult who requests it, regardless of a provider’s assessment of risk (Mast et al., 2006).

Recommendation

In 2007, there were more than 40,000 new acute HBV infections in adults (Daniels et al., 2009). To reduce the incidence of HBV infection in adults, the committee offers the following recommendation:

Recommendation 4-3. Additional federal and state resources should be devoted to increasing hepatitis B vaccination of at-risk adults.

-

Correctional institutions should offer hepatitis B vaccination to all incarcerated persons. Accelerated schedules for vaccine administration should be considered for jail inmates.

-

Organizations that serve high-risk people should offer the hepatitis B vaccination series.

-

Efforts should be made to improve identification of at-risk adults. Health-care providers should routinely seek risk histories from adult patients through direct questioning and self-assessment.

-

Efforts should be made to increase rates of completion of the vaccine series in adults.

-

Federal and state agencies should determine gaps in hepatitis B vaccine coverage among at-risk adults annually and estimate the resources needed to fill the gaps.

Immunization-Information Systems

Immunization registries are databases that allow the collection and consolidation of vaccination data from multiple health-care providers. They also make it possible to generate reminder and recall notifications and assess vaccination coverage in defined geographic areas. Immunization-information systems (IISs) are registries that have additional capabilities, such as vaccine management, adverse-event reporting, lifespan vaccination histories, and linkages with electronic data (CDC, 2005). According to a report of the National Vaccine Advisory Committee (NVAC), IISs have been demonstrated to improve immunization coverage, support vaccine safety, increase timeliness of immunization, and help in the study of immunization effectiveness in children (Hinman et al., 2007). IISs can also prevent unnecessary immunizations by giving providers a single source for patients’ immunization histories (Yawn et al., 1998), reduce “no-show” rates, reduce vaccine waste, save staff costs by avoiding manual review of multiple records, aid in the establishment of Healthcare Effectiveness Data and Information Set (HEDIS) performance measures, and avoid costs associated with the National Immunization Survey (NIS) (Bartlett et al., 2007).

The development of IISs began in 1993 when CDC started to award planning grants to develop registries in every state (CDC, 2001a). President Clinton established the national Childhood Immunization Initiative by directing the secretary of health and human services to work with states to build “an integrated immunization registry system.” That initiative led to the Initiative on Immunization Registries, which was spearheaded by the NVAC with support from CDC’s National Immunization Program and the Department of Health and Human Services National Vaccine Program Office (Bartlett et al., 2007). Since 1994, CDC’s National Center for Immunization and Respiratory Diseases (formerly the National Immunization Program) has provided funding to 64 grantees (all 50 states, 6 cities, and the US territories) through Section 317 of the Public Health Service Act for the development of IISs. From 1994 through 2001, $181.3 million was allocated by CDC, and an additional $20 million was provided by the Robert Wood Johnson Foundation (CDC, 2001a). Only one state had reported no efforts to develop and implement an IIS as of December 31, 2005 (Hinman et al., 2007). However, three other states did not report to CDC in 2005 the percentage of children younger than 6 years old who participated in an IIS, and this might indicate inadequacy of IISs in those states.

CDC has indicated a commitment to support the continued development and expansion of state and community IISs (CDC, 2008b) and has a goal of including more than 95% of children under 6 years old in grantee IISs by 2010. To address wide variation in the performance of IISs nationally, CDC required detailed business plans from grantees in 2006 to

describe operational and financial objectives of the systems. In addition, a technical work group was established to develop approaches to measuring performance of the systems against 12 functional standards (Hinman et al., 2007). There are also plans to develop an IIS certification process.

As the state and community IISs develop, they are increasingly used for broader purposes, such as emergency preparedness and response (Boom et al., 2007), monitoring the impact of vaccine shortages (Allred et al., 2006), and monitoring the use of new vaccines. There have also been calls to integrate IISs with other child-information systems—such as vital registration, newborn dried-blood spot screening, and early hearing detection and intervention (Saarlas et al., 2004)—and to expand the systems to include adolescents and adults. The NVAC reported that as of 2005, 87% of CDC grantees included adolescents in their IISs, and 75% included information on persons 50 years old and older (Hinman et al., 2007).

In 2009, the NVAC issued new recommendations for federal adult immunization programs (HHS, 2009).One recommendation was that CDC and the Health Resources and Services Administration (HRSA) devote resources to the inclusion of adult immunization records in all grantee IISs, and another was that all grantees be required to implement adult immunization activities and adopt ACIP recommendations for routine adult immunization.

Recommendation 4-4. States should be encouraged to expand immunization-information systems to include adolescents and adults.

-

Systems should allow the sharing of information between states so that immunization status can be tracked when people move from state to state.

-

Vaccine registries should include adult populations, such as incarcerated persons, IDUs, and people who have STDs.

-

Data sharing on vaccination status should be established between correctional facilities and public-health departments.

Barriers to Hepatitis B Vaccination

Mistrust of Vaccination

Like other childhood vaccinations, hepatitis B vaccination is sometimes refused because patients or parents of children have concerns about the safety of a vaccine (Allred et al., 2005; Gust et al., 2008; Smith et al., 2006a). The committee is unaware of credible evidence of serious harms caused by the hepatitis B vaccine in its many forms. In a 2002 scientific review by the Institute of Medicine, the hepatitis B vaccine was not found

to be associated with adverse health outcomes (IOM, 2002). The committee believes that it is one of the safest vaccines available. The efforts of groups opposed to vaccination present a serious obstacle to comprehensive vaccination coverage, which is essential for the prevention and control of hepatitis B in the United States.

Payment for Vaccines

Insurance Coverage

Health-insurance coverage for the nonelderly population (less than 65 years old) is provided by employers (63%) and public programs (11% by the Medicaid/Children’s Health Insurance Program and 2% by other public programs) or is acquired by individuals in the private market (5%) (Holahan and Cook, 2008). Some 17% of Americans under 65 years old were reported as chronically uninsured in 2007, but as many as one-third of Americans were uninsured for at least some of the time in 2007–2008 (Families USA, 2009b). Robust coverage for vaccinations, including hepatitis B vaccination, is provided by public insurance plans (Table 4-5). Private insurance plans have variable coverage for vaccinations and various degrees of cost-sharing. Insurance coverage for vaccinations also varies substantially with age: children under 5 years old and people 65 years old and over have high rates of private or public coverage (89% and nearly 100%, respectively). People 18–64 years old have much lower rates (50%) because of lack of insurance, inadequate insurance, and the absence of a public safety net for recommended adult vaccinations (IOM, 2003).

Insurance coverage has been demonstrated to have an important impact on access to preventive and other health services and on health outcomes (IOM, 2009). Studies in children involving various vaccine series, including hepatitis B vaccine, and in adults transitioning to Medicare have shown notable increases in vaccination rates in those with insurance coverage (IOM, 2009). In an NIS sample of children 19–24 months old, recommended vaccination completion rates were found in 76% of the children covered by private insurance, 70% of the children covered by Medicaid or the Children’s Health Insurance Program (CHIP), and 53% of uninsured children (Smith et al., 2006b).

Public Vaccine Programs and Insurance

Vaccines for Children program. Children with no private insurance may be covered up to the age of 18 years by the Vaccines for Children (VFC) program administered by CDC (CDC, 2003). The VFC program was created by the Omnibus Budget Reconciliation Act of 1993 as a new

entitlement program to be a required part of each state’s Medicaid plan. The program began in October 1994. The Office of Management and Budget approves funding for the VFC program. Funding is through the Centers for Medicare and Medicaid Services to CDC, and awards are made to eligible grantees. The VFC program provides a vaccination entitlement for Medicaid-eligible, uninsured, American Indian and Alaska Native, and underinsured children who receive vaccines at federally qualified health centers (FQHCs). The VFC program negotiates vaccine prices at the federal level and allocates credits to states to distribute vaccines free of charge. The program does not cover any of the practice-based costs associated with the administration of the vaccines. Payment for vaccine administration is generally sought from specific insurance programs, such as Medicaid, or from parents of VFC-eligible, non-Medicaid children (CDC, 2003).

Section 317 Immunization Grant program. The Section 317 Immunization Grant Program is a federal discretionary grants program for states and other US jurisdictions (CDC, 2009d). It was established by the 1962 Vaccination Assistance Act and was the primary source of federal funds for vaccine purchase until it was supplanted by the VFC program in 1993. Unlike the VFC program, Section 317 provides federal funds for both vaccine purchase and vaccine-related infrastructure, such as population needs assessments, surveillance, compliance monitoring, training, and school-based delivery systems. The program targets immunization coverage for underinsured children and youths not eligible for the VFC program and to a small degree uninsured and underinsured adults. In 2007, CDC created the Adult Hepatitis B Vaccine Initiative by using savings from Section 317 funds to provide free vaccine for high-risk adults in various community settings. Funding for vaccine costs totaled $36 million in the first 2 years; this resulted in the delivery of over 581,000 doses, 343,000 of which reportedly were administered. The initiative involves 56 grantees that enroll 2,437 sites, of which 38% are local health departments, 20% STD clinics, 13% primary-care loci, 11% jails or prisons, and 18% other sites, including substance-abuse and HIV centers (personal communication, J. Ward, CDC, July 30, 2009). However, Section 317 funding for adult vaccination initiatives does not support the infrastructure and medical-supply costs to deliver vaccines to people at highest risk.

Children’s Health Insurance Program. The federal CHIP was established in 1997 under Title IX of the Social Security Act and was expanded in the Children’s Health Insurance Program Reauthorization Act of 2009 (CMS, 2009). It is a federal block-grant program that requires state matching funds to expand health-care coverage to children under 18 years old and pregnant women who do not meet income eligibility requirements for

TABLE 4-5 Public Health-Insurance Plans

|

Vaccination |

Target Audience |

Cost Structure |

|

100% |

Veteransa |

No cost-sharing except for non-service-connected veterans |

|

Coverage similar to private plans |

Federal employees |

Coverage similar to private plans |

|

High-risk group coverage |

People at least 65 years old, disabled, people with end-stage renal disease |

Coinsurance or copayment applies only after yearly deductible has been met |

|

Yes |

Low-income people, families with children, SSI recipients, pregnant womenb |

States have option to impose nominal copayment for beneficiaries on basis of income |

|

Yes |

Children up to 18 years old who are uninsured, Medicaid-eligible, underinsured, American Indians, Alaska Natives |

Covers cost of vaccines but not administration; providers can charge administration fee for non–Medicaid-eligible children |

|

Yes |

Children, adolescents not served by VFC program; small percentage (about 5%) used for adults |

Can be used for infrastructure; annual appropriations vary |

|

Yes |

Insurance benefits for children up to 18 years old (for families making no more than $44,100/year) whose income is too high for Medicaid, too low for private insurance |

Block grant program: federal match more than Medicaid match |

Medicaid but cannot afford private health insurance. CHIP is available to citizens and some legal immigrants, and states can charge a premium for coverage and impose cost-sharing based on income. States have the option of using the grant money to establish independent insurance programs or to expand eligibility criteria for Medicaid; in the latter case, the coverage must conform to Medicaid requirements. Currently, 39 states have programs that are not expansions of Medicaid. Non-Medicaid CHIP programs must provide coverage for ACIP-recommended immunizations, including hepatitis B, and must meet a federally established minimal overall coverage.

Public programs for adults. Nonelderly adults have more limited access to publicly funded vaccination programs and public insurance benefits than children. Adults enrolled in Medicaid make up 25% of enrollees and are provided coverage for vaccinations, but the coverage varies between states. Most states provide coverage based on ACIP standards, including hepatitis B immunization. However, cost-sharing is common, and payment of providers varies from fixed-fee schedules, which allow separate billing for vaccine administration (Rosenbaum et al., 2003). Elderly adults covered under Medicare and enrolled in Medicare Part B are covered for hepatitis B vaccination if they fall into ACIP-designated high-risk or intermediate-risk populations. The Medicare Part B deductible must be met, and the relevant copayment or coinsurance is applicable to the hepatitis B coverage (CMS, 2008).

Federal law generally restricts coverage for adults under CHIP to pregnant women but does permit coverage of adults without dependent children under special waivers from the federal government. Eleven states are providing coverage to low-income adults under such waivers. The 2009 CHIP reauthorization act will phase out funding for such waivers by 2011 and thereby eliminate this public source of adult-vaccination coverage (Families USA, 2009a). Public Health Service Section 317 grants amounted to $527 million in 2008 and allow vaccination coverage for uninsured and under-insured adults. Nearly all the money, however, was used for vaccinating children and youths. In 2005, it was reported that less than 5% of Section 317 funding was used for adult-vaccination efforts (Mootrey, 2007).

Private Insurance Plans

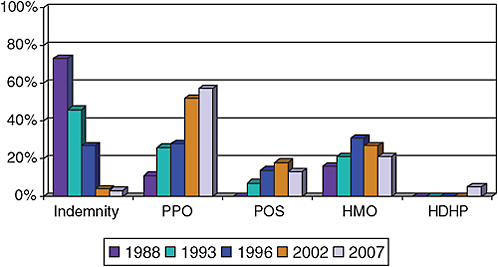

Employers provide over 66% of all health insurance for 177 million Americans under the age of 65 years (U.S. Census Bureau, 2007). Trends in private health-insurance coverage have reflected a shift from comprehensive coverage with low out-of-pocket costs (health maintenance organizations, HMOs) to broader access, network-driven, and higher-cost–sharing health plans (preferred provider organization, PPOs) (Figure 4-2). The latter offer

free choice of providers and hospitals but require out-of-pocket spending (deductibles) by the consumer before coverage under the plan, cost-sharing when the plan does provide coverage (flat dollar copayments or coinsurance payments), and different levels of coverage for the same service when acquired in-network versus out-of-network. PPO insurance arrangements now cover more than 58% of all persons who have employment-based health insurance (Figure 4-2).

Coverage for hepatitis B and other ACIP-recommended vaccinations is routine in HMOs but variable in PPOs and other private insurance plans. There is little or no cost-sharing for vaccinations and other preventive services in HMOs, whereas it is greater in PPOs and other health plans because of applicable deductibles and coinsurance or copayments. Cost-sharing is greatest in health plans that have very high deductibles (high-deductible health plans, HDHPs). In 2008, 8% of all privately insured Americans were covered by HDHPs with annual deductibles of $1,000 or more (Kaiser Family Foundation and HRET, 2008). HDHPs can pose formidable barriers to preventive care and vaccination unless these services are specifically exempted from the deductible or enrollees are provided a separate source of funds to pay for them (for example, a reimbursement arrangement or a

FIGURE 4-2 Trends in private health-insurance coverage.

Abbreviations: PPO, preferred provider organization; POS, point of service; HMO, health maintenance organization; HDHP, high-deductible health plan.

SOURCES: HIAA, 1988; Kaiser Family Foundation and HRET, 2008; KPMG, 1996.

funded health savings account). To ensure vaccination coverage for children under private insurance arrangements, most states have mandates for childhood immunizations. The regulations may also prohibit cost-sharing in the form of deductibles or coinsurance for those services (American Academy of Pediatrics, 2008). State mandates for recommended adult vaccinations are less common. Employers that use national health plans are exempted from the state mandates because their health-benefit plans operate under the federal Employee Retirement Security Act which pre-empts state laws that govern these plans.

Gaps and Barriers

Coverage for hepatitis B vaccination and other ACIP-recommended vaccinations is greater for children and youths than for adults. Federal and state funding for hepatitis B vaccination and other vaccinations provides a safety net for the poorest children and youths, but no such program, such as an adult version of the VFC program, exists for uninsured or underinsured adults. Public Health Section 317 provides a potential vehicle for filling that void, but funding has been increased only modestly since 2003 (Rodewald, 2008), and only recently has adult hepatitis B vaccination become a target for some of the Section 317 funds. CDC has reported to Congress that it would take about $1.6 billion—or 3 times the amount of current Section 317 funding—to fill gaps in coverage and support to states to provide a rigorous national vaccination program for children, adolescents, and adults, including $335 million for payments to providers for all vaccine administration (CDC, 2009d). In that report, CDC included only $49 million for hepatitis B vaccine purchase for 675,000 high-risk adults in a total high-risk population of 4.5 million people who visit STD-HIV and drug-treatment centers—a 15% uptake. If uptake at those venues reached 74% for the first dose, as was observed at a San Diego STD clinic that combined free vaccination with counseling (CDC, 2002), the cost for hepatitis B vaccine purchase alone would approach $80 million.

Except for Medicaid’s Early Periodic Screening, Diagnosis, and Treatment entitlement, public-health insurance often contains cost-sharing, which may create a barrier to vaccination for some people. Adults covered by Medicaid and Medicare and those being phased out of CHIP coverage must share the costs of hepatitis B vaccination. Families of non-Medicaid VFC-covered children may be responsible for the administration portion of the vaccination cost.

Private health insurance has gaps for vaccination coverage because it does not universally cover all ACIP-recommended vaccinations for children and adults. Furthermore, most privately insured persons are required to pay to receive vaccinations. More than two-thirds of privately insured persons

are enrolled in non-HMO health plans that require deductibles to be met before plan coverage and require out-of-pocket expenditures for services.

Recommendation 4-5. Private and public insurance coverage for hepatitis B vaccination should be expanded.

-

Public Health Section 317 should be expanded with sufficient funding to become the public safety net for underinsured and uninsured adults to receive the hepatitis B vaccination.

-

All private insurance plans should include coverage for all ACIP-recommended vaccinations. Hepatitis B vaccination should be free of any deductible so that first-dollar coverage exists for this preventive service.

Vaccine Accessibility

The hepatitis B vaccine is available at some physician offices, designated health clinics, and some community-based outreach programs. However, many health-care providers’ offices do not offer vaccination, and many US cities do not have health clinics or community-based programs that provide the hepatitis B vaccine (Rein et al., 2010). Making the vaccine available through nontraditional settings, such as pharmacies, would probably increase hepatitis B immunization rates in the United States. Previous studies have shown that use of nontraditional settings, such as pharmacies and supermarkets, to deliver vaccines to US adults results in increased accessibility and convenience, reduced cost, and increased public awareness of the need for adult immunization (Postema and Breiman, 2000). That strategy is also likely to be cost-saving (Prosser et al., 2008). The involvement of community pharmacies in vaccine distribution and administration has been growing in recent years (Westrick et al., 2009), and enlisting their participation in public delivery of the hepatitis B vaccine is a natural progression.

Vaccine-Supply Concerns

Several studies of vaccine supply in the United States have expressed concerns regarding vaccine shortages (Jacobson et al., 2006; Klein and Myers, 2006; Santoli et al., 2004). Reasons for vaccine shortages include cessation of production by manufacturers due to lack of profitability, liability issues, problems with vaccine production, and unanticipated vaccine demands (Klein and Myers, 2006; Santoli et al., 2004). From 2000 to 2004, there were shortages of six pediatric vaccines: combined tetanus–diphtheria toxoids (November 2000–June 2002), diphtheria–tetanus–acellular pertus-

sis (March 2001–July 2002), pneumococcal conjugate (September 2001– March 2003 and February 2004–September 2004), measles–mumps–rubella (October 2001–July 2002), and varicella (October 2001–August 2002) (Jacobson et al., 2006).

Although there has not been a national shortage of the hepatitis B vaccine, temporary supply problems occurred with this vaccine in 2008 (adult and dialysis formulations of Recombivax HB) and 2009 (pediatric formulations of Recombivax HB and Pediatric Engerix-B) (CDC, 2009a). A shortage was avoided because other manufacturers were able to provide an adequate supply of the vaccine in adult and dialysis formulations, and CDC released doses of pediatric vaccine from its stockpile.

Recommendation 4-6. The federal government should work to ensure an adequate, accessible, and sustainable hepatitis B vaccine supply.

HEPATITIS C VACCINE

Efforts are going on to develop a vaccine for hepatitis C, and several candidates are in phase I and phase II clinical trials (Inchauspe and Michel, 2007). Although some vaccines are being developed to treat people with chronic HCV infection (that is, therapeutic vaccines), this section focuses on vaccines to prevent chronic HCV infection. An incomplete understanding of how chronic HCV infection is spontaneously controlled in some people and antigenic variability of the virus remain barriers to development of a vaccine to prevent chronic hepatitis C.

Feasibility of Preventing Chronic Hepatitis C

The outcomes of HCV infections in humans and chimpanzees suggest that it may be possible to develop a vaccine to prevent HCV infection. Spontaneous clearance of the virus in 15–45% of persons after acute HCV infection demonstrates that immunity can prevent chronic infection and its long-term consequences, such as cirrhosis and hepatocellular carcinoma (HCC) (Alter et al., 1992; Barrera et al., 1995; Villano et al., 1999; Vogt et al., 1999). It also seems that immunity can be conditioned by prior exposure: humans and chimpanzees that recover from HCV infection appear to control a second infection better (the peak of viremia is lower than in the initial infection, and the chance of recovery is greater compared with that in persons not previously infected) (Lanford et al., 2004; Major et al., 2002; Mehta et al., 2002). In addition, IDUs who recovered from earlier HCV infections and have continuing HCV exposure have substantially less viremia than those who have similar exposure but had no earlier infection

(Mehta et al., 2002). Some hepatitis C vaccine candidates have shown similar potential (Forns et al., 2000; Weiner et al., 2001).

Although those clinical observations suggest that it is possible to develop a vaccine to prevent chronic HCV infection, there are important challenges. Immunity produced by natural infection does not prevent reinfection (that is, it is not sterilizing); such immunity reduces the frequency of chronic infection but does not prevent it (Farci et al., 1992). Moreover, the immunologic correlates of those critical clinical outcomes are not sufficiently understood for rational design or evaluation of vaccine products. Marked genetic variability in some HCV epitopes creates an especially formidable challenge if immunity to them is necessary for protection.

Need for a Vaccine to Prevent Chronic Hepatitis C

Although HCV infections occur in the general population of the United States and other economically developed countries, the incidence is probably too low to justify universal HCV vaccination. A hepatitis C vaccine is most likely to benefit populations that are at highest risk, include IDUs, health-care workers who perform high-risk procedures, and some men who report high-risk sexual practices with other men. A vaccine that prevents chronic HCV infection not only might reduce the likelihood of long-term disease, such as cirrhosis or HCC, but might reduce the likelihood of secondary transmission by reducing the infection reservoir. It may not be possible to produce a vaccine that prevents HCV infection, but a product that prevents acute HCV infections from becoming chronic would probably achieve many of the same benefits. In cases where acute HCV infection does not resolve within a few months, early treatment can prevent most cases from evolving into chronic HCV infection. However, because most acute HCV infections are not recognized, a vaccine is further likely to be of greatest benefit to populations in whom acute infection is rarely recognized and treated (for example, IDUs).

Cost Effectiveness of a Hepatitis C Vaccine

Estimates of the cost effectiveness of hepatitis C vaccination depend on a number of factors, including the cost of the vaccine, the target population’s incidence, and projections of its effectiveness and duration. Several studies have evaluated the potential cost effectiveness of an HCV vaccine that prevents acute (and chronic) infection. Krahn et al. (2005) calculated that if a hepatitis C vaccine with 80% efficacy was available, had a duration of effectiveness equivalent to that of the hepatitis B vaccine, and was cost-equivalent to that of the current hepatitis A vaccine ($51 per dose plus administration fees), it would be cost saving to vaccinate IDUs. The authors

also reported that vaccination of average-risk school-age children with such a vaccine would be cost-effective. The cost would be about $18,000 per QALY gained. Massad et al. (2009), on the basis of HCV incidence data for Sao Paolo, Brazil, calculated that a 100% effective hepatitis C vaccine that provides lifelong immunity and costs $300 per dose would cost $748,991 per death averted. If only high-risk people (for example, IDUs) were vaccinated, the cost would be $131,305 per death averted. If the hepatitis C vaccine had only 80% efficacy and lifelong duration, it would cost $242,667 per death averted if given only to high-risk people.

The committee recognizes the need for a safe, effective, and affordable hepatitis C vaccine. Such a vaccine could substantially enhance hepatitis C prevention efforts.

Recommendation 4-7. Studies to develop a vaccine to prevent chronic hepatitis C virus infection should continue.

REFERENCES

ACIP (Advisory Committee on Immunization Practices). 1991. Hepatitis B virus: A comprehensive strategy for eliminating transmission in the United States through universal childhood vaccination. Recommendations of the immunization practices advisory committee (ACIP). Morbidity and Morality Weekly: Recommendations and Reports 40(RR-13):1-25.

Allred, N. J., K. M. Shaw, T. A. Santibanez, D. L. Rickert, and J. M. Santoli. 2005. Parental vaccine safety concerns: Results from the national immunization survey, 2001-2002. American Journal of Preventive Medicine 28(2):221-224.

Allred, N. J., J. M. Stevenson, M. Kolasa, D. L. Bartlett, R. Schieber, K. S. Enger, and A. Shefer. 2006. Using registry data to evaluate the 2004 pneumococcal conjugate vaccine shortage. American Journal of Preventive Medicine 30(4):347-350.

Alter, M. J., H. S. Margolis, K. Krawczynski, F. N. Judson, A. Mares, W. J. Alexander, P. Y. Hu, J. K. Miller, M. A. Gerber, R. E. Sampliner, et al. 1992. The natural history of community-acquired hepatitis C in the United States. The sentinel counties chronic non-A, non-B hepatitis study team. New England Journal of Medicine 327(27):1899-1905.

Altice, F. L., R. D. Bruce, M. R. Walton, and M. I. Buitrago. 2005. Adherence to hepatitis B virus vaccination at syringe exchange sites. Journal of Urban Health 82(1):151-161.

American Academy of Pediatrics. 1961. Vitamin K compounds and the water-soluble analogues: Use in therapy and prophylaxis in pediatrics. Pediatrics 28:501-507.

———. 1980. Prophylaxis and treatment of neonatal gonococcal infections. Pediatrics 65(5): 1047-1048.

———. 2008. State legislation report. http://www.aap.org/advocacy/statelegrpt.pdf (accessed August 21, 2009).

———. 2009. Section 3. Summaries of infectious diseases: hepatitis B. Edited by L. K. Pickering, C. J. Baker, D. W. Kimberlin, and S. S. Long, Red book: 2009 report of the committee on infectious diseases. Elk Grove Village, IL: American Academy of Pediatrics.

Ashton, M. R., R. L. Cook, H. C. Wiesenfeld, M. A. Krohn, T. Zamborsky, S. H. Scholle, and G. E. Switzer. 2002. Primary care physician attitudes regarding sexually transmitted diseases. Sexually Transmitted Diseases 29(4):246-251.

Bailey, C. L., V. Smith, and M. Sands. 2008. Hepatitis B vaccine: A seven-year study of adherence to the immunization guidelines and efficacy in HIV-1-positive adults. International Journal of Infectious Diseases 12(6):e77-e83.

Barrera, J. M., M. Bruguera, M. G. Ercilla, C. Gil, R. Celis, M. P. Gil, M. del Valle Onorato, J. Rodes, and A. Ordinas. 1995. Persistent hepatitis C viremia after acute self-limiting posttransfusion hepatitis C. Hepatology 21(3):639-644.

Bartlett, D. L., M. L. Washington, A. Bryant, N. Thurston, and C. A. Perfili. 2007. Cost savings associated with using immunization information systems for vaccines for children administrative tasks. Journal of Public Health Management and Practice 13(6):559-566.

Boom, J. A., A. C. Dragsbaek, and C. S. Nelson. 2007. The success of an immunization information system in the wake of Hurricane Katrina. Pediatrics 119(6):1213-1217.

Bull, S. S., C. Rietmeijer, J. D. Fortenberry, B. Stoner, K. Malotte, N. Vandevanter, S. E. Middlestadt, and E. W. Hook, 3rd. 1999. Practice patterns for the elicitation of sexual history, education, and counseling among providers of STD services: Results from the gonorrhea community action project (GCAP). Sexually Transmitted Diseases 26(10): 584-589.

Campbell, J. V., R. S. Garfein, H. Thiede, H. Hagan, L. J. Ouellet, E. T. Golub, S. M. Hudson, D. C. Ompad, and C. Weinbaum. 2007. Convenience is the key to hepatitis A and B vaccination uptake among young adult injection drug users. Drug and Alcohol Dependence 91(Suppl 1):S64-S72.

CDC (Centers for Disease Control and Prevention). 2000. Vaccination coverage among adolescents 1 year before the institution of a seventh grade school entry vaccination requirement—San Diego, California, 1998. Morbidity and Mortality Weekly Report 49(5):101-102, 111.

———. 2001a. Development of community- and state-based immunization registries. CDC response to a report from the National Vaccine Advisory Committee. Morbidity and Morality Weekly: Recommendations and Reports 50(RR-17):1-17.

———. 2001b. Effectiveness of a middle school vaccination law—California, 1999-2001. Morbidity and Mortality Weekly Report 50(31):660-663.

———. 2002. Hepatitis B vaccination among high-risk adolescents and adults—San Diego, California, 1998-2001. Morbidity and Mortality Weekly Report 51(28):618-621.

———. 2003. Vaccines for children: Program management. http://www.cdc.gov/vaccines/programs/vfc/projects/program-mgmt.htm#pm (accessed August 27, 2009).

———. 2005. Immunization information system progress—United States, 2004. Morbidity and Mortality Weekly Report 54(45):1156-1157.

———. 2006. Hepatitis b vaccination coverage among adults—United States, 2004. Morbidity and Mortality Weekly Report 55(18):509-511.

———. 2007. Vaccination coverage among children in kindergarten—United States, 2006–07 school year. Morbidity and Mortality Weekly Report 56(32):819-821.

———. 2008a. Immunization administration requirements for correctional inmates and residents. http://www2a.cdc.gov/nip/stateVaccApp/StateVaccsApp/AdministrationbyPatientType.asp?PatientTypetmp=Correctional%20Inmates%20and%20Residents (accessed July 11, 2008).

———. 2008b. Immunization information systems progress—United States, 2006. Morbidity and Mortality Weekly Report 57(11):289-291.

———. 2008c. Newborn hepatitis B vaccination coverage among children born January 2003-June 2005—United States. Morbidity and Mortality Weekly Report 57(30):825-828.

———. 2009a. Current vaccine shortages and delays. http://www.cdc.gov/vaccines/vac-gen/shortages/default.htm (accessed June 11, 2009).

———. 2009b. Hepatitis B vaccine birth dose rates, national immunization survey. http://www.cdc.gov/Hepatitis/Partners/PeriHepBCoord.htm (accessed December 14, 2009).

———. 2009c. National, state, and local area vaccination coverage among children aged 19-35 months—United States, 2008. Morbidity and Mortality Weekly Report 58(33): 921-926.

———. 2009d. Report to congress on section 317 immunization program. Senate appropriations committee. http://www.317coalition.org/legislativeupdate/senate317reportfinal.pdf (accessed August 21, 2009).

Charuvastra, A., J. Stein, B. Schwartzapfel, A. Spaulding, E. Horowitz, G. Macalino, and J. D. Rich. 2001. Hepatitis B vaccination practices in state and federal prisons. Public Health Reports 116(3):203-209.

Christensen, P. B., N. Fisker, H. B. Krarup, E. Liebert, N. Jaroslavtsev, K. Christensen, and J. Georgsen. 2004. Hepatitis B vaccination in prison with a 3-week schedule is more efficient than the standard 6-month schedule. Vaccine 22(29-30):3897-3901.

CMS (Centers for Medicare and Medicaid Services). 2008. Adult immunizations. http://www.cms.hhs.gov/MLNProducts/downloads/Adult_Immunization.pdf (accessed August 21, 2009).

———. 2009. Overview of the Children’s Health Insurance Program (CHIP). http://www.cms.hhs.gov/LowCostHealthInsFamChild/ (accessed August 27, 2009).

Daniels, D., S. Grytdal, and A. Wasley. 2009. Surveillance for acute viral hepatitis—United States, 2007. Morbidity and Mortality Weekly Report: Surveillance Summaries 58(3): 1-27.

Darling, N. J., L. E. Barker, A. M. Shefer, and S. Y. Chu. 2005. Immunization coverage among Hispanic ancestry, 2003 national immunization survey. American Journal of Preventive Medicine 29(5):421-427.

Des Jarlais, D. C., T. Diaz, T. Perlis, D. Vlahov, C. Maslow, M. Latka, R. Rockwell, V. Edwards, S. R. Friedman, E. Monterroso, I. Williams, and R. S. Garfein. 2003. Variability in the incidence of human immunodeficiency virus, hepatitis B virus, and hepatitis C virus infection among young injecting drug users in New York city. American Journal of Epidemiology 157(5):467-471.

Des Jarlais, D. C., D. G. Fisher, J. C. Newman, B. N. Trubatch, M. Yancovitz, D. Paone, and D. Perlman. 2001. Providing hepatitis B vaccination to injection drug users: Referral to health clinics vs on-site vaccination at a syringe exchange program. American Journal of Public Health 91(11):1791-1792.

Edmunds, W. J., G. F. Medley, D. J. Nokes, A. J. Hall, and H. C. Whittle. 1993. The influence of age on the development of the hepatitis B carrier state. Proceedings. Biological Sciences 253(1337):197-201.

Families USA. 2009a. CHIPRA 101: Overview of the CHIP reauthorization legislation. Washington, DC: Families USA.

———. 2009b. Hidden health tax: American pay a premium. Washington, DC: Families USA.

Farci, P., H. J. Alter, S. Govindarajan, D. C. Wong, R. Engle, R. R. Lesniewski, I. K. Mushahwar, S. M. Desai, R. H. Miller, N. Ogata, et al. 1992. Lack of protective immunity against reinfection with hepatitis C virus. Science 258(5079):135-140.

Fishbein, D. B., B. C. Willis, W. M. Cassidy, D. Marioneaux, C. Bachino, T. Waddington, and P. Wortley. 2006. Determining indications for adult vaccination: Patient self-assessment, medical record, or both? Vaccine 24(6):803-818.

Forns, X., P. J. Payette, X. Ma, W. Satterfield, G. Eder, I. K. Mushahwar, S. Govindarajan, H. L. Davis, S. U. Emerson, R. H. Purcell, and J. Bukh. 2000. Vaccination of chimpanzees with plasmid DNA encoding the hepatitis C virus (HCV) envelope e2 protein modified the infection after challenge with homologous monoclonal HCV. Hepatology 32(3):618-625.

Gilbert, L. K., J. Bulger, K. Scanlon, K. Ford, D. Bergmire-Sweat, and C. Weinbaum. 2005.2005. Integrating hepatitis B prevention into sexually transmitted disease services: U.S. sexually transmitted disease program and clinic trends—1997 and 2001. Sexually Transmitted Diseases 32(6):346-350.

Gold, M. R., J. E. Siegel, L. B. Russell, and M. C. Weinstein, eds. 1996. Cost-effectiveness in health and medicine. New York: Oxford University Press.

Goldstein, S. T., M. J. Alter, I. T. Williams, L. A. Moyer, F. N. Judson, K. Mottram, M. Fleenor, P. L. Ryder, and H. S. Margolis. 2002. Incidence and risk factors for acute hepatitis B in the United States, 1982-1998: Implications for vaccination programs. Journal of Infectious Diseases 185(6):713-719.

Gust, D. A., N. Darling, A. Kennedy, and B. Schwartz. 2008. Parents with doubts about vaccines: Which vaccines and reasons why. Pediatrics 122(4):718-725.

Hagan, H., J. P. McGough, H. Thiede, N. S. Weiss, S. Hopkins, and E. R. Alexander. 1999. Syringe exchange and risk of infection with hepatitis B and C viruses. American Journal of Epidemiology 149(3):203-213.

Harris, J. L., T. S. Jones, and J. Buffington. 2007. Hepatitis B vaccination in six STD clinics in the United States committed to integrating viral hepatitis prevention services. Public Health Reports 122(Suppl 2):42-47.

Hennessey, K. A., A. A. Kim, V. Griffin, N. T. Collins, C. M. Weinbaum, and K. Sabin. 2009.2009. Prevalence of infection with hepatitis B and C viruses and co-infection with HIV in three jails: A case for viral hepatitis prevention in jails in the United States. Journal of Urban Health 86(1):93-105.

HHS (Department of Health and Human Services). 2009. National Vaccine Advisory Committee recommendations for federal adult immunization programs regarding immunization delivery, assessment, research, and safety monitoring. http://www.hhs.gov/ nvpo/nvac/NVACAdultImmunizationsWorkingGroupJune2009.html (accessed September 10, 2009).

HIAA (Health Insurance Association of America). 1988. Survey from the Health Insurance Association of America.

Hinman, A. R., G. A. Urquhart, and R. A. Strikas. 2007. Immunization information systems: National Vaccine Advisory Committee progress report, 2007. Journal of Public Health Management and Practice 13(6):553-558.

Holahan, J., and A. Cook. 2008. The decline in the uninsured in 2007: Why did it happen and can it last? Commission on Medicaid and the Uninsured, Kaiser Family Foundation.

Hu, Y., L. E. Grau, G. Scott, K. H. Seal, P. A. Marshall, M. Singer, and R. Heimer. 2008. Economic evaluation of delivering hepatitis B vaccine to injection drug users. American Journal of Preventive Medicine 35(1):25-32.

Hutchinson, S. J., S. Wadd, A. Taylor, S. M. Bird, A. Mitchell, D. S. Morrison, S. Ahmed, and D. J. Goldberg. 2004. Sudden rise in uptake of hepatitis B vaccination among injecting drug users associated with a universal vaccine programme in prisons. Vaccine 23(2):210-214.

Hutton, D. W., D. Tan, S. K. So, and M. L. Brandeau. 2007. Cost-effectiveness of screening and vaccinating Asian and Pacific Islander adults for hepatitis B. Annals of Internal Medicine 147(7):460-469.

Immunization Action Coalition. 2009. State information. Hepatitis B prevention mandates: Prenatal, daycare, and k-12. http://www.immunize.org/laws/hepb.asp (accessed June 9, 2009).

Inchauspe, G., and M. L. Michel. 2007. Vaccines and immunotherapies against hepatitis B and hepatitis C viruses. Journal of Viral Hepatitis 14(Suppl 1):97-103.

IOM (Institute of Medicine). 1994. Adverse events associated with childhood vaccines: Evidence bearing on causality. Edited by K. R. Stratton, C. J. Howe, and R. B. J. Johnston. Washington, DC: National Academy Press.

———. 2002. Immunization safety review: Hepatitis B vaccine and demyelinating neurological disorders. Edited by K. Stratton, D. Almario, and M. C. McCormick. Washington, DC: The National Academies Press.

———. 2003. Financing vaccines in the 21st century: Assuring access and availability. Public and private insurance coverage. Washington, DC: The National Academies Press.

———. 2009. America’s uninsured crisis. Consequences for health and healthcare. Washington, DC: The National Academies Press.

Jacobson, S. H., E. C. Sewell, and R. A. Proano. 2006. An analysis of the pediatric vaccine supply shortage problem. Health Care Management Science 9(4):371-389.

Jenkins, C. N., S. J. McPhee, C. Wong, T. Nguyen, and G. L. Euler. 2000. Hepatitis B immunization coverage among Vietnamese-American children 3 to 18 years old. Pediatrics 106(6):E78.

Kaiser Family Foundation and HRET. 2008. Employer health benefits 2008 annual survey. The Kaiser Family Foundation and Health Research & Educational Trust.

Kim, S.-Y., K. Billah, T. A. Lieu, and M. C. Weinstein. 2006. Cost effectiveness of hepatitis B vaccination at HIV counseling and testing sites. American Journal of Preventive Medicine 30(6):498-498.

Klein, J. O., and M. G. Myers. 2006. Vaccine shortages: Why they occur and what needs to be done to strengthen vaccine supply. Pediatrics 117(6):2269-2275.

Koff, R. S. 2000. Hepatitis B school-based vaccination programmes in the USA: A model for hepatitis A and B. Vaccine 18(Suppl 1):S77-S79.

KPMG. 1996. Survey of employer-sponsored health benefits, 1993.

Krahn, M. D., A. John-Baptiste, Q. Yi, A. Doria, R. S. Remis, P. Ritvo, and S. Friedman. 2005. Potential cost-effectiveness of a preventive hepatitis C vaccine in high risk and average risk populations in Canada. Vaccine 23(13):1549-1558.

Kuo, I., D. W. Mudrick, S. A. Strathdee, D. L. Thomas, and S. G. Sherman. 2004. Poor validity of self-reported hepatitis B virus infection and vaccination status among young drug users. Clinical Infectious Diseases 38(4):587-590.

Lanford, R. E., B. Guerra, D. Chavez, C. Bigger, K. M. Brasky, X. H. Wang, S. C. Ray, and D. L. Thomas. 2004. Cross-genotype immunity to hepatitis C virus. Journal of Virology 78(3):1575-1581.

Lum, P. J., J. A. Hahn, K. P. Shafer, J. L. Evans, P. J. Davidson, E. Stein, and A. R. Moss. 2008. Hepatitis B virus infection and immunization status in a new generation of injection drug users in San Francisco. Journal of Viral Hepatitis 15(3):229-236.

Lum, P. J., K. C. Ochoa, J. A. Hahn, K. Page Shafer, J. L. Evans, and A. R. Moss. 2003. Hepatitis B virus immunization among young injection drug users in San Francisco, Calif: The UFO study. American Journal of Public Health 93(6):919-923.

Luman, E. T., L. E. Barker, M. M. McCauley, and C. Drews-Botsch. 2005. Timeliness of childhood immunizations: A state-specific analysis. American Journal of Public Health 95(8):1367-1374.

Maheux, B., N. Haley, M. Rivard, and A. Gervais. 1995. STD risk assessment and risk-reduction counseling by recently trained family physicians. Academic Medicine 70(8):726-728.