1

The Long-Term Challenge

It is simple arithmetic. The federal government’s spending for current programs—already far in excess of current revenues—is projected to grow much faster than its revenues in the coming decades.

The cumulative effect of the fundamental mismatch between expected revenues and the spending implied by the federal government’s policies and commitments will be a very large and rapid increase in the amounts that the United States must borrow to finance current spending. This spending will include growing interest payments to the individuals, institutions, and countries that provide the financing through the purchase of U.S. Treasury debt. In addition to this fundamental imbalance, there has been a surge of spending and a drop in revenues because of the 2008-2009 economic downturn, which added more than $1.5 trillion of debt in just 1 year, about $4,500 of additional borrowing for each U.S. resident. This temporary borrowing surge is of concern, of course; however, it is the much larger longer-term mismatch between projected spending and projected revenues implied by current policies that is the greater concern and the focus of this report.

Three major programs that primarily serve the elderly and many people of modest means—Medicare, Medicaid, and Social Security—are largely responsible for the projected growth of spending. Medicare and Medicaid have been growing faster than either revenues or the economy for some time, driven by enhanced benefits, rapid growth of health care costs, and, more recently, by aging of the U.S. population. Social Security spending will grow faster than the economy in the near future as baby boomers retire.

Those three programs already account for nearly one-half of all spending (excluding interest on the debt). The challenge posed by this growth of spending will be compounded by the projected slowing growth of the labor force that is a direct result of the aging of the U.S. population. The number of people who receive retirement and health benefits will increase just as the growth of revenues from income and payroll taxes slows down.

If changes are not made, the nation’s debt is projected to surpass the immediate post-World War II record in less than 20 years, and it would be about seven times the size of the economy in 75 years. That, of course, is impossible. Long before the federal debt reached such a level, the United States would experience a financial crisis that would dwarf what the country has recently experienced, and with more lasting consequences.

The budgetary arithmetic may be simple, but making the necessary adjustments will not be. If policy changes are made, spending and revenues can gradually be brought into alignment, over several years. The required policy changes will entail some painful decisions, and action would have to begin soon. If such changes are delayed too long, it will not be possible to put the federal budget on a sustainable course before a fiscal disaster becomes inevitable.

In the face of the looming fiscal crisis, the John D. and Catherine T. MacArthur Foundation asked the National Academy of Sciences and the National Academy of Public Administration to undertake a comprehensive study to identify how to put the federal budget on a sustainable path; see Box 1-1 for the full charge to the committee. In response to that charge, the two organizations appointed our committee. (See Appendix H for biographical sketches of the committee members and staff.) The rest of this chapter discusses the size and nature of the budget challenge, how it arose, and its implications. Subsequent chapters discuss in detail how to approach solutions, what some major policy options look like, and how people of differing views might combine these options to put the budget on a sustainable long-term path. Chapter 2 provides a framework for thinking about how to address the fiscal challenge. Chapter 3 provides practical tests of fiscal prudence that can be applied to the federal budget or alternatives. Chapters 4 through 9 lay out major building blocks of possible corrective action—in three major areas of spending and in revenues—and then illustrate how such policy options can be combined in order to put the federal budget on a sustainable path. The results demonstrate that there are a wide range of possible ways to bring revenues and spending into alignment over the far horizon. Chapter 10 describes possible reforms of the budget process to make it easier to address the long-term fiscal challenge. Chapter 11 describes how citizens and leaders can use the results of this study as a basis for constructive analysis and discussion of alternatives.

|

BOX 1-1 Committee Charge An ad hoc committee will conduct the following tasks and prepare a report.

|

THE BUDGET OUTLOOK

Largely because of the severe downturn in the economy that began in 2008, the federal government borrowed $1.4 trillion in fiscal 2009 to pay for current spending, and it is expected to run an annual deficit in excess of $1 trillion for at least 1 more year. After the unprecedented deficits of 2009 and 2010, the economy’s recovery will reduce the annual deficit, although

it is likely to remain near historically high levels. But the debt, which was just over 40 percent of the gross domestic product (GDP) at the end of 2008 and approaching 55 percent just 1 year later, will continue to grow; see Box 1-2 on the debt and the deficit.

Using information as of June 2009 (Congressional Budget Office, 2009e) and projecting the likely effects of current policies, the long-term budget outlook if policies are not changed is bleak:

-

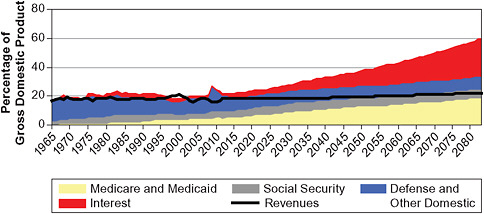

By 2020, current policies would raise the federal debt to nearly 80 percent of GDP; see Figure 1-1, which also shows trends in spending and revenue from 1965 to the present.

-

In about 30 years, if new revenues are not raised, and the three big retirement and health programs are not modified, those programs alone will consume all available federal revenues. Even sooner, their growth will intensify pressure to cut the portion of federal spending that is subject to annual appropriations, an array of programs that includes most of the core functions of government and many services and investments generally considered vital.

|

BOX 1-2 The Deficit and the Debt The “headline” federal budget deficit (or, in some years, surplus), is the difference in a given year between what the government spends and what it takes in (revenues). The deficit is mostly a measure of the net cash flows to and from the U.S. Department of the Treasury. The deficit is financed by borrowing from the public (individuals, governments, and investors here and in other countries). The deficit was $459 billion for fiscal 2008 (the year ending September 30, 2008) and $1.4 trillion in fiscal 2009. The debt is the cumulative amount the U.S. government owes. In most years, the annual deficit is a rough measure of the change that year in the federal debt. However, in fiscal 2008 and 2009 the federal government also borrowed to finance transactions related to the failure of major financial institutions. The publicly held portion of federal debt is that held by persons or organizations (foreign or domestic) outside the federal government. It excludes federal debt held inside the government, much of it in balances of the Social Security and Medicare trust funds dedicated to payment of future benefits. (The combined total of debt held by the public and held in government accounts is sometimes referred to as the gross federal debt.) Debt held by the public reached $5.8 trillion in fiscal 2008 and rose to about $7.5 trillion a year later, about $25,000 per person. A substantial fraction of the outstanding public debt matures each year and must be replaced by new borrowings at then-current interest rates. |

FIGURE 1-1 The long-term budget outlook.

-

Through about 2035, Social Security spending as a share of GDP will grow significantly, reflecting the broad demographic trend of an aging population. It will grow more slowly thereafter.

-

Medicare and Medicaid will consume an increasing share of GDP as per-capita health spending continues to grow at a faster rate than the economy. Federal health spending also will grow because the number of recipients will increase, even without legislation expanding program coverage, driven by the same aging demographic trend that affects Social Security.

-

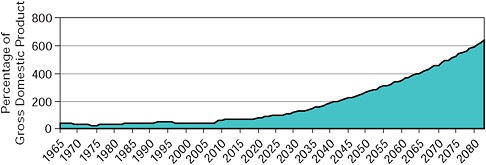

As noted above, if no action is taken to constrain or offset the growth of Social Security, Medicare, and Medicaid, if the tax rates stay near their current levels, and if other programs are held at their current share of GDP, the federal debt, deficits, and interest costs will explode over the long term. If all this were to occur, the federal debt would be more than seven times the nation’s GDP in 75 years; see Figure 1-2.

These projections, which largely rely on the Congressional Budget Office (CBO) for estimates (although making a few different assumptions, see Box 1-3), are similar to those that others have made using similar techniques. They estimate the budget effects of current policies if they are continued over a long period—what is commonly referred to as a budget baseline; see Box 1-3. CBO’s June 2009 long-term outlook reached the same basic conclusion as its previous updates, that “under current law, the federal budget is on an unsustainable path” (Congressional Budget Office, 2009e:1). The latest long-term projections from the Government Accountability Office (GAO), using somewhat different assumptions, also confirm that “the long-term fiscal outlook is unsustainable” (Government Accountability Office,

FIGURE 1-2 The long-term outlook for the debt.

2009:1). The U.S. Office of Management and Budget (OMB), in its annual long-run budget outlook published in April 2009, also says that “increasing health costs and the aging of the population will place the budget on an unsustainable course without changes in policy to address these challenges” (U.S. Office of Management and Budget, 2009a:191). In sum, our conclusion that a change of course is needed is not at all controversial among the government’s experts, and private analysts agree (Auerbach and Gale, 2009; Cox et al., 2009; Moore, 2009). What is controversial is just how urgent is corrective action, an issue we address later in the report. Similarly, there will be controversy, even among those who believe that action is needed very soon, on what mix of spending and revenue policies should be pursued to close the fiscal gap.

|

BOX 1-3 Constructing a Budget Baseline A baseline is useful for understanding the implications of current policies as they could playout over time and as a benchmark against which to measure the effects of proposed policy changes. A baseline is not a prediction—of course, no one can predict the fiscal future with much accuracy over even a few years. Nor is it a “realistic” projection in the sense that it unrealistically assumes no changes in policy. The study committee developed its baseline by making several modifications to baseline projections published by the Congressional Budget Office. In most cases, these modifications were to take account of likely congressional actions. Specifically, the committee’s baseline assumes that Congress acts to extend expiring tax breaks that have bipartisan support, continues providing relief from the alternative minimum tax, adjusts for expected costs of operations in Iraq and Afghanistan, assumes modest increases (instead of sharp cuts that are in the law but Congress annually overrides) in fees paid to physicians by Medicare, and adds an expected cost for federal disaster payments. |

If no major policy changes are made, debt service (the amount the U.S. government must spend each year for interest on the debt), which was more than $800 per person in 2008, would roughly double in those terms by 2020 at current interest rates. But average interest rates on government debt now are extraordinarily low, because of worldwide economic conditions: CBO and others project that, as the recovery proceeds, the government’s borrowing rates will return to more historically normal levels, roughly doubling over the 10-year period. With debt nearly doubling and the government’s average borrowing rate rising, spending for debt service in 2020 could approach $1,700 per person. And beyond 2020, the projected growth of the debt accelerates. Of course, uncertainties surround any budget forecast, especially over a long horizon; see Box 1-4. Each update changes the picture slightly, without changing the basic conclusion; for example, CBO’s August 2009 update of its 10-year baseline increased the projection of cumulative deficits over 10 years by about $1.5 trillion relative to its March estimate (Congressional Budget Office, 2009a, 2009g).1 However, this update does not change the committee’s conclusion that if action is not taken soon the necessary and nearly certain result will be a larger discrepancy between revenues and spending and heavier burden of debt that eventually will require very sharp cuts in spending or very sharp increases in taxes. These, in turn, could have disruptive effects on many people and inflict severe damage on the economy or raise the risk of a severe financial crisis.

|

BOX 1-4 Uncertainties The fiscal outlook could be worse than projected if:

The fiscal outlook could be better than projected if economic growth is stronger than forecast, if health spending growth slows, or if interest rates remain lower than predicted. |

A crisis could begin when, absent a credible plan to correct the fiscal mismatch, the nation’s creditors—the people and institutions that hold the nation’s debt—demand additional interest (or sell their dollar-denominated assets) to compensate for increased risk that the United States could default on its debts. Such a result seems unthinkable today, but so too, just 2 years ago, did the bankruptcy of General Motors and huge financial institutions. Although the “too late to turn back” date is unclear, it is clear that the clock is ticking. Certainly, the consequences of failing to address the fiscal challenge in time would be far more painful than those of acting to put the budget on a sustainable path. Fortunately, the nation still has reasonable options.

THE FISCAL CHALLENGE: HISTORICAL PERSPECTIVE

At the end of World War II, the size of the federal debt was a record 109 percent of GDP. So, in one sense, the United States has been here before. But in the immediate post-World War II period, the U.S. economy was growing rapidly. Rapid growth of the labor force after the war, combined with inflation that eroded the value of the debt principal, made the task of balancing the budget easier. The debt was reduced to about 25 percent of GDP by the 1970s. It rose again, to about 50 percent in the very early 1990s, but then reached another low—33 percent of GDP—in 2001. At the end of fiscal 2008, the federal debt was equal to about 41 percent of GDP, about where it had been in the 1960s and, again, as recently as 1999.

Yet there is a major difference in the post-World War II situation and the current situation. For one thing, labor force growth now is slowing (with the retirement of baby boomers) rather than accelerating. Furthermore, the debt incurred during World War II was owed almost entirely to average Americans; in contrast, today’s debt is largely held by governments and foreign investors. Governments and other investors held less than 5 percent of outstanding Treasury debt in the 1960s, but they held nearly 50 percent at the end of 2008. Realistically, a large proportion of the trillions of dollars of additional debt that the federal government will accumulate in coming years will have to be funded from foreign institutions and investors.

If people are willing to lend to the U.S. government, as they have been, then the current debt burden is sustainable. However, looking farther ahead, it is clear that the budget is on an unsustainable course, as noted above: Social Security, Medicare, and Medicaid have been growing and will continue to grow rapidly. Arithmetically, these three programs alone largely account for the long-term problem. In 2008, Social Security paid about $612 billion to beneficiaries of its old-age, survivors, and disability insurance programs. Although Medicare health benefit payments of $460

billion were partly offset by premiums paid by the program’s (mostly elderly) beneficiaries, net outlays were still almost $390 billion. The spending for Medicaid, the health program targeted for poor people, totaled just over $200 billion. Together, these three big programs in 2008 accounted for nearly 45 percent of federal spending (excluding interest on the debt).

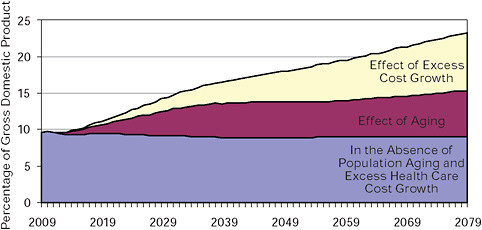

Rapidly rising health care costs are at the core of the federal government’s fiscal challenge. Although part of that rise results from predictable growth in the number of aged beneficiaries, more of it is attributable to the extent to which costs per beneficiary are expected to continue to grow faster than per capita GDP (even after adjusting for changes in the age-sex mix of the beneficiary population), as they have in the past. If such “excess cost growth”—as it is called—continues as CBO and others project, the federal spending on health care alone will exceed the total amount collected in federal revenues within 50 years. There is little evidence to date to suggest that the growth of health costs will slow any time soon without major changes in health policy, and some changes, such as expanded health insurance coverage, could exacerbate the budget problem unless they are offset or paid for by savings in health care or elsewhere, or by new revenues (see Chapter 5).

The United States—like many other affluent countries—faces a steep demographic transition. There are several factors in the transition. People 65 and older, who currently make up 13 percent of the population, are expected to account for 20 percent by 2035. Over the same time, the expected patterns of retirement, immigration, longevity, and birth rates will result in a decline in the percentage of the population of working age. Over the next 20 to 30 years, aging of the population will be as important, or more important than, the projected growth in health care costs in driving up spending for the three major entitlement programs (Biggs, 2008; U.S. Office of Management and Budget, 2009c). Over a longer term, a 70-year horizon, aging and cost increases are expected by most analysts to play roughly equal parts in driving up spending for Social Security, Medicare, and Medicaid; see Figure 1-3.

The slowdown in workforce growth not only means a rise in the proportion of the population who are recipients of federal retirement and health benefits, but also a long-term slowing of economic growth. A smaller proportion of the population working also means that, absent other changes, federal income and payroll tax revenues will grow more slowly than they have in the past.

The long-term problem existed before the economic downturn that began in 2008, but the downturn has made it worse. The downturn has thus far affected the fiscal outlook in four main ways (not all negative). It has (1) temporarily reduced individual and corporate incomes and therefore tax collections related to personal income and corporate profits; (2) temporar-

FIGURE 1-3 Factors in projected Social Security, Medicare, and Medicaid spending, 2009-2079, as a percentage of GDP.

SOURCE: Congressional Budget Office (2009e:12).

ily increased spending for economically vulnerable or newly unemployed people, their communities, and some sectors of the economy; (3) led to the “stimulus” legislation, including new temporary tax provisions and spending, and to a variety of new federal authority to provide financial support for or to rescue private financial institutions and provide relief for homeowners facing default; and (4) temporarily reduced inflation and interest rates.2 The jump in deficits and borrowing resulting from the downturn may be only temporary, but the extra trillions of debt that will have accumulated in that period will be a lasting burden. This extra burden also makes the challenge of facing the much larger long-term deficits implied by current policies greater and more urgent.

The United States is not alone in facing growing gross government debt. The International Monetary Fund (IMF) has projected that the average public debt-to-GDP ratio in 2014 for 19 major industrialized countries would exceed their weighted average at the end of 2007, which was then 78 percent of GDP, by 36 percentage points of GDP; and that debt ratios for these countries would continue to grow over the longer term because of demographic forces (International Monetary Fund, 2009a:26). (These international comparisons include debt for all levels of government, not just the central or federal level, and internal as well as publicly held debt.)

CHANGING PATTERNS OF SPENDING AND REVENUES

Over the past 50 years, the federal government’s budget has usually been somewhat out of balance—that is, revenues were less than spending

(outlays). In fiscal 2008, the budget deficit equaled 3.2 percent of GDP. However, in fiscal 2009, the combination of falling revenues and higher spending because of the downturn have caused the deficit to swell to about 10 percent of GDP (4 percentage points higher than the largest previous deficit since World War II), rapidly adding to the amounts the federal government must borrow to finance its current spending. For perspective, in the 1970s the federal debt had fallen to about 25 percent of GDP; the 2009 deficit alone increased the debt by more than 10 percent of GDP.

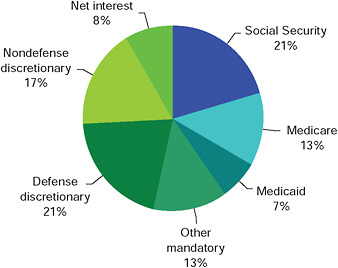

Federal government outlays in 2008 equaled just under 21 percent of the size of the U.S. economy, almost the same proportion as in 1979 (U.S. Office of Management and Budget, 2009c). In fiscal 2008, the federal government spent nearly $3 trillion, about $9,600 for every U.S. resident; see Figure 1-4.

In 2009, federal spending spiked to 25 percent of GDP, higher than the previous post-World War II maximum of 23.5 percent, in 1983. Revenues dipped to 15 percent of GDP in 2009, a low not seen since the 1950s. In 2009, the deficit approached 10 percent of GDP, far above the previous postwar high of 6 percent in 1983, another recession year.

Social Security, Medicare, and Medicaid (as well as some smaller but similarly designed programs) are sometimes referred to as “entitlements” because their spending is determined by provisions of law establishing who is eligible and for what payments. These are part of a broader class of federal programs (commonly referred to as “mandatory spending programs”) for which the level of spending is not determined through annual congressional appropriations; instead, absent a change in policies, spending

FIGURE 1-4 Federal outlays in fiscal 2008.

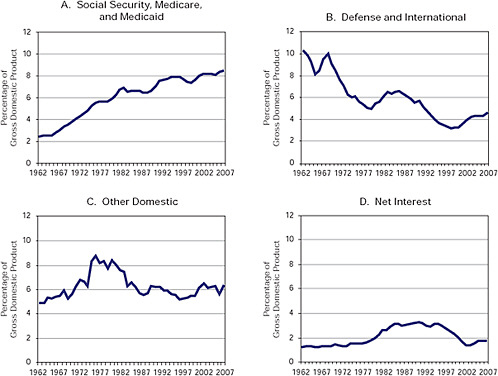

is largely determined by changes over time in demographic and cost factors. From 1962 to 2008, spending for the three large entitlement programs increased from 2.5 percent to 8.5 percent of GDP; see Figure 1-5A. As noted above, their costs are projected to continue growing faster than federal revenues and the economy in the decades ahead.

Over the same period, other noninterest spending declined from 15 percent to less than 11 percent of GDP; see Figures 1-5B and 1-5C. This diverse category of spending topped $1.4 trillion in 2008: about $610 billion for defense spending and $520 billion for nondefense spending. The category includes a wide range of programs (commonly referred to as “discretionary”) for which spending levels are set annually by congressional appropriations. These include foreign aid, science and space programs, environmental protection, transportation, biomedical research, grants to states for education and social services, veterans’ medical care, and the administration of justice. Although most of the programs are discretionary, the category also includes smaller entitlements (totaling about $400 billion)—food stamps, the Supplemental Security Income (SSI) program, the refundable Earned Income Tax Credit (EITC), federal military and civil service retirement, unemployment compensation, payments to disabled veterans, and farm price supports.

Defense and international spending, one of the largest components of this part of the budget, accounted for more than 10 percent of GDP 50 years ago and again at the height of the Vietnam War before falling to less than 5 percent 30 years ago and as low as 3 percent at the end of the 1990s (see Figure 1-5B). In 2008, as the United States was fighting wars in Iraq and Afghanistan, it had risen to just over 4 percent of GDP.

Because spending for federal programs other than the three large entitlements grew less rapidly than the U.S. economy from the early 1960s to 2008, the federal government was able to keep taxes stable and hold its debt in a sustainable range as a proportion of GDP. In other words, the high growth rate of the large entitlement programs for retirement and health over a long interval was offset by slower growth of spending for defense and some other programs. From 2008 on, however, it is hard to imagine how the anticipated continued growth of the large entitlements could be offset by further relative reductions in other spending. The large entitlements have grown even larger, and the smaller programs are now so small as a group that even eliminating them would not yield sufficient savings to offset future growth of the larger ones.

The government paid a net $253 billion in interest in fiscal 2008—the cost of servicing its debt less some interest earnings. This interest is paid to investors in U.S. Treasury bonds and other U.S. Treasury securities. The outstanding volume of the nation’s publicly held debt was $5.8 trillion at the end of 2008 and reached $7.6 trillion a year later. The interest total

excludes interest income from debt held by federal trust funds, like Social Security; see Figure 1-5D.

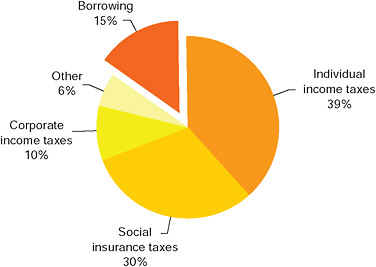

In 2008, the government collected just over $2.5 trillion in revenues—equal to 17.7 percent of GDP, or about $8,100 per person. For almost three decades, two sources have accounted for about 80 percent of the money the federal government takes in: the individual income tax, which brought in more than $1.1 trillion in fiscal 2008, and social insurance (payroll) taxes, which brought in $900 billion in that year. Social insurance taxes are dominated by the 15.3 percent payroll tax that workers and their employers pay for Social Security and the Medicare Hospital Insurance programs. For most workers, in fact, social insurance taxes are higher than income taxes (Congressional Budget Office, 2007a). Corporate income taxes accounted for about $300 billion of the government’s revenues in fiscal 2008. The remaining $170 billion came from excise taxes on gasoline, alcohol, tobacco, airline tickets, and other products and services; estate and gift taxes; customs duties; and miscellaneous receipts (chiefly the earnings of the Federal Reserve System); see Figure 1-6.

Because federal revenues fell far short of the $3 trillion in federal outlays in fiscal 2008, the government covered the gap by borrowing3—the “exploded” wedge in Figure 1-6. The deficit of $459 billion in that year amounted to 15 percent of total outlays and slightly more than 3 percent of GDP. On a per-person basis, it came to about $1,500 for each U.S. resident in 2008. However, the following year, as spending surged and revenues fell during the economic downturn, both borrowing and the debt increased significantly.

FIGURE 1-6 Federal revenues and borrowing in fiscal 2008.

Revenues, as a percentage of the economy, have stayed relatively constant since 1978. In fact, revenues have been remarkably stable in these terms over the past 40 years, never falling below 17 percent of GDP and only once (in 2000) exceeding 20 percent of GDP, despite many changes in tax policy and economic ups and downs. Missing from most discussion and representations of revenues is “tax expenditures,” revenues not received; see Box 1-5.

The downturn that began in 2008 has at least temporarily caused major changes in both spending and revenues, especially for fiscal 2009. Spending rose sharply as the federal government stepped in to stabilize the financial sector and stimulate the economy. As incomes and business profits fell, so did revenues. The resulting very large increase in the deficit was financed with additional borrowing.

Few economic experts would forgo strictly temporary increases in federal spending, deficits, and debt in an economic downturn as severe as this one. Such deficits are countercyclical—they help moderate the societal effects of a recession that might otherwise be far harsher, and they may speed

|

BOX 1-5 Tax Expenditures An invisible component of charts like Figure 1-6—because no one has figured out how to depict negative slices of pie—is tax expenditures. Also dubbed tax breaks, preferences, or loopholes, “tax expenditures” refer to departures from normal tax law that favor certain types of income or economic activity. Tax expenditures reduce the amount of money that the government collects from specified sources. Analysts debate how best to measure tax expenditures, but one commonly used measure is the annual loss of revenue resulting from each provision (assuming other parts of the current tax code are unchanged). The Joint Committee on Taxation (2008a) lists more than 200 tax expenditures, led by preferential rates on dividends and capital gains ($150 billion in 2008), favorable treatment of pensions and other retirement plans ($120 billion), the exclusion of employer contributions to health insurance and similar plans ($117 billion), the deductibility of mortgage interest on owner-occupied housing ($67 billion), and the deductibility of state and local income, sales, and property taxes ($48 billion). This list of the top five tax expenditures omits the tax rebates paid as part of the economic stimulus effort, which the Joint Committee estimated at $95 billion in 2008, because those rebates are not a permanent feature of the tax code. Although tax expenditures reduce federal revenues and thus make government’s role appear smaller by that measure, they have the same effect on the deficit as would equivalent spending for the same activities. If they were classified as federal spending instead of tax benefits, federal expenditures would have been about 30 percent higher in 2006 than OMB reported—slightly over 26 percent of GDP instead of 20.3 percent (Burman, Toder, and Geissler, 2008). |

recovery. The long-term problem with such widely accepted temporary deficits during a short-term downturn is that they add to the accumulated debt. As two prominent economists have noted: “[E]ven if the recovery occurs as projected and the stimulus package is allowed to expire, the country will face the highest debt-to-GDP ratio in 50 years and an increasingly unsustainable and urgent fiscal problem” (Auerbach and Gale, 2009:13).

Interest rates on U.S. Treasury bonds fell dramatically during the downturn. This may indicate that buyers of federal debt do not as yet perceive a significant risk of a future explicit default or an implicit default through inflation. As many analysts have noted, the confidence that investors have in the strength of the U.S. economy and its ability to manage its fiscal affairs enables it to borrow in its own currency, and at lower rates than other countries in comparable circumstances. However, investors’ confidence could falter as the government’s fiscal outlook worsens. The mere fact that a larger share of the budget must be dedicated to debt service increases the risk that, at any time, if investors demanded sharply higher interest returns, interest spending could become a substantially larger (and obligatory) share of federal spending. Larger interest payments to investors both in the United States and abroad would quickly increase the deficit. To offset such an outcome would require either painful cuts in other spending or increases in revenue.

How the Nation Got Here

How did the United States get into this situation? Some critics blame policy choices made during the George W. Bush administration, especially the tax cuts of 2001 and 2003 and the expansion of Medicare to cover prescription drugs. Those tax cuts significantly increased deficits, and their indefinite extension for people with incomes below $250,000—as proposed by President Obama and assumed in the committee’s study baseline—would increase annual deficits beyond what they would otherwise be over the next decade by an average of 1.3 percent of GDP.4 Although those policy choices made the long-run fiscal outlook worse, the roots of the problem go deeper and carry no particular political brand.

The three large entitlements whose projected growth is largely responsible for the budget’s unsustainable course are part of a major expansion of the federal government’s commitments to provide income support and health insurance to the old and the disabled. This expansion has roughly paralleled similar social program growth in other affluent countries. These and other federal programs help limit income inequality and prevent severe hardship for millions; for those with more personal resources, they supplement those resources, reducing uncertainty and the risk of personal financial catastrophe.5 They represent open-ended promises to future generations.

For both Social Security and Medicare, the primary sources of revenue for these programs grow with the economy, but the benefits grow with the size of the eligible population and other factors. Although the intention was—and is—to finance both programs in part from dedicated sources, the structure of both Social Security and Medicare creates the opportunity for benefits to outrun revenues (for details of the program structure and operations, see Chapters 5 and 6; see also Oberlander, 2003). As discussed above, the changing age structure of the population means that for at least the next two decades a smaller workforce will be supporting a growing retired population.

The growth of health care costs at a faster rate than the growth of the economy for a long period is another factor causing federal spending for Medicare, as well as other federal health care spending, to outpace dedicated revenue sources, including payroll taxes and premiums. As discussed in Chapter 5, the upward growth of Medicare costs has been driven largely by a broad dynamic that has caused all health care costs to rise faster than GDP over most of the last three decades—not primarily because more people were receiving care but mainly because on average the intensity and quality of care have increased. The same is true of spending for Medicaid, but this program does not have a dedicated revenue source.

Looking forward, it is difficult to quantify how much of the mismatch between projected spending and dedicated revenues for Social Security and Medicare is attributable to initial design, how much to subsequent expansion and other program changes, and how much to changing demographic and economic forecasts. In any case, their costs now far exceed early estimates. Medicare and Medicaid costs have grown at a rate similar to that of all health spending, which has been substantially faster than that of the economy. For example, when Medicare was enacted in 1965, it was then estimated to cost $3 billion a year (about $20 billion in 2008 dollars). In 2008, net outlays for a much-expanded Medicare program approached $400 billion. Tax expenditures for employer-provided health benefits have fueled the growth and generosity of private insurance plans, adding to the rising total of federal subsidies for health while reducing revenues.6 And medical science has advanced to provide far better, but also far more costly, treatments and services. Given that Social Security and Medicare were known to be structured in a way that allowed their costs to grow faster than tax revenues, the difficult question is why policy makers have been so slow to address their lack of sustainability. Initially, unintentional underestimates of what Social Security and Medicare would cost may have set the stage for later underfunding of those long-term commitments. Yet continuing warnings of underfunding or shortfalls have been discounted or ignored.

Even in 2000, when the budget was in surplus and many were actually concerned about the rate at which the federal debt was being reduced,

budget analysts warned of pitfalls ahead; the budget was already on an unsustainable path, with health and Social Security costs rising steeply outside the 10-year window conventionally used to assess the budget effects of policies (Congressional Budget Office, 2000; U.S. Office of Management and Budget, 2000). Since then, a succession of reports not only repeated the warning, but also outlined possible solutions to the looming problem (see, e.g., Rivlin and Sawhill, 2004). While the Social Security and Medicare program actuaries have projected and warned about shortfalls for a long time, such exercises for the whole budget were rarely done until about 20 years ago. The National Economic Commission, formed by the President and Congress in 1987 and reporting in 1989, was perhaps the first in a series of high-level independent bodies to call attention to the seriousness of the long-term budget challenge. Its findings were largely ignored. It was followed in 1994 by the Kerry-Danforth Commission, which also foresaw a long-term budget crisis. Kerry-Danforth, for example, concluded that, absent reforms, spending on five programs alone—Social Security, Medicare, Medicaid, and federal civilian and military pensions—would exceed federal revenues by 2030. However, its members could not agree on “any proposal to reform a system that it had in its own report concluded was ‘unsustainable’” (Peterson, 2004:124).

CBO made its first long-term projections of the federal budget in 1996. Looking out to 2050, CBO noted that the expected increase in the number of beneficiaries of federal programs for the elderly and a slowing in the rate of growth of the labor force—combined with the anticipated growth in the per-person cost of Medicare—would put enormous pressure on the budget. Its report (Congressional Budget Office, 1996:xxii) said that if those pressures were not dealt with by reducing spending or increasing taxes, mounting deficits could seriously erode future economic growth. At about the same time, OMB published its first long-term projections. The fiscal 1998 budget (U.S. Office of Management and Budget, 1997:21) noted: “Despite the improvement in the outlook after the passage of OBRA [President Clinton’s economic plan in 1993], serious long-run problems remain. Beginning around the year 2010 and continuing throughout the next several decades, the deficit would rise [under current policies], eventually reaching unsustainable levels.”

A fundamental obstacle to dealing with the nation’s long-term fiscal problem is that all solutions are painful. Thus, leaders who advocate them may well be voted out of office, especially if the voters are not well informed about the problem. Poorly informed voters are vulnerable to demagoguery, such as: (1) there is no long-run problem that cannot be solved by economic growth or immigration; (2) solving it through growth is possible only if you avoid any tax increases; and (3) any cut in promised benefits or increase in taxes will cause unacceptable suffering. These claims ignore the facts that one can get a long way to a solution by reducing the

rate of growth of benefits, rather than cutting them outright, by raising taxes, or with a judicious mix of benefit reductions and revenue increases. That is, as detailed in Chapters 4-9, there are several possible ways to solve the nation’s long-term fiscal problem that are less drastic than sometimes suggested, although it is important to emphasize that none is pain free.

It is generally assumed that electorates always prefer a combination of higher spending and lower taxes. Survey results and other evidence suggest a more complicated pattern of thinking (Modigliani and Modigliani, 1987; Schultze, 1992). Most Americans say that their taxes are too high (52 percent in a 2009 Gallup survey), although this proportion is lower than two or three decades ago. In a 2008 Pew survey, cutting middle-class income taxes was ranked 15th in importance in a list of 20 issues, although this survey was conducted prior to the current major recession. Another 2008 survey (by CBS and the New York Times) found that the public appears evenly split (43 percent to 43 percent) between those who favor a larger government that offers more services and those who favor a smaller government that offers fewer services. Other research shows that Americans object more to how their federal tax dollars are spent than to how much they pay (Bowman, 2009). Perhaps public opinion constrains leaders from acting unless or until the wolf is at the door, push comes to shove, or Scylla meets Charybdis (Weaver, 1986). Some observers have likened the lack of forceful action to address the long-term fiscal imbalance to a similar lack of forceful action in other major policy areas, such as climate change. Both the fiscal and climate problems exemplify a class of challenges that have enormous long-term cost—but pose no immediate pain—for the nation’s welfare and people’s way of living.

In addition to the dynamics of politics in a democracy, particular elements of the federal government’s policy-making process seemingly work against a focus on solving the long-term problem. The reasons for this are several, including natural limits on rational behavior and the normal incentives facing decision makers, especially elected officials. In principle, a better-informed and integrated decision-making process can help overcome these natural limits. But, expert observers have not found that a substantial increase in information and analysis available to policy makers has had a demonstrable effect to date on the quality of budget decisions (Joyce, 2008). Reforming the budget process may help focus attention on long-term consequences of today’s actions, thereby improving incentives for early action. Such options are discussed in Chapter 10.

Consequences of Inaction

One reason it has been relatively easy for most policy makers and the public to ignore the nation’s fiscal problem is that, to date, the United States has had no difficulty borrowing to finance current spending. And borrow-

ing is not necessarily a bad thing, any more than when a family takes out a mortgage in order to purchase a home. However, more resources spent to pay interest on debt means fewer resources available for other uses. And, borrowing when there will not be sufficient income in the future to repay debt is a serious problem. If higher federal debt and debt service squeeze other spending, then the federal government will be able to deliver less for a given level of taxation, perhaps leading more people to conclude that they are getting too little benefit for their taxes.

Political incentives for additional borrowing could change quickly if financial markets began to penalize the United States for failing to put its fiscal house in order. And because the recent economic downturn has been worldwide, all interest rates have trended down, while investors have favored U.S. Treasury securities as a perceived safer haven for their money than other countries’ debt. This situation has reduced the government’s debt service cost. Moreover, because the United States borrows in its own currency, it need not worry, as other nations do, that it may be punished by having to repay in a currency that has become stronger relative to its own.

However, if investors become less certain of full repayment or believe that the country is pursuing an inflationary course that would allow it to repay the debt with devalued dollars, they could begin to charge a “risk premium” on U.S. Treasury securities. That could happen suddenly in a confidence crisis and ensuing financial shock. The United States would be acutely vulnerable to such a crisis because it has to continually refinance its current debt. (The United States rolls over more than one-third of its marketable debt every year before raising a new dollar of borrowing; see U.S. Department of the Treasury, 2009; also see Table F-5 in Appendix F.)

There is precedent for a financial disruption first contributing to large, chronic deficits and then in some cases contributing to the loss of investor confidence and even to a default on a nation’s debt (Reinhart and Rogoff, 2009). The unique position of the United States—because of its economic dominance and the dominant role of the dollar internationally—make it difficult to extrapolate from the experience of other nations in estimating the risk or timing of a financial crisis arising from failure to address the projected U.S. fiscal imbalance. However, as many analysts have observed, there is a risk that the nation’s status as a world “reserve currency” could be damaged by deterioration of its economic performance arising from a chronic fiscal imbalance (Auerbach and Gale, 2009; Friedman, 1988).

Given the lack of precedent for such a trajectory for a country like the United States, one might get better information on possible effects if Japan or a major European country had a crisis first, but waiting for that to happen is neither reasonable nor practical. A provocative paper even before the current downturn asked whether the country was bankrupt (Kotlikoff,

2006). The paper’s answer was “yes” because all governments must satisfy a long-run budget constraint and the United States has made promises that it cannot keep. Its “creditors” (defined broadly as those who work and pay taxes, not just bondholders), will eventually balk—by refusing to lend money, refusing to work, or even emigrating. At that point, the government would have either to cut back from its promises, raise taxes, or renege on its debt. It could do this outright or by stealth, that is, through inflation that reduces the real value of debt principal.

It is impossible to determine or forecast, based on history or the specifics of the fiscal challenge, at what level of debt financial markets will decide that there is an increased risk that debt will not be fully repaid (or repaid in greatly inflated dollars) and react by demanding higher interest rates. Although the credit crisis that began in August 2007 and became a worldwide downturn in 2008 has not yet increased interest rates on U.S. Treasury securities, it serves as a sobering reminder that confidence is a fragile thing (Rubin et al., 2004). Auerbach and Gale (2009) note that a bleaker fiscal outlook already is affecting market assessments of U.S. government debt. By one measure, the implied probability of default rose from under 1 percent before September 2008 to almost 8 percent in early 2009 before declining again. Such a fluctuation illustrates how quickly financial markets could react in the future, triggering a possible spiral of rising federal interest spending and pressures to either reduce noninterest spending or increase revenues, possibly at a time when economic conditions would make these choices even more difficult than under “ordinary” circumstances.

Increased debt decreases U.S. wealth both by depressing the growth of the nation’s capital stock and increasing its liability to foreigners. Although the ability of the U.S. government to draw on foreign saving reduces any immediate negative effects of deficits on GDP growth, it also means that more of the income generated by that growth must be transferred abroad in the form of interest and dividends. Bergsten (2009b) notes the contribution that larger budget deficits are making to a projected rise in the broader measure of debt (both public and private borrowings) that the United States owes to investors abroad. He cites as credible a projection that by 2030 the United States would be “transferring a full seven percent ($2.5 trillion) of its entire economic output to foreigners every year in order to service its external debt” (Cline, 2009). Bergsten (2009b) also projects that large budget deficits by 2030 will drive long-term interest rates up by 2.5 percentage points. Even if investors at home and abroad remain confident about buying and holding U.S. Treasury debt, large deficits and debt can have a corrosive effect. And even without a crisis of confidence in the ability of the United States to manage its fiscal problem, chronic large deficits erode the growth of future living standards by reducing national savings, thereby slowing the accumulation of wealth (see Congressional Budget Office, 2005b).

Because economic models are bounded by historical experience, they struggle to illustrate the consequences of deficits and debts that are “off the charts.” However, one such exercise vividly demonstrates what the nation is facing. In response to a special request, the Congressional Budget Office (2008g) attempted to gauge what might happen to the economy if federal debt continued to climb. Answering the question meant departing from CBO’s (and other organizations’) standard practice of using mainstream, “sustainable” economic assumptions in order to analyze inherently unsustainable policies. The CBO analysis concluded that debt would drain funds from the nation’s pool of savings, reduce investment in the domestic capital stock and in foreign assets, and cause real interest rates to rise. CBO gauged effects on the economy using gross national product (GNP) per person, which averaged about $45,000 in 2007.7 The results suggested that rising deficits would cause real GNP per person to stop growing in the late 2040s, sinking from a peak of nearly $70,000 (in 2007 dollars) to about $55,000 in 2060. That is, the United States would begin to become a markedly less wealthy country. The CBO projections ended after 2060 because the model simply could not continue to compute such deterioration. Of course, a financial crisis might come well before that date. CBO noted that simply hiking income tax rates to cover projected spending would not forestall this deterioration because extremely high income tax rates would seriously distort work incentives and hobble economic growth.8

Can the country grow its way out of the problem? Some people have suggested that future increases in wealth will allow the United States to meet growing public needs and still have enough left for increased private consumption. A sober analysis of recent fiscal history offers little basis for that view. One reason is that labor force growth, a major driver of GDP, has slowed and will continue to slow. The annual rate of growth in the labor force decreased from an average of about 2.1 percent during the 1970s and 1980s to about 1.1 percent from 1990 to 2008. The 2009 report of the Social Security Trustees (Social Security Administration, 2009d:98) projects further slowing of labor force growth, resulting from slower growth in the working-age population as the baby-boom generation reaches retirement and the succeeding smaller cohorts reach working age. Under the Trustees’ intermediate assumptions, the U.S. labor force is projected to increase by about 0.7 percent per year, on average, through 2018. Thereafter, it is projected to increase still more slowly, at an average of 0.5 percent a year, from 2018 to 2050, and 0.4 percent over the remainder of the 75-year projection period. Wages subject to Social Security taxes are projected to fall from 38.5 percent of GDP in 2008 to 33.1 percent in 2083, in part because of a projected increase of nontaxable employer-provided benefits as a share of total compensation (Congressional Budget Office, 2009e; Lavery, 2009). With a smaller part of the population working and paying taxes, even if

productivity were to increase at roughly the same rate it has in the past 40 years, real GDP growth—which averaged 3 percent annually from 1967 to 2007—would slow. Under the Trustees’ intermediate assumptions, real GDP is projected to grow 2.4 percent annually through 2018, and more slowly thereafter, reflecting slower labor force growth (Social Security Administration, 2009d:100). Personal income and federal revenue growth also would slow as a direct result.

Some people have argued that an increase in immigration can be a solution. Because labor force growth is a major driver of GDP, one way to increase both is to admit more of those seeking to live and work here. U.S. immigration—roughly 1 million a year—has been high in comparison with most European countries and Japan. This immigration has helped keep the U.S. working-age population proportionately higher than in those countries, where high proportions of elderly people must count on a declining fraction of the population of working age to pay for services. In the future, larger numbers of immigrants—especially skilled workers—could boost the working portion of the U.S. population, helping to pay for benefits to the elderly. However, immigrants grow old, too, so it would be a temporary “solution.” In fact, to offset slowing labor force growth, immigration rates would have to rise substantially. In the past, immigration has been found to have a small net positive impact on U.S. economic activity, but the effect is so modest that even if immigration doubled or tripled from the current rate, it would make only a small long-term contribution to incomes and therefore to federal revenues (see Congressional Budget Office, 2005a:3; Council of Economic Advisers, 2007; National Research Council, 1997).9

Not only is there no easy way out of the nation’s fiscal problems, but the challenge now facing the United States is arguably worse than standard analyses suggest. Even as questions are raised about the sustainability of federal retirement and medical insurance programs, many people are concerned about the adequacy of those commitments. The 2009 debate over health reform legislation has highlighted the number of people who risk financial disaster because they lack adequate health insurance. The downturn has highlighted the exposure of many households to financial risk. Many baby boomers have not provided adequately for their own retirement, and recent drops in home and stock values have wiped out part of what they had saved (Lusardi and Mitchell, 2007). Private savings, which equaled 10.4 percent of national income in 1984, had become negative by 2006, even before the downturn (Conley, 2009): The decline in U.S. private savings has been partly offset by foreign purchases of U.S. debt.

A decline in private savings means that many households have a smaller savings cushion against loss of income or unexpected expenses, and therefore are potentially more dependent on government or private charities for financial help in these circumstances. Thus, even as questions are raised

about the sustainability of federal retirement and medical insurance programs, many are pressing to supplement or expand those commitments.

There is no escape from the arithmetic of the long-term fiscal challenge. No one can estimate with any accuracy the risk of any crisis in the financing of the federal government, nor when any such crisis might occur. The committee considers it unlikely the federal government would default outright on its debt. Nor does it believe it likely that the United States would pursue a policy of deliberately inflating its currency to reduce the real cost of repaying debt. Such a policy, in any case, would not be sufficient by itself to escape the debt obligation, partly because much of the debt is short term or indexed for inflation and partly because benefits of the three biggest entitlement programs rise in tandem with inflation. The greater risk of a sudden government fiscal crisis caused by rising interest rates is that the nation would be forced to respond precipitously. A rushed, ill-considered budget response to the threat of a debt crisis might deprive people of needed public services or hobble the economy for many years. The damage to the country’s residents would be immediate, but the damage to the nation’s credibility and ability to manage its finances could be profound and long lasting. Even if the United States is able to avoid a full-blown financial crisis, it would increasingly find its options narrowed as it juggled competing demands. Policy makers would lose flexibility to cope with such events as recession, natural disaster, war, or terrorist attack.

THE OPPORTUNITY TO ACT

Setting aside other priorities to address a seemingly distant, abstract fiscal challenge is asking a great deal of both leaders and the public. Both groups already must deal with many urgent matters. Yet the costs of inaction are potentially enormous. In a sense, all of the other goals that people value and pursue through government already are hostage to finding a politically feasible way to address the looming fiscal challenge.

The committee believes that this report will be helpful to both the public and the nation’s leaders in addressing the fiscal challenge through a distinctive approach:

-

We present a range of possible paths rather than a single solution. Because current policies cannot be sustained, Americans and their leaders must find a way to construct a sustainable budget. People hold many views on critical policy issues that reflect sharp differences in values and interests: These must be considered and balanced before the nation can find such a sustainable way. The committee’s paths can be a starting point for dialogue and compromise.

-

We present a clear set of standards that anyone can apply to assess how close any given set of budget proposals comes to achieving sustainability. All of the paths to sustainability involve tough choices—most likely requiring new limits on what the government will pay for and possibly requiring new ways to pay for programs that stay in the budget. By presenting some of the major building blocks of a sustainable budget and estimates of their budget effects, the report provides a starting point for practical choices.

-

We recognize that deeply held (and at times, conflicting) values are the lenses through which different people will study and choose among the alternatives. Because it is so difficult to achieve and maintain a sustainable budget, the committee believes that any effort that hopes to succeed must be rooted in the values of fairness, economic opportunity, and personal and family security that people hold dear.

-

The committee recognizes that prospects for addressing the U.S. fiscal challenge are intertwined with those of other nations around the globe. The many economic and financial ties between the United States and the rest of the world are now reinforced by increased dependence on foreign investors to fund the nation’s growing national debt. The same demographic trends and environmental challenges that contribute to budget pressures in the United States are affecting many other countries and may require cooperative solutions.

The economic downturn has complicated the fiscal challenge. Right now the nation faces an extraordinary clash between demands for expanded government and the inconvenient reality that commitments already made are expected to consume all the available revenues and then some. Reconciling those demands for more with the need to deliver less will require political creativity and compromise. However, the committee believes that reasonable options are still available if action is taken forcefully and soon.

It would be wise to take painful steps now to avoid more painful ones later on. These steps should distribute the required sacrifices fairly and give people affected by benefit changes ample notice so they can adjust their financial plans accordingly. The remainder of this report attempts to spell out some ways that this can be done.